Exhibit 2

Discussion and Analysis

Management's Discussion and Analysis of

Results of Operations and Financial Condition

for the Year Ended December 28, 2003

All amounts in this Management's Discussion and Analysis of Results of Operations and Financial Condition ("MD&A") of Wescast Industries Inc. ("Wescast" or the Company") are in Canadian dollars unless otherwise noted. This MD&A should be read in conjunction with the Company's audited consolidated financial statements for the year ended December 28, 2003, which are prepared in accordance with Canadian generally accepted accounting principles (GAAP).

For a discussion of the principal differences between Canadian and US GAAP, as they apply to the presentation of Wescast's consolidated financial statements; see Note 24 to the Company's consolidated financial statements. This MD&A contains commentary from Wescast's management regarding strategy, operating results and financial condition. Management is responsible for its accuracy, integrity and objectivity, and has developed, maintains and supports the necessary systems and controls to provide reasonable assurance as to the accuracy of the comments contained herein. This MD&A is current as of March 10, 2004. Additional information relating to the Company, including the Company's Annual Information Form ("AIF"), is available online at sedar.com.

Company Overview

Wescast designs, casts, machines and assembles high-quality engineered iron products for the automotive industry. Its resources are strategically aligned to meet the customer-specific requirements within two product segments, powertrain and chassis components. The Company believes that the combination of its design and high-quality manufacturing creates unique value for the customers in the markets that it serves. The Company believes that this is the reason for the Company being the world's largest supplier of exhaust manifolds for passenger cars and light truck applications.

The Powertrain segment is focused on the design and manufacture of exhaust system components for sale primarily to original equipment manufacturers ("OEMs") and Tier 1 customers for car and light truck markets in North America and Europe. The Company's Powertrain operations in North America, leaders in the design, manufacture and sale of exhaust manifolds, are well established and in 2003 represented 87.0% of consolidated sales. The segment's European operations are conducted through Weslin Industries Inc. ("Weslin"), a relatively new operation constructed and jointly owned by Wescast and Linamar Corporation. The European operation, which was in pre-production mode in 2002, represents a developing business and comprised 4.3% of the Company's consolidated sales in 2003. On March 10, 2004 the Company and Linamar Corporation announced Wescast's intention to sell its 50% interest in Weslin Industries Inc. to Linamar Corporation, pursuant to the terms of a joint-venture agreement between the parties. Negotiations between the parties are ongoing, and as a result the financial impact of the transaction is not yet known.

The Company views the market in Europe as a key strategic opportunity and is evaluating various alternatives to continue its participation in this market once the divestiture of the Company's interest in Weslin has been completed. It is expected that some of the resources generated from the Weslin transaction will be redeployed towards other initiatives aimed at maintaining the Company's presence in Europe.

In this MD&A, reference is made to Weslin and its impact on the historical results of the Company, as this information is relevant to understanding and assessing the Company's historic performance.

The Chassis segment is focused on the design and manufacture of brake and suspension components for sale to OEM and Tier 1 customers in the car and light truck markets. The Company entered the segment on September 12, 2002, with the acquisition of Georgia Ductile Foundries, LLC, renamed Wescast Industries Cordele, LLC ("Cordele"). This business, which was acquired while it was still in a start-up phase, is also a developing business, serving a North American customer base. In 2003, the Chassis segment represented 8.7% of the Company's consolidated sales.

Overview of Operations

Wescast experienced significant revenue growth in 2003, due to the inclusion of revenues from both its developing businesses, Weslin in Europe and its Chassis group. While the performance of the Company's core Powertrain segment in North America remained strong in 2003, the Company's consolidated net earnings experienced a significant decline. This decline was largely due to start-up costs associated with the development of its new businesses and challenging market conditions that contributed to the incurrence of a non-cash charge to reflect the impairment of goodwill associated with its Cordele operation.

Overall consolidated sales revenues in 2003 of $475.8 million represented a 12.2% increase over the $424.2 million reported in 2002. The revenue growth was primarily the result of three factors:

Sales from the Company's Chassis segment accounted for revenue growth of $26.7 million. The expansion into chassis components in 2002 took place in September of that year and, as a result, the sales in 2002 represented only a partial year of activity.

Wescast's proportionate share of sales from Weslin, the joint venture operation that constitutes the Company's Powertrain segment in Europe, represented a sales increase of $20.4 million. Fiscal 2003 marks the first year that Weslin sales are reflected in the Company's revenue base as the Weslin operation was in a pre-production phase in 2002. As a result, approximately $10.0 million, our proportion of sales for that year, were netted against operating expenditures and deferred as pre-production costs.

- Growth in the Company's machining activity in the North American Powertrain business was strong. In 2003, the number of units machined increased by 11.0%, and the percentage of North American powertrain sales representing both cast and machined components was 77.6% in 2003, compared with 63.0% in 2002.

The Company's net earnings in 2003 were $8.3 million, down $51.7 million compared to the $60.0 million reported in 2002. While the Company's North American Powertrain segment produced strong earnings, this performance was offset by the impact of the Company's developing businesses as follows:

- The Chassis segment had a year-over-year negative impact on net earnings of $38.4 million, representing 74.5% of the total decline in net earnings. This included the charge for the goodwill impairment of $27.4 million, after tax.

- The European Powertrain operations, in its first year of commercial production, had a year-over-year negative impact on net earnings of $6.1 million, 11.8% of the total decline.

Position in the Industry

In its core Powertrain segment, Wescast is the world's largest producer of exhaust manifolds. The worldwide demand for exhaust manifolds is basically satisfied by two distinct types or styles of manifold designs: fabricated and cast. Wescast's manifold production is exclusively focused on cast manifolds. A cast manifold is produced using various grades of ductile iron, each with different temperature and performance characteristics, using a green sand mould process. The manufacture of fabricated manifolds involves the bending and welding of steel tubes to meet the shape and style of the product design.

In North America, the use of cast iron manifolds has traditionally dominated the marketplace. Cast manifold designs are currently estimated to represent over 70% of the overall demand for manifolds in North America. In other parts of the world fabricated manifolds command a far greater share of the marketplace. It is estimated that 50% of the current worldwide demand for exhaust manifold production is represented by fabricated designs. The difference in demand is influenced by customer preferences, historical use and production volume levels.

The supply base for fabricated manifolds in areas such as Europe, where historically the market comprised a larger number of automakers with smaller individual platform volumes, has evolved to include a large number of suppliers and a very fragmented market. The market is not dominated by any one supplier. The Company has remained focused on cast manifold designs, primarily because it has been able to demonstrate to the market that by applying its design capabilities it can design and manufacture a cast manifold that meets or improves the performance characteristics offered by a fabricated manifold design, generally at a lower total cost.

