UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2021

Commission File Number 001-13314

Huaneng Power International, Inc.

(Translation of registrant’s name into English)

Huaneng Power International, Inc.

Huaneng Building,

6 Fuxingmennei Street,

Xicheng District,

Beijing, 100031 PRC

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Form 6-K consists of:

1. An announcement regarding 2021 interim results of Huaneng Power International, Inc.(the "Registrant"); and

2. An announcement regarding connected transaction of the Registrant;

Each made by the Registrant on July 28, 2021.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | HUANENG POWER INTERNATIONAL, INC. |

| | |

| | By: | /s/ Huang Chaoquan |

| | Name: | Huang Chaoquan |

| | Title: | Company Secretary |

| | |

| Date: July 29, 2021 | |

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

2021 Interim Results Announcement

| Consolidated operating revenue: | | RMB95.116 billion |

| | | |

| Net profit attributable to equity holders of the Company: | | RMB4.019 billion |

| | | |

| Earnings per share: | | RMB0.19 |

INTERIM RESULTS

The Board of Directors of Huaneng Power International, Inc. (the “Company”) announces the unaudited operating results for the six months ended 30 June 2021 and a comparison with the operating results for the same period of last year. For the six months ended 30 June 2021, the Company and its subsidiaries recorded consolidated operating revenue of RMB95.116 billion, representing an increase of 20.21% compared to the same period of last year. The net profit attributable to equity holders of the Company was RMB4.019 billion, representing a decrease of 26.14% compared to the same period of last year. The earnings per share was RMB0.19. The net asset (excluding equity interests attributable to minority shareholders and other equity instruments) per share was RMB5.16.

Please refer to the unaudited financial information below for details of the operating results.

BUSINESS REVIEW FOR THE FIRST HALF OF THE YEAR

In the first half of the year, based on the new development stage, the Company implemented the new development concept, integrated into the new development pattern and, in accordance with the annual work deployment and requirements, coordinated the epidemic prevention and control, and operation reform and development, achieved the main production and operation performance goals, which have laid a solid foundation for the whole year’s task.

In the first half of the year, the Company’s total electricity sold by the power plants within China on consolidated basis amounted to 207.926 billion kWh, representing an increase of 20.80% over the same period last year. The average utilization hours of the Company’s power plants within China were 1,980 hours, representing an increase of 263 hours over the same period last year. The company’s market-based transaction power ratio was 61.09%, representing an increase of 11.20 percentage points over the same period last year.

The increase in the Company’s power generation was mainly attributable to: the rapid growth in the demand for power in the whole society, which has driven the generation-side electricity consumption to increase significantly year-on-year. Among the Company’s 26 regions, 22 regions have achieved positive year-on-year growth in power generation. Among them, 10 regions including Guangdong, Chongqing, Fujian, Zhejiang, Jiangsu, and Shanghai have achieved growth rates of more than 20%.

In the first half of the year, coal supply and demand were at a high level. However, due to the limited release of domestic production, tight supply of overseas resources, continued improvement in the macro economy, and insufficient clean energy output, the growth of supply fell below the level of demand growth. The price pivot of coal has moved up significantly. The Company scientifically studied and assessed market trends, flexibly adjusted its procurement strategy, strengthened resource development, improved the fulfillment of long-term contract performance, and actively played the role of imported coal to supplement the supply. Thus the supply of thermal coal for Company was generally safe and stable. Notwithstanding the increase in coal price, the industry benchmarking of Company remained advanced.

| 3. | Energy Conservation and Environmental Protection |

In the first half of the year, the Company steadily promoted the three-year action plan for safety production special rectification, heating renovation, energy saving and emission reduction, wastewater treatment in key areas, and closure of coal yards. The safety, economy, and environmental protection operation of power generation units continued to improve, and the Company’s pollutant emission concentration and energy consumption indicators continued to maintain the industry lead. The Company’s cumulative coal consumption for power supply was 288.47 g/kWh, a year-on-year decrease of 2.10 g/kWh; the average emission concentrations of sulfur dioxide, nitrogen oxides, and soot from thermal power units were all better than the ultra-low emission standards. In the national benchmarking of the energy efficiency level of thermal power units released by CEC, the Company has 52 units with good results.

| 4. | Project Development and Construction |

In the first half of the year, the Company proceeded smoothly in the construction of power generation projects, adding 470 MW of wind power controlled generation capacity, 190 MW of solar energy controlled generation capacity, and 30 MW of biomass controlled generation capacity. In the meantime, some of the power plants invested or controlled by the Company underwent changes in capacity. As of June 30, 2021, the Company’s controlled generation capacity was 114,042 MW, and the equity generation capacity was 99,891 MW. Low carbon clean energy (wind power, solar energy, hydro-power, combined cycle, biomass power) accounted for 21.07% of the installed capacity.

In the first half of the year, the accumulated power generation of Tuas Power Ltd. (“Tuas Power”), a wholly-owned subsidiary of the Company in Singapore, accounted for a market share of 20.5%, representing a decrease of 1.0 percentage point compared to the same period last year. The sales revenue was RMB5.667 billion, representing an increase of RMB34 million from RMB5.633 billon of the same period last year. The pre-tax loss of Singapore business was RMB55 million, representing a decrease in pre-tax profit of RMB91 million over the same period last year (pre-tax profit of RMB36 million).

In the first half of the year, the pre-tax profit of the Sahiwal project in Pakistan was RMB407 million, representing an increase of RMB60 million compared to the same period last year.

PROSPECT FOR THE SECOND HALF OF 2021

At present, China’s economic operation continues to run steadily, to reinforce and improve in stability. In the second half of the year, the results of the overall planning of epidemic prevention and control, and economic and social development will continue to expand and consolidate. China’s economy will return from rapid recovery to normalization, and power generation and consumption will continue to maintain rapid growth. The Company will adhere to the general keynote of seeking progress while maintaining stability, adhere to new development concepts, coordinate energy security and green development, deepen supply-side structural reforms, comprehensively promote high-quality development, and further improve safety management and control, improve quality and efficiency, work in such areas as green development, technological innovation, deepening reforms, and overseas project management, and strive to complete the annual goals and tasks.

In terms of the power market, in the second half of the year, the Company will closely follow the power supply and demand situation, conduct in-depth research on regional market conditions, and adjust business strategies in a timely manner. The Company will actively participate in power market reform, increase policy influence, promote the healthy, orderly and sustainable development of the power market, adhere to the overall planning of volume and price, give full play to its own advantages, and enhance the Company’s ability in market response, development ability and competitiveness. On 16 July 2021, the national carbon market was officially launched, covering the Company’s 72 thermal power plants. The Company is accelerating continuously the pace of structural adjustment and energy saving and carbon reduction efforts, and its energy utilization level is in the leading position in the industry, thus facing relatively lower pressure on fulfillment of carbon trading. The Company will continue to strengthen carbon trading management, formulate carbon trading strategies, and try to complete the national carbon market transaction compliance work on schedule at a lower cost.

In terms of the coal market, in the second half of the year, the focus of domestic policies shifted to “steady growth”, and it is expected that the macro economy will be stable and positive, and the electricity load will continue to grow. After hydropower flood period, the demand for peak load of thermal power has further increased, and electricity coal consumption is likely to remain high. At present, safety supervision and environmental protection control are still strict, and the overall supply is relatively tight. However, the recent high coal price has attracted great attention at the national level. Various measures have been taken to ensure supply and stable prices. The policy impacted market for thermal coal will make coal supply gradually increase, with prices stabilizing and correction. The Company will continue to do a good job in coal market analysis and relevant policy interpretation, actively seek policy support, adhere to the principle of gradient procurement, actively improve the fulfillment of long-term contracts, increase the development of overseas high-quality resources, and leverage on the advantages of the internal industrial chain and the coal capacity from Huaneng Group, and strive to ensure the Company’s fuel supply and price control work.

In terms of the capital market, the monetary policy in the second half of the year will maintain continuity, stability, and sustainability, vigorously serve the real economy, and effectively prevent and control financial risks; promote green and low-carbon development, and establish monetary policy tools to support carbon emission reductions, so as to be stably, orderly and precisely support the development of clean energy, energy conservation and environmental protection, and carbon emission reduction technologies. The Company will pay close attention to the capital market, actively manage, prevent risks, and control capital costs.

