Flotek Industries 8846 N. Sam Houston Pkwy W., Suite 150 Houston, Texas 77064 (713)-849-9911 www.flotekind.com FLOTEK ANNOUNCES SECOND QUARTER 2022 FINANCIAL RESULTS HOUSTON, August 9, 2022 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced second quarter results for the three months ended June 30, 2022. “I’m pleased to report our second quarter 2022 results in which revenue of $29.4MM increased 2.3x compared to the first quarter 2022 and 3.2x compared to the second quarter of 2021. Our Supply Agreement with ProFrac was effective as of April 1st, spans 10 years, and covers an equivalent volume of our full suite of downhole chemistries to serve 30 of their frac fleets or 70% of their total frac fleet, whichever is greater. While we are still in the early days of the contract, serving an average of 8 fleets in Q2, we remain confident in our ramp up to the full contract scope over the coming quarters. We also have no reason to expect that our relationship is bounded by the 30 fleet or 70% numbers. As we continue to provide exemplary service, ProFrac has the incentive to maximize chemical deliveries from Flotek due to the structure of our arrangement. ProFrac recently announced the acquisition of US Well Services which is expected to close in Q4. As a result, they expect to be operating 44 active frac fleets by the end of 2022. While 70% of 44 is a bit less than 31, we fully expect that we will win more of that business as we scale up” said John W. Gibson, Jr., Chairman, President, and Chief Executive Officer. “While we are proud of our ability to increase volume and revenue thus far, and are confident that we have the capability to fulfill future demand, we recognize that the glide path to positive Adjusted EBITDA hinges on future margins. We further recognize that this was only the first quarter of the ProFrac contract, and economies of scale and operating leverage should drive better margins as we continue to grow. In