UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Rule14a-12 |

LIONS GATE ENTERTAINMENT CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

| þ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | |

| | (4) | | Date Filed: |

| | |

| | | | |

Notice of Annual General and Special Meeting

of Shareholders and Proxy Statement

LIONS GATE ENTERTAINMENT CORP.

Tuesday, September 13, 2016 at 10:00 a.m. local time

Shangri-La Hotel, 188 University Avenue, Toronto, Ontario, M5H 0A3, Canada

LIONS GATE ENTERTAINMENT CORP.

250 Howe Street, 20th Floor

Vancouver, British Columbia V6C 3R8

2700 Colorado Avenue

Santa Monica, California 90404

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

To Be Held September 13, 2016

To Our Shareholders:

You are invited to attend the Annual General and Special Meeting of Shareholders (the “Annual Meeting”) of Lions Gate Entertainment Corp. (“Lionsgate” or the “Company”), which will be held on Tuesday, September 13, 2016, beginning at 10:00 a.m., local time, at the Shangri-La Hotel, 188 University Avenue, Toronto, Ontario, M5H 0A3, Canada. At the Annual Meeting, shareholders will act on the following matters:

| | 1. | Elect 13 directors, each for a term of one year or until their respective successors are duly elected and qualified; |

| | 2. | Re-appoint Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2017; |

| | 3. | Conduct an advisory vote to approve executive compensation; |

| | 4. | Approve amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan; and |

| | 5. | Transact such further and other business as may properly come before the meeting and any continuations, adjournments or postponements thereof. |

In addition to the enclosed proxy statement, shareholders will also receive the audited consolidated financial statements of the Company for the fiscal year ended March 31, 2016, together with the auditor’s report thereon. Shareholders of record at 5:00 p.m. (Eastern Standard Time) on July 22, 2016 are entitled to notice of and to vote at the meeting or any continuations, adjournments or postponements thereof. It is expected that these materials will be mailed to shareholders on or about July 29, 2016.

Registered shareholders unable to attend the Annual Meeting in person are requested to read the enclosed proxy statement and the proxy card that accompany this notice and to complete, sign, date and deliver the proxy card, together with the power of attorney or other authority, if any, under which it was signed (or a notarized certified copy thereof) by mail to IVS Associates, Inc. (“IVS Associates”), Attn: Lionsgate Proxy Tabulation, 1000 N. West Street, Suite 1200, Wilmington, Delaware, 19801, via facsimile at 302-295-3811, or via the internet atwww.ivselection.com/lionsgate2016. To be effective, proxies must be received by IVS Associates by or at the Annual Meeting prior to the closing of the polls.

If you are not a registered shareholder, please refer to the accompanying proxy statement for information on how to vote your shares.

By Order of the Board of Directors,

Jon Feltheimer

Chief Executive Officer

Santa Monica, California

Vancouver, British Columbia

July 28, 2016

IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO COMPLETE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED.

In accordance with our security procedures, all persons attending the Annual Meeting will be required to present picture identification.

Table of Contents

EXECUTIVE SUMMARY

This summary highlights information contained elsewhere in this proxy statement. We hope this summary will be helpful to our shareholders in reviewing the proposals. This summary does not contain all of the information you should consider in making a voting decision, and you should read the entire proxy statement carefully before voting. These proxy materials are first being sent to shareholders of Lions Gate Entertainment Corp. commencing on or about July 29, 2016. For information on the details of the voting process and how to attend the Annual Meeting, please seeAbout the Annual Meeting on page 1.

Voting Matters and Vote Recommendation

| | | | | | |

| Proposal | | Board Vote

Recommendation | | For More Information, see: |

1. | | Election of 13 directors | | FOR EACH DIRECTOR NOMINEE | | Proposal 1—Election of Directors,

page 8 |

2. | | Re-appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2017 | | FOR | | Proposal 2—Re-appointment of Independent Registered Public Accounting Firm,

page 18 |

3. | | Advisory vote to approve executive compensation | | FOR | | Proposal 3—Advisory Vote to Approve Executive Compensation,

page 19 |

4. | | Amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan | | FOR | | Proposal 4—Amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan, page 20 |

i

2016 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF

LIONS GATE ENTERTAINMENT CORP.

PROXY STATEMENT

This proxy statement is part of a solicitation of proxies by the Board of Directors (the “Board”) and management of Lions Gate Entertainment Corp. (“Lionsgate,” the “Company,” “we,” “us” or “our”) and contains information relating to our annual general and special meeting of shareholders (the “Annual Meeting”) to be held on Tuesday, September 13, 2016, beginning at 10:00 a.m., local time, at the Shangri-La Hotel, 188 University Avenue, Toronto, Ontario, M5H 0A3, Canada, and to any continuations, adjournments or postponements thereof. All dollar figures contained in this proxy statement are in U.S. dollars, unless otherwise indicated. The notice of the Annual Meeting, this proxy statement and the enclosed proxy card will be mailed to shareholders on or about July 29, 2016.

ABOUTTHE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the matters outlined in the accompanying notice of meeting, including the election of directors, re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2017, conducting an advisory vote on executive compensation and approving amendments to the 2012 Lions Gate Entertainment Corp. Performance Incentive Plan. In addition, after the formal portion of the meeting, the Company’s management will report on the Company’s performance during fiscal 2016 and respond to appropriate questions from shareholders.

Who is entitled to vote at the Annual Meeting?

Only shareholders of record of the Company’s common shares (NYSE: LGF) at 5:00 p.m. (Eastern Standard Time) on July 22, 2016 (the “Record Date”) are entitled to receive notice of the Annual Meeting and to vote the common shares that they held on that date at the Annual Meeting, or any continuations, adjournments or postponements of the Annual Meeting. Each outstanding common share entitles its holder to cast one vote on each matter to be voted upon. As of the Record Date, 147,647,415 common shares were outstanding and entitled to vote and held by approximately 580 shareholders of record.

Each shareholder has the right to appoint a person or company to represent the shareholder other than the persons designated in the form of proxy.

Who can attend and vote at the Annual Meeting?

Only registered shareholders of the Company or the persons they appoint as their proxies are permitted to attend and vote at the Annual Meeting. Most shareholders of the Company are “non-registered” shareholders (“Non-Registered Shareholders”) because the shares they own are not registered in their names but are, instead, registered in the name of the brokerage firm, bank or trust company through which they hold the shares. Shares beneficially owned by a Non-Registered Shareholder are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the common shares of the Company (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered Registered Retirement Savings Plans, Registered Retirement Income Funds, Registered Education Savings Plans and similar plans); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited or The Depository Trust & Clearing Corporation) of which the Intermediary is a participant. In accordance with applicable securities law requirements, the Company will have distributed copies of the notice of Annual Meeting, this proxy statement and the proxy card (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Shareholders.

Lions Gate2016 Proxy Statement 1

Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders unless a Non-Registered Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive Meeting Materials will either:

| | (i) | be given a voting instruction formwhich is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder andreturned to the Intermediary or itsservice company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow. Typically, the voting instruction form will consist of a one-page printed form. Sometimes, instead of the one-page pre-printed form, the voting instruction form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label with a bar code and other information. In order for the form of proxy to validly constitute a voting instruction form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company; or |

| | (ii) | be given a form of proxywhich has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted to the number of shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with the Company, c/o IVS Associates, Inc., Attn: Lionsgate Proxy Tabulation, 1000 N. West Street, Suite 1200, Wilmington, Delaware, 19801, via facsimile at 302-295-3811. |

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the common shares of the Company they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Annual Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder shouldrequest a legal proxy from their Intermediary. Instructions for obtaining legal proxies may be found on the voting instruction form. If you have any questions about voting your shares, please call MacKenzie Partners, Inc. at 1-800-322-2885 or212-929-5500 or e-maillionsgate@mackenziepartners.com.

