3rd Quarter 2024 Earnings Presentation November 2024

Forward-Looking Statements Certain statements set forth in this presentation constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this presentation. Although forward-looking statements in this presentation reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the "Risk Factors" section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this presentation. This presentation includes certain non-GAAP measures. Please refer to the reconciliations provided in the earnings press release and the appendix in this presentation for the most comparable GAAP measure. // 2

// 3 8 Consecutive Quarters of Improved Adj. EBITDA* Strong Balance Sheet with Low Debt Data Analytics Technology with High ROI Long-term ‘Take or Pay’ Contract Insulates Risk Tangible Environmental, Health, &, Safety Impacts Flotek Industries CHEMISTRY AS A COMMON VALUE CREATION PLATFORM Value Creation through Chemistry & Data * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure

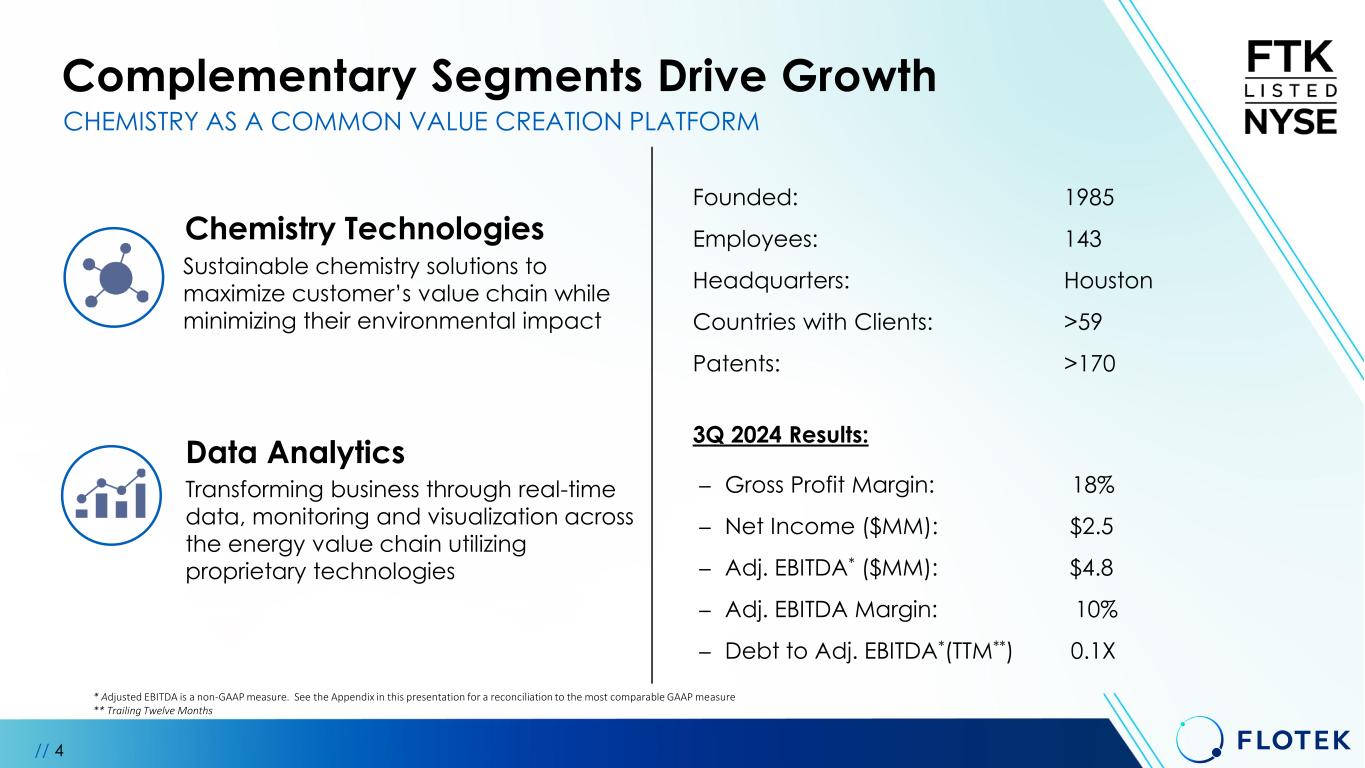

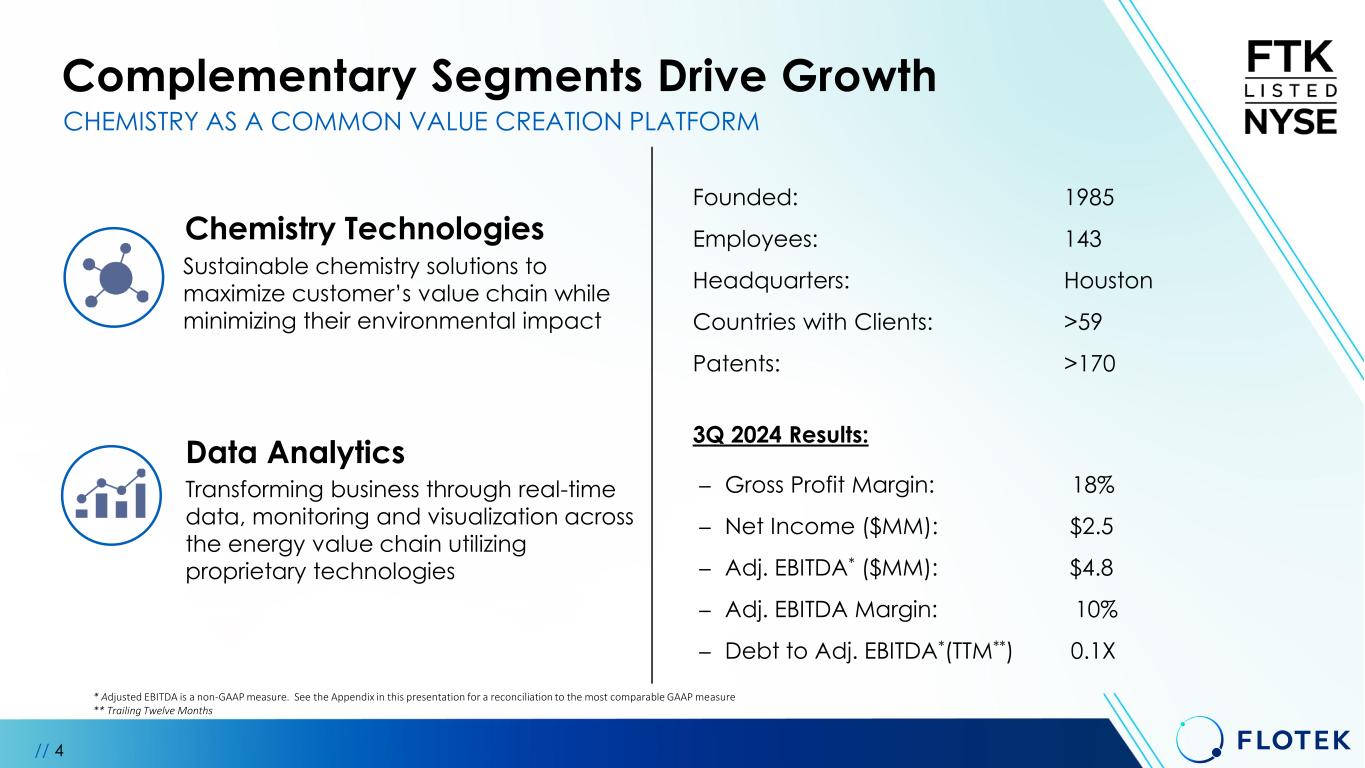

Complementary Segments Drive Growth // 4 Sustainable chemistry solutions to maximize customer’s value chain while minimizing their environmental impact Transforming business through real-time data, monitoring and visualization across the energy value chain utilizing proprietary technologies Chemistry Technologies Data Analytics CHEMISTRY AS A COMMON VALUE