Table of Contents

Index to Financial Statements

British Columbia, Canada | 7812 | N/A | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

British Columbia, Canada | 7812 | N/A | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

David E. Shapiro Mark A. Stagliano Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, New York 10019 (212) 403-1000 | Kimberly Burns Dentons Canada LLP 250 Howe Street, 20th Floor Vancouver, British Columbia Canada, V6C 3R8 |

Large Accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☐ | |||

| Emerging growth company ☐ | ||||||

| Large Accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | |||

| Emerging growth company ☐ | ||||||

| * | The co-Registrant is currently named Lionsgate Studios Holding Corp. In connection with the Transactions described in the joint proxy statement/prospectus included in this Registration Statement, Lionsgate Studios Holding Corp. plans to change its name to “Lionsgate Studios Corp.” |

| ** | The co-Registrant is currently named Lions Gate Entertainment Corp. In connection with the Transactions described in the joint proxy statement/prospectus included in this Registration Statement, Lions Gate Entertainment Corp. plans to change its name to “Starz Entertainment Corp.” |

Table of Contents

Index to Financial Statements

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of any offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION—DATED OCTOBER 15, 2024

|  |

JOINT PROXY STATEMENT/PROSPECTUS

[ ], 2024

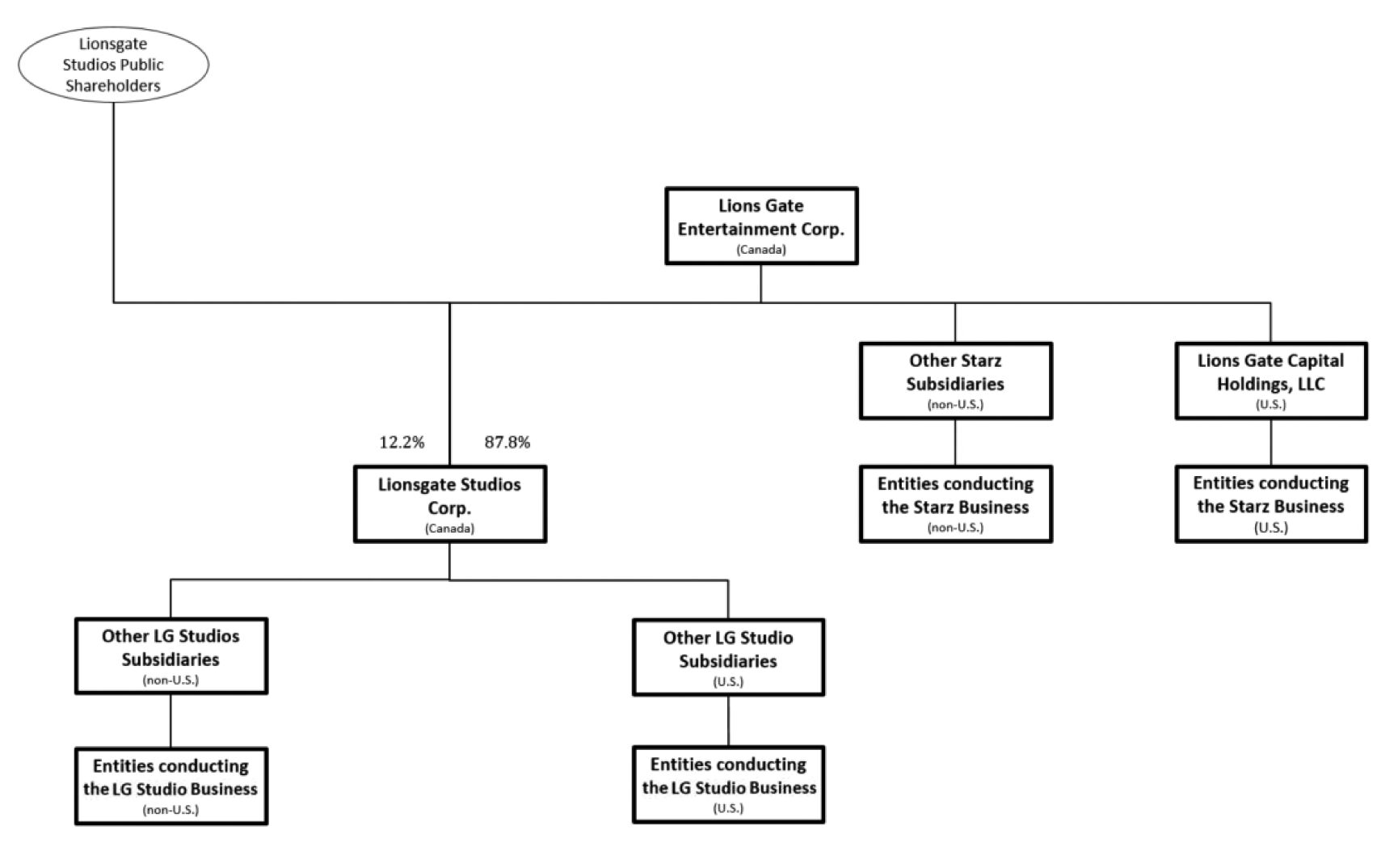

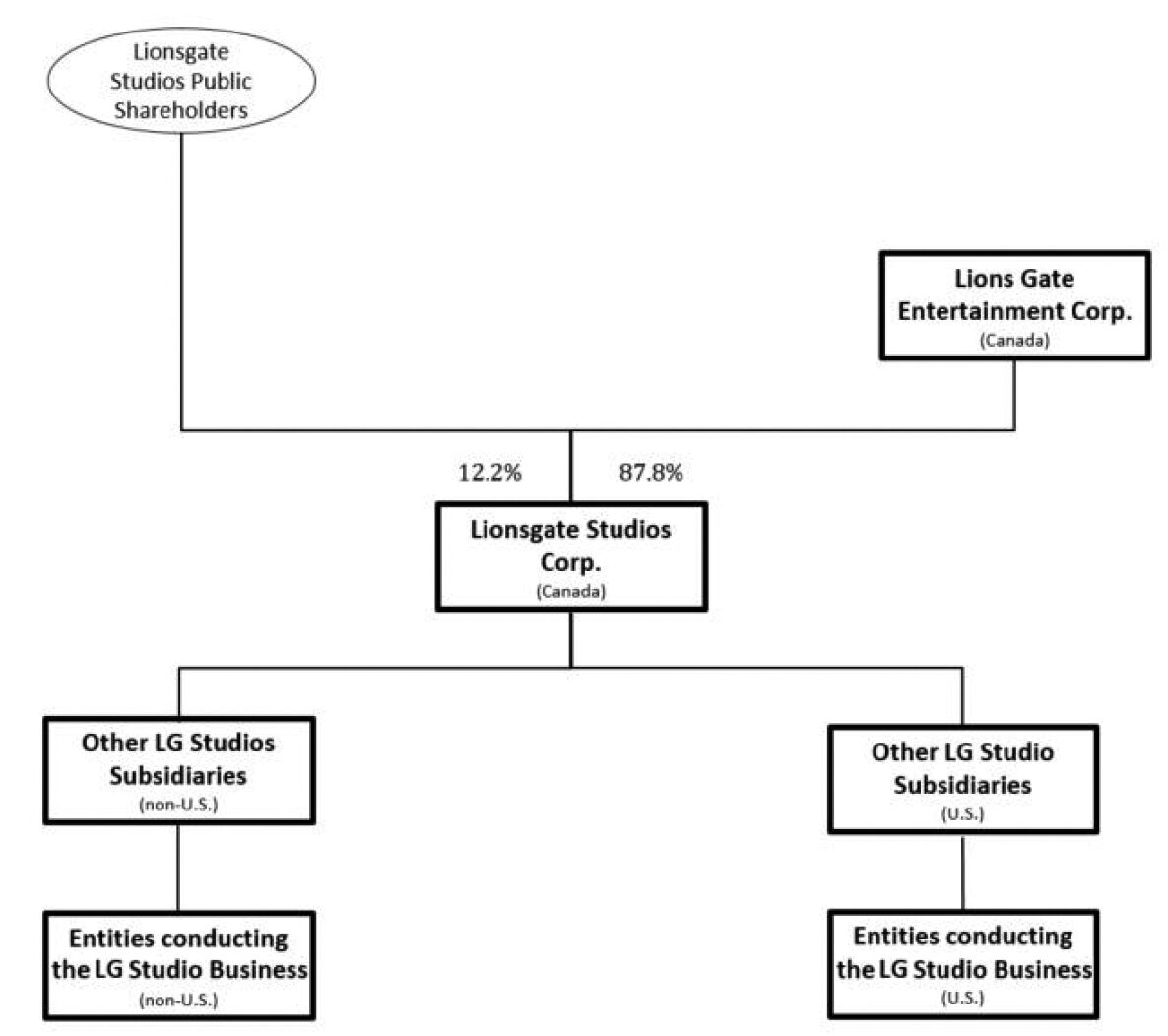

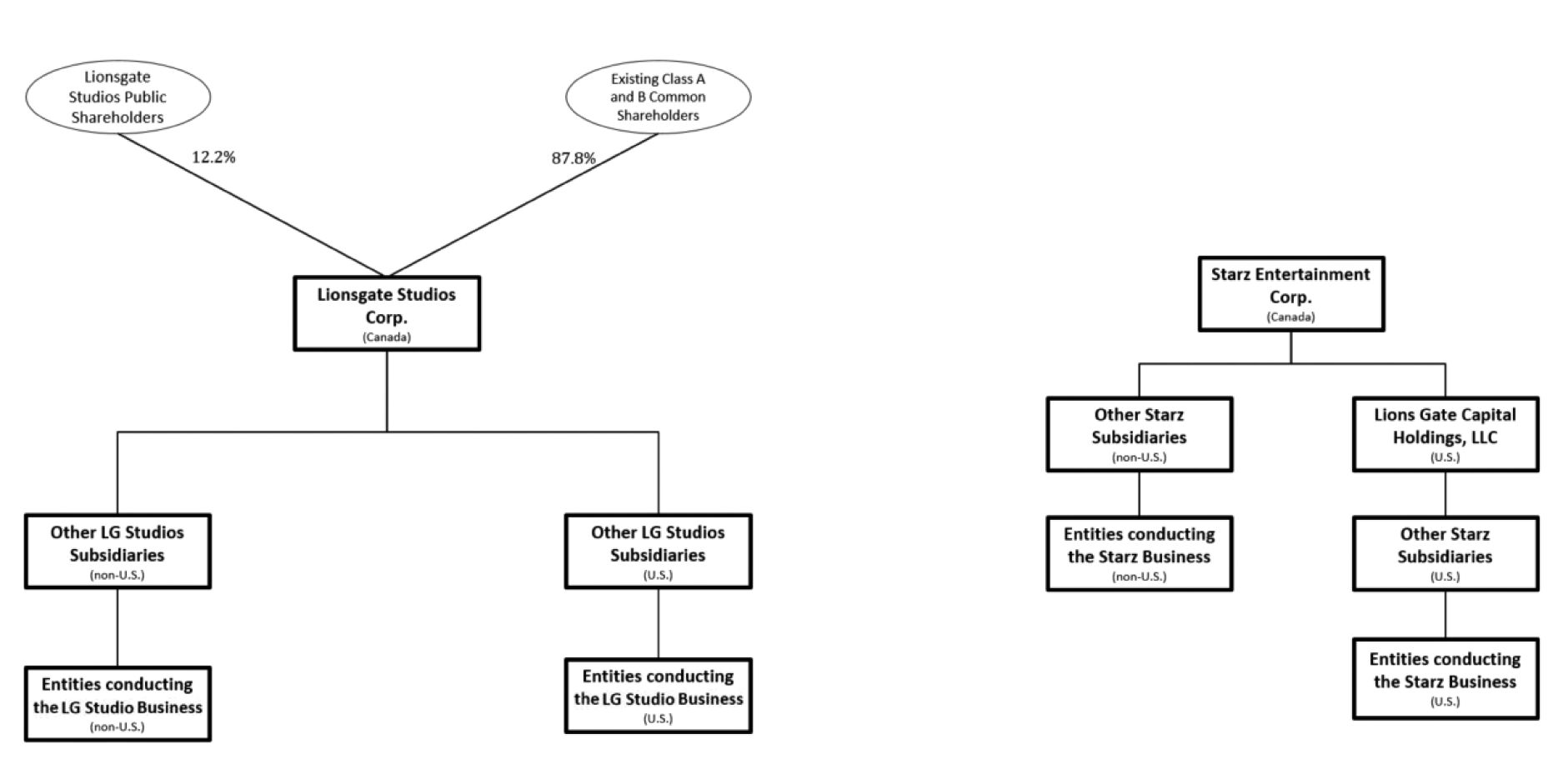

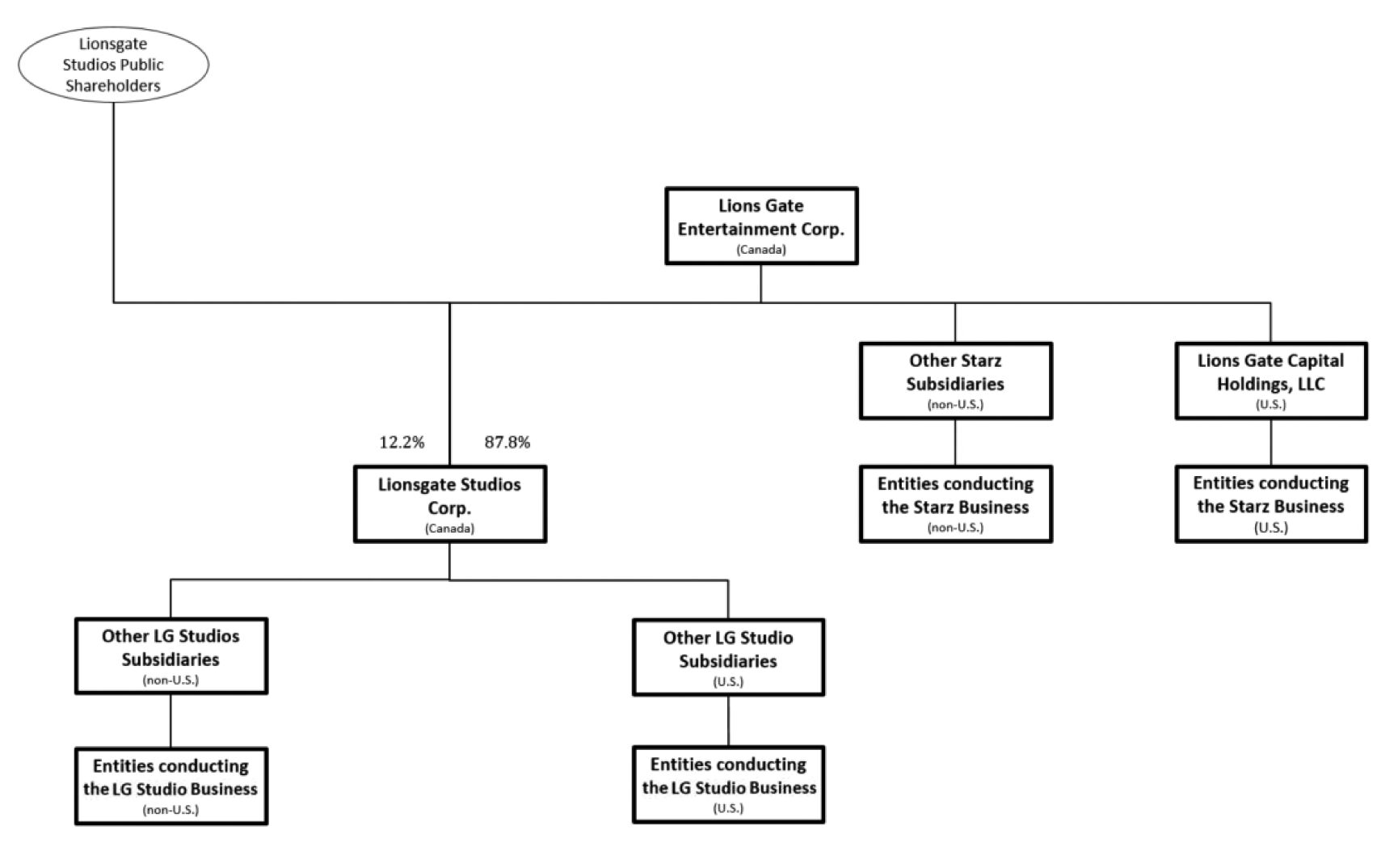

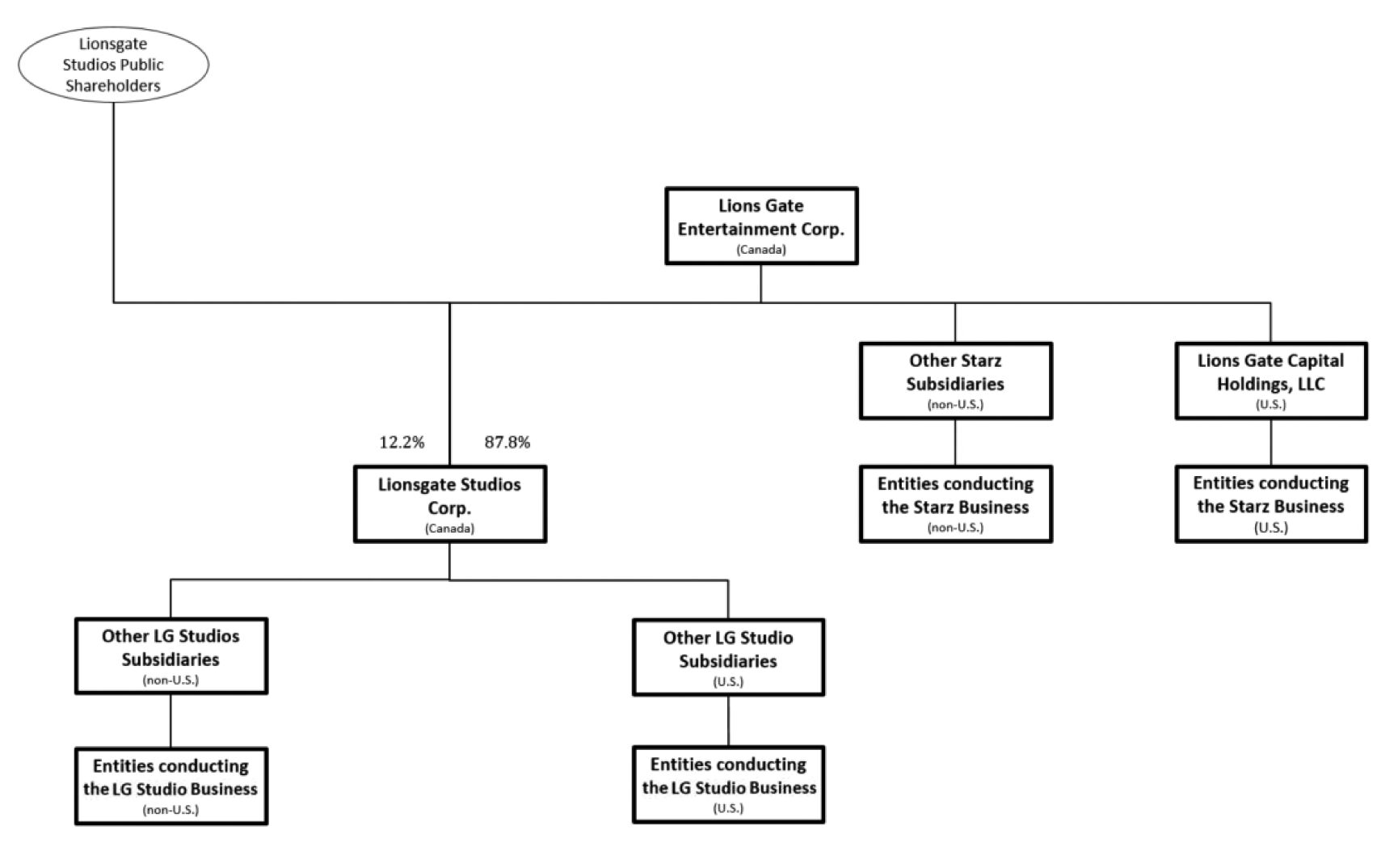

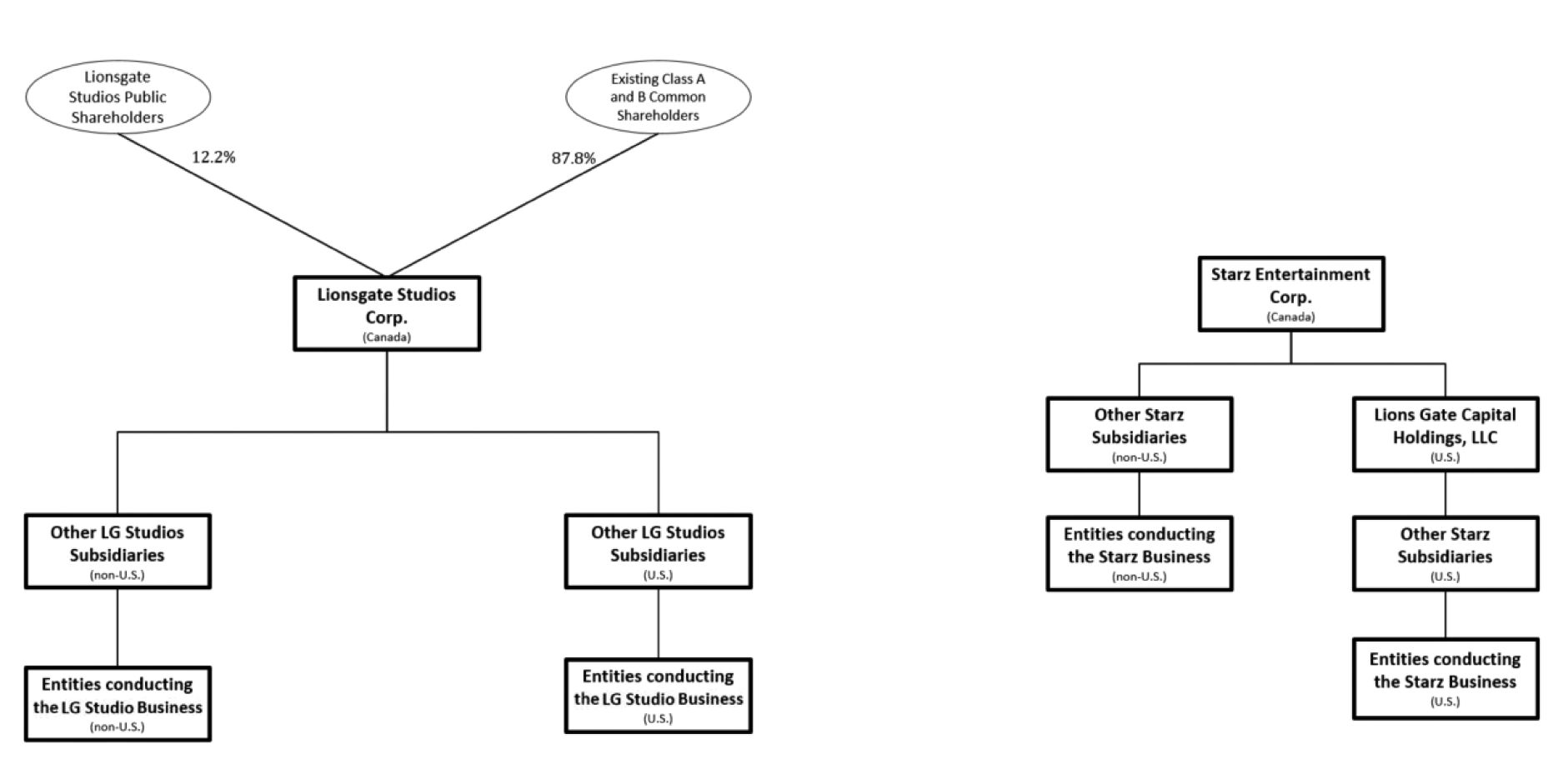

Lions Gate Entertainment Corp., a British Columbia corporation (“Lionsgate” or “LGEC”), Lionsgate Studios Holding Corp., a newly incorporated entity formed under the laws of the Province of British Columbia and a wholly-owned subsidiary of Lionsgate (“New Lionsgate”), and LG Sirius Holdings ULC, a British Columbia unlimited liability corporation (“LG Sirius”) and wholly owned subsidiary of Lionsgate that owns approximately 87.8% of the issued and outstanding shares of Lionsgate Studios Corp., a British Columbia corporation (“LG Studios”), have entered into an arrangement agreement dated as of [ ], 2024 (as it may be amended from time to time, the “Arrangement Agreement”). The Arrangement Agreement provides for the implementation of a plan of arrangement (the “Plan of Arrangement”) that will result in the separation of the businesses of LG Studios, which encompasses the motion picture and television studio operations (the “LG Studios Business”), from the other businesses of Lionsgate, including the STARZ-branded premium subscription platforms (the “Starz Business”), through a series of transactions (the “Transactions”) that will result in the pre-transaction shareholders of Lionsgate owning shares in two separately traded public companies: (1) LGEC, which will be renamed “Starz Entertainment Corp.” and will hold, directly and through subsidiaries, the Starz Business, and will continue to be owned by LGEC shareholders (thereafter referred to herein as “Starz”), and (2) New Lionsgate, which will be renamed “Lionsgate Studios Corp.” and will hold, directly and through subsidiaries, the LG Studios Business, and will be owned by LGEC shareholders and LG Studios shareholders.

In connection with the completion of the Transactions, among other things:

| • | LGEC shareholders will first receive in exchange for each outstanding Class A voting common share of Lionsgate, without par value (“LGEC Class A common shares”), that they hold: |

| ○ | One New Lionsgate Class A voting common share, without par value (“New Lionsgate Class A common shares”); and |

| ○ | One New Lionsgate Class C preferred share, with one-half (1/2) of a vote per share, without par value (“New Lionsgate Class C preferred shares”). |

| • | LGEC shareholders will first receive, in exchange for each outstanding Class B non-voting common share of Lionsgate, without par value (“LGEC Class B common shares”), that they hold: |

| ○ | One New Lionsgate Class B non-voting common share, without par value (“New Lionsgate Class B common shares”); and |

| ○ | One New Lionsgate Class C preferred share. |

| • | Such exchange transactions by LGEC shareholders are collectively referred to as the “Initial Share Exchange.” |

| • | LGEC will change its name to Starz Entertainment Corp. and create a new class of voting common shares (“Starz common shares”). |