addition to the challenge any company would face evolving to growth at this pace, we were confronted with a difficult freight & logistics environment which our team is working hard to neutralize. In summary, we remain committed to achieving positive Adjusted EBITDA margins and continue to be optimistic about the future and expect improving financial performance throughout the year.” Key Second Quarter 2022 Financial Results • Total Revenues: Flotek generated second quarter 2022 consolidated revenue of $29.4 million, up 128% from $12.9 million in the first quarter of 2022, driven by increased activity with ProFrac and continued growth in deliveries to transactional Chemistry Technologies customers. • Net Income and EPS: The Company recorded net income of $6.2 million, or $0.08 per basic and $(0.05) diluted share, in the second quarter 2022 compared to a net loss of $10.7 million, or $0.15 per basic/diluted share, in the first quarter of 2022. The sequential improvement is primarily due to the change in fair value of contingent convertible notes payable of $17.2 million. • Non-GAAP Adjusted EBITDA: Adjusted EBITDA for the second quarter 2022 was negative $7.2 million, a 33% decline compared to negative $5.4 million in the first quarter 2022. Operational Highlights • In the first quarter 2022, the Company entered into a long-term supply agreement with ProFrac Services, LLC (ProFrac), to provide full downhole chemistry solutions for the greater of 33% of ProFrac’s crews or 10 crews minimum for three years. In the second quarter, the Company entered into an amended agreement with ProFrac to expand the Agreement to a term of 10 years and 70% of ProFrac’s frac fleet or 30 hydraulic fracturing fleets, whichever is greater. The expansion was overwhelmingly approved by shareholders on May 9, 2022. Combined, the contracts are expected to exceed $2 billion in revenue over the next decade. Additional details can be found in the