Exhibit 99.1

Sims Metal Management Limited

ABN 69 114 838 630

| | |

| | ├ 000001 000 SGM MR SAM SAMPLE FLAT 123 123 SAMPLE STREET THE SAMPLE HILL SAMPLE ESTATE SAMPLEVILLE VIC 3030 |

13 October 2014

Dear Shareholder

I have pleasure in inviting you to attend the 2014 Annual General Meeting of Sims Metal Management Limited to be held at The Westin, Heritage Ballroom, 1 Martin Place, Sydney NSW on Thursday, 13 November 2014 at 10:30am (AEDT).

Enclosed is the Notice of Annual General Meeting which sets out the items of business to be considered.

If you are attending, please bring this letter with you to facilitate registration into the meeting.

If you are unable to attend the meeting, you are encouraged to complete the enclosed proxy form. The proxy form should be returned in the envelope provided so that it is received no later than 48 hours before the commencement of the meeting. Alternatively, you may vote online at www.investorvote.com.au.

Corporate shareholders will be required to complete a “Certificate of Appointment of Representative” to enable a person to attend on their behalf. A form of this certificate may be obtained from the Company’s share registry.

A copy of the address to be given by each of the Chairman and Chief Executive Officer at the meeting will be available for viewing and downloading from the Company’s website at www.simsmm.com, following the meeting. You may also request a copy from the Company.

I look forward to your attendance at the meeting.

Yours sincerely

Frank Moratti

Company Secretary

Samples/000001/000002

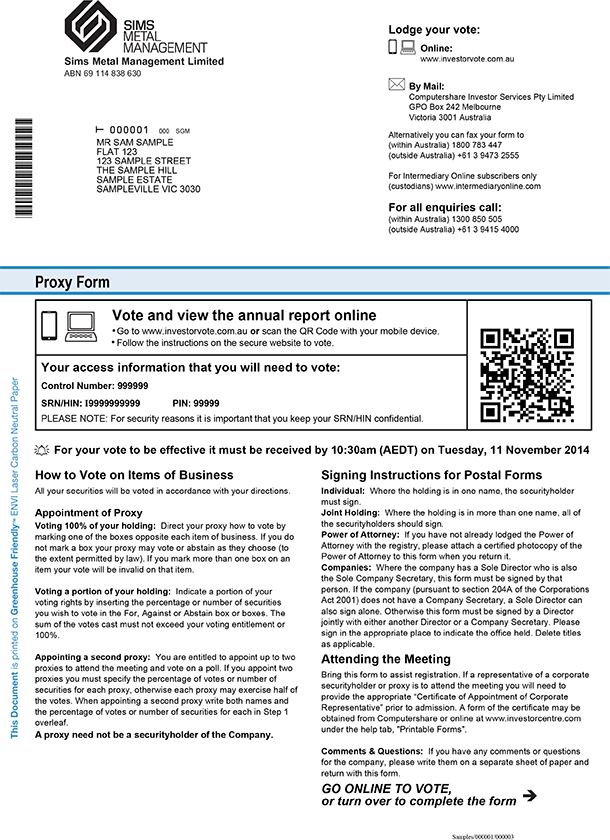

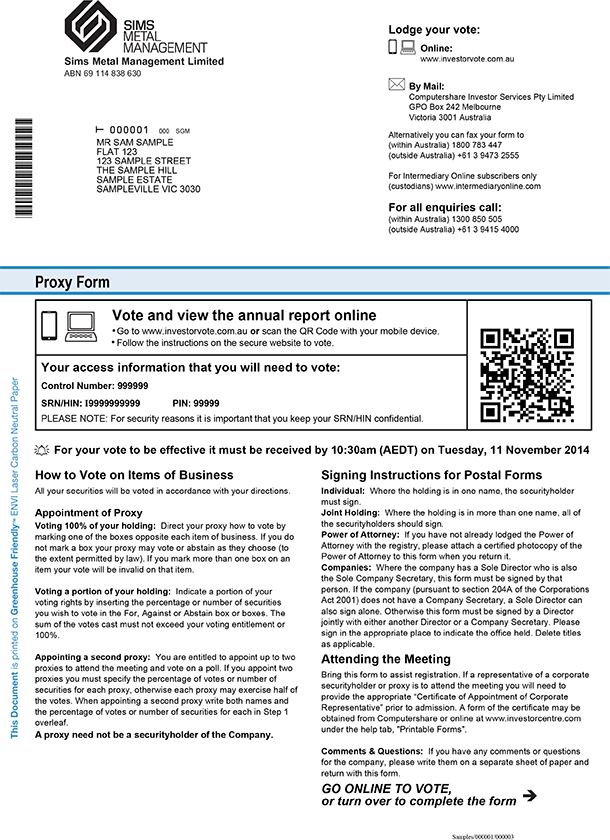

T 000001 000 SGM MR SAM SAMPLE FLAT 123 123 SAMPLE STREET THE SAMPLE HILL SAMPLE ESTATE SAMPLEVILLE VIC 3030 Lodge your vote: Online: www.investorvote.com.au ?By Mail: Computershare Investor Services Pty Limited GPO Box 242 Melbourne Victoria 3001 Australia Alternatively you can fax your form to (within Australia) 1800 783 447 (outside Australia) +61 3 9473 2555 For Intermediary Online subscribers only (custodians) www.intermediaryonline.com For all enquiries call: (within Australia) 1300 850 505 (outside Australia) +61 3 9415 4000 Proxy Form Vote and view the annual report online •Go to www.investorvote.com.au or scan the QR Code with your mobile device. • Follow the instructions on the secure website to vote. Your access information that you will need to vote: Control Number: 999999 SRN/HIN: I9999999999 PIN: 99999 PLEASE NOTE: For security reasons it is important that you keep your SRN/HIN confidential. For your vote to be effective it must be received by 10:30am (AEDT) on Tuesday, 11 November 2014 How to Vote on Items of Business All your securities will be voted in accordance with your directions. Appointment of Proxy Voting 100% of your holding: Direct your proxy how to vote by marking one of the boxes opposite each item of business. If you do not mark a box your proxy may vote or abstain as they choose (to the extent permitted by law). If you mark more than one box on an item your vote will be invalid on that item. Voting a portion of your holding: Indicate a portion of your voting rights by inserting the percentage or number of securities you wish to vote in the For, Against or Abstain box or boxes. The sum of the votes cast must not exceed your voting entitlement or 100%. Appointing a second proxy: You are entitled to appoint up to two proxies to attend the meeting and vote on a poll. If you appoint two proxies you must specify the percentage of votes or number of securities for each proxy, otherwise each proxy may exercise half of the votes. When appointing a second proxy write both names and the percentage of votes or number of securities for each in Step 1 overleaf. A proxy need not be a securityholder of the Company. Signing Instructions for Postal Forms Individual: Where the holding is in one name, the securityholder must sign. Joint Holding: Where the holding is in more than one name, all of the securityholders should sign. Power of Attorney: If you have not already lodged the Power of Attorney with the registry, please attach a certified photocopy of the Power of Attorney to this form when you return it. Companies: Where the company has a Sole Director who is also the Sole Company Secretary, this form must be signed by that person. If the company (pursuant to section 204A of the Corporations Act 2001) does not have a Company Secretary, a Sole Director can also sign alone. Otherwise this form must be signed by a Director jointly with either another Director or a Company Secretary. Please sign in the appropriate place to indicate the office held. Delete titles as applicable. Attending the Meeting Bring this form to assist registration. If a representative of a corporate securityholder or proxy is to attend the meeting you will need to provide the appropriate “Certificate of Appointment of Corporate Representative” prior to admission. A form of the certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab, “Printable Forms”. Comments & Questions: If you have any comments or questions for the company, please write them on a separate sheet of paper and return with this form. GO ONLINE TO VOTE, or turn over to complete the form