| • | New Lionsgate will create a new class of common shares, without par value (“New Lionsgate new common shares”) and New Lionsgate shareholders (formerly LGEC shareholders) will receive, in exchange for each: |

| ○ | New Lionsgate Class A common share and New Lionsgate Class C preferred share they hold, one and twelve one-hundredths (1.12) New Lionsgate new common shares and one and twelve one-hundredths (1.12) Starz common shares; and |

| ○ | New Lionsgate Class B common share and New Lionsgate Class C preferred share they hold, one (1) New Lionsgate new common share and one (1) Starz common share. |

Table of Contents

Index to Financial Statements

| • | As a result of the steps described above, each of New Lionsgate and Starz will have a single class of “one share, one vote” common shares. |

| • | LG Studios shareholders, other than New Lionsgate and dissenting shareholders will receive, in exchange for each LG Studios common share, without par value (“LG Studios common shares”), they hold, a number of New Lionsgate new common shares equal to [ ] (the “LG Studios Reorganization Ratio”). The LG Studios common shares will be delisted from The Nasdaq Global Select Market (“Nasdaq”) and deregistered under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| • | New Lionsgate will change its name to “Lionsgate Studios Corp.” |

LGEC Class A common shares currently trade on the New York Stock Exchange (the “NYSE”) under the ticker symbol “LGF.A” and LGEC Class B common shares currently trade on the NYSE under the ticker symbol “LGF.B”. LG Studios common shares currently trade on Nasdaq under the ticker symbol “LION.” After the Transactions are completed, the New Lionsgate new common shares are expected to trade on the [ ] under the symbol “LION” and the Starz common shares are expected to trade on the [ ] under the symbol “[ ]”. While trading in New Lionsgate new common shares and Starz common shares under these symbols is expected to begin on the first business day following the completion of the Transactions, there can be no assurance that a viable and active trading market will develop.

The Transactions are intended to be generally tax-free for U.S. federal income tax purposes to holders of LGEC common shares and LG Studios common shares. The Transactions are expected to give rise to capital gains or capital losses for Canadian federal income tax purposes for holders of LGEC common shares. However, non-residents of Canada will generally not be subject to Canadian income tax in respect of any such capital gains or losses. The Transactions are intended to be generally tax-free for Canadian federal income tax purposes to holders of LG Studios common shares.

Lionsgate will hold an annual general and special meeting of its shareholders on [ ], 2024 (the “Lionsgate Annual General and Special Meeting”) and LG Studios will hold a special meeting of its shareholders on [ ], 2024 (the “LG Studios Special Meeting”) in order to obtain the shareholder approvals required to complete the Transactions and to obtain the other shareholder approvals that are described in this joint proxy statement/prospectus.

The Lionsgate board of directors recommends that the Lionsgate shareholders vote “FOR” each of the proposals to be considered at the Lionsgate Annual General and Special Meeting. The LG Studios board of directors recommends that LG Studios shareholders vote “FOR” each of the proposals to be considered at the LG Studios Special Meeting.

Your vote is very important, regardless of the number of shares you own. Whether or not you expect to virtually attend the Lionsgate Annual General and Special Meeting or the LG Studios Special Meeting, as applicable, please submit a proxy to vote your shares as promptly as possible so that your shares may be represented and voted at such meeting.

The obligations of the parties to complete the Transactions are subject to the satisfaction or waiver of a number of conditions specified in the Arrangement Agreement. More information about Lionsgate, New Lionsgate, LG Studios, the Lionsgate Annual General and Special Meeting, the LG Studios Special Meeting and the Transactions is contained in this joint proxy statement/prospectus. Before voting, we urge you to read carefully and, in its entirety this joint proxy statement/prospectus, including the Annexes and the documents incorporated by reference herein. In particular, we urge you to read carefully the section entitled Risk Factors beginning on page 21 of this joint proxy statement/prospectus.

Table of Contents

