MidAmerican Energy Holdings Company

2010 Fixed-Income Investor Conference

Forward-Looking Statements

This report contains statements that do not directly or exclusively relate to historical facts. These statements are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can typically be identified by the use of forward-looking words, such as “may,” “could,” “project,”

“believe,” “anticipate,” “expect,” “estimate,” “continue,” “intend,” “potential,” “plan,” “forecast” and similar terms. These statements are

based upon MidAmerican Energy Holdings Company’s (“MEHC”) and its subsidiaries’ (collectively, the “Company”) current intentions,

assumptions, expectations and beliefs and are subject to risks, uncertainties and other important factors. Many of these factors are outside

the Company’s control and could cause actual results to differ materially from those expressed or implied by the Company’s forward-

looking statements. These factors include, among others:

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can typically be identified by the use of forward-looking words, such as “may,” “could,” “project,”

“believe,” “anticipate,” “expect,” “estimate,” “continue,” “intend,” “potential,” “plan,” “forecast” and similar terms. These statements are

based upon MidAmerican Energy Holdings Company’s (“MEHC”) and its subsidiaries’ (collectively, the “Company”) current intentions,

assumptions, expectations and beliefs and are subject to risks, uncertainties and other important factors. Many of these factors are outside

the Company’s control and could cause actual results to differ materially from those expressed or implied by the Company’s forward-

looking statements. These factors include, among others:

– general economic, political and business conditions in the jurisdictions in which the Company’s facilities operate;

– changes in federal, state and local governmental, legislative or regulatory requirements, including those pertaining to income taxes,

affecting the Company or the electric or gas utility, pipeline or power generation industries;

affecting the Company or the electric or gas utility, pipeline or power generation industries;

– changes in, and compliance with, environmental laws, regulations, decisions and policies that could, among other items, increase

operating and capital costs, reduce plant output or delay plant construction;

operating and capital costs, reduce plant output or delay plant construction;

– the outcome of general rate cases and other proceedings conducted by regulatory commissions or other governmental and legal

bodies;

bodies;

– changes in economic, industry or weather conditions, as well as demographic trends, that could affect customer growth and usage or

supply of electricity and gas or the Company’s ability to obtain long-term contracts with customers and suppliers;

supply of electricity and gas or the Company’s ability to obtain long-term contracts with customers and suppliers;

– a high degree of variance between actual and forecasted load and prices that could impact the hedging strategy and costs to balance

electricity and load supply;

electricity and load supply;

– changes in prices, availability and demand for both purchases and sales of wholesale electricity, coal, natural gas, other fuel sources

and fuel transportation that could have a significant impact on generation capacity and energy costs;

and fuel transportation that could have a significant impact on generation capacity and energy costs;

– the financial condition and creditworthiness of the Company’s significant customers and suppliers;

– changes in business strategy or development plans;

– availability, terms and deployment of capital, including reductions in demand for investment-grade commercial paper, debt

securities and other sources of debt financing and volatility in the London Interbank Offered Rate, the base interest rate for MEHC’s

and its subsidiaries’ credit facilities;

securities and other sources of debt financing and volatility in the London Interbank Offered Rate, the base interest rate for MEHC’s

and its subsidiaries’ credit facilities;

Forward-Looking Statements

– changes in MEHC’s and its subsidiaries’ credit ratings;

– performance of the Company’s generating facilities, including unscheduled outages or repairs;

– risks relating to nuclear generation;

– the impact of derivative contracts used to mitigate or manage volume, price and interest rate risk, including increased collateral

requirements, and changes in the commodity prices, interest rates and other conditions that affect the fair value of derivative

contracts;

requirements, and changes in the commodity prices, interest rates and other conditions that affect the fair value of derivative

contracts;

– increases in employee healthcare costs and the potential impact of federal healthcare reform legislation;

– the impact of investment performance and changes in interest rates, legislation, healthcare cost trends, mortality and morbidity on

pension and other postretirement benefits expense and funding requirements;

pension and other postretirement benefits expense and funding requirements;

– changes in the residential real estate brokerage and mortgage industries that could affect brokerage transaction levels;

– unanticipated construction delays, changes in costs, receipt of required permits and authorizations, ability to fund capital projects

and other factors that could affect future generating facilities and infrastructure additions;

and other factors that could affect future generating facilities and infrastructure additions;

– the impact of new accounting pronouncements or changes in current accounting estimates and assumptions on consolidated financial

results;

results;

– the Company’s ability to successfully integrate future acquired operations into its business;

– other risks or unforeseen events, including litigation, wars, the effects of terrorism, embargoes and other catastrophic events; and

– other business or investment considerations that may be disclosed from time to time in MEHC’s filings with the United

States Securities and Exchange Commission (“SEC”) or in other publicly disseminated written documents.

States Securities and Exchange Commission (“SEC”) or in other publicly disseminated written documents.

Further details of the potential risks and uncertainties affecting the Company are described in MEHC’s filings with the SEC, including

Item 1A and other discussions contained in Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-

Item 1A and other discussions contained in Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors should not be

construed as exclusive.

construed as exclusive.

Patrick J. Goodman

2010 Fixed-Income Investor Conference

Senior Vice President and Chief Financial Officer

MidAmerican Energy Holdings Company

MidAmerican Energy Holdings Company

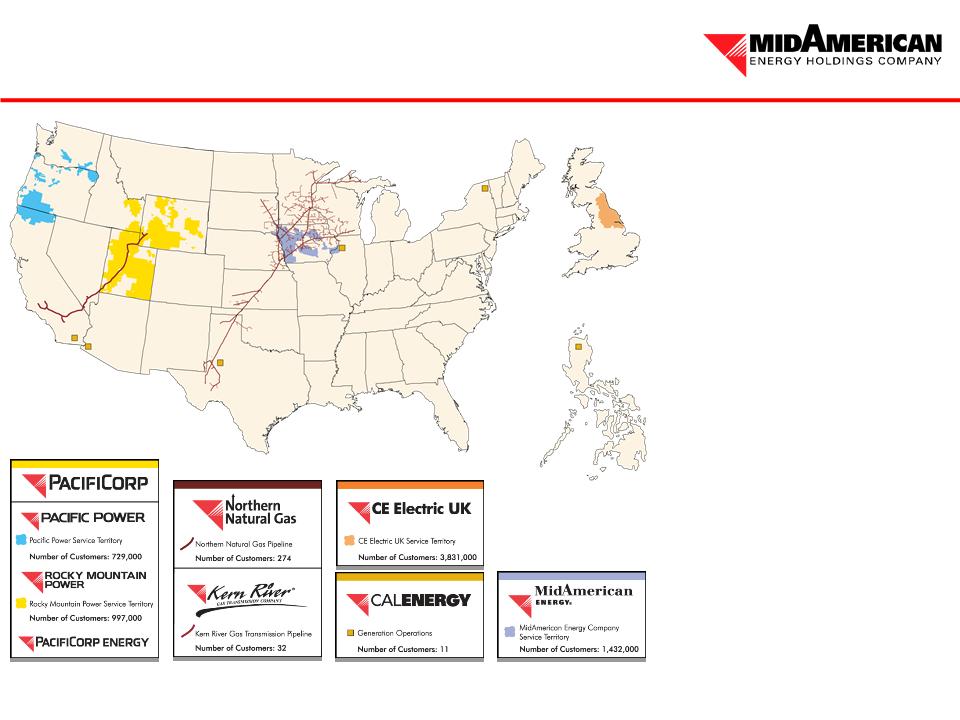

Energy Assets

Energy Assets

REVENUES $11.2 billion

ASSETS $45 billion

CUSTOMERS

Electric: 6.2 million

Natural Gas: 0.7 million

EMPLOYEES 16,300

NATURAL GAS TRANSMISSION

PIPELINE DESIGN CAPACITY

More than 7.0 billion cubic feet per day

GENERATION CAPACITY

18,092 megawatts(1)

NONCARBON GENERATION

More than 4,200 megawatts(1)