In the second half of the year, the Company will adhere to the concept of safe development, highlight the safety of production infrastructure, carry out epidemic prevention and control, resolutely prevent various safety incidents. Leading by the goal of carbon peaking and carbon neutrality, the Company will accelerate the pace of green development, increase the development and construction of new energy projects, promote the optimization and upgrade of the coal-fired power structure, continue to increase heating renovation, energy conservation and emission reduction, and actively participate in carbon market transactions; achieve new breakthroughs in transformation and upgrading; deepen the promotion of quality and efficiency enhancement, focus on ensuring the quantity and price of coal, actively do a good job in power marketing, strictly control costs and expenses, and strive to complete the annual operating performance; accelerate the advancement of scientific and technological innovation and strengthen key core technology research and development; deepen the application of intelligent digitalization, and enhance the core competitiveness of the Company; continue to deepen corporate reforms, strengthen and improve corporate governance, improve management efficiency, and stimulate corporate endogenous motivation; promote corporate culture construction, earnestly fulfill social responsibilities, and continue to create long-term, stable and increasing returns to the shareholders of the Company.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Prepared under International Financial Reporting Standards (“IFRS”))

General

The principal activities of the Company are investment in, and construction, operation and management of, power plants within China.

As of 30 June 2021, the Company had a controlled installed capacity of 114,042 MW and an equity-based installed capacity of 99,891 MW, of which approximately 21.07% was from clean energy sources (wind, photovoltaic, hydro, gas turbine and biomass power generation). The Company located its power in 26 provinces, autonomous region and municipalities within China; the Company also owns a wholly owned power enterprise located in Singapore, and invests in a power enterprise located in Pakistan. The Company is among the biggest listed power companies in China.

For the six months ended 30 June 2021, the operating revenue of the Company amounted to RMB95,116 million, representing an increase of 20.21% over the same period of last year. The net profit attributable to equity holders of the Company was RMB4.019 billion, representing a decrease of 26.14% over the same period of last year; the earnings per share was RMB0.19.

| 1. | Operating results of first half of 2021 |

For the second quarter of 2021, the Company’s total electricity sold by power plants within China on consolidated basis amounted to 102.917 billion kWh, representing an increase of 12.51% over the same period last year. In the first half of 2021, the Company’s total electricity sold by power plants within China on consolidated basis amounted to 207.926 billion kWh, representing an increase of 20.80% over the same period last year. In the first half of 2021, the Company’s average on-grid electricity settlement price for its power plants within China amounted to RMB418.81 per MWh, representing an increase of 0.52% over the same period last year. In the first half of 2021, the proportion of the Company’s market based electricity sold amounted to 61.09%, representing an increase of 11.20 percentage points over the same period last year.

The increase in the Company’s power generation was mainly attributable to the facts that in the first half of 2021, the rapid growth in the demand for power in the whole society, which has driven the generation-side electricity consumption to increase significantly year-on-year. Among the Company’s 26 regions, 22 regions have achieved positive year-on year growth in power generation. Among them, 10 regions including Guangdong, Chongqing, Fujian, Zhejiang, Jiangsu, and Shanghai have achieved growth rates of more than 20%.

The power generations (in billion kWh) of the Company, by regions, are listed below:

| | | | Electricity Sold | |

| Region | | | April to

June 2021 | | | | Change | | | | January to

June 2021 | | | | Change | |

| Heilongjiang Province | | | 3.280 | | | | -7.73 | % | | | 6.188 | | | | -2.23 | % |

| Coal-fired | | | 2.926 | | | | -8.99 | % | | | 5.512 | | | | -3.34 | % |

| Wind-power | | | 0.317 | | | | 4.81 | % | | | 0.608 | | | | 8.98 | % |

| PV | | | 0.037 | | | | -1.35 | % | | | 0.069 | | | | -1.02 | % |

| Jilin Province | | | 2.452 | | | | -9.20 | % | | | 4.718 | | | | -4.03 | % |

| Coal-fired | | | 1.944 | | | | -15.75 | % | | | 3.736 | | | | -11.16 | % |

| Wind-power | | | 0.335 | | | | 17.18 | % | | | 0.667 | | | | 24.43 | % |

| Hydro-power | | | 0.017 | | | | -48.45 | % | | | 0.017 | | | | -59.45 | % |

| PV | | | 0.076 | | | | 370.08 | % | | | 0.139 | | | | 337.33 | % |

| Biomass Power | | | 0.080 | | | | 38.54 | % | | | 0.160 | | | | 56.61 | % |

| Liaoning Province | | | 4.775 | | | | 25.64 | % | | | 8.975 | | | | 18.14 | % |

| Coal-fired | | | 4.600 | | | | 108.32 | % | | | 8.644 | | | | 18.69 | % |

| Wind-power | | | 0.120 | | | | 10.55 | % | | | 0.239 | | | | 13.26 | % |

| Hydro-power | | | 0.012 | | | | -1.12 | % | | | 0.012 | | | | -35.20 | % |

| PV | | | 0.043 | | | | -5.68 | % | | | 0.080 | | | | -5.32 | % |

| Inner Mongolia | | | 0.174 | | | | 196.50 | % | | | 0.241 | | | | 126.80 | % |

| Wind-power | | | 0.174 | | | | 196.50 | % | | | 0.241 | | | | 126.80 | % |

| Hebei Province | | | 2.610 | | | | -9.51 | % | | | 5.376 | | | | 2.64 | % |

| Coal-fired | | | 2.469 | | | | -10.30 | % | | | 5.104 | | | | 2.59 | % |

| Wind-power | | | 0.128 | | | | 10.48 | % | | | 0.250 | | | | 6.88 | % |

| PV | | | 0.013 | | | | -17.79 | % | | | 0.023 | | | | -22.35 | % |

| | | | Electricity Sold | |

| Region | | | April to

June 2021 | | | | Change | | | | January to

June 2021 | | | | Change | |

| Gansu Province | | | 3.208 | | | | -0.14 | % | | | 7.606 | | | | 8.84 | % |

| Coal-fired | | | 2.585 | | | | 2.72 | % | | | 6.339 | | | | 9.75 | % |

| Wind-power | | | 0.623 | | | | -10.45 | % | | | 1.267 | | | | 4.51 | % |

| Ningxia | | | 0.007 | | | | -10.56 | % | | | 0.011 | | | | -11.11 | % |

| PV | | | 0.007 | | | | -10.56 | % | | | 0.011 | | | | -11.11 | % |

| Beijing | | | 1.732 | | | | -12.82 | % | | | 4.090 | | | | 4.85 | % |

| Coal-fired | | | 0.00 | | | | – | | | | 0.648 | | | | 3.60 | % |

| Combined Cycle | | | 1.732 | | | | -12.82 | % | | | 3.442 | | | | 5.09 | % |

| Tianjin | | | 1.242 | | | | 20.02 | % | | | 2.881 | | | | 0.71 | % |

| Coal-fired | | | 1.074 | | | | 22.51 | % | | | 2.233 | | | | 2.11 | % |

| Combined Cycle | | | 0.163 | | | | 3.80 | % | | | 0.640 | | | | -4.68 | % |

| PV | | | 0.005 | | | | 423.99 | % | | | 0.007 | | | | 348.16 | % |

| Shanxi Province | | | 1.652 | | | | -2.91 | % | | | 4.523 | | | | 5.22 | % |

| Coal-fired | | | 1.337 | | | | -10.76 | % | | | 2.779 | | | | -3.89 | % |

| Combined Cycle | | | 0.00 | | | | -100.00 | % | | | 1.175 | | | | -2.06 | % |

| Wind-power | | | 0.066 | | | | – | | | | 0.139 | | | | – | |

| PV | | | 0.248 | | | | 52.99 | % | | | 0.430 | | | | 106.74 | % |

| Shandong Province | | | 18.501 | | | | 15.58 | % | | | 37.892 | | | | 15.29 | % |

| Coal-fired | | | 17.883 | | | | 14.58 | % | | | 36.746 | | | | 14.13 | % |

| Wind-power | | | 0.386 | | | | 78.25 | % | | | 0.756 | | | | 87.21 | % |

| PV | | | 0.148 | | | | -19.18 | % | | | 0.272 | | | | 1.70 | % |

| Biomass Power | | | 0.084 | | | | – | | | | 0.119 | | | | – | |

| Henan Province | | | 5.423 | | | | 3.64 | % | | | 10.708 | | | | 18.47 | % |

| Coal-fired | | | 4.393 | | | | -4.80 | % | | | 8.727 | | | | 6.27 | % |

| Combined Cycle | | | 0.070 | | | | -80.44 | % | | | 0.090 | | | | -76.73 | % |

| Wind-power | | | 0.953 | | | | 274.28 | % | | | 1.878 | | | | 339.80 | % |

| PV | | | 0.007 | | | | 6.13 | % | | | 0.013 | | | | 4.10 | % |

| Jiangsu Province | | | 10.193 | | | | 21.65 | % | | | 20.411 | | | | 26.69 | % |

