FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2002

CSR Limited

(Translation of registrant’s name into English)

9 Help Street, Chatswood NSW 2067 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F. ý Form 40-F..o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ..o. No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

CSR LIMITED

RESULTS FOR THE HALF YEAR ENDED 30 SEPTEMBER

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| | CSR Limited |

| | (Registrant) |

| | |

| By: | /s/ Luke Keighery |

| | Luke Keighery |

| | Manager, Investor Services |

Date 19 November, 2002

CSR LIMITED EARNINGS PER SHARE UP 17.2%

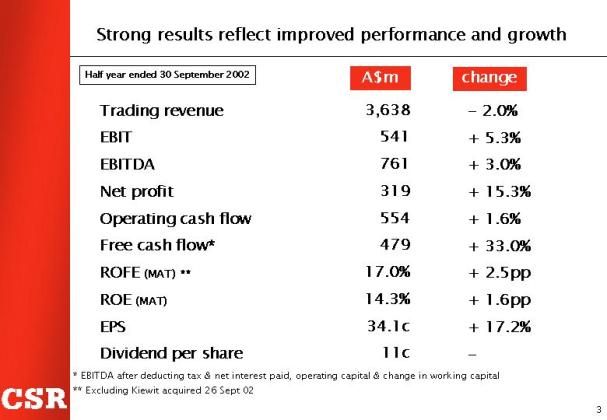

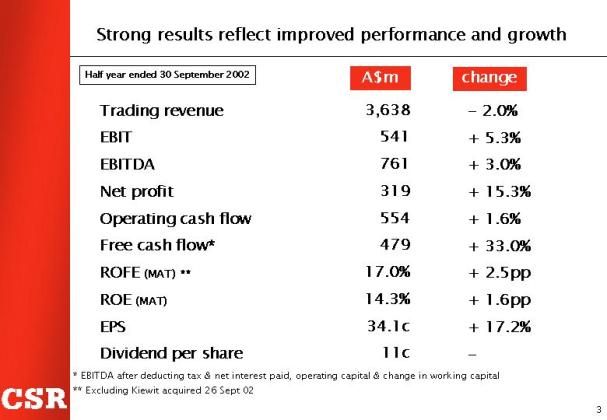

CSR Limited today announced that operating profit after tax (PAT) for the half year ended 30 September 2002 (HYES02) was A$319.4 million, up 15.3% on the previous corresponding period. Earnings per share (EPS) rose 17.2% to 34.1 cents.

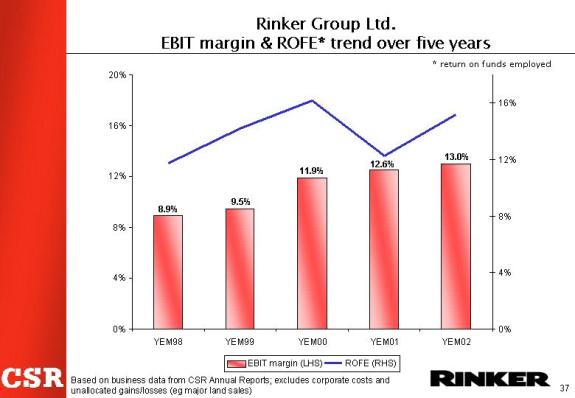

Earnings before interest and tax (EBIT) was up 5.3% to A$541 million. Trading revenue was down 2.0% to A$3,638 million. EBIT/sales margins rose from 13.8% to 14.9%. Excluding the impact of a higher Australian dollar on US$ earnings, EBIT was up 10.5% and revenue was up 2.6%.

Other highlights

Measure | | HYES02 result | | Increase | |

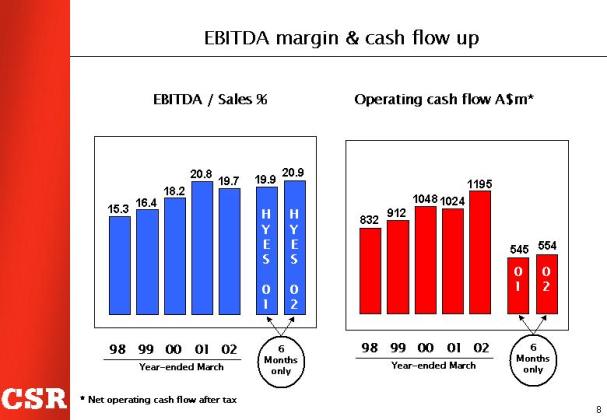

EBITDA | | A$761m | | 3% | |

EBITDA/sales | | 20.9% | | 1.0 pp | |

Net operating cash flow | | A$554m | | 2% | |

Free cash flow* | | A$479m | | 33% | |

Return on funds employed (ROFE)** # | | 17.0% | | 2.5 pp | |

Return on equity (ROE)# | | 14.3% | | 1.6 pp | |

Shareholder value added was again positive and up significantly on the previous year.

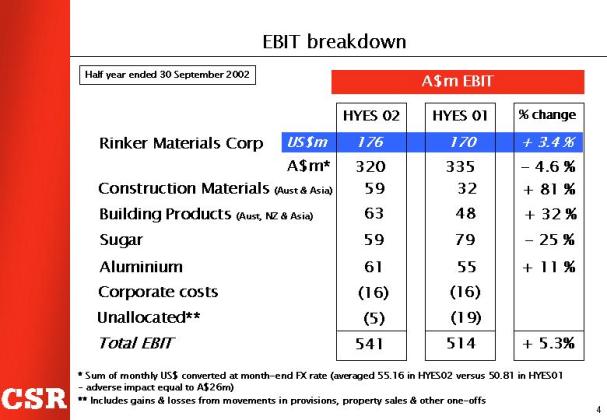

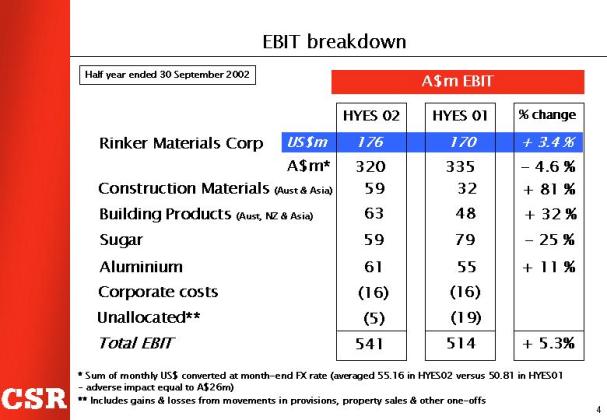

The heavy building materials businesses performed well, contributing 70% of CSR group EBIT. The US subsidiary, Rinker Materials Corporation (“Rinker”) delivered another solid result, with EBIT up 3% to US$176 million, although the stronger Australian dollar meant A$ EBIT fell 5% to A$320 million. Despite a tougher economic environment, all the major Rinker segments lifted US$ EBIT, apart from Concrete Pipe & Products. Construction Materials (Australia & Asia) delivered a very strong 81% increase EBIT, to A$59 million, due to improved margin management and operational improvement cost savings.

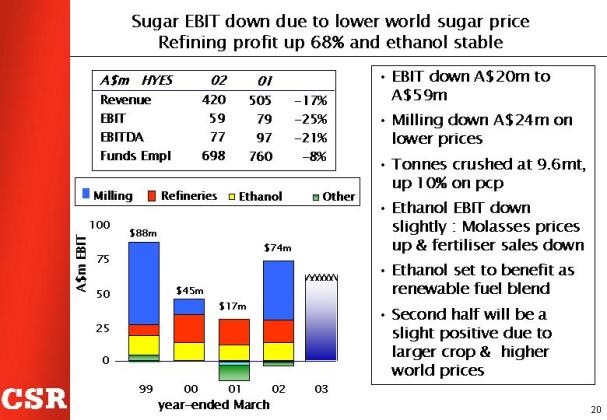

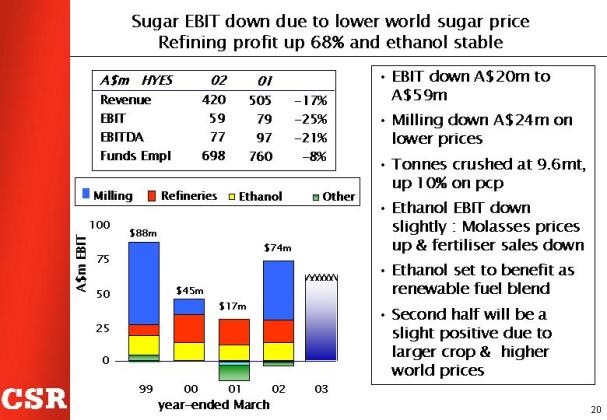

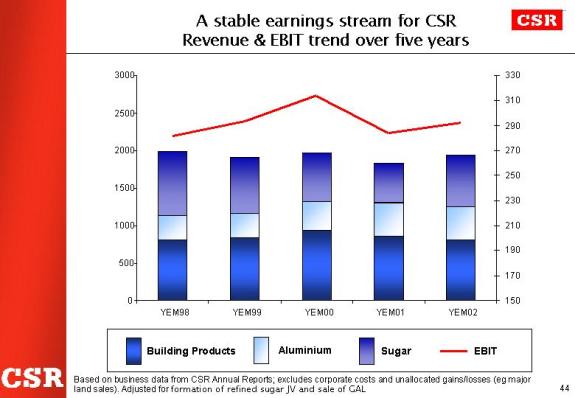

Building Products (Australia, NZ & Asia) EBIT was up 32% to A$63 million, helped by strong domestic housing activity. Aluminium EBIT rose 11% to A$61 million due mainly to lower costs. Sugar EBIT fell 25% on lower world prices, which impacted the milling business - although EBIT from the downstream businesses - mainly sugar refining and ethanol - rose 28%.

Directors declared an unchanged interim dividend of 11 cents per share, payable on 16 December. Franking increased to 70%, from 40% for the previous interim dividend.

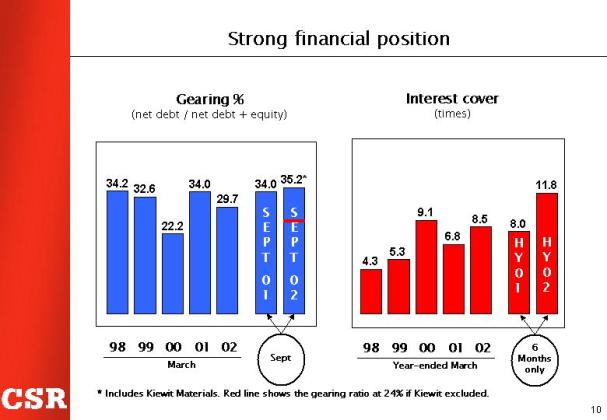

Financial position

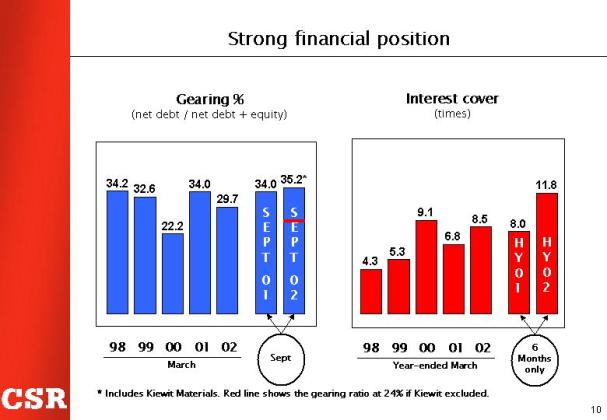

The group’s balance sheet remained very strong with net debt at end September of A$2,311 million, following the acquisition of Kiewit Materials Company, up from A$2,130 million a year earlier. Gearing (net debt / net debt plus equity) was 35.2% from 34.0%. Interest cover was 11.8 times, up from 8.0 times.

Overview

“This is another very pleasing result which reflects the strength of the group’s market positions and the hard work we have put in to improve our base businesses,” said CEO & Managing Director Peter Kirby. “Rinker’s position in Florida, and in high growth southern US states, helped offset the impact of a weak non-residential sector which hit the concrete pipe and products business particularly hard. In Australia, improvements in Construction Materials, bricks and roofing, and the downstream sugar businesses, also contributed strongly.”

* EBITDA after deducting tax and net interest paid, operating capital and change in working capital

** Excluding acquisition of Kiewit Materials Company, acquired 26 September 2002 # on a 12 month basis

CSR Limited ABN 90 000 001 276. Corporate and Investor Relations Group

Level 3, 9 Help Street, Chatswood NSW 2067, Locked Bag 6, Chatswood NSW 2057, Australia

Telephone (02) 9235 8171 Facsimile (02) 9235 8140 E-mail investorrelations@csr.com.au

Mr Kirby said Rinker’s US acquisitions are also performing well overall - in line with expectations and ahead of the weighted average cost of capital. Integration of the Arizona-based Kiewit, acquired in late September, is proceeding to schedule and earnings expectations have been affirmed. Operational improvement measures are well underway as part of the post-acquisition management plan.

“In Australia, internal initiatives to improve margin management and customer service in Construction Materials significantly lifted profit. The business is improving but it is still not earning its cost of capital,” said Mr Kirby. “Further price increases were implemented in October.

“Building Products benefited from the lift in residential housing in Australia. The lag effect seen earlier this year, attributed to issues with the availability of home warranty insurance, has largely been resolved. Bricks and roofing introduced several initiatives to lift profits, including lower production costs and price increases.

“Sugar was impacted by the decline in world prices, but this was partly offset by the improvement in refining. The ethanol business is poised to benefit from any moves to encourage the use of environmentally-friendly motor fuels. CSR Distilleries is supplying BP’s successful ethanol trial in Brisbane, where motorists have responded very favourably to the 10% ethanol fuel blend. We are optimistic about prospects in this area. The sugar industry meanwhile is working together on a major restructuring and efficiency program to help restore Australia’s productivity advantages over other sugar producers.”

