- WCC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

WESCO International (WCC) 8-KRegulation FD Disclosure

Filed: 16 Nov 11, 12:00am

Exhibit 99.1

Exhibit 99.1

Citi 2011 Small/Mid-Cap Conference

WESCO

John Engel

Chairman, President and Chief Executive Officer

November 2011

Safe Harbor Statement

Note: All statements made herein that are not historical facts should be considered as

“forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to, debt level, changes in general economic conditions, fluctuations in interest rates, increases in raw materials and labor costs, levels of competition and other factors described in detail in Form 10-K for WESCO International, Inc. for the year ended December 31, 2010 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do

not represent guidance by management and should not be construed as such.

2 |

| November 2011 |

WESCO Profile

Vision

Global Leader of

Supply Chain Solutions

that consistently delivers

Superior Customer Value

and Shareholder Returns

Known for the best customer service

Fortune 500 Company (NYSE: WCC) and the best people

Headquartered in Pittsburgh, PA

Approximately 7,000 employees Customer

Value Proposition

Over 400 locations in 16 countries

Providing customers the

A leading provider of electrical, industrial, and communications

products and supply chain

MRO and OEM products, construction materials and advanced

services they need for

supply chain management and logistics services

• MRO

Serving over 100,000 customers

• OEM

Partnering with 17,000 suppliers

• Capital Projects

Over 1,000,000 different products shipped annually

