Webcast Presentation April 28, 2016 Q1 2016 Earnings

2 Q1 2016 Earnings Webcast, 4/28/16 Safe Harbor Statement Note: All statements made herein that are not historical facts should be considered as “forward- looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to: adverse economic conditions; disruptions in operations or information technology systems; product, labor or other cost fluctuations; supply chain disruptions or loss of key suppliers; expansion of business activities; exchange rate fluctuations; tax law changes or challenges to tax matters; increase in competition; risks related to acquisitions, including the integration of acquired businesses; litigation, disputes, contingencies or claims; legal or regulatory matters; debt levels, terms, financial market conditions or interest rate fluctuations; goodwill or intangible asset impairment; common stock dilution; and other factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December 31, 2015 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do not represent guidance by management and should not be construed as such. The following presentation includes a discussion of certain non-GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial measures can be found in the appendix and obtained via WESCO’s website, www.wesco.com.

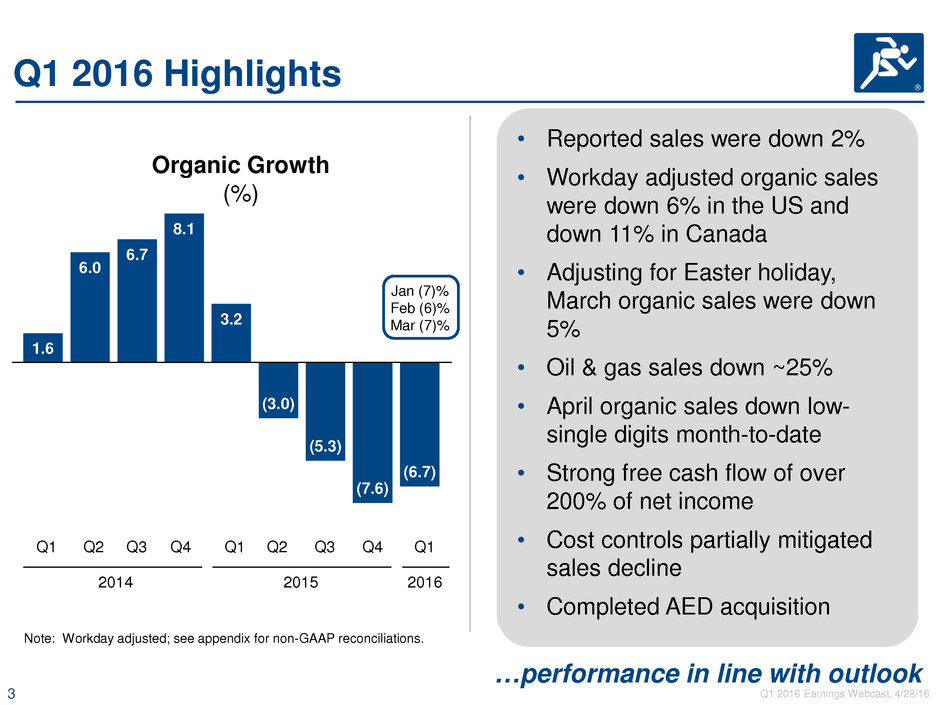

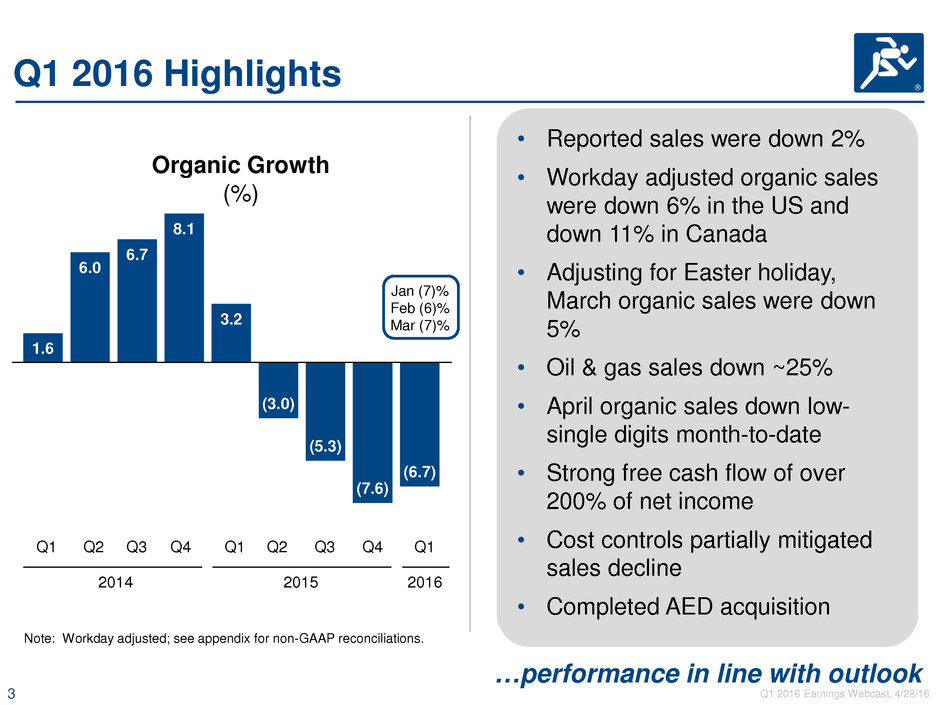

3 Q1 2016 Earnings Webcast, 4/28/16 Q1 2016 Highlights …performance in line with outlook • Reported sales were down 2% • Workday adjusted organic sales were down 6% in the US and down 11% in Canada • Adjusting for Easter holiday, March organic sales were down 5% • Oil & gas sales down ~25% • April organic sales down low- single digits month-to-date • Strong free cash flow of over 200% of net income • Cost controls partially mitigated sales decline • Completed AED acquisition 1.6 6.0 6.7 8.1 3.2 (3.0) (5.3) (7.6) (6.7) Organic Growth (%) Jan (7)% Feb (6)% Mar (7)% Note: Workday adjusted; see appendix for non-GAAP reconciliations. Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 Q1 2016

4 Q1 2016 Earnings Webcast, 4/28/16 Industrial End Market • Q1 2016 Sales − Workday adjusted organic sales down 14% versus prior year (down 14% in the U.S. and down 21% in Canada in local currency) − Down 7% sequentially − Sales declines driven by oil and gas, metals and mining, and OEM customers • Manufacturing headwinds remain strong with reduced demand outlook, weak commodity prices and strong U.S. dollar weighing on manufacturing sector causing deferred project and maintenance spending. • Global Account and Integrated Supply bidding activity levels remain strong. • Customer trends include high expectations for supply chain process improvements, cost reductions, and supplier consolidation. Core Sales Growth versus Prior Year 38% Industrial • Global Accounts • Integrated Supply • OEM • General Industrial Awarded a multi-year contract to supply MRO material across multiple plants for a global consumer products manufacturer. (4.1%) (10.2%) (14.2%) (16.7%) (15.8%) Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Q3 2015 Q2 2015 Q1 2015 2015 (11.3%) Q4 2015 Q1 2016 Organic Growth (13.7)%

