MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s Discussion and Analysis

BMO’s Chief Executive Officer and its Chief Financial Officer have signed a statement outlining management’s responsibility for financial information in the annual consolidated financial statements and Management’s Discussion and Analysis (MD&A). The statement, which can be found on page 132, also explains the roles of the Audit and Conduct Review Committee and Board of Directors in respect of that financial information.

The MD&A comments on BMO’s operations and financial condition for the years ended October 31, 2015 and 2014. The MD&A should be read in conjunction with our consolidated financial statements for the year ended October 31, 2015. The MD&A commentary is as of December 1, 2015. Unless otherwise indicated, all amounts are stated in Canadian dollars and have been derived from financial statements prepared in accordance with International Financial Reporting Standards (IFRS). References to generally accepted accounting principles (GAAP) mean IFRS.

Since November 1, 2011, BMO’s financial results have been reported in accordance with IFRS. Results for years prior to 2011 have not been restated and are presented in accordance with Canadian GAAP as defined at that time (CGAAP). As such, certain growth rates and compound annual growth rates (CAGR) may not be meaningful. On November 1, 2013, BMO adopted several new and amended accounting pronouncements issued by the International Accounting Standards Board. The consolidated financial statements for comparative periods in the fiscal years 2013 and 2012 have been restated. Certain other prior year data has been reclassified to conform with the current year’s presentation. The adoption of new IFRS standards in 2015 only impacted our results prospectively. Prior periods have been reclassified for methodology changes and transfers of certain businesses between operating groups. See pages 45 and 46.

| | | | |

| | 27 | | Who We Are provides an overview of BMO Financial Group, explains the links between our financial objectives and our overall vision, and outlines “Reasons to Invest in BMO” along with relevant key performance data. |

| | 28 | | Enterprise-Wide Strategy outlines our enterprise-wide strategy and the context in which it is developed, as well as our progress in relation to our priorities. |

| | 30 | | Caution Regarding Forward-Looking Statements advises readers about the limitations and inherent risks and uncertainties of forward-looking statements. |

| | |

| | |

| | 30 | | Economic Developments and Outlook includes commentary on the Canadian, U.S. and international economies in 2015 and our expectations for 2016. |

| | 32 | | Value Measures reviews financial performance on the four key measures that assess or most directly influence shareholder return. It also includes explanations of non-GAAP measures, a reconciliation to their GAAP counterparts for the fiscal year, and a summary of adjusting items that are excluded from results to assist in the review of key measures and adjusted results. |

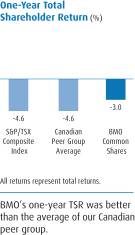

| | 32 | | Total Shareholder Return |

| | 33 | | Non-GAAP Measures |

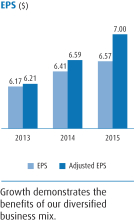

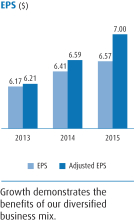

| | 34 | | Summary Financial Results and Earnings per Share Growth |

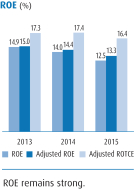

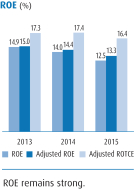

| | 35 | | Return on Equity |

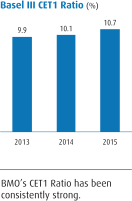

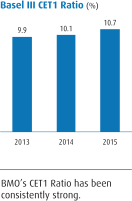

| | 35 | | Basel III Common Equity Tier 1 Ratio |

| | 36 | | 2015 Financial Performance Review provides a detailed review of BMO’s consolidated financial performance by major income statement category. It also includes a summary of the impact of changes in foreign exchange rates. |

| | |

| | 45 | | 2015 Operating Groups Performance Review outlines the strategies and key priorities of our operating groups and the challenges they face, along with their strengths and value drivers. It also includes a summary of their achievements in 2015, their focus for 2016, and a review of their financial performance for the year and the business environment in which they operate. |

| | 46 | | Summary |

| | 47 | | Personal and Commercial Banking |

| | 48 | | Canadian Personal and Commercial Banking |

| | 51 | | U.S. Personal and Commercial Banking |

| | 55 | | BMO Wealth Management |

| | 58 | | BMO Capital Markets |

| | 62 | | Corporate Services, including Technology and Operations |

| | 63 | | Review of Fourth Quarter 2015 Performance, 2014 Financial Performance Reviewand Summary Quarterly Earnings Trendsprovide commentary on results for relevant periods other than fiscal 2015. |

| | |

| | |

| | |

| | | | |

| | 68 | | | Financial Condition Review comments on our assets and liabilities by major balance sheet category. It includes a review of our capital adequacy and our approach to optimizing our capital position to support our business strategies and maximize returns to our shareholders. It also includes a review of off-balance sheet arrangements and certain select financial instruments. |

| | 68 | | | Summary Balance Sheet |

| | 70 | | | Enterprise-Wide Capital Management |

| | 76 | | | Select Financial Instruments |

| | 77 | | | Off-Balance Sheet Arrangements |

| | 78 | | | Accounting Matters and Disclosure and Internal Control reviews critical accounting estimates and changes in accounting policies in 2015 and for future periods. It also outlines our evaluation of disclosure controls and procedures and internal control over financial reporting, and provides an index of disclosures recommended by the Enhanced Disclosure Task Force. |

| | 78 | | | Critical Accounting Estimates |

| | 80 | | | Changes in Accounting Policies in 2015 |

| | 80 | | | Future Changes in Accounting Policies |

| | 81 | | | Transactions with Related Parties |

| | 82 | | | Management’s Annual Report on Disclosure Controls and Procedures and Internal Control over Financial Reporting |

| | 83 | | | Shareholders’ Auditors’ Services and Fees |

| | 84 | | | Enhanced Disclosure Task Force |

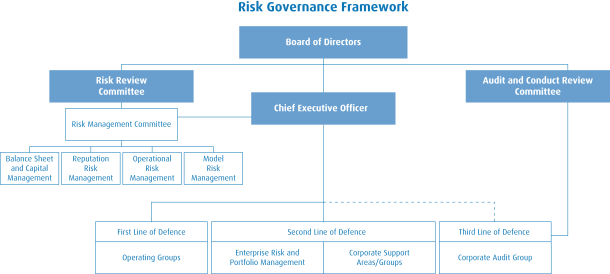

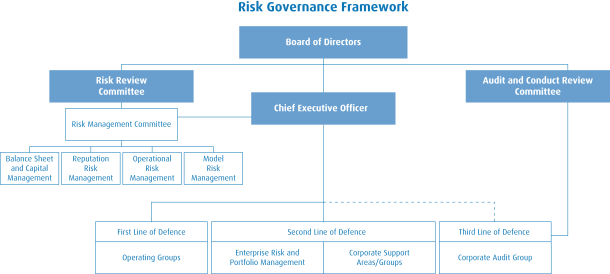

| | 86 | | | Enterprise-Wide Risk Management outlines our approach to managing key financial risks and other related risks we face. |

| | 87 | | | Overview |

| | 87 | | | Risks That May Affect Future Results |

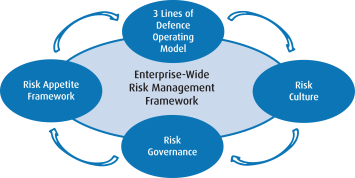

| | 89 | | | Framework and Risks |

| | 94 | | | Credit and Counterparty Risk |

| | 100 | | | Market Risk |

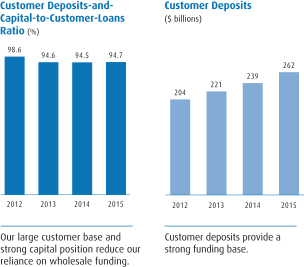

| | 105 | | | Liquidity and Funding Risk |

| | 111 | | | Operational Risk |

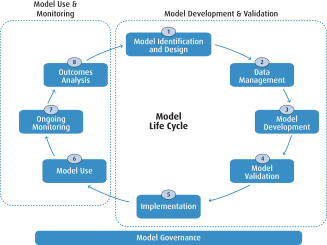

| | 112 | | | Model Risk |

| | 114 | | | Insurance Risk |

| | 114 | | | Legal and Regulatory Risk |

| | 116 | | | Business Risk |

| | 116 | | | Strategic Risk |

| | 116 | | | Reputation Risk |

| | 117 | | | Environmental and Social Risk |

| | 118 | | | Supplemental Information presents other useful financial tables and more historical detail. |

Regulatory Filings

Our continuous disclosure materials, including our interim financial statements and interim MD&A, annual audited consolidated financial statements and annual MD&A, Annual Information Form and Notice of Annual Meeting of Shareholders and Management Proxy Circular, are available on our website at www.bmo.com/investorrelations, on the Canadian Securities Administrators’ website at www.sedar.com and on the EDGAR section of the SEC’s website at www.sec.gov. BMO’s Chief Executive Officer and its Chief Financial Officer certify the appropriateness and fairness of BMO’s annual and interim consolidated financial statements, MD&A and Annual Information Form, the effectiveness of BMO’s disclosure controls and procedures and the effectiveness of, and any material weaknesses relating to, BMO’s internal control over financial reporting.