Index to Financial Statements

|

| |

Jon Feltheimer Chief Executive Officer Lions Gate Entertainment Corp. and Lionsgate Studios Corp. | Jeffrey A. Hirsch President and Chief Executive Officer Starz, LLC | |

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the transactions described in this joint proxy statement/prospectus or the securities to be issued under this joint proxy statement/prospectus or determined that this joint proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated [ ], 2024 and is first being mailed to the shareholders of Lionsgate and the shareholders of LG Studios on or about [ ], 2024.

Table of Contents

Index to Financial Statements

LIONS GATE ENTERTAINMENT CORP.

250 Howe Street, 20th Floor

Vancouver, British Columbia V6C 3R8

2700 Colorado Avenue

Santa Monica, California 90404

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

To Be Held

To LGEC Shareholders:

You are invited to attend the annual general and special meeting of shareholders (the “Lionsgate Annual General and Special Meeting” or the “Lionsgate Meeting”) of Lions Gate Entertainment Corp. (“LGEC” or “Lionsgate”), which will be held on [ ], [ ], beginning at [ ], Pacific Time, at Lionsgate’s head office in Canada at Dentons Canada LLP, 250 Howe Street, 20th Floor, Vancouver, British Columbia, V6C 3R8. At the Annual General and Special Meeting, shareholders will act on the following matters:

| 1. | Consider pursuant to the LGEC Interim Order and, if deemed advisable, approve, with or without variation, a special resolution of the holders of LGEC Class A common shares and a special resolution of the holders of LGEC Class B common shares (these identical resolutions, the “LGEC Arrangement Resolution”) adopting, for the holders of LGEC Class A common shares, and for the holders of the LGEC Class B common shares, a statutory Plan of Arrangement, effective as of the arrangement effective time (the “Arrangement Effective Time”), pursuant to Section 288 of the Business Corporations Act (British Columbia) among Lionsgate, the shareholders of Lionsgate, Studios, the shareholders of LG Studios, and New Lionsgate, pursuant to which, among other things: (a) New Lionsgate will be separated from Lionsgate and hold the LG Studios Business, (b) Starz (formerly LGEC) will hold the Starz Business, (c) LGEC shareholders will receive a number of New Lionsgate new common shares equal to [ ] and all of the issued and outstanding shares of Starz and (d) LG Studios shareholders will receive a number of New Lionsgate new common shares equal to [ ], all as more fully described in the joint proxy statement/prospectus accompanying this notice, which LGEC Arrangement Resolution, to be effective, must be passed by an affirmative vote of (i) at least two-thirds (66 2/3%) of the votes cast by holders of LGEC Class A common shares, voting separately as a class, present or represented by proxy at the Lionsgate Annual General and Special Meeting and entitled to vote at the Lionsgate Annual General and Special Meeting, (ii) at least two-thirds (66 2/3%) of the votes cast by holders of the LGEC Class B common shares, voting separately as a class, present or represented by proxy at the Lionsgate Annual General and Special Meeting and entitled to vote at the Lionsgate Annual General and Special Meeting, (iii) a simple majority of the votes cast by holders of the LGEC Class B common shares, voting as a separate class, present or represented by proxy at the Lionsgate Annual General and Special Meeting and entitled to vote at the Lionsgate Annual General and Special Meeting, excluding the votes cast by certain holders of LGEC Class B common shares that also hold LGEC Class A common shares and that are required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) (the “Lionsgate Transactions Proposal”); |

| 2. | Approve on a non-binding advisory basis, by ordinary resolution, several governance provisions each of which will be contained in the New Lionsgate Articles and the Starz Articles, respectively, if the Transactions are completed and that substantially affect LGEC shareholder rights, presented separately in accordance with U.S. Securities and Exchange Commission (the “SEC”) guidance (the “Lionsgate Advisory Organizational Documents Proposals” or “Proposal No. 2”). Proposal No. 2 is separated into sub-proposals as described in the following paragraps (a) – (j): |

| a. | Proposal No. 2(a): Advance Notice for Nomination of Directors for New Lionsgate Articles: A proposal to include advance notice procedures for shareholder nominations of directors. |