Business Performance

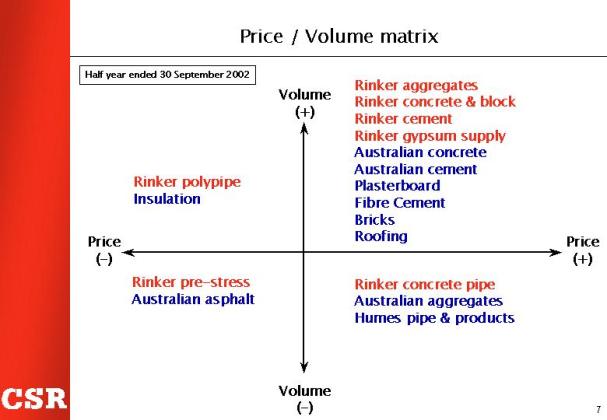

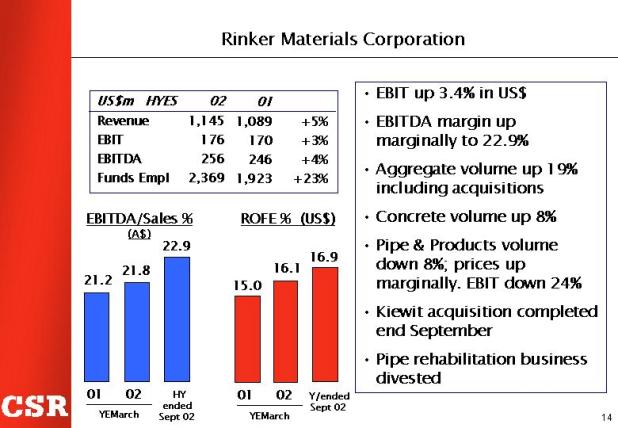

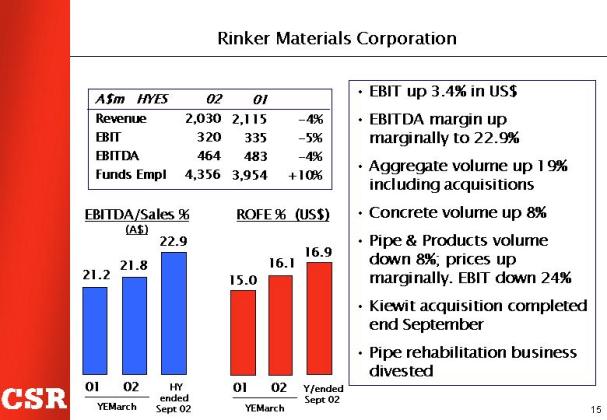

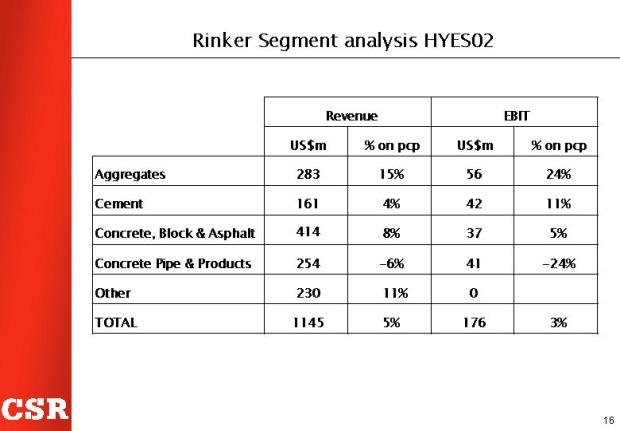

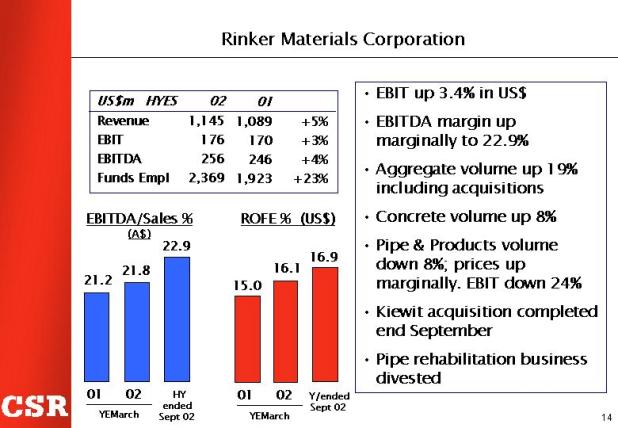

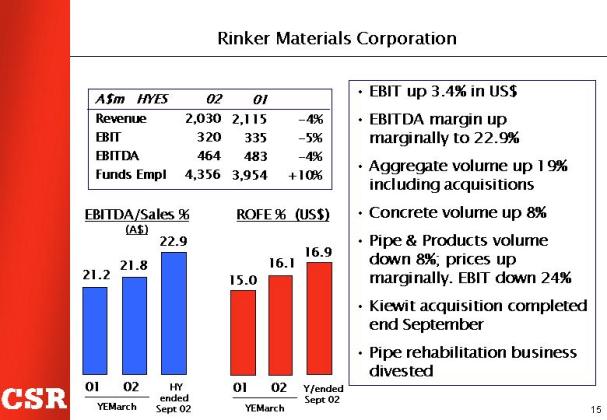

• Rinker sales rose 4% to US$1,119 million. EBITDA was up 4% to US$256 million. US$ EBITDA/sales margins increased slightly to 22.9%. US$ ROFE for the 12 months to September was 16.9% from 15.6%. Comparable $US sales (adjusted for acquisitions and divestments in the year to September) rose 3% and EBIT rose 1%.

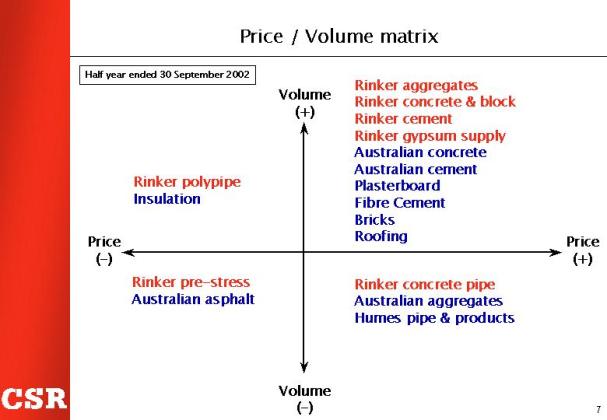

Price increases ranged from marginal to 5.0%. Volumes rose in all major businesses except Concrete Pipe & Products:

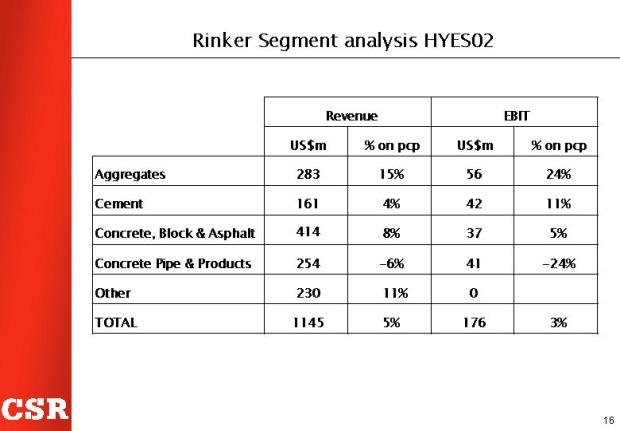

• Aggregates EBIT US$56 million, up 24%. Volumes up 19%.

• Concrete, Block & Asphalt EBIT US$37 million, up 5%. Concrete volumes up 8%.

• Cement EBIT US$42 million, up 11%. Volumes up 2%.

• Concrete Pipe & Products EBIT US$41 million, down 24%. Volumes down 8%. The business was impacted by the substantial fall in non-residential building.

Gypsum Supply profit increased 9% on increased volumes. The small Polypipe and Prestress businesses also continued to suffer from the non-residential construction downturn. Prestress EBIT was breakeven. The pipeline rehabilitation business was sold during the half.

• Construction Materials EBIT rose 81% on an 8% lift in sales. ROFE (12 month basis) was 11.1% from 4.7%. EBITDA/sales margin was 15.9%, up from 11.9%. The Tianjin Readymix quarry and concrete business in China continued to improve.

• Building Products EBIT was up 32% on a 17% lift in sales. ROFE (12 months basis) was 19.5%. EBITDA/sales margin was 17.3% from 16.2%. Installation of the SAP computer system was completed in plasterboard and insulation. Production started at the new roof tile plant at Rosehill, Sydney.

• Aluminium EBIT was A$61 million, up 11%. Aluminium prices were 7% lower on average and the A$ was stronger but profits were underpinned by hedging and lower alumina costs.

• Sugar EBIT fell 25% to A$59 million. Average raw sugar prices were down 27%. Harvested cane volumes were up 10%. Distilleries EBIT was down due to lower fertiliser sales as a result of the drought but export sales were stronger. Refining EBIT was A$12 million, up from A$7 million.

CSR Limited ABN 90 000 001 276. Corporate and Investor Relations Group

Level 3, 9 Help Street, Chatswood NSW 2067, Locked Bag 6, Chatswood NSW 2057, Australia

Telephone (02) 9235 8171 Facsimile (02) 9235 8140 E-mail investorrelations@csr.com.au

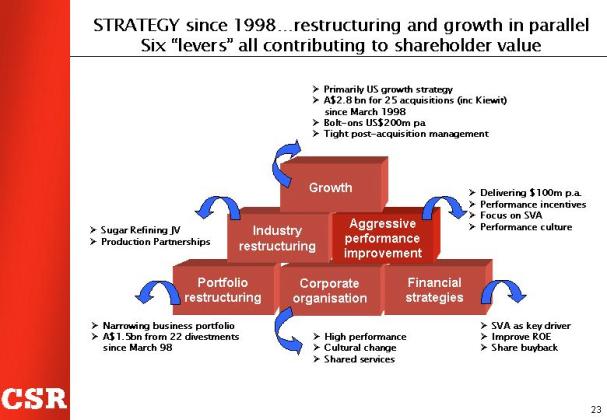

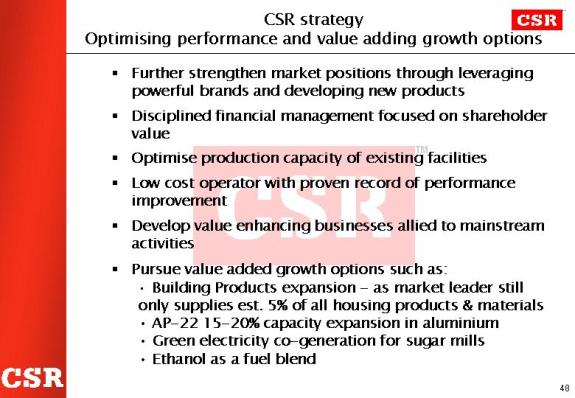

Strategy

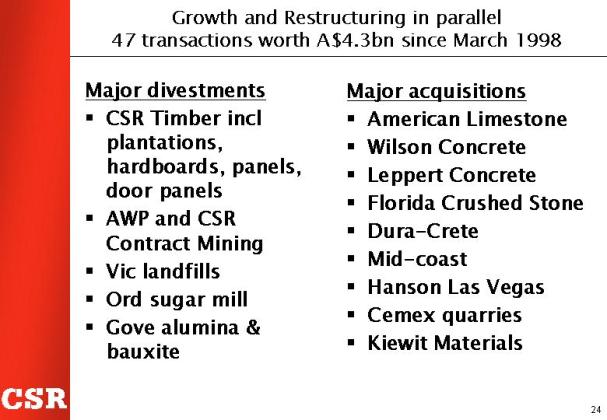

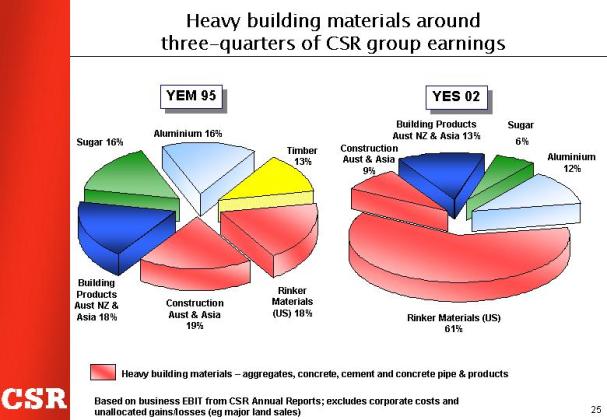

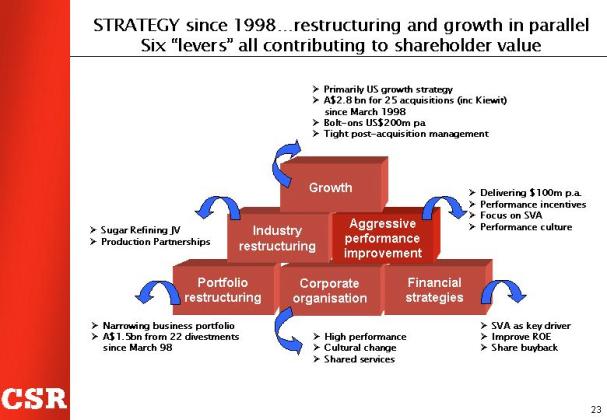

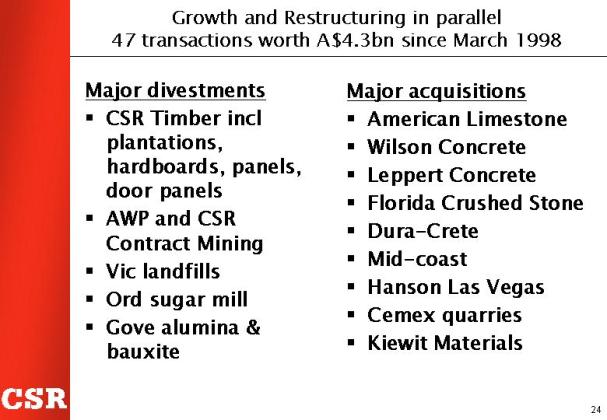

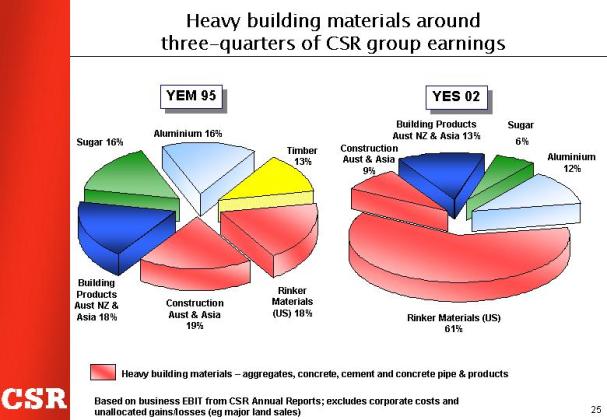

Almost three quarters of CSR group EBIT now comes from heavy building materials (primarily aggregates, premix concrete, cement and concrete pipe & products). Group strategy since 1998 has been to grow internationally in this sector, whilst concurrently working to separate the remaining assets, in a way that has delivered value for shareholders.

