Exhibit 99.2

Knight and Swift to Combine Creating North America’s Premier Truckload Carrier April 10, 2017

1 Forward Looking Statements This communication includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 199 5. Use of the words “may,” “will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,” “potential,” “expects,” “plans,” “seeks,” “intends,” “evaluates,” “pu rsu es,” “anticipates,” “continues,” “designs,” “impacts,” “affects,” “forecasts,” “target,” “outlook,” “initiative,” “objective,” “designed,” “priorities,” “goal,” or the negative of tho se words or other similar expressions is intended to identify forward - looking statements that represent our current judgment about possible future events. These forward - looking stat ements may include statements with respect to, among other things, the proposed Merger, including the expected timing of completion of the Merger; the benefits of the Merger; the combined company’s plans, objectives and expectations; future financial and operating results; and other statements that are not historical facts. These forward - looking statements are based on numerous assumptions (some of which may prove to be incorrect) and are subject to risks, uncertainties and other factors that could cause actual results and events to differ materially from those expressed or implied by these forward - looking stateme nts. In addition to the risks, uncertainties and other factors previously disclosed in Swift’s and Knight’s reports filed with the Securities and Exchange Commission (“SE C”) and those identified elsewhere in this communication, the following risks, uncertainties and other factors, among others, could cause actual results to differ mater ial ly from forward - looking statements and historical performance: the risk that the Merger may not be completed in a timely manner or at all due to the failure to obta in the approval of Swift’s or Knight’s stockholders or the failure to satisfy other conditions to completion of the Merger; the occurrence of any event, change or other circumst anc e that could give rise to the termination of the Merger Agreement; the outcome of any legal proceeding that may be instituted against Swift, Knight or others following the an nou ncement of the Merger; the amount of the costs, fees, expenses and charges related to the Merger; the risk that the benefits of the Merger, including synergies, may n ot be fully realized or may take longer to realize than expected; the risk that the Merger may not advance the combined company’s business strategy; the risk that the combined com pany may experience difficulty integrating Swift’s and Knight’s employees or operations; the potential diversion of Swift’s and Knight’s management’s attent ion resulting from the proposed Merger; economic conditions, including future recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries in which Swift or Knight has a significant concentration of customers; increasing competition from trucking, rail, intermodal, and bro ker age competitors; increases in driver compensation to the extent not offset by increases in freight rates and difficulties in driver recruitment and retention; add iti onal risks arising from contractual agreements with owner - operators that do not exist Swift or Knight drivers; the loss of key employees or inability to identify and recruit n ew employees Swift’s and Knight’s dependence on third parties for intermodal and brokerage business; potential failure in computer or communications systems; the conseque nce s of any armed conflict involving, or terrorist attack against, the United States; inflationary, deflationary and other general economic trends; seasonal factors s uch as severe weather conditions that increase operating costs; the possible re - classification of owner - operators as employees; changes in rules or legislation by the National Labor Relations Board, Congress, or states and/or union organizing efforts; government regulation with respect to captive insurance companies; uncertainties and risks a sso ciated with operations in Mexico; significant reduction in, or termination of, Swift’s or Knight’s trucking services by a key customer; Swift’s and Knight’s s ign ificant ongoing capital requirements; volatility in the price or availability of fuel, as well as Swift’s and Knight’s ability to recover fuel prices through a fuel surcharge pr ogr am; fluctuations in new and used equipment prices or replacement costs, and the potential failure of manufacturers to meet their sale and trade - back obligations; the impact that the combined company’s leverage may have on the way it operates its business and its ability to services debt, including compliance with its debt covenants; restricti ons contained in its debt agreements; adverse impacts of insuring risk through captive insurance companies, including the need to provide restricted cash and similar colla ter al for anticipated losses; potential volatility or decrease in the amount of earnings as a result of the claims exposure through captive insurance companies and third - party insura nce; goodwill impairment; fluctuations in interest rates; the outcome of pending or future litigation; the effects of losses from natural catastrophes in excess of in sur ance coverage; and the potential impact of announcement of the proposed Merger or consummation of the proposed Merger on relationships, including with employees, custom ers and competitors. Actual results may differ materially from those projected in the forward - looking statements. Neither Swift nor Knight undertakes to update any forward - looking statements. Non - GAAP Financial Metrics The attached charts include information that does not conform to generally accepted accounting principles (GAAP). Management of Knight Transportation, Inc. (“Knight”) and Swift Transportation Company (“Swift”) believe that an analysis of this data is meaningful to investors because it provid es insight with respect to comparisons of the ongoing operating results of each of Knight and Swift. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consistent with similar measures provided by other companies. This data should be read in conjunction wit h p reviously published reports by Knight and Swift on their respective Forms 10 - K, 10 - Q, and 8 - K. These reports, along with reconciliations of non - GAAP measures to GAAP are available on Knight and Swift’s respective websites. Reconciliations of non - GAAP measures to GAAP are also included with this presentation.

Additional Information and Where to Find It Certain Information Regarding Participants No Offer or Solicitation Investors and security holders are urged to carefully review and consider each of Swift’s and Knight’s public filings with th e S EC, including but not limited to their Annual Reports on Form 10 - K, their proxy statements, their Current Reports on Form 8 - K and their Quarterly Reports on Form 10 - Q. The documents filed by Swift with the SEC may be obtained free of charge at Swift’s website at http://investor.swifttrans.com/ or at the SE C’s website at www.sec.gov. These documents may also be obtained free of charge from Swift by requesting them in writing to 2200 S. 75th Ave., Phoenix, A Z 8 5043, or by telephone at 1 - 602 - 269 - 9700. The documents filed by Knight with the SEC may be obtained free of charge at Knight’s website at www.knighttr ans.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Knight by requesting them in writing t o 2 0002 N 19th Ave, Phoenix, AZ 85027, or by telephone at 1 - 602 - 606 - 6315. In connection with the proposed Merger, Swift intends to file a registration statement on Form S - 4 with the SEC which will inclu de a joint proxy statement of Knight and Swift and a prospectus of Swift, and each party will file other documents regarding the proposed Merger with the S EC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SWIFTAND KNIGHT ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. A definitive joint proxy statement/prospectus will be sent to t he shareholders of each party seeking the required shareholder approval. Investors and security holders will be able to obtain t he registration statement and the joint proxy statement/prospectus free of charge from the SEC’s website or from Swift or Knight as described above. The co nte nts of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/ pro spectus. Swift, Knight and their respective directors and executive officers may be deemed participants in the solicitation of proxies in connection with the proposed Merger. You can find information about Swift’s directors and executive officers in its definitive proxy statement for the 20 16 Annual Meeting of Stockholders, which was filed with the SEC on April 22, 2016, and in other documents filed with the SEC by Swift and its dire cto rs and executive officers. You can find information about Knight’s directors and executive officers in its definitive proxy statement for the 2017 Annua l M eeting of Stockholders, which was filed with the SEC on March 31, 2017, and in other documents filed with the SEC by Knight and its directors and executive of ficers. Additional information regarding the interests of these directors and executive officers in the Merger will be included in the registrat ion statement, joint proxy statement/prospectus or other documents filed with the SEC if any when they become available. You may obtain these documents (wh en they become available) free of charge at the SEC’s web site at www.sec.gov and from Swift or Knight as described above. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be an y sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec uri ties laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Se cur ities Act of 1933, as amended. 2

