First Quarter 2020 Webcast Presentation April 30, 2020 1

Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection with the proposed transaction, on each of March 4, 2020 and March 9, 2020, WESCO filed with the SEC an amendment to the registration statement originally filed on February 7, 2020, which includes a prospectus of WESCO International Inc. (“WESCO”) and a proxy statement of Anixter International Inc. (“Anixter”), and each party will file other documents regarding the proposed transaction with the SEC. The registration statement was declared effective by the SEC on March 11, 2020 and the proxy statement/prospectus has been mailed to Anixter’s stockholders. INVESTORS AND SECURITY HOLDERS OF WESCO AND ANIXTER ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WESCO, ANIXTER AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and other documents filed with the SEC by WESCO or Anixter through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by WESCO will be available free of charge on WESCO's website at http://wesco.investorroom.com/sec-filings and copies of the documents filed with the SEC by Anixter will be available free of charge on Anixter's website at http://investors.anixter.com/financials/sec-filings. Forward-Looking Statements All statements made herein that are not historical facts should be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding the expected completion and timing of the proposed transaction between WESCO and Anixter, expected benefits and costs of the proposed transaction, and management plans relating to the proposed transaction, statements that address WESCO's expected future business and financial performance, statements regarding the impact of natural disasters, health epidemics and other outbreaks, especially the outbreak of COVID-19 since December 2019, which may have a material adverse effect on WESCO’s business, results of operations, and financial condition, and other statements identified by words such as anticipate, plan, believe, estimate, intend, expect, project, will and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of WESCO's management as well as assumptions made by, and information currently available to, WESCO's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of WESCO's and WESCO's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Certain of these risks are set forth in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as well as the Company's other reports filed with the U.S. Securities and Exchange Commission (the "SEC"). These risks, uncertainties and assumptions also include the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction between WESCO and Anixter that could reduce anticipated benefits or cause the parties to abandon the proposed transaction, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of WESCO's common stock, the risk of any unexpected costs or expenses resulting from the proposed transaction, the risk of any litigation relating to the proposed transaction, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of WESCO or Anixter to retain customers and retain and hire key personnel and maintain relationships with their suppliers, customers and other business relationships and on their operating results and businesses generally, the risk that the pending proposed transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond WESCO's control. Non-GAAP Measures This presentation includes certain non-GAAP financial measures. These financial measures include organic sales growth, gross profit, gross margin, financial leverage, earnings before interest, taxes, depreciation and amortization (EBITDA), free cash flow, adjusted income from operations, and adjusted diluted earnings per share. WESCO believes that these non-GAAP measures are useful to investors as they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable basis. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above. 2

Response to COVID-19 Pandemic PRIORITIES ACTIONS TAKEN Protect • Implemented multi-shift strategy to promote social distancing 1 • Increased regular cleaning protocols Employees • Reward and recognition bonus for on-site employees • Implemented Business Continuity Plan Superserve • All U.S. and Canada facilities open to perform essential activities 2 Customers • Implemented “daily impact reporting” to provide supply chain visibility • Sourcing PPE equipment for customers as well as employees • Drew $100 million on inventory revolver; liquidity of $732 million • Adjusted hourly shifts to match demand and customer service needs • Implemented temporary compensation reductions – Board of Directors cash retainer 25% Respond to Current – C-suite executive salaries 25% 3 Environment – Vice President salaries 20% – Other employee salaries 12%-15% • Suspended 401(k) company match and deferred salary increases Ensure Liquidity | Reduce Costs | Preserve Flexibility • Reduced discretionary spending • Froze all non-essential capital expenditures WESCO Has Taken Quick and Decisive Actions 3

First Quarter Results Overview First Quarter Highlights Versus Q1 2019 2020 Adjustments PY Outlook • Results were on track with our outlook until mid-March • WESCO deemed an essential business and all U.S. and Sales $1,961 $1,969 0.4% 2% - 5% Canada branches are operational Gross Profit $382 $376 (1.6%) • Construction, Utility, and CIG growth in the U.S.; Industrial and Utility growth in Canada % of sales 19.5% 19.1% (40) bps • Strong sales in Communications and Security, and Safety Adjusted SG&A $297 $295 (0.6)% $4.6 • Gross margin up 50 basis points sequentially • Estimated pricing impact was slightly positive % of sales 15.1% 15.0% (10) bps • Preliminary April sales down ~16% Adjusted Operating Profit $71 $66 (7.4)% $4.6 3.4% - 3.6% • Anixter Acquisition – Waiting period for regulatory approval in the U.S. % of Sales 3.6% 3.3% (30) bps expired; obtained regulatory clearances from Turkey Effective Tax Rate 21.7% 23.1% 140 bps ~22% and Russia – Canada and Mexico regulatory approvals in process Adjusted Diluted EPS $0.93 $0.91 (2.2)% $0.09 – Obtained Anixter stockholder approval – Joint integration teams have accelerated planning – On track to close in Q2 or Q3 Company well positioned to navigate challenges of COVID-19 Note: Organic sales growth excludes the impact of acquisitions in the first year of ownership, foreign exchange rates and differences in the number of workdays. See appendix for non-GAAP reconciliations. 4

