Argument

First, we would like to point out that, according to the guidelines published in 2012 by the United Nations Principles for Responsible Investment (PRI) and the United Nations Global Compact, the use of ESG criteria can be an important factor in the protection and creation of value for shareholders.

The objectives could include: the proportion of women within decision-making bodies, the level of integration of people from various socio-cultural communities, initiatives to reduce paper, energy and water consumption, measures taken to ensure sustainable employability of various employees considering task automation, the different programs developed to promote the health and well-being of employees, etc.

In this respect, it should be noted that companies with specific ESG guidance generally enjoy a better reputation with their customers, adapt to change with more agility, better manage their risks, are more innovative and are therefore in a better position to develop long-term added value for their shareholders and stakeholders.

It goes without saying that the integration of financial objectives into the assessment of executive performance and the compensation-setting process plays a critical role in achieving such objectives. The same approach should be followed for ESG objectives.

AS AGREED WITH MÉDAC, THIS PROPOSAL IS NOT BEING PUT TO A SHAREHOLDER VOTE. THE BANK ALREADY CONSIDERS ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) ISSUES AS PART OF ITS DECISION-MAKING PROCESSES RELATED TO COMPENSATION.

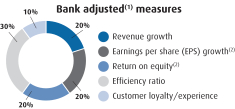

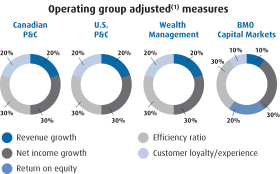

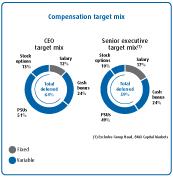

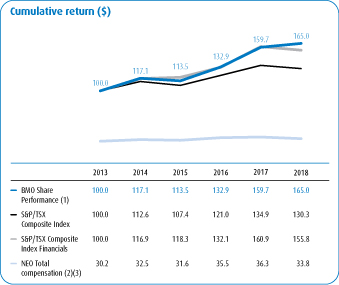

Short, mid and long-term incentive plan funding for executives is calculated using business performance factors tied to three key elements of the bank’s strategic priorities: customer, productivity and growth (for further details please see pages 71 to 78). And as our strategic priorities are complemented by a set of sustainability principles that shape how we conduct business, make key decisions, prudently manage risk and drive long-term growth, as part of its compensation decision-making processes BMO has a long history of considering additional factors outside of those used to calculate funding. These factors include relevant environmental, social and governance issues.

The Board understands and accepts its responsibility toward ensuring the soundness and stability of the financial markets in which BMO operates, and the need to balance BMO’s financial success with its commitments to customers, employees, the environment and to the communities in which we live and work. To meet this responsibility, it has developed a risk governance framework that fosters prudent and measured risk-taking in every aspect of BMO’s planning process andday-to-day business activities. This framework includes processes and activities that help manage current and future compensation risks as well (see pages 81 to 83).

Each year the management oversight committees, made up of BMO’s independent control function heads, complete a review of material risk events. These events, which may include any violations of civil or criminal laws, inappropriate risk-taking ornon-compliance with BMO’s risk appetite, failures to identify, mitigate or remediate regulatory, governance or compliance issues in a timely fashion, or instances where the behaviours or actions of our employees are not aligned with BMO’s values or standards of conduct.

When such events occur, BMO’s framework includes guidelines that each committee assesses and from which they may recommend courses of action to management and the Board. These range from the reduction and/or elimination of incentive pool funding at the line of business or group levels, to reductions and/or elimination of individual incentive awards to specific executives. Given the severity of an issue, they may also include recommendations to forfeit unvested or unexercised equity held under BMO’s plans, or the clawback of incentive payments previously received.

While the above framework is a key part of BMO’s commitment to ensuring that social, environmental and governance issues are captured and recognized at the broadest levels possible, at the individual level executives are held accountable by their managers as well. Every year, each executive is assigned qualitative objectives against which they are assessed. These include their contribution to the organization through leadership, demonstrated commitment to teamwork, innovation, sound governance practices and behaviours aligned with BMO’s values and standards of conduct. Those in the applicable functions are also assigned specific objectives reflecting their responsibilities toward meeting environmental sustainability and other ESG priorities.

At the end of every year, each executive’s individual performance is assessed against the objectives they are assigned. The results of these assessments inform decisions their managers make as to the incentive compensation awards the executives receive.

| | | | | | |

| Bank of Montreal Management Proxy Circular | | | | | 56 | |