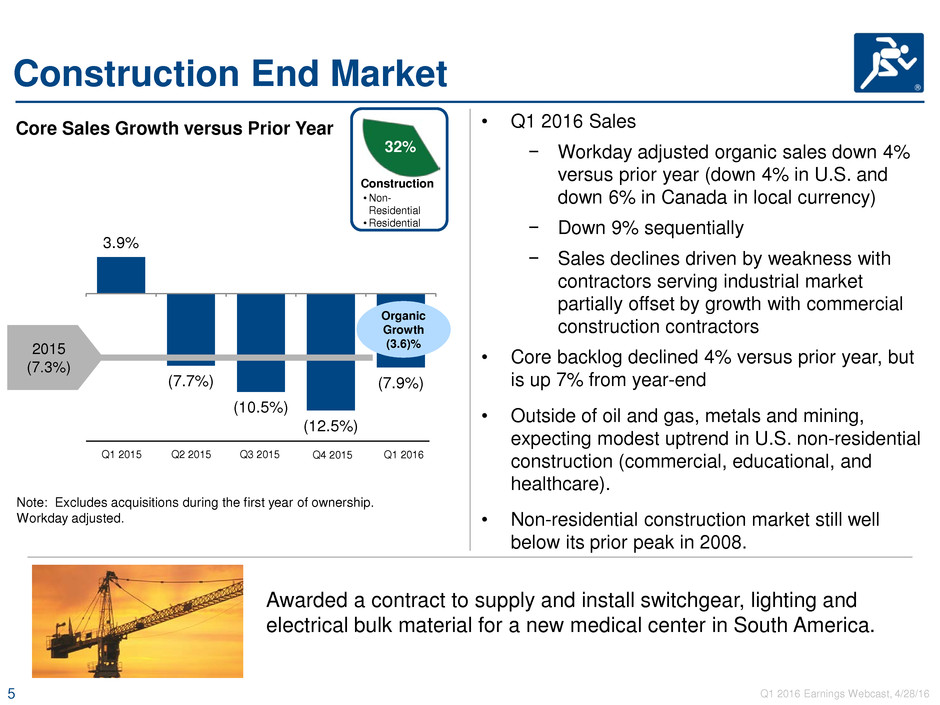

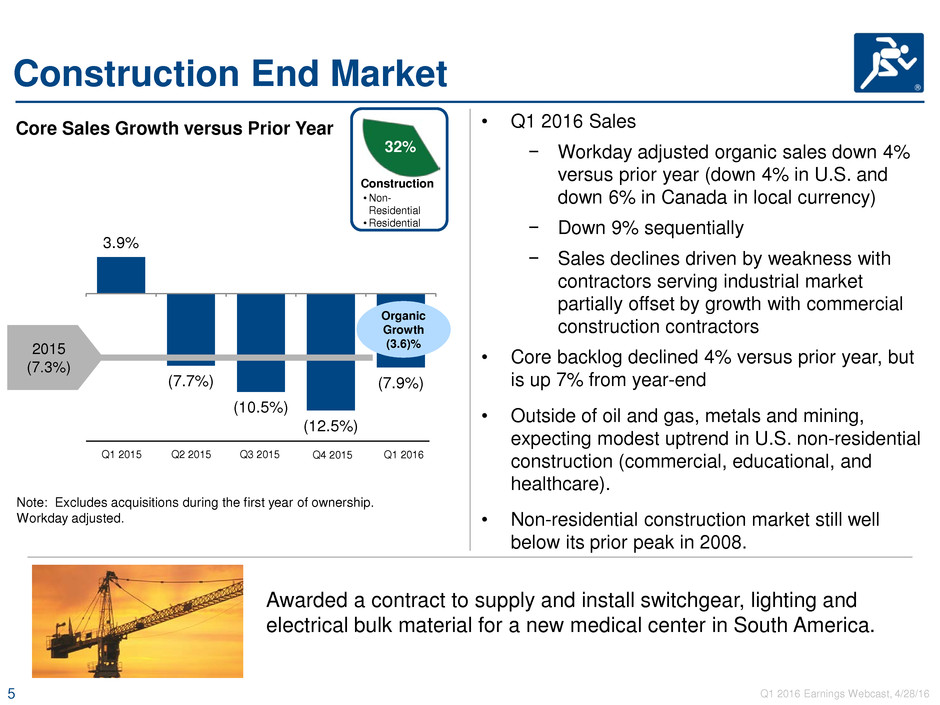

5 Q1 2016 Earnings Webcast, 4/28/16 • Q1 2016 Sales − Workday adjusted organic sales down 4% versus prior year (down 4% in U.S. and down 6% in Canada in local currency) − Down 9% sequentially − Sales declines driven by weakness with contractors serving industrial market partially offset by growth with commercial construction contractors • Core backlog declined 4% versus prior year, but is up 7% from year-end • Outside of oil and gas, metals and mining, expecting modest uptrend in U.S. non-residential construction (commercial, educational, and healthcare). • Non-residential construction market still well below its prior peak in 2008. Construction • Non- Residential • Residential 32% Core Sales Growth versus Prior Year Construction End Market Awarded a contract to supply and install switchgear, lighting and electrical bulk material for a new medical center in South America. 3.9% (7.7%) (10.5%) (12.5%) (7.9%) Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Q2 2015 Q1 2015 Q3 2015 Q4 2015 2015 (7.3%) Q1 2016 Organic Growth (3.6)%

6 Q1 2016 Earnings Webcast, 4/28/16 Utility End Market Core Sales Growth versus Prior Year 16% Utility • Investor Owned • Public Power • Utility Contractors • Q1 2016 Sales − Workday adjusted organic sales up 1% versus prior year (up 1% in U.S. and down 5% in Canada in local currency) − Down 6% sequentially • Five consecutive years of year-over-year sales growth. • Scope expansion and value creation with IOU, public power, and generation customers providing utility sales growth. • Continued interest for Integrated Supply solution offerings. • Secular improvement in housing market, renewables growth, and consolidation trend within Utility sector expected to be positive catalyst for future spending. Awarded a contract to provide high voltage equipment, steel structures and other miscellaneous materials for a wind farm substation being constructed for a large energy developer. Note: Excludes acquisitions during the first year of ownership. Workday adjusted. 6.5% 5.7% 1.7% 0.1% (0.6)% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 2015 3.4% Organic Growth 0.6%