| Coal-fired | | | 7.450 | | | | 8.20 | % | | | 15.339 | | | | 16.96 | % |

| Combined Cycle | | | 1.740 | | | | 103.04 | % | | | 2.952 | | | | 70.74 | % |

| Wind-power | | | 0.929 | | | | 54.00 | % | | | 1.987 | | | | 64.22 | % |

| PV | | | 0.074 | | | | 123.38 | % | | | 0.133 | | | | 134.78 | % |

| | | | Electricity Sold | |

| Region | | | April to

June 2021 | | | | Change | | | | January to

June 2021 | | | | Change | |

| Shanghai | | | 4.452 | | | | 16.05 | % | | | 9.819 | | | | 30.19 | % |

| Coal-fired | | | 4.031 | | | | 11.33 | % | | | 9.190 | | | | 33.96 | % |

| Combined Cycle | | | 0.413 | | | | 91.43 | % | | | 0.614 | | | | -9.91 | % |

| PV | | | 0.008 | | | | – | | | | 0.015 | | | | – | |

| Chongqing | | | 2.840 | | | | 34.50 | % | | | 6.505 | | | | 58.02 | % |

| Coal-fired | | | 2.204 | | | | 25.59 | % | | | 5.034 | | | | 47.99 | % |

| Combined Cycle | | | 0.572 | | | | 92.27 | % | | | 1.344 | | | | 120.74 | % |

| Wind-power | | | 0.063 | | | | 8.32 | % | | | 0.127 | | | | 19.68 | % |

| Zhejiang Province | | | 8.323 | | | | 21.69 | % | | | 14.838 | | | | 31.67 | % |

| Coal-fired | | | 7.932 | | | | 19.45 | % | | | 14.271 | | | | 29.62 | % |

| Combined Cycle | | | 0.375 | | | | 105.88 | % | | | 0.541 | | | | 132.95 | % |

| PV | | | 0.016 | | | | -4.53 | % | | | 0.026 | | | | -4.83 | % |

| Hubei Province | | | 3.696 | | | | 3.92 | % | | | 8.367 | | | | 21.08 | % |

| Coal-fired | | | 3.447 | | | | 3.63 | % | | | 7.895 | | | | 22.10 | % |

| Wind-power | | | 0.152 | | | | 2.45 | % | | | 0.331 | | | | 9.68 | % |

| Hydro-power | | | 0.092 | | | | 20.72 | % | | | 0.131 | | | | -0.49 | % |

| PV | | | 0.006 | | | | -14.74 | % | | | 0.010 | | | | -4.79 | % |

| Hunan Province | | | 2.301 | | | | -0.99 | % | | | 5.006 | | | | 14.81 | % |

| Coal-fired | | | 2.012 | | | | -0.67 | % | | | 4.488 | | | | 18.03 | % |

| Wind-power | | | 0.168 | | | | -2.74 | % | | | 0.343 | | | | 5.21 | % |

| Hydro-power | | | 0.109 | | | | -2.76 | % | | | 0.155 | | | | -26.86 | % |

| PV | | | 0.012 | | | | -12.00 | % | | | 0.021 | | | | 0.55 | % |

| Jiangxi Province | | | 5.033 | | | | 11.98 | % | | | 10.187 | | | | 18.35 | % |

| Coal-fired | | | 4.692 | | | | 11.35 | % | | | 9.574 | | | | 18.02 | % |

| Wind-power | | | 0.243 | | | | 5.59 | % | | | 0.433 | | | | 0.90 | % |

| PV | | | 0.098 | | | | 93.73 | % | | | 0.180 | | | | 171.66 | % |

| Anhui Province | | | 1.241 | | | | 2.38 | % | | | 2.777 | | | | 15.72 | % |

| Coal-fired | | | 1.029 | | | | -8.40 | % | | | 2.284 | | | | 2.16 | % |

| Wind-power | | | 0.174 | | | | 140.34 | % | | | 0.424 | | | | 187.19 | % |

| Hydro-power | | | 0.038 | | | | 131.85 | % | | | 0.069 | | | | 316.71 | % |

| | | | Electricity Sold | |

| Region | | | April to

June 2021 | | | | Change | | | | January to

June 2021 | | | | Change | |

| Fujian Province | | | 4.646 | | | | 22.00 | % | | | 8.894 | | | | 41.80 | % |

| Coal-fired | | | 4.643 | | | | 22.02 | % | | | 8.888 | | | | 41.83 | % |

| PV | | | 0.003 | | | | -7.18 | % | | | 0.006 | | | | 1.65 | % |

| Guangdong Province | | | 9.197 | | | | 43.91 | % | | | 16.371 | | | | 70.22 | % |

| Coal-fired | | | 7.963 | | | | 25.25 | % | | | 14.225 | | | | 48.49 | % |

| Combined Cycle | | | 1.228 | | | | 4431.97 | % | | | 2.134 | | | | 7774.37 | % |

| PV | | | 0.006 | | | | 0.89 | % | | | 0.012 | | | | 8.57 | % |

| Guangxi | | | 0.198 | | | | 21.94 | % | | | 0.383 | | | | 37.51 | % |

| Combined Cycle | | | 0.108 | | | | -2.80 | % | | | 0.212 | | | | 20.15 | % |

| Wind-power | | | 0.091 | | | | 74.53 | % | | | 0.170 | | | | 67.78 | % |

| Yunnan Province | | | 2.278 | | | | -16.44 | % | | | 5.327 | | | | 24.99 | % |

| Coal-fired | | | 2.153 | | | | -17.05 | % | | | 5.056 | | | | 28.63 | % |

| Wind-power | | | 0.124 | | | | -5.01 | % | | | 0.269 | | | | -17.88 | % |

| Hydro-power | | | 0.001 | | | | 141.89 | % | | | 0.002 | | | | -54.37 | % |

| Guizhou Province | | | 0.107 | | | | 42.42 | % | | | 0.178 | | | | 13.32 | % |

| Wind-power | | | 0.048 | | | | -5.46 | % | | | 0.102 | | | | -22.71 | % |

| PV | | | 0.059 | | | | 141.46 | % | | | 0.076 | | | | 202.93 | % |

| Hainan Province | | | 3.357 | | | | -0.56 | % | | | 5.656 | | | | -6.80 | % |

| Coal-fired | | | 3.112 | | | | -4.08 | % | | | 5.260 | | | | -10.06 | % |

| Combined Cycle | | | 0.164 | | | | 128.27 | % | | | 0.253 | | | | 143.09 | % |

| Wind-power | | | 0.017 | | | | -16.15 | % | | | 0.039 | | | | -17.06 | % |

| Hydro-power | | | 0.032 | | | | 228.54 | % | | | 0.049 | | | | 183.00 | % |

| PV | | | 0.031 | | | | 5.61 | % | | | 0.055 | | | | 4.96 | % |

| Total | | | 102.917 | | | | 12.51 | % | | | 207.926 | | | | 20.80 | % |

For the second quarter of 2021, the power generation of Tuas Power Ltd. in Singapore, which is wholly-owned by the Company, accounted for a market share of 20.4% in Singapore, representing a decrease of 1.2 percentage points compared to the same period of last year. The accumulated power generation of Tuas Power for the first half year accounted for a market share of 20.5%, representing a decrease of 1.0 percentage point compared to the same period of last year.

| 2. | Comparative Analysis of Operating results |

| 2.1 | Operating revenue and tax and levies on operations |

Operating revenue mainly consists of revenue from electricity sold. For the first half of 2021, the consolidated operating revenue of the Company and its subsidiaries amounted to RMB95.116 billion, representing an increase of 20.21% from RMB79.127 billion for the same period last year. The operating revenue from domestic operations of the Company increased by RMB15.607 billion over the same period of last year, while the operating revenue generated from newly operated generating units (put into operation since 1 January 2020, same below) increased by RMB3.988 billion.

