Table of Contents

British Columbia, Canada | N/A | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

250 Howe Street, 20th Floor Vancouver, British Columbia V6C 3R8(877) 848-3866 | 2700 Colorado Avenue Santa Monica, California 90404 (310) 449-9200 |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

Class A Voting Common Shares, no par value per share | LGF.A | New York Stock Exchange | ||

Class B Non-Voting Common Shares, no par value per share | LGF.B | New York Stock Exchange |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| ☐ | Emerging growth company | ☐ | ||||

Auditor Firm Id: 42 | Auditor Name: Ernst & Young LLP | Auditor Location: Los Angeles, CA |

| • | amend Part III, Items 10, 11, 12, 13 and 14 of the Original Filing to include the information required by and not included in such Items; |

| • | delete the reference on the cover of the Original Filing to the incorporation by reference of certain information from our proxy statement into Part III of the Original Filing; and |

| • | file new certifications of our principal executive officer and principal financial officer as exhibits to this Form 10/K-A under Item 15 of Part IV hereof pursuant toRule 12b-15 under the Securities Exchange Act of 1934, as amended, and to Section 302 of the Sarbanes-Oxley Act of 2002. |

Table of Contents

FORWARD-LOOKING STATEMENTS

This Form 10-K/A includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “potential,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “may,” “will,” “could,” “would” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those discussed under Part I, Item 1A. Risk Factors, in the Original Filing These risk factors should not be construed as exhaustive and should be read with the other cautionary statements and information in this report.

We caution you that forward-looking statements made in this report or anywhere else are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially and adversely from those made in or suggested by the forward-looking statements contained in this report as a result of various important factors, including, but not limited to: changes in our business strategy including the plan to potentially spin-off our studio business; the substantial investment of capital required to produce and market films and television series; budget overruns; limitations imposed by our credit facilities and notes; unpredictability of the commercial success of our motion pictures and television programming; risks related to acquisition and integration of acquired businesses; the effects of dispositions of businesses or assets, including individual films or libraries; the cost of defending our intellectual property; technological changes and other trends affecting the entertainment industry; potential adverse reactions or changes to business or employee relationships; the impact of global pandemics, such as COVID-19 on the Company’s business; weakness in the global economy and financial markets, including a recession and bank failures; wars, such as Russia’s invasion of Ukraine, terrorism, labor disruptions or strikes, such as the impact of the ongoing Writers Guild strike and/or potential strikes from the Directors Guild or Screen Actors Guild, and international conflicts that could cause significant economic disruption and political and social instability; and the other risks and uncertainties discussed under Part I, Item 1A. Risk Factors, in the Original Filing.

Any forward-looking statements which we make in this report speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

This report contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this report, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Unless otherwise indicated or the context requires, all references to the “Company,” “Lionsgate,” “we,” “us,” and “our” refer to Lions Gate Entertainment Corp., a corporation organized under the laws of the province of British Columbia, Canada, and its direct and indirect subsidiaries.

3

Table of Contents

TABLE OF CONTENTS

| PART III | ||||||

Item 10. | 5 | |||||

Item 11. | 18 | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 71 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 78 | ||||

Item 14. | 82 | |||||

| PART IV | ||||||

Item 15. | 83 | |||||

| 84 | ||||||

4

Table of Contents

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Directors

The following persons currently serve as members of the Board of Directors (the “Board”) of Lions Gate Entertainment Corp. (the “Company,” “Lionsgate,” “we,” “us” or “our”). There are no family relationships among the directors or executive officers of the Company. Ages are as of July 14, 2023.

Michael Burns

Age: 64

Director Since: August 1999

Position with Lionsgate: Vice Chair since March 2000

Residence: Los Angeles, California

Business Experience: Mr. Burns served as Managing Director and Head of the Office at Prudential Securities Inc.’s Los Angeles Investment Banking Office from 1991 to March 2000.

Other Directorships: Mr. Burns has been a director and member of the Finance and Capital Allocation Committee, and the Nominating, Governance & Social Responsibility Committees of Hasbro, Inc. (NASDAQ: HAS) since 2014.

Qualifications: Mr. Burns has worked with Chief Executive Officer Jon Feltheimer in building Lionsgate into a multibillion dollar media and entertainment leader with world-class film and television studio operations. With an accomplished investment banking career prior to Lionsgate, in which he specialized in raising equity within the media and entertainment industry, Mr. Burns brings to the Board important business and financial expertise in its deliberations on complex transactions and other financial matters. Additionally, Mr. Burns’ extensive knowledge of and history with Lionsgate, financial background, in-depth understanding of the media and entertainment industry, connections within the business community and relationships with Lionsgate shareholders, make him an invaluable member of the Board.

Mignon Clyburn

Age: 61

Independent Director Since: September 2020

Committee Membership: Nominating and Corporate Governance Committee

Business Experience: Ms. Clyburn is President of MLC Strategies, LLC, a Washington, D.C. based consulting firm, a position she has held since January 2019. Previously, Ms. Clyburn served as a Commissioner of the U.S. Federal Communications Commission (the “FCC”) from 2009 to 2018, including as acting chair. While at the FCC, she was committed to closing the digital divide and championed the modernization of the agency’s Lifeline Program, which assists low-income consumers with voice and broadband service. In addition, Ms. Clyburn promoted diversity in media ownership, initiated Inmate Calling Services reforms, supported inclusion in STEM opportunities and fought for an open internet. Prior to her federal appointment, Ms. Clyburn served 11 years on the Public Service Commission of South Carolina and worked for nearly 15 years as publisher of the Coastal Times, a Charleston weekly newspaper focused on the African American community.

Other Directorships: Ms. Clyburn has been the Chair of the Compensation Committee and a member of the Nominating and Corporate Governance Committee of Charah Solutions, Inc. (NYSE: CHRA) since March 2019 and a director of RingCentral, Inc. (NYSE: RNG) since November 2020.

Qualifications: Ms. Clyburn has extensive experience as a state regulator of investor-owned utilities and as a federal commissioner in the technology and telecommunications fields. Such expertise and additional background as a successful business executive, makes Ms. Clyburn invaluable and well qualified to serve on the Board.

5

Table of Contents

Gordon Crawford

Age: 76

Independent Director Since: February 2013

Committee Membership: Strategic Advisory Committee (Co-Chair)

Residence: Dana Point, California

Business Experience: For over 40 years, Mr. Crawford served in various positions at Capital Research and Management, a privately held global investment management company. In December 2012, Mr. Crawford retired as its Senior Vice President.

Other Directorships: Currently, Mr. Crawford serves as Director Emeritus of the Board of Trustees of the U.S. Olympic and Paralympic Foundation (which he Chaired for nine years from its inception in 2013), and as a Life Trustee on the Board of Trustees of Southern California Public Radio (which he Chaired from 2005 to 2012). Mr. Crawford formerly served as Vice Chairman at The Nature Conservancy and is currently a member of the Emeritus Board of the Nature Conservancy. Mr. Crawford is a past Vice Chairman of the Paley Center for Media and a member of the Board of Trustees of Berkshire School. Mr. Crawford also served on the Board of the U.S. Olympic and Paralympic Committee, and as a member of the Board of the LA24 Olympic and Paralympic Bid Committee.

Qualifications: Mr. Crawford has been one of the most influential and successful investors in the media and entertainment industry for over 40 years. Mr. Crawford’s professional experience and deep understanding of the media and entertainment sector makes Mr. Crawford a valuable member of the Board.

Jon Feltheimer

Age: 71

Director Since: January 2000

Position with Lionsgate: Chief Executive Officer since March 2000

Residence: Los Angeles, California

Business Experience: During his 30-year entertainment industry career, Mr. Feltheimer has held leadership positions at Lionsgate, Sony Pictures Entertainment and New World Entertainment, and has been responsible for tens of thousands of hours of television programming and hundreds of films. Prior to joining Lionsgate, he served as President of TriStar Television from 1991 to 1993, President of Columbia TriStar Television from 1993 to 1995, and President of Columbia TriStar Television Group and Executive Vice President of Sony Pictures Entertainment from 1995 to 1999, where he oversaw the launch of dozens of successful branded channels around the world.

