Exhibit 99.2 1st QUARTER 2019 EARNINGS May 6, 2019

IMPORTANT DISCLOSURES FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include all statements regarding wells anticipated to be drilled and placed on production; future levels of drilling activity and associated production and cash flow expectations; the Company's 2019 production guidance and capital expenditure forecast; estimated reserve quantities and the present value thereof; anticipated returns and financial position; and the implementation of the Company's business plans and strategy, as well as statements including the words "believe," "expect," “may,” “will,” "forecast," “outlook,” "plans" and words of similar meaning. These statements reflect the Company's current views with respect to future events and financial performance based on management’s experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. No assurances can be given, however, as of this date that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. Any forward-looking statement speaks only as of the date of which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Some of the factors which could affect our future results and could cause results to differ materially from those expressed in our forward-looking statements include the volatility of oil and natural gas prices, ability to drill and complete wells, operational, regulatory and environment risks, cost and availability of equipment and labor, our ability to finance our activities and other risks more fully discussed in our filings with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, available on our website or the SEC's website at www.sec.gov. SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP measures, such as Adjusted EBITDA, Adjusted Total Revenue, Adjusted G&A, Discretionary Cash Flow, PV-10, Net Debt to LTM Adjusted EBITDA, Total Liquidity and other measures identified as non-GAAP. Management also uses EBITDAX, which reflects EBITDA plus exploration and abandonment expense. Reconciliations are available in the Appendix. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation, depletion and amortization, asset retirement obligation accretion expense, exploration expense, (gains) losses on derivative instruments excluding net settled derivative instruments, impairment of oil and natural gas properties, non-cash equity based compensation, other income, gains and losses from the sale of assets and other non-cash operating items. Management believes Adjusted EBITDA is useful because it allows it to more effectively evaluate our operating performance and compare the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as an inference that our results will be unaffected by unusual or non-recurring items. Adjusted Total Revenues is a supplemental non-GAAP financial measure. We define Adjusted Total Revenues as Total Operating Revenues inclusive of the impact of commodity derivative settlements. We believe Adjusted Total Revenues is useful to investors because it provides readers with a revenue value more comparable to other companies who engage in price risk management activities through the use of commodity derivative instruments and reflects the results of derivative settlements with expected cash flow impacts within total revenues. Adjusted General and Administrative expense (“Adjusted G&A”) is a supplemental non-GAAP financial measure that excludes certain non-recurring expenses and non-cash valuation adjustments related to incentive compensation plans, as well as non-cash corporate depreciation and amortization expense. We believe that the non-GAAP measure of Adjusted G&A is useful to investors because it provides readers with a meaningful measure of our recurring G&A expense and provides for greater comparability period-over-period. Discretionary Cash Flow is defined by the Company as net cash provided by operating activities before changes in working capital and payments to settle asset retirement obligations and vested liability share-based awards. The Company has included this information because changes in operating assets and liabilities relate to the timing of cash receipts and disbursements, which the company may not control and the cashflow effect may not be reflected the period in which the operating activities occurred. We believe discretionary cash flow is a comparable metric against other companies in the industry and is a widely accepted financial indicator of an oil and natural gas company’s ability to generate cash for the use of internally funding their capital development program and to service or incur debt. Discretionary cash flow is not a measure of a company’s financial performance under GAAP and should not be considered as an alternative to net cash provided by operating activities (as defined under GAAP), or as a measure of liquidity, or as an alternative to net income Net Debt to Last Twelve Months (“LTM)” Adjusted EBITDA is a non-GAAP measure. The Company defines Net Debt to LTM Adjusted EBITDA as the sum of total long-term debt less unrestricted cash and cash equivalents and anticipated cash proceeds to be received upon closing of upcoming non-core assets divestiture, divided by the Company’s Adjusted EBITDA inclusive of pro-forma results over the last twelve month period from its completed acquisitions and upcoming divestiture. The Company presents this metric to help evaluate its capital structure, financial leverage, and forward-looking cash profile. The Company believes that Net Debt to LTM Adjusted EBITDA is widely used by industry professionals, research and credit analysts, and lending and rating agencies in the evaluation of total leverage.

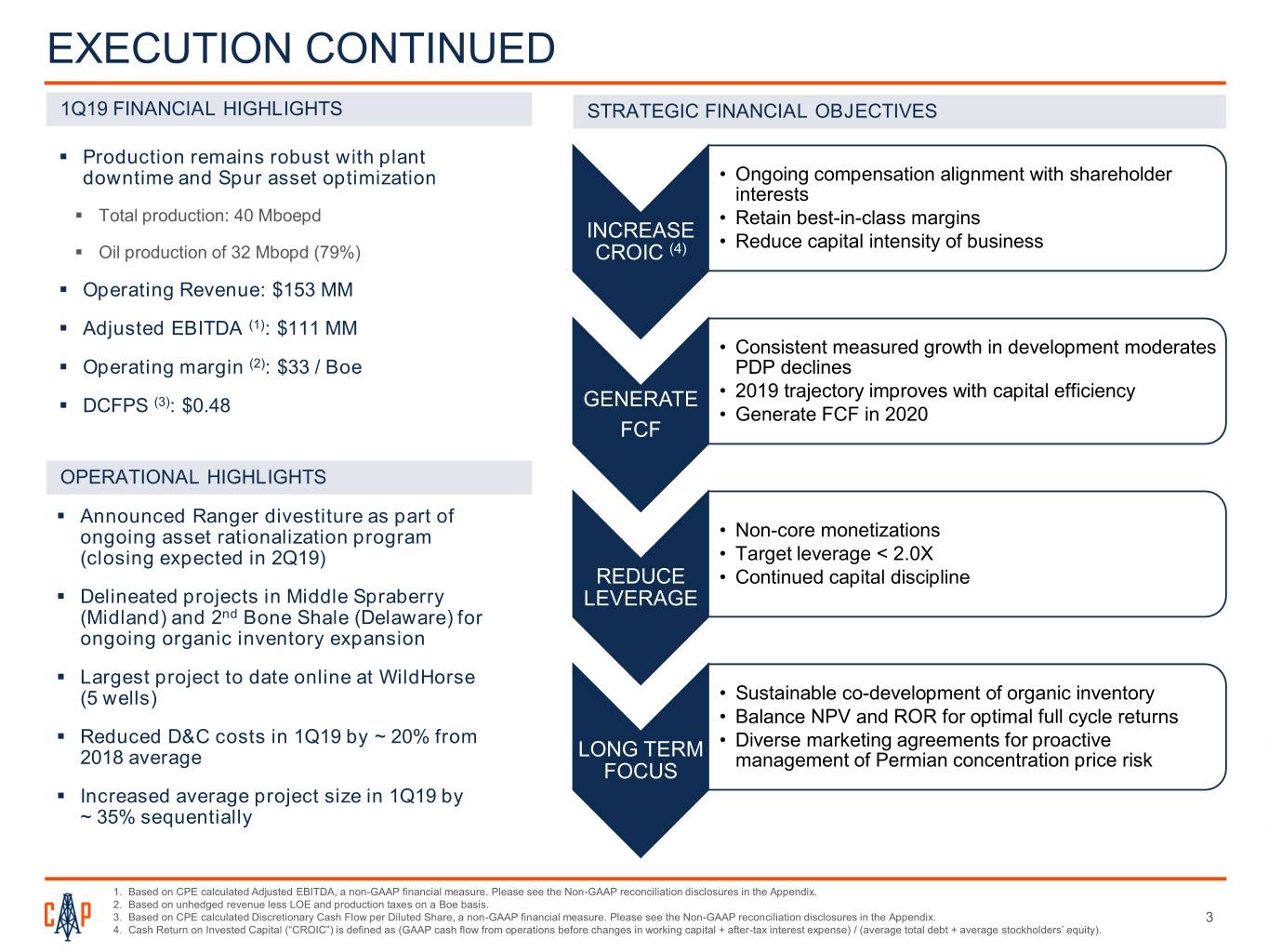

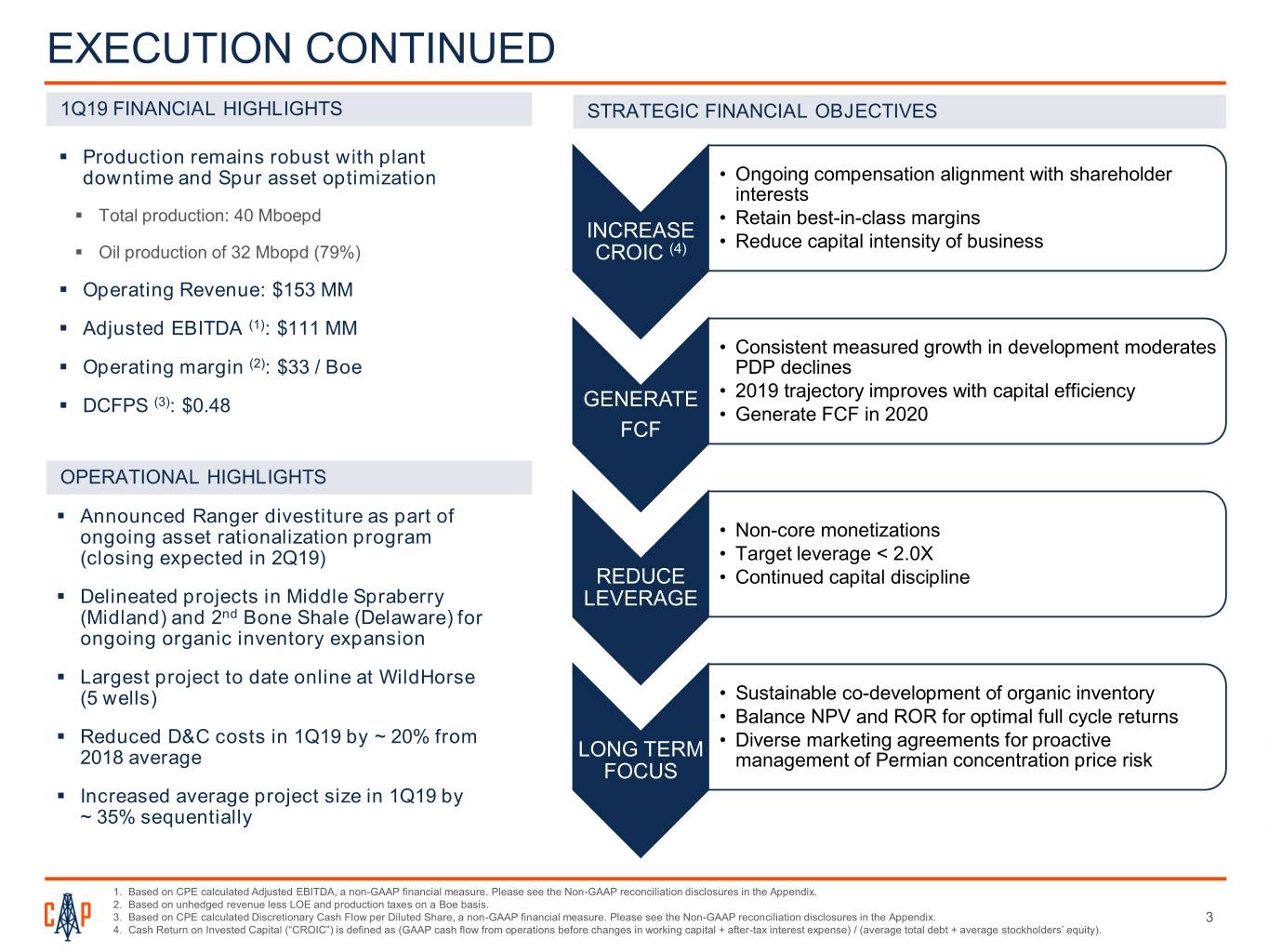

EXECUTION CONTINUED 1Q19 FINANCIAL HIGHLIGHTS STRATEGIC FINANCIAL OBJECTIVES . Production remains robust with plant downtime and Spur asset optimization • Ongoing compensation alignment with shareholder interests . Total production: 40 Mboepd • Retain best-in-class margins INCREASE • Reduce capital intensity of business . Oil production of 32 Mbopd (79%) CROIC (4) . Operating Revenue: $153 MM . Adjusted EBITDA (1): $111 MM • Consistent measured growth in development moderates . Operating margin (2): $33 / Boe PDP declines • 2019 trajectory improves with capital efficiency . (3) GENERATE DCFPS : $0.48 • Generate FCF in 2020 FCF OPERATIONAL HIGHLIGHTS . Announced Ranger divestiture as part of ongoing asset rationalization program • Non-core monetizations (closing expected in 2Q19) • Target leverage < 2.0X REDUCE • Continued capital discipline . Delineated projects in Middle Spraberry LEVERAGE (Midland) and 2nd Bone Shale (Delaware) for ongoing organic inventory expansion . Largest project to date online at WildHorse (5 wells) • Sustainable co-development of organic inventory • Balance NPV and ROR for optimal full cycle returns . Reduced D&C costs in 1Q19 by ~ 20% from LONG TERM • Diverse marketing agreements for proactive 2018 average management of Permian concentration price risk FOCUS . Increased average project size in 1Q19 by ~ 35% sequentially 1. Based on CPE calculated Adjusted EBITDA, a non-GAAP financial measure. Please see the Non-GAAP reconciliation disclosures in the Appendix. 2. Based on unhedged revenue less LOE and production taxes on a Boe basis. 3. Based on CPE calculated Discretionary Cash Flow per Diluted Share, a non-GAAP financial measure. Please see the Non-GAAP reconciliation disclosures in the Appendix. 3 4. Cash Return on Invested Capital (“CROIC”) is defined as (GAAP cash flow from operations before changes in working capital + after-tax interest expense) / (average total debt + average stockholders’ equity).