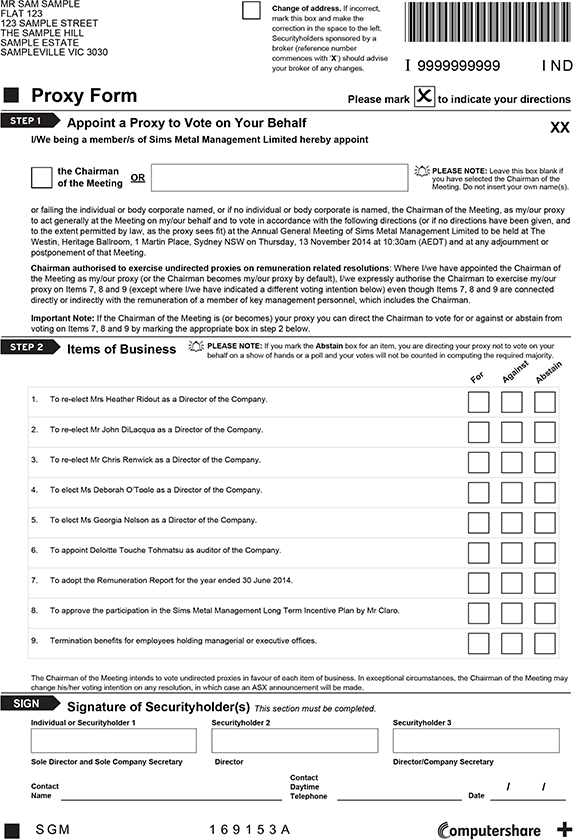

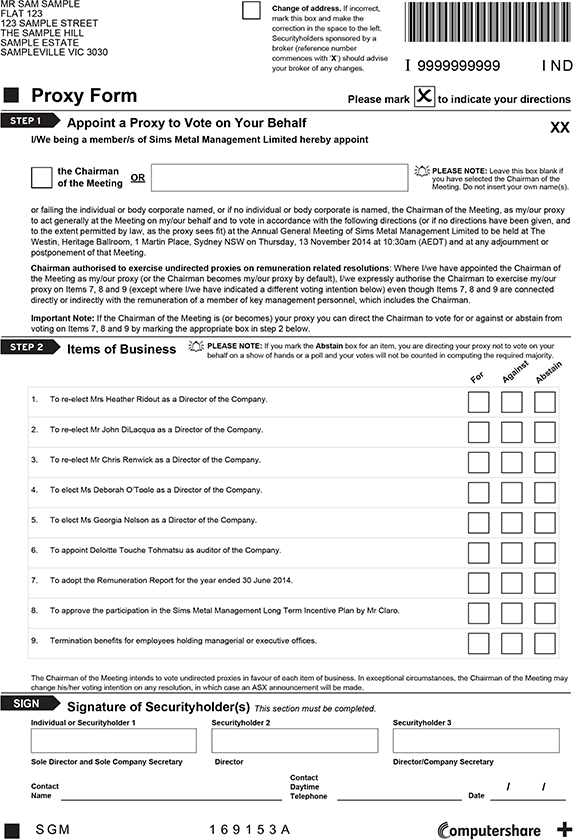

MR SAM SAMPLE FLAT 123 123 SAMPLE STREET THE SAMPLE HILL SAMPLE ESTATE SAMPLEVILLE VIC 3030 Change of address. If incorrect, mark this box and make the correction in the space to the left. Securityholders sponsored by a broker (reference number commences with ’X’) should advise your broker of any changes. Proxy Form Please mark to indicate your directions STEP 1 Appoint a Proxy to Vote on Your Behalf XX I/We being a member/s of Sims Metal Management Limited hereby appoint the Chairman OR?PLEASE NOTE: Leave this box blank if you have selected the Chairman of the of the Meeting Meeting. Do not insert your own name(s). or failing the individual or body corporate named, or if no individual or body corporate is named, the Chairman of the Meeting, as my/our proxy to act generally at the Meeting on my/our behalf and to vote in accordance with the following directions (or if no directions have been given, and to the extent permitted by law, as the proxy sees fit) at the Annual General Meeting of Sims Metal Management Limited to be held at The Westin, Heritage Ballroom, 1 Martin Place, Sydney NSW on Thursday, 13 November 2014 at 10:30am (AEDT) and at any adjournment or postponement of that Meeting. Chairman authorised to exercise undirected proxies on remuneration related resolutions: Where I/we have appointed the Chairman of the Meeting as my/our proxy (or the Chairman becomes my/our proxy by default), I/we expressly authorise the Chairman to exercise my/our proxy on Items 7, 8 and 9 (except where I/we have indicated a different voting intention below) even though Items 7, 8 and 9 are connected directly or indirectly with the remuneration of a member of key management personnel, which includes the Chairman. Important Note: If the Chairman of the Meeting is (or becomes) your proxy you can direct the Chairman to vote for or against or abstain from voting on Items 7, 8 and 9 by marking the appropriate box in step 2 below. STEP 2 Items of Business? PLEASE NOTE: If you mark the Abstain box for an item, you are directing your proxy not to vote on your behalf on a show of hands or a poll and your votes will not be counted in computing the required majority. 1. To re-elect Mrs Heather Ridout as a Director of the Company. 2. To re-elect Mr John DiLacqua as a Director of the Company. 3. To re-elect Mr Chris Renwick as a Director of the Company. 4. To elect Ms Deborah O’Toole as a Director of the Company. 5. To elect Ms Georgia Nelson as a Director of the Company. 6. To appoint Deloitte Touche Tohmatsu as auditor of the Company. 7. To adopt the Remuneration Report for the year ended 30 June 2014. 8. To approve the participation in the Sims Metal Management Long Term Incentive Plan by Mr Claro. 9. Termination benefits for employees holding managerial or executive offices. The Chairman of the Meeting intends to vote undirected proxies in favour of each item of business. In exceptional circumstances, the Chairman of the Meeting may change his/her voting intention on any resolution, in which case an ASX announcement will be made. SIGN Signature of Securityholder(s) This section must be completed. Individual or Securityholder 1 Securityholder 2 Securityholder 3 Sole Director and Sole Company Secretary Director Director/Company Secretary Contact Contact Daytime / / Name Telephone Date S G M 1 6 9 1 5 3 A

BUSINESS

ACCOUNTS AND REPORTS

To receive and consider the financial statements of the Company and its controlled entities for the year ended 30 June 2014 and the related Directors’ Report, Directors’ Declaration and Auditor’s Report.

RE-ELECTION OF DIRECTORS

MRS HEATHER RIDOUT

RESOLUTION 1

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That Mrs Heather Ridout, who retires by rotation at the Annual General Meeting in accordance with the Company’s Constitution and the ASX Listing Rules and having offered herself for re-election and being eligible, be re-elected as a Director of the Company.”

MR JOHN DILACQUA

RESOLUTION 2

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That Mr John DiLacqua, who retires by rotation at the Annual General Meeting in accordance with the Company’s Constitution and the ASX Listing Rules and having offered himself for re-election and being eligible, be re-elected as a Director of the Company.”

MR CHRISTOPHER RENWICK

RESOLUTION 3

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That Mr Christopher Renwick, who retires at this Annual General Meeting as Mitsui & Co., Ltd’s designated independent director and having offered himself for re-election and being eligible, be re-elected as a Director of the Company.”

MS DEBORAH O’TOOLE

RESOLUTION 4

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That Ms Deborah O’Toole, who having been appointed as an additional Director since the last Annual General Meeting retires at the Annual General Meeting in accordance with the Company’s Constitution and the ASX Listing Rules, be elected as a Director of the Company.”

MS GEORGIA NELSON

RESOLUTION 5

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That Ms Georgia Nelson, who having been appointed as an additional Director since the last Annual General Meeting retires at the Annual General Meeting in accordance with the Company’s Constitution and the ASX Listing Rules, be elected as a Director of the Company.”

Messrs Norman Bobins and Gerry Morris have informed the Company that they will each be retiring at the conclusion of the Annual General Meeting and will not be standing for re-election.

APPOINTMENT OF DELOITTE TOUCHE TOHMATSU AS AUDITOR OF THE COMPANY

RESOLUTION 6

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That:

| (a) | subject to the Australian Securities and Investments Commission (ASIC) consenting to the resignation of PricewaterhouseCoopers as auditor of the Company, pursuant to section 327B of the Corporations Act 2001 (Cth) and for all other purposes, Deloitte Touche Tohmatsu, having been duly nominated by a member of the Company and having consented in writing to act, be appointed to act as auditor of the Company with effect from the later of the close of this Annual General Meeting and the day on which ASIC gives its consent; and |

| (b) | the board of directors of the Company is authorised to fix the remuneration of Deloitte Touche Tohmatsu, as auditor of the Company, from time to time.” |

REMUNERATION REPORT

RESOLUTION 7

To consider and, if thought fit, pass the following resolution as a non-binding ordinary resolution:

“That the Remuneration Report for the year ended 30 June 2014 (as set out in the Directors’ Report) is adopted.”

BUSINESS

PARTICIPATION IN THE COMPANY’S LONG TERM INCENTIVE PLAN BY MR CLARO

RESOLUTION 8

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That approval is given for the purposes of ASX Listing Rules 7.1 and 10.14 and for all other purposes, for the Company to issue to Mr Galdino Claro, the Chief Executive Officer and Managing Director of the Company, 219,248 Performance Rights and 172,866 Options under the terms of the Company’s Long Term Incentive Plan, as more particularly described in the Explanatory Memorandum accompanying the Notice of Meeting convening this meeting.”

TERMINATION BENEFITS

RESOLUTION 9

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

“That approval be given for all purposes, including sections 200B and 200E of the Corporations Act 2001(Cth), for the giving of benefits to any persons who, from time to time, are key management personnel of the Company or who hold a managerial or executive office in the Company or a related body corporate, in connection with that person ceasing to hold an office or position of employment in the Company or a related body corporate, on the terms set out in the Explanatory Memorandum accompanying the Notice of Meeting convening this meeting.”