Table of Contents

Index to Financial Statements

| b. | Proposal No. 2(b): Number of Directors for New Lionsgate Articles: A proposal to allow the board to set the number of directors. |

| c. | Proposal No. 2(c): Removal of Casting Vote for New Lionsgate Articles: A proposal to remove a second or casting vote. |

| d. | Proposal No. 2(d): Renumeration of Auditor for New Lionsgate Articles: A proposal to allow the board to set the remuneration of the auditor without requiring shareholder approval by ordinary resolution. |

| e. | Proposal No. 2(e): Change in Authorized Share Capital for New Lionsgate Articles: A proposal to approve the amendment of the Lionsgate Articles such that, effective as of the Arrangement Effective Time, (1) each LGEC Class A common share issued and outstanding immediately prior to the Arrangement Effective Time will be reclassified and automatically converted into one (1) New Lionsgate Class A common share and one (1) New Lionsgate Class C preferred share, and (2) each LGEC Class B common share issued and outstanding immediately prior to the Arrangement Effective Time will be reclassified and automatically converted into one (1) New Lionsgate Class B common share and one (1) New Lionsgate Class C preferred share. Such exchange transactions by LGEC shareholders are collectively referred to as the “Initial Share Exchange.” Following the Initial Share Exchange, New Lionsgate will create the New Lionsgate new common shares. |

| f. | Proposal No. 2(f): Advance Notice for Nomination of Directors for Starz Articles: A proposal to include advance notice provisions for nominations of directors. |

| g. | Proposal No. 2(g): Number of Directors for Starz Articles: A proposal to allow the board to set the number of directors. |

| h. | Proposal No. 2(h): Removal of Casting Vote for Starz Articles: A proposal to remove a second or casting vote. |

| i. | Proposal No. 2(i): Renumeration of Auditor for Starz Articles: A proposal to allow the board to set the remuneration of the auditor without requiring shareholder approval by ordinary resolution. |

| j. | Proposal No. 2(j): Change in Authorized Share Capital for Starz Articles: A proposal to approve the amendment of the Lionsgate Articles such that, effective as of the Arrangement Effective Time and following the Initial Share Exchange, LGEC will change its name to Starz Entertainment Corp. and create the Starz common shares. |

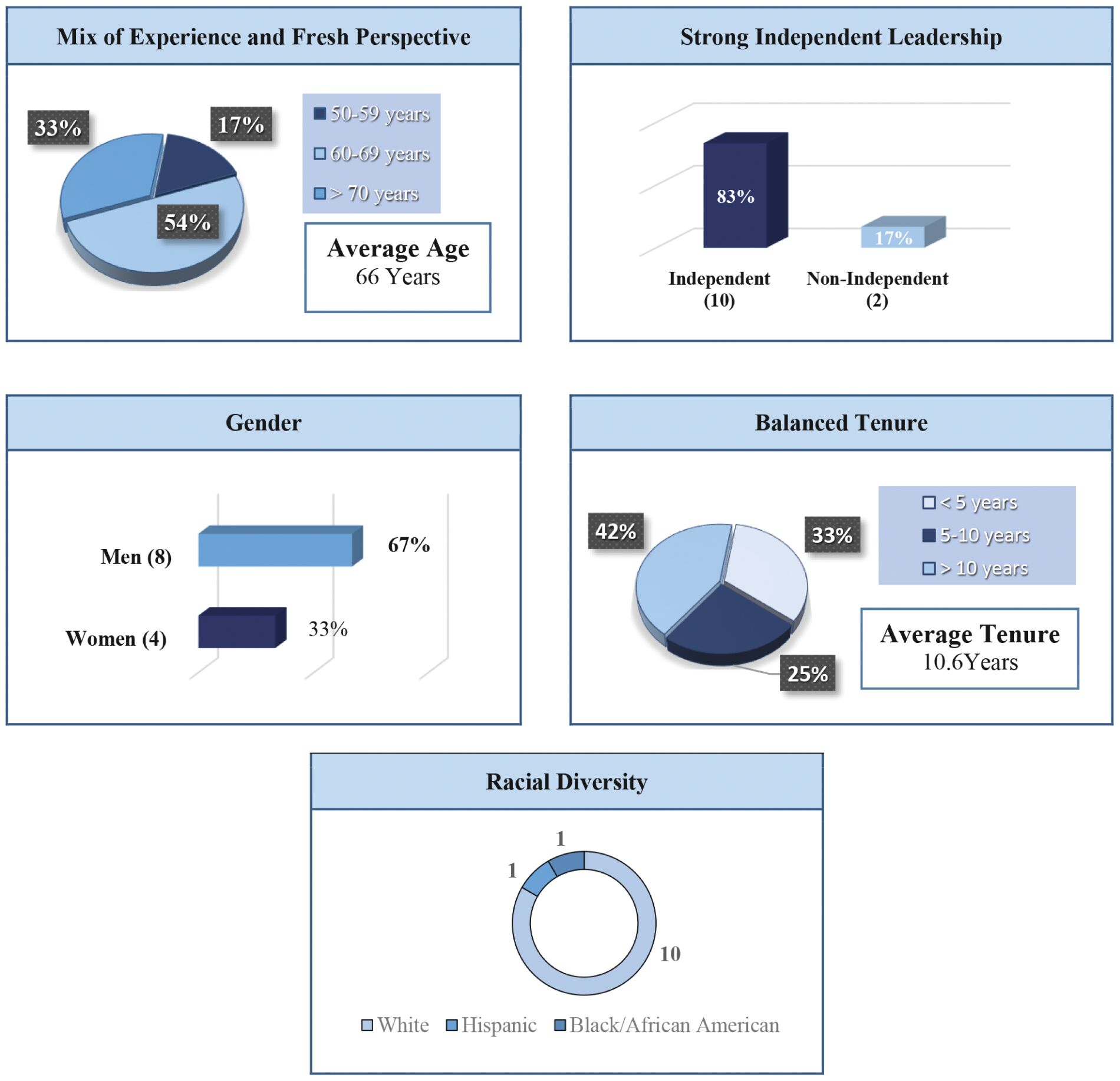

| 3. | Elect 12 directors as listed in the joint proxy statement/prospectus accompanying this notice to serve on the Board of Directors of Lionsgate (the “Lionsgate Board”), each for a term of one year or until their resignation, removal, replacement in connection with the Transactions, and their respective successors are duly elected or appointed; |

| 4. | Re-appoint Ernst & Young LLP as Lionsgate’s independent registered public accounting firm for the fiscal year ending March 31, 2025 and authorize the Audit & Risk Committee of the Lionsgate Board to fix its remuneration; |

| 5. | Conduct a non-binding advisory vote to approve executive compensation; |

| 6. | Approve the assumption by New Lionsgate of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan, as amended and restated as the Lionsgate Studios Corp. 2024 Performance Incentive Plan (the “New Lionsgate 2024 Plan”); and |

| 7. | Approve the Starz Entertainment Corp. 2024 Performance Incentive Plan (the “Starz 2024 Plan”). |

Holders of record of LGEC Class A common shares at [ ] (Eastern Time) on [ ] are entitled to receive notice of the Lionsgate Annual General and Special Meeting and to vote the LGEC Class A common shares that they held on the Record Date at the Lionsgate Annual General and Special Meeting, or any continuations, adjournments or postponements thereof, on matters to be considered by the holders of LGEC Class A common shares. Each outstanding LGEC Class A common share entitles its holder to cast one vote on each matter to be voted upon. Holders of record of LGEC Class B common shares at [ ] (Eastern Time)

Table of Contents

Index to Financial Statements

on [ ] are entitled to receive notice of the Lionsgate Annual General and Special Meeting and, solely with respect to the Lionsgate Transactions Proposal, to vote the LGEC Class B common shares that they held on the Record Date at the Lionsgate Annual General and Special Meeting, or any continuations, adjournments or postponements thereof. Holders of LGEC Class B common shares are not entitled to vote on the matters to be presented at the Lionsgate Annual General and Special Meeting other than the Lionsgate Transactions Proposal. Each outstanding LGEC Class B common share entitles its holder to cast one vote solely with respect to the Lionsgate Transactions Proposal.

Approval of the Lionsgate Transactions Proposal (Proposal No. 1) requires (i) the affirmative vote of at least two-thirds (66 2/3%) of the votes cast by holders of LGEC Class A common shares, voting separately as a class, present or represented by proxy at the Lionsgate Annual General and Special Meeting and entitled to vote at the Lionsgate Annual General and Special Meeting, (ii) the affirmative vote of the holders of at least two-thirds (66 2/3%) of the votes cast by holders of the LGEC Class B common shares, voting separately as a class, present or represented by proxy at the Lionsgate Annual General and Special Meeting, and (iii) a simple majority of the votes cast by holders of LGEC Class B common shares, each voting as a separate class, excluding the votes cast by certain holders of LGEC Class B common shares that also hold LGEC Class A common shares and that are required to be excluded pursuant to MI 61-101. The advisory vote on the Lionsgate Advisory Organizational Documents Proposals (Proposal No. 2) requires the affirmative vote of two-thirds (66 2/3%) of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting. The election of each director (Proposal No. 3) is determined by a plurality of the total number of votes cast. Adoption of the Ernst & Young LLP as Lionsgate’s independent registered public accounting firm and authorization for the Audit & Risk Committee of the Lionsgate Board to fix its remuneration (Proposal No. 4), the advisory vote on executive compensation (Proposal No. 5), the assumption of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan, as amended and restated as the New Lionsgate 2024 Plan (Proposal No. 6), and the approval of the Starz 2024 Performance Incentive Plan (Proposal No. 7) each requires the affirmative vote of at least a majority of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting.

Whether or not you plan to attend the Lionsgate Annual General and Special Meeting, Lionsgate urges you to submit your proxy or voting instructions as promptly as possible by Internet, telephone or mail to ensure your representation and the presence of a quorum at the Lionsgate Annual General and Special Meeting. If you attend the Lionsgate Annual General and Special Meeting and wish to vote in person, you may withdraw your proxy or voting instructions and vote your shares personally. Your proxy is revocable in accordance with the procedures set forth in the joint proxy statement/prospectus accompanying this notice.

THE LIONSGATE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS TO BE CONSIDERED AT THE LIONSGATE ANNUAL GENERAL AND SPECIAL MEETING.

The above matters are more fully described in the joint proxy statement/prospectus accompanying this notice.