Company’s SEC and 10-Q filings. Balance Sheet and Liquidity • As of June 30, 2022, the Company reported cash and equivalents of $33.1 million compared to $24.9 million at the end of the first quarter 2022, benefitted by the Private Investment in Public Equity (PIPE) transactions with ProFrac, which were disclosed previously. Exhibit 99.1

• On June 17, 2022, Flotek entered into a Securities Purchase Agreement with ProFrac. Pursuant to the Securities Purchase Agreement, the Company will receive $19,500,000 in cash and ProFrac will receive pre-funded warrants permitting ProFrac to purchase 13,104,839 shares of common stock of the Company at an exercise price equal to $0.0001 per share, representing a 20% premium to the 30-day volume average price of the Company’s common stock at the close of business on the day prior to the date of the Securities Purchase Agreement. ProFrac may not receive any voting or consent rights in respect of the Prefunded Warrants or the underlying shares unless and until the Company has obtained approval from a majority of its shareholders excluding ProFrac and its affiliates, and ProFrac has paid an additional $4,500,000 to the Company. • On April 18, 2022, the Company closed on a contract to sell the Waller, TX facility for $4.3 million. The proceeds are included in our second quarter 2022 results. In addition, the Company is currently entertaining an offer to sell the Monahans,TX facility and we expect to be able to close that sale in the coming quarters. The Monahans facility remained classified as held for sale as of June 30, 2022. Conference Call Details Flotek will host a conference call on August 10, 2022, at 9:00 a.m. CST (10:00 a.m. EST) to discuss its second quarter results for the three months ended June 30, 2022. Participants may access the call through Flotek’s website at www.flotekind.com under “Webcasts’’ or by telephone at 1-844-835-9986 approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website. About