By order of the Board

Frank Moratti

Company Secretary

13 October 2014

INFORMATION FOR SHAREHOLDERS

VOTING ENTITLEMENTS

For the purpose of the Meeting, shares will be taken to be held by persons who are registered as shareholders as at 7.00pm (Sydney time) on Tuesday, 11 November 2014. Accordingly, transactions registered after that time will be disregarded in determining shareholders entitled to attend and vote at the Meeting.

PROXIES

A shareholder who is entitled to attend and cast a vote at the Meeting has the right to appoint a proxy to attend and vote on behalf of the shareholder. The proxy need not be a shareholder of the Company and may be an individual or a body corporate. If a shareholder is entitled to cast two or more votes they may appoint two proxies and may specify the proportion or number of votes each proxy is appointed to exercise. If the proxy appointments do not specify a proportion or number, each proxy may exercise half of the shareholder’s votes.

The Proxy Form must be signed by you or your attorney. Proxies given by corporations must be executed either in accordance with section 127 of theCorporations Act 2001 (Cth) (Corporations Act) or under the hand of a duly authorised officer or attorney.

Voting restrictions apply to members of the key management personnel for the Sims Metal Management Limited consolidated group whose remuneration details are included in the Remuneration Report (each a KMP) and their closely related parties, which affect proxy voting.

The KMP (which includes, amongst others, each of the non-executive directors, the managing director and the chief financial officer) and their closely related parties will not be able to vote your proxy on Resolutions 7, 8 or 9 unless you direct them how to vote by marking the voting boxes for those items. The term “closely related party” is defined in the Corporations Act and includes the KMP’s spouse, dependants and certain other close family members, as well as any companies controlled by the KMP, or the KMP’s spouse, dependants and certain other close family members.

If you intend to appoint a KMP as your proxy, please ensure that you direct them how to vote on Resolutions 7, 8 and 9. If you intend to appoint the Chairman of the Meeting as your proxy, you can direct him to vote by marking the relevant boxes on the Proxy Form. If you sign and return your Proxy Form and do not provide any voting directions, you will be deemed to have expressly authorised the Chairman of the Meeting (where he is appointed your proxy or becomes your proxy by default) to cast your vote on each of Resolutions 7, 8 and 9 even though each of those Resolutions is connected with the remuneration of a KMP.

The Chairman of the Meeting intends to vote any undirected proxies held by him in favour of all items of business (subject to the requirements for voting directions noted above in relation to Resolutions 7, 8 and 9).

2

INFORMATION FOR SHAREHOLDERS

WHERE TO LODGE A PROXY

The Proxy Form and the power of attorney or other authority under which it is signed (if any), or a certified copy of the power of attorney or authority, must be:

| • | | deposited at the share registry of the Company, Computershare Investor Services Pty Limited, located at Level 4, 60 Carrington Street, Sydney NSW 2000 (or by mail to GPO Box 242, Melbourne Vic 3001); |

| • | | deposited at the Company’s Registered Office, Sir Joseph Banks Corporate Park, Suite 3, Level 2, 32-34 Lord Street, Botany NSW 2019; |

| • | | sent to the Company by mail to PO Box 651, Botany NSW 1455; or |

| • | | sent by facsimile to Computershare on 1800 783 447 or (03) 9473 2555 or to the Company on (02) 8113 1622. |

ELECTRONIC PROXY

You may lodge an electronic proxy online at www.investorvote.com.au. To do so, you will need to enter the Control Number shown on the front of the Proxy Form, followed by your Securityholder Reference Number (SRN) or Holder Identification Number (HIN).

You will be taken to have signed the Proxy Form if you lodge an electronic proxy online in accordance with the online instructions. Custodians, nominees, non-broker participants, portfolio administrators, portfolio aggregators and eligible financial advisers may lodge their proxy vote via Computershare’s Intermediary Online Vote and Confirmation website. Go to www.intermediaryonline.com.

To be effective, proxies must be lodged by 10.30am (Sydney time) on Tuesday, 11 November 2014. Proxies lodged or received after that time will be invalid.

CORPORATE REPRESENTATIVES

A body corporate which is a shareholder, or which has been appointed as a proxy, is entitled to appoint any person to act as its representative at the Meeting. The appointment of the representative must comply with the requirements under section 250D of the Corporations Act. The representative should bring to the Meeting a properly executed letter or other document confirming their authority to act as the shareholder’s representative.

SHAREHOLDER QUESTIONS

If you would like a question to be put to the Chairman of the Meeting or the Auditor and you are not able to attend the Meeting, please email your question to the Company Secretary at frank.moratti@simsmm.com.

To allow time to collate questions and prepare answers, questions are to be received by the Company Secretary by 10.30am (Sydney) on Tuesday, 11 November 2014.

The Company’s shareholders (Shareholders) should read the Explanatory Memorandum accompanying, and forming part of, this Notice of Meeting (Notice) for more details on the resolutions to be voted on at the Meeting.

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

BUSINESS OF THE MEETING

ACCOUNTS AND REPORT

The Financial Report, Directors’ Report and the Auditor’s Report for the financial year ended 30 June 2014 will be laid before the Meeting.

Together, the Financial Report, Directors’ Report and the Auditor’s Report constitute the Company’s 2014 Annual Report. Unless the Company’s Share Registry has been notified otherwise, Shareholders will not be sent a hard copy of the Annual Report. All Shareholders can view the 2014 Annual Report on the Company’s website at www.simsmm.com.

Following the consideration of the Reports, the Chairman will give Shareholders a reasonable opportunity to ask questions about or comment on the management of the Company.

The Chairman will also give Shareholders a reasonable opportunity to ask the Auditor questions relevant to:

| • | | the conduct of the audit; |

| • | | the preparation and content of the Auditor’s Report; |

| • | | the accounting policies adopted by the Company in relation to the preparation of the financial statements; and |

| • | | the independence of the Auditor in relation to the conduct of the audit. |

The Chairman will also give the Auditor a reasonable opportunity to answer written questions submitted by Shareholders that are relevant to the content of the Auditor’s Report or the conduct of the audit. A list of written questions, if any, submitted by Shareholders will be made available at the start of the Meeting and any written answers tabled by the Auditor at the Meeting will be made available as soon as practicable after the Meeting.

RESOLUTION 1 – RE-ELECTION OF DIRECTOR – HEATHER RIDOUT AO BEC (HONS) (AGE 60)

INDEPENDENT NON-EXECUTIVE DIRECTOR

The ASX Listing Rules require that the Company hold an election of Directors at least once per year. The Company’s Constitution requires that at least one Director, excluding the Managing Director, must retire each year. The retiring Director is then eligible to offer themself for re-election by Shareholders.

Mrs Ridout retires by rotation and, being eligible, offers herself for re-election as a Director.

Mrs Ridout was appointed as a Director in September 2011. She is a member of the Safety, Health, Environment & Community Committee, the Remuneration Committee, the Risk, Audit & Compliance Committee and the Nomination/Governance Committee. Mrs Ridout was formerly the Chief Executive Officer of the Australian Industry Group from 2004 until her retirement in April 2012. She is a member of the Board of the Reserve Bank of Australia (since December 2011), and is a director of Australian Securities Exchange Limited (since August 2012) and Chair of the AustralianSuper Trustee Board, the largest industry fund in Australia. Mrs Ridout also serves on the Board of the Australian Chamber Orchestra. She has an economics degree, with honours, from the University of Sydney.

The Board considers Mrs Ridout to be an Independent Director.

| | | | |

SIMS METAL MANAGEMENT LIMITED NOTICE OF 2014 ANNUAL GENERAL MEETING | | | 3 | |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

Mrs Ridout’s broad industry experience includes having served as CEO of the Australian Industry Group—a major, national employer organisation representing a diverse cross section of industry. She has a long history as a leading figure in the public policy debate in Australia, and was recently made an Officer (AO) in the general division of the Order of Australia (for distinguished service to business and industry through significant contributions to the development of economic and public policy). Mrs Ridout’s standing in the business community is evidenced by her membership of the Reserve Bank Board, and her role as co-Chair of the Australian-Canada Economic Leadership Dialogue and a delegate to the B20—which is the key business advisory body to the international economic forum. Mrs Ridout sits on, and contributes significantly to the undertakings of, four Board Committees.

Prior to submitting herself for re-election, Mrs Ridout acknowledged to the Company that she would have sufficient time to properly fulfil her duties to the Company.

Board’s recommendation

The Board, with Mrs Ridout absent and not voting, unanimously recommends you vote in favour of the re-election of Mrs Ridout.

RESOLUTION 2 – RE-ELECTION OF DIRECTOR – JOHN DILACQUA MBA (AGE 62)

INDEPENDENT NON-EXECUTIVE DIRECTOR

Mr DiLacqua retires by rotation and, being eligible, offers himself for re-election as a Director.