| | |

| 26 | | BMO Financial Group 198th Annual Report 2015 |

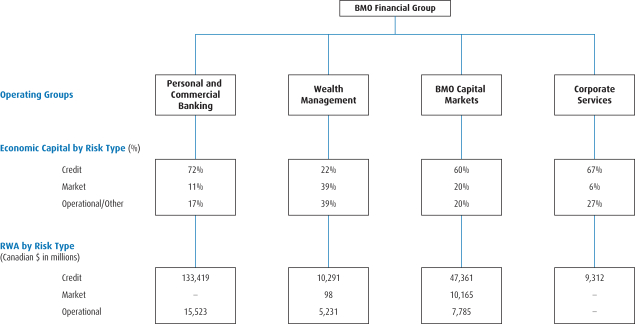

Who We Are

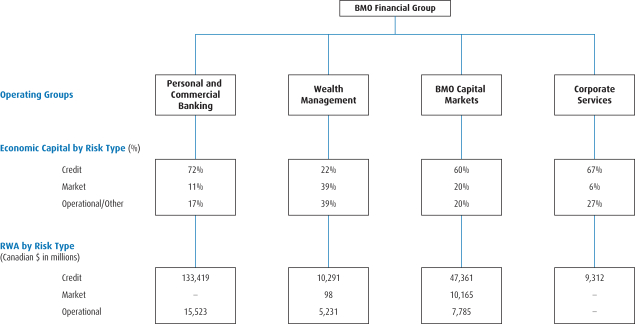

Established in 1817, BMO Financial Group is a highly diversified financial services provider based in North America. With total assets of $642 billion and close to 47,000 employees, BMO provides a broad range of personal and commercial banking, wealth management and investment banking products and services to more than 12 million customers. We serve eight million customers across Canada through our Canadian personal and commercial arm, BMO Bank of Montreal. We also serve customers through our wealth management businesses: BMO Global Asset Management, BMO Nesbitt Burns, BMO Private Banking, BMO Insurance and BMO InvestorLine. BMO Capital Markets, our investment and corporate banking and trading products division, provides a full suite of financial products and services to North American and international clients. In the United States, BMO serves customers through BMO Harris Bank, based in the U.S. Midwest with more than two million retail, small business and commercial customers. BMO Financial Group conducts business through three operating groups: Personal and Commercial Banking, Wealth Management and BMO Capital Markets.

Our Financial Objectives

BMO’s medium-term financial objectives for certain important performance measures are set out below. We believe that we will deliver top-tier total shareholder return and meet our medium-term financial objectives by aligning our operations with, and executing on, our strategic priorities, along with our vision and guiding principle, as outlined on the following page. We consider top-tier returns to be top-quartile shareholder returns relative to our Canadian and North American peer group.

BMO’s business planning process is rigorous, sets ambitious goals and considers the prevailing economic conditions, our risk appetite, our customers’ evolving needs and the opportunities available across our lines of business. It includes clear and direct accountability for annual performance that is measured against both internal and external benchmarks and progress toward our strategic priorities.

Over the medium term, our financial objectives on an adjusted basis are to achieve average annual earnings per share (adjusted EPS) growth of 7% to 10%, earn an average annual return on equity (adjusted ROE) of 15% or more, generate average annual adjusted net operating leverage of 2% or more and maintain strong capital ratios that exceed regulatory requirements. These objectives are key guideposts as we execute against our strategic priorities, and we believe they are consistent with delivering top-tier total shareholder return. In managing our operations and risk, we recognize that current profitability and the ability to meet these objectives in a single period must be balanced with the need to invest in our businesses for their future long-term health and growth prospects.

Our five-year average annual adjusted EPS growth rate was 7.9%, in line with our target growth range of 7% to 10%. We did not meet our medium-term objective of generating above 2% average annual adjusted operating leverage due to lower than expected source currency revenue. We remain focused on improving efficiency and generated improved operating leverage on a net revenue basis through 2015. Our five-year average annual adjusted ROE of 14.8% was slightly below our target range as we held increased levels of common shareholders’ equity to meet increased capital expectations for banks. Our capital position is strong, with a Common Equity Tier 1 Ratio of 10.7%.

Reasons to Invest in BMO

| | • | | Clear opportunities for growth across a diversified North American footprint: | |

| | • | | Large North American commercial banking business with advantaged market share. |

| | • | | Well-established, highly profitable core banking business in Canada. |

| | • | | Fast-growing, award-winning wealth franchise. |

| | • | | Leading Canadian and growing mid-cap focused U.S. capital markets business. |

| | • | | U.S. operations well-positioned to capture benefit of improving economic conditions. |

| | • | | Strong capital position and an attractive dividend yield. | |

| | • | | Focus on efficiency through technology innovation, simplifying and automating processes and extending the digital experience across our channels. | |

| | • | | Customer-centric operating model guided by disciplined loyalty measurement program. | |

| | • | | Adherence to the highest standards of business ethics and corporate governance. | |

Canadian banks have been ranked the world’s soundest for the 8th year in a row(1)

| | (1) | Based on the Global Competitiveness Report by the World Economic Forum. |

| | | | | | | | | | | | | | | | |

| | | As at and for the periods ended October 31, 2015 (%, except as noted) | | 1-year | | | 5-year* | | | 10-year* | | | |

| | Average annual total shareholder return | | | (3.0 | ) | | | 9.5 | | | | 7.7 | | | |

| | Average growth in annual adjusted EPS | | | 6.2 | | | | 7.9 | | | | 5.1 | | | |

| | Average annual adjusted ROE | | | 13.3 | | | | 14.8 | | | | 15.7 | | | |

| | Average growth in annual EPS | | | 2.5 | | | | 7.1 | | | | 5.4 | | | |

| | Average annual ROE | | | 12.5 | | | | 14.5 | | | | 14.4 | | | |

| | Compound growth in annual dividends declared per share | | | 5.2 | | | | 3.0 | | | | 5.8 | | | |

| | Dividend yield** | | | 4.3 | | | | 4.3 | | | | 4.6 | | | |

| | Price-to-earnings multiple** | | | 11.6 | | | | 11.6 | | | | 12.7 | | | |

| | Market value/book value ratio** | | | 1.35 | | | | 1.53 | | | | 1.70 | | | |

| | Common Equity Tier 1 Ratio (Basel III basis) | | | 10.7 | | | | na | | | | na | | | |

| | * | 5-year and 10-year growth rates reflect growth based on CGAAP in 2010 and 2005, respectively, and IFRS in 2015. |

| | ** | 1-year measure as at October 31, 2015. 5-year and 10-year measures are the average of year-end values. |

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

The Our Financial Objectives section above and the Enterprise-Wide Strategy and Economic Developments and Outlook sections that follow contain certain forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. Please refer to the Caution Regarding Forward-Looking Statements on page 30 of this MD&A for a discussion of such risks and uncertainties and the material factors and assumptions related to the statements set forth in such sections.

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 27 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Enterprise-Wide Strategy

Our Vision

To be the bank that defines great customer experience.

Our Guiding Principle

We aim to deliver top-tier total shareholder return and balance our commitments to financial performance, our customers and employees, the environment and the communities where we live and work.

Our 2015 Strategy in Context

The economic environment is constantly evolving. As we navigate through this constant change, we continue to remain grounded in our brand promise.We’re here to help is a simple statement meant to inspire and guide what we do every day. We aim to help customers feel valued, understood and confident in the decisions they make.

Our strategic priorities have proven to be robust, providing us with consistent direction in the midst of evolving expectations, increasingly intense competitive activity and continued market uncertainty. Digital technologies continue to play a critical role across our strategic priorities in enabling our objectives. We believe that the strength of our business model, customer base, balance sheet, risk management framework and leadership team, along with the advantages offered by the scale of our consolidated North American platform, will continue to generate sustainable growth and help us deliver on our vision and brand promise.

Our commitment to stakeholders is evident in our focus on delivering an industry-leading customer experience, managing revenues and expenses to achieve our financial goals, and maintaining a prudent approach to risk management. We have made good progress on our enterprise strategic priorities, with select accomplishments outlined below, as well as on our group strategies, detailed in the 2015 Operating Groups Performance Review, which starts on page 45.

Our 2015 Priorities and Progress

| 1. | Achieve industry-leading customer loyalty by delivering on our brand promise. |

| • | | Developed further capabilities in digital banking and investing to help customers in new and innovative ways: |

| | • | | LaunchedTouchID log-in in Canada and the United States, enabling customers to log in to the BMO mobile banking application using fingerprint recognition. Within a month of the launch in Canada, approximately 115,000 new users registered for the mobile app. |

| | • | | Introduced Mobile Cash in the United States, allowing customers to withdraw money from a BMO Harris automated banking machine (ABM) using their smartphone; we now have the largest network of mobile-enabled cardless ABMs in the United States. |

| | • | | Launched a new BMO Banking and InvestorLine portal, becoming the first major Canadian bank to provide customers with access to both personal banking and self-directed investment accounts all in one place. |

| | • | | Enhanced our cash management offerings with the launch of BMO DepositEdge™ in Canada, enabling business customers to deposit cheques remotely, and BMO Spend Dynamics™, giving corporate card clients convenient access to their transaction data and the ability to analyze their program spend. |

| | • | | For the third consecutive year, BMO was recognized by global financial services research firm Celent with a 2015 Model Bank Award for excellence in the digital banking category. |

| • | | Completed the successful launch of BMO’s refreshed brand with innovative tactics, including the “Help Given” social media campaign, which generated over 7.7 million views in Canada and the United States, and sponsorship ofTheAmazing Race Canada, which allowed BMO to reach millions of Canadians during its 12-week season. |

| • | | Recognized with awards across our groups, including Best Wealth Management in Canada, 2015(Global Banking and Finance Review), Best Full-Service Investment Advisory in Canada, 2015(Global Banking and Finance Review), 2015 Greenwich Quality Leader in Canadian Equity Sales and Corporate Access and 2015 Greenwich Share Leader for Canadian Fixed Income Research(Greenwich Associates) and, for the sixth consecutive year, World’s Best Metals & Mining Investment Bank(Global Finance). |

| 2. | Enhance productivity to drive performance and shareholder value. |

| • | | Continued to make our processes more efficient, enabling front-line employees to add new customers and strengthen existing relationships: |

| | • | | In Canadian P&C, our automated leads management engine, which uses data to identify customer opportunities, has generated incremental revenue by presenting customers with proactive needs-based product and service offers. |

| | • | | In U.S. P&C, launched a new Home Lending Loan Origination system with e-disclosures, online loan tracker and digital loan processing. |