Flotek Industries, Inc. Flotek Industries, Inc. creates solutions to reduce the environmental impact of energy on air, water, land and people. A technology-driven, specialty green chemistry and data company, Flotek helps customers across industrial, commercial, and consumer markets improve their Environmental, Social, and Governance performance. Flotek’s Chemistry Technologies segment develops, manufactures, packages, distributes, delivers, and markets high-quality cleaning, disinfecting and sanitizing products for commercial, governmental and personal consumer use. Additionally, Flotek empowers the energy industry to maximize the value of their hydrocarbon streams and improve return on invested capital through its real-time data platforms and green chemistry technologies. Flotek serves downstream, midstream, and upstream customers, both domestic and international. Flotek is a publicly traded company headquartered in Houston, Texas, and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK.” For additional information, please visit www.flotekind.com. Forward -Looking Statements Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the “Risk Factors” section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect, any event or circumstance that may arise after the date of this press release. Inquiries, contact: Bernie Colson SVP, Corporate Development & Sustainability E: ir@flotekind.com P: (713) 726-5322

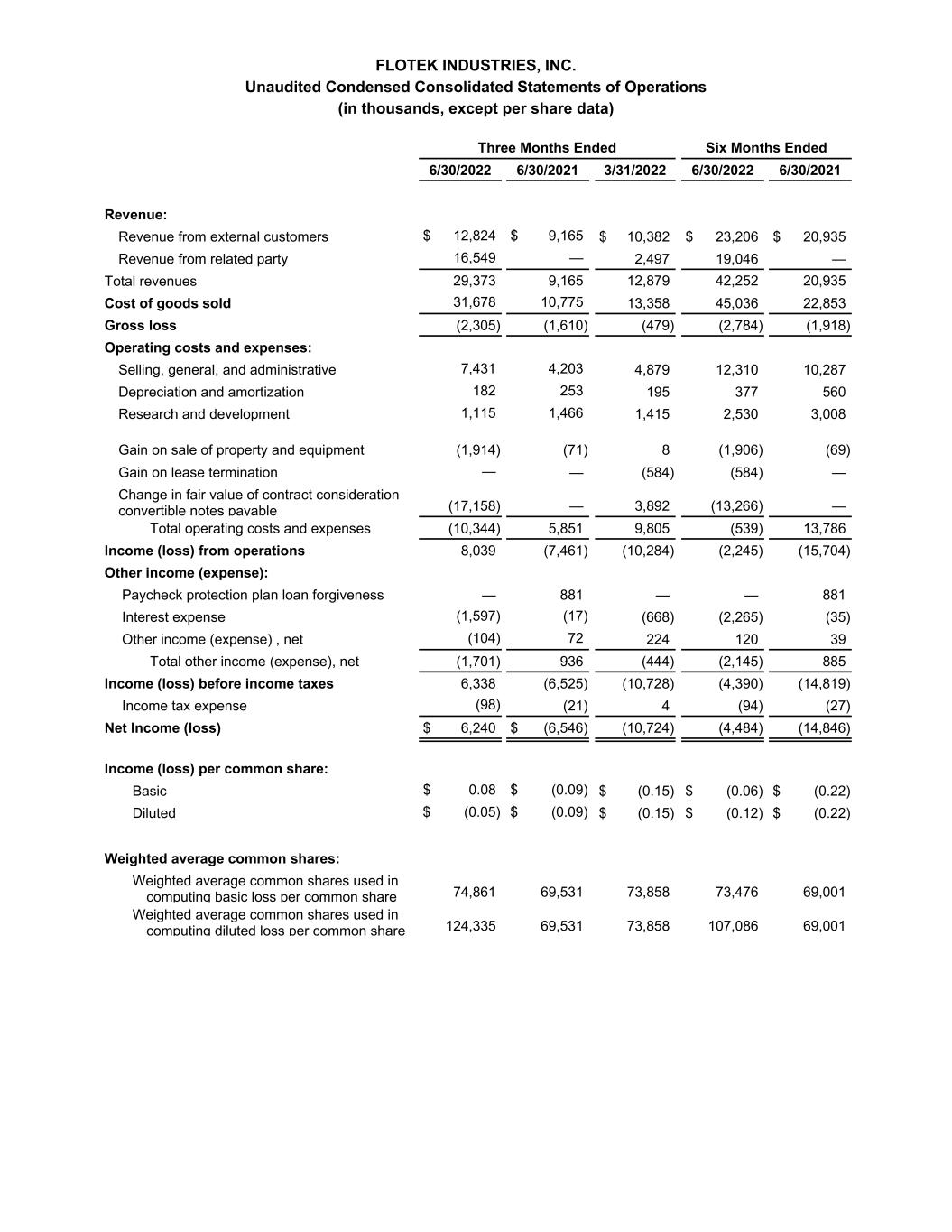

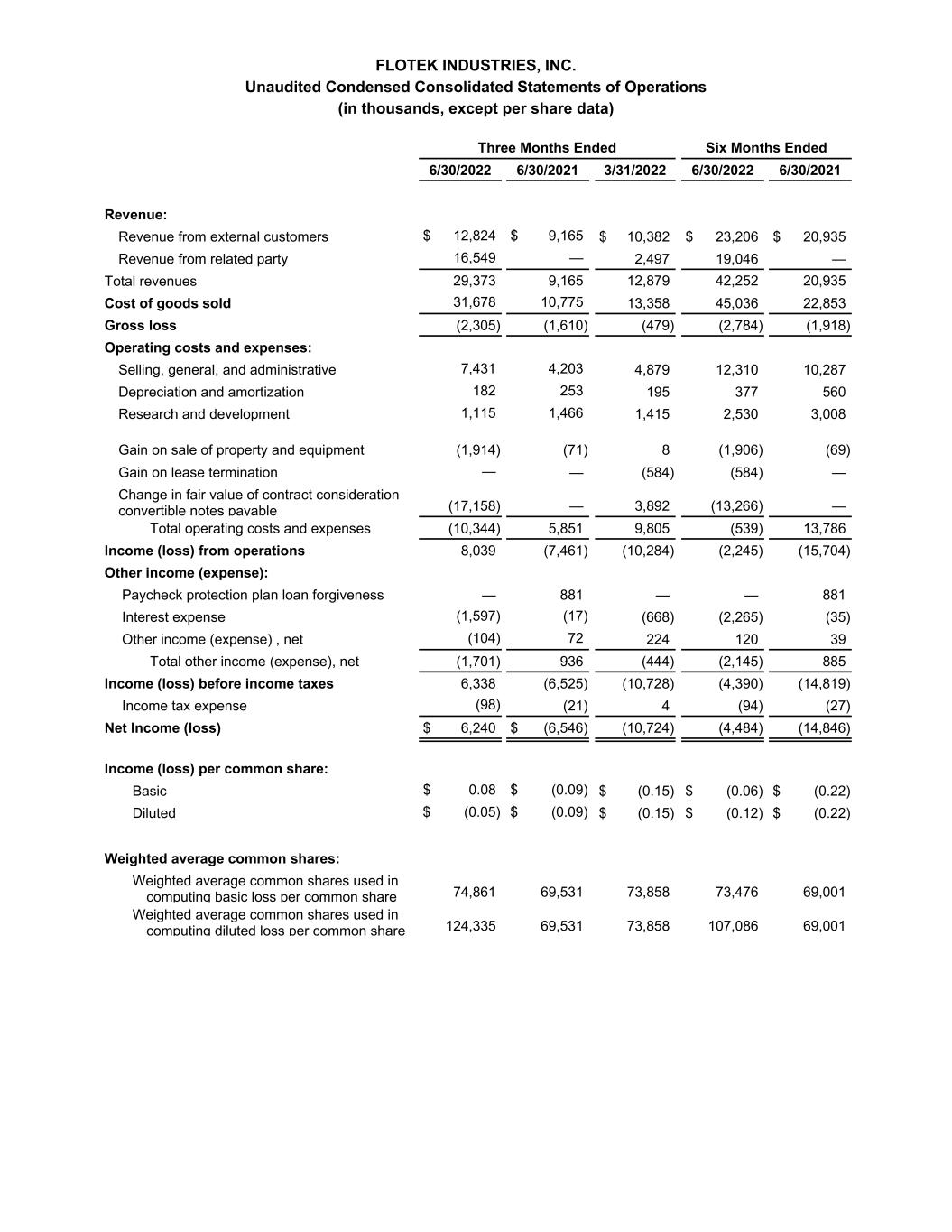

FLOTEK INDUSTRIES, INC. Unaudited Condensed Consolidated Statements of Operations (in thousands, except per share data) Three Months Ended Six Months Ended 6/30/2022 6/30/2021 3/31/2022 6/30/2022 6/30/2021 Revenue: Revenue from external customers $ 12,824 $ 9,165 $ 10,382 $ 23,206 $ 20,935 Revenue from related party 16,549 — 2,497 19,046 — Total revenues 29,373 9,165 12,879 42,252 20,935 Cost of goods sold 