The Company's primary customer base, the domestic Big 3 automakers, has experienced market share declines in recent years. The Company is focused on expanding its sales base by targeting growth in North America with new domestic customers, many of whom currently use fabricated manifolds in their engine designs. In addition, the Company is targeting strategic international growth to meet the demand requirements in markets outside of North America where the Company believes it can demonstrate that superior performance characteristics exist in cast manifold designs.

The engineering and design capabilities of the Company are well suited to meet the changing needs of its current and potential customers. Such customers are faced with the following specific needs:

- The need to reduce engine emission levels;

- The need to deal with higher engine temperatures;

- The need to meet customer-driven demand for high horsepower levels, given the constraints above; and

- The potential for an increased use of diesel-powered vehicles in North America to help meet fleet emission levels.

The Company's engineering and design efforts aimed at developing new higher- temperature alloys, its "hot-end solutions" efforts aimed at integrating the exhaust manifold with the catalytic converter, and the further expansion of integrated exhaust manifold-turbocharger designs for diesel engine applications that are already in use in Europe, all support the Company's current strategic direction.

Risks and Uncertainties

Described below are some of the more significant risks and trends relating to the overall economy, the automotive industry and Company-specific matters that could affect the Company's results.

- An economic downturn could have a negative impact on the Company's profitability. The global automotive industry is cyclical and is sensitive to changes in economic conditions such as interest rates, consumer demand, oil prices and international conflicts. The current consensus of industry forecasts project relatively stable markets in Europe and North America in 2004.

- Increasing price reduction pressures from the Company's customers could reduce profit margins. Historically, the Company has entered into, and will continue to enter into, supply agreements with its customers that provide for, among other things, price concessions over the term of the agreement. In the past these concessions have been largely offset by cost reductions resulting from product and process improvements. The competitive global automotive industry environment has caused these pricing pressures to intensify. To the extent that these price reductions continue in the future and are not offset through cost reductions, the Company's future profit margins may be adversely affected.

- The Company is currently dependent on one class of products, cast iron manifolds, and could be negatively impacted by heightened competition, including the intensification of price competition and the entry of new competitors, both domestic and foreign, particularly those based in low-cost countries such as China. The introduction by competitors of new manufacturing techniques or types of products could also have an adverse impact on the Company's results.

Estimated 2003

Total North American Manifold Production

(24.2 million units)

Estimated 2003

Total Europe Manifold Production

(20.8 million units)

- The Company is largely dependent upon three customers, the domestic Big 3 automakers. As a result, it is exposed to any loss in market share or less-than-projected light vehicle sales by General Motors, Ford and DaimlerChrysler, for which the Company supplies powertrain components.

The Company's top five North American powertrain programs projected for 2004, based on unit production, are represented by the following customer platforms:

| OEM | Platform/Program | Vehicle Application(s) |

| GM | 4.8/5.3/6.0L GEN III V8 | Silverado, Sierra, Suburban, Tahoe, Escalade, etc. |

| Ford | 5.4 L 3V V8 | F150, Expedition, Econoline, Navigator |

| GM | L850 | Cavalier, Sunfire, GrandAm, Alero, Saturn, etc. |

| Nissan | 3.5 L ZV5 V6 | Maxima, Altima, Quest |

| DCX | 4.7 L Truck V8 | Ram, Durango, Dakota, Ram Van, etc. |

Penetration of non-Big 3 customers and future revenue expansion in the Chassis component segment will help Wescast diversify its revenue base and reduce this concentration of risk.

- The Company could be negatively impacted by government regulations, including U.S. Corporate Average Fuel Economy standards or emissions regulations and Canadian, European and American federal, provincial, state and local environmental laws and regulations that have an adverse impact on the automotive industry. New product research at Wescast is focused on innovations that will allow the Company to take advantage of these changes.

- The Company's production costs are dependent on the price of certain raw materials and other commodities, including scrap steel, molybdenum ("moly") and electricity. Increases in any or all of these costs will cause the cost of production to rise. Under current sales contracts the Company can pass only a portion of these cost increases on to customers. For reference purposes, a CDN$10.00 increase in the per ton price of scrap steel, or a US$1.00 per pound increase in the price of moly, would result in annualized increases in operating costs, net of recoveries from customers, of CDN$0.5 million and CDN$1.0 million, respectively. The charts above illustrate the changes in scrap steel and moly prices over the past two years, in particular the significant rise experienced in 2003.

- The Company's financial results are reported in Canadian dollars. A portion of the Company's sales, operating costs and capital investment requirements are realized in U.S. dollars and other currencies. As a result, fluctuations in the exchange rate between foreign currencies and the Canadian dollar may affect the Company's profitability.

- The Company's developing Chassis segment is facing the challenges typically encountered in the ramp-up of a new foundry. These challenges include inconsistent operating performance measured in terms of internal scrap and yield rates. In addition, unexpected equipment downtime issues have a negative impact on plant uptime performance and result in increased maintenance costs and production inefficiencies. Historically, the Company's start-up operations have taken three to five years to achieve steady state operating metrics.

- In 2004, all segments of the Company's business will launch new programs for customers. Financial performance levels will be impacted by the timeliness and the efficiency of these program launches.

- Collective labour agreements in place at three plants in Canada expire in 2004. An inability to negotiate and secure new collective agreements would negatively impact the Company's ability to fulfill its obligations to its customers. At this time, management believes all of these collective agreements will be successfully renegotiated prior to their expiry.

Selected Annual Information

The following table sets forth for the years ended 2003, 2002 and 2001 selected information from the Company's consolidated financial statements.

Fiscal Year Ended

(in thousands of Canadian Dollars, except per share amounts and where otherwise noted)

| | 2003 | 2002 | 2001 |

| | | | |

| | | | |

| | | | |

| Sales | $475,800 | $424,207 | $383,502 |

| | | | |

| Earnings from continuing operations | $8,268 | $60,040 | $66,038 |

| | | | |

| Net earnings | $8,268 | $60,040 | $41,270 |

| | | | |

| Earnings from continuing operations per share | | | |

| Basic | $0.63 | $4.59 | $5.11 |

| Diluted | $0.63 | $4.59 | $5.01 |

| Net earnings per share | | | |

| Basic | $0.63 | $4.59 | $3.19 |

| Diluted | $0.63 | $4.59 | $3.12 |

| | | | |

| Total assets | $561,135 | $596,754 | $452,762 |

| | | | |

| Total long-term interest-bearing debt | $36,072 | $46,576 | $4,614 |

| | | | |

| Dividends declared per Glass A and | | | |

| Class B common share | $0.48 | $0.48 | $0.48 |

| | | | |

| Issued and outstanding capital stock (thousands) | | | |

| Class A common shares | 5,722 | 5,707 | 5,627 |

| Class B common shares | 7,377 | 7,377 | 7,377 |

| | | | |

| Stock options outstanding | | | |

| Class A common shares | 931 | 944 | 973 |

| | | | |

Results of Operations: 2002 to 2003

Net Earnings

Net earnings decreased from $60.0 million in 2002 to $8.3 million in 2003.