A Non-Registered Shareholder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote which has been given to an Intermediary at any time by written notice to the Intermediary, provided that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote which is not received by the Intermediary in a timely manner in advance of the Annual Meeting.

What constitutes a quorum?

A quorum is necessary to hold a valid meeting of shareholders. The presence at the Annual Meeting, in person or by proxy, of two holders of the Company’s common shares outstanding on the Record Date who, in the aggregate, hold at least 10% of the issued common shares of the Company entitled to vote at the Annual Meeting, will constitute a quorum. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for purposes of determining the presence of a quorum.

How do I vote at the Annual Meeting?

If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as you direct. Registered shareholders that are unable to attend the Annual Meeting in person are requested to read this proxy statement and accompanying proxy card and to complete, sign and date the proxy card, and to return it, together with the power of attorney or other authority, if any, under which it was signed or a notarized certified copy thereof, via mail, to IVS Associates, Inc., Attn: Lionsgate Proxy Tabulation, 1000 N. West Street, Suite 1200, Wilmington, Delaware, 19801, via facsimile at 302-295-3811, Attn: Lionsgate Proxy Tabulation, or via the internet atwww.ivselection.com/lionsgate2016. To be effective, proxies must be received by IVS Associates prior to or at the Annual Meeting prior to the closing of the polls.

“Non-Registered Shareholders” who wish to vote their shares in person at the Annual Meeting will need to obtain a legal proxy from their Intermediary. SeeWho can attend and vote at the Annual Meeting? above.

2 Lions Gate2016 Proxy Statement

At the Annual Meeting, a representative from IVS Associates, Inc., an independent, third-party company, shall be appointed to act as scrutineer. The scrutineer will determine the number of common shares represented at the Annual Meeting, the existence of a quorum and the validity of proxies, will count the votes and ballots, if required, and will determine and report the results to the Company.

If you are a registered shareholder but do not wish to, or cannot, attend the Annual Meeting in person, you can appoint someone who will attend the Annual Meeting and act as your proxy holder to vote in accordance with your instructions by striking out the printed names of the proposed management nominees on the accompanying proxy card and inserting the name of such other person in the blank space provided therein for that purpose. To vote your shares, your proxy must attend the Annual Meeting. If you do not fill a name in the blank space in the enclosed form of proxy, the persons named in the form of proxy are appointed to act as your proxy holder. Those persons are directors and/or officers of the Company.

Can I change or revoke my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote by submitting a duly executed proxy bearing a later date in the manner and within the time described above. SeeHow do I vote at the Annual Meeting? above if you are a Non-Registered Shareholder. If you are a shareholder of record, you may also revoke a previously deposited proxy (i) by an instrument in writing that is received by or at the Annual Meeting prior to the closing of the polls, (ii) by an instrument in writing provided to the Chairman of the Annual Meeting at the Annual Meeting or any adjournment thereof, or (iii) in any other manner permitted by law. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| | • | | As necessary to meet applicable legal requirements; |

| | • | | To allow for the tabulation and certification of votes; and |

| | • | | To facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

What are the Board of Directors’ recommendations?

The enclosed proxy is solicited on behalf of the Board and the Company’s management. Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board set forth with the description of each item in this proxy statement.

The Board recommends a vote:

| | • | | “FOR” the election of each of the nominated directors (see page 8); |

| | • | | “FOR” the re-appointment of Ernst & Young LLP as our independent registered public accounting firm (see page 18); |

| | • | | “FOR” the proposal regarding an advisory vote to approve executive compensation (see page 19); and |

| | • | | “FOR” the proposal regarding approval of amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan (see page 20). |

Other than the proposals described in this document, the Board does not know of any other matters that may be brought before the Annual Meeting. If any other matter should properly come before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in accordance with their best judgment.

Lions Gate2016 Proxy Statement 3

What vote is required to approve each item?

For the election of each of the 13 nominated directors (Proposal 1), a plurality of the common shares voting in person or by proxy is required to elect each of the 13 nominees for director. A plurality means that the 13 nominees receiving the largest number of votes cast (votes “FOR”) will be elected. Shareholders are not permitted to cumulate their shares for purposes of electing directors.

For the re-appointment of Ernst & Young LLP as our independent registered public accounting firm (Proposal 2), the advisory vote to approve executive compensation (Proposal 3) and approval of amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan (Proposal 4) - each requires the affirmative vote of a majority of the votes cast by holders of the Company’s common shares present or represented by proxy at the Annual Meeting. Notwithstanding the vote required, please be advised that Proposal 3 (an advisory vote on executive compensation) is advisory only and is not binding on us. The Board will consider the outcome of the vote of this proposal in considering what action, if any, should be taken in response to the advisory vote by shareholders.

Note that if your shares are held by a broker or nominee, such broker or nominee may exercise his or her discretion to vote your shares for Proposal 2 (re-appointment of independent registered public accounting firm) but such broker or nominee will not have authority to vote your shares on Proposal 1 (election of directors), Proposal 3 (an advisory vote on executive compensation) or Proposal 4 (approval of amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan) unless you provide instructions to him or her regarding how you would like your shares to be voted. If such broker or nominee does not receive such instructions, and as a result is unable to vote your shares on Proposal 1, Proposal 3 or Proposal 4, this will result in a “broker non-vote.”

Other than for Proposal 4 - amendments to the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan), for purposes of determining the number of votes cast, only shares voting “FOR,” “WITHHOLD” or “AGAINST” are counted. As such, abstentions are not treated as votes cast and are not counted in the determination of the outcome of Proposals 1, 2 or 3. For purposes of Proposal 4, under New York Stock Exchange (the “NYSE”) listing standards applicable to shareholder approval of equity compensation plans, abstentions are treated as votes cast. Accordingly, for purposes of Proposal 4 only, abstentions will have the effect of a vote “AGAINST” the proposal.

Broker non-votes are not treated as votes cast and are not counted in the determination of the outcome of Proposals 1, 3 or 4. There are no broker non-votes for Proposal 2. Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present at the Annual Meeting.

Who pays for the preparation of this proxy statement?

The Company will pay the cost of proxy solicitation, including the cost of preparing, assembling and mailing this proxy statement, notice of the Annual Meeting and enclosed proxy card. In addition to the use of mail, the Company’s employees and advisors may solicit proxies personally and by telephone, facsimile, courier service, telegraph, the Internet, e-mail, newspapers and other publications of general distribution. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy materials to their principals and to request authority for the execution of proxies, and the Company will reimburse those persons for their reasonable out-of-pocket expenses incurred in connection with these activities. The Company will compensate only independent third-party agents that are not affiliated with the Company but who solicit proxies. We have retained MacKenzie Partners, Inc., a third-party solicitation firm, to assist in the distribution of proxy materials and solicitation of proxies on our behalf for an estimated fee of $20,000 plus reimbursement of certain out-of-pocket expenses.

May I propose actions or recommend director nominees for consideration at next year’s annual general meeting of shareholders?

Yes. Under U.S. laws, for your proposal or recommendation for director nominees to be considered for inclusion in the proxy statement for next year’s annual meeting, we must receive your written proposal no later than March 31, 2017. You should also be aware that your proposal must comply with U.S. Securities and Exchange Commission (the “SEC”) regulations regarding inclusion of shareholder proposals in company-sponsored proxy materials. Shareholder proposals or recommendation for director nominees submitted as per theBusiness Corporations Act (British Columbia) (the “BC Act”) to be presented at the next annual general meeting of

4 Lions Gate2016 Proxy Statement

shareholders must be received by our Corporate Secretary at our registered office no later than June 13, 2017, and must comply with the requirements of the BC Act. If you wish to recommend a director nominee you should also provide the information set forth underInformation Regarding the Board of Directors and Committees of the Board of Directors — Shareholder Communications.

If the date of the 2017 annual meeting is advanced or delayed by more than 30 days from the date of the 2016 annual meeting, under U.S. laws, shareholder proposals intended to be included in the proxy statement for the 2017 annual meeting must be received by us within a reasonable time before we begin to print and mail the proxy statement for the 2017 annual meeting.