31,678 10,775 13,358 45,036 22,853 Gross loss (2,305) (1,610) (479) (2,784) (1,918) Operating costs and expenses: Selling, general, and administrative 7,431 4,203 4,879 12,310 10,287 Depreciation and amortization 182 253 195 377 560 Research and development 1,115 1,466 1,415 2,530 3,008 Gain on sale of property and equipment (1,914) (71) 8 (1,906) (69) Gain on lease termination — — (584) (584) — Change in fair value of contract consideration convertible notes payable (17,158) — 3,892 (13,266) — Total operating costs and expenses (10,344) 5,851 9,805 (539) 13,786 Income (loss) from operations 8,039 (7,461) (10,284) (2,245) (15,704) Other income (expense): Paycheck protection plan loan forgiveness — 881 — — 881 Interest expense (1,597) (17) (668) (2,265) (35) Other income (expense) , net (104) 72 224 120 39 Total other income (expense), net (1,701) 936 (444) (2,145) 885 Income (loss) before income taxes 6,338 (6,525) (10,728) (4,390) (14,819) Income tax expense (98) (21) 4 (94) (27) Net Income (loss) $ 6,240 $ (6,546) (10,724) (4,484) (14,846) Income (loss) per common share: Basic $ 0.08 $ (0.09) $ (0.15) $ (0.06) $ (0.22) Diluted $ (0.05) $ (0.09) $ (0.15) $ (0.12) $ (0.22) Weighted average common shares: Weighted average common shares used in computing basic loss per common share 74,861 69,531 73,858 73,476 69,001 Weighted average common shares used in computing diluted loss per common share 124,335 69,531 73,858 107,086 69,001

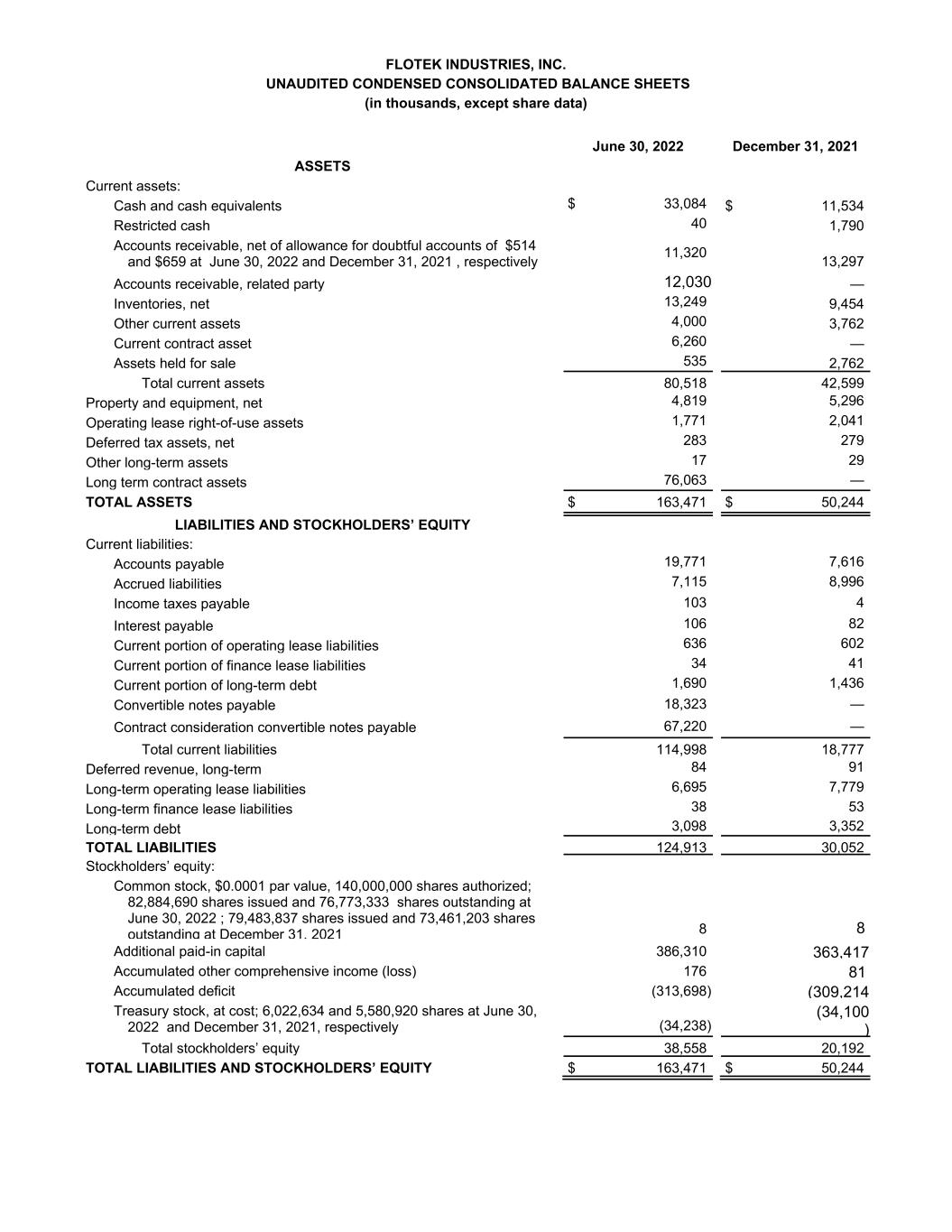

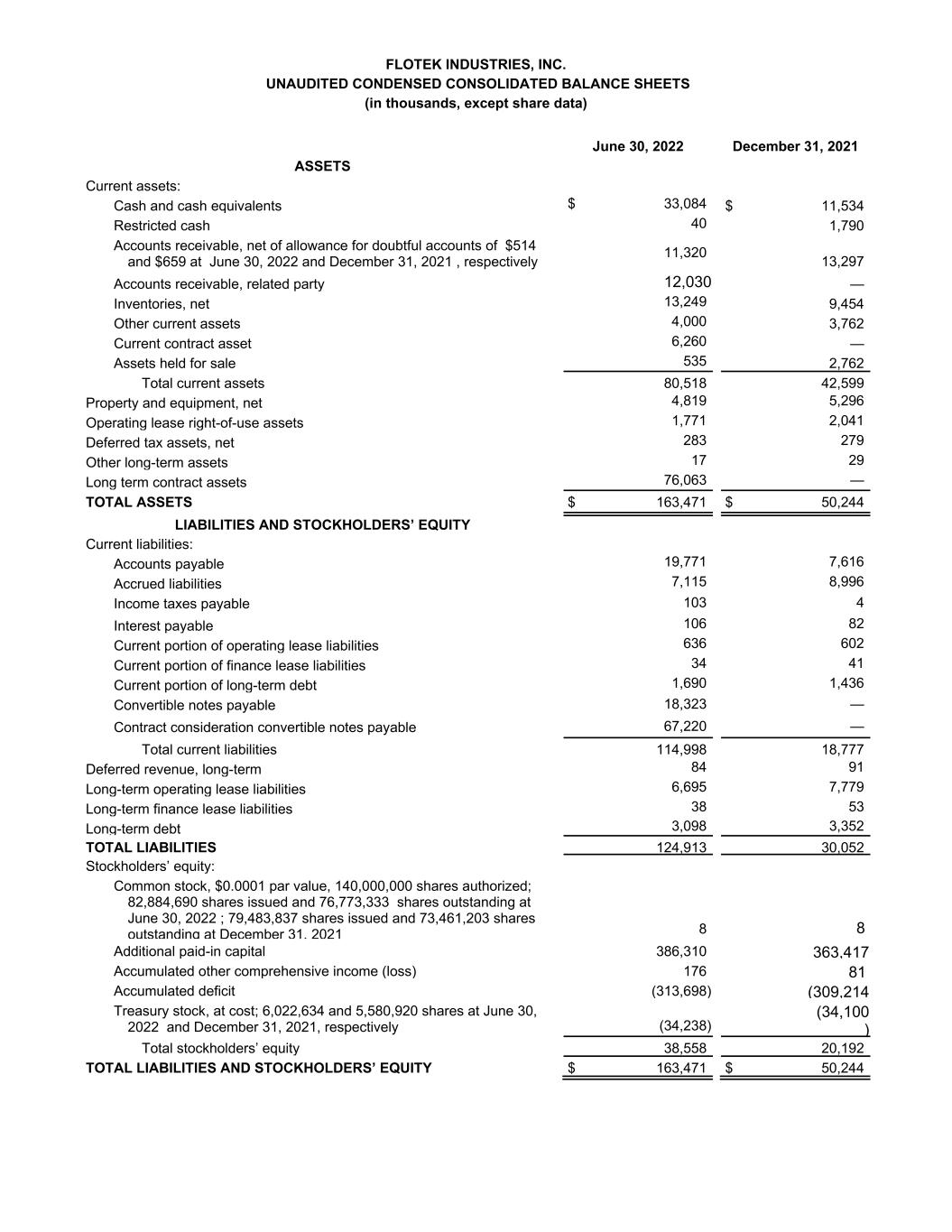

FLOTEK INDUSTRIES, INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share data) June 30, 2022 December 31, 2021 ASSETS Current assets: Cash and cash equivalents $ 33,084 $ 11,534 Restricted cash 40 1,790 Accounts receivable, net of allowance for doubtful accounts of $514 and $659 at June 30, 2022 and December 31, 2021 , respectively 11,320 13,297 Accounts receivable, related party 12,030 — Inventories, net 