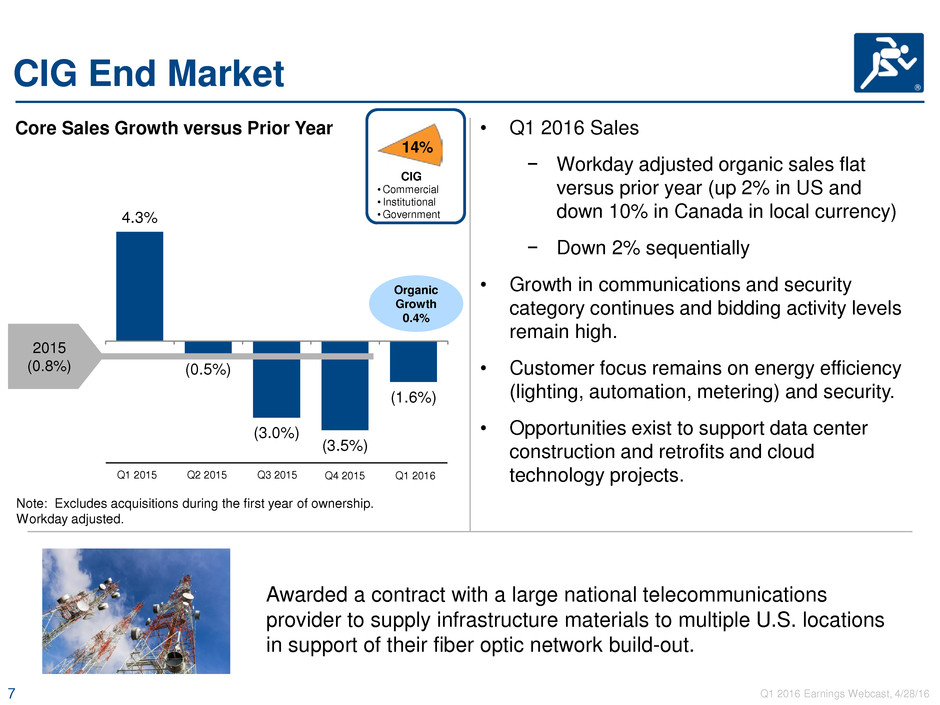

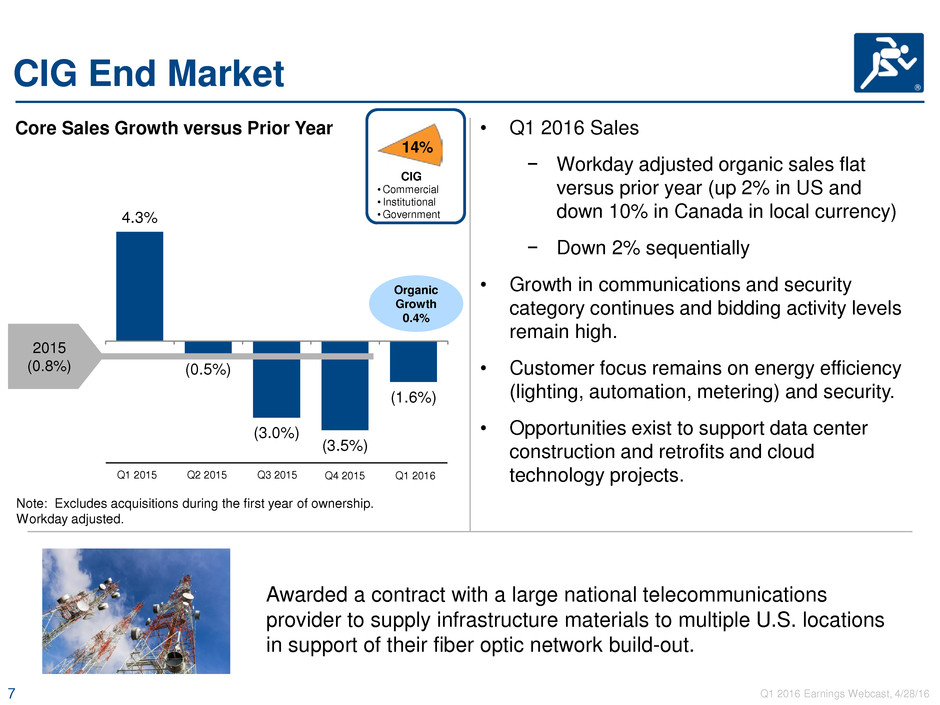

7 Q1 2016 Earnings Webcast, 4/28/16 CIG End Market • Q1 2016 Sales − Workday adjusted organic sales flat versus prior year (up 2% in US and down 10% in Canada in local currency) − Down 2% sequentially • Growth in communications and security category continues and bidding activity levels remain high. • Customer focus remains on energy efficiency (lighting, automation, metering) and security. • Opportunities exist to support data center construction and retrofits and cloud technology projects. Core Sales Growth versus Prior Year CIG • Commercial • Institutional • Government 14% Awarded a contract with a large national telecommunications provider to supply infrastructure materials to multiple U.S. locations in support of their fiber optic network build-out. 4.3% (0.5%) (3.0%) (3.5%) (1.6%) Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Q2 2015 Q1 2015 Q3 2015 Q4 2015 2015 (0.8%) Q1 2016 Organic Growth 0.4%

8 Q1 2016 Earnings Webcast, 4/28/16 Q1 2016 Results Outlook Actual YOY Sales (4)% to (1)% $1.78B (2.2)% growth Gross Margin 20.0% Down 20 bps SG&A $269M, 15.2% Up 2%, up 60 bps; core down 2% Operating Profit $70M Down 20% Operating Margin 3.8% to 4.1% 3.9% Down 90 bps Effective Tax Rate ~30% 31.9% Up 250 bps 390 bps (6.3)% Growth 240 bps 460 bps $1.78B $1.82B Q1 2016 Sales Acquisitions Foreign Exchange Rest of World Canada U.S. Q1 2015 Sales 260 bps 30 bps (11.2)% Growth 6.6% Growth (6.7)% Organic Growth (2.2)% Growth 320 bps Workday Impact

9 Q1 2016 Earnings Webcast, 4/28/16 EPS Walk Q1 2015 $0.90) Core Operations (0.13) Acquisitions 0.04) Foreign Exchange Impact (0.09) Tax (0.03) Share Count 0.08) 2016 $0.77)

10 Q1 2016 Earnings Webcast, 4/28/16 1.5 2 2.5 3 3.5 4 4.5 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 85.1 75.0 Q1 2015 Q1 2016 Cash Generation Free Cash Flow ($ Millions) See appendix for non-GAAP reconciliations. 217% of net income 182% of net income > $1B of free cash flow over last 4 years 2014 Target Leverage 2.0x – 3.5x 3.8X Leverage (Total Par Debt to TTM EBITDA) 2015 2016

11 Q1 2016 Earnings Webcast, 4/28/16 2016 Outlook Q2 FY Sales (3)% to (1)% Flat to (5)% Operating Margin 4.5% to 4.9% 4.8% to 5.0% Effective Tax Rate ~30% ~ 30% EPS $3.75 to $4.20 Free Cash Flow >90% of net income Notes: Excludes unannounced acquisitions. Assumes a CAD/USD exchange rate of 0.77 in Q2.