Mr DiLacqua was appointed as a Director in September 2011. He is Chairperson of the Finance & Investment Committee, and is a member of the Risk, Audit & Compliance Committee. Mr DiLacqua was formerly a director of Metal Management, Inc (since 2001), and was a director of Sims Metal Management Limited between March and November 2008. He was the Executive Chairman of Envirosource, Inc from May 2004 to December 2004 and had served as President and Chief Executive Officer of Envirosource from January 1999 to May 2004. From October 1997 to December 1998, Mr DiLacqua served as President of the US Ferrous Operations of Philip Metals, Inc, and, prior to that, from May 1994, as the President of Luria Brothers. He is a graduate of Temple University and received an MBA from Carnegie Mellon University. Mr DiLacqua is a Certified Public Accountant.

The Board considers Mr DiLacqua to be an Independent Director.

Mr DiLacqua strongly believes that he has the appropriate experience to serve on the Board of the Company. He has 15 years of metals recycling experience and an additional

15 years of Fortune 500 experience. He was formerly the CFO for five years, and subsequently, President/CEO, of a metals recycling company. He was also the CEO of a publicly listed steel service company for two years. Mr DiLacqua serves as Chairman of the Board Finance & Investment Committee where he believes his financial discipline has helped the Company achieve the goals of zero debt and controlled capital expenditures.

Prior to submitting himself for re-election, Mr DiLacqua acknowledged to the Company that he would have sufficient time to properly fulfil his duties to the Company.

Board’s recommendation

The Board, with Mr DiLacqua absent and not voting, unanimously recommends you vote in favour of the re-election of Mr DiLacqua.

RESOLUTION 3 – RE-ELECTION OF DIRECTOR—CHRISTOPHER RENWICK AM, FAIM, FAIE, FTSE—BA, LLB (AGE 72)

INDEPENDENT NON-EXECUTIVE DIRECTOR

Mr Renwick is retiring as Mitsui & Co., Ltd’s (Mitsui) designated independent director at this Annual General Meeting and, being eligible, offers himself for re-election as a Director.

Mr Renwick was appointed as a Director in June 2007 as Mitsui’s designated independent director, but is not standing for re-election in that capacity at this Annual General Meeting. Consequently, if re-elected, Mr Renwick will not be Mitsui’s designated independent director. Mitsui has not nominated anyone else to the Board for election at this Annual General Meeting. Of course, Mr Sato continues as the Mitsui Associate director in accordance with Mitsui’s right of nomination under the Company’s Constitution. Mr Renwick is Chairperson of the Remuneration Committee, and is a member of the Safety, Health, Environment & Community Committee and the Nomination/Governance Committee. Mr Renwick was employed with the Rio Tinto Group for over 35 years, rising, in 1997, to Chief Executive, Rio Tinto Iron Ore, a position he held until his retirement in 2004. He has previously served as Chairman and director of Coal and Allied Industries Limited (2004 to 2011) and Chairman of the Rio Tinto Aboriginal Fund (2004 to 2011).

Mr Renwick has had substantial experience in the mining industry working for large global organisations. Such experience has been extremely beneficial in Mr Renwick’s contribution to the Board. Mr Renwick was previously Chairman of the Safety, Health, Environment & Community Committee, and currently serves as Chairman of the Remuneration Committee where he believes his skillset has assisted the Company in setting incentive plans carefully to control remuneration and cost in FY 2014.

The Board considers Mr Renwick to be an Independent Director.

Prior to submitting himself for re-election, Mr Renwick acknowledged to the Company that he would have sufficient time to properly fulfil his duties to the Company.

Board’s recommendation

The Board, with Mr Renwick absent and not voting, unanimously recommends you vote in favour of the re-election of Mr Renwick.

RESOLUTION 4 – ELECTION OF DIRECTOR – DEBORAH O’TOOLE LLB, MAICD (AGE 57)

INDEPENDENT NON-EXECUTIVE DIRECTOR

Ms O’Toole has agreed to be appointed as a Director, with effect from 1 November 2014. Following her appointment, Ms O’Toole is to become a member of the Risk, Audit & Compliance Committee, and the Finance & Investment Committee. Ms O’Toole has extensive executive experience across a number of sectors including over 20 years in the mining industry and, more recently, in transport and logistics which included managerial, operational and financial roles. She has been Chief Financial Officer in three ASX listed companies, M.I.M Holdings Limited, Queensland Cotton Holdings Limited and, most recently, through the privatisation of Aurizon Holdings Limited. Ms O’Toole’s board experience includes directorships of the CSIRO, Norfolk Group, various companies in the MIM and Aurizon Groups, and Government and private sector advisory boards. She has acted as Chairman of the Audit Committees of CSIRO, Norfolk Group and Pacific Aluminium. Ms O’Toole is currently a director of Credit Union Australia and the Wesley Research Institute.

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

As Ms O’Toole’s appointment is to take effect before this Annual General Meeting, in accordance with the Company’s Constitution and the ASX Listing Rules, she offers herself for election as a Director at this Annual General Meeting.

The Board considers that Ms O’Toole will be an Independent Director.

Ms O’Toole brings a skillset comprising strategic, financial, commercial and operational expertise, as well as substantial knowledge and understanding of global metals markets and supply chains. She has also been at the frontline of large business transformations and organisational change.

Prior to submitting herself for election, Ms O’Toole acknowledged to the Company that she would have sufficient time to properly fulfil her duties to the Company.

Board’s recommendation

The Board unanimously recommends you vote in favour of the election of Ms O’Toole.

RESOLUTION 5 – ELECTION OF DIRECTOR – GEORGIA NELSON BS, MBA (AGE 64)

INDEPENDENT NON-EXECUTIVE DIRECTOR

Ms Nelson has agreed to be appointed as a Director, with effect from 1 November 2014. Following her appointment, Ms Nelson will become a member of the Safety, Health, Environment & Community Committee, and the Remuneration Committee. Ms Nelson is the former founding president of Midwest Generation EME, LLC, an Edison International company with its corporate headquarters in Chicago. Previously, Ms Nelson was senior vice president of worldwide operations for Edison Mission Energy where she was responsible for worldwide power plant construction, as well as international environmental, fuel and technical policy, and plant personnel and operations on four continents. Ms Nelson previously spent more than 25 years with Southern California Edison, a large U.S. electric utility. Ms Nelson serves as a director of three publicly traded corporations: Cummins Inc. (CMI) a global engine and equipment manufacturer, Ball Corporation (BLL) a global metals container manufacturing company, and TransAlta Corporation (TAC), a power generation and wholesale marketing company. Ms Nelson has been appointed by the Secretary of Energy in the last four administrations to the Executive Committee of the National Coal Council, a federal advisory committee to the US Department of Energy. She served as Chair of this Council from May 2006 to May 2008. She also serves on the advisory committee of the Center for Executive Women at Northwestern University and formerly served on the Women’s Advisory Board of the JFK School of Government at Harvard University. Ms Nelson holds an MBA from the University of Southern California and a BS from Pepperdine University.

As Ms Nelson’s appointment is to take effect before this Annual General Meeting, in accordance with the Company’s Constitution and the ASX Listing Rules, she offers herself for election as a Director at this Annual General Meeting.

The Board considers that Ms Nelson will be an Independent Director.

Ms Nelson has broad experience as a corporate director with particular expertise in large and complex organizations, international and domestic operations, and manufacturing and human resources. She has been responsible for the construction and operation of large power projects in both Melbourne and Perth. In addition, her previous responsibilities have also included environmental policy for a global energy company, and she has lectured at Northwestern University in Chicago on global sustainability and environmental policy. Ms Nelson firmly

believes that she will be able to apply this knowledge to a global organization like Sims Metal Management Limited.

Prior to submitting herself for election, Ms Nelson acknowledged to the Company that she would have sufficient time to properly fulfil her duties to the Company.

Board’s recommendation

The Board unanimously recommends you vote in favour of the election of Ms Nelson.

RESOLUTION 6 – APPOINTMENT OF AUDITOR

It is the policy of the Company and its Risk, Audit & Compliance Committee (RAC Committee) to appoint external auditors who clearly demonstrate quality and independence. In accordance with the Company’s External Auditor Policy, applications for tender of external audit services are requested as deemed appropriate, taking into consideration assessment of performance, existing value and tender costs.

PricewaterhouseCoopers (PwC) was appointed as the external auditor of the Company in 1991 at the time of the listing of Simsmetal Limited on the Australian Securities Exchange. The Board believed that it was in the interests of best corporate governance practice to undertake a tender process for the audit services. Following this tender process, in which PwC was also invited to participate, the Board, on the recommendation of the RAC Committee, selected Deloitte Touche Tohmatsu (Deloitte) to, subject to Shareholder approval, act as the Company’s auditor. The Board believes that Deloitte has the capabilities to serve a group of the scale, scope and global reach of Sims Metal Management, as well as the experience and expertise in providing services to a leading participant in the metals recycling and e-recycling industries. Consequently, the Board believes that the appointment of Deloitte is in the best interests of the Company and its Shareholders. Non-Executive Director, Mr Bass, a retired former partner of Deloitte, abstained from voting both on the recommendation of the RAC Committee, and the vote of the Board, in respect of the appointment of Deloitte.

