Exhibit 99.6

Mattson Merger Announcement December 2, 2015

Today’s Press Release • Mattson has entered a merger agreement with Beijing E-Town Dragon Semiconductor Industry Investment Center (Limited Partnership) (“E-Town”) • E-Town will acquire all outstanding shares of MTSN stock for $3.80 per share in cash • Final approvals need to be given by: – MTSN shareholders • A special shareholders meeting to be convened for the purpose of voting on the merger – Regulatory and antitrust agencies 20 August 2015 – slide 1 Mattson Confidential Innovation • Speed • Solutions

Today’s Press Release • Why Mattson is entering this agreement – This merger will give significant value to MTSN shareholders • The purchase price of $3.80 per share represents a 55 percent premium to the 30-trading day average closing price for the period ending December 1, 2015, and a 23 percent premium to Mattson’s closing stock price on December 1, 2015 – New ownership and corporate structure will better support Mattson’s long-term goals • Product innovation to provide value to our existing customers and to expand our customer base • Growth of the business for our employees and partners 20 August 2015 – slide 2 Mattson Confidential Innovation • Speed • Solutions

Who Are the Proposed New Owners Innovation • Speed • Solutions

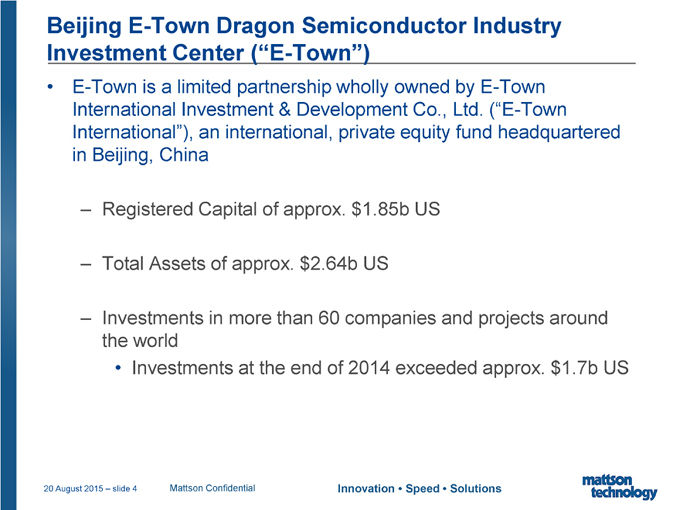

Beijing E-Town Dragon Semiconductor Industry Investment Center (“E-Town”) • E-Town is a limited partnership wholly owned by E-Town International Investment & Development Co., Ltd. (“E-Town International”), an international, private equity fund headquartered in Beijing, China – Registered Capital of approx. $1.85b US – Total Assets of approx. $2.64b US – Investments in more than 60 companies and projects around the world • Investments at the end of 2014 exceeded approx. $1.7b US 20 August 2015 – slide 4 Mattson Confidential Innovation • Speed • Solutions

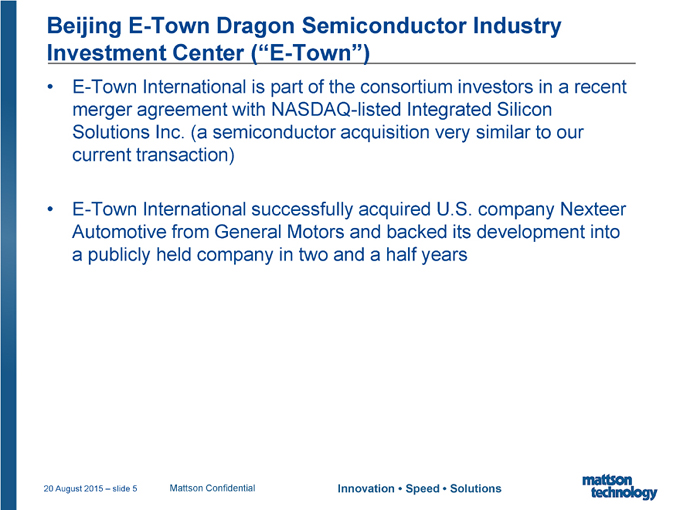

Beijing E-Town Dragon Semiconductor Industry Investment Center (“E-Town”) • E-Town International is part of the consortium investors in a recent merger agreement with NASDAQ-listed Integrated Silicon Solutions Inc. (a semiconductor acquisition very similar to our current transaction) • E-Town International successfully acquired U.S. company Nexteer Automotive from General Motors and backed its development into a publicly held company in two and a half years 20 August 2015 – slide 5 Mattson Confidential Innovation • Speed • Solutions

