SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Featherlite, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

FEATHERLITE, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

June 4, 2004

The Annual Meeting of Shareholders of Featherlite, Inc. will be held at the Cresco Country Club, 22006 115th Street, Cresco, Iowa, on Friday, June 4, 2004, at 9:00 a.m. (Central Daylight Time), for the following purposes:

| | 1. | To set the number of members of the Board of Directors at seven (7) for the ensuing year. |

| | 2. | To elect directors of the Company for the ensuing year. |

| | 3. | To adopt the Featherlite, Inc. 2004 Equity Incentive Plan. |

| | 4. | To take action upon any other business that may properly come before the meeting or any postponement or adjournment thereof. |

Only shareholders of record shown on the books of the Company at the close of business on April 8, 2004 will be entitled to vote at the meeting or any adjournment thereof. Each shareholder is entitled to one vote per share of common stock on all matters to be voted on at the annual meeting.

You are cordially invited to attend the meeting. Whether or not you plan to attend the meeting, please promptly submit your proxy as soon as possible. Your cooperation in promptly signing and returning the proxy will help avoid further solicitation expense to the Company.

This notice, the Proxy Statement and the enclosed proxy are sent to you by order of the Board of Directors.

Gary H. Ihrke,

Secretary

| | |

| Dated: | | April 29, 2004 |

| | | Cresco, Iowa |

YOUR VOTE IS IMPORTANT. PLEASE PROMPTLY SUBMIT YOUR PROXY.

FEATHERLITE, INC.

PROXY STATEMENT

For

Annual Meeting of Shareholders

To Be Held

June 4, 2004

GENERAL INFORMATION

This Proxy Statement is furnished by the Board of Directors (the “Board of Directors”) of Featherlite, Inc., a Minnesota corporation (the “Company”), to holders of the Company’s common stock in connection with a solicitation of proxies by the Board of Directors for use at the Annual Meeting of Shareholders to be held on June 4, 2004, and at any postponement or adjournment thereof, for the purposes set forth in the attached Notice of Annual Meeting of Shareholders. The Company expects that this Proxy Statement and the accompanying materials will first be mailed to shareholders on or about April 29, 2004.

If your shares of common stock are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the internet or telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program. This program provides eligible shareholders who receive a paper copy of the Annual Report and Proxy Statement the opportunity to vote via the internet or telephone. If your bank or brokerage firm is participating in ADP’s program, your proxy will provide instructions. If your voting form does not refer to internet or telephone information, please complete and return the paper proxy card in the postage paid envelope provided.

Any proxy delivered pursuant to this solicitation is revocable at the option of the person giving the proxy at any time before it is exercised. A proxy may be revoked, prior to its exercise, by executing and delivering a later-dated proxy via the Internet or via telephone (if proxy contains instructions for voting via the Internet or telephone) or by mail, by delivering written notice of the revocation of the proxy to the Company’s Secretary prior to the annual meeting, or by attending and voting at the annual meeting. Attendance at the annual meeting, in and of itself, will not constitute a revocation of a proxy. The shares represented by a proxy will be voted in accordance with the shareholder’s directions if the proxy is duly submitted and not validly revoked prior to the annual meeting. If no directions are specified on a duly submitted proxy, the shares will be voted, in accordance with the recommendations of the Board of Directors,FOR approval of the number of directors to be set at seven,FOR the election of the directors nominated by the Board of Directors,FOR the approval of the 2004 Equity Incentive Plan, and in accordance with the discretion of the persons appointed as proxies on any other matters properly brought before the annual meeting and any all postponements or adjournments thereof.

If a shareholder abstains from voting as to any matter, then the shares held by such shareholder shall be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but shall not be deemed to have been voted in favor of such matter. Abstentions, therefore, as to any proposal will have the same effect as votes against such proposal. If a broker returns a “non-vote” proxy, indicating a lack of voting instruction by the beneficial holder of the shares and a lack of discretionary authority on the part of the broker to vote on a particular matter, then the shares covered by such non-vote shall be deemed present at the meeting for purposes of determining a quorum but shall not be deemed to be represented at the meeting for purposes of calculating the vote required for approval of such matter.

The cost of soliciting proxies, including preparing, assembling and mailing the proxies and soliciting material, will be borne by the Company. The Company will also request brokerage firms, banks, nominees, custodians and other fiduciaries to forward proxy materials to the beneficial owners of shares of common stock as of the record date, and will provide for reimbursement for the cost of forwarding the proxy materials in accordance with customary practice. Directors, officers and regular employees of the Company may, without compensation other than their regular compensation, solicit proxies personally or by the Internet, telephone or facsimile.

1

OUTSTANDING SHARES AND VOTING RIGHTS

The Board of Directors of the Company has fixed April 8, 2004, as the record date for determining shareholders entitled to vote at the annual meeting. Persons who were not shareholders on such date will not be allowed to vote at the annual meeting. At the close of business on April 8, 2004, 7,198,428 shares of the Company’s common stock were issued and outstanding. Such common stock is the only outstanding class of stock of the Company. Each share of common stock is entitled to one vote on each matter to be voted upon at the annual meeting. Holders of the common stock are not entitled to cumulative voting rights.

PRINCIPAL SHAREHOLDERS

The following table provides information concerning the only persons known to the Company to be the beneficial owners of more than five percent (5%) of the Company’s outstanding common stock as of April 8, 2003:

| | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Shares Beneficially Owned(1)(2)

| | Percent of Class

|

Conrad D. Clement(3) | | 1,680,000 | | 23.1% |

Tracy J. Clement(3) | | 1,030,000 | | 14.3% |

Larry D. Clement(3) | | 1,000,000 | | 13.9% |

Eric P. Clement(3) | | 442,000 | | 6.1% |

Bulk Resources, Inc.(4) | | 811,314 | | 11.0% |

| (1) | The above beneficial ownership information is determined in accordance with Rule 13d-3 under the Securities Exchange Act, as required for purposes of this Proxy Statement. Accordingly, it includes shares of common stock that are issuable upon the exercise of stock options exercisable within 60 days of April 8, 2004. Such information is not necessarily to be construed as an admission of beneficial ownership for other purposes. Unless otherwise indicated, the person listed as the beneficial owner of the shares has sole voting and sole investment power with respect to identified shares. |

| (2) | See Note (2) below with respect to the number of shares not outstanding but deemed beneficially owned by virtue of the right of a person to acquire them as of April 8, 2004, or within sixty days of such date. |

| (3) | Address: Highways 63 and 9, P.O. Box 320, Cresco, Iowa 54136. |

| (4) | Includes a warrant to purchase 150,000 shares at $2.00 per share at anytime before January 31, 2007. The address for Bulk Resources, Inc. is P.O. Box 50401, Henderson, NV 89016. |

