MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s Discussion and Analysis

BMO’s President and Chief Executive Officer and its Executive Vice-President and Chief Financial Officer have signed a statement outlining management’s responsibility for financial information in the annual consolidated financial statements and Management’s Discussion and Analysis (MD&A). The statement, which can be found on page 112, also explains the roles of the Audit Committee and Board of Directors in respect of that financial information.

The MD&A comments on BMO’s operations and financial condition for the years ended October 31, 2011 and 2010. The MD&A should be read in conjunction with our consolidated financial statements for the year ended October 31, 2011. The MD&A commentary is as of December 6, 2011. Unless otherwise indicated, all amounts are stated in Canadian dollars and have been derived from financial statements prepared in accordance with Canadian generally accepted accounting principles (GAAP).

Certain prior year data has been reclassified to conform with the current year’s presentation, including restatements arising from transfers of certain businesses between operating groups. See pages 44 and 45.

| | | | |

| | 27 | | Who We Are provides an overview of BMO Financial Group, explains the links between our financial objectives and our overall vision, and outlines “Reasons to invest in BMO” along with relevant key performance data. |

| | 28 | | Enterprise-Wide Strategy outlines our enterprise-wide strategy and the context in which it is developed, as well as our progress in relation to our priorities. |

| | 29 | | Caution Regarding Forward-Looking Statements advises readers about the limitations and inherent risks and uncertainties of forward-looking statements. |

| | 30 | | Factors That May Affect Future Results outlines certain industry and company-specific factors that investors should consider when assessing BMO’s earnings prospects. |

| | 32 | | Economic Developments includes commentary on the impact of the economy on our businesses in 2011 and our expectations for the Canadian and U.S. economies in 2012. |

| | | | Value Measures reviews financial performance on the four key measures that assess or most directly influence shareholder return. It also includes a summary of adjusting items that are excluded from results to assist in the review of key measures and adjusted results. |

| | 33 | | Total Shareholder Return |

| | 34 | | Adjusting Items |

| | 34 | | Earnings per Share Growth |

| | 35 | | Return on Equity |

| | 35 | | Net Economic Profit Growth |

| | 36 | | Acquisition of Marshall & Ilsley Corporation (M&I)provides an overview of the major acquisition completed in 2011. |

| | 37 | | 2011 Financial Performance Review provides a detailed review of BMO’s consolidated financial performance by major income statement category. It also includes summaries of the impact of business acquisitions and changes in foreign exchange rates. |

| | | | Operating Group Review outlines the strategies of our operating groups, how they choose to differentiate their businesses and the challenges they face, along with their strengths and key value drivers. It also includes a summary of their achievements in 2011, their priorities for 2012, the business environment and a review of their financial performance for the year. |

| | | | | | |

| | 44 | | Summary | | |

| | 46 | | Personal and Commercial Banking | | |

| | 47 | | Personal and Commercial Banking Canada | | |

| | 50 | | Personal and Commercial Banking U.S. | | |

| | 53 | | Private Client Group | | |

| | 56 | | BMO Capital Markets | | |

| | 59 | | Corporate Services, including Technology and Operations | | |

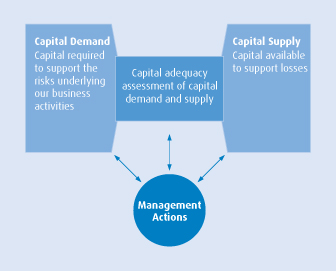

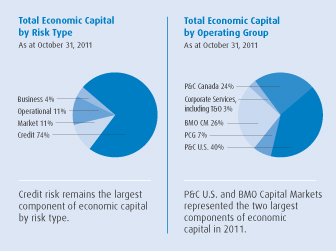

| | | | Financial Condition Review comments on our assets and liabilities by major balance sheet category. It includes a review of our capital adequacy and our approach to optimizing our capital position to support our business strategies and maximize returns to our shareholders. It outlines proposed regulatory changes that are expected to impact capital and liquidity management as well as certain business operations. It also includes a review of off-balance sheet arrangements and certain select financial instruments and European balances. | | |

| | 59 | | Summary Balance Sheet | | |

| | 61 | | Enterprise-Wide Capital Management | | |

| | 65 | | Select Financial Instruments | | |

| | 69 | | U.S. Regulatory Developments | | |

| | 70 | | Off-Balance Sheet Arrangements | | |

| | | | Accounting Matters and Disclosure and Internal Control reviews critical accounting estimates and changes in accounting policies in 2011 and for future periods. It also outlines our evaluation of disclosure controls and procedures and internal control over financial reporting. | | |

| | 70 | | Critical Accounting Estimates | | |

| | 73 | | Changes in Accounting Policies in 2011 | | |

| | 73 | | Future Changes in Accounting Policies – IFRS | | |

| | 77 | | Disclosure Controls and Procedures and Internal Control over Financial Reporting | | |

| | 77 | | Shareholders’ Auditors’ Services and Fees | | |

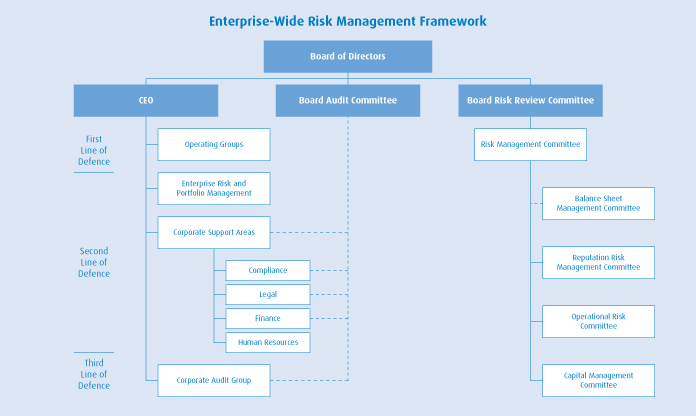

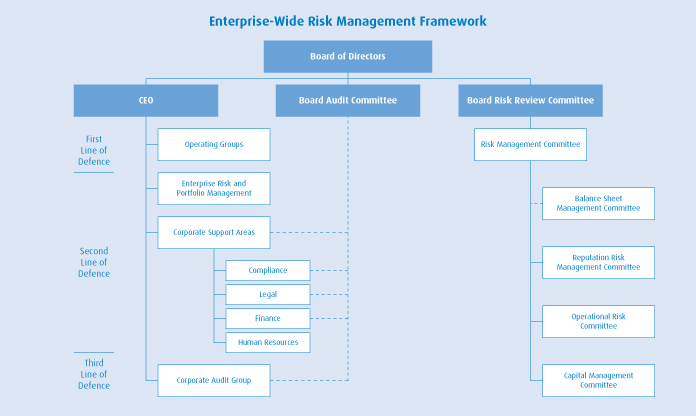

| | 78 | | Enterprise-Wide Risk Management outlines our approach to managing the key financial risks and other related risks we face. | | |

| | 94 | | Non-GAAP Measures includes explanations of non-GAAP measures and a reconciliation to their GAAP counterparts for the fiscal year and fourth quarter. | | |

| | | |

| | 96 | | 2010 Performance Review, Review of Fourth Quarter Performanceand Quarterly Earnings Trends provide commentary on results for relevant periods other than fiscal 2011. | | |

| | | |

| | 100 | | Supplemental Information presents other useful financial tables and more historical detail. | | |

Regulatory Filings

Our continuous disclosure materials, including our interim financial statements and interim MD&A, annual audited consolidated financial statements and annual MD&A, Annual Information Form and Notice of Annual Meeting of Shareholders and Management Proxy Circular, are available on our website at www.bmo.com, on the Canadian Securities Administrators’ website at www.sedar.com and on the EDGAR section of the SEC’s website at www.sec.gov. BMO’s President and Chief Executive Officer and its Executive Vice-President and Chief Financial Officer certify the appropriateness and fairness of BMO’s annual and interim consolidated financial statements and MD&A and Annual Information Form, and the effectiveness of BMO’s disclosure controls and procedures and material changes in our internal control over financial reporting.

| | |

| 26 | | BMO Financial Group 194th Annual Report 2011 |

Who We Are

Established in 1817, BMO Financial Group is a highly diversified financial services provider based in North America. With total assets of $477 billion and 47,000 employees, BMO provides a broad range of retail banking, wealth management and investment banking products and services to more than 12 million customers. We serve more than seven million customers across Canada through our Canadian retail arm, BMO Bank of Montreal. We also serve customers through our wealth management businesses: BMO Nesbitt Burns, BMO InvestorLine, BMO Global Private Banking, BMO Global Asset Management and BMO Insurance. BMO Capital Markets, our North American investment and corporate banking division, provides a full suite of financial products and services to our North American and international clients. In the United States, BMO serves customers through BMO Harris Bank, an integrated financial services organization based in the U.S. Midwest with more than two million retail, small business and commercial customers. BMO Financial Group conducts business through three operating groups: Personal and Commercial Banking, Private Client Group and BMO Capital Markets.

Our Financial Objectives

BMO’s vision, guiding principle and medium-term financial objectives for certain important performance measures are set out in the adjacent chart. We believe that we will deliver top-tier total shareholder return and meet our medium-term financial objectives by aligning our operations with and executing on our strategic priorities, as outlined on the following page. We consider top-tier returns to be top-quartile shareholder returns relative to our Canadian and North American peer group.

BMO’s business planning process is rigorous and considers the prevailing economic conditions, our customers’ evolving needs and the opportunities available across our lines of business. It includes clear and direct accountability for annual performance that is measured against internal and external benchmarks and progress towards our strategic priorities.