| | • | | Across the business, improved online sales processes driving growth in sales volumes. Online retail banking sales volumes across Canada are now equivalent to sales at over 100 branches. |

| • | | Optimized our cost structure to deliver greater efficiencies: |

| | • | | Continued to roll out new branch formats offering smaller, more flexible and more cost-effective points of distribution across North America, including the introduction of our Smart Branch format in the United States, which allows customers to conduct transactions with ABM video-tellers and makes day-to-day banking easier and more convenient. |

| | • | | Continued to expand eStatements participation across North America, as more customers move to the paperless option. |

| | • | | Divested our retirement services and municipal bond trading businesses to increase focus on our core Wealth and Capital Markets businesses. |

| | • | | Improved data and analytical capabilities, which helped generate revenues and improved management of BMO’s expense base. |

| | |

| 28 | | BMO Financial Group 198th Annual Report 2015 |

| 3. | Leverage our consolidated North American platform to deliver quality earnings growth. |

| • | | Continued to develop consolidated North American capabilities and platforms in priority areas: |

| | • | | Provided consistent brand messaging across the Canadian and U.S. businesses, building on shared customer insights to address the changing expectations of the banking industry. |

| | • | | Completed a reorganization of Trading Products by asset class to further enhance customer experience and North American franchise value. |

| | • | | Maintained key North-South leadership mandates to achieve greater consistency, eliminate duplication and leverage best practices. |

| • | | Continued to expand our business and capabilities in the United States: |

| | • | | Announced the signing of an agreement to acquire General Electric Capital Corporation’s (GE Capital) Transportation Finance business with net earning assets on closing of approximately $11.9 billion (US$8.9 billion). The acquisition builds on our position as a market leader in commercial banking, and enhances our business position in the United States by further diversifying net income, adding scale and enhancing profitability and margins. |

| | • | | Improved sales productivity across key products and segments through enhanced coaching and performance management, and deployment of customer acquisition programs. |

| • | | Introduced compelling offers in Canada that increased sales and established and strengthened client relationships, including the new Savings Builder Account, Spring Home Financing and Summer Everyday Banking Campaigns. |

| 4. | Expand strategically in select global markets to create future growth. |

| • | | Completed the integration of F&C Asset Management plc (F&C), and rebranded it as BMO Global Asset Management. This acquisition strengthens the position of BMO Global Asset Management as a top 50 global asset manager. |

| • | | BMO served as a co-chair of the Toronto Financial Services Alliance (TFSA) Renminbi (RMB) Working Group, which played a crucial role in establishing an offshore renminbi clearing hub in Canada. The Canadian hub facilitates settlements in renminbi, with the intention of encouraging trade and strengthening ties between Canadian companies and their Chinese business partners. |

| • | | Ranked among top 20 global investment banks and 12th largest investment bank in North and South America, based on fees, by Thomson Reuters. |

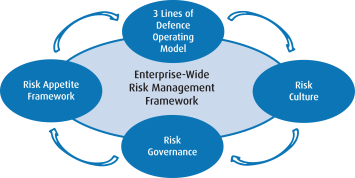

| 5. | Ensure our strength in risk management underpins everything we do for our customers. |

| • | | Leveraged our capital processes to enhance our risk appetite and limit framework through further alignment with our businesses’ capacity to bear risk. |

| • | | Developed and embedded our stress testing capabilities in business management processes and provided additional risk insights. |

| • | | Continued to improve risk culture as evidenced by internal and external surveys. |

| • | | Responded to rising regulatory expectations, evidenced by improvements in stress testing, market risk measurement and anti-money laundering. |

| • | | Continued to develop the next generation of our risk infrastructure by integrating, automating and upgrading our foundational capabilities. |

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 29 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Factors That May Affect Future Results

As noted in the following Caution Regarding Forward-Looking Statements, all forward-looking statements and information, by their nature, are subject to inherent risks and uncertainties, both general and specific, which may cause actual results to differ materially from the expectations expressed in any forward-looking statement. The Enterprise-Wide Risk Management section starting on page 86 describes a number of risks, including credit and counterparty, market, liquidity and funding, operational, model, insurance, legal and regulatory, business, strategic, reputation, environmental and social. Should our risk management framework prove ineffective, there could be a material adverse impact on our financial position.

| | | | |

| | Caution Regarding Forward-Looking Statements Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United StatesPrivate Securities Litigation Reform Act of 1995and any applicable Canadian securities legislation. Forward-looking statements may involve, but are not limited to, comments with respect to our objectives and priorities for 2016 and beyond, our strategies or future actions, our targets, expectations for our financial condition or share price, and the results of or outlook for our operations or for the Canadian, U.S. and international economies. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that predictions, forecasts, conclusions or projections will not prove to be accurate, that our assumptions may not be correct, and that actual results may differ materially from such predictions, forecasts, conclusions or projections. We caution readers of this document not to place undue reliance on our forward-looking statements, as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in which we operate; weak, volatile or illiquid capital and/or credit markets; interest rate and currency value fluctuations; changes in monetary, fiscal, tax or economic policy; the level of competition in the geographic and business areas in which we operate; changes in laws or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance; judicial or regulatory proceedings; the accuracy and completeness of the information we obtain with respect to our customers and counterparties; our ability to execute our strategic plans and to complete and integrate acquisitions, including obtaining regulatory approvals; the anticipated benefits from the acquisition of the GE Capital Transportation Finance business are not realized in the time frame anticipated or at all; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations on these estimates; operational and infrastructure risks; changes to our credit ratings; general political conditions; global capital markets activities; the possible effects on our business of war or terrorist activities; outbreaks of disease or illness that affect local, national or international economies; natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; technological changes; and our ability to anticipate and effectively manage risks associated with all of the foregoing factors. We caution that the foregoing list is not exhaustive of all possible factors. Other factors and risks could adversely affect our results. For more information, please see the discussion in the Risks That May Affect Future Results section on page 87, and the sections related to credit and counterparty, market, liquidity and funding, operational, model, insurance, legal and regulatory, business, strategic, reputation and environmental and social risk, which begin on page 94 and outline certain key factors and risks that may affect Bank of Montreal’s future results. When relying on forward-looking statements to make decisions with respect to Bank of Montreal, investors and others should carefully consider these factors and risks, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. Bank of Montreal does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by the organization or on its behalf, except as required by law. The forward-looking information contained in this document is presented for the purpose of assisting our shareholders in understanding our financial position as at and for the periods ended on the dates presented, as well as our strategic priorities and objectives, and may not be appropriate for other purposes. Assumptions about the performance of the Canadian and U.S. economies, as well as overall market conditions and their combined effect on our business, are material factors we consider when determining our strategic priorities, objectives and expectations for our business. In determining our expectations for economic growth, both broadly and in the financial services sector, we primarily consider historical economic data provided by the Canadian and U.S. governments and their agencies. See the Economic Developments and Outlook section of this document. Assumptions about current and expected capital requirements, GE Capital’s Transportation Finance business revenues and expenses, potential for earnings growth as well as costs associated with the transaction and expected synergies, were material factors we considered in estimating the impact of the acquired business on our net income, profitability and margins in 2016 and beyond. Assumptions about current and expected capital requirements and our models used to assess those requirements under applicable capital guidelines, GE Capital’s Transportation Finance business revenues and expenses, potential for earnings growth as well as costs associated with the transaction and expected synergies were material factors we considered in estimating the impact on our capital ratios in 2016 and beyond. | | |

Economic Developments and Outlook

Economic Developments in 2015 and Outlook for 2016

Growth in the Canadian economy weakened in the first half of 2015, largely due to a sharp reduction in investment in the oil-producing regions and to continued weakness in the mining sector. Still, growth remained steady across most of the country, supported by an upturn in exports, as well as stable consumer spending and housing markets. Exports have benefitted from the effects of stronger U.S. demand, a weaker Canadian dollar and a modest pickup in the Eurozone economy, offset in part by slower growth in most emerging-market economies, notably China. While growth in Canadian consumer spending has moderated as a result of elevated debt levels, it continues at a healthy rate, reflecting record sales of motor vehicles and steady demand for services. Home sales remain strong in the Vancouver and Toronto regions, supported by immigration and the millennial generation, many of whom are now in their prime home-buying years. Real GDP growth is expected to improve from an estimated 1.1% in 2015 to 2.0% in 2016, supported by modestly expansionary federal fiscal policy. Canadian households should continue to help sustain the economic expansion, as growth in employment remains healthy and interest rates are low, while the downturn in business investment is projected to stabilize in response to an expected partial recovery in oil prices. Growth in residential mortgages is expected to slow modestly to around 5% in 2016, and consumer credit should expand by close to 3%. Growth in business loans is projected to moderate from recent rates of around 8% this year to about 6%, reflecting lower levels of capital expenditures in the resource sector. After two rate reductions in 2015, the Bank of Canada is expected to hold interest rates steady in 2016, before shifting to a tightening stance in early 2017. The Canadian dollar is projected to weaken modestly in response to expected higher U.S. interest rates, before an anticipated upturn in oil prices provides some support in 2016.

| | |

| 30 | | BMO Financial Group 198th Annual Report 2015 |

After a slow start to 2015 due to severe winter weather, shipping disruptions and a reduction in oil drilling activity, the U.S. economy has strengthened over the course of the year. Consumer spending has been sustained by improvements in household finances and steady growth in employment, while the housing market continues to benefit from low mortgage rates and less restrictive lending standards. Economic growth has also been impacted by weakness in exports due to the strong dollar, a decline in agriculture investment owing to low crop prices, and the effects of the downturn in the oil industry. Overall, real GDP is expected to grow by 2.5% in 2015 and 2.6% in 2016. Despite an expected modest increase in borrowing costs, growth in consumer credit and residential mortgages is expected to strengthen in 2016, supported by rising consumer confidence and robust demand for automobiles. Business loan growth should also remain healthy, supported by lower costs for imported machinery. With the unemployment rate projected to fall below 5% in 2016, the Federal Reserve is expected to increase interest rates. However, we anticipate a very modest tightening cycle in the face of global economic headwinds and continued low inflation. This should help to keep long-term interest rates relatively low in 2016.