SEC rules also govern a company’s ability to use discretionary proxy authority with respect to shareholder proposals that were not submitted by the shareholders in time to be included in the proxy statement. In the event a shareholder proposal is not submitted to us prior to June 14, 2017, the proxies solicited by the Board for the 2017 annual meeting of shareholders will confer authority on the proxyholders to vote the shares in accordance with the recommendations of the Board if the proposal is presented at the 2017 annual meeting of shareholders without any discussion of the proposal in the proxy statement for such meeting. If the date of the 2017 annual meeting is advanced or delayed more than 30 days from the date of the 2016 annual meeting, then the shareholder proposal must have been submitted to us within a reasonable time before we mail the proxy statement for the 2017 annual meeting.

Who can I contact if I have questions?

Shareholders who have questions about deciding how to vote should contact their financial, legal or professional advisors. For any queries referencing information in this proxy statement or in respect of voting your shares, please call MacKenzie Partners, Inc. at 1-800-322-2885 or 212-929-5500 or e-maillionsgate@mackenziepartners.com.

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and disclose final voting results in a Current Report on Form 8-K to be filed with the SEC within four (4) business days following the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on September 13, 2016

The Meeting Materials will be mailed to shareholders on or about July 29, 2016. Our proxy statement and fiscal 2016 Annual Report to Shareholders will also be available in theCorporate/Reports section on our website atwww.lionsgate.com.

NO PERSON IS AUTHORIZED ON BEHALF OF THE COMPANY TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS WITH RESPECT TO THE PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION AND/OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED, AND THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE HEREOF.

Our registered and head office is located at 250 Howe Street, 20th Floor, Vancouver, British Columbia V6C 3R8. Our principal executive offices and our corporate head office is located at 2700 Colorado Avenue, Santa Monica, California 90404, and our telephone number is (310) 449-9200. Our website is located atwww.lionsgate.com. Website addresses referred to in this proxy statement are not intended to function as hyperlinks, and the information contained on our website is not a part of this proxy statement. As used in this proxy statement, unless the context requires otherwise, the terms “Lionsgate,” “we,” “us,” “our” and the “Company” refer to Lions Gate Entertainment Corp. and its subsidiaries.

The date of this proxy statement is July 28, 2016

Lions Gate2016 Proxy Statement 5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table presents certain information about beneficial ownership of our common shares as of July 22, 2016 (unless otherwise indicated) by each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common shares. Except as indicated in the footnotes to this table, the persons named in the table have sole voting and dispositive power with respect to all common shares shown as beneficially owned by them, subject to community property laws, where applicable.

| | | | | | | | | | |

| Name of Beneficial Owner(1) | | Number of Shares | | Percent of Total(2) |

Mark H. Rachesky, M.D.(3) | | | | 30,273,049 | | | | | 20.5 | % |

Kornitzer Capital Management, Inc.(4) | | | | 10,554,722 | | | | | 6.7 | % |

Capital World Investors(5) | | | | 8,819,000 | | | | | 6.0 | % |

FMR, LLC(6) | | | | 8,483,605 | | | | | 5.7 | % |

Capital Research Global Investors(7) | | | | 7,829,000 | | | | | 5.3 | % |

Vanguard Group Inc.(8) | | | | 7,403,290 | | | | | 5.0 | % |

| (1) | The addresses for the listed beneficial owners are as follows: Mark H. Rachesky, M.D. c/o MHR Fund Management LLC, 1345 Avenue of the Americas, 42nd Floor, New York, NY 10105; Kornitzer Capital Management, Inc., 5420 West 61st Place, Shawnee Mission, Kansas 66205; Capital World Investors, 333 South Hope Street, Los Angeles, California 90071; JANA Partners, LLC, 767 Fifth Avenue, 8th Floor, New York, NY 10153; FMR, LLC, 245 Summer Street, Boston, Massachusetts 02210; Capital Research Global Investors, 333 South Hope Street, Los Angeles, California 90071; and Vanguard Group, Inc., PO Box 2600, V26, Valley Forge PA 19482-2600. |

| (2) | The percentage of total common shares beneficially owned by each person (or group of affiliated persons) is calculated by dividing: (1) the number of common shares deemed to be beneficially held by such person (or group of affiliated persons) as of July 22, 2016 (unless otherwise indicated), as determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) by (2) the sum of (A) 147,647,415 which is the number of common shares outstanding as of July 22, 2016; plus (B) the number of common shares issuable upon the exercise of options and other derivative securities, if any, exercisable as of July 22, 2016 or within 60 days thereafter, held by such person (or group of affiliated persons) (i.e., September 20, 2016). |

| (3) | The information is based solely on the information in a Schedule 13D/A filed with the SEC on July 1, 2016 by Dr. Rachesky. According to the information in the Schedule 13D/A, as of June 30, 2016: MHR Institutional Advisors III LLC and MHR Institutional Partners III LP each have sole voting and dispositive power over 23,748,947 shares; MHR Fund Management LLC (“MHR Fund Management”) and MHR Holdings LLC each have sole voting and dispositive power over 30,211,049 shares; and Dr. Rachesky has sole voting and dispositive power over 30,273,049 shares. |

| (4) | The information is based solely on a Schedule 13G/A filed on January 22, 2016 by Kornitzer Capital Management, Inc. According to the schedule, Kornitzer Capital Management, Inc. has sole voting power over 10,554,722 shares, sole dispositive power over 3,176,621 shares and shared dispositive power over 7,378,101 shares. |

| (5) | The information is based solely on a Schedule 13F-HR filed on May 16, 2016 with the SEC by Capital World Investors, which shows Capital World Investors as having sole voting authority over such shares. |

| (6) | The information is based solely on a Schedule 13F-HR filed on May 16, 2016 with the SEC by FMR, LLC, which shows FMR, LLC as having sole voting authority over such shares. |

| (7) | The information is based solely on a Schedule 13F-HR filed on May 15, 2016 with the SEC by Capital Research Global Investors, which shows Capital Research Global Investors as having sole voting authority over such shares. |

| (8) | The information is based solely on a Schedule 13F-HR filed on May 13, 2016 with the SEC by Vanguard Group Inc., which shows Vanguard Group Inc. as having sole voting authority over such shares. |

6 Lions Gate2016 Proxy Statement

SECURITY OWNERSHIPOF MANAGEMENT

The following table presents certain information about beneficial ownership of our common shares as of July 22, 2016 (unless otherwise indicated) by (i) each current director, nominee for director and current Named Executive Officer (as defined herein), and (ii) all current directors and executive officers as a group. Except as indicated in the footnotes to this table, the persons named in the table have sole voting and dispositive power with respect to all common shares shown as beneficially owned by them, subject to community property laws, where applicable. Except for common shares in brokerage accounts, which may, from time to time together with other securities in the account, serve as collateral for margin loans made in such accounts (other than a $150,000 minimum value of shares required to be held in the Company by directors), no shares reported as beneficially owned have been pledged as security for any loan or indebtedness.

