- CPE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Callon Petroleum (CPE) 425Business combination disclosure

Filed: 4 Jan 24, 5:05pm

Filed by APA Corporation

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Callon Petroleum Company

Commission File No. 001-14039

Date: January 4, 2024

The following investor presentation was posted on APA’s investor website on January 4, 2024.

Accretive Permian Transaction JANUARY 4, 2024

Disclaimer Forward-Looking Statements This presentation and the oral statements made in connection therewith relate to a proposed business combination transaction between APA and Callon and contain “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements relate to future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction on the combined company’s business and future financial and operating results, the expected amount and timing of synergies from the proposed transaction, the anticipated closing date for the proposed transaction, and other aspects of our operations or operating results. Words and phrases such as “anticipate,” “estimate,” “believe,” “budget,” “continue,” “could,” “intend,” “may,” “might,” “plan,” “potential,” “possibly,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “prospect,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and other similar words can be used to identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. All such forward-looking statements are based upon current plans, estimates, expectations, and ambitions that are subject to risks, uncertainties, and assumptions, many of which are beyond the control of APA and Callon, that could cause actual results to differ materially from those expressed or forecast in such forward-looking statements. The following important factors and uncertainties, among others, could cause actual results or events to differ materially from those described in these forward-looking statements: the risk that the approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 is not obtained or is obtained subject to conditions that are not anticipated by APA and Callon; uncertainties as to whether the potential transaction will be consummated on the expected time period or at all, or if consummated, will achieve its anticipated benefits and projected synergies within the expected time period or at all; APA’s ability to integrate Callon’s operations in a successful manner and in the expected time period; the occurrence of any event, change, or other circumstance that could give rise to the termination of the transaction, including receipt a competing acquisition proposal; risks that the anticipated tax treatment of the potential transaction is not obtained; unforeseen or unknown liabilities; customer, shareholder, regulatory, and other stakeholder approvals and support; unexpected future capital expenditures; potential litigation relating to the potential transaction that could be instituted against APA and Callon or their respective directors; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement, pendency, or completion of the potential transaction on the parties’ business relationships and business generally; risks that the potential transaction disrupts current plans and operations of APA or Callon and their respective management teams and potential difficulties in Callon’s ability to retain employees as a result of the transaction; negative effects of this announcement and the pendency or completion of the proposed acquisition on the market price of APA’s or Callon’s common stock and/or operating results; rating agency actions and APA’s and Callon’s ability to access short- and long-term debt markets on a timely and affordable basis; various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches, and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and technological changes; labor disputes; changes in labor costs and labor difficulties; the effects of industry, market, economic, political, or regulatory conditions outside of APA’s or Callon’s control; legislative, regulatory, and economic developments targeting public companies in the oil and gas industry; and the risks described in APA’s and Callon’s respective periodic and other filings with the U.S. Securities and Exchange Commission (“SEC”), including their most recent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K. Forward-looking statements represent management’s current expectations and are inherently uncertain and are made only as of the date hereof. Except as required by law, neither APA nor Callon undertakes or assumes any obligation to update any forward-looking statements, whether as a result of new information or to reflect subsequent events or circumstances or otherwise. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserves that meet the SEC’s definitions for such terms. This presentation and the oral statements made in connection therewith may use certain terms, such as “resources,” “potential resources,” “resource potential,” “estimated net reserves,” “recoverable reserves,” and other similar terms that the SEC guidelines strictly prohibit oil and gas companies from including in filings with the SEC. Such terms do not take into account the certainty of resource recovery, which is contingent on exploration success, technical improvements in drilling access, commerciality, and other factors, and are therefore not indicative of expected future resource recovery and should not be relied upon. Investors are urged to consider carefully the disclosure in APA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and Callon’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022. A copy of APA’s Annual Report on Form 10-K is available free of charge on APA’s website at https://investor.apacorp.com. A copy of Callon’s Annual Report on Form 10-K is available free of charge on Callon’s website at https://callon.com/investors. You may also obtain these reports from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov. A P A C O R P O R A T I O N 2