Following modest economic growth in recent years, the pace of expansion in the U.S. Midwest region, which includes the six contiguous states comprising the BMO footprint, should improve to 1.8% in 2015 and 2.1% in 2016 in response to an increase in automobile production, the recovery in housing markets and generally expansionary fiscal policies. However, because of the ongoing weakness in exports, the region could continue to lag the national average.

This Economic Developments and Outlook section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements.

Note: Data points are averages for the month, quarter or year, as appropriate. References to years are calendar years.

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 31 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Value Measures

Total Shareholder Return

The average annual total shareholder return (TSR) is a key measure of shareholder value, and confirms that our strategic priorities drive value creation for our shareholders. Our one-year TSR of negative 3% was better than the average of our Canadian bank peer group and the overall market return in Canada. Our three-year average annual TSR of 13.5% was strong, outperforming our Canadian bank peer group and the overall market return in Canada. Our five-year average annual TSR of 9.5% outperformed the overall market return in Canada, although it was slightly below our Canadian bank peer group.

The table below summarizes dividends paid on BMO common shares over the past five years and the movements in BMO’s share price. An investment of $1,000 in BMO common shares made at the beginning of fiscal 2011 would have been worth $1,576 at October 31, 2015, assuming reinvestment of dividends, for a total return of 57.6%.

On December 1, 2015, BMO announced that the Board of Directors had declared a quarterly dividend payable to common shareholders of $0.84 per common share, an increase of $0.02 per share or 2% from the prior quarter and up $0.04 per share or 5% from a year ago. The dividend is payable on February 26, 2016 to shareholders of record on February 2, 2016. We have increased our quarterly dividend declared four times over the past two years from $0.76 per common share for the first quarter of 2014. Dividends paid over a ten-year period have increased at an average annual compound rate of 5.9%.

Theaverage annual total shareholder return (TSR) represents the average annual total return earned on an investment in BMO common shares made at the beginning of a fixed period. The return includes the change in share price and assumes that dividends received were reinvested in additional common shares.

Total Shareholder Return

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the year ended October 31 | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 3-year CAGR (1) | | | 5-year CAGR (1) | |

Closing market price per common share ($) | | | 76.04 | | | | 81.73 | | | | 72.62 | | | | 59.02 | | | | 58.89 | | | | 8.8 | | | | 4.8 | |

Dividends paid ($ per share) | | | 3.20 | | | | 3.04 | | | | 2.92 | | | | 2.80 | | | | 2.80 | | | | 4.6 | | | | 2.7 | |

Dividend yield (%) | | | 4.3 | | | | 3.8 | | | | 4.0 | | | | 4.8 | | | | 4.8 | | | | nm | | | | nm | |

Increase (decrease) in share price (%) | | | (7.0 | ) | | | 12.5 | | | | 23.0 | | | | 0.2 | | | | (2.2 | ) | | | nm | | | | nm | |

Total annual shareholder return (%) (2) | | | (3.0 | ) | | | 17.1 | | | | 28.8 | | | | 5.2 | | | | 2.4 | | | | 13.5 | | | | 9.5 | |

| | (1) | Compound annual growth rate (CAGR) expressed as a percentage. |

| | (2) | Total annual shareholder return assumes reinvestment of quarterly dividends and therefore does not equal the sum of dividend and share price returns in the table. |

| | |

| 32 | | BMO Financial Group 198th Annual Report 2015 |

Non-GAAP Measures

Results and measures in this MD&A are presented on a GAAP basis. They are also presented on an adjusted basis that excludes the impact of certain items as set out in the following table. Management assesses performance on a reported basis and on an adjusted basis and considers both to be useful in assessing underlying ongoing business performance. Presenting results on both bases provides readers with a better understanding of how management assesses results. It also permits readers to assess the impact of certain specified items on results for the periods presented and to better assess results excluding those items if they consider the items to not be reflective of ongoing results. As such, the presentation may facilitate readers’ analysis of trends, as well as comparisons with our competitors. Adjusted results and measures are non-GAAP and as such do not have standardized meaning under GAAP. They are unlikely to be comparable to similar measures presented by other companies and should not be viewed in isolation from or as a substitute for GAAP results.

| | | | | | | | | | | | |

| (Canadian $ in millions, except as noted) | | 2015 | | | 2014 | | | 2013 | |

| | | |

Reported Results | | | | | | | | | | | | |

Revenue (1) | | | 19,389 | | | | 18,223 | | | | 16,830 | |

Insurance claims, commissions and changes in policy benefit liabilities (CCPB) (1) | | | (1,254 | ) | | | (1,505 | ) | | | (767 | ) |

Revenue, net of CCPB | | | 18,135 | | | | 16,718 | | | | 16,063 | |

Provision for credit losses | | | (612 | ) | | | (561 | ) | | | (587 | ) |

Non-interest expense | | | (12,182 | ) | | | (10,921 | ) | | | (10,226 | ) |

Income before income taxes | | | 5,341 | | | | 5,236 | | | | 5,250 | |

Provision for income taxes | | | (936 | ) | | | (903 | ) | | | (1,055 | ) |

Net Income | | | 4,405 | | | | 4,333 | | | | 4,195 | |

Diluted EPS ($) | | | 6.57 | | | | 6.41 | | | | 6.17 | |

| | | |

Adjusting Items (Pre-tax)(2) | | | | | | | | | | | | |

Credit-related items on the purchased performing loan portfolio (3) | | | – | | | | – | | | | 406 | |

Acquisition integration costs (4) | | | (53 | ) | | | (20 | ) | | | (251 | ) |

Amortization of acquisition-related intangible assets (5) | | | (163 | ) | | | (140 | ) | | | (125 | ) |

Decrease in the collective allowance for credit losses (6) | | | – | | | | – | | | | 2 | |

Run-off structured credit activities (7) | | | – | | | | – | | | | 40 | |

Restructuring costs (8) | | | (149 | ) | | | – | | | | (82 | ) |

Adjusting items included in reported pre-tax income | | | (365 | ) | | | (160 | ) | | | (10 | ) |

| | | |

Adjusting Items (After tax)(2) | | | | | | | | | | | | |

Credit-related items on the purchased performing loan portfolio (3) | | | – | | | | – | | | | 250 | |

Acquisition integration costs (4) | | | (43 | ) | | | (16 | ) | | | (155 | ) |

Amortization of acquisition-related intangible assets (5) | | | (127 | ) | | | (104 | ) | | | (89 | ) |

Increase in the collective allowance for credit losses (6) | | | – | | | | – | | | | (9 | ) |

Run-off structured credit activities (7) | | | – | | | | – | | | | 34 | |

Restructuring costs (8) | | | (106 | ) | | | – | | | | (59 | ) |

Adjusting items included in reported net income after tax | | | (276 | ) | | | (120 | ) | | | (28 | ) |

Impact on diluted EPS ($) | | | (0.43 | ) | | | (0.18 | ) | | | (0.04 | ) |

| | | |

Adjusted Results | | | | | | | | | | | | |

Revenue (1) | | | 19,391 | | | | 18,223 | | | | 16,139 | |

Insurance claims, commissions and changes in policy benefit liabilities (CCPB) (1) | | | (1,254 | ) | | | (1,505 | ) | | | (767 | ) |

Revenue, net of CCPB | | | 18,137 | | | | 16,718 | | | | 15,372 | |

Provision for credit losses | | | (612 | ) | | | (561 | ) | | | (357 | ) |

Non-interest expense | | | (11,819 | ) | | | (10,761 | ) | | | (9,755 | ) |

Income before income taxes | | | 5,706 | | | | 5,396 | | | | 5,260 | |

Provision for income taxes | | | (1,025 | ) | | | (943 | ) | | | (1,037 | ) |

Net Income | | | 4,681 | | | | 4,453 | | | | 4,223 | |

Diluted EPS ($) | | | 7.00 | | | | 6.59 | | | | 6.21 | |

Adjusted results and measures in this table are non-GAAP amounts or non-GAAP measures.

| | (1) | Effective the first quarter of 2015, insurance claims, commissions and changes in policy benefit liabilities (CCPB) are reported separately. They were previously reported as a reduction in insurance revenue in non-interest revenue. Prior period amounts and ratios have been reclassified. |

| | (2) | Adjusting items are included in Corporate Services with the exception of the amortization of acquisition-related intangible assets, which is charged to the operating groups, and acquisition integration costs in 2015 and 2014 related to F&C, which are charged to Wealth Management. |

| | (3) | Credit-related items on the purchased performing portfolio in 2013 were comprised of revenue of $638 million, provisions for credit losses of $232 million and provisions for income taxes of $156 million, resulting in an increase in reported net income after tax of $250 million. Effective the first quarter of 2014, Corporate Services adjusted results include credit-related items in respect of the purchased performing loan portfolio, including $103 million of revenue and $5 million of specific provisions for credit losses in 2015 ($238 million and $82 million in 2014, respectively). |

| | (4) | Acquisition integration costs related to F&C are charged to Wealth Management and acquisition integration costs related to Marshall & Isley Corporation and GE Capital’s Transportation Finance business are charged to Corporate Services. Acquisition integration costs are primarily recorded in non-interest expense. |

| | (5) | These expenses were included in the non-interest expense of the operating groups. Before and after-tax amounts for each operating group are provided on pages 47, 49, 53, 56 and 60. |

| | (6) | In 2013, the impact of the purchased performing portfolio on the collective allowance is reflected in credit-related items. |

| | (7) | Primarily comprised of valuation changes associated with these activities that are mainly included in trading revenues in non-interest revenue. |

| | (8) | Primarily due to restructuring to drive operational efficiencies. The charge in 2015 also includes the settlement of a legacy legal matter from an acquired entity. |

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 33 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