ALIGNED TO RETURNS OVER GROWTH MANAGEMENT COMPENSATION EVOLUTION Compensation criteria are squarely aligned with cost and value focused metrics that drive long-term enterprise value and profitability 2014 2019 100% DISCRETIONARY 40% DISCRETIONARY SAFETY SAFETY STRATEGIC INITIATIVES STRATEGIC INITIATIVES PRODUCTION GROWTH ORGANIZATIONAL DEVELOPMENT RESERVE GROWTH 60% PERFORMANCE LIQUIDITY / WELL RESULTS LEVERAGE (15.0%) LOE + G&A CASH RETURN ON INVESTED CAPITAL (1) (12.5%) LOE + G&A (12.5%) PROVED DEVELOPED F&D (10.0%) OIL PRODUCTION (10.0%) Early stage growth / asset aggregation phase FCF growth with measured and durable returns 1. Cash Return on Invested Capital (“CROIC”) is defined as (GAAP cash flow from operations before changes in working capital + after-tax interest expense) / (average total debt + average stockholders’ equity). 4

2019 PLAN PROGRESSION SUMMARY HIGHLIGHTS TRANSITION TO LARGE PAD DEVELOPMENT . Solid operational efficiencies 350 . Current DUC inventory of 16 net (21 gross) wells to support larger 300 projects ahead of plan . Average D&C costs below $1MM/ lateral foot (~ 15% decline QoQ) 250 . Capital plan unchanged 200 . 1H19 completion time efficiencies reduce needs for 2H19 150 . 60% of FY19 capital expected in 1H19 . 100 Visible path to FCF in 4Q19 (M) FeetNetLateral . Outlook 50 . Delaware mega-pads in 3Q19 0 . Ongoing larger developments in Midland Basin focused on WildHorse 1H19E 2H19E . Reducing to 4 rigs by mid-year Drilled Completed PoP D&C COST REDUCTIONS AHEAD OF SCHEDULE (1) BUILDING DUC BACKLOG FOR LARGER PROJECTS 5 18 $1.3 15 4 DUC Net Build Exit at ~ 15% Decline QoQ $1.2 12 3 9 $1.1 2 6 Gross D&C / 1,000' D&C Gross $1.0 1 3 Average Gross Project Size PoP Size ProjectGrossAverage 0 0 $0.9 2017 2018 1Q19 2Q18 3Q18 4Q18 1Q19 Gross Project Size Net DUC Build 1. Based on frac start dates. 5

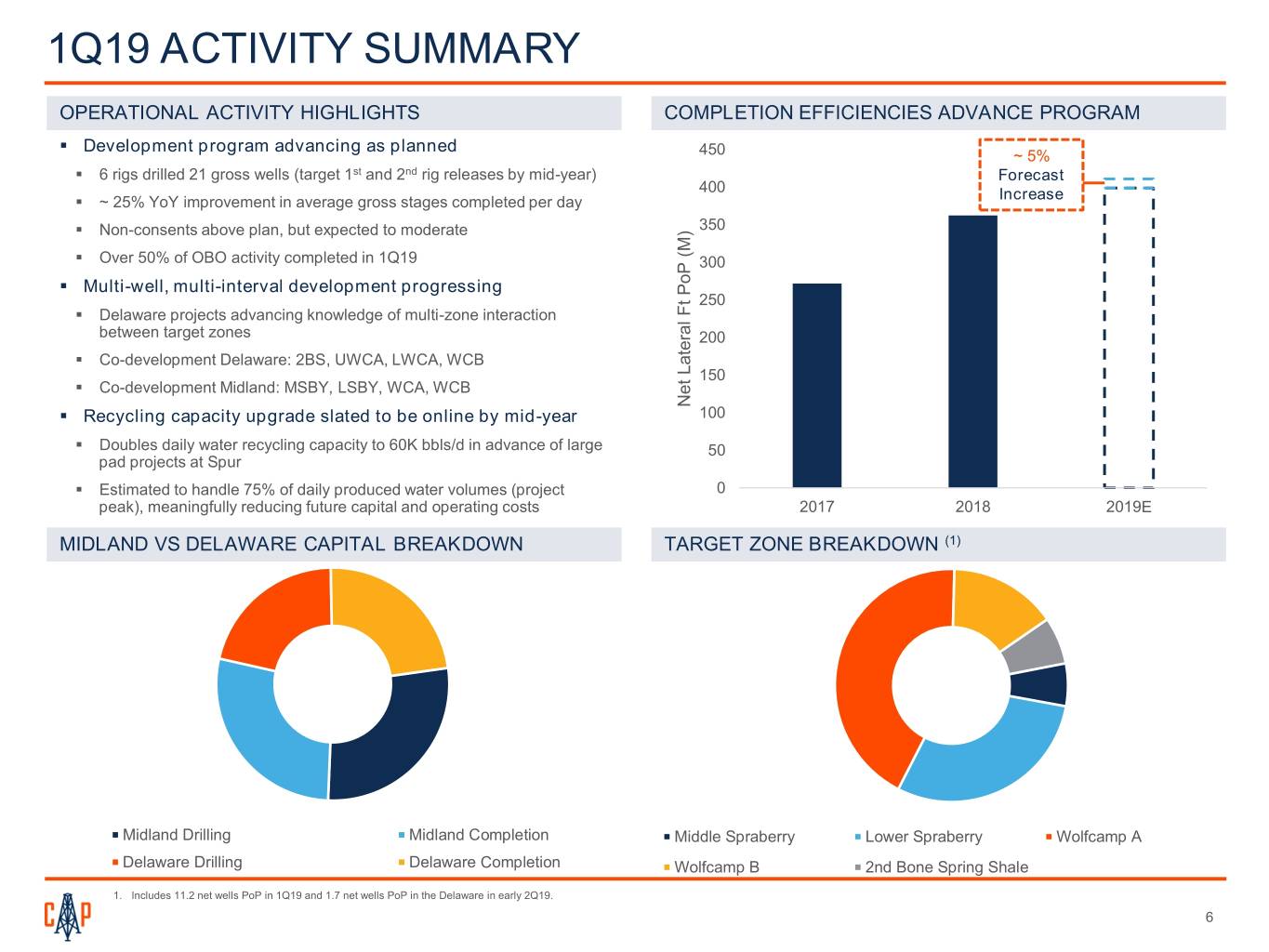

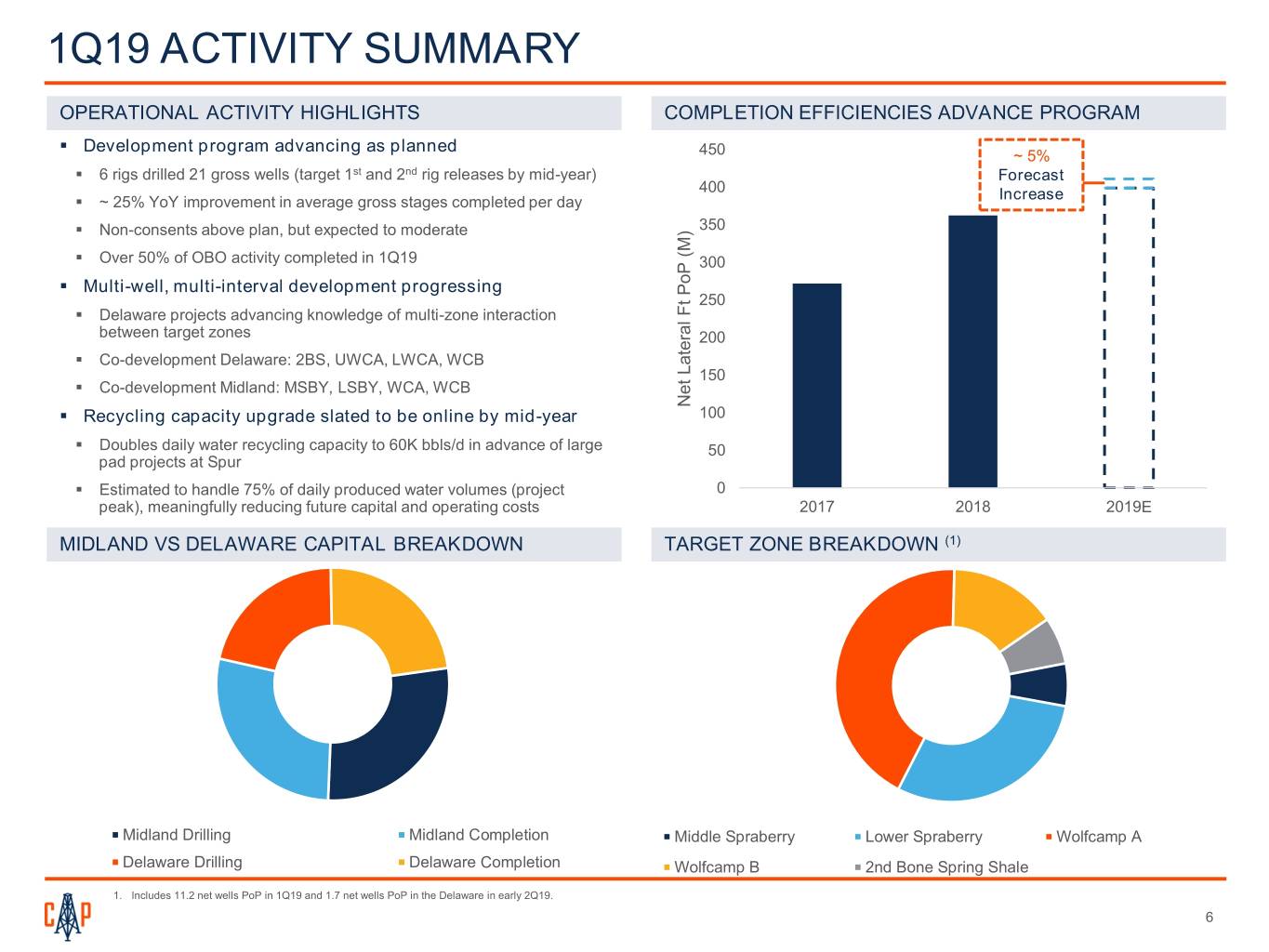

1Q19 ACTIVITY SUMMARY OPERATIONAL ACTIVITY HIGHLIGHTS COMPLETION EFFICIENCIES ADVANCE PROGRAM . Development program advancing as planned 450 ~ 5% . 6 rigs drilled 21 gross wells (target 1st and 2nd rig releases by mid-year) Forecast 400 Increase . ~ 25% YoY improvement in average gross stages completed per day . Non-consents above plan, but expected to moderate 350 . Over 50% of OBO activity completed in 1Q19 300 . Multi-well, multi-interval development progressing 250 . Delaware projects advancing knowledge of multi-zone interaction between target zones 200 . Co-development Delaware: 2BS, UWCA, LWCA, WCB 150 . Co-development Midland: MSBY, LSBY, WCA, WCB Net Lateral Net Lateral FtPoP (M) . Recycling capacity upgrade slated to be online by mid-year 100 . Doubles daily water recycling capacity to 60K bbls/d in advance of large 50 pad projects at Spur . Estimated to handle 75% of daily produced water volumes (project 0 peak), meaningfully reducing future capital and operating costs 2017 2018 2019E MIDLAND VS DELAWARE CAPITAL BREAKDOWN TARGET ZONE BREAKDOWN (1) Midland Drilling Midland Completion Middle Spraberry Lower Spraberry Wolfcamp A Delaware Drilling Delaware Completion Wolfcamp B 2nd Bone Spring Shale 1. Includes 11.2 net wells PoP in 1Q19 and 1.7 net wells PoP in the Delaware in early 2Q19. 6