The operating revenue from the operations in Singapore increased by RMB34 million over the same period of last year. The operating revenue from the operations in Pakistan increased by RMB348 million over the same period of last year.

Tax and levies on operations mainly consist of surcharges of value-added tax. According to relevant administrative regulations, these surcharges include City Construction Tax and Education Surcharges calculated at prescribed percentages on the amounts of the value-added tax paid. For the first half of 2021, the tax and levies on operations of the Company and its subsidiaries were RMB0.941 billion, representing an increase of RMB54 million from RMB0.887 billion for the same period of last year.

For the first half of 2021, the total operating expenses of the Company and its subsidiaries was RMB85.002 billion, representing an increase of 29.16% from the same period last year. The operating expenses in domestic operations of the Company increased by RMB18.569 billion, or 31.46%, from the same period last year, which was primarily attributable to increase of fuel costs, while the operating expenses generated from newly operated generating units increased by RMB2.425 billion.

The operating expenses from the operations in Singapore increased by RMB0.183 billion from the same period last year. The operating expenses from the operations in Pakistan increased by RMB0.438 billion from the same period last year.

Fuel costs account for the majority of the operating expenses for the Company and its subsidiaries. For the first half of 2021, fuel costs of the Company and its subsidiaries increased by 40.53% to RMB57.380 billion. The fuel costs from domestic operations of the Company and its subsidiaries increased by RMB16.532 billion, which was primarily attributable to the increase of coal price. The fuel costs of the newly operated generating units increased by RMB1.575 billion. Fuel costs in Singapore increased by RMB17 million from the same period last year.

For the first half of 2021, depreciation expenses of the Company and its subsidiaries increased by RMB251 million to RMB11.094 billion from the same period last year. The depreciation expenses of domestic operations increased by RMB357 million compared to the same period last year, of which the depreciation costs incurred by the newly operated generating units increased by RMB548 million. The depreciation expenses of the operations in Singapore decreased by RMB106 million compared to the same time last year.

Labor costs consist of salaries to employees and contributions payable for employees’ housing funds, medical insurance, pension and unemployment insurance, as well as training costs. For the first half of 2021, the labor costs of the Company and its subsidiaries amounted to RMB6.886 billion, representing an increase of RMB1.32 billion from RMB5.566 billion for same period last year.

For the first half of 2021, the maintenance expenses of the Company and its subsidiaries amounted to RMB1.778 billion, representing an increase of RMB131 million from the same period last year. The maintenance expenses of the Company’s domestic operations increased by RMB107 million compared to the same period last year. The maintenance expenses of operations in Singapore increased by RMB24 million compared to the same period last year.

| 2.2.5 | Other operating expenses (including electricity power purchase costs) |

For the first half of 2021, other operating expenses of the Company and its subsidiaries was RMB7.865 billion, representing an increase of RMB0.940 billion from RMB6.925 billion for the same period last year. The other operating expenses from the Company’s domestic operations increased by RMB256 million. Other operating expenses of the newly operated generating units increased by RMB110 million. Other operating expenses of the operations in Singapore increased by RMB247 million compared to the same period last year. Other operating expenses of the operations in Pakistan increased by RMB437 million compared to the same period last year.

| 2.3 | Financial expenses, net |

The consolidated net financial expenses of the Company and its subsidiaries for the first half of 2021 amounted to RMB4.323 billion, representing a decrease of RMB0.611 billion from RMB4.934 billion for the same period last year, which is mainly due to the decrease of average interest rate and the overall debt amount compared with the same period last year. The financial expenses of domestic operations decreased by RMB0.465 billion, of which the interest expense of newly operated generating unit increased by RMB0.359 billion. The financial expenses of the operations in Singapore increased by RMB19 million. The financial expenses of the operations in Pakistan decreased by RMB165 million.

| 2.4 | Share of profits less losses of associates and joint ventures |

The share of profits less losses of associates and joint ventures of the Company and its subsidiaries for the first half of 2021 was RMB887 million, representing a decrease of RMB162 million from RMB1,049 million for the same period last year. This was mainly attributable to decreased profits of the associates and joint ventures of the Company, including Shenzhen Energy.

For the first half of 2021, the Company and its subsidiaries registered consolidated income tax expenses of RMB1.057 billion, representing a decrease of RMB838 million from RMB1.895 billion for the same period last year. The income tax expenses for the domestic operations decreased by RMB0.820 billion over the same period last year mainly due to the changes in pre-tax profit structure in the current period, in which the profit of coal power generation units has declined and the portion of profit of new energy units has increased. The latter are mostly in the preferential tax period with low tax rate.

| 2.6 | Profit/loss attributable to equity holders of the Company |

The net profit attributable to equity holders of the Company for the first half of 2021 amounted to RMB4.019 billion, representing a decrease of 26.14% from RMB5.441 billion for the same period last year. The net profit attributable to equity holders of the Company from its domestic operations was RMB3.921 billion, representing a decrease of 25.75% over the same period last year, which is mainly due to reduced profits from domestic power and heat operations resulting from increased coal prices. The net loss attributable to equity holders of the Company from its operations in Singapore was RMB62 million. The net profit attributable to equity holders of the Company from its operations in Pakistan was RMB160 million.

| 2.7 | Comparison of financial positions |

As of June 30, 2021, consolidated total assets of the Company and its subsidiaries were RMB459.537 billion, representing an increase of 2.14% from RMB449.905 billion as of December 31, 2020. Total liabilities amounted to RMB306.520 billion, representing an increase of 2.76% from RMB298.288 billion as at the end of 2020. The gearing ratio was 66.70%.

| 2.8 | Major financial position ratios |

Calculation formula of the financial ratios:

Ratio of liabilities to shareholders’ equity = balance of liabilities at the end of the period/balance of shareholders’ equity (excluding non-controlling interests) at the end of the period

Current ratio = balance of the current assets at the end of the period/balance of current liabilities at the end of the period

Quick ratio = (balance of current assets at the end of the period – net amounts of inventories at the end of the period)/balance of current liabilities at the end of the period

Multiples of interest earned = (profit before tax + interest expenses)/interest expenditure (including capitalized interest)

| | | The Company and its subsidiaries | |

| Item | | As of

June 30, 2021 | | | As of

December 31, 2020 | |

| Ratio of liabilities to shareholders’ equity | | | 2.38 | | | | 2.30 | |

| Current ratio | | | 0.50 | | | | 0.43 | |

| Quick ratio | | | 0.44 | | | | 0.39 | |

| Item | | For the

six months ended

June 30, 2021 | | | For the

six months ended

June 30, 2020 | |

| Multiples of interest earned | | | 2.12 | | | | 2.51 | |

The ratio of liabilities to owner’s equity increased compared with the beginning of the year, mainly due to the increase in the company’s liabilities. The current ratio and the quick ratio increased from the beginning of the year, mainly due to the decrease in short-term interest-bearing debts of the company, which led to a decrease in current liabilities. Multiples of interest earned has decreased compared to the same period of last year, mainly due to the decrease in profit before tax.

As of June 30, 2021, the Company and its subsidiaries had net current liabilities of RMB72.164 billion. Based on the successful financing history of the Company, the undrawn banking facilities available to the Company and its good credit rating, the Company believes it would be able to meet its liabilities as and when they fall due and secure the funds required for operations.

| II. | Liquidity and Cash Resources |

| | | For the six months ended

June 30, 2021 | | | For the six months ended

June 30, 2020 | | | Change | |

| | | (RMB in 100 Million) | | | (RMB in 100 Million) | | | (%) | |

| Net cash from operating activities | | | 191.35 | | | | 158.36 | | | | 20.83 | |

| Net cash used in investing activities | | | (170.85 | ) | | | (158.45 | ) | | | 7.83 | |

| Net cash (used in)/from financing activities | | | (17.55 | ) | | | 26.89 | | | | (165.27 | ) |

| Effect of foreign exchange rate changes, net | | | 0.73 | | | | (2.15 | ) | | | (133.95 | ) |

| | | | | | | | | | | | | |

| Net increase in cash and cash equivalent | | | 3.68 | | | | 24.65 | | | | (85.07 | ) |

| Cash and cash equivalent at beginning of the reporting period | | | 132.58 | | | | 124.43 | | | | 6.55 | |

| | | | | | | | | | | | | |

| Cash and cash equivalent at the end of the reporting period | | | 136.26 | | | | 149.09 | | | | (8.61 | ) |

The net cash provided by operating activities of the Company for the first half of 2021 was RMB19.135 billion, representing an increase of 20.83% over the same period last year. The increase was mainly due to that the cash inflow from operating activities generated by the period-on-period increase in sales of electricity was higher than cash outflow from operating activities resulting from the growth in fuel costs.

