华能国际电力股份有限公司

HUANENG POWER INTERNATIONAL, INC.

Annual Report On Form 20-F

2009

As filed with the Securities and Exchange Commission on April 19, 2010

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 20-F

(Mark One)

| | £ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR |

| | R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009 |

| | OR |

| | £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR |

| | £ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report ………………. |

For the transaction period form ____________ to __________

Commission file number: 1-13314

华能国际电力股份有限公司

HUANENG POWER INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

PEOPLE'S REPUBLIC OF CHINA

(Jurisdiction of incorporation or organization)

WEST WING, BUILDING C, TIANYIN MANSION,

2C, FUXINGMENNAN STREET, BEIJING, PEOPLE'S REPUBLIC OF CHINA

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of Each Class | Name of each exchange on which registered |

| Ordinary American Depositary Shares | New York Stock Exchange |

| Overseas Listed Foreign Shares of RMB1.00 each | New York Stock Exchange* |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

NONE

(Title of Class)

______________________

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

NONE

(Title of Class)

______________________

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

| Domestic Shares of RMB1.00 each | | | 9,000,000,000 | |

| Overseas Listed Foreign Shares of RMB1.00 each | | | 3,055,383,440 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer R | Accelerated filer £ | Non-accelerated filer £ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP £ | International Financial Reporting Standards as issued by the International Accounting Standards Board R | Other £ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

_______________

* Not for trading, but only in connection with the registration of American Depositary Shares.

TABLE OF CONTENTS

Page

| PART I. | 1 |

| | ITEM 1 | Identity of Directors, Senior Management and Advisers | 1 |

| | ITEM 2 | Offer Statistics and Expected Timetable | 1 |

| | ITEM 3 | Key Information | 1 |

| | | A. | Selected financial data | 1 |

| | | B. | Capitalization and indebtedness | 2 |

| | | C. | Reasons for the offer and use of proceeds | 2 |

| | | D. | Risk factors | 3 |

| | ITEM 4 | Information on the Company | 9 |

| | | A. | History and development of the Company | 9 |

| | | B. | Business overview | 11 |

| | | C. | Organizational structure | 20 |

| | | D. | Property, plants and equipment | 22 |

| | ITEM 4A | Unresolved Staff Comments | 37 |

| | ITEM 5 | Operating and Financial Review and Prospects | 37 |

| | | A. | General | 37 |

| | | B. | Operating results | 39 |

| | | C. | Financial position | 48 |

| | | D. | Liquidity and cash resources | 49 |

| | | E. | Trend information | 54 |

| | | F. | Employee benefits | 55 |

| | | G. | Guarantee on loans and restricted assets | 55 |

| | | H. | Off-balance sheet arrangements | 55 |

| | | I. | Performance of significant investments and their prospects | 55 |

| | | J. | Tabular disclosure of contractual obligations and commercial commitments | 56 |

| | | K. | Business plan | 56 |

| | ITEM 6 | Directors, Senior Management and Employees | 57 |

| | | A. | Directors, members of the supervisory committee and senior management | 57 |

| | | B. | Compensation for Directors, Supervisors and Executive Officers | 61 |

| | | C. | Board practice | 62 |

| | | D. | Employees | 63 |

| | | E. | Share ownership | 64 |

| | ITEM 7 | Major Shareholders and Related Party Transactions | 64 |

| | | A. | Major shareholders | 64 |

| | | B. | Related party transactions | 65 |

| | | C. | Interests of experts and counsel | 69 |

| | ITEM 8 | Financial Information | 69 |

| | | A. | Consolidated statements and other financial information | 69 |

| | | B. | Significant changes | 70 |

| | ITEM 9 | The Offer and Listing | 70 |

| | | A. | Offer and listing details and markets | 70 |

| | ITEM 10 | Additional Information | 71 |

| | | A. | Share capital | 71 |

| | | B. | Memorandum and articles of association | 71 |

| | | C. | Material contracts | 77 |

| | | D. | Exchange controls | 77 |

| | | E. | Taxation | 78 |

| | | F. | Dividends and paying agents | 82 |

| | | G. | Statement by experts | 82 |

| | | H. | Documents on display | 82 |

| | | I. | Subsidiary information | 83 |

| | ITEM 11 | Quantitative and Qualitative Disclosures About Market Risk | 83 |

| | ITEM 12 | Description of Securities Other than Equity Securities | 85 |

| PART II. | 87 |

| | ITEM 13 | Defaults, Dividend Arrearages and Delinquencies | 87 |

| | ITEM 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | 87 |

| | ITEM 16 | Reserved | 87 |

| | ITEM 16A | Audit Committee Financial Expert | 87 |

| | ITEM 16B | Code of Ethics | 88 |

| | ITEM 16C | Principal Accountant Fees and Services | 88 |

| | ITEM 16D | Exemptions from the Listing Standards for Audit Committees | 89 |

| | ITEM 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 89 |

| | ITEM 16F | Change in Registrant's Certifying Accountant | 89 |

| | ITEM 16G | Corporate Governance | 89 |

| | ITEM 17 | Financial Statements | 91 |

| | ITEM 18 | Financial Statements | 91 |

| | ITEM 19 | Exhibit | 91 |

INTRODUCTION

We maintain our accounts in Renminbi yuan ("Renminbi" or "RMB"), the lawful currency of the People's Republic of China (the "PRC" or "China"). References herein to "US$" or "US Dollars" are to United States Dollars, references to "HK$" are to Hong Kong Dollars, and references to “S$” are to Singapore Dollars. References to ADRs and ADSs are to American Depositary Receipts and American Depositary Shares, respectively. Translations of amounts from Renminbi to US Dollars are solely for the convenience of the reader. Unless otherwise indicated, any translations from Renminbi to US Dollars or from US Dollars to Renminbi were translated at the average rate announced by the People's Bank of China (the "PBOC Rate") on December 31, 2009 of US$1.00 to RMB6.8282. No representation is made that the Renminbi or US Dollar amounts re ferred to herein could have been or could be converted into US Dollars or Renminbi, as the case may be, at the PBOC Rate or at all.

References to "A Shares" are to common tradable shares issued to domestic shareholders.

References to the "central government" refer to the national government of the PRC and its various ministries, agencies and commissions.

References to the "Company", "we", "our" and "us" include, unless the context requires otherwise, Huaneng Power International, Inc. and the operations of our power plants and our construction projects.

References to "HIPDC" are to Huaneng International Power Development Corporation and, unless the context requires otherwise, include the operations of the Company prior to the formation of the Company on June 30, 1994.

References to "Huaneng Group" are to China Huaneng Group.

References to the "key contracts" refer to coal purchase contracts entered into between the Company and coal suppliers for the amount of coals at the annual national coal purchase conferences attended by, among others, representatives of power companies, coal suppliers and railway authorities. These conferences were coordinated and sponsored by National Development and Reform Commission (“NDRC”). The Company enjoys priority railway transportation services with respect to coal purchased under such contracts. Starting from 2008, NDRC ceased to coordinate annual national coal purchase conference. At the end of each year subsequent to 2008, the Ministry of Railways will promulgate the railway transportation capacity plan for the next year. References to the "key contracts" for the year 2008 and thereafter refer to coal pur chase contracts entered into between the Company and coal suppliers under the guidance of such railway transportation capacity plan, which, once confirmed by the Ministry of Railways, secures the railway transportation capacity for the coal purchased thereunder.

References to "local governments" in the PRC are to governments at all administrative levels below the central government, including provincial governments, governments of municipalities directly under the central government, municipal and city governments, county governments and township governments.

References to "power plants" or "our power plants" are to the power plants that are wholly-owned by the Company or to the power plants in which the Company owns majority equity interests.