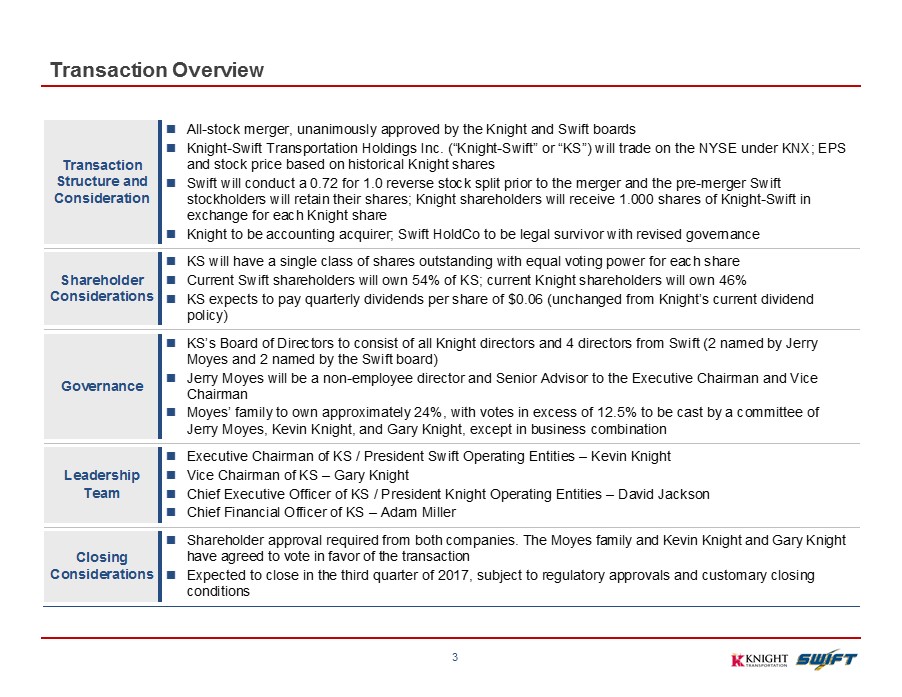

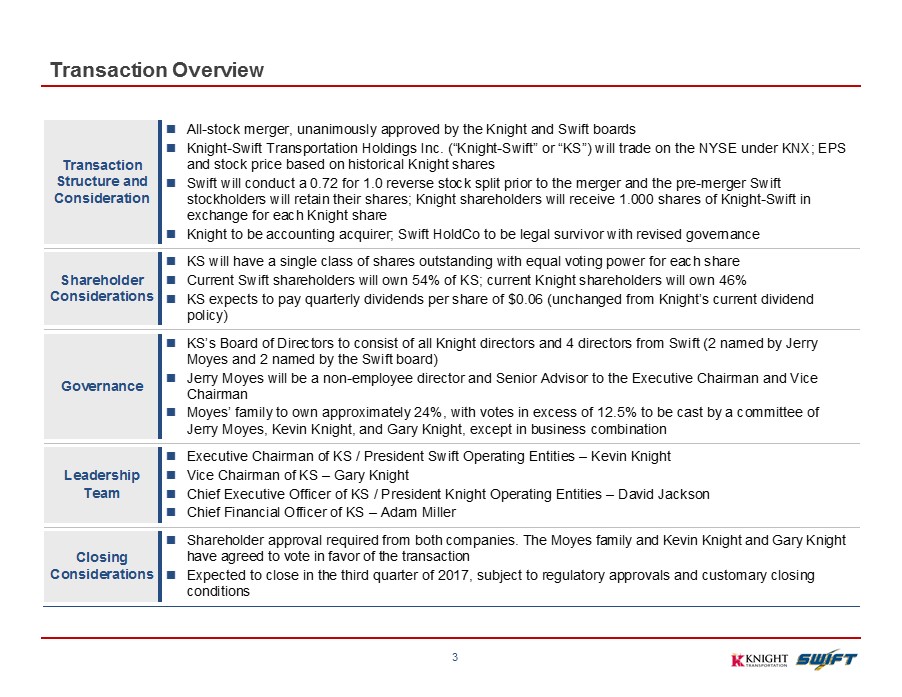

Transaction Overview 3 Transaction Structure and Consideration All-stock merger, unanimously approved by the Knight and Swift boards Knight-Swift Transportation Holdings Inc. (“Knight-Swift” or “KS”) will trade on the NYSE under KNX; EPS and stock price based on historical Knight shares Swift will conduct a 0.72 for 1.0 reverse stock split prior to the merger and the pre-merger Swift stockholders will retain their shares; Knight shareholders will receive 1.000 shares of Knight-Swift in exchange for each Knight share Knight to be accounting acquirer; Swift HoldCo to be legal survivor with revised governance Shareholder Considerations KS will have a single class of shares outstanding with equal voting power for each share Current Swift shareholders will own 54% of KS; current Knight shareholders will own 46% KS expects to pay quarterly dividends per share of $0.06 (unchanged from Knight’s current dividend policy) Governance KS’s Board of Directors to consist of all Knight directors and 4 directors from Swift (2 named by Jerry Moyes and 2 named by the Swift board) Jerry Moyes will be a non-employee director and Senior Advisor to the Executive Chairman and Vice Chairman Moyes’ family to own approximately 24%, with votes in excess of 12.5% to be cast by a committee of Jerry Moyes, Kevin Knight, and Gary Knight, except in business combination Leadership Team Executive Chairman of KS / President Swift Operating Entities – Kevin Knight Vice Chairman of KS – Gary Knight Chief Executive Officer of KS / President Knight Operating Entities – David Jackson Chief Financial Officer of KS – Adam Miller Closing Considerations Shareholder approval required from both companies. The Moyes family and Kevin Knight and Gary Knight have agreed to vote in favor of the transaction Expected to close in the third quarter of 2017, subject to regulatory approvals and customary closing conditions