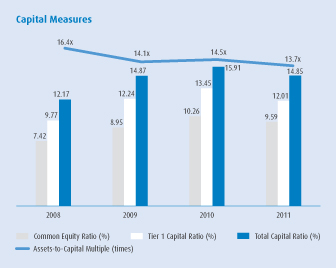

Over the medium term, our financial objectives are to achieve average annual adjusted earnings per share (EPS) growth of 8% to 10%, earn average annual adjusted return on equity (ROE) of between 15% and 18%, generate average annual adjusted operating leverage of 2% or more, and maintain strong capital ratios that exceed regulatory requirements. These objectives are key guideposts as we execute against our strategic priorities. Our operating philosophy is to increase revenues at rates higher than general economic growth rates, while limiting expense growth to achieve average annual adjusted operating leverage (defined as the difference between the growth rates of adjusted revenue and adjusted non-interest expense) of 2% or more. In managing our operations, we balance current profitability with the need to invest in our businesses for future growth.

|

Our Vision To be the bank that defines great customer experience. |

|

Our Guiding Principle We aim to deliver top-tier total shareholder return and balance our commitments to financial performance, our customers, our employees, the environment and the communities where we live and work. |

Our Medium-Term Financial Objectives Over the medium term, achieve average annual adjusted EPS growth of 8% to 10%, earn average annual adjusted ROE of between 15% and 18%, generate average annual adjusted operating leverage of 2% or more, and maintain strong capital ratios that exceed regulatory requirements. |

Reasons to Invest in BMO Ÿ Clear growth strategy Ÿ Well-positioned businesses in the current environment Ÿ Strong financial position Ÿ Proactive risk management Ÿ Commitment to stakeholders |

| | | | | | | | | | | | | | | | |

| | | As at or for the periods ended October 31, 2011 (%, except as noted) | | 1-year | | | 5-year | | | 10-year | | | |

| | Compound annual total shareholder return | | | 2.4 | | | | 1.9 | | | | 10.2 | | | |

| | Compound growth in annual EPS | | | 10.7 | | | | 0.4 | | | | 7.1 | | | |

| | Compound growth in annual adjusted EPS | | | 10.0 | | | | na | | | | na | | | |

| | Average annual ROE | | | 15.3 | | | | 13.6 | | | | 15.2 | | | |

| | Average annual adjusted ROE | | | 15.3 | | | | na | | | | na | | | |

| | Compound growth in annual dividends declared per share | | | – | | | | 4.4 | | | | 9.6 | | | |

| | Dividend yield at October 31, 2011 | | | 4.75 | | | | na | | | | na | | | |

| | Price-to-earnings multiple | | | 11.20 | | | | na | | | | na | | | |

| | Market value/book value ratio | | | 1.49 | | | | na | | | | na | | | |

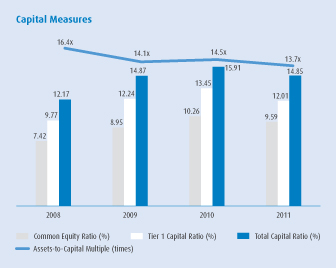

| | Common Equity Ratio | | | 9.59 | | | | na | | | | na | | | |

| | | | | | | | | | | | | | | | |

| | Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94. |

The Our Financial Objectives section above and the Enterprise-Wide Strategy and Economic Developments sections that follow contain certain forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. Please refer to the Caution Regarding Forward-Looking Statements on page 29 of this MD&A for a discussion of such risks and uncertainties and the material factors and assumptions related to the statements set forth in such sections.

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 27 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Enterprise-Wide Strategy

Our Vision

To be the bank that defines great customer experience.

Our Guiding Principle

We aim to deliver top-tier total shareholder return and balance our commitments to financial performance, our customers, our employees, the environment and the communities where we live and work.

Our Strategy in Context

Changes in the economic environment, and their effects on our customers, are ongoing. Our focus on helping our customers succeed and giving them confidence they are making the right financial choices — Making Money Make Sense — serves as a compass for us in all economic environments. It also drives our employees to deliver their best, every day.

Our strategies have proven robust despite significant market uncertainty over the past few years. Recognizing that a company’s first responsibility is to be well managed, we believe that the strength of our business model, balance sheet, risk management framework and leadership team, along with the benefits we expect from the acquisition of Marshall & Ilsley Corporation (M&I) and its successful integration, will continue to generate sustainable growth. We remain steadfastly committed to our strategy, our customers and our shareholders.

Our Priorities and Progress

Drive quality earnings growth across all North American personal and commercial banking businesses by focusing on industry-leading customer experience and enhancing operating and sales force productivity.

In Canada:

| Ÿ | | Strengthened our branch network, opening or upgrading 58 branches and significantly expanding our automated banking machine (ABM) network by adding 136 machines. |

| Ÿ | | Increased the number of mortgage specialists by 13%, financial planners by 9%, commercial cash management specialists and support staff by 18%, and added 150 small business bankers. |

| Ÿ | | Significantly improved the online customer experience, ranking second among the public websites of the largest Canadian banks in Forrester Research Inc.’s 2011 Canadian Online Bank Rankings (July 2011). |

| Ÿ | | Launched compelling new offers, including BMO SmartSteps for Parents, BMO Mobile Banking, a new Online Banking for Business site and a new online personal account application. BMO MoneyLogic continues to be popular, with 280,000 customers using the application. |

| Ÿ | | Invested $43 million in training and development for front-line employees, focusing on improving the quality and consistency of the customer experience, which drives improvement in our loyalty scores. |

In the United States:

| Ÿ | | We now have a significant market presence in eight U.S. states, primarily focused in the U.S. Midwest. The integration of the acquired M&I business is a key focus for the organization and it is well underway. |

| Ÿ | | BMO Harris Bank was ranked as the most reputable U.S. bank by Reputation Institute in a study conducted in collaboration withAmerican Banker. BMO Harris Bank improved on its top 10 ranking from 2010. |

| Ÿ | | Our personal banking Net Promoter Score (excluding M&I) was 43, an increase of three points from 2010. |

| Ÿ | | Continued to help our customers with their financial needs with Helpful Steps; launched Helpful Steps for Small Business and Parents; and strengthened our New Customer Welcome Program. |

| Ÿ | | For the third year in a row, BMO Harris Contact Center was certified as a Center of Excellence by BenchmarkPortal, reflecting our focus on maintaining the highest-quality distribution network. |

| Ÿ | | Customer retention rates continue to be strong. |

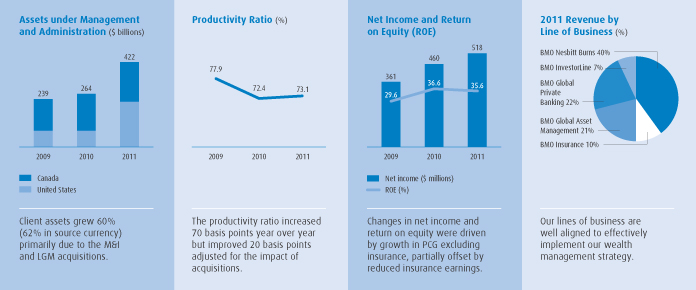

Accelerate the growth of our wealth management businesses by helping our broad range of clients meet all their wealth management needs and by continuing to invest in our North American and global operations.

| Ÿ | | Launched Retirement Savings Outlook, an innovative online tool to help clients determine how much money they need for retirement. |

| Ÿ | | Developed an enhanced creditor insurance offering that increased sales. |

| Ÿ | | Achieved significant ongoing success with joint deal teams, better addressing the complex financial needs of our clients. |

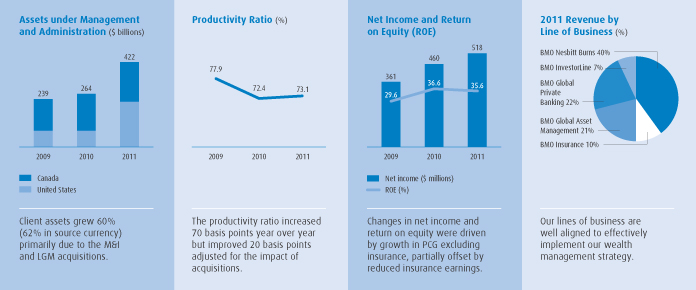

| Ÿ | | The M&I acquisition almost doubled our U.S. private banking footprint. With the acquisition of M&I and Lloyd George Management (LGM), our global asset management business is now one of the 100 largest investment managers worldwide based on assets under management. |

| Ÿ | | In the United States, we now have an established family of mutual funds, a large team of financial advisors and strong capabilities in institutional trust services. |

| Ÿ | | Expanded our Exchange Traded Funds family of lower-cost and risk-diversifying investment products to 44 funds. |

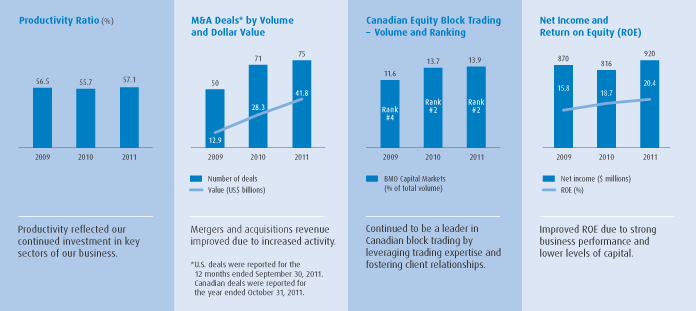

Build deeper client relationships in our capital markets businesses to deliver growth in net income and strong ROE, while maintaining an appropriate risk/return profile.