References to “power companies” or “our power companies” are to the power companies in which we hold minority equity interests.

References to the "PRC Government" include the central government and local governments.

References to "provinces" include provinces, autonomous regions and municipalities directly under the central government.

References to “Singapore” are to the Republic of Singapore.

References to the "State Plan" refer to the plans devised and implemented by the PRC Government in relation to the economic and social development of the PRC.

References to "tons" are to metric tons.

Previously, the Overseas Listed Foreign Shares were also referred to as the "Class N Ordinary Shares" or "N Shares". Since January 21, 1998, the date on which the Overseas Listed Foreign Shares were listed on The Stock Exchange of Hong Kong Limited by way of introduction, the Overseas Listed Foreign Shares have been also referred to as "H Shares".

GLOSSARY

| actual generation | The total amount of electricity generated by a power plant over a given period of time. |

| | |

| auxiliary power | Electricity consumed by a power plant in the course of generation. |

| | |

| availability factor | For any period, the ratio (expressed as a percentage) of a power plant's available hours to the total number of hours in such period. |

| | |

| available hours | For a power plant for any period, the total number of hours in such period less the total number of hours attributable to scheduled maintenance and planned overhauls as well as to forced outages, adjusted for partial capacity outage hours. |

| | |

| capacity factor | The ratio (expressed as a percentage) of the gross amount of electricity generated by a power plant in a given period to the product of (i) the number of hours in the given period multiplied by (ii) the power plant's installed capacity. |

| | |

| demand | For an integrated power system, the amount of power demanded by consumers of energy at any point in time. |

| | |

| dispatch | The schedule of production for all the generating units on a power system, generally varying from moment to moment to match production with power requirements. As a verb, to dispatch a plant means to direct the plant to operate. |

| | |

| GW | Gigawatt. One million kilowatts. |

| | |

| GWh | Gigawatt-hour. One million kilowatt-hours. GWh is typically used as a measure for the annual energy production of large power plants. |

| | |

| installed capacity | The manufacturers' rated power output of a generating unit or a power plant, usually denominated in MW. |

| | |

| kV | Kilovolt. One thousand volts. |

| | |

| kW | Kilowatt. One thousand watts. |

| | |

| kWh | Kilowatt-hour. The standard unit of energy used in the electric power industry. One kilowatt-hour is the amount of energy that would be produced by a generator producing one thousand watts for one hour. |

| | |

| MVA | Million volt-amperes. A unit of measure used to express the capacity of electrical transmission equipment such as transformers. |

| | |

| MW | Megawatt. One million watts. The installed capacity of power plants is generally expressed in MW. |

| | |

| MWh | Megawatt-hour. One thousand kilowatt-hours. |

| | |

| peak load | The maximum demand on a power plant or power system during a specific period of time. |

| planned generation | An annually determined target gross generation level for each of our operating power plants used as the basis for determining planned output. |

| | |

| total output | The actual amount of electricity sold by a power plant in a particular year, which equals total generation less auxiliary power. |

| | |

| transmission losses | Electric energy that is lost in transmission lines and therefore is unavailable for use. |

PART I.

| ITEM 1 | Identity of Directors, Senior Management and Advisers |

Not applicable.

| ITEM 2 | Offer Statistics and Expected Timetable |

Not applicable.

| ITEM 3 | Key Information |

| | |

| A. | Selected financial data |

Our consolidated balance sheet data as of December 31, 2009 and 2008 and the consolidated income statement and cash flow data for each of the years in the three-year period ended December 31, 2009 are derived from the historical financial statements included herein. Our consolidated balance sheet data as of December 31, 2007, 2006 and 2005 and income statement and cash flow data for each of the years in the two-year period ended December 31, 2006, are derived from the historical financial statements not included herein. The revenue and other income has been reclassified to consistent with the current year's presentation. The Selected Financial Data should be read in conjunction with the consolidated financial statements and "Item 5 - Operating and Financial Review and Prospects". The financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. The Selected Financial Data may not be indicative of future earnings, cash flows or financial position.

| | | | |

| | | | | | | | | | | | | | | | | | | |

| RMB and US Dollars in thousands except per share data | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (US$)(1) | |

| | | | | | | | | | | | | | | | | | | |

| Income Statement Data | | | | | | | | | | | | | | | | | | |

| IFRS | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Operating revenue | | | 40,370,261 | | | | 44,422,501 | | | | 49,892,049 | | | | 67,835,114 | | | | 76,862,896 | | | | 11,256,685 | |

Sales tax | | | (113,475 | ) | | | (148,057 | ) | | | (139,772 | ) | | | (106,385 | ) | | | (151,912 | ) | | | (22,248 | ) |

Operating expenses | | | (33,245,435 | ) | | | (35,705,591 | ) | | | (41,817,349 | ) | | | (68,964,955 | ) | | | (67,537,281 | ) | | | (9,890,934 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit/ (Loss) from operations | | | 7,011,351 | | | | 8,568,853 | | | | 7,934,928 | | | | (1,236,226 | ) | | | 9,173,703 | | | | 1,343,503 | |

Interest income | | | 53,685 | | | | 51,910 | | | | 53,527 | | | | 83,522 | | | | 60,397 | | | | 8,845 | |

Financial expenses, net | | | (1,178,076 | ) | | | (1,523,214 | ) | | | (1,927,988 | ) | | | (3,707,943 | ) | | | (4,309,325 | ) | | | (631,107 | ) |

Investment income | | | 60,872 | | | | 28,415 | | | | 585,379 | | | | 51,061 | | | | 56,675 | | | | 8,300 | |

Gain/ (Loss) on fair value changes | | | - | | | | 100,180 | | | | 87,132 | | | | (54,658 | ) | | | (33,638 | ) | | | (4,926 | ) |

| Share of profits of associates | | | 644,376 | | | | 790,629 | | | | 586,323 | | | | 72,688 | | | | 756,164 | | | | 110,741 | |

Profit/ (Loss) before tax | | | 6,592,208 | | | | 8,016,773 | | | | 7,319,301 | | | | (4,791,556 | ) | | | 5,703,976 | | | | 835,356 | |

| Income tax (expense)/benefit | | | (1,044,297 | ) | | | (1,127,699 | ) | | | (838,270 | ) | | | 239,723 | | | | (593,787 | ) | | | (86,961 | ) |

Profit/ (Loss) for the year | | | 5,547,911 | | | | 6,889,074 | | | | 6,481,031 | | | | (4,551,833 | ) | | | 5,110,189 | | | | 748,395 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Attributable to: | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity holders of the Company | | | 4,871,794 | | | | 6,071,154 | | | | 6,161,127 | | | | (3,937,688 | ) | | | 4,929,544 | | | | 721,939 | |

Minority interests | | | 676,117 | | | | 817,920 | | | | 319,904 | | | | (614,145 | ) | | | 180,645 | | | | 26,456 | |

| Basic earnings/(loss) per share | | | 0.40 | | | | 0.50 | | | | 0.51 | | | | (0.33 | ) | | | 0.41 | | | | 0.06 | |

| Diluted earnings/(loss) per share | | | 0.40 | | | | 0.50 | | | | 0.51 | | | | (0.33 | ) | | | 0.41 | | | | 0.06 | |

| | | | |

| | | | | | | | | | | | | | | | | | | |

| RMB and US Dollars in thousands | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (US$)(1) | |

| | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data | | | | | | | | | | | | | | | | | | |

| IFRS | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Current assets | | | 12,063,175 | | | | 13,564,516 | | | | 18,551,059 | | | | 20,018,177 | | | | 24,189,765 | | | | 3,542,627 | |

| Property, plant and equipment | | | 78,997,297 | | | | 90,444,225 | | | | 90,125,919 | | | | 116,737,198 | | | | 140,777,336 | | | | 20,617,049 | |

| Available-for-sale financial assets | | | 1,033,225 | | | | 1,458,759 | | | | 3,462,158 | | | | 1,524,016 | | | | 2,555,972 | | | | 374,326 | |