First Quarter Sales Summary ORGANIC SALES ORGANIC SALES Year Over Year Year Over Year GROWTH GROWTH Total U.S. Canada International January 2.2% Industrial (6.2)% (8.6)% 1.5% 3.5% February 2.0% Construction (2.0)% 1.7% (8.3)% (5.4)% March (8.6)% Utility 8.9% 8.2% 27.5% (20.7)% CIG (0.7)% 2.3% (9.8)% (6.2)% (1.7)% (1.0)% (4.3)% (1.5)% INDUSTRIAL UTILITY • Global Account bidding activity robust • Organic growth driven by new wins and scope expansion with • COVID-19 driven declines with industrial customers starting in March current customers across most verticals • Awarded large utility alliance contracts in the first quarter • Secured new Global Account customer wins to be implemented post • Integrated Supply solutions continue to drive customer value COVID-19 restrictions • Expect renewable energy as well as grid reliability and modernization projects to drive future demand CONSTRUCTION CIG • Growth in January and February offset by March slowdown due to • U.S. growth through February offset by reduced COVID-19 demand in March COVID-19 driven project delays • Supply chain solutions driving results in datacenter, security, and cloud • Backlog at historically high level due to new wins technology projects • Project pipeline remains strong with order conversion being paced by • Continue to be well positioned to serve data center construction, LED lighting customer project restart schedules renovation and retrofits, FTTx deployments and broadband build outs Strong growth in Utilities, U.S. growth in Construction and CIG offset primarily by decline in Industrial Note: See appendix for non-GAAP reconciliations. 5

Strong Balance Sheet Liquidity (as of 3/31/20) Bank Credit Facilities Limited Operating Covenants • Liquidity: $732 million • Mature in 2022 and 2024 • No maximum leverage covenant – Invested cash: $285 million • Low cost LIBOR based • Fixed charge coverage covenant based on liquidity or availability – Revolver availability: $447 million • Borrowing bases provide confidence in availability – Used $100 million in Q1 to pay – Inventory holds value throughout the cycle CD&R break-up fee – Diversified receivables pool with limited – Additional financing anticipated to concentration replace Bridge Commitments for o Largest balances with high credit quality Anixter transaction customers o Collection activities performing consistent with historical levels o Bad debt experience consistent with recent quarters Covenant Summary Fixed Charge Facility Maturity Measurement Test Covenant Revolver Sept 2024 1.0 to 1.0 Revolver availability >$60 million $447 million AR Facility Sept 2022 1.0 to 1.0 Liquidity > $100 million $789 million1 1 Balance sheet cash plus borrowing availability Strong Liquidity and Free Cash Flow Generation 6

Strong Free Cash Flow Through the Cycle Cumulative Free Cash Flow Free Cash Flow as % of Last 3 years $569M 89% of net income Adjusted Net Income Last 5 years $1,113M 108% of net income Last 10 years $2,163M 103% of net income Great Recession 300% Industrial 250% 265% Recession 200% 150% 154% 100% 118% 121% 125% 116% 97% 50% 84% 68% 68% 81% 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Free Cash $279M $112M $134M $265M $308M $230M $261M $282M $128M $261M $180M Flow Note: See appendix for Stable, Consistent, and Counter-Cyclical Free Cash Flow 7 non-GAAP reconciliations

