Table of Contents

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule14a-12 |

| ☑ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

Table of Contents

LIONS GATE ENTERTAINMENT CORP.

2023

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Table of Contents

LIONS GATE ENTERTAINMENT CORP.

250 Howe Street, 20th Floor

Vancouver, British Columbia V6C 3R8

2700 Colorado Avenue

Santa Monica, California 90404

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

To Be Held November 28, 2023

To Our Shareholders:

You are invited to attend the annual general and special meeting of shareholders (the “Annual Meeting”) of Lions Gate Entertainment Corp. (“Lionsgate” or the “Company”), which will be held on November 28, 2023, beginning at 1:00 p.m., Pacific Time, at Lionsgate’s head office in Canada at Dentons Canada LLP, 250 Howe Street, 20th Floor, Vancouver, British Columbia, V6C 3R8. At the Annual Meeting, shareholders will act on the following matters:

1. | Elect 13 directors, each for a term of one year or until their respective successors are duly elected and qualified; |

2. | Re-appoint Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2024 and authorize the Audit & Risk Committee of the Board of Directors (the “Board”) of the Company to fix their remuneration; |

3. | Conduct an advisory vote to approve executive compensation; |

4. | Conduct an advisory vote on the frequency of future advisory votes on executive compensation; |

5. | Approve the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan; |

| 6. | Conduct a vote on a shareholder proposal; and |

7. | Transact such further and other business as may properly come before the meeting and any continuations, adjournments or postponements thereof. |

We are using the Securities and Exchange Commission rule that allows companies to furnish their proxy materials over the Internet. As a result, we are mailing our shareholders a “Notice of Internet Availability of Proxy Materials” (the “Notice”) instead of a printed copy of the notice of the Annual Meeting, proxy statement, and proxy card or voting instruction form and our Annual Report for the fiscal year ended March 31, 2023, as amended (including the audited consolidated financial statements of the Company as of and for the fiscal year ended March 31, 2023, together with the auditor’s report therein) (the “Meeting Materials”). Each shareholder (other than those who previously requested electronic delivery of all materials or previously elected to receive delivery of a paper copy of the Meeting Materials) will receive a Notice. The Notice contains instructions on how shareholders can access the Meeting Materials over the Internet and vote their Company Class A voting shares, without par value (the “Class A voting shares”). The Notice also contains instructions on how shareholders can receive a printed copy of the Meeting Materials. We believe this process will expedite shareholders’ receipt of the Meeting Materials, lower the costs of the Annual Meeting and conserve natural resources. The Meeting Materials are also available at www.proxyvote.com.

We are also utilizing the “Notice and Access” rules adopted by the Canadian Securities Administrators pursuant to which the Company will post electronic copies of the Meeting Materials on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.com and also on our website at https://investors.lionsgate.com/financial-reports/annual-reports-and-proxy-statements/proxy-statements rather than mailing paper copies to all registered and Non-Registered Shareholders (as defined in this proxy statement).

Shareholders of record of Class A voting shares at 5:00 p.m. (Eastern Time) on October 9, 2023 are entitled to notice of, and to vote on all the proposals at, the Annual Meeting or any continuations, adjournments or postponements thereof. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions as promptly as possible by Internet, telephone or mail to ensure your representation and the presence of a quorum at the Annual Meeting. If you attend the Annual Meeting and wish to vote in person, you may withdraw your proxy or voting instructions and vote your shares personally.

Your proxy is revocable in accordance with the procedures set forth in the proxy statement accompanying this notice.

By Order of the Board of Directors,

Jon Feltheimer

Chief Executive Officer

Santa Monica, California

Vancouver, British Columbia

October 13, 2023

In accordance with our security procedures, all persons attending the Annual Meeting will be required to present picture identification.

Table of Contents

TABLE OF CONTENTS

ESG HIGHLIGHTS

| ||||||

| ENVIRONMENTAL, SOCIAL RESPONSIBILITY AND HUMAN CAPITAL MATTERS | 33 | |||||

| CORPORATE GOVERNANCE | 36 | |||||

| SHAREHOLDER ENGAGEMENT | 54 | |||||

Table of Contents

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information you should consider in making a voting decision. You should read the entire proxy statement carefully before voting. For information on the voting process and how to attend the Annual Meeting, please see About the Annual Meeting on page 1.

Fiscal 2023 Performance Highlights

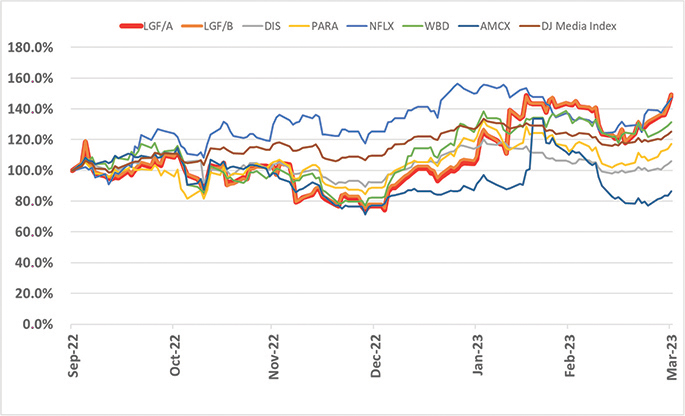

Stock Performance Returns Relative to Peers

* Reflects the restructuring of LIONSGATE+ by exiting seven international territories, commencing the three months |

Over $1 Billion

John Wick films at global box office; John Wick: Chapter 4 over $425 million at global box office (franchise best) |

$884 Million

Film and television library revenue for the trailing 12-months |

29.7 Million

STARZ global subscribers* (14% year-over-year growth)

* Including STARZPLAY Arabia, a non

| ||||||

$200 Million of

Repurchased for $135.0 million; |

New Starz Bundling

With Amazon/MGM+ and AMC+ |

Treasury

Undrawn revolving credit facility of

|

Lions Gate 2023 Proxy Statement i

Table of Contents

85% and 89%

Motion Picture segment revenue and |

1.3 Million and

Total STARZ global over-the-top

* Including STARZPLAY Arabia, a non-consolidated equity method investee

|

$1.5 Billion

Studio backlog* at March 31, 2023

* The backlog portion of remaining |

Meeting Information and Voting*

| Date November 28, 2023 |  | Time 1:00 p.m. Pacific Time |  | Place Dentons Canada LLP 250 Howe Street Vancouver, British Columbia V6C 3R8 |

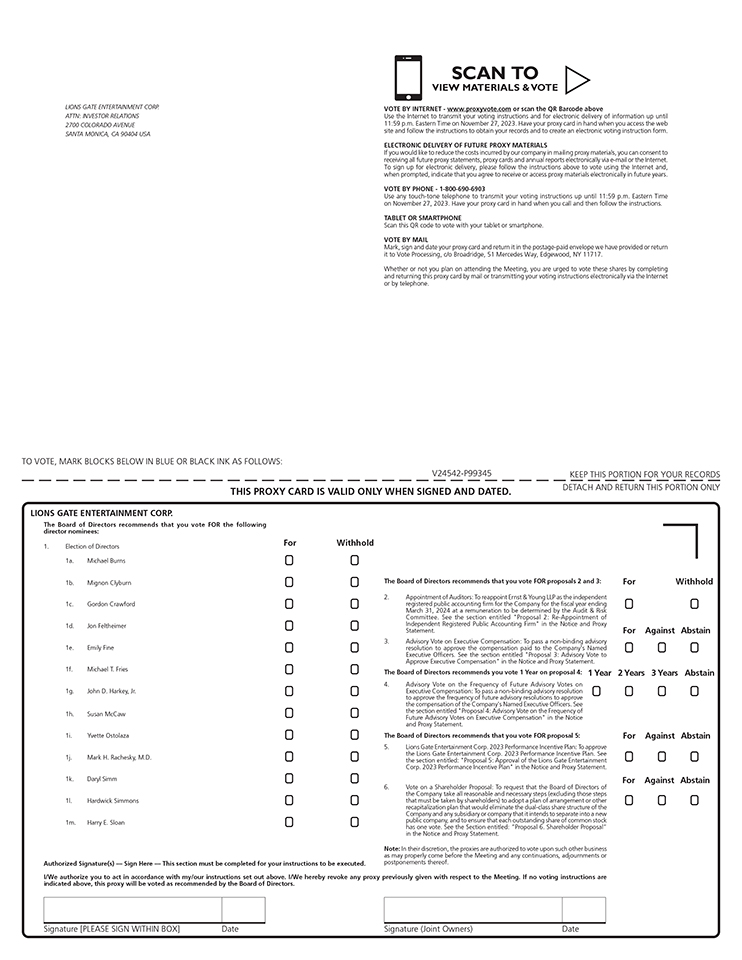

| Telephone 1 (800) 690-6903 |  | Tablet/Smartphone Scan this QR code |  | Internet www.proxyvote.com |  | Mark, sign and date the proxy card or voting instruction form |