MANAGEMENT SHAREHOLDINGS

The following table sets forth the number of shares of the Company’s common stock beneficially owned as of April 8, 2004, by each executive officer of the Company named in the Summary Compensation Table, by each director and director nominee for reelection and by all directors and executive officers (including the named individuals) as a group:

| | | | | | |

Name of Director or Officer or

Identity of Group

| | Number of Shares Beneficially Owned(1)

| | Outstanding Options(2)

| | Percent of Class(3)

|

Conrad D. Clement | | 1,680,000(4) | | 80,000 | | 23.1% |

Tracy J. Clement | | 1,030,000(4) | | 30,000 | | 14.3% |

Eric P. Clement | | 442,000(4) | | 42,000 | | 6.1% |

Jeffery A. Mason | | 162,000(4) | | 152,000 | | 2.2% |

Gary H. Ihrke | | 152,000(4) | | 152,000 | | 2.1% |

James S. Wooley | | 40,000 | | 40,000 | | * |

Thomas J. Winkel | | 23,000(4) | | 21,000 | | * |

Charles A. Elliott | | 23,000(4) | | 15,000 | | * |

Kenneth D. Larson | | 43,750(4)(5) | | 21,000 | | * |

Terry E. Branstad | | 21,000(4) | | 21,000 | | * |

| Officers and Directors as a group (11 persons) | | 4,616,750 | | 577,000 | | 59.4% |

2

| (1) | See Note (1) to preceding table. |

| (2) | Shares deemed beneficially owned by virtue of the right of a person to acquire them as of April 8, 2004, or within sixty days of such date, that are included in this column are included in the total number of shares beneficially owned be each listed person. |

| (3) | Shares not outstanding but deemed beneficially owned by virtue of the right of a person to acquire them as of April 8, 2004, or within sixty days of such date, are treated as outstanding only when determining the percent owned by such individual and when determining the percent owned by the group. |

| (4) | Does not include 3,000 shares subject to an option that will be granted to and become purchasable by such individual on the date of the annual meeting pursuant to an automatic grant under the Company’s 1994 Stock Option Plan. |

| (5) | Includes 1,000 shares held by Mr. Larson’s wife. |

ELECTION OF DIRECTORS

(Proposals #1 and #2)

The Bylaws of the Company provide that the number of directors shall be determined by the shareholders at each annual meeting. The Board of Directors recommends that the number of directors be set at seven for the ensuing year, and that seven directors be elected at the annual meeting to serve until the next annual meeting or until their successors are duly elected and qualified. Under applicable Minnesota law, approval of the proposal to set the number of directors at seven requires the affirmative vote of the holders of the greater of (1) a majority of the voting power of the shares represented in person or by proxy at the annual meeting with authority to vote on such matter or (2) a majority of the voting power of the minimum number of shares that would constitute a quorum for the transaction of business at the annual meeting.

In the election of directors, each proxy will be voted for each of the nominees listed below unless the proxy withholds a vote for one or more of the nominees. Each person elected as a director shall serve for a term of one year or until his successor is duly elected and qualified. If any of the nominees should be unable to serve as a director by reason of death, incapacity or other unexpected occurrence, the proxies solicited by the Board of Directors shall be voted by the proxy representatives for such substitute nominee as is selected by the Board, or, in the absence of such selection, for such fewer number of directors as results from such death, incapacity or other unexpected occurrence. The election of each nominee requires the affirmative vote of the holders of the greater of (1) a majority of the voting power of the shares represented in person or by proxy at the annual meeting with authority to vote on such matter or (2) a majority of the voting power of the minimum number of shares that would constitute a quorum for the transaction of business at the annual meeting.

The following table provides certain information with respect to the nominees for director.

| | | | |

Name

| | Age

| | Positions Held

|

Conrad D. Clement | | 59 | | President, Chief Executive Officer and Director |

Jeffery A. Mason | | 63 | | Chief Financial Officer and Director |

Tracy J. Clement | | 37 | | Executive Vice President and Director |

Terry E. Branstad(1) | | 58 | | Director |

Kenneth D. Larson(1) | | 63 | | Director |

Thomas J. Winkel(1)(2) | | 61 | | Director |

Charles A. Elliott(1) | | 71 | | Director |

| (1) | Member of the Audit Committee, Compensation Committee and Nominating/Corporate Governance Committee. |

| (2) | Audit Committee financial expert. |

Conrad D. Clement has been the Chairman, President and Chief Executive Officer and a director of the Company since its inception in 1988. Mr. Clement is also the President and Chief Executive Officer and a director and shareholder of Featherlite Credit Corporation, an affiliate of the Company (“Featherlite Credit”). Mr. Clement is a shareholder of Nevada Coach Partners, LLP, the entity that owns a controlling interest in Universal Luxury Coaches (“ULC”), an entity to which the Company sells motorcoaches from time to time. He is also owner of Valley Trailer Sales, a Featherlite dealer, and an owner of Clement Enterprises and Clement Properties, all affiliates of the Company. Mr. Clement is the brother of Larry D. Clement and

3

the father of Tracy J. Clement and Eric P. Clement. For more information on certain transactions between the Company and affiliates of Mr. Clement, see “Certain Transactions.”

Jeffery A. Mason has been the Chief Financial Officer of the Company since August 1989 and has been a director of the Company since June 1993. Mr. Mason is also an officer of Featherlite Credit. Mr. Mason is also certified public accountant with an inactive status.

Tracy J. Clement has been Executive Vice President and a director of the Company since 1988. Mr. Clement is also an officer and shareholder of Featherlite Credit, and an owner of Valley Trailers, a Featherlite dealer and Clement Properties, all affiliates of the Company. Mr. Clement is a shareholder of Nevada Coach Partners, LLP, the entity that owns a controlling interest in ULC. For more information on certain transactions between the Company and affiliates of Mr. Clement, see “Certain Transactions.”

Thomas J. Winkel has been a director since April 1994. Since January 1994, Mr. Winkel has been a management and financial consultant and private investor. From 1990 to 1994, Mr. Winkel was the majority owner, Chairman of the Board, Chief Executive Officer and President of Road Rescue, Inc., a manufacturer of emergency response vehicles. Mr. Winkel is a certified public accountant, and from 1977 to 1990, was a partner in a national accounting firm. Mr. Winkel also is a director of Marten Transport, Ltd., a public company where he serves on the audit, compensation and nominating/corporate governance committees.

Kenneth D. Larson has been a director since August 1994. Mr. Larson is the retired President and COO of Polaris Industries, Inc. Mr. Larson is a director and chairman of Restaurant Technologies, Inc., a private company and a director of Nortech Systems Inc., a public company where he serves on the audit and compensation committees. Mr. Larson is also a director of Bellacor.com, Inc., a private company.

Terry E. Branstad has been a director since 1999 and served as governor of the state of Iowa from January of 1983 to January of 1999. Governor Branstad is an attorney-at-law and since August of 2003 has been the President of Des Moines University. He serves as a director of the Iowa Health System, and Liberty Bank FSB, both private organizations and is a public member of the American Institute of Certified Public Accountants Board

Charles A. Elliott has been a director of the Company since 2000, joined Crenlo, Inc., a manufacturer of cabs and ROPS for agricultural and construction equipment, in 1951 and was named President, Chief Executive Officer and Chairman in 1985, a position held until October 1999 when the Company was sold. Mr. Elliott currently serves as an advisory board member and trustee for several private companies and organizations.

The Board recommends that you vote FOR Proposals # 1 and # 2.

CORPORATE GOVERNANCE

Corporate Governance

*

The Board of Directors believes that sound corporate governance practices and policies provide an important framework to assist it in fulfilling its fiduciary responsibilities to its shareholders. In February 2003, the Board adopted a revised Audit Committee Charter, and in December 2003 adopted a Compensation Committee Charter. In February 2004, the Board updated and amended the Company’s Audit and Compensation Committee Charters, respectively, and adopted Corporate Governance Principles, a Nominating/Corporate Governance Committee Charter, a Code of Ethics for Senior Financial Management and a Code of Ethics and Business Conduct applicable to all directors, officers and employees. All of these documents are available on the Company’s website at www.fthr.com. The information contained in or connected to our website is not incorporated by reference into or considered a part of this Proxy Statement.