Other Directorships: Mr. Feltheimer is a director of Grupo Televisa, S.A.B. (NYSE: TV; BMV: TLEVISA CPO).

Qualifications: During Mr. Feltheimer’s tenure, Lionsgate has grown from its independent studio roots into a global media and entertainment leader encompassing world-class film and television operations backed by an 18,000-title library. As Lionsgate’s Chief Executive Officer since 2000, Mr. Feltheimer provides a critical link to management’s perspective in Board discussions regarding the business and strategic direction of Lionsgate. With extensive experience at three different studios in the entertainment industry, Mr. Feltheimer brings an unparalleled level of strategic and operational experience to the Board, as well as an in-depth understanding of Lionsgate’s industry and invaluable relationships within the business and entertainment community.

6

Table of Contents

Emily Fine

Age: 49

Independent Director Since: November 2015

Committee Membership: Nominating and Corporate Governance Committee

Residence: New York, New York

Business Experience: Ms. Fine is a principal of MHR Fund Management, a New York based private equity firm that manages approximately $5 billion of capital and has holdings in public and private companies in a variety of industries. Ms. Fine joined MHR Fund Management in 2002 and is a member of the firm’s investment committee. Prior to joining MHR Fund Management, Ms. Fine served as Senior Vice President at Cerberus Capital Management, L.P. and also worked at Merrill Lynch in the Telecom, Media & Technology Investment Banking Group, where she focused primarily on media merger and acquisition transactions.

Other Directorships: Ms. Fine serves on the Board of Directors of Rumie Initiative, a non-profit organization dedicated to providing access to free educational content through digital microlearning.

Qualifications: Ms. Fine brings to the Board a unique perspective of Lionsgate’s business operations and valuable insight regarding financial matters. Ms. Fine has over 20 years of investing experience and experience working with various companies in the media industry, including, as a principal of MHR Fund Management, working closely with Lionsgate over the past ten years.

Investor Rights Agreement: Ms. Fine serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

Michael T. Fries

Age: 60

Independent Director Since: November 2015

Committee Membership: Compensation Committee, Strategic Advisory Committee

Residence: Denver, Colorado

Business Experience: Mr. Fries has served as the Chief Executive Officer, President and Vice Chairman of the Board of Directors of Liberty Global, plc (“Liberty Global”) (NASDAQ: LBTYA, LBTYB, LBTYK) since June 2005.

Mr. Fries was Chief Executive Officer of UnitedGlobalCom LLC (“UGC”) from January 2004 until the businesses of UGC and Liberty Media International, Inc. were combined to form Liberty Global.

Other Directorships: Mr. Fries is Executive Chairman of Liberty Latin America Ltd. (since December 2017) (NASDAQ: LILA) and a director of Grupo Televisa S.A.B. (since April 2015) (NYSE: TV; BMV: TLEVISA CPO). Mr. Fries serves as board member of CableLabs® and as a Digital Communications Governor and Steering Committee member of the World Economic Forum. Mr. Fries serves as trustee and finance committee member for The Paley Center for Media.

Qualifications: Mr. Fries has over 30 years of experience in the cable and media industry. As an executive officer of Liberty Global and co-founder of its predecessor, Mr. Fries has overseen its growth into a world leader in converged broadband, video and mobile communications. Liberty Global delivers next-generation products through advanced fiber and 5G networks, and currently provides over 86 million connections across Europe and the U.K. Liberty Global’s joint ventures in the U.K. and the Netherlands generate combined annual revenue of over $17 billion, while remaining operations generate consolidated revenue of more than $7 billion. Through its substantial scale and commitment to innovation, Liberty Global is building Tomorrow’s Connections Today, investing in the infrastructure and platforms that empower customers and deploying the advanced technologies that nations and economies need to thrive. Additionally, Liberty Global’s investment arm includes a portfolio of more than 75 companies across content, technology and infrastructure. Mr. Fries’ significant executive experience in building and managing international distribution and programming businesses, in-depth knowledge of all aspects of a global telecommunications business and responsibility for setting the strategic, financial and operational direction for Liberty Global contribute to the Board’s consideration of the strategic, operational and financial challenges and opportunities of Lionsgate’s business, and strengthen the Board’s collective qualifications, skills and attributes.

Investor Rights Agreement: Mr. Fries serves as the designee of Liberty under the Investor Rights Agreement (discussed below).

7

Table of Contents

John D. Harkey, Jr.

Age: 62

Independent Director Since: June 2023

Committee Membership: Audit & Risk Committee

Residence: Dallas, Texas

Business Experience: Mr. Harkey has served as the principal and founder of JDH Investment Management, LLC, an investment advisory firm, since 2007, and as chairman and chief executive officer of Consolidated Restaurant Operations, Inc., a full-service and franchise restaurants company, since 1998. Mr. Harkey is also a co-founder, and has served on the board of directors, of Cessation Therapeutics, a developer of vaccines for addictions to fentanyl, heroin and nicotine, since June 2018. In addition, he was a co-founder of AveXis, Inc., a biotechnology company, from 2010 until it was acquired in 2018 by Novartis AG, and served as executive chairman from 2010 to 2015. Mr. Harkey holds a B.B.A. in Business Honors from the University of Texas at Austin, a J.D. from the University of Texas School of Law, and an M.B.A. from Stanford Graduate School of Business.

Other Directorships: Mr. Harkey serves on the board of directors of several privately-held companies and non-profit organizations, and previously served on the board of directors of Sumo Logic, Inc. until its acquisition by Francisco Partners in May 2023, Loral Space & Communications Inc., until its merger with Telesat Canada in November 2021, and Emisphere Technologies, Inc., until its acquisition by Novo Nordisk in December 2020.

Qualifications: Mr. Harkey has extensive operational experience as a private investor and chief executive, in both public and private companies, across a wide range of industries. Mr. Harkey qualifications and experiences, including executive leadership, global leadership, growth and operational scale, business development and strategy, finance and accounting, legal, regulatory, and compliance, and public company board membership, are invaluable to the Board.

Investor Rights Agreement: Mr. Harkey serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

Susan McCaw

Age: 61

Independent Director Since: September 2018

Committee Membership: Audit & Risk Committee, Compensation Committee

Residence: North Palm Beach, Florida

Business Experience: Ms. McCaw is currently the President of SRM Capital Investments, a private investment firm. Before this, Ms. McCaw served as President of COM Investments, a position she held from April 2004 to June 2019 except while serving as U.S. Ambassador to the Republic of Austria from November 2005 to December 2007. Prior to April 2004, Ms. McCaw was the Managing Partner of Eagle Creek Capital, a private investment firm investing in private technology companies, a Principal with Robertson, Stephens & Company, a San Francisco-based technology investment bank, and an Associate in the Robertson Stephens Venture Capital Group. Earlier in her career, Ms. McCaw was a management consultant with McKinsey & Company.

Other Directorships: Ms. McCaw is a Director and member of the Leadership Development and Compensation Committee of Air Lease Corporation (NYSE: AL). Ms. McCaw is the Vice Chair of the Hoover Institution and a board member of the Ronald Reagan Presidential Foundation & Institute, Teach for America, and the Stanford Institute for Economic Policy Research. She is also a founding board member of the Malala Fund and serves as the Chair of the Knight-Hennessy Scholars Global Advisory Board. Ms. McCaw is also Trustee Emerita of Stanford University.

Qualifications: Ms. McCaw brings deep experience and relationships in global business and capital markets to the Board through her private sector experience in investment banking and investment management, and through her public service as a former U.S. Ambassador. Ms. McCaw holds a Bachelor’s Degree in Economics from Stanford University and a Masters of Business Administration from Harvard Business School. Ms. McCaw’s experience both as an investor and diplomat brings broad and meaningful insight to the Board’s oversight of Lionsgate’s business.