CREATION PLATFORM Founded: 1985 Employees: 143 Headquarters: Houston Countries with Clients: >59 Patents: >170 3Q 2024 Results: – Gross Profit Margin: 18% – Net Income ($MM): $2.5 – Adj. EBITDA* ($MM): $4.8 – Adj. EBITDA Margin: 10% – Debt to Adj. EBITDA*(TTM**) 0.1X * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure ** Trailing Twelve Months

• Delivered year-over-year Improvements: Revenue: 5% SG&A: 12% Net income: 97% Adj. EBITDA*: 43% 3Q 2024 Highlights // 5 • Increased FY24 adj. EBITDA** guidance range to $16.5MM to $18.5MM • Mid-point of new guidance represents a 35% increase from mid-point of original guidance • SG&A continues to trend down with lower personnel costs and professional fees • Borrowings outstanding under ABL reduced by 75% during 3Q24 • Debt to TTM adj. EBITDA* falls below 0.1X at 9/30/24 • Initial sales related to flare monitoring made up 25% of 3Q24 Data Analytics ("DA") revenues, of which 86% closed in September IMPROVED PROFIT AND REVENUE WITH LOWER NORTH AMERICAN FRAC FLEET COUNT * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure ** We are unable to reconcile this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure, including, among other items, the future amortization of our contract assets, certain stock-based compensation costs and the impact of the revaluation of certain liabilities, which is based upon our future stock price. These items do not impact the non-GAAP financial measure.