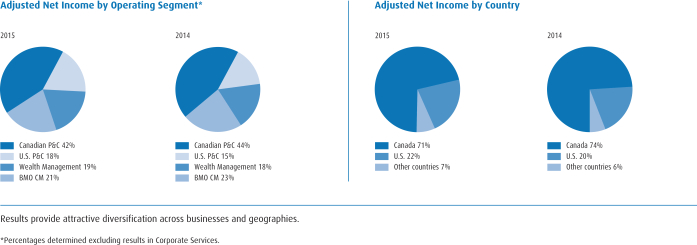

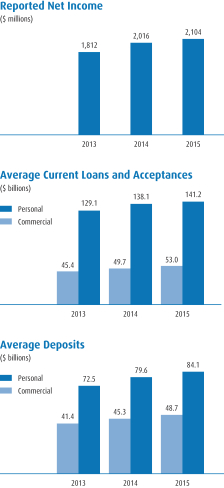

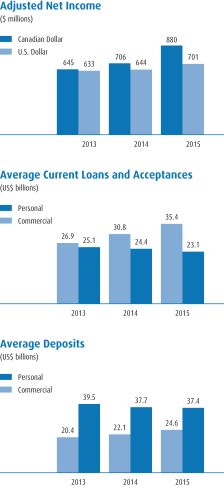

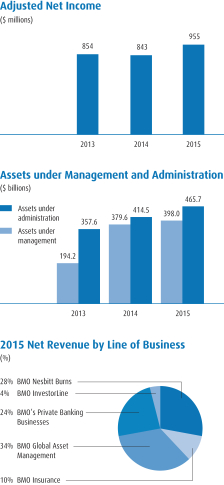

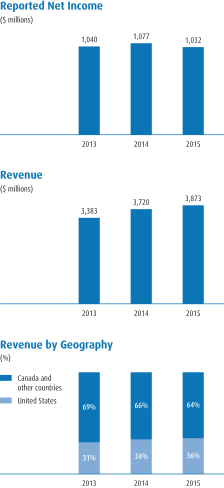

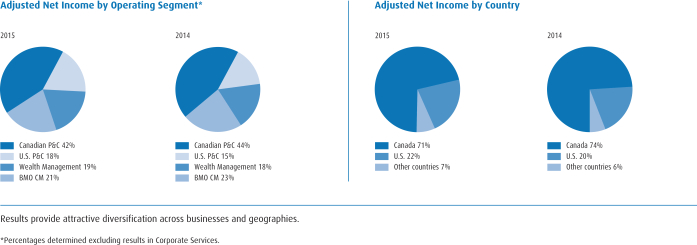

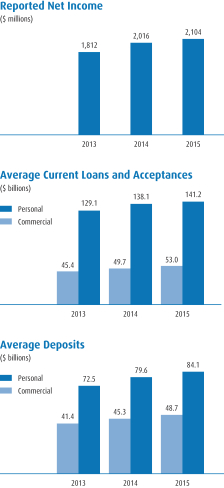

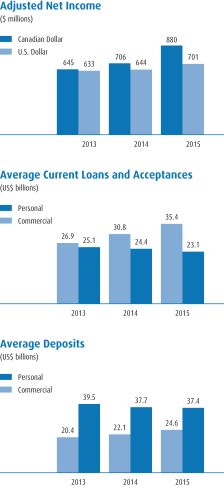

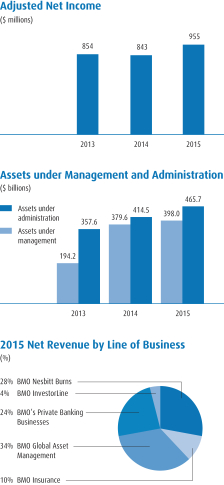

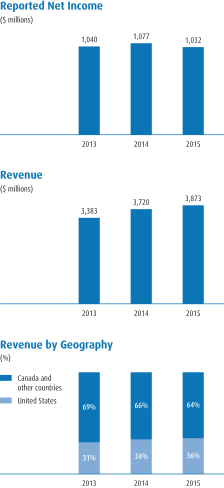

Summary Financial Results and Earnings per Share Growth The year-over-year percentage change in earnings per share (EPS) and in adjusted EPS are our key measures for analyzing earnings growth. All references to EPS are to diluted EPS, unless indicated otherwise. EPS was $6.57, up $0.16 or 2% from $6.41 in 2014. Adjusted EPS was $7.00, up $0.41 or 6% from $6.59 in 2014. Our five-year average annual adjusted EPS growth rate was 7.9%, in line with our current medium-term objective of achieving average annual adjusted EPS growth of 7% to 10%. EPS growth in both 2015 and 2014 primarily reflected increased earnings. Adjusted net income available to common shareholders was 67% higher over the five-year period, while the average number of diluted common shares outstanding increased 15% over the same period. Net income was $4,405 million in 2015, up $72 million or 2% from the previous year. Adjusted net income was $4,681 million, up $228 million or 5%. On an adjusted basis, there was solid revenue growth in 2015. Higher revenue exceeded incremental costs, contributing to growth in net income. There were modestly higher provisions for credit losses and a slightly higher effective income tax rate in 2015. There was good adjusted net income growth in Canadian P&C, Wealth Management and U.S. P&C, a decline in BMO Capital Markets and lower results in Corporate Services. In addition to operating performance, adjusted net income benefitted from the stronger U.S. dollar. This benefit was more than offset by lower purchased loan accounting benefits. Canadian P&C adjusted net income increased $88 million or 4% to $2,108 million, due to continued revenue growth as a result of higher balances and improved non-interest revenue, with stable net interest margin, partially offset by higher expenses. Expenses rose primarily due to continued investment in the business, net of expense management, and higher costs associated with a changing business and regulatory environment. Canadian P&C results are discussed in the operating group review on page 48. U.S. P&C adjusted net income increased $174 million or 25% to $880 million, and increased $57 million or 9% to $701 million on a U.S. dollar basis, primarily due to lower provisions for credit losses. Revenue was stable as higher balances and increased mortgage banking revenue offset the effects of lower net interest margin. Non-interest expenses also remained stable. U.S. P&C results are discussed in the operating group review on page 51. Wealth Management adjusted net income was $955 million, up $112 million or 13% from a year ago. Adjusted net income in traditional wealth was $715 million, up $158 million or 28% from a year ago, due to good organic growth from the businesses, a gain on the sale of BMO’s U.S. retirement services business, and the full year benefit from the acquired F&C business. Adjusted net income in insurance was $240 million, compared to $286 million a year ago, primarily due to higher taxes in the current year and higher actuarial benefits in the prior year. Wealth Management results are discussed in the operating group review on page 55. BMO Capital Markets adjusted net income decreased $44 million or 4% to $1,034 million as the benefit of the stronger U.S. dollar was more than offset by higher provisions in the current year compared to net recoveries in the prior year. BMO Capital Markets results are discussed in the operating group review on page 58. Corporate Services adjusted net loss for the year was $296 million, compared with an adjusted net loss of $194 million a year ago. Adjusted results decreased mainly due to lower purchased loan portfolio revenues and lower credit recoveries. Corporate Services results are discussed in the operating group review on page 62. Changes to reported and adjusted net income for each of our operating groups are discussed in more detail in the 2015 Operating Groups Performance Review, which starts on page 45. | |

|

Earnings per share (EPS) is calculated by dividing net income attributable to bank shareholders, after deduction of preferred dividends, by the average number of common shares outstanding. Diluted EPS, which is our basis for measuring performance, adjusts for possible conversions of financial instruments into common shares if those conversions would reduce EPS, and is more fully explained in Note 25 on page 191 of the financial statements. Adjusted EPS is calculated in the same manner using adjusted net income.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

| | |

| 34 | | BMO Financial Group 198th Annual Report 2015 |

| | |

Return on Equity Increased capital expectations for banks internationally have resulted in increased levels of common shareholders’ equity over the last several years which, all else being equal, negatively impacts return on equity (ROE). ROE was 12.5% in 2015 and adjusted ROE was 13.3%, compared with 14.0% and 14.4%, respectively, in 2014. ROE declined in 2015 primarily due to growth in common equity exceeding growth in income. There was an increase of $96 million in earnings ($252 million in adjusted earnings) available to common shareholders in 2015. Average common shareholders’ equity increased by $4.5 billion from 2014, primarily due to the impact of the stronger U.S. dollar on our investments in foreign operations and increased retained earnings. Adjusted return on tangible common equity (ROTCE) was 16.4%, compared with 17.4% in 2014. Book value per share increased 17% from the prior year to $56.31, given the substantial increase in shareholders’ equity. ROTCE is meaningful both because it measures the performance of businesses consistently, whether they were acquired or developed organically, and because it is commonly used in the North American banking industry. | |

|

Return on common shareholders’ equity (ROE) is calculated as net income, less non-controlling interest in subsidiaries and preferred dividends, as a percentage of average common shareholders’ equity. Common shareholders’ equity is comprised of common share capital, contributed surplus, accumulated other comprehensive income (loss) and retained earnings. Adjusted ROE is calculated using adjusted net income rather than net income. Adjusted return on tangible common equity (ROTCE) is calculated as adjusted net income available to common shareholders as a percentage of average tangible common equity. Tangible common equity is calculated as common shareholders’ equity less goodwill and acquisition-related intangible assets, net of related deferred tax liabilities. | |

| |

Return on Equity and Adjusted Return on Tangible Common Equity

| | | | | | | | | | | | | | | | | | | | |

(Canadian $ in millions, except as noted) For the year ended October 31 | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011* | |

Reported net income | | | 4,405 | | | | 4,333 | | | | 4,195 | | | | 4,156 | | | | 3,114 | |

Attributable to non-controlling interest in subsidiaries | | | (35 | ) | | | (56 | ) | | | (65 | ) | | | (74 | ) | | | (73 | ) |

Preferred dividends | | | (117 | ) | | | (120 | ) | | | (120 | ) | | | (136 | ) | | | (146 | ) |