Disclaimer (continued) Non-GAAP Financial Measures This presentation includes financial information not prepared in conformity with generally accepted accounting principles (GAAP). Net debt and adjusted EBITDAX are non-GAAP measures. This non-GAAP information should be considered by the reader in addition to, but not instead of, the financial information prepared in accordance with GAAP. For a reconciliation to the most directly comparable GAAP financial measure, please refer to the companies’ quarterly results posted on APA’s website at https://investor.apacorp.com and on Callon’s website at https://callon.com/investors. No Offer or Solicitation This presentation and the oral statements made in connection therewith are not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information about the Merger and Where to Find It In connection with the proposed transaction, APA intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of APA and Callon and that also constitutes a prospectus of APA common stock. Each of APA and Callon may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that APA or Callon may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of APA and Callon. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about APA, Callon, and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by APA will be available free of charge on APA’s website at https://investor.apacorp.com. Copies of the documents filed with the SEC by Callon will be available free of charge on Callon’s website at https://callon.com/investors. Participants in the Solicitation APA, Callon, and certain of their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of APA, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in APA’s proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on April 11, 2023, and APA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Information about the directors and executive officers of Callon, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Callon’s proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on March 13, 2023, and Callon’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from APA or Callon using the sources indicated above. A P A C O R P O R A T I O N 3

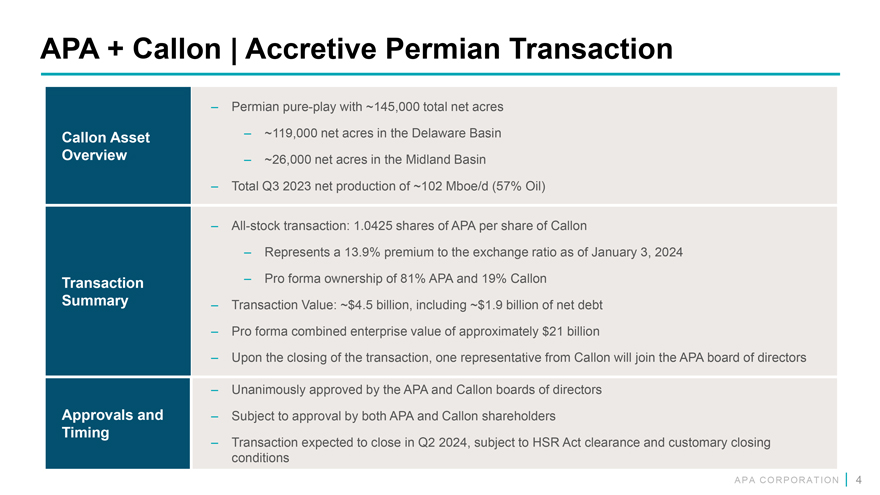

APA + Callon | Accretive Permian Transaction – Permian pure-play with ~145,000 total net acres Callon Asset – ~119,000 net acres in the Delaware Basin Overview – ~26,000 net acres in the Midland Basin – Total Q3 2023 net production of ~102 Mboe/d (57% Oil) – All-stock transaction: 1.0425 shares of APA per share of Callon – Represents a 13.9% premium to the exchange ratio as of January 3, 2024 Transaction – Pro forma ownership of 81% APA and 19% Callon Summary – Transaction Value: ~$4.5 billion, including ~$1.9 billion of net debt – Pro forma combined enterprise value of approximately $21 billion – Upon the closing of the transaction, one representative from Callon will join the APA board of directors – Unanimously approved by the APA and Callon boards of directors Approvals and – Subject to approval by both APA and Callon shareholders Timing – Transaction expected to close in Q2 2024, subject to HSR Act clearance and customary closing conditions A P A C O R P O R A T I O N 4