12 Q1 2016 Earnings Webcast, 4/28/16 Appendix

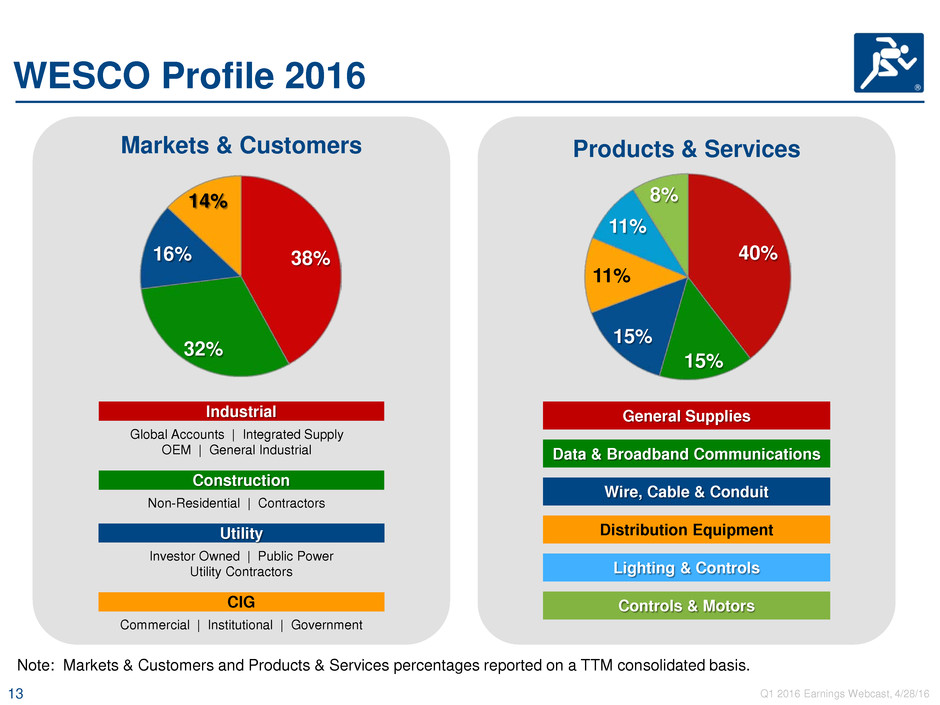

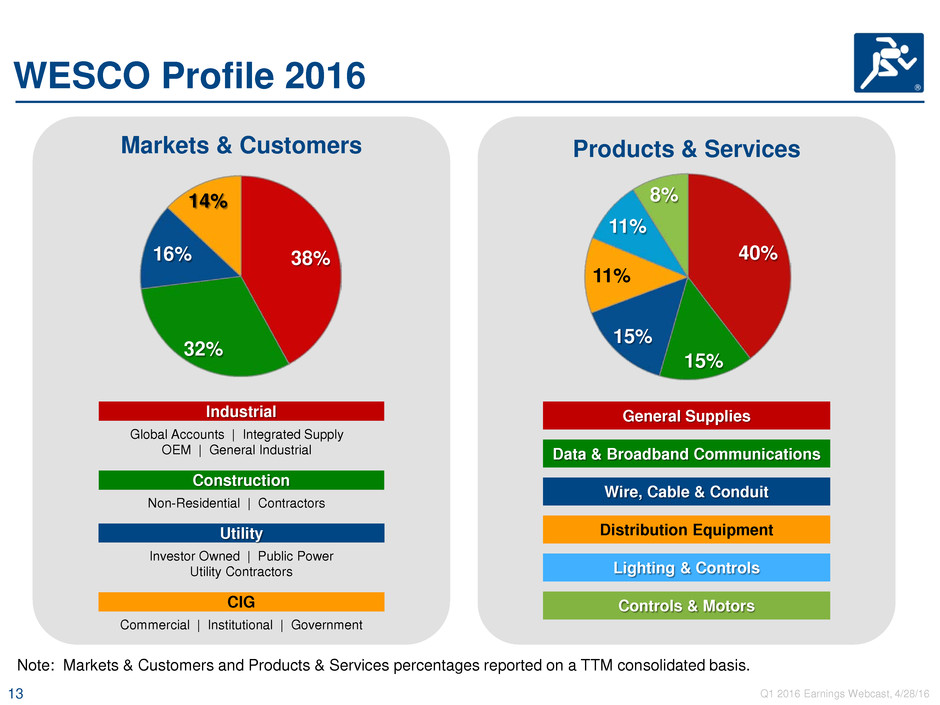

13 Q1 2016 Earnings Webcast, 4/28/16 WESCO Profile 2016 38% 32% 16% 14% 40% 15% 15% 11% 11% 8% Controls & Motors Lighting & Controls General Supplies Data & Broadband Communications Wire, Cable & Conduit Distribution Equipment Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis. Products & Services Markets & Customers Utility CIG Industrial Construction Investor Owned | Public Power Utility Contractors Commercial | Institutional | Government Global Accounts | Integrated Supply OEM | General Industrial Non-Residential | Contractors