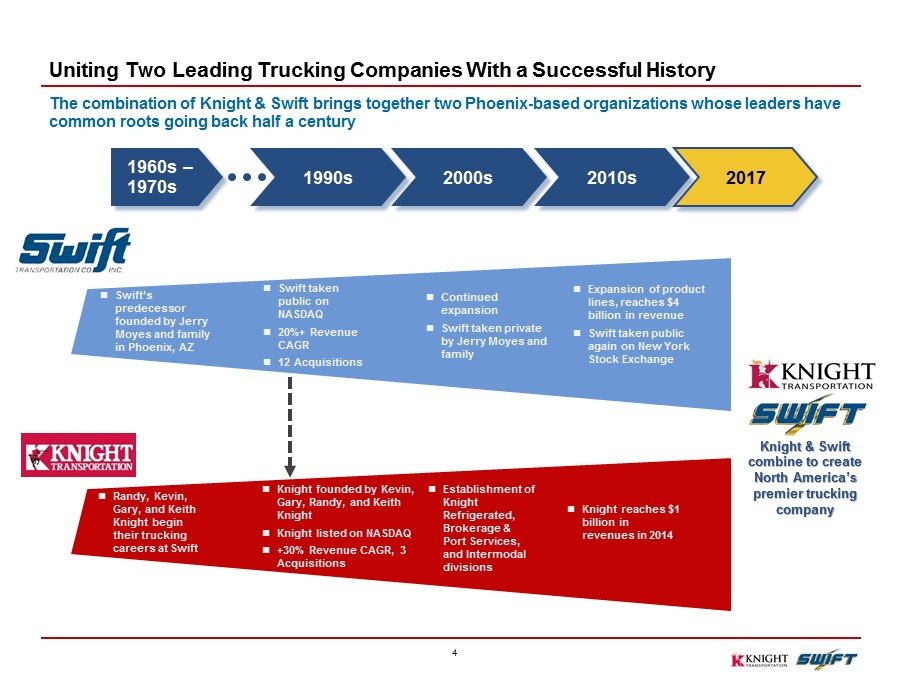

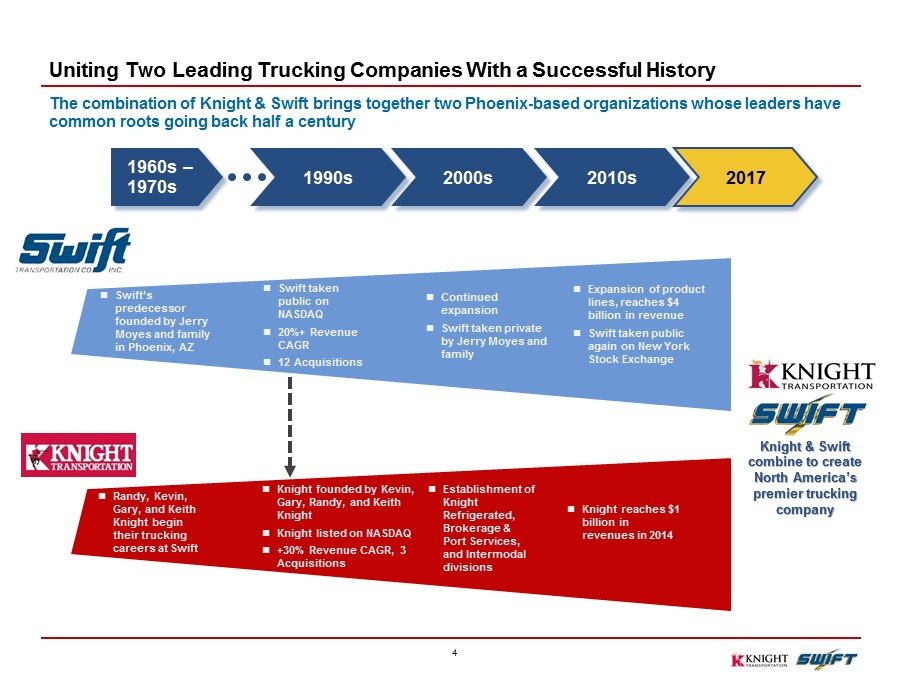

Uniting Two Leading Trucking Companies With a Successful History The combination of Knight & Swift brings together two Phoenix - based organizations whose leaders have common roots going back half a century 1960s – 1970s 1990s 2000s 2010s 2017 Continued expansion Swift taken private by Jerry Moyes and family Knight & Swift combine to create North America’s premier trucking company Swift’s predecessor founded by Jerry Moyes and family in Phoenix, AZ Swift taken public on NASDAQ 20%+ Revenue CAGR 12 Acquisitions Expansion of product lines, reaches $4 billion in revenue Swift taken public again on New York Stock Exchange Knight founded by Kevin, Gary, Randy, and Keith Knight Knight listed on NASDAQ +30% Revenue CAGR, 3 Acquisitions Establishment of Knight Refrigerated, Brokerage & Port Services, and Intermodal divisions Knight reaches $1 billion in revenues in 2014 Randy, Kevin, Gary, and Keith Knight begin their trucking careers at Swift 4