Net cash used in investing activities of the Company was RMB17.085 billion, representing An increase of 7.83% from the same period last year, which was mainly due to the expansion of investment in new projects during the current period which contributed to an increase in fixed assets procurement, engineering expenditures and engineering material procurement.

The financing activities of the Company were principally debt financings. For the first half of 2021, the Company drew down new loans of RMB82.309 billion, issued super short-term notes of RMB13.000 billion and long-term bonds of RMB11.300 billion, and repaid loans of RMB77.475 billion, super short-term bonds of RMB18.000 billion and long-term bonds of RMB7.500 billion upon maturity.

As of 30 June 2021, cash and cash equivalents of the Company and its subsidiaries denominated in RMB and Singapore dollar, U.S. dollar, Pakistani Rupee and Japanese Yen, each of which is measured at RMB equivalent, were RMB12.522 billion, RMB0.826 billion, RMB0.607 billion, RMB0.180 billion and RM0.2021 million, respectively.

| 2. | Capital expenditure and cash resources |

| 2.1 | Capital expenditure for infrastructure construction and renovation projects |

The capital expenditure for construction and renovation projects of the Company for the first half of 2021 was RMB14.733 billion, including RMB1.619 billion for Zhuanghe Wind Power, RMB1.548 billion for Qingneng Tongyu Power, RMB1.049 billion for Ruijin Power Generation, RMB0.762 billion for Zhejiang Cangnan Offshore, RMB0.720 billion for Yantai New Energy, RMB0.643 billion for Pinghu Offshore, RMB0.561 billion for Dalian Chuanbo, RMB0.448 billion for Jiuquan Wind Power, RMB0.409 billion for Qingdao Co-generation, RMB0.378 billion for Dalian Co-generation, RMB0.374 billion for Luobei Wind Power, RMB0.362 billion for Shengdong Rudong Offshore, RMB0.34 billion for Yuhuan Power, RMB0.319 billion for Huangmei New Energy, RMB0.300 billion for Shidongkou I, RMB0.266 billion for Diandong Energy, RMB0.262 billion for Weihai Power, RMB0.228 billion for Yangpu Co-generation, RMB0.220 billion for Anhui Mengcheng Wind Power, RMB0.218 billion for Wuzhai Wind Power, RMB0.205 billion for Dezhou New Energy, RMB0.176 billion for Lindian Clean Energy, RMB0.169 billion for Zhumadian Wind Power, RMB0.158 billion for Diandong Mining and RMB0.155 billion for Qinbei Power. The infrastructure and renovation expenditure of other units was RMB2.844 billion.

The above capital expenditures are sourced mainly from internal capital, cash flows provided by operating activities, and debt financing. The Company expects to have significant capital expenditures in the next few years. During the course, the Company will make active efforts to improve project planning process on a commercially viable basis. The Company will also actively develop new projects to pave the way for its long-term growth. The Company expects to finance the above capital expenditures through internal capital, cash flows provided by operating activities, and debt and equity financing.

| 2.2 | Cash resources and anticipated financing costs |

The Company expects to finance its capital expenditure and acquisition costs primarily from internal capital, cash flows from operating activities, and debt and equity financings.

Good operating results and sound credit status provide the Company with strong financing capabilities. As of June 30, 2021, the undrawn banking facilities available to the Company and its subsidiaries amount to more than RMB318.971 billion from, among others, Bank of China, China Construction Bank and Industrial and Commercial Bank of China.

The Company issued unsecured super short-term bonds with face value of RMB2 billion, RMB3 billion, RMB3 billion, RMB2 billion and RMB3 billion bearing annual interest rates of 2.18%, 2.25%, 2.40%, 2.10% and 2.13% on January 20, 2021, January 25, 2021, February 25, 2021, April 26, 2021 and April 29, 2021, respectively. Such bonds are denominated in RMB, issued at face value and mature in 37 days, 30 days, 41 days, 37 days and 36 days, respectively.

The Company issued green mid-term notes with face value of RMB1 billion and RMB2.5 billion bearing annual interest rates of 3.45% and 3.35% on February 9, 2021 and April 16, 2021, respectively. Such mid-term notes are denominated in RMB, issued at face value and both mature in 3 years.

The Company issued corporate bonds with face value of RMB0.5 billion, RMB1.5 billion, RMB0.5 billion, RMB3.5 billion and RMB1.8 billion bearing annual interest rates of 3.35%, 3.97%, 3.33%, 3.97% and 3.99% on May 24, 2021 (two tranches), June 7, 2021 (two tranches) and June 21, 2021, respectively. Such bonds are denominated in RMB, issued at face value and mature in 3 years, 10 years, 3 years, 10 years and 10 years, respectively.

As of June 30, 2021, the Company and its subsidiaries had outstanding short-term loans of RMB68.462 billion (RMB66.311 billion as of the end of 2020), of which borrowings from banks were charged at annual interest rates ranging from 2.80% to 8.33% (2.15% to 4.90% at the end of 2020).

As of June 30, 2021, the Company and its subsidiaries had no outstanding short-term bonds (RMB5.003 billion at the end of 2020).

As of June 30, 2021, the Company and its subsidiaries had total long-term borrowings (including long-term borrowings maturing within one year) of RMB134.555 billion (at the end of 2020: RMB131.886 billion), of which RMB borrowings were RMB118.305 billion (at the end of 2020: RMB114.350 billion), USD borrowings were approximately $1.371 billion (at the end of 2020: $1.480 billion), euro borrowings of approximately €9 million (at the end of 2020: €11 million), Singapore dollar borrowings of S$1.513 billion (at the end of 2020: S$1.551 billion), and Japanese yen borrowings of ¥2.211 billion (at the end of 2020: ¥2.266 billion). US dollar and Singapore dollar borrowings are floating rate borrowings and all other foreign currency loans are fixed rate loans. As of June 30, 2021, the annual interest rate on long-term bank borrowings ranged from 0.75% to 5.20% (at the end of 2020: 0.75% to 6.55%).

The Company will maintain close watch on fluctuations of exchange rate and interest rate markets, and prudently assess currency and interest rate risks.

In addition to meeting cash requirements from operations, constructions and acquisitions in its ordinary course, the Company, along with due consideration of overall development of power generation industry and growth of the Company, will make efforts to control financing costs and financial risks, establish an optimal capital structure for effective financial management activities, with the view to providing sustainable and stable returns to its shareholders.

| 2.3 | Other financing requirements |

The objective of the Company is to bring long-term, consistent and growing returns to its shareholders. In line with this objective, the Company follows a proactive, stable and balanced dividend policy. Upon the approval from the annual general meeting of the shareholders for the year 2020 held on June 22, 2021, the Company declared a cash dividend of RMB0.18 per ordinary share (inclusive of tax), with total dividends of approximately RMB2.826 billion. The Company has not made payment of the dividends as of June 30, 2021.

| III. | Performance and Prospects of Significant Investments |

The Company acquired 25% equity interests in Shenzhen Energy Group (“Shenneng Group”) with payment of RMB2.390 billion on April 22, 2003. In 2011, Shenneng Group divided into a remainder company Shenneng Group and a new company Shenneng Energy Management Company, and the Company holds 25% equity interests in each of the two successors. The Company acquired 200 million shares from Shenzhen Energy Corporation (“Shenzhen Energy”), a subsidiary of Shenneng Group, in December 2007. Shenzhen Energy allotted shares with its capital surplus in 2011. In February 2013, Shenzhen Energy merged Shenzhen Energy Management Company through the combination of directional seasoned offering and cash payment to the shareholders of Shenzhen Energy Management Company. After the merger, the Company directly held 991,741,659 shares of Shenzhen Energy, representing 25.02% of its equity interests. These investments brought a net profit attributable to the equity holders of the Company of RMB396 million for the Company for the first half of 2021 under IFRS. This investment is expected to provide steady returns to the Company.