Investments in associates | | | 4,593,984 | | | | 5,418,213 | | | | 8,731,490 | | | | 8,758,235 | | | | 9,568,576 | | | | 1,401,332 | |

Land use rights and other non- current assets | | | 2,016,144 | | | | 2,282,884 | | | | 2,658,583 | | | | 3,643,431 | | | | 4,911,678 | | | | 719,322 | |

Power generation licence | | | - | | | | - | | | | - | | | | 3,811,906 | | | | 3,898,121 | | | | 570,886 | |

| Deferred income tax assets | | | 64,075 | | | | 98,429 | | | | 211,654 | | | | 316,699 | | | | 374,733 | | | | 54,880 | |

Goodwill | | | 671,796 | | | | 671,796 | | | | 555,266 | | | | 11,108,096 | | | | 11,610,998 | | | | 1,700,448 | |

Total assets | | | 99,439,696 | | | | 113,938,822 | | | | 124,296,129 | | | | 165,917,758 | | | | 197,887,179 | | | | 28,980,870 | |

Current liabilities | | | (23,107,142 | ) | | | (26,842,684 | ) | | | (31,376,561 | ) | | | (52,486,200 | ) | | | (59,581,608 | ) | | | (8,725,815 | ) |

Non-current liabilities | | | (30,188,367 | ) | | | (36,487,446 | ) | | | (40,839,926 | ) | | | (70,871,605 | ) | | | (87,657,451 | ) | | | (12,837,563 | ) |

Total liabilities | | | (53,295,509 | ) | | | (63,330,130 | ) | | | (72,216,487 | ) | | | (123,357,805 | ) | | | (147,239,059 | ) | | | (21,563,378 | ) |

Net assets | | | 46,144,187 | | | | 50,608,692 | | | | 52,079,642 | | | | 42,559,953 | | | | 50,648,120 | | | | 7,417,492 | |

Total equity | | | 46,144,187 | | | | 50,608,692 | | | | 52,079,642 | | | | 42,559,953 | | | | 50,648,120 | | | | 7,417,492 | |

| | | | |

| | | | | | | | | | | | | | | | | | | |

| RMB and US Dollars in thousands except per share data | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (RMB) | | | (US$)(1) | |

| Cash Flow Data | | | | | | | | | | | | | | | | | | |

| IFRS | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Purchase of property, plant and equipment | | | (13,842,293 | ) | | | (15,998,575 | ) | | | (14,223,310 | ) | | | (27,893,520 | ) | | | (22,426,098 | ) | | | (3,284,335 | ) |

Net cash provided by operating activities | | | 10,652,419 | | | | 14,005,841 | | | | 12,078,833 | | | | 5,185,893 | | | | 14,980,990 | | | | 2,193,988 | |

Net cash used in investing activities | | | (15,413,369 | ) | | | (15,915,542 | ) | | | (16,257,355 | ) | | | (47,957,065 | ) | | | (24,880,261 | ) | | | (3,643,751 | ) |

Net cash (used in) / provided by financing activities | | | 5,119,559 | | | | 2,473,002 | | | | 8,287,893 | | | | 41,255,291 | | | | 9,503,886 | | | | 1,391,858 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Data | | | | | | | | | | | | | | | | | | | | | | | | |

| IFRS | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Dividend declared per share | | | 0.25 | | | | 0.28 | | | | 0.30 | | | | 0.10 | | | | 0.21 | | | | 0.03 | |

Number of ordinary shares (’000) | | | 12,055,383 | | | | 12,055,383 | | | | 12,055,383 | | | | 12,055,383 | | | | 12,055,383 | | | | 12,055,383 | |

| (1) | The US Dollar data has been translated from RMB solely for convenience at the PBOC Rate on December 31, 2009 of US$1.00 to RMB6.8282. See “Item 10 Additional Information — Exchange controls for more information on exchange rates between RMB and US Dollars”. |

| B. | Capitalization and indebtedness |

Not applicable.

| C. | Reasons for the offer and use of proceeds |

Not applicable.

Risks relating to our business and the PRC's power industry

Government regulation of on-grid power tariffs and other aspects of the power industry may adversely affect our business

Similar to electric power companies in other countries, we are subject to governmental and electric grid regulations in virtually all aspects of our operations, including the amount and timing of electricity generations, the setting of on-grid tariffs, the performance of scheduled maintenance and compliance with power grid control and dispatch directives and environment protection. There can be no assurance that these regulations will not change in the future in a manner which could adversely affect our business.

The on-grid tariffs for our planned output are subject to a review and approval process involving the NDRC and the relevant provincial government. Prior to April 2001, the on-grid tariffs of our planned output were designed to enable us to recover all operating and debt servicing costs and to earn a fixed rate of return. Since April 2001, however, the PRC government has started to gradually implement a new on-grid tariff-setting mechanism based on the operating terms of power plants as well as the average costs of comparable power plants. Pursuant to the NDRC circular issued in June 2004, the on-grid tariffs for our newly built power generating units commencing operation from June 2004 have been set on the basis of the average cost of comparable units adding tax and reasonable return in the regional grid. Any future reductions in our tariffs, or our inability to raise tariffs (for example, to cover any increased costs we may have to incur) as a result of the new on-grid tariff-setting mechanism, may adversely affect our revenue and profit.

In addition, the PRC government started in 1999 to experiment with a program to effect power sales through competitive bidding in some of the provinces where we operate our power plants. The on-grid tariffs for power sold through competitive bidding are generally lower than the pre-approved on-grid tariffs for planned output. Although the power sales through competitive bidding in the last few years constituted only a small fraction of our total output, the PRC government is in the process of gradually expanding the program with a view to create a market-oriented electric power industry. Any increased power sales through competitive bidding may reduce our on-grid tariffs and adversely affect our revenue and profits.

Furthermore, the PRC government started in 2009 to promote the practice of direct power purchase by large power end-users. Pursuant to the circular jointly issued by NDRC, The State Electricity Regulatory Commission (“SERC”) and China National Energy Administration in June 2009, the direct power purchase price consists of direct transaction price, on-grid dispatch and distribution price and governmental levies and charges, in which the direct transaction price shall be freely determined through negotiation between the power generation company and the large power end-user. The price of direct power purchase shall be subject to the demand in the power market, and may increase due to power supply shortfall. In terms of power generation company engaged in direct power purchase, direct power sales constitute a portion of th e total power sales, thus affecting the on-grid power sales of the company. As of December 31, 2009, most of the provinces and municipalities in China have not promulgated detailed implementation rules with respect to direct power purchase. Furthermore, the scale and mode of the transaction are also subject to the structure and level of development of the local economy. Although the direct power purchase may act as an alternative channel for our power sales, there is uncertainty as to the effect of the practice of direct power purchase over our operating results.The on-grid tariff-setting mechanism is evolving with the reforming of the PRC electric power industry. There is no assurance that it will not change in a manner which could adversely affect our business and results of operations. See “Item 4 Information of the Company – B. Business Overview – Pricing Policy”.

If our power plants receive less dispatching than planned generation, the power plants will sell less electricity than planned

Our profitability depends, in part, upon each of our power plants generating electricity at a level sufficient to meet or exceed the planned generation, which in turn will be subject to local demand for electric power and dispatching to the grids by the dispatch centres of the local grid companies.