* You may also vote personally or by proxy by attending the Annual Meeting. If you hold shares through a bank, broker, trustee or other nominee who holds your shares, you cannot vote your shares at the Annual Meeting unless you have obtained a legal proxy from your bank, broker, trustee or other nominee who holds your shares.

Annual Meeting Proposals

Matters to Be Voted On

| Elect 13 directors, each for a term of one year or until their respective successors are duly elected and qualified. |  |

| Re-appoint Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2024 and authorize the Audit & Risk Committee of the Board to fix its remuneration.

|  |

| Conduct an advisory vote to approve executive compensation. | |||||||||||||||||||||||

| FOR EACH NOMINEE | Page 8 |

|

FOR |

Page 19 |

|

FOR |

Page 20 | ||||||||||||||||||||||

| Conduct an advisory vote on the frequency of future advisory votes on executive compensation.

|

|

| Approve the Lionsgate Gate Entertainment Corp. 2023 Performance Incentive Plan.

|  |

| Conduct a vote on a shareholder | |||||||||||||||||||||||

| EVERY ONE YEAR | Page 21 |

|

FOR |

Page 22 |

NO RECOMMENDATION |

Page 31 | |||||||||||||||||||||||

ii Lions Gate 2023 Proxy Statement

Table of Contents

At the Annual Meeting, the Company’s shareholders will also consider any other business that may properly come before the Annual Meeting and any continuations, adjournments or postponements thereof regardless of whether you attend the meeting. Should any other business come before the Annual Meeting, the persons named on the enclosed proxy will, as stated therein, have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 28, 2023

This proxy statement is available at www.proxyvote.com and on our website at http://investors.lionsgate.com/financialreports/annual-reports-and-proxy-statements/proxy-statements. The other information on our corporate website does not constitute part of this proxy statement.

Lions Gate 2023 Proxy Statement iii

Table of Contents

2023 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

OF LIONS GATE ENTERTAINMENT CORP.

PROXY STATEMENT

This proxy statement is part of a solicitation of proxies by the Board of Directors (the “Board”) of Lions Gate Entertainment Corp. (“Lionsgate,” the “Company,” “we,” “us” or “our”) and contains information relating to our annual general and special meeting of shareholders (the “Annual Meeting”) to be held on Tuesday, November 28, 2023, beginning at 1:00 p.m., Pacific Time, at the Company’s head office in Canada at Dentons Canada LLP, 250 Howe Street, Vancouver, British Columbia, V6C 3R8, and to any continuations, adjournments or postponements thereof. All dollar figures contained in this proxy statement are in U.S. dollars, unless otherwise indicated. We are first mailing the Notice, and the Meeting Materials were first made available, to our shareholders on or about October 13, 2023.

ABOUT THE ANNUAL MEETING

Why did I receive a “Notice of Internet Availability of Proxy Materials” in the mail instead of a full set of proxy materials?

We are using the Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish their proxy materials over the Internet. As a result, we are mailing to our shareholders a “Notice of Internet Availability of Proxy Materials” (the “Notice”) instead of a printed copy of the notice of the Annual Meeting, proxy statement, proxy card or voting instruction form, and our Annual Report for the fiscal year ended March 31, 2023, as amended (including the audited consolidated financial statements of the Company as of and for the fiscal year ended March 31, 2023, together with the auditor’s report therein) (collectively, the “Meeting Materials”). Each shareholder (other than those who previously requested electronic delivery of all materials or previously elected to receive delivery of a paper copy of the Meeting Materials) will receive a Notice. The Notice contains instructions on how shareholders can access the Meeting Materials over the Internet and vote their Company Class A voting shares, without par value (the “Class A voting shares”). The Notice also contains instructions on how shareholders can receive a printed copy of the Meeting Materials. We believe this process will expedite shareholders’ receipt of the Meeting Materials, lower the costs of the Annual Meeting and conserve natural resources.

In addition, the Company will utilize the “Notice and Access” rules adopted by the Canadian Securities Administrators pursuant to which the Company will post electronic copies of the Meeting Materials on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.com and also at http://investors.lionsgate.com/financial-reports/annual-reports-and-proxy-statements, rather than mailing paper copies to all registered and Non-Registered Shareholders (as defined below). Notwithstanding the foregoing, paper copies of the Meeting Materials are available but will only be mailed to those registered and Non-Registered Shareholders who request paper copies. All other shareholders will receive the Notice which will contain information on how to obtain either electronic or paper copies of the Meeting Materials in advance of the Annual Meeting. Registered shareholders and Non-Registered Shareholders may request free paper copies of the Meeting Materials in advance of the Annual Meeting by contacting Broadridge Financial Solutions, Inc. toll- free at (800) 579-1639 or by email at sendmaterial@proxyvote.com.

The Company has elected not to use the procedure known as “stratification” in relation to its use of the “Notice and Access” rules. Stratification occurs when a reporting issuer using the “Notice and Access” rules provides a paper copy of proxy-related materials to some, but not all, of its shareholders.

What is the purpose of the Annual Meeting? | At the Annual Meeting, shareholders will be asked to vote upon the following matters outlined in the notice of the Annual Meeting:

• the election of directors;

• re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2024 and authorization of the Audit & Risk Committee to fix their remuneration;

• an advisory vote on executive compensation;

• an advisory vote on the frequency of future advisory votes on executive compensation;

• approving the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan;

• A vote on a shareholder proposal; and

• any other matters as may properly come before the annual general and special meeting and any continuations, adjournments or postponements thereof. | |

Lions Gate 2023 Proxy Statement 1

Table of Contents

About the Annual Meeting

|

Who is entitled to vote at the Annual Meeting? | Only shareholders of record of Class A voting shares at 5:00 p.m. (Eastern Time) on October 9, 2023 (the “Record Date”) are entitled to receive notice of the Annual Meeting and to vote the Class A voting shares that they held on the Record Date at the Annual Meeting, or any continuations, adjournments or postponements of the Annual Meeting. Each outstanding Class A voting share entitles its holder to cast one vote on each matter to be voted upon. As of the Record Date, 83,530,119 Class A voting shares were outstanding and entitled to vote and held by approximately 580 shareholders of record.

Holders of the Company’s Class B non-voting shares, without par value (the “Class B non-voting shares”) are entitled to receive notice of and to attend the Annual Meeting but are not entitled to vote on the matters to be presented at the Annual Meeting. As of the Record Date, there were 151,413,937 Class B non-voting shares outstanding. Unless the context dictates otherwise, all references to “you,” “your,” “yours” or other words of similar import in this proxy statement refer to holders of Class A voting shares.