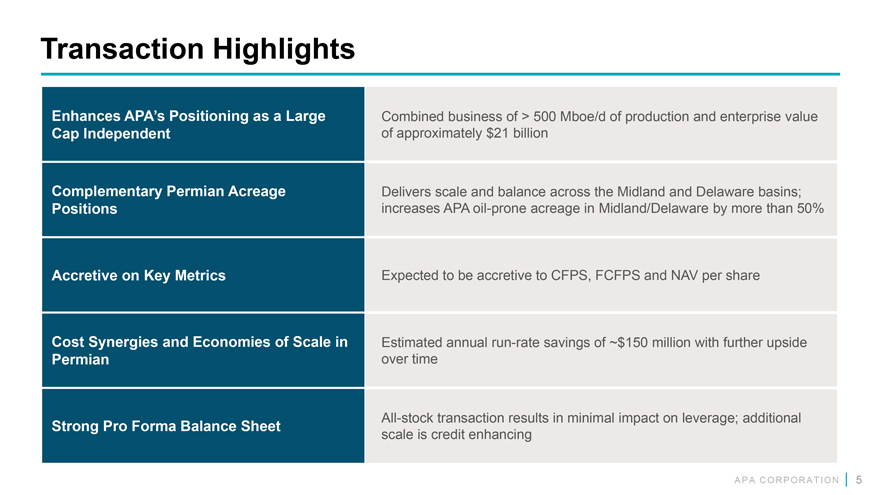

Transaction Highlights Enhances APA’s Positioning as a Large Combined business of > 500 Mboe/d of production and enterprise value Cap Independent of approximately $21 billion Complementary Permian Acreage Delivers scale and balance across the Midland and Delaware basins; Positions increases APA oil-prone acreage in Midland/Delaware by more than 50% Accretive on Key Metrics Expected to be accretive to CFPS, FCFPS and NAV per share Cost Synergies and Economies of Scale in Estimated annual run-rate savings of ~$150 million with further upside Permian over time All-stock transaction results in minimal impact on leverage; additional Strong Pro Forma Balance Sheet scale is credit enhancing A P A C O R P O R A T I O N 5

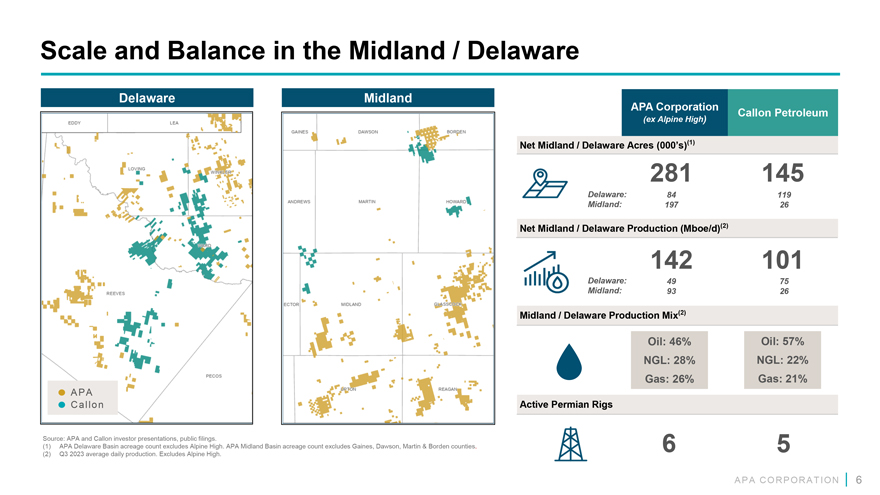

Scale and Balance in the Midland / Delaware Delaware Midland APA Corporation Callon Petroleum (ex Alpine High) Net Midland / Delaware Acres (000’s)(1) 281 145 Delaware: 84 119 Midland: 197 26 Net Midland / Delaware Production (Mboe/d)(2) 142 101 Delaware: 49 75 Midland: 93 26 Midland / Delaware Production Mix(2) Oil: 46% Oil: 57% NGL: 28% NGL: 22% Gas: 26% Gas: 21% APA Ca l l o n Active Permian Rigs Source: APA and Callon investor presentations, public filings. (1) APA Delaware Basin acreage count excludes Alpine High. APA Midland Basin acreage count excludes Gaines, Dawson, Martin & Borden counties. 6 5 (2) Q3 2023 average daily production. Excludes Alpine High. A P A C O R P O R A T I O N 6