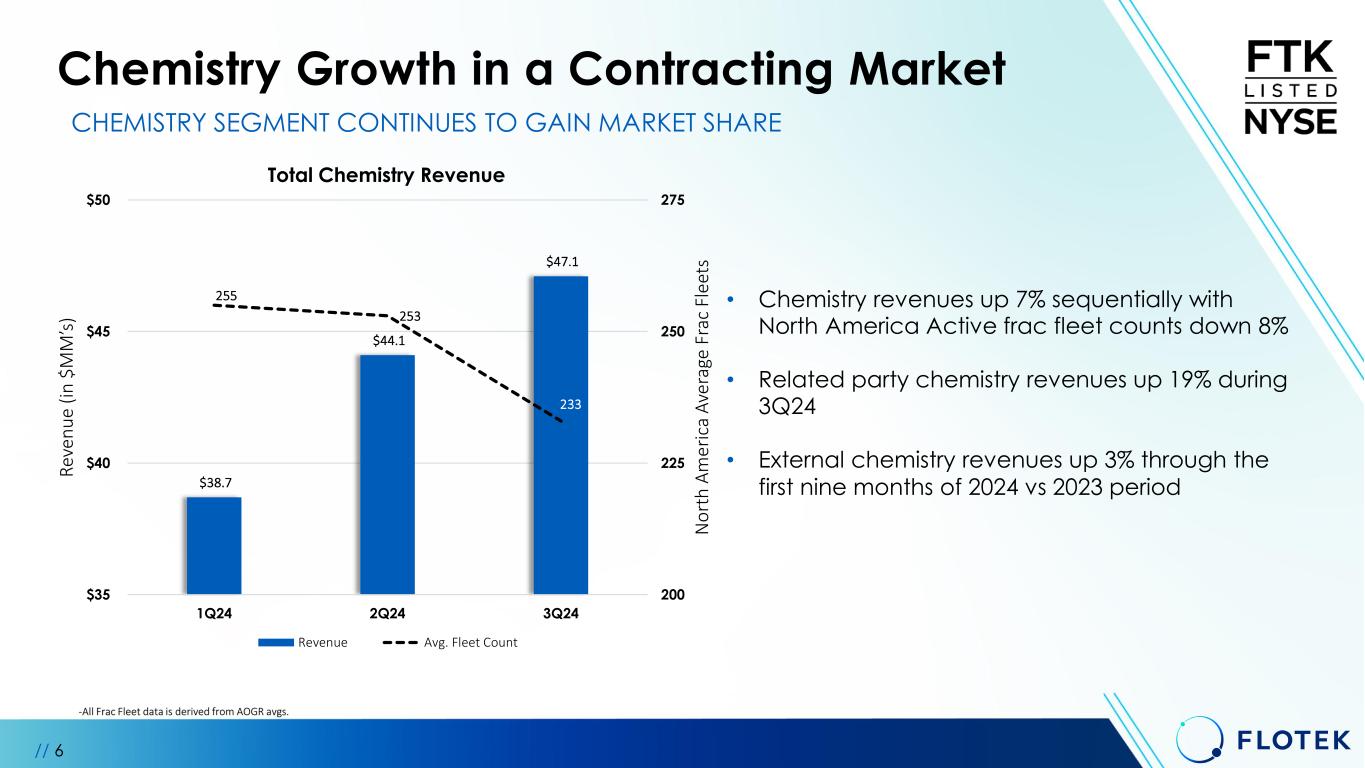

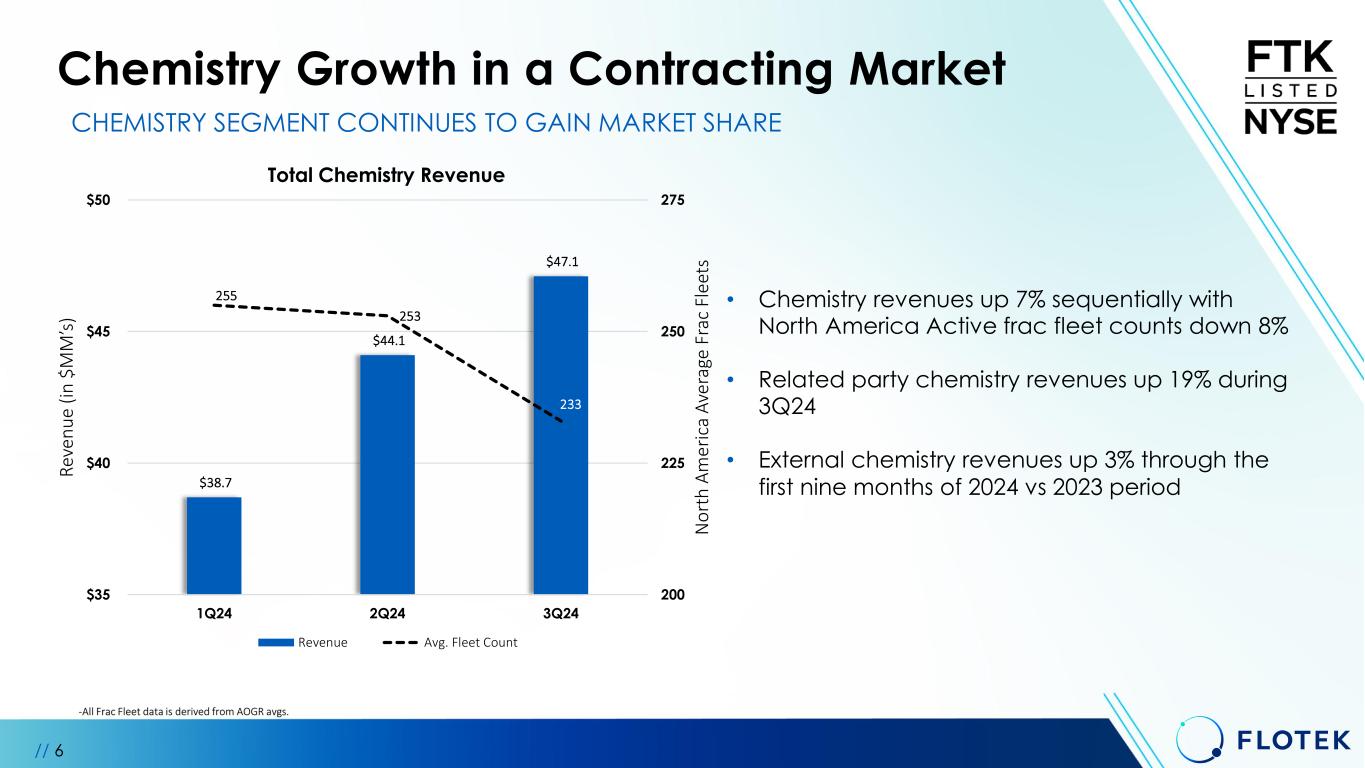

Chemistry Growth in a Contracting Market // 6 • Chemistry revenues up 7% sequentially with North America Active frac fleet counts down 8% • Related party chemistry revenues up 19% during 3Q24 • External chemistry revenues up 3% through the first nine months of 2024 vs 2023 period CHEMISTRY SEGMENT CONTINUES TO GAIN MARKET SHARE $38.7 $44.1 $47.1 255 253 233 200 225 250 275 $35 $40 $45 $50 1Q24 2Q24 3Q24 N o rt h A m er ic a A ve ra ge F ra c Fl ee ts R ev en u e (i n $ M M ’s ) Total Chemistry Revenue Revenue Avg. Fleet Count -All Frac Fleet data is derived from AOGR avgs.