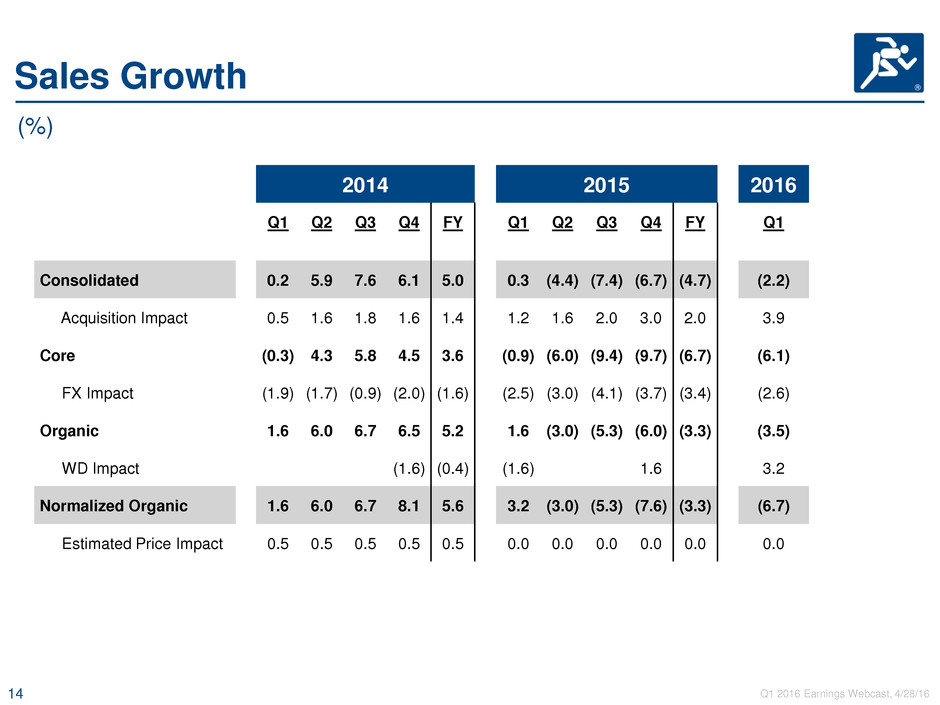

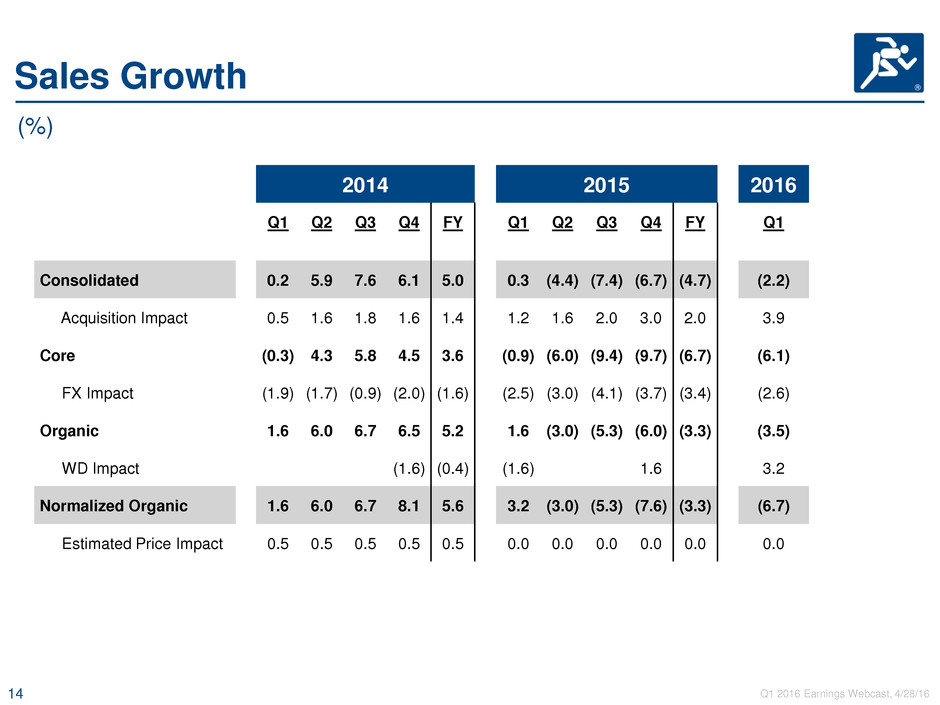

14 Q1 2016 Earnings Webcast, 4/28/16 Sales Growth 2014 2015 2016 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Consolidated 0.2 5.9 7.6 6.1 5.0 0.3 (4.4) (7.4) (6.7) (4.7) (2.2) Acquisition Impact 0.5 1.6 1.8 1.6 1.4 1.2 1.6 2.0 3.0 2.0 3.9 Core (0.3) 4.3 5.8 4.5 3.6 (0.9) (6.0) (9.4) (9.7) (6.7) (6.1) FX Impact (1.9) (1.7) (0.9) (2.0) (1.6) (2.5) (3.0) (4.1) (3.7) (3.4) (2.6) Organic 1.6 6.0 6.7 6.5 5.2 1.6 (3.0) (5.3) (6.0) (3.3) (3.5) WD Impact (1.6) (0.4) (1.6) 1.6 3.2 Normalized Organic 1.6 6.0 6.7 8.1 5.6 3.2 (3.0) (5.3) (7.6) (3.3) (6.7) Estimated Price Impact 0.5 0.5 0.5 0.5 0.5 0.0 0.0 0.0 0.0 0.0 0.0 (%)

15 Q1 2016 Earnings Webcast, 4/28/16 Q1 2016 Sales Growth – Geography U.S. Canada International Total Change in net sales 2.1 (18.0) 2.2 (2.2) Impact from acquisitions 5.2 - - 3.9 Impact from foreign exchange rates - (10.0) (7.6) (2.6) Impact from number of workdays 3.2 3.2 3.2 3.2 Normalized organic sales growth (6.3) (11.2) 6.6 (6.7) (%)

16 Q1 2016 Earnings Webcast, 4/28/16 Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation. ($ Millions) Sales Growth-End Markets Q1 2016 vs. Q1 2015 Q1 2016 vs. Q4 2015 Q1 Q1 Q1 Q4 2016 2015 % Growth 2016 2015 % Growth Industrial Core 664 760 (12.6) % 669 706 (5.3)% Construction Core 522 547 (4.7) % 555 601 (7.7)% Utility Core 279 272 2.6 % 279 291 (4.1)% CIG Core 247 243 1.6 % 249 249 - % Total Core Gross Sales 1,712 1,822 6.1 % 1,752 1,847 (5.1)% Total Gross Sales from Acquisitions 70 - - 30 22 -00 Total Gross Sales 1,782 1,822 (2.2) % 1,782 1,869 (4.6)% Gross Sales Reductions/Discounts (6) (6) - (6) (7) -00 Total Net Sales 1,776 1,816 (2.2) % 1,776 1,862 (4.6)%