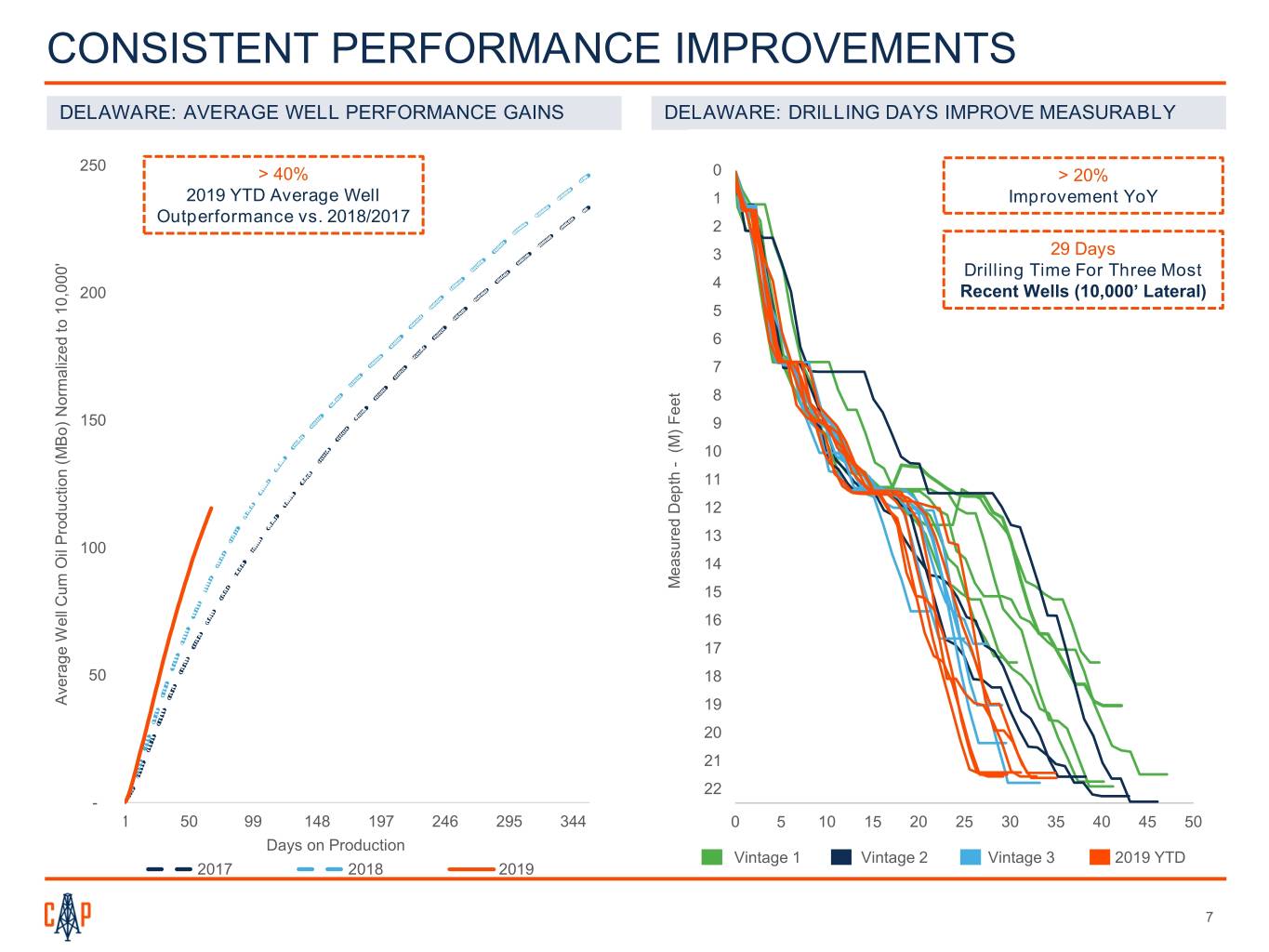

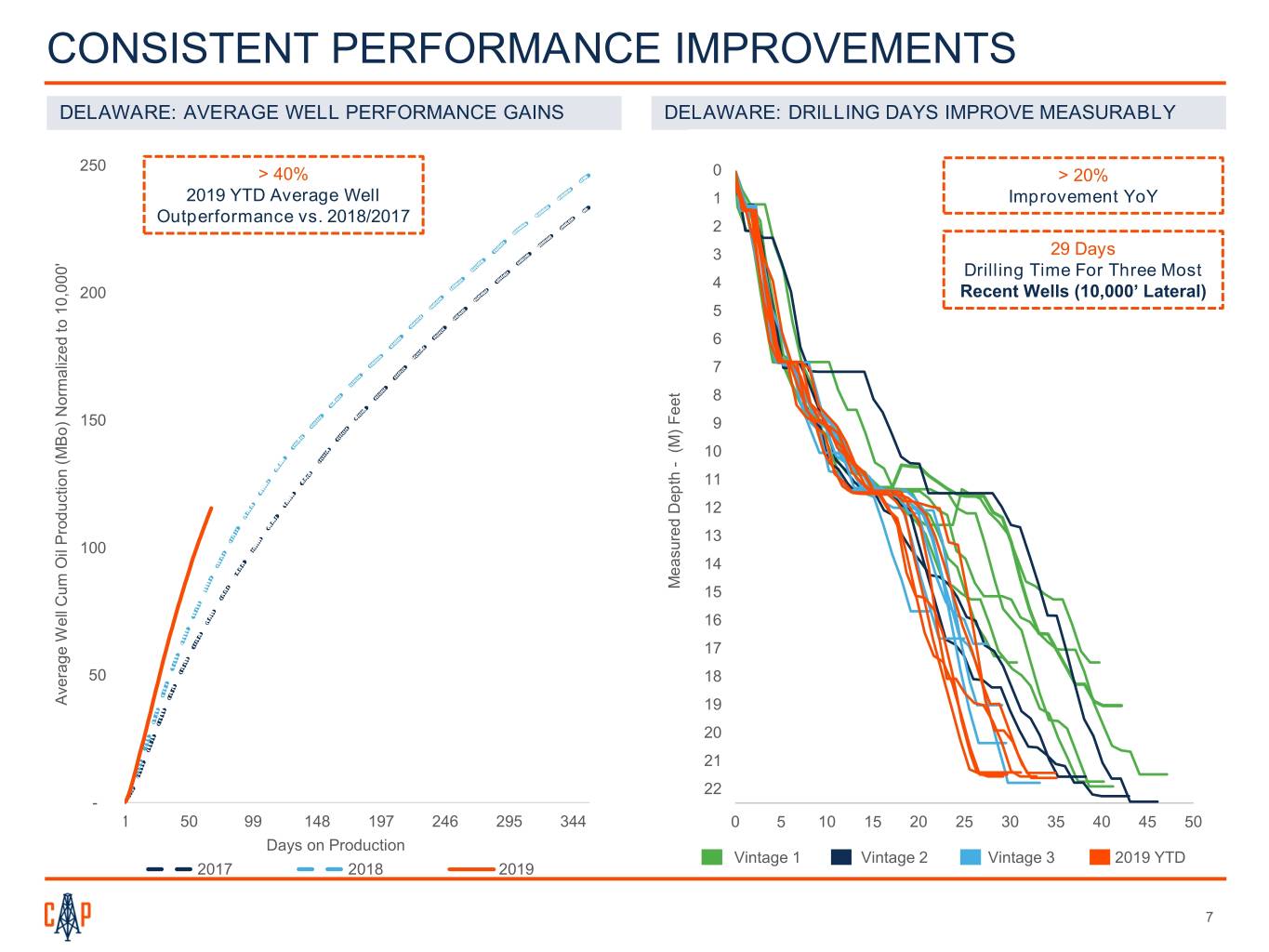

CONSISTENT PERFORMANCE IMPROVEMENTS DELAWARE: AVERAGE WELL PERFORMANCE GAINS DELAWARE: DRILLING DAYS IMPROVE MEASURABLY 250 > 40% 0 > 20% 2019 YTD Average Well 1 Improvement YoY Outperformance vs. 2018/2017 2 29 Days Thousands 3 Drilling Time For Three Most 4 200 Recent Wells (10,000’ Lateral) 5 6 7 8 ) ) 10,000'to Normalized 150 9 (M) Feet(M) MBo 10 - 11 12 13 100 14 Measured Depth Measured 15 16 17 50 18 Average Well Cum Oil Production( OilWell CumAverage 19 20 21 22 - 1 50 99 148 197 246 295 344 0 5 10 15 20 25 30 35 40 45 50 Days on Production Vintage 1 Vintage 2 Vintage 3 2019 YTD 2017 2018 2019 7