The dispatch of electric power generated by a power plant is controlled by the dispatch centre of the applicable grid companies pursuant to a dispatch agreement with us and to governmental dispatch regulations. In each of the markets we operate, we compete against other power plants for power sales. No assurance can be given that the dispatch centres will dispatch the full amount of the planned generation of our power plants. A reduction by the dispatch centre in the amount of electric power dispatched relative to a power plant's planned generation could have an adverse effect on the profitability of our operations. However, we have not encountered any such event in the past.

In August 2007, General Office of the State Council issued a notice, providing that the energy saving and electricity dispatch shall consolidate with the development of the power market, which optimize the power market. The SERC is conducting research on how to effectively combine the energy saving and electricity dispatch with the development of the power market, and the detailed measures are still in the process of drafting. In October 2008, the SERC approved the trial implementation of the policy of energy saving and electricity dispatch in certain pilot provinces. There can be no assurance that such implementation will not results in any decrease in the amount of the power dispatched of any of our power plants.

The power industry reform may affect our business

PRC government in 2002 announced and started to implement measures to further reform the power industry, with the ultimate goal to create a more open and fair power market. As part of the reform, five power generating companies, including Huaneng Group, were created or restructured to take over all the power generation assets originally belonging to the State Power Corporation of China. In addition, two grid companies were created to take over the power transmission and distribution assets originally belonging to the State Power Corporation of China. An independent power supervisory commission, the SERC, was created to regulate the power industry. It is uncertain how these reform measures and any further reforms are going to be implemented and how they will impact our business.

On April 6, 2007, the PRC State Council issued the Opinions on Implementing Further Reform in Power Industry during the “Eleventh Five-Year Plan” period, or the Implementing Opinions, which confirm the direction of reform and present further guidance. According to the Implementing Opinions, the government encourages environment protection and renovation and replacement of outdated generating units. The further reform will not only bring opportunities to power industry but also intensify the competition which may affect our business.

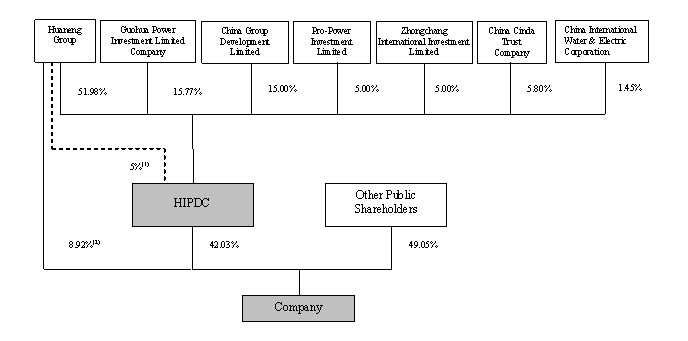

We are effectively controlled by Huaneng Group and HIPDC, whose interests may differ from those of our other shareholders

Huaneng Group, directly or through its wholly-owned subsidiary, and HIPDC directly hold 8.92% and 42.03% of our total outstanding shares respectively. As Huaneng Group is HIPDC’s parent company, they may exert effective control over us in concert. Their interests may sometimes conflict with those of our other minority shareholders. There is no assurance that Huaneng Group and HIPDC will always vote their shares, or direct the directors nominated by them to act in a way that will benefit our other minority shareholders.

Disruption in coal supply and its transportation as well as increase in coal price may adversely affect the normal operation of our power plants

A substantial majority of our power plants are fueled by coal. We have obtained coal for our power plants through a combination of purchases pursuant to the key contracts and purchases in the open market. We have not experienced shutdowns or reduced electricity generation caused by inadequate coal supply or transportation services, there can be no assurance that, in the event of national coal supply shortfalls, our operations will not be adversely affected. In addition, our results of operation are sensitive to the fluctuation of coal price. Since 2003, the continuous increase of coal price has increased our costs substantially and caused our profits to decline. Although the government has established a coal-electricity price linkage mechanism to allow power generating companies to increase their power tariffs to respond to the increase of coal price, the implementation of the mechanism involves significant uncertainties. There is no assurance that we will be able to adjust our power tariff to pass on the increase of coal price to our customers. For a detailed discussion of the coal-electricity price linkage mechanism, see “Item 4 Information of the Company-B Business Overview – Pricing Policy”. Starting from 2009, in furtherance of the coal purchase reform, NDRC ceased to coordinate annual coal purchase conference and will no longer make allocation of coal supply to power companies. The price and amount of coal supply will be determined based on the free negotiation between power companies, coal suppliers, and the railway authorities, which increases the uncertainty of the coal supply and the coal price and may adversely affect our operations.

Power plant development, acquisition and construction are a complex and time-consuming process, the delay of which may negatively affect the implementation of our growth strategy

We develop, construct, manage and operate large power plants; success depends upon our ability to secure all required PRC Government approvals, power sales and dispatch agreements, construction contracts, fuel supply and transportation and electricity transmission arrangements. Delay or failure to secure any of these could increase cost or delay or prevent commercial operation of the affected power plant. Although each of our power plants in operation and the power plants under construction received all required PRC Government

approvals in a timely fashion, no assurances can be given that all the future projects will receive approvals in a timely fashion or at all.

We have generally acted as, and intend to continue to act as, the general contractor for the construction of our power plants. As with any major infrastructure construction effort, the construction of a power plant involves many risks, including shortages of equipment, material and labor, labor disturbances, accidents, inclement weather, unforeseen engineering, environmental, geological, delays and other problems and unanticipated cost increases, any of which could give rise to delays or cost overruns. Construction delays may result in loss of revenues. Failure to complete construction according to specifications may result in liabilities, decrease power plant efficiency, increase operating costs and reduce earnings. Although the construction of each of our power plants was complete d on or ahead of schedule and within its budget, no assurance can be given that construction of future projects will be completed on schedule or within budget.

In addition, from time to time, we may acquire existing power plants from HIPDC, Huaneng Group or other parties. The timing and the likelihood of the consummation of any such acquisitions will depend, among other things, on our ability to obtain financing and relevant PRC Government approvals and to negotiate relevant agreements for terms acceptable to us.

Substantial capital is required for investing in or acquiring new power plants and failure to obtain capital on reasonable commercial terms will increase our finance cost and cause delay in our expansion plans

An important component of our growth strategy is to develop new power plants and acquire operating power plants and related development rights from HIPDC, Huaneng Group or other companies on commercially reasonable terms. Our ability to arrange financing and the cost of such financing depend on numerous factors, including general economic and capital market conditions, credit availability from banks or other lenders, investor confidence in us and the continued success of our power plants. The People’s Bank of China has reduced RMB benchmark lending interest rates for five consecutive times from September to the end of 2008 to counteract the impact of international financial crisis on China’s economy. Chinese government has implemented appropriately liberated monetary pol icies during 2009, thus creating a favorable environment for the Company to control financing costs. Chinese government is expected to continue implementing the liberated monetary policies during 2010 to enhance the recovery of China’s economy from the international financial crisis. However, there is no assurance that the lending interest rates would not be raised in the future. Although we have historically been able to obtain financing on terms acceptable to us, there can be no assurance that financing for future power plant developments and acquisitions will be available on terms acceptable to us or, in the event of an equity offering, that such offering will not result in substantial dilution to existing shareholders.

Operation of power plants involves many risks and we may not have enough insurance to cover the economic losses if any of our power plants’ ordinary operation is interrupted

The operation of power plants involves many risks and hazards, including breakdown, failure or substandard performance of equipment, improper installation or operation of equipment, labor disturbances, natural disasters, environmental hazards and industrial accidents. The occurrence of material operational problems, including but not limited to the above events, may adversely affect the profitability of a power plant.