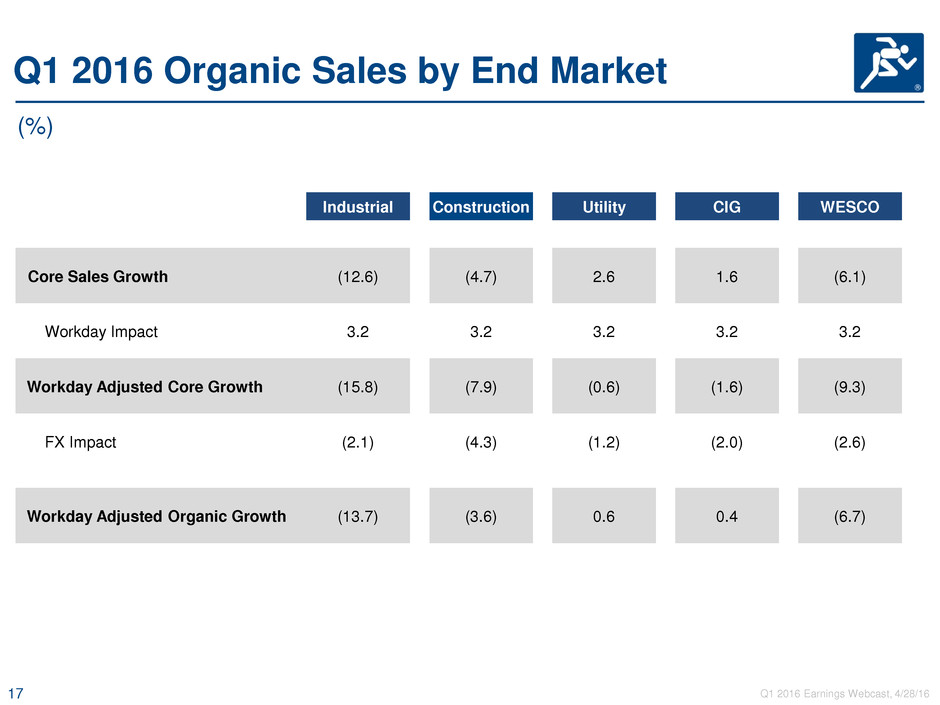

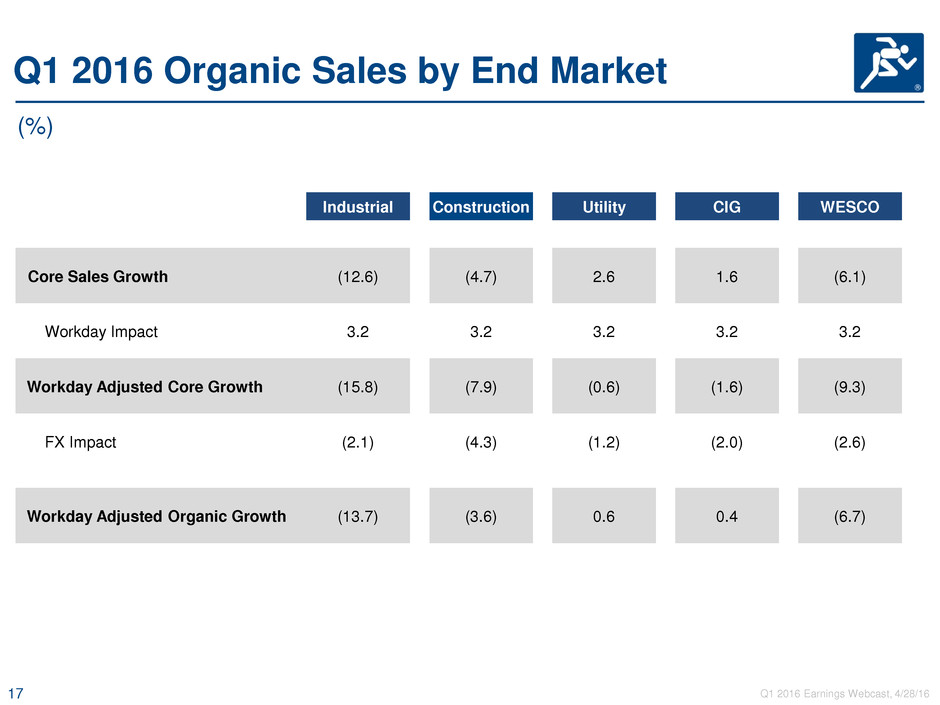

17 Q1 2016 Earnings Webcast, 4/28/16 Q1 2016 Organic Sales by End Market Industrial Construction Utility CIG WESCO Core Sales Growth (12.6) (4.7) 2.6 1.6 (6.1) Workday Impact 3.2 3.2 3.2 3.2 3.2 Workday Adjusted Core Growth (15.8) (7.9) (0.6) (1.6) (9.3) FX Impact (2.1) (4.3) (1.2) (2.0) (2.6) Workday Adjusted Organic Growth (13.7) (3.6) 0.6 0.4 (6.7) (%)