8

Table of Contents

Yvette Ostolaza

Age: 58

Independent Director Since: December 2019

Committee Membership: Nominating and Corporate Governance Committee (Chair)

Residence: Dallas, Texas

Business Experience: Since October 2013, Ms. Ostolaza has been a partner at Sidley Austin LLP, an international law firm with 21 offices and nearly $3 billion in revenue. She currently serves as Sidley’s Management Committee Chair and as a member of the firm’s Executive Committee. Ms. Ostolaza has also served on a number of nonprofit organizations as a board member or trustee. Ms. Ostolaza has received various legal and leadership awards, including being recognized by the Hispanic National Bar as Law Firm Leader of 2022, as a “Thought Leader” at Corporate Counsel’s 2019 Women, Influence & Power in Law Awards. Ms. Ostolaza has been selected as one of 20 “Women of Excellence” nationally by Hispanic Business magazine. In 2018, she received the Anti-Defamation League’s prestigious Schoenbrun Jurisprudence Award for her outstanding leadership and exemplary contributions to the community. Ostolaza also received the Texas Lawyer’s Lifetime Achievement Award and named by that publication as one of ten “Winning Women” and as a “Woman to Watch.” She also has been recognized by the Texas Diversity Counsel as one of its “Most Powerful and Influential Women,” and by Latino Leaders Magazine as one of its “Most Powerful Latino Lawyers.” Ms. Ostolaza is also a past recipient of Girls, Inc.’s annual “Woman of Achievement” award.

Qualifications: Ms. Ostolaza has spent her career developing a global practice representing public and private companies, board committees, and directors and officers in high-profile litigation, investigations, shareholder activism, regulatory, governance, and crisis management matters across a wide variety of industries. This breadth of experience provides important insight and counsel to the Board’s oversight of Lionsgate’s business.

Mark H. Rachesky, M.D.

Age: 64

Independent Director Since: September 2009

Committee Membership: Chair of the Board, Compensation Committee, Strategic Advisory Committee (Co-Chair)

Residence: New York, New York

Business Experience: Dr. Rachesky is Founder and Chief Investment Officer of MHR Fund Management LLC, a New York-based private equity firm that manages approximately $5 billion of capital and has holdings in public and private companies across a variety of industries.

Other Directorships: Dr. Rachesky is the Non-Executive Chairman of the Board of Directors, member of the Nominating Committee and the Human Resources and Compensation Committee of Telesat Corporation (NASDAQ: TSAT), and a director and member of the Nominating Committee, the Corporate Governance Committee and the Compensation Committee of Titan International, Inc. (NYSE: TWI). Dr. Rachesky formerly served on the Board of Directors of Loral Space & Communications Inc. until its merger with Telesat Canada in November 2021, on the Board of Directors of Navistar International Corporation (NYSE: NAV) until its merger with Traton SE in July 2021, and on the Board of Directors of Emisphere Technologies Inc. until it was acquired by Novo Nordisk in December 2020. Dr. Rachesky also serves on the Board of Directors of Mt. Sinai Hospital Children’s Center Foundation, the Board of Advisors of Columbia University Medical Center, as well as the Board of Overseers of the University of Pennsylvania.

Qualifications: Dr. Rachesky has demonstrated leadership skills as well as extensive financial expertise and broad-based business knowledge and relationships. In addition, as the Chief Investment Officer of MHR Fund Management LLC, with a demonstrated investment record in companies engaged in a wide range of businesses over the last 20 plus years, together with his experience as chair and director of other public and private companies, Dr. Rachesky brings broad and insightful perspectives to the Board relating to economic, financial and business conditions affecting Lionsgate and its strategic direction.

Investor Rights Agreement: Dr. Rachesky serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

9

Table of Contents

Daryl Simm

Age: 62

Independent Director Since: September 2004

Committee Memberships: Compensation Committee (Chair)

Residence: Naples, Florida

Business Experience: Since November 2021, Mr. Simm has been the President and Chief Executive Officer of Omnicom Group, Inc. (NYSE: OMC). From February 1998 to November 2021, Mr. Simm was Chairman and Chief Executive Officer of Omnicom Media Group, a division of Omnicom Group, Inc.

Qualifications: Mr. Simm leads one of the industry’s largest media planning and buying groups representing blue-chip global advertisers that connect their brands to consumers through entertainment content. The agencies he leads routinely receive accolades as the most effective and creative in their field and he has been recognized as one of the “100 most influential leaders in marketing, media and tech.” Earlier in his career, Mr. Simm ran P&G Productions, a prolific producer of television programming, where he was involved in large co-production ventures and international content distribution. Mr. Simm was also the top media executive at Procter & Gamble, the world’s largest advertiser and a pioneer in the use of branded entertainment content. Mr. Simm’s broad experience across the media and content space makes him well qualified to serve on Board.

Hardwick Simmons

Age: 83

Independent Director Since: June 2005

Committee Membership: Audit & Risk Committee (Chair), Strategic Advisory Committee

Residence: Marion, Massachusetts

Business Experience: Mr. Simmons currently serves as a director of several privately held companies. From February 2001 to June 2003, Mr. Simmons served first as Chief Executive Officer and then as Chairman and Chief Executive Officer at The NASDAQ Stock Market Inc. From May 1991 to December 2000, Mr. Simmons served as President and Chief Executive Officer of Prudential Securities Incorporated.

Other Directorships: From 2003 to 2016, Mr. Simmons was the Lead Director and Chairman of the Audit and Risk Committee of Raymond James Financial (NYSE: RJF).

Qualifications: Mr. Simmons, through an accomplished career overseeing one of the largest equity securities trading markets in the world and other large complex financial institutions, brings important business and financial expertise to the Board in its deliberations on complex transactions and other financial matters. In addition, his broad business knowledge, connections in the business community and valuable insight regarding investment banking and regulation are relevant to the Board’s oversight of Lionsgate’s business.

Harry E. Sloan

Age: 73

Independent Director Since: December 2021

Committee Membership: Compensation Committee, Strategic Advisory Committee

Residence: Los Angeles, California

Business Experience: Mr. Sloan is a founder, public company chief executive officer and a leading investor in the media, entertainment and technology industries. Mr. Sloan is the Chairman and CEO of Eagle Equity Partners II, LLC (“Eagle Equity”). Under Mr. Sloan’s leadership, Eagle Equity has acquired and taken public, through special purpose acquisition companies, several digital media companies including, during 2020, DraftKings, Inc. (Nasdaq: DKNG) (“DraftKings”) and Skillz Inc. (NYSE: SKLZ). Mr. Sloan has been at the forefront and evolution of the video gaming industry as one of the founding investors and a Board Member of Zenimax/Bethesda Game Studios, the awarding winning studio acquired by Microsoft in March 2021. Mr. Sloan co-founded Soaring Eagle Acquisition Corp., which raised $1.725 billion in its initial public offering in February 2021, and in September 2021, completed its initial business combination with Ginkgo Bioworks Holdings, Inc.

10

Table of Contents

(NYSE: DNA) (“Ginkgo”). In January 2022, Mr. Sloan and his partners launched Screaming Eagle Acquisition Corp. (NASDAQ: SCRM). Earlier in his career, Mr. Sloan was Chairman and Chief Executive Officer of MGM Studios and founded and led two public companies in the entertainment media arena, New World Entertainment and SBS Broadcasting, S.A. Mr. Sloan was also one of the founding investors of Lionsgate and served as Lionsgate’s Non-Executive Chairman from 2004 to 2005.

Other Directorships: Mr. Sloan is a member of the Board of Directors and a member of the Audit Committee of Ginkgo, and Vice Chairman of the Board of Directors and Chair of the Nominating and Corporate Governance Committee of DraftKings.