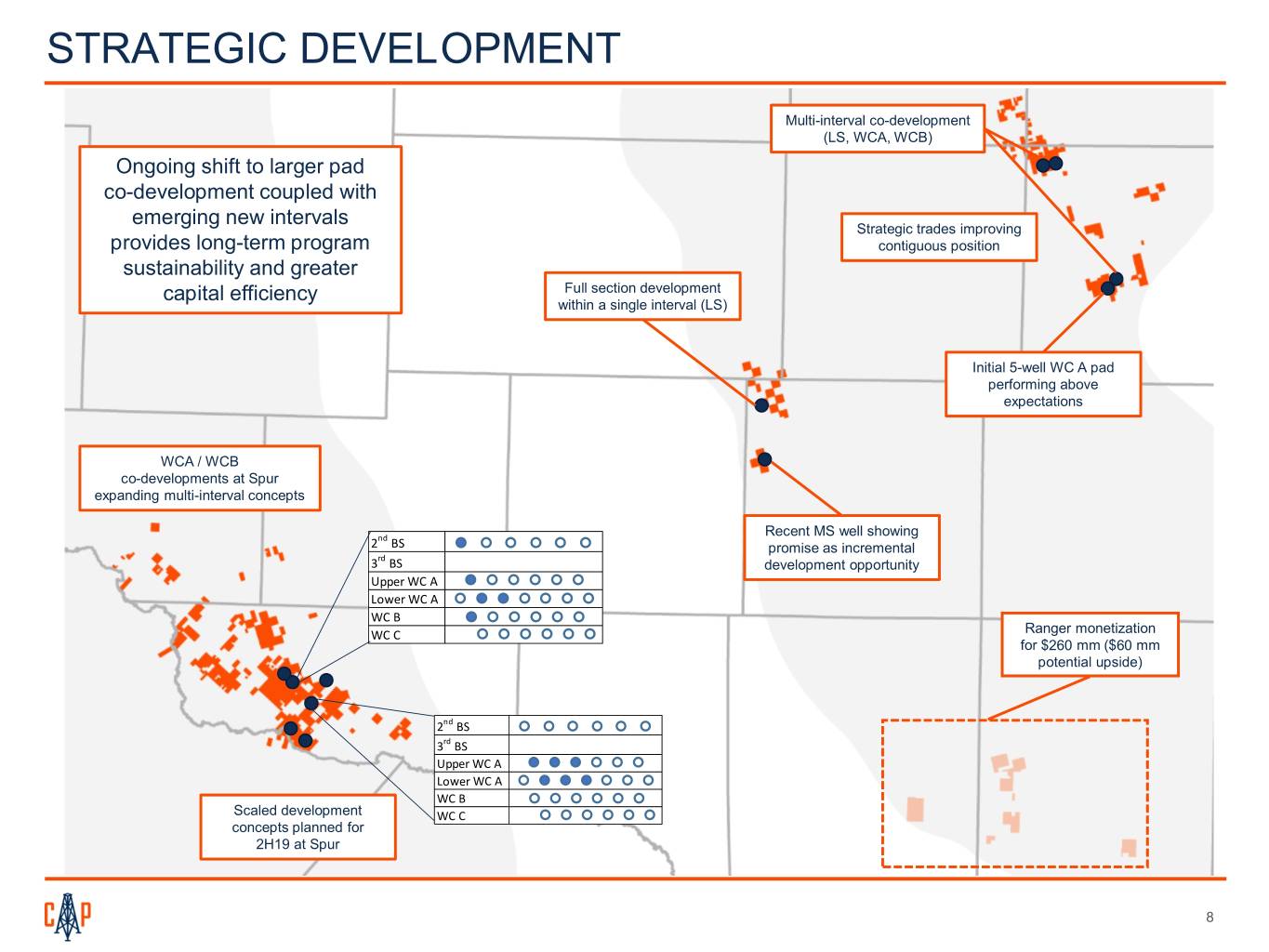

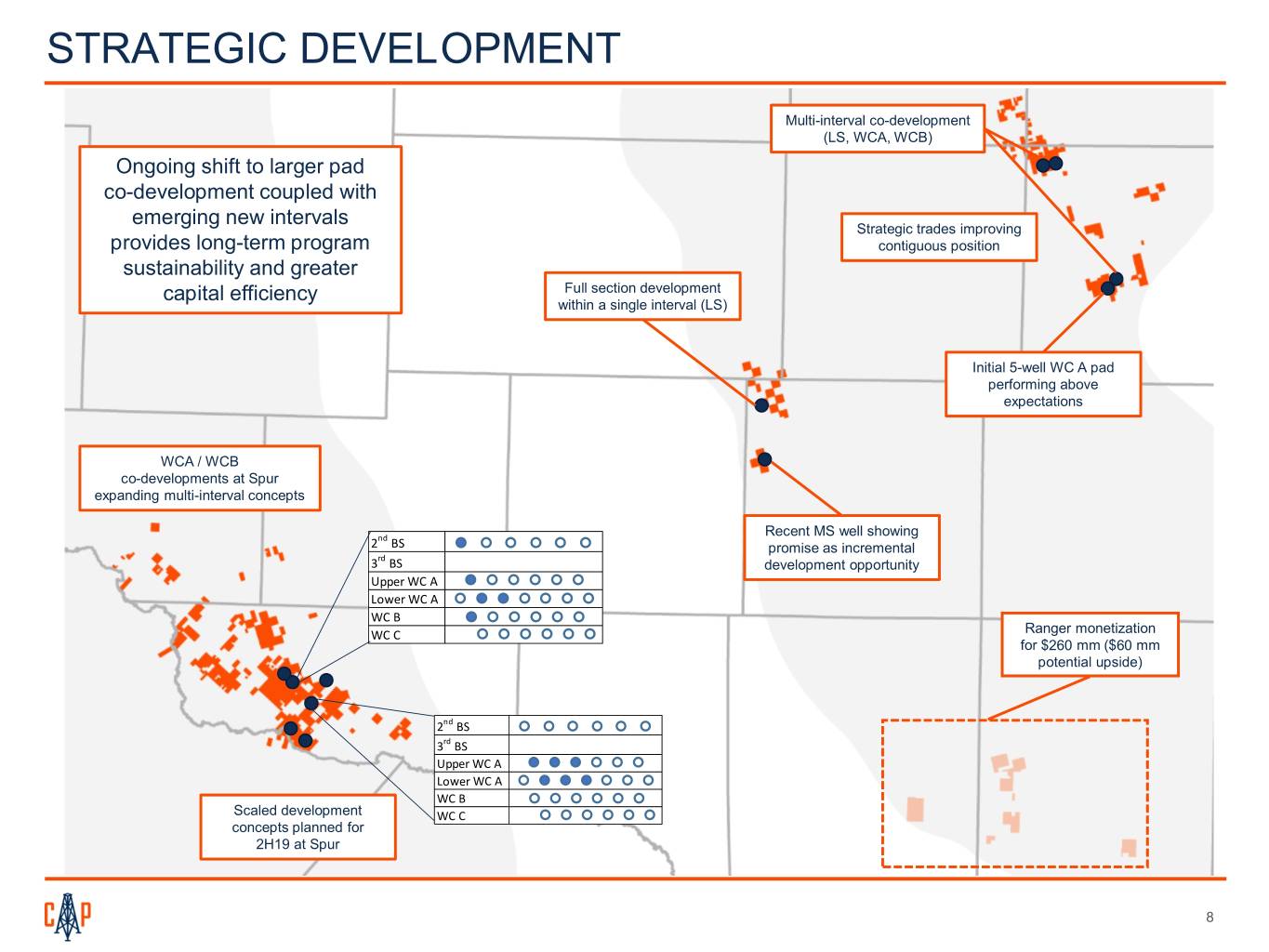

STRATEGIC DEVELOPMENT Multi-interval co-development (LS, WCA, WCB) Ongoing shift to larger pad co-development coupled with emerging new intervals Strategic trades improving provides long-term program contiguous position sustainability and greater capital efficiency Full section development within a single interval (LS) Initial 5-well WC A pad performing above expectations WCA / WCB co-developments at Spur expanding multi-interval concepts nd Recent MS well showing 2 BS promise as incremental 3rd BS development opportunity Upper WC A Lower WC A WC B Ranger monetization WC C for $260 mm ($60 mm potential upside) 2nd BS 3rd BS Upper WC A Lower WC A WC B Scaled development WC C concepts planned for 2H19 at Spur 8