Net income available to common shareholders | | | 4,253 | | | | 4,157 | | | | 4,010 | | | | 3,946 | | | | 2,895 | |

Average common shareholders’ equity | | | 34,135 | | | | 29,680 | | | | 26,956 | | | | 24,863 | | | | 19,145 | |

Return on equity (%) | | | 12.5 | | | | 14.0 | | | | 14.9 | | | | 15.9 | | | | 15.1 | |

Adjusted net income available to common shareholders | | | 4,529 | | | | 4,277 | | | | 4,038 | | | | 3,849 | | | | 3,056 | |

Adjusted return on equity (%) | | | 13.3 | | | | 14.4 | | | | 15.0 | | | | 15.5 | | | | 16.0 | |

Average tangible common equity | | | 27,666 | | | | 24,595 | | | | 22,860 | | | | 20,798 | | | | 16,790 | |

Adjusted return on tangible common equity (%) | | | 16.4 | | | | 17.4 | | | | 17.3 | | | | 18.0 | | | | 17.9 | |

* 2011 has not been restated to reflect the IFRS standards adopted in 2014.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

| | |

Basel III Common Equity Tier 1 Ratio BMO’s Basel III Common Equity Tier 1 (CET1) Ratio is the last of our four key value measures. BMO’s CET1 Ratio is strong and exceeds the Office of the Superintendent of Financial Institutions Canada’s requirements for large Canadian banks. Our CET1 Ratio was 10.7% at October 31, 2015, compared to 10.1% at October 31, 2014. The CET1 Ratio increased by 60 basis points from the end of fiscal 2014 primarily due to higher capital, partially offset by an increase in risk-weighted assets. The acquisition of GE Capital’s Transportation Finance business is expected to reduce BMO’s CET1 Ratio by approximately 70 basis points on closing in the first quarter of 2016. | |

|

Basel III Common Equity Tier 1 (CET1) Ratio is calculated as CET1 capital, which is comprised of common shareholders’ equity less deductions for goodwill, intangible assets, pension assets, certain deferred tax assets and other items, divided by risk-weighted assets for CET1. | |

| |

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 35 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

2015 Financial Performance Review

This section provides a review of our enterprise financial performance for 2015 that focuses on the Consolidated Statement of Income included in our consolidated financial statements, which begin on page 135. A review of our operating groups’ strategies and performance follows the enterprise review. A summary of the enterprise financial performance for 2014 appears on page 64. This section contains adjusted results, which are non-GAAP and are disclosed in more detail in the Non-GAAP Measures section on page 33.

Highlights

| | • | | On a net revenue basis(1), revenue increased $1,417 million or 8% in 2015 to $18,135 million. Adjusted revenue increased $1,419 million or 8% to $18,137 million. Revenue growth was due to the benefits of our diversified business mix and successful execution against our strategic priorities. The impact of the stronger U.S. dollar increased adjusted net revenue growth by $732 million or 4%. The remaining increase was mainly due to revenue growth in Canadian P&C and Wealth Management. |

| | • | | Revenue growth in Canadian P&C reflected higher balances and improved non-interest revenue. U.S. P&C revenue increased $458 million or 15% on a Canadian dollar basis, and was stable on a U.S. dollar basis as strong commercial loan growth and increased mortgage banking revenue offset the effects of lower net interest margin. Wealth Management revenue growth was driven by traditional wealth growth of 20%, including the full year contribution from the acquired F&C business. Insurance net revenue declined due to higher actuarial benefits in the prior year. BMO Capital Markets revenue increased, driven by the stronger U.S. dollar. Corporate Services adjusted revenue declined mainly due to lower revenue related to the purchased loan portfolio. |

| | • | | Provisions for credit losses totalled $612 million in the current year, up from $561 million in 2014, primarily due to lower recoveries in Corporate Services and higher provisions in BMO Capital Markets, partially offset by reduced provisions in the P&C businesses. | |

| | • | | Adjusted non-interest expense increased $1,058 million or 10% to $11,819 million, of which approximately 6% was due to the stronger U.S. dollar, 2% was due to the inclusion of F&C results for two additional quarters relative to a year ago, and 2% was due to business growth. | |

| | • | | The effective income tax rate in 2015 was 17.5%, compared with 17.2% in 2014. The adjusted effective income tax rate(2) was 18.0%, compared with 17.5% in 2014. The higher adjusted effective tax rate was attributable to a lower proportion of income from lower tax rate jurisdictions. | |

| | (1) | See page 38 for a description of net revenue. |

| | (2) | The adjusted rate is computed using adjusted net income rather than net income in the determination of income subject to tax. |

| | |

| 36 | | BMO Financial Group 198th Annual Report 2015 |

Foreign Exchange

The U.S. dollar was stronger compared to the Canadian dollar at October 31, 2015 than at October 31, 2014. BMO’s U.S.-dollar-denominated assets and liabilities are translated at year-end rates. The average exchange rate over the course of 2015, which is used in the translation of BMO’sU.S.-dollar-denominated revenues and expenses, was higher in 2015 than in 2014. Consequently, the Canadian dollar equivalents of BMO’sU.S.-dollar-denominated net income, revenues, expenses, recovery of (provision for) credit losses and income taxes in 2015 increased relative to the preceding year. The table below indicates average Canadian/U.S. dollar exchange rates in 2015, 2014 and 2013 and the impact of changes in the average rates on our U.S. segment results. At October 31, 2015, the Canadian dollar traded at $1.3075 per U.S. dollar. It traded at $1.1271 per U.S. dollar at October 31, 2014.

Changes in the exchange rate will affect future results measured in Canadian dollars and the impact on those results is a function of the periods in which revenues, expenses and provisions for (recoveries of) credit losses arise. If future results are consistent with results in 2015, each one cent increase (decrease) in the Canadian/U.S. dollar exchange rate, expressed in terms of how many Canadian dollars one U.S. dollar buys, would be expected to increase (decrease) the Canadian dollar equivalent of U.S.-dollar-denominated adjusted net income before income taxes for the year by $10 million in the absence of hedging transactions.

Economically, our U.S. dollar income stream was largely unhedged to changes in foreign exchange rates during the year. During 2015, we hedged a portion of the forecasted BMO Capital Markets U.S. dollar net income. These hedges are subject to mark-to-market accounting, which resulted in a $21 million after tax loss in 2015, which was recorded in our BMO Capital Markets business.

We regularly determine whether to execute hedging transactions to mitigate the impact of foreign exchange rate movements on net income.

Effects of Changes in Exchange Rates on BMO’s Reported and Adjusted Results

| | | | | | | | |

(Canadian $ in millions, except as noted) | | 2015 vs. 2014 | | | 2014 vs. 2013 | |

Canadian/U.S. dollar exchange rate (average) | | | | | | | | |

2015 | | | 1.2550 | | | | | |

2014 | | | 1.0937 | | | | 1.0937 | |

2013 | | | | | | | 1.0235 | |

| | |

Effects on reported results | | | | | | | | |

Increased net interest income | | | 409 | | | | 183 | |

Increased non-interest revenue | | | 351 | | | | 150 | |

Increased revenues | | | 760 | | | | 333 | |

Increased provision for credit losses | | | (5 | ) | | | (1 | ) |

Increased expenses | | | (598 | ) | | | (262 | ) |

Increased income taxes | | | (33 | ) | | | (14 | ) |

Increased reported net income before impact of hedges | | | 124 | | | | 56 | |

Hedging losses in current year after tax | | | (21 | ) | | | (10 | ) |

Increased reported net income | | | 103 | | | | 46 | |

| | |

Effects on adjusted results | | | | | | | | |

Increased net interest income | | | 409 | | | | 183 | |

Increased non-interest revenue | | | 351 | | | | 150 | |

Increased revenues | | | 760 | | | | 333 | |

Increased provision for credit losses | | | (15 | ) | | | (2 | ) |

Increased expenses | | | (578 | ) | | | (255 | ) |

Increased income taxes | | | (34 | ) | | | (15 | ) |

Increased adjusted net income before impact of hedges | | | 133 | | | | 61 | |

Hedging losses in current year after tax | | | (21 | ) | | | (10 | ) |

Increased adjusted net income | | | 112 | | | | 51 | |

Caution

This Foreign Exchange section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements.

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 37 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Revenue(1)

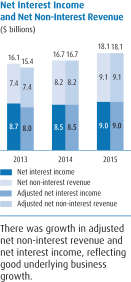

Revenue increased $1,166 million or 6% in 2015 to $19,389 million. On a basis that nets insurance claims, commissions and changes in policy benefit liabilities (CCPB) against insurance revenue (net revenue), revenue increased $1,417 million or 8% to $18,135 million.

Amounts in the rest of this Revenue section are stated on an adjusted basis.

Net revenue increased $1,419 million or 8% to $18,137 million, including a $732 million or 4% impact of the stronger U.S. dollar, mainly due to growth in Canadian P&C and Wealth Management. BMO analyzes revenue at the consolidated level based on GAAP revenues as reported in the financial statements, and on an adjusted basis. Consistent with our Canadian peer group, we analyze revenue on a taxable equivalent basis (teb) at the operating group level. The teb adjustments for 2015 totalled $524 million, up from $476 million in 2014.

Canadian P&C revenue increased $235 million or 4% as a result of higher balances and improved non-interest revenue, with stable net interest margin.

U.S. P&C revenue increased $458 million or 15% on a Canadian dollar basis and remained stable at $2,877 million on a U.S. dollar basis, as higher balances and increased mortgage banking revenue offset the effects of lower net interest margin.

Wealth Management revenue increased $676 million or 18% to $4,509 million on a net revenue basis, with traditional wealth growth of 20% due to good growth in client assets, including the full year benefit from the acquired F&C business. Net insurance revenue decreased due to higher actuarial benefits in the prior year.

BMO Capital Markets revenue increased $153 million or 4% to $3,873 million due to the stronger U.S. dollar. Higher trading revenues, including the prior year unfavourable impact of implementing a funding valuation adjustment, and higher lending revenues were offset by lower investment banking fees and reduced securities gains.

