MANAGEMENT’S DISCUSSION AND ANALYSIS

Credit and Counterparty Risk Management

Collateral Management

Collateral is used for credit risk mitigation purposes to minimize losses that would otherwise be incurred in the event of a default. Depending on the type of borrower or counterparty, the assets available and the structure and term of the credit obligations, collateral can take various forms. For corporate and commercial borrowers, collateral can take the form of pledges of the assets of a business, such as accounts receivable, inventory, machinery, real estate, or personal assets pledged in support of guarantees. For trading counterparties, we may enter into legally enforceable netting agreements foron-balance sheet credit exposures, when possible. In our securities financing transaction business (including repurchase agreements and securities lending), we take eligible financial collateral that we control and can readily liquidate.

Collateral for our derivatives trading counterparty exposures is primarily comprised of cash and high-quality liquid securities (U.S. and Canadian treasury securities, U.S. agency securities, Canadian provincial government securities and certain high-quality European sovereign securities) that are monitored and revalued on a daily basis. Collateral is obtained under the contractual terms of standardized industry documentation. With limited exceptions, we utilize the International Swaps and Derivatives Association Inc. Master Agreement, frequently with a Credit Support Annex, to document our collateralized trading relationships with our counterparties forover-the-counter (OTC) derivatives that are not centrally cleared. Credit Support Annexes entitle a party to demand collateral (or other credit support) when its OTC derivatives exposure to another party exceeds an agreed threshold. Collateral transferred can include an independent initial margin and/or variation margin. Credit Support Annexes contain, among other things, provisions setting out acceptable types of collateral and a method for their valuation (discounts are often applied to the market values), as well as thresholds, whether or not the collateral can bere-pledged by the recipient and how interest is to be calculated.

Many G20 jurisdictions are implementing new regulations that require certain counterparties with significant OTC derivatives exposures to post or collect prescribed types and amounts of collateral for uncleared OTC derivatives transactions. For additional discussion, see Legal and Regulatory Risk – Derivatives Reform on page 114.

To document our contractual securities financing relationships with our counterparties, we utilize master repurchase agreements for repurchase transactions and for securities lending transactions, we utilize master securities lending agreements.

On a periodic basis, collateral is subject to revaluation specific to asset type. For loans, the value of collateral is initially established at the time of origination, and the frequency of revaluation is dependent on the type of collateral. For commercial real estate collateral, a full external appraisal of the property is typically obtained at the time of loan origination, unless the exposure is below a specified threshold amount, in which case an internal evaluation and a site inspection are conducted. Internal evaluations may consider property tax assessments, purchase prices, real estate listings or realtor opinions. The case for an updated appraisal is reviewed annually, with consideration given to the borrower risk rating, existing tenants and lease contracts, as well as current market conditions.

When a commercial loan is determined to be impaired, a thorough review of collateral is conducted and updated external appraisals or valuations may be obtained. Quarterly reviews are then completed and collateral positions are reviewed and updated as deemed appropriate.

In Canada, for residential real estate that has a loan-to-value (LTV) ratio of less than 80%, an external property appraisal is routinely obtained at the time of loan origination. We may use an external service provided by Canada Mortgage and Housing Corporation or an automated valuation model provided by our appraisal management company to assist with determining either the current value of a property or the necessity of a full property appraisal.

For insured mortgages in Canada with a high LTV ratio (greater than 80%), we determine the value of the property through the default insurer.

Portfolio Management and Concentrations of Credit and Counterparty Risk

BMO’s credit risk governance policies require an acceptable level of diversification to help ensure we avoid undue concentrations of credit risk. Concentrations of credit risk may exist if a number of clients are engaged in similar activities, are located in the same geographic region or have similar economic characteristics such that their ability to meet contractual obligations could be similarly affected by changes in economic, political or other conditions. Limits may be specified for several portfolio dimensions, including industry, specialty segment (e.g., hedge funds and leveraged lending), country, product and single-name concentrations. The diversification of our credit exposure may be supplemented by the purchase or sale of credit protection through guarantees, insurance or credit default swaps.

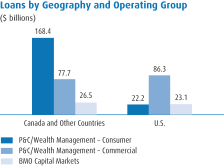

Our credit assets consist of a well-diversified portfolio representing millions of clients, the majority of them consumers and small tomedium-sized businesses. From an industry viewpoint, our most significant exposure at October 31, 2018 was to individual consumers, comprising $238,400 million ($223,962 million in 2017).

Wrong-way Risk

Wrong-way risk occurs when our exposure to a counterparty or the magnitude of our potential loss is highly correlated with the counterparty’s probability of default. There is specificwrong-way risk, which arises when the credit quality of the counterparty and the market risk factors affecting collateral or other risk mitigants display a high correlation, and generalwrong-way risk, which arises when the credit quality of the counterparty, fornon-specific reasons, is highly correlated with macroeconomic or other factors that affect the value of the mitigant. Our procedures require specificwrong-way risk be identified in transactions and accounted for in the assessment of risk. Stress testing of replacement risk is conducted monthly and can be used to identify existing or emerging concentrations of generalwrong-way risk in our portfolios.

Credit and Counterparty Risk Measurement

We quantify credit risk at both the individual borrower or counterparty level and the portfolio level. In order to limit earnings volatility, manage expected credit losses and minimize unexpected losses, credit risk is assessed and measured using the following risk-based parameters:

Exposure at Default (EAD) represents an estimate of the outstanding amount of a credit exposure at the time a default may occur.

Loss Given Default (LGD) is a measure of our economic loss, such as the amount that may not be recovered in the event of a default, presented as a proportion of the exposure at default.

Probability of Default (PD) represents the likelihood that a borrower or counterparty will go into default over aone-year time horizon.

Expected Loss (EL) is a measure representing the loss that is expected to occur in the normal course of business in a given period of time. EL is calculated as a function of EAD, LGD and PD.

Material presented in a blue-tinted font above is an integral part of the 2018 annual consolidated financial statements (see page 78).

| | |

| 88 | | BMO Financial Group 201st Annual Report 2018 |