Qualifications: Mr. Sloan’s extensive experience as an international media investor, entrepreneur and studio executive makes him well qualified to serve on the Board.

Investor Rights Agreement: Mr. Sloan serves as a designee of Discovery Lightning under the Investor Rights Agreement (discussed below).

Investor Rights Agreement

On November 10, 2015, (i) Liberty, a limited company organized under the laws of the United Kingdom and a wholly-owned subsidiary of Liberty Global, agreed to purchase 5,000,000 of Lionsgate’s then outstanding common shares from funds affiliated with MHR Fund Management, and (ii) Discovery Lightning, a limited company organized under the laws of the United Kingdom and a wholly-owned subsidiary of Warner Bros. Discovery, Inc. (“Discovery”) agreed to purchase 5,000,000 of Lionsgate’s then outstanding common shares from funds affiliated with MHR Fund Management (collectively, the “Purchases”).

In connection with the Purchases, on November 10, 2015, Lionsgate entered into an investor rights agreement with Liberty Global, Discovery, Liberty, Discovery Lightning and certain affiliates of MHR Fund Management (as amended from time to time, the “Investor Rights Agreement”). The Investor Rights Agreement provides that, among other things, (i) for so long as funds affiliated with MHR Fund Management beneficially own at least 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include three (3) designees of MHR Fund Management (at least one of whom will be an independent director and will be subject to Board approval) on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders and (ii) for so long as funds affiliated with MHR Fund Management beneficially own at least 5,000,000, but less than 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include one designee of MHR Fund Management on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders. Dr. Rachesky, Ms. Fine and a former director were appointed as initial designees of MHR Fund Management pursuant to the Investor Rights Agreement. Mr. Harkey serves as the current third designee under the Investor Rights Agreement.

In addition, the Investor Rights Agreement provides that (i) for so long as Liberty and Discovery Lightning (together with certain of their affiliates) beneficially own at least 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate’s will include one designee of Liberty and one designee of Discovery Lightning on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders and (ii) for so long as Liberty and Discovery Lightning (together with certain of their affiliates) beneficially own at least 5,000,000, but less than 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include one designee of Liberty and Discovery Lightning, collectively, on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders, selected by (a) Liberty, if Liberty individually exceeds such 5,000,000 common share threshold but Discovery Lightning does not, (b) Discovery Lightning, if Discovery Lightning individually exceeds such 5,000,000 common share threshold but Liberty does not and (c) Liberty and Discovery Lightning, jointly, if neither Liberty nor Discovery Lightning individually exceeds such 5,000,000 common share threshold. Mr. Fries was appointed as a designee of Liberty and a former director was appointed as a designee of Discovery Lightning, and both were appointed as directors of Lionsgate effective on November 12, 2015. Currently, Mr. Sloan serves as the designee of Discovery Lightning under the Investor Rights Agreement.

11

Table of Contents

In addition, under the Investor Rights Agreement, Lionsgate has also agreed to provide Liberty, Discovery Lightning and MHR Fund Management with certain pre-emptive rights on shares that Lionsgate may issue in the future for cash consideration.

Under the Investor Rights Agreement, Liberty and Discovery Lightning (together with certain of their affiliates) have agreed that if they sell or transfer any of their shares of Lionsgate common stock to a shareholder or group of shareholders that beneficially own 5% or more of Lionsgate’s then outstanding common shares, or that would result in a person or group of persons beneficially owning 5% or more of Lionsgate’s then outstanding common shares, any such transferee would have to agree to the restrictions and obligations set forth in the Investor Rights Agreement, including transfer restrictions, subject to certain exceptions set forth in the Investor Rights Agreement.

Executive Officers

The following is a list of our executive officers followed by their biographical information (other than for Messrs. Feltheimer and Burns, whose biographical information appears above). Ages are as of July 14, 2023.

Name | Age | Position | ||||

Jon Feltheimer | 71 | Chief Executive Officer | ||||

Michael Burns | 64 | Vice Chair | ||||

James W. Barge | 67 | Chief Financial Officer | ||||

Brian Goldsmith | 51 | Chief Operating Officer | ||||

Bruce Tobey | 64 | Executive Vice President and General Counsel | ||||

James W. Barge has been Lionsgate’s Chief Financial Officer since October 2013. From October 2010 to November 2012, Mr. Barge served as the Executive Vice President, Chief Financial Officer of Viacom, Inc. (having served as its Executive Vice President, Controller, Tax and Treasury since January 2008), where he was responsible for overseeing all aspects of the company’s global finances and capital structure, as well as information technology, risk management and internal audit activities. Prior to joining Viacom, Mr. Barge served as Senior Vice President, Controller and Chief Accounting Officer (from October 2002 to December 2007) and Vice President and Controller (from February 2000 to October 2002) of Time Warner Inc., where he was responsible for the company’s overall financial planning, reporting and analysis, including budgeting and long range planning, and led several shared service and global process improvement initiatives. Mr. Barge joined Time Warner in March 1995 as Assistant Controller. Prior to joining Time Warner, Mr. Barge held several positions at Ernst & Young, including Area Industry Leader of the Consumer Products Group and National Office Partner, where he was responsible for the resolution of SEC accounting and reporting issues. Mr. Barge is the Chair of the Audit Committee and a member of the Nominating and Governance Committee of Scholastic Corporation (NASDAQ: SCHL).

Brian Goldsmith has been Lionsgate’s Chief Operating Officer since October 2012, and served as Lionsgate’s Executive Vice President, Corporate Development and Strategy, from September 2008 to October 2012. Prior to that, Mr. Goldsmith served as the Chief Operating Officer and Chief Financial Officer of Mandate Pictures, LLC, a wholly-owned subsidiary of Lionsgate since September 2007.

Bruce Tobey has been Lionsgate’s Executive Vice President and General Counsel since March 2023. Prior to that, Mr. Tobey was a partner at O’Melveny & Myers LLP, where he worked from August 2012 to March 2023. Prior to joining O’Melveny & Myers LLP, Mr. Tobey also served as Chief Operating Officer at CBS Films from March 2007 to December 2010, as Executive Vice President at Paramount Pictures Corporation from February 2001 to August 2005, and as a partner at Troop Steuber Pasich Reddick & Tobey, LLP (and its predecessor firm), where he worked from May 1986 to March 2000.

12

Table of Contents

Appointment of Executive Officers

Lionsgate’s officers are appointed and serve at the discretion of the Board. The employment agreements for the Named Executive Officers (as defined under Item 11, Executive Compensation below) are described in “— Executive Compensation Information of Lionsgate — Description of Employment Agreements” below.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires Lionsgate’s executive officers and directors and persons who own more than 10% of a registered class of Lionsgate’s equity securities to file reports of ownership and changes in ownership with the SEC. As an administrative matter, Lionsgate assists its executive officers and directors by monitoring transactions and filing Section 16 reports on their behalf. Based solely on a review of the copies of such forms we received, or representations from certain reporting persons that no forms were required for those persons, we believe that during fiscal 2023, our executive officers, directors and greater than 10% beneficial owners complied with all applicable Section 16(a) filing requirements.

Code of Conduct and Ethics

Lionsgate has a Code of Business Conduct and Ethics that applies to all its directors, officers and employees (and, where applicable, to its suppliers, vendors, contractors and agents) and is available on its website at https://investors.lionsgate.com/governance/governance-documents, and can be obtained in print, without charge, by any shareholder upon request to Lionsgate’s Corporate Secretary. Lionsgate will disclose on its website any waivers of, or amendments to, the code that applies to Lionsgate’s Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer or persons performing similar functions.

