Filed by F.N.B. Corporation

(Commission File No. 001-31940)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: PVF Capital Corp.

(Commission File No. 0-24948)

The following slides were included in the slide presentation referenced during the First Quarter 2013 Earnings Report and Conference Call of F.N.B. Corporation on April 24, 2013:

Cautionary Statement Regarding Forward-looking Information:

This presentation and the reports F.N.B. Corporation files with the Securities and Exchange Commission often contain “forward-looking statements” relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause F.N.B. Corporation’s future results to differ materially from historical performance or projected performance. These factors include, but are not limited to: (1) a significant increase in competitive pressures among financial institutions; (2) changes in the interest rate environment that may reduce interest margins; (3) changes in prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions; (5) various monetary and fiscal policies and regulations of the U.S. government that may adversely affect the businesses in which F.N.B. Corporation is engaged; (6) technological issues which may adversely affect F.N.B. Corporation’s financial operations or customers; (7) changes in the securities markets; (8) risk factors mentioned in the reports and registration statements F.N.B. Corporation files with the Securities and Exchange Commission; (9) housing prices; (10) the job market; (11) consumer confidence and spending habits; (12) estimates of fair value of certain F.N.B. Corporation assets and liabilities; (13) transaction risks associated with the pending merger of PVF Capital Corp, and integration challenges related to the recently completed merger with Annapolis Bancorp, Inc. and the difficulties encountered in expanding into a new market; and (14) the effects of current, pending and future legislation, regulation and regulatory actions. F.N.B. Corporation undertakes no obligation to revise these forward-looking statements or to reflect events or circumstances after the date on which the forward-looking statements were made, or April 24, 2013.

Additional Information About the Merger:

F.N.B. Corporation and PVF Capital Corp. will file a proxy statement/prospectus and other relevant documents with the SEC in connection with their pending merger. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents F.N.B. and PVF Capital have filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents that F.N.B. has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA 16148, telephone: (724) 983-3317, and free copies of the documents that PVF Capital has filed with the SEC by contacting Jeffrey N. Male, Secretary, PVF Capital Corp., 30000 Aurora Road, Solon, OH 44139, telephone: (440) 248-7171.

SHAREHOLDERS OF PVF CAPITAL CORP. ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENT FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

F.N.B., PVF Capital and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of PVF Capital in connection with the proposed merger. The proxy statement/prospectus, when it becomes available, will describe any interests those directors and officers may have in the merger.

|

1Q13 Highlights 3 Very Productive Quarter and Great Start to 2013 Year-over-year EPS growth of 5% Consistent loan growth driven by C&I lending Stable net interest margin Solid asset quality results Positive trends seen in fee-based businesses Seamless integration of Annapolis Bancorp Announced PVF Capital acquisition Completed infrastructure build-out of e-delivery strategy, now offer complete suite of electronic banking options Solid Operating Results Continued Progress on Strategic Actions |