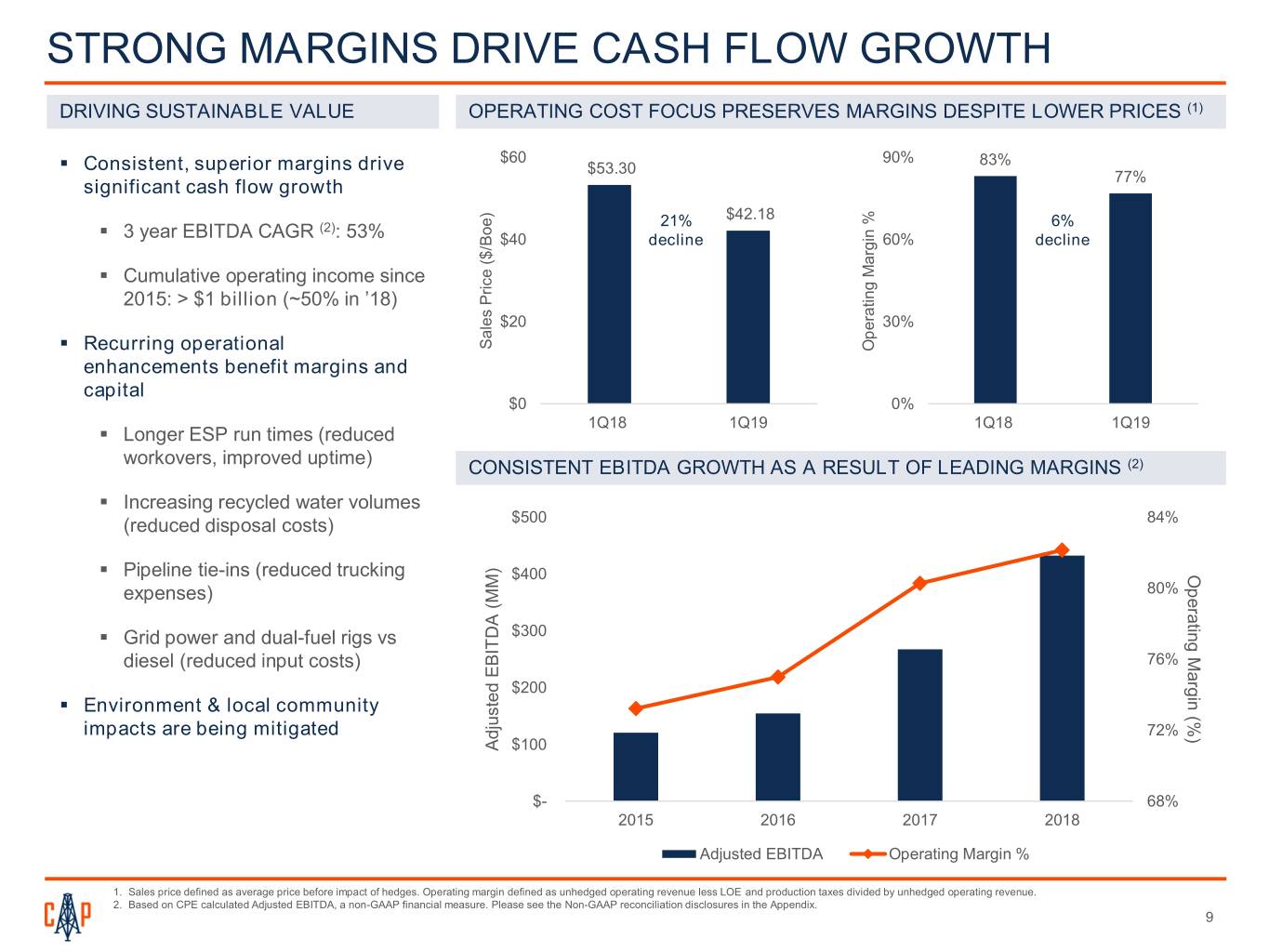

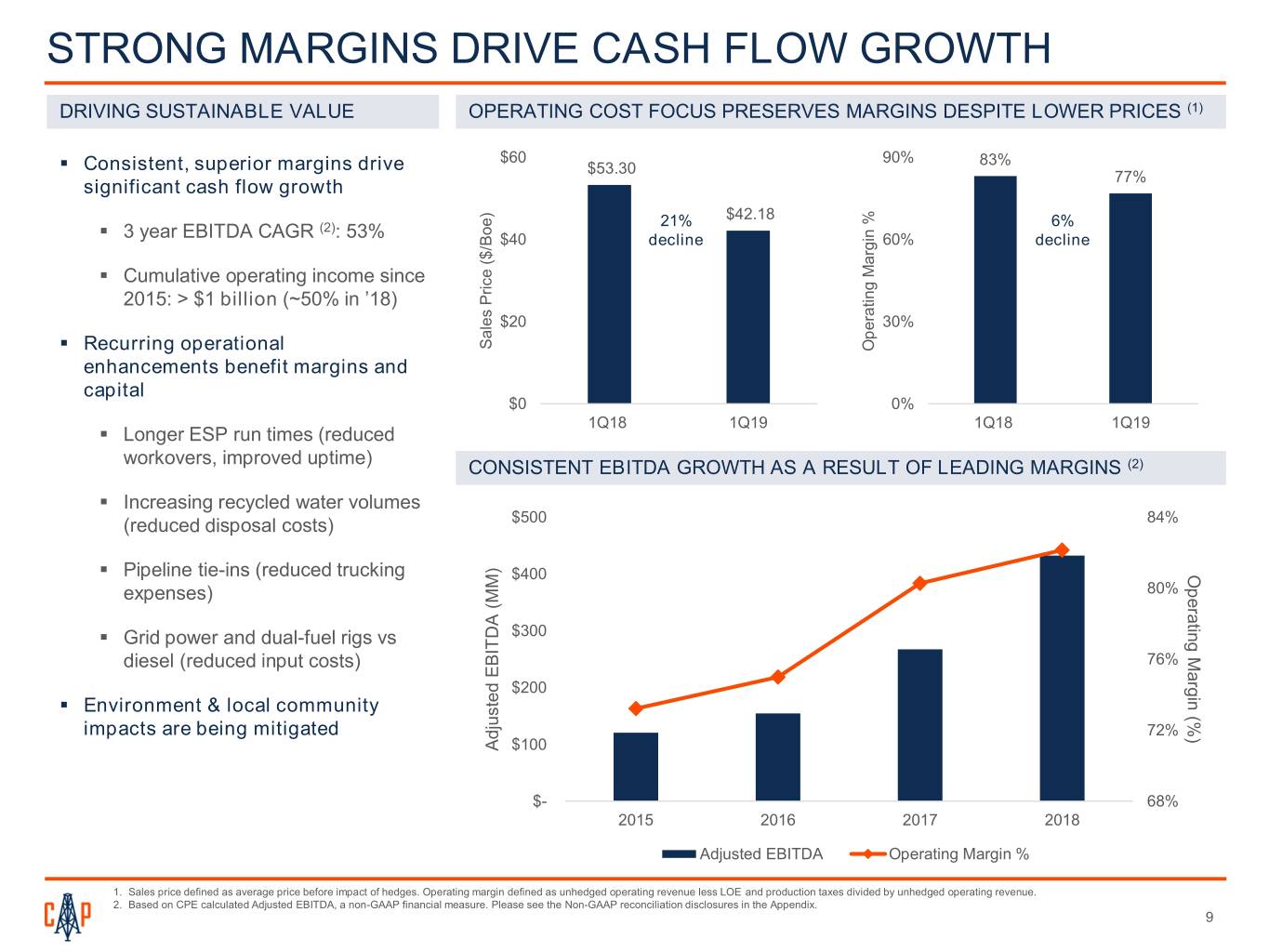

STRONG MARGINS DRIVE CASH FLOW GROWTH DRIVING SUSTAINABLE VALUE OPERATING COST FOCUS PRESERVES MARGINS DESPITE LOWER PRICES (1) . $60 90% 83% Consistent, superior margins drive $53.30 77% significant cash flow growth ) 21% $42.18 6% . 3 year EBITDA CAGR (2): 53% Boe $40 decline 60% decline . Cumulative operating income since 2015: > $1 billion (~50% in ’18) $20 30% . Sales Price($/ Sales Recurring operational % Margin Operating enhancements benefit margins and capital $0 0% 1Q18 1Q19 1Q18 1Q19 . Longer ESP run times (reduced workovers, improved uptime) CONSISTENT EBITDA GROWTH AS A RESULT OF LEADING MARGINS (2) . Increasing recycled water volumes (reduced disposal costs) $500 84% . Pipeline tie-ins (reduced trucking $400 (%) Margin Operating expenses) 80% . Grid power and dual-fuel rigs vs $300 diesel (reduced input costs) 76% $200 . Environment & local community impacts are being mitigated 72% Adjusted Adjusted EBITDA (MM) $100 $- 68% 2015 2016 2017 2018 Adjusted EBITDA Operating Margin % 1. Sales price defined as average price before impact of hedges. Operating margin defined as unhedged operating revenue less LOE and production taxes divided by unhedged operating revenue. 2. Based on CPE calculated Adjusted EBITDA, a non-GAAP financial measure. Please see the Non-GAAP reconciliation disclosures in the Appendix. 9

FINANCIAL POSITIONING HIGHLIGHTS CAPITALIZATION ($MM) . Prioritizing sustainable FCF generation . Corporate-level free cash flow in 4Q19 at planning price deck 1Q19 (3Q19 at current strip) Cash $10 . Corporate-level free cash flow generation in 2020 Credit Facility $330 . Divesting non-core inventory for debt reduction Senior Notes due 2024 600 . Announced $260MM Ranger divestiture with potential incremental cash payments of $60MM (2Q19 expected close) Senior Notes due 2026 400 . Reaffirmed borrowing base of $1.1 billion, pro-forma for non-core Total Debt $1,320 asset sales Stockholders’ Equity 2,428 . Focusing on leverage target of < 2.0x Net Debt (2) / Total Capitalization $3,748 Adjusted EBITDA (1) . Flexibility of capital structure with no near-term debt Pro-Forma Total Liquidity $773 maturities further enhances liquidity strength Pro-Forma Net Debt to LTM EBITDA (2) 2.4x DEBT MATURITY SUMMARY ($MM) $1,200 $1,000 $1.1BN Borrowing $600MM Base Senior Notes $800 No Near-term $400MM Maturities Senior Notes $600 $850MM Elected $400 Commitment $200 $0 2019 2020 2021 2022 2023 2024 2025 2026 1. Based on current elected commitment amount and inclusive of anticipated cash proceeds to be received upon closing of upcoming non-core assets divestiture . All figures are as of 3/31/2019 and reflect certain items, such as letters of credit, not specifically shown in the capitalization table. 2. Net Debt to LTM Adjusted EBITDA is a non-GAAP measure and is calculated as the sum of total long-term debt less unrestricted cash and cash equivalents and anticipated cash proceeds to be received upon closing of upcoming non-core 10 assets divestiture, divided by the Company’s Adjusted EBITDA inclusive of annualized pro-forma results from its acquisitions completed over the last twelve month period. Please refer to the Appendix for reconciliation.

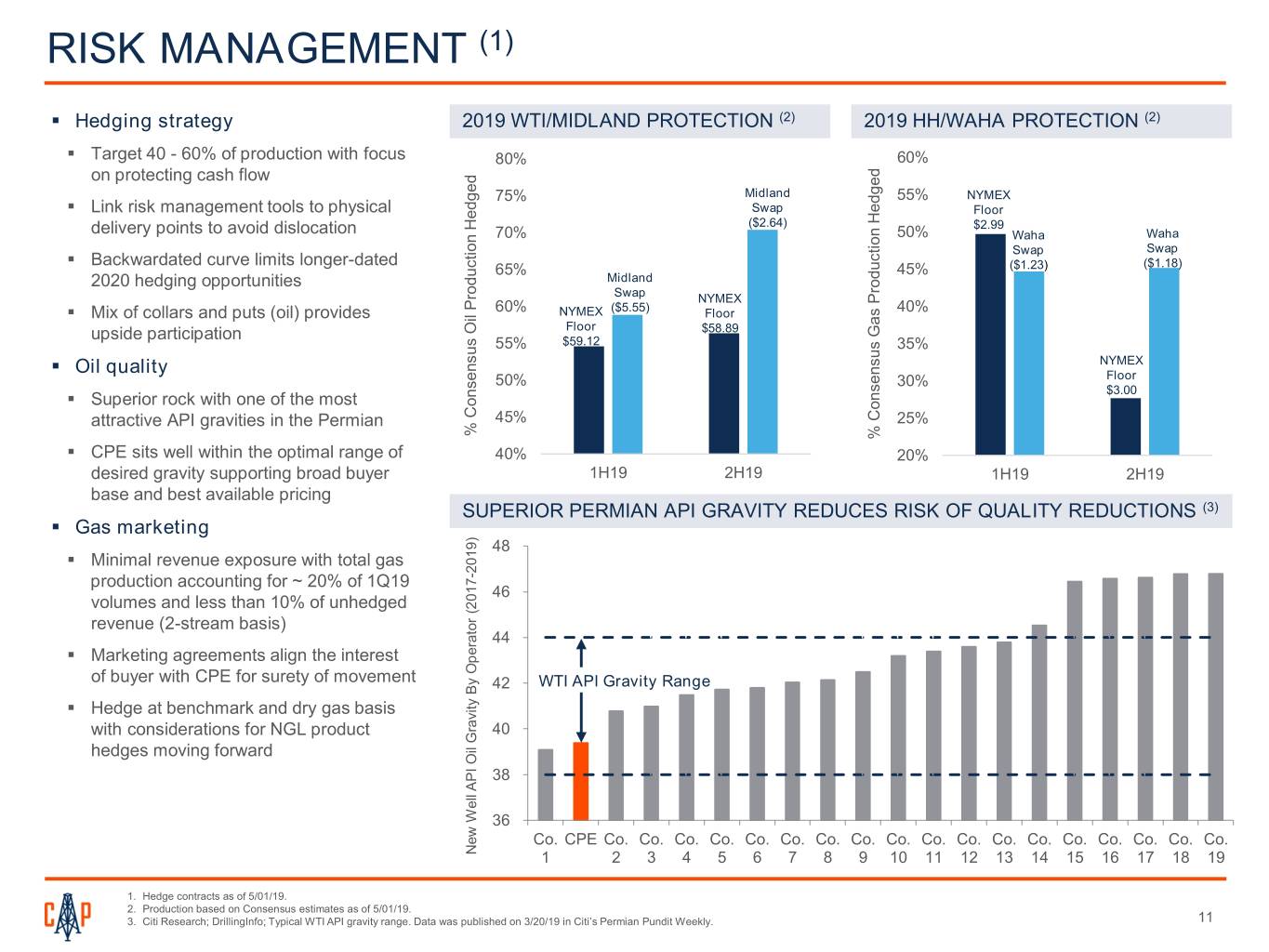

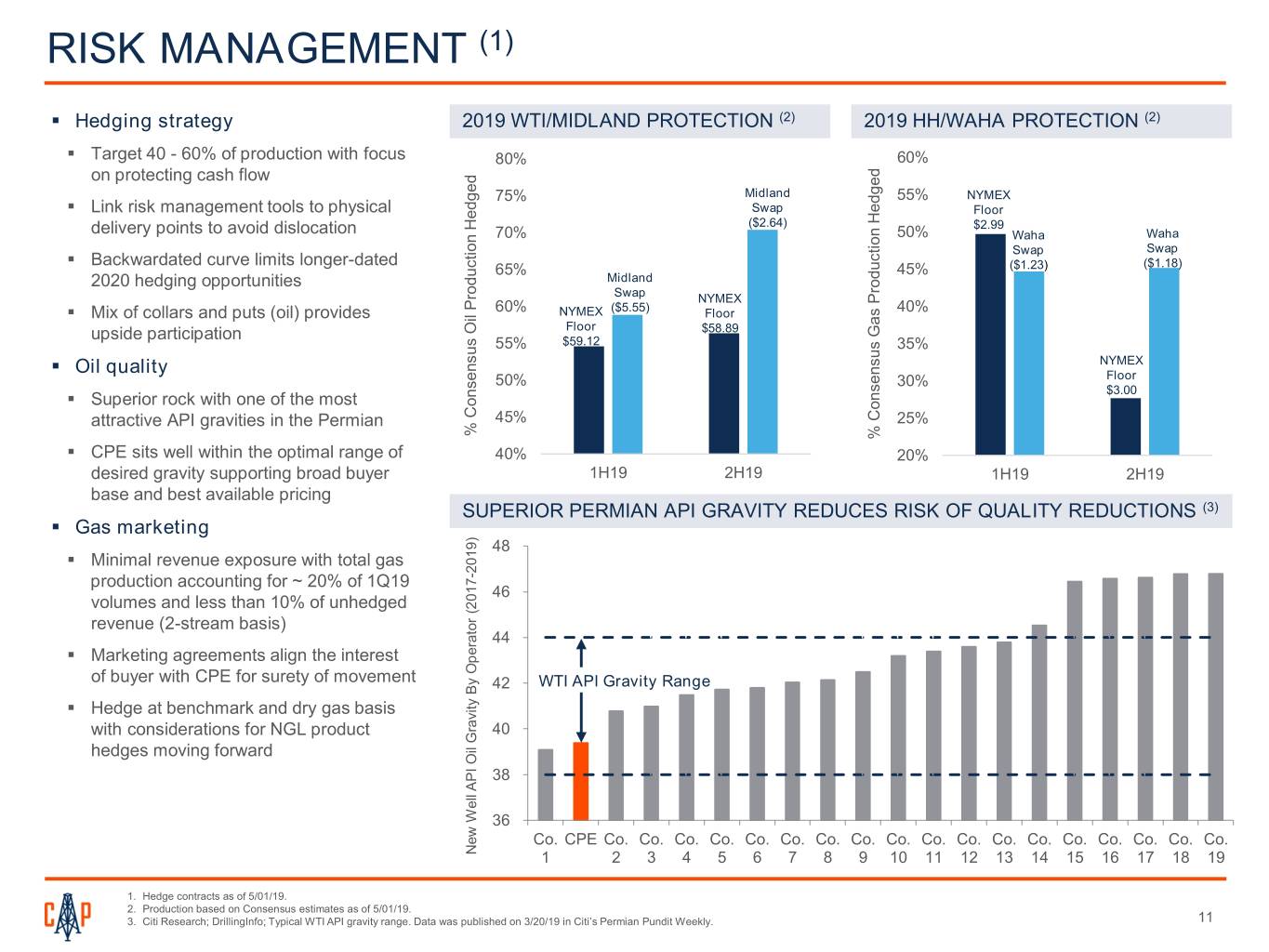

RISK MANAGEMENT (1) . Hedging strategy 2019 WTI/MIDLAND PROTECTION (2) 2019 HH/WAHA PROTECTION (2) . Target 40 - 60% of production with focus 80% 60% on protecting cash flow . 75% Midland 55% NYMEX Link risk management tools to physical Swap Floor ($2.64) $2.99 delivery points to avoid dislocation 70% 50% Waha Waha Swap Swap . Backwardated curve limits longer-dated 65% 45% ($1.23) ($1.18) 2020 hedging opportunities Midland Swap NYMEX . ($5.55) Mix of collars and puts (oil) provides 60% NYMEX Floor 40% upside participation Floor $58.89 55% $59.12 35% . Oil quality NYMEX 50% 30% Floor $3.00 . Superior rock with one of the most attractive API gravities in the Permian 45% 25% % Consensus Oil Production Hedged ProductionConsensusOil% . Hedged ProductionConsensusGas% CPE sits well within the optimal range of 40% 20% desired gravity supporting broad buyer 1H19 2H19 1H19 2H19 base and best available pricing SUPERIOR PERMIAN API GRAVITY REDUCES RISK OF QUALITY REDUCTIONS (3) . Gas marketing 48 . Minimal revenue exposure with total gas 2019) 2019) production accounting for ~ 20% of 1Q19 - 46 volumes and less than 10% of unhedged (2017 revenue (2-stream basis) 44 . Marketing agreements align the interest Operator of buyer with CPE for surety of movement 42 WTI API Gravity Range . Hedge at benchmark and dry gas basis with considerations for NGL product 40 hedges moving forward 38 36 Co. CPE Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. Co. New Well API Oil Gravity By Gravity API Oil WellNew 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 1. Hedge contracts as of 5/01/19. 2. Production based on Consensus estimates as of 5/01/19. 3. Citi Research; DrillingInfo; Typical WTI API gravity range. Data was published on 3/20/19 in Citi’s Permian Pundit Weekly. 11