In comparing the level of earnings in 2003 to 2002, the following highlights should be considered:

- The Company's North American Powertrain operations delivered strong financial performance under challenging market conditions, generating net earnings of $60.1 million in 2003.

- The European Powertrain operations had a negative impact on net earnings of $8.9 million in 2003, compared to a negative impact of $2.8 million in 2002.

- The Chassis operations had a negative impact on net earnings of $42.9 million in 2003, compared to a negative impact of $4.5 million in 2002. Included in the 2003 impact was a goodwill impairment charge of $27.4 million, after tax.

- Stock-based compensation expense for 2003 was $0.8 million, compared to $5.3 million in 2002.

Sales

Consolidated sales for 2003 increased by 12.2% over 2002 due to strong growth in machining volumes in the Company's North American Powertrain operations, the inclusion of Weslin sales in 2003 and the reporting of a full year of sales by the Chassis segment compared to 2002.

The sale of powertrain products in North America, comprised mainly of cast and machined iron manifolds, decreased by 2.1% in 2003 compared to 2002. However, several positive trends emerged during 2003, including improved machining penetration and a favourable product mix. In addition, sales with a new domestic customer increased significantly in 2003. Sales of internally machined powertrain products increased 11.0% from 9.7 million units in 2002 to 10.7 million units in 2003. The level of powertrain products that were both cast and internally machined rose to 77.6% of total products produced, up from 63.0% in 2002. Wescast's exhaust manifold sales volume in North America of 13.8 million units in 2003 decreased by 9.5% compared to 2002. This decrease compares to an overall decline in 2003 of 3.0% in North American light vehicle production and a 6.3% decline in the production of the Company's primary customers, the domestic Big 3 automakers, who collectively continued to lose North American market share. The Company's overall North American market share decreased from 61.0% in 2002 to 55.4% in 2003. The decrease in manifold sales volume and market share was mainly due to program losses with DaimlerChrysler, which occurred in the latter part of 2002. Also contributing to the decline in volume was the partial transfer of the production requirements for the Ford 4.0L program to Weslin during 2003. These decreases were partially offset by increased sales volumes to General Motors, primarily due to the strength of the GEN III light truck programs, and the growth of sales volumes with Nissan.

The Company's proportionate share of powertrain component sales, excluding prototype and tooling sales, generated by its European Powertrain operations through Weslin totalled $19.6 million. The Company did not report any sales for Weslin in 2002 as the operation was in a pre-production phase.

The Company entered the Chassis component marketplace in September 2002 by way of an acquisition. This business generated $37.9 million in sales of brake and suspension components in 2003, compared to $13.9 million in the post-acquisition period in 2002. The level of sales in 2003 was lower due to the discontinuation of programs in early 2003, including programs that were selectively culled as they did not align with the strategic focus established for the Chassis segment. In addition, the impact of a stronger Canadian dollar in 2003 reduced Chassis segment sales on translation to Canadian dollars by approximately $4.0 million or 9.5%.

Consolidated prototype and tooling sales was $32.2 million in 2003, up $16.5 million from the $15.7 million reported in 2002, reflecting a significant increase in the number of new program launches in 2003 versus 2002. Prototype and tooling sales by the Chassis segment and Weslin accounted for $2.8 million and $0.8 million of the increase, respectively.

Gross Profit

Consolidated gross profit for 2003 was $104.8 million or 22.0% of sales, compared to $129.9 million or 30.6% of sales in 2002.

The profitability of the Company's North American Powertrain operations has remained strong compared to 2002 in spite of lower casting volumes. The negative pressure on gross profit during 2003 due to lower volumes, market- driven price concessions, significant increases of raw material costs, and increased depreciation and amortization charges was partially offset by strong operating performance and the positive impact of cost-reduction activities in the Company's manufacturing facilities. Wescast's strategy to increase machining penetration volume also resulted in a significantly increased contribution to gross profit. In addition, the Company revised its estimate of government investment tax credits realized on qualifying scientific research and development expenditures of prior periods. This resulted in a positive impact on gross profit of $2.4 million for 2003. There were no similar adjustments in 2002.

The majority of the decline in gross profit, compared to 2002, was as a result of the negative impact on earnings to support the ramp-up efforts at Weslin and Cordele. Weslin had a negative impact on gross profit of $6.8 million during 2003. This operation was in a pre-production phase during 2002. During 2003, Weslin has begun to demonstrate improved operating performance in terms of foundry equipment uptime rates, finishing throughput and scrap levels. These improvements did not translate into improved financial performance due to the costs associated with a significant number of new product launches and other start-up-related expenses. The Chassis segment, while in commercial production, is still in the process of ramping up its foundry operation. This segment had a negative impact on gross profit of $20.9 million in 2003, compared to a negative impact of $5.3 million in 2002 from the date of acquisition in September 2002. During 2003, this operation has also shown improved operating performance in the areas of output, measured in moulds per hour, finishing throughput rates and scrap levels. Unfortunately, these improvements were disrupted throughout the year by unexpected equipment downtime of the facility. Management believes that unplanned equipment downtime is part of the start-up phase of a major foundry and machining facility.

Depreciation and amortization charges, included in cost of sales, increased by $10.1 million from $26.2 million in 2002 to $36.3 million in 2003. The majority of the increase relates to depreciation charges on new machine lines, increased depreciation associated with Cordele and the amortization of the Weslin deferred pre-production costs.

The gross profit on prototype and tooling sales in 2003 was $4.2 million or 13.0% of sales, down from $4.5 million or 28.6% of sales in 2002. The level of gross profit on prototype and tooling sales depends on the type of program launch and the volume of prototype tooling and castings required to validate production.

Selling, General and Administration

Selling, general and administration expenses were $37.5 million in 2003 compared to $31.6 million in 2002. The Company's fixed-cost base has increased over the 2002 level in support of its growth and diversification initiatives, specifically the absorption of the sales force supporting the Company's Chassis segment and the depreciation and operating costs associated with the new technical development centre and corporate office. Cost-reduction efforts within the administrative departments have offset a portion of the fixed-cost base increase. In addition, lower profit-sharing and variable compensation payments compared to 2002 also partially offset the increase. Depreciation charges, included in selling, general and administration expenses, accounted for $2.7 million of the increase in 2003.

Stock-based Compensation

During 2002 the Company amended its stock option plan to authorize the grant of tandem stock appreciation rights in connection with options granted under the plan at or after the time of the grant of such options. Under the amended plan, participants have the choice of exercising stock options or receiving cash from the Company for the options equal to their intrinsic value, being the difference between the option exercise price and the current market value of the shares.