23% of total generation capacity

(1) Net MW owned in operation and under

construction as of December 31, 2009

construction as of December 31, 2009

United Kingdom

Philippines

• Berkshire Hathaway ownership allows focus to be on managing medium-

to long-term risks, which promotes long-term sustainability

– Bondholder friendly

• No dividend requirement

– Cash flow is retained in the business and used to help fund growth and improve credit

metrics

metrics

• Access to capital from Berkshire Hathaway allows MEHC to take

advantage of market opportunities

advantage of market opportunities

• Berkshire Hathaway is a long-term holder of assets, and its never-sell

philosophy promotes stability and helps make MEHC the buyer of choice

philosophy promotes stability and helps make MEHC the buyer of choice

Berkshire Hathaway Ownership Benefits

Berkshire Hathaway Equity Commitment

• Equity commitment from AA+ rated parent

– The $3.5 billion commitment has been amended such that the maturity date has

been extended for three years to February 28, 2014, and on March 1, 2011, the

commitment will be changed to $2.0 billion

been extended for three years to February 28, 2014, and on March 1, 2011, the

commitment will be changed to $2.0 billion

• The $2.0 billion level reflects lower debt maturities at MEHC and a reduced need for

equity contributions into our regulated subsidiaries

equity contributions into our regulated subsidiaries

– Access to capital even in times of utility sector and general market stress

No other utility has this quality of explicit financial support

– Commitment can only be drawn for two purposes:

• Paying MEHC parent debt when due

• Funding the general corporate purposes and capital requirements of MEHC’s regulated

subsidiaries

subsidiaries

– Agreement requires funding within 180 days of request

– Future mergers and acquisitions funded separate from this agreement

• Diversification of revenue sources reduces regulatory concentrations

• In 2009, 95% of EBITDA came from investment grade subsidiaries

Consolidated EBITDA(2): $3.7 Billion

MEHC 2009

(1) Excludes HomeServices, which has operations in 20 states and adds further diversification, and equity income from CalEnergy

(2) EBITDA represents operating income plus depreciation and amortization; percentages based on $3.9 billion of EBITDA which excludes Corporate/other of $(190) million

MEHC 2009

Energy Revenue(1): $10.2 Billion

Revenue and EBITDA Diversification

MEHC Financial Summary

Net Income Attributable to MEHC

MEHC Shareholders’ Equity

Property, Plant and Equipment (Net)

Cash Flows from Operations

$1,850

(1)

(1) $1,850m net income includes $646m of after-tax gains related to the termination fee and profit from the investment in Constellation Energy

(2) $1,210m net income excludes a $75m after-tax charge for stock-based compensation and $22m of after-tax income from the sale of Constellation

Energy shares

Energy shares

(3) $2,587m and $3,572m cash flows from operations include $175m and $128m for 2008 and 2009, respectively, related to the termination fee and

profit from the investment in Constellation Energy

profit from the investment in Constellation Energy

(3)

(3)

$1,210

(2)

Segment Information

Segment Information

(1) PacifiCorp includes the acquisition of Chehalis in 2008

Credit Metrics and Ratings

(1) Interest excludes interest on MEHC subordinated debt

(2) Debt excludes MEHC subordinated debt

(3) MEHC subordinated debt excluded from Debt but included in Capital

(4) Ratings for PacifiCorp and Kern River are senior secured rating

• MidAmerican Energy Holdings Company Key Ratios

• Ratings

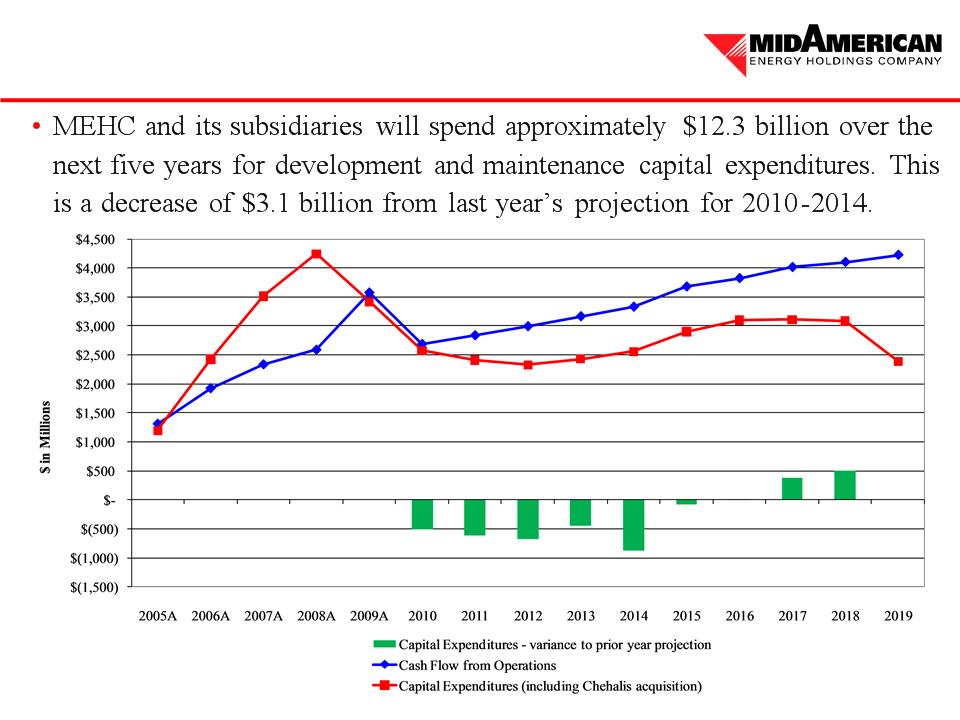

Projected Capital Expenditures

and Cash Flows

and Cash Flows

Projected Capital Expenditures

and Debt Maturities

and Debt Maturities

Projected Capital Expenditures

Long-Term Debt Maturities(1)

(1) Excludes subordinated debt, capital leases and nonregulated project debt

(2) Debt maturities at CE Electric UK exclude maturities at CE UK Gas

($ millions)

Current Credit Facilities

(3) Credit facilities at MEHC, PacifiCorp and MidAmerican Energy Company expire on July 6, 2013

(1)

(2) Credit facility at CE Electric UK expires March 2013; assumes 1.60 $/£ exchange rate

$2,990 Total

$2,792 Total

$1,879 Total

$1,879 Total

(1) Credit facility at HomeServices expires on December 31, 2010

(2)

(3)

Financing Plan 2010-2011

• PacifiCorp anticipates a 2011 debt issuance to, in part, refinance its $500

million November 2011 maturity

million November 2011 maturity

• Northern Natural Gas anticipates a 2011 debt issuance to, in part,

refinance its $250 million June 2011 maturity

refinance its $250 million June 2011 maturity

• MidAmerican Energy Company will issue if additional wind generation

capital expenditures are economic

capital expenditures are economic

• Yorkshire Electricity and Northern Electric plan debt issuances in 2010

and 2011 to support distribution business growth

and 2011 to support distribution business growth

• Kern River 2010 and Apex expansions

• Geothermal plants in Imperial Valley, California, for potential 150 MW

expansion

expansion

• Electric Transmission Texas, LLC issued $225 million in early 2010

with additional issuances likely later in 2010 and 2011

with additional issuances likely later in 2010 and 2011

Questions

2010 Fixed-Income Investor Conference

Richard Walje

President – Rocky Mountain Power

Overview

(1) Net MW owned in operation and under construction as of

December 31, 2009

December 31, 2009

• Headquartered in Portland, Oregon

• 6,447 employees

• 1.7 million electricity customers

• 10,594 net MW generation

capacity(1)

capacity(1)

• Generating capacity by fuel type(1)

– Coal 58%

– Natural gas 21%

– Hydro 11%

– Wind, geothermal & other 10%

(a) Access to other entities’ transmission lines through wheeling arrangements

Business Update

• Rocky Mountain Power’s commitment to employee safety

was recognized both at the state and national level. Currently

ranked in the top 6% of the industry (EEI survey).

was recognized both at the state and national level. Currently

ranked in the top 6% of the industry (EEI survey).

• Rate case settlements with fair revenue results in Utah,

Wyoming and Idaho.

Wyoming and Idaho.

• Retail load in 2009 was 34,256 GWh, a 3.2% decrease from

2008, primarily a recession impact on industrial customers.

Load is anticipated to rebound with a 3.0% increase in 2010

and a 2.6% increase in 2011.

