Fourth Quarter 2024 Webcast Presentation February 11, 2025 NYSE: WCC

2 All statements made herein that are not historical facts should be considered as "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding business strategy, growth strategy, competitive strengths, productivity and profitability enhancement, competition, new product and service introductions, and liquidity and capital resources. Such statements can generally be identified by the use of words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," and similar words, phrases or expressions or future or conditional verbs such as "could," "may," "should," "will," and "would," although not all forward-looking statements contain such words. These forward-looking statements are based on current expectations and beliefs of Wesco's management, as well as assumptions made by, and information currently available to, Wesco's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of Wesco's and Wesco's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Important factors that could cause actual results or events to differ materially from those presented or implied in the forward-looking statements include, among others, the failure to achieve the anticipated benefits of, and other risks associated with, acquisitions, joint ventures, divestitures and other corporate transactions; the inability to successfully integrate acquired businesses; the impact of increased interest rates or borrowing costs; fluctuations in currency exchange rates; failure to adequately protect Wesco's intellectual property or successfully defend against infringement claims; the inability to successfully deploy new technologies, digital products and information systems or to otherwise adapt to emerging technologies in the marketplace, such as those incorporating artificial intelligence; failure to execute on our efforts and programs related to environmental, social and governance (ESG) matters; unanticipated expenditures or other adverse developments related to compliance with new or stricter government policies, laws or regulations, including those relating to data privacy, sustainability and environmental protection; the inability to successfully develop, manage or implement new technology initiatives or business strategies, including with respect to the expansion of e-commerce capabilities and other digital solutions and digitalization initiatives; disruption of information technology systems or operations; natural disasters (including as a result of climate change), health epidemics, pandemics and other outbreaks; supply chain disruptions; geopolitical issues, including the impact of the evolving conflicts in the Middle East and Russia/Ukraine; the impact of sanctions imposed on, or other actions taken by the U.S. or other countries against, Russia or China; the failure to manage the increased risks and impacts of cyber incidents or data breaches; and exacerbation of key materials shortages, inflationary cost pressures, material cost increases, demand volatility, and logistics and capacity constraints, any of which may have a material adverse effect on the Company's business, results of operations and financial condition. All such factors are difficult to predict and are beyond the Company's control. Additional factors that could cause results to differ materially from those described above can be found in Wesco's most recent Annual Report on Form 10-K and other periodic reports filed with the U.S. Securities and Exchange Commission. Non-GAAP Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) above, this presentation includes certain non-GAAP financial measures. These financial measures include organic sales growth, gross profit, gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin, financial leverage, free cash flow, adjusted selling, general and administrative expenses, adjusted income from operations, adjusted operating margin, adjusted other non-operating expense (income), adjusted provision for income taxes, adjusted income before income taxes, adjusted net income, adjusted net income attributable to WESCO International, Inc., adjusted net income attributable to common stockholders, and adjusted earnings per diluted share. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of our financial condition and results of operations on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude items impacting comparability of results such as digital transformation costs, restructuring costs, merger-related and integration costs, cloud computing arrangement amortization, pension settlement cost and excise taxes on excess pension plan assets related to the settlement of the Anixter Inc. Pension Plan, loss on abandonment of assets, the gain recognized on the divestiture of the WIS business, the loss on termination of business arrangement, and the related income tax effects, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above. Forward-Looking Statements and Non-GAAP Measures

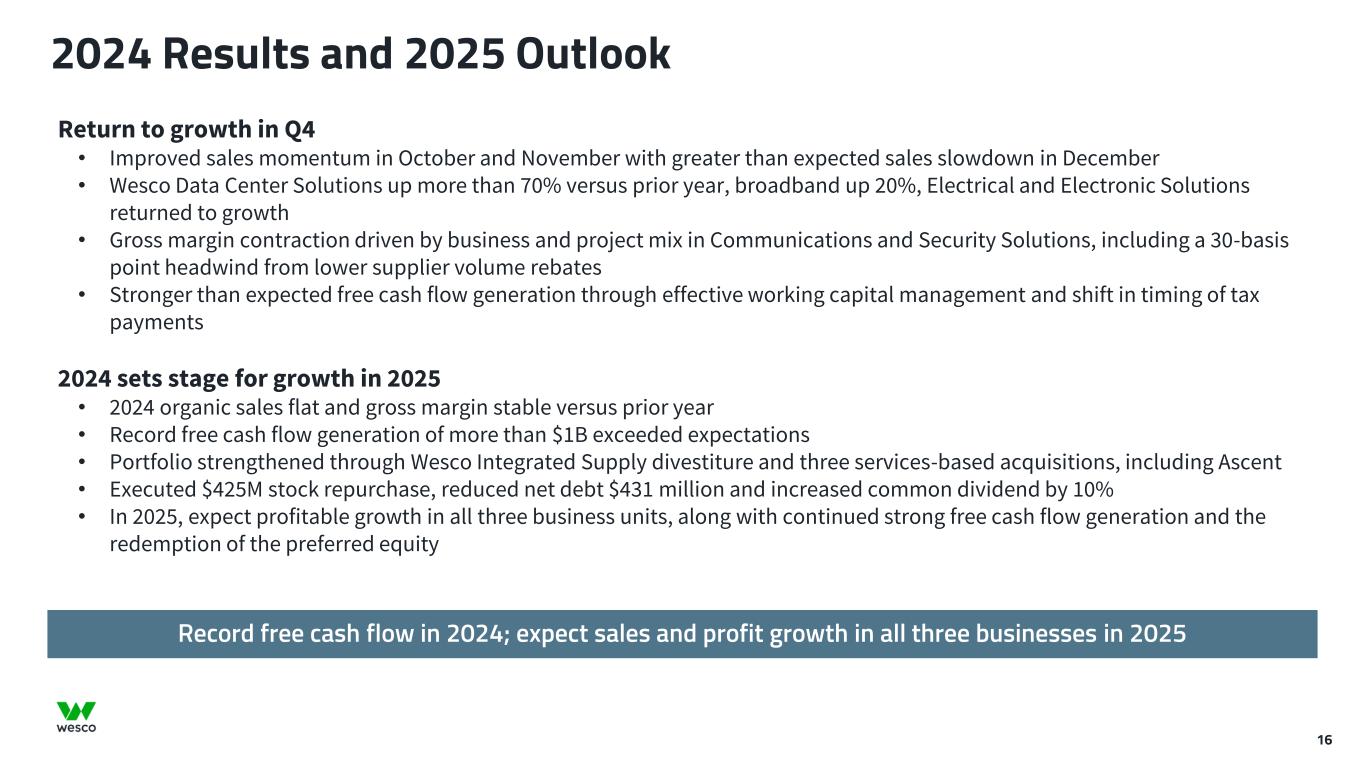

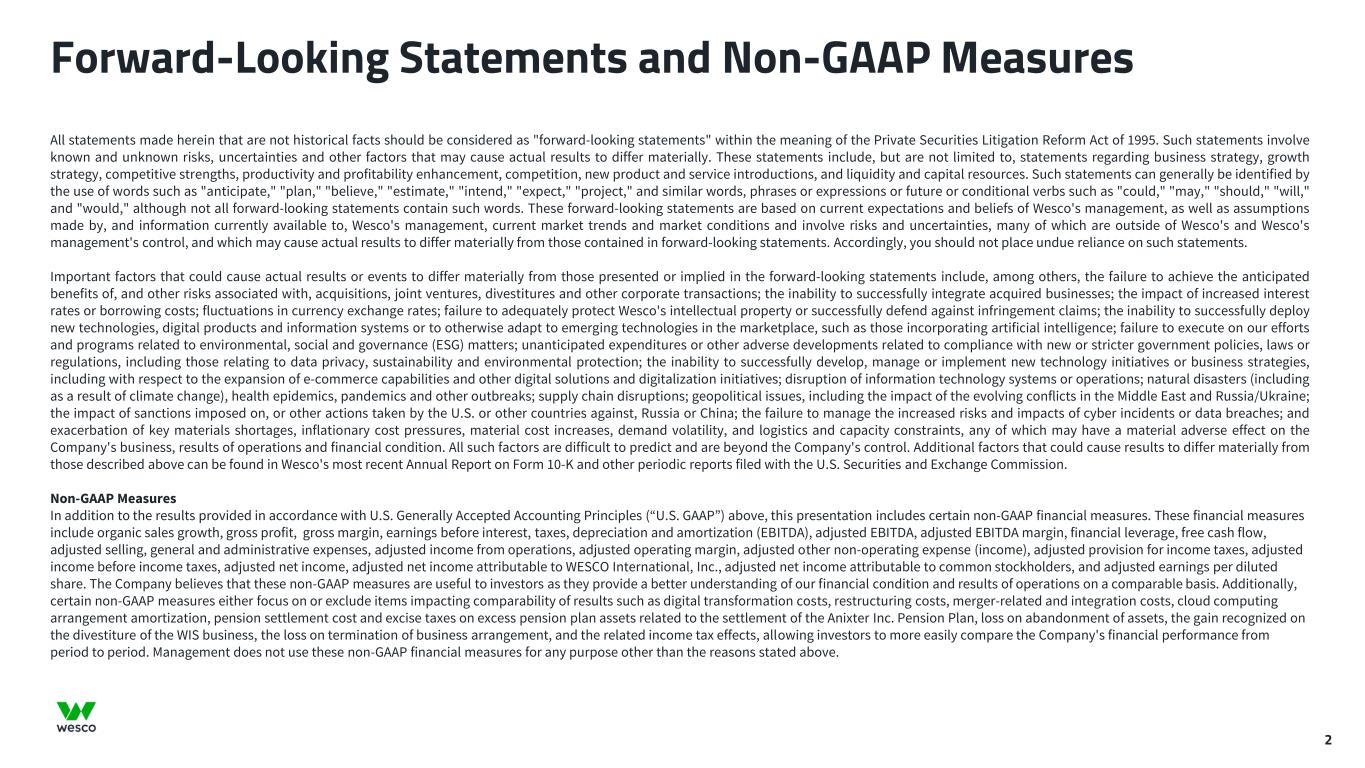

3 2024 Results and 2025 Outlook Record free cash flow in 2024; expect sales and profit growth in all three businesses in 2025 Return to growth in Q4 • Improved sales momentum in October and November with greater than expected sales slowdown in December • Wesco Data Center Solutions up more than 70% versus prior year, broadband up 20%, Electrical and Electronic Solutions returned to growth • Gross margin contraction driven by business and project mix in Communications and Security Solutions, including a 30-basis point headwind from lower supplier volume rebates • Stronger than expected free cash flow generation through effective working capital management and shift in timing of tax payments 2024 sets stage for growth in 2025 • 2024 organic sales flat and gross margin stable versus prior year • Record free cash flow generation of more than $1B exceeded expectations • Portfolio strengthened through Wesco Integrated Supply divestiture and three services-based acquisitions, including Ascent • Executed $425M stock repurchase, reduced net debt $431 million and increased common dividend by 10% • In 2025, expect profitable growth in all three business units, along with continued strong free cash flow generation and the redemption of the preferred equity

4 $5,473 $5,500 Q4 2023 Sales Price Volume M&A, Fx, and Workdays Q4 2024 Sales Adjusted EBITDA Net Sales1 Fourth Quarter YOY Results Returned to growth in Q4 despite mixed and multi-speed economy $ millions 1 Sales growth attribution based on company estimates 2 SG&A excludes the impact of stock-based compensation and cloud computing amortization See appendix for non-GAAP definitions and reconciliations • Reported sales flat, organic sales up 2% • Divestiture of Integrated Supply and differences in foreign exchange rates partially offset by higher number of workdays • Estimated growth from price of ~1.5% • Gross margin 21.2%, down 20 bps from prior year • UBS gross margin up YOY, EES flat; offset by lower CSS gross margin due to business and project mix • SG&A up ~1% as inflation was partially offset by lower incentive costs • Adjusted EPS up 19% $385 $371 Q4 2023 Adjusted EBITDA Reported Sales Gross Margin % SG&A $ Q4 2024 Adjusted EBITDA 6.7% of sales 7.0% of sales 2

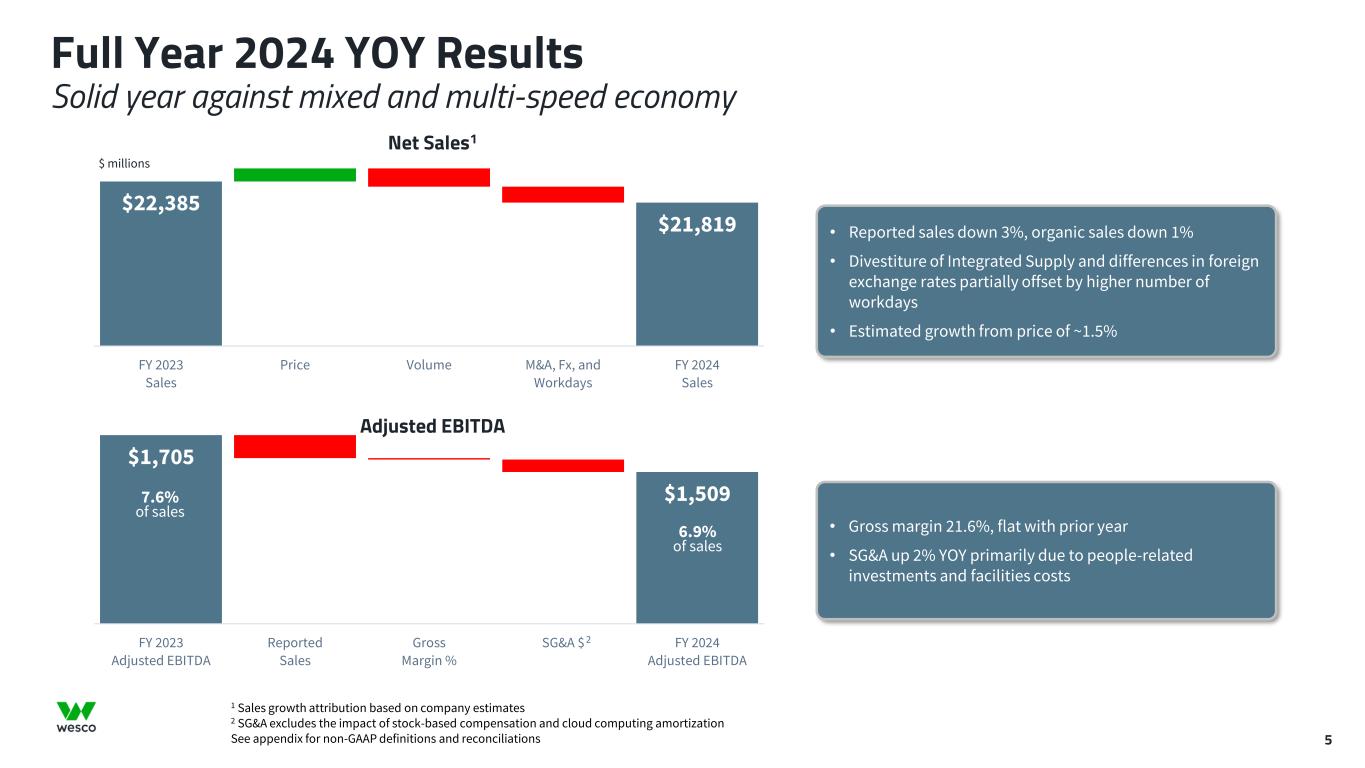

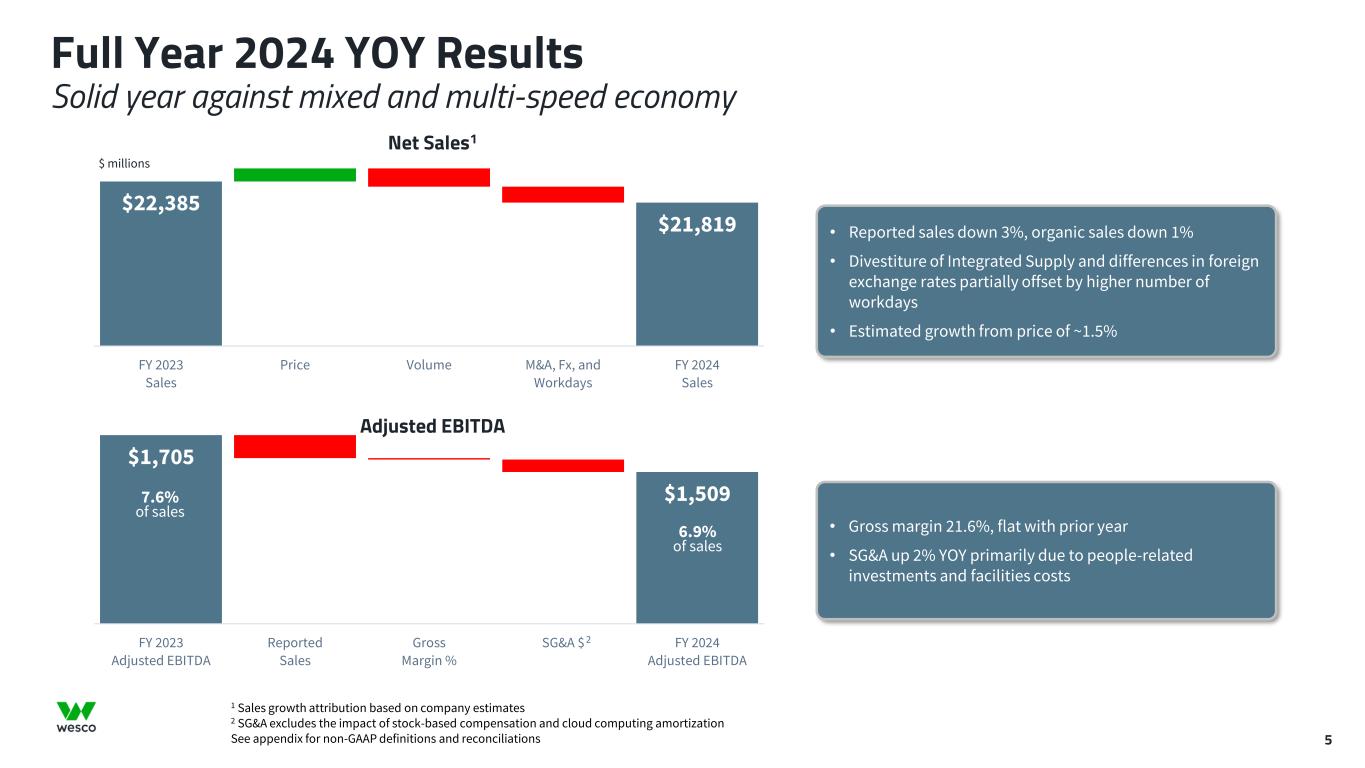

5 $22,385 $21,819 FY 2023 Sales Price Volume M&A, Fx, and Workdays FY 2024 Sales Adjusted EBITDA Net Sales1 Full Year 2024 YOY Results Solid year against mixed and multi-speed economy $ millions 1 Sales growth attribution based on company estimates 2 SG&A excludes the impact of stock-based compensation and cloud computing amortization See appendix for non-GAAP definitions and reconciliations • Reported sales down 3%, organic sales down 1% • Divestiture of Integrated Supply and differences in foreign exchange rates partially offset by higher number of workdays • Estimated growth from price of ~1.5% • Gross margin 21.6%, flat with prior year • SG&A up 2% YOY primarily due to people-related investments and facilities costs $1,705 $1,509 FY 2023 Adjusted EBITDA Reported Sales Gross Margin % SG&A $ FY 2024 Adjusted EBITDA 6.9% of sales 7.6% of sales 2