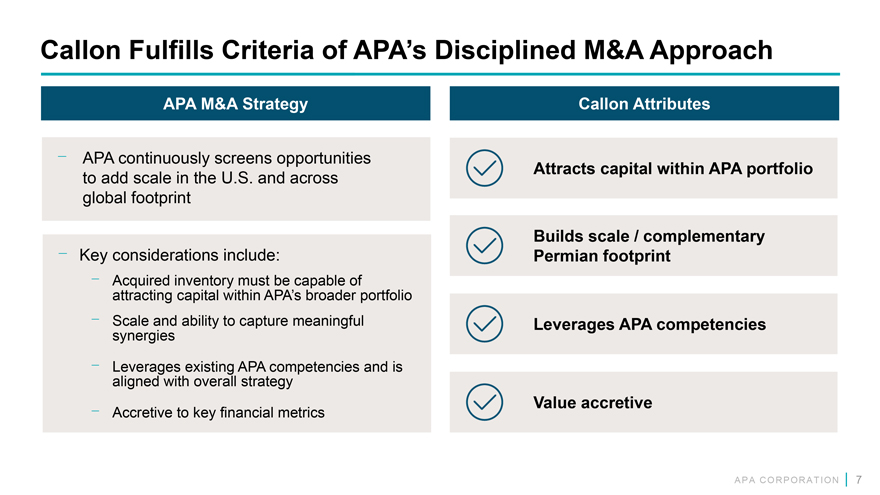

Callon Fulfills Criteria of APA’s Disciplined M&A Approach APA M&A Strategy Callon Attributes APA continuously screens opportunities Attracts capital within APA portfolio to add scale in the U.S. and across global footprint Builds scale / complementary Key considerations include: Permian footprint Acquired inventory must be capable of attracting capital within APA’s broader portfolio Scale and ability to capture meaningful Leverages APA competencies synergies Leverages existing APA competencies and is aligned with overall strategy Value accretive Accretive to key financial metrics A P A C O R P O R A T I O N 7

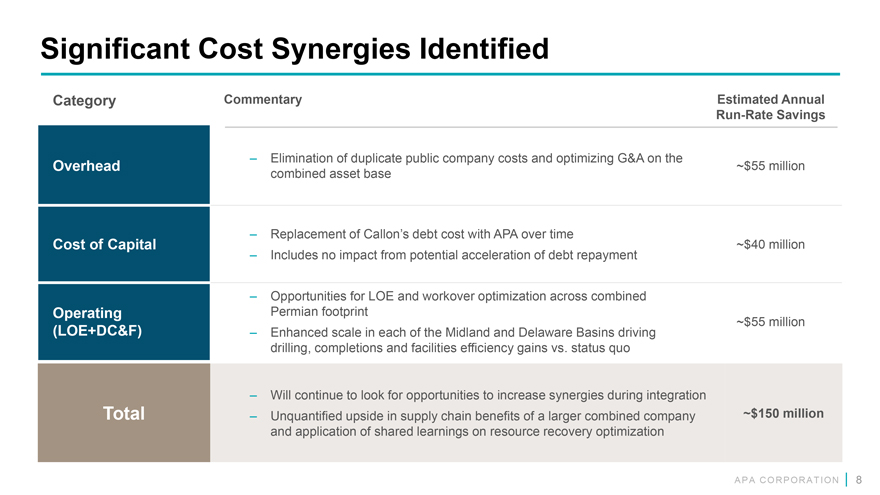

Significant Cost Synergies Identified Category Commentary Estimated Annual Run-Rate Savings – Elimination of duplicate public company costs and optimizing G&A on the Overhead ~$55 million combined asset base – Replacement of Callon’s debt cost with APA over time Cost of Capital ~$40 million – Includes no impact from potential acceleration of debt repayment – Opportunities for LOE and workover optimization across combined Operating Permian footprint ~$55 million (LOE+DC&F) – Enhanced scale in each of the Midland and Delaware Basins driving drilling, completions and facilities efficiency gains vs. status quo – Will continue to look for opportunities to increase synergies during integration Total – Unquantified upside in supply chain benefits of a larger combined company ~$150 million and application of shared learnings on resource recovery optimization A P A C O R P O R A T I O N 8