By order of the Board of Directors,

|

|

|

Jon Feltheimer, Chief Executive Officer

Santa Monica, California Vancouver, British Columbia |

In accordance with Lionsgate’s security procedures, all persons attending the Lionsgate Annual General and Special Meeting will be required to present picture identification.

Table of Contents

Index to Financial Statements

LIONSGATE STUDIOS CORP.

250 Howe Street, 20th Floor

Vancouver, British Columbia V6C 3R8

2700 Colorado Avenue

Santa Monica, California 90404

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held [ ]

To LG Studios Shareholders:

You are invited to attend the special meeting of shareholders (the “LG Studios Special Meeting” or the “Studios Meeting”) of Lionsgate Studios Corp. (“LG Studios”), which will be held on [ ], [ ], beginning at [ ], Pacific Time, at Lionsgate’s head office in Canada at Dentons Canada LLP, 250 Howe Street, 20th Floor, Vancouver, British Columbia, V6C 3R8. At the LG Studios Special Meeting, shareholders will act on the following matters:

| 1. | Consider, pursuant to the Studios Interim Order and, if deemed advisable, approve, with or without variation, a special resolution (the “Studios Arrangement Resolution”) of the shareholders of LG Studios common shares adopting a statutory Plan of Arrangement pursuant to Section 288 of the Business Corporations Act (British Columbia) among Lionsgate, the shareholders of Lionsgate, LG Studios, the shareholders of LG Studios, and New Lionsgate, pursuant to which, among other things, LG Studios shareholders will receive a number of New Lionsgate new common shares equal to [ ], as more fully described in the joint proxy statement/prospectus accompanying this notice, which resolution, to be effective, must be passed by an affirmative vote of at least two-thirds (66 2/3%) of the votes cast by the LG Studios shareholders present or represented by proxy at the LG Studios Special Meeting and entitled to vote at the LG Studios Special Meeting (the “LG Studios Reorganization Proposal”); and |

| 2. | Approve on a non-binding advisory basis, by ordinary resolution, several governance provisions that will be contained in the New Lionsgate Articles and that substantially affect LG Studios shareholder rights, presented separately in accordance with SEC guidance (the “LG Studios Advisory Organizational Documents Proposals” or “LG Studios Shareholder Proposal No. 2”). Proposal No. 2 is separated into sub-proposals as described in the following paragraps (a) – (j): |

| a. | Proposal No. 2(a): Change in Authorized Share Capital for New Lionsgate Articles: A proposal to include 200,000,000 preference shares without par value that may be issued in series as authorized and approved by the directors of New Lionsgate. |

| b. | Proposal No. 2(b): Quorum at Shareholder Meetings for New Lionsgate Articles: A proposal to reduce the quorum required among LG Studios shareholders to make decisions on business transacted at a meeting of shareholders of LG Studios from at least 33 1/3% of the issued shares entitled to be voted at the meeting to at least 10% of the issued shares entitled to be voted at the meeting. |

Holders of record of LG Studios common shares at [ ] (Eastern Time) on [ ] are entitled to notice of, and to vote on all of the proposals at, the LG Studios Special Meeting or any continuations, adjournments or postponements thereof. Approval of the proposals presented at the LG Studios Special Meeting requires the affirmative vote of at least two-thirds (66 2/3%) of the votes cast by holders of LG Studios common shares present or represented by proxy at the LG Studios Special Meeting.

Table of Contents

Index to Financial Statements

Whether or not you plan to attend the LG Studios Special Meeting, LG Studios urges you to submit your proxy or voting instructions as promptly as possible by Internet, telephone or mail to ensure your representation and the presence of a quorum at the LG Studios Special Meeting. If you attend the LG Studios Special Meeting and wish to vote in person, you may withdraw your proxy or voting instructions and vote your shares personally. Your proxy is revocable in accordance with the procedures set forth in the joint proxy statement/prospectus accompanying this notice.

THE LG STUDIOS BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS TO BE CONSIDERED AT THE LG STUDIOS SPECIAL MEETING.

The above matters are more fully described in the joint proxy statement/prospectus accompanying this notice.

Table of Contents

Index to Financial Statements

By order of the Board of Directors,

|

|

|

Jon Feltheimer, Chief Executive Officer

Santa Monica, California Vancouver, British Columbia [ ] |

In accordance with LG Studios’ security procedures, all persons attending the LG Studios Special Meeting will be required to present picture identification.

Table of Contents

Index to Financial Statements

ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates by reference important business and financial information about Lions Gate Entertainment Corp. (“Lionsgate” or “LGEC”) from other documents that are not included in or delivered with this joint proxy statement/prospectus. This information is available to you without charge upon your request. You can obtain copies of the documents incorporated by reference into this document through the U.S. Securities and Exchange Commission website at www.sec.gov or by requesting them in writing or by telephone from the appropriate company at the following addresses and telephone numbers:

Lions Gate Entertainment Corp.

2700 Colorado Avenue

Santa Monica, CA 90404

(310) 449-9200

Attention: Investor Relations

or

MacKenzie Partners, Inc.

7 Penn Plaza

Suite 503

New York, NY 10001

lionsgate@mackenziepartners.com

Attention: Lionsgate Tabulation

If you are an LG Studios shareholder and have any questions about the Transactions, the LG Studios Special Meeting or the joint proxy statement/prospectus, would like additional copies of the joint proxy statement/prospectus, need a proxy card or need help voting your shares of LG Studios, please contact:

Lionsgate Studios Corp.

2700 Colorado Avenue

Santa Monica, CA 90404

(310) 449-9200

Attention: Investor Relations

or

MacKenzie Partners, Inc.

7 Penn Plaza

Suite 503

New York, NY 10001

lgstudios@mackenziepartners.com

Attention: LG Studios Tabulation

Investors may also consult the investor relations websites of Lionsgate or LG Studios for more information concerning the transactions described in this joint proxy statement/prospectus. The investor relations website of Lionsgate is https://investors.lionsgate.com and the investor relations website of LG Studios is https://investors.lionsgatestudios.com. Information included on these websites is not incorporated by reference into and does not form part of this document.

You should make any request for documents by [ ] to ensure timely delivery of the documents prior to the Lionsgate Annual General and Special Meeting and the LG Studios Special Meeting, as applicable.

To find more information, see “Where You Can Find More Information.”

Table of Contents

Index to Financial Statements

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This joint proxy statement/prospectus, which forms part of a joint registration statement on Form S-4 (File No. [ ]) filed with the U.S. Securities and Exchange Commission (the “SEC”) by New Lionsgate and Lionsgate, constitutes a prospectus of each of New Lionsgate and Lionsgate under Section 5 of the Securities Act of 1933, as amended, with respect to the New Lionsgate new common shares and Starz common shares, respectively, to be issued to shareholders of Lionsgate and LG Studios, as applicable, pursuant to the Arrangement Agreement, as further described in this document. This joint proxy statement/prospectus also constitutes a proxy statement of each of Lionsgate and LG Studios under Section 14(a) of the Securities Exchange Act of 1934, as amended. It also constitutes a notice of meeting for the Lionsgate Annual General and Special Meeting scheduled to be held on [ ] and the LG Studios Special Meeting scheduled to be held on [ ].

You should rely only on the information contained in or incorporated by reference into this joint proxy statement/prospectus. No one has been authorized to provide you with any other information regarding the transactions described in this document. This joint proxy statement/prospectus is dated [ ], 2024, and you should assume that the information contained in, or incorporated by reference into, this joint proxy statement/prospectus is accurate only as of such date. None of the mailing of this joint proxy statement/prospectus to LGEC shareholders or LG Studios shareholders, the issuance by New Lionsgate of New Lionsgate new common shares or the issuance by Starz of Starz common shares in connection with the transactions described in this joint proxy statement/prospectus, will create any implication to the contrary.

This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which, or from any person to whom, it is unlawful to make any such offer or solicitation in such jurisdiction.

Information contained in this joint proxy statement/prospectus regarding Lionsgate and its affiliates (other than LG Studios) has been provided by Lionsgate and its affiliates; information contained in this proxy statement/prospectus regarding LG Studios and its affiliates (other than Lionsgate) has been provided by LG Studios and its affiliates.

You should not construe the contents of this joint proxy statement/prospectus as legal, tax or financial advice. You should consult with your own legal, tax, financial or other professional advisors. All summaries of, and references to, the agreements governing the terms of the transactions described in this joint proxy statement/prospectus are qualified by the full copies of and complete text of such agreements, which are attached to this joint proxy statement/prospectus as annexes and/or filed as exhibits to the registration statement on Form S-4 of which this joint proxy statement/prospectus forms a part and incorporated by reference into this joint proxy statement/prospectus. All such exhibits are available on the Electronic Data Gathering Analysis and Retrieval System of the SEC website at www.sec.gov. See the section of this joint proxy statement/prospectus entitled “Where You Can Find More Information.”

Table of Contents

Index to Financial Statements

CERTAIN DEFINITIONS

Unless otherwise indicated or as the context otherwise requires, all references in this joint proxy statement/prospectus to:

“Arrangement” refers to an arrangement proposed by Lionsgate to the holders of the LGEC Class A common shares and to the holders of the LGEC Class B common shares, and by LG Studios to the shareholders of the LG Studios common shares, in each case under Part 9, Division 5 of the BC Act on the terms and subject to the conditions set forth in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of the Arrangement Agreement or the provisions of the Plan of Arrangement or made at the direction of the BC Court in the Interim Orders or Final Order with the prior written consent of Lionsgate and LG Studios, as applicable;

“Arrangement Agreement” refers to that certain Arrangement Agreement, dated [ ] 2024, as it may be amended from time to time, by and among Lionsgate, New Lionsgate, LG Studios, and LG Sirius, a by copy of which is attached hereto as Annex [ ];

“BC Act” refers to the Business Corporations Act (British Columbia);

“BC Court” refers to the Supreme Court of British Columbia;

“Competition Act” refers to the Competition Act (Canada) and the regulations made thereunder;

“Computershare” refers to Computershare Limited with offices located at 510 Burrard Street, 3rd Floor, Vancouver, BC V6C 3B9;

“Employee Matters Agreement” refers to the employee matters agreement, by and between New Lionsgate and Starz, to be entered into prior to the Arrangement Effective Time;

“Interim Orders” means the LGEC Interim Order with respect to the Arrangement for LGEC and the LG Studios Interim Order with respect to the Arrangement for LG Studios, in each case pursuant to the Arrangement Agreement;

“Investment Canada Act” refers to the Investment Canada Act (Canada) and the regulations made thereunder;

“LG Sirius” refers to LG Sirius Holdings ULC, a British Columbia unlimited liability corporation;

“LG Sirius Owned Shares” refers to all of the LG Studios common shares owned by LG Sirius at the Arrangement Effective Time;

“LG Studios” refers to Lionsgate Studios Corp., a British Columbia corporation;

“LG Studios Articles” refers to the articles of LG Studios, as amended from time to time;

“LG Studios Board” refers to the board of directors of LG Studios;

“LG Studios Business” refers to the business held by LG Studios prior to the Transactions;

“LG Studios common shares” refers to the common shares, without par value, of LG Studios;

“LG Studios Interim Order” refers to the interim order of the BC Court with respect ot the Arrangement for LG Studios made pursuant to section 291 of the BC Act, providing for, among other things, the calling and holding of the LG Studios Special Meeting;