Resilient Business Model with Substantial Free Cash Flow and Rapid Deleveraging Proven ability to delever through economic cycles and post strategic M&A Deleveraging Through the Cycle 1 Deleveraging Post M&A 1 Proven ability to deleverage through economic cycles... Demonstrated ability to delever post M&A... 4.5x 2.9x ~$1.0 2.7x ~$800 1.6x Acq. billion EECOL 2 million Cumulative FCF Cumulative FCF 2007 2011 2007 - 2011 2012 2014 2012 - 2014 4.1x 2.1x ~$900 Acq. HDS 2.8x ~$500 2.0x Power million Solutions 3 million Cumulative FCF Cumulative FCF 2007 2011 2007 - 2011 2015 2017 2015 - 2017 ...aided by dynamic countercyclical cash flow profile ...through efficient integration and synergy realization Since the Global Financial Crisis 4, on a combined basis, WESCO and Anixter have generated free cash flow 5 in excess of $4.0 billion 1. Charts reflect net debt to EBITDA. 2. WESCO completed its acquisition of EECOL in December 2012 for ~$1.1 billion. 3. Anixter competed its acquisition of HD Supply Power Solutions in October 2015 for ~$825 million. 4. Period reflects CY2009 through CY2019. 5. Free cash flow defined as cash flow from operating activities less capital expenditures. 8

WESCO is Larger and More Diverse than 2009 Acquisitions have diversified WESCO by Product Line, End Market, Supplier, Customer, and Geography Sales ($ billions) Broadband Communications 6.1% CAGR $8.4 Safety Canada $4.6 Expansion Turnkey Lighting Solutions Construction 2009 2019 Stronger, More Stable, and More Diversified 9

Transformational Combination of WESCO and Anixter Transaction Milestones Integration Planning Progress ✓ Agreement announced ✓ Integration planning underway ✓ Obtained committed financing ✓ Progress has been rapid and is accelerating ✓ HSR waiting period expired ✓ Joint integration teams established with over ✓ Approval received from Turkey and Russia 500 separate initiatives developed to date ✓ Anixter stockholders approved the ✓ Planning process has revealed upside synergy transaction opportunities ✓ Canada and Mexico regulatory approvals in ✓ Cultural alignment is strong process; supplementary information request received in Canada ✓ Tender and change of control process for Anixter 2023 and 2025 notes Remain on track to complete the Expect to exceed cost, sales growth, transaction in Q2 or Q3 and cash generation synergies 10

Evolving Secular Trends Benefit WESCO + Anixter Secular Trends Benefitting WESCO and Anixter…. …Contribute to Financial Benefits of the Transformational Combination IoT and Remote Automation Connectivity Increased reliance Increase in number of Estimated Impact in Year Three on remote automated communications for processes Utility Grid work, school, and Supply Chain home Investments in grid Relocation ✓ Accelerates sales growth by more reliability and Return of supply hardening chains to the U.S. and Canada than 100 bps ✓ Significant cross-selling and Communications Connected Real 5G build-out, fiber-to-the-x, Estate and proliferation of streaming international expansion opportunities Converged infrastructure and mobile data consumption driven by bandwidth needs + ✓ Doubles standalone EPS growth rate Increased LED Adoption Security ✓ Expands Adjusted EBITDA margin Material increase in Expansion of coverage rate of LED adoption in metro areas 100+ bps and delivers 50 - 60% EPS accretion Electrification Secure Increasing Networks electrification of Secure networks and ✓ Generates annual pro forma free cash infrastructure, EVs, data centers and renewables Ongoing Mobility and Data Center flow of ~$600 million Accessibility Capacity 24/7/365 connectivity Emerging Increased bandwidth driving bandwidth and power demands demand WESCO + Anixter combination benefits from numerous ongoing and attractive growth opportunities 11

Summary • Quick and decisive actions taken in response to COVID-19 pandemic • Strong liquidity and favorable borrowing covenants • Resilient business model and strong free cash flow throughout the cycle • Larger and more diverse by product line, end market, and geography • Anixter transaction is on track to close in Q2 or Q3 • Substantial integration planning progress has already been completed • WESCO + Anixter well positioned for evolving secular growth trends • Expect to exceed cost, sales growth and cash generation synergies of the transformational combination of WESCO and Anixter 12

APPENDIX

First Quarter Diluted EPS and Sales Growth Walk Diluted EPS Walk1 Sales Growth Walk Reported Q1 2019 Diluted EPS $0.93 Q1 2019 Sales $1,961 M Core operations $(0.02) U.S. (80) bps Canada (80) bps Foreign exchange rates $0.00 International (10) bps SLS acquisition $(0.05) Organic Growth (1.7)% Tax $(0.02) Foreign exchange rates 0 bps Lower share count $0.07 SLS acquisition 50 bps Adjusted Q1 2020 Diluted EPS $0.91 Number of workdays 160 bps Merger-related transaction costs $(0.09) Q1 2020 Sales $1,969M Reported Q1 2020 Diluted EPS $0.82 Reported Growth 0.4% 1 Calculation differences due to rounding.