The increase or decrease in the intrinsic value of the stock options is reported as stock-based compensation expense. As a result of the market price of the Company's shares increasing by approximately $1 during 2003, the impact for that year was an expense of $0.8 million. The initial impact of the amendment to the plan, recorded in 2002 when the share market price was $56.47, was a non-cash charge to earnings of $14.9 million reported as stock-based compensation expense for options issued in prior periods. The market price of the Company's shares at December 29, 2002, was $37.81, resulting in a full-year impact of only $5.3 million related to the amendment of the stock option plan.

Research, Development and Design

Research, development and design expenses decreased in 2003 by $0.5 million or 5.6% from 2002. The Company remains committed to funding research and development activities, including its "hot-end solutions" strategy and the continued development of high-temperature alloys. The "hot-end solutions" program has successfully moved through the research-intense process and product-development phase. The Company is quoting on specific customer applications that could benefit from this technology. As a result, expenses related to this activity have declined from those incurred during 2002. In addition, the Company-wide focus on cost-reduction initiatives has resulted in lower discretionary spending.

Interest Expense

Interest expense in 2003 was significantly higher than in 2002. This was mainly attributable to interest related to short-term borrowings of the Company during 2003 and increased interest on the long-term debt that was assumed on the acquisition of Cordele in September 2002.

Goodwill Impairment

During the fourth quarter of 2003, the Company completed its impairment test of the goodwill acquired in conjunction with the 2002 acquisition of Cordele. The impairment test was carried out to determine whether the fair value of the Cordele operation supported the carrying value of the operation's net assets including goodwill. As a result of the review it was concluded that the goodwill was fully impaired. The Company recorded a pre-tax non-cash goodwill impairment charge of $41.5 million related to its Chassis segment. The goodwill impairment charge reflects the ongoing volatility associated with the business outlook for the Chassis segment. Some of the key factors that had an impact on the impairment test and affect the outlook for the Chassis segment include:

- Challenging market conditions that include a growing amount of open foundry capacity in the industry, combined with increased offshore competition based in low-cost countries and pricing pressures;

- The escalation in raw material and electricity costs; and

- Inconsistent operating performance of equipment.

As a result of these factors, it is taking longer to achieve the financial performance targets originally projected. This delay has changed the original outlook for the Chassis segment and has resulted in the goodwill impairment charge.

Other Income

Other income and expense represented a net expense of $1.7 million in 2003, compared to income of $1.3 million in 2002. The change was due to:

Foreign exchange losses on working capital in 2003 were $1.9 million as compared to losses of $0.4 million in 2002, attributed primarily to the significant strengthening of the Canadian dollar.

Interest and miscellaneous income of $1.1 million in 2003 was less than $2.1 million in 2002 as a result of lower cash and investment balances throughout 2003.

Losses on disposal of property and equipment in 2003 were $0.4 million higher than in 2002.

Income Taxes

Wescast's effective income tax rate increased to 41.4% in 2003 compared to 29.6% in 2002. The higher rate was due to:

- Ontario provincial statutory income tax rates increased, impacting future tax levels.

- A tax benefit has not been recognized with respect to the loss realized by Weslin as the operation is subject to a tax holiday during the first ten years of operations.

- Payments were lower in 2003 compared to 2002 under the cost- sharing arrangements with Weslin. Under these arrangements certain technology development, marketing and human resource development costs are funded by the Company. The tax holiday applicable to these amounts in Hungary results in a lower effective tax rate upon consolidation.

Results of Operations: 2001 to 2002

The following discussion provides significant highlights in comparing the Company's results of operations from 2001 to 2002. A more detailed discussion is included in the Company's Management Discussion and Analysis for the year ended December 29, 2002 contained in the 2002 Annual Report.

Sales

Consolidated sales in 2002 increased by 10.6% over 2001. The sale of exhaust manifolds by the Company's Powertrain group accounted for 9% of the increase. Exhaust manifold sales volume of 15.3 million units increased by 6% over 2001. This increase compared favourably to the 5% increase in North American light vehicle production over 2001. Wescast's primary customers, the domestic Big 3 automakers, experienced a 4.7% increase in production levels. The Company recorded a slight increase in its overall North American market share to 61%, which represented continued strong performance with the Company's domestic Big 3 customers and growth with new domestic customers. The increase in manifold sales dollars in 2002, up 9% over 2001 compared to a unit volume increase of 6% over 2001, reflected a richer mix of higher-valued parts sold, primarily related to the light truck market.

Sales of internally machined manifolds increased 10.2% from 8.8 million units in 2001 to 9.7 million units in 2002. The percentage of manifolds sold that were also internally machined increased from 61.0% in 2001 to 63.0% in 2002.

The Company's Cordele operation generated $13.9 million in sales of brake and suspension components in the post-acquisition period in 2002.

Tooling and prototype sales of $15.7 million in 2002 were down 30% from 2001.

Several program launches were delayed in 2002 and the corresponding tooling and prototype sales were realized in 2003.

Earnings from Continuing Operations

Earnings from continuing operations decreased from $66.0 million in 2001 to $60.0 million in 2002, a year-over-year decrease of 9.1%. In comparing the level of earnings in 2002 to 2001, the following items should be considered:

- The Company's North American Powertrain segment delivered strong financial results during 2002, contributing $67.3 million to earnings from continuing operations. This level of earnings was consistent with 2001.

- Stock-based compensation expense of $5.3 million, or $3.5 million after tax, was recorded in 2002 but there was no such expense recorded in 2001.

- Weslin was in a start-up phase during 2002. The majority of expenses were deferred as pre-production costs; however, the European Powertrain operations had a negative impact on earnings of $2.8 million in 2002 versus $1.6 million in 2001.

- The Chassis segment had a negative impact on earnings of $4.5 million after tax in 2002.

Net Earnings

Net earnings for 2002 were $60.0 million, up from $41.3 million in 2001.

In 2001 a loss from discontinued operations of $24.8 million, related to the shutdown of the Company's stainless steel business, was reported.

Other Balance Sheet Items

Total assets increased from $452.8 million in 2001 to $596.8 million in 2002. Total long-term interest-bearing debt increased from $4.6 million in 2001 to $46.6 million in 2002. These year-over-year increases were primarily due to the acquisition of Cordele in September 2002.

Fourth Quarter 2003

The 2003 fourth quarter results were significantly impacted by the goodwill impairment charge of $41.5 million, or $27.4 million after tax, related to the Chassis segment.