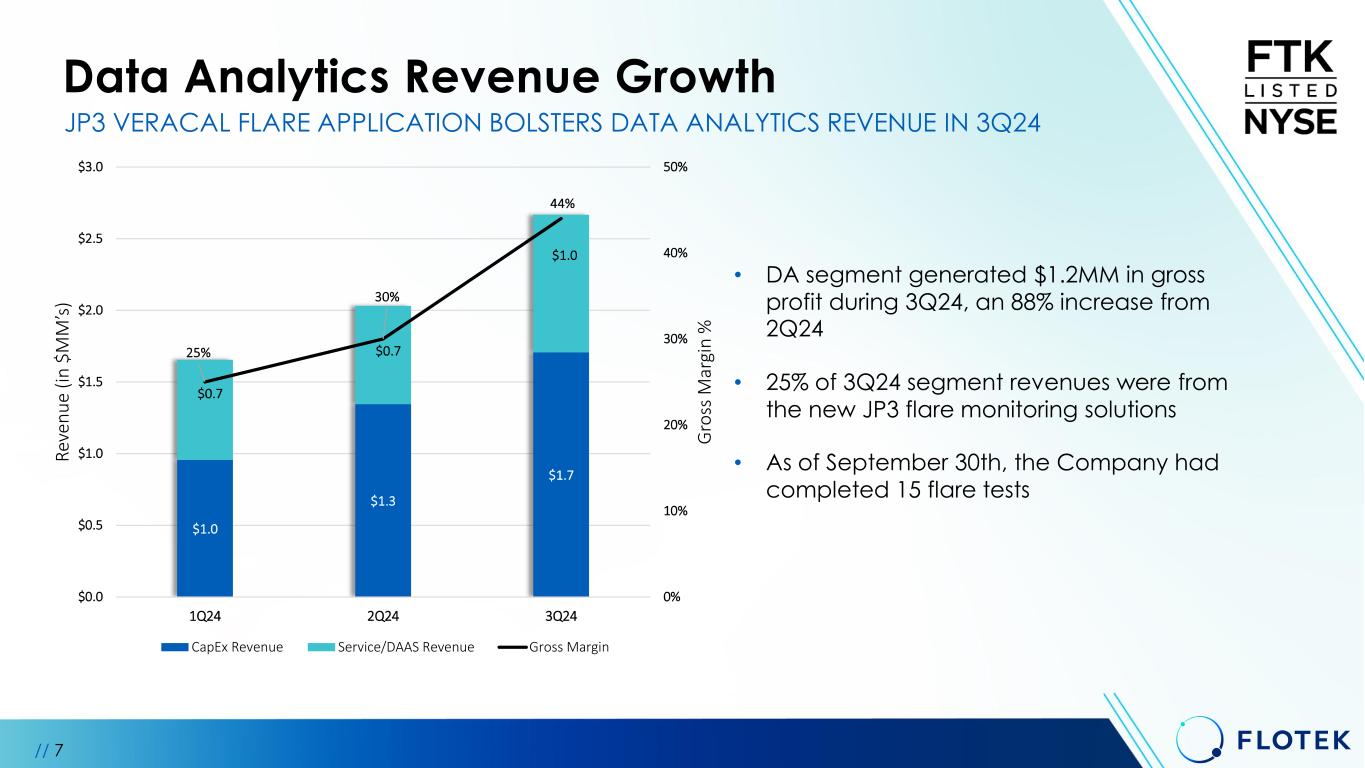

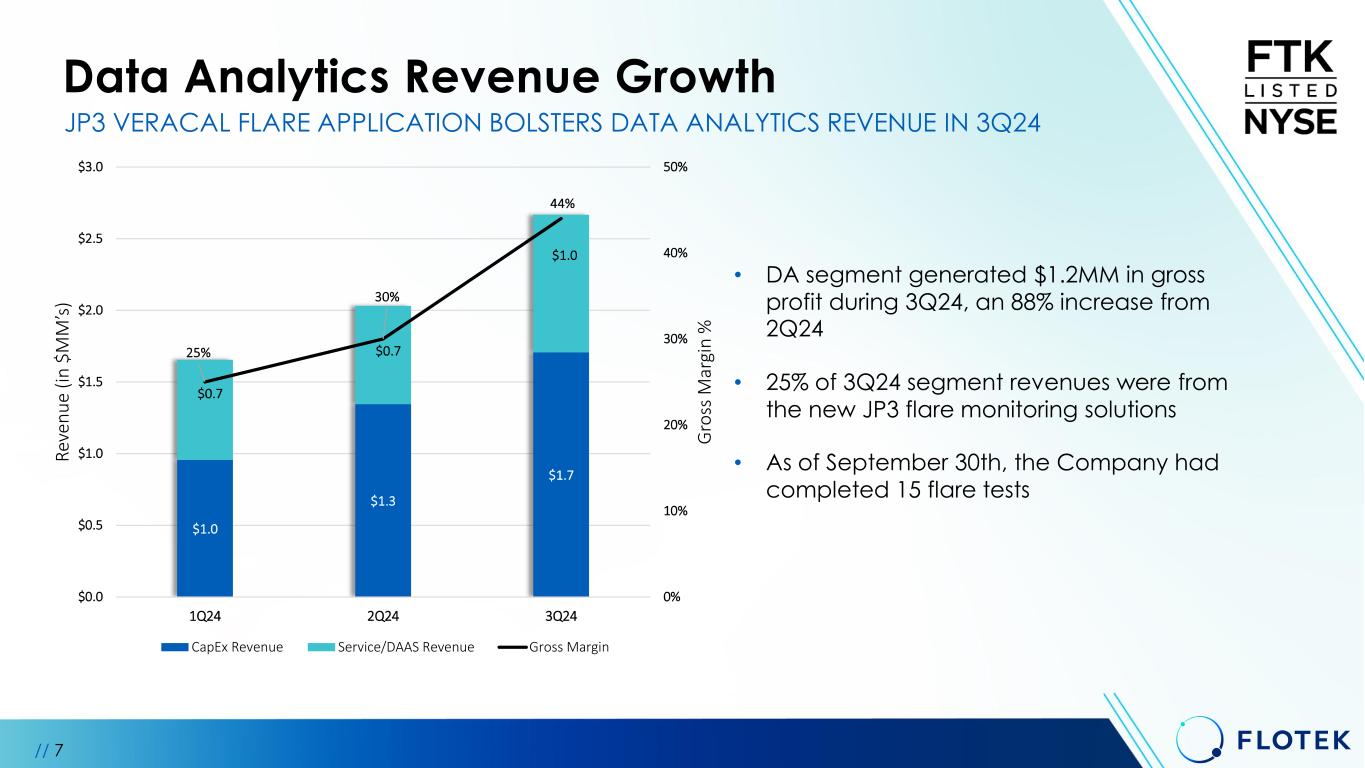

Data Analytics Revenue Growth // 7 • DA segment generated $1.2MM in gross profit during 3Q24, an 88% increase from 2Q24 • 25% of 3Q24 segment revenues were from the new JP3 flare monitoring solutions • As of September 30th, the Company had completed 15 flare tests JP3 VERACAL FLARE APPLICATION BOLSTERS DATA ANALYTICS REVENUE IN 3Q24 $1.0 $1.3 $1.7 $0.7 $0.7 $1.0 25% 30% 44% 0% 10% 20% 30% 40% 50% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 1Q24 2Q24 3Q24 G ro ss M ar gi n % R ev en u e (i n $ M M ’s ) CapEx Revenue Service/DAAS Revenue Gross Margin