Corporate Governance Principles

The Company’s Corporate Governance Principles provide guidelines which govern the qualifications and conduct of the Board of Directors. These principles are consistent with the corporate governance requirements of the Sarbanes-Oxley Act of 2002, and the corporate governance listing requirements applicable to companies whose securities are listed

4

on the Nasdaq SmallCap Market. The Company’s Corporate Governance Principles address, among other matters, the following:

| | • | regular meetings of the Board of Directors; |

| | • | conduct of Board meetings; |

| | • | regular meetings of independent directors; |

| | • | director access to executive officers and employees; |

| | • | the composition, membership and selection of the Board of Directors; |

| | • | the evaluation of the performance of the Board of Directors and its committees; |

| | • | the organization and basic function of Board committees; |

| | • | the evaluation of the performance of the Chairman of the Board and Chief Executive Officer; and |

| | • | stockholder communications with directors. |

Code of Ethics for Senior Financial Management

The Company has adopted the Featherlite Code of Ethics for Senior Financial Management (the “Code of Ethics”), a code of ethics that applies to members of senior financial management, including the Company’s Chief Executive Officer, President, Executive Vice President, Chief Financial Officer, Corporate and Division Controllers and other employees performing similar functions who have been identified by the Chief Executive Officer, and meets the requirements of the Securities and Exchange Commission. The Featherlite Code of Ethics for Senior Financial Management is available on the Company’s website at www.fthr.com. If the Board makes any substantive amendments to the Code of Ethics or grants any waiver, including any implicit waiver from a provision of the Code of Ethics, the nature of such amendments or waiver will be disclosed on the Company’s website or in a report on Form 8-K.

Code of Ethics and Business Conduct

The Company has adopted the Featherlite Code of Ethics and Business Conduct (the “Code of Conduct”), a code of conduct that applies to all of our directors, officers and employees, including senior financial management. The Code of Conduct is intended to promote honest and ethical conduct and to provide guidance for the appropriate handling of various business situations. The Code of Conduct addresses, among other matters, legal and regulatory compliance, insider trading, confidentiality, conflicts of interest, competition and fair dealing, financial reporting and record-keeping, protection and proper use of company assets, and the reporting of illegal or unethical behavior. Employees may anonymously report possible violations of the Code of Ethics Conduct via a toll free telephone number. Waivers of the Code of Conduct for officers and directors may be made only by the Board of Directors and will be promptly disclosed if and as required by law or Nasdaq listing requirements. The Featherlite Code of Ethics and Business Conduct is available on the Company’s website at www.fthr.com.

Communications with the Board

Shareholders may communicate directly with the Board of Directors. All communications regarding general matters should be directed to our Corporate Secretary at the address below and should prominently indicate on the outside of the envelope that it is intended for the complete Board of Directors or for outside directors only. If no such designation is made, the communication will be forwarded to the entire Board. Shareholder communications to the Board should be sent to:

| | | | |

Corporate Secretary Attention: Board of Directors Featherlite, Inc. P.O. Box 320 Hwys. 63 and 9 Cresco, Iowa 52136 | | or | | Corporate Secretary Attention: Outside Directors Featherlite, Inc. P.O. Box 320 Hwys. 63 and 9 Cresco, Iowa 52136 |

As discussed more below, the Company’s Nominating/Corporate Governance committee will also review and evaluate materials submitted to it by shareholders.

5

Director Attendance at Annual Meetings

Directors’ attendance at annual meetings can provide shareholders with an opportunity to communicate with directors about issues affecting the Company. The Company does not have a policy regarding director attendance, but all directors are encouraged to attend annual meetings of shareholders. Four (4) directors attended the 2003 Annual Meeting of Shareholders.

Majority of Independent Directors; Committees of Independent Directors

The Board of Directors has determined that Messrs. Branstad, Elliott, Larson and Winkel, constituting a majority the Board of Directors, are independent directors in accordance with Nasdaq rules since none of them are believed to have any relationships that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Messrs. C. Clement, T. Clement and Mason are precluded from being considered independent by Nasdaq rules since they currently serve as executive officers of the Company.

The Company’s Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating/Corporate Governance Committee. Each member of each of these committees has been determined, in the opinion of the Board of Directors, to be independent in accordance with Nasdaq rules and, with respect to the Audit Committee, SEC rules.

Audit Committee

Messrs. Branstad, Elliott, Larson and Winkel currently serve as members of the Audit Committee. This committee met five times during 2003. The Board has determined that all members of the Audit Committee meet the financial literacy requirements for audit committee members under Nasdaq rules. The Board has also determined that Mr. Winkel qualifies as an “audit committee financial expert” as defined by Securities and Exchange Commission rules. The Company acknowledges that the designation of Mr. Winkel as the audit committee financial expert does not impose on Mr. Winkel any duties, obligations or liability that are greater than the duties, obligations and liability imposed on Mr. Winkel as a member of the Audit Committee and the Board of Directors in the absence of such designation or identification.

The Audit Committee is responsible for assisting the Board of Directors in satisfying its fiduciary responsibilities for the Company’s accounting, auditing, operating and reporting practices. The Audit Committee oversees the financial reporting process, has the authority to appoint, compensate, retain and oversee the work of the Company’s independent auditors, reviews and pre-approves all audit services and permissible non-audit services performed by the independent auditors, establishes procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by the Company’s employees of concerns regarding questionable accounting or auditing matters, oversees the establishment and administration of a written code of ethics for senior financial management, reviews and either approves or disapproves of all related party transactions in accordance with formal, written guidelines and principles, and performs other related duties delegated to it by the Board. The responsibilities and functions of the Audit Committee are further described in the Audit Committee Report on page 9 of this Proxy Statement.

Compensation Committee

Messrs. Branstad, Elliott, Larson and Winkel currently serve as members of the Compensation Committee. The Compensation Committee met once during the last fiscal year. The Compensation Committee is responsible for establishing the compensation philosophy and policy for the Company’s executive officers and other key employees, which includes reviewing and approving corporate goals and objectives relevant to their compensation, reviewing and evaluating their performance, monitoring the effectiveness of the Company’s benefit plans, recommending to the full Board of Directors the base salaries and executive incentive compensation and stock based plans of its executive officers and other key employees and reviewing the compensation levels of independent directors from time to time. The responsibilities and functions of the Compensation Committee are further described in the Compensation Committee Report beginning on page 10 of this Proxy Statement.

6

Nominating/Corporate Governance Committee

Messrs. Branstad, Elliott, Larson and Winkel currently serve as members of the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee did not meet in fiscal year 2003. The Nominating/Corporate Governance Committee is responsible for evaluating and recommending candidates for the Company’s Board of Directors and for evaluating and recommending changes to the Company’s corporate governance profile. The Board of Directors has adopted a Nominating/Corporate Governance Committee Charter, which specifies the composition and responsibilities of the committee. A copy of the Nominating/Corporate Governance Committee Charter is available on the Company’s website, www.fthr.com.