13,249 9,454 Other current assets 4,000 3,762 Current contract asset 6,260 — Assets held for sale 535 2,762 Total current assets 80,518 42,599 Property and equipment, net 4,819 5,296 Operating lease right-of-use assets 1,771 2,041 Deferred tax assets, net 283 279 Other long-term assets 17 29 Long term contract assets 76,063 — TOTAL ASSETS $ 163,471 $ 50,244 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable 19,771 7,616 Accrued liabilities 7,115 8,996 Income taxes payable 103 4 Interest payable 106 82 Current portion of operating lease liabilities 636 602 Current portion of finance lease liabilities 34 41 Current portion of long-term debt 1,690 1,436 Convertible notes payable 18,323 — Contract consideration convertible notes payable 67,220 — Total current liabilities 114,998 18,777 Deferred revenue, long-term 84 91 Long-term operating lease liabilities 6,695 7,779 Long-term finance lease liabilities 38 53 Long-term debt 3,098 3,352 TOTAL LIABILITIES 124,913 30,052 Stockholders’ equity: Common stock, $0.0001 par value, 140,000,000 shares authorized; 82,884,690 shares issued and 76,773,333 shares outstanding at June 30, 2022 ; 79,483,837 shares issued and 73,461,203 shares outstanding at December 31, 2021 8 8 Additional paid-in capital 386,310 363,417 Accumulated other comprehensive income (loss) 176 81 Accumulated deficit (313,698) (309,214 Treasury stock, at cost; 6,022,634 and 5,580,920 shares at June 30, 2022 and December 31, 2021, respectively (34,238) (34,100 ) Total stockholders’ equity 38,558 20,192 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 163,471 $ 50,244

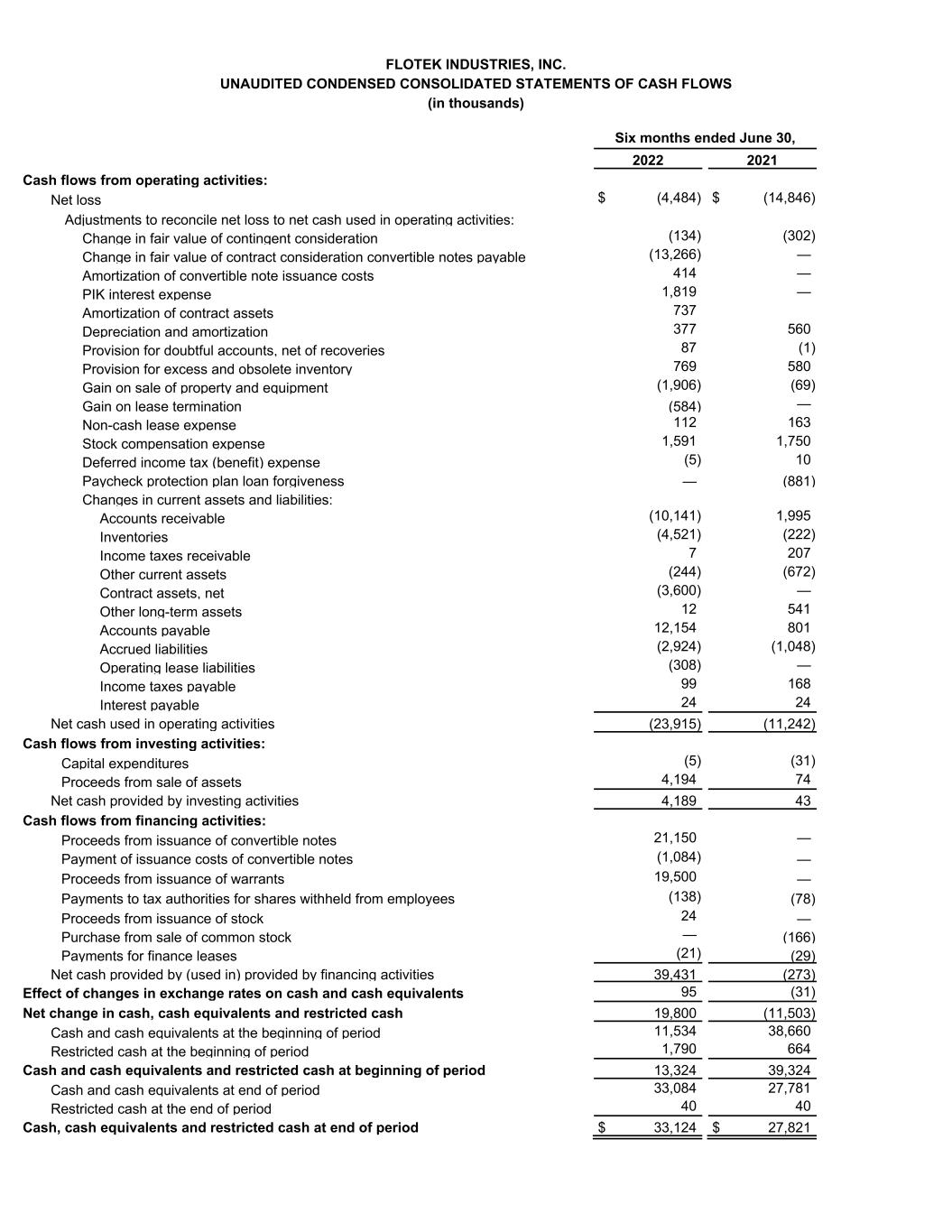

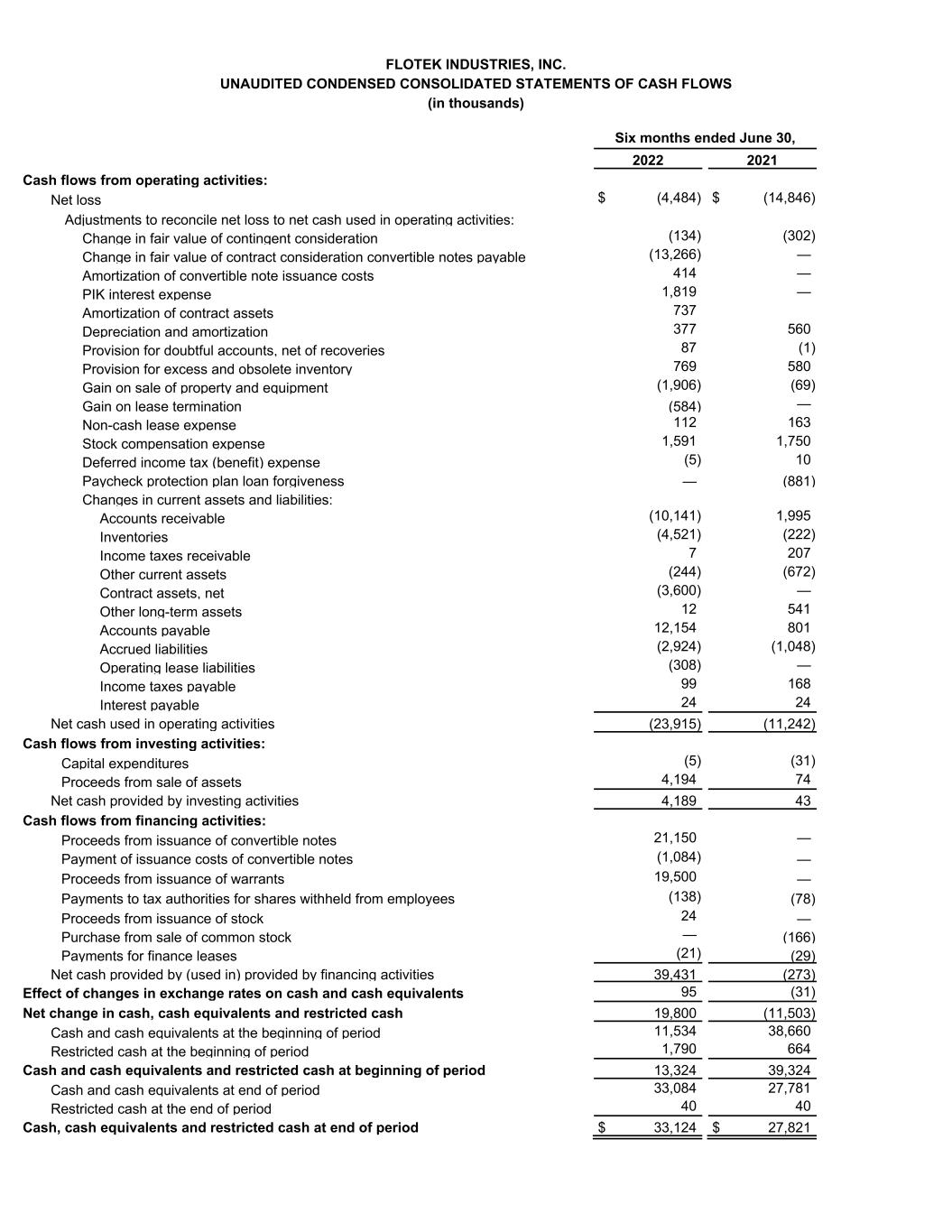