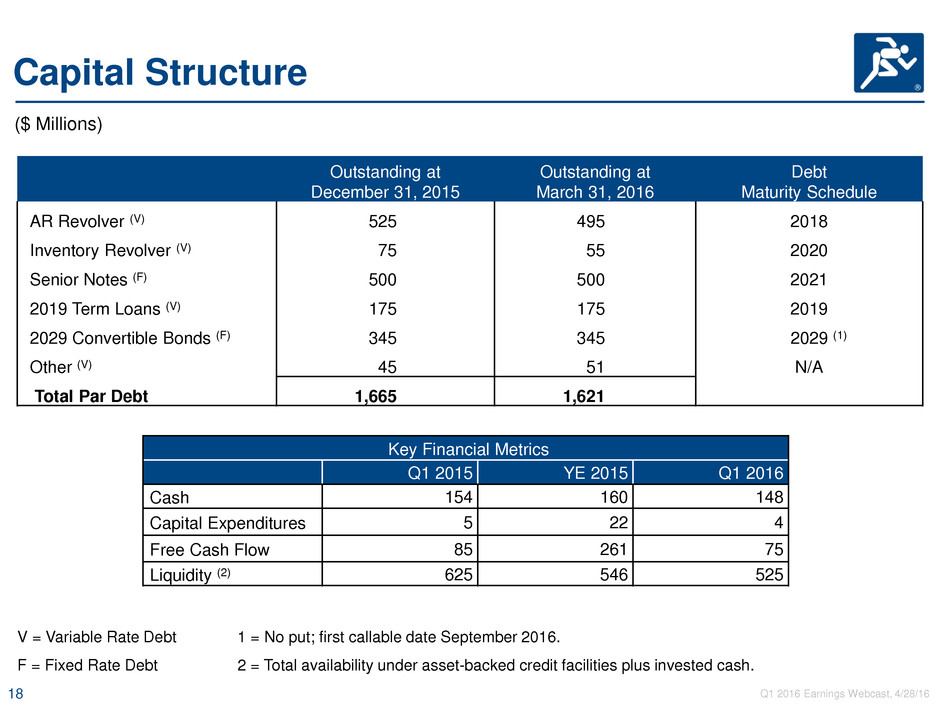

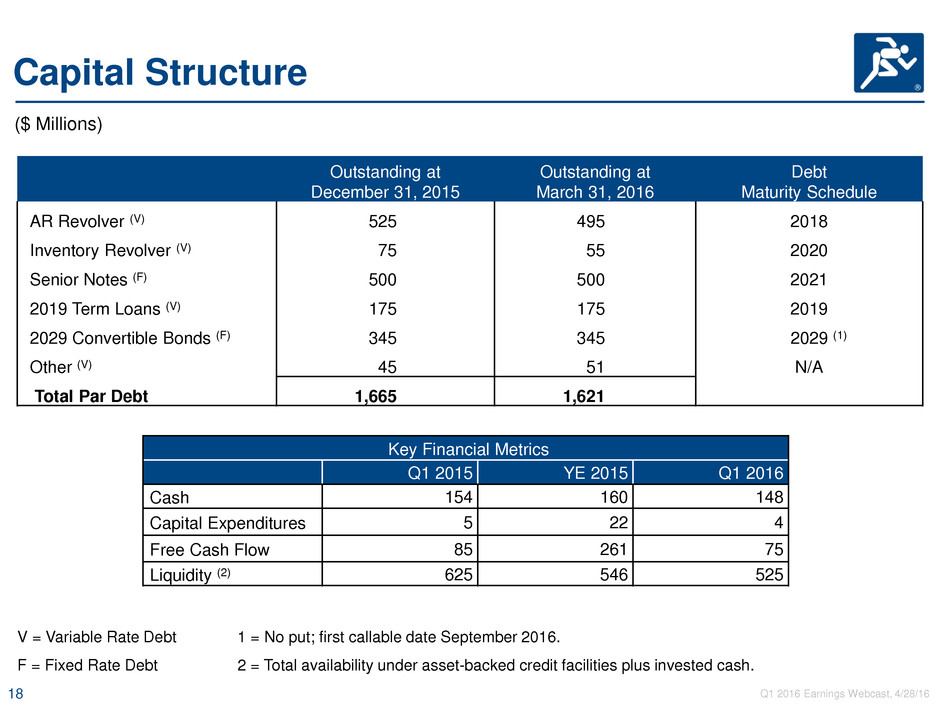

18 Q1 2016 Earnings Webcast, 4/28/16 Outstanding at December 31, 2015 Outstanding at March 31, 2016 Debt Maturity Schedule AR Revolver (V) 525 495 2018 Inventory Revolver (V) 75 55 2020 Senior Notes (F) 500 500 2021 2019 Term Loans (V) 175 175 2019 2029 Convertible Bonds (F) 345 345 2029 (1) Other (V) 45 51 N/A Total Par Debt 1,665 1,621 Capital Structure Key Financial Metrics Q1 2015 YE 2015 Q1 2016 Cash 154 160 148 Capital Expenditures 5 22 4 Free Cash Flow 85 261 75 Liquidity (2) 625 546 525 ($ Millions) V = Variable Rate Debt 1 = No put; first callable date September 2016. F = Fixed Rate Debt 2 = Total availability under asset-backed credit facilities plus invested cash.

19 Q1 2016 Earnings Webcast, 4/28/16 Financial Leverage Twelve Months Ended March 31, 2016 Financial leverage ratio: Income from operations $ 356 Depreciation and amortization 65 EBITDA $ 421 March 31, 2016 Current debt and short-term borrowings $ 50 Long-term debt 1,391 Debt discount and deferred financing (1) 180 Total debt $ 1,621 Less: cash and cash equivalents $ 148 Total debt, net of cash $ 1,473 Financial leverage ratio 3.8X Financial leverage ratio, net of cash 3.5X (1)Long-term debt is presented in the condensed consolidated balance sheets net of deferred financing fees and discount related to the convertible debentures and term loan. ($ Millions)

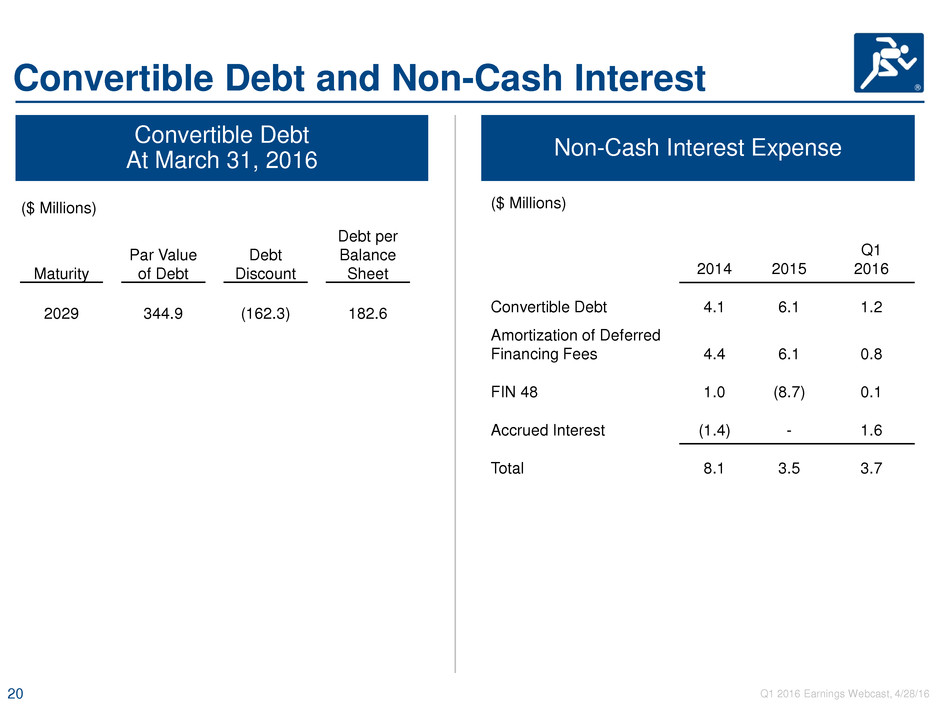

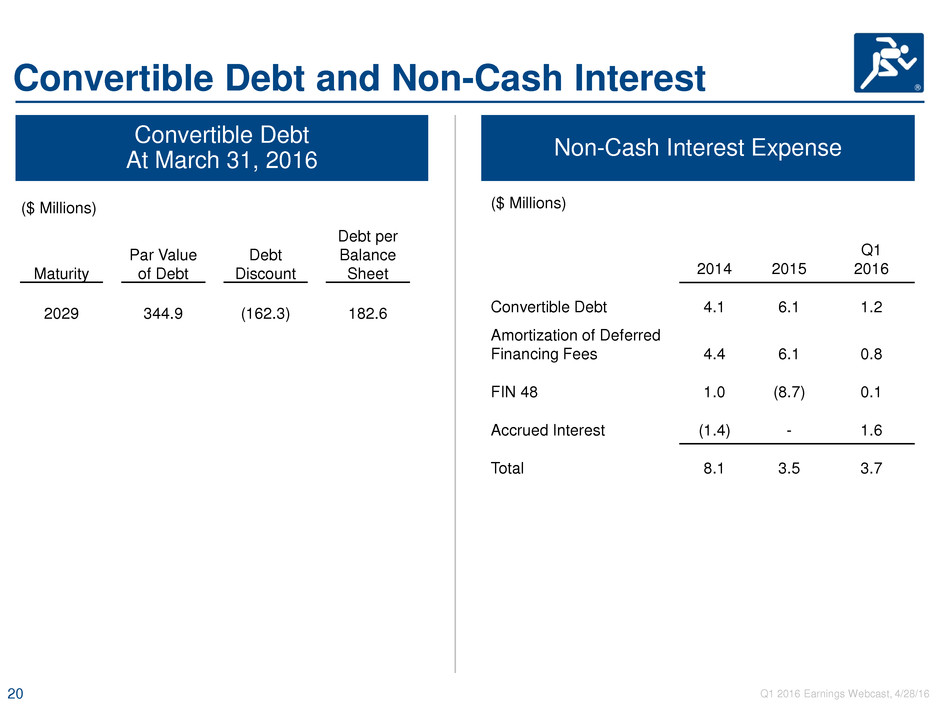

20 Q1 2016 Earnings Webcast, 4/28/16 ($ Millions) Maturity Par Value of Debt Debt Discount Debt per Balance Sheet 2029 344.9 (162.3) 182.6 Convertible Debt At March 31, 2016 Non-Cash Interest Expense ($ Millions) 2014 2015 Q1 2016 Convertible Debt 4.1 6.1 1.2 Amortization of Deferred Financing Fees 4.4 6.1 0.8 FIN 48 1.0 (8.7) 0.1 Accrued Interest (1.4) - 1.6 Total 8.1 3.5 3.7 Convertible Debt and Non-Cash Interest