Our power plants in the PRC currently maintain insurance coverage that is typical in the electric power industry in the PRC and in amounts that we believe to be adequate. Such insurance, however, may not provide adequate coverage in certain circumstances. In particular, in accordance with industry practice in the PRC, our power plants in the PRC do not generally maintain business interruption insurance, or any of third party liability insurance other than that included in construction all risks insurance or erection all risks insurance to cover claims in respect of bodily injury or property or environment damage arising from accidents on our property or relating to our operation. Although each of our power plants has a good record of safe operation, there is no assurance that the af ore-mentioned accidents will not occur in the future.

If the PRC government adopts new and stricter environmental laws and additional capital expenditure is required for complying with such laws, the operation of our power plants may be adversely affected and we may be required to make more investment in compliance with these environmental laws

Our power plants, like all coal-fired power plants, discharge pollutants into the environment. We are subject to central and local government environmental protection laws and regulations, which currently impose base-level discharge fees for various polluting substances and graduated schedules of fees for the discharge of waste substances. The amount of discharge fees shall be determined by the local environmental protection authority based on the periodic inspection of the type and volume of pollution discharges. In addition, such environmental protection laws and regulations also set up the goal for the overall control on the discharge

volume of key polluting substances. These laws and regulations impose fines for violations of laws, regulations or decrees and provide for the possible closure by the central government or local government of any power plant which fails to comply with orders requiring it to cease or cure certain activities causing environmental damage. In 2007, the PRC government issued additional policies on discharge of polluting substances and on desulphurization for coal-fired generating units. Certain provinces have raised the rates of waste disposal feessince 2008. Such increases in the discharge fees and in the environmental protection expenditure will lead to an increase of the operating costs of power plants like ours and may have adverse impact on our operating results.

We attach great importance to the environmental related matters of our existing power plants and our power plants under construction. We have implemented a system that is designed to control pollution caused by our power plants, including the establishment of an environmental protection office at each power plant, adoption of relevant control and evaluation procedures and the installation of certain pollution control equipment. We believe our environmental protection systems and facilities for the power plants are adequate for us to comply with applicable central government and local government environmental protection laws and regulations. The PRC Government may impose new, stricter laws and regulations which would require additional expenditure on environmental protection.

The PRC is a party to the Framework Convention on Climate Change ("Climate Change Convention"), which is intended to limit or capture emissions of "greenhouse" gases, such as carbon dioxide. Ceilings on such emissions could limit the production of electricity from fossil fuels, particularly coal, or increase the costs of such production. At present, ceilings on the emissions of "greenhouse" gases have not been assigned to developing countries under the Climate Change Convention. Therefore, the Climate Change Convention would not have a major effect on the Company in the short-term because the PRC as a developing country is not obligated to reduce its emissions of “greenhouse” gases at present, and the PRC government has not adopted relevant control standards and policies . If the PRC were to agree to such ceilings, or otherwise reduce its reliance on coal-fired power plants, our business prospects could be adversely affected.

Our business benefits from certain PRC government tax incentives. Expiration of, or changes to, the incentives could adversely affect our operating results

Prior to January 1, 2008, according to the relevant income tax law, foreign invested enterprises were, in general, subject to statutory income tax of 33% (30% enterprise income tax and 3% local income tax). If these enterprises are located in certain specified locations or cities, or are specifically approved by State Tax Bureau, a lower tax rate would be applied. Effective from January 1, 1999, in accordance with the practice notes on the PRC income tax laws applicable to foreign invested enterprises investing in energy and transportation infrastructure businesses, a reduced enterprise income tax rate of 15% (after the approval of State Tax Bureau) was applicable across the country. We applied this rule to all of our wholly owned operating power plants after obtaining the approval of State Tax Bureau. In addition, certain power plants were exempted from enterprise income tax for two years starting from the first profit-making year, after offsetting all tax losses carried forward from the previous years (at most of five years), followed by a 50% reduction of the applicable tax rate for the next three years. The statutory income tax was assessed individually based on each of their results of operations.

On March 16, 2007, the Enterprise Income Tax Law of PRC, or the New Enterprise Income Tax Law, was enacted, and became effective on January 1, 2008. The New Enterprise Income Tax Law imposes a uniform income tax rate of 25% for domestic enterprises and foreign invested enterprises. Therefore, our power plants subject to a 33% income tax rate prior to January 1, 2008 are subject to a lower tax rate of 25% starting on January 1, 2008. With regard to our power plants entitled to a reduced enterprise income tax rate of 15% prior to January 1, 2008, their effective tax rate is being gradually increased to 25% within a five-year transition period commencing on January 1, 2008. Accordingly, the effective tax rate of our wholly-owned po wer plants will increase over time. In addition, although our power plants currently entitled to tax exemption and reduction under the income tax laws and regulations that are effective prior to the the New Enterprise Income Tax Law will continue to enjoy such preferential treatments until the expiration of the same, newly established power plants will not be able to benefit from such tax incentives, unless they can satisfy specific qualifications, if any, provided by then effective laws and regulations on preferential tax treatment.

Pursuant to Guo Shui Han [2009] 33 document, starting from January 1, 2008, the Company and its branches calculate and pay income tax on a combined basis according to relevant tax laws and regulations. The original regulation specifying locations for power plants and branches of the Company to make enterprise income tax payments was abolished. The income tax of subsidiaries remains to be calculated individually based on their individual operating results.

The increase of applicable income tax rate and elimination of the preferential tax treatment with regard to certain of our power plants may adversely affect our financial condition and results of operations. Moreover, our historical operating results may not be indicative of our operating results for future periods as a result of the expiration of the tax benefits currently available to us.

In addition, according to the New Enterprise Income Tax Law and its implementation rules, any dividends derived from the distributable profits accumulated from January 1, 2008 and are paid to the shareholders who are non-resident enterprises in the PRC will be subject to the PRC withholding tax at the rate of 10%. The withholding tax will be exempted if such dividends are derived from the distributable profits accumulated before January 1, 2008. Under a notice issued by the State Administration of Taxation of the PRC on November 6, 2008, we are required to withhold PRC income tax at the rate of 10% on annual dividends paid for 2008 and later years payable to our H Share investors who are non-resident enterprises.

If there is a devaluation of Renminbi or Singapore dollar, our debt burden will increase and the dividend return to our overseas shareholders may decrease

As a power producer operating mainly in China, we collect our revenues in Renminbi and have to convert Renminbi into foreign currencies to (i) repay some of our borrowings which are denominated in foreign currencies, (ii) purchase foreign made equipment and parts for repairs and maintenance, and (iii) pay out dividend to our overseas shareholders.

The value of the Renminbi against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in China's political and economic conditions. The conversion of Renminbi into foreign currencies, including US dollars, has historically been set by the People's Bank of China. On July 21, 2005, the PRC government changed its policy of pegging the value of the Renminbi to the US dollar. Under the new policy, the Renminbi is permitted to fluctuate within a band against a basket of certain foreign currencies. This change in policy resulted initially in an approximately 2.0% appreciation in the value of the Renminbi against the US dollar. Since the adoption of this new policy, the value of Renminbi against the US dollar has fluctuated on a daily basis withi n narrow ranges, but overall has further strengthened against the US dollar. There remains significant international pressure on the PRC government to further liberalize its currency policy, which could result in a further and more significant appreciation in the value of the Renminbi against the US dollar. However, there is no assurance that there will not be a devaluation of Renminbi in the future. If there is such devaluation, our debt servicing cost will increase and the return to our overseas investors may decrease.