The Company held 60% direct equity interests in Sichuan Hydropower as of December 31, 2006. In January 2007, Huaneng Group increased its capital investment in Sichuan Hydropower by RMB615 million, thus reducing the Company’s equity interests in Sichuan Hydropower to 49% and making Huaneng Group the controlling shareholder of Sichuan Hydropower. This investment brought to the Company a net profit attributable to the equity holders of the Company of RMB110 million for the first half of 2021 under IFRS. This investment is expected to provide steady returns to the Company.

| IV. | Employee Benefits Policies |

As of June 30, 2021, the Company and its subsidiaries had 57,212 employees. During this reporting period, there was no significant change regarding remuneration policies and training programs of the Company.

| V. | Guarantee for Loans and Restricted Assets |

As of June 30, 2021, the Company provided guarantees of approximately RMB10.521 billion for the long-term bank loans and long-term bonds of Tuas Power; Huaneng Heilongjiang Power Co., Ltd., a subsidiary of the Company, provided guarantee of approximately RMB351 million, RMB692 million and RMB239 million for the long-term bank loans of its subsidiaries Huaneng Daqing Cogeneration Co., Ltd., Daqing Lvyuan Wind Power Co., Ltd., and Huaneng Tongjing Wind Power Co., Ltd., respectively; Huaneng Shandong Power Generation Co., Ltd., a subsidiary of the Company, provided guarantee of RMB0.517 billion for Huaneng Shandong Ruyi (Hong Kong) Energy Co, Ltd.

As of June 30, 2021, the details of secured loans of the Company and its subsidiaries are as follows:

| 1. | As of June 30, 2021, short-term loans of approximately RMB952 million (RMB1.317 billion at the end of 2020) represented the notes receivable that were discounted with recourse. As these notes receivable had not yet matured, the proceeds received were recorded as short-term loans. |

| 2. | As of June 30, 2021, long-term loans of approximately RMB3.405 billion (RMB3.322 billion at the end of 2020) of the Company and its subsidiaries were secured by certain property, plant and equipment with net book value of RMB4.209 billion (RMB3.400 billion at the end of 2020). |

| 3. | As of June 30, 2021, long-term loans of approximately RMB7.730 billion (RMB7.435 billion at the end of 2020) were secured by future electricity revenue of the Company and its subsidiaries. |

As of June 30, 2021, the restricted bank deposits of the Company and its subsidiaries were RMB510 million (RMB614 million at the end of 2020).

As of June 30, 2021, the discounted or endorsed un-matured accounts receivable have a book value of RMB2.416 billion (RMB2.817 billion at the end of 2020).

As of June 30, 2021, the Company and its subsidiaries had no material contingent liability.

| 1. | Risks relating to Covid-19 |

The Pandemic of Covid-19, though under effective control within China, could be exposed to localized and seasonal outbreak which could impact general economic conditions, electricity demand, project construction, coal production and transportation.

The Company will strictly implement the measures to prevent and control Covid-19 in its ordinary course of business, maintain emergency plan to ensure prevention or mitigation of any risk to which the safety of our people, power production, project construction, materials procurement and fuel supply may be exposed.

| 2. | Risks relating to Electricity Sector and Market |

| (1) | Thermal power business is expected to bear the brunt from extensive utilization of renewable energies along with the proposal of which is topping the agenda of the governments in China and other countries in their efforts to achieve targets in carbon peaking and neutralization. The continued decline of unit utilization hours, shutdown of small-scale units required by government policies and out of operating conditions, and other policies restricting thermal power generation, will have negative impact on the Company’s thermal power business both within and outside China. |

| (2) | The coal-fired power units in China will gradually change from a source of power supply to that of power supplement. The deficiency of capacity recovery cost mechanism, the imperfection of the auxiliary service market, and the one-way, downward pricing regime of the electricity market, have imposed obstacles on effective control of power generation costs and increased the operation risk of thermal power businesses. |

| (3) | The dual-way energy control policies are expected to be implemented increasingly strictly in certain regions of China, which would restrict electricity consumption by certain high-energy-consuming users and limit the total amount of regional coal consumption, creating persistent impact on thermal power generation. |

| (4) | The continuingly reformed power market, expanded volumes of transactions between power producers and users, and the further promoted spot transaction practices market-wide have made it possible to access electricity generated from renewable energies at the price comparable to those from thermal power. The consistently increased market-based transactions of electricity by the Company would subject it to the risk of a downward pricing trend of electricity. |

The Company will accelerate its clean-energy transformation by increasing the proportion of renewable energies in power generation, and actively promote carbon reduction. It will streamline its generation structure by replacement, transformation, upgrade, elimination, and transaction of coal-fueled generating units. It will make coordinated arrangements to carry out upgrades of existing coal power units for energy saving and emission reduction, flexibility, heat supply and biomass coupling, so as to create new competitive advantage for the Company. The Company will closely follow the development of government policies and power market reform, take initiatives to interact with competent price authorities, actively cooperate with the government to establish reasonable, fair and regulated market conditions, take initiatives to respond to market changes, timely adjust pricing strategies, and make efforts to prevent and control the risks affecting electricity prices.

| 3. | Risks relating to Carbon Market |

The recent operation of the national carbon emission trading market will increase benefits for the power generating units with low carbon emissions at the cost of those units with higher carbon emissions. The Company is leading the industry on general energy utilization, and more effective in controlling carbon trading compliance costs from 2019 to 2020 than the comparable companies in the industry. However, the quota allocation plan for 2021 and beyond has not yet been issued, and the risk of an increase in power generation costs due to the gradual tightening of quota allocation cannot be ruled out. The compliance cost of power generation companies could also be subject to further increase along with potential inclusion of other entities and individuals into the market at a later stage.

The Company will pay close attention to the development of policy landscape in carbon market, continuingly strengthen carbon trading management, develop strategies, and try to complete timely and cost-effective fulfilment of carbon trading targets nationwide. Power generation businesses would also benefit from the voluntary emission reduction filing system once renewed by the government, which would help control carbon trading costs by increasing supply of emission reduction available for trading.

| 4. | Risks relating to Coal Market |

The first half of 2021 saw significant upward movement of coal prices. The second half of this year is expected to be subject to certain market risks. First, overcapacity production is officially criminalized, forcing mines producers to strictly comply with approved capacity amount, limiting potential increase of production along with enhanced carbon remission controls. Secondly, the relatively short supply of coal resources around the global, coupled with the sharp rise in crude oil prices and record shipping costs in ten years, has had strong impact on the supply of imported coal. The main source of our coal import is Indonesia. The potentially major change in epidemic situation of covid-19 in Indoenesia would significantly influence the coal import. Consequently, the coal import policy and foreign supply and demand situation in the second half of the year would be major and important concerns. Thirdly, thermal power generators are expected to continuingly play a primary role in meeting the increasing demand for electricity in the second half of 2021, which, coupled with existing low inventories of coals by power plants and tight demand-supply condition in the coal sector, would cause coal prices to maintain at a high level.

In response to the complicated coal market conditions, the Company will (i) take full advantage of its centralized fuel control mechanism to maintain effective control of procurement costs; (ii) strive to reinforce resource development, improve fulfillment of long term contracts, optimize coal category and procurement structure, and improve deployment of power plant resources; (iii) secure high quality coal supply and procurement by utilizing its strength in coal imports and owned transportation capacity; (iv) use coal production capacities of its own and Huaneng Group to maintain consistent coal prices; (v) increase coal blending efforts without compromising safety and environmental protection, and make endeavors to reduce fuel costs; (vi) take initiatives to voice out its concerns on high coal price, communicate its negative impact on secure power supply to national regulatory authorities, with the view to seeking policy support to guide downward movement of coal price.

| 5. | Risks relating to Environmental Protection |

In accordance with the current situation and needs of ecological civilization construction, the central government of China and local governments at all levels were continuously improving and deepening environmental protection policies, and constantly raised new and stricter requirements in water protection and dust control. Consequently, the Company’s power stations, which were established at different times and geographically distributed with large differences in natural and social environments, were confronted with environmental risks in various degrees.

The Company is committed to protecting the environment throughout the life cycle of power generation units, and maintain coordinated management and operation of power generation projects in line with the requirements of the Chinese government.

The Company’s newly operated coal-fired power plants are equipped with advanced technologies and powerful flue gas purification systems for new operating units. The existing generating units are completed with ultra-low emission upgrade required by the Chinese government, readily adaptable to fluctuations in weather conditions, fuel quality, electric and thermal loads and other internal and external factors, and are acceptable to local environmental protection authorities and energy regulators.