| Ÿ | | Continued to build a North American Capital Markets business with a unified approach to client coverage, creating a better client experience. |

| Ÿ | | Strengthened our distribution capabilities, including designation as a Primary Dealer by the Federal Reserve Bank of New York, augmenting our U.S. Fixed Income business. |

| Ÿ | | Aligned our capital and capabilities with client opportunity, including expanding our capabilities in U.S. Equity Research and Sales & Trading, as well as extending our Metals & Mining capabilities beyond North America, while also introducing a standardized client prioritization system for Investment and Corporate Banking business in Canada and the United States. |

| Ÿ | | Focused on strategic sectors by expanding coverage in Investment and Corporate Banking and in Research in sectors such as Food & Consumer & Retail, Energy and Technology. |

| Ÿ | | Upgraded talent across our North American and global sectors. |

Develop our business in select global markets to grow with our clients, expand our capabilities and reach new customers.

| Ÿ | | Strengthened our presence in China and globally by expanding our footprint in existing markets and exploring new opportunities to address our current and potential clients’ specific wealth management and capital markets needs. |

| | |

| 28 | | BMO Financial Group 194th Annual Report 2011 |

Sustain a culture that focuses on customers, high performance and our people.

| Ÿ | | Enhanced our offering at BMO’s Institute for Learning, our educational facility that develops inspirational leaders and passionate, customer-focused employees, while fostering BMO’s culture of integrity and ethical decision-making. |

| Ÿ | | Continued to enhance our leading talent management practices, reaffirming BMO as an employer of choice where everyone can contribute to their fullest and strong performance is rewarded. |

| Ÿ | | Sustained a high-performance risk management culture that continually focuses on strengthening and embedding our risk management capabilities and practices across the enterprise. |

| Ÿ | | Strengthened our Technology and Operations (T&O) leadership team, launched a comprehensive communications plan to engage all 9,700 of our T&O employees, and continued to drive productivity improvements across T&O and build capabilities to support our business in delivering a great customer experience. |

| | | | |

| | |

| | Caution Regarding Forward-Looking Statements Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this Annual Report, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United StatesPrivate Securities Litigation Reform Actof 1995 and any applicable Canadian securities legislation. Forward-looking statements may involve, but are not limited to, comments with respect to our objectives and priorities for 2012 and beyond, our strategies or future actions, our targets, expectations for our financial condition or share price, and the results of or outlook for our operations or for the Canadian and U.S. economies. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that predictions, forecasts, conclusions or projections will not prove to be accurate, that our assumptions may not be correct and that actual results may differ materially from such predictions, forecasts, conclusions or projections. We caution readers of this Annual Report not to place undue reliance on our forward-looking statements as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in which we operate; weak, volatile or illiquid capital and/or credit markets; interest rate and currency value fluctuations; changes in monetary, fiscal or economic policy; the degree of competition in the geographic and business areas in which we operate; changes in laws or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance; judicial or regulatory proceedings; the accuracy and completeness of the information we obtain with respect to our customers and counterparties; our ability to execute our strategic plans and to complete and integrate acquisitions; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations on these estimates; operational and infrastructure risks; changes to our credit ratings; general political conditions; global capital markets activities; the possible effects on our business of war or terrorist activities; disease or illness that affects local, national or international economies; natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; technological changes; and our ability to anticipate and effectively manage risks associated with all of the foregoing factors. With respect to the recently completed acquisition of Marshall & Ilsley Corporation (M&I), factors that may influence the future outcomes that relate to forward-looking statements include, but are not limited to: the possibility that the anticipated benefits from the transaction, such as expanding our North American presence, providing synergies, being accretive to earnings and resulting in other impacts on earnings, are not realized in the time frame anticipated, or at all, as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations (including changes to capital requirements) and their enforcement, and the degree of competition in the geographic and business areas in which the combined business now operates; our ability to effectively integrate the businesses of M&I and BMO on a timely basis; reputational risks and the reaction of M&I’s customers to the transaction; diversion of management time to issues related to integration and restructuring; and increased exposure to exchange rate fluctuations. A significant amount of M&I’s business involved making loans or otherwise committing resources to specific borrowers, industries or geographic areas. Unforeseen events affecting such borrowers, industries or geographic areas could have a material adverse effect on the performance of our integrated U.S. operations. Our anticipation that annual cost savings from the integration of M&I and BMO will exceed US$300 million is based on the assumption that changes to business operations and support infrastructure and staffing will be consistent with our plans and that our expectations for business volumes are met. Our anticipation that the M&I acquisition will be accretive to adjusted earnings per share in 2012 is based on the assumption that results in 2012 will be consistent with our expectations based on our experience since the acquisition, our expectations for the economy and anticipated savings from integration and restructuring in 2012. We caution that the foregoing list is not exhaustive of all possible factors. Other factors could adversely affect our results. For more information, please see the discussion below, which outlines in detail certain key factors that may affect Bank of Montreal’s future results. When relying on forward-looking statements to make decisions with respect to Bank of Montreal, investors and others should carefully consider these factors, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. Bank of Montreal does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by the organization or on its behalf, except as required by law. The forward-looking information contained in this document is presented for the purpose of assisting our shareholders in understanding our financial position as at and for the periods ended on the dates presented, as well as our strategic priorities and objectives, and may not be appropriate for other purposes. In calculating the pro-forma impact of Basel III on our regulatory capital, risk-weighted assets (including Counterparty Credit Risk and Market Risk) and regulatory capital ratios, we have assumed that our interpretation of the proposed rules announced by the Basel Committee on Banking Supervision (BCBS) as of this date and our models used to assess those requirements are consistent with the final requirements that will be promulgated by BCBS and the Office of the Superintendent of Financial Institutions Canada (OSFI). We have also assumed that the proposed changes affecting capital deductions, risk-weighted assets, the regulatory capital treatment for non-common share capital instruments (i.e. grandfathered capital instruments) and the minimum regulatory capital ratios are adopted as proposed by BCBS and OSFI. We have also assumed that existing capital instruments that are non-Basel III compliant but are Basel II compliant can be fully included in the October 31, 2011, pro-forma calculations. The full impact of the Basel III proposals has been quantified based on our financial and risk positions at year end or as close to year end as was practical. The impacts of the transition to International Financial Reporting Standards (IFRS) are set out in Transition to International Financial Reporting Standards in the Future Changes in Accounting Policies – IFRS section in this Annual Report. In setting out the expectation that we will be able to refinance certain capital instruments in the future, as and when necessary to meet regulatory capital requirements, we have assumed that factors beyond our control, including the state of the economic and capital markets environment, will not impair our ability to do so. Assumptions about the level of asset sales, expected asset sale prices, net funding cost, credit quality, risk of default and losses on default of the underlying assets of certain structured investment vehicles were material factors we considered when establishing our expectations regarding the structured investment vehicles discussed in this Annual Report, including the amount to be drawn under the BMO liquidity facilities and whether the first-loss protection provided by the subordinated capital notes will exceed future losses. Key assumptions included that assets will continue to be sold with a view to reducing the size of the structured investment vehicles, under various asset price scenarios, and that the level of default and losses will be consistent with the credit quality of the underlying assets and our current expectations regarding continuing difficult market conditions. In determining amounts of asset maturities by year, we have made assumptions as to which issuers will or will not redeem subordinated debt prior to its maturity date, where permitted. Assumptions about the level of default and losses on default were material factors we considered when establishing our expectations regarding the future performance of the transactions into which Apex Trust has entered. Among the key assumptions were that the level of default and losses on default will be consistent with historical experience. Material factors that were taken into account when establishing our expectations regarding the future risk of credit losses in Apex Trust and risk of loss to BMO included industry diversification in the portfolio, initial credit quality by portfolio, the first-loss protection incorporated into the structure and the hedges that BMO has entered. In determining the impact of reductions to interchange fees in the U.S. Regulatory Developments section, we have assumed that business volumes remain consistent with our expectations and that certain management actions are implemented that will modestly reduce the impact of the rules on our revenues. Assumptions about the performance of the Canadian and U.S. economies, as well as overall market conditions and their combined effect on our business, are material factors we consider when determining our strategic priorities, objectives and expectations for our business. In determining our expectations for economic growth, both broadly and in the financial services sector, we primarily consider historical economic data provided by the Canadian and U.S. governments and their agencies. See the Economic Developments section of this Annual Report. | | |

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 29 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Factors That May Affect Future Results

As noted in the preceding Caution Regarding Forward-Looking Statements, all forward-looking statements and information, by their nature, are subject to inherent risks and uncertainties, both general and specific, which may cause actual results to differ materially from the expectations expressed in any forward-looking statement. The Enterprise-Wide Risk Management section starting on page 78 describes a number of risks, including credit and counterparty, market, liquidity and funding, operational, insurance, legal and regulatory, business, model, strategic, reputation and environmental. Should our risk management framework prove ineffective, there could be a material adverse impact on our financial position. The sections that follow outline some additional risks and uncertainties.

General Economic and Market Conditions in the Countries in which We Conduct Business

We conduct business in Canada, the United States and other countries. Factors such as the general health of capital and/or credit markets, including liquidity, level of activity, volatility and stability, could have a material impact on our business. As well, interest rates, foreign exchange rates, consumer saving and spending, consumer borrowing and repayment, business investment, government spending and the rate of inflation affect the business and economic environments in which we operate. Therefore, the amount of business we conduct in a specific geographic region and its local economic and business conditions may have an effect on our revenues and earnings. For example, a regional economic decline may result in an increase in credit losses, a decrease in loan growth and reduced capital markets activity. In addition, the financial services industry is characterized by interrelations among financial services companies. As a result, defaults by other financial services companies in Canada, the United States or other countries could adversely affect our earnings. Given the interconnectedness of global financial markets and the importance of trade flows, deterioration of the still-unresolved European sovereign debt situation could affect the supply and cost of credit and constrain the pace of economic growth in North America.