Each shareholder of record of the Class A voting shares has the right to appoint a person or company to represent the shareholder to vote in person at the Annual Meeting other than the persons designated in the form of proxy. See “How do I vote at the Annual Meeting?” below. | |

Who can attend and vote at the Annual Meeting? | Only registered shareholders of Class A voting shares or the persons they appoint as their proxies are permitted to attend and vote at the Annual Meeting. Holders of Class B non-voting shares are entitled to notice of and to attend the Annual Meeting but are not entitled to vote at the Annual Meeting. Most shareholders of Class A voting shares of the Company are “non-registered” shareholders (“Non-Registered Shareholders”) because the Class A voting shares they own are not registered in their names but are, instead, registered in the name of the brokerage firm, bank or trust company through which they hold the Class A voting shares. Class A voting shares beneficially owned by a Non-Registered Shareholder are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the Class A voting shares (which may be, among others, a bank, trust company, securities dealer or broker and trustees or administrator of self-administered Registered Retirement Savings Plans, Registered Retirement Income Funds, Registered Education Savings Plans and similar plans); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited or The Depository Trust & Clearing Corporation) of which the Intermediary is a participant. In accordance with applicable securities law requirements, the Company will have distributed copies of the Notice to such clearing agencies and Intermediaries for distribution to Non-Registered Shareholders.

Such Non-registered Shareholders are able to access the Notice and vote their shares following the instructions provided by their Intermediaries. If shareholders have requested printed copies, Intermediaries are required to forward the Meeting Materials to such Non-Registered Shareholders, unless such Non-Registered Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the Notice to Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive the Notice and who have requested a printed copy of the Meeting Materials will either:

(i) be given a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow. Typically, the voting instruction form will consist of a one-page printed form. Sometimes, instead of the one-page pre-printed form, the voting instruction form will consist of a regular printed form accompanied by a page of instructions which contains a removable label with a bar code and other information. In order for the form of proxy to validly constitute a voting instruction form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company; or

(ii) be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile or stamped signature), which is restricted to the number of Class A voting shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed | |

2 Lions Gate 2023 Proxy Statement

Table of Contents

About the Annual Meeting

|

by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with the Company, c/o MacKenzie Partners, Inc. Attention Lionsgate Tabulation, 105 Madison Avenue, New York, NY 10016.

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to directly vote the Class A voting shares they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Annual Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should request a legal proxy from their Intermediary. Instructions for obtaining legal proxies may be found on the voting instruction form. If you have any questions about voting your shares, please call MacKenzie Partners, Inc. at (800) 322-2885 or (212) 929-5500 or e-mail lionsgate@mackenziepartners.com.

A Non-Registered Shareholder may revoke a voting instruction form or request to receive the Meeting Materials and to vote, which has been given to an Intermediary, at any time by written notice to the Intermediary, provided that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive the Meeting Materials and to vote, which is not received by the Intermediary in a timely manner in advance of the Annual Meeting. | ||

What constitutes a quorum? | A quorum is necessary to hold a valid meeting of shareholders. The quorum for the Annual Meeting is two (2) persons who are, or who represent by proxy, registered shareholders of the Class A voting shares who, in the aggregate, hold at least 10% of the issued Class A voting shares entitled to be voted at the Annual Meeting.

Broker non-votes (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for purposes of determining the presence of a quorum at the Annual Meeting. | |

How do I vote at the Annual Meeting? | If you are a shareholder of record of Class A voting shares, you have the right to vote in person at the Annual Meeting. If you choose to do so, you can vote using the ballot that will be provided at the Annual Meeting, or, if you requested and received printed copies of the Meeting Materials by mail, you can complete, sign and date the proxy card enclosed with the Meeting Materials you received and submit it at the Annual Meeting. If you are a Non-Registered Shareholder, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker, trustee or other nominee that holds your shares, giving you the right to vote the Class A voting shares at the Annual Meeting.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the Annual Meeting as described herein, so that your vote will be counted if you later decide not to attend the Annual Meeting.

At the Annual Meeting, a representative from Broadridge Financial Solutions, Inc. shall be appointed to act as scrutineer. The scrutineer will determine the number of Class A voting shares represented at the Annual Meeting, the existence of a quorum and the validity of proxies, will count the votes and ballots, if required, and will determine and report the results to the Company. | |

How can I vote my Class A voting shares without attending the Annual Meeting? | Whether you are a shareholder of record or a Non-Registered Shareholder, you may direct how your Class A voting shares are voted without attending the Annual Meeting.

If you are a shareholder of record, you may submit a proxy to authorize how your Class A voting shares are to be voted at the Annual Meeting. You can submit a proxy over the Internet, by mail or by telephone pursuant to the instructions provided in the Notice. If you are a Non-Registered Shareholder, you may also submit your voting instructions over the Internet, telephone, tablet or smartphone by following the instructions provided in the Notice, or, if you requested and received printed copies of the Meeting Materials, you can also submit voting instructions by Internet, telephone, tablet or smartphone, or mail by following the instructions provided in the voting instruction form sent by your Intermediary. If you do not fill a name in the blank space in the form of proxy, the persons named in the form of proxy are appointed to act as your proxy holder. Those persons are directors and/or officers of the Company. If you are a | |

Lions Gate 2023 Proxy Statement 3

Table of Contents

About the Annual Meeting

|

shareholder of record, your proxy must be received by telephone or the Internet by 11:59 p.m. (Eastern Time) on November 27, 2023 in order for your shares to be voted at the Annual Meeting. If you are a Non-Registered Shareholder, please comply with the deadlines included in the voting instructions provided by the Intermediary that holds your shares.

Submitting your proxy or voting instructions over the Internet, by telephone, tablet or smartphone or by mail will not affect your right to vote in person should you decide to attend the Annual Meeting, although Non-Registered Shareholders must obtain a “legal proxy” from the Intermediary that holds their shares giving them the right to vote the shares in person at the Annual Meeting. | ||

Can I change or revoke my vote after I return my proxy card? | Yes. If you are a shareholder of record, even after you have submitted your proxy, you may change your vote by submitting a duly executed proxy bearing a later date in the manner and within the time described above under “How can I vote my Class A voting shares without attending the Annual Meeting?” (your latest voting instructions will be followed). If you are a Non-Registered Shareholder, you should contact your Intermediary to find out how to change or revoke your voting instructions within the time described above under “How can I vote my Class A voting shares without attending the Annual Meeting?” If you are a shareholder of record, you may also revoke a previously deposited proxy (i) by an instrument in writing that is received by or at the Annual Meeting prior to the closing of the polls, (ii) by an instrument in writing provided to the Chair of the Annual Meeting at the Annual Meeting or any continuation, postponement or adjournment thereof, or (iii) in any other manner permitted by law. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy. | |

Is my vote confidential? | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

• As necessary to meet applicable legal requirements;

• To allow for the tabulation and certification of votes; and

• To facilitate a successful proxy solicitation.

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board. | |

What are the Board’s recommendations? | The enclosed proxy is solicited on behalf of the Board. Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board set forth with the description of each item in this proxy statement.

The Board recommends a vote:

• “FOR” the election of each of the nominated directors (see page 8);

• “FOR” the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and authorization of the Audit & Risk Committee to fix their remuneration (see page 19);

• “FOR” the proposal regarding an advisory vote to approve executive compensation (see page 20);

• “EVERY ONE YEAR” for the frequency for future advisory votes on executive compensation (see page 21);

• “FOR” the approval of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan (see page 22). and

• The Board is not making a recommendation on the shareholder proposal (see page 31).

Other than the proposals described in this document, the Board does not know of any other matters that may be brought before the Annual Meeting. If any other matter should properly come before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in accordance with their best judgment. | |

4 Lions Gate 2023 Proxy Statement

Table of Contents

About the Annual Meeting

|

What vote is required to approve the election of each of the nominated directors? | A plurality of the Class A voting shares voting in person or by proxy is required to elect each of the 13 nominees for director (“Proposal No. 1”). A plurality means that the 13 nominees receiving the largest number of votes cast (votes “FOR”) will be elected. Shareholders are not permitted to cumulate their Class A voting shares for purposes of electing directors.

Note that if your Class A voting shares are held by a broker or nominee, such broker or nominee will not have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 1 unless you provide instructions to him or her regarding how you would like your Class A voting shares to be voted. If such broker or nominee does not receive such instructions, and as a result, is unable to vote your Class A voting shares on Proposal No. 1, this will result in a broker non-vote.