Financial Momentum Continues // 8 Quarterly Adjusted EBITDA* Growth * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure $(5.1) $(3.9) $(2.0) $3.4 $4.0 $4.0 $4.4 $4.8 -$6.0 -$4.0 -$2.0 $0.0 $2.0 $4.0 $6.0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 A d j. EB IT D A ( $ M M ’s ) TREND OF PROFITABILITY IMPROVEMENT REACHES 8 CONSECUTIVE QUARTERS TTM 3Q23 3Q24 Growth Gross Profit: $ 12.8 MM $ 36.5 MM $ 23.7 MM SG&A: $ 27.5 MM $ 24.6 MM ($ 2.9 MM) Net Income: $ 3.6 MM $ 8.2 MM $ 4.6 MM Adj. EBITDA*: ($7.5 MM) $ 17.3 MM $ 24.8 MM

Chemistry Technologies: Competitive Advantage // 9 • Prescriptive Chemistry Management (PCM)TM • Proprietary energy chemistry solutions • Experienced chemistry energy team • Customized solutions to each well’s geology • Leveraging Data and Advanced Testing to enable predictive chemistry solutions • Leveraging over 170 active patents to design the best chemistry for each well • Strong well performance with 75,000 BOE uplift versus competition DELIVERING THE BEST UPLIFT PERFORMANCE IN INDUSTRY Advanced reservoir simulation analysis DATA SUPPORTED GEOCENTRIC CHEMISTRY MODELING

Data Analytics: VeraCal Flare Solution // 10 INITIAL PENETRATION INTO SIGNIFICANT UPSTREAM APPLICATIONS * Total Addressable Market Pictured above: The proprietary VeraCal mobile flaring cart on location EPA Approval on Flaring Measurement Application • Expected to unlock an estimated $220 million oil & gas upstream TAM* annually • First EPA approved alternative measurement solution • 15 tests performed in 3Q24 Our Flare Measurement System is Differentiated • Continuous and autonomous monitoring • No consumable calibration gas • No manual sampling errors • Fast install and extreme durability Customer Emission Savings via EPA Subpart-W • 4-6% additional savings in emission penalties • Gain 3-4% in production before Super Emitter Status

Investor Contact: Mike Critelli Director of Finance & Investor Relations ir@flotekind.com // 11

Appendix

Data Analytics: “Measure More Strategy” Upstream • Flare monitoring: comply with EPA regulations • Custody Transfer: improves accuracy of payments to royalty owners and operators • Power Generation: facilitate field gas utilization in powering rigs and frac fleets Midstream • Gas processing plant control and optimization • Pipeline batch detection to optimize pipeline transmix processes • Vapor pressure controls to achieve product specifications • Emerging market in carbon capture Downstream • Process Controls: real-time measurement to optimize distillation tower efficiency • Chemicals: quality measurement in pipelines and terminals UTILIZING TECHNOLOGIES FOR EXPANSION INTO NEW MARKETS // 13 Growth Growth

• JP3 field gas monitoring system allows frac fleets and drilling rigs to safely run on field gas displacing more expensive and higher carbon footprint diesel • Provides meaningful cost savings compared to gas chromatograph • A three-pad customer case study July - August 2023: • Achieved 70% field gas substitution rate • Eliminated 1.2 mm gallons of diesel usage • Realized 100% uptime Data Analytics: Upstream Field Gas Usage // 14 Delivered 70% Reduction in Diesel and CNG usage Frac Trailer Mounted System

Upstream Custody Transfer challenges: • Readings only taken every 3 to 6 weeks with gas chromatography (gc) • Revenue degradation on inconsistent readings impacted by temperature, timing, and conditions • Requires onsite personnel JP3 technology changes the market: • Accurate readings every 5 seconds • Stakeholders paid on more consistent hydrocarbon quality readings • A more valuable hydrocarbon stream • Autonomous measurement Data Analytics: Upstream Market Disruptor // 15 From 3 weeks to 5 Seconds! Local System Mobile App and SCADA Reporting Real-Time Wellsite Readings

Recent Financials Unaudited Condensed Consolidated Statement of Operations (in thousands) // 16