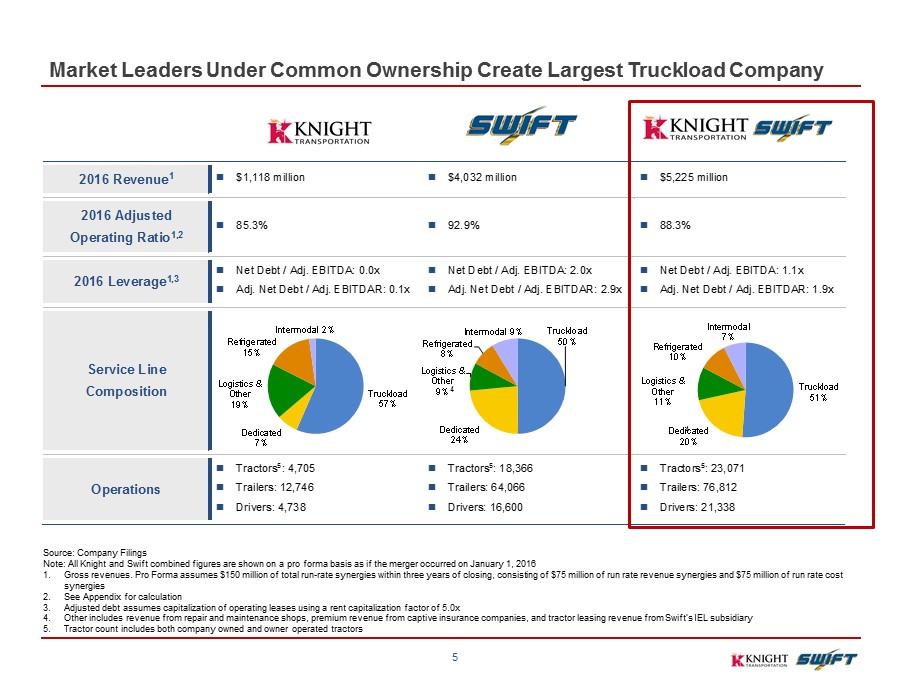

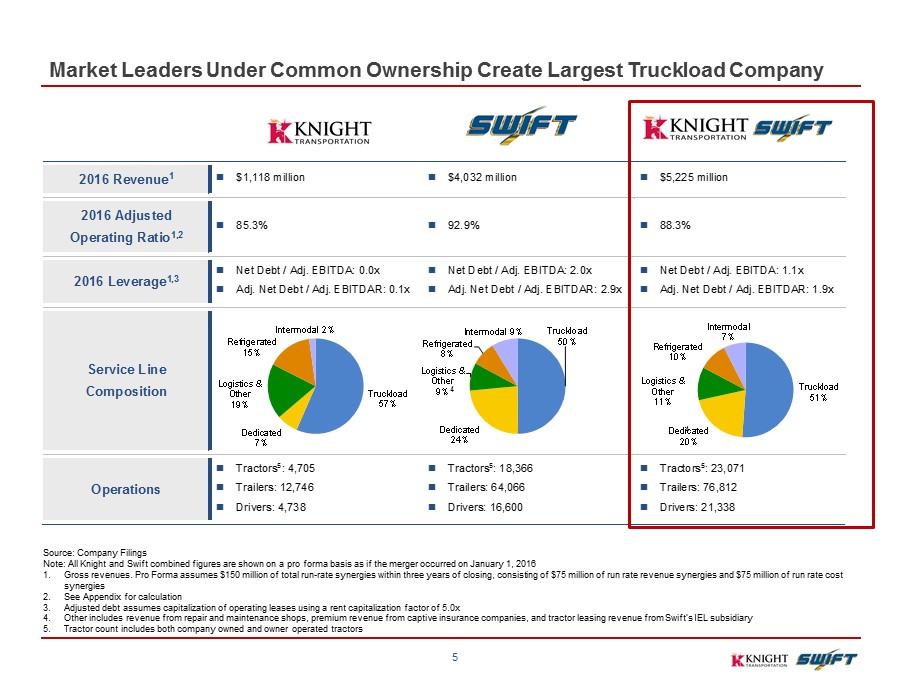

2016 Revenue 1 $1,118 million $4,032 million $5,225 million 2016 Adjusted Operating Ratio 1,2 85.3% 92.9% 88.3% 2016 Leverage 1,3 Net Debt / Adj. EBITDA: 0.0x Adj. Net Debt / Adj. EBITDAR: 0.1x Net Debt / Adj. EBITDA: 2.0x Adj. Net Debt / Adj. EBITDAR: 2.9x Net Debt / Adj. EBITDA: 1.1x Adj. Net Debt / Adj. EBITDAR: 1.9x Service Line Composition Operations Tractors 5 : 4,705 Trailers: 12,746 Drivers: 4,738 Tractors 5 : 18,366 Trailers: 64,066 Drivers: 16,600 Tractors 5 : 23,071 Trailers: 76,812 Drivers: 21,338 Truckload 51% Dedicated 20% Logistics & Other 11% Refrigerated 10% Intermodal 7% Market Leaders Under Common Ownership Create Largest Truckload Company Truckload 50% Dedicated 24% Logistics & Other 9% Refrigerated 8% Intermodal 9% Truckload 57% Dedicated 7% Logistics & Other 19% Refrigerated 15% Intermodal 2% Source: Company Filings Note: All Knight and Swift combined figures are shown on a pro forma basis as if the merger occurred on January 1, 2016 1. Gross revenues. Pro Forma assumes $150 million of total run - rate synergies within three years of closing, consisting of $75 mill ion of run rate revenue synergies and $75 million of run rate cost synergies 2. See Appendix for calculation 3. Adjusted debt assumes capitalization of operating leases using a rent capitalization factor of 5.0x 4. Other includes revenue from repair and maintenance shops, premium revenue from captive insurance companies, and tractor leasing revenue from Swift’s IEL sub sidiary 5. Tractor count includes both company owned and owner operated tractors 5 4 4