The Nominating/Corporate Governance Committee will consider candidates for nomination as a director recommended by shareholders, directors, third party search firms and other sources. In evaluating director nominees, the Nominating/Corporate Governance Committee considers the following factors and qualifications, among others:

| | • | the appropriate size and the diversity of the Company’s Board of Directors; |

| | • | the needs of the Board with respect to the particular talents and experience of its directors; |

| | • | the knowledge, skills and experience of nominees, including experience in technology, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| | • | familiarity with domestic and international business matters; |

| | • | age and legal and regulatory requirements; |

| | • | experience with accounting rules and practices; |

| | • | appreciation of the relationship of the Company’s business to the changing needs of society; and |

| | • | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

The Nominating/Corporate Governance Committee will consider the attributes of the candidates and the needs of the board, and will review all candidates in the same manner. The Nominating/Corporate Governance Committee believes that candidates for directors should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 18 years of age, having familiarity with the Company’s business and industry, having high moral character and mature judgment, being able to work collegially with others, and not currently serving on more than three Boards of public companies. The Nominating/Corporate Governance Committee may modify these minimum qualifications from time to time.

A shareholder who wishes to recommend one or more directors must provide a written recommendation to the Chairman of the Nominating/Corporate Governance Committee as the following address.

Featherlite, Inc.

Attn: Chairman, Nominating/Corporate Governance Committee

P.O. Box 320

Hwys. 63 and 9

Cresco, Iowa 52136

Notice of a recommendation must include name, address and telephone number of the shareholder and the class and number of shares such shareholder owns. With respect to the nominee, the shareholder should include the nominee’s name, age, business address, residence address, current principal occupation, five year employment history with employer names and a description of the employer’s business, the number of shares beneficially owned by the nominee, whether such nominee can read and understand basic financial statements, and Board membership, if any.

The recommendation must be accompanied by a written consent of the nominee to stand for election if nominated by the Board of Directors and to serve if elected by the shareholders. The Company may require any nominee to furnish additional information that may be needed to determine the eligibility of the nominee.

7

Executive Sessions of Independent Directors

The independent directors of the Board will meet separately as a group at the beginning of each regularly scheduled Board meeting or, as an alternative, at the beginning of any committee meeting if all of the independent directors serve on such committee. A chairman will be selected by the independent directors and will assume the responsibility of chairing the regularly scheduled meetings of independent directors and bear such further responsibilities that the independent directors as a whole might designate from time to time with respect to the topic discussed at such meeting.

Committee and Board Meetings

During fiscal 2003, the Board of Directors held four regular meetings and one special meeting. Each director attended 75% or more of the total number of meetings of the Board and of committees of which he was a member.

Directors’ Fees

Directors who are not employees of the Company are compensated at the rate of $4,000 for each quarterly Board meeting attended, including two committee meetings per year, $2,000 for each special Board or committee meeting as required, plus $1,000 per quarter. The Chairman of the Audit Committee receives additional compensation of $4,500 per quarter because of the oversight responsibilities of this committee. In 2003, the outside directors, acting as a special committee to evaluate various long-term financing alternatives, each received for their work an additional $20,000 fee, except for Mr. Winkel who received $40,000 as chair of the special committee. In addition, pursuant to the Company’s proposed 2004 Equity Incentive Plan, non-employee directors will receive automatic grants of nonqualified stock options to purchase 3,000 shares upon their initial election to the Board and upon their re-election by the shareholders. The exercise price shall be 100% of the common stock’s current fair market value as of the date of grant. Each nonqualified stock option granted to non-employee directors shall be immediately exercisable and shall expire at the end of the term specified when granted. As of June 6, 2003, the date of the 2003 annual meeting, Messrs. Winkel, Elliott, Larson and Branstad each received an option for the purchase of 3,000 shares at an exercise price of $1.88 per share.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed of four directors and acts under a written charter adopted and approved by the Board of Directors. The Audit Committee Charter was updated and amended in February 2004 and a copy is included as Appendix A to this Proxy Statement. The Audit Committee will periodically review the Audit Committee Charter in light of new developments and may make additional recommendations to the Board of Directors for further revision of the Audit Committee Charter to reflect evolving best practices and changes in applicable laws and regulations.

Management has the primary responsibility for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting processes, and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Company’s independent auditor, Deloitte & Touche LLP, is responsible for performing an independent audit of our Company’s financial statements in accordance with generally accepted auditing standards and to issue its report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes on behalf of the Board of Directors. In fulfilling its oversight responsibilities, the Audit Committee:

| | • | reviewed and discussed with management the audited financial statements for the year ended December 31, 2003; |

| | • | reviewed with the independent auditor, who is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters that are required to be discussed with the Audit Committee under generally accepted auditing standards and by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as amended; and |

8

| | • | received from the independent auditor the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with the independent auditor the auditor’s independence from management and Featherlite, Inc, including a consideration of the compatibility of non-audit services with their independence. |

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003, as filed with the Securities and Exchange Commission.

AUDIT COMMITTEE

Thomas J. Winkel, Chairman

Terry E. Branstad

Charles A. Elliott

Kenneth D. Larson

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

Compensation Committee Interlocks and Insider Participation. During fiscal 2003, the Compensation Committee of the Board of Directors of the Company was composed of directors Thomas J. Winkel, Charles A. Elliott, Kenneth D. Larson and Terry E. Branstad. None of the members of the Committee is or ever has been an employee or an officer of the Company and none is affiliated with any entity (other than the Company) with which an executive officer of the Company is affiliated.

Compensation Plan. The executive compensation plan adopted by the Compensation Committee is comprised of base salaries, annual performance bonuses, long-term incentive compensation in the form of stock options, and various benefits in which all qualified employees of the Company participate. In addition, the Compensation Committee from time to time may award special cash bonuses or stock options related to non-recurring, extraordinary performance.

The Compensation Committee adopted an approach of paying annual base salaries which are on the moderate side of being competitive in its industry, taking into account particular positive and negative aspects of the Company’s location in rural Iowa, and of awarding performance bonuses in cash based on achievement of specific annual goals. The goals are established annually by the Compensation Committee. Options are currently being determined on an individual basis.

Generally, if the Company achieves its earnings per share goal and also one or more of its sales, income before taxes and return on assets objectives for the year, each executive officer will accrue a bonus that is equal to 65 percent of the officer’s base pay (85 percent for the chief executive officer (CEO). If the Company’s performance achieves the earnings per share goal and is no more than 10 percent below its other objectives, each officer will accrue a bonus equal to 32.5 percent of base pay (42.5 percent for CEO). If the Company’s performance is 110 percent or more of each objective, each officer may accrue a bonus of up to 78 percent of base pay (102 percent for CEO). Bonuses are prorated for Company performance that falls between these achievement percentages. Each of the objectives other than earnings per share is weighted as a percentage of the total and may be achieved on a stand-alone basis. There is a minimum income before tax goal must be achieved for any bonus to be earned regardless of the achievement of the other goals. Bonuses are paid in the calendar year following the year in which they are earned by the officers.

In 2003, the Company did not achieve its minimum earnings per share goal and, therefore, no bonuses were earned by any of the executive officers.

Compensation in 2003 and 2004. In 2003, there were no increases in base salaries of executive officers except for Eric Clement, whose salary was increased from $135,660 to $149,940. For 2004, there will be no increases in base salaries of executive officers. For 2004, base annual salaries for executive officers named in the compensation table below, except for Conrad D. Clement, are as follows: Tracy J. Clement—$226,440; Jeffery A. Mason—$149,940; Gary Ihrke—$149,940; Eric Clement—$149,940 and James S. Wooley- $208,000.