The table at right sets forth selected financial information of the Company for the specified periods.

| Quarterly Results of Operations | | | | | | | |

| (in thousands of Canadian dollars, except per share amounts) | | | | | |

| | | | | | | | | |

| | First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

| | 2003 | 2002 | 2003 | 2002 | 2003 | 2002 | 2003 | 2002 |

| | | | | | | | | |

| | | | | | | | | |

| Sales | $125,159 | $104,900 | $116,851 | $112,140 | $110,088 | $97,260 | $123,702 | $109,907 |

| | | | | | | | | |

| Gross profit | 26,749 | 36,477 | 28,910 | 40,199 | 20,819 | 27,097 | 28,362 | 26,141 |

| | | | | | | | | |

| Net earnings (loss) | $10,695 | $18,493 | $10,599 | $12,143 | $4,975 | $12,020 | ($18,001) | $17,384 |

| | | | | | | | | |

| Net earnings (loss) per share | | | | | | | | |

| Basic | $0.81 | $1.42 | $0.82 | $0.93 | $0.38 | $0.92 | ($1.38) | $1.32 |

| Diluted | $0.76 | $1.39 | $0.82 | $0.93 | $0.38 | $0.91 | ($1.39) | $0.93 |

| | | | | | | | | |

Notes:

- The Company's sales and production volumes are generally lower in the third quarter, in comparison to the other quarters, as North American vehicle production is lowest during the third quarter due to model changeovers by the domestic Big 3 automakers. Also, the Company's facilities traditionally shut down for a period during the third quarter to allow for summer vacations.

- Stock-based compensation expense was $12.8 million or $8.6 million after tax, for the second quarter of 2002 compared to $0.5 million, or $0.3 million after tax, for the same period of 2003. The level of expense in 2002 reflected the amendment of the Company's stock option plan to authorize the grant of tandem stock appreciation rights.

- A goodwill impairment charge of $41.5 million, or $27.4 million after tax, was recorded in the net earnings of the fourth quarter of 2003.

Liquidity and Capital Resources

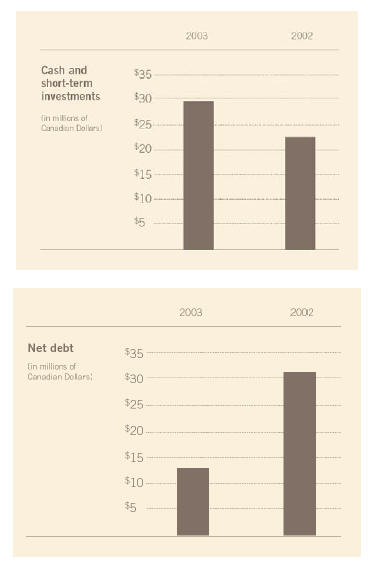

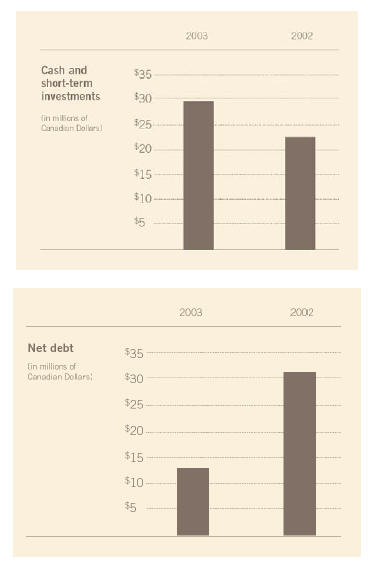

The Company ended 2003 in a very strong financial position. Cash and short-term investments were $28.7 million at the end of 2003 versus $21.9 million a year earlier. Cash generated from continuing operations and dispositions exceeded capital spending and dividend requirements by $10.4 million and the Company reduced debt by $4.3 million, before currency adjustments, to account for the majority of the increase in liquidity for the year.

| Financial Condition Highlights | | |

| (in thousands of Canadian Dollars, except where otherwise noted) | |

| | | |

| Fiscal Year Ended | 2003 | 2002 |

| Cash and cash equivalents | $28,699 | $9,984 |

| Short-term investments | $- | $11,909 |

| Total debt(1) | $40,440 | $52,766 |

| Net debt(2) | $11,741 | $30,873 |

| | | |

| Current assets | $140,311 | $142,961 |

| Current liabilities | $53,327 | $85,703 |

| Current ratio | 2.6:1 | 1.7:1 |

| Net working capital | $86,984 | $57,258 |

| | | |

| Shareholders' equity | $437,221 | $436,263 |

| Total capital(3) | $477,661 | $489,029 |

| Ratio of total debt to total capital | 8.5% | 10.8% |

| | | |

| (1) Total debt defined as the sum of short-term and long-term interest-bearing debt. |

| (2) Net debt is defined as total debt minus cash and cash equivalents and short- and long-term investments. |

| (3) Total capital is defined as total debt plus shareholders' equity. |

Higher cash balances and reduced total debt arising from scheduled repayments and the translation impact of the strengthening Canadian dollar resulted in a decrease in net debt to $11.7 million at the end of 2003 from $30.9 million at the end of 2002. Net working capital and the current ratio are used to monitor the Company's ability to meet its short-term obligations. Both measures increased year over year due to a significant reduction in payables and accruals in 2003. Significant capital spending near the end of 2002 comprised a large part of payables and accruals at the end of that year. Wescast uses the ratio of total debt to total capital to monitor the capitalization of the Company. As a result of the reduction in the Company's debt and the net earnings contribution to shareholders' equity, the ratio of total debt to total capital fell year over year to 8.5% at the end of 2003 from 10.8% at the end of 2002.

The following charts show the Company's cash and short-term investments and net debt positions in 2003 versus 2002:

The Company is well positioned to fund its short- and long-term growth objectives through positive operating cash flows, efficient working capital management and the financial flexibility that accompanies a conservative capital structure.

The following chart shows the Company's ratio of total debt to total capital in 2003 versus 2002:

Available Financing Sources

The Company has uncommitted demand operating facilities totalling US$36.5 million. At December 28, 2003, all facilities were undrawn. The Company's balance sheet is very strong, and management believes it could arrange committed lines of credit should the need arise.

Cash Flows

The table below provides information from the Company's statements of cash flows.

| Fiscal Year Ended | | |

| (in thousands of Canadian Dollars) | | |

| | 2003 | 2002 |

| | | |

| Cash derived from continuing operations | $54,030 | $90,402 |

| Cash used for investing activities | $25,449 | $109,611 |

| Cash used in financing activities | $9,514 | $28,626 |

| | | |

Operating Activities

Cash flows from continuing operations were $54.0 million in 2003 versus $90.4 million in 2002, reflecting the continuing ramp-up of the Cordele and Weslin facilities and an increase in non-cash working capital. The change in non-cash working capital was primarily the result of significant payments made in 2003 relating to 2002 spending. The prior year activities included the addition of new machine lines, the construction of the Company's technical development centre and corporate office complex, and payment of customer-related liabilities that were included in payables and accruals at the end of 2002.

During 2003, the Company established new standard payment terms with its suppliers, the effect of which was a lengthening of average payment terms of approximately ten days.