Role of the Board and Corporate Governance Guidelines

Lionsgate’s corporate governance practices are embodied in its Corporate Governance Guidelines established by the Board. These guidelines, which provide a framework for the conduct of the Board’s business, provide that:

| • | the Board review and regularly monitor the effectiveness of Lionsgate’s fundamental operating, financial and other business plans, policies and decisions, including the execution of its strategies and objectives; |

| • | the Board act in the best interest of Lionsgate to enhance long-term shareholder value; |

| • | a majority of the members of the Board be independent directors; |

| • | the independent directors meet at least quarterly in executive session, or otherwise as needed; |

| • | directors have unimpeded access to management and, as necessary and appropriate, independent advisors; and |

| • | the Board and its committees conduct annual self-evaluations to determine whether they are functioning effectively. |

The full text of the key practices and procedures of the Board are outlined the Corporate Governance Guidelines available on Lionsgate’s website at http://investors.lionsgate.com/governance/governance-documents, or may be obtained in print, without charge, by any shareholder upon request to Lionsgate’s Corporate Secretary, at either of its principal executive offices.

13

Table of Contents

Board Committees and Responsibilities

The Board has a standing Audit & Risk Committee, Compensation Committee, Nominating and Corporate Governance Committee and Strategic Advisory Committee. The table below provides current membership information for its standing committees, as well as meeting information for such committees.

| Audit & Risk Committee | Compensation Committee | Nominating & Corporate Governance Committee | Strategic Advisory Committee | |||||

Michael Burns | ||||||||

Mignon Clyburn* |  | |||||||

Gordon Crawford* |  | |||||||

Jon Feltheimer | ||||||||

Emily Fine* |  | |||||||

Michael T. Fries* |  |  | ||||||

John D. Harkey, Jr.* |  | |||||||

Susan McCaw* |  |  | ||||||

Yvette Ostolaza* |  | |||||||

Mark H. Rachesky, M.D.* |  |  | ||||||

Daryl Simm* |  | |||||||

Hardwick Simmons* |   |  | ||||||

Harry E. Sloan* |  |  | ||||||

*Independent Director |  | Chairperson |  | Member |

Audit & Risk Committee

Messrs. Simmons (Chair) and Harkey and Ms. McCaw are the current members of the Audit & Risk Committee.

The Audit & Risk Committee is governed by a written charter adopted by the Board, which is available on Lionsgate’s website at http://investors.lionsgate.com/governance/governance-documents, or may be obtained in print, without charge, by any shareholder upon request to Lionsgate’s Corporate Secretary.

Pursuant to its charter, the duties and responsibilities of the Audit & Risk Committee include, among other things, the following:

| • | overseeing the integrity of Lionsgate’s financial statements, accounting and financial reporting processes; |

| • | overseeing Lionsgate’s exposure to risk and compliance with legal and regulatory requirements; |

| • | overseeing the independent auditor’s qualifications and independence; |

| • | overseeing the performance of Lionsgate’s internal audit function and independent auditor; |

| • | overseeing the development, application and execution of all Lionsgate’s risk management and risk assessment policies and programs; |

| • | preparing the reports required by applicable SEC and Canadian securities commissions’ disclosure rules; and |

14

Table of Contents

| • | reviewing and providing oversight over Lionsgate’s information technology and cybersecurity risk, policies and procedures. |

The Board has determined that each member of the Audit & Risk Committee qualifies as an “independent” director under the New York Stock Exchange listing standards and the enhanced independence standards applicable to audit committee members pursuant to Rule 10A-3(b)(1) under the Exchange Act, and that each member of the Audit & Risk Committee is “independent” and “financially literate” as prescribed by Canadian securities laws, regulations, policies and instruments. Additionally, the Board has determined that Mr. Simmons is an “audit committee financial expert” under applicable SEC rules and has “accounting or related financial management expertise” under the New York Stock Exchange listing standards.

Compensation Committee

Messrs. Simm (Chair), Fries, Rachesky, Sloan and Ms. McCaw are the current members of the Compensation Committee.

The Compensation Committee is governed by a written charter adopted by the Board, which is available on Lionsgate’s website at http://investors.lionsgate.com/governance/governance-documents, or may be obtained in print, without charge, by any shareholder upon request to Lionsgate’s Corporate Secretary.

Pursuant to its charter, the duties and responsibilities of the Compensation Committee include, among other things, the following:

| • | reviewing, evaluating and making recommendations to the Board with respect to management’s proposals regarding Lionsgate’s overall compensation policies and practices and overseeing the development and implementation of such policies and practices; |

| • | evaluating the performance of and reviewing and approving the level of compensation for Lionsgate’s Chief Executive Officer and Vice Chair; |

| • | in consultation with Lionsgate’s Chief Executive Officer, considering and approving the selection, retention and remuneration arrangements for other executive officers and employees of Lionsgate with compensation arrangements that meet the requirements for Compensation Committee review, and establishing, reviewing and approving compensation plans in which such executive officers and employees are eligible to participate; |

| • | reviewing and recommending for adoption or amendment by the Board and, when required, Lionsgate’s shareholders, incentive compensation plans and equity compensation plans and administering such plans and approving award grants thereunder to eligible persons; and |

| • | reviewing and recommending to the Board compensation for the Board and committee members. |

The Compensation Committee is also authorized, after considering such independence factors as may be required by the New York Stock Exchange rules or applicable SEC rules, to retain independent compensation consultants and other outside experts or advisors as it believes to be necessary or appropriate to carry out its duties. See “— Compensation Discussion and Analysis of Lionsgate” for additional discussion of the Compensation Committee’s role and responsibilities, including a discussion on the role of Lionsgate’s compensation consultant in fiscal 2023.

Lionsgate’s executive officers, including the Named Executive Officers, do not have any role in determining the form or amount of compensation paid to the Named Executive Officers and Lionsgate’s other senior executive officers (other than Lionsgate’s Chief Executive Officer, who makes recommendations to the Compensation Committee with respect to compensation paid to the other Named Executive Officers (other than Lionsgate’s Vice Chair)). The Board has determined that each member of the Compensation Committee qualifies

15

Table of Contents

as an “independent” director under the New York Stock Exchange listing standards and the enhanced independence standards applicable to compensation committee members under the New York Stock Exchange listing standards. In making its independence determination for each member of the Compensation Committee, the Board considered whether the director has a relationship with Lionsgate that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member.

Nominating and Corporate Governance Committee

Mmes. Ostolaza (Chair), Clyburn and Fine are the current members of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee is governed by a written charter adopted by the Board which is available on Lionsgate’s website at http://investors.lionsgate.com/governance/governance-documents, or may be obtained in print, without charge, by any shareholder upon request to Lionsgate’s Corporate Secretary.

Pursuant to its charter, the duties and responsibilities of the Nominating and Corporate Governance Committee include, among other things, the following:

| • | identifying, evaluating and recommending individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| • | considering and recommending to the Board the director nominees for each annual meeting of shareholders, the Board committees and the Chairpersons thereof; |

| • | periodically reviewing Lionsgate’s activities and practices regarding corporate responsibility and environmental, social and related governance (“ESG”) matters that are significant to Lionsgate, oversee Lionsgate’s public reporting on these topics and receive updates from Lionsgate’s management committee responsible for significant ESG activities; |

| • | reviewing Lionsgate’s human capital management policies, programs and initiatives focused on Lionsgate’s culture, talent development, retention, and diversity and inclusion; |

| • | developing and recommending to the Board a set of corporate governance guidelines applicable to Lionsgate and assisting in the oversight of such guidelines; and |

| • | overseeing the evaluation of the Board and management. |

The Board has determined that each member of the Nominating and Corporate Governance Committee qualifies as an “independent” director under the New York Stock Exchange listing standards.

Strategic Advisory Committee

Messrs. Crawford (Co-Chair), Rachesky (Co-Chair), Fries, Simmons and Sloan are the current members of the Strategic Advisory Committee.

The Strategic Advisory Committee is responsible for reviewing Lionsgate’s strategic plan, meeting with management on a periodic basis to review operations against the plan, as well as overseeing preliminary negotiations regarding strategic transactions and, when applicable, acting as a pricing and approval committee on certain transactions.

Each member of the Strategic Advisory Committee qualifies as an “independent” director under the New York Stock Exchange listing standards.