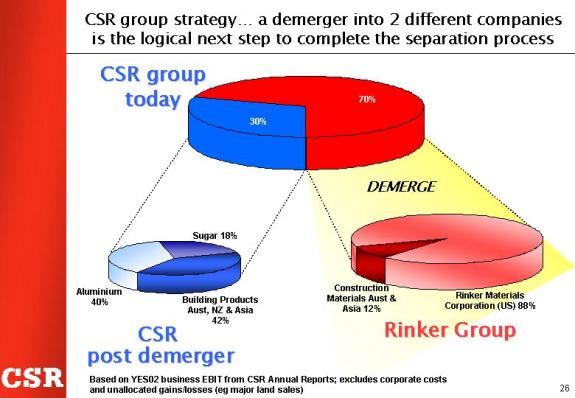

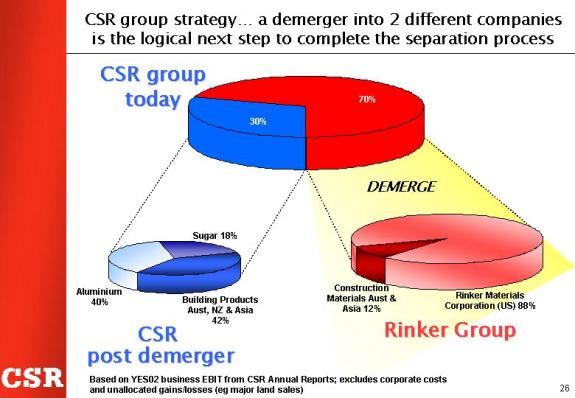

“The logical next step in our strategy is to complete the separation of the heavy building materials assets through a demerger,” said Mr Kirby.

“For some time now we have been carefully examining the various separation options. We believe a demerger will be the best option for shareholders. The new demerger legislation means that we can now do this without shareholders incurring substantial tax penalties. Accordingly we are moving forward with a demerger proposal which would involve splitting the group into two listed Australian companies. We are completing our own due diligence process, aiming to propose to shareholders a demerger to take effect in the first half of next year.

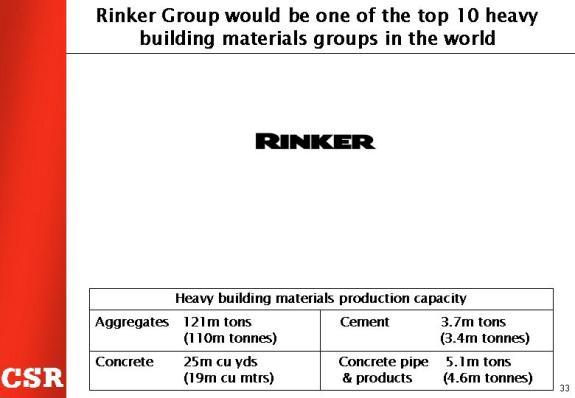

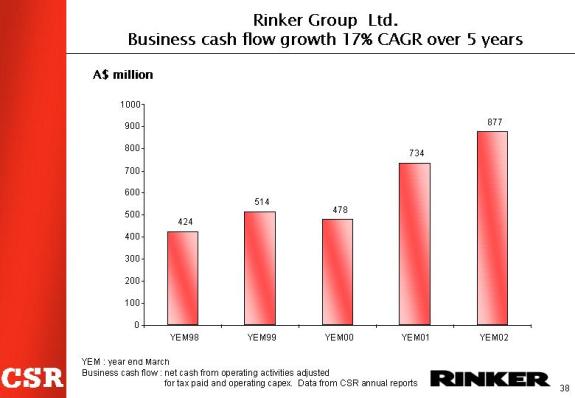

The demerger would mean the formation of a focused, heavy building materials group Rinker Group Ltd (“Rinker Group”). It would be spun off from CSR Limited and would comprise US subsidiary Rinker Materials Corporation and the Readymix and Humes businesses (Australia & Asia).

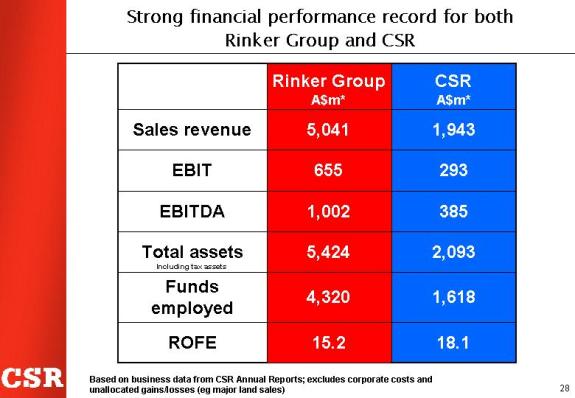

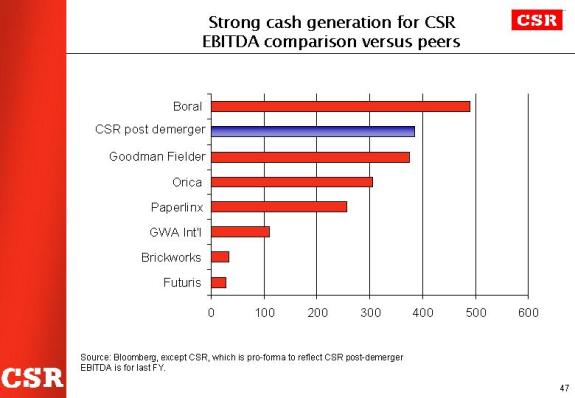

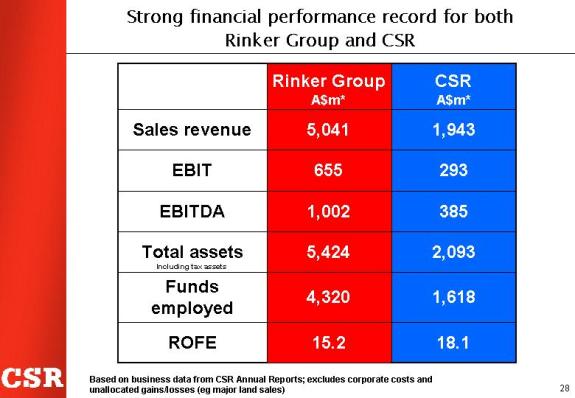

“Based on historical performance, both Rinker Group and CSR would have substantial free cash flows. We expect both companies to receive investment grade credit ratings, and to be listed in the ASX Top 50 and Top 100 stocks respectively,” said Mr Kirby.

“We anticipate that Rinker Group will be one of the top 10 heavy building materials stocks in the world and a disciplined, top quartile performer in its sector,” he said. “Rinker Group is expected to be a growth stock - able to participate more effectively in the global consolidation of the industry. With around 85% of earnings from Rinker Materials in the US, over time we would expect it to be re-rated by investors, more in line with its US peers.

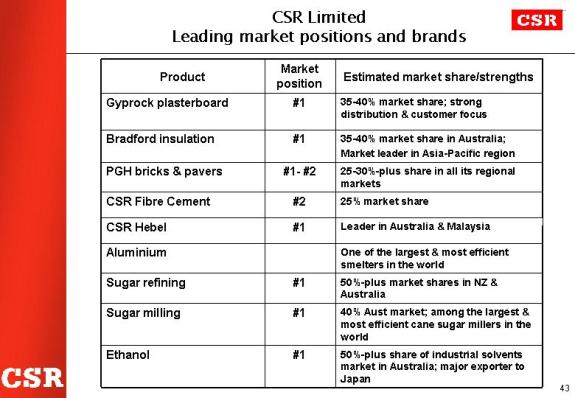

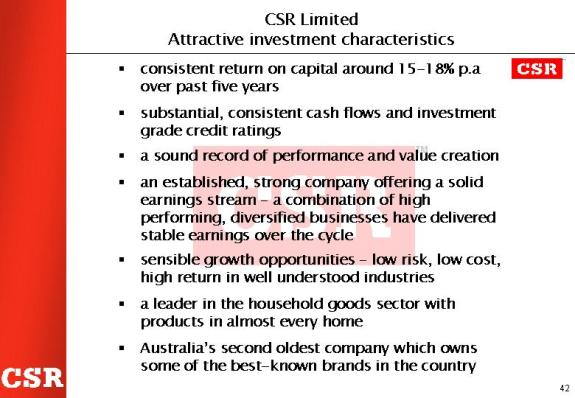

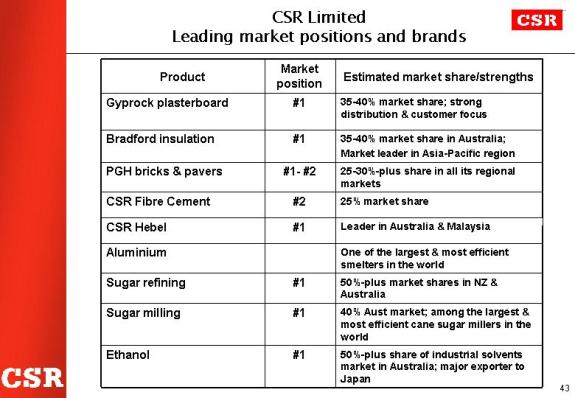

“CSR Limited would return to its roots as a diversified, Australian company, holding some of the strongest and best known household brands in the country. It will comprise three businesses - CSR Building Products, Aluminium and CSR Sugar - each of which is a leader in its industry. A demerger will allow these businesses to focus more effectively on their respective strengths and to pursue value-adding, low risk growth options which have previously ranked as a lesser priority for the CSR group.

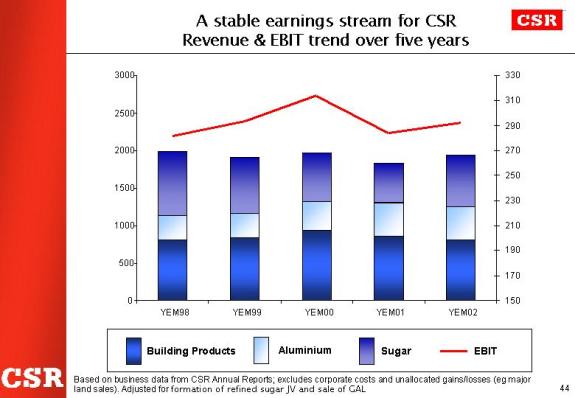

“CSR Limited is expected to be a highly franked stock, appealing to yield driven investors. It has been a strong generator of cash and of shareholder value – that is, earning above its cost of capital – for many years.

“A demerger will facilitate choice for the different types of shareholders – that is, those who prefer Rinker Group’s growth characteristics and those who prefer CSR’s higher, franked yields. We expect both companies to be well-regarded and to prove attractive to these respective shareholders.”

Mr Kirby will lead the company through the demerger process. Upon completion of the demerger, he will hand over his role to David Clarke, current chief executive of Rinker Materials and Alec Brennan, current CSR group deputy managing director, who will become chief executives of Rinker Group and CSR respectively.

CSR group chairman John Morschel said Mr Kirby would then remain with the group for up to four months as an advisor, to assist in the critical phase of demerger implementation.

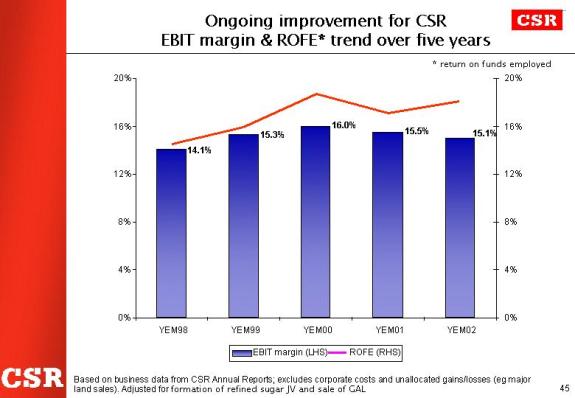

“Since joining the company in January 1998, Mr Kirby has played the key role in transforming the CSR group from a poorly-regarded Australian conglomerate into a respected international building materials group. “In that time, EPS growth has averaged 22% p.a. compound, EBIT has doubled and return on equity has risen from 6.1% in 1997 to the 14.3% we announced today,” said Mr Morschel. “On behalf of the Board, I would like to thank him for his enormous contribution and wish him all the best for the future post the demerger.”

CSR Limited ABN 90 000 001 276. Corporate and Investor Relations Group

Level 3, 9 Help Street, Chatswood NSW 2067, Locked Bag 6, Chatswood NSW 2057, Australia

Telephone (02) 9235 8171 Facsimile (02) 9235 8140 E-mail investorrelations@csr.com.au

All current CSR group non-executive directors are expected to join the boards of one or other of the two companies. Mr Morschel will become chairman of Rinker Group. Ian Blackburne, currently a CSR non-executive director and former CEO and managing director of Caltex Australia, will become CSR chairman.

Mr Kirby said that subject to the necessary approvals as outlined above, the demerger should be concluded prior to the middle of next year. “We are confident that a demerger will add further value for our shareholders, although we recognize that the nature of demergers is such that this may take time to be realized,” he said.