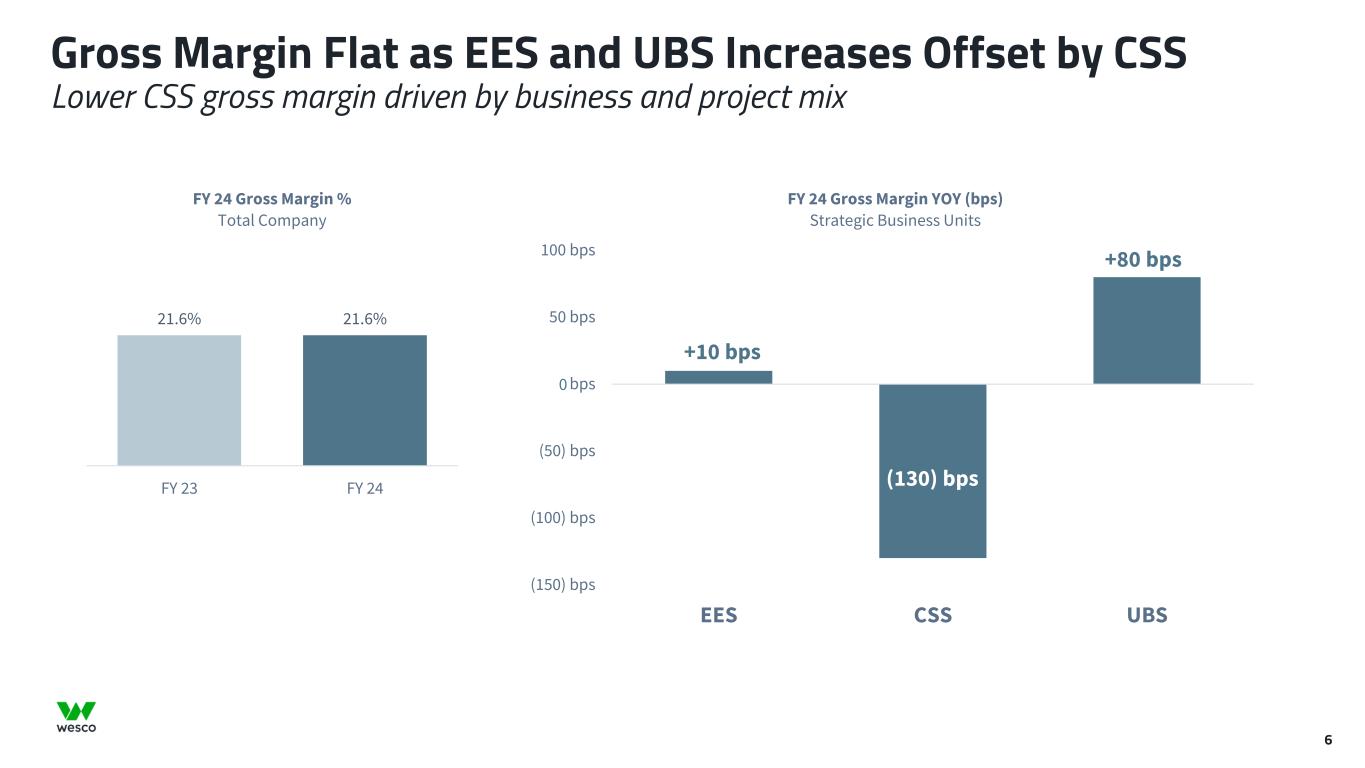

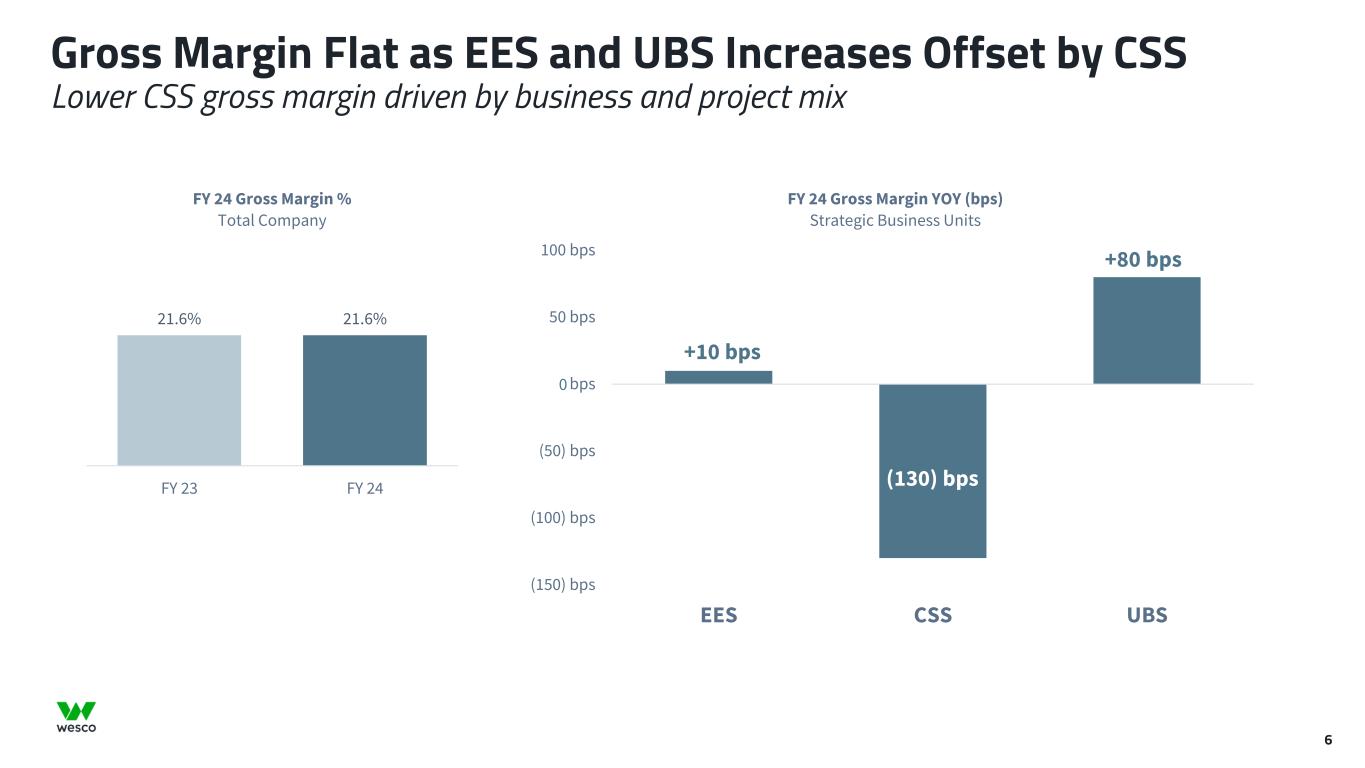

6 (150) bps (100) bps (50) bps bps 50 bps 100 bps EES CSS UBS FY 24 Gross Margin YOY (bps) Strategic Business Units 0 +10 bps Gross Margin Flat as EES and UBS Increases Offset by CSS Lower CSS gross margin driven by business and project mix (130) bps +80 bps 21.6% 21.6% FY 23 FY 24 FY 24 Gross Margin % Total Company

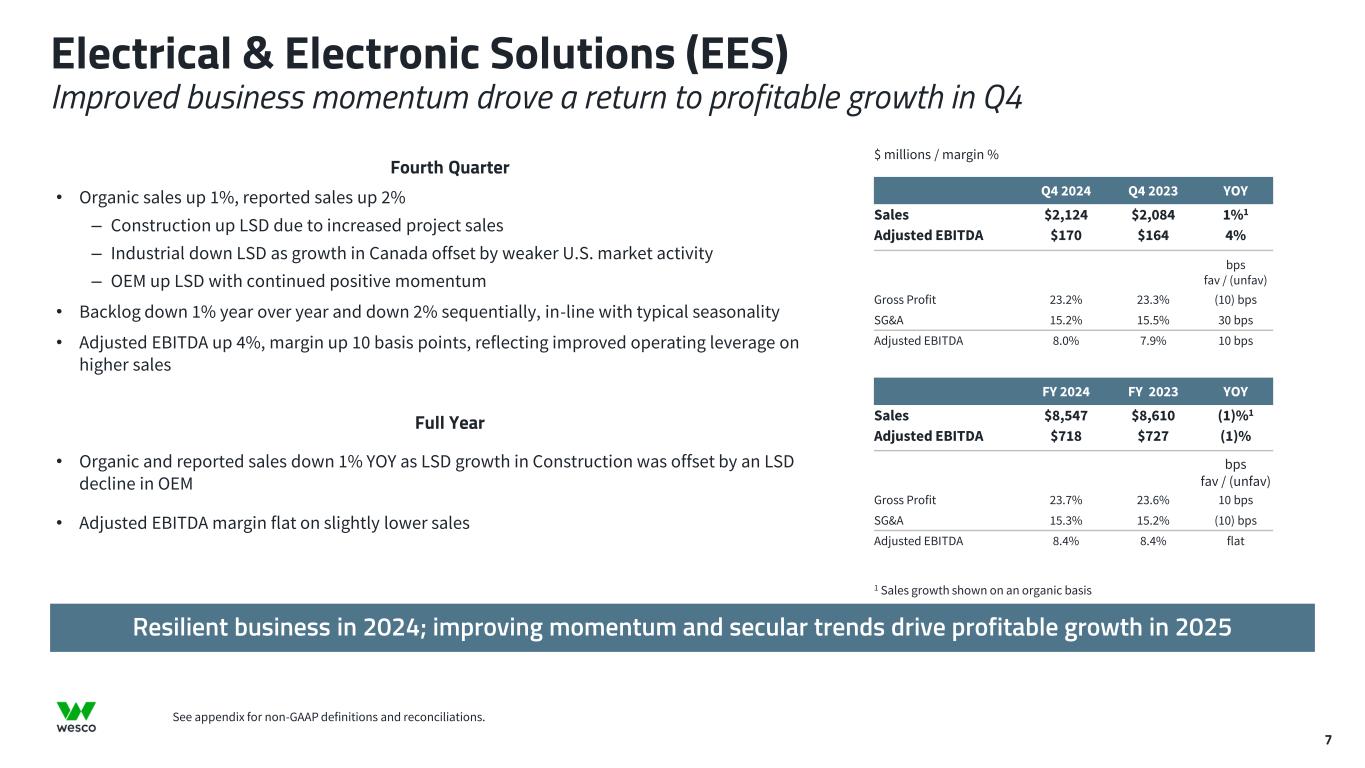

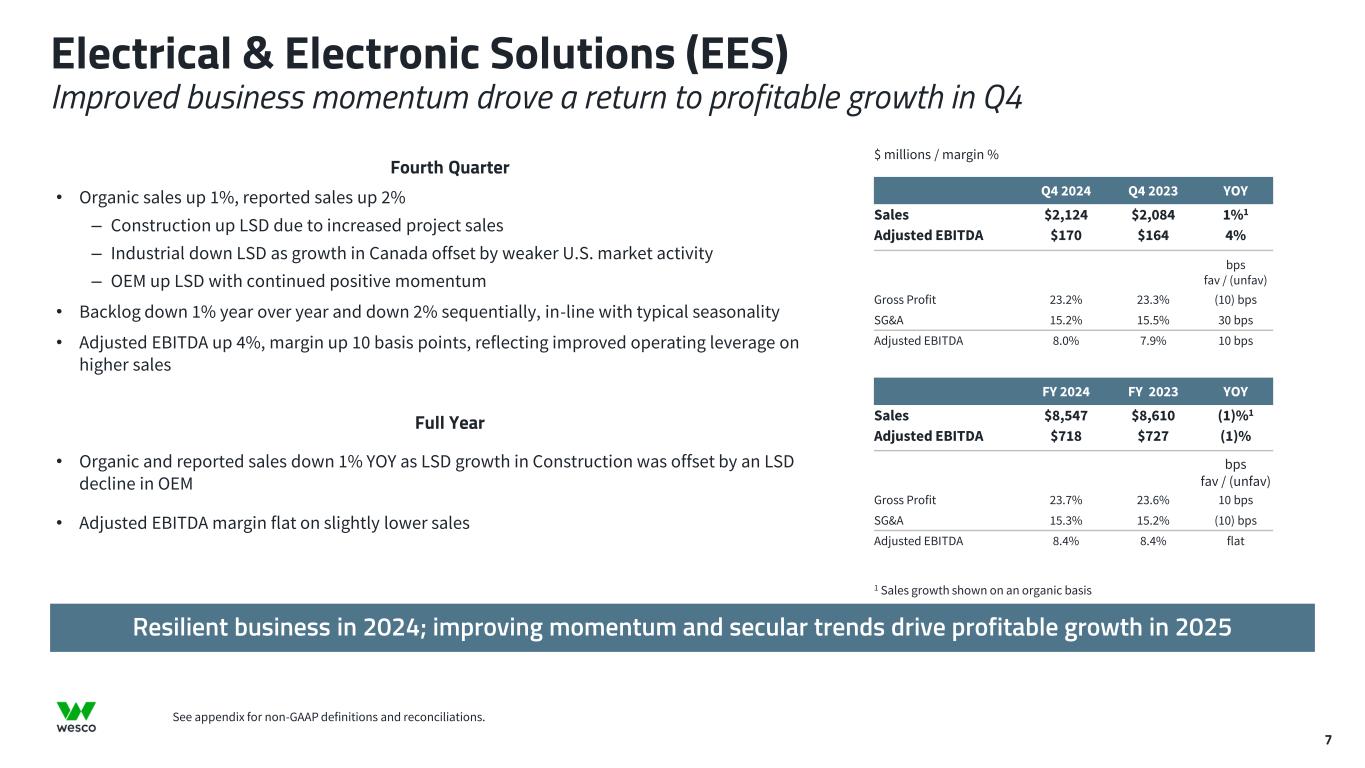

Fourth Quarter • Organic sales up 1%, reported sales up 2% – Construction up LSD due to increased project sales – Industrial down LSD as growth in Canada offset by weaker U.S. market activity – OEM up LSD with continued positive momentum • Backlog down 1% year over year and down 2% sequentially, in-line with typical seasonality • Adjusted EBITDA up 4%, margin up 10 basis points, reflecting improved operating leverage on higher sales Full Year • Organic and reported sales down 1% YOY as LSD growth in Construction was offset by an LSD decline in OEM • Adjusted EBITDA margin flat on slightly lower sales Resilient business in 2024; improving momentum and secular trends drive profitable growth in 2025 See appendix for non-GAAP definitions and reconciliations. Electrical & Electronic Solutions (EES) Improved business momentum drove a return to profitable growth in Q4 1 Sales growth shown on an organic basis 7 Q4 2024 Q4 2023 YOY Sales $2,124 $2,084 1%1 Adjusted EBITDA $170 $164 4% bps fav / (unfav) Gross Profit 23.2% 23.3% (10) bps SG&A 15.2% 15.5% 30 bps Adjusted EBITDA 8.0% 7.9% 10 bps FY 2024 FY 2023 YOY Sales $8,547 $8,610 (1)%1 Adjusted EBITDA $718 $727 (1)% bps fav / (unfav) Gross Profit 23.7% 23.6% 10 bps SG&A 15.3% 15.2% (10) bps Adjusted EBITDA 8.4% 8.4% flat $ millions / margin %