Our revenues from SinoSing Power and its subsidiary, Tuas Power Ltd. (“Tuas Power”), are collected in Singapore dollar. However, commencing from 2008, the operation results of SinoSing Power and its subsidiary are consolidated into our financial statements, which use Renminbi as the functional currency and presentation currency. As a result, we are exposed to foreign exchange fluctuations between Renminbi and Singapore dollar. Appreciation of Renminbi against Singapore dollar may cause a foreign exchange loss upon conversion of SinoSing Power and its subsidiary’s operating results denominated in Singapore dollar into Renminbi, which may have adverse impact on our operation results.

Forward-looking information may prove inaccurate

This document contains certain forward-looking statements and information relating to us that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this document, the words "anticipate," "believe," "estimate," "expect," "going forward" and similar expressions, as they relate to us or our management, are intended to identify forward-looking statement. Such statements reflect the current views of our management with respect to future events and are subject to certain risks, uncertainties and assumptions, including the risk factors described in this document. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary mate rially from those described herein as anticipated, believed, estimated or expected. We do not intend to update these forward-looking statements.

Risks relating to the PRC

China's economic, political and social conditions as well as government policies could significantly affect our business

As of December 31, 2009, the majority of our business, assets and operations are located in China. The economy of China differs from the economies of most developed countries in many respects, including government involvement, level of development, economy growth rate, control of foreign exchange, and allocation of resources.

The economy of China has been transitioning from a planned economy to a more market-oriented economy. Although the majority of productive assets in China are still owned by the PRC government at various levels, in recent years the PRC government has implemented economic reform measures emphasizing utilization of market forces in the development of the economy of China and a high level of management autonomy. Some of these measures will benefit the overall economy of China, but may have a negative effect on us. For example, our operating results and financial condition may be adversely affected by changes in taxation, changes in power tariff for our power plants, changes in the usage and costs of State controlled transportation services, and changes in State policies affecting the power industry.

Interpretation of PRC laws and regulations involves significant uncertainties

The PRC legal system is based on written statutes and their interpretation by the Supreme People's Court. Prior court decisions may be cited for reference but have limited value as precedents. Since 1979, the PRC government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncer tainties. In addition, as the PRC legal system develops, we cannot assure that changes in such laws and regulations, and their interpretation or their enforcement will not have a material adverse effect on our business operations.

We are subject to certain PRC regulations governing PRC companies that are listed overseas. These regulations contain certain provisions that are required to be included in the articles of association of these PRC companies and are intended to regulate the internal affairs of these companies. The PRC Company Law and these regulations, in general, and the provisions for protection of shareholders' rights and access to information, in particular, are less developed than those applicable to companies incorporated in Hong Kong, the US, the UK and other developed countries or regions. Such limited investor protections are compensated for, to a certain extent, by the Mandatory Provisions for the Articles of Association of Companies to be Listed Overseas an d certain additional requirements that are imposed by the Listing Rules of The Hong Kong Stock Exchange with a view to reduce the magnitude of differences between the Hong Kong Company Law and PRC Company Law. The articles of association of all PRC companies listed in Hong Kong must incorporate such Mandatory Provisions and these additional requirements. Although our Articles of Association have incorporated such provisions and requirements, there can be no assurance that our shareholders will enjoy protections to which they may be entitled in other jurisdictions.

Risks relating to our operations in Singapore

Tuas Power Ltd. (“Tuas Power”), one of our wholly-owned subsidiaries, operates in Singapore. Tuas Power is a power generation company incorporated in Singapore which is engaged in the business of generation, wholesale and retail of power. With two 600 MW oil-fired steam generating units and four 367.5 MW gas-fired combined cycle generating units, Tuas Power has a total generating capacity of 2,670 MW. The total assets and revenue of Tuas Power represented approximately 13% and 14%, respectively, of our total assets and revenue as of and for the year ended December 31, 2009.

The operations of Tuas Power are subject to a number of risks, including, among others, risks relating to electricity pricing, dispatching, fuel supply, project development, capital expenditure, environmental regulations, government policies, and Singapore’s economic, political and social conditions. Any of these risks could materially and adversely affect the business, prospects, financial condition and results of operations of Tuas Power.

Decrease in market demand and intensified competition may adversely affect Tuas Power’s business and results of operations.

Power demand in Singapore is dependent upon the economic development of Singapore. Due to the impact of the global financial crisis and economic downturn, Singapore’s economy had a negative growth in 2009, and the power demand had a moderate decrease in 2009. Power demand is expected to see a moderate growth in 2010 on the back of emerging global recovery. Significant and sustained adverse changes in Singapore’s economy and a material reduction in power demand in Singapore may adversely affect Tuas Power’s business, prospects, financial condition and results of operations.

The Singapore electricity industry had traditionally been vertically integrated and owned by the government. Since 1995, much progress has been made to liberalize the electricity industry for greater

efficiency and innovation. Steps taken to liberalize the power industry include corporatization of the Public Utilities Board (“PUB”) in 1995, establishment of Singapore Electricity Pool (“SEP”) in 1998, formation of Energy Market Authority (“EMA”) in 2001, and the evolvement of the SEP into the New Electricity Market of Singapore (“NEMS”) in 2003, and respective divestment of three major generating companies (Tuas Power, PowerSenoko, PowerSeraya) by Temasek Holdings in 2008 and 2009. The liberalization of Singapore’s power market and the further deregulation of its power industry have resulted in more intense competition among the power generating companies in Singapore. Tuas Power is one of t he three largest power generating companies in Singapore. If Tuas Power is unable to compete successfully against other power generating companies in Singapore, its business, prospects, financial condition and results of operations may be adversely affected.

Decrease in the quantity of generating capacity covered by Tuas Power’s vesting contracts may further expose Tuas Power to electricity price volatility and adversely affect its business and results of operations.

Tuas Power derives its revenue mainly from sale of electricity to the National Electricity Market of Singapore (the “NEMS”) through a bidding process and vesting contracts under which a significant portion of power sales is predetermined by EMA. Vesting contracts are a form of bilateral contract imposed/vested on the major power generating companies in Singapore. The vesting contract regime in Singapore is targeted at mitigation of market power in the wholesale electricity spot market. The regime achieves this objective by assigning a quantity of vesting contracts to generating companies, thereby limiting their incentives to exercise whatever level of market power they may possess. Vesting contract price is set by the Energy Market Authority (the “EMA”), which is Singapore’s power market regulator. It is set at the long run marginal cost of the most efficient base-loaded technology plant employed in Singapore and is reviewed every two years. On a quarterly basis, the EMA allows for the vesting contract price to be adjusted to account for inflation and changes in fuel prices. Such mechanism helps protect the profit margins of the power generating companies in the Singapore market such as Tuas Power to a large degree. The quantity of each power generation company’s capacity reserved for vesting contracts depends on the proportion of such power generation company’s capacity to total capacity in the NEMS system. The contract quantity and price are recalculated every three months. For the period from January 1, 2009 to December 31, 2009, power sold through vesting contracts represented approximately 60% of Tuas Power's total power sold.

As an important governmental policy in Singapore’s power market, vesting contracts may continue as long as the EMA considers that high market concentration persists and that power generating companies may potentially exercise their market power. Although it is expected that it will take at least eight to ten years for market concentration to be substantially diluted, the Singapore government recently planned to decrease the quantities of capacity covered by vesting contracts. The timetable and details for such plan remain uncertain and Tuas Power is actively communicating with the EMA and requesting a relatively stable policy. Any significant decrease in the quantity of capacity covered by Tuas Power’s vesting contracts will further expose Tuas Power to electricity price vola tility and may have an adverse impact on its business and results of operations.

The fuel cost of Tuas Power is exposed to the volatility of international fuel price and foreign currency risk.