For purposes of determining the number of votes cast, only the Class A voting shares voting “FOR” or “WITHHOLD” are counted. As such, broker non-votes are not treated as votes cast and are not counted in the determination of the outcome of Proposal No. 1. | |

What vote is required to approve the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and authorize the Audit & Risk Committee of to fix their remuneration? | The affirmative vote of at least a majority of the votes cast by holders of the Class A voting shares present or represented by proxy at the Annual Meeting is required for the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and authorization of the Audit & Risk Committee to fix their remuneration (“Proposal No. 2”).

Note that because this proposal is considered a routine matter, if your Class A voting shares are held by a broker or nominee, such broker or nominee will have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 2 if you do not provide instructions regarding how you would like your Class A voting shares to be voted.

For purposes of determining the number of votes cast, only the Class A voting shares voting “FOR” or “WITHHOLD” are counted. As such, abstentions are not treated as votes cast and are not counted in the determination of the outcome of Proposal No. 2. There are no broker non-votes for Proposal No. 2. | |

What vote is required to approve the proposal regarding an advisory vote to approve executive compensation? | The affirmative vote of at least a majority of the votes cast by holders of the Class A voting shares present or represented by proxy at the Annual Meeting is required for the advisory vote to approve executive compensation (“Proposal No. 3”). Notwithstanding the vote required, please be advised that Proposal No. 3 is advisory only and is not binding on the Company. The Board will consider the outcome of the vote on this proposal in considering what action, if any, should be taken in response to the advisory vote by shareholders.

Note that if your Class A voting shares are held by a broker or nominee, such broker or nominee will not have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 3 unless you provide instructions regarding how you would like your Class A voting shares to be voted. If such broker or nominee does not receive your instructions, and as a result is unable to vote your Class A voting shares on Proposal No. 3, this will result in a broker non-vote.

For purposes of determining the number of votes cast, only Class A voting shares voting “FOR” or “AGAINST” are counted. As such, abstentions and broker-non votes are not treated as votes cast and are not counted in the determination of the outcome of Proposal No. 3. | |

What vote is required to approve the proposal regarding the frequency of future advisory votes on executive compensation? | Shareholders’ choices for the frequency of advisory vote on executive compensation are limited to “EVERY ONE YEAR,” “EVERY TWO YEARS,” “EVERY THREE YEARS,” and “ABSTAIN” (“Proposal No. 4”). If no option receives the affirmative vote of at least a majority of the votes cast by Class A voting shares present in person or represented by proxy at the Annual Meeting, then the Board will consider the option receiving the highest number of votes as the preferred option of the shareholders. Notwithstanding the vote required, please be advised that Proposal No. 4 is advisory only and is not binding on the Company. The Board will consider the outcome of the vote on this proposal in considering what action, if any, should be taken in response to the advisory vote by shareholders. | |

Lions Gate 2023 Proxy Statement 5

Table of Contents

About the Annual Meeting

|

Note that if your Class A voting shares are held by a broker or nominee, such broker or nominee will not have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 4 unless you provide instructions regarding how you would like your Class A voting shares to be voted. If such broker or nominee does not receive your instructions, and as a result is unable to vote your Class A voting shares on Proposal No. 4, this will result in a broker non-vote.

For purposes of determining the number of votes cast, only shares of your Class A voting shares voting “EVERY ONE YEAR,” “EVERY TWO YEARS,” or “EVERY THREE YEARS” are counted. As such, abstentions and broker non-votes are not treated as votes cast and are not counted in the determination of the frequency option receiving the highest number of votes. | ||

What vote is required to approve the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan? | The affirmative vote of at least a majority of the votes cast by holders of Class A voting shares present or represented by proxy at the Annual Meeting is required for approval of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan (“Proposal No. 5”).

Note that if your Class A voting shares are held by a broker or nominee, such broker or nominee will not have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 5 unless you provide instructions regarding how you would like your Class A voting shares to be voted. If such broker or nominee does not receive your instructions, and as a result is unable to vote your Class A voting shares on Proposal No. 5, this will result in a broker non- vote.

For purposes of determining the number of votes cast, only shares of Class A voting shares voting “FOR” or “AGAINST” are counted. As such, abstentions and broker non-votes are not treated as votes cast and are not counted in the determination of the outcome of Proposal No. 5. | |

What vote is required to approve the shareholder proposal? | The affirmative vote of at least a majority of the votes cast by holders of the Class A voting shares present or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve the shareholder proposal (“Proposal No. 6”). Notwithstanding the vote required, please be advised that Proposal No. 6, if approved, constitutes a request to the Board and is not binding on the Company. The Board will consider the outcome of the vote on this proposal in considering what action, if any, should be taken in response to the vote by shareholders.

Note that if your Class A voting shares are held by a broker or nominee, such broker or nominee will not have authority to exercise his or her discretion to vote your Class A voting shares on Proposal No. 6 unless you provide instructions regarding how you would like your Class A voting shares to be voted. If such broker or nominee does not receive your instructions, and as a result is unable to vote your Class A voting shares on Proposal No. 6, this will result in a broker non-vote.

For purposes of determining the number of votes cast, only Class A voting shares voting “FOR” or “AGAINST” are counted. As such, abstentions and broker-non votes are not treated as votes cast and are not counted in the determination of the outcome of Proposal No. 6. | |

Who pays for the preparation of this proxy statement? | The Company will pay the cost of proxy solicitation, including the cost of preparing, assembling and mailing the Notice and, as applicable, the Meeting Materials. In addition to the use of mail, the Company’s employees and advisors may solicit proxies personally and by telephone, facsimile, courier service, telegraph, the Internet, e-mail, newspapers and other publications of general distribution. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the Meeting Materials to their principals and to request authority for the execution of proxies, and the Company will reimburse those persons for their reasonable out-of-pocket expenses incurred in connection with these activities. The Company will compensate only independent third-party agents that are not affiliated with the Company but who solicit proxies. We have retained MacKenzie Partners, Inc., a third- party solicitation firm, to assist in the distribution of the Meeting Materials and solicitation of proxies on our behalf for an estimated fee of $20,000 plus reimbursement of certain out-of-pocket expenses. | |

6 Lions Gate 2023 Proxy Statement

Table of Contents

About the Annual Meeting

|

May I propose actions or recommend director nominees for consideration at next year’s annual general meeting of shareholders? | Yes. Under U.S. laws, for your proposal or recommendation for director nominees to be considered for inclusion in the proxy statement for next year’s annual general and special meeting, we must receive your written proposal no later than June 15, 2024. You should also be aware that your proposal must comply with Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) regarding inclusion of shareholder proposals in company-sponsored Meeting Materials.

Shareholder proposals submitted in accordance with the Business Corporations Act (British Columbia) (the “BC Act”) to be presented at the next annual general meeting of shareholders must be received by our Corporate Secretary at our registered office at least three months before the annual reference date of the Company which, if the meeting is held on November 28, 2023, will be November 28 for the 2024 year, and must otherwise comply with the requirements of the BC Act.

If you wish to recommend a director nominee, you should also provide the information set forth under Information Regarding the Board of Directors and Committees of the Board of Directors — Shareholder Communications.

If the date of the 2024 annual general and special meeting is advanced or delayed by more than 30 days from the date of the 2023 annual general and special meeting under U.S. laws, shareholder proposals intended to be included in the proxy statement for the 2024 annual general and special meeting must be received by us within a reasonable time before we begin to print and mail the proxy statement for the 2024 annual general and special meeting.

SEC rules also govern a company’s ability to use discretionary proxy authority with respect to shareholder proposals that were not submitted by the shareholders in time to be included in the proxy statement. In the event a shareholder proposal is not submitted to us prior to August 29, 2024, the proxies solicited by the Board for the 2024 annual general and special meeting of shareholders will confer authority on the proxy holders to vote the shares in accordance with the recommendations of the Board if the proposal is presented at the 2024 annual general and special meeting of shareholders without any discussion of the proposal in the proxy statement for such meeting. If the date of the 2024 annual general and special meeting is advanced or delayed more than 30 days from the date of the 2023 annual general and special meeting, then the shareholder proposal must have been submitted to us within a reasonable time before we mail the proxy statement for the 2024 annual general and special meeting.