2008, primarily a recession impact on industrial customers.

Load is anticipated to rebound with a 3.0% increase in 2010

and a 2.6% increase in 2011.

• Network reliability improved over the last 5 years, with the

system average interruption duration index improving by 8%

and the system average interruption frequency index by 13%.

system average interruption duration index improving by 8%

and the system average interruption frequency index by 13%.

Rocky Mountain Power service territory

• Wyoming HB 101 (passed) imposes a $1 per MWh wind generation tax beginning in 2012.

This is the first wind tax in the nation. Estimated 2012 impact is less than $2.0m for Rocky

Mountain Power.

This is the first wind tax in the nation. Estimated 2012 impact is less than $2.0m for Rocky

Mountain Power.

• Utah SB 47 (passed) sets state policy to encourage direct load control programs. This is a

first-in-the-nation law to permit an opt-out load control program.

first-in-the-nation law to permit an opt-out load control program.

Business Update – 2010 Challenges

• Given the economic uncertainty, Rocky Mountain Power has

implemented a risk reduction and economic recovery plan that includes:

implemented a risk reduction and economic recovery plan that includes:

– Continued focus on efficiency and cost reductions

• Automated meter reading projects in Rock Springs, Wyoming, and Cedar City and

Smithfield, Utah

Smithfield, Utah

• Encouraging customers to use the company’s Web, paperless billing and

electronic payment

electronic payment

– Continuing to work with at-risk customers

• Bad debt expense increased from $4.1 million in 2007 to $6.1 million in 2008 and

$5.9 million in 2009

$5.9 million in 2009

• Net write-offs of 0.27% of retail revenue are still below the industry average of

0.74% of retail revenue

0.74% of retail revenue

– Prioritizing capital spending to respond to the economic recovery

• New connect activity rebounding in the Salt Lake Valley starting in the 4th quarter

of 2009

of 2009

• Monthly review of large industrial loads and projections for load growth

• Continuing to monitor economic recovery in Utah, Wyoming and Idaho and

update capital allocation

update capital allocation

Regulatory Highlights

• Utah

– 2008 rate case settled for an annual increase of $45 million (3%) effective

May 2009

May 2009

– 2009 rate case order resulted in annual increase of $32 million (2%) effective

February 2010

February 2010

• Includes a 8.34% cost of capital, reflecting a 10.6% authorized return on

equity

equity

– Commission order to proceed to second phase of Energy Cost Adjustment

Mechanism

Mechanism

• Parties will now address design considerations

– PacifiCorp filed an alternative cost recovery application requesting a rate

increase of $34 million (2%) associated with $561 million on two major

construction projects expected to be completed and in-service by June 2010; a

ruling is expected July 1, 2010

increase of $34 million (2%) associated with $561 million on two major

construction projects expected to be completed and in-service by June 2010; a

ruling is expected July 1, 2010

Regulatory Highlights

• Wyoming

– 2008 rate case settled for $18 million (4%) effective May 2009

– Power Cost Adjustment Mechanism effective, $7 million recovery authorized

beginning September 2009; annual filing in January 2010 requesting recovery

of $8 million in deferred net power costs

beginning September 2009; annual filing in January 2010 requesting recovery

of $8 million in deferred net power costs

– General rate case filed in October 2009 requesting an increase of $71 million

based on test period ending December 2010; new rates expected to be effective

August 2010

based on test period ending December 2010; new rates expected to be effective

August 2010

• Idaho

– 2008 general rate case settled for an annual increase of $4 million (3%) for

noncontract retail customers effective April 2009; also found acquisition of

Chehalis generating facility prudent

noncontract retail customers effective April 2009; also found acquisition of

Chehalis generating facility prudent

– Energy Cost Adjustment Mechanism implemented with effective date of July 1,

2009; February 2010 filing by PacifiCorp requesting recovery of $2 million in

deferred net power costs

2009; February 2010 filing by PacifiCorp requesting recovery of $2 million in

deferred net power costs

2010 Fixed-Income Investor Conference

Pat Reiten

President – Pacific Power

Business Update

Pacific Power service territory

• Pacific Power has a 50% reduction in lost-time cases

(lower severity of incidents)

(lower severity of incidents)

• Rate case settlements with fair revenue results –

Washington, Oregon and California

Washington, Oregon and California

• Retail load was 18,454 GWh in 2009 vs. 18,982

GWh in 2008, a 2.8% decrease, and is anticipated to

decrease 2.4% from 2009 to 2011

GWh in 2008, a 2.8% decrease, and is anticipated to

decrease 2.4% from 2009 to 2011

• Significant progress in the Energy Gateway

transmission expansion; the first line segment fully

in-service December 31, 2010

transmission expansion; the first line segment fully

in-service December 31, 2010

• Signed settlement agreement with federal, state and

other parties concerning the Klamath hydroelectric

system

other parties concerning the Klamath hydroelectric

system

• Network reliability has remained relatively

consistent over the last five years

consistent over the last five years

• Signed contract with an employee union

• Initiated six-state enhanced customer

communication campaign

communication campaign

Business Update – 2010 Challenges

• Managing costs, identifying savings and operating below 2005 run rates

- Carefully review staffing requirements

- Assure contract and spending discipline

- Engage employees

• Bad debt expense was $5.9 million in 2009 vs. $8.6 million in 2008 mainly due

to improved communications with customers whose accounts were delinquent

to improved communications with customers whose accounts were delinquent

• Taking action regarding customers and carefully managing risks, including

investment, credit, customer debt and load forecasts

investment, credit, customer debt and load forecasts

- Monitor all key customers; deposits and prompt payments required

- Communicate through quarterly meetings, regional customer conferences, and key

account services and outreach, targeting economically stressed

account services and outreach, targeting economically stressed

Regulatory Highlights

• Oregon

– Power costs update increase of $4 million effective January 1, 2010, through the

Transition Adjustment Mechanism

Transition Adjustment Mechanism

– Order approving 2009 general rate case settlement authorized annual increase of

$42 million (4%) effective February 2010; also approved tariff riders to collect

$8 million over three years

$42 million (4%) effective February 2010; also approved tariff riders to collect

$8 million over three years

– Filed 2010 general rate case requesting an increase of $130.9 million (13.1%)

• Includes Populus to Terminal segment of transmission plan, two new wind

resources, environmental improvement projects at Dave Johnston plant, system

reliability, hydro relicensing and other investments; if approved, new rates to

take effect January 1, 2011

resources, environmental improvement projects at Dave Johnston plant, system

reliability, hydro relicensing and other investments; if approved, new rates to

take effect January 1, 2011

– Initial filing for 2011 Transition Adjustment Mechanism supports an increase of

$69.1 million (7.0%); filing will be updated and adjusted during the year with new

rates effective January 1, 2011

$69.1 million (7.0%); filing will be updated and adjusted during the year with new

rates effective January 1, 2011

• Washington

– Washington Utilities and Transportation Commission approved an all-party

settlement of general rate case resulting in annual increase of $14 million (5%)

effective January 1, 2010

settlement of general rate case resulting in annual increase of $14 million (5%)

effective January 1, 2010

Regulatory Highlights

Energy Gateway

Transmission Expansion

Transmission Expansion

• Highlights

– Approximately 2,000 new line

miles

miles

– More than 100 communities

– Five new substations

– More than 150 million pounds

of conductor

of conductor

– PacifiCorp investment of more

than $6 billion

than $6 billion

Energy Gateway Transmission Expansion Plan

(1,500 MW build-out configuration)