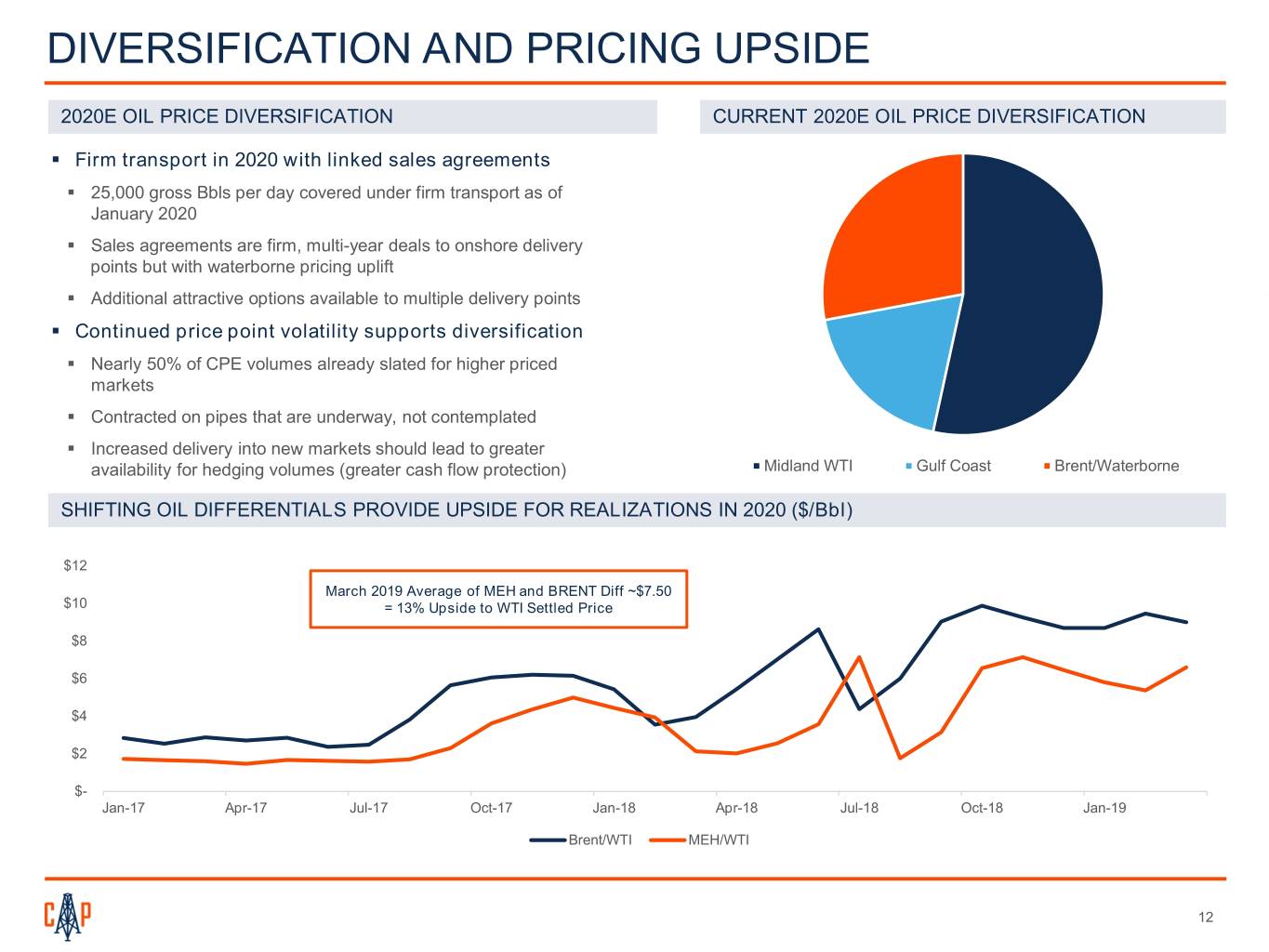

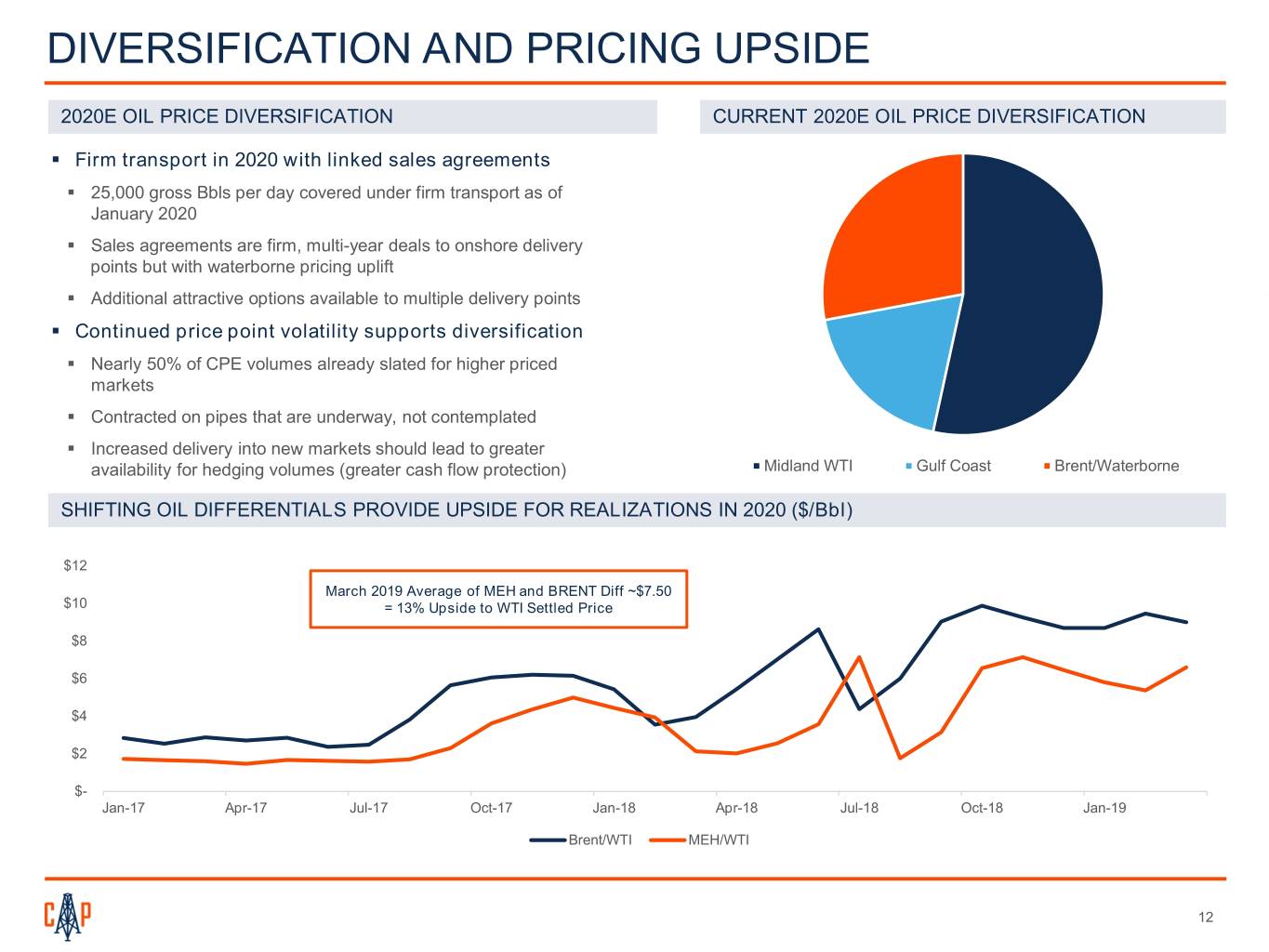

DIVERSIFICATION AND PRICING UPSIDE 2020E OIL PRICE DIVERSIFICATION CURRENT 2020E OIL PRICE DIVERSIFICATION . Firm transport in 2020 with linked sales agreements . 25,000 gross Bbls per day covered under firm transport as of January 2020 . Sales agreements are firm, multi-year deals to onshore delivery points but with waterborne pricing uplift . Additional attractive options available to multiple delivery points . Continued price point volatility supports diversification . Nearly 50% of CPE volumes already slated for higher priced markets . Contracted on pipes that are underway, not contemplated . Increased delivery into new markets should lead to greater availability for hedging volumes (greater cash flow protection) Midland WTI Gulf Coast Brent/Waterborne SHIFTING OIL DIFFERENTIALS PROVIDE UPSIDE FOR REALIZATIONS IN 2020 ($/Bbl) $12 March 2019 Average of MEH and BRENT Diff ~$7.50 $10 = 13% Upside to WTI Settled Price $8 $6 $4 $2 $- Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Jan-19 Brent/WTI MEH/WTI 12

OUTLOOK RESPONSIBILITY: EXECUTION AND SAFETY OPTIMIZE HIGH-QUALITY PERMIAN INVENTORY DRIVE CORPORATE LEVEL RETURNS WITH PEER LEADING CASH MARGINS EFFICIENT CAPITAL CONVERSION WITHIN CASH FLOWS GENERATES DOUBLE DIGIT PRODUCTION GROWTH DELINEATE AND RATIONALIZE RESOURCE BASE INTEGRATE SUSTAINABLE INVESTMENTS TO DRIVE FUTURE COST SAVINGS AND LONG-TERM EFFICIENCY GAINS 13