| | | | | | | | | | |

| Name of Beneficial Owner | | Number of Shares(1) | | Percent of Total(2) |

James W. Barge(3) | | | | 341,607 | | | | | * | |

Steven Beeks(4) | | | | 479,507 | | | | | * | |

Michael Burns(5) | | | | 4,392,541 | | | | | 2.9 | % |

Gordon Crawford(6) | | | | 243,648 | | | | | * | |

Arthur Evrensel(6) | | | | 37,689 | | | | | * | |

Jon Feltheimer(7) | | | | 5,012,002 | | | | | 3.3 | % |

Emily Fine | | | | 895 | | | | | * | |

Michael T. Fries | | | | 0 | | | | | * | |

Brian Goldsmith(8) | | | | 367,570 | | | | | * | |

Sir Lucian Grainge | | | | 0 | | | | | * | |

Wayne Levin(9) | | | | 507,438 | | | | | * | |

Harald Ludwig(6) | | | | 134,073 | | | | | * | |

Dr. John C. Malone(10) | | | | 4,967,695 | | | | | 3.4 | % |

G. Scott Paterson(6) | | | | 235,301 | | | | | * | |

Mark H. Rachesky, M.D.(11) | | | | 30,273,049 | | | | | 20.5 | % |

Daryl Simm(6) | | | | 69,056 | | | | | * | |

Hardwick Simmons(6) | | | | 85,274 | | | | | * | |

Phyllis Yaffe(6) | | | | 32,980 | | | | | * | |

David M. Zaslav | | | | 0 | | | | | * | |

All current executive officers and directors as a group (19 persons) | | | | 47,180,325 | | | | | 30.4 | % |

| (1) | Pursuant to Rule 13d-3(d)(1) of the Exchange Act, amount includes vested restricted share units and restricted share units vesting and options exercisable within 60 days of July 22, 2016 (i.e., September 20, 2016). |

| (2) | The percentage of total common shares owned by each person (or group of affiliated persons) is calculated by dividing: (1) the number of common shares deemed to be beneficially held by such person (or group of affiliated persons) as of July 22, 2016 (unless otherwise indicated), as determined in accordance with Rule 13d-3 under the Exchange Act by (2) the sum of (A) 147,647,415 which is the number of common shares outstanding as of July 22, 2016; plus (B) the number of common shares issuable upon the exercise of options and other derivative securities, if any, exercisable as of July 22, 2016 or within 60 days thereafter, held by such person (or group of affiliated persons) (i.e., September 20, 2016). |

| (3) | Includes 11,875 restricted share units and 83,125 common shares subject to options that are exercisable on or before September 20, 2016 and 191,667 common shares subject to options that are currently exercisable. |

| (4) | Includes 385,252 common shares subject to options that are currently exercisable. |

| (5) | Includes 2,642,857 common shares subject to options that are currently exercisable. |

| (6) | Includes 1,384 restricted share units that will vest on or before September 20, 2016. |

| (7) | Includes 3,687,500 common shares subject to options that are currently exercisable. |

Lions Gate2016 Proxy Statement 7

| (8) | Includes 266,667 common shares subject to options that are currently exercisable. |

| (9) | Includes 360,834 common shares subject to options that are currently exercisable. |

| (10) | The information is based solely on the information in a Schedule 13D/A filed with the SEC on July 11, 2016 by Dr. Malone. Includes (i) 250,000 shares held by the Malone Family Land Preservation Foundation and 206,500 shares held by the Malone Family Foundation, as to which shares Dr. Malone has disclaimed beneficial ownership; (ii) 539,657 shares held by the John C. Malone June 2003 Charitable Remainder Trust with respect to which Dr. Malone is the sole trustee and, with his wife, retains a unitrust interest; (iii) 3,871,538 shares held by the Malone Starz 2015 Charitable Remainder Trust with respect to which Mr. Malone is the sole trustee and, with his wife, retains a unitrust interest. This amount does not reflect (A) the 5,000,000 shares held by Discovery Lighting Investments Ltd. (B) the 5,000,000 shares held by Liberty Global Incorporated Limited or (C) an aggregate of 30,273,049 shares beneficially owned by Dr. Rachesky and the MHR entities as described in footnote (11) below. SeeProposal 1 – Election of Directors – Investor, Voting and Standstill Agreements. |

| (11) | The information is based solely on the information in a Schedule 13D/A filed with the SEC on July 1, 2016 by Dr. Rachesky. According to the information in the Schedule 13D/A as of June 30, 2016: MHR Institutional Advisors III LLC and MHR Institutional Partners III LP each have sole voting and dispositive power over 23,748,947 shares; MHR Fund Management and MHR Holdings LLC each have sole voting and dispositive power over 30,211,049 shares; and Dr. Rachesky has sole voting and dispositive power over 30,273,049 shares. |

8 Lions Gate2016 Proxy Statement

PROPOSAL 1

ELECTIONOF DIRECTORS

Nominees for Directors

Nominees for Directors

Our Board currently consists of 14 directors. Mr. Ludwig and Ms. Yaffe, current directors of the Company, will not stand for re-election at the Annual Meeting. Mr. Ludwig and Ms. Yaffe will, however, continue to serve as members of the Board until the date of the Annual Meeting. Additionally, at this Annual Meeting, Sir Lucian Grainge has been designated to serve as the third designee of MHR Fund Management pursuant to the Investor Rights Agreement discussed below and will be standing for election to the Board for the first time.

Upon the recommendation of the Nominating and Corporate Governance Committee of the Board, the 13 persons named below have been nominated for election as directors. Each nominee, if elected at the Annual Meeting, will serve until our 2017 Annual General Meeting of Shareholders, or until his or her successor is duly elected or appointed, unless his or her office is earlier vacated in accordance with our Articles or applicable law. Proxies cannot be voted for a greater number of persons than the nominees named.

Pursuant to the Investor Rights Agreement discussed below, Mr. Zaslav serves as the designee of Discovery, Mr. Fries serves as the designee of Liberty, and Dr. Rachesky and Ms. Fine serve as designees of MHR Management Fund.

The nominees have consented to serve on the Board if elected and the Board has no reason to believe that they will not serve if elected. If, any of the nominees should become unable or unwilling for good cause to serve as a director if elected, the persons the Board has designated as proxies may vote for a substitute nominee if the Board has designated a substitute nominee or for the balance of the nominees, leaving a vacancy, unless the Board chooses to reduce the number of directors serving on our Board.

Notwithstanding the foregoing, Sir Lucian’s term of service as a director shall commence only upon his resignation from, or his otherwise ceasing to serve on, the Board of Directors of DreamWorks Animation SKG, even if the Company shareholders vote to elect him as a director at the Annual Meeting. Sir Lucian has advised the Company that he expects such resignation or cessation of service to occur no later than the closing of DreamWorks Animation’s pending acquisition by NBCUniversal, a division of Comcast.

There are no family relationships among the nominees for directors or executive officers of the Company. Ages are as of July 22, 2016.

| | |

Michael Burns | | |

Age: 57 Director Since: August 1999 Position with the Company:

Vice Chairman since

March 2000 Residence: Santa Monica, California | | Business Experience Mr. Burns served as Managing Director and Head of the Office at Prudential Securities Inc.’s Los Angeles Investment Banking Office from 1991 to March 2000. Other Directorships Mr. Burns is a director, member of the Audit Committee and member of the Finance Committee of Hasbro, Inc. (HAS: NASDAQ). Mr. Burns is also the Chairman and a co-founder of Novica.com, a private company, and a member of the Board of Visitors of the John E. Anderson Graduate School of Management at the University of California Los Angeles. Qualifications Mr. Burns joined Mr. Feltheimer in building the Company into a premier next generation global entertainment company with annual revenue of approximately $2.35 billion in fiscal 2016. Through an accomplished career specialized in raising equity within the media and entertainment industry, |