PwC has submitted its resignation as auditor of the Company and advised the Company that it has applied to ASIC for consent to resign effective from the later of the conclusion of this Annual General Meeting and the day on which ASIC gives its consent. The Company expects that ASIC will give its consent prior to the Annual General Meeting.

Deloitte has provided consent to its appointment as auditor of the Company, subject to ASIC consenting to the resignation of PwC as auditor of the Company and the approval by Shareholders.

On the assumption that ASIC consents to PwC’s resignation as auditor, the Chairman of the Company, Mr Brunsdon, as a member of the Company, nominated Deloitte to act as the auditor of the Company. In accordance with section 328B(3) of the Corporations Act, a copy of the notice of nomination is included in Annexure 4.

Under the Corporations Act, Shareholder approval is required for the appointment of a new auditor. Subject to this approval being obtained, the appointment of Deloitte will become effective from the later of the conclusion of this Annual General Meeting and the day on which ASIC gives its consent to PwC’s resignation.

If passed, this Resolution also authorises the Board to fix the remuneration from time to time of Deloitte as the Company’s new auditor.

Board’s recommendation

The Board, with Mr Bass absent and not voting, unanimously recommends you vote in favour of Resolution 6.

| | | | |

SIMS METAL MANAGEMENT LIMITED NOTICE OF 2014 ANNUAL GENERAL MEETING | | | 5 | |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

RESOLUTION 7 – REMUNERATION REPORT

The Remuneration Report is contained in the Directors’ Report of the Company’s 2014 Annual Report. The Report explains the Company’s executive remuneration practices and the link between the remuneration of employees and the Company’s performance and sets out remuneration details for each Director and for each named Executive.

The Corporations Act requires listed companies to put the Remuneration Report for each financial year to a resolution of members at their Annual General Meeting. Under section 250R(3) of the Corporations Act, the vote is advisory only and does not bind the Directors or the Company. However, if at least 25% of the votes cast on Resolution 7 are against adoption of the Remuneration Report at this Meeting, and then again at the 2015 Annual General Meeting, the Company will be required to put to Shareholders at the 2015 Annual General Meeting a resolution proposing the calling of an extraordinary general meeting to consider a spill of the Board (spill resolution).

If more than 50% of Shareholders vote in favour of the spill resolution, the Company must convene the extraordinary general meeting (spill meeting) within 90 days of the 2015 Annual General Meeting. All of the Directors who were in office when the 2015 Directors’ Report was approved, other than the Managing Director, will cease to hold office immediately before the end of the spill meeting but may stand for re-election at the spill meeting. Following the spill meeting those persons whose election or re-election as Directors is approved will be the Directors of the Company.

The Chairman will give Shareholders a reasonable opportunity to ask questions about or make comments on the Remuneration Report.

Voting exclusion statement

The Company will disregard any votes cast on Resolution 7 by or on behalf of a member of the key management personnel for the Sims Metal Management Limited consolidated group whose remuneration details are included in the Remuneration Report (each aKMP), or a closely related party (such as close family members and any companies the person controls) of a KMP, in any capacity (including as proxy), unless the vote is cast as proxy for a person entitled to vote on Resolution 7:

| • | | in accordance with a direction in the Proxy Form; or |

| • | | by the Chairman of the Meeting where the proxy appointment expressly authorises the Chairman to exercise an undirected proxy even if the Resolution is connected directly or indirectly with the remuneration of a KMP (please refer to the Proxy Form for this authorisation). |

Board’s recommendation

The Board unanimously recommends you vote in favour of adopting the Remuneration Report.

RESOLUTION 8 – PARTICIPATION IN THE COMPANY’S LONG TERM INCENTIVE PLAN (LTIP) BY MR CLARO

The Board (with Mr Claro absent and not voting) believes it is appropriate that Group CEO, Mr Claro be entitled to be granted Performance Rights (which are subject to the performance hurdles described below) and Options (collectivelyEquity Rights), under the LTIP.

The Board believes that the grant of the Equity Rights, more fully described below, pursuant to the LTIP which was introduced in 2007, is an important element of the Company’s remuneration

strategy for the Group CEO, which includes fixed remuneration and other benefits (Total Fixed Remuneration orTFR), a short-term incentive (STI) and a long-term incentive (LTI) as set out in the Company’s Annual Report. Mr Claro’s total compensation currently comprises TFR of US$1,150,000 per annum, an annual STI opportunity of 100% of TFR (target) and 200% (maximum), and an annual LTI award equal to 200% of TFR. Consequently, the FY2015 LTI Award has a value of US$2,300,000. Subject to this Resolution 8 being passed, Mr Claro will be entitled to an LTI award (FY2015 LTI Award), comprising:

| (a) | 127,467 Performance Rights with a relative Total Shareholder Return (TSR) performance hurdle set against a peer group of companies and vesting conditions based on this hurdle and on continued employment; |

| (b) | 91,781 Performance Rights with an earnings performance hurdle, with vesting conditions based on this hurdle and on continued employment; and |

| (c) | 172,866 Options with a market price exercise price, with vesting conditions based on continued employment. |

More details regarding the terms of these Equity Rights are set out below.

Reasons for the Equity Rights structure for the 2015 financial year grant

The Company is an organisation with approximately 60% of its revenue generated from North America, and a significant number of its executive team are based there.

Consequently, the Company must ensure that its executive remuneration approach reflects United States (US) compensation systems/practices, while being cognisant of Australian practices. The Board is of the view that Mr Claro’s FY2015 LTI Award meets both these requirements.

Reasons for approval

The approval of Shareholders is sought under Resolution 8 for the purposes of ASX Listing Rules 7.1 and 10.14.

| 1. | Under ASX Listing Rule 7.1 (subject to certain exceptions), the Company must not issue equity securities (which include a right to a Share and a security convertible into a Share) which, when aggregated with the equity securities issued by the Company during the previous 12 months without Shareholder approval (or under a specified exception), exceed 15% of the number of Shares on issue at the commencement of that 12-month period, unless the issue is approved by Shareholders. |

If Resolution 8 is passed, then the Equity Rights, and any Shares issued on vesting and exercise of the Equity Rights, will not count towards the 15% limit imposed by ASX Listing Rule 7.1.

Exception 4 of ASX Listing Rule 7.2 provides that ASX Listing Rule 7.1 does not apply to an issue of equity securities on the conversion of convertible securities if the Company complied with the ASX Listing Rules when it issued the convertible securities. Therefore, if Resolution 8 is passed, Shareholder approval is not required under ASX Listing Rule 7.1 for the future issue of any Shares on exercise of any of the Equity Rights.

| 2. | Under ASX Listing Rule 10.14, the Company must not permit a director of the Company to acquire securities under the LTIP without approval of Shareholders. |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

ASX Listing Rule 10.11 provides that unless a specified exception applies, the Company must not issue or agree to issue equity securities to a related party (which includes a director of the Company) without the approval of Shareholders. One of the exceptions to ASX Listing Rule 10.11 is if the issue of the securities is approved under ASX Listing Rule 10.14. Therefore, Shareholder approval is sought for the purposes of ASX Listing Rule 10.14, and if Resolution 8 is passed, Shareholder approval is not required under ASX Listing Rule 10.11 for the grant of the Equity Rights.

Additionally, Exception 7 of ASX Listing Rule 10.12 provides that ASX Listing Rule 10.11 does not apply if the director receives the securities on the conversion of convertible securities, if the Company complied with the ASX Listing Rules when it issued the convertible securities. Therefore, if Resolution 8 is passed, Shareholder approval is also not required under ASX Listing Rule 10.11 for the future issue of any Shares on exercise of any of the Equity Rights.

Detail of FY2015 LTI Award

If approved by Shareholders, Mr Claro will receive his FY2015 LTI Award in three components:

| 1. | A grant of Performance Rights with a nil issue and exercise price, with automatic vesting based on the TSR of the Company relative to the performance of an international peer group of companies in the Company’s sector (subject to a continued employment vesting condition described in more detail below) (TSR Performance Rights). The list of these comparators is in Annexure 1 to this Explanatory Memorandum. While performance hurdles for vesting are common in Australia, they are only used in a minority of US plans. This grant would constitute two-fifths of Mr Claro’s FY2015 LTI Award. |

| 2. | A grant of Performance Rights with a nil issue and exercise price, with automatic vesting based on the earnings performance of the Company (subject to a continued employment vesting condition described in more detail below) (Earnings Performance Rights). This grant would constitute two-fifths of Mr Claro’s FY2015 LTI Award. |

| 3. | A grant of Options, with an exercise price based on the average of the closing prices of the Shares traded on ASX in the ordinary course of trade during the five trading days up to, but not including, the grant date (FY2015 Options). The FY2015 Options will vest automatically in three equal tranches on each of 31 August 2015, 31 August 2016 and 31 August 2017 (subject to a continued employment vesting condition described in more detail below). The vesting of any of the FY2015 Options is not subject to any performance hurdles. Whilst option grants without performance hurdles are uncommon in Australia, they are common practice in the US. Moreover, no gains will be available to Mr Claro unless the Share price of the Company increases above the exercise price for the FY2015 Options. This grant would constitute one-fifth of Mr Claro’s FY2015 LTI Award. |

The grant of the FY2015 LTI Award will provide:

| • | | a reward for strong performance relative to peers; and |

| • | | a reward for generating returns for Shareholders, |

with vesting based both on performance and on continued employment.