16

Table of Contents

Shareholder Communications

The Board recognizes the importance of providing Lionsgate shareholders and interested parties with a means of direct communication with the members of the Board. Shareholders and interested parties who would like to communicate with the Chair of the Board or its non-employee directors may do so by writing to the Board or its non-employee directors, care of Lionsgate’s Corporate Secretary, at either of its principal executive offices. Additionally, shareholder recommendations for director nominees are welcome and should be sent to Lionsgate at 2700 Colorado Avenue, Santa Monica, California 90404, who will forward such recommendations to the Chair of the Nominating and Corporate Governance Committee. The full text of Lionsgate’s Policy on Shareholder Communications is available on Lionsgate’s website at http://investors.lionsgate.com/governance/governance-documents.

17

Table of Contents

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

This Compensation Discussion and provides a detailed description of our executive compensation philosophy and program, the compensation decisions made by Lionsgate and the matters considered in making such decisions, in each case in respect of fiscal 2023.

Named Executive Officers

This “Compensation Discussion and Analysis” is designed to provide shareholders with an understanding of Lionsgate’s historical executive compensation philosophy, objectives, and practices. In doing so, it describes the material elements of compensation at Lionsgate awarded to, earned by, or paid to the individuals who served as Lionsgate’s principal executive officer, Lionsgate’s principal financial officer, and Lionsgate’s three other most highly compensated executive officers for fiscal 2023 (the “Named Executive Officers”). The Named Executive Officers that served for fiscal 2023 are set forth below.

Named Executive | Officer Position | |

Jon Feltheimer | Chief Executive Officer | |

Michael Burns | Vice Chair | |

James W. Barge | Chief Financial Officer | |

Brian Goldsmith | Chief Operating Officer | |

Corii D. Berg* | Former Executive Vice President and General Counsel | |

Bruce Tobey** | Executive Vice President and General Counsel |

| * | Mr. Berg resigned as Lionsgate’s Executive Vice President and General Counsel effective December 20, 2022. |

| ** | Mr. Tobey was appointed as Lionsgate’s Executive Vice President and General Counsel effective March 27, 2023. |

Executive Summary

| WHO LIONSGATE IS | |||

Business Segments | ||||

Studio Business | Starz Business | |||

Motion Picture Television Production | Media Networks

| |||

• Diversified motion picture business with 10-12 wide theatrical releases and slate of 40-50 multiplatform and direct-to-streaming titles a year.

• Television business encompassing more than 100 shows spanning dozens of platforms from its scripted operations, 3 Arts Entertainment, Pilgrim Media Group and Debmar-Mercury. | • Leading global premium subscription platform with content strategy focused on two valuable and scalable core demographics.

• Majority of subscribers from streaming. | |||

18

Table of Contents

World Class Franchises and Series | ||||||||||||

| • 4 films • $3.0 billion+ global box office • The Ballad of Songbirds and Snakes (November 2023) |  | • 5 films • $3.4 billion+ global box office |  | • 4 films • Over $1 billion global box office • The Continental (September 2023) • Ballerina (June 2024) | |||||||

| • 7 seasons • 4 consecutive Best Drama Emmy’s (116 nominations) |  | • 7 seasons • 4 consecutive Best Drama Emmy’s (116 nominations) |  | • 3 spinoffs (Power Book II: Ghost, Power Book III: Raising Kanan, Power Book IV: Force) | |||||||

| • 3 films • $700 million box office • Expendables 4 (September 2023) |  | • $450 million box office • 14 nominations and 6 Oscar wins • Broadway musical in development |  | • 10 films • $1 billion+ global box office • Saw 10 (October 2023) | |||||||

| • 2 seasons (renewed for season 3) • Season 2: over • 10 million multi-platform views per episode. |  | • 2 seasons (renewed for season 3) • Neilsen’s top 10 of top 100 shows of 2022-2023 based on total viewers |  | • 8 seasons • 2 Emmy awards (14 nominations) • Reboot in development | |||||||

| • Best-selling library title • 35th anniversary in 2022 • Re-imagining in development for 2025 |  | • 2 films • $600 million+ global box office • Now You See Me 3 in development |  | • 7 films • $700 million box office • STARZ television series | |||||||

19

Table of Contents

| WHAT MANAGEMENT ACCOMPLISHED IN FISCAL 2023

| |||||||||

Over $1 Billion

John Wick films at global box office; John Wick: Chapter 4 over $425 million at global box office (franchise best) | $884 Million

Film and television library revenue for the trailing 12-months | 29.7 Million

STARZ global subscribers* (14% year-over-year growth)

* Including STARZPLAY Arabia, a non-consolidated equity method investee and excluding subscribers in exited territories

| ||||||||

$200 Million of 5.500% Senior Notes

Repurchased for $135.0 million; additional $85.0 million repurchased for $61.4 million in May 2023 | New Starz Bundling Agreements

With Amazon/MGM+ and AMC+ domestically, Hayu on Amazon in the U.K. and Disney+ in Latin America | Treasury Management

Undrawn revolving credit facility of $1.25 billion and $272 million in cash and cash equivalents at quarter ended March 31, 2023

| ||||||||

85% and 89% Q4 2023 Increase

Motion Picture segment revenue and segment profit, respectively, compared to prior year quarter |

1.3 Million and 700,000 Q4 2023 Increase

Total STARZ global over-the-top subscribers* (sequential quarter, excluding subscribers in exited territories) and domestic over-the top subscribers, respectively

* Including STARZPLAY Arabia, a non-consolidated equity method investee

|

$1.5 Billion

Studio backlog* at March 31, 2023 from Motion Picture and Television Production segments

* The backlog portion of remaining performance obligations (excluding deferred revenue) | ||||||||

20

Table of Contents

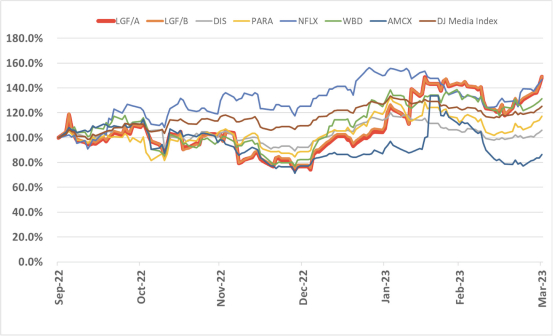

| STOCK PERFORMANCE RETURNS RELATIVE TO PEERS (SEPTEMBER 20, 2022* – MARCH 31, 2023) | |||||

| ||||||

* Reflects the restructuring of LIONSGATE+ by exiting seven international territories, commencing the three months ended September 30, 2022. | ||||||

| Goals of the Lionsgate Compensation Program | |

• Attract, motivate and retain top executive talent in an intensely competitive industry • Align executive pay with operating and financial performance • Align executive pay with execution of long-term performance • Align executive interests with those of shareholders • Incentivize shareholder value creation | ||

| Basic Lionsgate Compensation Program Principles | |

• Balance components of compensation • Be competitive within Lionsgate’s industry • Maintain appropriate level of “at-risk” compensation • Balance metric-driven and qualitative decision-making • Maintain “clawback” policy to recover unjustified payments • No tax gross-ups • No repricing or buyouts of stock options/SARs without shareholder approval • No single-trigger change-of-control provisions | ||

| How the Compensation Committee Works | |

• Maintain proactive, ongoing, and transparent dialogue with investors • Use multiple operational, financial, and intangible metrics • Review cost and dilutive impact of stock compensation • Use performance metrics for all employees, including Named Executive Officers • Use updated peer group and industry survey data for compensation context • Take counsel from Pay Governance, its independent outside consultant | ||