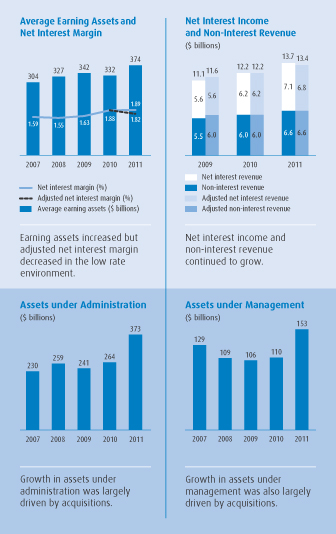

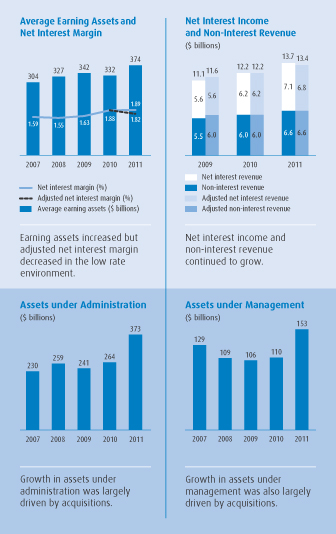

Fiscal, Monetary and Interest Rate Policies

Our earnings are affected by fiscal, monetary, interest rate and economic policies that are adopted by Canadian, U.S. and other regulatory authorities. Such policies can have the effect of reducing competition and increasing uncertainty in the markets. Such policies may also adversely affect our customers and counterparties in the countries in which we operate, causing an increased risk of default by these customers and counterparties. As well, bond and money market expectations about inflation and central bank monetary policy have an impact on the level of interest rates. Changes in market expectations and monetary policy are difficult to anticipate and predict. Fluctuations in interest rates that result from these changes can have an impact on our earnings. The current prolonged low interest rate policies have had a negative impact on results and a continuation of such policies would likely continue to pressure earnings. Refer to the Market Risk section on pages 85 to 88 for a more complete discussion of our interest rate risk exposures.

Changes in Laws, Regulations and Approach to Supervision

Regulations are in place to protect our clients, investors and the public interest. Considerable changes in laws and regulations that relate to the financial services industry have been proposed, including changes related to capital and liquidity requirements. Changes in laws and regulations, including their interpretation and application, and in approaches to supervision could adversely affect our earnings. For example, such changes could limit the products or services we can provide and the manner in which we provide them and, potentially, lower our ability to

compete, while also increasing the costs of compliance. These changes could also affect the levels of capital and liquidity we choose to maintain. In particular, the Basel III global standards for capital and liquidity, which are discussed in the Enterprise-Wide Capital Management section that starts on page 61, and enactment of theDodd-Frank Wall Street Reform and ConsumerProtection Act, which is discussed in the U.S. Regulatory Developments section on page 69, will have an impact on our results or activities. Liquidity and funding risk is discussed starting on page 88. In addition to the factors outlined here, our failure to comply with laws and regulations could result in sanctions and financial penalties that could adversely affect our reputation and earnings.

Execution of Strategy

Our financial performance is influenced by our ability to execute strategic plans developed by management. If these strategic plans do not meet with success or if there is a change in these strategic plans, our earnings could grow at a slower pace or decline. In addition, our ability to execute our strategic plans is dependent to a large extent on our ability to attract, develop and retain key executives, and there is no assurance we will continue to do so successfully.

Acquisitions

We conduct thorough due diligence before completing an acquisition. However, it is possible that we might make an acquisition that subsequently does not perform in line with our financial or strategic objectives. Our ability to successfully complete an acquisition may be subject to regulatory and shareholder approvals and we may not be able to determine when or if, or on what terms, the necessary approvals will be granted. Changes in the competitive and economic environment as well as other factors may lower revenues, while higher than anticipated integration costs and failure to realize expected cost savings could also adversely affect our earnings after an acquisition. Integration costs may increase as a result of increased regulatory costs related to an acquisition, unanticipated costs that were not identified in the due diligence process or more significant demands on management time than anticipated, as well as unexpected delays in implementing certain plans that in turn lead to delays in achieving full integration. In particular, risks associated with the acquisition of M&I are discussed in the Acquisition of Marshall & Ilsley Corporation (M&I) section on page 36. Our post-acquisition performance is also contingent on retaining the clients and key employees of acquired companies, and there can be no assurance that we will always succeed in doing so.

Level of Competition

The level of competition among financial services companies is high. Furthermore, non-financial companies have increasingly been offering services traditionally provided by banks. Customer loyalty and retention can be influenced by a number of factors, including service levels, prices for products or services, our reputation and the actions of our competitors. Also, laws and regulations enacted by regulatory authorities in the United States and other jurisdictions in which we operate may provide benefits to our international competitors that could affect our ability to compete. Changes in these factors or any subsequent loss of market share could adversely affect our earnings.

Currency Rates

The Canadian dollar equivalents of our revenues and expenses denominated in currencies other than the Canadian dollar are subject to fluctuations in the value of the Canadian dollar relative to those currencies. Changes in the value of the Canadian dollar relative to the U.S. dollar may also affect the earnings of our small business, corporate and commercial clients in Canada. Refer to the Foreign Exchange section on page 38 and the Market Risk section on pages 85 to 88 for a more complete discussion of our foreign exchange risk exposures.

| | |

| 30 | | BMO Financial Group 194th Annual Report 2011 |

Changes to Our Credit Ratings

Credit ratings are important to our ability to raise both capital and funding to support our business operations. Maintaining strong credit ratings allows us to access the capital markets at competitive pricing. Should our credit ratings experience a material downgrade, our costs of funding would likely increase significantly and our access to funding and capital through capital markets could be reduced. A material downgrade of our ratings could also have other consequences, including those set out in Note 10 on page 138 of the financial statements.

Operational and Infrastructure Risks

We are exposed to many of the operational risks that affect large enterprises conducting business in multiple jurisdictions. Such risks include the risk of fraud by employees or others, unauthorized transactions by employees, and operational or human error. We also face the risk that computer or telecommunications systems could fail, despite our efforts to maintain these systems in good working order. Some operational aspects of our services, such as online banking, have inherent security risks due to the nature of the risks related to the use of the internet in the delivery of these services, which may impact our customers and infrastructure. Given the high volume of transactions we process on a daily basis, certain errors may be repeated or compounded before they are discovered and rectified. Shortcomings or failures of our internal processes, employees or systems, or those provided by third parties, including any of our financial, accounting or other data processing systems, could lead to financial loss and damage our reputation. In addition, despite the contingency plans we have in place, our ability to conduct business may be adversely affected by a disruption in the infrastructure that supports both our operations and the communities in which we do business, including but not limited to disruption caused by public health emergencies or terrorist acts.

Judicial or Regulatory Judgments and Legal and Regulatory Proceedings

We take reasonable measures to comply with the laws and regulations of the jurisdictions in which we conduct business. Should these measures prove not to be effective, it is possible that we could be subject to a judicial or regulatory judgment or decision which results in fines, damages or other costs that would adversely affect our earnings and reputation. We are also subject to litigation arising in the ordinary course of our business. The unfavourable resolution of any litigation could have a material adverse effect on our financial results. Damage to our reputation could also result, harming our future business prospects. Information about certain legal and regulatory proceedings we currently face is provided in Note 28 on page 170 of the financial statements.

Critical Accounting Estimates and Accounting Standards

Beginning on November 1, 2011, we will prepare our financial statements in accordance with International Financial Reporting Standards (IFRS). Changes by the International Accounting Standards Board to international financial accounting and reporting standards that will govern the preparation of our financial statements can be difficult to anticipate and may materially affect how we record and report our financial results. The impact of the adoption of these standards is discussed in the Future Changes in Accounting Policies – IFRS section on page 73. Significant accounting policies and the impact of the adoption of IFRS are discussed in Note 1 on page 119 of the financial statements.

We currently prepare our financial statements in accordance with Canadian generally accepted accounting principles (GAAP). The application of GAAP and IFRS require that management make significant judgments and estimates that can affect when certain assets, liabilities, revenues and expenses are recorded in our financial statements and their recorded values. In making these judgments and estimates, we rely on the best information available at the time. However, it is possible that circumstances may change or new information may become available.

Our financial results would be affected in the period in which any such new information or change in circumstances became apparent, and the extent of the impact could be significant. More information is included in the discussion of Critical Accounting Estimates on page 70.

Accuracy and Completeness of Customer and Counterparty Information

When deciding to extend credit or enter into other transactions with customers and counterparties, we may rely on information provided by or on behalf of those customers and counterparties, including audited financial statements and other financial information. We also may rely on representations made by customers and counterparties that the information they provide is accurate and complete. Our financial results could be adversely affected if the financial statements or other financial information provided by customers and counterparties is materially misleading.

Other Factors

Other factors beyond our control that may affect our future results are noted in the Caution Regarding Forward-Looking Statements on page 29.

We caution that the preceding discussion of factors that may affect future results is not exhaustive. When relying on forward-looking statements to make decisions with respect to BMO, investors and others should carefully consider these factors, as well as other uncertainties, potential events and industry and company-specific factors that may adversely affect future results. We do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by law.