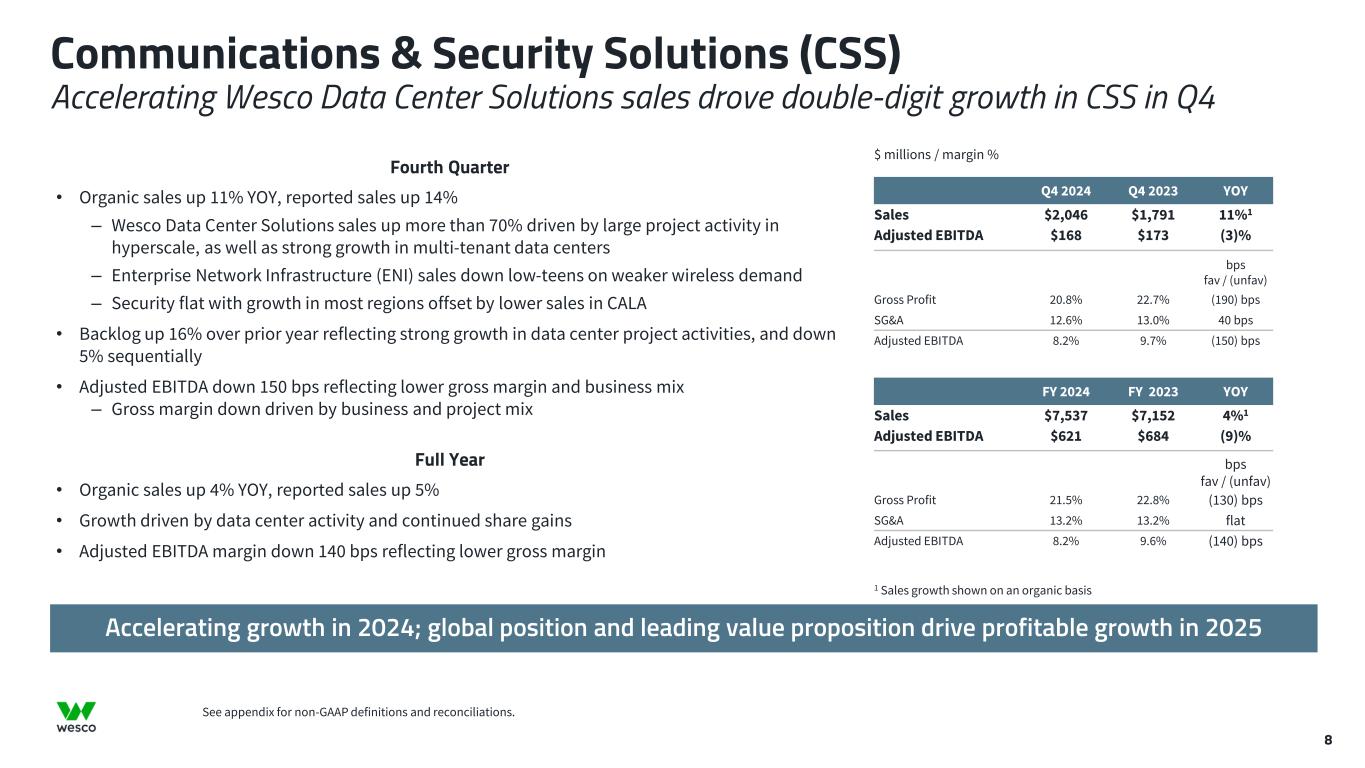

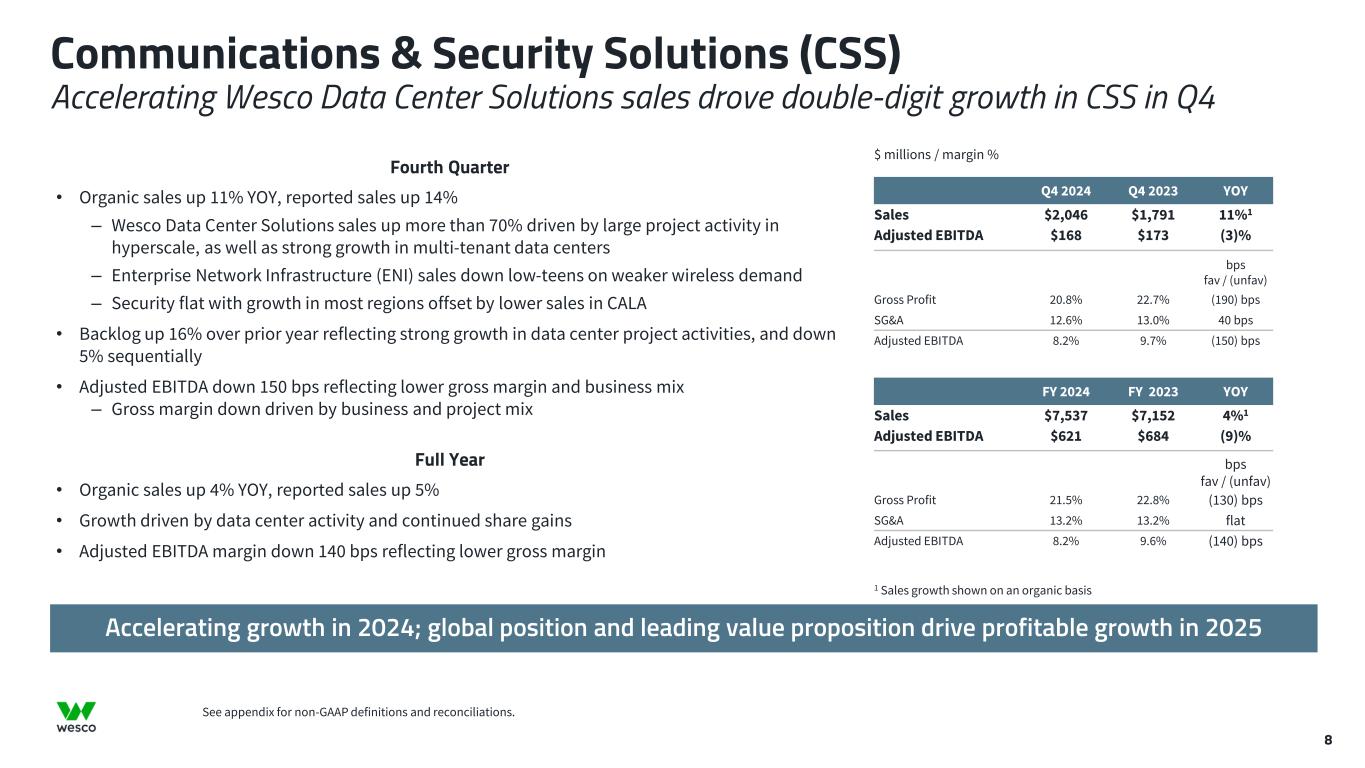

Fourth Quarter • Organic sales up 11% YOY, reported sales up 14% – Wesco Data Center Solutions sales up more than 70% driven by large project activity in hyperscale, as well as strong growth in multi-tenant data centers – Enterprise Network Infrastructure (ENI) sales down low-teens on weaker wireless demand – Security flat with growth in most regions offset by lower sales in CALA • Backlog up 16% over prior year reflecting strong growth in data center project activities, and down 5% sequentially • Adjusted EBITDA down 150 bps reflecting lower gross margin and business mix – Gross margin down driven by business and project mix Full Year • Organic sales up 4% YOY, reported sales up 5% • Growth driven by data center activity and continued share gains • Adjusted EBITDA margin down 140 bps reflecting lower gross margin Accelerating growth in 2024; global position and leading value proposition drive profitable growth in 2025 See appendix for non-GAAP definitions and reconciliations. Communications & Security Solutions (CSS) Accelerating Wesco Data Center Solutions sales drove double-digit growth in CSS in Q4 8 Q4 2024 Q4 2023 YOY Sales $2,046 $1,791 11%1 Adjusted EBITDA $168 $173 (3)% bps fav / (unfav) Gross Profit 20.8% 22.7% (190) bps SG&A 12.6% 13.0% 40 bps Adjusted EBITDA 8.2% 9.7% (150) bps FY 2024 FY 2023 YOY Sales $7,537 $7,152 4%1 Adjusted EBITDA $621 $684 (9)% bps fav / (unfav) Gross Profit 21.5% 22.8% (130) bps SG&A 13.2% 13.2% flat Adjusted EBITDA 8.2% 9.6% (140) bps 1 Sales growth shown on an organic basis $ millions / margin %

AI-Driven Data Centers Driving Strong Growth Transformers Data CenterSite Substation Land acquisition with access to power Civil construction 3-5 Years Time to Power Generators white space gray space Electrical distribution inside data hall CommissioningMechanical, plumbing and electrical equipment Q1 '24 Q2 '24 Q3 '24 Q4 '24 Wesco Data Center Solutions YOY Growth in 2024Transmission lines to a substation for site Generator sets to enable backup power Transformers to data center Growth and expansion of capabilities through M&A November 2022 Hyperscale solutions Data center facility services across the entire lifecycle December 2024 Data center building intelligence software June 2024 Substantial expansion of capabilities through M&A has rapidly increased our exposure to this high-growth secular trend 1-2 Year Construction Period Up LSD Up high teens Up more than 40% Up more than 70% 9

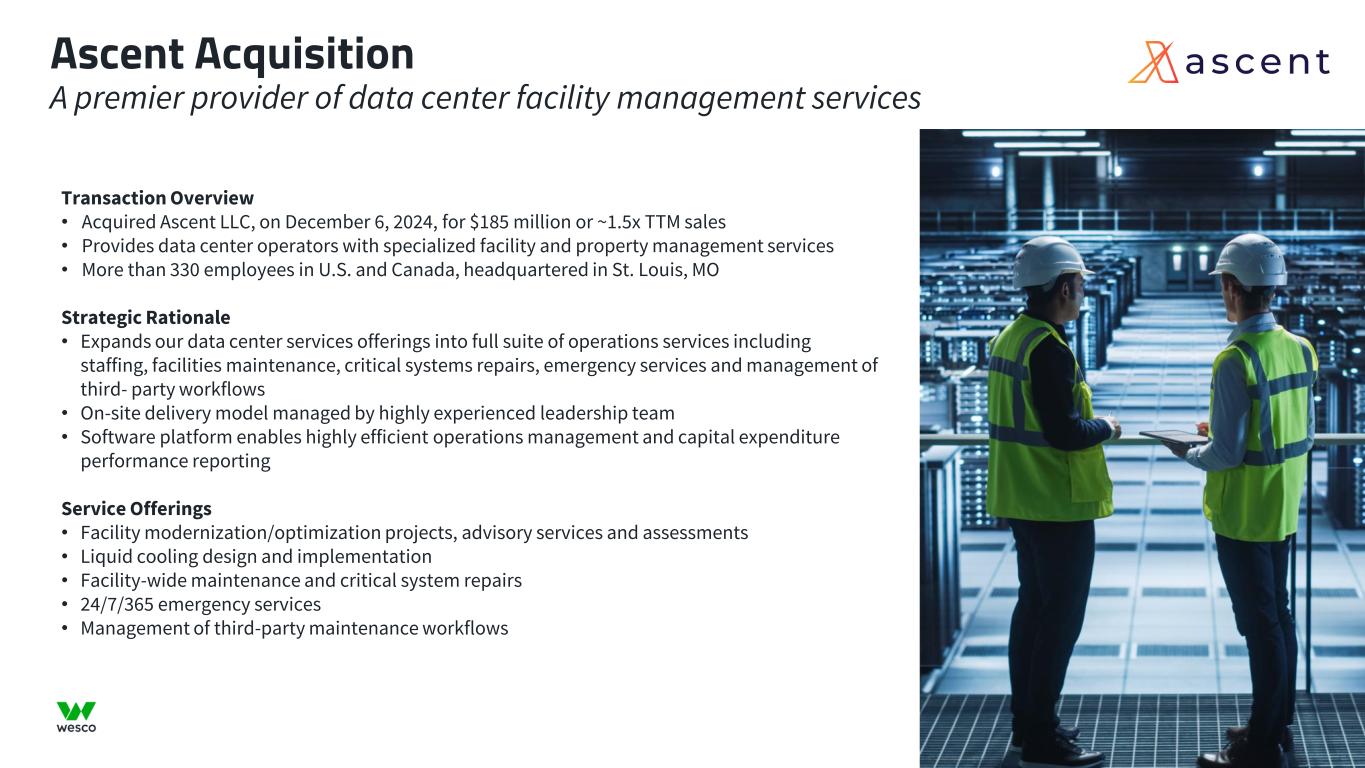

10 Ascent Acquisition A premier provider of data center facility management services Transaction Overview • Acquired Ascent LLC, on December 6, 2024, for $185 million or ~1.5x TTM sales • Provides data center operators with specialized facility and property management services • More than 330 employees in U.S. and Canada, headquartered in St. Louis, MO Strategic Rationale • Expands our data center services offerings into full suite of operations services including staffing, facilities maintenance, critical systems repairs, emergency services and management of third- party workflows • On-site delivery model managed by highly experienced leadership team • Software platform enables highly efficient operations management and capital expenditure performance reporting Service Offerings • Facility modernization/optimization projects, advisory services and assessments • Liquid cooling design and implementation • Facility-wide maintenance and critical system repairs • 24/7/365 emergency services • Management of third-party maintenance workflows

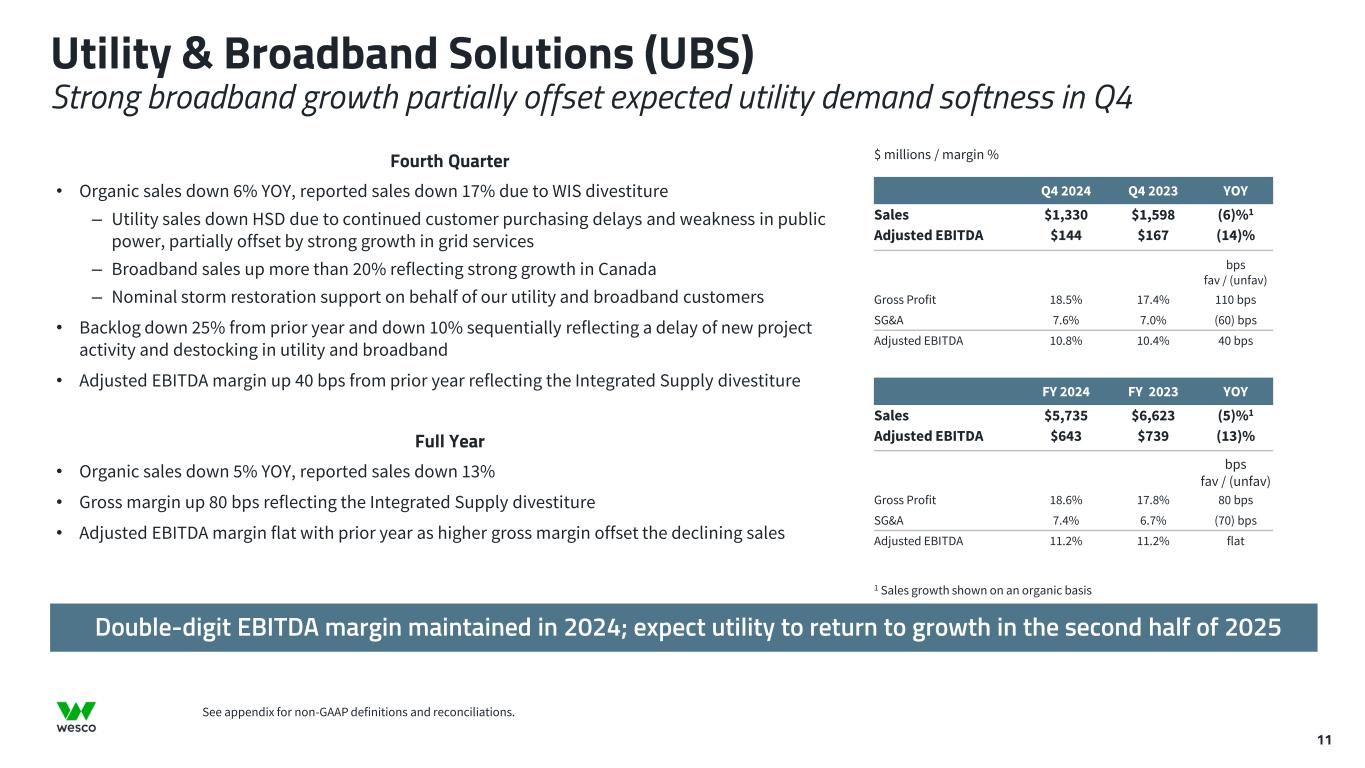

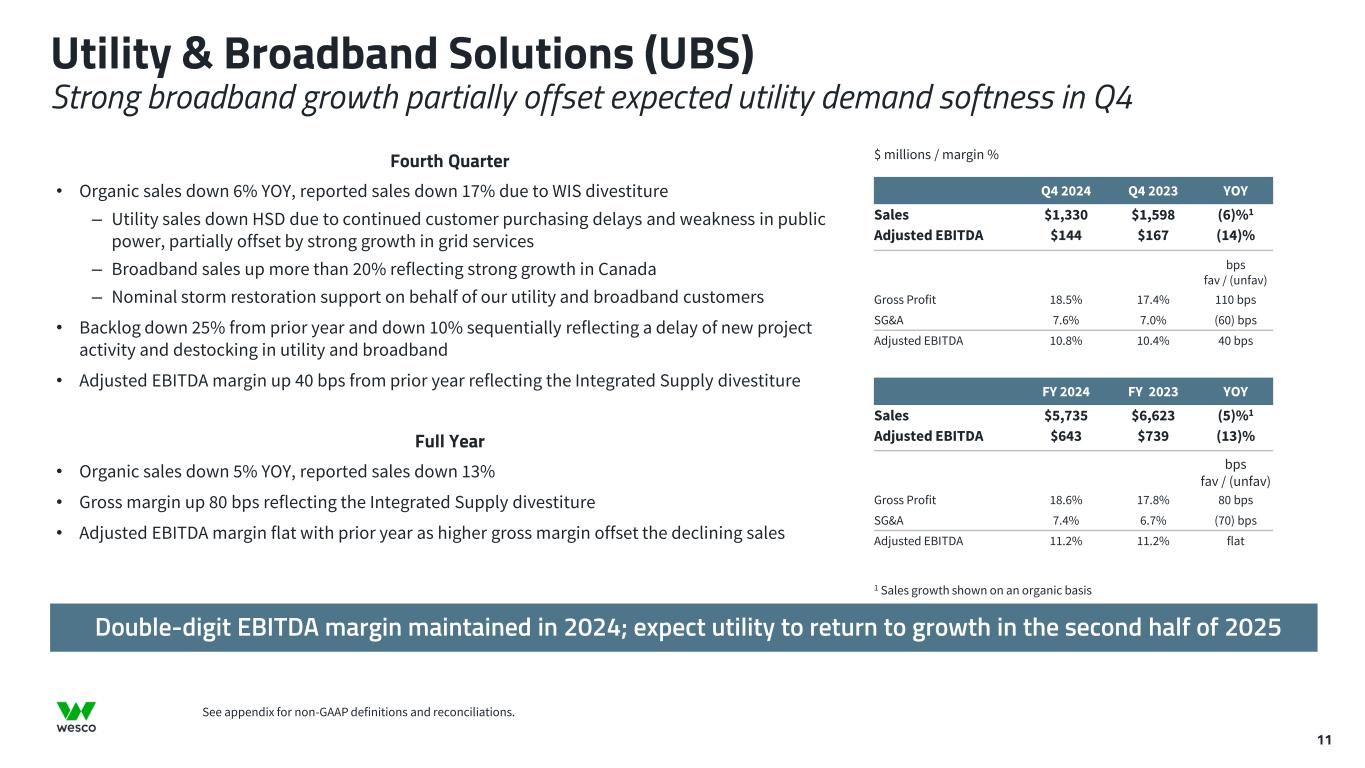

Double-digit EBITDA margin maintained in 2024; expect utility to return to growth in the second half of 2025 See appendix for non-GAAP definitions and reconciliations. Utility & Broadband Solutions (UBS) Strong broadband growth partially offset expected utility demand softness in Q4 Q4 2024 Q4 2023 YOY Sales $1,330 $1,598 (6)%1 Adjusted EBITDA $144 $167 (14)% bps fav / (unfav) Gross Profit 18.5% 17.4% 110 bps SG&A 7.6% 7.0% (60) bps Adjusted EBITDA 10.8% 10.4% 40 bps Fourth Quarter • Organic sales down 6% YOY, reported sales down 17% due to WIS divestiture – Utility sales down HSD due to continued customer purchasing delays and weakness in public power, partially offset by strong growth in grid services – Broadband sales up more than 20% reflecting strong growth in Canada – Nominal storm restoration support on behalf of our utility and broadband customers • Backlog down 25% from prior year and down 10% sequentially reflecting a delay of new project activity and destocking in utility and broadband • Adjusted EBITDA margin up 40 bps from prior year reflecting the Integrated Supply divestiture Full Year • Organic sales down 5% YOY, reported sales down 13% • Gross margin up 80 bps reflecting the Integrated Supply divestiture • Adjusted EBITDA margin flat with prior year as higher gross margin offset the declining sales 11 FY 2024 FY 2023 YOY Sales $5,735 $6,623 (5)%1 Adjusted EBITDA $643 $739 (13)% bps fav / (unfav) Gross Profit 18.6% 17.8% 80 bps SG&A 7.4% 6.7% (70) bps Adjusted EBITDA 11.2% 11.2% flat 1 Sales growth shown on an organic basis $ millions / margin %