• Key Principles

– Secure capacity for the long-

term benefit of customers

term benefit of customers

– Support multiple resource

scenarios

scenarios

– Secure regulatory and

community support

community support

– Build it

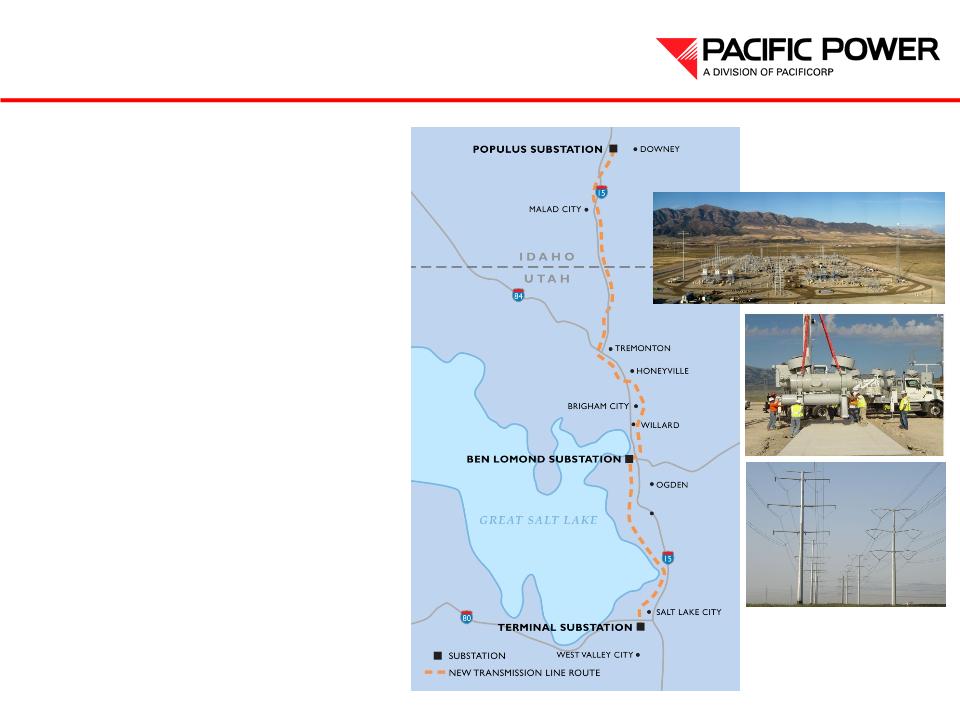

Energy Gateway

Current Construction

Current Construction

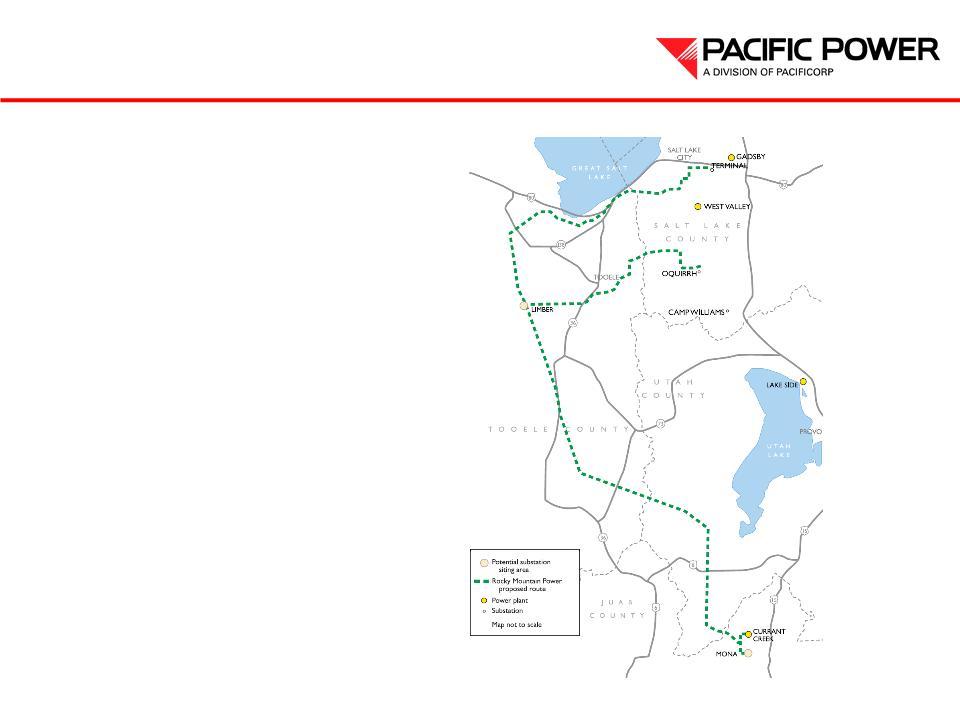

• Gateway Central

– Populus to Terminal

• 135 miles – double-circuit

345kV construction

345kV construction

• In-service date:

– Ben Lomond to Terminal –

June 2010

– Populus to Ben Lomond –

December 2010

December 2010

• Status

– Contract award October 2008

– Commenced February 2009

• Regulatory recovery process

underway

underway

Energy Gateway

Current Construction

Current Construction

• Gateway Central

– Mona to Oquirrh

• 114 miles – double-circuit

345 kV and single-circuit

500 kV construction

345 kV and single-circuit

500 kV construction

• In-service 2013-2014

• Permitting and bid process

underway

underway

Energy Gateway Progress Update

• Gateway South

– Aeolus to Mona

• 395 miles – single-

circuit 500 kV

construction

circuit 500 kV

construction

• In-service 2017 – 2019

• Permitting initiated

– Sigurd to Red Butte

• 165 miles – single-

circuit 345 kV

circuit 345 kV

• In-service 2014

• Permitting underway

Energy Gateway Progress Update

• Gateway West

– Windstar to Populus to

Hemingway

Hemingway

• 1,050 miles – single-

circuit 500 kV and

single-circuit 230 kV

construction

circuit 500 kV and

single-circuit 230 kV

construction

• In-service 2014 – 2018

• Permitting underway

• Westside

– Wallula to McNary

segment under

development

segment under

development

– Exploring development

west of Hemingway

west of Hemingway

2010 Fixed-Income Investor Conference

Micheal Dunn

President – PacifiCorp Energy

Resource Portfolio

(1) Net MW owned in operation and under construction as of December 31, 2009

10,594 net MW generation capacity(1)

• 6,116 MW coal-fueled generation

• 2,232 MW gas-fueled generation

• 1,158 MW hydroelectric

• 1,032 MW wind

• 34 MW geothermal

• 22 MW other

CA

NV

AZ

UT

WY

OR

WA

MT

CO

ID

Pacific Power Service Territory

Coal Plants

Natural Gas Plants

Wind Projects

Coal Mines

Geothermal and Other

Hydro Systems

Rocky Mountain Power Service

Territory

Territory

Generating Capability (MW)

by Fuel Type

by Fuel Type

March 31, 2006

December 31, 2009

(1) Net MW owned in operation and under construction

8,470 MW (1)

10,594 MW (1)

Wind Resource Additions

PacifiCorp’s owned wind-powered generation resource portfolio is composed of the

following projects:

following projects:

• MEHC Renewable Energy Commitment:

– PacifiCorp expects to exceed the 2015 commitment to acquire at least 1,400 MW of new cost-effective renewable

resources by the end of 2010 with a combination of owned and purchased power agreements

resources by the end of 2010 with a combination of owned and purchased power agreements

Future Resource Requirements

• Near-term resource gaps addressed with demand response programs, energy efficiency, and

firm market purchases; long-term resource gaps will also be addressed with thermal

generation and renewables

firm market purchases; long-term resource gaps will also be addressed with thermal

generation and renewables

Future Generation

• Long-term mix and timing of resources largely will depend on the

specifics of climate change, renewable portfolio requirements and

comparative resource type economics

specifics of climate change, renewable portfolio requirements and

comparative resource type economics

• In response to regulatory uncertainty, the company is planning for a

diverse resource mix consisting of:

diverse resource mix consisting of:

– Wind and other types of renewable resources

– Natural gas-fueled generation

– Firm market purchases

– Demand-side management, including both dispatchable load control and

energy efficiency measures

energy efficiency measures

Impact of Economy on

Capital Requirements

Capital Requirements

Given lower load growth, capital projects were deferred or removed

which totaled $1.3 billion in reduction between 2010 and 2014

which totaled $1.3 billion in reduction between 2010 and 2014

– Deferral of two natural gas-fueled plants; one from 2012 to 2015 and another from