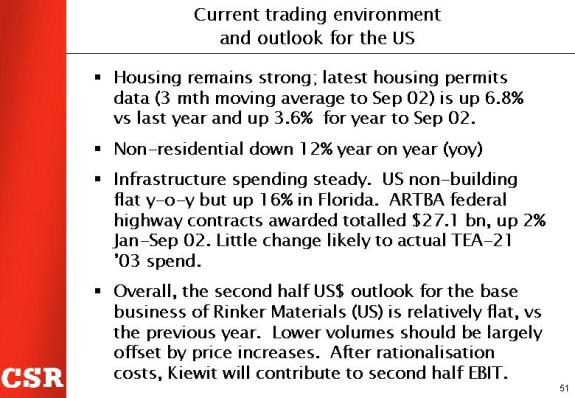

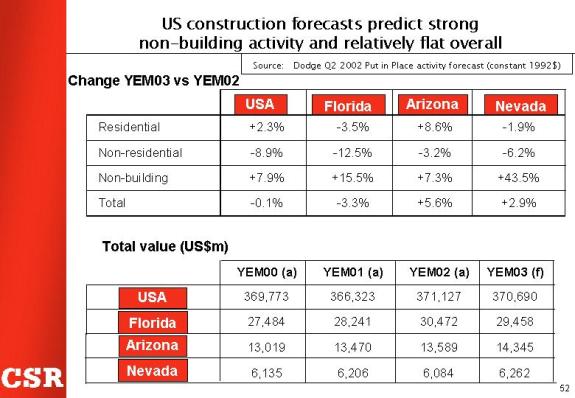

Outlook for the second half

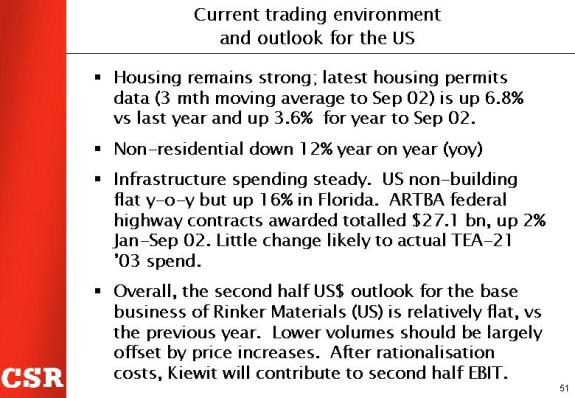

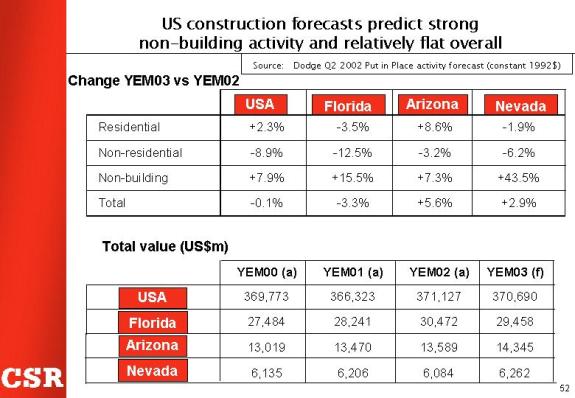

There are indications that the US economy is bottoming. However, the short term outlook is for a further softening. Overall, US construction activity for calendar 2003 is forecast to be down about 1.1%, according to the US economic forecaster McGraw Hill Construction–Dodge.

Rinker is expecting an improved second half, compared with the previous year, due to the addition of Kiewit. The base business is expected to be relatively flat. The exposure to the high growth southern states and strong road spending under the federal TEA-21 program should help offset declining non-residential activity. Price increases for aggregate and concrete are forecast to be slightly ahead of inflation. Rinker’s short-term focus is on bedding down the important Kiewit acquisition.

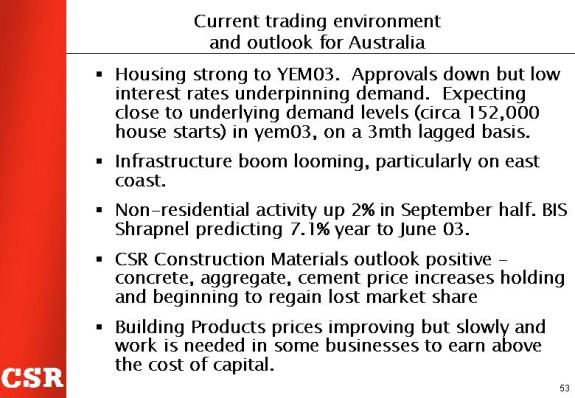

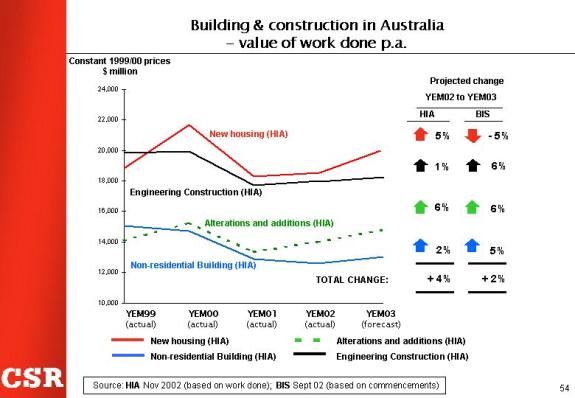

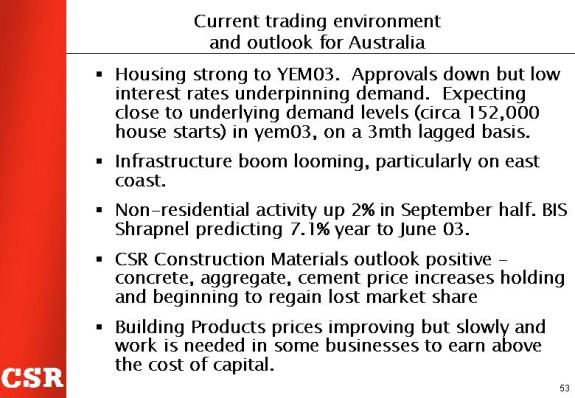

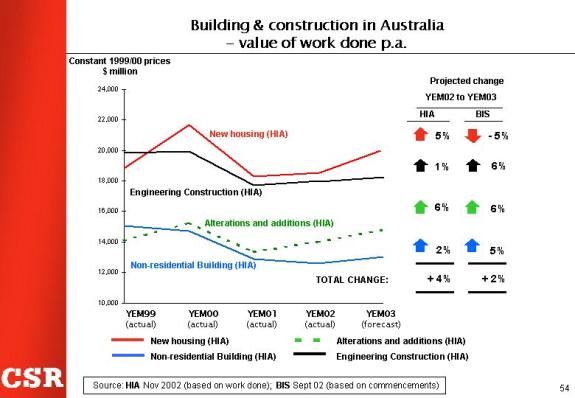

In Australia, BIS Shrapnel forecasts a 2% increase in total construction during the year to March 2003. Commercial activity is expected to improve, with housing declining in the second half in line with lower approvals. We expect housing starts over the year to be around 142,000, from 152,000 last year.

The developing boom in Australian engineering construction is expected to benefit Construction Materials. Major projects are currently being tendered, although commencement is not generally expected during the current year. Further price increases are being implemented.

Around 74% of Building Products’ sales are related to housing but the business should also benefit from any uplift in commercial activity, which represents 21% of sales. We expect the result to be ahead of YEM02.

Aluminium profit should be slightly above last year, due to hedging of both the currency and the metal price.

Sugar prices are now at a 14-month high, but with much of the current season’s crop already priced at lower levels, it will have a limited impact on current year results. Crop volumes are up over 15% on YEM02. These factors are expected to at least offset the usual small loss in the second half due to seasonal factors. Low cost growth initiatives are also underway to improve the overall stability of returns.

“The CSR group has lifted its forecasts for the current year’s trading profit. We now expect a small improvement over last year’s underlying earnings – that is, excluding demerger costs and the A$41 million one-off tax refund benefit. Kiewit is not expected to contribute to after-tax profit this year after goodwill charges, but it is contributing as expected to EBIT. However we are cautiously optimistic that the improvement in Construction Materials, ongoing work to lift the base business performance across the group and further operational improvement cost savings will offset the effects of a higher A$, low sugar prices, and the expected softening in US construction.

“Our priorities will be the successful implementation of the demerger, to further improve the performance of the base business and to pursue value-adding, bolt-on growth opportunities as they arise. As always, our commitment remains to further deliver value for our shareholders, and it is our expectation that we will continue to do so in the year ahead.”

For further information, please call Peter Kirby on 61 2 9235 8095 or Debra Stirling on 61 2 9235 8040 or 0419 476 546

19 NOVEMBER 2002 | | C&IR 04/03 |

CSR Limited ABN 90 000 001 276. Corporate and Investor Relations Group

Level 3, 9 Help Street, Chatswood NSW 2067, Locked Bag 6, Chatswood NSW 2057, Australia

Telephone (02) 9235 8171 Facsimile (02) 9235 8140 E-mail investorrelations@csr.com.au

CSR half yearly report

for the six months ended 30 September 2002

Contents

Review of Operations

Company overview

Operating profit after tax (PAT) for the half year ended 30 September 2002 was A$319.4 million, up 15.3% on the previous corresponding period. Earnings per share rose 17.2% to 34.1 cents.

Earnings before interest and tax (EBIT) was up 5.3% to A$541 million. Trading revenue was down 2.0% to A$3,638 million. EBIT/sales margins rose from 13.8% to 14.9%. Excluding the impact of a higher Australian dollar on US$ earnings, EBIT was up 10.5% and revenue was up 2.6%.

Other half year highlights included:

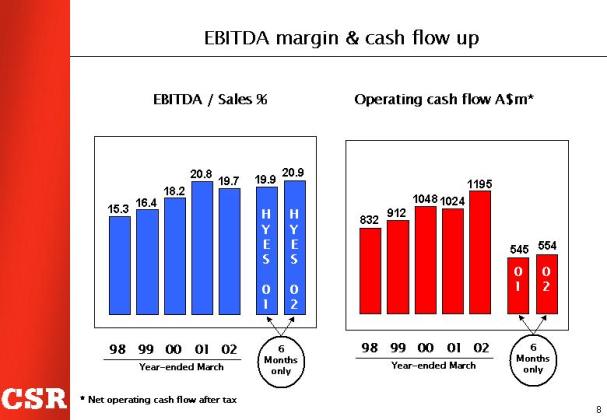

• Earnings before interest, tax, depreciation and amortisation (EBITDA) rose 3% to A$761 million

• EBITDA/sales rose from 19.9% to 20.9%

• Net operating cash flow rose 2% to A$554 million

• Free cash flow* rose 33% to A$479 million

• Return on funds employed (ROFE)** # rose from 14.5% to 17%

• Return on equity (ROE) # rose from 12.7% to 14.3%

Shareholder value added was again positive and up significantly on the previous year.

This result reflects the strength of the group’s market positions and the work done on improving base businesses. Rinker’s position in Florida, and in high growth southern US states, helped offset the impact of a weak non-residential sector which hit the concrete pipe and products business particularly hard. In Australia, improvements in Construction Materials, bricks and roofing, and the downstream sugar businesses, also contributed strongly.

The heavy building materials businesses performed well, contributing 70% of CSR group EBIT. The US subsidiary, Rinker Materials Corporation (“Rinker”) delivered another solid result, with EBIT up 3% to US$176 million, although the stronger Australian dollar meant A$ EBIT fell 5% to A$320 million. Despite a tougher economic environment, all the major Rinker segments lifted US$ EBIT, apart from Concrete Pipe & Products. Construction Materials (Australia & Asia) delivered a very strong 81% increase EBIT, to A$59 million, due to improved margin management and operational improvement cost savings.

Building Products (Australia, NZ & Asia) EBIT was up 32% to A$63 million, helped by strong domestic housing activity. Aluminium EBIT rose 11% to A$61 million due mainly to lower costs. Sugar EBIT fell 25% on lower world prices, which impacted the milling business - although EBIT from the downstream businesses – mainly sugar refining and ethanol - rose 28%.

Financial position

The group’s balance sheet remained very strong with net debt at end September of A$2,311 million, following the acquisition of Kiewit Materials Company, up from A$2,130 million a year earlier. Gearing (net debt / net debt plus equity) was 35.2% from 34.0%. Interest cover was 11.8 times, up from 8.0 times.

Directors declared an unchanged interim dividend of 11 cents per share, payable on 16 December. Franking increased to 70%, from 40% for the previous interim dividend.

Overview

Rinker’s US acquisitions are performing well overall - in line with expectations and ahead of the weighted average cost of capital. Integration of the Arizona-based Kiewit, acquired in late September, is proceeding to schedule and earnings expectations have been affirmed. Operational improvement measures are well underway as part of the post-acquisition management plan.

* EBITDA after deducting tax and net interest paid, operating capital and change in working capital

** Excluding acquisition of Kiewit Materials Company, acquired 26 September 2002 # on a 12 month basis

In Australia, internal initiatives to improve margin management and customer service in Construction Materials significantly lifted profit. The business is improving but it is still not earning its cost of capital. Further price increases were implemented in October.

Building Products benefited from the lift in residential housing in Australia. The lag effect seen earlier this year, attributed to issues with the availability of home warranty insurance, has largely been resolved. Bricks and roofing introduced several initiatives to lift profits, including lower production costs and price increases.

Sugar was impacted by the decline in world prices, but this was partly offset by the improvement in refining. The ethanol business is poised to benefit from any moves to encourage the use of environmentally-friendly motor fuels. CSR Distilleries is supplying BP’s successful ethanol trial in Brisbane, where motorists have responded very favourably to the 10% ethanol fuel blend. The prospects in this area look optimistic. The sugar industry meanwhile is working together on a major restructuring and efficiency program to help restore Australia’s productivity advantages over other sugar producers.

Business Performance

• Rinker sales rose 4% to US$1,119 million. EBITDA was up 4% to US$256 million. US$ EBITDA/sales margins increased slightly to 22.9%. US$ ROFE for the 12 months to September was 16.9% from 15.6%. Comparable $US sales (adjusted for acquisitions and divestments in the year to September) rose 3% and EBIT rose 1%.

Price increases ranged from marginal to 5.0%. Volumes rose in all major businesses except Concrete Pipe & Products:

• Aggregates EBIT US$56 million, up 24%. Volumes up 19%.

• Concrete, Block & Asphalt EBIT US$37 million, up 5%. Concrete volumes up 8%.

• Cement EBIT US$42 million, up 11%. Volumes up 2%.

• Concrete Pipe & Products EBIT US$41 million, down 24%. Volumes down 8%. The business was impacted by the substantial fall in non-residential building.

Gypsum Supply profit increased 9% on increased volumes. The small Polypipe and Prestress businesses also continued to suffer from the non-residential construction downturn. Prestress EBIT was breakeven. The pipeline rehabilitation business was sold during the half.

• Construction Materials EBIT rose 81% on an 8% lift in sales. ROFE (12 month basis) was 11.1% from 4.7%. EBITDA/sales margin was 15.9%, up from 11.9%. The Tianjin Readymix quarry and concrete business in China continued to improve.

• Building Products EBIT was up 32% on a 17% lift in sales. ROFE (12 months basis) was 19.5%. EBITDA/sales margin was 17.3% from 16.2%. Installation of the SAP computer system was completed in plasterboard and insulation. Production started at the new roof tile plant at Rosehill, Sydney.

• Aluminium EBIT was A$61 million, up 11%. Aluminium prices were 7% lower on average and the A$ was stronger but profits were underpinned by hedging and lower alumina costs.

• Sugar EBIT fell 25% to A$59 million. Average raw sugar prices were down 27%. Harvested cane volumes were up 10%. Distilleries EBIT was down due to lower fertiliser sales as a result of the drought but export sales were stronger. Refining EBIT was A$12 million, up from A$7 million.

Strategy & demerger proposal

Almost three quarters of CSR group EBIT now comes from heavy building materials (primarily aggregates, premix concrete, cement and concrete pipe & products). Group strategy since 1998 has been to grow internationally in this sector, whilst concurrently working to separate the remaining assets, in a way that has delivered value for shareholders.