International operations and global sourcing capabilities …an industry leader

3 |

| November 2011 |

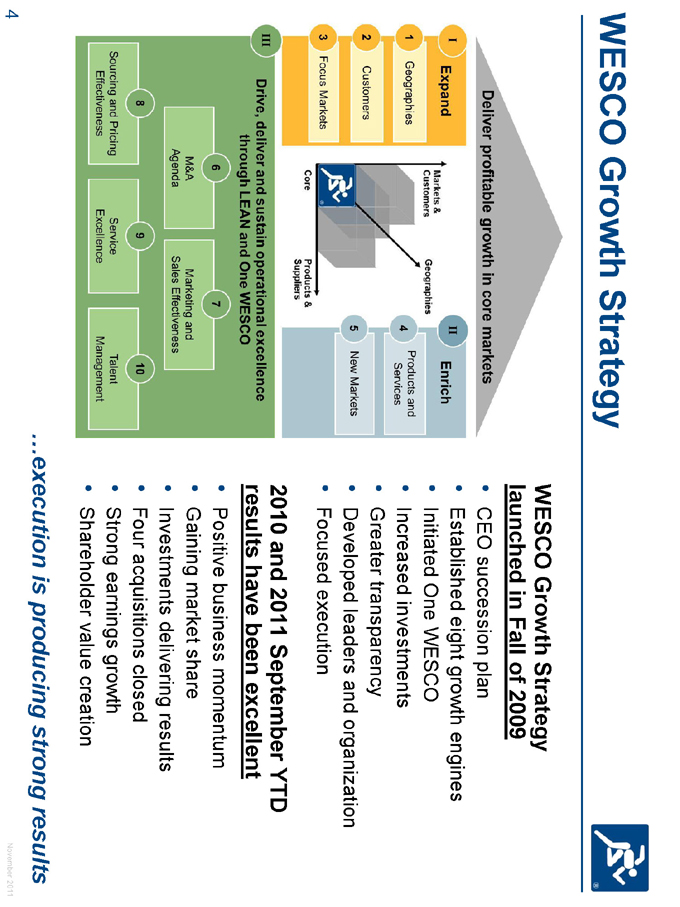

WESCO Growth Strategy

WESCO Growth Strategy launched in Fall of 2009

• CEO succession plan

• Established eight growth engines

• Initiated One WESCO

• Increased investments

• Greater transparency

• Developed leaders and organization

• Focused execution

2010 and 2011 September YTD results have been excellent

• Positive business momentum

• Gaining market share

• Investments delivering results

• Four acquisitions closed

• Strong earnings growth

• Shareholder value creation

…execution is producing strong results

4 |

| November 2011 |

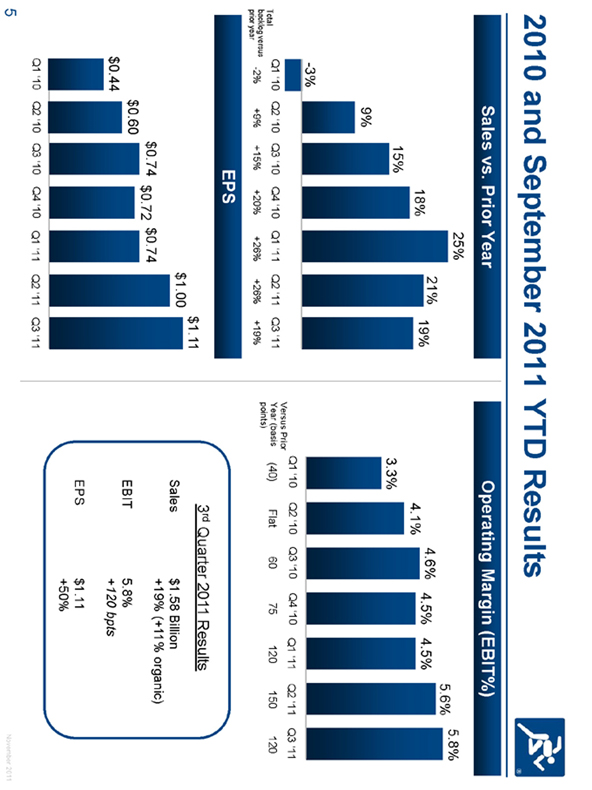

2010 and September 2011 YTD Results

25%

18% 21% 19%

15%

9%

-3%

4.1%

3.3%

5.6% |

| 5.8% |

4.6% |

| 4.5% 4.5% |

Total Q1 „10 Q2 „10 Q3 „10 Q4 „10 Q1 „11 Q2 „11 Q3 „11

backlog versus -2% +9% +15% +20% +26% +26% +19%

prior year

$1.00 |

| $1.11 |

$0.60 |

| $0.74 $0.72 $0.74 |

$0.44

Q1 „10 Q2 „10 Q3 „10 Q4 „10 Q1 „11 Q2 „11 Q3 „11

5 |

|

[GRAPHIC APPEARS HERE]

Versus Prior Q1 „10 Q2 „10 Q3 „10 Q4 „10 Q1 „11 Q2 „11 Q3 „11

Year (basis(40) Flat 60 75 120 150 120

points)

3rd Quarter 2011 Results

Sales $1.58 Billion

+19% (+11% organic)

EBIT 5.8%

+120 bpts

EPS $1.11

+50%

November 2011

WESCO Portfolio

Portfolio expanded and strengthened over last 17 years…

Captive Distributor (1922-1994)

175 branches in U.S. and Canada with

over 80% non-residential construction

market exposure and

limited supply relationships other than Westinghouse

Over $1B in annual communications products with the addition of TVC versus less than $100M five years ago