2013 to 2017

2013 to 2017

– Postponement of 260.5 MW of wind resource acquisitions from 2012-2016 until

after 2016

after 2016

• Aligns with planned in-service date of Energy Gateway transmission in

Wyoming, which is necessary to access low cost wind resources in Wyoming

Wyoming, which is necessary to access low cost wind resources in Wyoming

• Maintains state and potential federal renewable portfolio standard requirements

and exceeds MidAmerican Energy Holdings Company acquisition commitments

and exceeds MidAmerican Energy Holdings Company acquisition commitments

• Deferred gas and wind generation projects are replaced with economic, flexible

purchased power in the interim

purchased power in the interim

– A general reduction in overall capital spending

Questions

2010 Fixed-Income Investor Conference

Bill Fehrman

President – MidAmerican Energy Company

Overview

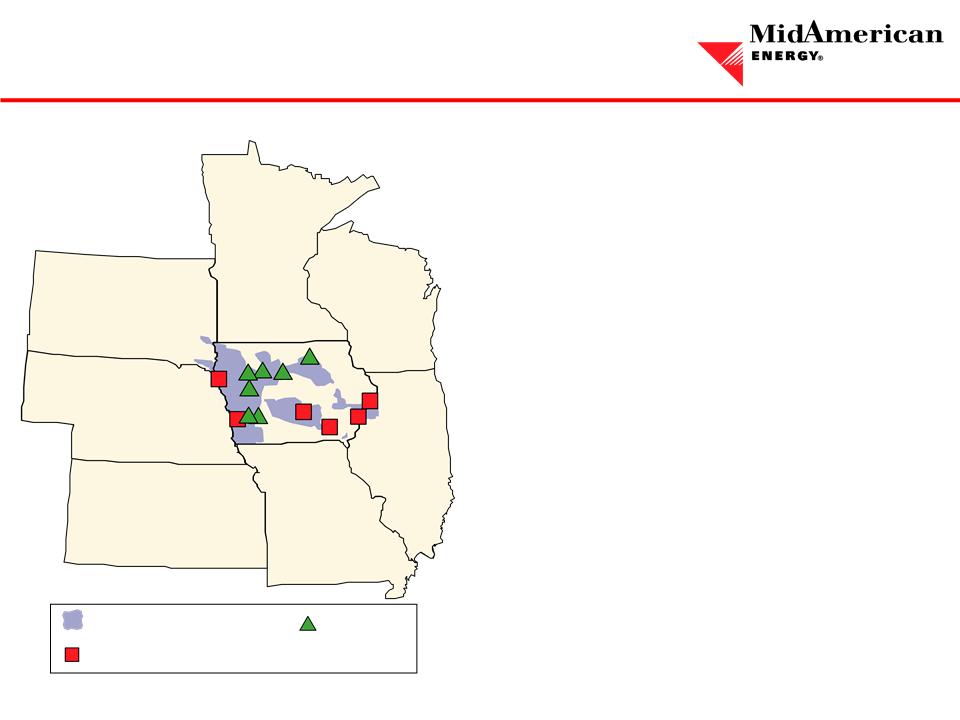

Wind Projects

MidAmerican Energy

Service Territory

Service Territory

Major Generating Facilities

(1) Net MW owned as of December 31, 2009

SD

NE

KS

MO

IL

WI

MN

IA

• Headquartered in Des Moines, Iowa

• 3,567 employees

• 1.4 million electric and natural gas

customers in four Midwestern states

customers in four Midwestern states

• 6,443 net MW generation

capacity(1)

capacity(1)

• Generating capacity by fuel type(1)

– Coal 52%

– Natural gas 20%

– Wind 20%

– Nuclear 7%

– Other 1%

Business Update

• Customer Service

– One of the top ranked utilities in the Midwest region according to 2009 customer

satisfaction studies by J.D. Power and Associates

satisfaction studies by J.D. Power and Associates

– Regulated bad debt expense decreased from $11.2 million in 2008 to $10.1 million

in 2009

in 2009

– Expanded energy efficiency programs to Illinois, South Dakota and Nebraska to

provide our customers with an opportunity to better manage their energy costs

provide our customers with an opportunity to better manage their energy costs

• Employee Commitment

– 2010 is showing improvement in safety performance in numbers of accidents

– Focused on control of benefit costs and overall staffing levels

Business Update

• Financial Strength

– Maintained strong financial results despite economic slowdown and cooler than normal summer

weather – regulated electric retail sales were 3.6% lower in 2009 than 2008 and regulated electric

wholesale margins were $104.7 million lower in 2009 than 2008

weather – regulated electric retail sales were 3.6% lower in 2009 than 2008 and regulated electric

wholesale margins were $104.7 million lower in 2009 than 2008

– Successfully implemented cost containment efforts to lower both capital and O&M spending in

2009 and achieved income tax benefits; continue with aggressive cost containment efforts in

2010

2009 and achieved income tax benefits; continue with aggressive cost containment efforts in

2010

– 2009 net income up 2.0% to $350 million with a return on average equity of 12.7%

– Base electric rate stability for Iowa customers through 2013 – opportunity for rate relief if returns

fall below 10%

fall below 10%

– Significantly higher operating cash flows in 2009 due to 2008 wind projects and other income tax

benefits for the year

benefits for the year

– Experiencing an increase in 2010 retail sales but significant winter storms in January resulted in

increased O&M and capital expenditures of approximately $26.5 million in total

increased O&M and capital expenditures of approximately $26.5 million in total

– MidAmerican Energy Company is in a long generation position with a diversified portfolio,

which will be a significant strategic advantage as markets regain strength and new federal

environmental programs are enacted

which will be a significant strategic advantage as markets regain strength and new federal

environmental programs are enacted

Business Update

• Environmental Respect

– Continued investment in emissions control projects

• Low NOx combustion systems at all coal-fueled units

• Dry scrubber and baghouse projects installed at Louisa Generating Station and

Walter Scott, Jr. Energy Center Unit 3

Walter Scott, Jr. Energy Center Unit 3

• Regulatory Integrity

– Focus is on a balanced outcome for our customers, communities, regulators and

legislators

legislators

– Significant use of binding rate-making principles in Iowa in advance of construction

provides for greater regulatory certainty during future rate cases while meeting the

expectations of policymakers and regulators

provides for greater regulatory certainty during future rate cases while meeting the

expectations of policymakers and regulators

– Approximately 40% of Iowa electric rate base subject to advanced rate-making

principles

principles

– Working with regulators, legislators and other stakeholders to promote legislation

allowing for recovery of expenses up to $5 million per year for no more than three

years to consider potential sites for nuclear generation in Iowa

allowing for recovery of expenses up to $5 million per year for no more than three

years to consider potential sites for nuclear generation in Iowa

Business Update

• Operational Excellence

– Significant operational focus on minimizing plant emissions

– Walter Scott, Jr. Energy Center Unit 4 maintenance outage in 2010

– Seamlessly entered the Midwest ISO as a transmission owning member

September 1, 2009

September 1, 2009

• MidAmerican generation plants have set several production records since

entering the market

entering the market

– Automated meter reading

• Project completed in October 2009, six months ahead of schedule

• 599,507 electric meters and 534,343 gas meters were changed out

• Ability to collect meter reads within the billing window rose from 93.75% in

2007 to 98.8% in 2009

2007 to 98.8% in 2009

• 1,284 MW owned and operated, which ranks MidAmerican Energy

Company No. 1 in wind generation ownership among rate-regulated

utilities in the United States

Company No. 1 in wind generation ownership among rate-regulated

utilities in the United States

• Continue to improve MidAmerican Energy Company’s overall carbon

footprint

footprint

Wind Project Summary

(1) Including AFUDC

Year | Net MW | |||

Facility | Location | Installed | Owned | Capital (1) |

Intrepid | Schaller, IA | 2004-2005 | 176 | |

Century | Blairsburg, IA | 2005-2008 | 200 | |

Victory | Westside, IA | 2006 | 99 | |

Pomeroy | Pomeroy, IA | 2007-2008 | 256 | |

Adair | Adair, IA | 2008 | 175 | |

Carroll | Carroll, IA | 2008 | 150 | |

Charles City | Charles City, IA | 2008 | 75 | |

Walnut | Walnut, IA | 2008 | 153 | |

Total Wind Installed at 12/31/2009 | 1,284 | $2.2 Billion | ||

• MidAmerican Energy Company reached a settlement on rate-making

principles with the Iowa Office of Consumer Advocate for the development

of up to 1,001 MW additional wind generation

principles with the Iowa Office of Consumer Advocate for the development

of up to 1,001 MW additional wind generation

• MidAmerican Energy Company filed a rate-making principles application

filing with the Iowa Utilities Board March 24, 2009

filing with the Iowa Utilities Board March 24, 2009

• Iowa Utilities Board approved the application on December 14, 2009

– A challenge to the Iowa Utilities Board order has been filed in Iowa District Court