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 31 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Economic Developments

Economic and Financial Services Developments in 2011

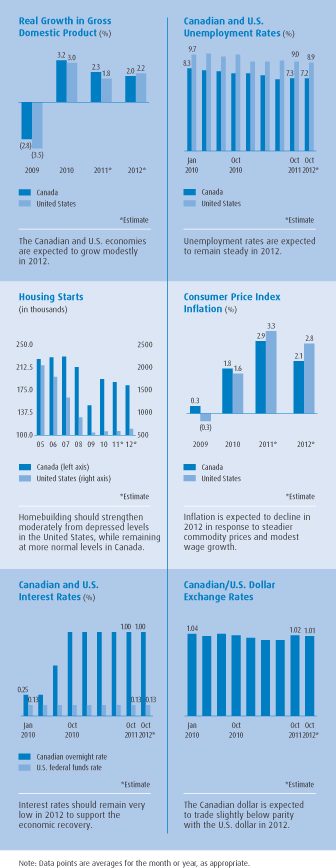

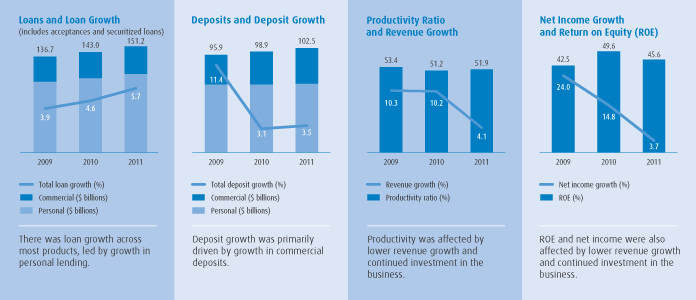

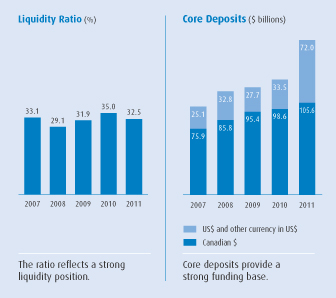

After recovering strongly in 2010, economic growth in Canada slowed to 2.3% in 2011. The export sector was the major constraint on growth as a result of the strong Canadian dollar and weak demand in the developed economies of the United States and Europe. Consumer spending also moderated in response to high levels of household debt, reducing personal loan growth. In contrast, business investment remained strong and business loan growth picked up in response to low interest rates and continued robust demand for resources from emerging-market economies. Housing markets also remained buoyant, supporting mortgage growth, but have moderated in response to tighter mortgage insurance rules. Employment growth remained healthy, reducing the unemployment rate. Despite low interest rates, personal deposit growth improved, reflecting a decrease in investors’ risk tolerance in the face of growing concerns about a U.S. recession and European sovereign debt and economic difficulties. Business deposit growth also remained healthy due to strong growth in profits and the uncertain investment climate.

Economic growth in the United States in 2011 is estimated to have slowed to 1.8% from 3% in 2010. While exports and business investment remained strong, consumer spending weakened, housing markets and commercial construction remained soft, and state and municipal governments continued to reduce spending and payrolls. In response to increased economic and fiscal uncertainty, businesses held back on hiring, undermining consumer spending. Demand for consumer credit and residential mortgages remained weak. The Federal Reserve maintained its near-zero rate policy and expanded its asset purchases in the first half of the year to support the economic recovery. In the Midwest, where most of our U.S. operations are located, the economy grew at an estimated 1.9%, with strong export sales and healthy manufacturing and agricultural activity offsetting soft housing markets and the effects of state and local budget cuts.

Economic and Financial Services Outlook for 2012

Assuming European credit and economic difficulties are contained, the Canadian economy is expected to continue growing at a real rate of close to 2% in 2012, led by the resource-producing Western provinces. Support from low interest rates and relatively high commodity prices will likely be offset by the effects of the strong Canadian dollar and slow growth in the developed economies. In this modest growth environment, the unemployment rate is likely to remain above 7%. Growth in residential mortgages and personal credit will likely moderate, although demand for business credit should continue to improve in response to strong investment spending. The Bank of Canada is expected to keep interest rates at low levels in 2012 to support the economic recovery. The Canadian dollar should trade slightly below parity with the U.S. dollar, supported by firm commodity prices.

The U.S. economy is projected to grow by approximately 2.2% in 2012, restrained by continued fiscal retrenchment at the state and municipal levels. Depending on the outcome of various budgetary and stimulus measures being considered by congress, growth could be weaker than expected. However, healthy business balance sheets will likely encourage investment growth, supporting demand for business credit. Housing markets and residential mortgage growth are expected to improve modestly in 2012, supported by the Federal Reserve’s low

interest rate policy. Continued uncertainty about Europe’s economy could constrain capital markets activity.

The U.S. Midwest economy is expected to grow 2.3% in 2012, a rate slightly faster than the national economy, supported by strong business investment, a pickup in the automotive industry and continued solid demand for farm products.

| | |

| 32 | | BMO Financial Group 194th Annual Report 2011 |

Value Measures

Highlights

| | Ÿ | | Total shareholder return (TSR) – Our three-year TSR was 17.4%, driven by annual returns of more than 20% in 2009 and 2010. |

| | Ÿ | | Earnings per share (EPS) growth – EPS grew 10% from 2010 on an adjusted basis, as net income rose significantly. There was good revenue growth, along with lower provisions for credit losses. Expenses increased at a slightly higher rate than revenues, but incremental revenues exceeded incremental costs, contributing to net income growth. There was a higher effective income tax rate in 2011. The average number of common shares outstanding increased, primarily due to the issuance of common shares on the acquisition of M&I. |

| Ÿ | | Net income increased $456 million or 16% to $3,266 million. Adjusted net income was up 15%, increasing $439 million to $3,281 million. There was continued growth in all operating groups. | |

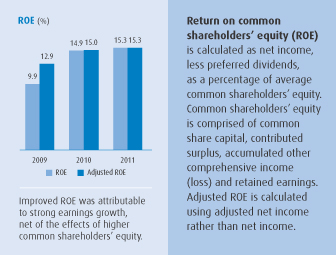

| Ÿ | | Adjusted return on equity (ROE) was 15.3% in 2011, up from 15.0% in 2010 due to increased adjusted net income. BMO has achieved an ROE of 13% or better in 21 of the past 22 years, one of only two banks in our North American peer group to have done so. | |

| Ÿ | | We maintained our dividend payments at $2.80 per common share in 2011 while issuing common shares for the M&I acquisition and continuing to maintain strong capital levels. Dividends paid per common share over five-year and ten-year periods have increased at average annual compound rates of 5.6% and 9.9%, respectively. | |

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94.

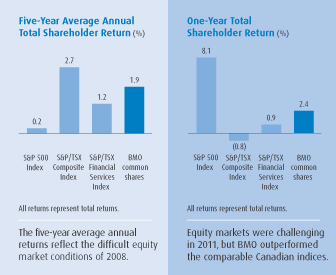

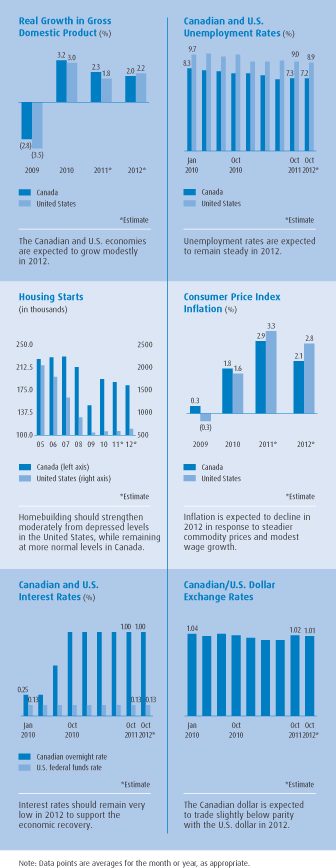

Total Shareholder Return

The five-year average annual TSR is a key measure of shareholder value and is the most important of our financial performance and condition measures, since it assesses our success in achieving our guiding principle of achieving top-tier shareholder returns. Over the past five years, shareholders have earned an average annual TSR of 1.9% on their investment in BMO common shares. The five-year average was suppressed primarily by the low valuations in the difficult equity market conditions of 2008. BMO’s one-year TSR of 2.4% was higher than the comparable Canadian indices. Annual returns of more than 20% in each of 2009 and 2010 resulted in a strong three-year average annual TSR of 17.4%.

The table below summarizes dividends paid on BMO common shares over the past five years and the movements in BMO’s share price. An investment of $1,000 in Bank of Montreal common shares made at the beginning of fiscal 2007 would have been worth $1,099 at October 31, 2011, assuming reinvestment of dividends, for a total return of 9.9%. We maintained our dividend payments at $0.70 per common share in each quarter of 2011, consistent with payments in the past two years, but dividends paid over five-year and ten-year periods have increased at average annual compound rates of 5.6% and 9.9%, respectively.

The average annual TSR of 1.9% for the most recent five-year period deteriorated from the 5.9% average annual return for the five years ended October 31, 2010. The averages are affected by each one-year TSR included in the calculations.

Thefive-year average annual total shareholder return (TSR) represents the average annual total return earned on an investment in Bank of Montreal common shares made at the beginning of a five-year period. The return includes the change in share price and assumes that dividends received were reinvested in additional common shares. The one-year TSR also assumes that dividends were reinvested in shares.