FLOTEK INDUSTRIES, INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Six months ended June 30, 2022 2021 Cash flows from operating activities: Net loss $ (4,484) $ (14,846) Adjustments to reconcile net loss to net cash used in operating activities: Change in fair value of contingent consideration (134) (302) Change in fair value of contract consideration convertible notes payable (13,266) — Amortization of convertible note issuance costs 414 — PIK interest expense 1,819 — Amortization of contract assets 737 Depreciation and amortization 377 560 Provision for doubtful accounts, net of recoveries 87 (1) Provision for excess and obsolete inventory 769 580 Gain on sale of property and equipment (1,906) (69) Gain on lease termination (584) — Non-cash lease expense 112 163 Stock compensation expense 1,591 1,750 Deferred income tax (benefit) expense (5) 10 Paycheck protection plan loan forgiveness — (881) Changes in current assets and liabilities: Accounts receivable (10,141) 1,995 Inventories (4,521) (222) Income taxes receivable 7 207 Other current assets (244) (672) Contract assets, net (3,600) — Other long-term assets 12 541 Accounts payable 12,154 801 Accrued liabilities (2,924) (1,048) Operating lease liabilities (308) — Income taxes payable 99 168 Interest payable 24 24 Net cash used in operating activities (23,915) (11,242) Cash flows from investing activities: Capital expenditures (5) (31) Proceeds from sale of assets 4,194 74 Net cash provided by investing activities 4,189 43 Cash flows from financing activities: Proceeds from issuance of convertible notes 21,150 — Payment of issuance costs of convertible notes (1,084) — Proceeds from issuance of warrants 19,500 — Payments to tax authorities for shares withheld from employees (138) (78) Proceeds from issuance of stock 24 — Purchase from sale of common stock — (166) Payments for finance leases (21) (29) Net cash provided by (used in) provided by financing activities 39,431 (273) Effect of changes in exchange rates on cash and cash equivalents 95 (31) Net change in cash, cash equivalents and restricted cash 19,800 (11,503) Cash and cash equivalents at the beginning of period 11,534 38,660 Restricted cash at the beginning of period 1,790 664 Cash and cash equivalents and restricted cash at beginning of period 13,324 39,324 Cash and cash equivalents at end of period 33,084 27,781 Restricted cash at the end of period 40 40 Cash, cash equivalents and restricted cash at end of period $ 33,124 $ 27,821