The logical next step in the strategy is to complete the separation of the heavy building materials assets through a demerger.

2

For some time now CSR has been carefully examining the various separation options. The company expects that a demerger will be the best option for shareholders. The new demerger legislation means that this can be done without shareholders incurring substantial tax penalties. Accordingly CSR is moving forward with a demerger proposal which would involve splitting the group into two listed Australian companies. CSR’s due diligence process is continuing, with the aim of putting a demerger proposal to shareholders, which would take effect in the first half of next year.

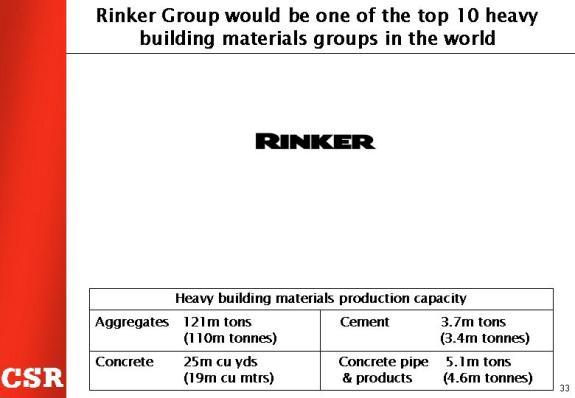

The demerger would mean the formation of a focused, heavy building materials group – Rinker Group Ltd (“Rinker Group”). It would be spun off from CSR Limited and would comprise US subsidiary Rinker Materials Corporation and the Readymix and Humes businesses (Australia & Asia).

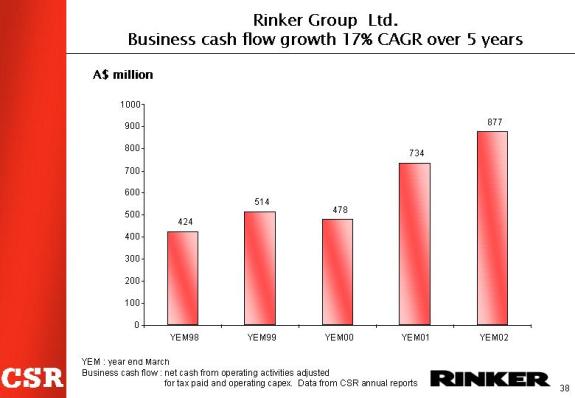

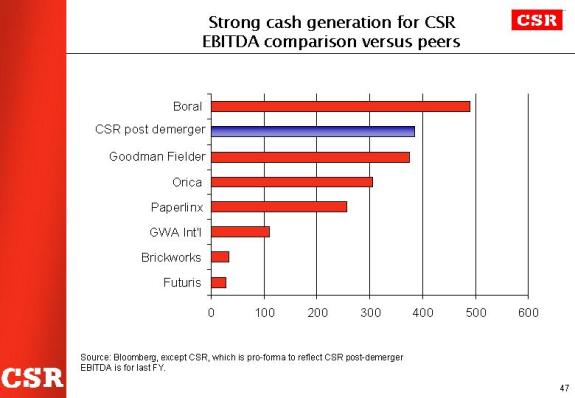

Based on historical performance, both Rinker Group and CSR would have substantial free cash flows. Both companies are expected to receive investment grade credit ratings and to be listed in the ASX Top 50 and Top 100 stocks respectively.

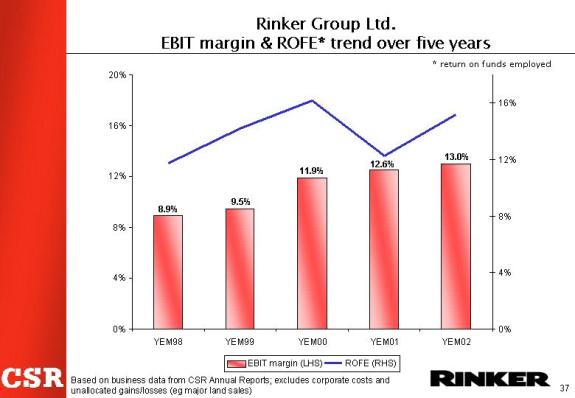

Rinker Group would be one of the top 10 heavy building materials stocks in the world and a disciplined, top quartile performer in its sector. Rinker Group is expected to be a growth stock - able to participate more effectively in the global consolidation of the industry. With around 85% of earnings from Rinker Materials in the US, over time we would expect it to be re-rated by investors, more in line with its US peers.

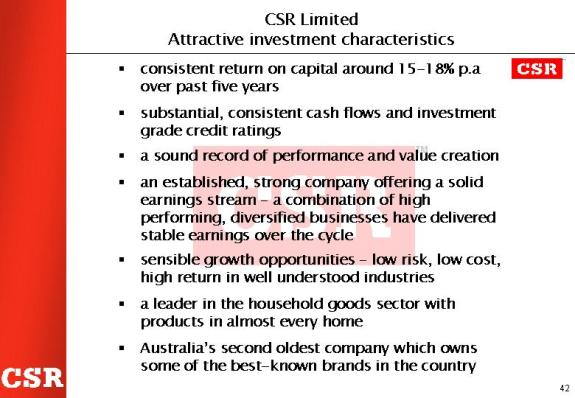

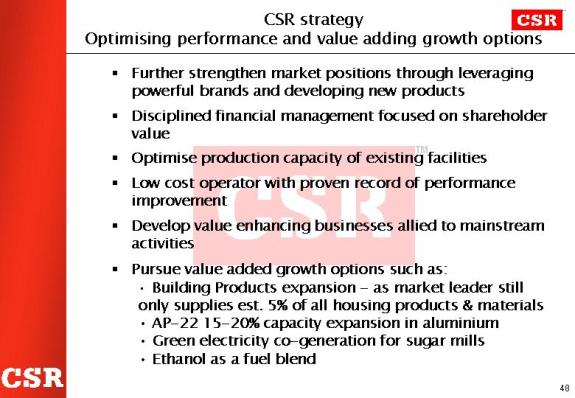

CSR Limited would return to its roots as a diversified, Australian company, holding some of the strongest and best-known household brands in the country. It will be comprised of three businesses - CSR Building Products, Aluminium and CSR Sugar, each of which is a leader in its industry. Both Building Products and Sugar have long term performance records which rank them leaders in their respective Australian industries, while Aluminium has delivered returns well above its cost of capital for many years.

A demerger will allow these businesses to focus more effectively on their respective strengths and to pursue value-adding, low risk growth options which have previously ranked as a lesser priority for the CSR group.

CSR Limited is expected to be a highly franked stock appealing to yield driven investors. It has been a strong generator of cash and of shareholder value – that is, earning above its cost of capital.

A demerger will facilitate choice for the different types of shareholders – that is, those who prefer Rinker Group’s growth characteristics and those who prefer CSR’s higher, franked yields. It is expected that both companies will be well-regarded and prove attractive to these respective shareholders.

Managing director Peter Kirby will lead the company through the demerger process. Upon completion of the demerger, he will hand over his role to David Clarke, current chief executive of Rinker Materials and Alec Brennan, currently CSR group deputy managing director, who will become chief executive of Rinker Group and CSR Limited respectively.

CSR group chairman John Morschel said Mr Kirby would then remain with the group for up to four months as an advisor, to assist in the critical phase of demerger implementation.

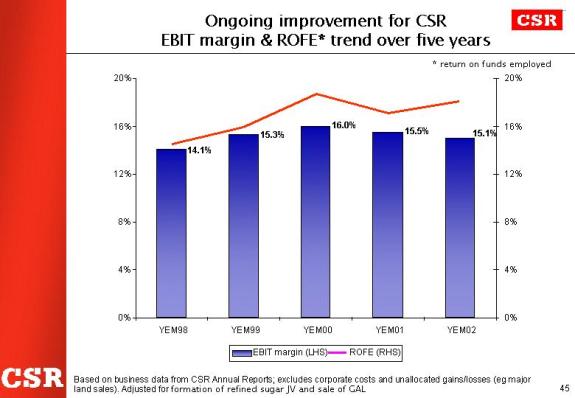

Since joining the company in January 1998, Mr Kirby has played the key role in transforming the CSR group from a poorly-regarded Australian conglomerate into a respected international building materials group. In that time, EPS growth has averaged 22% p.a. compound, EBIT has doubled and return on equity has risen from 6.1% in 1997 to the current rate of 14.3%.

All current CSR group non-executive directors are expected to join the boards of one or other of the two companies. Mr Morschel will become chairman of Rinker Group. Ian Blackburne, currently a CSR non-executive director and former CEO and managing director of Caltex Australia , will become CSR chairman.

Subject to the necessary approvals as outlined above, the demerger should be concluded prior to the middle of next year.

3

Outlook for the second half

There are indications that the US economy is bottoming. However, the short term outlook is for a further softening. Overall, US construction activity for calendar 2003 is forecast to be down about 1.1%, according to the US economic forecaster McGraw Hill Construction–Dodge.

Rinker is expecting an improved second half, compared with the previous year, due to the addition of Kiewit. The base business is expected to be relatively flat. The exposure to the high growth southern states and strong road spending under the federal TEA-21 program should help offset declining non-residential activity. Price increases for aggregate and concrete are forecast to be slightly ahead of inflation. Rinker’s short-term focus is on bedding down the important Kiewit acquisition.

In Australia, BIS Shrapnel forecasts a 2% increase in total construction during the year to March 2003. Commercial activity is expected to improve, with housing declining in the second half in line with lower approvals. Housing starts over the year are expected to be around 142,000, from 152,000 last year.

The developing boom in Australian engineering construction is expected to benefit Construction Materials. Major projects are currently being tendered, although commencement is not generally expected during the current year. Further price increases are being implemented.

Around 74% of Building Products’ sales are related to housing but the business should also benefit from any uplift in commercial activity, which represents 21% of sales. The result should be ahead of the last financial year.

Aluminium profit should be slightly above last year, due to hedging of both the currency and the metal price.

Sugar prices are now at a 14-month high, but with much of the current season’s crop already priced at lower levels, it will have a limited impact on current year results. Crop volumes are up over 15% on the last financial year. These factors are expected to at least offset the usual small loss in the second half due to seasonal factors. Low cost growth initiatives are also underway to improve the overall stability of returns.

The CSR group has lifted its forecasts for the current year’s trading profit. There is now a small improvement expected over last year’s underlying earnings – that is, excluding demerger costs and the A$41 million one-off tax refund benefit. Kiewit is not expected to contribute to after-tax profit this year after goodwill charges, but it is contributing as expected to EBIT. However CSR is cautiously optimistic that the improvement in Construction Materials, ongoing work to lift the base business performance across the group and further operational improvement cost savings will offset the effects of a higher A$, low sugar prices, and the expected softening in US construction.

The group’s priority will be the successful implementation of the demerger, to further improve the performance of the base business and to pursue value-adding, bolt-on growth opportunities as they arise. The commitment remains to further deliver value for shareholders, and it is expected that the group will continue to so in the year ahead.

4

Operations summary

Rinker Materials Corporation

United States of America

Performance summary

• Trading revenue A$2,030 million, down 4% (US$1,119 million, up 4%). Results in $A adversely impacted by exchange rate movements.

• Earnings before interest and tax (EBIT) A$320 million, down 5% (US$176 million, up 3%).

• Earnings before interest, tax, depreciation and amortisation (EBITDA) A$464 million, down 4% (US$256 million, up 4%).

• Profit margin (EBIT/trading revenue) 15.7%, down from 15.8%.

Features

• Federal infrastructure spending and residential construction increased, largely offsetting a significant downturn in commercial construction.

• Rinker successfully completed the US$540 million acquisition of Kiewit Materials Company, a major integrated aggregate, concrete and asphalt company which has the leading market position in Arizona and excellent opportunities for further growth.

• Costs were reduced through ongoing operational improvements, although insurance, health and pension costs increased.

• The commissioning of Rinker’s third new highly-automated large scale concrete pipe plant – in Houston, Texas – reduced costs, replacing less efficient operations.

Business strategy

• To be a leading supplier of materials for the building and construction industry in North America with a particular focus on heavy building materials, growing in selected geographic markets.

• Key objectives

• Growth, by improving the underlying businesses and through acquisition

• Being number 1 or 2 in all our regional markets

• Overall cost leadership

• Aggressive downturn management

• Finding and keeping talented people, with a high performance ethic

• Providing a safe and environmentally sound workplace.

Progress against priorities

• Grow through bolt-on acquisitions and, if opportunities present, major acquisitions; investigate new geographic markets: In September, Rinker acquired Kiewit Materials Company.

• Reduce costs through operational improvement: Operational cost savings totalled A$33 million.

• Improve safety and environment performance: Lost time injury and medical treatment injury frequency rates, and environmental incidents, fell.

Construction Materials

Australia and Asia

Performance summary

• Trading revenue A$512 million, up 8%.

• EBIT A$59 million, up 81%.

• EBITDA A$82 million, up 44%.

• Profit margin 11.4%, up from 6.8%.

5

Features

• Activity levels improved in the housing, commercial and civil construction sectors.

• Price increases introduced earlier this year helped to lift profit margins.

• Improved operational efficiencies reduced costs across the business.

Business strategy

• To ensure that the business is earning above its cost of capital at all stages of the construction cycle.

• To improve customer service, logistics, production capacity, and to be the supplier of choice.

• To develop incremental, value-adding growth opportunities in Australia and China.

Progress against priorities

• Restore profit levels above the cost of capital. More disciplined management of profit margins. Lift prices: Price increases in concrete and quarries helped lift profit levels. The business is improving but is still not earning its cost of capital.

• Localise the businesses, focusing on customers: We have localised the business by reorganising it into 62 cells or business units. Cell managers are now much more accountable for results in their businesses.

• Improve safety and environment performance: The lost time injury frequency rate increased, although medical treatment injury frequency rates decreased. Environmental incidents fell.

Building Products

Australia, New Zealand and Asia

Performance summary

• Trading revenue A$462 million, up 17%.

• EBIT A$63 million, up 32%.

• EBITDA A$80 million, up 25%.

• Profit margin 13.7%, up from 12.1%.

Features

• Returns improved in line with stronger activity in the new homes, alterations and commercial construction sectors.

• Competitive conditions continued, although there are some signs of prices in our markets increasing.

• SAP computer systems are being installed across all businesses.

• We are investing in e-commerce to enable customers to efficiently access product and accounts data.

• Business renamed from Building Materials to better reflect its market focus.