Total Shareholder Return

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the year ended October 31 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | Three-year CAGR (1) | | | Five-year CAGR (1) | |

Closing market price per common share ($) | | | 58.89 | | | | 60.23 | | | | 50.06 | | | | 43.02 | | | | 63.00 | | | | 11.0 | | | | (3.2 | ) |

Dividends paid ($ per share) | | | 2.80 | | | | 2.80 | | | | 2.80 | | | | 2.80 | | | | 2.63 | | | | – | | | | 5.6 | |

Dividends paid (%) (2) | | | 4.6 | | | | 5.6 | | | | 6.5 | | | | 4.4 | | | | 3.8 | | | | | | | | | |

Increase (decrease) in share price (%) | | | (2.2 | ) | | | 20.3 | | | | 16.4 | | | | (31.7 | ) | | | (9.3 | ) | | | | | | | | |

Total shareholder return (%) | | | 2.4 | | | | 26.4 | | | | 25.1 | | | | (27.9 | ) | | | (5.8 | ) | | | 17.4 | | | | 1.9 | |

| | Total annual shareholder return assumes reinvestment of quarterly dividends and therefore does not equal the sum of dividend and share price returns in the table. |

| | (1) | Compound annual growth rate (CAGR) expressed as a percentage. |

| | (2) | As a percentage of the closing market price in the prior year. |

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 33 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Adjusting Items

We have designated certain amounts as adjusting items and have adjusted GAAP results so that we can present and discuss financial results without the effects of adjusting items to facilitate understanding of business performance and related trends. Management assesses performance on a GAAP basis and on an adjusted basis and considers both to be useful in the assessment of underlying business performance. Presenting results on both bases provides readers with an enhanced understanding of how management assesses results. Adjusted results and measures are non-GAAP and, together with items excluded in determining adjusted results, are disclosed in more detail in the Non-GAAP Measures section on page 94, along with comments on the uses and limitations of such measures.

The adjusting items that reduced net income in 2011 by $15 million or $0.03 per share were:

| Ÿ | | the $107 million after-tax net benefit of credit-related items in respect of the acquired M&I loan portfolio, including $271 million for the recognition in net interest income of a portion of the credit mark on the portfolio (including $161 million for credit mark amortization and $110 million for the release of the credit mark related to early repayment of loans), net of a $98 million increase in provisions for credit losses on the portfolio, primarily due to an $80 million increase in the general allowance; |

| Ÿ | | costs of $131 million ($84 million after tax) for M&I integration and restructuring, including professional fees for integration planning as well as costs for systems development and certain severance; |

| Ÿ | | amortization of acquisition-related intangible assets of $70 million ($54 million after tax), including $34 million ($22 million after tax) related to the acquired M&I business; |

| Ÿ | | a charge to revenue for the hedge of foreign exchange risk on the purchase of M&I of $20 million ($14 million after tax); and |

| Ÿ | | a decrease in the general allowance for credit losses, for loans other than the acquired M&I portfolio of $42 million ($30 million after tax). |

In 2010, there was one adjusting item, the amortization of acquisition-related intangible assets of $36 million ($32 million after tax).

Adjusting Items (Pre-Tax)

| | | | | | | | | | | | |

| ($ millions) | | 2011 | | | 2010 | | | 2009 | |

Hedge of foreign exchange risk on the purchase of M&I | | | (20 | ) | | | – | | | | – | |

Credit-related items on the acquired M&I loan portfolio | | | 173 | | | | – | | | | – | |

Costs of M&I integration and restructuring | | | (131 | ) | | | – | | | | – | |

Amortization of acquisition-related intangible assets | | | (70 | ) | | | (36 | ) | | | (43 | ) |

Decrease (increase) in the general allowance (other than M&I) | | | 42 | | | | – | | | | (60 | ) |

Charges related to deterioration in capital markets environment | | | – | | | | – | | | | (521 | ) |

Severance costs | | | – | | | | – | | | | (118 | ) |

Reduction in pre-tax income due to adjusting items in reported results | | | (6 | ) | | | (36 | ) | | | (742 | ) |

Adjusting Items (After Tax)

| | | | | | | | | | | | |

| ($ millions) | | 2011 | | | 2010 | | | 2009 | |

Hedge of foreign exchange risk on the purchase of M&I | | | (14 | ) | | | – | | | | – | |

Credit-related items on the acquired M&I loan portfolio | | | 107 | | | | – | | | | – | |

Costs of M&I integration and restructuring | | | (84 | ) | | | – | | | | – | |

Amortization of acquisition-related intangible assets | | | (54 | ) | | | (32 | ) | | | (35 | ) |

Decrease (increase) in the general allowance (other than M&I) | | | 30 | | | | – | | | | (39 | ) |

Charges related to deterioration in capital markets environment | | | – | | | | – | | | | (355 | ) |

Severance costs | | | – | | | | – | | | | (80 | ) |

Reduction in net income after tax due to adjusting items in reported results | | | (15 | ) | | | (32 | ) | | | (509 | ) |

Adjusting items in 2009 included amounts related to deterioration in the capital markets environment charged to BMO Capital Markets and severance charges recorded in Corporate Services.

Further details on the effects of adjusting items can be found on page 95.

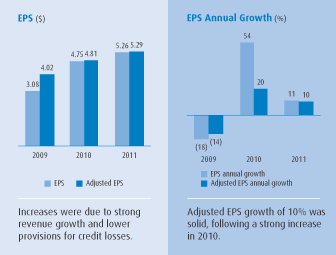

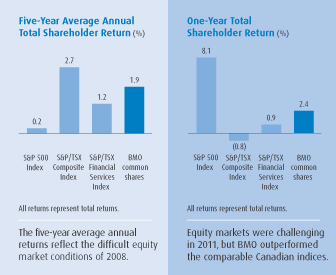

Earnings per Share Growth

The year-over-year percentage change in earnings per share (EPS) and in adjusted EPS are our key measures for analyzing earnings growth. All references to EPS are to diluted EPS, unless indicated otherwise.

EPS was $5.26, up $0.51 or 11% from $4.75 in 2010. Adjusted EPS was $5.29, up $0.48 or 10% from $4.81 in 2010. Our three-year compound average annual adjusted EPS growth rate was 4.0%, below our current medium-term objective of average annual adjusted EPS growth of 8% to 10%, as EPS growth was affected by our decision to increase capital. Adjusted net income available to common shareholders was 33% higher than in the 2008 base year, while the average number of diluted common shares outstanding increased 17% over the same period as we chose to bolster capital levels in 2009 and 2010 and issued common shares on the acquisition of M&I in July 2011.

Net income was $3,266 million in 2011, up $456 million or 16% from $2,810 million a year ago. Adjusted net income was $3,281 million, up $439 million or 15%.

Amounts in the rest of this Earnings per Share Growth section are stated on an adjusted basis.

There was good revenue growth and a decrease in provisions for credit losses. Expenses increased at a slightly higher rate than revenues, but incremental revenues exceeded incremental costs, contributing to net income growth. There was a higher effective income tax rate in 2011.

| | | | |

| | Earnings per share (EPS) is calculated by dividing net income, after deduction of preferred dividends, by the average number of common shares outstanding. Diluted EPS, which is our basis for measuring performance, adjusts for possible conversions of financial instruments into common shares if those conversions would reduce EPS, and is more fully explained in Note 25 on page 166 of the financial statements. Adjusted EPS is calculated in the same manner using adjusted net income. | | |

| | |

| 34 | | BMO Financial Group 194th Annual Report 2011 |

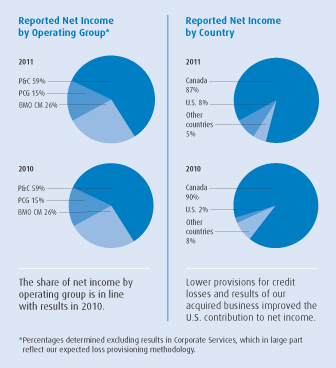

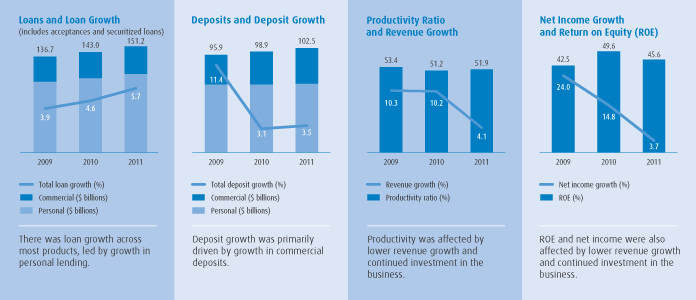

Personal and Commercial Banking results in 2011 continued to show strong growth, while net income in Private Client Group and BMO Capital Markets was up significantly from 2010 and the net loss in Corporate Services was reduced.

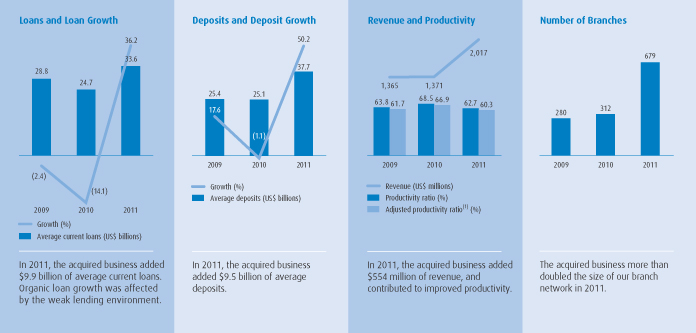

Personal and Commercial Banking (P&C) net income rose $221 million or 12% from a year ago to $2,100 million. The P&C group combines our two retail and business banking operating segments, Personal and Commercial Banking Canada (P&C Canada) and Personal and Commercial Banking U.S. (P&C U.S.). P&C Canada net income rose $64 million or 3.9% to $1,710 million. The improvement was attributable to volume-driven revenue growth, partially offset by lower net interest margin. P&C Canada results are discussed in the operating group review on page 47. P&C U.S. net income increased $157 million or 67% to $390 million, but increased US$171 million or 77% on a U.S. dollar basis. That increase was attributable to the US$142 million impact of the acquired M&I business and a US$29 million or 13% increase from organic operations. P&C U.S. results are discussed in the operating group review on page 50.