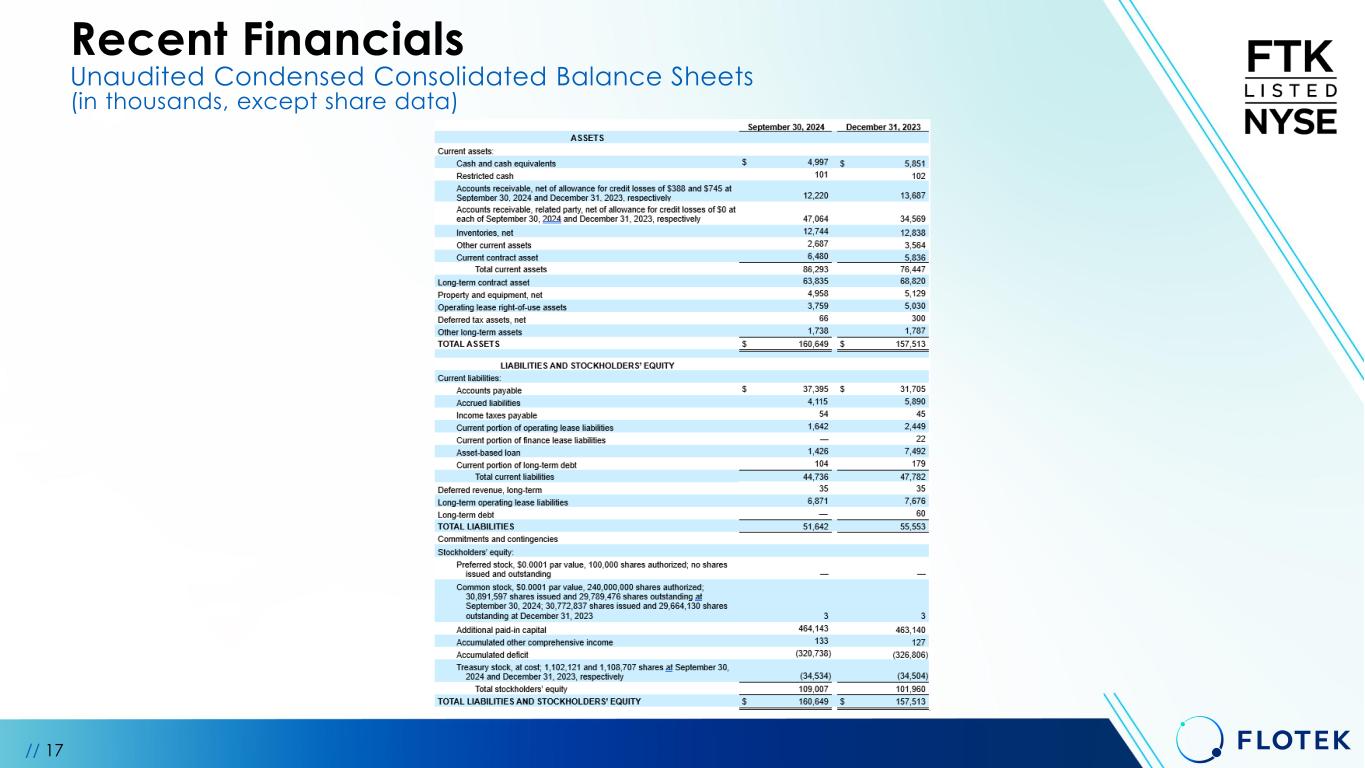

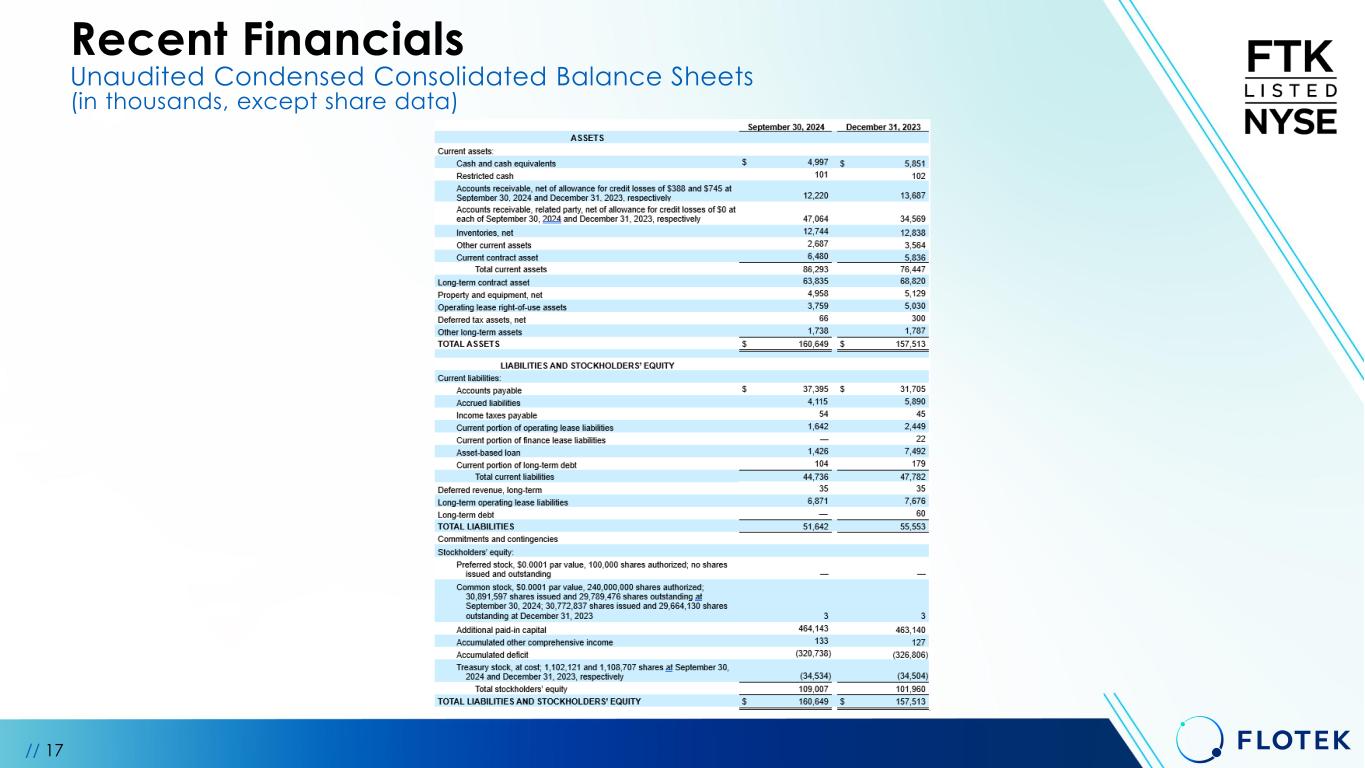

// 17 Recent Financials Unaudited Condensed Consolidated Balance Sheets (in thousands, except share data)