12 $201 $51 $18 $330 $95 Adjusted Net Income D&A and Other Accounts Receivable Inventory Accounts Payable Capex Free Cash Flow $1,045 $678 154% of Adjusted Net Income Record Free Cash Flow >$1B of free cash flow in 2024; progress on reducing net working capital intensity FY 2024 $ millions Highest free cash flow in company history; on track to deliver $3 billion over next three years See appendix for non-GAAP reconciliations 1 Represents a four quarter average of net working capital as of March 31, June 30, September 30, and December 31, as a percentage of revenue for the twelve months ended December 31. 21.4% 19.8% FY 2023 FY 2024 Net Working Capital1 % of FY Sales 160 basis point improvement

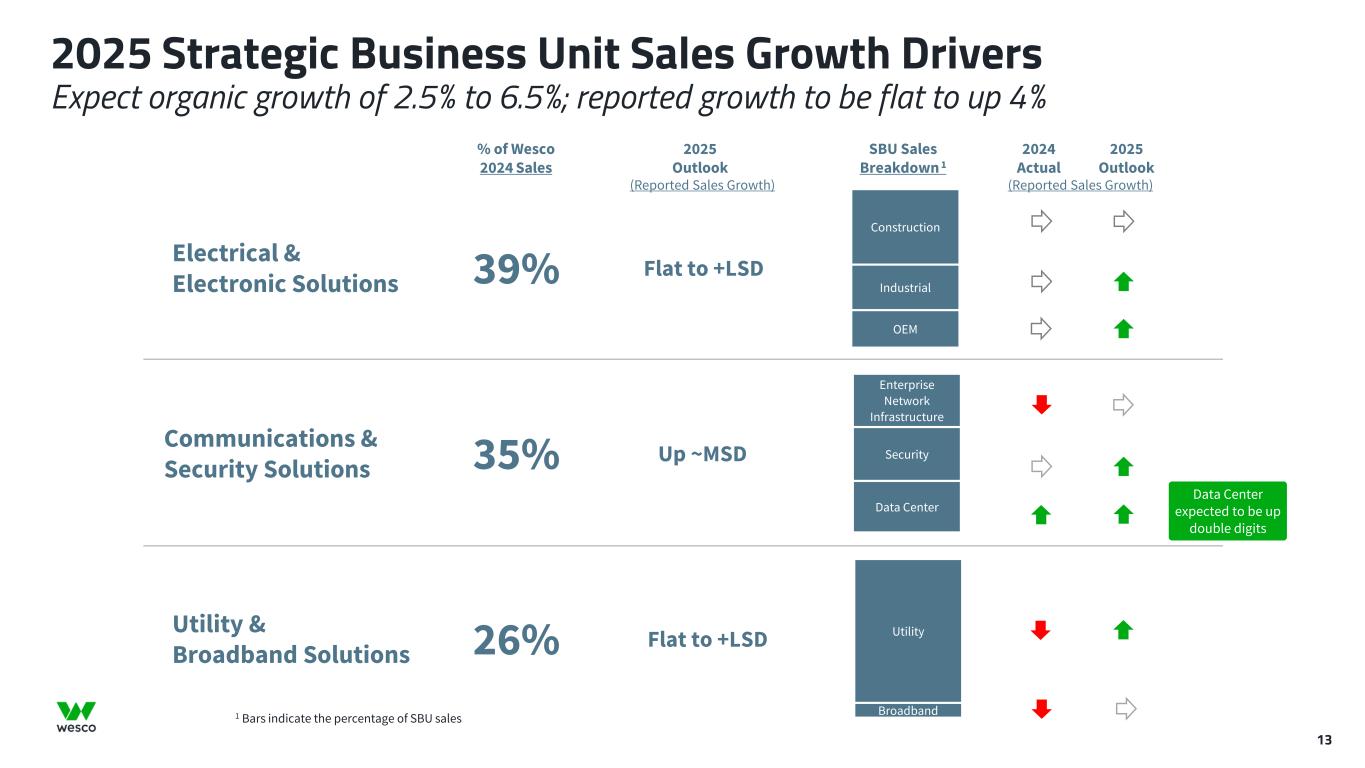

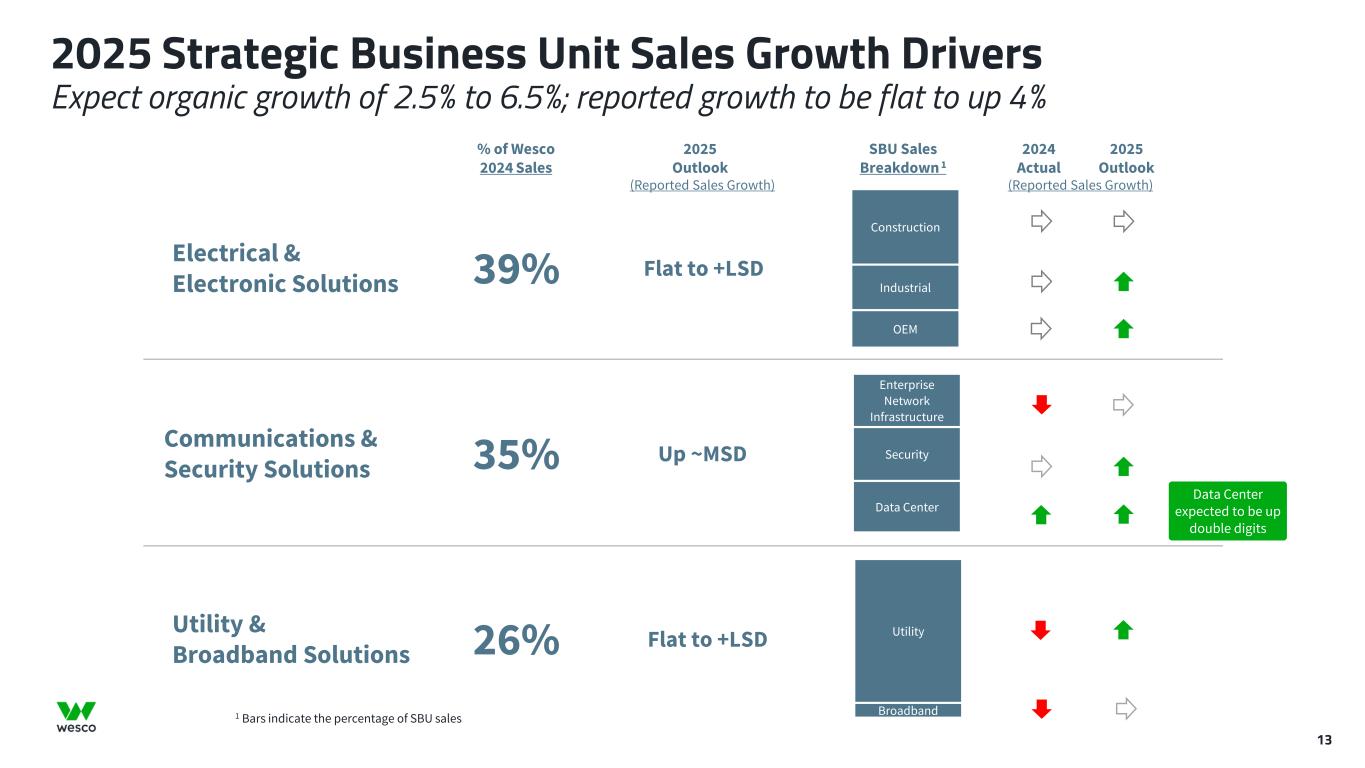

13 2025 Strategic Business Unit Sales Growth Drivers Expect organic growth of 2.5% to 6.5%; reported growth to be flat to up 4% OEM Industrial Construction Data Center Security Enterprise Network Infrastructure Broadband Utility % of Wesco 2024 Sales 1 Bars indicate the percentage of SBU sales SBU Sales Breakdown 1 2024 Actual 2025 Outlook 2025 Outlook Electrical & Electronic Solutions 39% Flat to +LSD 35% Communications & Security Solutions Up ~MSD 26% Utility & Broadband Solutions Data Center expected to be up double digits (Reported Sales Growth) (Reported Sales Growth) Flat to +LSD

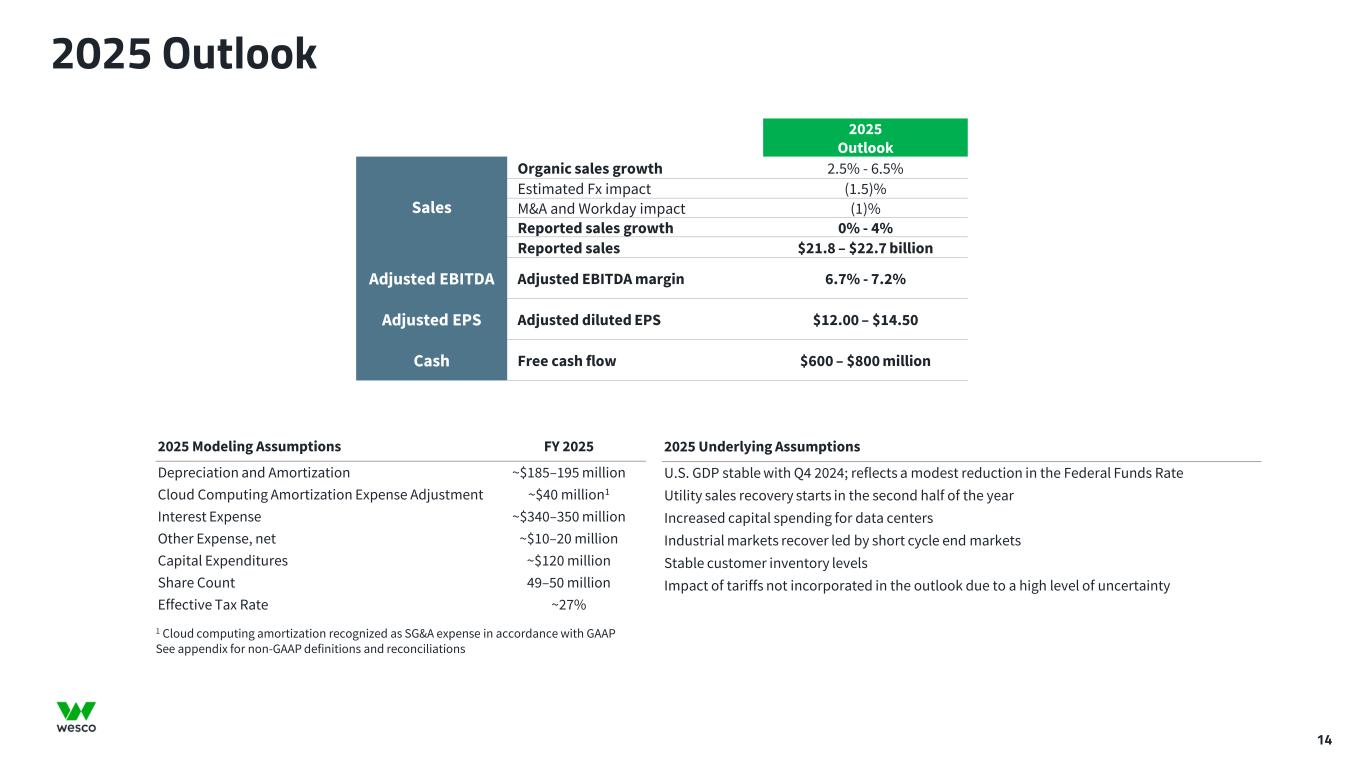

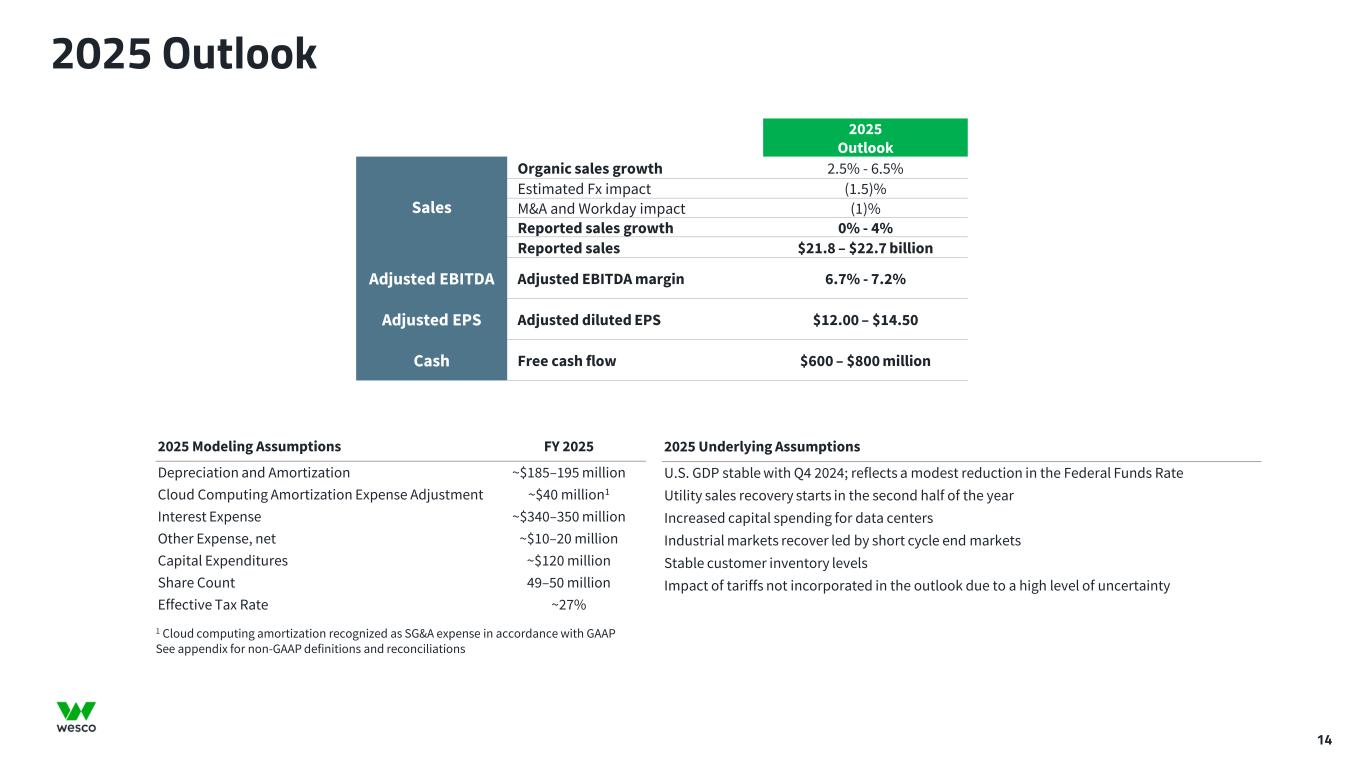

14 2025 Outlook 2025 Outlook Sales Organic sales growth 2.5% - 6.5% Estimated Fx impact (1.5)% M&A and Workday impact (1)% Reported sales growth 0% - 4% Reported sales $21.8 – $22.7 billion Adjusted EBITDA Adjusted EBITDA margin 6.7% - 7.2% Adjusted EPS Adjusted diluted EPS $12.00 – $14.50 Cash Free cash flow $600 – $800 million 2025 Modeling Assumptions FY 2025 Depreciation and Amortization ~$185–195 million Cloud Computing Amortization Expense Adjustment ~$40 million1 Interest Expense ~$340–350 million Other Expense, net ~$10–20 million Capital Expenditures ~$120 million Share Count 49–50 million Effective Tax Rate ~27% 1 Cloud computing amortization recognized as SG&A expense in accordance with GAAP See appendix for non-GAAP definitions and reconciliations 2025 Underlying Assumptions U.S. GDP stable with Q4 2024; reflects a modest reduction in the Federal Funds Rate Utility sales recovery starts in the second half of the year Increased capital spending for data centers Industrial markets recover led by short cycle end markets Stable customer inventory levels Impact of tariffs not incorporated in the outlook due to a high level of uncertainty