The Company is making company-wide efforts to actively follow up comments from environmental protection departments, carefully select advanced and applicable technical solutions, and take initiatives to make improvement in wastewater treatment system, construction of coal yard closure facilities, and comprehensive utilization of ash, and have all risks to environmental protection been efficiently responded and effectively resolved.

| 6. | Risks relating to Interest Rates |

The monetary policies in China in the second half of 2021 are expected to maintain continuity, stability and sustainability, provide strong support for businesses, and effectively prevent and control financial risks; promote green and low-carbon development, put in place policy instruments to sustain carbon emission reduction, and advance development of clean energy, energy conservation and environmental protection, and carbon emission reduction technologies consistently, orderly and effectively. The fluctuation of interest rates of foreign currency debts, which account for an insignificant proportion of our total debts, will have limited impact on the Company.

The Company will pay close attention to changes in the domestic and overseas capital markets. While ensuring meeting funding requirements, the Company will focus on controlling financing costs by making timely adjustment to financing strategy, capitalizing on preferential policies for renewable energy utilization and carbon reduction, and reducing the risk of interest rate fluctuations.

SHARE CAPITAL STRUCTURE

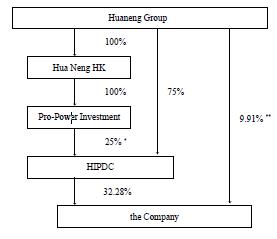

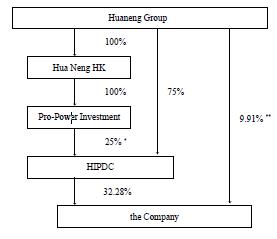

As at 30 June 2021, total issued share capital of the Company amounted to 15,698,093,359 shares, of which 10,997,709,919 shares were domestic shares, representing 70.06% of the total issued share capital of the Company, and 4,700,383,440 shares were foreign shares, representing 29.94% of the total issued share capital of the Company. In respect of foreign shares, Huaneng Group through its wholly-owned subsidiaries China Hua Neng Group Hong Kong Limited and China Huaneng Group Treasury Management (Hong Kong) Limited, held 472,000,000 and 131,596,000 shares, representing 3.01% and 0.84% of the total issued share capital of the Company, respectively. In respect of domestic shares, Huaneng International Power Development Corporation (“HIPDC”) owned a total of 5,066,662,118 shares, representing 32.28%of the total issued share capital of the Company, while Huaneng Group held 1,555,124,549 shares, representing 9.91% of the total issued share capital of the Company. Through its controlling subsidiary China Huaneng Finance Corporation Limited, Huaneng Group held 61,194,199 shares, representing 0.39% of the total issued share capital of the Company. Other domestic shareholders held a total of 4,314,729,053 shares, representing 27.49% of the total issued share capital.

PURCHASE, SALE OR REDEMPTION OF SHARES

The Company and its subsidiaries did not sell any other types of securities and did not purchase or redeem its own shares or other securities in the first half of 2021.

SHAREHOLDINGS OF MAJOR SHAREHOLDERS

The following table summarises the shareholdings of the top ten shareholders of the Company’s shares as at 30 June 2021:

| Name of Shareholders | | Total

shareholdings

as at end of the

reporting

period | | | Percentage of

shareholding in

total issued

shares (%) | |

| Huaneng International Power Development Corporation | | | 5,066,662,118 | | | | 32.28 | % |

| HKSCC Nominees Limited* | | | 4,094,234,802 | | | | 26.08 | % |

| China Huaneng Group Co., Ltd. | | | 1,555,124,549 | | | | 9.91 | % |

| Hebei Construction & Investment Group Co., Ltd. | | | 527,548,946 | | | | 3.36 | % |

| China Hua Neng Group Hong Kong Limited | | | 472,000,000 | | | | 3.01 | % |

| China Securities Finance Corporation Limited | | | 466,953,720 | | | | 2.97 | % |

| Jiangsu Guoxin Investment Group Limited | | | 416,500,000 | | | | 2.65 | % |

| Liaoning Energy Investment (Group) Limited Liability Company | | | 284,204,999 | | | | 1.81 | % |

| Fujian Investment & Development Group Co., Ltd. | | | 251,814,185 | | | | 1.60 | % |

| Dalian Municipal Construction Investment Company Limited | | | 151,500,000 | | | | 0.97 | % |

| * | HKSCC Nominees Limited acts as nominee of holders of H shares of the Company and its shareholdings in the Company represent the total number of H shares held by it as nominee of H shareholders. |

DIRECTORS’ AND SUPERVISORS’ RIGHT TO PURCHASE SHARES

The Company has adopted a code with the standard not lower than that of the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix 10 to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (“Listing Rules”). Following enquiries made by the Company, all Directors and Supervisors confirmed that they have complied with the Code throughout the first half of 2021.

As at 30 June 2021, none of the directors, chief executive officer or supervisors of the Company had any interest or short position in the shares, underlying shares and/or debentures (as the case may be) of the Company or any of its associated corporations (within the definition of Part XV of the Securities and Futures Ordinance (“SFO”) which was required to be notified to the Company and the Stock Exchange of Hong Kong Limited (“Hong Kong Stock Exchange”) pursuant to Divisions 7 and 8 of Part XV of the SFO (including interest and short position which any such Director, chief executive officer or Supervisor is taken or deemed to have under such provisions of the SFO) or which was required to be entered in the register required to be kept by the Company pursuant to Section 352 of the SFO or which was otherwise required to be notified to the Company and the Hong Kong Stock Exchange pursuant to the Model Code for Securities Transactions by Directors of Listed Companies as contained in Appendix 10 to the Listing Rules.

PUBLIC FLOAT

As at the date of this announcement, the Company has maintained the prescribed public float under the Listing Rules and as agreed with the Hong Kong Stock Exchange, based on the information that is publicly available to the Company and within the knowledge of the directors of the Company.

DIVIDENDS

It was resolved by the Board not to distribute dividends for the first half of 2021.

DISCLOSURE OF MATERIAL EVENTS

Status on Change of Supervisor of the Supervisory Committee

On 9 June 2021, due to age reason, Ms. Zhang Xiaojun, a staff representative supervisor of the Company, applied to resign from the duties of the staff representative supervisor of the Tenth Session of the Supervisory Committee of the Company. Pursuant to relevant rules and regulations and the relevant stipulations of the Company, the staff of the Company has unanimously elected Mr. Zhu Tong to be the staff representative supervisor of the Tenth Session of the Supervisory Committee.

At the annual general meeting convened by the Company on 22 June 2021, Mr. Xia Aidong was elected as the supervisor of the Tenth Session of the Supervisory Committee of the Company. Mr. Ye Cai ceased to be the supervisor of the Company due to change of work.

CORPORATE GOVERNANCE

The Company always places emphasis on corporate governance. After years of experience and practice, the Company has gradually formed a standardised and enhanced governance structure, thereby establishing a sound and effective system that is appropriate to the Company’s own development requirements. The Company persists on maximising the benefits of the Company and its shareholders as a whole, treating all of its shareholders fairly and striving for the long-term, stable and increasing returns for shareholders of the Company.

During the reporting period, the Company has complied with the relevant provisions of Corporate Governance Code and Corporate Governance Report set out in Appendix 14 of the Listing Rules.

| (A) | Code of Corporate Governance |

In recent years, the Company adopted the following measures in order to strengthen corporate governance and enhance the Company’s operation quality:

| (1) | Enhancing and improving corporate governance |

In addition to complying with the provisions of the applicable laws, as a public company listed in three markets both domestically and internationally, the Company is subject to the regulations of the securities regulatory authorities of the three listing places and the supervision of investors at large. Accordingly, our fundamental principles are to adopt a corporate governance structure that balances and coordinates the decision-making powers, supervisory powers and operating powers, to act with honesty and integrity, and to operate in accordance with laws and regulations.

Over the years, the Board has formulated and implemented the Rules and Procedures of the General Meetings; Rules and Procedures of the Board of Directors Meetings; the Rules and Procedures of the Supervisory Committee Meetings; the Detailed Rules on the Work of the General Manager; the Detailed Rules on the Work of the Strategy Committee of the Board of Directors; the Detailed Rules on the Work of the Audit Committee of the Board of Directors; the Detailed Rules on the Work of the Nomination Committee of the Board of Directors; the Detailed Rules on the Work of the Remuneration and Appraisal Committee of the Board of Directors; the System on Work of Independent Directors, the System on Work of Independent Directors on the Annual Report and the Work Regulations on Annual Report for the Audit Committee, and amended relevant regulations and systems according to the applicable laws and the development needs of the Company.