|

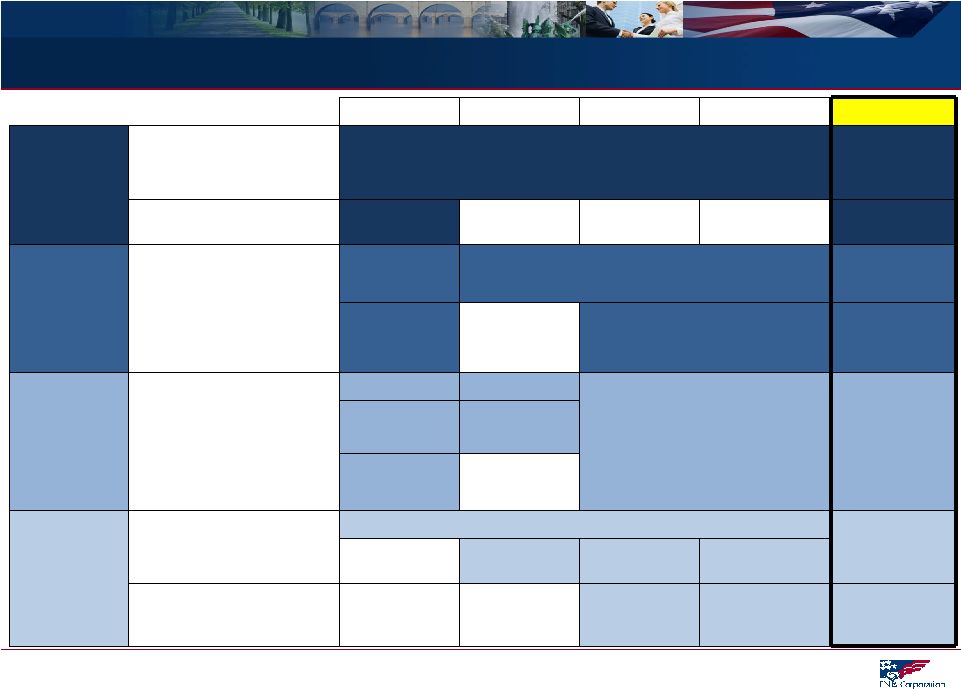

Reposition and Reinvest – Actions Drive Long-Term Performance 12 2009 2010 2011 2012 1Q13 PEOPLE Talent Management Strengthened team through key hires; Continuous team development Attract, retain, develop best talent Continued Success Geographic Segmentation Regional model Regional Realignment 5th Region Created PROCESS Sales Management/Cross Sell Proprietary sales management system developed and implemented: Balanced scorecards, cross-functional alignment Consumer Banking Scorecards Consumer Banking Refinement/Daily Monitoring Continued Utilization Commercial Banking Sales Management Expansion to additional lines of business Continued Expansion PRODUCT Product Development Deepened product set and niche areas allow FNB to successfully compete with larger banks and gain share Private Banking Capital Markets Online and mobile banking investment /implementation – Online banking enhancements, mobile banking and app Online/mobile banking infrastructure complete with mobile remote deposit capture and online budgeting tools Asset Based Lending Small Business Realignment Treasury Management PRODUCTIVITY Branch Optimization Continuous evolution of branch network to optimize profitability and growth prospects De-Novo Expansion 9 Locations Ongoing Evaluation Consolidate 2 Locations Consolidate 6 Locations Consolidate 37 Locations Acquisitions Opportunistically expand presence in attractive markets CB&T Parkvale ANNB Closed PVFC Announced |