Investing Activities

Cash flows used in investing activities were $25.4 million in 2003, down from $109.6 million in 2002, due mainly to lower capital expenditures in 2003 compared to 2002 and the acquisition of Cordele in 2002.

Capital expenditures in 2003 were $39.4 million compared to $83.0 million in 2002. The decrease was due primarily to:

- A year-over-year reduction in capital spending on the Company's technical development centre and corporate office complex of $18.2 million;

- The purchase of an aircraft in 2002 for $12.4 million;

- Lower capital spending on new machine lines in 2003 of $4.9 million; and

- Lower capital spending at Weslin in 2003 of $3.2 million.

As a result of ongoing expansion programs, the Company has commitments to acquire capital assets of $5.2 million in 2004. Total capital expenditures, including the committed amount of $5.2 million, are expected to be approximately $70.0 million in 2004, but this includes $12.0 million related to Weslin, a portion of which may not be spent in light of the expected Weslin divestiture. These expenditures will be funded by cash on hand, internally generated funds from operations and, if required, unutilized operating lines of credit. Capital expenditures for 2004 will consist primarily of machining expansion in the Powertrain operations in North America and productivity projects exhibiting less than two-year paybacks across all Wescast facilities.

In 2002, the cash consideration paid to acquire Cordele was $39.5 million. There were no acquisitions in 2003.

By the end of 2002, Weslin's operations had achieved commercial production status. Consequently, the Company ceased deferring pre-production costs at that time. The Company incurred deferred pre-production costs of $3.9 million in 2002 related to this business. These costs began to be amortized in 2003 at a rate of about $2.0 million per annum.

Financing Activities

Cash flows used in financing activities decreased to $9.5 million in 2003 from $28.6 million in 2002. In 2002, subsequent to the acquisition of Cordele, the Company paid down $22.0 million of long-term debt assumed on the acquisition.

Off-Balance Sheet Financing

The Company's off-balance sheet financing arrangements are limited to standard operating lease contracts with various commercial enterprises relating primarily to equipment and office space. As at December 28, 2003, operating lease commitments totalled $1.9 million for 2004. The leases expire at various times through 2008, but will likely be renewed or replaced upon expiration. Management does not believe that the early termination of any of these lease contracts would have a material impact on its consolidated financial statements.

Contractual Obligations

The following table summarizes the expected cash outflows resulting from certain financial contracts and commitments:

Payments Due by Period

(in thousands of Canadian Dollars)

| | | Less than | | | |

| | Total | 1 year | 1-3 years | 4-5 years | After 5 years |

| | | | | | |

| Revenue bond obligations | $37,842 | $2,600 | $5,200 | $4,561 | $25,481 |

| Capital lease obligations | 1,421 | 591 | 797 | 33 | - |

| Operating leases | 6,127 | 1,837 | 2,925 | 1,365 | - |

| Bank loans | 1,177 | 1,177 | - | - | - |

| Operating leases (Weslin) | 122 | 81 | 41 | - | - |

| | | | | | |

| Total contractual obligations | $46,689 | $6,286 | $8,963 | $5,959 | $25,481 |

| | | | | | |

The revenue bond obligations relate to financings for Cordele and the Company's jointly controlled entity, United Machining Inc., and are more fully described in Note 9 to the consolidated financial statements. The capital lease obligations relate to the Company's fleet of vehicles provided to sales staff and executives.

The operating leases are primarily for equipment and office space. The bank loans relate to certain equipment financings of United Machining Inc. The above table includes amounts for Weslin which is expected to be divested in 2004.

Other Obligations

The Company's employee benefit plans are described in Note 10 to the consolidated financial statements. Only one of the Company's defined benefit plans is registered and funded. The most significant plans are not funded or registered. The total defined benefit plan deficit of the Company was $23.6 million at December 28, 2003. The benefit payments required during 2004 are not expected to be of a material amount and will be funded through cash flow from operations.

During the fourth quarter of 2003, the Company established a Restricted Share Unit ("RSU") plan. Under the RSU plan the Company has granted RSUs to certain employees. This entitles the employee to receive a cash payment for each RSU granted in an amount equal to the weighted average closing price of the Company's Class A common shares as traded on the Toronto Stock Exchange during the five-day period prior to the third anniversary date on which the RSU was granted. The RSUs vest, and the cash value is paid, on the third anniversary of the date on which such RSUs were granted. The related compensation expense is accrued over this period. As at December 28, 2003, there were 34,622 RSUs outstanding. Based on the year-end closing price of the Company's Class A common shares, the payments required to settle the RSUs would total $1.3 million.

Shareholders' Equity

Shareholders' equity increased $1.0 million in 2003 as compared to 2002. During the year, 14,551 Class A common shares were issued under the Employee Share Purchase Plan, adding $0.5 million to shareholders' equity. Net earnings contributed $8.3 million to shareholders' equity. Dividends of $6.3 million or $0.48 per share on Class A and Class B common shares were paid during 2003. Director and employee share purchase plan loans reduced shareholders' equity by $1.0 million. The decrease in the cumulative translation adjustment of $0.4 million represents the change in the unrealized foreign exchange loss on the Company's net investment in its self-sustaining foreign subsidiaries.

During 2003, the Company changed its accounting treatment with respect to director and employee share purchase plan loans to comply with recent changes in Canadian accounting standards. Share purchase plan loans are now reported as a deduction from shareholders' equity as compared to other assets.

As a result of the growing independence of Weslin, management determined during the year that, for accounting purposes, it is appropriate to treat this investment as self-sustaining and thereby use the current rate method to translate the net assets of the operation. This change was applied prospectively, resulting in an increase to the cumulative translation adjustment account of $3.8 million at June 30, 2003.

Financial Instruments

The Company negotiates sales contracts with customers in a number of currencies. To the extent sales are made in U.S. dollars, the Company has a partial natural hedge against exchange rate fluctuations due to the purchase of certain raw materials and other inputs to the manufacturing process in U.S. dollars.

The Company believes its exposure to exchange rate fluctuations on these working capital items is not significant.

The Company also purchases certain capital equipment denominated in U.S. dollars and provides financial support to Cordele during the foundry ramp-up phase in U.S. dollars. In order to manage the exposure to exchange rate fluctuations on these expenditures, the Company employs a hedging program primarily through the use of foreign exchange forward contracts. The contracts are purchased based on committed purchase orders for capital equipment denominated in U.S. dollars and an estimate of the U.S. dollar requirements of Cordele on a rolling fifteen-month basis.

The Company does not use derivative instruments to hedge the long-term investments in its self-sustaining foreign subsidiaries. Accordingly, the Company's cumulative translation adjustment account could be affected by a significant change in the relative values of the Canadian dollar, U.S. dollar and Hungarian forint.