21 Q1 2016 Earnings Webcast, 4/28/16 EPS Dilution Weighted Average Quarterly Share Count Stock Price Incremental Shares from 2029 Convertible Debt (in millions)3 Incremental Shares from Equity Awards (in millions) Total Diluted Share Count (in millions)4 $20.00 - 0.10 42.31 $30.00 0.45 0.18 42.85 $40.00 3.33 0.33 45.86 Q1 2016 Average $44.45 4.19 0.41 46.81 $50.00 5.05 0.47 47.73 $60.00 6.20 0.57 48.98 $70.00 7.02 0.80 50.03 2029 Convertible Debt Details Conversion Price $28.8656 Conversion Rate 34.6433 1 Underlying Shares 11,947,533 2 Footnotes: 2029 Convertible Debenture 1 1000/28.8656 2 $344.9 million/1,000 x 34.6433 3 (Underlying Shares x Avg. Quarterly Stock Price) minus $344.9 million Avg. Quarterly Stock Price 4 Basic Share Count of 42.2 million shares

22 Q1 2016 Earnings Webcast, 4/28/16 Free Cash Flow Reconciliation Q1 2015 Q1 2016 Cash flow provided by operations 90.1 78.6 Less: Capital expenditures (5.0) (3.6) Free Cash Flow 85.1 75.0 Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund the Company's financing needs. ($ Millions)

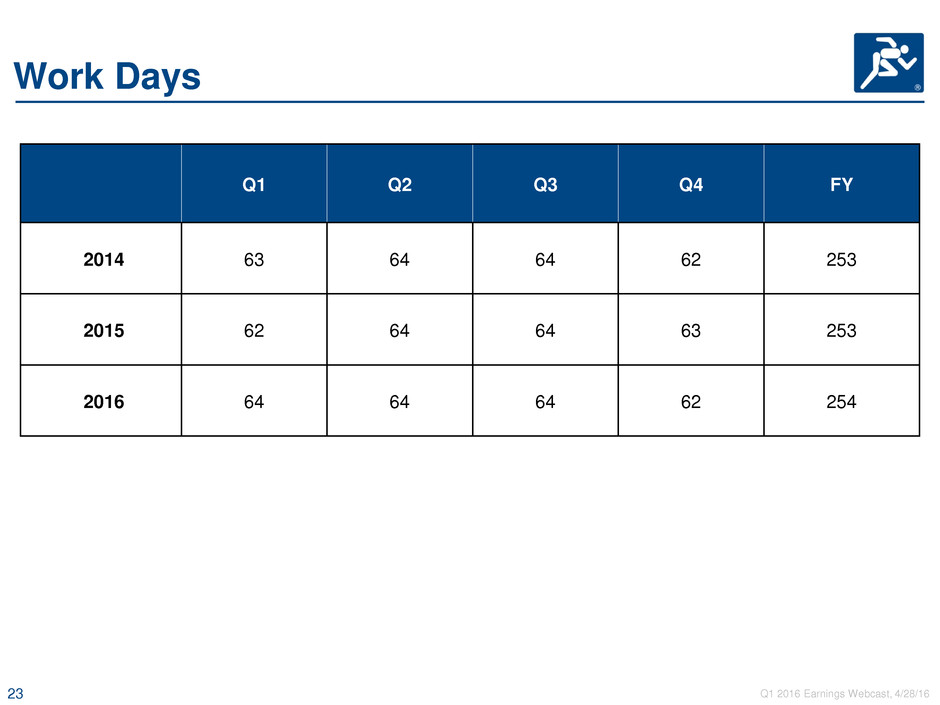

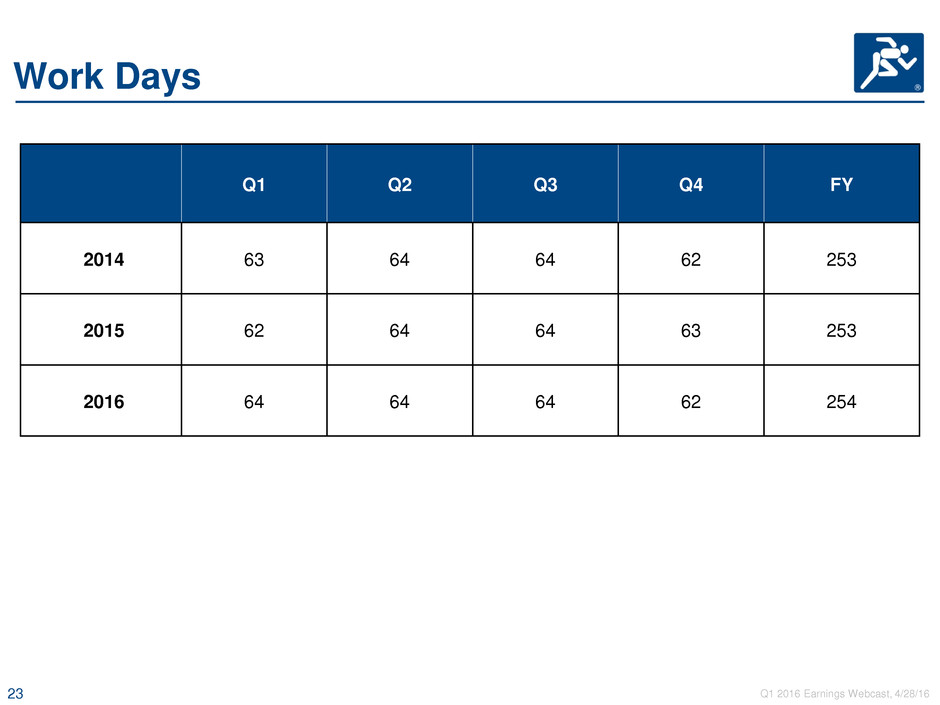

23 Q1 2016 Earnings Webcast, 4/28/16 Work Days Q1 Q2 Q3 Q4 FY 2014 63 64 64 62 253 2015 62 64 64 63 253 2016 64 64 64 62 254