Business strategy

• Provide high quality, price competitive products to the building industry, utilising our customer-focused channels of distribution.

• Improve efficiencies and output to meet growth in market demand, while introducing innovative new products in all businesses.

• Search for value-adding growth opportunities in Australia and Asia.

Progress against priorities

• Increase effectiveness of our sales force and servicing of our customers: Each business has focused on sales planning and margin analysis. They are also identifying opportunities to cross sell products to customers.

• Closely manage pricing, while maintaining market share: Each business has implemented pricing strategies, very closely monitored by the management team.

• Tightly control operating capital: Operating capital continued to be controlled tightly.

• Improve safety and environment performance: The lost time injury frequency rate increased, although medical treatment injury frequency rates fell. Environmental incidents remain at low levels.

6

Sugar

Australia and New Zealand

Performance summary

• Trading revenue A$420 million, down 17%.

• EBIT A$59 million, down 25%.

• EBITDA A$ 77 million, down 21%.

• Profit margin 14.1%, down from 15.7%.

Features

• Returns declined with a significant decrease in world sugar prices, relative to the previous corresponding period. This impacts on expected Queensland Sugar Limited pool prices.

• CSR milled 9.6 million tonnes of sugar cane (up 10%), producing 1.4 million tonnes of sugar (up 9%).

• The refined sugar business (50% CSR) improved, due to higher sales volumes and profit margins. Ethanol returns fell slightly, due to higher molasses prices and lower fertiliser volumes.

• CSR is actively monitoring the current debate on ethanol as a fuel extender. We are well placed to take advantage of opportunities that may arise, depending on the outcome of the current government review.

Business strategy

To create value for all stakeholders by reshaping the Australian sugar industry, which will be achieved through:

• creating a high performance way of doing things across the industry structure in our mill regions (including effective regional industry boards)

• driving a sugarcane productivity initiative that will deliver a 20% sustainable improvement in sugar yield, involving working with growers, harvesters and others to optimise harvesting and sugarcane transport systems

• pursuing growth opportunities – particularly in green energy such as increased electricity cogeneration and the use of ethanol as a fuel extender.

Progress against priorities

• Obtain commitment and cooperation from others in the Australian sugar industry for productivity initiatives: Regional industry boards have been established. The productivity initiative is being implemented.

• Get renewable energy projects under way: Progress is being made on various opportunities for energy initiatives. Potential ethanol projects require regulatory clarification.

• Improve safety and environment performance: Lost time injury and medical treatment injury frequency rates decreased. Environmental incidents also fell.

Aluminium

Australia

Performance summary

• Trading revenue was A$215 million, down 3%.

• EBIT A$61 million, up 11%.

• EBITDA A$72 million, up 9%.

• Profit margin 28.5%, up from 24.9%.

Features

• Value added billet and slab sales increased by 15% over the corresponding period last year.

• Demand for aluminium increased in line with slow growth in the global economy, but continuing production surplus weighed on the world price.

• The world price of aluminium averaged US$1,353 a tonne over the half year, down 7% on the previous corresponding period.

7

• A project to expand production capacity of the Tomago smelter by 15% commenced. Gove Aluminium Finance (GAF; CSR 70%) has an option to participate in this project, which has a low investment cost per tonne of additional annual capacity.

Business strategy

• Focus on operational improvements aimed at productivity, cost reduction and revenue enhancement.

• Continue to sell all of GAF’s share of production from the Tomago smelter, principally to long term customers in Japan and other Asian countries.

• Continue to hedge to reduce GAF’s exposures to movements in the world aluminium price and to movements in the US$:A$ exchange rate.

Progress against priorities

• Continue to manage CSR’s aluminium investment to achieve the best outcome for shareholders: The business has performed well in a period of low world aluminium prices.

• Continue to hedge the world market aluminium price and US$ revenue: Hedging continues to provide a base level of profitability and to reduce volatility of earnings.

8

Directors of CSR Limited

Directors of CSR Limited at any time during the half-year ended 30 September 2002, or since that date, are shown below. Unless otherwise stated, they have each been a director from 1 April 2002, up to and including the date of this report.

John Arthur, John Ballard, Ian Blackburne, Alec Brennan, David Clarke, Carolyn Hewson, Peter Kirby, John Morschel, and John Wylie.

Signed in accordance with a resolution of the directors.

Peter Kirby

Managing director

Sydney, 19 November 2002

9

Financial performance summary

Half-year ended 30 September (A$ million unless indicated) | | 2002 | | 2001 | | % change | |

| | | | | | | |

For the half-year | | | | | | | |

| | | | | | | |

Total revenue | | 3725.0 | | 3771.9 | | -1 | |

| | | | | | | |

Trading revenue | | 3638.4 | | 3711.8 | | -2 | |

| | | | | | | |

Profit from ordinary activities before finance, and income tax (EBIT) | | 541.0 | | 513.9 | | 5 | |

| | | | | | | |

Profit from ordinary activities before finance, income tax, and depreciation & amortisation (EBITDA) | | 761.2 | | 739.0 | | 3 | |

| | | | | | | |

Net profit | | 319.4 | | 277.0 | | 15 | |

| | | | | | | |

Net cash from operating activities | | 554.1 | | 545.4 | | 2 | |

| | | | | | | |

Capital investment | | 1142.3 | | 278.0 | | 311 | |

| | | | | | | |

Per share [A cents] | | | | | | | |

| | | | | | | |

Earnings | | 34.1 | | 29.1 | | 17 | |

| | | | | | | |

Dividend (declared) | | 11.0 | | 11.0 | | — | |

| | | | | | | |

Key measures | | | | | | | |

| | | | | | | |

EBIT/Trading revenue [%] | | 14.9 | | 13.8 | | | |

| | | | | | | |

Return on funds employed (excluding Kiewit) [%] (last twelve months) | | 17.0 | | 14.5 | | | |

| | | | | | | |

Interest cover [times] | | 11.8 | | 8.0 | | | |

| | | | | | | |

Gearing at 30 September (including Kiewit acquisition) | | | | | | | |

| | | | | | | |

Net debt: equity plus net debt [%] | | 35.2 | | 34.0 | | | |

| | | | | | | |

Net debt: equity [%] | | 54.3 | | 51.4 | | | |

10

Australian Stock Exchange Limited

Half yearly report

CSR Limited

ABN 90 000 001 276

For the half-year ended 30 September 2002

For announcement to the market

Item | | | | | | A$ million | |

| | | | | | | |

1.1 | | Revenues from ordinary activities | | down 1% to | | 3725.0 | |

| | | | | | | |

1.22 | | Profit from ordinary activities after tax attributable to members | | up 15% to | | 319.4 | |

| | | | | | | |

2.5(d) | | Profit from extraordinary items after tax attributable to members | | | | — | |

| | | | | | | |

1.11 | | Net profit attributable to members | | up 15% to | | 319.4 | |

| | | | | | | |

| | Interim dividend per share: | | | | | |

15.6 | | Current half-year | | 11 cents | | (seventy percent franked at 30% tax rate) | |

| | | | | | | |

15.7 | | Previous corresponding half-year | | 11 cents | | (forty percent franked at 30% tax rate) | |

| | | | | | | |

15.2 | | Registrable transfers received by 29 November 2002 up to the times specified in the Listing Rules and SCH Business Rules will be registered before entitlements to the dividend are determined. | | | | | |

This half yearly report should be read in conjunction with the financial report for the year ended 31 March 2002.

11

Consolidated statement of financial performance

Half-year ended 30 September (A$ million) | | 2002 | | 2001 | |

| | | | | |

1.1 | | Revenues from ordinary activities | | 3725.0 | | 3771.9 | |

| | | | | | | |

1.2 | | Expenses from ordinary activities | | (3207.1 | ) | (3272.0 | ) |

| | | | | | | |

1.3 | | Borrowing costs | | (54.9 | ) | (70.2 | ) |

| | | | | | | |

1.4 | | Share of associate entities net profit [see item 16.7] | | 28.9 | | 21.4 | |

| | | | | | | |

1.5 | | Profit from ordinary activities before income tax | | 491.9 | | 451.1 | |

| | | | | | | |

1.6 | | Income tax on ordinary activities | | 159.6 | | 162.9 | |

| | | | | | | |

1.7 | | Profit from ordinary activities after income tax | | 332.3 | | 288.2 | |

| | | | | | | |

1.8 | | Profit from extraordinary items after income tax | | — | | — | |

| | | | | | | |

1.9 | | Net profit | | 332.3 | | 288.2 | |

| | | | | | | |

1.10 | | Net profit attributable to outside equity interests | | 12.9 | | 11.2 | |

| | | | | | | |

1.11 | | Net profit attributable to members | | 319.4 | | 277.0 | |

| | | | | | | |

| | Non-Owner Transaction Changes in Equity | | | | | |

| | | | | | | |

1.12 | | Increase (decrease) in revaluation reserves | | — | | — | |

| | | | | | | |

1.13 | | Net exchange differences recognised in equity | | (43.0 | ) | 32.7 | |

| | | | | | | |

1.14 | | Other revenue, expense and initial adjustments recognised directly in equity | | — | | — | |

| | | | | | | |

1.15 | | Adjustment from AASB 1044 transitional provisions (refer page 23) | | (143.7 | ) | — | |

| | | | | | | |

1.16 | | Total transactions and adjustments recognised directly in equity (item 1.12 to 1.15) | | (186.7 | ) | 32.7 | |

| | | | | | | |

1.17 | | Total changes in equity not resulting from transactions with owners as owners | | 132.7 | | 309.7 | |

| | | | | | | |

| | Earnings per security [A cents] | | | | | |

| | | | | | | |

1.18 | | Basic EPS | | 34.1 | | 29.1 | |

| | | | | | | |

1.19 | | Diluted EPS | | 34.0 | | 28.9 | |

| | | | | | | |

| | Total interest expense | | 51.5 | | 72.1 | |

| | | | | | | |

| | Less capitalised interest (item 1.28) | | — | | (1.2 | ) |

| | | | | | | |

| | Funding costs | | 2.2 | | 1.3 | |

| | | | | | | |

| | Foreign exchange loss (gain) | | 1.2 | | (2.0 | ) |

| | | | | | | |

| | Borrowing costs (item 1.3) | | 54.9 | | 70.2 | |

| | | | | | | |

| | Interest income (item 1.24) | | (5.8 | ) | (7.4 | ) |

| | | | | | | |

| | Net finance expense | | 49.1 | | 62.8 | |

12

Half-year ended 30 September (A$ million) | | 2002 | | 2001 | | % change | |

| | | | | | | | | |

| | Profit from ordinary activities attributable to members | | | | | | | |

| | | | | | | | | |

1.20 | | Profit from ordinary activities after income tax (item 1.7) | | 332.3 | | 288.2 | | 15 | |

| | | | | | | | | |

1.21 | | Less outside equity interests | | 12.9 | | 11.2 | | 15 | |

| | | | | | | | | |

1.22 | | Profit from ordinary activities after tax, attributable to members | | 319.4 | | 277.0 | | 15 | |

| | | | | | | | | |

| | Revenues and Expenses from ordinary activities | | | | | | | |

| | | | | | | | | |

1.23 | | Revenue from sales or services | | 3638.4 | | 3711.8 | | -2 | |

| | | | | | | | | |

1.24 | | Interest revenue | | 5.8 | | 7.4 | | -22 | |

| | | | | | | | | |

1.25 | | Other revenue | | 80.8 | | 52.7 | | 53 | |

| | | | | | | | | |

1.26 | | Details of relevant expenses | | | | | | | |

| | Cost of sales | | (2281.6 | ) | (2368.7 | ) | -4 | |

| | Warehouse and distribution costs | | (508.7 | ) | (495.9 | ) | 3 | |

| | Selling costs | | (104.5 | ) | (95.1 | ) | 10 | |

| | Administration and other costs | | (272.6 | ) | (275.0 | ) | -1 | |

| | Other expenses (non trading) | | (39.7 | ) | (37.3 | ) | 6 | |

| | | | | | | | | |

| | Included in above is total depreciation and amortisation of | | (220.2 | ) | (225.1 | ) | -2 | |

| | | | | | | | | |

1.27 | | Depreciation and amortisation excluding amortisation of intangibles (see item 2.1 and 2.2) | | (180.5 | ) | (182.8 | ) | -1 | |

| | | | | | | | | |

| | Capitalised Outlays | | | | | | | |

| | | | | | | | | |

1.28 | | Borrowing costs capitalised in asset values | | — | | 1.2 | | -100 | |

| | | | | | | | | |

1.29 | | Outlays capitalised in intangibles (unless arising from an acquisition of a business) | | — | | — | | — | |

| | | | | | | | | |

| | Consolidated Retained Profits | | | | | | | |

| | | | | | | | | |

1.30 | | Retained profits at the beginning of the financial period | | 1602.3 | | 1273.9 | | 26 | |

| | | | | | | | | |

1.31 | | Net profit attributable to members (item 1.11) | | 319.4 | | 277.0 | | 15 | |

| | | | | | | | | |

1.32 | | Net transfers to reserves | | (2.7 | ) | — | | | |

| | | | | | | | | |

1.33 | | Net effect of adoption of AASB1044 – product liability | | (143.7 | ) | — | | | |

| | | | | | | | | |

1.33 | | Net effect of adoption of AASB1044 – dividend provision | | 121.7 | | — | | | |

| | | | | | | | | |

1.34 | | Dividends paid | | (121.8 | ) | (102.6 | ) | 19 | |

| | | | | | | | | |

1.35 | | Retained profits at 30 September | | 1775.2 | | 1448.3 | | 23 | |

| | | | | | | | | |

| | Intangible and extraordinary items | | | | | | | |

| | | | | | | | | |

2.1 | | Amortisation of goodwill | | 34.7 | | 36.9 | | -6 | |

| | | | | | | | | |

| | less income tax expense | | 5.2 | | 6.0 | | -13 | |

| | | | | | | | | |

| | less outside equity interests | | — | | — | | | |

| | | | | | | | | |

| | Net amortisation of goodwill | | 29.5 | | 30.9 | | -5 | |

| | | | | | | | | |

2.2 | | Amortisation of other intangibles | | 5.0 | | 5.4 | | -7 | |

| | | | | | | | | |

| | less income tax expense | | 1.7 | | 1.8 | | -6 | |

| | | | | | | | | |

| | less outside equity interests | | — | | — | | | |

| | | | | | | | | |

| | Net amortisation of other intangibles | | 3.3 | | 3.6 | | -8 | |

| | | | | | | | | |

2.3 | | Total net amortisation of intangibles | | 32.8 | | 34.5 | | -5 | |

| | | | | | | | | |

2.4/2.5 | | Total extraordinary items for half-years ended 30 September 2002 and 2001 are nil. | | | | | | | |

| | | | | | | | | |

3 | | Not applicable | | | | | | | |

13

Consolidated statement of financial position

| | (A$ million) | | As at

30 September 2002 | | As at

31 March 2002 | | As at

30 September 2001 | |

| | | | | | | | | |

| | Current assets | | | | | | | |

4.1 | | Cash | | 166.6 | | 156.6 | | 213.7 | |

4.2 | | Receivables | | 1244.7 | | 988.0 | | 1206.5 | |

4.4 | | Inventories | | 582.7 | | 572.5 | | 632.4 | |

4.6 | | Other current assets | | 40.5 | | 25.5 | | 38.3 | |

| | | | | | | | | |

4.7 | | Total current assets | | 2034.5 | | 1742.6 | | 2090.9 | |

| | | | | | | | | |

| | Non-current assets | | | | | | | |

4.8 | | Receivables | | 46.8 | | 50.9 | | 54.8 | |

4.9 | | Investments accounted for using the equity method | | 332.4 | | 316.6 | | 320.6 | |