Lions Gate2016 Proxy Statement 9

| | |

| | Mr. Burns brings important business and financial expertise to the Board in its deliberations on complex transactions and other financial matters. Additionally, Mr. Burns’ extensive knowledge of, and history with, the Company, his financial and investment banking expertise, his in-depth understanding of our industry, his connections in the business community and relationships with our shareholders, makes Mr. Burns an invaluable advisor to the Board. |

| |

Gordon Crawford | | |

Age: 69 Director Since: February 2013 Committee Membership: Strategic Advisory Committee Residence: La Cañada, �� California | | Business Experience Since June 1971, Mr. Crawford served in various positions at Capital Research and Management, a privately held investment management company. In December 2012, Mr. Crawford retired as its Senior Vice President. Currently, Mr. Crawford serves as Chairman of the Board of Trustees of the U.S. Olympic and Paralympic Foundation, and is a Life Trustee on the Board of Trustees of Southern California Public Radio. Mr. Crawford formerly served as Vice Chairman at The Nature Conservancy and Vice Chairman of the Paley Center for Media. Qualifications Mr. Crawford has been one of the most influential and successful investors in the media and entertainment industry since 1971. This professional experience and deep understanding of the media and entertainment sector makes Mr. Crawford a valuable member of our Board. |

| |

Arthur Evrensel | | |

Age: 58 Director Since: September 2001 Committee Membership: Compensation Committee (Chair) Residence: North Vancouver, British Columbia | | Business Experience Mr. Evrensel is a founding partner of the law firm of Michael, Evrensel & Pawar LLP, which was formed in February 2014. Prior to that, Mr. Evrensel was a partner with the law firm of Heenan Blaikie LLP from 1992 until February 2014. Qualifications Mr. Evrensel is a leading counsel in entertainment law relating to television and motion picture development, production, financing and distribution, as well as in the areas of new media and video game law. Mr. Evrensel is recognized as one of Canada’s leading entertainment lawyers, including his recognition in theGuide to the Leading 500 Lawyers in Canadapublished by Lexpert/American Lawyer (since 2002), the Euromoney Legal Media Group’sGuide to the World’s Leading Technology,Media & Telecommunications Lawyers (since 2002) andThe Best Lawyers in Canada (Woodward/White). In 2012, Mr. Evrensel was named Vancouver Best Lawyer of the Year in Entertainment Law. Mr. Evrensel has also been recognized since 2002 in the annual Canadian Legal Lexpert Directory in entertainment law asMost Frequently Recommended. Mr. Evrensel has also published numerous articles on entertainment law as it pertains to international co-productions and bank financing in the filmed entertainment industry, has lectured on entertainment law at McGill University in Montreal, the University of British Columbia in Vancouver, as well as at the University of Victoria, and has chaired numerous seminars and conferences relating to the film and television industry in Canada, the United States, China and England. Mr. Evrensel was the contributing editor of the Entertainment Agreements Volume of Canadian Forms & Precedent (2001 to 2007) published by Butterworths Canada. This expertise, along with his in-depth understanding of our industry and his network in the business and entertainment community provide meaningful leadership for the Board. |

10 Lions Gate2016 Proxy Statement

| | |

Jon Feltheimer | | |

Age: 64 Director Since: January 2000 Position with the Company: Chief Executive Officer since March 2000 and Co-Chairman of the Board from June 2005 to February 2012 Residence: Los Angeles, California | | Business Experience Mr. Feltheimer worked for Sony Pictures Entertainment from 1991 to 1999, serving as Founder and President of TriStar Television from 1991 to 1993, as President of Columbia TriStar Television from 1993 to 1995, and, from 1995 to 1999, as President of Columbia TriStar Television Group and Executive Vice President of Sony Pictures Entertainment. Other Directorships Mr. Feltheimer is a director of the Board of Directors of Grupo Televisa, S.A.B. (NYSE: TV; BMV: TLEVISA CPO). Mr. Feltheimer is also a director of EPIX, the Company’s joint venture with Viacom, Paramount Pictures and MGM, Celestial Tiger Entertainment, the Company’s joint venture with Saban Capital Group, Inc. and Celestial Pictures (a company wholly-owned by Astro Malaysia Holdings Sdn. Bhd.), and POP, the Company’s joint venture with CBS. Qualifications During Mr. Feltheimer’s tenure, the Company has grown from its independent studio roots into a premier next generation global content leader with a reputation for innovation. As our Chief Executive Officer, Mr. Feltheimer provides a critical link to management’s perspective in Board discussions regarding the business and strategic direction of the Company. With over 30 years of experience in the entertainment industry, Mr. Feltheimer brings an unparalleled level of strategic and operational experience to the Board, as well as an in-depth understanding of our industry and invaluable relationships in the business and entertainment community. |

| | |

Emily Fine | | |

Age: 42 Director Since: November 2015 Residence: New York, New York | | Business Experience Ms. Fine is a principal of MHR Fund Management LLC, a New York based private equity firm that manages approximately $5 billion of capital and has holdings in public and private companies in a variety of industries Ms. Fine joined MHR Fund Management in 2002 and is a member of the firm’s investment committee. Prior to joining MHR Fund Management, Ms. Fine served as Senior Vice President at Cerberus Capital Management, L.P. and also worked at Merrill Lynch in the Telecom, Media & Technology Investment Banking Group, where she focused primarily on media M&A transactions. Ms. Fine also serves on the Board of Directors of Rumie Initiative, a non-profit organization dedicated to delivering free digital educational content to the world’s underprivileged children Qualifications Ms. Fine brings to the Board a unique perspective of our business operations and valuable insight regarding financial matters. Ms. Fine has close to 20 years of investing experience and experience working with various companies in the media industry, including, as a principal of MHR Fund Management, working closely with the Company over the past 7 years. Ms. Fine holds a Bachelor of Business Administration from the University of Michigan. Investor Rights Agreement As discussed below, Ms. Fine serves as a designee of MHR Fund Management under the Investor Rights Agreement. |

Lions Gate2016 Proxy Statement 11

| | |

Michael T. Fries | | |

Age: 53 Director Since: November 2015 Residence: New York, New York | | Business Experience Mr. Fries has served as the Chief Executive Officer, President and Vice Chairman of the Board of Directors of Liberty Global, plc since June 2005. Mr. Fries was Chief Executive Officer of UnitedGlobalCom LLC (“UGC”) from January 2004 until the businesses of UGC and LGI International, Inc. (“LGI”) were combined under Liberty Global, plc’s predecessor, LGI. Other Directorships Mr. Fries is the Vice Chairman of the Board of Directors of Liberty Global, plc (since June 2005) and a director of Grupo Television S.A.B. (since April 2015). Previously, he served as a director of UGC and its predecessor from 1999 to 2005. Mr. Fries was chairman of the supervisory boards of two UGC publicly-held European subsidiaries, UPC (1998 to 2003) and Priority Telecom N.V. (2002 to 2006). Mr. Fries also served as executive chairman of Austar from 1999 until 2003, and thereafter as non-executive chairman of Austar until its sale in May 2012. Mr. Fries is a director of CableLabs®, The Cable Center, the non-profit educational arm of the U.S. cable industry, and various other non-profit and privately held corporate organizations. Mr. Fries serves as a Telecom Governor and Steering Committee member of the World Economic Forum. Mr. Fries received his Bachelor’s Degree from Wesleyan University (where he is a member of the board of trustees) and his Masters of Business Administration from Columbia University. Qualifications Mr. Fries’ significant executive experience building and managing international distribution and programming businesses, in-depth knowledge of all aspects of current global business and responsibility for setting the strategic, financial and operational direction for Liberty Global, plc contributes a unique perspective to the Board’s consideration of the strategic, operational and financial challenges and opportunities of the Company’s business. |

| | Investor Rights Agreement As discussed below, Mr. Fries serves as the designee of Liberty under the Investor Rights Agreement. |

| | |

Sir Lucian Grainge | | |

Age: 56 Director Nominee Residence: Los Angeles, California | | Business Experience Sir Lucian is the Chairman and Chief Executive Officer of Universal Music Group (“UMG”), the world leader in music-based entertainment, a position he has held since March 2011. Prior to that, he held positions of increasing responsibility within the UMG organization, a subsidiary of Vivendi S.A., including serving as the Chairman and Chief Executive Officer of Universal Music UK from 2001 until 2005 and as the Chairman and Chief Executive Officer of UMG’s international division from 2005 until 2010. Other Directorships Sir Lucian is a director of DreamWorks Animation SKG, Inc. (DWA: NASDAQ) and serves on its Compensation Committee. He has also served from March 2011 until October 2013 as a member of the Board of Directors of Activision Blizzard, Inc. (ATVI: NASDAQ). |