Markets & Customers

Construction Utility

• Non-Residential • Investor Owned

Electrical • Public Power

Data Communications • Utility Contractors

• Program Management

11%

Industrial CIG

• Global Accounts • Commercial

• Integrated Supply • Institutional

• MRO & OEM • Government

• Industrial Capex

Products & Services

Wire, Cable & Distribution Equipment

Conduit

Lighting &

Data & Controls

Broadband

Communications Controls &

Motors

General Supplies

…by diversifying markets, customer base, product lines, and suppliers

6 |

| November 2011 |

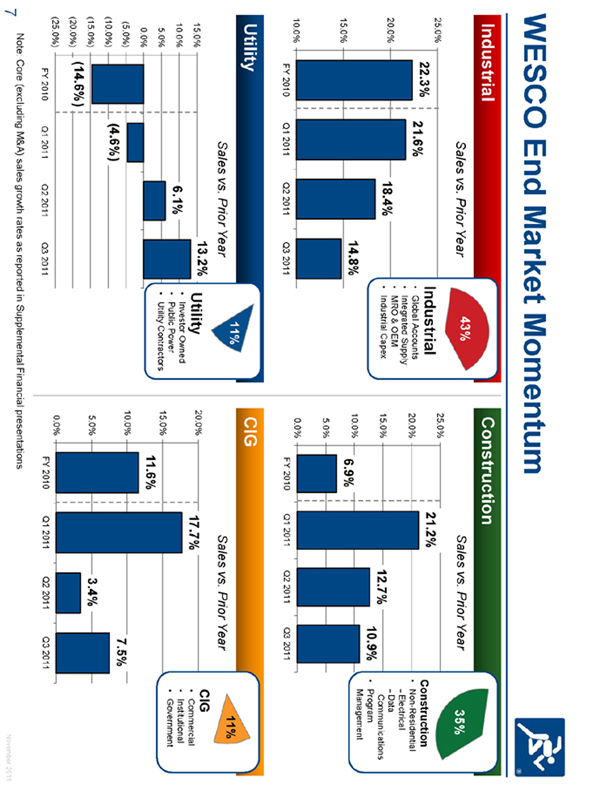

WESCO End Market Momentum

Sales vs. Prior Year 43%

25.0% |

| Industrial |

22.3% |

| 21.6% |

• Global Accounts

• Integrated Supply

20.0% |

| 18.4% • MRO & OEM |

• Industrial Capex

15.0% |

| 14.8% |

10.0%

FY 2010 Q1 2011 Q2 2011 Q3 2011

11%

[GRAPHIC APPEARS HERE] Sales vs. Prior Year

Sales vs. Prior Year 35%

25.0% |

| 21.2% |

Construction

20.0% |

| • Non-Residential |

Electrical

15.0% |

| 12.7% Data |

Communications

10.9%

• Program

10.0% |

| Management |

6.9%

5.0%

0.0%

FY 2010 Q1 2011 Q2 2011 Q3 2011

[GRAPHIC APPEARS HERE]

11%

Sales vs. Prior Year

15.0% |

| 13.2% |

10.0% |

| 6.1% |

5.0%

0.0%

(5.0%)

(10.0%)(4.6%)

(15.0%)

(20.0%)(14.6%)

(25.0%)

FY 2010 Q1 2011 Q2 2011 Q3 2011

Utility

Investor Owned

Public Power

Utility Contractors

20.0% |

| 17.7% CIG |

• Commercial

• Institutional

15.0% |

| • Government |

11.6%

10.0% |

| 7.5% |

5.0% |

| 3.4% |

0.0%

FY 2010 Q1 2011 Q2 2011 Q3 2011

7 |

|

Note: Core (excluding M&A) sales growth rates as reported in Supplemental Financial presentations

November 2011

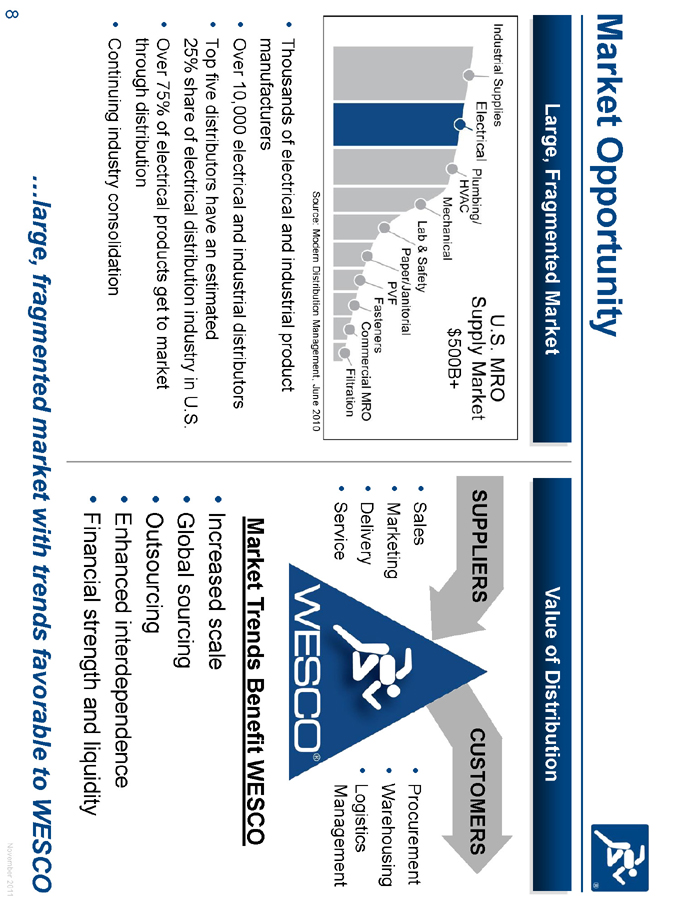

Market Opportunity

$500B+

Source: Modern Distribution Management, June 2010

Thousands of electrical and industrial product manufacturers

Over 10,000 electrical and industrial distributors

Top five distributors have an estimated

25% share of electrical distribution industry in U.S.