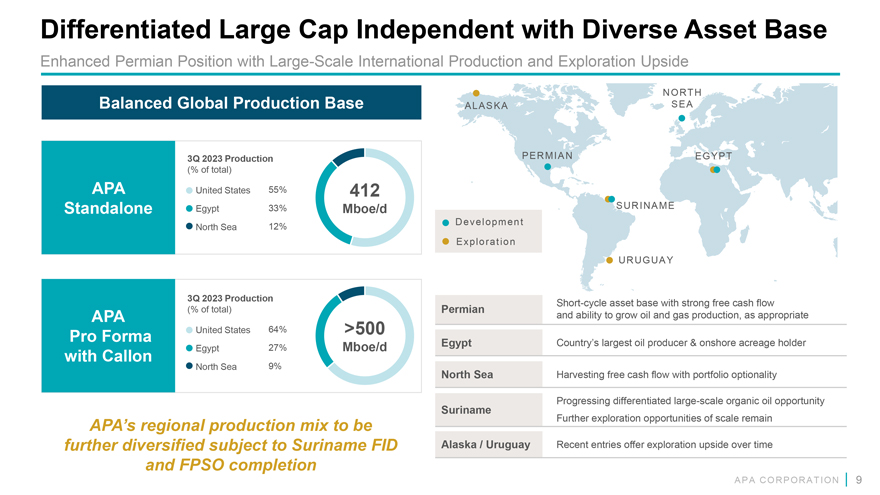

Differentiated Large Cap Independent with Diverse Asset Base Enhanced Permian Position with Large-Scale International Production and Exploration Upside NO RT H Balanced Global Production Base A L A S K A S E A 3Q 2023 Production P E RM I A N E G Y P T (% of total) APA United States 55% 412 Standalone Egypt 33% Mboe/d S URI NA M E De ve l o p m e n t North Sea 12% E xp l o r a t i o n URUG UA Y 3Q 2023 Production Short-cycle asset base with strong free cash flow (% of total) Permian APA and ability to grow oil and gas production, as appropriate Pro Forma United States 64% >500 Egypt Country’s largest oil producer & onshore acreage holder Egypt 27% Mboe/d with Callon North Sea 9% Harvesting free cash flow with portfolio optionality North Sea Suriname Progressing differentiated large-scale organic oil opportunity APA’s regional production mix to be Further exploration opportunities of scale remain further diversified subject to Suriname FID Alaska / Uruguay Recent entries offer exploration upside over time and FPSO completion A P A C O R P O R A T I O N 9

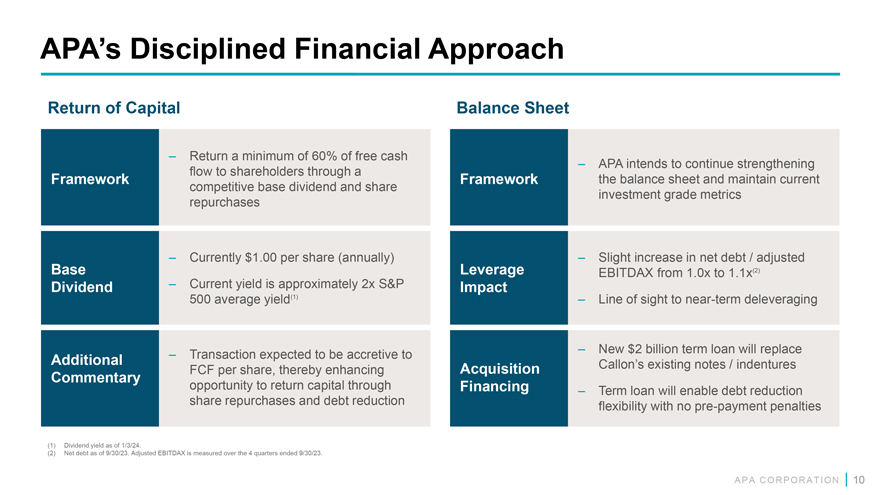

APA’s Disciplined Financial Approach Return of Capital Balance Sheet – Return a minimum of 60% of free cash – APA intends to continue strengthening flow to shareholders through a Framework Framework the balance sheet and maintain current competitive base dividend and share investment grade metrics repurchases – Currently $1.00 per share (annually) – Slight increase in net debt / adjusted Base Leverage EBITDAX from 1.0x to 1.1x(2) Dividend – Current yield is approximately 2x S&P Impact 500 average yield(1) – Line of sight to near-term deleveraging – Transaction expected to be accretive to – New $2 billion term loan will replace Additional Callon’s existing notes / indentures FCF per share, thereby enhancing Acquisition Commentary opportunity to return capital through Financing – Term loan will enable debt reduction share repurchases and debt reduction flexibility with no pre-payment penalties (1) Dividend yield as of 1/3/24. (2) Net debt as of 9/30/23. Adjusted EBITDAX is measured over the 4 quarters ended 9/30/23. A P A C O R P O R A T I O N 10