The fuel for Tuas Power consists of oil and gas. Since the procurement price of gas is closely linked to oil price, the fuel cost of Tuas Power is exposed to the volatility of international oil price. In addition, the commitments for the purchase of fuel are denominated in US dollars, which further exposes Tuas Power to foreign currency risk. The increase in fuel price and the appreciation of US dollars against Singapore dollar would increase the fuel cost of Tuas Power and adversely affects its results of operations.

| ITEM 4 | Information on the Company |

| A. | History and development of the Company |

Our legal and commercial name is Huaneng Power International, Inc. Our head office is at West Wing, Building C, Tianyin Mansion, 2C, Fuxingmennan Street, Beijing, People's Republic of China and our telephone number is (8610) 66491999. We were established in June 1994 as a company limited by shares organized under the laws of the People's Republic of China.

On April 19, 2006, we carried out the reform to convert all non-tradable domestic shares to tradable domestic shares. According to the reform plan, Huaneng Group and HIPDC offered three shares to each holder of A Shares for every ten shares held by them. The total number of shares offered in connection with the reform was 150,000,000 shares. As a result, all non-tradable domestic shares were permitted to be listed on stock exchange for trading with certain selling restrictions. The period of selling restrictions is sixty months for the non-tradable shares held by Huaneng Group and HIPDC, and one year for most non-tradable shares held by

others starting from April 19, 2006. As of March 31, 2010, approximately 6.122 billion of our shares, including our shares directly held by Huaneng Group and HIPDC, remained subject to selling restrictions. The reform did not affect the rights of shareholders of our overseas listed foreign shares.

On March 25, 2008, we signed a letter of intent with Huaneng Group on the transfer of the equity of SinoSing Power, which is a wholly-owned subsidiary of Huaneng Group that was established to acquire 100% equity interest in Tuas Power Ltd. from Temasek Holdings (Private) Limited. Huaneng Group’s equity investment in SinoSing Power is US$985 million. On April 29, 2008, we entered into a transfer agreement with Huaneng Group in this regard, pursuant to which we should pay the consideration in full, of which US$788 million settled by assignment of debts and the remaining balance of approximately RMB1.572 billion paid in cash in Renminbi. On June 27, 2008, we completed the acquisition of SinoSing Power. Tuas Power Ltd., with a total installed capac ity of 2,670MW, became one of our indirectly wholly-owned subsidiaries.

As resolved at the shareholders’ meeting held on May 13, 2008, our company has been given a mandate to issue within the PRC short-term debentures of a principal amount not exceeding RMB10 billion within 12 months from the date on which the shareholders’ approval was obtained. On July 25, 2008, we issued short-term RMB denominated debentures in the amount of RMB5 billion with a maturity period of 365 days, a unit face value of RMB100 and an interest rate of 4.83%. On February 24, 2009, we issued the second tranche of the short-term debenture in the amount of RMB5 billion, with a maturity period of 365 days, a unit face value of RMB100 and an interest rate of 1.88%. These two tranches of short-term debentures were repaid in July 2009 and February 2010, respectively.

As resolved at the extraordinary general meeting held on December 23, 2008, our company has been given a mandate to issue within the PRC medium-term notes of a principal amount not exceeding RMB10 billion within 12 months from the date on which the shareholder’s approval was obtained. On May 14, 2009, we issued medium-term RMB denominated notes in the amount of RMB4 billion, with a maturity period of 5 years, a unit face value of RMB100 and an interest rate of 3.72%.

As resolved at the 2008 annual general meeting held on June 18, 2009, our company has been given a mandate to issue within the PRC short-term debentures of a principal amount not exceeding RMB10 billion within 12 months from the date on which the shareholder’s approval was obtained. On September 9, 2009, we issued the first tranche of the short-term RMB denominated debenture in the amount of RMB5 billion with a maturity period of 270 days, a unit face value of RMB100 and an interest rate of 2.32%. On March 23, 2010, we issued the second tranche of the short-term debenture in the amount of RMB5 billion, with a maturity period of 270 days, a unit face value of RMB100 and an interest rate of 2.55%.

On March 31, 2009, we entered into a transfer agreement with Huaneng New Energy Industrial Holding Limited Company (“Huaneng New Energy”) , a subsidiary of Huaneng Group, pursuant to which we agreed to acquire from Huaneng New Energy its 65% equity interest in Huaneng Qidong Wind Power Generation Co., Ltd. (“Qidong Wind Power”) for a consideration of RMB103 million. Phase I of Qidong Wind Power has a generating capacity of 91.5 MW and commenced operations in March 2009. In September 2009, we completed the acquisition of 65% equity interest in Qidong Wind Power.

On April 21, 2009, we entered into a transfer agreement with Huaneng Group, pursuant to which we agreed to acquire the 55% equity interest in Tianjin Huaneng Yangliuqing Co-generation Limited Liability Company held by Huaneng Group for a consideration of RMB1.076 billion. On the same day, we entered into a transfer agreement with HIPDC, pursuant to which we agreed to acquire the 41% equity interest in Huaneng Beijing Co-generation Limited Liability Company held by HIPDC for a consideration of RMB1.272 billion. In September 2009, we completed the acquisition of 55% equity interest in Tianjin Huaneng Yangliuqing Co-generation Limited Liability Company and 41% equity interest in Huaneng Beijing Co-generation Limited Liability Company. We exercise effective control over Huaneng Beijing Co-generation Limited Liability Compan y. As a result of these acquisitions, our company's generation capacity is increased by 1,006MW on an equity basis.

On November 11, 2009, Tuas Power commenced the construction of Tembusu multi-utilities complex at Jurong Island, Singapore. The complex consists of a co-generation plant, a desalination plant and a wastewater treatment facility. The cogeneration plant will have three biomass clean coal cogeneration units which use circulating fluidized bed technology and three gas fired boilers, with a capacity to supply up to 1000 t/h of steam and a power generation capacity of 165 MW. The project has a total investment of SGD2 billion and is expect to be completed in two phases with the co-generation plant to commence commercial operation in 2012.

On December 31, 2009, we entered into an equity interest transfer contract with Shandong Electric Power Corporation (“Shandong Power”) and Shandong Luneng Development Group Company Limited (“Luneng Development”), pursuant to which we agreed to acquire 100% equity interest in each of Yunnan Diandong Energy Limited Company, Yunnan Diandong Yuwang Energy Limited Company, Shandong Zhanhua Co-generation Limited Company, Jilin Luneng Biological Power Generation Limited Company and Qingdao Luneng Jiaonan Port Limited Company, 60.25% equity interest in Fujian Luoyuanwan Luneng Harbour Limited Liability Company, 58.3% equity interest in Fuzhou Port Luoyuanwan Pier Limited Liability Company, 73.46% equity interest in Luoyuan Luneng Ludao Pier Limited Liability Company, and 53% equity interest in Luneng Sea Transporta tion Limited Company, as well as the preliminary stage project achievements of 4x660MW coal-fired project of Rizhao Lanshan and 2x660MW coal-fired project of Luoyuanwan from Shandong Power, and 39.75% equity interest in Fujian Luoyuanwan Luneng Harbour Limited Liability Company from Luneng Development, for an aggregate consideration of RMB8.625 billion. As of April 15, 2010, the proposed transaction was still subject to approvals by relevant governmental authorities.