12 Lions Gate2016 Proxy Statement

| | |

| | Qualifications With vast experience in the music and entertainment businesses, including serving as the Chairman and Chief Executive Officer of a large entertainment company with worldwide operations, Sir Lucian brings extensive knowledge of the entertainment industry to the Board. In 2011, he was named a Trustee of the American Friends of the Royal Foundation of the Duke and Duchess of Cambridge and Prince Harry. In 2012, he was appointed a UK Business Ambassador with a special remit from British Prime Minister David Cameron on global media, digital and entertainment and he currently serves on the Board of Trustees of Northeastern University in Boston, MA. In June 2016, Sir Lucian was bestowed with a knighthood in 2016 by Her Majesty Queen Elizabeth II in the Queen’s 90th Birthday Honours list for accomplishments in the music industry and leadership through its challenging times, contributions to British business and inward investment, as well as his development of innovative business models, technology and media partnerships that have expanded UMG’s global presence. Investor Rights Agreement As discussed below, Sir Lucian will serve as a designee of MHR Fund Management under the Investor Rights Agreement. As discussed above, Sir Lucian’s term of service as a director shall commence only upon his resignation from, or his otherwise ceasing to serve on, the Board of Directors of DreamWorks Animation SKG. |

| | |

Dr. John C. Malone | | |

Age: 75 Director Since: March 2015 Residence: Englewood, Colorado | | Business Experience and Directorships Dr. Malone has served as the Chairman of the Board of Liberty Media Corporation (LMCA, LMCB, LMCK: NASDAQ) (including its predecessor) since August 2011 and as a director since December 2010. Dr. Malone served as the Chief Executive Officer of Liberty Interactive Corporation (QVCA, QVCB, LVNTA, LVNTB: NASDAQ) (including its predecessors, Liberty Interactive) from August 2005 to February 2006. Dr. Malone served as the Chairman of the Board of Tele-Communications, Inc. (“TCI”) from November 1996 until March 1999, when it was acquired by AT&T, and as Chief Executive Officer of TCI from January 1994 to March 1997. Dr. Malone holds a Bachelor’s Degree in electrical engineering and economics from Yale University and a Master’s Degree in industrial management and a Ph.D. in operations research from Johns Hopkins University. |

| | Other Directorships Dr. Malone has served as (i) a director and the Chairman of the Board of Liberty Interactive Corporation since 1994, (ii) the Chairman of the Board of Liberty Broadband Corporation (LBRDA, LBRDK: NASDAQ) since November 2014, (iii) the Chairman of the Board of Liberty Global plc (LBTYA, LBTYB, LBTYK: NASDAQ) since June 2013, having previously served as the Chairman of the Board of Liberty Global plc’s predecessor, Liberty Global, Inc., from June 2005 to June 2013, (iv) a director of Discovery Communications, Inc. (DISCA, DISCB, DISCK: NASDAQ) since September 2008, (v) a director of Expedia, Inc. (EXPE: NASDAQ) since December 2012, having previously served as a director from August 2005 to November 2012 and (vi) a director of Charter Communications, Inc. (CHTR: NASDAQ) since May 2013. Dr. Malone served as (i) a director of Ascent Capital Group, Inc. from January 2010 to September 2012, (ii) a director of Live Nation Entertainment, Inc. from January 2010 to February 2011, (iii) the Chairman of the Board of DIRECTV from November 2009 to June 2010, and DIRECTV’s predecessor, The DIRECTV Group, Inc., from February 2008 to November 2009, (iv) a director of Sirius XM Radio Inc. from April 2009 to May 2013, (v) a director of IAC/InterActiveCorp from May 2006 to June 2010 and (vi) the Chairman of the Board of Liberty TripAdvisor Holdings, Inc. from August 2014 to June 2015. |

Lions Gate2016 Proxy Statement 13

| | |

| | Qualifications Dr. Malone has played a pivotal role in the cable television industry since its inception and is considered one of the preeminent figures in the media and telecommunications industry. Dr. Malone’s industry knowledge and unique perspective on our business make him an invaluable member of the Board. Exchange Agreement On March 27, 2015, pursuant to the terms of a stock exchange agreement entered into on February 10, 2015 (the “JM Exchange Agreement”), the Company exchanged 4,967,695 of its newly issued common shares for 2,118,038 shares of Series A common stock of Starz and 2,590,597 shares of Series B common stock of Starz held by certain affiliates of Dr. Malone (the “JM Exchange”). After the closing of the JM Exchange, on March 27, 2015, the Company appointed Dr. Malone to its Board. Pursuant to the JM Exchange Agreement, the Company has agreed to nominate Dr. Malone for election to its Board at each annual meeting of the Company’s stockholders that occurs prior to the earlier of (x) the date that is two years from the closing of the JM Exchange and (y) such time as both of the following occur: (i) the affiliates of Dr. Malone collectively hold less than 75% of the 4,967,695 newly issued common shares of the Company and (ii) Dr. Malone and his affiliates collectively hold less than 2.7% of the Company’s outstanding common shares. |

| |

G. Scott Paterson | | |

Age: 52 Director Since: November 1997 Committee Membership:

Audit & Risk Committee (Chair) Residence: Toronto, Ontario | | Business Experience Mr. Paterson is a media/technology venture capitalist. Mr. Paterson previously served as Chairman & Chief Executive Officer of Yorkton Securities Inc. which, during his tenure, was Canada’s leading technology and entertainment-focused investment bank. Mr. Paterson has also served as Chairman of the Canadian Venture Stock Exchange, Vice Chairman of the Toronto Stock Exchange, a Director of the Investment Dealer’s Association of Canada and a Director of the Canadian Investor Protection Fund. In 2009, Mr. Paterson obtained an ICD.D designation by graduating from the Rotman Institute of Corporate Directors at the University of Toronto. In 2014, Mr. Paterson obtained a Certificate in Entertainment Law from Osgoode Hall Law School. Other Directorships Mr. Paterson is a member of the Nominating & Governance Committee and Chairman of Symbility Solutions Inc. (SY:TSXV); Chairman of Engagement Labs Inc. (EL:TSXV); and Chairman of Apogee Opportunities Ltd. (APE:TSXV). Mr. Paterson is also a director of Giftgram Inc. and Chairman of each of FutureVault Inc. and QYOU Media Inc., all privately held companies. Mr. Paterson was instrumental in the evolution of NeuLion Inc. (TSX:NLN), having led the company’s predecessor company JumpTV as Chairman and Chief Executive Officer until its takeover of NeuLion in 2008, becoming Vice Chairman of the Board, 2 role he held until June 2015. In addition, Mr. Paterson is Chairman of the Merry Go Round Children’s Foundation and a Governor of Ridley College. |