Corporate Services adjusted revenue declined by $105 million, mainly due to lower revenue related to the purchased loan portfolio.

| | (1) | Commencing in 2015, insurance claims, commissions and changes in policy benefit liabilities are reported separately. They were previously reported as a reduction in insurance revenue in non-interest revenue. Prior period amounts and ratios have been reclassified. Insurance can experience variability arising from fluctuations in the fair value of insurance assets and the related liabilities. The investments which support actuarial liabilities are predominantly fixed income assets recorded at fair value with changes in the fair values recorded in insurance revenue in the Consolidated Statement of Income. These fair value changes are largely offset by changes in the fair value of policy benefit liabilities, the impact of which is reflected in insurance claims, commissions and changes in policy benefit liabilities. The discussion of revenue on a net basis reduces this variability in the results, which allows for a better discussion of operating results. |

Taxable equivalent basis (teb) Revenues of operating groups are presented in our MD&A on a taxable equivalent basis (teb). The teb adjustment increases GAAP revenue and the provision for income taxes by an amount that would increase revenue on certain tax-exempt items to a level that would incur tax at the statutory rate, to facilitate comparisons. This adjustment is offset in Corporate Services.

Revenue and Adjusted Revenue (1)

| | | | | | | | | | | | | | | | | | | | |

(Canadian $ in millions, except as noted) For the year ended October 31 | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011* | |

Net interest income | | | 8,970 | | | | 8,461 | | | | 8,677 | | | | 8,937 | | | | 7,474 | |

Year-over-year growth (%) | | | 6 | | | | (3 | ) | | | (3 | ) | | | 20 | | | | 20 | |

Non-interest revenue | | | 10,419 | | | | 9,762 | | | | 8,153 | | | | 8,166 | | | | 7,587 | |

Year-over-year growth (%) | | | 7 | | | | 20 | | | | – | | | | 8 | | | | 8 | |

Total revenue | | | 19,389 | | | | 18,223 | | | | 16,830 | | | | 17,103 | | | | 15,061 | |

Cdn./U.S. dollar translation effect | | | 732 | | | | 319 | | | | 87 | | | | 98 | | | | (188 | ) |

Year-over-year growth (%) | | | 6 | | | | 8 | | | | (2 | ) | | | 14 | | | | 14 | |

Impact of Cdn./U.S. dollar translation effect (%) | | | 4 | | | | 2 | | | | 1 | | | | 1 | | | | 1 | |

Adjusted net interest income | | | 8,971 | | | | 8,461 | | | | 8,020 | | | | 8,158 | | | | 7,248 | |

Year-over-year growth (%) | | | 6 | | | | 5 | | | | (2 | ) | | | 13 | | | | 16 | |

Adjusted non-interest revenue | | | 10,420 | | | | 9,762 | | | | 8,119 | | | | 7,882 | | | | 7,612 | |

Year-over-year growth (%) | | | 7 | | | | 20 | | | | 3 | | | | 4 | | | | 8 | |

Total adjusted revenue (2) | | | 19,391 | | | | 18,223 | | | | 16,139 | | | | 16,040 | | | | 14,860 | |

Year-over-year growth (%) | | | 6 | | | | 13 | | | | 1 | | | | 8 | | | | 12 | |

Total adjusted revenue, net of CCPB (2) | | | 18,137 | | | | 16,718 | | | | 15,372 | | | | 14,866 | | | | 13,742 | |

Cdn./U.S. dollar translation effect | | | 732 | | | | 319 | | | | 78 | | | | 85 | | | | (173 | ) |

Year-over-year growth (%) | | | 8 | | | | 9 | | | | 3 | | | | 8 | | | | 12 | |

Impact of Cdn./U.S. dollar translation effect (%) | | | 4 | | | | 2 | | | | 1 | | | | 1 | | | | 1 | |

* Growth rates for 2011 reflect growth based on CGAAP in 2010 and IFRS in 2011. 2011 has not been restated to reflect the new IFRS standards adopted in 2014.

| | (1) | Commencing in the first quarter of 2015, insurance claims, commissions and changes in policy benefit liabilities (CCPB) are reported separately. They were previously reported as a reduction in insurance revenue in non-interest revenue. Prior period amounts and ratios have been reclassified. |

| | (2) | Adjusted revenue for 2011-2013 excludes the portion of the credit mark recorded in net interest income on the purchased performing loan portfolio and income or losses from run-off structured credit activities recorded in non-interest revenue, which are recorded in Corporate Services, as discussed in the Non-GAAP Measures section on page 33. |

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

| | |

| 38 | | BMO Financial Group 198th Annual Report 2015 |

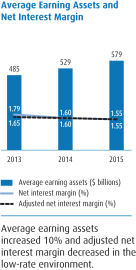

Net Interest Income

Net interest income for the year was $8,970 million, an increase of $509 million or 6% from 2014, due to the impact of the stronger U.S. dollar and volume growth, partially offset by lower net interest margin and lower revenue from the purchased loan portfolio. The impact of the stronger U.S. dollar increased net interest income by $409 million.

BMO’s average earning assets increased $51 billion or 10% in 2015, including a $32 billion increase as a result of the stronger U.S. dollar. There was growth in all operating groups.

The main drivers of BMO’s overall net interest margin are the individual group margins, changes in the magnitude of each operating group’s average earning assets and changes in net interest income in Corporate Services. Changes are discussed in the 2015 Operating Groups Performance Review section starting on page 45.

Table 5 on page 122 and Table 6 on page 123 provide further details on net interest income and net interest margin.

Net interest income is comprised of earnings on assets, such as loans and securities, including interest and dividend income and BMO’s share of income from investments accounted for using the equity method of accounting, less interest expense paid on liabilities, such as deposits.

Net interest margin is the ratio of net interest income to average earning assets, expressed as a percentage or in basis points.

Change in Net Interest Income, Average Earning Assets and Net Interest Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net interest income (teb) | | | | | Average earning assets | | | | | Net interest margin | |

(Canadian $ in millions, except as noted) For the year ended October 31 | | | | | Change | | | | | | | | Change | | | | | (in basis points) | |

| | 2015 | | | 2014 | | | % | | | | | 2015 | | | 2014 | | | % | | | | | 2015 | | | 2014 | | | Change | |

Canadian P&C | | | 4,937 | | | | 4,780 | | | | 3 | | | | | | 189,505 | | | | 183,406 | | | | 3 | | | | | | 261 | | | | 261 | | | | – | |

U.S. P&C | | | 2,834 | | | | 2,482 | | | | 14 | | | | | | 81,965 | | | | 68,312 | | | | 20 | | | | | | 346 | | | | 363 | | | | (17 | ) |

Personal and Commercial Banking (P&C) | | | 7,771 | | | | 7,262 | | | | 7 | | | | | | 271,470 | | | | 251,718 | | | | 8 | | | | | | 286 | | | | 289 | | | | (3 | ) |

Wealth Management | | | 642 | | | | 560 | | | | 15 | | | | | | 23,784 | | | | 21,169 | | | | 12 | | | | | | 270 | | | | 265 | | | | 5 | |

BMO Capital Markets | | | 1,334 | | | | 1,177 | | | | 13 | | | | | | 238,916 | | | | 222,471 | | | | 7 | | | | | | 56 | | | | 53 | | | | 3 | |

Corporate Services | | | (777 | ) | | | (538 | ) | | | 44 | | | | | | 45,301 | | | | 33,428 | | | | 36 | | | | | | nm | | | | nm | | | | nm | |

Total BMO reported | | | 8,970 | | | | 8,461 | | | | 6 | | | | | | 579,471 | | | | 528,786 | | | | 10 | | | | | | 155 | | | | 160 | | | | (5 | ) |

U.S. P&C (US$ in millions) | | | 2,259 | | | | 2,269 | | | | – | | | | | | 65,319 | | | | 62,443 | | | | 5 | | | | | | 346 | | | | 363 | | | | (17 | ) |

nm – not meaningful

Adjusted results in this section are non-GAAP and are discussed in the Non-GAAP Measures section on page 33.

| | | | |

| BMO Financial Group 198th Annual Report 2015 | | | 39 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Non-Interest Revenue

Non-interest revenue, which comprises all revenue other than net interest income, increased $908 million or 11% on a net revenue basis to $9,165 million. Excluding the impact of the stronger U.S. dollar, net non-interest revenue increased 7% with the majority of the growth driven by strong performance in Wealth Management, as well as growth in the P&C businesses.

Mutual fund revenue increased $312 million and investment management and custodial fees increased $254 million, both due to good organic growth in client assets and the contribution from six additional months of revenue from the F&C business relative to a year ago and the impact of the stronger U.S. dollar.

Deposit and payment service charges increased $75 million, due to the impact of the stronger U.S. dollar and growth in Canadian P&C.

Lending fees increased $57 million, due to the impact of the stronger U.S. dollar and growth in lending activity in BMO Capital Markets and in the Canadian P&C loan portfolio.

Trading revenues increased $38 million and are discussed in the Trading-Related Revenues section that follows.

Securities commissions and fees increased $19 million. These revenues consist largely of brokerage commissions within Wealth Management, which account for about three-quarters of the total, and institutional equity trading commissions within BMO Capital Markets. The increase is due to the stronger U.S. dollar and higher client activity in BMO Capital Markets, partially offset by lower securities commissions in Wealth Management due to softer equity markets.

Insurance revenue decreased $246 million from a year ago, when lower long-term interest rates increased the fair value of insurance investments, partially offset by increased underlying business premium income in 2015. The decrease in insurance revenue was largely offset by lower insurance claims, commissions and changes in policy benefit liabilities as discussed on page 41.

Underwriting and advisory fees decreased $38 million, due to more challenging market conditions, offset in part by the impact of the stronger U.S. dollar.