As resolved at the extraordinary general meeting and the H Share class meeting held on March 16, 2010, respectively, we would issue (i) no more than 1,200 million new A Shares by way of placement to no more than 10 designated investors including Huaneng Group, which would subscribe for no more than 400 million new A Shares, and (ii) no more than 400 million new H Shares to China Hua Neng Hong Kong Company Limited (“Hua Neng HK”), a wholly-owned subsidiary of Huaneng Group. The subscription price for new A Shares shall be no less than RMB7.13 per share and will be determined on the book-building basis after obtaining the approvals for the new issue. The subscription price for new H Shares shall be HK$4.97 per share. The proposed issue of new A Shares and H Shares has been approved by the State Assets Supervision and Adm inistration Commission of the State Council, and is subject to approvals by relevant governmental authorities in accordance with applicable PRC laws and regulations.

See “Item 5 Operating and Financial Review and Prospects — Liquidity and Cash Resources” for a description of our principal capital expenditures since the beginning of the last three financial years.

We are one of the China's largest independent power producers. As of March 31, 2010, we had controlling generating capacity of 49,443MW, and a total generating capacity of 45,912MW on an equity basis.

Operations in China

We are engaged in developing, constructing, operating and managing power plants throughout China. Our domestic power plants are located in 17 provinces, provincial-level municipalities and autonomous regions. We also have a wholly-owned power plant in Singapore.

In 2009, the Chinese government has taken a series of measures including economic stimulus packages and various monetary and fiscal policies, which enabled China’s macro economy to recover gradually from the adverse impact of the international financial crisis. Recovery of downstream industries continued to contribute to the growing power demand. Meanwhile, coal price in the domestic market declined from the previous year, indicating that the policy guidance in respect of electricity tariff adjustment implemented by the NDRC has gradually effected on the macro-economy. The macro economic conditions of China have provided opportunities for the development of China’s power industry and the growth of power generating companies. In response to the international financial crisis and complicated operating conditions, our man agement and all employees worked together and made every effort to actively deal with the challenges. We achieved the target of turning a loss into a gain and made new progress in the areas of safe production, operation management, energy saving, environmental protection, project development, capital operation and corporate governance. With respect to our operations in Singapore, Tuas Power achieved remarkable annual operating result in 2009, thus making contribution to our profit growth.

In the year of 2009, new generating units with a total installed capacity of 5,832 MW were put into commercial operations, , including our Huade Wind Power Plant, which has an installed capacity of 49.5 MW. In 2009, our total domestic power generation from all operating power plants on a consolidated basis amounted to 203.520 billion kWh, representing a 10.23% increase as compared to the same period of the previous year. The annual average utilization hours of our coal-fired generating units reached 5,220 hours, representing 381 hours above the average rate of the coal-fired generating units in China. Our fuel cost per unit of power sold by coal-fired power plants decreased by 13.73% to RMB214.53 per MWh.

We believe our significant capability in the development and construction of power projects, as exemplified in the completion of our projects under construction ahead of schedule, and our experience gained

in the successful acquisitions of power assets in recent years will enable us to take full advantage of the opportunities presented in China's power market and made available to us through our relationship with HIPDC and Huaneng Group.

With respect to the acquisition or development of any project, we will consider, among other factors, changes in power market conditions, and adhere to prudent commercial principles in the evaluation of the feasibility of the project. In addition to business development strategies, we will continue to work on our profit enhancement through relentlessly strengthening cost control, especially in respect of fuel costs and construction costs, so as to hedge against fluctuations in fuel price and increase competitiveness in the power market.

Operations in Singapore

In 2008, we acquired Tuas Power which is one of the three largest power generating companies in Singapore and had a total generating capacity of 2,670 MW as of December 31, 2009. We have consolidated Tuas Power’s results of operations since March 2008. In 2009, the power generated by Tuas Power in Singapore accounted for 24.30% of the total power generated in Singapore, maintaining a similar level from 2008.

Development of power plants

The process of identifying potential sites for power plants, obtaining government approvals, completing construction and commencing commercial operations is usually lengthy. However, because of our significant experience in developing and constructing power plants, we have been able to identify promising power plant projects and to obtain all required PRC Government approvals in a timely manner.

Opportunity identification and feasibility study

We initially identify an area in which additional electric power is needed by determining its existing installed capacity and projected demand for electric power. The initial assessment of a proposed power plant involves a preliminary feasibility study. The feasibility study examines the proposed power plant's land use requirements, access to a power grid, fuel supply arrangements, availability of water, local requirements for permits and licenses and the ability of potential customers to afford the proposed power tariff. To determine projected demand, factors such as economic growth, population growth and industrial expansion are used. To gauge the expected supply of electricity, the capacities of existing plants and plants under construc tion or development are studied.

Approval process

Prior to July 2004, any project proposal and supporting documents for new power plants must first be submitted to the NDRC for approval and then be submitted to the State Council. In July 2004, the State Council of the PRC reformed the fixed asset investment regulatory system in China. Under the new system, new projects in the electric power industry that do not use government funds will no longer be subject to the examination and approval procedure. Instead, they will only be subject to a confirmation and registration process. Coal-fired projects will be subject to confirmation by the NDRC. Wind power projects with installed capacity exceeding 50 MW will be subject to confirmation and registration with the relevant department of the centr al government while wind power project with installed capacity lower than 50 MW will be subject to confirmation and relevant local government departments. Wind power projects confirmed by local government departments at provincial level shall also be filed with the NDRC and China National Energy Administration.

Joint venture power projects are subject to additional governmental approvals. Approval by Ministry of Commerce is also required when foreign investment is involved.

In January 2007, the Office of the National Energy Leading Group and the NDRC with the approval of the State Council jointly issued the opinions to accelerate shutdowns of small coal-fired generating units. Power generating companies are encouraged to close small coal-fired generating units and replace them with newly built large units, and their new projects may be granted priority in the confirmation and registration process on the basis of their proactive implementation of the opinions.

Permits and contracts

In developing a new power plant, we and third parties are required to obtain permits before commencement of the project. Such permits include operating licenses and similar approvals related to plant site, land use, construction, and the environment. To encourage the cooperation and support of the local

governments of the localities of the power plants, it has been and will be our policy to seek investment in such power plants by the relevant local governments.

Power plant construction

We have generally acted as the general contractor for the construction of our power plants. Equipment procurement and installation, site preparation and civil works are subcontracted to domestic and foreign subcontractors through a competitive bidding process. All of our power plants were completed on or ahead of schedule, enabling certain units to enter service and begin generating income earlier than the estimated in-service date.

Import duties

China's general import-tariff level has been declining since China acceded to the WTO in November 2001. China's average import-tariff rate was reduced annually from 15.3% in 2001 to 9.9% in 2005 and 2006. Starting from January 1, 2007, the average import-tariff rate was further reduced to 9.8%. In general, China's accession to WTO will bring its import-tariff to a level consistent with the average level of all other WTO members.

Under the relevant PRC laws and regulations, foreign invested enterprises, or “FIE”, will be entitled to import duty exemption in respect of self-use imported equipment and raw materials for investment projects that fall into the encouraged category under the Catalogue for the Guidance of Foreign Investment Industries (the “Catalogue”). Pursuant to the current Catalogue effective on December 1, 2007, construction and operation of power stations using integrated gasification combined cycle, circulating fluidized bed with a generating capacity of 300MW or above, pressurized fluided bed combustor with a generating capacity of 100MW or above and other clean combustion technologies belong to the category of encouraged projects. Therefore, our construction projects that meet the conditions for encouraged projects under the current catalogue are eligible for import-duty exemption for imported generating units.

In addition, pursuant to the Interim Rules to Promote Structural Adjustment of Industries and Guidance Catalogue for Structural Adjustment of Industries issued in December 2005, our power plants construction projects with independent legal person status belong to an encouraged category of investments, and therefore are eligible for exemption from import duty and related value-added tax with regard to the imported equipments used in such projects, subject to the approval of the relevant government authorities.

Plant start-up and operation