14 Lions Gate2016 Proxy Statement

| | |

| | Qualifications Mr. Paterson’s investment banking background and experience with the Canadian securities industry, together with management experience with media/entertainment/technology-related companies, provide the Board with significant operational and financial expertise with specific application to these industries. His varied service as a director and chairman of other public companies brings him a wide range of knowledge surrounding strategic transactions, board of director oversight, corporate responsibility and securities regulations that is valuable to the Board when considering recommendations and decisions for the Company. |

| | |

Mark H. Rachesky, M.D. | | |

Age: 57 Director Since: September 2009 Position with the Company: Chairman of the Board, Strategic Advisory Committee and Compensation Committee Residence: New York, New York | | Business Experience Dr. Rachesky is the founder and President of MHR Fund Management LLC. Dr. Rachesky holds an M.B.A. from the Stanford University School of Business, an M.D. from the Stanford University School of Medicine, and a B.A. from the University of Pennsylvania. Other Directorships Dr. Rachesky is the Non-Executive Chairman of the Board of Directors, member of the Executive Committee and Chairman of the Compensation Committee of Loral Space & Communications Inc. (LORL: NASDAQ); a director and member of the Nominating and Governance Committee and the Compensation Committee of Emisphere Technologies, Inc. (EMIS: OTCBB); a director and member of the Nominating Committee, the Governance Committee and the Compensation Committee of Titan International, Inc. (TWI: NYSE); and a director and member of the Nominating and Governance Committee, Co-Chairman of the Finance Committee and a member of the Compensation Committee of Navistar International Corporation (NAV: NYSE). Dr. Rachesky formerly served on the Board of Directors of Leap Wireless International, Inc. (NASDAQ: LEAP) until its merger with AT&T in March 2014. Dr. Rachesky also serves on the Board of Directors of Mt. Sinai Hospital Children’s Center Foundation, the Board of Advisors of Columbia University Medical Center, as well as the Board of Overseers of the University of Pennsylvania. |

| | Qualifications Dr. Rachesky has demonstrated leadership skills as well as extensive financial expertise and broad-based business knowledge and relationships. In addition, as the President of MHR Fund Management LLC, with a demonstrated investment record in companies engaged in a wide range of businesses over the last 20 years, together with his experience as chairman and director of other public and private companies, Dr. Rachesky brings broad and insightful perspectives to the Board relating to economic, financial and business conditions affecting the Company and its strategic direction. Investor Rights Agreement As discussed below, Dr. Rachesky serves as a designee of MHR Fund Management under the Investor Rights Agreement. |

Lions Gate2016 Proxy Statement 15

| | |

Daryl Simm | | |

Age: 55 Director Since: September 2004 Committee Memberships: Nominating and Corporate Governance Committee and Compensation Committee Residence: Old Greenwich, Connecticut | | Business Experience Since February 1998, Mr. Simm has been Chairman and Chief Executive Officer of Omnicom Media Group, a division of Omnicom Group, Inc. (OMC:NYSE), of which he is an officer. Qualifications Mr. Simm leads one of the industry’s largest media planning and buying groups representing blue-chip global advertisers that connect their brands to consumers through entertainment content. The agencies he leads routinely receive accolades as the most effective and creative in their field and he has been recognized as one of the “100 most influential leaders in marketing, media and tech.” Earlier in his career, Mr. Simm ran P&G Productions, a prolific producer of television programming, where he was involved in large co-production ventures and international content distribution. Mr. Simm was also the top media executive at Procter & Gamble, the world’s largest advertiser and a pioneer in the use of branded entertainment content. Mr. Simm’s broad experience across the media and content space makes him well qualified to serve on the Board. |

| | |

Hardwick Simmons | | |

Age: 76 Director Since: June 2005 Committee Membership: Strategic Advisory Committee (Chair) and Audit & Risk Committee Residence: Marion, Massachusetts | | Business Experience Mr. Simmons currently serves as a director of Invivoscribe, Inc. and Stonetex Oil Company, privately held companies. From February 2001 to June 2003, Mr. Simmons served first as Chief Executive Officer and then as Chairman and Chief Executive Officer at The NASDAQ Stock Market Inc. From May 1991 to December 2000, Mr. Simmons served as President and Chief Executive Officer of Prudential Securities Incorporated. Other Directorships From 2003 to 2016, Mr. Simmons was the Lead Director and Chairman of the Audit and Risk Committee of Raymond James Financial (RJF: NYSE). Additionally, from 2007 to 2009, Mr. Simmons was a director of Geneva Acquisition Corp., a company listed on the American Stock Exchange. Qualifications Mr. Simmons, through an accomplished career overseeing one of the largest equity securities trading markets in the world and other large complex financial institutions, brings important business and financial expertise to the Board in its deliberations on complex transactions and other financial matters. In addition, his broad business knowledge, connections in the business community and valuable insight regarding investment banking and regulation are relevant to the Board’s oversight of the Company’s business. |

| | |

David M. Zaslav | | |

Age: 56 Director Since: November 2015 Residence: New York, New York | | Business Experience Mr. Zaslav serves as President and Chief Executive Officer (since January 2007), and a common stock director of Discovery Communications, Inc. Mr. Zaslav served as President, Cable & Domestic Television and New Media Distribution of NBC Universal, Inc. (“NBC”), a media and entertainment company, from May 2006 to December 2006. Mr. Zaslav served as Executive Vice President of NBC, and President of NBC Cable, a division of NBC, from October 1999 to May 2006. |

16 Lions Gate2016 Proxy Statement

| | |

| | Other Directorships Mr. Zaslav serves on the Board of Directors of The Cable Center, the Center for Communication, Discovery Communications, Inc. (NASDAQ: DISCA), Grupo Televisa, S.A.B. (NYSE: TV; BMW: TLEVISA CPO), the National Cable & Telecommunications Association, Partnership for New York City, Skills for America’s Future, Sirius XM Holdings Inc. (NASDAQ: SIRI), and USC Shoah Foundation. Mr. Zaslav also serves on Sirius XM Radio Inc.’s Nominating and Corporate Governance committee of the Board of Directors. Mr. Zaslav is also a member of the Board of Trustees for the Paley Center for Media, the Mt. Sinai Medical Center. Mr. Zaslav was a director of Univision from 2012-2015 and TiVo Inc. from 2000 to 2010. Qualifications Mr. Zaslav’s value to the Board includes his extensive executive experience in the media and entertainment business, focusing on cable television. Mr. Zaslav has a deep understanding of the media business, both domestically and internationally, through years of leadership at both Discovery Communications, a large media company which owns several cable networks, and former executive positions at NBC Universal. Mr. Zaslav’s expertise positions him to advise the Company in considering business opportunities and provide a concrete understanding of developing cable networks. |

| | Investor Rights Agreement As discussed below, Mr. Zaslav serves as the designee of Discovery under the Investor Rights Agreement. |

Investor, Voting and Standstill Agreements

Investor Rights Agreement

On November 10, 2015, (i) Liberty Global Incorporated Limited (“Liberty”), a limited company organized under the laws of the United Kingdom and a wholly owned subsidiary of Liberty Global plc, agreed to purchase 5,000,000 of the Company’s common shares from funds affiliated with MHR Fund Management and (ii) Discovery Lightning Investments Ltd. (“Discovery”), a limited company organized under the laws of the United Kingdom and a wholly owned subsidiary of Discovery Communications, Inc., agreed to purchase 5,000,000 of the Company’s common shares from funds affiliated with MHR Fund Management (collectively, the “Purchases”). Dr. Malone, a director of the Company and holder of approximately 3.4% of the Company’s outstanding common shares, is also the chairman of the board of Liberty Global plc and holds shares representing approximately 24.7% of the votes of Liberty Global plc, based on Liberty Global plc’s Definitive Proxy Statement on Schedule 14A filed with the SEC on April 29, 2016. In addition, Dr. Malone is a director of Discovery Communications, Inc. and holds shares representing approximately 28.6% of its votes, based on Discovery Communications, Inc.’s Definitive Proxy Statement on Schedule 14A filed with the SEC on March 30, 2016.

In connection with the Purchases, on November 10, 2015, the Company entered into an investor rights agreement with Liberty Global plc, Discovery Communications, Inc., Liberty, Discovery and certain affiliates of MHR Fund Management (the “Investor Rights Agreement”). Pursuant to the Investor Rights Agreement, the Company agreed to expand the size of its Board to 14 members and to appoint (a) Mr. Fries, President and Chief Executive Officer of Liberty Global plc, (b) Mr. Zaslav, President and Chief Executive Officer of Discovery Communications, Inc., and (c) Ms. Fine, a Principal of MHR Fund Management, as directors to fill the resulting vacancies, which became effective on November 12, 2015.