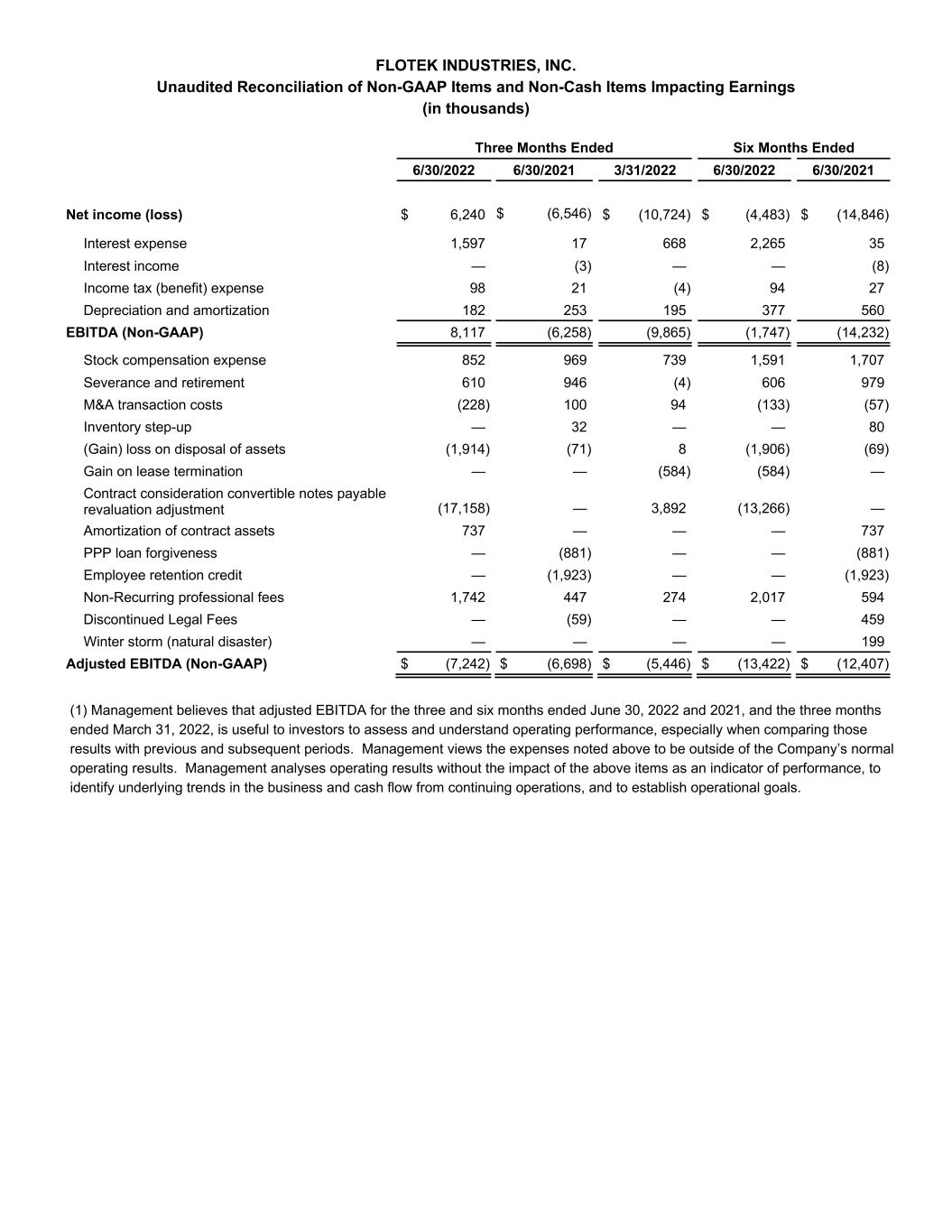

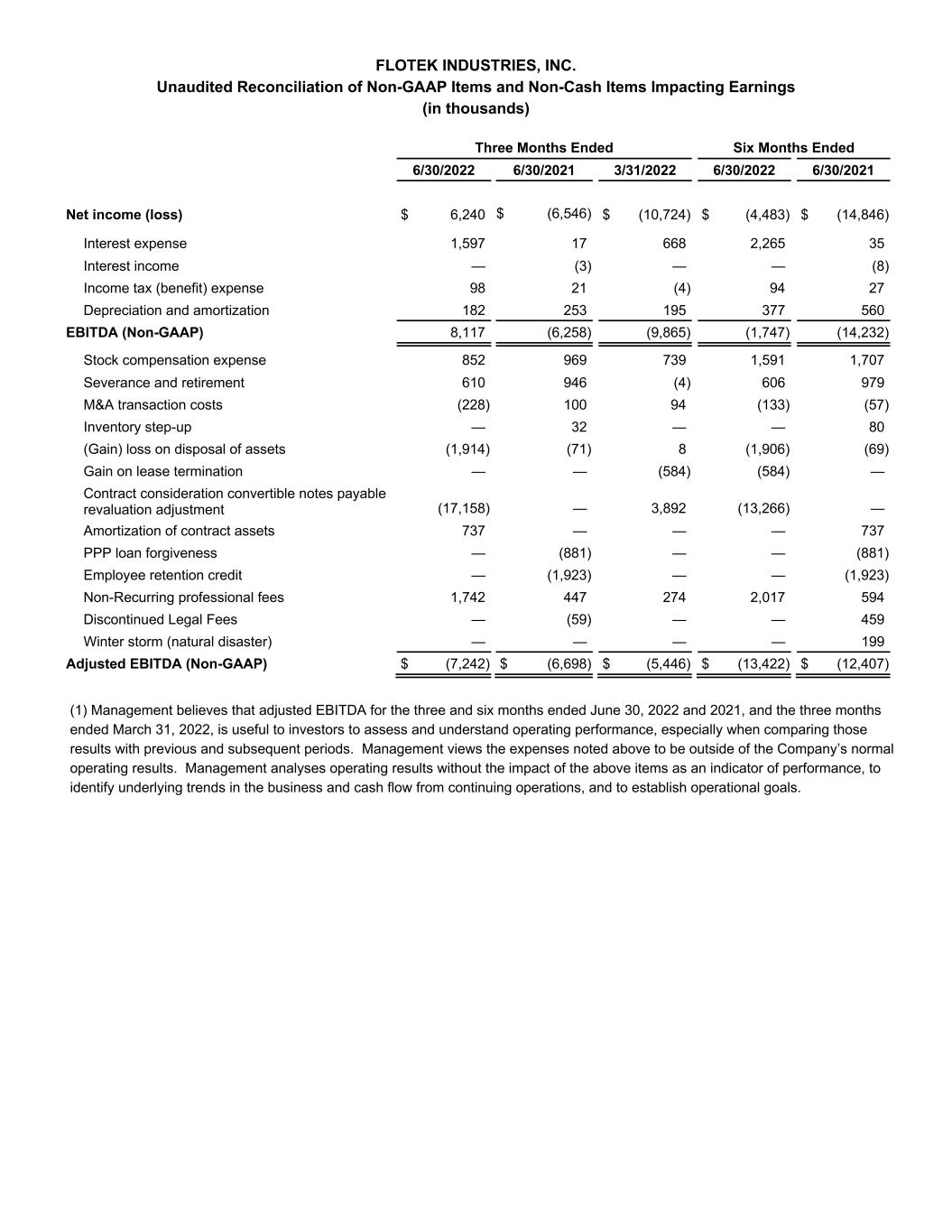

FLOTEK INDUSTRIES, INC. Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings (in thousands) Three Months Ended Six Months Ended 6/30/2022 6/30/2021 3/31/2022 6/30/2022 6/30/2021 Net income (loss) $ 6,240 $ (6,546) $ (10,724) $ (4,483) $ (14,846) Interest expense 1,597 17 668 2,265 35 Interest income — (3) — — (8) Income tax (benefit) expense 98 21 (4) 94 27 Depreciation and amortization 182 253 195 377 560 EBITDA (Non-GAAP) 8,117 (6,258) (9,865) (1,747) (14,232) Stock compensation expense 852 969 739 1,591 1,707 Severance and retirement 610 946 (4) 606 979 M&A transaction costs (228) 100 94 (133) (57) Inventory step-up — 32 — — 80 (Gain) loss on disposal of assets (1,914) (71) 8 (1,906) (69) Gain on lease termination — — (584) (584) — Contract consideration convertible notes payable revaluation adjustment (17,158) — 3,892 (13,266) — Amortization of contract assets 737 — — — 737 PPP loan forgiveness — (881) — — (881) Employee retention credit — (1,923) — — (1,923) Non-Recurring professional fees 1,742 447 274 2,017 594 Discontinued Legal Fees — (59) — — 459 Winter storm (natural disaster) — — — — 199 Adjusted EBITDA (Non-GAAP) $ (7,242) $ (6,698) $ (5,446) $ (13,422) $ (12,407) (1) Management believes that adjusted EBITDA for the three and six months ended June 30, 2022 and 2021, and the three months ended March 31, 2022, is useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the expenses noted above to be outside of the Company’s normal operating results. Management analyses operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish operational goals.