To comply with the SEC universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than our Board’s nominees must provide notice that sets forth any additional information required by Rule 14a-19 under the Exchange Act no later than September 30, 2024. | |

What does it mean if I receive more than one Notice? | If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on your proxy card or voting instruction form, as applicable, to ensure that all of your shares are voted. | |

Who can I contact if I have questions? | Shareholders who have questions about deciding how to vote should contact their financial, legal or professional advisors. For any queries referencing information in this proxy statement or in respect of voting your Class A voting shares, please call MacKenzie Partners, Inc. at (800) 322-2885 or (212) 929-5500 or email lionsgate@mackenziepartners.com. | |

Where can I find the voting results of the Annual Meeting? | We intend to announce preliminary voting results at the Annual Meeting and disclose final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting. | |

The date of this proxy statement is October 13, 2023

Lions Gate 2023 Proxy Statement 7

Table of Contents

PROPOSAL 1 ELECTION OF DIRECTORS

NOMINEES FOR DIRECTORS

Our Board currently consists of 13 directors. Upon the recommendation of the Nominating and Corporate Governance Committee of the Board, our Board nominated the 13 persons named below for election as a director. Each of the nominees listed below is currently a director of the Company, and except for John D. Harkey, Jr., was previously elected by shareholders.

Each nominee, if elected at the Annual Meeting, will serve until our 2024 annual general meeting, or until his or her successor is duly elected or appointed, unless his or her office is earlier vacated in accordance with our Articles or applicable law.

Other than as discussed herein, there are no arrangements or understandings between any nominee and any other person for selection as a nominee. Pursuant to the Investor Rights Agreement discussed below, Michael T. Fries currently serves as the designee of Liberty Global Incorporated Limited (“Liberty”), Harry E. Sloan currently serves as the designee of Discovery Lighting Investments Ltd. (“Discovery Lightning”) and Mark H. Rachesky, M.D., Emily Fine and Mr. Harkey currently serve as designees of MHR Fund Management, LLC (“MHR Fund Management”).

The nominees have consented to serve on the Board if elected and the Board has no reason to believe that they will not serve if elected. If any of the nominees should become unable or unwilling for good cause to serve as a director if elected, the persons the Board has designated as proxies may vote for a substitute nominee if the Board has designated a substitute nominee or for the balance of the nominees.

There are no family relationships among the nominees for directors, current directors or executive officers of the Company, except as noted below. Ages are as of October 9, 2023. Their skills and experience as reflected in the Board Profile section below are noted for each of the directors.

| Committee Membership | ||||||||||||||||

Name | Age | Independent | Director Since | Audit & Risk Committee | Compensation Committee | Nominating and Governance Committee | Strategic Advisory Committee | |||||||||

Michael Burns | 65 | No | 08/1999 |

|

|

|

| |||||||||

Mignon Clyburn | 61 | Yes | 09/2020 |

|

| ✓ |

| |||||||||

Gordon Crawford | 76 | Yes | 02/2013 |

|

|

|  | |||||||||

Jon Feltheimer | 72 | No | 01/2000 |

|

|

|

| |||||||||

Emily Fine | 49 | Yes | 11/2015 |

|

| ✓ |

| |||||||||

Michael T. Fries | 60 | Yes | 11/2015 |

| ✓ |

| ✓ | |||||||||

John D. Harkey, Jr. | 63 | Yes | 06/2023 | ✓ |

|

|

| |||||||||

Susan McCaw | 61 | Yes | 09/2018 | ✓ | ✓ |

|

| |||||||||

Yvette Ostolaza | 58 | Yes | 12/2019 |

|

|  |

| |||||||||

Mark H. Rachesky, M.D. | 64 | Yes | 09/2009 |

| ✓ |

|  | |||||||||

Daryl Simm | 62 | Yes | 09/2004 |

|  |

|

| |||||||||

Hardwick Simmons | 83 | Yes | 06/2005 |   |

|

| ✓ | |||||||||

Harry E. Sloan | 73 | Yes | 12/2021 |

| ✓ |

| ✓ | |||||||||

| ✓ | Member |  | Chair |  | Financial Expert |

8 Lions Gate 2023 Proxy Statement

Table of Contents

Proposal 1 Election of Directors

|

MICHAEL BURNS |  | |

Age: 65

Director Since: August 1999

Position with the Company: Vice Chair since March 2000

Residence: Los Angeles, California

|

Business Experience Mr. Burns served as Managing Director and Head of the Office at Prudential Securities Inc.’s Los Angeles Investment Banking Office from 1991 to March 2000.

Other Directorships Mr. Burns has been a director and member of the Finance and Capital Allocation Committee, and the Nominating, Governance & Social Responsibility Committees of Hasbro, Inc. (NASDAQ: HAS) since 2014.

| |

Qualifications Mr. Burns has worked with Chief Executive Officer Jon Feltheimer in building Lionsgate into a multibillion-dollar media and entertainment leader with world-class film and television studio operations. With an accomplished investment banking career prior to Lionsgate, in which he specialized in raising equity within the media and entertainment industry, Mr. Burns brings to the Board important business and financial expertise in its deliberations on complex transactions and other financial matters. Additionally, Mr. Burns’ extensive knowledge of and history with Lionsgate, financial background, in-depth understanding of the media and entertainment industry, connections within the business community and relationships with Lionsgate shareholders, make him an invaluable member of the Board.

| ||

MIGNON L. CLYBURN* |  | |

Age: 61

Independent Director Since: September 2020

Committee Membership: Nominating and Corporate Governance Committee

Residence: Washington, DC

* Ethnic/gender diverse member of the Board

|

Business Experience Ms. Clyburn is President of MLC Strategies, LLC, a Washington, D.C. based consulting firm, a position she has held since January 2019. Previously, Ms. Clyburn served as a Commissioner of the U.S. Federal Communications Commission (the “FCC”) from 2009 to 2018, including as acting chair. While at the FCC, she was committed to closing the digital divide and championed the modernization of the agency’s Lifeline Program, which assists low-income consumers with voice and broadband service. In addition, Ms. Clyburn promoted diversity in media ownership, initiated Inmate Calling Services reforms, supported inclusion in STEM opportunities and fought for an open internet. Prior to her federal appointment, Ms. Clyburn served 11 years on the Public Service Commission of South Carolina and worked for nearly 15 years as publisher of the Coastal Times, a Charleston weekly newspaper focused on the African American community.

Other Directorships Ms. Clyburn has been a director of RingCentral, Inc. (NYSE: RNG) since November 2020. Ms. Clyburn previously served on the board of directors of Charah Solutions, Inc. until July 2023.

| |

Qualifications Ms. Clyburn has extensive experience as a state regulator of investor-owned utilities and as a federal commissioner in the technology and telecommunications fields. Such expertise and additional background as a successful business executive, makes Ms. Clyburn invaluable and well qualified to serve on the Board.

| ||

Lions Gate 2023 Proxy Statement 9

Table of Contents

Proposal 1 Election of Directors

|

GORDON CRAWFORD |  | |

Age: 76

Independent Director Since: February 2013

Committee Membership: Strategic Advisory Committee (Co-Chair)

Residence: Dana Point, California

|

Business Experience For over 40 years, Mr. Crawford served in various positions at Capital Research and Management, a privately held global investment management company. In December 2012, Mr. Crawford retired as its Senior Vice President.