Chief Executive Officer Compensation. Conrad D. Clement served as the Company’s Chief Executive Officer in 2003. His annual base compensation in 2003 was $356,000. He earned no bonus under the compensation plan in 2003. For 2004, the Compensation Committee has left unchanged his annual base salary of $356,000 and he is eligible for a cash

9

bonus of up to 85 percent of base salary (102 percent if 110 percent of all defined performance objectives are achieved) on the same basis as other officers as described above.

Compensation Committee

Kenneth D. Larson (Chair)

Thomas J. Winkel

Terry E. Branstad

Charles A. Elliott

Summary Compensation Table

The following table sets forth certain information regarding compensation paid during each of the Company’s last three fiscal years to the Company’s Chief Executive Officer and each of the most highly compensated executive officers who received total salary and bonus in excess of $100,000 for 2003:

| | | | | | | | | | | | | | |

| | | | | | | Long Term

Compensation

| | | | |

| | | | | Annual Compensation

| | Securities Underlying Options/ SARs(#)

| | | All Other Compen- sation ($)

| |

Name and Principal Position

| | Fiscal Year

| | Salary ($)

| | Bonus ($)

| | Other(1)

| | |

Conrad D. Clement, President and Chief Executive Officer | | 2003

2002

2001 | | 355,692

322,092

331,808 | | -0-

-0-

-0- | | 8,767

10,837

1,517 | | -0-

50,000

30,000 |

(3)

| | 14,000

12,000

10,500 | (2)

|

| | |

| |

| |

| |

| |

|

| |

|

|

Tracy J. Clement, Executive Vice President | | 2003

2002

2001 | | 223,149

201,505

207,231 | | -0-

-0-

-0- | | 253

253

253 | | -0-

-0-

30,000 |

| | 12,000

11,000

10,500 | (2)

|

| | |

| |

| |

| |

| |

|

| |

|

|

Jeffery A. Mason, Chief Financial Officer | | 2003

2002

2001 | | 144,288

131,270

135,523 | | -0-

-0-

-0- | | 6,047

4,745

4,492 | | -0-

112,000

40,000 |

(3)

| | 11,419

9,443

8,650 | (2)

|

| | |

| |

| |

| |

| |

|

| |

|

|

Gary H. Ihrke, Vice President of Operations & Secretary | | 2003

2002

2001 | | 144,288

131,270

135,523 | | -0-

-0-

-0- | | 51

253

253 | | -0-

112,000

40,000 |

(3)

| | 11,419

9,443

8,650 | (2)

|

| | |

| |

| |

| |

| |

|

| |

|

|

Eric P. Clement, Vice President of Sales | | 2003

2002

2001 | | 145,745

123,597

125,068 | | -0-

-0-

-0- | | 3,932

8,632

7,297 | | 0

12,000

30,000 |

(3)

| | 9,303

7,889

7,983 | (2)

|

| | |

| |

| |

| |

| |

|

| |

|

|

James S. Wooley, Vice President & President, Luxy Coach Division | | 2003

2002

2001 | | 216,000

184,500

129,000 | | -0-

4,000

-0- | | 253

253

253 | | -0-

-0-

50,000 |

| | -0-

-0-

-0- |

|

| | |

| |

| |

| |

| |

|

| |

|

|

| (1) | Related to automobiles and other fringe benefits. |

| (2) | Company contribution to 401(k) Plan. |

| (3) | Shares issued as the result of a Board of Directors authorized voluntary cancellation of previously issued options in exchange for agreement to reissue the options cancelled six months and 1 day after cancellation at the closing market price on that date. |

| (4) | Salary reflects cash payments received in fiscal year and reported on W-2. The year 2003 included one extra bi-weekly pay period. |

10

Option/SAR Grants During 2003 Fiscal Year

There were no options/SAR grants to executive officers during fiscal year 2003.

Option/SAR Exercises During 2003 Fiscal Year and Fiscal Year End Option/SAR Values

The following table provides information related to options exercised by the named executive officers during the 2003 fiscal year and the number and value of options held at fiscal year end:

| | | | | | | | | |

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Unexercised Options/SARs at FY-End (#) Exercisable/ Unexercisable

| | Value of Unexercised In-the-Money Options/SARs at FY-End ($)(1) Exercisable/ Unexercisable

|

Conrad D. Clement | | -0- | | -0- | | 72,500/7,500 | | $ | 90,828/5,109 |

Tracy J. Clement | | -0- | | -0- | | 22,500/7,500 | | $ | 15,328/5,109 |

Jeffery A. Mason | | -0- | | -0- | | 142,000/10,000 | | $ | 217,405/9,375 |

Gary H. Ihrke | | -0- | | -0- | | 142,000/10,000 | | $ | 217,405/9,375 |

Eric P. Clement | | -0- | | -0- | | 34,500/7,500 | | $ | 41,374/7,031 |

James S. Wooley | | -0- | | -0- | | 30,000/20,000 | | $ | 28,125/18,750 |

| (1) | Based on the difference between $3.50 (the closing price of the Company’s common stock on December 31, 2003 as reported by Nasdaq) and the option exercise price. |

Equity Compensation Plans

The following table provides information as of December 31, 2003 about the Company’s equity compensation plans.

| | | | | | |

| | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

|

| | | (a) | | (b) | | (c) |

| | | |

Equity compensation plans approved by security holders | | 808,900 | | $2.39 | | 291,100 |

| | | |

Equity compensation plans not approved by security holders | | None | | None | | None |

| | |

| |

| |

|

| | | |

TOTAL | | 808,900 | | $2.39 | | 291,100 |

| | |

| |

| |

|

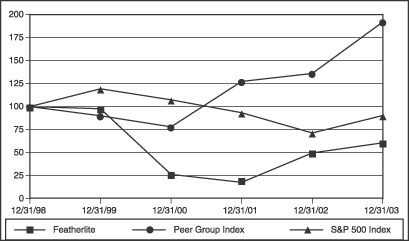

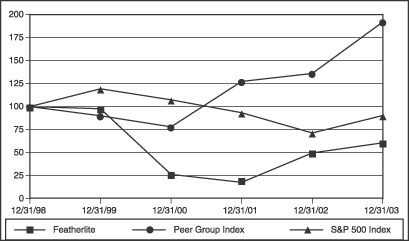

Stock Performance Chart

The following chart compares the cumulative total shareholder return on the Company’s common stock with the S&P 500 Index and an index of peer companies selected by the Company (the “Peer Group Index”). The comparison

11

assumes $100 was invested on December 31, 1998 in the Company’s common stock and in each of the foregoing indices and assumes reinvestment of dividends.

The Peer Group Index includes the following companies: Arctco, Inc., Harley Davidson, Inc., Miller Industries, Inc., Polaris Industries, Inc., Spartan Motors, Inc., Dorsey Trailers, Inc. and Wabash National Corp.

CERTAIN TRANSACTIONS

Featherlite Credit Corporation (or Featherlite Credit), which provides retail financing to customers of the Company’s dealers, is wholly-owned by the following officers, directors and shareholders of the Company: Conrad D. Clement (40%), Tracy J. Clement (25%), Larry D. Clement (25%), and Eric P. Clement (10%). Featherlite Credit leases trailers and coaches to outside parties under operating leases with terms varying from three to six years. It buys trailers and coaches from Featherlite dealers and in some cases, directly from the Company at normal selling prices and pays for the trailers at the time the lease is signed. Aggregate trailer and coach sales of $2.4 million were made by the Company to Featherlite Credit in 2003. The Company also sold for $947,000 for Featherlite Credit in 2003 trailers and coaches that had been returned from expired leases. Featherlite Credit was not indebted to the Company for transactions related to such sales at December 31, 2003.