Over 75% of electrical products get to market through distribution

Continuing industry consolidation

SUPPLIERS CUSTOMERS

• Sales • Procurement

• Marketing • Warehousing

• Delivery • Logistics

• Service Management

Market Trends Benefit WESCO

Increased scale

Global sourcing

Outsourcing

Enhanced interdependence

Financial strength and liquidity

…large, fragmented market with trends favorable to WESCO

8 |

| November 2011 |

Growth Engines

I Expand

1 |

| Geographies |

2 |

| Customers |

3 |

| Focus Markets |

II Enrich

BUSINESS MODELS

Global Accounts &

Integrated Supply

Global Accounts

Provides comprehensive supply chain solutions to Fortune 1000 and other

END MARKETS PRODUCT CATEGORIES

[GRAPHIC APPEARS HERE]

Construction Communications

& Security

Government

4 |

| Products |

and Services

5 |

| New Markets |

III Drive

6 |

| M&A Agenda |

multi-site companies for their MRO, OEM, and capital expenditure needs

Integrated Supply

Provides turnkey outsourcing solutions for MRO and OEM procurement and other supply chain needs

Utility

Lighting &

Sustainability

CAPABILITIES

[GRAPHIC APPEARS HERE]

International M&A Agenda

…improve our position in core markets while expanding through acquisitions

9 November 2011

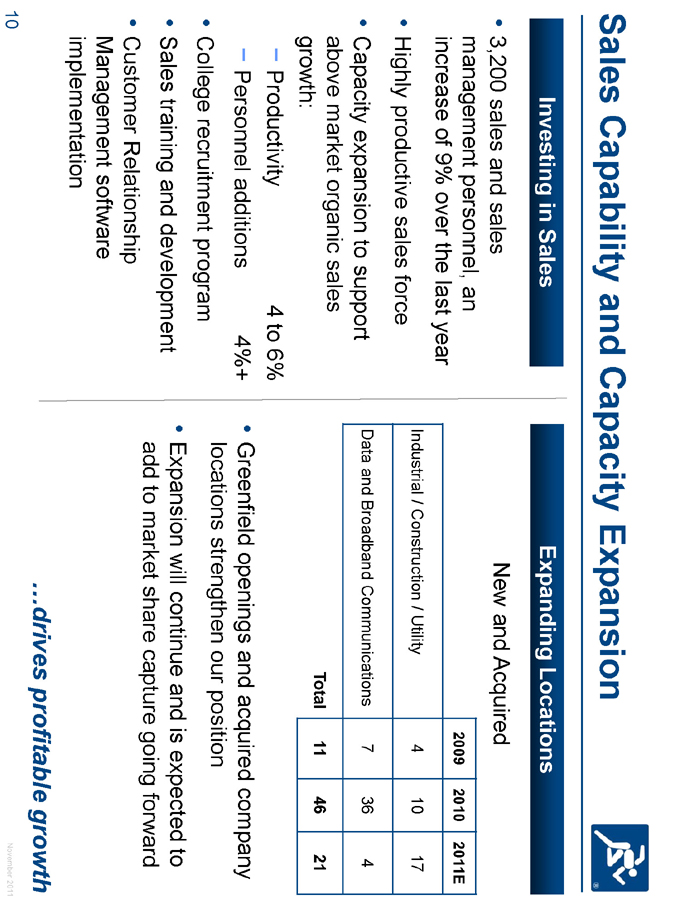

Sales Capability and Capacity Expansion

3,200 sales and sales management personnel, an increase of 9% over the last year

Highly productive sales force

Capacity expansion to support above market organic sales growth:

Productivity 4 to 6%

Personnel additions 4%+

College recruitment program

Sales training and development

Customer Relationship Management software implementation

10

New and Acquired

2009 2010 2011E

Industrial / Construction / Utility 4 10 17

Data and Broadband Communications 7 36 4

Total 11 46 21

Greenfield openings and acquired company locations strengthen our position

Expansion will continue and is expected to add to market share capture going forward