Effective for the 2004 fiscal year, the Company is required under Canadian GAAP to adopt Accounting Guideline, AcG-13, "Hedging Relationships."

The Company has performed a thorough review of its hedging program and has implemented measures to ensure compliance with the new guideline.

Note 22 to the consolidated financial statements provides additional information about financial instruments.

Related-Party Transactions

In 2003, the Company paid freight and logistics charges of $4.9 million to a related company, 30% of whose shares are owned by a Class B shareholder of Wescast. These transactions were negotiated at fair value. As at December 28, 2003, $0.8 million was owed to this company. The current freight and logistics agreement was entered into by Wescast and the company in 1999 and expires at the end of 2004.

Critical Accounting Estimates

The significant accounting policies of the Company are described in Note 2 to the consolidated financial statements. Note 24 to the Company's consolidated financial statements sets out the material differences between Canadian and US GAAP.

The Company's financial statements are based on the selection and application of accounting policies that require management to make significant estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. The Company bases its estimates on historical experience and various other assumptions that are believed to be reasonable in the circumstances. Wescast evaluates its estimates on an ongoing basis. Actual results may differ from these estimates under different assumptions or conditions.

The Company believes the following accounting policies affect its more significant estimates and assumptions used in the preparation of its consolidated financial statements. Management has discussed the selection of the following accounting policies with the Audit Committee of the Board of Directors. The Audit Committee has reviewed the Company's disclosure related to accounting policies in this MD&A.

Deferred Pre-production Costs

The Company capitalizes, as deferred pre-production costs, start-up expenditures incurred in establishing new facilities that require significant time to reach commercial production levels. These costs are amortized over a period not to exceed five years commencing on completion of the pre-production or start-up period. The application of this policy requires estimates as to when a new facility or business achieves commercial production status. In estimating when a new facility or business achieves commercial production status, the Company considers production volumes, scrap levels, equipment uptime rates and operating cash flow. During 2003, there were no costs incurred that were capitalized as deferred pre-production costs. The Company recorded total amortization of pre-production costs of $3.5 million in 2003 related to two facilities in North America and its Weslin operation. As at December 28, 2003, deferred pre-production costs on the Company's balance sheet totalled $9.8 million, of which $8.2 million related to Weslin.

Goodwill

Effective January 1, 2002, goodwill is subject to an annual impairment test or more frequently when an event or circumstance occurs that more likely than not reduces the fair value of a reporting unit below its carrying value. In assessing goodwill impairment, the Company must make forward-looking assumptions regarding future industry market conditions and the operating performance of the reporting unit. These assumptions are subject to significant measurement uncertainty. As described in the "Goodwill Impairment" section of this MD&A, the Company recorded a $41.5 million pre-tax goodwill impairment charge in 2003.

Future Income Tax Assets

As at December 28, 2003, the Company had recorded future income tax assets related to losses available to be carried forward, the tax basis of goodwill in excess of book value and other deductible temporary differences of $10.6 million, $13.0 million and $8.1 million, respectively. The future income tax assets with respect to the loss carryforwards and the goodwill tax basis relate mainly to the Company's Cordele operation. The Company evaluates the carrying value of its future tax assets by assessing its valuation allowance and by adjusting the amount of such allowance, if necessary. The factors used to assess the likelihood of realization include the Company's forecast of future taxable income and available tax- planning strategies that could be implemented to realize the future tax assets.

Employee Benefits

The Company has a number of plans providing pension and other retirement benefits. The determination of the obligation and expense for these plans is dependent on the selection of certain assumptions used by actuaries. Those assumptions are included in Note 10 to the Company's consolidated financial statements and include the discount rate, expected long-term rate of return on plan assets and the rate of increase in compensation costs. Actual results that differ from the assumptions used are amortized over future periods and, therefore, have an impact on the obligation and expense recognized in future periods. Significant changes in assumptions or significant plan enhancements could materially affect the Company's future obligation and expense. As at December 28, 2003, the Company had net unrecognized past service costs, actuarial losses and transitional obligations totalling $11.4 million, which will be amortized to future benefit expense over the expected average remaining service life of the employees.

Accounting Changes

In December 2002, the Emerging Issues Committee issued Emerging Issues Committee Abstract 132 "Share Purchase Financing" (EIC 132). This Abstract, which is effective for fiscal years beginning on or after January 1, 2003, addresses issues relating to share purchase loans that are provided by a company to its directors, officers or employees to assist in the purchase of shares of a company. The Committee concluded that share purchase loans should be reported as a deduction from shareholders' equity, as opposed to an asset, unless the borrower assumes the risk for a decline in the price of the underlying shares and there is reasonable assurance that the full amount of the loan will be collected. As a result, the Company changed its accounting treatment, on a prospective basis, with respect to director and employee share purchase plan loans such that share purchase loans are reported as a deduction from shareholders' equity as compared to other assets.

In December 2002, the Canadian Institute of Chartered Accountants ("CICA") amended Handbook Section 3475, "Disposal of Long-Lived Assets and Discontinued Operations" ("CICA 3475"). CICA 3475 provides guidance on differentiating between assets held for sale and held for disposal other than by sale and on the presentation of discontinued operations. CICA 3475 applies to disposal activities initiated on or after May 1, 2003. The adoption of CICA 3475 did not have an impact on the Company's consolidated financial statements during 2003.

In February 2003, the CICA issued Accounting Guideline AcG-14, "Disclosure of Guarantees" ("AcG-14"). AcG-14 provides recommendations on disclosures required related to guarantees that a guarantor has provided. AcG-14 was effective for fiscal years beginning on or after January 1, 2003. The Company has not provided any guarantees as defined in AcG-14.

New Accounting Pronouncements

In January 2003, the CICA issued Handbook Section 3063 "Impairment of Long-Lived Assets" ("CICA 3063"). This section establishes new standards for the recognition, measurement, presentation and disclosure of the impairment of long-lived assets. An impairment loss is measured as the amount by which the long-lived asset's carrying value exceeds its fair value. CICA 3063 is effective for fiscal years beginning on or after April 1, 2003, and should be applied on a prospective basis. The Company adopted this standard effective December 29, 2003, and does not expect a material impact on its consolidated financial statements.

In March 2003, the CICA issued Handbook Section 3110 "Asset Retirement Obligations" ("CICA 3110"). CICA 3110 addresses obligations required to be settled as a result of an existing law, regulation or contract related to the retirement of an asset. This section requires that a liability be recognized at its fair value when a legal obligation is incurred. The corresponding amount is added to the carrying value of the related asset. The obligation can no longer be accrued over the life of the related asset. CICA 3110 requires retroactive application for fiscal years beginning on or after January 1, 2004. The Company adopted this standard effective December 29, 2003, and does not expect a material impact on its consolidated financial statements.