“LG Studios Reorganization Proposal” refers to a special resolution of the holders of LG Studios common shares adopting a statutory plan of arrangement pursuant to Section 288 of the BC Act among Lionsgate, the

Table of Contents

Index to Financial Statements

shareholders of Lionsgate, LG Studios, the shareholders of LG Studios, and New Lionsgate, pursuant to which, among other things, LG Studios shareholders will receive a number of New Lionsgate new common shares equal to [ ], as more fully described in this joint proxy statement/prospectus;

“LGEC common shares” refers to LGEC Class A common shares and LGEC Class B common shares;

“LGEC Class A common shares” refers to the Class A voting common shares, without par value, of Lionsgate;

“LGEC Class B common shares” refers to the Class B non-voting common shares, without par value, of Lionsgate;

“LGEC Interim Articles” refers to the interim articles of LGEC in the form attached as Schedule [ ] to the Arrangement Agreement;

“LGEC Interim Order” refers to the interim order of the BC Court with respect to the Arrangement for LGEC made pursuant to section 291 of the BC Act, providing for, among other things, the calling and holding of the Lionsgate Annual General and Special Meeting;

“LGEC preference shares” refers to the preference shares, without par value, of Lionsgate;

“Lionsgate” or “LGEC” refers to Lions Gate Entertainment Corp., a British Columbia corporation, which, as part of the Transactions, will change its name to “Starz Entertainment Corp.”;

“Lionsgate Articles” refers to the notice of articles and the articles of Lions Gate Entertainment Corp., as amended from time to time;

“Lionsgate Board” refers to the board of directors of Lionsgate;

“Lionsgate Transactions Proposal” refers to a special resolution of the holders of LGEC Class A common shares and a special resolution of the holders of LGEC Class B common shares, in each case adopting a statutory plan of arrangement pursuant to Section 288 of the BC Act among Lionsgate, the shareholders of Lionsgate, Studios, the shareholders of Studios, and New Lionsgate, pursuant to which, among other things, (a) New Lionsgate will be separated from Lionsgate and hold the Studios Business, (b) Starz (formerly LGEC) will hold the Starz Business, (c) LGEC shareholders will receive a number of New Lionsgate new common shares equal to [ ] and all of the issued and outstanding shares of Starz and (d) LG Studios shareholders will receive a number of New Lionsgate new common shares equal to [ ], all as more fully described in this joint proxy statement/prospectus;

“New Lionsgate” refers to Lionsgate Studios Holding Corp., a British Columbia corporation;

“New Lionsgate 2024 Plan” refers to the Lionsgate Studios Corp. 2024 Performance Incentive Plan;

“New Lionsgate Articles” refers to the notice of articles and articles of New Lionsgate to be effective upon completion of the Transactions, as amended from time to time;

“New Lionsgate Board” refers to the board of directors of New Lionsgate;

“New Lionsgate Class A common shares” refers to the Class A common shares, without par value, of New Lionsgate having substantially the same powers, preferences and rights as LGEC Class A common shares;

“New Lionsgate Class B common shares” refers to the Class B common shares, without par value, of New Lionsgate having substantially the same powers, preferences and rights as LGEC Class B common shares;

Table of Contents

Index to Financial Statements

“New Lionsgate Class C preferred shares” refers to the Class C preferred shares, with one-half (1/2) of a vote per share, without par value, with a redemption price of $0.01 per share, of New Lionsgate;

“New Lionsgate Initial Exchange Shares” refers to (i) New Lionsgate Class A common shares and New Lionsgate Class C preferred shares received on an exchange of LGEC Class A common shares pursuant to the Plan of Arrangement and (ii) New Lionsgate Class B common shares and New Lionsgate Class C preferred shares received in exchange for LGEC Class B common shares pursuant to the Plan of Arrangement;

“New Lionsgate Interim Articles” refers to the interim articles of New Lionsgate in the form attached as Schedule [ ] to the Arrangement Agreement;

“New Lionsgate new common shares” refers to the common shares, without par value, of New Lionsgate, following the Initial Share Exchange;

“New Lionsgate preference shares” refers to the preference shares, without par value, of New Lionsgate, following the Initial Share Exchange;

“Plan of Arrangement” refers to the Plan of Arrangement in respect of the Arrangement, the form of which is attached hereto as Annex [ ], subject to any amendments or variations to such plan made in accordance with the Arrangement Agreement and the Plan of Arrangement or made at the direction of the BC Court in the Interim Orders or Final Order with the prior written consent of Lionsgate and Studios, as applicable;

“Prior Plans” refers to the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan, the Lions Gate Entertainment Corp. 2019 Performance Incentive Plan, the Lions Gate Entertainment Corp. 2017 Performance Incentive Plan and the Lions Gate Entertainment Corp. 2012 Performance Incentive Plan;

“Separation Agreement” refers to the separation agreement by and between New Lionsgate and Starz, to be entered into prior to the Arrangement Effective Time;

“Starz” refers to LGEC following its name change to Starz Entertainment Corp. in connection with the Transactions;

“Starz 2024 Plan” refers to the Starz Entertainment Corp. 2024 Performance Incentive Plan;

“Starz Articles” refers to the notice of articles and articles of Starz to be effective upon completion of the Transactions, as may be amended from time to time;

“Starz Board” refers to the board of directors of Starz;

“Starz Business” refers to the businesses of Lionsgate, other than the LG Studios Business, as in existence prior to the Transactions;

“Starz common shares” refers to voting common shares, each without par value, of Starz (formerly LGEC);

“Starz preference shares” refers to the preference shares, each without par value, of Starz (formerly LGEC);

“Tax Matters Agreement” refers to the tax matters agreement, by and between New Lionsgate and Starz, to be entered into prior to the Arrangement Effective Time; and

“Transition Services Agreement” refers to the transition services agreement, by and between New Lionsgate and Starz, to be entered into in connection with the Transactions.

Table of Contents

Index to Financial Statements

TABLE OF CONTENTS

| Page | ||||

QUESTIONS AND ANSWERS ABOUT THE LIONSGATE ANNUAL GENERAL AND SPECIAL MEETING | vii | |||

| xv | ||||

| xxi | ||||

| 1 | ||||

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

Interests of Lionsgate Directors and Officers in the Transactions | 15 | |||

Interests of LG Studios Directors and Officers in the Transactions | 15 | |||

| 16 | ||||

Opinions of Financial Advisors to the Lionsgate Special Committee | 16 | |||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 37 | ||||

| 52 | ||||

Risks Related to New Lionsgate New Common Shares and Starz Common Shares | 60 | |||

| 63 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 67 | ||||

Date, Time and Place of the Lionsgate Annual General and Special Meeting | 67 | |||

| 67 | ||||

Lionsgate Record Date; Outstanding Shares; Shares Entitled to Vote | 68 | |||

| 68 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 72 | ||||

-i-

Table of Contents

Index to Financial Statements

-ii-

Table of Contents

Index to Financial Statements

| Page | ||||

| 132 | ||||

| 134 | ||||

When and How LG Studios Shareholders Will Receive Their Shares | 134 | |||

| 135 | ||||

| 137 | ||||

| 137 | ||||

| 138 | ||||

Markets for New Lionsgate New Common Shares and Starz Common Shares | 138 | |||

| 138 | ||||

| 139 | ||||

| 142 | ||||

Interests of Lionsgate Directors and Officers in the Transactions | 142 | |||

Interests of LG Studios Directors and Officers in the Transactions | 143 | |||

| 143 | ||||

| 144 | ||||

| 145 | ||||

| 145 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION OF NEW LIONSGATE | 147 | |||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION OF STARZ | 167 | |||

| 178 | ||||

| 178 | ||||

| 178 | ||||

| 179 | ||||

| 187 | ||||

| 187 | ||||

| 187 | ||||

| 187 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

Environmental and Social Responsibility and Human Capital Management | 188 | |||

| 188 | ||||

| 188 | ||||

| 189 | ||||

| 189 | ||||

| 189 | ||||

| 190 | ||||

Management’s Discussion & Analysis of Financial Condition and Results of Operations of New Lionsgate | 191 | |||

| 248 | ||||

| 248 | ||||

| 252 | ||||

| 255 | ||||

Federal Income Tax Consequences of Awards under the New Lionsgate 2024 Plan | 262 | |||

| 262 | ||||

-iii-

Table of Contents

Index to Financial Statements

| Page | ||||

| 262 | ||||

| 263 | ||||

| 264 | ||||

| 268 | ||||

| 268 | ||||

| 268 | ||||

| 270 | ||||

| 270 | ||||

| 271 | ||||

| 271 | ||||

| 275 | ||||

| 275 | ||||

| 275 | ||||

| 276 | ||||

| 276 | ||||

| 276 | ||||

| 276 | ||||

| 276 | ||||

Environmental and Social Responsibility and Human Capital Management | 276 | |||

| 276 | ||||

| 277 | ||||

| 277 | ||||

| 277 | ||||

| 277 | ||||

| 277 | ||||

| 277 | ||||

Management’s Discussion & Analysis of Financial Condition and Results of Operations of Starz | 279 | |||

| 321 | ||||

| 322 | ||||

| 322 | ||||

| 325 | ||||

Federal Income Tax Consequences of Awards under the Starz 2024 Plan | 330 | |||

| 331 | ||||

| 331 | ||||

| 335 | ||||

| 335 | ||||

| 336 | ||||

| 336 | ||||

ADDITIONAL LIONSGATE ANNUAL GENERAL AND SPECIAL MEETING MATTERS | 337 | |||

| 337 | ||||

| 338 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 340 | ||||

| 341 | ||||

| 341 | ||||

| 341 | ||||

| 341 | ||||

| 341 | ||||

-iv-

Table of Contents

Index to Financial Statements

| Page | ||||

| 342 | ||||

| 342 | ||||

| 342 | ||||

| 342 | ||||

| 342 | ||||

Indebtedness of Directors and Executive Officers of Lionsgate | 342 | |||

Securities Issued or Sold in the 12-Month Period Preceding the Proxy-Statement | 343 | |||

| 344 | ||||

| 348 | ||||

| 349 | ||||

| 349 | ||||

| 350 | ||||

| 350 | ||||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTIONS FOR LIONSGATE SHAREHOLDERS | 351 | |||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTIONS FOR LG STUDIOS SHAREHOLDERS | 355 | |||