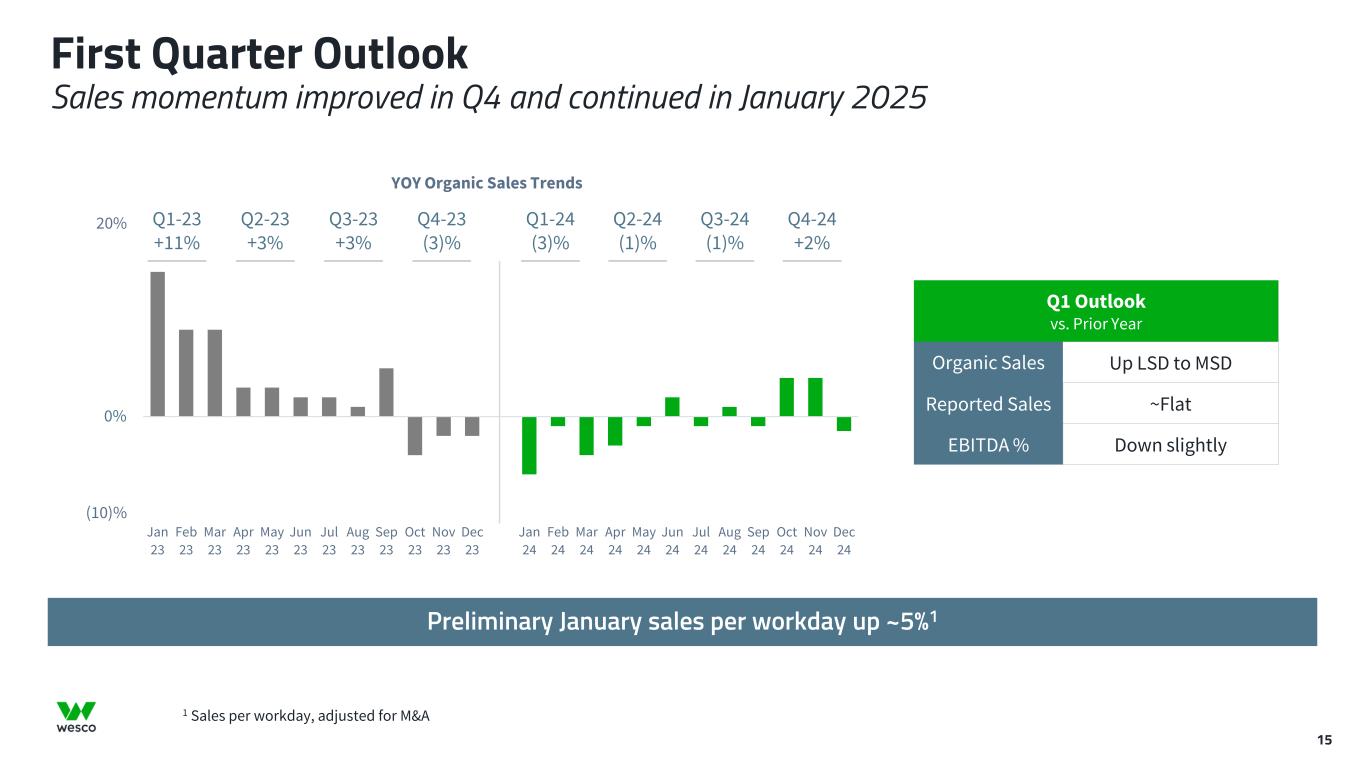

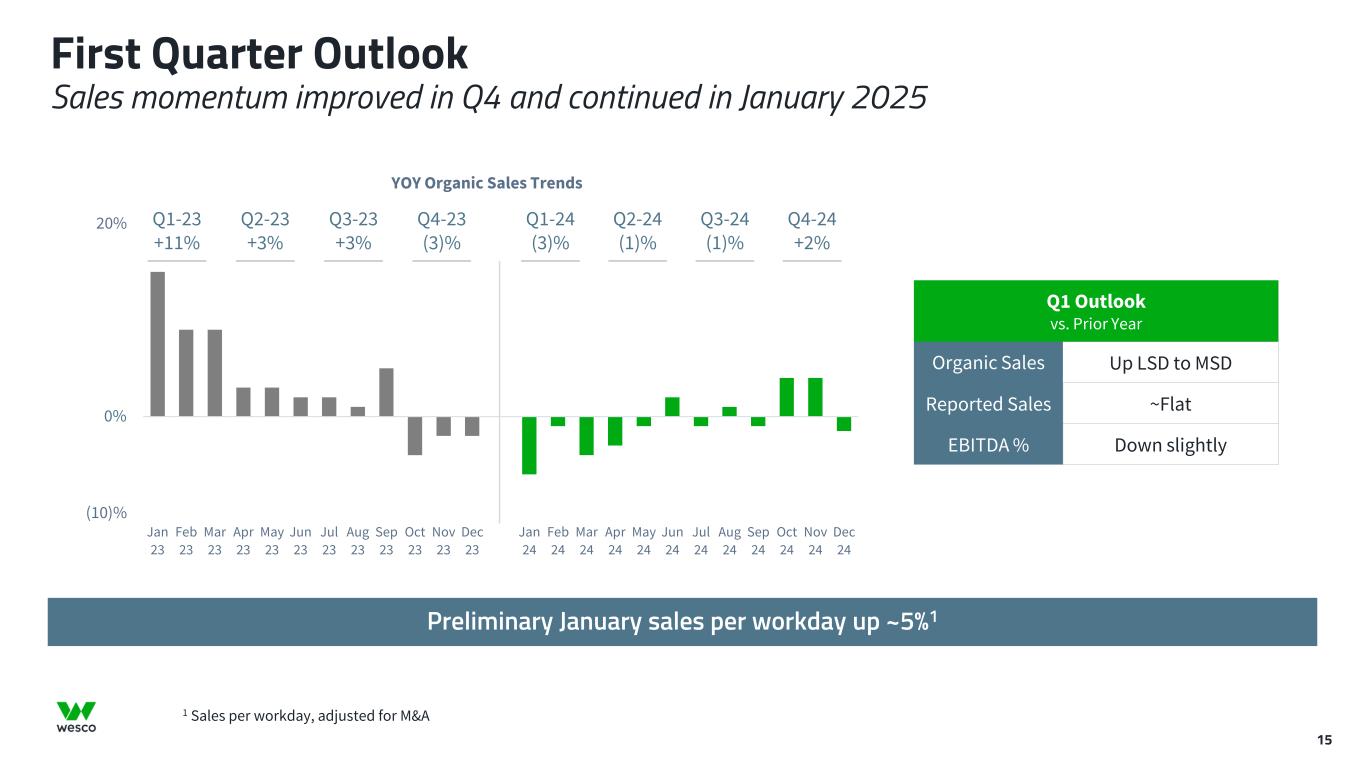

15 First Quarter Outlook Sales momentum improved in Q4 and continued in January 2025 Preliminary January sales per workday up ~5%1 (10)% 20% Jan 23 Feb 23 Mar 23 Apr 23 May 23 Jun 23 Jul 23 Aug 23 Sep 23 Oct 23 Nov 23 Dec 23 Jan 24 Feb 24 Mar 24 Apr 24 May 24 Jun 24 Jul 24 Aug 24 Sep 24 Oct 24 Nov 24 Dec 24 YOY Organic Sales Trends 0% Q1-23 +11% Q1 Outlook vs. Prior Year Organic Sales Up LSD to MSD Reported Sales ~Flat EBITDA % Down slightly Q2-23 +3% Q3-23 +3% Q4-23 (3)% Q1-24 (3)% Q2-24 (1)% Q3-24 (1)% Q4-24 +2% 1 Sales per workday, adjusted for M&A

16 2024 Results and 2025 Outlook Record free cash flow in 2024; expect sales and profit growth in all three businesses in 2025 Return to growth in Q4 • Improved sales momentum in October and November with greater than expected sales slowdown in December • Wesco Data Center Solutions up more than 70% versus prior year, broadband up 20%, Electrical and Electronic Solutions returned to growth • Gross margin contraction driven by business and project mix in Communications and Security Solutions, including a 30-basis point headwind from lower supplier volume rebates • Stronger than expected free cash flow generation through effective working capital management and shift in timing of tax payments 2024 sets stage for growth in 2025 • 2024 organic sales flat and gross margin stable versus prior year • Record free cash flow generation of more than $1B exceeded expectations • Portfolio strengthened through Wesco Integrated Supply divestiture and three services-based acquisitions, including Ascent • Executed $425M stock repurchase, reduced net debt $431 million and increased common dividend by 10% • In 2025, expect profitable growth in all three business units, along with continued strong free cash flow generation and the redemption of the preferred equity

APPENDIX

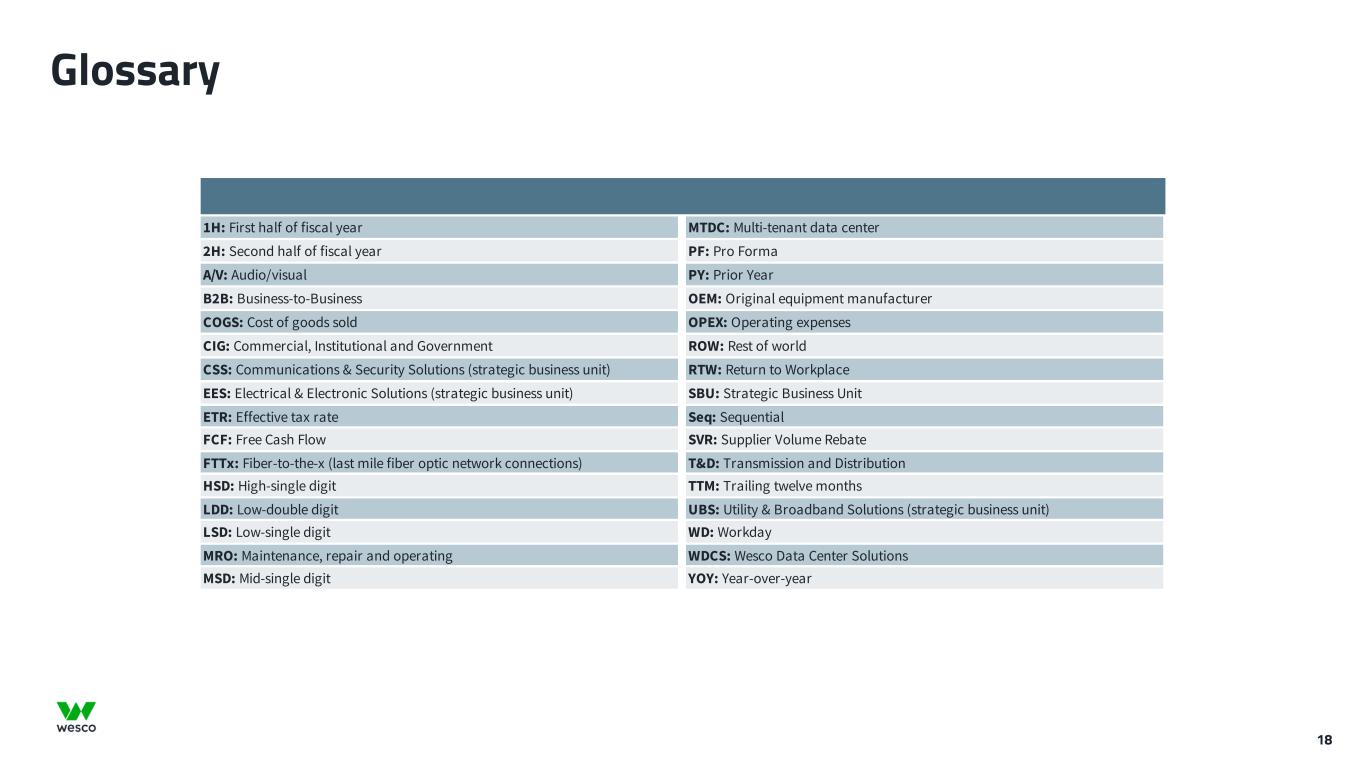

18 Glossary 1H: First half of fiscal year MTDC: Multi-tenant data center 2H: Second half of fiscal year PF: Pro Forma A/V: Audio/visual PY: Prior Year B2B: Business-to-Business OEM: Original equipment manufacturer COGS: Cost of goods sold OPEX: Operating expenses CIG: Commercial, Institutional and Government ROW: Rest of world CSS: Communications & Security Solutions (strategic business unit) RTW: Return to Workplace EES: Electrical & Electronic Solutions (strategic business unit) SBU: Strategic Business Unit ETR: Effective tax rate Seq: Sequential FCF: Free Cash Flow SVR: Supplier Volume Rebate FTTx: Fiber-to-the-x (last mile fiber optic network connections) T&D: Transmission and Distribution HSD: High-single digit TTM: Trailing twelve months LDD: Low-double digit UBS: Utility & Broadband Solutions (strategic business unit) LSD: Low-single digit WD: Workday MRO: Maintenance, repair and operating WDCS: Wesco Data Center Solutions MSD: Mid-single digit YOY: Year-over-year

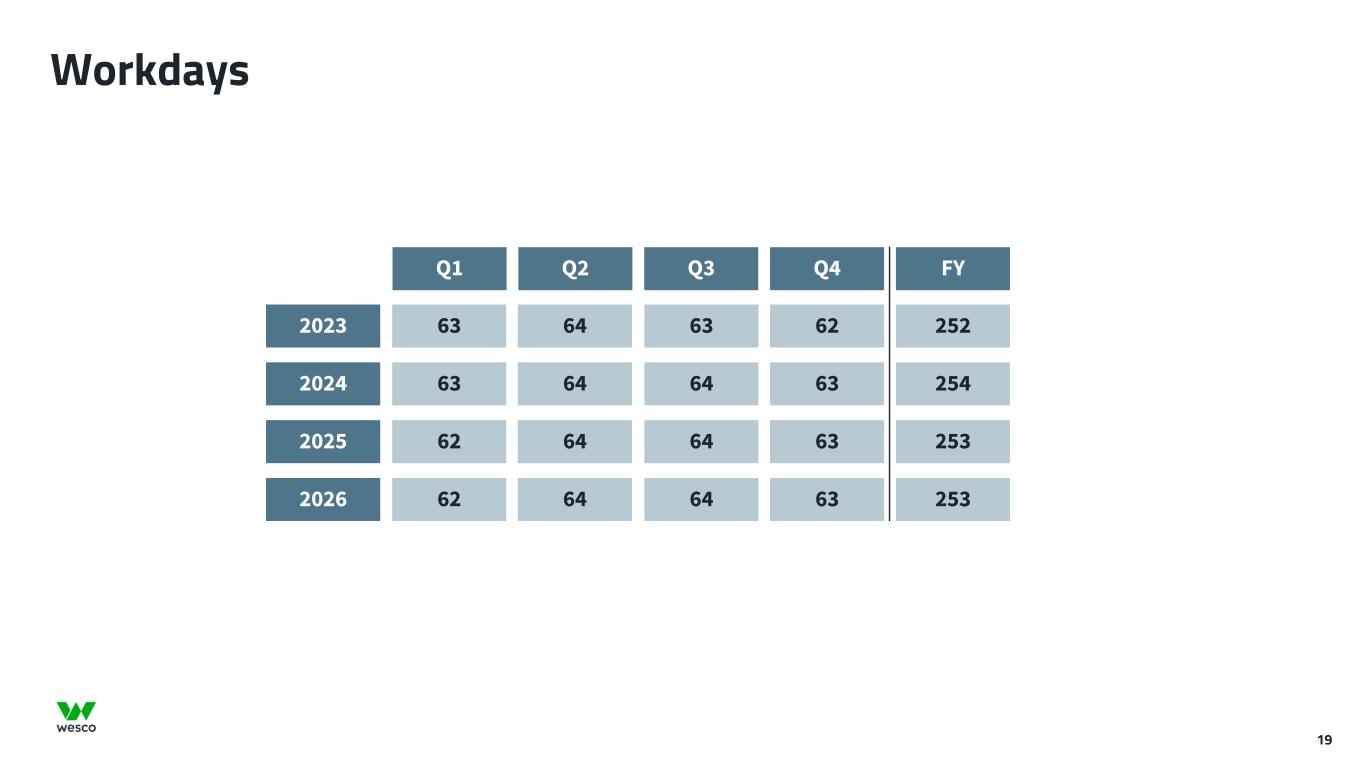

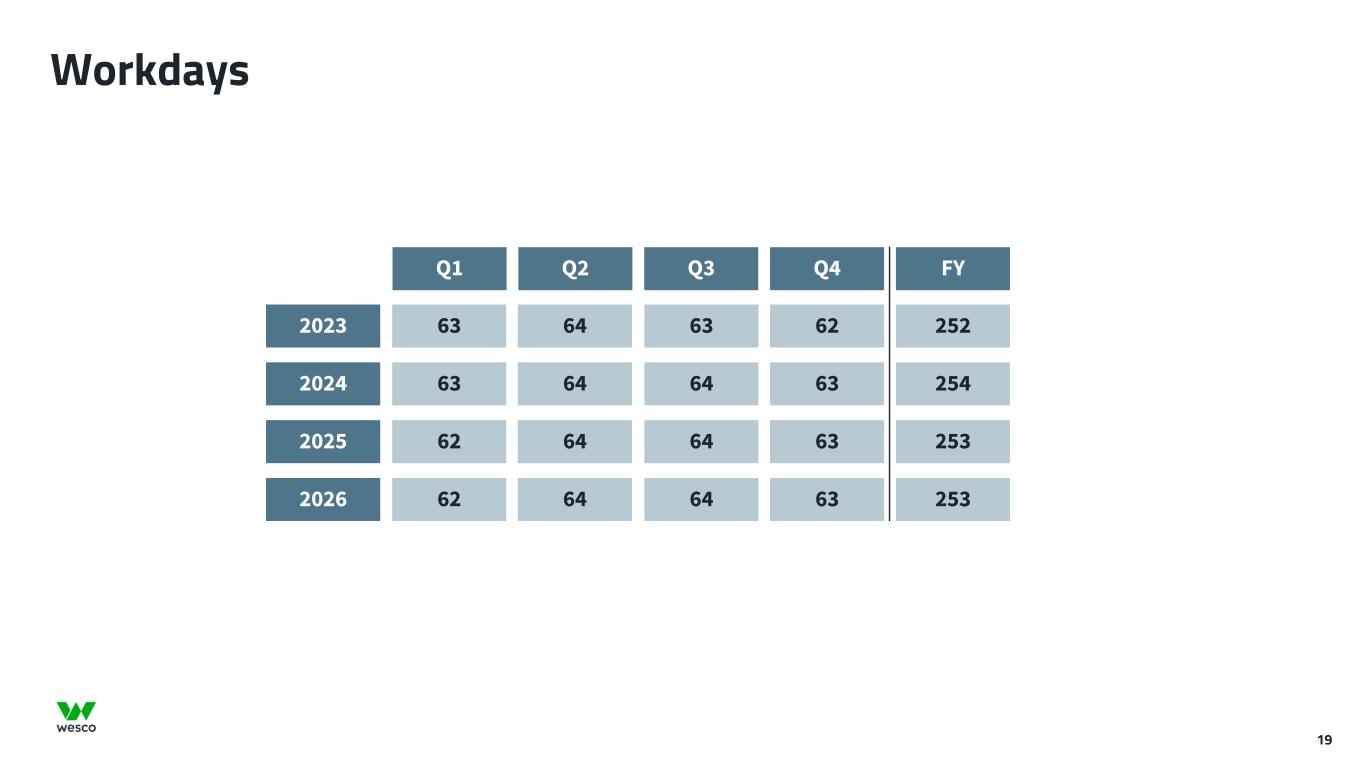

19 Workdays Q1 Q2 Q3 Q4 FY 2024 63 64 64 63 254 2025 62 64 64 63 253 2026 62 64 64 63 253 2023 63 64 63 62 252

20 Organic Sales Growth $ millions Three Months Ended Growth/(Decline) December 31, 2024 December 31, 2023 Reported Sales Acquisitions/ Divestiture Foreign Exchange Workday Organic Sales EES $ 2,123.7 $ 2,084.2 1.9 % — % (0.7) % 1.6 % 1.0 % CSS 2,045.9 1,791.3 14.2 % 1.8 % (0.5) % 1.6 % 11.3 % UBS 1,330.1 1,597.9 (16.8) % (12.3) % (0.2) % 1.6 % (5.9) % Total net sales $ 5,499.7 $ 5,473.4 0.5 % (3.0) % (0.5) % 1.6 % 2.4 % Twelve Months Ended Growth/(Decline) December 31, 2024 December 31, 2023 Reported Sales Acquisitions/ Divestiture Foreign Exchange Workday Organic Sales EES $ 8,546.8 $ 8,610.3 (0.7) % — % (0.5) % 0.8 % (1.0) % CSS 7,537.0 7,152.2 5.4 % 0.5 % (0.2) % 0.8 % 4.3 % UBS 5,735.0 6,622.7 (13.4) % (8.9) % (0.1) % 0.8 % (5.2) % Total net sales $ 21,818.8 $ 22,385.2 (2.5) % (2.5) % (0.2) % 0.8 % (0.6) % Organic sales growth is a non-GAAP financial measure of sales performance. Organic sales growth is calculated by deducting the percentage impact from acquisitions and divestitures for one year following the respective transaction, fluctuations in foreign exchange rates and number of workdays from the reported percentage change in consolidated net sales. Workday impact represents the change in the number of operating days period-over-period after adjusting for weekends and public holidays in the United States. The fourth quarter of 2024 had one more workday compared to the fourth quarter of 2023; 2024 had two more workdays compared to 2023. The fourth quarter of 2024 had one less workday compared to the third quarter of 2024.