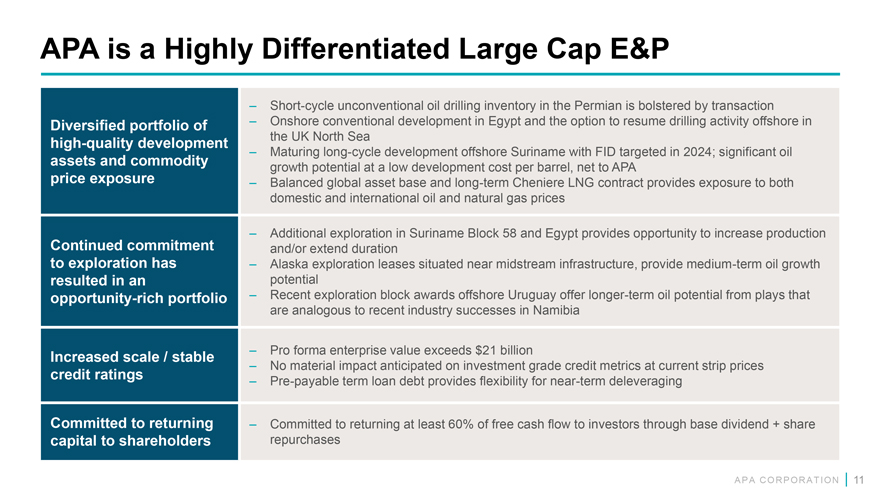

APA is a Highly Differentiated Large Cap E&P – Short-cycle unconventional oil drilling inventory in the Permian is bolstered by transaction Diversified portfolio of – Onshore conventional development in Egypt and the option to resume drilling activity offshore in the UK North Sea high-quality development – Maturing long-cycle development offshore Suriname with FID targeted in 2024; significant oil assets and commodity growth potential at a low development cost per barrel, net to APA price exposure – Balanced global asset base and long-term Cheniere LNG contract provides exposure to both domestic and international oil and natural gas prices Continued commitment – Additional exploration in Suriname Block 58 and Egypt provides opportunity to increase production and/or extend duration to exploration has – Alaska exploration leases situated near midstream infrastructure, provide medium-term oil growth resulted in an potential opportunity-rich portfolio – Recent exploration block awards offshore Uruguay offer longer-term oil potential from plays that are analogous to recent industry successes in Namibia – Pro forma enterprise value exceeds $21 billion Increased scale / stable – No material impact anticipated on investment grade credit metrics at current strip prices credit ratings – Pre-payable term loan debt provides flexibility for near-term deleveraging Committed to returning – Committed to returning at least 60% of free cash flow to investors through base dividend + share capital to shareholders repurchases A P A C O R P O R A T I O N 11

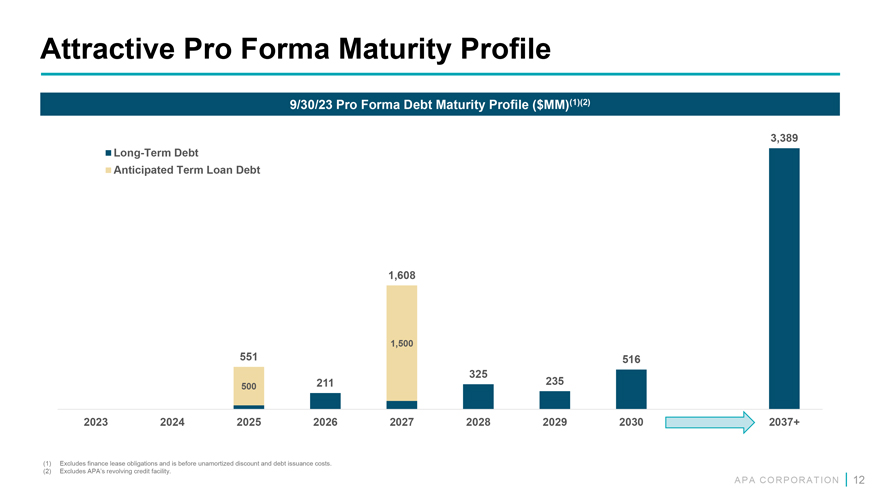

Attractive Pro Forma Maturity Profile 9/30/23 Pro Forma Debt Maturity Profile ($MM)(1)(2) 3,389 Long-Term Debt Anticipated Term Loan Debt 1,608 1,500 551 516 325 211 235 500 2023 2024 2025 2026 2027 2028 2029 2030 …. 2037+ (1) Excludes finance lease obligations and is before unamortized discount and debt issuance costs. (2) Excludes APA’s revolving credit facility. A P A C O R P O R A T I O N 12

apacorp.com