MATERIAL CANADIAN FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTIONS FOR LIONSGATE SHAREHOLDERS | 358 | |||

MATERIAL CANADIAN FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTIONS FOR LG STUDIOS SHAREHOLDERS | 365 | |||

| 371 | ||||

| 373 | ||||

| 374 | ||||

| 375 | ||||

| 377 | ||||

| 378 | ||||

| 378 | ||||

| 378 | ||||

| 378 | ||||

| 379 | ||||

| 379 | ||||

| 379 | ||||

Limitation on Liability of Directors and Indemnification of Directors and Officers | 379 | |||

| 380 | ||||

| 382 | ||||

| 382 | ||||

| 383 | ||||

| 384 | ||||

| 384 | ||||

| 384 | ||||

| 384 | ||||

| 385 | ||||

| 385 | ||||

| 385 | ||||

Limitation on Liability of Directors and Indemnification of Directors and Officers | 385 | |||

| 386 | ||||

| 388 | ||||

| 388 | ||||

| 388 | ||||

-v-

Table of Contents

Index to Financial Statements

| Page | ||||

| 389 | ||||

| 395 | ||||

| 397 | ||||

| 397 | ||||

| 397 | ||||

| 397 | ||||

| 398 | ||||

| 399 | ||||

| 400 | ||||

| 401 | ||||

| 402 | ||||

| F-1 | ||||

| II-1 | ||||

| II-6 | ||||

-vi-

Table of Contents

Index to Financial Statements

QUESTIONS AND ANSWERS ABOUT THE LIONSGATE ANNUAL GENERAL AND SPECIAL MEETING

The following section provides brief answers to certain questions that you may have regarding the Lionsgate Annual General and Special Meeting. You should carefully read this entire joint proxy statement/prospectus, including its Annexes and the documents incorporated by reference into this joint proxy statement/prospectus, because the information in this section may not provide all of the information that might be important to you. Additional important information is contained in the Annexes to, and the documents incorporated by reference into, this joint proxy statement/prospectus. For a description of, and instructions as to how to obtain, this information, see the section of this joint proxy statement/prospectus entitled “Where You Can Find More Information.”

| Q: | What are the proposals on which LGEC shareholders are being asked to vote? |

| A: | LGEC shareholders are being asked to vote on the following proposals: |

| 1. | the Lionsgate Transactions Proposal; |

| 2. | a non-binding advisory vote on the Lionsgate Advisory Organizational Documents Proposals; |

| 3. | election of 12 directors; |

| 4. | re-appointment of Ernst & Young LLP as Lionsgate’s independent registered public accounting firm for the fiscal year ending March 31, 2025 and authorization of the Audit & Risk Committee of the Lionsgate Board to fix their remuneration; |

| 5. | a non-binding advisory vote on executive compensation; |

| 6. | assumption by New Lionsgate of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan, as amended and restated as the New Lionsgate 2024 Plan; and |

| 7. | approving the Starz 2024 Plan. |

| Q: | Who is entitled to vote at the Annual General and Special Meeting? |

| A: | Holders of record of LGEC Class A common shares at [ ] (Eastern Time) on [ ] (the “Record Date”) are entitled to receive notice of the Lionsgate Annual General and Special Meeting and to vote the LGEC Class A common shares that they held on the Record Date at the Lionsgate Annual General and Special Meeting, or any continuations, adjournments or postponements thereof, on matters to be considered by the holders of LGEC Class A common shares. Each outstanding LGEC Class A common share entitles its holder to cast one vote on each matter to be voted upon. As of the Record Date, [ ] LGEC Class A common shares held by approximately [ ] shareholders of record were outstanding and entitled to vote. |

Holders of record of LGEC Class B common shares on the Record Date are entitled to receive notice of the Lionsgate Annual General and Special Meeting and, solely with respect to the Lionsgate Transactions Proposal, to vote the LGEC Class B common shares that they held on the Record Date at the Lionsgate Annual General and Special Meeting, or any continuations, adjournments or postponements thereof. Holders of LGEC Class B common shares are not entitled to vote on the matters to be presented at the Lionsgate Annual General and Special Meeting other than the Lionsgate Transactions Proposal. Each outstanding LGEC Class B common share entitles its holder to cast one vote solely with respect to the Lionsgate Transactions Proposal. As of the Record Date, [ ] LGEC Class B common shares held by approximately [ ] shareholders of record were outstanding and entitled to vote.

Each holder of record of LGEC Class A common shares and LGEC Class B common shares has the right to appoint a person or company to represent such holder to vote in person at the Lionsgate Annual General and Special Meeting other than the persons designated in the form of proxy. See “—How do I vote at the Lionsgate Annual General and Special Meeting?” below.

-vii-

Table of Contents

Index to Financial Statements

| Q: | Who can attend and vote at the Lionsgate Annual General and Special Meeting? |

| A: | Only registered shareholders of Lionsgate or the persons they appoint as their proxies are permitted to attend the Lionsgate Annual General and Special Meeting. Most shareholders of Lionsgate are “non-registered” shareholders because the LGEC common shares they own are not registered in their names but are, instead, registered in the name of the brokerage firm, bank or trust company through which they hold such shares. LGEC common shares beneficially owned by a “non-registered” shareholder are registered either: (i) in the name of an intermediary that the “non-registered” shareholder deals with in respect of such shares (which may be, among others, a bank, trust company, securities dealer or broker or trustee or administrator of self-administered Registered Retirement Savings Plans, Registered Retirement Income Funds, Registered Education Savings Plans and similar plans); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited or The Depository Trust & Clearing Corporation) of which such intermediary is a participant. In accordance with applicable securities law requirements, Lionsgate will have distributed copies of the notice of the Lionsgate Annual General and Special Meeting and this joint proxy statement/prospectus and related meeting materials to such clearing agencies and intermediaries for distribution to “non-registered” shareholders. |

Such “non-registered” shareholders are able to access the notice of the Lionsgate Annual General and Special Meeting and vote their shares by following the instructions provided by their intermediaries. If shareholders have requested printed copies, intermediaries are required to forward this joint proxy statement/prospectus and related meeting materials to such “non-registered” shareholders, unless such shareholder has waived the right to receive them. Intermediaries often use service companies to forward notices and proxy materials to “non-registered” shareholders. Generally, “non-registered” shareholders who have not waived the right to receive the notice of the Lionsgate Annual General and Special Meeting and who have requested a printed copy of this joint proxy statement/prospectus and related meeting materials will either:

| i. | be given a voting instruction form which is not signed by the intermediary and which, when properly completed and signed by the shareholder and returned to the intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the intermediary must follow. Typically, the voting instruction form will consist of a one-page printed form. Sometimes, instead of the one-page pre-printed form, the voting instruction form will consist of a regular printed form accompanied by a page of instructions which contains a removable label with a bar code and other information. In order for the form of proxy to validly constitute a voting instruction form, the shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the intermediary or its service company in accordance with the instructions of the intermediary or its service company; or |

| ii. | be given a form of proxy which has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted to the number of shares beneficially owned by the shareholder but which is otherwise not completed by the intermediary. Because the intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the shareholder when submitting the proxy. In this case, the holder who wishes to submit a proxy should properly complete the form of proxy and deposit it with Lionsgate, c/o MacKenzie Partners, Inc. Attention: Lionsgate Tabulation, 7 Penn Plaza, Suite 503, New York, NY 10001. |

In either case, the purpose of these procedures is to permit “non-registered” shareholders to directly vote the LGEC common shares they beneficially own. Should a “non-registered” shareholder who receives one of the above forms wish to vote at the Lionsgate Annual General and Special Meeting in person (or have another person attend and vote on their behalf), the “non-registered” shareholder should request a legal proxy from their intermediary. Instructions for obtaining legal proxies may be found on the voting instruction form. If you have any questions about voting your shares, please call MacKenzie Partners, Inc. at (800) 322-2885 or (212) 929-5500 or e-mail lionsgate@mackenziepartners.com.

-viii-

Table of Contents

Index to Financial Statements

A “non-registered” shareholder may revoke a voting instruction form or request to receive this joint proxy statement/prospectus and related meeting materials and to vote, which has been given to an intermediary, at any time by written notice to the intermediary, provided that an intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive this joint proxy statement/prospectus and related meeting materials and to vote, which is not received by the intermediary in a timely manner in advance of the Lionsgate Annual General and Special Meeting.

| Q: | What constitutes quorum? |

| A: | A quorum is necessary to hold a valid meeting of shareholders. The quorum for the Lionsgate Annual General and Special Meeting is: (i) for LGEC Class A common shares, two (2) persons who are, or who represent by proxy, registered shareholders who, in the aggregate, hold at least 10% of the issued LGEC Class A common shares entitled to be voted on matters presented to the holders of LGEC Class A common shares at the Lionsgate Annual General and Special Meeting, and (ii) for LGEC Class B common shares, two (2) persons who are, or who represent by proxy, registered shareholders who, in the aggregate, hold at least 10% of the issued LGEC Class B common shares entitled to be voted on matters to be presented to holders of LGEC Class B common shares. |

Abstentions will be included in determining the number of shares present at the Lionsgate Annual General and Special meeting for the purpose of determining the presence of a quorum. Broker non-votes (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter), if any, will also be counted in determining the number of shares present at the Lionsgate Annual General and Special Meeting for the purpose of determining the presence of a quorum, because it is expected that at least one proposal to be voted on at the Lionsgate Annual General and Special Meeting will be a “routine” matter.

| Q: | How do I vote at the Lionsgate Annual General and Special Meeting? |

| A: | If you are a holder of record of LGEC Class A common shares, you have the right to vote in person at the Lionsgate Annual General and Special Meeting. If you are a holder of record of LGEC Class B common shares, you have the right to vote in person, solely with respect to the Lionsgate Transactions Proposal, at the Lionsgate Annual General and Special Meeting. |

If you choose to do so, you can vote using the ballot that will be provided at the Lionsgate Annual General and Special Meeting, or, if you received printed copies of this joint proxy statement/prospectus and related meeting materials by mail, you can complete, sign and date the proxy card enclosed with this joint proxy statement/prospectus and submit it at the Lionsgate Annual General and Special Meeting. If you are a “non-registered” shareholder, you may not vote your shares in person at the Lionsgate Annual General and Special Meeting unless you obtain a “legal proxy” from the bank, broker, trustee or other nominee that holds your shares, giving you the right to vote LGEC Class A common shares or, solely with respect to the Lionsgate Transactions Proposal, LGEC Class B common shares, as applicable, at the Lionsgate Annual General and Special Meeting.

Even if you plan to attend the Lionsgate Annual General and Special Meeting, Lionsgate recommends that you submit your proxy or voting instructions in advance of the Lionsgate Annual General and Special Meeting as described in this joint proxy statement/prospectus, so that your vote will be counted if you later decide not to attend the Lionsgate Annual General and Special Meeting.

At the Lionsgate Annual General and Special Meeting, a representative from Broadridge Financial Solutions, Inc. (“Broadridge”) will be appointed to act as scrutineer. The scrutineer will determine the number of shares of each class of LGEC common shares represented at the Lionsgate Annual General and Special Meeting, the existence of a quorum and the validity of proxies, will count the votes and ballots, if required, and will determine and report the results to Lionsgate.

-ix-

Table of Contents

Index to Financial Statements

| Q: | How can I vote my LGEC common shares without attending the Lionsgate Annual General and Special Meeting? |

| A: | Whether you are a holder of record or a “non-registered” shareholder, you may direct how your LGEC Class A common shares or LGEC Class B common shares, as applicable, are voted without attending the Lionsgate Annual General and Special Meeting. |

If you are a holder of record, you may submit a proxy to authorize how your shares are to be voted at the Lionsgate Annual General and Special Meeting. You can submit a proxy over the Internet, by mail or by telephone pursuant to the instructions provided in the proxy card enclosed with this joint proxy statement/prospectus. If you are a “non-registered” shareholder, you may also submit voting instructions by Internet, telephone, tablet or smartphone, or mail by following the instructions provided in the voting instruction form sent by your intermediary. If you do not fill a name in the blank space in the form of proxy, the persons named in the form of proxy are appointed to act as your proxy holder. Those persons are directors and/or officers of Lionsgate. If you are a holder of record, your proxy must be received by telephone or the Internet by [ ] (Eastern Time) on [ ] in order for your shares to be voted at the Lionsgate Annual General and Special Meeting. If you are a “non-registered” shareholder, please comply with the deadlines included in the voting instructions provided by the intermediary that holds your shares.