Clement Auto and Truck, Inc. (“CATI”), which is wholly-owned by Larry D. Clement, is an authorized FEATHERLITE® dealer located in Fort Dodge, Iowa. Sales to CATI were $1.1 million in 2002. All such sales were on terms and conditions comparable to those available to other Company dealers. CATI was indebted to the Company in the amount of $17,432 for transactions related to such sales at December 31, 2003.

Valley Trailer Sales (“Valley”), which is 65 percent owned by Conrad D. Clement and Tracy J. Clement is a FEATHERLITE® dealer located in Waterloo, Iowa and Rochester, Minnesota. Sales of trailers to Valley were $2.6 million in 2003. All such sales were on terms and conditions comparable to those available to other Company dealers. Valley was indebted to the Company in the amount of $18,582 for transactions related to such sales at December 31, 2003.

In July 1999, the Company renewed for another five years a lease agreement with Conrad D. Clement, Tracy J. Clement and Eric P. Clement, each equal owners of a loader. Aggregate payments under this lease will total $118,500 over the lease term. In addition, the Company insures the loader and pays all ordinary maintenance and expenses related to the loader. In 2003, payments under this lease totaled $23,712. All material lease provisions were on terms and conditions comparable to those generally available from independent third party vendors.

In June and October 2000, the Company entered into agreements with Clement Properties, LLC, an entity equally owned by Conrad D. Clement, Tracy J. Clement, and Eric P. Clement, to lease a total of six forklifts for a term of four years. Aggregate payments under these leases will total $240,200 during their terms. In addition, the Company insures the forklifts and pays all ordinary maintenance and operating expenses related to the equipment. In 2003, rental payments

12

totaled $60,076. All material lease provisions were on terms and conditions comparable to those generally available from independent third party vendors.

From time to time, the Company leases aircraft owned by Larry D. Clement. Payments for leased aircraft totaled $11,000 in 2003, $25,800 in 2002, and $49,000 in 2001. All material lease provisions were on terms and conditions comparable to those generally available from independent third party vendors.

In 2001, the Company agreed to pay $302,000 to Clement Properties, Inc., an entity owned by Conrad D. Clement, Tracy J. Clement and Eric P. Clement, for costs related to the acquisition and development of land for a sales and service center in Statesville, North Carolina. The Company decided not to lease this property and agreed to pay Clement Properties this amount to be released from this obligation. This amount is being paid in equal monthly installments, without interest, over a three-year period beginning in 2002. In 2003, aggregate payments of $108,000 were made. Clement Properties released the Company from any liabilities related to this project.

In 2003, the Company entered into a Master Sales Agreement with Universal Luxury Coaches (or ULC) under which ULC may purchase from Featherlite up to 20 Featherlite Vantare and Featherlite Vogue motorcoaches over a one-year period at market prices. ULC is controlled by Nevada Coach Partners LLP, which owns 63.25 percent of the common stock of ULC. Nevada Coach Partners is 87.35 percent owned by Conrad Clement (49.4%), Tracy Clement (12.65%), Eric Clement (12.65%), and James Wooley (12.65%), who are majority shareholders and executive officers of the Company. ULC has been approved by Florida’s Department of Business & Professional Regulators to sell timeshares of luxury motorcoaches and will purchase these coaches exclusively from Featherlite as timeshares are sold. The Company also has agreements with ULC to lease it office space in the Featherlite Sales and Service Center in Sanford, Florida and to perform service work on ULC motorcoaches. During 2003, ULC purchased from the Company motorcoach and related parts and services in a total aggregate amount of $3.6 million. At December 31, 2002, the Company had a receivable from ULC for $21,500.

In 2003, the Company purchased a motorcoach for $600,000 from Clement Enterprises, LLC, a company wholly-owned by Conrad Clement, at its estimated fair market value. This motorcoach was then resold to ULC by the Company for $630,000. In 2004, the Company leased this motorcoach back from ULC under the terms of a ten month operating lease for a total rental payment of $120,000. This motorcoach is being used by an independent third party for sales promotion purposes, for which the Company receives certain sponsor and promotional rights.

INDEPENDENT PUBLIC ACCOUNTANTS

For the years ended December 31, 2003 and 2002, Deloitte & Touche LLP, the member firm of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”) acted as our principal accountant. Representatives of Deloitte and Touche are expected to be present at the annual meeting, will be given an opportunity to make a statement regarding financial and accounting matters if they so desire and will be available to respond to appropriate questions from the Company’s shareholders.

On August 2, 2002, the Audit Committee determined to cease the Company’s relationship with Arthur Andersen LLP, the Company’s principal accountant for 2001 and prior years. The decision to change accountants was recommended by the Company’s Audit Committee and approved by the Company’s Board of Directors. The reports of Arthur Andersen, LLP on the Company’s consolidated financial statements for 2001 and 2000 expressed an unqualified opinion on those consolidated financial statements and included an explanatory paragraph regarding certain matters raising substantial doubt as to the Company’s ability to continue as a going concern as discussed in Note 2 to the consolidated financial statements. There were not, in connection with the audits for the years ended December 31, 2001 and 2000 and any subsequent periods prior to August 2, 2002, any disagreements between the Company and Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Arthur Andersen LLP, would have caused it to make reference thereto in its report on the financial statements for the Company for such years, and there were no reportable events as defined in Item 304(a)(1(v) of Regulation S-K.

13

FEES OF INDEPENDENT PUBLIC ACCOUNTANTS

The following table presents the aggregate fees billed for professional services rendered by Deloitte & Touche LLP and Arthur Andersen LLP for the fiscal years ended December 31, 2003 and 2002. All services rendered by Deloitte & Touche LLP and Arthur Andersen LLP were permissible under applicable laws and regulations.

Pursuant to its written charter, the Audit Committee is required to pre-approve the audit and non-audit services performed by the Company’s independent accountant in order to assure that the provision of such services does not impair the accountant’s independence. Unless a particular service has received general pre-approval by the Audit Committee, each service provided must be specifically pre-approved. Any proposed services exceeding pre-approved costs levels will require specific pre-approval by the Audit Committee. The term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different term. The Audit Committee retains the right to periodically revise the nature of pre-approved services.