21

Table of Contents

| The Components of Executive Compensation

| |||||||

Item | Nature | Purpose | Basis | |||||

| Base Salary | Fixed; Short-term | Provide degree of financial stability; Retention | Competitive within peer and industry context | |||||

| Annual Incentive Bonus | At-risk; Short-term | Reward near-term performance; Promotion and contribution of business strategy; Ensure competitive compensation | Competitive within peer and industry context; Performance-based, with defined target opportunity | |||||

| Long-Term Incentive Awards | At-risk; Long-term | Retention; Reward long- term performance; Alignment with shareholder interests | Competitive within peer and industry context; Time and performance- based equity, vesting in tranches over multiple years | |||||

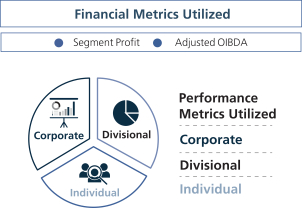

| Determination of Annual Bonus for Fiscal 2023 | |||||

| 1/3 Corporate Performance | |||||

Overall Lionsgate financial and operating performance – the Compensation Committee determined to award 96% for corporate performance. | ||||||

| 1/3 Divisional Performance | ||||||

Overall financial and operational performance of each operating division – the Compensation Committee determined to award 120%, 100% and 70% for Motion Picture, Television Production, and Media Networks segment performance, respectively. | ||||||

| 1/3 Individual Performance | ||||||

Individual achievements and contributions of each executive – individual performance percentages for fiscal 2023 noted below. | ||||||

For more information on the compensation of the Named Executive Officers, see the Summary Compensation Table below.

Shareholder Engagement

Lionsgate proactively engages with shareholders and other stakeholders throughout the year to discuss significant issues, including company performance and strategy, corporate governance, executive compensation, and environmental, social, and governance topics. Lionsgate takes feedback and insights from its engagement with shareholders and other stakeholders into consideration as it reviews and evolves its practices and disclosures, and further shares them with the Board, as appropriate.

In fiscal 2023, Lionsgate engaged with 30 of its top 50 shareholders and actively-managed institutional investors owning approximately 75% of existing common stock (not including shares held by officers and

22

Table of Contents

directors). Participating in this outreach were Messrs. Feltheimer, Burns, Barge, Goldsmith, Jeff Hirsch, the President and Chief Executive Officer of Starz, Lionsgate’s wholly-owned subsidiary, and other senior executives from all of Lionsgate’s businesses with support from Lionsgate’s Investor Relations Department.

Lionsgate presented at 9 major investor conferences, including: The Morgan Stanley 2023 Tech, Media, & Telecom Conference and The Bank of America 2022 Media, Communications and Entertainment Conference. Lionsgate also hosted media investor “bus tour” meetings through MoffettNathanson, Cowen, JP Morgan, Credit Suisse and Wells Fargo, that included interactions with over 50 analysts/investors in Lionsgate’s Santa Monica office, and held more than 100 virtual and in-person investor meetings, representing virtually all of Lionsgate’s analysts and top 25 shareholders.

At Lionsgate’s annual general and special meeting of shareholder held in September 2022, 96.3% of votes cast at that meeting voted in favor of Lionsgate’s executive compensation program (referred to as a “say-on-pay proposal”). Lionsgate believes the results of last year’s “say-on-pay” vote and input from its shareholder engagement affirmed its shareholders’ support of the Lionsgate compensation program. This informed Lionsgate’s decision to maintain a consistent overall approach in setting executive compensation for fiscal 2023.

Key Actions in Response to Shareholder Engagement

| • | No grants of special equity awards in fiscal 2023 outside of Lionsgate’s regular compensation program. |

| • | Annual equity awards to Named Executive Officers in fiscal 2023 (other than to Mr. Burns, who is not eligible for such awards) were granted at 85% of respective equity target amounts, as set forth in the applicable employment agreements, reflecting financial performance in fiscal 2022. |

| • | 50% of such awards consisted of performance-based restricted share units, vesting over three years only if the volume-weighted average of the closing price of Class B non-voting shares over a period of twenty consecutive trading days ending on or before such three-year period is equal to or greater than $14.61. |

| • | Continued to utilize Adjusted OIBDA and segment profit as the performance metrics to determine fiscal 2023 annual incentive bonuses (see “Compensation Components – Fiscal 2023 Company Financial Performance” below). |

| • | Based on analysis by Pay Governance, capped individual performance measure for annual incentive bonuses at 300%. |

| • | Continued disclosure with respect to environment, social and governance matters. |

Key Features of the Lionsgate Executive Compensation Program

The Compensation Committee believes that the Lionsgate executive compensation program aligns the interests of the Named Executive Officers with Lionsgate’s long-term strategic direction and the interests of Lionsgate’s shareholders. The Lionsgate program’s key features include:

| • | Competitive pay using updated peer group and industry survey data for compensation decisions. |

| • | Significant “at risk” pay: |

| • | Lionsgate provides annual incentive opportunities and other long-term equity awards, which constitute a significant portion of each executive’s total compensation opportunity. |

| • | The Compensation Committee retains discretion in assessing performance and awarding payouts under the annual incentive plan and performance-based equity awards. |

| • | Compensation is balanced – the compensation program provides a mix of fixed compensation and short-term and long-term variable compensation. |

| • | Limited benefits and perquisites are provided. |

23

Table of Contents

Lionsgate has entered into employment agreements with each of its Named Executive Officers and believes these agreements have helped create stability for the management team. These agreements have been structured to incorporate a number of features that Lionsgate believes represent best practices in executive compensation and are generally favored by shareholders. In particular, these agreements do not provide for any accelerated vesting of equity awards or other payments or benefits that are triggered solely by a change in control (i.e., there are no “single-trigger” benefits) or any rights for the executive to be grossed up for any taxes imposed on excess parachute payments in connection with a change in control. These agreements also do not include any right for the executive to voluntarily terminate employment in connection with a change in control and receive severance (other than certain “good reason” terminations that Lionsgate believes would constitute a constructive termination of the executive’s employment).

As noted below, equity award grants to Named Executive Officers at Lionsgate are generally determined in connection with a new or amended employment agreement with Lionsgate (which includes specifying grants to be made annually over its term). Lionsgate typically does not consider equity-based awards to its executive officers at any other time, but may pay annual bonuses in cash and/or equity awards, and retains discretion to grant equity awards to executives at other times as the Compensation Committee may determine appropriate.

Program Objectives

The goal of the Lionsgate executive compensation program is to facilitate the creation of long-term value for shareholders by attracting, motivating, and retaining qualified senior executive talent. To this end, the Compensation Committee has designed and administered the Lionsgate compensation program to reward executives for sustained financial and operating performance, to align their interests with those of shareholders, and to encourage them to remain with Lionsgate for long and productive careers. A significant portion of Lionsgate’s senior executives’ compensation is “at risk” in the form of annual and long-term incentive awards that are paid, if at all, based upon performance.

Compensation Practices

What Lionsgate Does | What Lionsgate Does Not Do | |

✓ Pay for Performance: A significant portion of Named Executive Officers compensation is “at risk” in the form of annual and long-term incentive awards that are tied to Lionsgate financial results or the performance of Lionsgate’s stock price, or both. | × No Excise Tax Gross-ups: Employment agreements and other compensation arrangements with the Named Executive Officers do not provide for any gross-up payments to cover excise taxes incurred by the executive. | |

✓ Use Multiple Performance Metrics: Lionsgate’s annual bonus and long-term incentive programs rely on diversified performance metrics, including individual and group contributions, and Lionsgate’s financial and operating performance. | × No Tax Gross-ups for Personal Benefits: No Named Executive Officer is entitled to receive gross-ups for taxes on personal benefits. | |

✓ Risk Mitigation: Lionsgate’s compensation program has provisions to mitigate undue risk, including caps on the maximum level of payouts, clawback provisions, multiple performance metrics, and board and management processes to identify risk. | × No Single-Trigger Change-in-Control Agreements: No employment agreements or arrangements for the Named Executive Officers provide benefits triggered solely by a change in control of Lionsgate. | |

24

Table of Contents

What Lionsgate Does | What Lionsgate Does Not Do | |

✓ Review of Share Utilization: The Compensation Committee evaluates share utilization levels by reviewing the cost and dilutive impact of stock compensation. | × No Hedging/Pledging: Lionsgate prohibits all directors and employees, including the Named Executive Officers, from collateral pledging and margin practices involving Lionsgate’s common shares. | |

✓ Competitive Peer Group: Lionsgate’s peer group generally consists of companies with which Lionsgate directly competes for executive talent and are generally similar to Lionsgate in terms of revenues, market-capitalization, and focus of its business. | × No Repricing of Stock Options or SARs: Repricing of stock options or SARs is not allowed without the approval of Lionsgate’s shareholders. | |

✓ Independent Compensation Consultant: The Compensation Committee retains Pay Governance, an independent compensation consultant, to provide advice on matters concerning executive and non-employee director pay. | × No Buyout of Underwater Stock Options or SARs: Lionsgate may not provide for cash buyouts of underwater option or SARs without shareholder approval. | |

Process for Determining Executive Compensation

Set forth below is a description of Lionsgate’s process for determining executive compensation in fiscal 2023.