Submitting your proxy or voting instructions over the Internet, by telephone, tablet or smartphone or by mail will not affect your right to vote in person should you decide to attend the Lionsgate Annual General and Special Meeting, although “non-registered” shareholder must obtain a “legal proxy” from the intermediary that holds their shares giving them the right to vote the shares in person at the Lionsgate Annual General and Special Meeting.

| Q: | How does the Lionsgate Board recommend that I vote at the Lionsgate Annual General and Special Meeting? |

| A: | The Lionsgate Board has approved and recommends that all LGEC shareholders vote: |

“FOR” the Lionsgate Transaction Proposal;

“FOR” the Lionsgate Advisory Organizational Documents Proposals;

“FOR” the election of each of the nominated directors;

“FOR” the re-appointment of Ernst & Young LLP as Lionsgate’s independent registered public accounting firm and authorization of the Audit & Risk Committee of the Lionsgate Board to fix their remuneration;

“FOR” the proposal regarding a non-binding advisory vote to approve executive compensation;

“FOR” the approval of the assumption by New Lionsgate of the Lions Gate Entertainment Corp. 2023 Performance Incentive Plan, as amended and restated as the New Lionsgate 2024 Plan; and

“FOR” the approval of the Starz 2024 Plan.

| Q: | What votes are required to approve the proposals on which LGEC shareholders are being asked to vote? |

| A: | The votes required for each proposal are as follows: |

Proposal No. 1: Approval of the Lionsgate Transactions Proposal requires (i) the affirmative vote of the holders of at least two-thirds (66 2/3%) of the votes cast with respect to LGEC Class A common shares that were present or represented by proxy at the Lionsgate Annual General and Special Meeting in respect of the Lionsgate Transactions Proposal, voting as a separate class, (ii) the affirmative vote of the holders of at least two-thirds (66 2/3%) of the votes cast with respect to LGEC Class B common shares that were present or represented by proxy at the Lionsgate Annual Geeral and Special Meeting in respect of the Lionsgate

-x-

Table of Contents

Index to Financial Statements

Transactions Proposal, voting as a separate class, and (iii) a simple majority of the votes cast by the holders of LGEC Class B common shares, voting as a separate class, excluding the votes cast by certain holders of LGEC Class B common shares that also hold LGEC Class A common shares and that are required to be excluded pursuant to MI 61-101. For more information, see, “Canadian Securities Law Matters - MI 61-101.” LGEC Class A common shares and LGEC Class B common shares not present, and shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of Proposal No. 1.

Proposal No. 2: The affirmative vote of two-thirds (66 2/3%) of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting is required for the non-binding advisory vote to approve governance provisions each of which will be contained in the New Lionsgate Articles and the Starz Articles, respectively if the Transactions are completed. Regardless of the outcome of the non-binding advisory vote on the Lionsgate Advisory Organizational Documents Proposals, the New Lionsgate Articles will be adopted by New Lionsgate and the Starz Articles will be adopted by Starz, in each case, as part of the Transactions, assuming the approval of the Lionsgate Transactions Proposal and the completion of the Transactions. LGEC Class A common shares not present, and shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of Proposal No. 2.

Proposal No. 3: Directors are elected by plurality, meaning that the 12 nominees receiving the largest number of votes cast by holders of LGEC Class A common shares (votes “FOR”) will be elected. Shareholders are able to vote “FOR”, “WITHHELD”, and “ABSTAIN” for each nominee. There is no minimum or maximum number of shares that must be cast for, or withheld from, any candidate nominated for election in order for that nominee to be elected. The 12 nominees receiving the greatest number of “FOR” votes will be eligible to form the Lionsgate Board following the Lionsgate Annual General and Special Meeting. Shareholders are not permitted to cumulate their LGEC Class A common shares for purposes of electing directors.

Proposal No. 4: The affirmative vote of at least a majority of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting is required for the re-appointment of Ernst & Young LLP as Lionsgate’s independent registered public accounting firm and for the holders of LGEC Class A common shares to authorize the Audit & Risk Committee of the Lionsgate Board to fix their remuneration. Note that, because this proposal is considered a routine matter, if your LGEC Class A common shares are held by a broker or nominee, such broker or nominee will have authority to exercise his or her discretion to vote your LGEC Class A common shares on Proposal No. 4 if you do not provide instructions to him or her regarding how you would like your LGEC Class A common shares to be voted. Abstentions are not treated as votes cast and are not counted in the determination of the number of votes necessary for the reappointment of Ernst & Young LLP as Lionsgate’s independent registered public accounting firm.

Proposal No. 5: The affirmative vote of at least a majority of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting is required for the non-binding advisory vote to approve executive compensation. Notwithstanding the vote required, please be advised that Proposal No. 5 is advisory only and is not binding on Lionsgate. LGEC Class A common shares not present, and shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of Proposal No. 5.

Proposal No. 6: The affirmative vote of at least a majority of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting is required for the assumption by New Lionsgate of the Lionsgate Gate Entertainment Corp. 2023 Performance Incentive Plan, as amended and restated as the New Lionsgate 2024 Plan. LGEC Class A common shares not present, and shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of Proposal No. 6.

-xi-

Table of Contents

Index to Financial Statements

Proposal No. 7: The affirmative vote of at least a majority of the votes cast by holders of LGEC Class A common shares present or represented by proxy at the Lionsgate Annual General and Special Meeting is required for approval of the Starz 2024 Plan. LGEC Class A common shares not present, and shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of Proposal No. 7.

| Q: | Could other matters be decided at the Lionsgate Annual General and Special Meeting? |

| A: | As of the date of this joint proxy statement/prospectus, the Lionsgate Board does not know of any other matters that may be presented for action at the Lionsgate Annual General and Special Meeting. Should any other business come before the Lionsgate Annual General and Special Meeting, the persons named on the enclosed proxy will, as stated therein, have discretionary authority to vote the shares represented by such proxies in accordance with the recommendation of the Lionsgate Board or, if no recommendation is given, in accordance with their best judgment. |

| Q: | What shares are included on the enclosed proxy card? |

| A: | If you are a shareholder of record, you will receive one proxy card from Broadridge for all of the shares of Lionsgate that you hold directly. If you hold Lionsgate shares in street name through one or more banks, brokers and/or other shareholders of record, you will receive proxy materials, together with voting instructions and information regarding the consolidation of your votes, from the third party or parties through which you hold your Lionsgate shares. If you are a holder of record and hold additional Lionsgate shares in street name, you will receive proxy materials from Broadridge and the third party or parties through which you hold your Lionsgate shares. |

| Q: | What do I need to do now to vote at the Lionsgate Annual General and Special Meeting? |

| A: | The Lionsgate Board is soliciting proxies for use at the Lionsgate Annual General and Special Meeting. LGEC shareholders may submit proxies to instruct the designated proxies to vote their shares, before the date of the Lionsgate Annual General and Special Meeting, in any of three ways: over the Internet, by mail or by telephone pursuant to the instructions provided in the proxy card enclosed with this joint proxy statement/prospectus. If you are a “non-registered” shareholder, you may also submit voting instructions by Internet, telephone, tablet or smartphone, or mail by following the instructions provided in the voting instruction form sent by your intermediary. If you do not fill a name in the blank space in the form of proxy, the persons named in the form of proxy are appointed to act as your proxy holder. Those persons are directors and/or officers of Lionsgate. If you are a holder of record, your proxy must be received by telephone or the Internet by [ ] (Eastern Time) on [ ] in order for your shares to be voted at the Lionsgate Annual General and Special Meeting. If you are a “non-registered” shareholder, please comply with the deadlines included in the voting instructions provided by the intermediary that holds your shares. |

Submitting your proxy or voting instructions over the Internet, by telephone, tablet or smartphone or by mail will not affect your right to vote in person should you decide to attend the Lionsgate Annual General and Special Meeting, although “non-registered” shareholders must obtain a “legal proxy” from the intermediary that holds their shares giving them the right to vote the shares in person at the Lionsgate Annual General and Special Meeting.

| Q: | Can I change my vote or revoke my proxy? |

| A: | Yes. If you are a holder of record, even after you have submitted your proxy, you may change your vote by submitting a duly executed proxy bearing a later date in the manner and within the time described above under “What do I need to do now to vote at the Lionsgate Annual General and Special Meeting?” (your |

-xii-

Table of Contents

Index to Financial Statements

| latest voting instructions will be followed). If you are a non-registered shareholder, you should contact your Intermediary to find out how to change or revoke your voting instructions within the time described above under “What do I need to do now to vote at the Annual General and Special Meeting?” If you are a holder of record, you may also revoke a previously deposited proxy (i) by an instrument in writing that is received by or at the Lionsgate Annual General and Special Meeting prior to the closing of the polls, (ii) by an instrument in writing provided to the chair of the Lionsgate Annual General and Special Meeting at the Lionsgate Annual General and Special Meeting or any continuation, postponement or adjournment thereof, or (iii) in any other manner permitted by law. The powers of the proxy holders will be suspended if you attend the Lionsgate Annual General and Special Meeting in person and so request, although attendance at the Lionsgate Annual General and Special Meeting will not by itself revoke a previously granted proxy. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Lionsgate or to third parties, except: |

| • | As necessary to meet applicable legal requirements; |

| • | To allow for the tabulation and certification of votes; and |

| • | To facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to Lionsgate’s management and the Lionsgate Board.

| Q: | Who pays for the preparation of this joint proxy statement/prospectus? |

| A: | Lionsgate will pay the cost of proxy solicitation, including the cost of preparing, assembling and mailing this joint proxy statement/prospectus. In addition to the use of mail, Lionsgate’s employees and advisors may solicit proxies personally and by telephone, facsimile, courier service, telegraph, the Internet, e-mail, newspapers and other publications of general distribution. Lionsgate’s employees will receive no compensation for soliciting proxies other than their regular salaries. Lionsgate may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of this joint proxy statement/prospectus to their principals and to request authority for the execution of proxies, and Lionsgate will reimburse those persons for their reasonable out-of-pocket expenses incurred in connection with these activities. Lionsgate will solely compensate independent third-party agents that are not affiliated with Lionsgate but who solicit proxies. Lionsgate has retained MacKenzie Partners, Inc., a third-party solicitation firm, to assist in the distribution of the proxy statement/prospectus and solicitation of proxies on our behalf for an estimated fee of $[ ] plus reimbursement of certain out-of-pocket expenses. |

| Q: | May I propose actions or recommend director nominees for consideration at next year’s annual general meeting of shareholders? |

| A: | Yes. Under U.S. laws, for your proposal or recommendation for director nominees to be considered for inclusion in the proxy statement for next year’s annual general meeting (which will be the annual meeting for Starz if the Transactions are completed), Lionsgate (or Starz, if the Transactions are completed) must receive your written proposal no later than [ ], 2025. You should also be aware that any proposal made pursuant to Rule 14a-8 promulgated under the Exchange Act regarding inclusion of shareholder proposals in company-sponsored proxy materials must comply with the provisions of Rule 14a-8. |