As part of the Company’s annual engagement agreement with its independent accountant, the Audit Committee has pre-approved the following audit services to be provided by the independent accountant: statutory and financial audits for the Company, audit services associated with SEC registration statements, periodic reports and other documents filed with the SEC, production of other documents issued by the independent accountant in connection with securities offerings (e.g., comfort letters, consents), and assistance in responding to SEC comment letters. The Audit Committee also pre-approved the audit of its employee benefit plan as an audit-related service, and has given its independent accountant pre-approval for U.S. federal, state, and local tax compliance.

| | | | | | | | | | | |

| | | Aggregate Amount Billed by Deloitte & Touche LLP ($)

| | Aggregate Amount Billed by Arthur Andersen LLP ($)

|

Services Rendered

| | 2003

| | 2002

| | 2003

| | 2002

|

Audit Fees (1) | | $ | 133,750 | | $ | 124,000 | | — | | $ | 13,125 |

Audit-Related Fees (2) | | | 8,700 | | | 8,450 | | — | | | — |

Tax Fees (3) | | | 38,075 | | | 63,800 | | — | | | — |

All Other Fees | | | — | | | — | | — | | $ | 13,125 |

| | |

|

| |

|

| |

| |

|

|

Total | | $ | 180,525 | | $ | 196,250 | | — | | $ | 13,125 |

| | |

|

| |

|

| |

| |

|

|

| (1) | With respect to Deloitte & Touche LLP, these fees consisted of the annual audit of our financial statements for the applicable fiscal year, and the reviews of our financial statements included in our Form 10-Q’s for the first, second and third quarters of the applicable year. In 2003, these fees also included the review of and consent provided for a Form S-3 registration statement filed in the fourth quarter of 2003. With respect to Arthur Andersen LLP in 2002, these fees consisted of the review of our financial statements included in our Form 10-Q for the first quarter of 2002. |

| (2) | These fees related to the audit of our 401(k) plan for the applicable fiscal year. |

| (3) | These fees related to corporate tax compliance and consulting services. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10 percent of the Company’s common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than 10% shareholders (“Insiders”) are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based on a review of the copies of such reports furnished to the Company, during the fiscal year ended December 31, 2003 all Section 16(a) filing requirements applicable to Insiders were complied with, except that Messrs. Branstad, Elliott, Larson and Winkel were late filing one Form 4 each reporting one transaction.

14

ADOPTION OF FEATHERLITE, INC. 2004 EQUITY INCENTIVE PLAN

(Proposal #3)

General

At the annual meeting, shareholders will be asked to approve the Featherlite, Inc. 2004 Equity Incentive Plan. This plan is a replacement to the 1994 Stock Option Plan which expires on July 31, 2004. The Board of Directors believes that this plan will place the Company in an appropriate range of shares available under incentive plans for similarly situated Companies. The Board believes that granting fairly priced stock options and other stock awards to employees, officers, consultants and directors are an effective means to promote the future growth and development of the Company. Such options and awards, among other things, increase these individuals’ proprietary interest in the Company’s success and enables the Company to attract and retain qualified personnel. The Board of Directors and Compensation Committee intend to tie individual officer grants closely to the performance of the Company. The Board of Directors and the Compensation Committee also believe the 2004 Plan will tie the employees’ goals and interests to those of the Company and its shareholders.

Description of the Featherlite, Inc. 2004 Equity Incentive Plan

A general description of the material features of the 2004 Plan follows, but this description is qualified in its entirety by reference to the full text of the 2004 Plan, a copy of which may be obtained without charge upon request to the Company’s Chief Financial Officer.

General. Under the 2004 Plan, the Board of Directors may award incentive or nonqualified stock options and restricted stock to those officers and employees of the Company (including its subsidiaries and affiliates), or to directors of or consultants or advisors to the Company, whose performance, in the judgment of the Board or Committee, can have a significant effect on the success of the Company. As of the date of the Proxy Statement, the Company had approximately forty-five (45) officers and employees and four non-employee directors who would be considered for these awards.

Shares Available. The 2004 Plan provides for the issuance of up to 600,000 shares of common stock of the Company, subject to adjustment of such number in the event of certain increases or decreases in the number of outstanding shares of common stock of the Company effected as a result of stock splits, stock dividends, combinations of shares or similar transactions in which the Company receives no consideration. The closing sale price of a share of the Company’s common stock was $3.20 on April 8, 2004. If any options or stock awards granted under the Plan expire or terminate prior to exercise, the shares subject to that portion of the option or stock award are available for subsequent grants.

Administration and Types of Awards. The 2004 Plan will be administered by the Compensation Committee. The Committee has broad powers to administer and interpret the Plan, including the authority to (i) establish rules for the administration of the Plan, (ii) select the participants in the Plan, (iii) determine the types of awards to be granted and the number of shares covered by such awards, and (iv) set the terms and conditions of such awards.

Options. Options granted under the 2004 Plan may be either “incentive” stock options within the meaning of Section 422 of the Internal Revenue Code (“IRC”) or “nonqualified “ stock options that do not qualify for special tax treatment under the IRC. No incentive stock option may be granted with a per share exercise price less than the fair market value of a share of the Company’s common stock on the date the option is granted. The Committee will determine the term of the option (which in case of an incentive stock option, generally may not exceed ten years) and how it will become exercisable. An incentive stock option may not be transferred by an optionee except by will or the laws of descent and distribution. In certain circumstances, a nonqualified option may be transferred to a member of an optionee’s family, a trust for the benefit of such immediate family members or a partnership in which such family members are the only partners.

Restricted Stock Awards. The Committee is also authorized to grant awards of restricted stock. Each restricted stock award granted under the Plan shall be for a number of shares as determined by the Committee, and the Committee, in its discretion, may also establish continued employment, vesting or other conditions that must be satisfied for the restrictions on the transferability of the shares and the risks of forfeiture to lapse.

Amendment. The Board of Directors may, from time to time, suspend or discontinue the Plan or revise or amend it in any respect; provided, (i) no such revision or amendment may impair the terms and conditions of any outstanding option or stock award to the material detriment of the participant without the consent of the participant except as authorized in the event of merger, consolidation or liquidation of the Company, and (ii) the Plan may not be amended in any manner that will (a) materially increase the number of shares subject to the Plan except as provided in the case of stock splits,

15

consolidations, stock dividends or similar events, (b) change the designation of the class of employees eligible to receive awards; (c) decrease the price at which options will be granted; or (d) materially increase the benefits accruing to participants under the Plan without the approval of the shareholders, to the extent such approval is required by applicable law or regulation.

Federal Income Tax Matters

Options. Under present law, an optionee will not realize any taxable income on the date a nonqualified option is granted pursuant to the Plan. Upon exercise of the option, however, the optionee must recognize, in the year of exercise, ordinary income equal to the difference between the option price and the fair market value of the Company’s common stock on the date of exercise. Upon the sale of the shares, any resulting gain or loss will be treated as capital gain or loss. The Company will receive an income tax deduction in its fiscal year in which nonqualified options are exercised equal to the amount of ordinary income recognized by those optionees exercising options, and must withhold income and other employment related taxes on such ordinary income.

Incentive stock options granted under the Plan are intended to qualify for favorable tax treatment under Section 422 of the Internal Revenue Code of 1986, as amended. Under Section 422, an optionee recognizes no taxable income when the option is granted. Further, the optionee generally will not recognize any taxable income when the option is exercised if he or she has at all times from the date of the option’s grant until three months before the date of exercise been an employee of the Company. The Company ordinarily is not entitled to any income tax deduction upon the grant or exercise of an incentive stock option. Certain other favorable tax consequences may be available to the optionee if he or she does not dispose of the shares acquired upon the exercise of an incentive stock option for a period of two years from the granting of the option and one year from the receipt of the shares.

Restricted Stock Awards. Generally, no income is taxable to the recipient of a restricted stock award in the year that the award is granted. Instead, the recipient will recognize compensation taxable as ordinary income equal to the fair market value of the shares in the year in which the transfer restrictions lapse. Alternatively, if a recipient makes a “Section 83(b)” election, the recipient will, in the year that the restricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date of the award. The Company normally will receive a deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

New Plan Benefits

No options or other stock awards have been granted to date under the 2004 Equity Incentive Plan. Because future grants and awards under the Plan are subject to the Compensation Committee’s discretion, the future benefits or amounts that may be received by employees and directors under the Plan cannot be determined at this time.