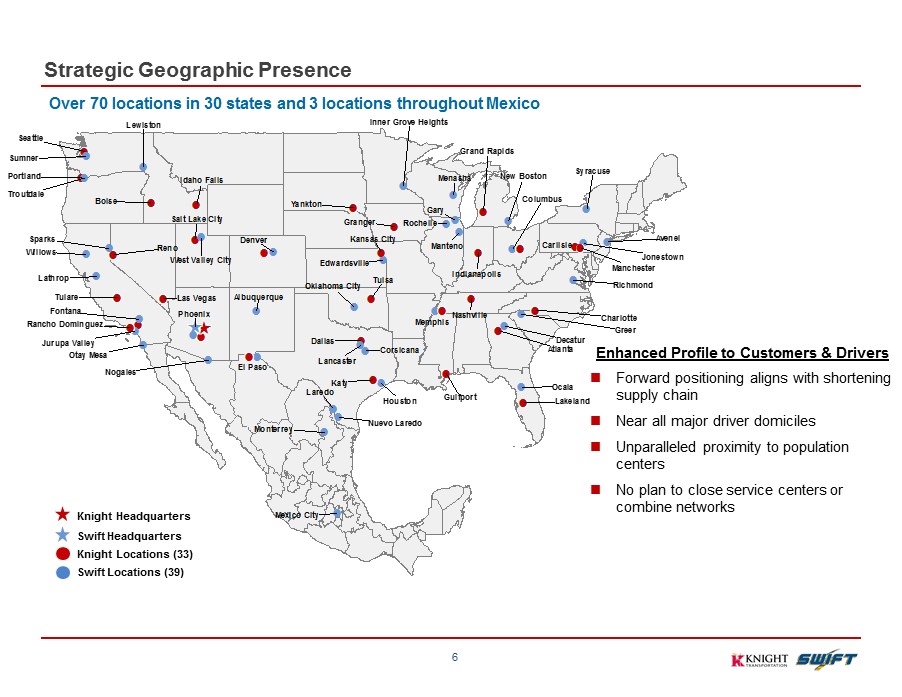

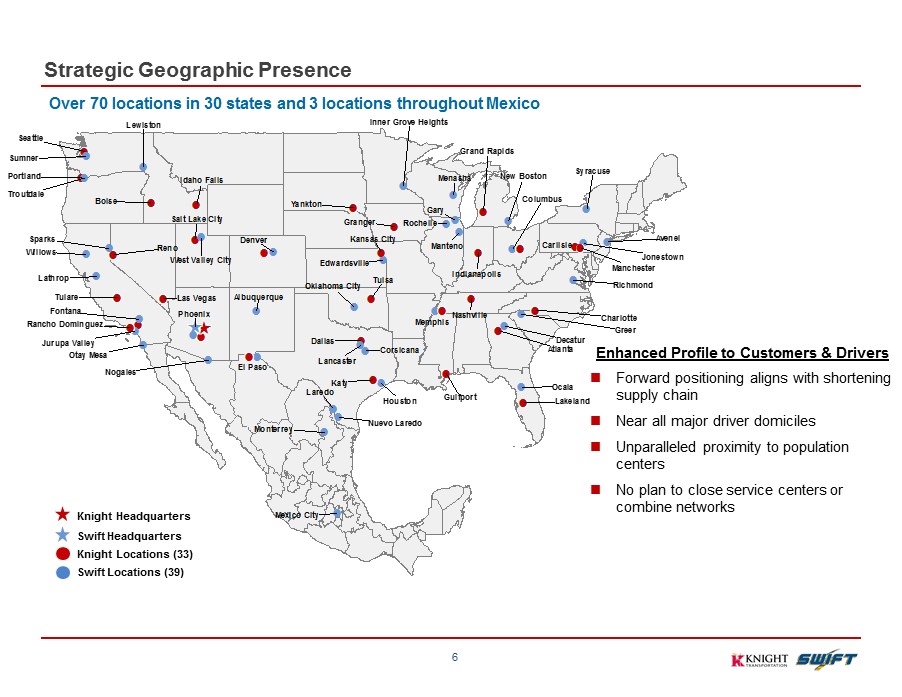

l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l ll l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l « « « « « « « « « l l l l l l l l l « « « « « « « « « l F:\Word Processing\MapInfo\MapInfo Jobs\Lai, Kevin\02-28-17_a\Rook and Bishop Locations.WOR Phoenix Nogales El Paso Las Vegas Albuquerque Rancho Dominguez Fontana Jurupa Valley Tulare Otay Mesa Indianapolis Columbus Manteno Nashville Troutdale Portland Boise Sumner Seattle Lewiston West Valley City Salt Lake City Idaho Falls Reno Sparks Lathrop Willows Nuevo Laredo Laredo Monterrey Houston Decatur Atlanta Greer Charlotte Granger Yankton Rochelle Kansas City Inner Grove Heights Grand Rapids Gary New Boston Menasha Tulsa Edwardsville Denver Memphis Dallas Oklahoma City Avenel Syracuse Jonestown Manchester Carlisle Richmond Gulfport Corsicana Lancaster Katy Ocala Lakeland Mexico City Strategic Geographic Presence Over 70 locations in 30 states and 3 locations throughout Mexico 6 Knight Locations (33) Swift Locations (39) Knight Headquarters Swift Headquarters Enhanced Profile to Customers & Drivers Forward positioning aligns with shortening supply chain Near all major driver domiciles Unparalleled proximity to population centers No plan to close service centers or combine networks

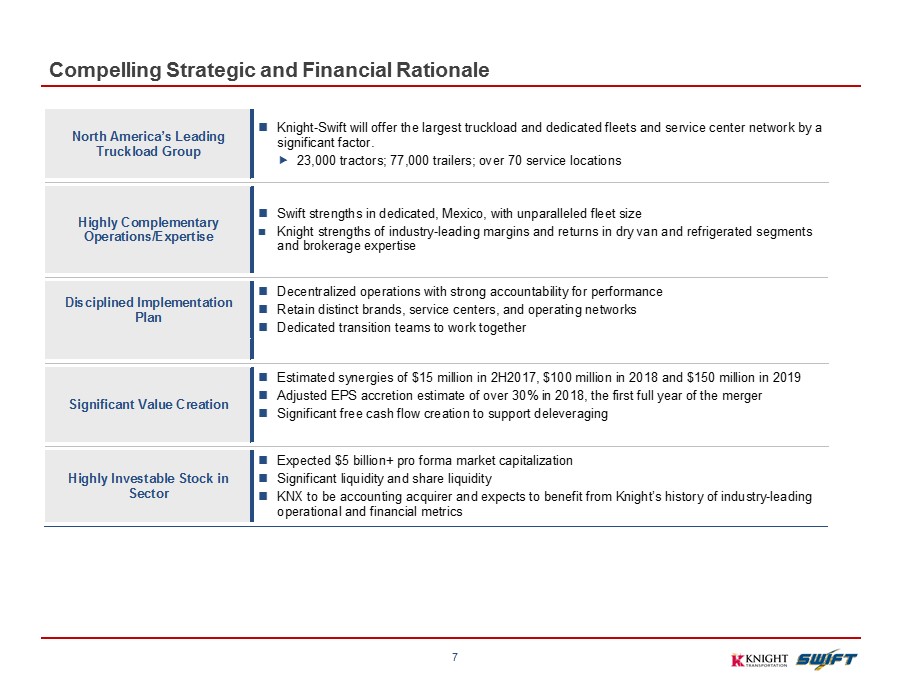

Compelling Strategic and Financial Rationale 7 North America’s Leading Truckload Group Knight-Swift will offer the largest truckload and dedicated fleets and service center network by a significant factor. 23,000 tractors; 77,000 trailers; over 70 service locations Highly Complementary Operations/Expertise Swift strengths in dedicated, Mexico, with unparalleled fleet size Knight strengths of industry-leading margins and returns in dry van and refrigerated segments and brokerage expertise Disciplined Implementation Plan Decentralized operations with strong accountability for performance Retain distinct brands, service centers, and operating networks Dedicated transition teams to work together Significant Value Creation Estimated synergies of $15 million in 2H2017, $100 million in 2018 and $150 million in 2019 Adjusted EPS accretion estimate of over 30% in 2018, the first full year of the merger Significant free cash flow creation to support deleveraging Highly Investable Stock in Sector Expected $5 billion+ pro forma market capitalization Significant liquidity and share liquidity KNX to be accounting acquirer and expects to benefit from Knight’s history of industry-leading operational and financial metrics

Business Strategy 8 Separate Operations Knight and Swift will maintain their distinct brands in customer and driver facing activities, sustaining many years of strong relationships and operating knowledge Execution Managing on a per load, per truck, and a per service center basis Efficiency/Accountability Operating ratio drives both companies Target areas include sharing best practices (safety, operating efficiency, technology), improving yield, and identifying purchasing economies Business Intelligence Leverage combined freight market knowledge when making decisions to commit capacity Technology Collaborate on the development and adoption of impactful technology