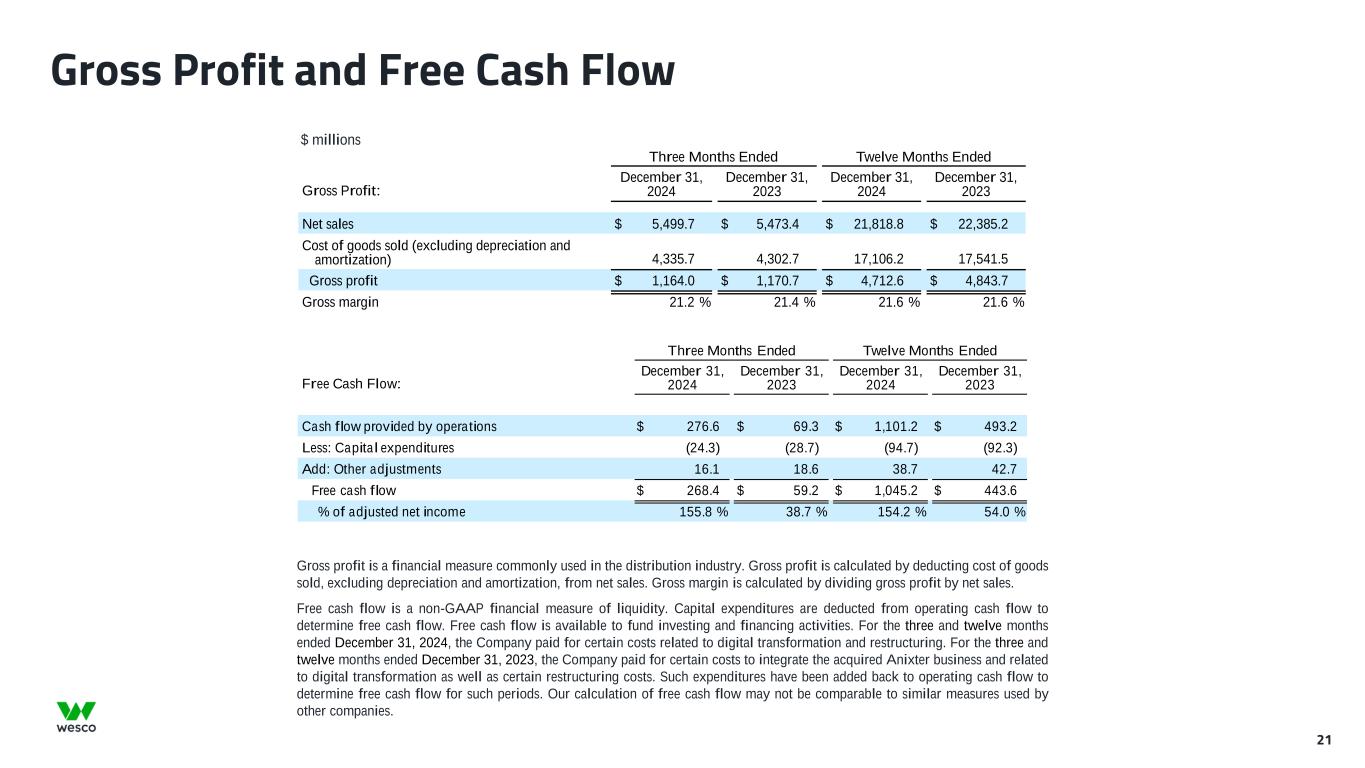

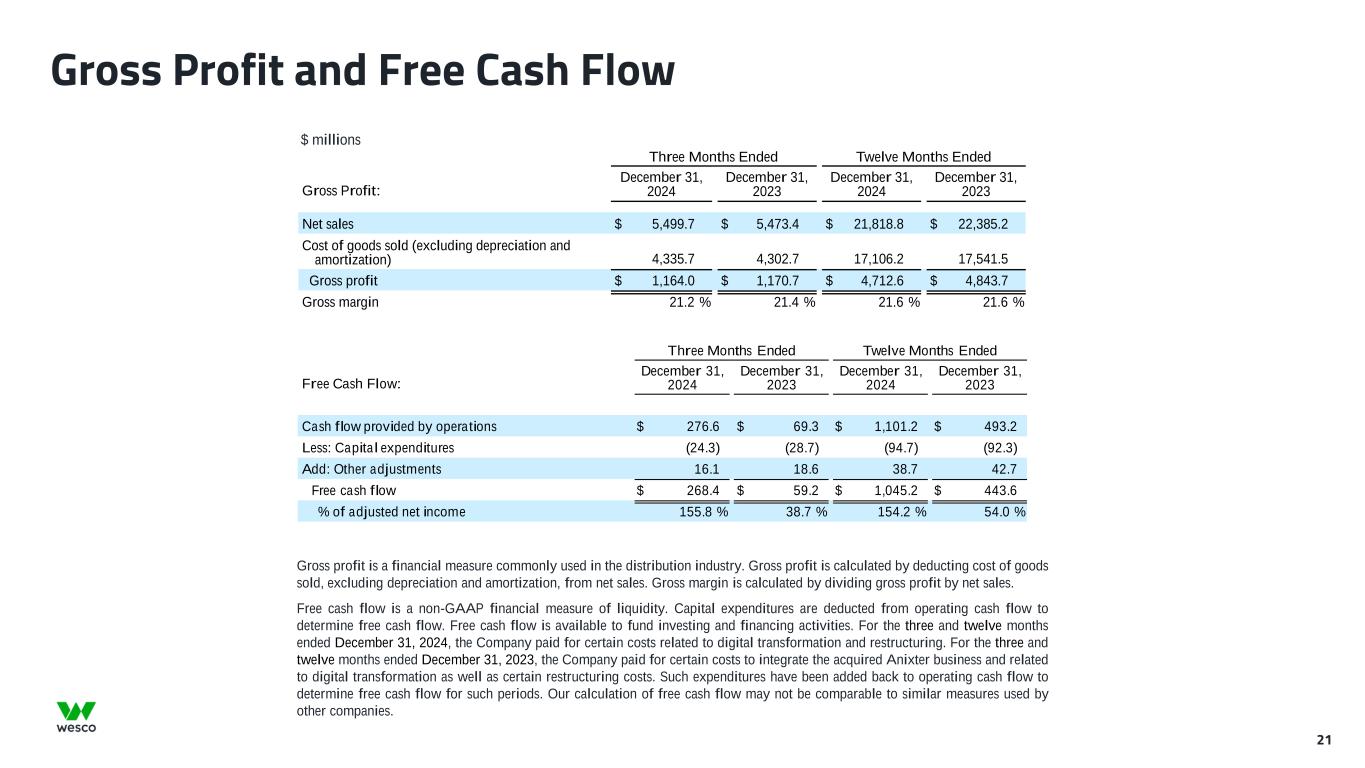

21 Gross Profit and Free Cash Flow $ millions Three Months Ended Twelve Months Ended Gross Profit: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net sales $ 5,499.7 $ 5,473.4 $ 21,818.8 $ 22,385.2 Cost of goods sold (excluding depreciation and amortization) 4,335.7 4,302.7 17,106.2 17,541.5 Gross profit $ 1,164.0 $ 1,170.7 $ 4,712.6 $ 4,843.7 Gross margin 21.2 % 21.4 % 21.6 % 21.6 % Gross profit is a financial measure commonly used in the distribution industry. Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales. Free cash flow is a non-GAAP financial measure of liquidity. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund investing and financing activities. For the three and twelve months ended December 31, 2024, the Company paid for certain costs related to digital transformation and restructuring. For the three and twelve months ended December 31, 2023, the Company paid for certain costs to integrate the acquired Anixter business and related to digital transformation as well as certain restructuring costs. Such expenditures have been added back to operating cash flow to determine free cash flow for such periods. Our calculation of free cash flow may not be comparable to similar measures used by other companies. Three Months Ended Twelve Months Ended Free Cash Flow: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Cash flow provided by operations $ 276.6 $ 69.3 $ 1,101.2 $ 493.2 Less: Capital expenditures (24.3) (28.7) (94.7) (92.3) Add: Other adjustments 16.1 18.6 38.7 42.7 Free cash flow $ 268.4 $ 59.2 $ 1,045.2 $ 443.6 % of adjusted net income 155.8 % 38.7 % 154.2 % 54.0 %

22 Business Unit Gross Profit and Gross Margin Electrical & Electronic Solutions (EES) Gross Profit: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net Sales $ 2,123.7 $ 2,084.2 $ 8,546.8 $ 8,610.3 Cost of goods sold (excluding depreciation and amortization) 1,630.1 1,598.0 6,517.8 6,576.2 Gross Profit $ 493.6 $ 486.2 $ 2,029.0 $ 2,034.1 Gross Margin 23.2% 23.3% 23.7% 23.6% Communications & Security Solutions (CSS) Gross Profit: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net Sales $ 2,045.9 $ 1,791.3 $ 7,537.0 $ 7,152.2 Cost of goods sold (excluding depreciation and amortization) 1,621.2 1,384.5 5,918.4 5,524.6 Gross Profit $ 424.7 $ 406.8 $ 1,618.6 $ 1,627.6 Gross Margin 20.8% 22.7% 21.5% 22.8% Utility & Broadband Solutions (UBS) Gross Profit: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net Sales $ 1,330.1 $ 1,597.9 $ 5,735.0 $ 6,622.7 Cost of goods sold (excluding depreciation and amortization) 1,084.4 1,320.1 4,670.0 5,440.7 Gross Profit $ 245.7 $ 277.8 $ 1,065.0 $ 1,182.0 Gross Margin 18.5% 17.4% 18.6% 17.8% Three Months Ended Twelve Months Ended Three Months Ended Twelve Months Ended Three Months Ended Twelve Months Ended Gross profit is a financial measure commonly used in the distribution industry. Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales.

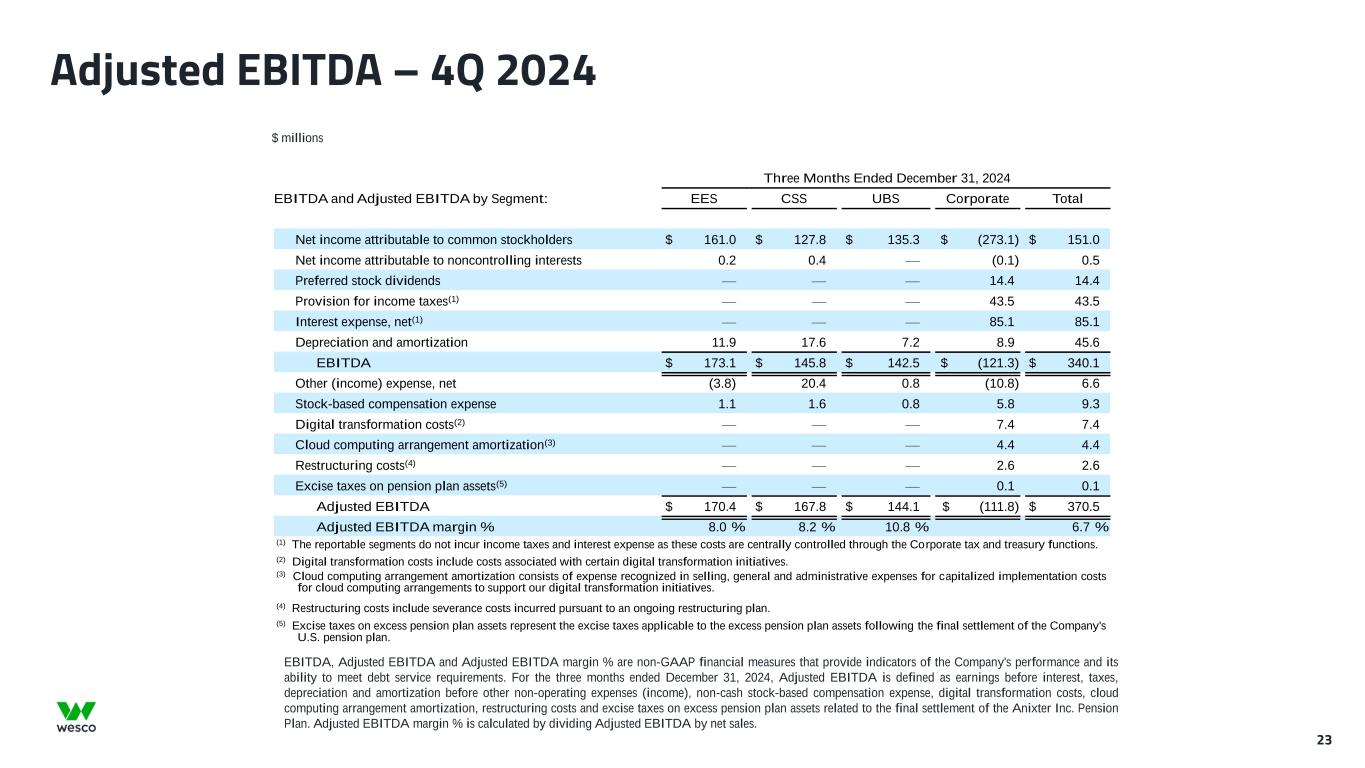

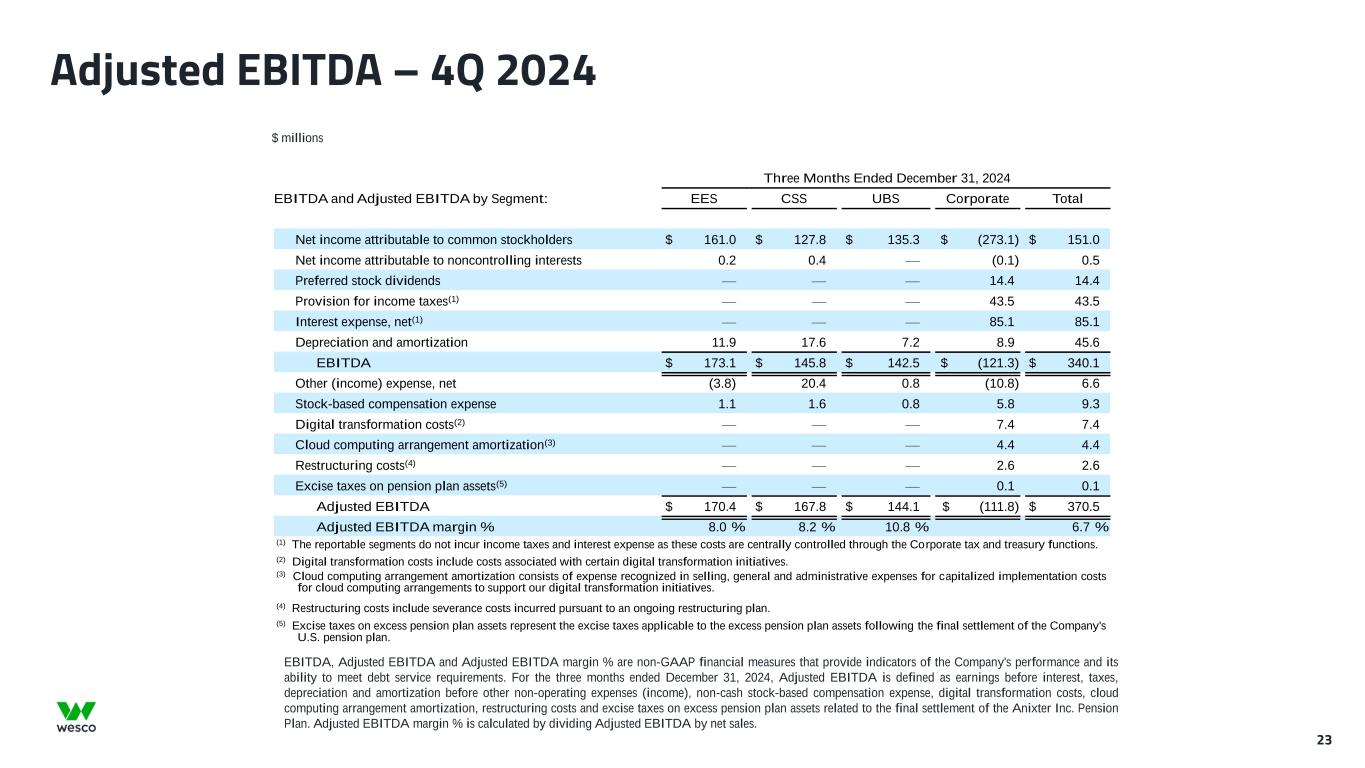

23 Adjusted EBITDA – 4Q 2024 $ millions Three Months Ended December 31, 2024 EBITDA and Adjusted EBITDA by Segment: EES CSS UBS Corporate Total Net income attributable to common stockholders $ 161.0 $ 127.8 $ 135.3 $ (273.1) $ 151.0 Net income attributable to noncontrolling interests 0.2 0.4 — (0.1) 0.5 Preferred stock dividends — — — 14.4 14.4 Provision for income taxes(1) — — — 43.5 43.5 Interest expense, net(1) — — — 85.1 85.1 Depreciation and amortization 11.9 17.6 7.2 8.9 45.6 EBITDA $ 173.1 $ 145.8 $ 142.5 $ (121.3) $ 340.1 Other (income) expense, net (3.8) 20.4 0.8 (10.8) 6.6 Stock-based compensation expense 1.1 1.6 0.8 5.8 9.3 Digital transformation costs(2) — — — 7.4 7.4 Cloud computing arrangement amortization(3) — — — 4.4 4.4 Restructuring costs(4) — — — 2.6 2.6 Excise taxes on pension plan assets(5) — — — 0.1 0.1 Adjusted EBITDA $ 170.4 $ 167.8 $ 144.1 $ (111.8) $ 370.5 Adjusted EBITDA margin % 8.0 % 8.2 % 10.8 % 6.7 % (1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. (2) Digital transformation costs include costs associated with certain digital transformation initiatives. (3) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. (4) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. (5) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. For the three months ended December 31, 2024, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, cloud computing arrangement amortization, restructuring costs and excise taxes on excess pension plan assets related to the final settlement of the Anixter Inc. Pension Plan. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

24 Adjusted EBITDA – 4Q 2023 $ millions Three Months Ended December 31, 2023 EBITDA and Adjusted EBITDA by Segment: EES CSS UBS Corporate Total Net income attributable to common stockholders $ 152.4 $ 117.4 $ 160.4 $ (302.6) $ 127.6 Net income (loss) attributable to noncontrolling interests 0.3 0.6 — (0.3) 0.6 Preferred stock dividends — — — 14.4 14.4 Provision for income taxes(1) — — — 65.7 65.7 Interest expense, net(1) — — — 97.0 97.0 Depreciation and amortization 11.0 17.8 6.3 9.7 44.8 EBITDA $ 163.7 $ 135.8 $ 166.7 $ (116.1) $ 350.1 Other (income) expense, net (1.8) 36.1 (0.9) (22.9) 10.5 Stock-based compensation expense 2.1 1.4 0.8 9.1 13.4 Digital transformation costs(2) — — — 7.6 7.6 Merger-related and integration costs(3) — — — 2.4 2.4 Restructuring costs(4) — — — 1.3 1.3 Adjusted EBITDA $ 164.0 $ 173.3 $ 166.6 $ (118.6) $ 385.3 Adjusted EBITDA margin % 7.9 % 9.7 % 10.4 % 7.0 % (1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. (2) Digital transformation costs include costs associated with certain digital transformation initiatives. (3) Merger-related and integration costs include integration and professional fees associated with the integration of Wesco and Anixter, as well as advisory, legal, and separation costs associated with the merger between the two companies. (4) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. For the three months ended December 31, 2023, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, merger-related and integration costs, and restructuring costs. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