Other Directorships Mr. Crawford serves as Director Emeritus of the Board of Trustees of the U.S. Olympic and Paralympic Foundation (which he Chaired for nine years from its inception in 2013), and as a Life Trustee on the Board of Trustees of Southern California Public Radio (which he Chaired from 2005 to 2012). Mr. Crawford formerly served as Vice Chairman at The Nature Conservancy and is currently a member of the Emeritus Board of the Nature Conservancy. Mr. Crawford is a past Vice Chairman of the Paley Center for Media and a member of the Board of Trustees of Berkshire School. Mr. Crawford also served on the Board of the U.S. Olympic and Paralympic Committee, and as a member of the Board of the LA24 Olympic and Paralympic Bid Committee.

| |

Qualifications Mr. Crawford has been one of the most influential and successful investors in the media and entertainment industry for over 40 years. Mr. Crawford’s professional experience and deep understanding of the media and entertainment sector makes Mr. Crawford a valuable member of the Board.

| ||

JON FELTHEIMER |  | |

Age: 72

Director Since: January 2000

Position with the Company: Chief Executive Officer since March 2000

Residence: Los Angeles, California

|

Business Experience During his entertainment industry career, Mr. Feltheimer has held leadership positions at Lionsgate, Sony Pictures Entertainment and New World Entertainment, and has been responsible for tens of thousands of hours of television programming and hundreds of films. Prior to joining Lionsgate, he served as President of TriStar Television from 1991 to 1993, President of Columbia TriStar Television from 1993 to 1995, and President of Columbia TriStar Television Group and Executive Vice President of Sony Pictures Entertainment from 1995 to 1999, where he oversaw the launch of dozens of successful branded channels around the world.

Other Directorships Other Directorships Mr. Feltheimer is a director of Grupo Televisa, S.A.B. (NYSE: TV; BMV: TLEVISA CPO).

| |

Qualifications During Mr. Feltheimer’s tenure, Lionsgate has grown from its independent studio roots into a global media and entertainment leader encompassing world-class film and television operations backed by an 18,000-title library. As Lionsgate’s Chief Executive Officer since 2000, Mr. Feltheimer provides a critical link to management’s perspective in Board discussions regarding the business and strategic direction of Lionsgate. With extensive experience at three different studios in the entertainment industry, Mr. Feltheimer brings an unparalleled level of strategic and operational experience to the Board, as well as an in-depth understanding of Lionsgate’s industry and invaluable relationships within the business and entertainment community.

| ||

10 Lions Gate 2023 Proxy Statement

Table of Contents

Proposal 1 Election of Directors

|

EMILY FINE* |  | |

Age: 49

Independent Director Since: November 2015

Committee Membership: Nominating and Corporate Governance Committee

Residence: New York, New York

* Ethnic/gender diverse member of the Board

|

Business Experience Ms. Fine is a principal of MHR Fund Management, a New York-based private equity firm that manages approximately $5 billion of capital and has holdings in public and private companies in a variety of industries. Ms. Fine joined MHR Fund Management in 2002 and is a member of the firm’s investment committee. Prior to joining MHR Fund Management, Ms. Fine served as Senior Vice President at Cerberus Capital Management, L.P. and also worked at Merrill Lynch in the Telecom, Media & Technology Investment Banking Group, where she focused primarily on media merger and acquisition transactions.

Other Directorships Ms. Fine serves on the Board of Directors of Rumie Initiative, a non-profit organization dedicated to providing access to free educational content through digital microlearning.

| |

Qualifications Ms. Fine brings to the Board a unique perspective of Lionsgate’s business operations and valuable insight regarding financial matters. Ms. Fine has over 25 years of investing experience and experience working with various companies in the media industry, including, as a principal of MHR Fund Management, working closely with Lionsgate over the past fourteen years.

Investor Rights Agreement Ms. Fine serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

| ||

MICHAEL T. FRIES |  | |

Age: 60

Independent Director Since: November 2015

Committee Membership: Compensation Committee, Strategic Advisory Committee

Residence: Denver, Colorado

|

Business Experience Mr. Fries has served as the Chief Executive Officer, President and Vice Chairman of the Board of Directors of Liberty Global, plc (“Liberty Global”) (NASDAQ: LBTYA, LBTYB, LBTYK) since June 2005. Mr. Fries was Chief Executive Officer of UnitedGlobalCom LLC (“UGC”) from January 2004 until the businesses of UGC and Liberty Media International, Inc. were combined to form Liberty Global.

Other Directorships Mr. Fries is Executive Chairman of Liberty Latin America Ltd. (since December 2017) (NASDAQ: LILA) and a director of Grupo Televisa S.A.B. (since April 2015) (NYSE: TV; BMV: TLEVISA CPO). Mr. Fries serves as a board member of CableLabs® and as a Digital Communications Governor and Steering Committee member of the World Economic Forum. Mr. Fries serves as trustee and finance committee member for The Paley Center for Media.

| |

Qualifications Mr. Fries has over 30 years of experience in the cable and media industry. As an executive officer of Liberty Global and co-founder of its predecessor, Mr. Fries has overseen its growth into a world leader in converged broadband, video and mobile communications. Liberty Global delivers next generation products through advanced fiber and 5G networks, and currently provides over 86 million connections across Europe and the U.K. Liberty Global’s joint ventures in the U.K. and the Netherlands generate combined annual revenue of over $17 billion, while remaining operations generate consolidated revenue of more than $7 billion. Through its substantial scale and commitment to innovation, Liberty Global is building Tomorrow’s Connections Today, investing in the infrastructure and platforms that empower customers and deploying the advanced technologies\ that nations and economies need to thrive. Additionally, Liberty Global’s investment arm includes a portfolio of more than 75 companies across content, technology and infrastructure. Mr. Fries’ significant executive experience in building and managing international distribution and programming businesses, in-depth knowledge of all aspects of a global telecommunications business and responsibility for setting the strategic, financial and operational direction for Liberty Global contribute to the Board’s consideration of the strategic, operational and financial challenges and opportunities of Lionsgate’s business, and strengthen the Board’s collective qualifications, skills and attributes.

Investor Rights Agreement Mr. Fries serves as the designee of Liberty under the Investor Rights Agreement (discussed below).

| ||

Lions Gate 2023 Proxy Statement 11

Table of Contents

Proposal 1 Election of Directors

|

JOHN D. HARKEY, JR. |  | |

Age: 63

Independent Director Since: June 2023

Committee Membership: Audit & Risk Committee

Residence: Dallas, Texas

|

Business Experience Mr. Harkey has served as the principal and founder of JDH Investment Management, LLC, an investment advisory firm, since 2007, and as chairman and chief executive officer of Consolidated Restaurant Operations, Inc., a full-service and franchise restaurant company, since 1998. Mr. Harkey is also co-founder, and serves on the board of directors, of Cessation Therapeutics, a developer of vaccines for addictions to fentanyl, heroin and nicotine, since June 2018 and co-founder and chairman of the board of Dialectic Therapeutics, which develops cancer immunotherapies, since 2019. In addition, he was a co-founder of AveXis, Inc., a biotechnology company, from 2010 until it was acquired in 2018 by Novartis AG, and served as executive chairman from 2010 to 2015. Mr. Harkey holds a B.B.A. in Business Honors from the University of Texas at Austin, a J.D. from the University of Texas School of Law, and an M.B.A. from Stanford Graduate School of Business.

Other Directorships Mr. Harkey serves on the board of directors of several privately-held companies and non-profit organizations, and previously served on the board of directors of Sumo Logic, Inc. until its acquisition by Francisco Partners in May 2023, Loral Space & Communications Inc., until its merger with Telesat Canada in November 2021, and Emisphere Technologies, Inc., until its acquisition by Novo Nordisk in December 2020.

| |

Qualifications Mr. Harkey has extensive operational experience as a private investor and chief executive, in both public and private companies, across a wide range of industries. Mr. Harkey qualifications and experiences, including executive leadership, global leadership, growth and operational scale, business development and strategy, finance and accounting, legal, regulatory, and compliance, and public company board membership, are invaluable to the Board.