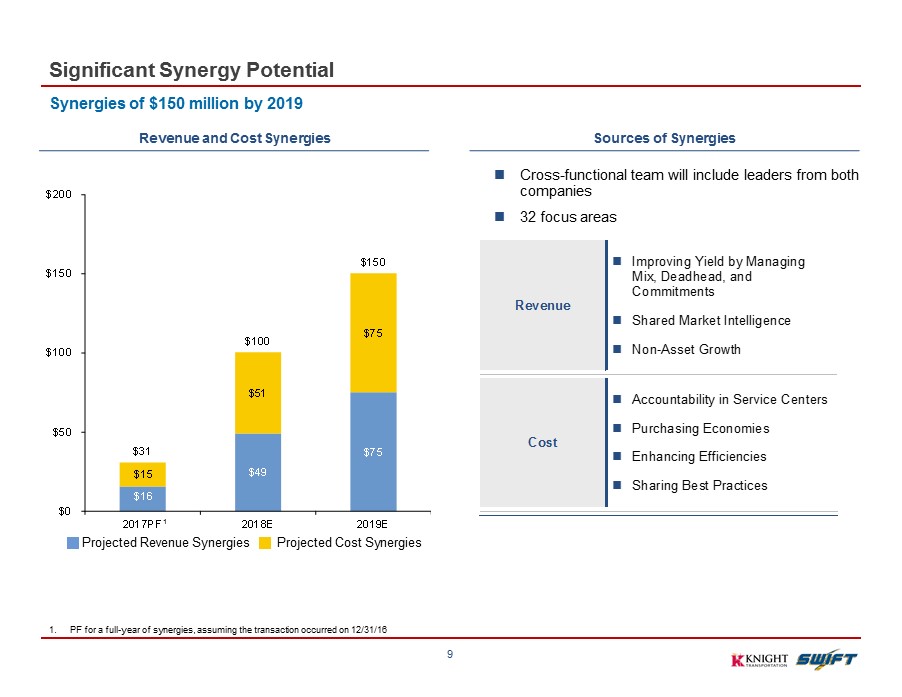

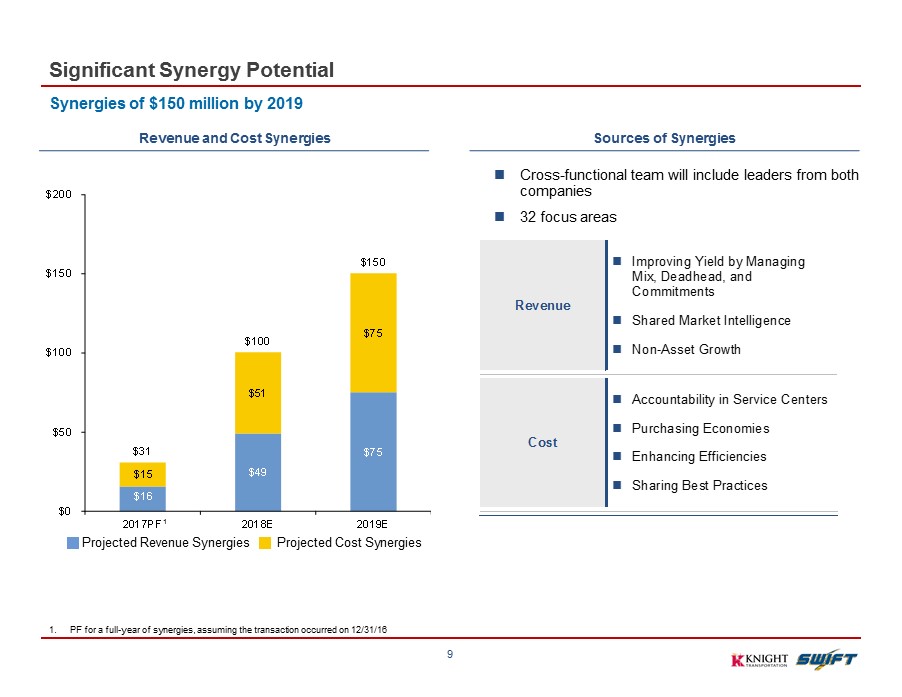

$16 $49 $75 $15 $51 $75 $31 $100 $150 $0 $50 $100 $150 $200 2017PF 2018E 2019E Significant Synergy Potential Synergies of $150 million by 2019 Revenue and Cost Synergies Sources of Synergies Projected Cost Synergies Projected Revenue Synergies 1 1. PF for a full - year of synergies, assuming the transaction occurred on 12/31/16 9 Revenue Improving Yield by Managing Mix, Deadhead, and Commitments Shared Market Intelligence Non-Asset Growth Cost Accountability in Service Centers Purchasing Economies Enhancing Efficiencies Sharing Best Practices Cross - functional team will include leaders from both companies 32 focus areas