What Does This Mean to Mattson Technology Innovation • Speed • Solutions

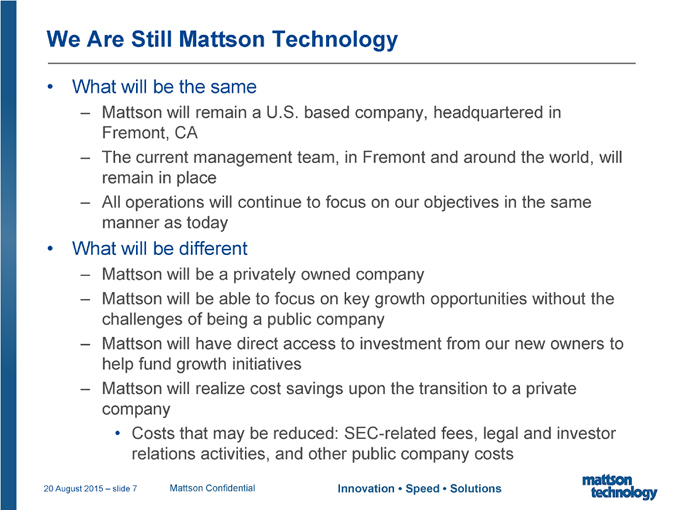

We Are Still Mattson Technology • What will be the same – Mattson will remain a U.S. based company, headquartered in Fremont, CA – The current management team, in Fremont and around the world, will remain in place – All operations will continue to focus on our objectives in the same manner as today • What will be different – Mattson will be a privately owned company – Mattson will be able to focus on key growth opportunities without the challenges of being a public company – Mattson will have direct access to investment from our new owners to help fund growth initiatives – Mattson will realize cost savings upon the transition to a private company • Costs that may be reduced: SEC-related fees, legal and investor relations activities, and other public company costs 20 August 2015 – slide 7 Mattson Confidential Innovation • Speed • Solutions

How This Affects Our Customers • Operationally, there will be no changes – All field operations will continue without interruption – Customers will continue to work with the same Mattson personnel • Mattson remains committed to providing the best support possible throughout this process • Mattson views this change as an opportunity to focus on our product innovation and field support capabilities – Becoming a private company will: • Allow more streamlined decision making • Reduce the expenses incurred as a public company 20 August 2015 – slide 8 Mattson Confidential Innovation • Speed • Solutions

Forward Looking Statements Throughout this document pertaining to the merger transaction between Mattson and E-Town, we make forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be typically identified by such words as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions among others. Although we believe the expectations reflected in any forward-looking statements are reasonable, they involve known and unknown risks and uncertainties, are not guarantees of future performance, and actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements and any or all of our forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Mattson or its businesses or operations. Factors which could cause our actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the merger are not satisfied (including a failure of the stockholders of Mattson to approve, on a timely basis or otherwise, the merger and the risk that regulatory approvals required for the merger are not obtained, on a timely basis or otherwise, or are obtained subject to conditions that are not anticipated); (2) litigation relating to the merger; (3) uncertainties as to the timing of the consummation of the merger and the ability of each of Mattson and E-Town to consummate the merger; (4) risks that the proposed transaction disrupts the current plans and operations of Mattson; (5) the ability of Mattson to retain and hire key personnel; (6) competitive responses to the proposed merger; (7) unexpected costs, charges or expenses resulting from the merger; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; and (9) legislative, regulatory and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Mattson’s most recent Annual Report on Form 10-K, and Mattson’s more recent Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed with the SEC. Mattson can give no assurance that the conditions to the merger will be satisfied. Except as required by applicable law, Mattson cannot undertake any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Mattson does not intend, and assumes no obligation, to update any forward-looking statements. 20 August 2015 – slide 9 Mattson Confidential Innovation • Speed • Solutions

Participants in the Solicitation Mattson and its respective directors, executive officers and other members of management and certain of its employees may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information about Mattson’s directors and executive officers is included in Mattson’s Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 12, 2015, and the proxy statement for Mattson’s 2015 annual meeting of stockholders, filed with the SEC on April 13, 2015. Additional information regarding these persons and their interests in the merger will be included in the proxy statement relating to the proposed merger when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated below. 20 August 2015 – slide 10 Mattson Confidential Innovation • Speed • Solutions

Additional Information This communication is being made in respect of the proposed transaction involving Mattson and E-Town. Mattson intends to file with the SEC a proxy statement in connection with the proposed transaction with E-town as well as other documents regarding the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Mattson and will contain important information about the proposed transaction and related matters. MATTSON’S SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials (when they become available), and any other documents filed by Mattson with the SEC, may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, security holders of Mattson will be able to obtain free copies of the proxy statement from Mattson by contacting Investor Relations by mail at Attn: Investor Relations, 47131 Bayside Parkway, Fremont, California 95438. 20 August 2015 – slide 11 Mattson Confidential Innovation • Speed • Solutions

Thank You!