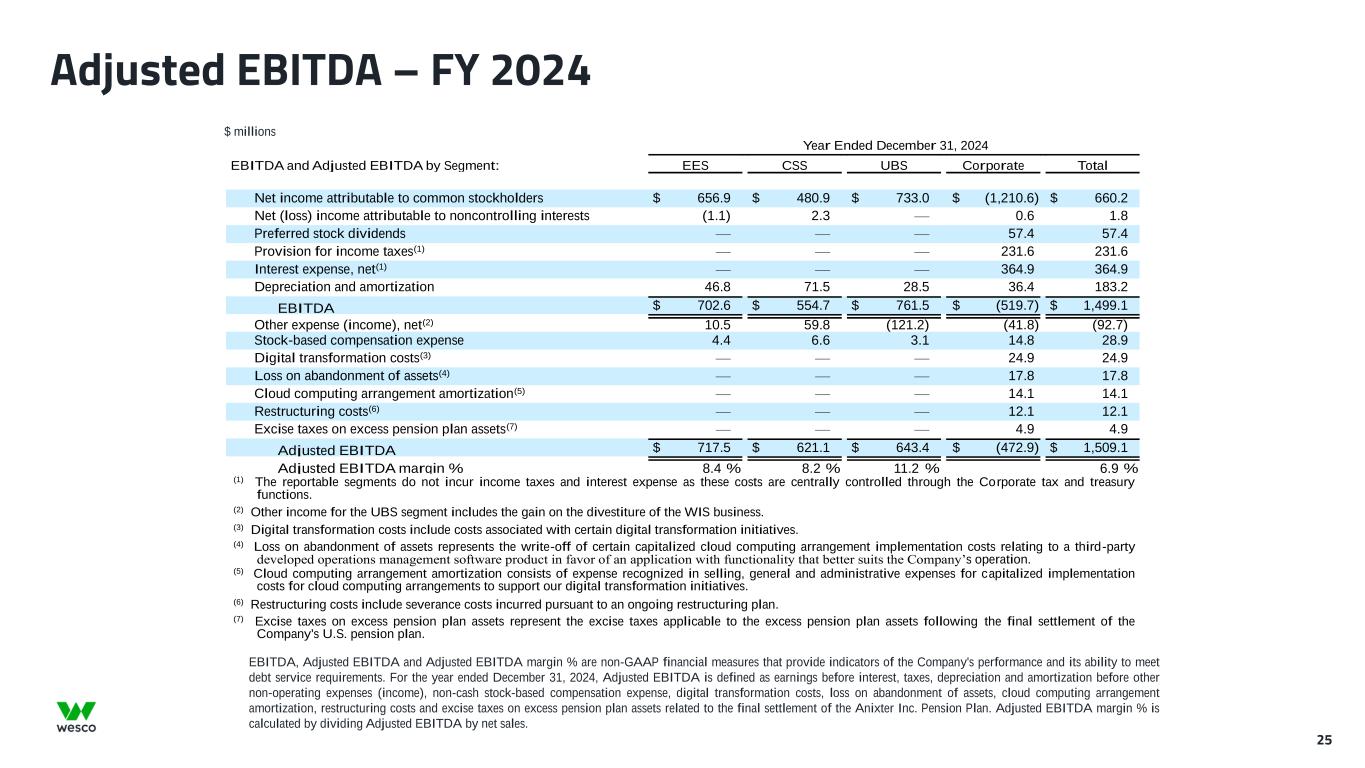

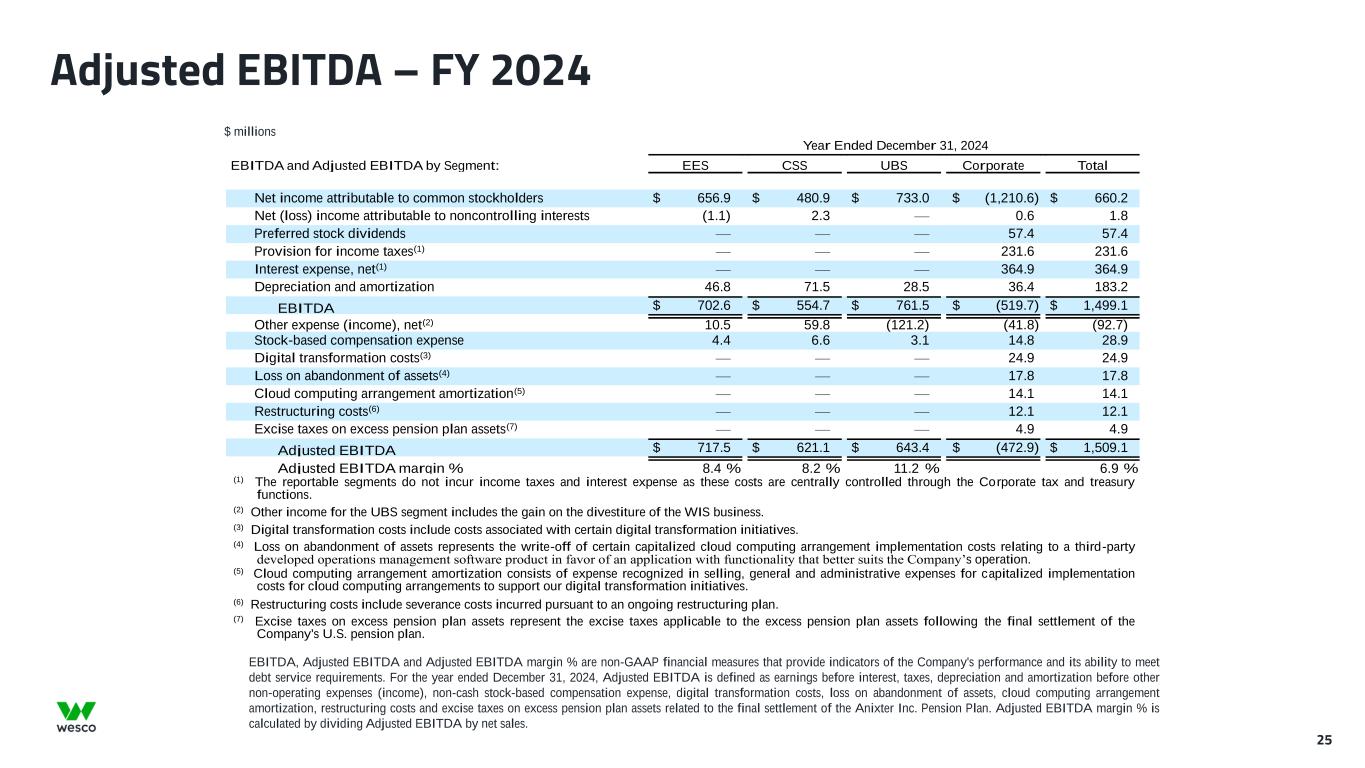

25 Adjusted EBITDA – FY 2024 $ millions Year Ended December 31, 2024 EBITDA and Adjusted EBITDA by Segment: EES CSS UBS Corporate Total Net income attributable to common stockholders $ 656.9 $ 480.9 $ 733.0 $ (1,210.6) $ 660.2 Net (loss) income attributable to noncontrolling interests (1.1) 2.3 — 0.6 1.8 Preferred stock dividends — — — 57.4 57.4 Provision for income taxes(1) — — — 231.6 231.6 Interest expense, net(1) — — — 364.9 364.9 Depreciation and amortization 46.8 71.5 28.5 36.4 183.2 EBITDA $ 702.6 $ 554.7 $ 761.5 $ (519.7) $ 1,499.1 Other expense (income), net(2) 10.5 59.8 (121.2) (41.8) (92.7) Stock-based compensation expense 4.4 6.6 3.1 14.8 28.9 Digital transformation costs(3) — — — 24.9 24.9 Loss on abandonment of assets(4) — — — 17.8 17.8 Cloud computing arrangement amortization(5) — — — 14.1 14.1 Restructuring costs(6) — — — 12.1 12.1 Excise taxes on excess pension plan assets(7) — — — 4.9 4.9 Adjusted EBITDA $ 717.5 $ 621.1 $ 643.4 $ (472.9) $ 1,509.1 Adjusted EBITDA margin % 8.4 % 8.2 % 11.2 % 6.9 % (1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. (2) Other income for the UBS segment includes the gain on the divestiture of the WIS business. (3) Digital transformation costs include costs associated with certain digital transformation initiatives. (4) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operation. (5) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. (6) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. (7) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. For the year ended December 31, 2024, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, loss on abandonment of assets, cloud computing arrangement amortization, restructuring costs and excise taxes on excess pension plan assets related to the final settlement of the Anixter Inc. Pension Plan. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

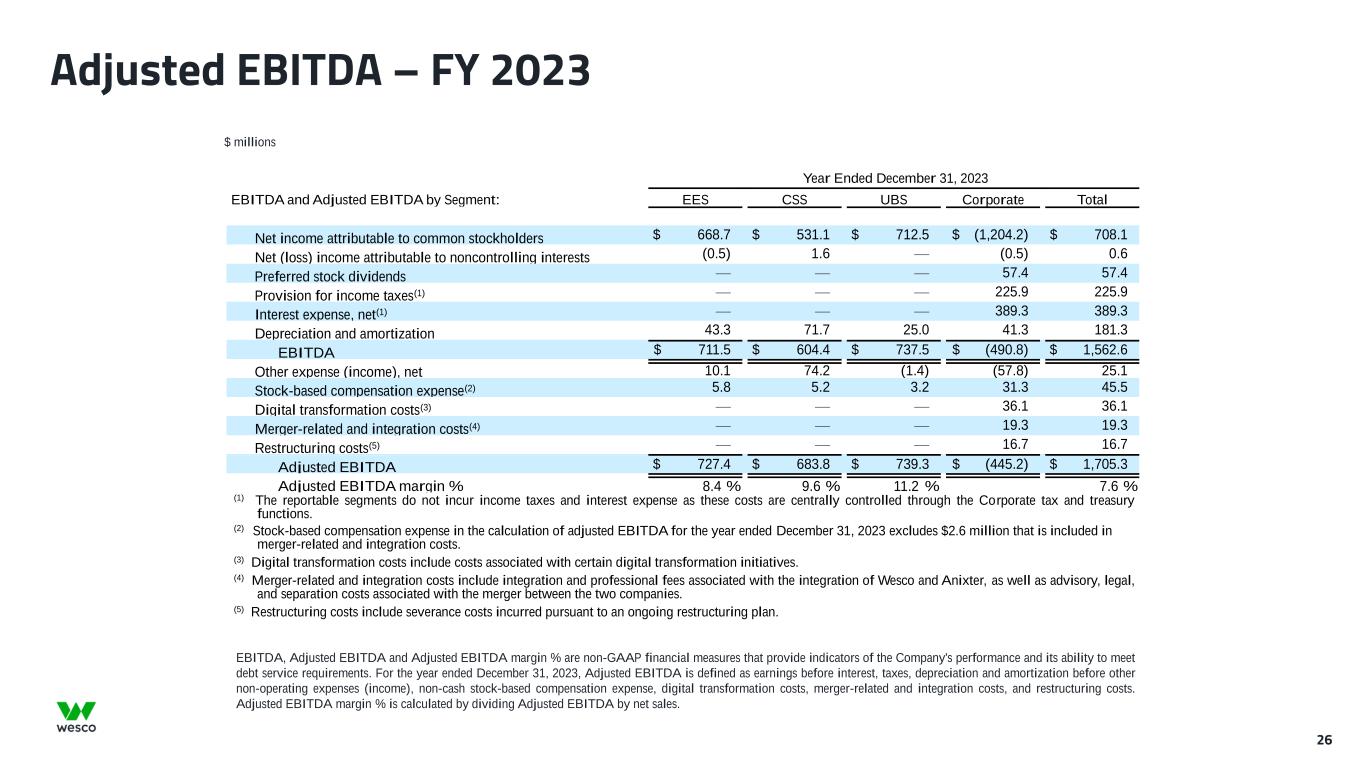

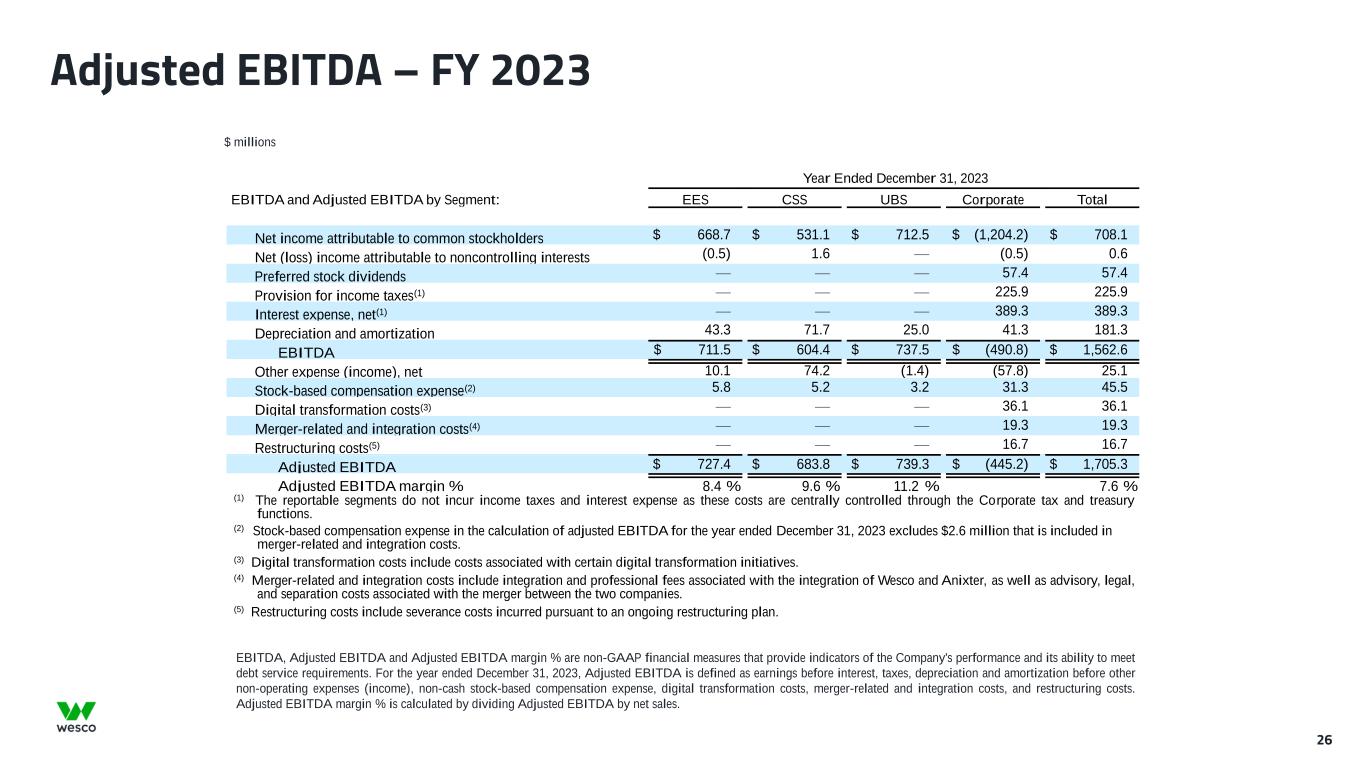

26 Adjusted EBITDA – FY 2023 Year Ended December 31, 2023 EBITDA and Adjusted EBITDA by Segment: EES CSS UBS Corporate Total Net income attributable to common stockholders $ 668.7 $ 531.1 $ 712.5 $ (1,204.2) $ 708.1 Net (loss) income attributable to noncontrolling interests (0.5) 1.6 — (0.5) 0.6 Preferred stock dividends — — — 57.4 57.4 Provision for income taxes(1) — — — 225.9 225.9 Interest expense, net(1) — — — 389.3 389.3 Depreciation and amortization 43.3 71.7 25.0 41.3 181.3 EBITDA $ 711.5 $ 604.4 $ 737.5 $ (490.8) $ 1,562.6 Other expense (income), net 10.1 74.2 (1.4) (57.8) 25.1 Stock-based compensation expense(2) 5.8 5.2 3.2 31.3 45.5 Digital transformation costs(3) — — — 36.1 36.1 Merger-related and integration costs(4) — — — 19.3 19.3 Restructuring costs(5) — — — 16.7 16.7 Adjusted EBITDA $ 727.4 $ 683.8 $ 739.3 $ (445.2) $ 1,705.3 Adjusted EBITDA margin % 8.4 % 9.6 % 11.2 % 7.6 % (1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. (2) Stock-based compensation expense in the calculation of adjusted EBITDA for the year ended December 31, 2023 excludes $2.6 million that is included in merger-related and integration costs. (3) Digital transformation costs include costs associated with certain digital transformation initiatives. (4) Merger-related and integration costs include integration and professional fees associated with the integration of Wesco and Anixter, as well as advisory, legal, and separation costs associated with the merger between the two companies. (5) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. $ millions EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. For the year ended December 31, 2023, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, merger-related and integration costs, and restructuring costs. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

27 $ millions Adjusted SG&A and Income from Operations Three Months Ended Twelve Months Ended Adjusted SG&A Expenses: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Selling, general and administrative expenses $ 817.3 $ 810.1 $ 3,306.2 $ 3,256.0 Digital transformation costs(1) (7.4) (7.6) (24.9) (36.1) Loss on abandonment of assets(2) — — (17.8) — Restructuring costs(3) (2.6) (1.3) (12.1) (16.7) Excise taxes on excess pension plan assets(4) (0.1) — (4.9) — Merger-related and integration costs(5) — (2.4) — (19.3) Adjusted selling, general and administrative expenses $ 807.2 $ 798.8 $ 3,246.5 $ 3,183.9 % of net sales 14.7 % 14.6 % 14.9 % 14.2 % Adjusted Income from Operations: Income from operations $ 301.1 $ 315.8 $ 1,223.2 $ 1,406.4 Digital transformation costs(1) 7.4 7.6 24.9 36.1 Loss on abandonment of assets(2) — — 17.8 — Restructuring costs(3) 2.6 1.3 12.1 16.7 Excise taxes on excess pension plan assets(4) 0.1 — 4.9 — Merger-related and integration costs(5) — 2.4 — 19.3 Accelerated trademark amortization(6) — 0.4 — 1.6 Adjusted income from operations $ 311.2 $ 327.5 $ 1,282.9 $ 1,480.1 Adjusted income from operations margin % 5.7 % 6.0 % 5.9 % 6.6 % Adjusted Other Expense (Income), net: Other expense (income), net $ 6.6 $ 10.5 $ (92.7) $ 25.1 Gain on divestiture — — 122.2 — Loss on termination of business arrangement(7) 0.2 — (3.6) — Pension settlement cost(8) 0.8 (2.8) (2.5) (2.8) Adjusted other expense, net $ 7.6 $ 7.7 $ 23.4 $ 22.3 Adjusted Provision for Income Taxes: Provision for income taxes $ 43.5 $ 65.7 $ 231.6 $ 225.9 Income tax effect of adjustments to income from operations and other expense (income), net(9) 2.7 4.2 (14.8) 21.0 Adjusted provision for income taxes $ 46.2 $ 69.9 $ 216.8 $ 246.9 (1) Digital transformation costs include costs associated with certain digital transformation initiatives. (2) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operations. (3) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. (4) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan. (5) Merger-related and integration costs include integration and professional fees associated with the integration of Wesco and Anixter, as well as advisory, legal, and separation costs associated with the merger between the two companies. (6) Accelerated trademark amortization represents additional amortization expense resulting from changes in the estimated useful lives of certain legacy trademarks that have migrated to our master brand architecture. (7) Loss on termination of business arrangement represents the loss recognized as a result of management's decision to terminate a business arrangement with a third party. (8) For the year ended December 31, 2024, pension settlement cost represents expense related to the final settlement of the Company's U.S. pension plan. For the year ended December 31, 2023, pension settlement cost represents expense related to the partial settlement of the Company's U.S. pension plan, partially offset by pension settlement gains related to other plans. (9) The adjustments to income from operations and other expense (income), net have been tax effected at rates of 29.7% and 26.2% for the three and twelve months ended December 31, 2024, respectively, and 29.0% and 27.5% for the three and twelve months ended December 31, 2023, respectively.