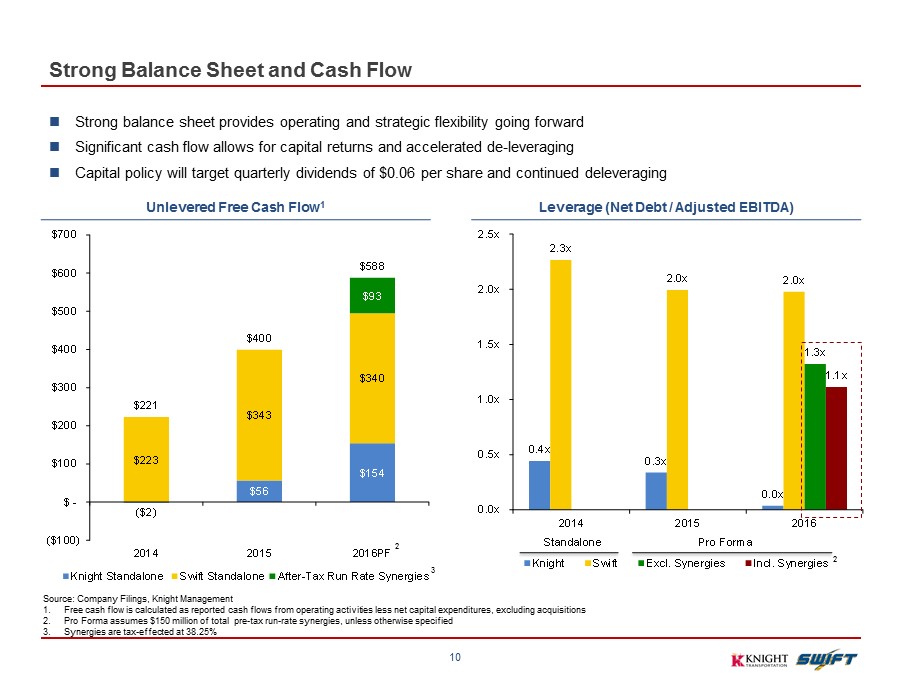

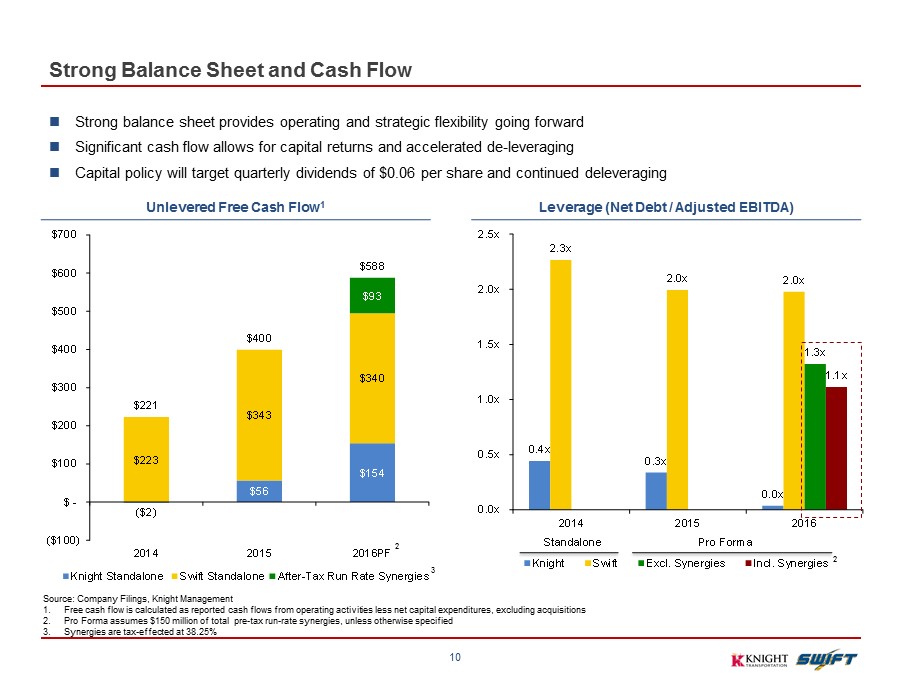

Strong Balance Sheet and Cash Flow Unlevered Free Cash Flow 1 Leverage (Net Debt / Adjusted EBITDA) Strong balance sheet provides operating and strategic flexibility going forward Significant cash flow allows for capital returns and accelerated de - leveraging Capital policy will target quarterly dividends of $0.06 per share and continued deleveraging ($2) $56 $154 $223 $343 $340 $93 $221 $400 $588 ($100) $ - $100 $200 $300 $400 $500 $600 $700 2014 2015 2016PF Knight Standalone Swift Standalone After-Tax Run Rate Synergies 0.4x 0.3x 0.0x 2.3x 2.0x 2.0x 1.3x 1.1x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 2014 2015 2016 Knight Swift Excl. Synergies Incl. Synergies Standalone Pro Forma Source: Company Filings, Knight Management 1. Free cash flow is calculated as reported cash flows from operating activities less net capital expenditures, excluding acquis iti ons 2. Pro Forma assumes $150 million of total pre - tax run - rate synergies, unless otherwise specified 3. Synergies are tax - effected at 38.25% 10 2 2 3

Maintenance of distinct brands Create significant shareholder value through strength and scale of business, and synergy realization Unites two long - standing industry leaders with complementary operations under common ownership Strong, experienced management team with long - history of operational excellence to realize significant synergies F:\WordProcessing\__Monthly Jobs\2017-04(Apr)\04-09-17\Lai, Kevin\HalfCircleImages_v02.aiv 1 2 3 4 Creating North America’s Premier Truckload Company 11

Appendix

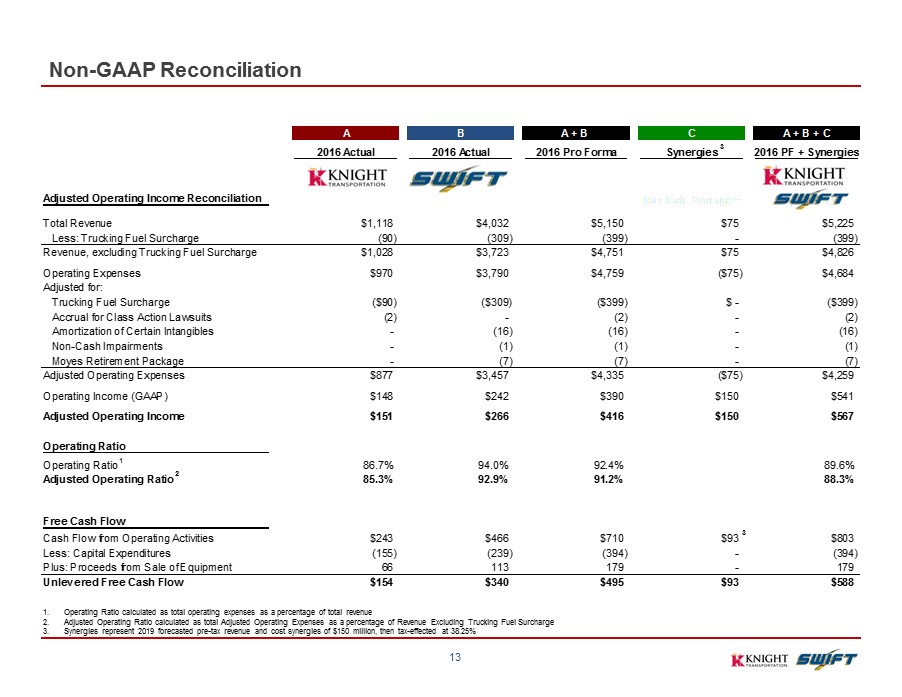

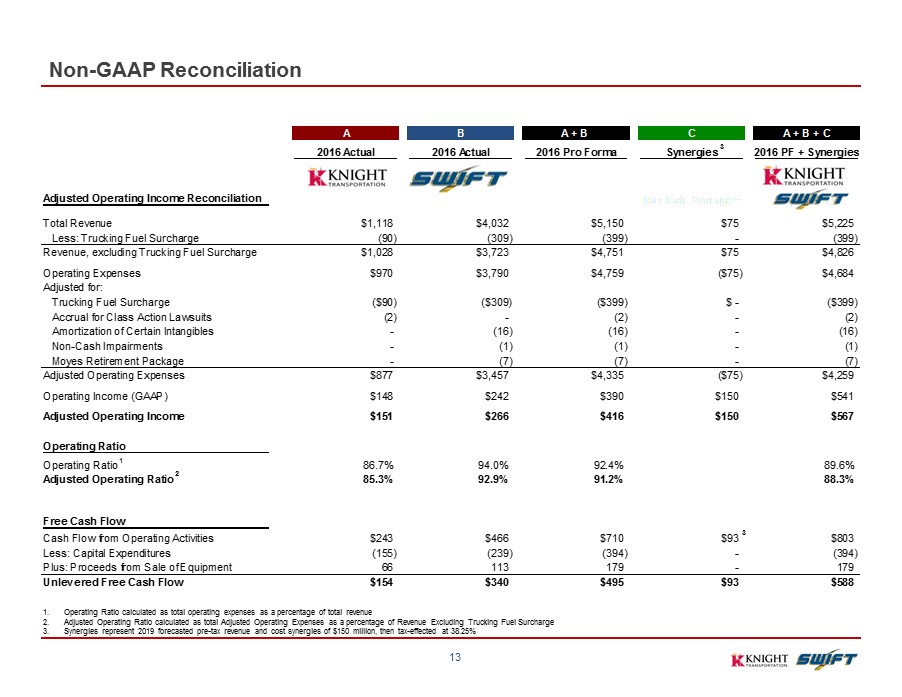

Non - GAAP Reconciliation 13 A B A + B C A + B + C 2016 Actual 2016 Actual 2016 Pro Forma Synergies 2016 PF + Synergies Adjusted Operating Income Reconciliation Run Rate Synergies Knight / Swift Total Revenue $1,118 $4,032 $5,150 $75 $5,225 Less: Trucking Fuel Surcharge (90) (309) (399) - (399) Revenue, excluding Trucking Fuel Surcharge $1,028 $3,723 $4,751 $75 $4,826 Operating Expenses $970 $3,790 $4,759 ($75) $4,684 Adjusted for: Trucking Fuel Surcharge ($90) ($309) ($399) $ - ($399) Accrual for Class Action Lawsuits (2) - (2) - (2) Amortization of Certain Intangibles - (16) (16) - (16) Non-Cash Impairments - (1) (1) - (1) Moyes Retirement Package - (7) (7) - (7) Adjusted Operating Expenses $877 $3,457 $4,335 ($75) $4,259 Operating Income (GAAP) $148 $242 $390 $150 $541 Adjusted Operating Income $151 $266 $416 $150 $567 Operating Ratio Operating Ratio 86.7% 94.0% 92.4% 89.6% Adjusted Operating Ratio 85.3% 92.9% 91.2% 88.3% Free Cash Flow Cash Flow from Operating Activities $243 $466 $710 $93 $803 Less: Capital Expenditures (155) (239) (394) - (394) Plus: Proceeds from Sale of Equipment 66 113 179 - 179 Unlevered Free Cash Flow $154 $340 $495 $93 $588 1. Operating Ratio calculated as total operating expenses as a percentage of total revenue 2. Adjusted Operating Ratio calculated as total Adjusted Operating Expenses as a percentage of Revenue Excluding Trucking Fuel S urc harge 3. Synergies represent 2019 forecasted pre - tax revenue and cost synergies of $150 million, then tax - effected at 38.25% 1 2 3 3