Private Client Group (PCG) net income increased $62 million or 13% to $528 million. The increase was largely attributable to revenue growth in all of PCG’s businesses, except insurance, and the results of the acquired M&I business. PCG results are discussed in the operating group review on page 53.

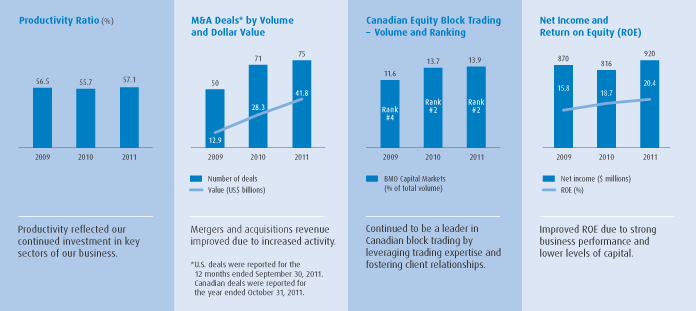

BMO Capital Markets (BMO CM) net income increased $103 million or 13% to $920 million due to a lower provision for credit losses, improved investment banking fees and a lower effective income tax rate. Revenue growth was affected by a weaker market environment late in the year. BMO CM results are discussed in the operating group review on page 56.

Corporate Services net loss decreased $53 million to $267 million as a result of improved revenues, in part reflecting the M&I acquisition, and lower provisions for credit losses recorded in Corporate Services under BMO’s expected loss provisioning methodology. This methodology and Corporate Services results are discussed in the operating group review on page 59.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94.

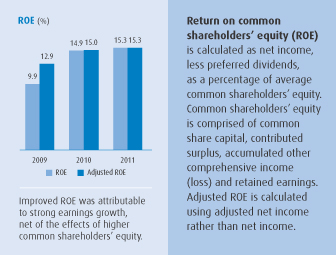

Return on Equity

Return on equity (ROE) is another key value measure. ROE and adjusted ROE were 15.3% in 2011, compared with 14.9% and 15.0%, respectively, in 2010. The improvements were primarily attributable to an increase of $448 million in earnings ($431 million in adjusted earnings) available to common shareholders. Average common shareholders’ equity increased by almost $2.5 billion from 2010 primarily due to the issuance of common shares to M&I shareholders in July as consideration for the acquisition, as well as internally generated capital. Adjusted ROE of 15.3% was in line with our medium-term objective of earning average annual adjusted ROE of 15% to 18%. BMO has achieved an ROE of 13% or better in 21 of the past 22 years, one of only two banks in our North American peer group to have done so. As in 2010, our ROE in 2011 compared favourably with our global peers. Table 3 on page 101 includes ROE statistics for the past 10 years.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94.

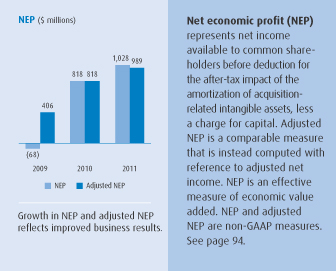

Net Economic Profit Growth

The last of our four key value measures is net economic profit (NEP)growth. Adjusted NEP was $989 million, up $171 million or 21%. The improvement was attributable to an increase in earnings across all groups, net of a higher charge for capital as a result of the increase in shareholders’ equity. NEP calculations are set out in the table that follows.

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 35 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Net Economic Profit($ millions, except as noted)

| | | | | | | | | | | | | | | | | | | | |

| For the year ended October 31 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net income available to common shareholders | | | 3,122 | | | | 2,674 | | | | 1,667 | | | | 1,905 | | | | 2,088 | |

After-tax impact of the amortization of acquisition-related intangible assets | | | 54 | | | | 32 | | | | 35 | | | | 35 | | | | 38 | |

Net income available to common shareholders after adjusting for the amortization of acquisition-related intangible assets | | | 3,176 | | | | 2,706 | | | | 1,702 | | | | 1,940 | | | | 2,126 | |

Charge for capital* | | | (2,148 | ) | | | (1,888 | ) | | | (1,770 | ) | | | (1,535 | ) | | | (1,523 | ) |

Net economic profit | | | 1,028 | | | | 818 | | | | (68 | ) | | | 405 | | | | 603 | |

| | | | | |

After-tax impact of the amortization of acquisition-related intangible assets | | | (54 | ) | | | (32 | ) | | | (35 | ) | | | (35 | ) | | | (38 | ) |

After-tax impact of adjusting items | | | 15 | | | | 32 | | | | 509 | | | | 460 | | | | 675 | |

Adjusted net economic profit | | | 989 | | | | 818 | | | | 406 | | | | 830 | | | | 1,240 | |

Net economic profit growth (%) | | | 26 | | | | +100 | | | | (+100 | ) | | | (33 | ) | | | (51 | ) |

Adjusted net economic profit growth (%) | | | 21 | | | | +100 | | | | (51 | ) | | | (33 | ) | | | 3 | |

*Charge for capital | | | | | | | | | | | | | | | | | | | | |

Average common shareholders’ equity | | | 20,452 | | | | 17,980 | | | | 16,865 | | | | 14,612 | | | | 14,506 | |

Cost of capital (%) | | | 10.5 | | | | 10.5 | | | | 10.5 | | | | 10.5 | | | | 10.5 | |

Charge for capital | | | (2,148 | ) | | | (1,888 | ) | | | (1,770 | ) | | | (1,535 | ) | | | (1,523 | ) |

NEP and adjusted results in this section are non-GAAP measures and are discussed in the Non-GAAP Measures section on page 94.

Acquisition of Marshall & Ilsley Corporation (M&I)

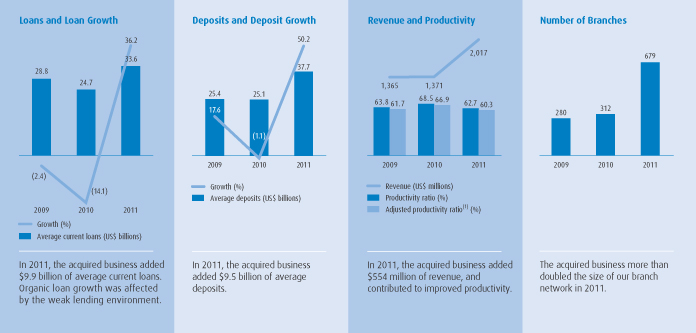

On July 5, 2011, BMO completed the acquisition of M&I for consideration of $4.0 billion in the form of approximately 67 million common shares issued to M&I shareholders. M&I Bank combined with Harris Bank to form BMO Harris Bank. In addition, immediately prior to the closing of the transaction, a BMO subsidiary purchased from the U.S. Treasury all of M&I’s outstanding Troubled Asset Relief Program (TARP) preferred shares and warrants for cash consideration of approximately US$1.7 billion.

At acquisition, inclusion of the assets and liabilities of M&I added $29 billion of loans, after adjustment for expected credit losses, and $34 billion of deposits. The allocation of the purchase price is subject to refinement as we complete the valuation of the assets acquired and liabilities assumed. The acquisition more than doubled our U.S. branch count to 688, added more than one million customers and increased BMO’s total assets under management and administration to over $530 billion at the date of acquisition.

We expect that annual cost savings from the integration of M&I and BMO will exceed US$300 million. We also expect there to be opportunities to add to revenues through expanded access to existing and new markets resulting from increased brand awareness and a greater ability to compete in the market. In fiscal 2011, M&I acquired businesses contributed $167 million to BMO’s net income and $180 million to adjusted net income. We now anticipate that the M&I acquisition will be accretive to BMO’s adjusted EPS for fiscal 2012.

M&I’s activities are primarily reflected in our P&C U.S., Private Client Group and Corporate Services segments, with a small amount included in BMO Capital Markets.

Integration and restructuring costs are included in non-interest expense in Corporate Services and are expected to total approximately US$600 million by the time integration has been completed in the next few years. We recorded US$131 million of such expenses in 2011. These include amounts related to system conversions, severance and other employee-related charges, as well as other integration expenses, such as consulting fees and marketing costs in connection with customer communications and rebranding activities.

Prior to the close of the transaction, approximately US$1.0 billion of impaired real estate secured assets, comprised primarily of commercial real estate loans, were transferred from P&C U.S. to Corporate Services to allow our businesses to focus on ongoing customer relationships and leverage the risk management expertise in our special assets management unit. Prior period loan balances, revenues and expenses have been restated to reflect the transfer. In addition, similar assets valued at approximately

US$1.5 billion that were acquired on the M&I transaction were included in Corporate Services for the same reasons.