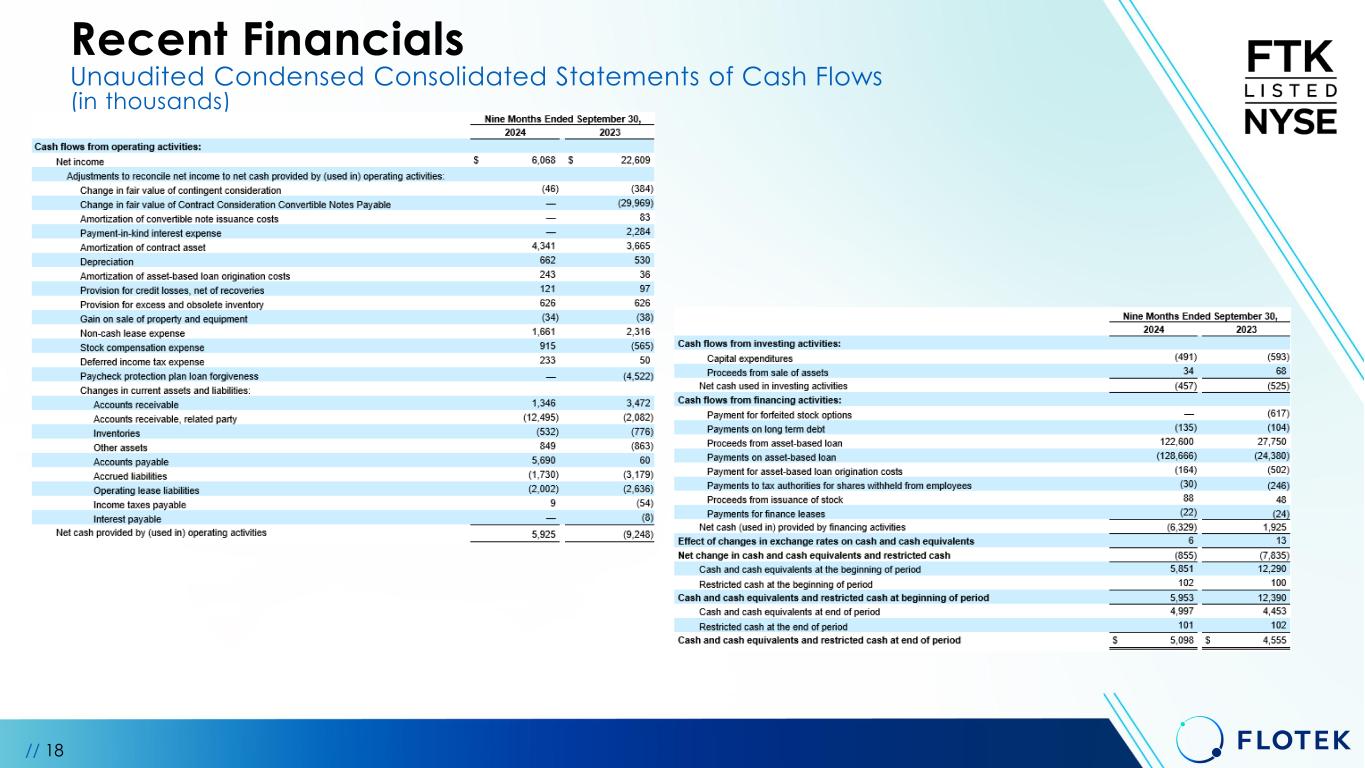

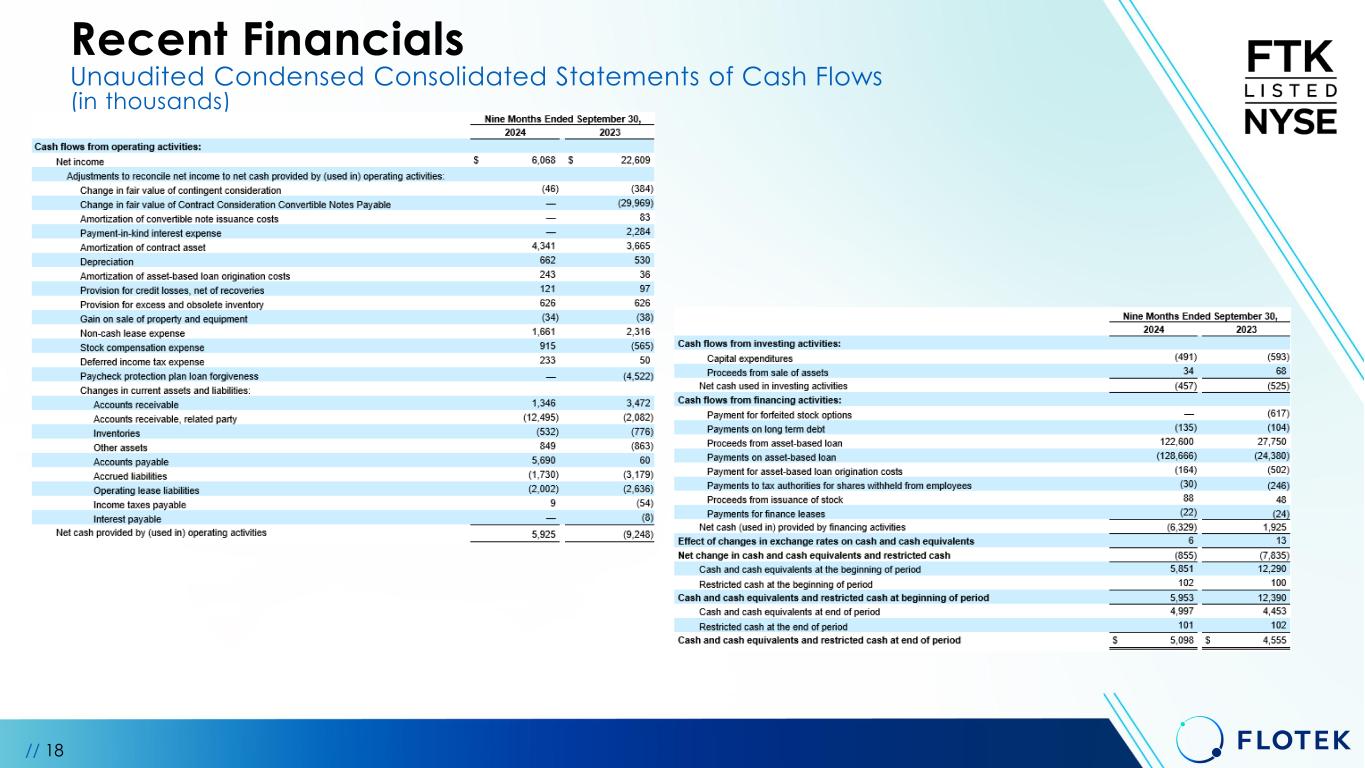

// 18 Recent Financials Unaudited Condensed Consolidated Statements of Cash Flows (in thousands)