• Key provisions of the Iowa Utilities Board order are:

– Develop up to 1,001 MW of new wind generation by December 31, 2012, but not more than

500 MW completed in 2012

500 MW completed in 2012

– Return on equity of 12.2% in all future Iowa rate proceedings

– Projects that do not exceed stipulated cost cap levels (installed cost/kW) are not subject to

prudence or other regulatory review

prudence or other regulatory review

– Depreciable life for wind generation is 20 years

Future Wind

Generating Capacity by Fuel Type

December 31, 2000

December 31, 2009

(1) Net MW owned

4,086 MW (1)

6,443 MW (1)

Wind Benefit –

Decreasing Carbon Footprint

Note: MidAmerican Energy Company sold the environmental attributes of some of this generation to third parties and values do not represent the

carbon footprint of energy delivered to MidAmerican Energy Company’s retail customers

carbon footprint of energy delivered to MidAmerican Energy Company’s retail customers

Ongoing Risk Mitigation

• Continued cost containment efforts

– Fewer contractors

– Manage head count

• Minimize counterparty credit risk through collateral offsets and

other provisions

other provisions

• Continue to pursue hedging strategies to minimize market risk

• Balanced unregulated retail portfolio

• Evaluating transmission opportunities that will enhance the value of

generation resources

generation resources

• With 27% of generating capacity currently provided by noncarbon

sources and authorization to construct up to an additional 1,001 MW

of wind generation in Iowa, MidAmerican Energy Company is well-

positioned to meet the long-term needs of its customers in an

environmentally responsible manner

sources and authorization to construct up to an additional 1,001 MW

of wind generation in Iowa, MidAmerican Energy Company is well-

positioned to meet the long-term needs of its customers in an

environmentally responsible manner

Questions

2010 Fixed-Income Investor Conference

Mark Hewett

President – Northern Natural Gas Company

Overview

TX

OK

KS

NE

SD

MN

WI

IA

• Headquartered in Omaha, Nebraska

• 878 employees

• 15,000-mile interstate natural gas

transmission pipeline system

transmission pipeline system

• Market area design capacity of 5.5 Bcf/day

plus 2.0 Bcf/day field area delivery

capacity

plus 2.0 Bcf/day field area delivery

capacity

• Five natural gas storage facilities with a

total firm capacity of 73 Bcf and more than

2.0 Bcf of peak day delivery capability

total firm capacity of 73 Bcf and more than

2.0 Bcf of peak day delivery capability

• Access to six major supply basins

• Annual deliveries of more than 920 Bcf

Recent Accomplishments

• Continued favorable operating results in 2009

– Continued to demonstrate financial strength during the economic crisis

– Completed several Northern Lights expansion projects, including Zone EF

expansion adding almost 110,000 dth per day of additional market area capacity

expansion adding almost 110,000 dth per day of additional market area capacity

– Identified and executed on sustainable cost-reduction and revenue-growth strategies

of $16 million

of $16 million

– Increased the integrity and reliability of the pipeline while managing operating

costs and staffing

costs and staffing

• In the 2010 Mastio & Company pipeline industry survey report,

Northern was ranked No. 1 out of 16 Mega Pipelines and tied for No. 2

out of 43 interstate pipelines in customer satisfaction

Northern was ranked No. 1 out of 16 Mega Pipelines and tied for No. 2

out of 43 interstate pipelines in customer satisfaction

Strong Market and Competitive Position

• Strategic location in high-demand, upper Midwest market areas

• Retains competitive advantage by providing delivery to city gates in

Northern’s upper Midwest market area

Northern’s upper Midwest market area

• Expanding electric generation and other end-use markets enabled

Northern to establish daily peak delivery record in January 2009

Northern to establish daily peak delivery record in January 2009

• Customer base dominated by local distribution companies

• Lowest transportation cost of natural gas to customers in the upper

Midwest

Midwest

• Provides customers with flexibility to access multiple supply basins

– Hugoton, Permian, Anadarko, Rocky Mountain, Williston and Canada

Revenue Stability

Market Area Transportation

Contract Maturities (1)

(1) Based on MDQ (Maximum Daily Quantities of market area

entitlement in decatherms)

entitlement in decatherms)

Transportation & Storage Revenue

• 70% of 2009 market area transportation revenue was derived from local

distribution companies

distribution companies

• 56% of 2009 storage revenue resulted from long-term firm contracts, with an

average remaining contract life of approximately 8 years

average remaining contract life of approximately 8 years

• 50% of market area capacity is contracted beyond 2015

• Shippers that do not meet our tariff credit standards are required to post collateral

• Northern’s system accesses Granite

Wash tight sands

Wash tight sands

• Working with several customers to

attach incremental supply to its

system from this play; however,

market prices continue to support

movement of gas to the east

attach incremental supply to its

system from this play; however,

market prices continue to support

movement of gas to the east

• Continued shale development

should improve the prospects for

gas demand due to increased supply

availability

should improve the prospects for

gas demand due to increased supply

availability

• Change in gas flow patterns across

the U.S. is likely as nontraditional

supply is developed and brought to

market

the U.S. is likely as nontraditional

supply is developed and brought to

market

Shale Gas Opportunities

Section 5 Rate Proceeding

• Section 5 of the Natural Gas Act allows any party or the Federal Energy

Regulatory Commission to challenge the current rates or service of an

interstate pipeline as no longer being just and reasonable

Regulatory Commission to challenge the current rates or service of an

interstate pipeline as no longer being just and reasonable

– FERC staff and intervenors have the burden of proof

– Rate changes are prospective only and no service changes

• FERC issued order on November 19, 2009

– First time in more than 20 years (Order was initiated by FERC)

– Evaluation based solely on 2008 Form 2 information

– Commission concluded:

• Northern’s calculated cost of service indicates an over recovery of $167.4 million

• Commission calculated return on equity of 24.4%

– Northern submitted a cost and revenue study on February 4, 2010

• Northern study indicated an under recovery of $63 million and an 8% return on equity