Other non-interest revenue includes various sundry amounts and increased by $186 million from the prior year, primarily due to a gain on sale of BMO’s U.S. retirement services business and a legal settlement.

Foreign exchange, other than trading, securities gains and card fees were largely consistent with the prior year.

Table 3 on page 120 provides further details on revenue and revenue growth.

Non-Interest Revenue(1)

| | | | | | | | | | | | | | | | |

| (Canadian $ in millions) | | | | | | | | Change from 2014 | |

| For the year ended October 31 | | 2015 | | | 2014 | | | 2013 | | | (%) | |

Securities commissions and fees | | | 953 | | | | 934 | | | | 846 | | | | 2 | |

Deposit and payment service charges | | | 1,077 | | | | 1,002 | | | | 916 | | | | 8 | |

Trading revenues | | | 987 | | | | 949 | | | | 849 | | | | 4 | |

Lending fees | | | 737 | | | | 680 | | | | 603 | | | | 8 | |

Card fees | | | 460 | | | | 462 | | | | 461 | | | | – | |

Investment management and custodial fees | | | 1,500 | | | | 1,246 | | | | 971 | | | | 20 | |

Mutual fund revenues | | | 1,385 | | | | 1,073 | | | | 832 | | | | 29 | |

Underwriting and advisory fees | | | 706 | | | | 744 | | | | 659 | | | | (5 | ) |

Securities gains, other than trading | | | 171 | | | | 162 | | | | 285 | | | | 6 | |

Foreign exchange, other than trading | | | 172 | | | | 179 | | | | 172 | | | | (4 | ) |

Insurance revenue (1) | | | 1,762 | | | | 2,008 | | | | 1,212 | | | | (12 | ) |

Other | | | 509 | | | | 323 | | | | 347 | | | | 58 | |

Total BMO reported (1) | | | 10,419 | | | | 9,762 | | | | 8,153 | | | | 7 | |

BMO reported, net of CCPB | | | 9,165 | | | | 8,257 | | | | 7,386 | | | | 11 | |

Insurance revenue, net of CCPB | | | 508 | | | | 503 | | | | 445 | | | | 1 | |

| | (1) | Commencing in the first quarter of 2015, insurance claims, commissions and changes in policy benefit liabilities (CCPB) are reported separately. They were previously reported as a reduction in insurance revenue in non-interest revenue. Prior period amounts and ratios have been reclassified. |

| | |

| 40 | | BMO Financial Group 198th Annual Report 2015 |

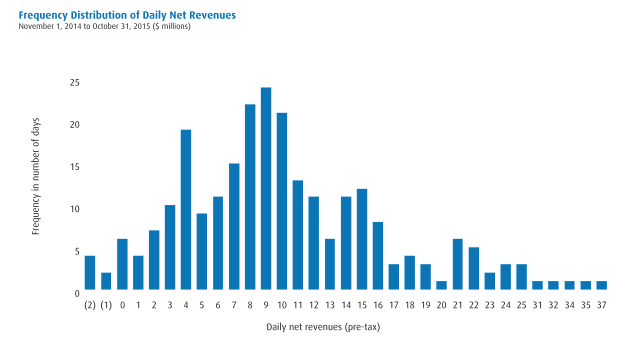

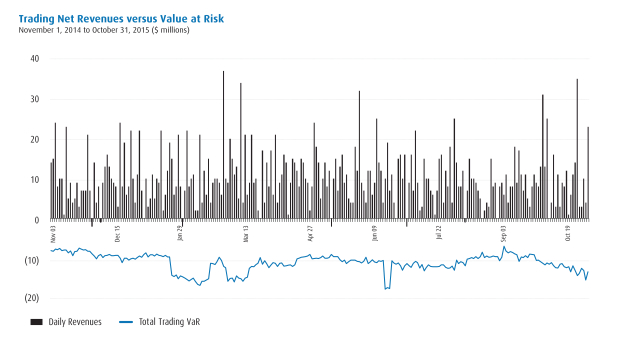

Trading-Related Revenues

Trading-related revenues are dependent on, among other things, the volume of activities undertaken for clients who enter into transactions with BMO to mitigate their risks or to invest. BMO earns a spread or profit on the net sum of its client positions by profitably managing, within prescribed limits, the overall risk of the net positions. On a limited basis, BMO also earns revenue from principal trading positions.

Interest and non-interest trading-related revenues increased $86 million or 9%. Excluding the impact of the stronger U.S. dollar and the result of hedging a portion of U.S. net income, trading-related revenues increased by $75 million or 8%. Interest rate trading-related revenues increased $82 million or 25%, including the prior year unfavourable impact of implementing a funding valuation adjustment, primarily due to increased client activity in our fixed income businesses. Foreign exchange trading-related revenues were up $25 million or 7%, driven by increased client activity in response to, among other things, the Bank of Canada rate changes and potential changes by the U.S. Federal Reserve. Equities trading-related revenues increased $7 million or 1%, reflecting increased activity with corporate and investor clients. Commodities trading-related revenues increased $3 million or 6% due to increased client hedging activity.

The Market Risk section on page 100 provides more information on trading-related revenues.

Trading-related revenues include net interest income and non-interest revenue earned from on and off-balance sheet positions undertaken for trading purposes. The management of these positions typically includes marking them to market on a daily basis. Trading-related revenues also include income (expense) and gains (losses) from both on-balance sheet instruments and interest rate, foreign exchange (including spot positions), equity, commodity and credit contracts.

Interest and Non-Interest Trading-Related Revenues (1)

| | | | | | | | | | | | | | | | |

(Canadian $ in millions) | | | | | | | | | | | Change

from 2014 | |

| (taxable equivalent basis) | | | | | | | | | | |

| For the year ended October 31 | | 2015 | | | 2014 | | | 2013 | | | (%) | |

Interest rates | | | 422 | | | | 325 | | | | 479 | | | | 30 | |

Foreign exchange | | | 364 | | | | 356 | | | | 285 | | | | 2 | |

Equities | | | 638 | | | | 626 | | | | 499 | | | | 2 | |

Commodities | | | 56 | | | | 46 | | | | 43 | | | | 21 | |

Other (2) | | | 6 | | | | 13 | | | | 29 | | | | (54 | ) |

Total (teb) | | | 1,486 | | | | 1,366 | | | | 1,335 | | | | 9 | |

Teb offset | | | 467 | | | | 433 | | | | 309 | | | | 8 | |

Reported Total | | | 1,019 | | | | 933 | | | | 1,026 | | | | 9 | |

Reported as: | | | | | | | | | | | | | | | | |

Net interest income | | | 499 | | | | 417 | | | | 486 | | | | 20 | |

Non-interest revenue – trading revenues | | | 987 | | | | 949 | | | | 849 | | | | 4 | |

Total (teb) | | | 1,486 | | | | 1,366 | | | | 1,335 | | | | 9 | |

Teb offset | | | 467 | | | | 433 | | | | 309 | | | | 8 | |

Reported Total, net of teb offset | | | 1,019 | | | | 933 | | | | 1,026 | | | | 9 | |

Adjusted net interest income, net of teb offset | | | 32 | | | | (16 | ) | | | 157 | | | | +100 | |

Adjusted non-interest revenue – trading revenues | | | 987 | | | | 949 | | | | 815 | | | | 4 | |

Adjusted total, net of teb offset | | | 1,019 | | | | 933 | | | | 972 | | | | 9 | |

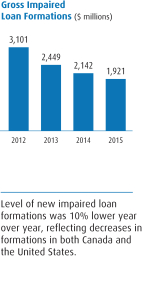

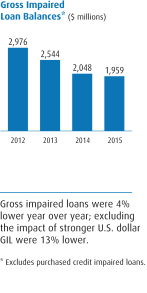

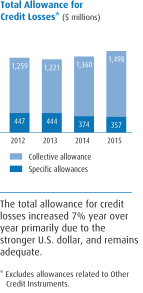

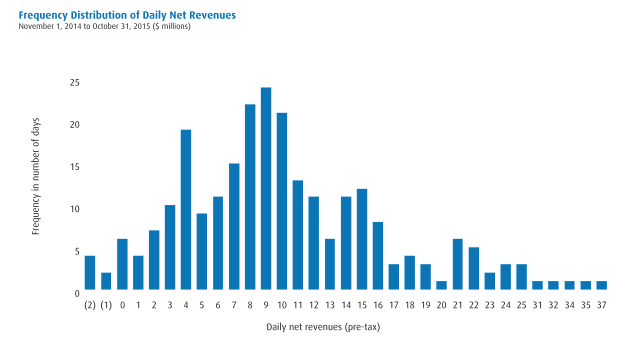

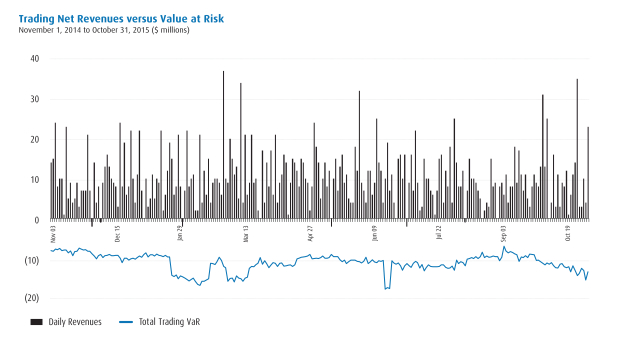

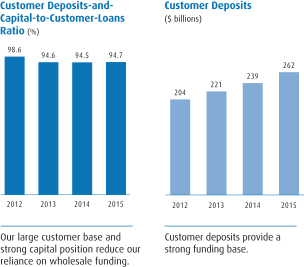

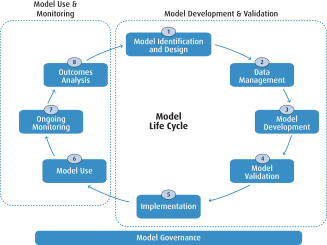

| | (1) | Trading-related revenues are presented on a taxable equivalent basis. |