…drives profitable growth

November 2011

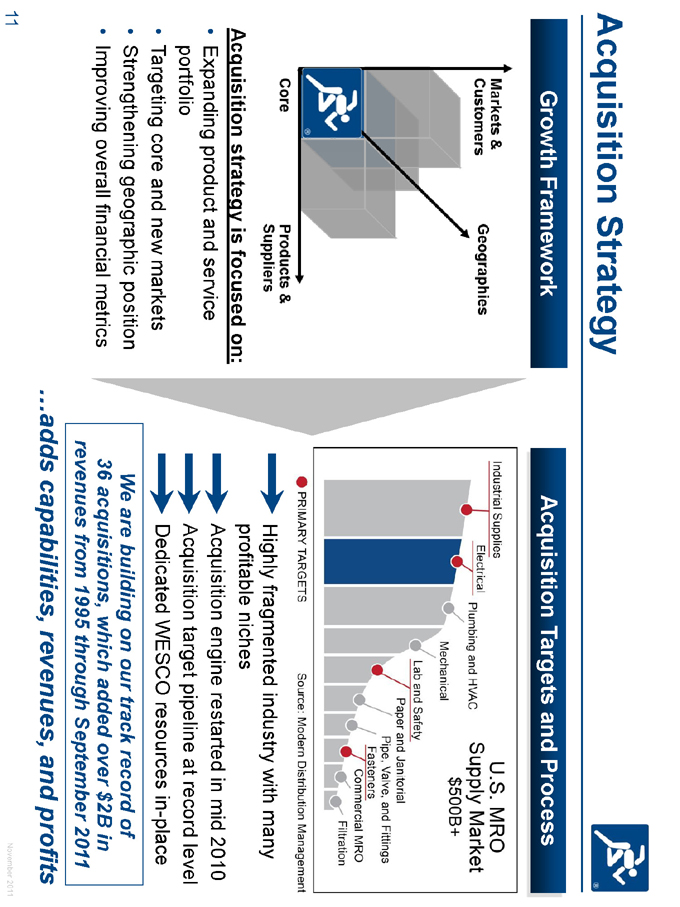

Acquisition Strategy

Acquisition strategy is focused on:

Expanding product and service portfolio

Targeting core and new markets

Strengthening geographic position

Improving overall financial metrics

11

Highly fragmented industry with many profitable niches

Acquisition engine restarted in mid 2010

Acquisition target pipeline at record level Dedicated WESCO resources in-place

We are building on our track record of

36 acquisitions, which added over $2B in revenues from 1995 through September 2011

…adds capabilities, revenues, and profits

November 2011

One WESCO Product and Services Portfolio

Automation and Control

Broadband Communications

Data Communications

Electrical

• Electromechanical

• Electronics

• Industrial MRO and

Consumables

• Lighting

• Network and Physical

Security

• OEM

• Solar

• Utility

• Wind

• Wire and Cable

…comprehensive supply chain solutions for our customers

12 |

| November 2011 |

[GRAPHIC APPEARS HERE]