The Board of Directors of the Company always regards the enhancement of corporate governance and the regulation of the three meetings as its own responsibility, continuously strengthens its own construction, and operates in compliance with laws and regulations, laying a solid foundation for the Company’s sustained and healthy development. In 2021, the Board of Directors of the Company has continuously led the Company to adhere to strategic leadership, closely focused on the “Four revolutions, One cooperation” new energy security strategy, thoroughly implement the new development concept, vigorously implement the green development strategy, and achieve carbon neutrality. The goal is to lead, formulate and implement the “14th Five-Year” carbon peak action plan, accelerate the development of new energy, and accelerate the optimization and upgrading of coal power structure, implement the three-year action plan for the reform of state-owned enterprises, adhere to the fundamental principle of improving the quality of listed companies, continue to strengthen the construction of corporate management systems and management capabilities, comprehensively promote high-quality development, and accelerate the pace of establishing a world-class listed power company with global competitiveness. At the same time, the Company will strictly abide by the Securities Law, Guidelines for the Governance of Listed Companies”, with the fundamental aim of maximizing the interests of shareholders, treat all shareholders fairly, maintain a positive, balanced and stable dividend policy, and manage well the relationship between its long-term development of the Company and the short-term benefits of its investors.

All members of the Board jointly perform the duties of corporate governance. During the reporting period, the Board has included the following in its scope of duties and authority:

| 1. | Establishing and reviewing the Company’s corporate governance policies and codes, and making such amendments as it deems necessary to ensure the effectiveness of such policies and codes; |

| 2. | Reviewing and supervising the training and sustained professional development of the Company’s directors and senior management; |

| 3. | Reviewing and supervising the Company’s policies and codes regarding the observance of laws and regulatory requirements; |

| 4. | Formulating, reviewing and supervising the codes of conduct and compliance handbook applicable to directors and employees; and |

| 5. | Reviewing the Company’s status on compliance with the Code on Corporate Governance Practices and the disclosures made in the Corporate Governance Report. |

| (2) | Enhancing and improving the information disclosure system |

The Company stresses on the importance of external information disclosure. The Company has established the Information Disclosure Committee which comprises the secretary to the Board of Directors, the chief accountant, managers of each functional department to be responsible for reviewing the Company’s regular reports. The Company has implemented the system of holding regular information disclosure meetings every Monday, chaired by the secretary to the Board of Directors and attended by relevant business departments, to notify and discuss major issues relating to the Company’s operations, which provide a guarantee for the Company to perform its information disclosure obligations timely. The Company has successively formulated and implemented the relevant information disclosure system, and has made timely amendments thereto according to regulatory requirements. The current functioning systems include the Measures on Information Disclosure Management, the Measures on Related Transaction Management, Measures for the Administration of Insiders, the Measures on Investor Relations Management, the Detailed Rules on the Work of the Information Disclosure Committee, Management Measures for Pursuing Responsibility regarding Material Errors in Information Disclosure of Annual Report, etc.. In the first half of 2021, in accordance with relevant regulatory rules and requirements and in conjunction with the Company’s actual situation, the Measures on Information Disclosure Management and the Measures for the Administration of Insiders of the Company have correspondingly been revised to ensure that the system of the Company meets with the latest regulatory requirements. The above measures and system ensure the regulated operation of the Company, strengthen the truthfulness, accuracy, completeness and the timely disclosure of information, and at the same time enhance the quality as well as transparency of the information disclosure.

Relevant departments of the Company compiled answers (and subsequent updates) to questions regarding the hot topics of market concerns, and the Company’s production, operation and operating results in a timely manner. The replies shall become the basis of external communication upon the approval of the Company’s management and the authorised representatives of the Information Disclosure Committee. In addition, the Company engages professional personnel to conduct specialized training for the staff of the Company who are responsible for information disclosure on an irregular basis in order to continuously enhance their expertise.

| (3) | Regulating financial management system, strengthening internal control |

The credibility of a listed company, to a large extent, relates to the quality of the preparation of financial statements and a regulated operation of financial activities. In 2021, the Company continues to adhere to the principle of good faith and fair treatment to its shareholders and makes a lot of detailed work in preparing the financial reports and regulated financial operations, including:

| 1. | In order to strictly implement the accounting rules, accounting standards and accounting systems, to strengthen accounting and accounts supervision, and to truthfully and fairly reflect the financial position, operating results and cash flow, the Company has formulated the Measures on Accounting, the Management Measures on Financial Accounting Reports, the Measures on Fixed Assets Management, Lists of Fixed Assets, the Measures on Cost Management and the Joint Audit Management Regulations on Financial Accounting and other rules and regulations. The Company’s Board, the Supervisory Committee and the Audit Committee have reviewed the Company’s financial reports on a regular basis and the Company has fulfilled the requirements of making the Chairman, the President and the Chief Accountant responsible for the truthfulness and completeness of the financial reports. |

| 2. | In regard to fund management, the Company has formulated a number of management measures including the Measures on Financial Management, the Measures on the Management of the Income and Expenditure of the Funds, the Measures on the Use and Management of Large Amount by Headquarter of the Company, the Measures on the Management of Bills of Exchange, the Measures on Management of Fund Raised, Rules on the Management of Transactions Involving Financial Derivatives, the Measures on the Management of Provision of Security to Third Parties and the Measures for Regulating Fund Transfers with the Related Parties. The Company’s Articles of Association also set out provisions relating to loans, guarantees and investment. In the annual reports of the Company over the previous years, the Company has engaged certified accountants to conduct auditing on the use of funds by the controlling shareholders and other related parties, and issue specific statements according to the requirements of the China Securities Regulatory Commission (“China Securities Regulatory Commission”) and the Shanghai Stock Exchange (“Shanghai Stock Exchange”) for confirmation that there has not been any violation of rules relating to the use of funds. Moreover, the Company also conducted quarterly checking and clearing with related parties in relation to the operational fund transfers in order to ensure the safety of funds. |

| 3. | The overall objective of internal control of the Company is to promote implementation of the corporate strategy. Specific goals are to maintain lawful operation and management of the Company, asset safety, and truthfulness and completeness of financial reports and related information, thus promoting the overall enhancement of operating efficiency and actual effect. |

The Company has comprehensively sort out internal and external risks and various business processes, and completed the “Internal Control Manual”. From 5 aspects of environment control, risk assessment, process control, information and communication and monitoring, the sixth version of the “Internal Control Manual” currently in use by the Company detailed 25 business processes in revenue, material procurement, fuel procurement and capital management, and 19 soft elements including organizational structures, human resources management, antifraud and risk management, thereby comprehensively elaborating the Company’s guiding principles and policies, work procedures and job duties of various posts, regulating the standard procedures of various business processes and realising a streamlined system. The Company has compiled the “Internal Control Evaluation Handbook”, clarifying the three-tier internal control evaluation management system, the internal control evaluation mode that cooperates with daily evaluation and key supervision, standardized internal control evaluation procedures, evaluation methods, defect defining procedures and standards, and realizes internal control and standardization of evaluation. The Company conducts annual assessment on the applicability and effectiveness of the above system and regularly conducts revision and perfection in order to realise dynamic maintenance of the internal control system.

For the purpose of risk identification, the Company in the “Internal Control Manual” stipulates the corresponding control measures and defines key control points. Through the implementation of the “one post for one item system” at each control point, the control responsibility is divided to every post at various levels so that internal control and job responsibilities are combined and all members of staff can participate in the construction of internal control. The Company has implemented the internal control routine evaluation mechanism, set up the post of internal control evaluators in each department and subordinate unit respectively, conducted monthly internal control evaluation, and established a three- tier evaluation quality supervision mechanism respectively at the three levels of the Company, regional offices and basic level units by way of the internal control management system in order to conduct real-time tracking of the implementation of internal control. During the first half of 2021, the Company has successfully completed a six-month internal control routine evaluation, thus effectively protecting and promoting the sustained and healthy development of the businesses of the Company and realising the stable operation of the internal control system. The Company has combined the new requirements and new changes in business and management and constantly advanced experience and common issues, and launched comprehensive and multilevel internal control training each year, and widely publicised internal control concepts and knowledge, thus continuously optimising the internal control environment.