In December 2001, the CICA approved amendments to Accounting Guideline AcG-13, "Hedging Relationships" ("AcG-13"). AcG-13 has since been revised in January 2002, November 2002 and June 2003. The Guideline significantly increases the documentation, designation and effectiveness criteria necessary to achieve hedge accounting. Certain types of hedging relationships will be specifically prohibited, such as relationships where it is not highly probable the derivative instrument will be effective, where hedging net positions or where hedging portfolios of dissimilar items. A derivative that does not meet the criteria for hedge accounting should be recognized on the balance sheet and measured at fair value. AcG-13 is effective for fiscal years beginning on or after July 1, 2003. The Company adopted these recommendations effective December 29, 2003. The Company has performed a thorough review of its hedging program and has implemented measures to ensure compliance with this Guideline.

In June 2003, the CICA issued Accounting Guideline AcG-15, "Consolidation of Variable Interest Entities" ("AcG-15"). AcG-15 has since been revised in November 2003 and January 2004. This Guideline provides guidance for determining when an enterprise should consolidate a variable interest entity, defined as an entity without substantive third-party equity. The main objective of the Guideline is to identify those entities for which consolidation will be assessed based on a voting interest framework and those that require a variable interest framework. AcG-15 is effective for fiscal years beginning on or after November 1, 2004. The Company is in the process of assessing the impact of AcG-15 on its consolidated financial statements.

Outlook

Although there can be no certainty as to future levels of production, based on currently available information the Company views the economic outlook for the automotive industry in 2004 to be stable. North American light vehicle production is projected in the range of 16.0 to 16.4 million vehicles in 2004. This represents a slight increase over 2003 levels. The Company anticipates its 2004 production levels of its North American Powertrain segment will also remain in a range consistent with those achieved in 2003.

The Company's results are sensitive to raw material prices for scrap steel and moly. These costs have escalated significantly in recent months, and if this trend continues it will have a negative impact on future financial results.

The Company's strategic direction remains unchanged.

- The focus of the core Powertrain segment in North America will be on becoming more cost-competitive in an effort to address the significant pressure on pricing that is being exerted by the customer base. This pressure has intensified with the growing threat from competitors based in low-cost countries, specifically China. To meet this challenge the Company will continue to pursue aggressive year-over-year cost-reduction targets in these operations. Progress has been made toward achieving these targets by applying the Company's HEART participative management process and continuous improvement focus. To date many cost-reduction initiatives have been proposed and are being implemented.

- The Company will continue to focus on growth and diversification through the expansion of its customer base, product offerings and geographic coverage.

- The efficiency gains targeted in the Company's core Powertrain operations will create available foundry capacity that can be utilized to support the production needs of automakers with operations in North America who are not current customers of the Company, or can be utilized to produce new products that fit the focus of these manufacturing operations. In 2003, a dedicated team was assembled to review and develop business case recommendations on specific products meeting these criteria. This team will continue to evaluate new opportunities in 2004.

- The Company will maintain its commitment to fund research and development activities, specifically:

The deployment to customers of the "hot-end solutions" strategy;The continued development of high-temperature alloys; andThe validation of new product opportunities that can utilize existing foundry capacity.The Company's product diversification strategy was accelerated with the addition of the Chassis segment in 2002. Market prices are under pressure due to foundry industry overcapacity and an increase in offshore competition. The business is also faced with the typical ramp-up issues that impact new foundry operations. The primary focus for this operation in 2004 will be on improving manufacturing efficiencies and demonstrating consistent operating performance. These improvements, if achieved, will yield improved financial performance.

The Company will continue to evaluate both the threat and opportunities that may exist in the emerging automotive industry in Asia, specifically China. The cross-functional team that was assembled in 2002 has visited many customers and prospective business partners in Asia and is reviewing specific opportunities that would enable Wescast to participate in this market.

The continued investment in the growth initiatives in the Company's Chassis segment will impact earnings in 2004. This operation, while expected to demonstrate improved performance, is not expected to be profitable in 2004 as it continues to ramp up production.

The Company believes that maintaining the focus on these areas is the best means to ensure the long-term success of the business.

Forward-Looking Information

Certain information provided by Wescast in this MD&A and in other documents published throughout the year that is not a recitation of historical facts may constitute forward-looking information, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. The words "estimate," "anticipate," "believe," "expect" and similar expressions are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could materially alter results in the future from those expressed in any forward-looking statements made by or on behalf of the Company.

These risks and uncertainties include, but are not limited to, global economic and industry conditions causing changes to production volumes, changes in raw material and other input costs, price reduction pressures, dependence on certain vehicles and major OEM customers, program launch delays, currency exposure, contract negotiations with the unionized workforce, failure in implementing Company strategy, technological developments by the Company's competitors, government and regulatory policies and changes in the competitive environment in which the Company operates. While the Company believes that its forecasts and assumptions are reasonable, persons reading this report are cautioned that such statements are only predictions and that actual events or results may differ materially. In evaluating such forward-looking statements readers should specifically consider the various factors that could cause actual events or results to differ from those indicated by such forward-looking statements.

Management's Responsibility for Financial Reporting

The accompanying financial statements of Wescast Industries Inc. and all the information in this annual report are the responsibility of management and have been approved by the Board of Directors.

The financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles. When alternative accounting methods exist, management has chosen those it deems most appropriate in the circumstances. Financial statements are not precise since they include certain amounts based on estimates and judgments.

Management has determined such amounts on a reasonable basis in order to ensure that the financial statements are presented fairly, in all material respects. Management has prepared the financial information presented elsewhere in the annual report and has ensured that it is consistent with that in the financial statements.

Wescast Industries Inc. maintains high-quality, consistent systems of internal accounting and administrative controls. Such systems are designed to provide reasonable assurance that the financial information is relevant, reliable and accurate and that the Company's assets are appropriately accounted for and adequately safeguarded.

The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting and is ultimately responsible for reviewing and approving the financial statements. The Board is assisted in its responsibility by the Audit Committee and the external auditors.

The Audit Committee is appointed by the Board, and all of its members are outside directors. The Committee meets periodically with management, as well as the external auditors, to discuss internal controls over the financial reporting process, auditing matters and financial reporting issues, to satisfy itself that each party is properly discharging its responsibilities, and to review the annual report, the financial statements and the external auditors' report.

The findings and recommendations of the Committee, as with all committees of the Board, are submitted to the full Board for approval or other disposition. The Committee also considers, for review by the Board and approval by the shareholders, the engagement or re-appointment of the external auditors.

The annual financial statements have been audited by Deloitte & Touche LLP, the external auditors, for the year ended December 28, 2003, in accordance with Canadian generally accepted auditing standards on behalf of the shareholders. Deloitte & Touche LLP has full and free access to the Audit Committee.

Sincerely,

Edward G. Frackowiak

Executive Chairman

Chief Executive Officer (Interim)

March 22, 2004