Investor Rights Agreement Mr. Harkey serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

| ||

SUSAN MCCAW* |  | |

Age: 61

Independent Director Since: September 2018

Committee Membership: Audit & Risk Committee, Compensation Committee

Residence: North Palm Beach, Florida

* Ethnic/gender diverse member of the Board

|

Business Experience Ms. McCaw is currently the President of SRM Capital Investments, a private investment firm. Before this, Ms. McCaw served as President of COM Investments, a position she held from April 2004 to June 2019 except while serving as U.S. Ambassador to the Republic of Austria from November 2005 to December 2007. Prior to April 2004, Ms. McCaw was the Managing Partner of Eagle Creek Capital, a private investment firm investing in private technology companies, a Principal with Robertson, Stephens & Company, a San Francisco-based technology investment bank, and an Associate in the Robertson Stephens Venture Capital Group. Earlier in her career, Ms. McCaw was a management consultant with McKinsey & Company.

Other Directorships Ms. McCaw is a Director and member of the Leadership Development and Compensation Committee of Air Lease Corporation (NYSE: AL). Ms. McCaw is the Vice Chair of the Hoover Institution and a board member of the Ronald Reagan Presidential Foundation & Institute, Teach for America, and the Stanford Institute for Economic Policy Research. She is also a founding board member of the Malala Fund and serves as the Chair of the Knight-Hennessy Scholars Global Advisory Board. Ms. McCaw is also Trustee Emerita of Stanford University.

| |

Qualifications Ms. McCaw brings deep experience and relationships in global business and capital markets to the Board through her private sector experience in investment banking and investment management, and through her public service as a former U.S. Ambassador. Ms. McCaw holds a Bachelor’s Degree in Economics from Stanford University and a Masters of Business Administration from Harvard Business School. Ms. McCaw’s experience both as an investor and diplomat brings broad and meaningful insight to the Board’s oversight of Lionsgate’s business.

| ||

12 Lions Gate 2023 Proxy Statement

Table of Contents

Proposal 1 Election of Directors

|

YVETTE OSTOLAZA* |  | |

Age: 58

Independent Director Since: December 2019

Committee Membership: Nominating and Corporate Governance Committee (Chair)

Residence: Dallas, Texas

* Ethnic/gender diverse member of the Board

|

Business Experience Since October 2013, Ms. Ostolaza has been a partner at Sidley Austin LLP, an international law firm with 21 offices and nearly $3 billion in revenue. She currently serves as Sidley’s Management Committee Chair and as a member of the firm’s Executive Committee. Ms. Ostolaza has also served on a number of nonprofit organizations as a board member or trustee. Ms. Ostolaza has received various legal and leadership awards, including being recognized by the Hispanic National Bar as Law Firm Leader of 2022, as a “Thought Leader” at Corporate Counsel’s 2019 Women, Influence & Power in Law Awards. Ms. Ostolaza has been selected as one of 20 “Women of Excellence” nationally by Hispanic Business magazine. In 2018, she received the Anti-Defamation League’s prestigious Schoenbrun Jurisprudence Award for her outstanding leadership and exemplary contributions to the community. Ostolaza also received the Texas Lawyer’s Lifetime Achievement Award and named by that publication as one of ten “Winning Women” and as a “Woman to Watch.” She also has been recognized by the Texas Diversity Counsel as one of its “Most Powerful and Influential Women,” and by Latino Leaders Magazine as one of its “Most Powerful Latino Lawyers.” Ms. Ostolaza is also a past recipient of Girls, Inc.’s annual “Woman of Achievement” award.

| |

Qualifications Ms. Ostolaza has spent her career developing a global practice representing public and private companies, board committees, and directors and officers in high-profile litigation, investigations, shareholder activism, regulatory, governance, and crisis management matters across a wide variety of industries. This breadth of experience provides important insight and counsel to the Board’s oversight of Lionsgate’s business.

| ||

MARK H. RACHESKY, M.D. |  | |

Age: 64

Independent Director Since: September 2009

Committee Membership: Chair of the Board, Compensation Committee, Strategic Advisory Committee (Co-Chair)

Residence: New York, New York

|

Business Experience Dr. Rachesky is Founder and Chief Investment Officer of MHR Fund Management LLC, a New York-based private equity firm that manages approximately $5 billion of capital and has holdings in public and private companies across a variety of industries.

Other Directorships Dr. Rachesky is the Non-Executive Chairman of the Board of Directors, member of the Nominating Committee and the Human Resources and Compensation Committee of Telesat Corporation (NASDAQ: TSAT), and a director and member of the Nominating Committee, the Corporate Governance Committee and the Compensation Committee of Titan International, Inc. (NYSE: TWI). Dr. Rachesky formerly served on the Board of Directors of Loral Space & Communications Inc. until its merger with Telesat Canada in November 2021, on the Board of Directors of Navistar International Corporation (NYSE: NAV) until its merger with Traton SE in July 2021, and on the Board of Directors of Emisphere Technologies Inc. until it was acquired by Novo Nordisk in December 2020. Dr. Rachesky also serves on the Board of Directors of Mt. Sinai Hospital Children’s Center Foundation, the Board of Advisors of Columbia University Medical Center, as well as the Board of Overseers of the University of Pennsylvania.

| |

Qualifications Dr. Rachesky has demonstrated leadership skills as well as extensive financial expertise and broad-based business knowledge and relationships. In addition, as the Chief Investment Officer of MHR Fund Management LLC, with a demonstrated investment record in companies engaged in a wide range of businesses over the last 25 plus years, together with his experience as chair and director of other public and private companies, Dr. Rachesky brings broad and insightful perspectives to the Board relating to economic, financial and business conditions affecting Lionsgate and its strategic direction.

Investor Rights Agreement Dr. Rachesky serves as a designee of MHR Fund Management under the Investor Rights Agreement (discussed below).

| ||

Lions Gate 2023 Proxy Statement 13

Table of Contents

Proposal 1 Election of Directors

|

DARYL SIMM |  | |

Age: 62

Independent Director Since: September 2004

Committee Membership: Compensation Committee (Chair)

Residence: Naples, Florida

|

Business Experience Since November 2021, Mr. Simm has been the President and COO of Omnicom Group, Inc. (NYSE: OMC). From February 1998 to November 2021, Mr. Simm was Chairman and Chief Executive Officer of Omnicom Media Group, a division of Omnicom Group, Inc.

| |

Qualifications Mr. Simm leads one of the industry’s marketing services companies representing blue-chip global advertisers that connect their brands to consumers through entertainment content. The agencies he leads routinely receive accolades as the most effective and creative in their field and he has been recognized as one of the “100 most influential leaders in marketing, media and tech.” Earlier in his career, Mr. Simm ran P&G Productions, a prolific producer of television programming, where he was involved in large co-production ventures and international content distribution. Mr. Simm was also the top media executive at Procter & Gamble, the world’s largest advertiser and a pioneer in the use of branded entertainment content. Mr. Simm’s broad experience across the media and content space makes him well qualified to serve on Board.

| ||

HARDWICK SIMMONS |  | |

Age: 83

Independent Director Since: June 2005

Committee Membership: Audit & Risk Committee (Chair), Strategic Advisory

Residence: Marion, Massachusetts

|

Business Experience Mr. Simmons currently serves as a director of several privately held companies. From February 2001 to June 2003, Mr. Simmons served first as Chief Executive Officer and then as Chairman and Chief Executive Officer at The NASDAQ Stock Market Inc. From May 1991 to December 2000, Mr. Simmons served as President and Chief Executive Officer of Prudential Securities Incorporated.