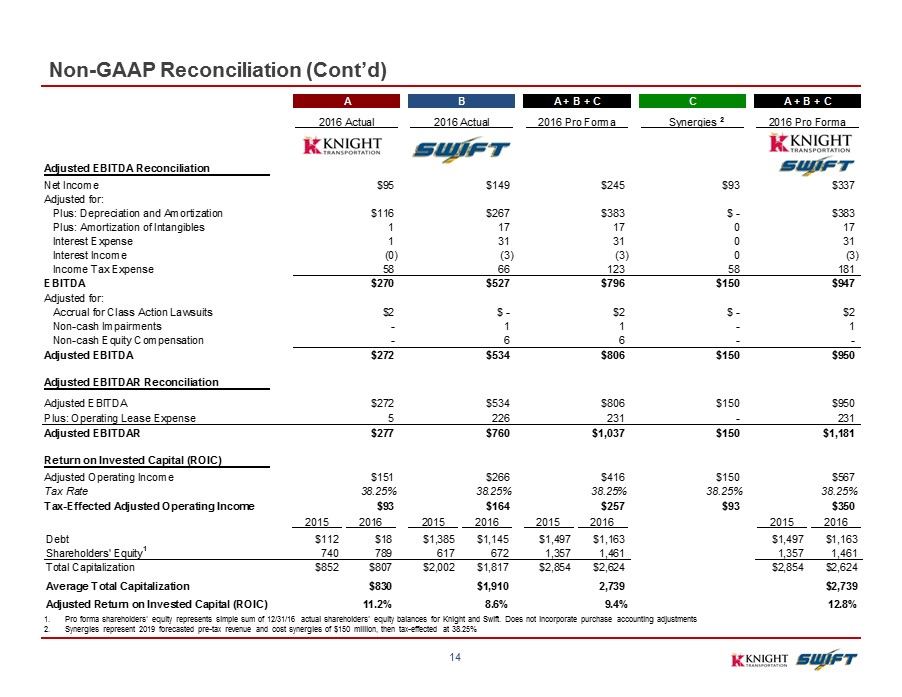

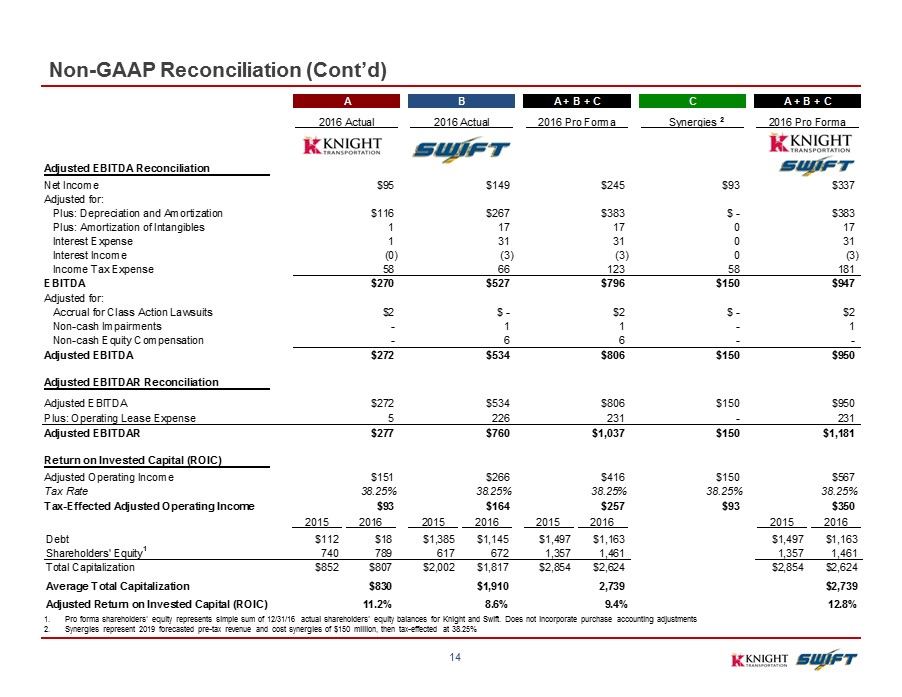

Non - GAAP Reconciliation (Cont’d) 14 A B A + B + C C A + B + C 2016 Actual 2016 Actual 2016 Pro Forma Synergies 2016 Pro Forma Adjusted EBITDA Reconciliation Net Income $95 $149 $245 $93 $337 Adjusted for: Plus: Depreciation and Amortization $116 $267 $383 $ - $383 Plus: Amortization of Intangibles 1 17 17 0 17 Interest Expense 1 31 31 0 31 Interest Income (0) (3) (3) 0 (3) Income Tax Expense 58 66 123 58 181 EBITDA $270 $527 $796 $150 $947 Adjusted for: Accrual for Class Action Lawsuits $2 $ - $2 $ - $2 Non-cash Impairments - 1 1 - 1 Non-cash Equity Compensation - 6 6 - - Adjusted EBITDA $272 $534 $806 $150 $950 Adjusted EBITDAR Reconciliation Adjusted EBITDA $272 $534 $806 $150 $950 Plus: Operating Lease Expense 5 226 231 - 231 Adjusted EBITDAR $277 $760 $1,037 $150 $1,181 Return on Invested Capital (ROIC) Adjusted Operating Income $151 $266 $416 $150 $567 Tax Rate 38.25% 38.25% 38.25% 38.25% 38.25% Tax-Effected Adjusted Operating Income $93 $164 $257 $93 $350 2015 2016 2015 2016 2015 2016 2015 2016 Debt $112 $18 $1,385 $1,145 $1,497 $1,163 $1,497 $1,163 Shareholders' Equity 740 789 617 672 1,357 1,461 1,357 1,461 Total Capitalization $852 $807 $2,002 $1,817 $2,854 $2,624 $2,854 $2,624 Average Total Capitalization $830 $1,910 2,739 $2,739 Adjusted Return on Invested Capital (ROIC) 11.2% 8.6% 12.8%9.4% 1. Pro forma shareholders' equity represents simple sum of 12/31/16 actual shareholders' equity balances for Knight and Swift. D oes not incorporate purchase accounting adjustments 2. Synergies represent 2019 forecasted pre - tax revenue and cost synergies of $150 million, then tax - effected at 38.25% 1 2