APPENDIX

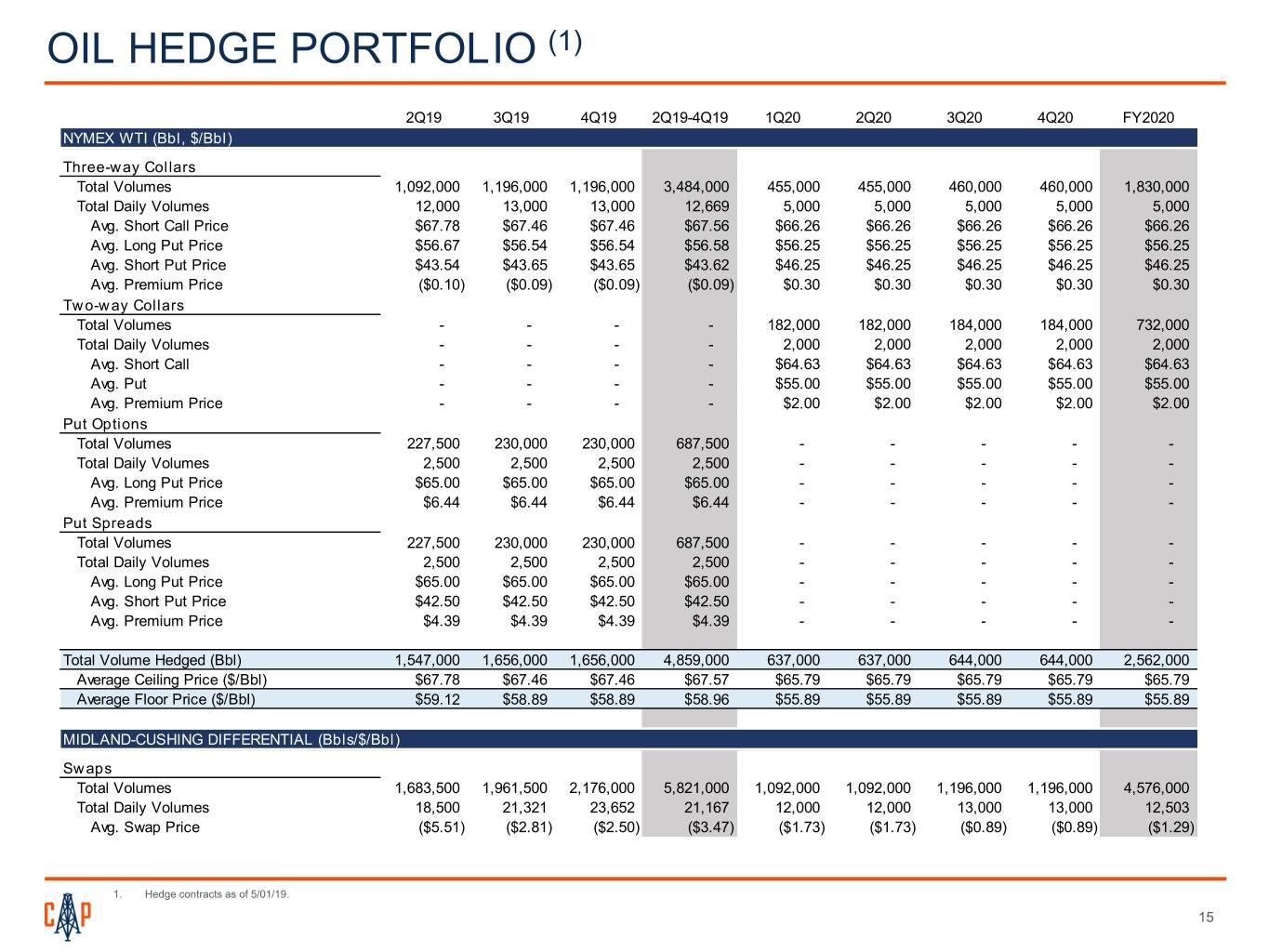

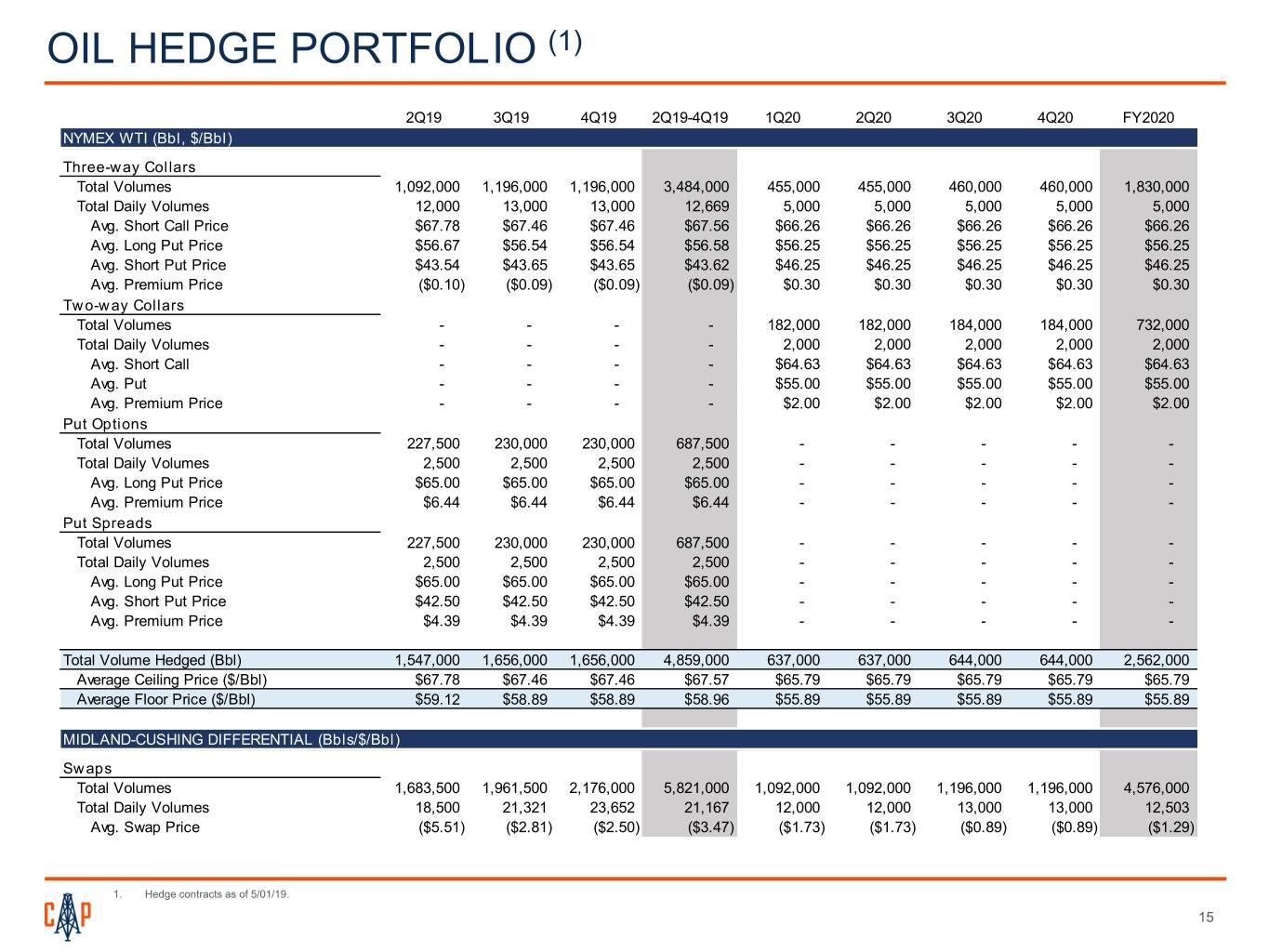

OIL HEDGE PORTFOLIO (1) 2Q19 3Q19 4Q19 2Q19-4Q19 1Q20 2Q20 3Q20 4Q20 FY2020 NYMEX WTI (Bbl, $/Bbl) Three-way Collars Total Volumes 1,092,000 1,196,000 1,196,000 3,484,000 455,000 455,000 460,000 460,000 1,830,000 Total Daily Volumes 12,000 13,000 13,000 12,669 5,000 5,000 5,000 5,000 5,000 Avg. Short Call Price $67.78 $67.46 $67.46 $67.56 $66.26 $66.26 $66.26 $66.26 $66.26 Avg. Long Put Price $56.67 $56.54 $56.54 $56.58 $56.25 $56.25 $56.25 $56.25 $56.25 Avg. Short Put Price $43.54 $43.65 $43.65 $43.62 $46.25 $46.25 $46.25 $46.25 $46.25 Avg. Premium Price ($0.10) ($0.09) ($0.09) ($0.09) $0.30 $0.30 $0.30 $0.30 $0.30 Two-way Collars Total Volumes - - - - 182,000 182,000 184,000 184,000 732,000 Total Daily Volumes - - - - 2,000 2,000 2,000 2,000 2,000 Avg. Short Call - - - - $64.63 $64.63 $64.63 $64.63 $64.63 Avg. Put - - - - $55.00 $55.00 $55.00 $55.00 $55.00 Avg. Premium Price - - - - $2.00 $2.00 $2.00 $2.00 $2.00 Put Options Total Volumes 227,500 230,000 230,000 687,500 - - - - - Total Daily Volumes 2,500 2,500 2,500 2,500 - - - - - Avg. Long Put Price $65.00 $65.00 $65.00 $65.00 - - - - - Avg. Premium Price $6.44 $6.44 $6.44 $6.44 - - - - - Put Spreads Total Volumes 227,500 230,000 230,000 687,500 - - - - - Total Daily Volumes 2,500 2,500 2,500 2,500 - - - - - Avg. Long Put Price $65.00 $65.00 $65.00 $65.00 - - - - - Avg. Short Put Price $42.50 $42.50 $42.50 $42.50 - - - - - Avg. Premium Price $4.39 $4.39 $4.39 $4.39 - - - - - Total Volume Hedged (Bbl) 1,547,000 1,656,000 1,656,000 4,859,000 637,000 637,000 644,000 644,000 2,562,000 Average Ceiling Price ($/Bbl) $67.78 $67.46 $67.46 $67.57 $65.79 $65.79 $65.79 $65.79 $65.79 Average Floor Price ($/Bbl) $59.12 $58.89 $58.89 $58.96 $55.89 $55.89 $55.89 $55.89 $55.89 MIDLAND-CUSHING DIFFERENTIAL (Bbls/$/Bbl) Swaps Total Volumes 1,683,500 1,961,500 2,176,000 5,821,000 1,092,000 1,092,000 1,196,000 1,196,000 4,576,000 Total Daily Volumes 18,500 21,321 23,652 21,167 12,000 12,000 13,000 13,000 12,503 Avg. Swap Price ($5.51) ($2.81) ($2.50) ($3.47) ($1.73) ($1.73) ($0.89) ($0.89) ($1.29) 1. Hedge contracts as of 5/01/19. 15

GAS HEDGE PORTFOLIO (1) 2Q19 3Q19 4Q19 2Q19-4Q19 1Q20 2Q20 3Q20 4Q20 FY2020 NYMEX Henry Hub (MMBtu, $/MMBtu) Swaps Total Volumes 455,000 1,242,000 155,000 1,852,000 - - - - - Total Daily Volumes 5,000 13,500 1,685 6,735 - - - - - Avg. Swap Price $2.87 $2.89 $2.87 $2.88 - - - - - Two-way Collars Total Volumes 1,501,500 598,000 598,000 2,697,500 - - - - - Total Daily Volumes 16,500 6,500 6,500 9,809 - - - - - Avg. Short Call Price $3.82 $3.50 $3.50 $3.68 - - - - - Avg. Put Price $3.06 $3.13 $3.13 $3.09 - - - - - Total Volume Hedged (MMBtu) 1,956,500 1,840,000 753,000 4,549,500 - - - - - Average Ceiling Price ($/MMBtu) $3.60 $3.09 $3.37 $3.36 - - - - - Average Floor Price ($/MMBtu) $3.02 $2.97 $3.07 $3.01 - - - - - WAHA DIFFERENTIAL (MMBtu, $/MMBtu) Swaps Total Volumes 1,729,000 2,116,000 2,116,000 5,961,000 1,183,000 1,183,000 1,196,000 1,196,000 4,758,000 Total Daily Volumes 19,000 23,000 23,000 21,676 13,000 13,000 13,000 13,000 13,000 Avg. Swap Price ($1.22) ($1.18) ($1.18) ($1.19) ($1.12) ($1.12) ($1.12) ($1.12) ($1.12) 1. Hedge contracts as of 5/01/19. 16

QUARTERLY CASH FLOW STATEMENT 1Q18 2Q18 3Q18 4Q18 1Q19 Cash flows from operating activities: Net income (loss) $ 55,761 $ 50,474 $ 37,931 $ 156,194 $ (19,543) Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, depletion and amortization 36,066 39,387 48,977 60,301 60,672 Accretion expense 218 206 202 248 241 Amortization of non-cash debt related items 453 588 708 734 738 Deferred income tax (benefit) expense 495 481 1,487 5,647 (5,149) (Gain) loss on derivatives, net of settlements (3,978) 8,572 25,100 (105,512) 66,970 (Gain) loss on sale of other property and equipment - 22 (102) (64) 28 Non-cash expense related to equity share-based awards 1,131 1,627 1,708 1,823 4,545 Change in the fair value of liability share-based awards 1,012 (463) 879 (1,053) 1,881 Payments to settle asset retirement obligations (366) (207) (507) (389) (664) Payments for cash-settled restricted stock unit awards (3,089) (1,901) - - (1,296) Changes in current assets and liabilities: Accounts receivable (8,067) 10,447 (56,764) 37,033 (5,390) Other current assets 61 (5,611) 3,885 (5,936) (2,294) Current liabilities 12,938 4,123 47,741 9,510 (26,003) Other (420) 19 4,791 (6,897) (177) Net cash provided by operating activities 92,215 107,764 116,036 151,639 74,559 Cash flows from investing activities: Capital expenditures (111,330) (187,040) (156,982) (155,821) (193,211) Acquisitions (38,923) (6,469) (550,592) (122,809) (27,947) Acquisition deposit 900 (28,500) 27,600 - - Proceeds from sales of assets - 3,077 5,249 683 13,879 Additions to other assets - - - (3,100) - Net cash used in investing activities (149,353) (218,932) (674,725) (281,047) (207,279) Cash flows from financing activities: Borrowings on senior secured revolving credit facility 80,000 85,000 105,000 230,000 220,000 Payments on senior secured revolving credit facility (30,000) (160,000) (40,000) (95,000) (90,000) Issuance of 6.375% senior unsecured notes due 2026 - 400,000 - - - Payment of deferred financing costs - (8,664) (1,296) 530 - Issuance of common stock - 288,357 7 (376) - Payment of preferred stock dividends (1,824) (1,824) (1,823) (1,824) (1,824) Tax withholdings related to restricted stock units (560) (1,028) (216) - (1,025) Net cash provided by financing activities 47,616 601,841 61,672 133,330 127,151 Net change in cash and cash equivalents (9,522) 490,673 (497,017) 3,922 (5,569) Balance, beginning of period 27,995 18,473 509,146 12,129 16,051 Balance, end of period $ 18,473 $ 509,146 $ 12,129 $ 16,051 $ 10,482 17