This LTI structure ensures that Mr Claro focuses on shareholder value creation relative to companies within the Company’s industry, as well as earnings growth and absolute share price growth. This structure is more rigorous than other structures typically seen in the Australian market where, in difficult economic conditions, 100% of the LTI opportunity can still vest even if relative TSR performance is strong but no shareholder value has been created.

Accordingly, the Board believes that the proposed grant of the FY2015 LTI Award to Mr Claro is an approach which will support both the business direction of the Company in accordance with its 5 year strategic plan, and shareholder expectations.

Key terms of FY2015 Performance Rights

| (a) | 219,248 Performance Rights (which comprise 127,467 TSR Performance Rights and 91,781 Earnings Performance Rights) (FY2015 Performance Rights) will be granted to Mr Claro under the LTIP Rules, conditional on obtaining Shareholder approval pursuant to Resolution 8. A Performance Right is the right to be issued a Share upon satisfaction of all applicable vesting conditions for a nil issue price. Under the LTIP Rules, the Company may, in its discretion, cause existing Shares to be transferred to Mr Claro in satisfaction of its obligation to issue Shares to him on exercise of his FY2015 Performance Rights. |

The performance period for the FY2015 Performance Rights is the three-year period commencing 1 July 2014 (Start Date) and ending 30 June 2017 (Test Date) (Performance Period).

The FY2015 Performance Rights will be tested for satisfaction of their vesting conditions at the Test Date. Any FY2015 Performance Rights which have not vested as at the Test Date will immediately lapse.

If the FY2015 Performance Rights vest, they will be automatically exercised (with no further action required on the part of Mr Claro) into Shares on 31 August 2017, being the last business day in August following the Test Date (Rights Vesting Date).

| (c) | TSR Performance Hurdle: |

The TSR Performance Rights are subject to a vesting condition based on a TSR performance hurdle.

TSR measures the growth over a particular period in the price of shares plus dividends notionally re-invested in shares.

In order for any of Mr Claro’s TSR Performance Rights granted to him under the FY2015 LTI Award to vest, the Company’s TSR for the relevant Performance Period must be at the 50th percentile or higher against the TSRs of an international peer group of 15 specified comparator companies in the Company’s sector. The list of these comparators is in Annexure 1 to this Explanatory Memorandum.

Based on the Company’s relative TSR performance over the Performance Period, Mr Claro’s TSR Performance Rights will vest in accordance with the following table:

| | | | |

SIMS METAL MANAGEMENT LIMITED NOTICE OF 2014 ANNUAL GENERAL MEETING | | | 7 | |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

| | |

TSR of the Company relative to TSRs of Comparators | | Proportion of TSR Performance Rights vesting |

| Less than the 50thpercentile | | 0% |

| 50thpercentile | | 50% |

| Between 50thpercentile and 75thpercentile | | Straight-line vesting between 50% and 100% |

| 75thpercentile or higher | | 100% |

TSR is calculated in each case on the following basis:

| | • | | dividends are re-invested on the ex-dividend date; |

| | • | | share prices are calculated as a volume weighted average sale price of shares on the ASX for the three months preceding the Start Date and the three-month period up to and including the Test Date; |

| | • | | local currencies are used for non-Australian comparator companies, so currency movements are ignored; and |

| | • | | tax and any franking credits (or similar) will be ignored. |

(d) Earnings Performance Hurdle:

The Earnings Performance Rights are subject to a vesting condition based on an earnings performance hurdle. This hurdle measures the Company’s cumulative Earnings per Share (EPS) growth over the Performance Period.

The proportion of Earnings Performance Rights that vest will be determined in accordance with the vesting schedule below. The EPS hurdle assesses the success of the business in generating continued growth in earnings.

The EPS vesting schedule is as follows:

| | |

EPS Growth Target | | Proportion of Earnings Performance Rights vesting |

| Cumulative EPS target of less than $1.70 | | 0% |

| Cumulative EPS target of $1.70 | | 50% |

| Cumulative EPS target of between $1.70 and $2.00 | | Straight-line vesting between 50% and 100% |

| Cumulative EPS target of greater than $2.00 | | 100% |

The EPS figure of the Company for a particular financial year (EPS Figure) is calculated taking the profit after tax of the Company and dividing it by the number of Company shares outstanding on the basis of diluted shares that takes into account the dilutive effect of share-based awards.

In the case of a bonus or pro-rata issue of shares, or certain other reorganisations of capital of the Company, then the methodology for calculating the EPS Figure shall be adjusted accordingly so that parity is preserved.

The Board may adjust the EPS Figure to exclude the effects of material business acquisitions or divestments and for certain one-off costs.

| (e) | Continued employment vesting condition: |

In addition to the Company meeting the applicable TSR performance hurdle and the earnings performance hurdle specified above, Mr Claro must also continue to be a full-time employee of the Company (or its subsidiary) at the Rights Vesting Date for the FY2015 Performance Rights to vest.

Unvested FY2015 Performance Rights lapse upon Mr Claro ceasing to be an employee, subject to his Executive Employment Agreement dated 7 October 2013 which may allow continued vesting in certain circumstances (referred to as aQualifying Cessation). A Qualifying Cessation allowing continued vesting of any unvested FY2015 Performance Rights will occur in the following circumstances:

| | (i) | If Mr Claro’s employment is terminated by the Company for convenience, unless the Board determines otherwise acting reasonably having regard to the performance of Mr Claro over the preceding years. |

| | (ii) | If Mr Claro terminates his employment for good reason. |

| | (iii) | If Mr Claro’s employment is terminated on his death or permanent disablement, or in other circumstances determined at the discretion of the Board. |

In the event of a Qualifying Cessation on or prior to the Test Date, Mr Claro’s unvested FY2015 Performance Rights will not immediately lapse, but instead will be retained and tested for satisfaction of vesting conditions at the end of the Performance Period (that is, the Test Date).

Where there is a Qualifying Cessation after the Test Date but prior to the Rights Vesting Date, Mr Claro’s vested FY2015 Performance Rights will, assuming they have satisfied the vesting conditions, not lapse but will instead be automatically exercised on the Rights Vesting Date.

All FY2015 Performance Rights will lapse and be immediately forfeited in cases of fraud, gross dishonesty or termination of Mr Claro’s employment for cause.

The Board has the discretion to immediately vest Mr Claro’s unvested FY2015 Performance Rights if:

| | • | | a person who did not control the Company at the date of grant of the FY2015 Performance Rights gains control of the Company; or |

| | • | | a takeover bid is recommended by the Board, or a scheme of arrangement which would have a similar effect to a full takeover bid is approved by the Company’s Shareholders. |

Key terms of FY2015 Options

| (a) | 172,866 Options will be granted to Mr Claro under the FY2015 LTI Award, conditional on obtaining Shareholder approval to Resolution 8. An Option is a right to be issued a Share upon the applicable vesting conditions being met and payment of the exercise price. The FY2015 Options to be issued to Mr Claro will be issued for nil issue price. Under the LTIP Rules, the Company may, in its discretion, cause existing Shares to be transferred to Mr Claro in satisfaction of its obligation to issue Shares to him on exercise of his FY2015 Options. |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

| (b) | The exercise price of the FY2015 Options will be calculated using the average of the closing prices of the Shares traded on the ASX in the ordinary course of trade during the five trading days up to, but not including, the date of grant of the FY2015 Options. If Resolution 8 is passed, the FY2015 Options will be granted to Mr Claro on 14 November 2014. |

| (c) | The FY2015 Options will vest, and become exercisable, in three equal tranches over approximately three years on 31 August 2015, 31 August 2016 and 31 August 2017 (Options Vesting Date) as set out below (Vesting Schedule). |

Vesting Schedule

| | | | | | |

| | | Number of | | | |

| | | FY2015 Options | | | |

| | | which will vest | | | Date |

Tranche 1 | | | 57,622 | | | 31 August 2015 |

Tranche 2 | | | 57,622 | | | 31 August 2016 |

Tranche 3 | | | 57,622 | | | 31 August 2017 |

| (d) | Once vested, the FY2015 Options can be exercised up until the date which is 7 years from the date of their grant, at which time all unexercised FY2015 Options will expire. |

| (e) | Continued employment vesting condition: |

Mr Claro must continue to be a full-time employee of the Company (or its subsidiary) at the relevant Options Vesting Date for the relevant tranche of FY2015 Options to vest.

Unvested FY2015 Options lapse upon Mr Claro ceasing to be an employee, subject to his Executive Employment Agreement dated 7 October 2013 which may allow continued vesting in certain circumstances (referred to as aQualifying Cessation). These circumstances are detailed above in paragraph (e) under the heading ‘Key terms of FY2015 Performance Rights’.