4.10 | | Other financial assets | | 45.3 | | 40.2 | | 89.9 | |

4.11 | | Inventories | | 129.0 | | 129.2 | | 114.5 | |

4.14 | | Property, plant and equipment (net) | | 4294.1 | | 4137.9 | | 4352.6 | |

4.15 | | Intangibles (net) | | 1737.1 | | 1111.6 | | 1223.7 | |

4.16 | | Deferred income tax assets | | 321.7 | | 283.0 | | 329.5 | |

4.17 | | Other non-current assets | | 145.1 | | 138.7 | | 135.5 | |

| | | | | | | | | |

4.18 | | Total non-current assets | | 7051.5 | | 6208.1 | | 6621.1 | |

| | | | | | | | | |

4.19 | | Total assets | | 9086.0 | | 7950.7 | | 8712.0 | |

| | | | | | | | | |

| | Current liabilities | | | | | | | |

4.20 | | Payables | | 847.8 | | 745.3 | | 855.3 | |

4.21 | | Interest-bearing liabilities | | 272.9 | | 104.0 | | 73.4 | |

4.22 | | Income tax liabilities | | 113.3 | | 17.3 | | 138.0 | |

4.23 | | Provisions | | 293.7 | | 352.6 | | 377.1 | |

| | | | | | | | | |

4.25 | | Total current liabilities | | 1527.7 | | 1219.2 | | 1443.8 | |

| | | | | | | | | |

| | Non-current liabilities | | | | | | | |

4.26 | | Payables | | 41.1 | | 43.2 | | 52.1 | |

4.27 | | Interest-bearing liabilities | | 2204.9 | | 1790.7 | | 2269.8 | |

4.28 | | Deferred income tax liabilities | | 573.4 | | 519.6 | | 524.2 | |

4.29 | | Provisions | | 480.2 | | 273.6 | | 280.3 | |

| | | | | | | | | |

4.31 | | Total non-current liabilities | | 3299.6 | | 2627.1 | | 3126.4 | |

| | | | | | | | | |

4.32 | | Total liabilities | | 4827.3 | | 3846.3 | | 4570.2 | |

| | | | | | | | | |

4.33 | | Net assets | | 4258.7 | | 4104.4 | | 4141.8 | |

| | | | | | | | | |

| | Equity | | | | | | | |

4.34 | | Contributed equity | | 2146.7 | | 2139.4 | | 2164.9 | |

4.35 | | Reserves | | 240.8 | | 281.1 | | 419.5 | |

4.36 | | Retained profits | | 1775.2 | | 1602.3 | | 1448.3 | |

4.37 | | Equity attributable to members of CSR Limited | | 4162.7 | | 4022.8 | | 4032.7 | |

| | | | | | | | | |

4.38 | | Outside equity interests in controlled entities | | 96.0 | | 81.6 | | 109.1 | |

| | | | | | | | | |

4.39 | | Total equity | | 4258.7 | | 4104.4 | | 4141.8 | |

| | | | | | | | |

4.40 | CSR has no preference shares on issue | | | | | | | |

| | | | | | | | |

5 | Exploration and evaluation expenditure capitalised:- Not material | | | | | | | |

| | | | | | | | |

6 | Development properties:- Not material | | | | | | | |

14

Consolidated statement of cash flows

| | Half-year ended 30 September (A$ million) | | 2002 | | 2001 | |

| | | | | | | |

| | Cash flows from operating activities | | | | | |

7.1 | | Receipts from customers | | 3632.5 | | 3639.0 | |

7.2 | | Payments to suppliers and employees | | (3090.1 | ) | (3080.0 | ) |

7.3 | | Dividends and distributions from associate entities | | 22.2 | | 17.7 | |

7.4 | | Other dividends received | | 2.2 | | 1.6 | |

7.5 | | Interest received | | 6.6 | | 7.5 | |

7.7 | | Income taxes paid | | (19.3 | ) | (40.4 | ) |

7.9 | | Net cash from operating activities | | 554.1 | | 545.4 | |

| | | | | | | |

| | Cash flows from investing activities | | | | | |

7.10 | | Purchase of property, plant, equipment and other non-current assets | | (147.3 | ) | (193.4 | ) |

7.11 | | Proceeds from sale of property, plant, equipment and other non-current assets | | 58.0 | | 39.4 | |

7.12 | | Purchase of controlled entities and businesses net of cash acquired | | (962.2 | ) | (85.0 | ) |

7.13 | | Proceeds from sale of interest in controlled entities and businesses | | 33.7 | | 13.0 | |

7.14 | | Loans and receivables advanced | | (1.5 | ) | (0.8 | ) |

7.15 | | Loans and receivables repaid | | 2.8 | | 11.2 | |

7.17 | | Net cash used in investing activities | | (1016.5 | ) | (215.6 | ) |

| | | | | | | |

| | Cash flows from financing activities | | | | | |

7.18 | | Proceeds from issue of shares | | 14.0 | | 18.7 | |

7.18 | | Share buyback | | (6.7 | ) | (178.7 | ) |

7.19 | | Proceeds from borrowings | | 638.0 | | 26.1 | |

7.21 | | Dividends paid | | (121.0 | ) | (114.0 | ) |

7.22 | | Interest and other finance costs paid | | (52.0 | ) | (72.1 | ) |

7.22 | | Hedging of foreign operations | | — | | 2.7 | |

7.23 | | Net cash from (used in financing activities) | | 472.3 | | (317.3 | ) |

7.24 | | Net increase in cash held | | 9.9 | | 12.5 | |

7.25 | | Net cash at beginning of the financial period | | 156.6 | | 199.5 | |

7.26 | | Effects of exchange rate changes | | 0.1 | | 1.2 | |

7.27 | | Net cash at 30 September | | 166.6 | | 213.2 | |

| | Non-cash financing and investing activities - nil | | | | | |

| | | | | | | |

| | Reconciliation of Net cash | | | | | |

| | Reconciliation of net cash at the end of the period (as shown in the consolidated statement of cash flows) to the related items in the statement of financial position is as follows. | | | | | |

8.1 | | Cash at banks and on hand | | 82.5 | | 71.7 | |

8.2 | | Short-term loans and deposits | | 84.1 | | 142.0 | |

| | | | 166.6 | | 213.7 | |

8.3 | | Bank overdrafts | | — | | (0.5 | ) |

8.5 | | Net cash at 30 September | | 166.6 | | 213.2 | |

15

Consolidated statement of financial performance information

| | Half-year ended 30 September (A$ million unless indicated) | | 2002 | | 2001 | | % Change | |

| | | | | | | | | |

| | Ratios | | | | | | | |

| | | | | | | | | |

9.1 | | Profit before tax/revenue (%) | | 13.2 | | 12.0 | | | |

| | Profit from ordinary activities before income tax (item 1.5) as a percentage of revenue from ordinary activities (item 1.1) | | | | | | | |

| | | | | | | | | |

9.2 | | Profit after tax/equity (%) | | | | | | | |

| | Net profit attributable to members (item 1.11) as a percentage of equity (similarly attributable) at the end of the half-year (item 4.37) | | 7.7 | | 6.9 | | | |

| | | | | | | | | |

10.1 | | Earnings per share (calculated in accordance with AASB 1027) | | | | | | | |

| | | | | | | | | | |

| | a | Basic earnings per share (A cents) | | 34.1 | | 29.1 | | 17 | |

| | | | | | | | | | |

| | b | Diluted earnings per share (A cents) | | 34.0 | | 28.9 | | 18 | |

| | | | | | | | | | |

| | c | Weighted average number of ordinary shares used in calculation of basic earnings per share (millions) | | 936.5 | | 953.3 | | -2 | |

| | | | | | | | | | |

| | | Weighted average number of potential shares issued due to dilutive options | | 3.1 | | 5.8 | | | |

| | | | | | | | | | |

| | | Weighted average number of ordinary shares used in calculation of diluted earnings per share (millions) | | 939.6 | | 959.1 | | -2 | |

| | | | | | | | | | |

| | d | Net profit used in calculating basic and diluted earnings per share | | 319.4 | | 277.0 | | 15 | |

| | | | | | | | | | |

| | e | The 2002 options were issued at a price above current market price and are therefore not considered to be dilutive. | | | | | | | |

| | | | | | | | | |

11.1 | | Net tangible asset backing per ordinary share (A$) | | 2.83 | | 3.18 | | -11 | |

| | | | | | | | | |

12 | | Discontinuing Operations - see section 19 | | | | | | | |

| | | | | | | | | |

13 | | Control gained over entities having material effect | | | | | | | |

| | No controlled entities were acquired during the period which affected net profit by more than 5% compared with the previous corresponding half-year. | | | | | | | |

| | | | | | | | | |

14 | | Loss of controlled entities having material effect | | | | | | | |

| | | | | | | | | |

| | No controlled entities were disposed of during the period which affected net profit by more than 5% compared with the previous corresponding half-year. | | | | | | | |

| | | | | | | | | |

| | Dividends: | | | | | | | |

| | | | | | | | | |

15.1 | | An interim ordinary dividend was declared on 19 November 2002 and is payable on 16 December 2002. | | | | | | | |

| | | | | | | | | |

15.2 | | Registrable transfers received by CSR’s external share registrar, Computershare Investor Services Pty Limited, on 29 November 2002 up to the times specified in the Listing Rules and SCH Business Rules will be registered before entitlements to the dividend are determined. | | | | | | | |

| | | | | | | | | |

| | Share register: | Computershare Investor Services Pty Limited

Level 3,

60 Carrington Street,

Sydney, NSW 2000 Australia.

GPO Box 7045,

Sydney, NSW 1115 Australia. | | | | | | | |

| | | | | | | | | |

| | Amount per share | | | | | | | |

15.6 | | current half-year: | 11 cents (seventy percent franked at 30% tax rate) | | | | | | | |

| | As the unfranked part of this dividend derives from the foreign dividend account, no withholding tax is payable by non-resident holders or by nominee holders on behalf of non-resident beneficiaries. | | | | | | | |

| | | | | | | | | |

15.7 | | previous corresponding half-year: | 11 cents (forty percent franked at 30% tax rate) | | | | | | | |

| | | | | | | | | |

15.11 | | CSR does not have any preference shares on issue | | | | | | | |

| | | | | | | | | |

15.13 | | Total ordinary interim dividend | | 103.2 | | 102.3 | | | |

| | The 2002 dividend was declared on 19 November 2002 and in accordance with new accounting standard AASB1044 which CSR adopted early (see page 23) was not included in the financial statements for half-year ended 30 September 2002. The dividend reinvestment plan remains suspended until further notice. | | | | | | | |

| | | | | | | | | |

| | Investments accounted for using the equity method | | | | | | | |

| | | | | | | | | |

| | Details of aggregate share of profits (losses) of associate entities: | | | | | | | |

16.1 | | Profit from ordinary activities before income tax | | 40.0 | | 30.1 | | | |

16.2 | | Income tax expense | | 11.1 | | 8.7 | | | |

16.3 | | Profit from ordinary activities after income tax | | 28.9 | | 21.4 | | | |

16.4 | | Extraordinary items net of tax | | — | | — | | | |

16.5 | | Net profit | | 28.9 | | 21.4 | | | |

16.6 | | Outside equity interest | | — | | — | | | |

16.7 | | Share associate entities net profit | | 28.9 | | 21.4 | | | |

| | | | | | | | | |

| | Material interests in entities which are not controlled entities: | | | | | | | |

17.1 | | CSR Limited and its controlled entities have an interest which is material from its viewpoint, in the following equity accounted associated entities: | | | | | | | |

| | | | | | | | | |

| | | Australian Cement Holdings Pty Ltd | | | | | | | |

| | | | | | | | | | |

| | | Percentage of issued capital held at 30 September | | 50.0 | | 50.0 | | | |

| | | | | | | | | | |

| | | Contribution to net profit (item 1.9) | | 12.9 | | 12.2 | | | |

| | | | | | | | | | |

| | | New Zealand Sugar Company Limited | | | | | | | |

| | | | | | | | | | |

| | | Percentage of issued capital held at 30 September | | 50.0 | | 50.0 | | | |

| | | | | | | | | | |

| | | Contribution to net profit (item 1.9) | | 3.9 | | 2.9 | | | |

| | | | | | | | | | |

| | | Sugar Australia joint venture | | | | | | | |

| | | | | | | | | | |

| | | Percentage of ownership interest held at 30 September | | 50.0 | | 50.0 | | | |

| | | | | | | | | | |

| | | Contribution to net profit (item 1.9) (1) | | 7.1 | | 3.3 | | | |

| | | | | | | | | | | | | |

(1) CSR Limited as a joint venturer incurred a tax expense of A$2.1 million (2001 A$1.0 million) as a result of this profit. This expense is included under item 1.6 but excluded from item 16.2 and 17.1.