First Quarter Gross Margin Drivers Mix Impact Summary Historical Gross Margin vs. Q1 2020 vs. WESCO Average Q4 2019 Gross margin versus fourth quarter driven by three factors: Industrial ABOVE CIG AVERAGE • Getting traction on our margin Neutral improvement initiatives Construction BELOW • Pass-through of supplier price END MARKET Utility BELOW increases in multi-year contracts Canada ABOVE • Shipment mix U.S. AVERAGE Neutral GEOGRAPHY International BELOW Stock ABOVE Special Order AVERAGE Tailwind SHIPMENT Direct BELOW 15

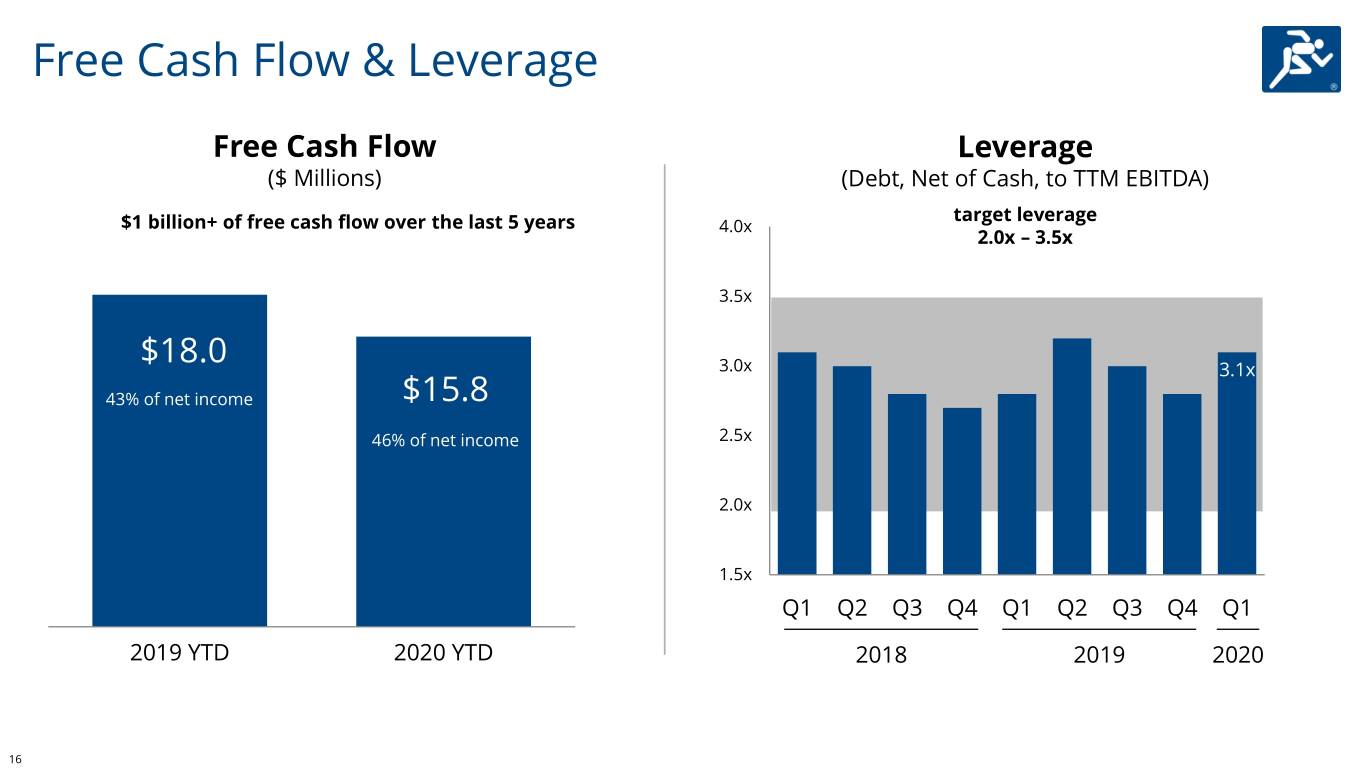

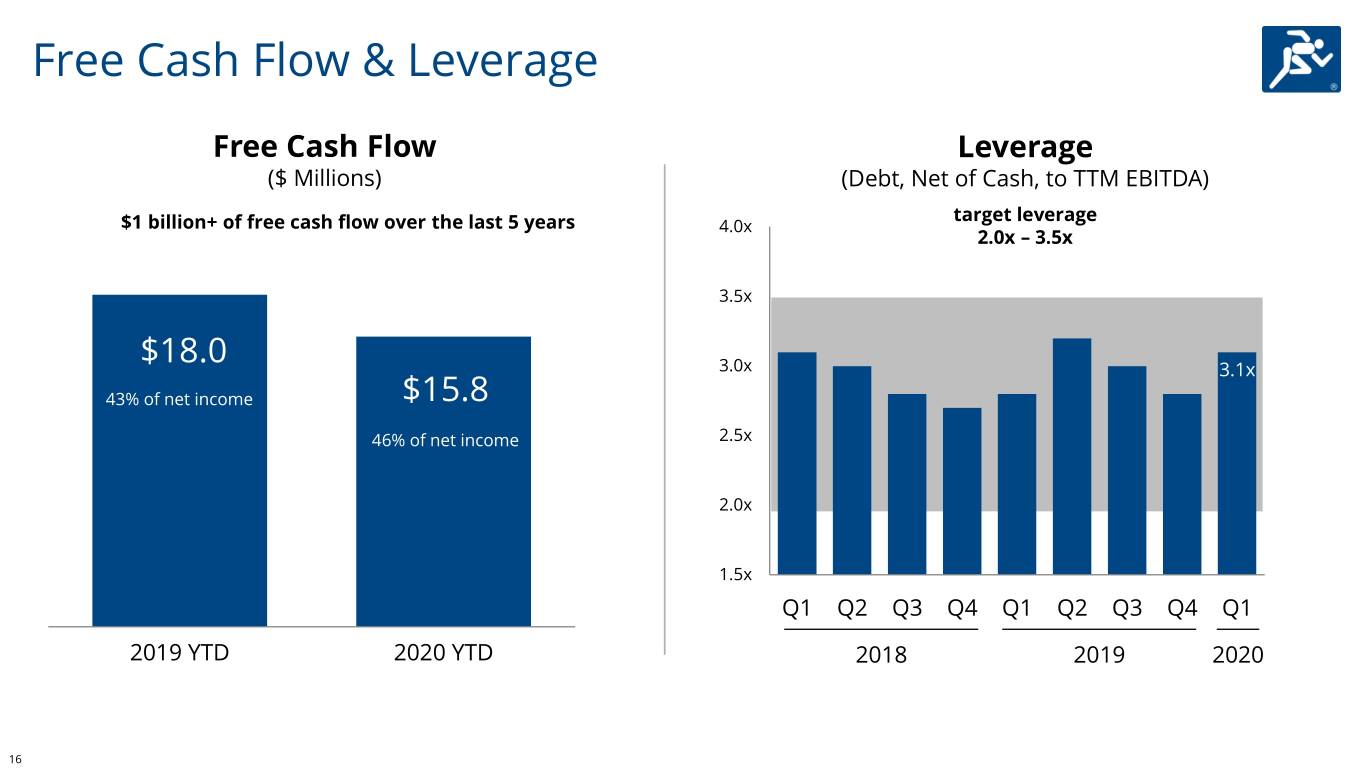

Free Cash Flow & Leverage Free Cash Flow Leverage ($ Millions) (Debt, Net of Cash, to TTM EBITDA) target leverage $1 billion+ of free cash flow over the last 5 years 4.0x 2.0x – 3.5x 3.5x $18.0 3.0x 3.1x 43% of net income $15.8 46% of net income 2.5x 2.0x 1.5x Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2019 YTD 2020 YTD 2018 2019 2020 16

Work Days Q1 Q2 Q3 Q4 FY 2018 64 64 63 62 253 2019 63 64 63 62 252 2020 64 64 64 61 253

Adjusted Results Q1 2020 Reported Adjusted Results Adjustments (1) Results (in millions, except for EPS) SG&A expenses $ 299.4 $ (4.6) $ 294.8 Income from operations 60.9 4.6 65.5 Net interest and other 16.5 (0.5) 16.0 Income before income taxes $ 44.4 5.1 $ 49.6 Income tax 10.3 1.2 11.4 Effective tax rate 23.1% 23.1% Net income 34.2 2.5 38.1 Less: Non-controlling interests (0.2) - (0.2) Net income attributable to WESCO $ 34.4 2.5 $ 38.4 Diluted Shares 42.1 42.1 EPS $ 0.82 $ 0.91 1 Merger-related transaction expenses and related income tax effect.