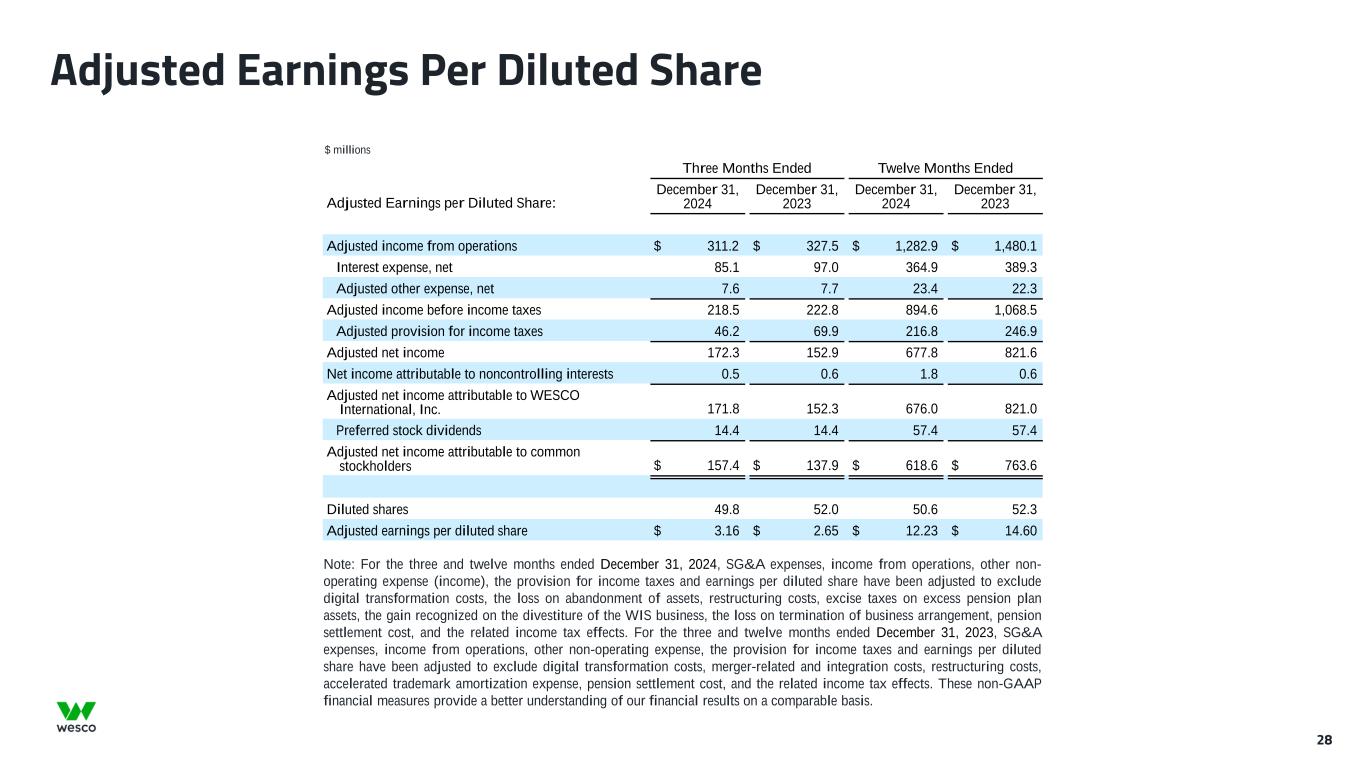

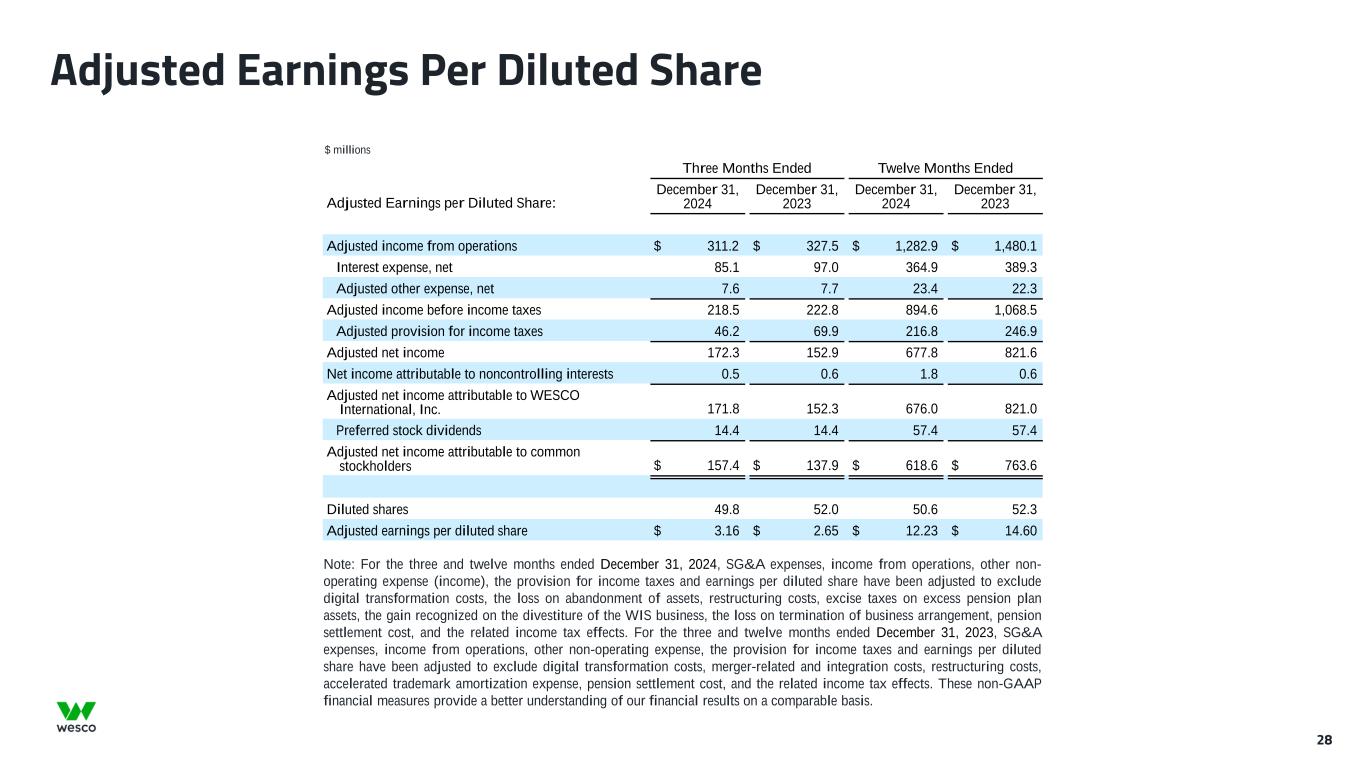

Adjusted Earnings Per Diluted Share 28 $ millions Three Months Ended Twelve Months Ended Adjusted Earnings per Diluted Share: December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Adjusted income from operations $ 311.2 $ 327.5 $ 1,282.9 $ 1,480.1 Interest expense, net 85.1 97.0 364.9 389.3 Adjusted other expense, net 7.6 7.7 23.4 22.3 Adjusted income before income taxes 218.5 222.8 894.6 1,068.5 Adjusted provision for income taxes 46.2 69.9 216.8 246.9 Adjusted net income 172.3 152.9 677.8 821.6 Net income attributable to noncontrolling interests 0.5 0.6 1.8 0.6 Adjusted net income attributable to WESCO International, Inc. 171.8 152.3 676.0 821.0 Preferred stock dividends 14.4 14.4 57.4 57.4 Adjusted net income attributable to common stockholders $ 157.4 $ 137.9 $ 618.6 $ 763.6 Diluted shares 49.8 52.0 50.6 52.3 Adjusted earnings per diluted share $ 3.16 $ 2.65 $ 12.23 $ 14.60 Note: For the three and twelve months ended December 31, 2024, SG&A expenses, income from operations, other non- operating expense (income), the provision for income taxes and earnings per diluted share have been adjusted to exclude digital transformation costs, the loss on abandonment of assets, restructuring costs, excise taxes on excess pension plan assets, the gain recognized on the divestiture of the WIS business, the loss on termination of business arrangement, pension settlement cost, and the related income tax effects. For the three and twelve months ended December 31, 2023, SG&A expenses, income from operations, other non-operating expense, the provision for income taxes and earnings per diluted share have been adjusted to exclude digital transformation costs, merger-related and integration costs, restructuring costs, accelerated trademark amortization expense, pension settlement cost, and the related income tax effects. These non-GAAP financial measures provide a better understanding of our financial results on a comparable basis.

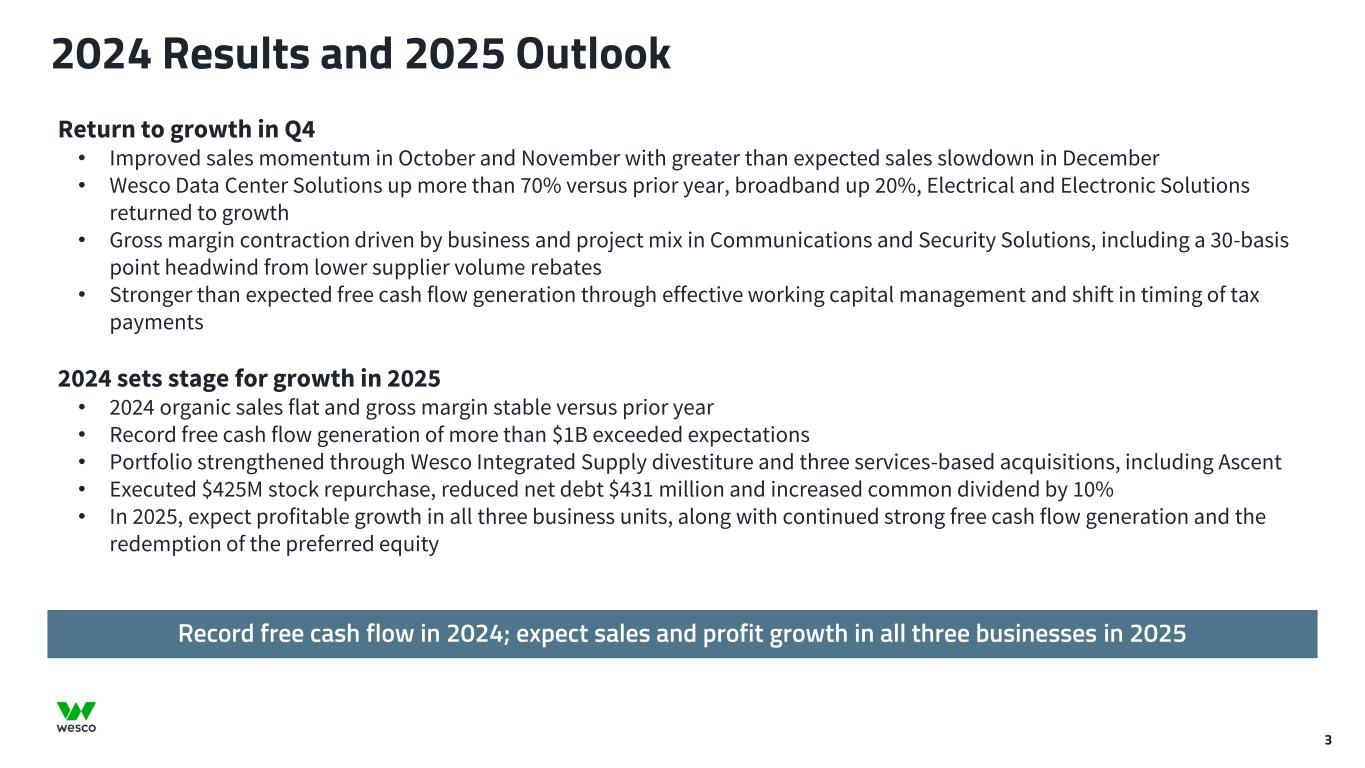

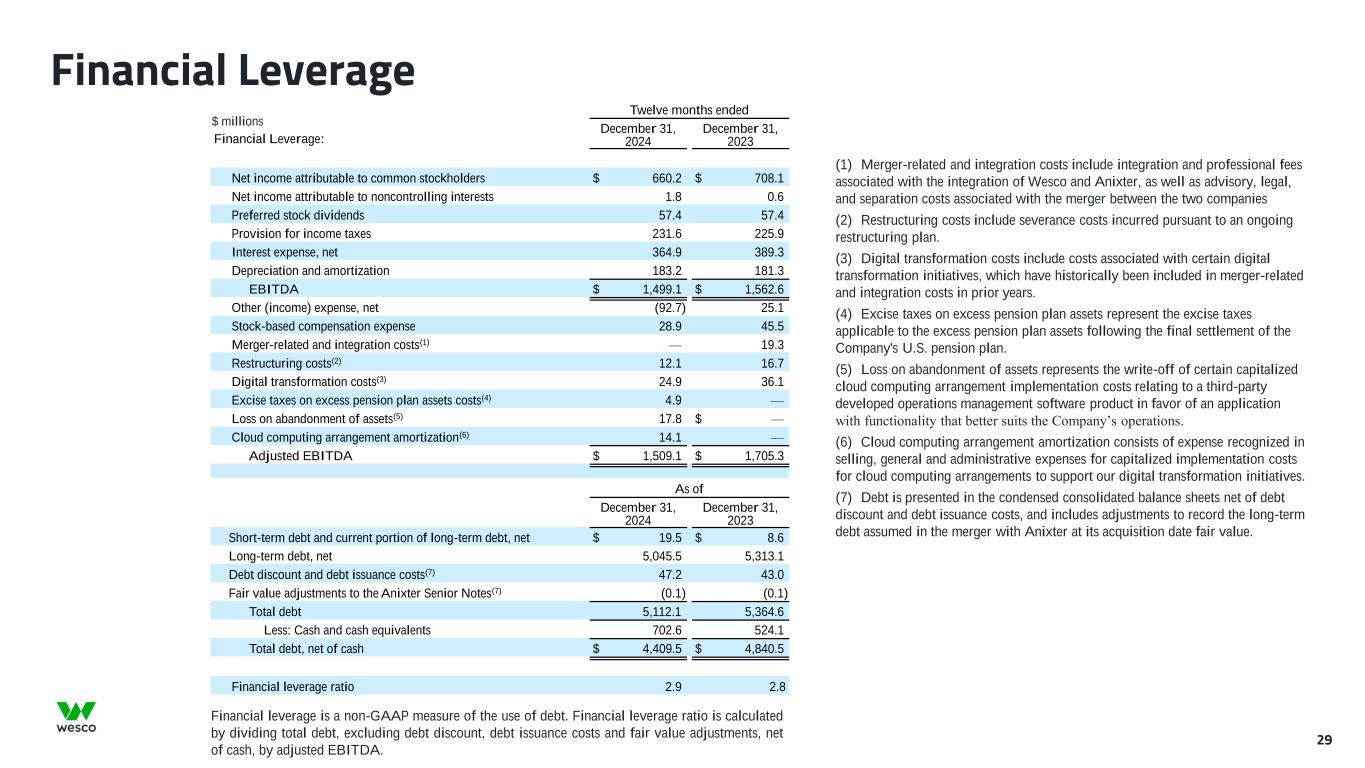

Twelve months ended Financial Leverage: December 31, 2024 December 31, 2023 Net income attributable to common stockholders $ 660.2 $ 708.1 Net income attributable to noncontrolling interests 1.8 0.6 Preferred stock dividends 57.4 57.4 Provision for income taxes 231.6 225.9 Interest expense, net 364.9 389.3 Depreciation and amortization 183.2 181.3 EBITDA $ 1,499.1 $ 1,562.6 Other (income) expense, net (92.7) 25.1 Stock-based compensation expense 28.9 45.5 Merger-related and integration costs(1) — 19.3 Restructuring costs(2) 12.1 16.7 Digital transformation costs(3) 24.9 36.1 Excise taxes on excess pension plan assets costs(4) 4.9 — Loss on abandonment of assets(5) 17.8 $ — Cloud computing arrangement amortization(6) 14.1 — Adjusted EBITDA $ 1,509.1 $ 1,705.3 As of December 31, 2024 December 31, 2023 Short-term debt and current portion of long-term debt, net $ 19.5 $ 8.6 Long-term debt, net 5,045.5 5,313.1 Debt discount and debt issuance costs(7) 47.2 43.0 Fair value adjustments to the Anixter Senior Notes(7) (0.1) (0.1) Total debt 5,112.1 5,364.6 Less: Cash and cash equivalents 702.6 524.1 Total debt, net of cash $ 4,409.5 $ 4,840.5 Financial leverage ratio 2.9 2.8 Financial Leverage 29 $ millions (1) Merger-related and integration costs include integration and professional fees associated with the integration of Wesco and Anixter, as well as advisory, legal, and separation costs associated with the merger between the two companies (2) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. (3) Digital transformation costs include costs associated with certain digital transformation initiatives, which have historically been included in merger-related and integration costs in prior years. (4) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan. (5) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operations. (6) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. (7) Debt is presented in the condensed consolidated balance sheets net of debt discount and debt issuance costs, and includes adjustments to record the long-term debt assumed in the merger with Anixter at its acquisition date fair value. Financial leverage is a non-GAAP measure of the use of debt. Financial leverage ratio is calculated by dividing total debt, excluding debt discount, debt issuance costs and fair value adjustments, net of cash, by adjusted EBITDA.