|

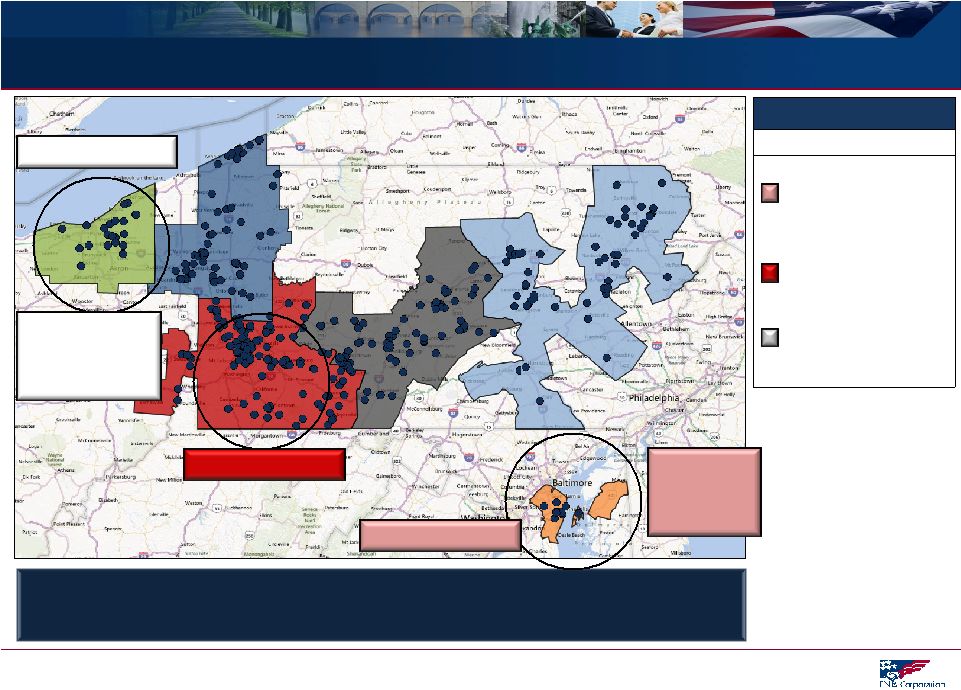

Regional Footprint: Pro-Forma View 13 Source: SNL Financial, Pro-Forma FNB’s regional model utilizes six regions, including three in top 30 MSA markets, with each region having a regional headquarters housing cross-functional teams. Top 30 MSA Presence MSA Population Baltimore 2.7 million (#20 MSA) Pittsburgh 2.4 million (#22 MSA) Cleveland 2.1 million (#28 MSA) Cleveland MSA Pittsburgh MSA Baltimore MSA ANNB Acquisition Completed April 6, 2013 PVFC Acquisition Target Completion October 2013 |

|

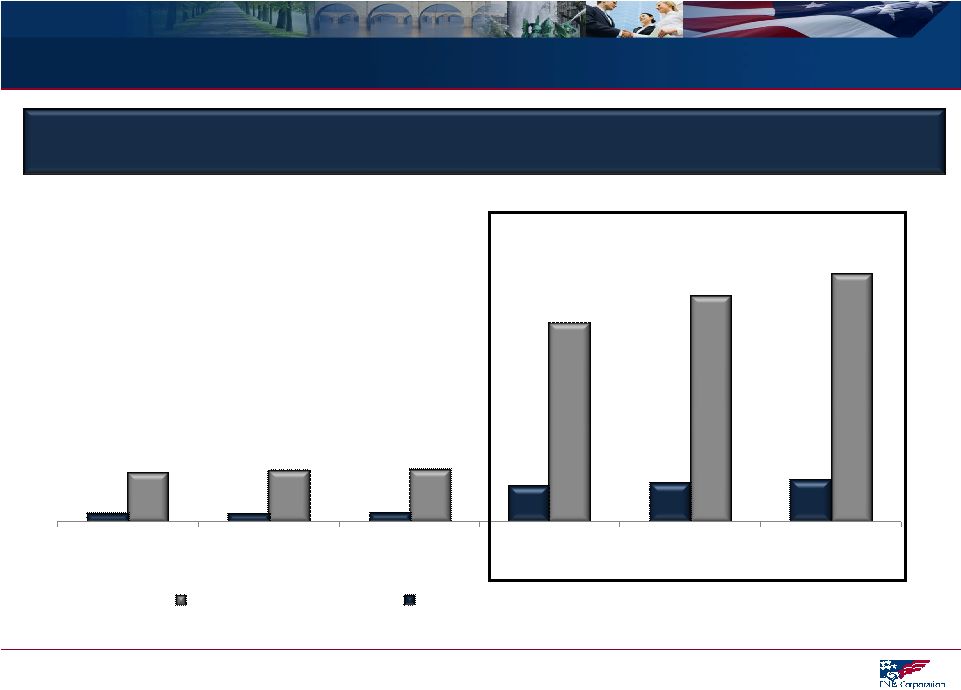

ANNB and PVFC Acquisitions = Opportunity 14 Note: Above metrics at the MSA level (1) Data per U.S. Census Bureau (2) Data per Hoover’s Significant Commercial Prospects = Opportunity to Leverage Core Competency and Drive Sustained Organic Growth 65,169 59,240 52,149 13,410 13,345 12,851 10,863 9,988 9,251 2,210 2,064 1,972 Baltimore MSA Pittsburgh MSA Cleveland MSA Harrisburg MSA Scranton MSA Youngstown MSA Total Businesses # of Companies with Revenue Greater Than $1 Million (1) (2) Over 175,000 Total Businesses (1) |

|

Summary 15 Very Productive Quarter and Great Start to 2013 Strong foundation for the future Completed infrastructure build-out of e-delivery strategy, now offer complete suite of electronic banking options Seamlessly integrated Annapolis Bancorp acquisition and announced PVF Capital acquisition Solid 1Q13 Operating Results Continued Execution of Reposition and Reinvest Strategy Aggressive pursuit of households Enhanced retention Lower delivery costs Allows branches to consult and generate loan growth and cross-sell opportunities Presence in three major MSA’s Significant opportunity to leverage strong commercial platform Deploy proven cross-functional sales management model Continued success attracting talent in new markets |