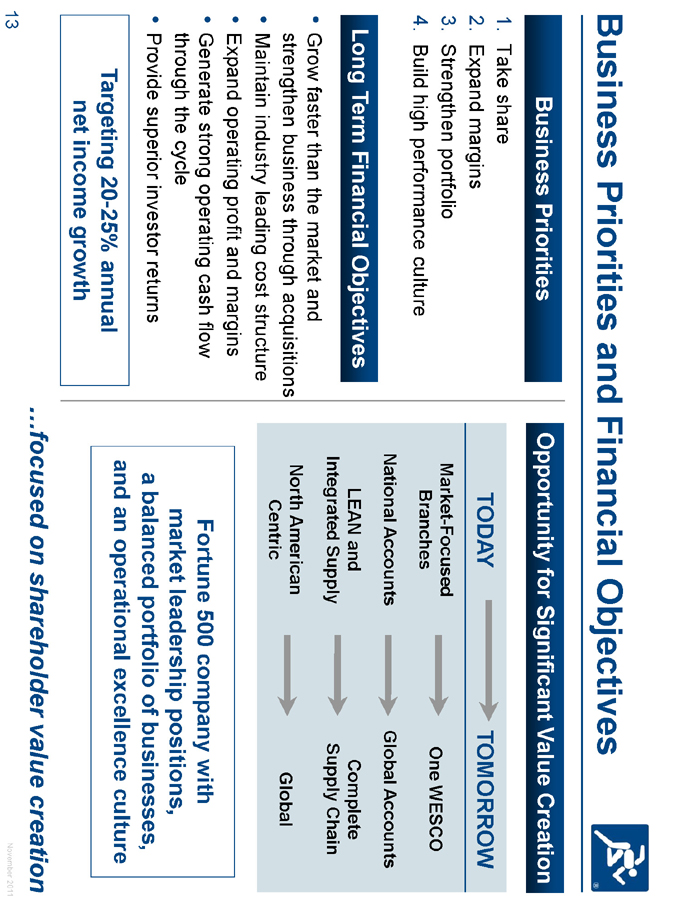

Business Priorities and Financial Objectives

Take share

Expand margins

Strengthen portfolio

Build high performance culture

Grow faster than the market and strengthen business through acquisitions

Maintain industry leading cost structure

Expand operating profit and margins

Generate strong operating cash flow through the cycle

Provide superior investor returns

Targeting 20-25% annual net income growth

TODAY TOMORROW

Market-Focused One WESCO

Branches

National Accounts Global Accounts

LEAN and Complete

Integrated Supply Supply Chain

North American Global

Centric

Fortune 500 company with market leadership positions,

a balanced portfolio of businesses, and an operational excellence culture

…focused on shareholder value creation

13 |

| November 2011 |

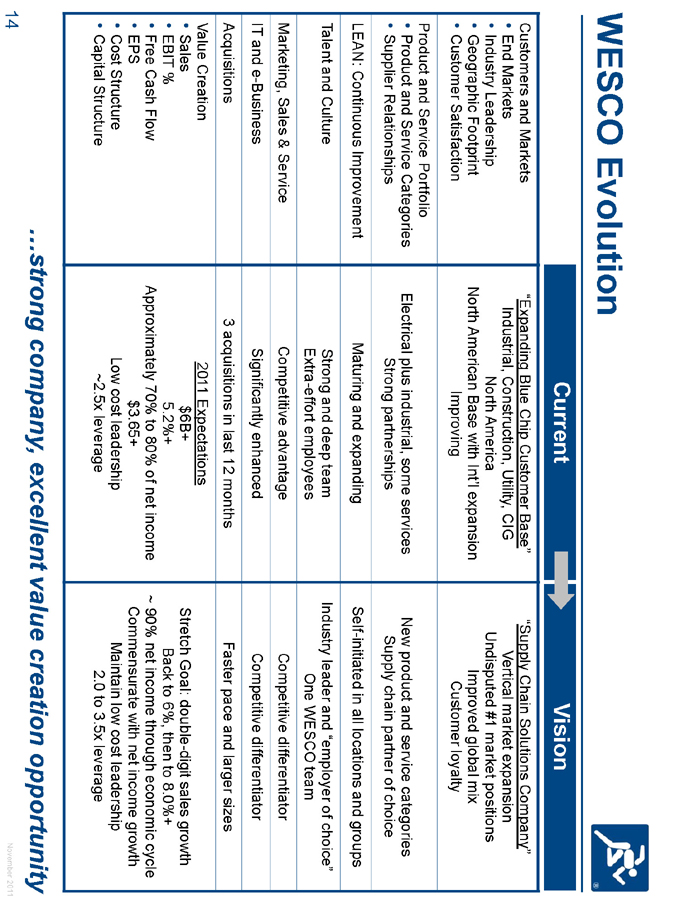

WESCO Evolution

Current Vision

Customers and Markets “Expanding Blue Chip Customer Base” “Supply Chain Solutions Company”

• End Markets Industrial, Construction, Utility, CIG Vertical market expansion

• Industry Leadership North America Undisputed #1 market positions

• Geographic Footprint ot mrcnBs ihItlepnin Improved global mix

• Customer Satisfaction Improving Customer loyalty

Product and Service Portfolio

• Product and Service Categories Electrical plus industrial, some services New product and service categories

• Supplier Relationships Strong partnerships Supply chain partner of choice

LEAN: Continuous Improvement Maturing and expanding Self-initiated in all locations and groups

Talent and Culture Strong and deep team nutylae n “mlyro hie”

Extra-effort employees One WESCO team

Marketing, Sales & Service Competitive advantage Competitive differentiator

IT and e-Business Significantly enhanced Competitive differentiator

Acquisitions 3 acquisitions in last 12 months Faster pace and larger sizes

Value Creation 2011 Expectations

• Sales $6B+ Stretch Goal: double-digit sales growth

• EBIT % 5.2%+ Back to 6%, then to 8.0%+

• Free Cash Flow Approximately 70% to 80% of net income ~ 90% net income through economic cycle

• EPS $3.65+ Commensurate with net income growth

• Cost Structure Low cost leadership Maintain low cost leadership

• Capital Structure ~2.5x leverage 2.0 to 3.5x leverage

[GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE]

…strong company, excellent value creation opportunity

14 |

| November 2011 |

Invest in WESCO

Industry leader with low risk business profile

Proven business model and well positioned in large, fragmented markets

Organic sales growth faster than the market

Operational excellence culture founded on LEAN

Excellent margin expansion results and future potential

Proven acquirer in a consolidating industry

Strong free cash flow generation through economic cycle

…strong company, excellent value creation opportunity

15 |

| November 2011 |

16 |

| November 2011 |