– Set for hearing-expedited schedule

• Initial decision (ALJ) by November 15, 2010

• Commission decision not expected before the first quarter of 2011

Overall Strategy

• Aggressively challenge appropriateness of Section 5 proceeding

• Demonstrate existing rates are just and reasonable

• Take control of the Section 5 proceeding by filing a Section 4

general rate case proceeding

general rate case proceeding

• Propose service and rate design changes in the Section 4

proceeding that redistribute operating and financial risk between

the company and its customers

proceeding that redistribute operating and financial risk between

the company and its customers

• Prepare to litigate

• Support customer driven settlement discussions to terminate

Section 5 proceeding

Section 5 proceeding

2010 Fixed-Income Investor Conference

Gary Hoogeveen

President – Kern River Gas Transmission Company

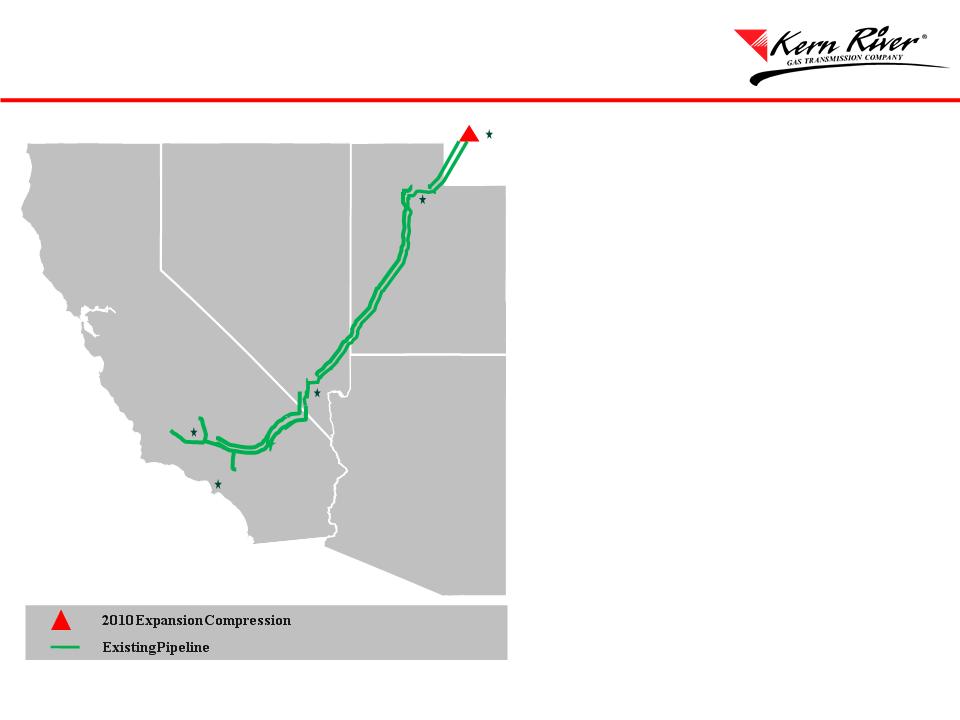

Overview

CA

NV

WY

UT

AZ

• Headquartered in Salt Lake City, Utah

• 162 employees

• 1,700-mile interstate natural gas

transmission pipeline system

transmission pipeline system

• Delivers natural gas from Rocky

Mountain basin to markets in Utah,

Nevada, California and Arizona

Mountain basin to markets in Utah,

Nevada, California and Arizona

• Design capacity: 1.8 million Dth per

day of natural gas

day of natural gas

• Pipeline of choice to Southern

California and Las Vegas

California and Las Vegas

• Delivered approximately 22%(1) of

California’s demand for natural gas

California’s demand for natural gas

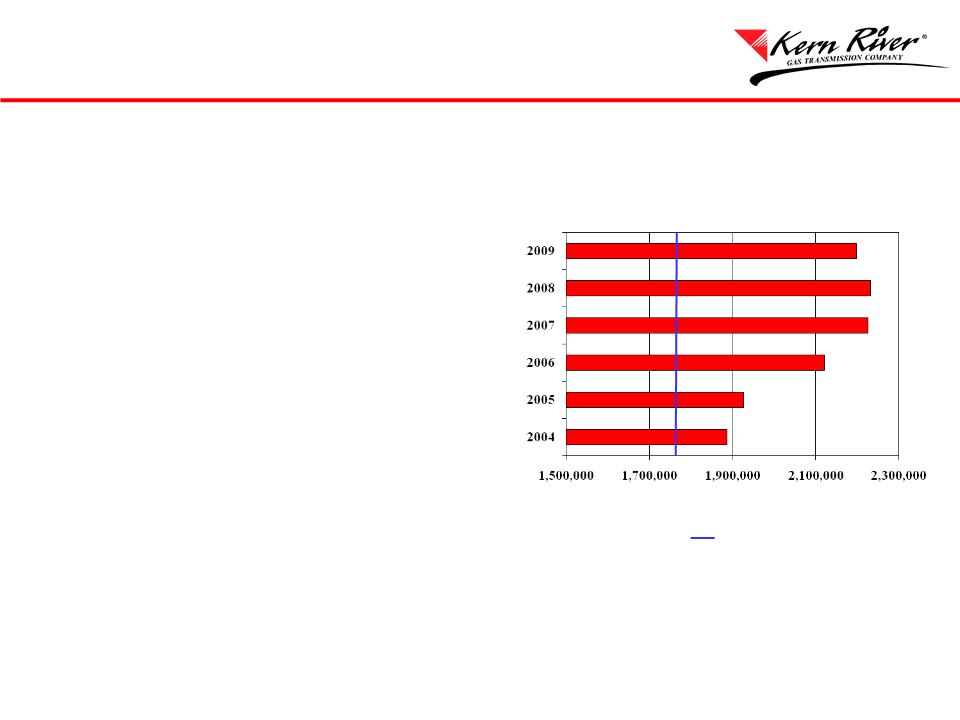

• During 2009, scheduled throughput

averaged 123% of design capacity

averaged 123% of design capacity

• Ranked No. 2 out of 43 interstate

pipelines in 2010 Mastio & Company

survey for customer satisfaction

pipelines in 2010 Mastio & Company

survey for customer satisfaction

• Two expansion projects developed to

expand the pipeline capacity by 23%

expand the pipeline capacity by 23%

Recent Accomplishments

Daily Average Scheduled Volume

Throughput in Dth

Design capacity

(1) Based on the 2009 California Gas Report

• Federal Energy Regulatory Commission order issued

December 17, 2009

December 17, 2009

– Minor adjustments to current rates

– Hearing and settlement procedures for future rates

• Kern River filed compliance filings

• Ongoing settlement discussions with customers related

to future rates after initial contract periods end

to future rates after initial contract periods end

• Expect final order for current rates by second quarter

2010

2010

Rate Case

Competitive Position

• Access to economical Rocky Mountain gas

supplies

supplies

• Direct service to end-users avoids rate stacks of

local distribution companies

local distribution companies

• Relatively new system

– Efficient

– Low fuel rates

– Limited cost for integrity management

• Reasonable market growth from incremental

electric generation

electric generation

– 8,378 MW projected for California

– 500 MW projected for Nevada

• Kern River is the only major pipeline

delivering gas from favorably priced Rocky

Mountain supply basin directly to California

delivering gas from favorably priced Rocky

Mountain supply basin directly to California

– Ruby Pipeline – El Paso’s 1.5 Bcf/d pipeline

from Rockies to Northern California is

scheduled to be in-service in spring 2011

from Rockies to Northern California is

scheduled to be in-service in spring 2011

• REX Pipeline – Kinder Morgan’s 1.8 Bcf/d

pipeline, originating in the Rockies and

delivering to Midwest and Eastern U.S.

markets, became fully operational in

November 2009

pipeline, originating in the Rockies and

delivering to Midwest and Eastern U.S.

markets, became fully operational in

November 2009

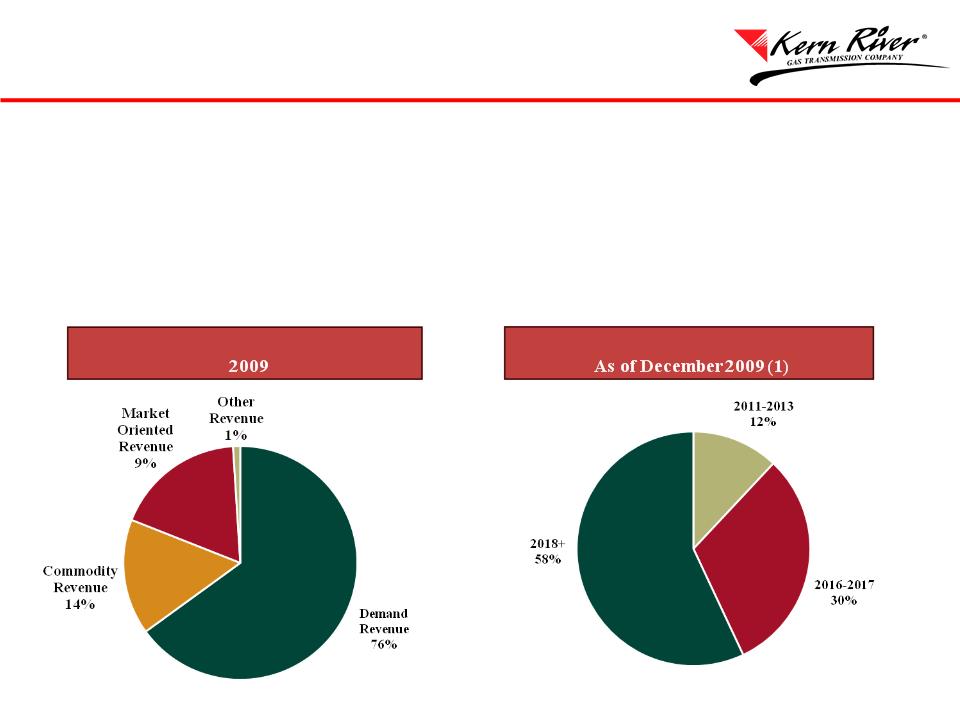

Revenue Stability

Contract Maturities

Revenue Distribution

• 76% of revenue is from demand charges

• 88% of contracts mature after 2015

• Weighted average shipper rating of BBB+/Baa1

• Shippers that do not meet our tariff credit standards are required to post collateral