17.3 | | CSR Limited and its controlled entities do not have any other material interests. | | | | | | | |

16

18 Issued and quoted securities

Category of securities | | Number

Issued | | Number

quoted | | Issue

price

(A$) | | Paid-up

value

(A$) | |

ORDINARY SHARES | | | | | | | | | |

| | | | | | | | | |

Fully paid shares(a) | | | | | | | | | |

| | | | | | | | | |

On issue/quoted at 31 March 2002 | | 935 834 472 | | 935 834 472 | | | | | |

| | | | | | | | | |

Movements during the half-year | | | | | | | | | |

Partly to fully paid(b) | | 10 000 | | 10 000 | | 4.21 | | 4.21 | |

Conversion of options | | 2 867 166 | | 2 867 166 | | 4.13 | | 4.13 | |

Universal Share/Option Plan(c) | | 670 800 | | 670 800 | | 3.18 | | 3.18 | |

Share buyback(d) | | (1 100 000 | ) | (1 100 000 | ) | 6.05 | (k) | 6.05 | (k) |

| | | | | | | | | |

Issued/quoted during the half-year | | 2 447 966 | | 2 447 966 | | | | | |

| | | | | | | | | |

On issue/quoted at 30 September 2002 | | 938 282 438 | | 938 282 438 | | | | | |

| | | | | | | | | |

Movements after the half-year | | | | | | | | | |

Partly to fully paid(b) | | 7 000 | | 7 000 | | 4.02 | | 4.02 | |

Conversion of options | | 5 000 | | 5 000 | | 4.47 | | 4.47 | |

| | | | | | | | | |

On issue/quoted at 19 November 2002 | | 938 294 438 | | 938 294 438 | | | | | |

| | | | | | | | | |

Partly paid shares(b) | | | | | | | | | |

| | | | | | | | | |

On issue at 31 March 2002 | | 517 000 | | | | 4.76 | | 0.10 | |

Partly to fully paid | | (10 000 | ) | | | 4.21 | | 4.21 | |

| | | | | | | | | |

On issue at 30 September 2002 | | 507 000 | | | | 4.77 | | 0.10 | |

| | | | | | | | | |

Movements after the half-year | | | | | | | | | |

Partly to fully paid | | (7 000 | ) | | | 4.02 | | 4.02 | |

| | | | | | | | | |

On issue at 19 November 2002 | | 500 000 | | | | 4.78 | | 0.10 | |

| | | | | | | | | |

Options(e) | | | | | | | | | |

On issue at 31 March 2002 | | 12 693 334 | | | | | | | |

| | | | | | | | | |

1998 issue (g) | | 2 825 000 | | | | 3.86 | | | |

converted to fully paid shares | | (1 325 000 | ) | | | 3.86 | | | |

lapsed | | — | | | | | | | |

remaining | | 1 500 000 | | | | 3.86 | | | |

| | | | | | | | | |

1998 issue (h) | | 1 350 000 | | | | 3.86 | | | |

converted to fully paid shares | | — | | | | — | | 0.01 | |

lapsed | | — | | | | — | | | |

remaining | | 1 350 000 | | | | 3.86 | | 0.01 | |

| | | | | | | | | |

1999 issue (g) | | 1 903 334 | | | | 4.33 | | | |

converted to fully paid shares | | (1 277 166 | ) | | | 4.35 | | | |

lapsed | | (5 000 | ) | | | — | | | |

remaining | | 621 168 | | | | 4.29 | | | |

| | | | | | | | | |

2000 issue (g) | | 150 000 | | | | 4.04 | | | |

converted to fully paid shares | | (50 000 | ) | | | 4.04 | | | |

lapsed | | — | | | | — | | | |

remaining | | 100 000 | | | | 4.04 | | | |

| | | | | | | | | |

2000 issue (i) | | 2 815 000 | | | | 4.50 | | | |

converted to fully paid shares | | (215 000 | ) | | | 4.51 | | | |

lapsed | | (10 000 | ) | | | — | | | |

remaining | | 2 590 000 | | | | 4.50 | | | |

| | | | | | | | | |

2001 issue (i) | | 3 650 000 | | | | 6.96 | | | |

converted to fully paid shares | | — | | | | — | | | |

lapsed | | (15 000 | ) | | | — | | | |

remaining | | 3 635 000 | | | | 6.96 | | | |

| | | | | | | | | |

2002 issued (i)(j) | | 720 000 | | | | 6.39 | | | |

converted to fully paid shares | | — | | | | — | | | |

lapsed | | — | | | | — | | | |

remaining | | 720 000 | | | | 6.39 | | | |

| | | | | | | | | |

On issue at 30 September 2002 | | 10 516 168 | | | | | | | |

| | | | | | | | | |

Movements after half-year | | | | | | | | | |

1998 lapsed | | (25 000 | ) | | | 3.86 | | | |

2000 lapsed | | (40 000 | ) | | | 4.47 | | | |

2000 converted to fully paid shares | | (5 000 | ) | | | 4.47 | | | |

2001 lapsed | | (230 000 | ) | | | 7.00 | | | |

| | | | | | | | | |

On issue at 19 November 2002 | | 10 216 168 | | | | | | | |

17

a Ordinary fully paid shares are listed on the Australian and London stock exchanges and are traded in sponsored American Depositary Receipt form on the over-the-counter market in the United States. Fully paid ordinary shares carry one vote per share and the right to dividends.

b Ordinary shares were issued between 1986 and 1990 under the now superseded Executive Share/Option Plan. The shares are partly paid to A$0.10, are entitled to one-thirtieth of the dividend, and have no voting rights. Issue prices ranged between A$3.00 and A$5.35 per share.

c. Ordinary fully paid shares were issued in September 2002 under the employee Universal Share/Option Plan. For tax reasons, shares cannot be sold by participants within three years of allotment, unless they finish their employment with the company. Offers of fully paid shares were made to all eligible employees (6,477). 3,354 accepted the offer, subscribing for 100 shares and receiving a further 100 shares at no cost.

d. On 1 June 2001 CSR commenced a twelve month share buyback of up to 10% of its fully paid shares. A total of 23.8 million shares were repurchased under the buyback.

e. The holders of the options do not have any right, by virtue of the options, to participate in any share or other interest issue of CSR or any other body corporate, but the amount payable on exercise or number of shares issued may be varied as a result of pro rata rights or bonus issues.

f. The issue price is the CSR share market price at the time of each issue, hence no cost was recognised in the statement of financial performance.

g. Options issued under the Executive Share Option Plan approved at the 1998 annual general meeting. Options have been issued in 1998 and 1999 and June 2000 and are eligible for conversion progressively over varying periods as from mid 2000 to mid 2005. The conversion of each portion of options to shares is conditional on the percentage growth in the cumulative value of a notional investment in CSR exceeding the growth of an equivalent investment in the ASX All Industrials Accumulation Index, measured over defined periods. Options are issued at the CSR share market price at the time of issue. The obligation to pay this amount is deferred until these options are exercised or lapse.

h. Options issued to Rinker Materials Corporation executives are on the same basis as set out in Note g. above, except that the options are paid to A$0.01 with the balance of the issue price payable when the options are exercised.

i. Options issued under the Executive Share Option Plan approved at the 1998 annual general meeting and amended at the 2000 annual general meeting. Options have been issued in August 2000, December 2000, June 2001, August 2001, December 2001 and June 2002 and are eligible for conversion progressively over varying periods as from mid 2003 to mid 2007. The conversion of options to shares is conditional on the percentage growth in the cumulative value of a notional investment in CSR exceeding the growth of an equivalent investment in the ASX All Industrials Accumulation Index (including manufacturing and industrial organisations, but excluding such companies as banks, finance, insurance, investment, financial services, media, property trusts, telecommunications, leisure and tourism), measured over defined periods. Options are issued at the CSR share market price at the time of issue. The obligation to pay this amount is deferred until these options are exercised or lapse.

j. In June 2002 720,000 options were offered to 7 executives.

k. Average price of shares bought back over the period.

18

Business segment analysis

Half-year ended 30 September | | External Revenue | | Internal Revenue | | Total Revenue (3) | |

(A$ million except percentages) | | 2002 | | 2001 | | 2002 | | 2001 | | 2002 | | % | | 2001 | | % | |

Rinker Materials | | | | | | | | | | | | | | | | | |

Aggregates | | 313.4 | | 293.0 | | 199.3 | | 189.0 | | 512.7 | | 14 | | 482.0 | | 13 | |

Cement | | 133.3 | | 154.1 | | 157.6 | | 151.4 | | 290.9 | | 8 | | 305.5 | | 8 | |

Concrete, Block, Asphalt | | 751.8 | | 752.3 | | | | | | 751.8 | | 20 | | 752.3 | | 20 | |

Concrete pipe and products | | 462.2 | | 531.9 | | | | | | 462.2 | | 12 | | 531.9 | | 14 | |

Other | | 416.8 | | 408.5 | | | | | | 416.8 | | 12 | | 408.5 | | 11 | |

Eliminations | | — | | — | | (356.9 | ) | (340.4 | ) | (356.9 | ) | (10 | ) | (340.4 | ) | -9 | |

Total Rinker Materials Corporation | | 2,077.5 | | 2,139.8 | | — | | — | | 2,077.5 | | 56 | | 2,139.8 | | 57 | |

Construction Materials | | 516.9 | | 478.9 | | | | | | 516.9 | | 14 | | 478.9 | | 13 | |

Building Products | | 463.7 | | 396.2 | | | | | | 463.7 | | 12 | | 396.2 | | 10 | |

Sugar - milling | | 387.8 | | 468.3 | | | | | | 387.8 | | 10 | | 468.3 | | 12 | |

Sugar - other | | 34.9 | | 39.3 | | | | | | 34.9 | | 1 | | 39.3 | | 1 | |

Aluminium | | 215.7 | | 222.4 | | | | | | 215.7 | | 6 | | 222.4 | | 6 | |

Segment Total | | 3,696.5 | | 3,744.9 | | — | | — | | 3,696.5 | | 99 | | 3,744.9 | | 99 | |

Corporate | | — | | — | | — | | — | | | | | | | | | |

Unallocated Items (2) | | 22.7 | | 19.6 | | | | | | 22.7 | | 1 | | 19.6 | | 1 | |

Group Total | | 3,719.2 | | 3,764.5 | | — | | — | | 3,719.2 | | 100 | | 3,764.5 | | 100 | |

Interest Revenue | | 5.8 | | 7.4 | | | | | | 5.8 | | | | 7.4 | | | |

Total | | 3,725.0 | | 3,771.9 | | — | | — | | 3,725.0 | | | | 3,771.9 | | | |

Half-year ended 30 September | | Profit from ordinary activities before income tax | | Total assets(5) | |

(A$ million except percentages) | | 2002 | | % | | 2001 | | % | | 2002 | | % | | 2001 | | % | |

Rinker Materials | | | | | | | | | | | | | | | | | |

Aggregates | | 102.4 | | 19 | | 89.6 | | 17 | | 1,260.4 | | 15 | | 1,424.0 | | 17 | |

Cement | | 75.7 | | 14 | | 73.7 | | 14 | | 784.3 | | 9 | | 869.8 | | 11 | |

Concrete, Block, Asphalt | | 67.2 | | 12 | | 69.5 | | 14 | | 776.4 | | 9 | | 853.0 | | 11 | |

Concrete pipe and products | | 74.7 | | 14 | | 106.1 | | 21 | | 886.1 | | 10 | | 1,018.8 | | 13 | |

Other (1) | | (0.5 | ) | — | | (4.1 | ) | (1 | ) | 1,709.1 | | 20 | | 668.4 | | 8 | |

Eliminations | | — | | — | | — | | — | | (55.1 | ) | (1 | ) | (41.1 | ) | (1 | ) |

Total Rinker Materials Corporation (4) | | 319.5 | | 59 | | 334.8 | | 65 | | 5,361.2 | | 62 | | 4,792.9 | | 59 | |

Construction Materials | | 58.6 | | 11 | | 32.3 | | 6 | | 963.3 | | 11 | | 979.3 | | 12 | |

Building Products | | 63.2 | | 12 | | 47.9 | | 9 | | 785.0 | | 9 | | 767.0 | | 9 | |

Sugar - milling | | 41.9 | | 8 | | 65.7 | | 13 | | 779.0 | | 9 | | 872.2 | | 11 | |

Sugar - other | | 17.4 | | 3 | | 13.6 | | 3 | | 185.1 | | 2 | | 187.5 | | 2 | |

Aluminium | | 61.1 | | 11 | | 55.2 | | 11 | | 400.2 | | 5 | | 407.7 | | 5 | |

Segment Total | | 561.7 | | 104 | | 549.5 | | 107 | | 8,473.8 | | 98 | | 8,006.6 | | 98 | |

Corporate | | (16.0 | ) | (3 | ) | (16.1 | ) | (3 | ) | 123.9 | | 2 | | 162.2 | | 2 | |

Unallocated Items | | (4.7 | ) | (1 | ) | (19.5 | ) | (4 | ) | | | | | | | | |

Group Total | | 541.0 | | 100 | | 513.9 | | 100 | | 8,597.7 | | 100 | | 8,168.8 | | 100 | |

Borrowing costs less interest revenue | | (49.1 | ) | | | (62.8 | ) | | | | | | | | | | |

Cash | | | | | | | | | | 166.6 | | | | 213.7 | | | |

Tax Assets | | | | | | | | | | 321.7 | | | | 329.5 | | | |

Total | | 491.9 | | | | 451.1 | | | | 9,086.0 | | | | 8,712.0 | | | |

(1) Includes A$1168.2 million of assets acquired from Kiewit on 26 September 2002.

(2) Includes profit (loss) on major asset sales, product liability charges, discontinued operations and certain rationalisation costs.

(3) Excludes net profit from associates.

(4) Profit from ordinary activities before tax increased from US$170.4 million in 2001 to US$176.3 million in 2002.

(5) Excludes intragroup.

19

19 Comments by directors

i. Basis of financial report preparation. This Half Yearly Report is a general purpose financial report prepared in accordance with the Accounting Standard AASB 1029 “Interim Financial Reporting” and the Listing Rules of the Australian Stock Exchange Limited. It should be read in conjunction with the last Annual Report and announcements to the market made by the company during the half-year in accordance with the company’s continuous disclosure obligations arising under the Corporations Act 2001 and Listing Rule 3.1. The financial statements in this report are “condensed financial statements” as defined in AASB 1029 “Interim Financial Reporting”. This report does not include all the notes of the type normally included in an annual financial report.

ii. Material factors affecting revenue and expenses of CSR Limited and its controlled entities for the half-year ended 30 September 2002 are included on pages 1 - 9.

iii. There has been no event since the end of the half-year which has had a material effect on the matters already reported except as noted in (iv) below.

iv. Subsequent Events – Demerger proposal. On 19 November 2002 the CSR board announced it was moving forward with a demerger proposal that involves splitting the CSR group into two listed Australian companies. Under the proposal, Rinker Materials Corporation and the Readymix and Humes businesses would be demerged from the CSR group. The de-merged businesses would not be materially different from those indicated in the segment analysis on page 22. The aim is to propose to shareholders a demerger to take effect in the first half of next year.