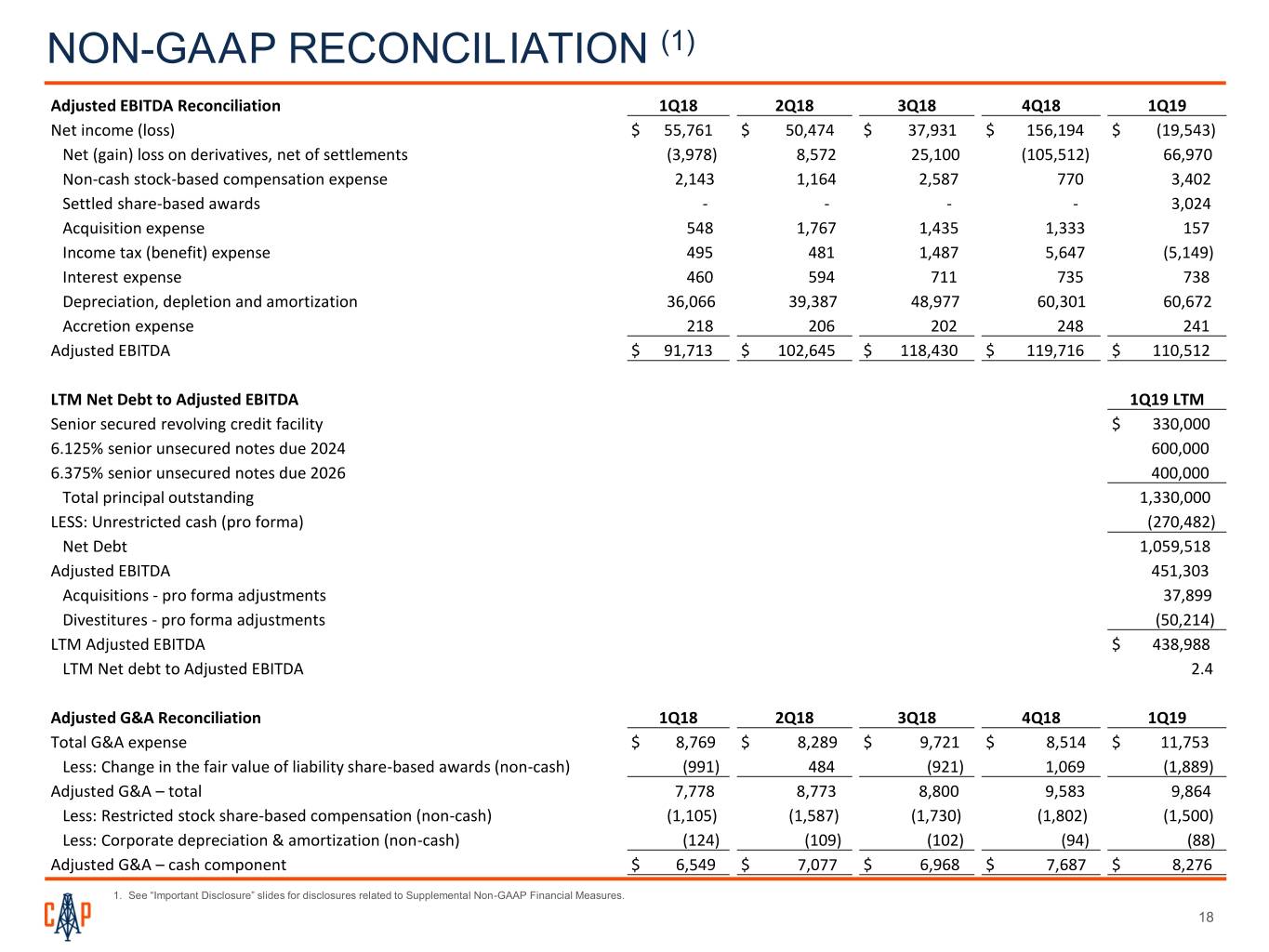

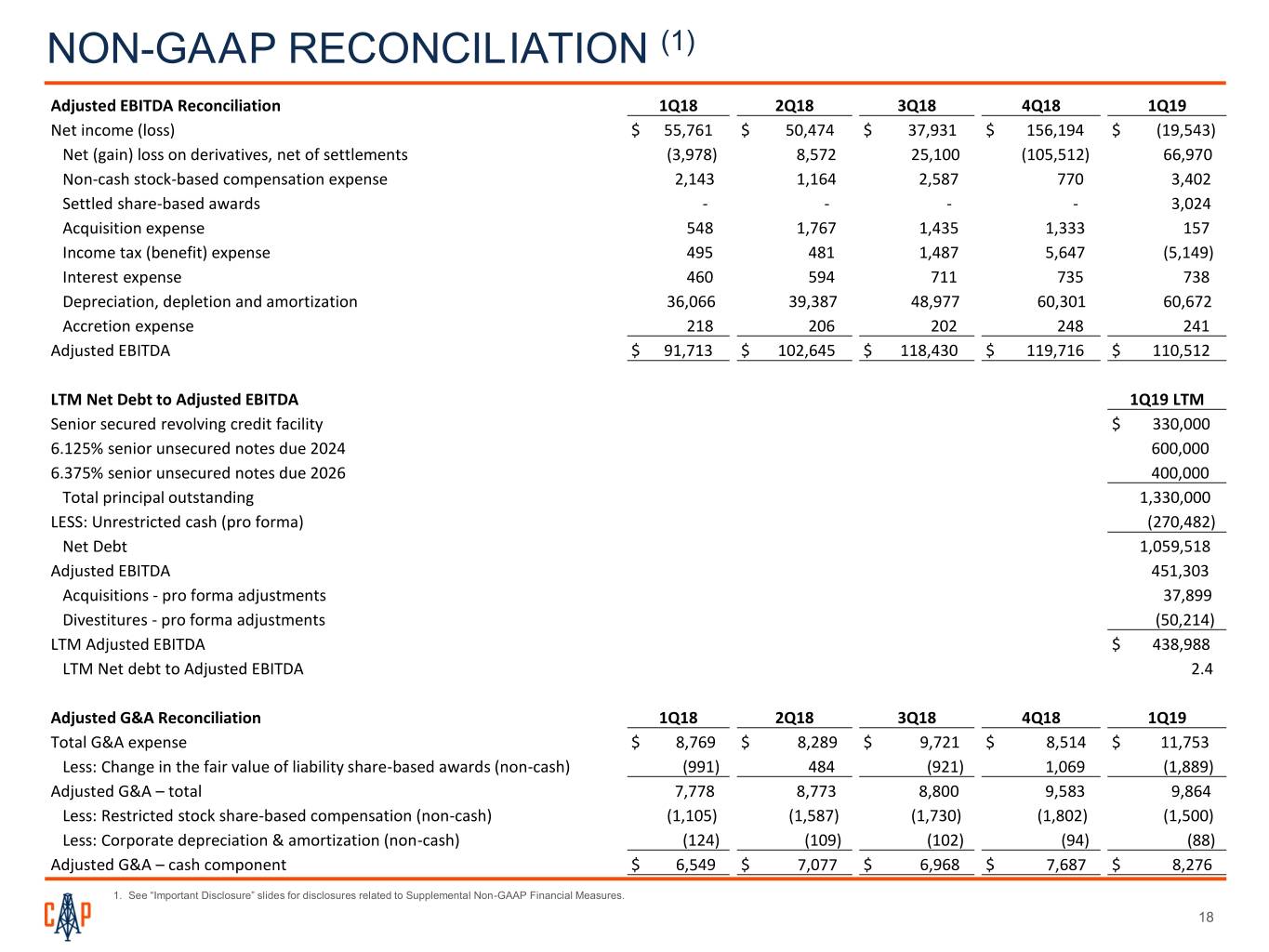

NON-GAAP RECONCILIATION (1) Adjusted EBITDA Reconciliation 1Q18 2Q18 3Q18 4Q18 1Q19 Net income (loss) $ 55,761 $ 50,474 $ 37,931 $ 156,194 $ (19,543) Net (gain) loss on derivatives, net of settlements (3,978) 8,572 25,100 (105,512) 66,970 Non-cash stock-based compensation expense 2,143 1,164 2,587 770 3,402 Settled share-based awards - - - - 3,024 Acquisition expense 548 1,767 1,435 1,333 157 Income tax (benefit) expense 495 481 1,487 5,647 (5,149) Interest expense 460 594 711 735 738 Depreciation, depletion and amortization 36,066 39,387 48,977 60,301 60,672 Accretion expense 218 206 202 248 241 Adjusted EBITDA $ 91,713 $ 102,645 $ 118,430 $ 119,716 $ 110,512 LTM Net Debt to Adjusted EBITDA 1Q19 LTM Senior secured revolving credit facility $ 330,000 6.125% senior unsecured notes due 2024 600,000 6.375% senior unsecured notes due 2026 400,000 Total principal outstanding 1,330,000 LESS: Unrestricted cash (pro forma) (270,482) Net Debt 1,059,518 Adjusted EBITDA 451,303 Acquisitions - pro forma adjustments 37,899 Divestitures - pro forma adjustments (50,214) LTM Adjusted EBITDA $ 438,988 LTM Net debt to Adjusted EBITDA 2.4 Adjusted G&A Reconciliation 1Q18 2Q18 3Q18 4Q18 1Q19 Total G&A expense $ 8,769 $ 8,289 $ 9,721 $ 8,514 $ 11,753 Less: Change in the fair value of liability share-based awards (non-cash) (991) 484 (921) 1,069 (1,889) Adjusted G&A – total 7,778 8,773 8,800 9,583 9,864 Less: Restricted stock share-based compensation (non-cash) (1,105) (1,587) (1,730) (1,802) (1,500) Less: Corporate depreciation & amortization (non-cash) (124) (109) (102) (94) (88) Adjusted G&A – cash component $ 6,549 $ 7,077 $ 6,968 $ 7,687 $ 8,276 1. See “Important Disclosure” slides for disclosures related to Supplemental Non-GAAP Financial Measures. 18

NON-GAAP RECONCILIATION (1) Adjusted Total Revenue Reconciliation 1Q18 2Q18 3Q18 4Q18 1Q19 Oil revenue $ 115,286 $ 122,613 $ 142,601 $ 150,398 $ 141,098 Natural gas revenue 12,154 14,462 18,613 11,497 11,949 Total revenue 127,440 137,075 161,214 161,895 153,047 Impact of cash-settled derivatives (8,459) (7,980) (9,239) (1,594) (290) Adjusted Total Revenue $ 118,981 $ 129,095 $ 151,975 $ 160,301 $ 152,757 Total Production (Mboe) 2,391 2,635 3,212 3,780 3,628 Adjusted Total Revenue per Boe $ 49.76 $ 48.99 $ 47.31 $ 42.41 $ 42.11 Discretionary Cash Flow Reconciliation 1Q18 2Q18 3Q18 4Q18 1Q19 Net cash provided by operating activities $ 92,215 $ 107,764 $ 116,036 $ 151,639 $ 74,559 Changes in working capital (4,512) (8,978) 347 (33,710) 33,864 Payments to settle asset retirement obligations 366 207 507 389 664 Payments for cash-settled restricted stock unit awards 3,089 1,901 - - 1,296 Discretionary cash flow $ 91,158 $ 100,894 $ 116,890 $ 118,318 $ 110,383 1. See “Important Disclosure” slides for disclosures related to Supplemental Non-GAAP Financial Measures. 19