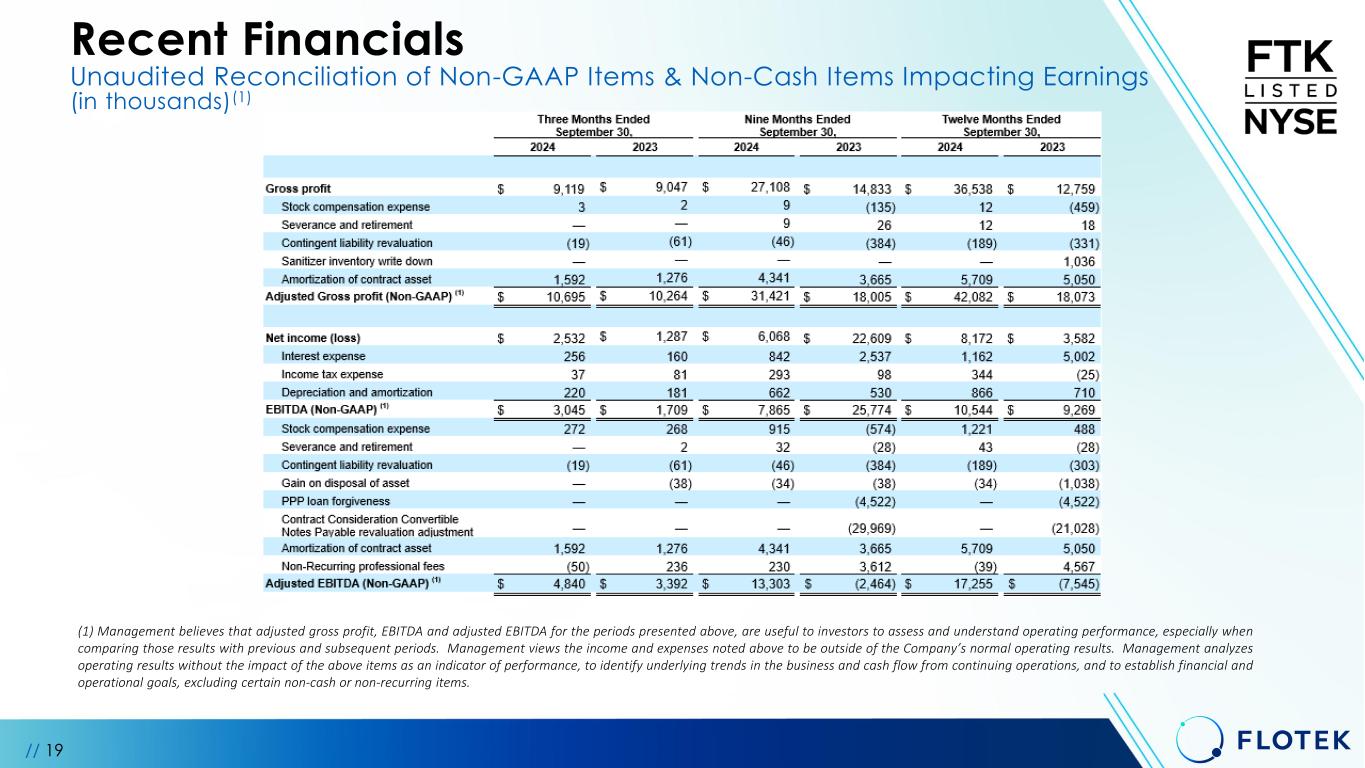

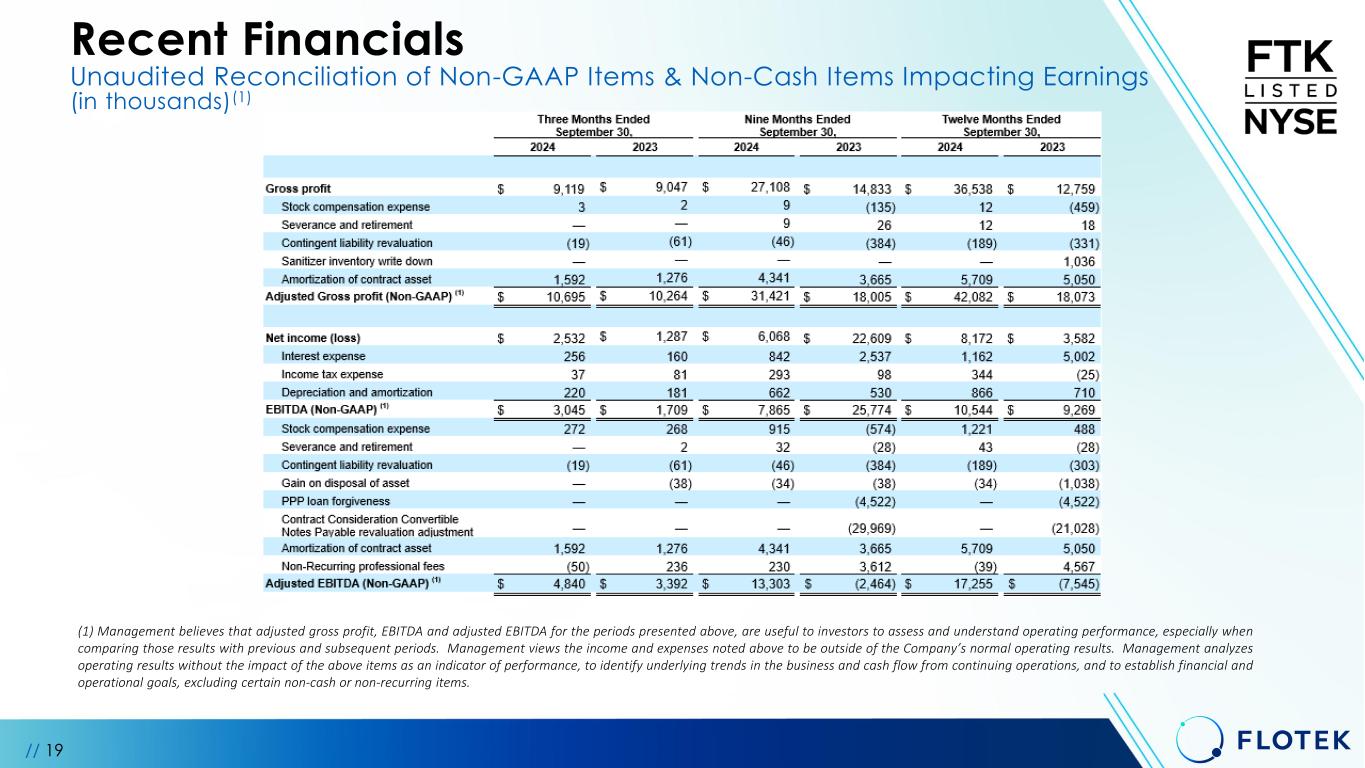

// 19 (1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the periods presented above, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items. Recent Financials Unaudited Reconciliation of Non-GAAP Items & Non-Cash Items Impacting Earnings (in thousands)(1)