In the event of a Qualifying Cessation, Mr Claro’s unvested FY2015 Options will not immediately lapse, but instead will vest in accordance with the original Vesting Schedule.

All FY2015 Options will lapse and be immediately forfeited in cases of fraud, gross dishonesty or termination of Mr Claro’s employment for cause.

The Board has the discretion to immediately vest Mr Claro’s unvested FY2015 Options if:

| | • | | a person who did not control the Company at the date of grant of the FY2015 Options gains control of the Company; or |

| | • | | a takeover bid is recommended by the Board, or a scheme of arrangement which would have a similar effect to a full takeover bid is approved by the Company’s Shareholders. |

Equity Rights generally

In relation to both Performance Rights and Options, the Plan Rules:

| (a) | prohibit the executive from hedging unvested awards; |

| (b) | allow the Company to settle awards in cash upon vesting at the Board’s discretion; |

| (c) | state that if, prior to their exercise, the Company undergoes a reorganisation of capital (other than by way of a bonus |

issue or issue for cash), the terms of the Equity Rights will be changed to the extent necessary to comply with the ASX Listing Rules as they apply at the relevant time to a reorganisation of capital at the time of the reorganisation; and

| (d) | state that the holder is not entitled to participate in a new issue of shares or other securities made by the Company to holders of its shares unless the Equity Rights are vested and exercised before the record date for the relevant issue. |

ASX Listing Rules requirements

The following information is provided for the purposes of these ASX Listing Rules 7.3 and 10.15A:

| (a) | The approval sought under Resolution 8 is in relation to the grant of securities (being the Equity Securities under Mr Claro’s FY2015 LTI Award) to Mr Claro, who is a director of the Company. |

| (b) | Under Mr Claro’s FY2015 LTI Award, the maximum number of FY2015 Performance Rights that will be granted to him is 219,248 and the maximum number of FY2015 Options that will be granted to him is 172,866. Each FY2015 Performance Right and FY2015 Option, on vesting, entitles Mr Claro to be issued one Share. |

| (c) | No issue price is payable by Mr Claro for the grant of the FY2015 Performance Rights and FY2015 Options to him. |

No exercise price is payable to exercise the FY2015 Performance Rights (subject to the vesting conditions being satisfied).

The exercise price of the FY2015 Options is based on the average of the closing prices of the Shares traded on the ASX in the ordinary course of trade during the five trading days up to, but not including, the grant date of the FY2015 Options.

| (d) | No funds are being raised from the grant of the FY2015 Performance Rights or FY2015 Options. |

| (e) | The terms of the FY2015 Performance Rights and FY2015 Options proposed to be granted to Mr Claro are summarised above. Shares issued on exercise of any of the FY2015 Performance Rights and FY2015 Options have the same rights as the then existing fully paid ordinary shares of the Company. |

| (f) | Since the date of the last Shareholder approval under ASX Listing Rule 10.14 (being 14 November 2013), grants of 201,589 Performance Rights, 138,714 Options and 116,505 Restricted Stock Units were made to Mr Claro for nil consideration under the LTIP. |

| (g) | All Directors are eligible under the terms of the LTIP to participate in the LTIP, although there is no intention to make awards to Non-Executive Directors. The names of the current Directors are Mr Robert Bass, Mr Norman Bobins (who will retire at the conclusion of this Annual General Meeting), Mr Geoffrey Brunsdon, Mr Galdino Claro, Mr John DiLacqua, Mr Gerald Morris (who will retire at the conclusion of this Annual General Meeting), Mr Christopher Renwick, Mrs Heather Ridout, Mr Tamotsu Sato and Mr James Thompson. In addition, Ms Deborah O’Toole and Ms Georgia Nelson have both agreed to be appointed as Non-Executive Directors with effect from 1 November 2014. |

| (h) | If Resolution 8 is passed, the FY2015 Performance Rights and FY2015 Options will be granted to Mr Claro on 14 November 2014. |

| | | | |

SIMS METAL MANAGEMENT LIMITED NOTICE OF 2014 ANNUAL GENERAL MEETING | | | 9 | |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

| (i) | No loan is advanced to Mr Claro in relation to the proposed grant of the FY2015 Performance Rights and FY2015 Options to him. |

| (j) | A voting exclusion statement for Resolution 8 is set out below. |

| (k) | The following statements are provided as required by ASX Listing Rule 10.15A.8: |

| | • | | Details of any securities issued under the LTIP will be published in each annual report of the Company relating to a period in which securities have been issued, together with a statement that approval for the issue of the securities was obtained under ASX Listing Rule 10.14. |

| | • | | Any additional persons who become entitled to participate in the LTIP after this Resolution 8 is approved, who require approval under ASX Listing Rule 10.14 to participate and who are not named in this Notice, will not participate in the LTIP until approval is obtained under ASX Listing Rule 10.14. |

Voting exclusion statement

The Company will disregard any votes cast on Resolution 8:

| • | | by Mr Claro and any other Director of the Company (and any of their associates); and |

| • | | by a KMP, or a closely related party of a KMP, as a proxy, |

unless the vote is cast as proxy for a person entitled to vote on Resolution 8:

| • | | in accordance with a direction in the Proxy Form; or |

| • | | by the Chairman of the Meeting where the proxy appointment expressly authorises the Chairman to exercise an undirected proxy even if the Resolution is connected directly or indirectly with the remuneration of a KMP (please refer to the Proxy Form for this authorisation). |

Board’s recommendation

The Board, with Mr Claro absent and not voting, unanimously recommends you vote in favour of Resolution 8 which will complete the Company’s remuneration strategy for Mr Claro for the 2015 financial year.

RESOLUTION 9 – TERMINATION BENEFITS

Background

Under section 200B of the Corporations Act, the Company must not give a person a benefit in connection with the person’s retirement from an office, or position of employment, in the Company (or a related body corporate of the Company) (each, aGroup Company) if:

| • | | the office or position is a managerial or executive office; or |

| • | | the person has, at any time during the last three years before their retirement, held a managerial or executive office in a Group Company, |

unless Shareholder approval is obtained under section 200E of the Corporations Act for the giving of the benefit (or if a specified exception applies).

A “benefit” is defined broadly in the Corporations Act to include a payment or other valuable consideration. It also includes the accelerated or automatic vesting of share-based payments on or as a result of retirement from an office or position, a payment made in lieu of giving of notice of termination and a payment that

is made as part of a restrictive covenant, restraint-of-trade clause or non-compete clause.

There are exceptions for the provision of certain kinds of benefits, such as statutory entitlements to accrued annual and long service leave and certain benefits within a monetary cap. This monetary cap is, in broad terms, equivalent to one year’s annual average base salary of the relevant person over the period during which that person held a managerial or executive office (up to a period of three years).

If a termination benefit is given in excess of what is permitted under the Corporations Act, a breach of the Corporations Act can occur even if the person receiving the benefit is entitled to the benefit under their contractual arrangements with a Group Company.

Having regard to the potentially wide application of the restriction under section 200B of the Corporations Act, the Directors consider it to be appropriate and prudent to seek Shareholder approval under sections 200B and 200E of the Corporations Act, so that termination benefits may be paid or provided to relevant executives without breach of the Corporations Act.

Who does the approval relate to?

Persons affected by the restriction under section 200B of the Corporations Act, and in respect of whom approval is being sought under this Resolution 9, are any current or future director or employee who, at the time of his or her cessation from his or her office or employment, or at any time during the last three years before his or her cessation from his or her office or employment, held a managerial or executive office in a Group Company (Relevant Executives). These include members of the Company’s KMP and directors of the Company’s subsidiaries.

Relevant Executives are employed through a number of Group Companies and, due to the Group’s global scale, many of the Relevant Executives are employed outside Australia, particularly in the United States where the Group competes for much of its talent and business. The remuneration practices of the Group have therefore been designed to be consistent with local practices and regulations in the jurisdictions where these Relevant Executives are employed.

As at the date of this Explanatory Memorandum, the Relevant Executives include:

| • | | the KMPs of the Company, who are currently: |

| | • | | Galdino Claro – Group Chief Executive Officer and Managing Director; |

| | • | | Bob Kelman – Managing Director, European Metals; |

| | • | | Steve Skurnac – President – Global Sims Recycling Solutions; |

| | • | | Fred Knechtel – Group Chief Financial Officer (who will commence employment with the Company in November 2014); and |

| | • | | Darron McGree – Managing Director – Australia and New Zealand Metals. |

Details about the remuneration of these executives (other than Mr Knechtel who will commence employment with the Company in November 2014) are included in the Remuneration Report; and

| • | | other executives who hold a “managerial or executive office” in the Company or a related body corporate. Executives who may fall into this category include those who are not KMPs but who hold a management position and also serve as a director of one or more of the Company’s subsidiaries. |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

Although the number will vary from time to time, the Company estimates that there are currently approximately 30 Relevant Executives that the restriction under section 200B of the Corporations Act could apply to.