First Quarter Organic Sales Growth Year-over-Year Three Months Ended, Core Less: Less: Organic March 31, 2019 March 31, 2020 Growth FX Impact Workday Growth Industrial core sales 737 702 (4.6)% 0.0% 1.6% (6.2)% Construction core sales 630 629 (0.2)% 0.2% 1.6% (2.0)% Utility core sales 308 341 10.6% 0.1% 1.6% 8.9% CIG core sales 280 281 0.7% (0.2)% 1.6% (0.7)% Total core sales $ 1,955 $ 1,954 (0.1)% 0.0% 1.6% (1.7)% U.S. core sales 1,455 1,464 0.6% 0.0% 1.6% (1.0)% Canada core sales 384 377 (2.1)% 0.7% 1.6% (4.3)% International core sales 116 113 (2.6)% (2.7)% 1.6% (1.5)% Total core sales $ 1,955 $ 1,954 (0.1)% 0.0% 1.6% (1.7)% Plus: SLS sales 6 15 Total net sales $ 1,961 $ 1,969 Sequential Three Months Ended, Reported Less: Less: Organic December 31, 2019 March 31, 2020 Growth FX Impact Workday Growth Industrial sales 746 702 (5.9)% 0.1% 3.2% (9.2)% Construction sales 692 637 (8.0)% 0.1% 3.2% (11.3)% Utility sales 335 341 1.9% 0.2% 3.2% (1.5)% CIG sales 327 289 (11.5)% 0.2% 3.2% (14.9)% Total net sales 2,099 1,969 (6.2)% 0.2% 3.2% (9.6)%

Capital Structure and Leverage EBITDA Twelve Months Ended, December 31,2019 March 31, 2020 Income from operations 346 336 Depreciation and amortization 62 63 EBITDA 408 399 Debt As of, Maturity December 31, 2019 March 31, 2020 AR Revolver (variable) 415 600 September 2022 Inventory Revolver (variable) - 100 September 2024 2021 Senior Notes (fixed) 500 500 December 2021 2024 Senior Notes (fixed) 350 350 June 2024 Other 28 25 Various Total debt1 1,293 1,575 Less: cash and cash equivalents 151 343 Total debt, net of cash 1,142 1,233 Leverage 2.8x 3.1x Liquidity2 823 732 (1) Debt is presented in the condensed consolidated balance sheets net of debt discount and debt issuance costs. (2) Total availability under asset-backed credit facilities plus cash in investment accounts. Note: For financial leverage ratio in prior periods, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the Investor Relations page of WESCO’s website at www.wesco.com.

Gross Profit and Free Cash Flow - Quarter Gross Profit Three Months Ended, March 31, 2019 March 31, 2020 Net sales 1,961 1,969 Cost of goods sold1 1,579 1,592 Gross profit2 382 376 Gross margin 2 19.5% 19.1% Free Cash Flow Three Months Ended March 31, 2019 March 31, 2020 Net cash provided by operating activities 29 32 Less: capital expenditures (11) (16) Free cash flow3 18 16 Net income 42 34 % of net income 43% 46% 1 Excluding depreciation and amortization. 2 Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales. 3 Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund investing and financing activities. Note: For gross profit in prior periods, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the Investor Relations page of WESCO’s website at www.wesco.com.

Free Cash Flow - Annual Twelve Months Ended December 31, ($ millions) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net cash provided by operating activities 292 127 168 288 315 251 283 300 149 297 224 Less: capital expenditures (13) (15) (33) (23) (28) (21) (22) (18) (21) (36) (44) Plus: non-recurring pension contribution - - - - 21 - - - - - - Free cash flow 279 112 134 265 308 230 261 282 128 261 180 Net income attributable to WESCO International, Inc. 105 115 196 202 276 276 211 102 164 227 222 Loss on debt redemption, net of tax - - - - - - - 82 - - - ArcelorMittal litigation charge (recovery), net of tax - - - 22 (22) - - - - - - Income tax expense for the Tax Cuts and Jobs Act of 2017 - - - - - - - - 26 - - Adjusted net income attributable to WESCO International, Inc. 105 115 196 224 254 276 211 184 190 227 222 Net (loss) income attributable to noncontrolling interests - - (0) (0) 0 (0) (2) (0) (0) (2) - Adjusted net income 105 115 196 224 254 276 209 184 190 225 222 Free cash flow / Adjusted net income 265% 97% 68% 118% 121% 84% 125% 154% 68% 116% 81%