Corporate Services net income includes the $107 million net after-tax benefit of credit-related items on the acquired M&I loan portfolio. A portion of the credit mark is recognized as higher effective yield in net interest income over the life of the purchased loan portfolio to reflect the risk profile of the acquired portfolio. Of the total credit mark of $3.5 billion on the loans and $0.2 billion on undrawn commitments and letters of credit, $1.3 billion will be amortized over time to net interest income as increased yield on the portfolio, and $2.4 billion will not be amortized. The portion that will not be amortized relates to credit impaired loans and the portion of the credit mark on performing term loans in respect of losses that existed in the portfolio on the acquisition date that were not specifically identified at that time. This latter portion of the credit mark will be reviewed regularly and any changes in the credit quality of the portfolio will be recognized through the provision for credit losses when they occur. When acquired performing loans are repaid at amounts above their discounted value, any remaining credit mark will be recognized in net interest income. In 2011, $110 million was recognized in net interest income as a result of loan repayments. The entire credit mark is amortized on non-credit impaired revolving facilities, undrawn commitments and letters of credit and a general allowance is built as appropriate as the credit mark is amortized. These impacts, together with any related provision for credit losses, are considered adjusting items and are not included in adjusted net income.

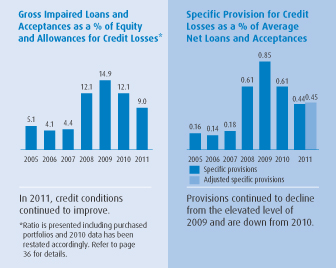

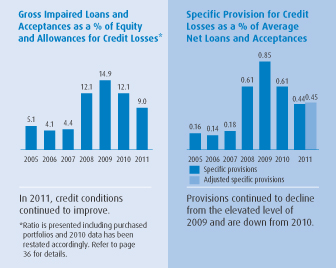

As a result of the addition of loans acquired in the M&I transaction, certain credit quality ratios are now less comparable to the ratios of prior periods or our peer group, as the ratios now reflect the impact of the acquired loans and certain adjusting items related to them. The ratios most affected are the provision for credit losses-to-average net loans and acceptances, allowance for credit losses-to-gross impaired loans (GIL), GIL-to-gross loans and acceptances and general allowance to credit risk-weighted assets. We have presented these ratios in the MD&A including and excluding the impact of the purchased portfolios to provide for better comparison to the ratios in prior periods and the ratios of our peers.

While the acquisition of M&I adds scale and provides an effective entry into new markets, integration risk is a key focus for the organization. It includes risks related to customer and employee retention and system integration. We are addressing these risks by maintaining our program management office, along with experienced BMO and former M&I staff who are tasked with ensuring these risks are well managed. Both organizations have considerable experience with integrating acquired businesses and the integration is now well underway.

Caution

This Acquisition of Marshall & Ilsley Corporation (M&I) section contains forward-looking statements.

Please see the Caution Regarding Forward-Looking Statements.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94.

| | |

| 36 | | BMO Financial Group 194th Annual Report 2011 |

2011 Financial Performance Review

This section provides a review of our enterprise financial performance for 2011 that focuses on the Consolidated Statement of Income included in our consolidated financial statements, which begin on page 115. A review of our operating groups’ strategies and performance follows the enterprise review. A summary of the enterprise financial performance for 2010 appears on page 96. This section contains adjusted results, which are non-GAAP and are disclosed in more detail in the Non-GAAP Measures section on page 94.

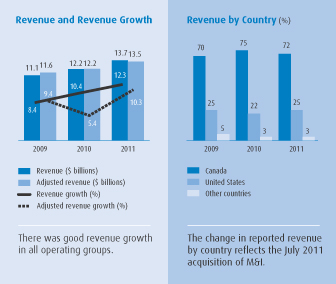

Highlights

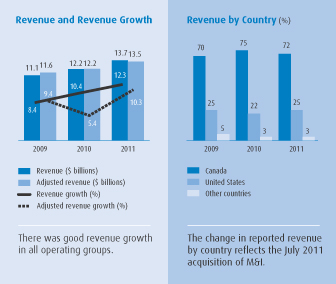

| | Ÿ | | Revenue increased $1,508 million or 12% in 2011 to $13.7 billion. Adjusted revenue increased $1,257 million or 10% to $13.5 billion, following growth of 5% in 2010 and 9% in 2009. This consistently high rate of revenue growth demonstrates the benefit of our diversified business mix and successful execution against our strategic priorities, in market conditions that have been challenging at times. |

| | Ÿ | | Revenue growth in P&C Canada was primarily attributable to volume growth in most products, offset in part by a modest decline in net interest margin. P&C U.S. revenue growth reflected the results of our acquired M&I business, as well as significant margin improvement. Revenue growth in Private Client Group was strong in most businesses, reflecting the impact of acquisitions, but was reduced by the impact of earthquake-related reinsurance claims. BMO Capital Markets recorded modest revenue growth, but contributed increased profitability. There was also a modest improvement in Corporate Services revenue. |

| | Ÿ | | Specific provisions for credit losses were $819 million, compared with $1,049 million in 2010. Specific provisions were down $248 million on an adjusted basis and down $230 million on a reported basis. While credit market conditions have improved over the past two years, uncertainty regarding the global economic recovery persists. | |

| | Ÿ | | Adjusted non-interest expense increased due to continued investment in our people and in technology and due to the impact of our acquired businesses, reduced in part by the effects of the weaker U.S. dollar. | |

| | Ÿ | | The effective income tax rate was 21.5%, compared with 19.2% in 2010. The adjusted effective income tax rate(1) was21.3%, compared with a rate of 19.2% in 2010. The higher effective rate in 2011 was mainly attributable to proportionately lower tax-exempt income and lower net recoveries of prior periods’ income taxes. | |

| (1) | The adjusted rate is computed using adjusted net income rather than net income in the determination of income subject to tax. |

Impact of Business Acquisitions

BMO Financial Group has selectively acquired a number of businesses. These acquisitions increase revenues and expenses, affecting year-over-year comparisons of operating results. The adjacent table outlines significant acquisitions by operating group and their impact on BMO’s adjusted revenues, adjusted expenses and adjusted net income for 2011, 2010 and 2009, to assist in analyzing changes in results. The impact on adjusted net income includes the impact of adjusted provisions for credit losses and income taxes, which are not disclosed separately in the table. Adjusting items are excluded from amounts reflected in the table and are discussed in the Adjusting Items section on page 34.

For 2011, on an adjusted basis, the significant business acquisitions contributed $926 million of revenue, $587 million of expense and $214 million of net income. On a reported basis, they contributed $1,178 million of revenue, $767 million of expense and $190 million of net income.

Impact of Significant Business Acquisitions on Adjusted Operating Results($ millions)

| | | | | | | | | | | | |

Business acquired | | Adjusted | |

| | Revenue | | | Expense | | | Net income | |

Personal and Commercial Banking Canada | | | | | | | | | | | | |

Diners Club North American franchise (1) Acquired December 2009 | | | | | | | | | |

Effects on results for:2011 | | | 110 | | | | 65 | | | | 12 | |

2010 | | | 114 | | | | 40 | | | | 27 | |

Personal and Commercial Banking U.S. | | | | | | | | | | | | |

M&I | | | | | | | | | | | | |

Effects on results for:2011 | | | 552 | | | | 275 | | | | 142 | |

AMCORE Bank N.A. – certain assets and liabilities Acquired April 2010 | | | | | | | | | |

Effects on results for:2011 | | | 66 | | | | 48 | | | | 8 | |

2010 | | | 44 | | | | 39 | | | | 3 | |

Private Client Group | | | | | | | | | | | | |

M&I | | | | | | | | | | | | |

Effects on results for:2011 | | | 115 | | | | 92 | | | | 14 | |

Lloyd George Management Acquired April 2011 Effects on results for:2011 | | | 15 | | | | 18 | | | | (2 | ) |

AIG Life Insurance Company of Canada (BMO Life Assurance) Acquired April 2009 | | | | | |

Effects on results for:2011 | | | 95 | | | | 74 | | | | 15 | |

2010 | | | 106 | | | | 69 | | | | 26 | |

2009 | | | 64 | | | | 33 | | | | 21 | |

BMO Capital Markets | | | | | | | | | | | | |

M&I | | | | | | | | | | | | |

Effects on results for:2011 | | | 7 | | | | 9 | | | | 1 | |

BMO Financial Group | | | | | | | | | | | | |

Effects on results for:2011 (2) | | | 926 | | | | 587 | | | | 214 | |

2010 | | | 264 | | | | 148 | | | | 56 | |

2009 | | | 64 | | | | 33 | | | | 21 | |

For Reference Only | | | | | | | | | | | | |

M&I Acquired July 2011 | | | | | | | | | | | | |

Effects on results for:2011 (2) | | | 640 | | | | 381 | | | | 180 | |

| | (1) | The Diners Club franchise acquisition raised provisions for credit losses by $24 million in 2011 and $32 million in 2010. |

| | (2) | The effects of the M&I acquisition on results of BMO Financial Group as shown above include the adjusted results of Corporate Services, which are not separately disclosed above. |

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 94.

| | | | |

| BMO Financial Group 194th Annual Report 2011 | | | 37 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Foreign Exchange

The U.S. dollar was weaker at October 31, 2011 than at October 31, 2010, and assets and liabilities are translated at year-end rates. The average exchange rate over the course of 2011 is used for translation of revenues and expenses in 2011, and this rate also weakened in 2010 relative to 2009. The Canadian dollar equivalents of BMO’s U.S.-dollar-denominated net income, revenues, expenses, income taxes and provision for credit losses in 2011 were reduced relative to the preceding year by the weakening of the U.S. dollar. The adjacent table indicates average Canadian/U.S. dollar exchange rates in 2011, 2010 and 2009 and the impact of changes in the average rates. At October 31, 2011, the Canadian dollar traded at $0.997 per U.S. dollar. It traded at $1.020 per U.S. dollar at October 31, 2010.