It is important to note that Resolution 9 seeks approval, not just for the persons identified above, but also for any other current or future director or employee who, at the time of his or her termination or at any time in the three years prior to that date, was a KMP of the Company or held a managerial or executive office in the Company or a related body corporate.

Categories of termination benefits approval is being sought for

Shareholder approval is sought for the purposes of sections 200B and 200E of the Corporations Act for termination benefits that may be provided to Relevant Executives under the following agreements or plans:

| (a) | individual employment agreements or service contracts(EmploymentAgreements); |

| (b) | the Company’s Short-Term Incentive Plan(STIPlan); |

| (c) | the Company’s Long-Term Incentive Plan(LTI Plan); |

| (d) | medical, insurance, pension and superannuation plans and schemes; |

| (e) | the redundancy policy of Sims Group Australia Holdings Limited (a subsidiary of the Company) and the Group’s legacy redundancy policy(Redundancy Policies); and |

| (f) | other practices and policies described in Annexure 2. |

Further information about these potential termination benefits is set out in Annexure 2.

Aspects of the Group’s Employment Agreements, STI Plan, LTI Plan, Redundancy Policies and other employment practices and policies may be varied from time to time by the Company in line with market practice, changing governance standards and needs of the Group. Where relevant, these changes will be reported in the Company’s Remuneration Report. However, it is intended that the approval set out in Resolution 9 will remain valid despite such variation, as long as the termination benefits continue to be within the scope of benefits set out in this Explanatory Memorandum.

Value of the termination benefits

Under section 200E of the Corporations Act, when seeking Shareholder approval of a termination benefit, Shareholders must be given details of the amount or value of the proposed payment or benefit, or if that amount or value cannot be ascertained at the time of disclosure, the manner in which that amount or value is to be calculated and any matter, event or circumstance that will, or is likely to, affect the calculation of that amount or value.

The amount and value of the termination benefits that may be provided to each Relevant Executive cannot be ascertained in advance. This is because various matters, events and circumstances (including the manner in which the individual retires from their role, the length of time they have been in their role, fluctuations in the Company’s share price and the exercise of discretions by the Board or Remuneration Committee), some of which are not within the Company’s control, will or are likely to affect the calculation of the amount or value. Annexure 3 sets out the manner in which the amount or value of the potential benefits will be calculated, and the matters, events and circumstances that will affect the calculation of that amount or value.

The amount and value of the benefits for which Shareholder approval is being sought under Resolution 9 is the maximum

amount or value of the benefit that could be provided to the Relevant Executive in connection with that person ceasing to hold an office, or position of employment, in the Company or a related body corporate.

Effect of the approval

Enables the Group to provide maximum benefits set out in this Explanatory Memorandum

If Shareholder approval is obtained to Resolution 9, then the Group will be able to provide termination benefits to Relevant Executives up to the maximum scope, amount and value described in this Explanatory Memorandum (including in Annexures 2 and 3). In particular, the Board will be able to exercise the discretions described in Annexure 2.

If approved by Shareholders, these benefits may be given to current or future Relevant Executives, and under existing, varied or new arrangements.

KMPs

All of the current KMPs of the Company (other than Mr McGree, who has a pre-existing employment agreement) have entered into new employment agreements with the Company (or a related body corporate) which entitle them to, subject to Shareholder approval, termination benefits on substantially similar terms to those approved by Shareholders at the Company’s 2013 Annual General Meeting for the Group Chief Executive Officer, Mr Claro. Shareholder approval to Resolution 9 will enable the Company to implement these new arrangements. If Shareholder approval is not obtained, the Company would need to consider potential alternative arrangements for these KMPs which may affect the Company’s ability to treat the KMPs on a consistent basis and impact on its ability to retain them or recruit new executives, particularly in the United States. The signing of these KMPs to new employment agreements was an integral precursor to the Company’s five year strategic plan that was announced to the market on 23 July 2014. The termination benefits that these KMPs would be entitled to, if approved, are linked to 12 month non-compete and non-solicitation provisions contained in their employment agreements.

If Shareholder approval is obtained, it is the Company’s current intention that all future KMPs will be provided termination benefits on terms which are substantially similar. Annexure 2 contains details of the potential benefits that the Company proposes to provide to current and future KMPs.

Any termination benefits provided to KMPs from time to time will be disclosed in the Company’s Remuneration Report for the relevant year.

Non KMP Executives

As noted above, Resolution 9 also covers other Relevant Executives who are not KMPs (Non KMP Executives). A number of these Non KMP Executives are entitled to termination benefits under their existing agreements with the Company (or a related body corporate), where some of these benefits are in accordance with local market practice in the jurisdiction in which that Non KMP Executive is employed.

Approval by Shareholders of Resolution 9 will also enable the Group to meet its contractual obligations to provide termination benefits to these Non KMP Executives where it might otherwise have been prohibited from providing that benefit under the Corporations Act.

| | | | |

SIMS METAL MANAGEMENT LIMITED NOTICE OF 2014 ANNUAL GENERAL MEETING | | | 11 | |

EXPLANATORY MEMORANDUM FOR THE 2014 ANNUAL GENERAL MEETING (MEETING)

Other effects

Further, Shareholder approval to Resolution 9 will enable the Group to:

| • | | remunerate Relevant Executives and generally operate a remuneration framework in a way that the Board considers is in the interests of the Company, within the scope set out in this Explanatory Memorandum (including, in particular, Annexures 2 and 3). This includes enabling the Board (or its delegate) to exercise those discretions referred to in Annexure 2, in favour of the Relevant Executive where the Board considers appropriate; |

| • | | as mentioned above, give effect to existing arrangements with Relevant Executives (including the proposed new arrangements with the KMPs); |

| • | | give effect to its LTI Plan, STI Plan, Redundancy Policies and other plans and policies, including enabling the Board (or its delegate) to exercise its discretion under those plans and policies as referred to in Annexure 2; |

| • | | give effect to the remuneration practices in the markets that the Group operates in (particularly its largest operational jurisdiction of the United States) that the Board considers is fair and reasonable; |

| • | | as far as possible and as the Board considers appropriate, apply consistent remuneration practices across jurisdictions; |

| • | | increase certainty for staff regarding their current and future remuneration arrangements; and |

| • | | implement with a degree of certainty its five year strategic plan that was announced to the market on 23 July 2014. |

If Resolution 9 is not passed, the Group’s ability to achieve the objectives mentioned above may be affected. It may also affect the willingness of employees to join the Group or serve as a KMP or a director of a Group Company, and the Group’s ability to retain employees or recruit new executives, particularly in the United States.

Voting exclusion statement

A vote must not be cast on Resolution 9:

| • | | (in any capacity) by or on behalf of any person who may be entitled to receive a benefit in connection with that person’s retirement from office or position of employment, the subject of Resolution 9, or an associate of such a person; or |

| • | | by a KMP, or a closely related party of a KMP, as a proxy, |

unless the vote is cast as proxy for a person entitled to vote on Resolution 9:

| • | | in accordance with a direction in the Proxy Form; or |

| • | | by the Chairman of the Meeting where the proxy appointment expressly authorises the Chairman to exercise an undirected proxy even if the Resolution is connected directly or indirectly with the remuneration of a KMP (please refer to the Proxy Form for this authorisation). |

Board’s recommendation

The Board (with Mr Claro absent) has formed the view that the termination benefits described in this Explanatory Memorandum are fair and reasonable. The Board, with Mr Claro absent and not voting, therefore unanimously recommends you vote in favour of Resolution 9.

12

ANNEXURE 1

Comparator companies for TSR performance hurdle

ANNEXURE 2

Summary of potential termination benefits for which approval is being sought

| | | | |

| | | Potential benefits / treatment on cessation of employment |

Agreement / Plan | | KMP | | Non KMP Executives |

| | |

Employment Agreements All of the Relevant Executives who are KMPs as described in the Remuneration Report are employed under Employment Agreements. Further details about the Employment Agreements of those KMPs are contained in section F of the Remuneration Report. For the KMPs (other than Mr McGree, who has a pre-existing agreement), the potential termination benefits available to them under their Employment Agreements are or will be substantially similar to those that Mr Claro is entitled to and which were approved by Shareholders at the Company’s 2013 Annual General Meeting. The other Relevant Executives (Non KMPExecutives) are, or will be, also employed under Employment Agreements, the terms and conditions of which may vary from individual to individual. | | Payment in lieu of notice The Employment Agreements for KMPs (other than Mr McGree) typically contain or will contain the ability for the Company or the relevant Group Company that is the employer (EmployerCompany) to make a payment in lieu of some or all of the applicable termination notice period (which is three months). In the case of Mr McGree, the Employer Company may make a payment in lieu of the applicable termination notice period which is 12 months. Where payment in lieu of notice is made, the payment will be calculated by reference to the KMP’s total fixed remuneration. | | Payment in lieu of notice The Employment Agreements for some of the Non KMP Executives also contain or will contain the ability for the Employer Company to make a payment in lieu of some or all of the applicable termination notice period (which is between one month and 12 months). The payment in lieu of notice will also be calculated by reference to the Non KMP Executive’s total fixed remuneration. |