Role of the Compensation Committee

Lionsgate’s executive compensation program is administered by the Compensation Committee, which operates pursuant to a written charter. The Compensation Committee, working with management, determines and implements Lionsgate’s executive compensation philosophy, structure, policies and programs, and administers Lionsgate’s compensation and benefit plans. The Compensation Committee is ultimately responsible for determining the compensation arrangements for Lionsgate’s executive officers and reports to the Board on all compensation matters regarding Lionsgate’s executives and other key salaried employees.

Role of Management

The Compensation Committee reviews information provided by management in order to help align the design and operation of the executive compensation program with Lionsgate’s business strategies and objectives. At various times during fiscal 2023, Lionsgate’s Chief Executive Officer and other executives attended relevant portions of Compensation Committee meetings in order to provide information and answer questions regarding Lionsgate’s strategic objectives and financial performance that may be relevant to the Compensation Committee’s decisions. Generally, Lionsgate’s Chief Executive Officer makes recommendations to the Compensation Committee with respect to terms of employment for other executive officers (other than himself and the vice chair), taking into account competitive market information, Lionsgate’s compensation strategy, his qualitative assessment of the particular executive’s individual performance, and the experience level of the particular executive. The Compensation Committee discusses these recommendations with Lionsgate’s Chief Executive Officer and either approves or modifies them in its discretion. The Compensation Committee is solely responsible for determining the compensation of Lionsgate’s chief Executive Officer and Lionsgate’s Vice Chair. None of the Named Executive Officers are members of the Compensation Committee or otherwise have any role in determining their own compensation.

25

Table of Contents

Role of Compensation Consultant

The Compensation Committee retains the services of an outside compensation consultant to assist in its review and determination of Lionsgate’s executive compensation program. For fiscal 2023, the Compensation Committee engaged Pay Governance as its independent compensation consultant. Pay Governance assists the committee in the development and evaluation of Lionsgate’s executive compensation program, policies, and practices, and its determination of executive compensation, and provides advice to the Compensation Committee, on other matters related to its responsibilities. Pay Governance reports directly to the Compensation Committee and the Compensation Committee has the sole authority to retain and terminate the consultant and to review and approve the consultant’s fees and other retention terms. In fiscal 2023, Lionsgate paid Pay Governance $196,148 for various engagement services for the Compensation Committee.

Consultant Independence

During fiscal 2023, Pay Governance did not perform work for Lionsgate other than pursuant to its engagement by the Compensation Committee. The Compensation Committee has assessed the independence of Pay Governance and concluded that its engagement of Pay Governance does not raise any conflict of interest with Lionsgate or any of its directors or executive officers.

Peer Group Analysis

The Compensation Committee utilizes a peer group to make comparisons of its executives’ compensation with that of similarly situated executives with other companies in order to help ensure that Lionsgate’s compensation packages are competitive with the broader market and aligned with shareholder interests. The peer group is generally comprised of companies focused on film production, television programming, digital content creation and live entertainment, which the Compensation Committee considers to be similar to Lionsgate in terms of revenue, market capitalization, and business focus.

In fiscal 2023, the Compensation Committee retained Pay Governance to update its peer group. Pay Governance noted that Lionsgate competes in a talent market where traditional scope markers such as revenue size and market capitalization are not as relevant as they might be in a typical industrial or general industry company. For instance, many traditional film and television production companies have gradually consolidated over the past decade into a small group of major diversified public entertainment companies, smaller independent studios are private or divisions of non-U.S. based companies, new streaming or digital competitors have experienced rapid growth or are also divisions of much larger public companies, and compensation data for executives running larger studios at competitors are typically not publicly disclosed. Accordingly, Pay Governance developed a broader universe of potential peers by reviewing companies within a specified range of Lionsgate’s revenue (e.g., $850 million to $13.5 billion, or approximately 0.25 to 4 times revenue at such time) and market capitalization (e.g., $700 million to $15 billion, or approximately 0.25 to 5 times market capitalization at such time), considering peers in adjacent or similar entertainment content creation/distribution industries, reviewing companies utilized by certain shareholder service firms in their reports on Lionsgate from the previous fiscal year, identifying “peer to peer” companies (i.e., those used by multiple Lionsgate peers but not currently used by Lionsgate), and noting “reverse peer” companies (i.e., those disclosing Lionsgate as a peer).

Based on its review, Pay Governance recommended, and the Compensation Committee selected, the following peer group for fiscal 2023:

General Peer Group | ||

AMC Networks Inc. | Madison Square Garden Entertainment Corp. | |

Electronic Arts Inc. | Nexstar Media Group, Inc. | |

Fox Corporation | Sirius XM Holdings Inc. | |

Hasbro, Inc. | Take-Two Interactive Software, Inc. | |

Live Nation Entertainment, Inc. | World Wrestling Entertainment, Inc. | |

26

Table of Contents

Pay Governance also recommended that Lionsgate continue to utilize industry survey data (such as the Willis Towers Watson Entertainment Industry Survey) to provide compensation data for entertainment-industry specific roles that may not be reflected within the peer group. The participants in this survey include the following:

Entertainment Industry Group | ||

ABC | Showtime | |

Amazon Studios | Sony Pictures Entertainment | |

AMC Networks | The CW | |

CBS | Viacom Media Networks | |

NBCUniversal | Walt Disney Studios | |

Netflix | Warner Bros. Discovery | |

Paramount | ||

The Compensation Committee determined that it would be appropriate to consider this survey data for executive positions, in addition to the peer group data, as companies in these surveys reflect critical competitors for talent. In using this survey data, the Compensation Committee does not focus on any particular companies in the survey (other than the peer companies listed above). In this Compensation Discussion and Analysis, the term “market” as used for comparison purposes generally refers to the peer companies and the survey data described above.

Use of Market Data

Utilizing this market data, the Compensation Committee evaluates the amount and proportions of base salary, annual incentive pay, and long-term compensation, as well as the target total direct compensation (defined as base salary, target annual bonus, and the grant date fair value of equity awards granted to the executive during the fiscal year) for a select number of Lionsgate’s executive officers, including each of the Named Executive Officers, relative to the compensation of similarly situated executives with these companies. In general, the Compensation Committee uses this data as background information for its compensation decisions and does not “benchmark” compensation at any particular level relative to the peer companies. Except as otherwise noted in this Compensation Discussion and Analysis, decisions by the Compensation Committee are qualitative and the result of the Compensation Committee’s business judgment, which is informed by the analysis of the members of the Compensation Committee as well as input from, and peer group and survey data provided by, Pay Governance. The Compensation Committee believes that the compensation opportunities provided to the Named Executive Officers are appropriate in light of competitive considerations. The Compensation Committee continues to monitor current trends and issues in Lionsgate’s competitive landscape and will modify its programs as it determines appropriate.

Employment Agreements