Other Directorships From 2003 to 2016, Mr. Simmons was the Lead Director and Chairman of the Audit and Risk Committee of Raymond James Financial (NYSE:RJF).

| |

Qualifications Mr. Simmons, through an accomplished career overseeing one of the largest equity securities trading markets in the world and other large complex financial institutions, brings important business and financial expertise to the Board in its deliberations on complex transactions and other financial matters. In addition, his broad business knowledge, connections in the business community and valuable insight regarding investment banking and regulation are relevant to the Board’s oversight of Lionsgate’s business.

| ||

14 Lions Gate 2023 Proxy Statement

Table of Contents

Proposal 1 Election of Directors

|

HARRY E. SLOAN |  | |

Age: 73

Independent Director Since: December 2021

Committee Membership: Compensation Committee, Strategic Advisory Committee

Residence: Los Angeles, California

|

Business Experience Mr. Sloan is a founder, public company chief executive officer and a leading investor in the media, entertainment and technology industries. Mr. Sloan is the Chairman and CEO of Eagle Equity Partners II, LLC (“Eagle Equity”). Under Mr. Sloan’s leadership, Eagle Equity has acquired and taken public, through special purpose acquisition companies, several digital media companies including, during 2020, DraftKings, Inc. (Nasdaq: DKNG) (“DraftKings”) and Skillz Inc. (NYSE: SKLZ). Mr. Sloan has been at the forefront and evolution of the video gaming industry as one of the founding investors and a Board Member of Zenimax/ Bethesda Game Studios, the awarding winning studio acquired by Microsoft in March 2021. Mr. Sloan co-founded Soaring Eagle Acquisition Corp., which raised $1.725 billion in its initial public offering in February 2021, and in September 2021, completed its initial business combination with Ginkgo Bioworks Holdings, Inc. (NYSE: DNA) (“Ginkgo”). In January 2022, Mr. Sloan and his partners launched Screaming Eagle Acquisition Corp. (NASDAQ: SCRM). Earlier in his career, Mr. Sloan was Chairman and Chief Executive Officer of MGM Studios and founded and led two public companies in the entertainment media arena, New World Entertainment and SBS Broadcasting, S.A. Mr. Sloan was also one of the founding investors of Lionsgate and served as Lionsgate’s Non-Executive Chairman from 2004 to 2005. In May 2023, Mr. Sloan was appointed as a member of the United States Holocaust Memorial Council.

Other Directorships Mr. Sloan is a member of the Board of Directors and a member of the Audit Committee of Ginkgo, and Vice Chairman of the Board of Directors and Chair of the Nominating and Corporate Governance Committee of DraftKings.

| |

Qualifications Mr. Sloan’s extensive experience as an international media investor, entrepreneur and studio executive makes him well qualified to serve on the Board.

Investor Rights Agreement Mr. Sloan serves as a designee of Discovery Lightning under the Investor Rights Agreement (discussed below).

| ||

Lions Gate 2023 Proxy Statement 15

Table of Contents

Proposal 1 Election of Directors

|

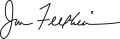

Board Profile

The Board and the Corporate Governance and Nominating Committee are committed to ensuring that the Board is composed of directors who possess highly relevant skills, professional experience and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of shareholders. The following provides a snapshot of the skills and experience of our current Board.

|  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance and Risk Management Understanding Board and management accountability, transparency, and protection of shareholders’ interests, overseeing the various risks facing Lionsgate and ensuring that appropriate policies and procedures are in place to effectively manage risk. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||

| Finance and Capital Allocation Management or oversight of the finance function of a company, resulting in proficiency in complex financial management, capital allocation, and financial reporting processes. | ✓ |

|

|

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

| Global Business Expertise in global business cultures and consumer preferences gained through experience in international markets. | ✓ |

|

|

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

| Media and Entertainment Experience and expertise with the entertainment and media industry. | ✓ |

|

|

| ✓ | ✓ |

|

|

| ✓ |

|

|

|

|

|

|

|

|

|

|

|

| ✓ |

|

|

| ✓ | ||||||||||||||||||||||||||

| Public Company Experience of modern board practice and principles and the ability and business acumen to debate and address critical board-level issues. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||

| Strategic Planning Expertise in identifying and developing opportunities for long-term value creation, including experience in driving innovation, improving operations, identifying risks and executing Lionsgate’s strategic goals. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||

| Ethnic/Gender Diversity Contributes to the representation of varied backgrounds, perspectives and experience in the boardroom. |

|

|

| ✓ |

|

|

|

|

|

| ✓ |

|

|

|

|

|

| ✓ | ✓ |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

16 Lions Gate 2023 Proxy Statement

Table of Contents

Proposal 1 Election of Directors

|

Investor Rights Agreement

On November 10, 2015, (i) Liberty, a limited company organized under the laws of the United Kingdom and a wholly-owned subsidiary of Liberty Global, agreed to purchase 5,000,000 of Lionsgate’s then outstanding common shares from funds affiliated with MHR Fund Management, and (ii) Discovery Lightning, a limited company organized under the laws of the United Kingdom and a wholly-owned subsidiary of Warner Bros. Discovery, Inc. (“Discovery”) agreed to purchase 5,000,000 of Lionsgate’s then outstanding common shares from funds affiliated with MHR Fund Management (collectively, the “Purchases”).

In connection with the Purchases, on November 10, 2015, Lionsgate entered into an investor rights agreement with Liberty Global, Discovery, Liberty, Discovery Lightning and certain affiliates of MHR Fund Management (as amended from time to time, the “Investor Rights Agreement”). The Investor Rights Agreement provides that, among other things, (i) for so long as funds affiliated with MHR Fund Management beneficially own at least 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include three (3) designees of MHR Fund Management (at least one of whom will be an independent director and will be subject to Board approval) on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders and (ii) for so long as funds affiliated with MHR Fund Management beneficially own at least 5,000,000, but less than 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include one designee of MHR Fund Management on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders. Dr. Rachesky, Ms. Fine and a former director were appointed as initial designees of MHR Fund Management pursuant to the Investor Rights Agreement. Mr. Harkey serves as the current third designee under the Investor Rights Agreement.

In addition, the Investor Rights Agreement provides that (i) for so long as Liberty and Discovery Lightning (together with certain of their affiliates) beneficially own at least 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate’s will

Lions Gate 2023 Proxy Statement 17

Table of Contents

Proposal 1 Election of Directors

|

include one designee of Liberty and one designee of Discovery Lightning on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders and (ii) for so long as Liberty and Discovery Lightning (together with certain of their affiliates) beneficially own at least 5,000,000, but less than 10,000,000 of Lionsgate’s then outstanding common shares in the aggregate, Lionsgate will include one designee of Liberty and Discovery Lightning, collectively, on its slate of director nominees for election at each future annual general and special meeting of Lionsgate’s shareholders, selected by (a) Liberty, if Liberty individually exceeds such 5,000,000 common share threshold but Discovery Lightning does not, (b) Discovery Lightning, if Discovery Lightning individually exceeds such 5,000,000 common share threshold but Liberty does not and (c) Liberty and Discovery Lightning, jointly, if neither Liberty nor Discovery Lightning individually exceeds such 5,000,000 common share threshold. Mr. Fries was appointed as a designee of Liberty and a former director was appointed as a designee of Discovery Lightning, and both were appointed as directors of Lionsgate effective on November 12, 2015. Currently, Mr. Sloan serves as the designee of Discovery Lightning under the Investor Rights Agreement.

In addition, under the Investor Rights Agreement, Lionsgate has also agreed to provide Liberty, Discovery Lightning and MHR Fund Management with certain pre-emptive rights on shares that Lionsgate may issue in the future for cash consideration.

Under the Investor Rights Agreement, Liberty and Discovery Lightning (together with certain of their affiliates) have agreed that if they sell or transfer any of their shares of Lionsgate common stock to a shareholder or group of shareholders that beneficially own 5% or more of Lionsgate’s then outstanding common shares, or that would result in a person or group of persons beneficially owning 5% or more of Lionsgate’s then outstanding common shares, any such transferee would have to agree to the restrictions and obligations set forth in the Investor Rights Agreement, including transfer restrictions, subject to certain exceptions set forth in the Investor Rights Agreement.

VOTE REQUIRED AND BOARD RECOMMENDATION

A plurality of the Class A voting shares voting in person or by proxy is required to elect each of the 13 nominees for director. A plurality means that the 13 nominees receiving the largest number of votes cast (votes “FOR”) will be elected. Shareholders are not permitted to cumulate their shares for the purpose of electing directors.