The Investor Rights Agreement provides that (1) for so long as funds affiliated with MHR Fund Management beneficially own at least 10,000,000 of the Company’s common shares in the aggregate, the Company will include three designees of MHR Fund Management (at least one of whom will be an independent director and

Lions Gate2016 Proxy Statement 17

will be subject to Board approval) on its slate of director nominees for election at each future annual meeting of the Company’s shareholders and (2) for so long as funds affiliated with MHR Fund Management beneficially own at least 5,000,000, but less than 10,000,000 of the Company’s common shares in the aggregate, the Company will include one designee of MHR Fund Management on its slate of director nominees for election at each future annual meeting of the Company’s shareholders. Dr. Rachesky, the Chairman of the Board of the Company, and Ms. Fine, were appointed as designees of MHR Fund Management pursuant to the Investor Rights Agreement. Sir Lucian has been designated to serve as the third designee of MHR Fund Management and is a nominee for director at the Annual Meeting.

In addition, the Investor Rights Agreement provides that (1) for so long as Liberty and Discovery (together with certain of their affiliates) beneficially own at least 10,000,000 of the Company’s common shares in the aggregate, the Company will include one designee of Liberty and one designee of Discovery on its slate of director nominees for election at each future annual meeting of the Company’s shareholders and (2) for so long as Liberty and Discovery (together with certain of their affiliates) beneficially own at least 5,000,000, but less than 10,000,000 of the Company’s common shares in the aggregate, the Company will include one designee of Liberty and Discovery, collectively, on its slate of director nominees for election at each future annual meeting of the Company’s shareholders, selected by (a) Liberty, if Liberty individually exceeds such 5,000,000 common share threshold but Discovery does not, (b) Discovery, if Discovery individually exceeds such 5,000,000 common share threshold but Liberty does not and (c) Liberty and Discovery, jointly, if neither Liberty nor Discovery individually exceeds such 5,000,000 common share threshold. As stated above, Mr. Zaslav was appointed as a designee of Discovery and Mr. Fries was appointed as a designee of Liberty and were appointed as directors of the Company effective on November 12, 2015.

Under the Investor Rights Agreement, Liberty and Discovery (together with certain of their affiliates) have agreed that they will not sell or transfer any of their Company common shares until November 10, 2016. After November 10, 2016, Liberty and Discovery (together with certain of their affiliates) have agreed that if they sell or transfer any of their Company common shares to a shareholder or group of shareholders that beneficially own 5% or more of the Company’s common shares, or that would result in a person or group of persons beneficially owning 5% or more of the Company’s common shares, any such transferee would have to agree to the standstill, transfer and voting provisions set forth in the Investor Rights Agreement and the Voting and Standstill Agreement (described below), subject to certain exceptions set forth in the Investor Rights Agreement.

In addition, Liberty and Discovery have agreed to not solicit or hire any members of the Company’s senior management until November 10, 2018, subject to certain exceptions. The Company has also agreed to provide Liberty, Discovery and MHR Fund Management with certain pre-emptive rights on common shares that the Company may issue in the future for cash consideration. Furthermore, the Company has agreed that, until November 10, 2020, the Company will not adopt a “poison pill” or “shareholder rights plan” that would prevent Liberty, Discovery and Dr. Malone (together with certain of their affiliates) from beneficially owning at least 18.5% of the outstanding voting power of the Company in the aggregate.

The foregoing description of the Investor Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Investor Rights Agreement, which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on November 10, 2015.

Amendment to Investor Rights Agreement

On June 30, 2016, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Starz, a Delaware corporation (“Starz”), and Orion Arm Acquisition Inc., a Delaware corporation and an indirect wholly-owned subsidiary of the Company (“Orion Arm”) pursuant to which Orion Arm will merge with and into Starz, with Starz continuing as the surviving corporation and becoming an indirect wholly-owned subsidiary of the Company (the “Merger”). In connection with the Merger Agreement, the parties entered into Amendment No. 1 to the Investor Rights Agreement (“Amendment No. 1 to the Investor Rights Agreement”), which, among other things, requires the Company to call a stockholder meeting in order to seek the approval of its stockholders for any issuance of New Issue Securities (as defined therein) to the Investors (as defined therein) pursuant to the pre-emptive rights granted in the Investor Rights Agreement, that occurs between the date of such stockholder meeting and the date that is five years following such meeting. Pursuant to Amendment No. 1 to the Investor Rights Agreement, MHR Fund Management, Liberty, Discovery, Liberty Global plc, Discovery Communications, Inc., and the affiliated funds of MHR Fund Management party thereto have agreed to vote in favor of such approval, as has Dr. Malone pursuant to the JM Voting Agreement (discussed below). The

18 Lions Gate2016 Proxy Statement

Company agreed that it will not issue any New Issue Securities until it obtains stockholder approval for such issuance if stockholder approval would be required in order to give effect to the pre-emptive rights granted in the Investor Rights Agreement.

The foregoing description of various terms of Amendment No. 1 to the Investor Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of Amendment No. 1 to the Investor Rights Agreement, which is attached as Exhibit 10.8 to the Company’s Current Report on Form 8-K filed with the SEC on July 1, 2016.

Voting and Standstill Agreement

On November 10, 2015, the Company entered into a voting and standstill agreement with Liberty Global plc, Discovery Communications Inc., Liberty, Discovery, Dr. Malone and certain affiliates of MHR Fund Management (the “Voting and Standstill Agreement”). Under the Voting and Standstill Agreement, Liberty, Discovery and Dr. Malone have agreed that, until November 10, 2020 (the “Standstill Period”), they (together with certain of their affiliates) will not beneficially own more than 18.5% of the Company’s outstanding voting power in the aggregate.

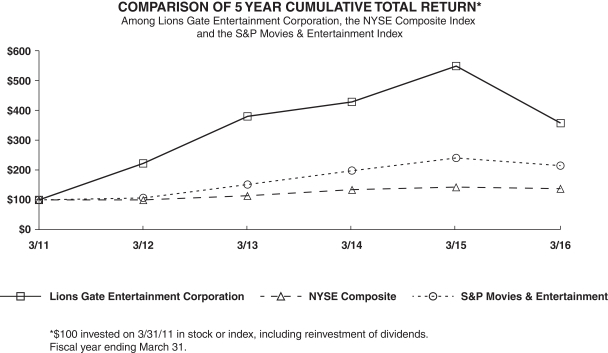

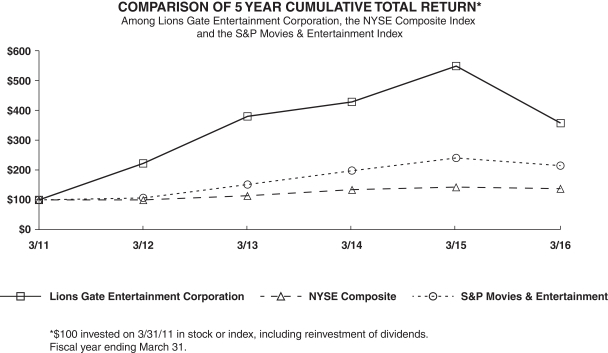

During the Standstill Period, Liberty, Discovery and Dr. Malone have each agreed to vote, in any vote of the Company’s shareholders, all of the Company’s common shares beneficially owned by them (together with certain of their affiliates) in the aggregate in excess of 13.5% of the Company’s outstanding voting power in the aggregate in the same proportion as the votes cast by shareholders other than Liberty, Discovery and Dr. Malone (together with certain of their affiliates). After the expiration of the Standstill Period, Liberty, Discovery and Dr. Malone have agreed to vote, in any vote of the Company’s shareholders on a merger, amalgamation, plan of arrangement, consolidation, business combination, third party tender offer, asset sale or other similar transaction involving the Company or any of the Company’s subsidiaries (and any proposal relating to the issuance of capital, increase in the authorized capital or amendment to any constitutional documents in connection with any of the foregoing), all of the Company’s common shares beneficially owned by them (together with certain of their affiliates) in excess of 18.5% of the Company’s outstanding voting power in the aggregate in the same proportion as the votes cast by shareholders other than Liberty, Discovery and Dr. Malone (together with certain of their affiliates).