The Board recommends that you vote FOR proposal # 3.

SHAREHOLDER PROPOSALS

Any appropriate proposal submitted by a shareholder of the Company and intended to be presented at the 2005 annual meeting must be received by the Company at its offices by December 31, 2004 to be considered for inclusion in the Company’s proxy statement and related proxy for the 2005 annual meeting.

Also, if a shareholder proposal intended to be presented at the 2005 annual meeting but not included in the Company’s proxy materials is received by the Company after March 15, 2005, then management named in the Company’s proxy form for the 2005 annual meeting will have discretionary authority to vote shares represented by such proxies on the shareholder proposal, if presented at the meeting without including information about the proposal in the Company’s proxy materials.

16

OTHER BUSINESS

The Board of Directors knows of no other matters to be presented at the meeting. If any other matter does properly come before the meeting, the appointees named in the proxies will vote the proxies in accordance with their best judgment.

ANNUAL REPORT

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, including financial statements, accompanies this Notice of Annual Meeting and Proxy Statement. The Company will furnish to any shareholder, upon written request, any exhibit described in the list accompanying the Form 10-K upon payment, in advance, of reasonable fees related to the Company’s furnishing such exhibit(s). Any such request should include a representation that the shareholder was the beneficial owner of shares of the Company’s common stock on April 8, 2004, the record date for the annual meeting, and should be directed to Mr. Jeffery Mason, Chief Financial Officer, at the Company’s principal address. No portion of the Form 10-K is incorporated herein or is to be considered proxy soliciting material.

Dated: April 29, 2004

Cresco, Iowa

17

APPENDIX TO 2003

PROXY STATEMENT

ANNUAL MEETING JUNE 4, 2004

FEATHERLITE, INC.

AUDIT COMMITTEE CHARTER

Organization

The Audit Committee (the “Committee”) is a standing committee of the Board of Directors (the ”Board”) of Featherlite, Inc. (the “Company”). This Audit Committee Charter shall guide the operations of the Committee.

Statement of Purpose and Policy

The purpose of the Committee shall be to oversee the accounting and financial reporting processes of the Company. In doing so, the Committee will strive to maintain free and open communication between the Committee, the independent auditors and management of the Company. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention, with full access to all books, records, facilities and personnel of the Company and the power to engage and determine funding for independent counsel or other advisors as the Committee deems necessary for these purposes and with respect to its other duties. The Company shall provide appropriate funding, as determined by the Committee, for payment of compensation to the independent auditors and all such advisors, as well as for ordinary administration expenses of the Committee that are necessary or appropriate in carrying out its duties.

Composition and Qualifications

The members of the Committee shall be appointed by the Board and shall consist of at least three independent Board directors. Each member of the Committee shall, at the time of his or her appointment, be able to read and understand fundamental financial statements, including the Company’s balance sheet, statement of operations and cash flow statement. In addition, at least one member of the Committee shall be an “audit committee financial expert,” as defined and required under the federal securities laws and rules and regulations of the Securities Exchange Commission (SEC), as amended from time to time.

All Committee members shall meet the independence requirements set forth in the federal securities laws and under the rules and regulations established by the SEC and the Nasdaq Stock Market, as may be amended from time to time.

The Board shall be responsible for determining “independence” of Committee members and qualifications of a member as an “audit committee financial expert.”

The Committee shall meet a minimum of four (4) times per year, either in person or telephonically (if appropriate). Additional meetings will be scheduled as circumstances dictate. The Committee shall require members of management, the independent auditors and others to attend meetings and to provide pertinent information, as necessary. As part of its job to foster open communications, the Committee shall meet in separate executive sessions during certain of its meetings with management and the independent auditors to discuss any matters that the Committee (or either of the two groups) believes should be discussed in private.

Responsibilities and Processes

In carrying out its responsibilities the Committee shall:

| • | Oversee the Company’s accounting and financial reporting process on behalf of the Board and report the results of their activities to the Board. |

| • | Have sole authority to appoint, compensate, retain, terminate and oversee the work of the Company’s independent auditors. The Company’s independent auditors shall report directly to the Committee. |

1

| • | Pre-approve all audit services and permissible non-audit services provided by the independent auditors as required under the federal securities laws and rules and regulations of the SEC, as may be amended from time to time. |

| • | Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including for the confidential, anonymous submission by Company employees of complaints regarding accounting, internal control or auditing matters. |

| • | Oversee the establishment and administration (including the grant of any waiver from) of a written code of ethics applicable to each of the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. |

| • | Have authority to engage outside advisers and consultants. |

| • | Have adequate funding necessary for the Committee to perform its obligations and utilize its authority. |

| • | Review and either approve or disapprove all related party transactions. |

The Committee, in carrying out its responsibilities, believes its policies and procedures should remain flexible in order to react more effectively to changing conditions and circumstances. The Committee shall take the appropriate actions to set the overall corporate “tone” for quality accounting and financial reporting, sound business risk practices and ethical behavior.

The following shall be the principal recurring processes of the Committee in carrying out its oversight responsibilities. These processes are set forth as a guide, with the understanding that the Committee may supplement them as appropriate. More specifically, the Committee shall:

| • | Discuss with the auditors their independence from management and the Company. The Committee shall obtain and review a written statement from the auditors regarding their independence consistent with the Independence Standards Board Statement No. 1 or any successor standard, as either may be amended from time to time. |

| • | Discuss with the independent auditors the overall scope and plans for their audits. In addition, the Committee shall discuss with management and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company’s system to monitor and manage business risk, and legal and ethical compliance programs. |

| • | On a periodic basis, but not less than annually, the Committee shall discuss with the independent auditors, reports regarding. |

| | - | the selection of, or any changes in, the Company’s critical accounting policies, and alternative and preferred treatment of financial information under GAAP, |

| | - | the independent auditor’s internal quality-control procedures, |

| | - | any material issues raised by the most recent internal quality-control review or peer review of the independent auditor, |

| | - | any material issues raised by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the independent auditor, |

| | - | any steps taken to deal with any issues described in the two preceding clauses, |

| | - | all relationships between the independent auditor and the Company, and |

| | - | any issues regarding the Company that the independent auditor discussed with its national office. |

2

| • | Prior to release, the Committee shall review all announcements of interim and annual financial results, as well as periodic earnings guidance to be publicly released by the Company, and discuss such announcements with management and the independent auditors. The chair or other designated representative of the Committee may represent the entire Committee for purposes of this review. |

| • | Review the interim financial statements with management and the independent auditors prior to public release of quarterly results or, if quarterly results are not released, prior to the filing of the Company’s Quarterly Report on Form 10-Q. The Committee shall discuss the results of the quarterly review and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards. The chair or other designated representative of the Committee may represent the entire Committee for purposes of this review. |

| • | Review with management and the independent auditors the financial statements to be included in the Company’s Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of the Form 10-K), including their judgment about the quality, not just acceptability, of critical accounting policies and practices, the reasonableness of significant judgments, the clarity of the disclosures in the financial statements and whether the financial statements fairly present the results and operations of the Company. Further, the Committee shall indicate to the Board whether the Committee recommends that the audited financial statements be included in the Company’s Annual Report on Form 10-K and shall review and approve the report of the Committee required to be included in the Company’s annual proxy statement. |