(1) Based on daily demand quantity

• Economically expand by 145,000 Dth

per day

per day

• Fully contracted with signed

precedent agreements from 11

shippers with a weighted average

rating of BBB/Baa1

precedent agreements from 11

shippers with a weighted average

rating of BBB/Baa1

• Service to Southern California and

Las Vegas

Las Vegas

• $62 million capital cost

• Add 20,500 HP of incremental

compression

compression

• Restage existing compression

• Increase maximum allowable

operating pressure from 1,200 psig to

1,333 psig

operating pressure from 1,200 psig to

1,333 psig

• FERC certificate received June 2009

• Anticipated in-service April 2010

Las Vegas

Bakersfield

Los Angeles

Salt Lake

City

2010 Expansion Project

Muddy Creek

Apex Expansion Project

Mainline Expansion

• Economically expand by 266,000 Dth

per day

per day

• 20-year term contract with NV Energy

• Service to Las Vegas

• $373 million capital cost

• Close Wasatch Loop with 28 miles of

36” pipe

36” pipe

• Add 78,000 HP of new compression at

four locations and restage four existing

compressors

four locations and restage four existing

compressors

• Filed for certificate authority from

FERC December 2009

FERC December 2009

• Approval expected by October 2010

• Anticipated in-service November 1, 2011

Backhaul Capacity Contract

• New ability to receive 400 MDth/d of

firm backhaul

firm backhaul

• In-service April 1, 2009

Bakersfield

Los Angeles

Salt Lake

City

Apex Expansion Loop

Las Vegas

Apex Expansion Pipe

Existing Pipeline

Questions

2010 Fixed-Income Investor Conference

Phil Jones

President – CE Electric UK

Overview

U.K.

London

Newcastle

• Predominantly a wires-only business

serving 3.8 million electricity end-users –

no generation or retail activity

serving 3.8 million electricity end-users –

no generation or retail activity

• Two adjacent license areas allowing us to

operate as a single business

operate as a single business

• Ofgem operates as the single energy regulator covering the gas and electricity

markets.

markets.

• Price controls are set to recover Ofgem’s view of efficient costs over the next

five years (fiscal year beginning April 1).

five years (fiscal year beginning April 1).

• The 14 distribution network operators are licensed to construct and maintain the

electricity network within each geographic area; license requires a 25-year

notice period to be served by the regulator.

electricity network within each geographic area; license requires a 25-year

notice period to be served by the regulator.

• Transmission and distribution is subject to significant economic regulation,

whereas generation, metering and retail operations are open to competition.

whereas generation, metering and retail operations are open to competition.

• The seven DNO ownership groups include different business models – CE

Electric UK is one of three wires-only groups whereas other groups, for example

EDF and E.ON, hold generation and retail in addition to distribution.

Electric UK is one of three wires-only groups whereas other groups, for example

EDF and E.ON, hold generation and retail in addition to distribution.

• DNOs bill retail companies for their use of the electricity network. This charge

amounts to approximately 15 percent of an average domestic customer’s bill, or

around £76 per year.

amounts to approximately 15 percent of an average domestic customer’s bill, or

around £76 per year.

On balance, we are comfortable with the

DPCR 5 settlement

DPCR 5 settlement

Negatives

Positives

Revenues increase annually by an average of 6.4% plus

inflation from April 2010 – March 2015

inflation from April 2010 – March 2015

• Revenues decoupled from volume risk

• Properly designed and calibrated incentive schemes

Cost allowances cover our projected costs

• Full funding of our forecasted indirect costs

• Funds an increased asset-related capital program

• Approval of our proposed outputs

Pension costs covered

• Full funding of distribution business pension costs

• Faster recovery of pension costs than in DPCR 4

Income taxes covered

• Tax-related revenues sufficient to meet projected taxes

• Protection against changes in tax legislation or

accounting standards

accounting standards

Out-performance opportunities exist

• Already rewarded for provision of challenging forecasts

• The opportunity to enhance the base equity return

through cost and service performance

through cost and service performance

Rate of Return

• Base equity return was under our targeted floor of 10.5%

and set at ~ 9.4%

and set at ~ 9.4%

• Over the five-year period, approximately £100m of our

cost recovery has been included as RAV and effectively

defers recovery to 2015 and beyond relative to the

DPCR 4 treatment

cost recovery has been included as RAV and effectively

defers recovery to 2015 and beyond relative to the

DPCR 4 treatment

Ofgem factored in outperformance

when it set the cost of capital

when it set the cost of capital

Assumes Ofgem

gearing, debt rates and

expenditure baselines are

matched

gearing, debt rates and

expenditure baselines are

matched

Source: Electricity Distribution Price Control Review Final Proposals Ref: 144/09 7 December 2009 Chapter 4 – Risks and rewards Page 58 Figure 4.2 -

Potential equity returns (RoRE) at 4.7 per cent WACC (vanilla)

Potential equity returns (RoRE) at 4.7 per cent WACC (vanilla)

Range of

possible

RORE

outcome

possible

RORE

outcome

RAV grows by £401m in real terms and

we aim to deliver outperformance

we aim to deliver outperformance

Notes:

1. All values are shown in 2007/08 prices.

2. Network investment is not directly comparable because outputs are more clearly specified in DPCR 5 than they were in DPCR 4.

3. The costs above exclude all pension costs, as per the Ofgem efficiency comparisons. Pension costs are assessed and funded separately through the price control

• RAV grows by

22% in real terms

and inflation will

also be added

22% in real terms

and inflation will

also be added

Incentives provide upside opportunities

• We have already secured some benefits as a result of our forward plan

being well received by Ofgem

being well received by Ofgem

– An additional £33m is included in our DPCR 5 allowances

• We expect modest outperformance from the Quality of Supply incentives

– The DPCR 5 targets are more reasonable than the DPCR 4 equivalents

– We continue to invest in remote control to improve network performance and reliability

• Line losses represent an opportunity for further upside

– The targets are tighter than in DPCR 4; however, the downside risk is now capped

– The incentive rate has been increased; for DPCR 4 it was set at £48 per MWh, and in

DPCR 5 it has increased to £60 per MWh

DPCR 5 it has increased to £60 per MWh

• Average debt costs are still above the Ofgem assumption but will improve

– We are planning incremental financing during the second quarter of 2010

– We will retain gearing just below the Ofgem assumption of 65%

Key Strengths

• Our performance in 2005 – 2010 (DPCR 4) has consistently been above the sector

average, particularly in safety.

average, particularly in safety.

• We are delivering positive trends on network performance, cost efficiency and customer

satisfaction and will continue to focus on these areas during the DPCR 5 period.

satisfaction and will continue to focus on these areas during the DPCR 5 period.

• Our projections are built on controllable operational cost performance.

• We have secured ongoing cost reimbursement of our significant pension liabilities over

the long term.

the long term.

• The new price control:

– Retains the inflation protection built into the existing arrangement

– Introduces full protection against a reduction in the demand for electricity

– Introduces a tax correction mechanism that covers legislative or accounting

standard changes

standard changes

– Builds in an average annual revenue increase of 6.4%, before inflation, over the five

year period, consistently strengthening our credit metrics as the period unfolds

year period, consistently strengthening our credit metrics as the period unfolds

• We will continue to evaluate growth opportunities that are credit positive.

Questions

Gregory E. Abel

2010 Fixed-Income Investor Conference

President and Chief Executive Officer

MidAmerican Energy Holdings Company

Managing Through Uncertain Times

• Our overall strategy remains unchanged

• Operating in challenging economic times

• Balanced resource decisions

• Transmission investment opportunities

• Energy policy

• Regulatory uncertainty

• Acquisition philosophy

• BYD

Questions