Prior to the October 26, 2023 amendment and restatement, the Fund had access to a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A., Citibank, N.A. and Wells Fargo Bank, N.A. which permitted collective borrowings up to $950 million. Interest was charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the secured overnight financing rate plus 0.10% and (iii) the overnight bank funding rate plus, in each case, 1.00%.

The Fund had no borrowings during the six months ended June 30, 2024.

Note 8. Fund reorganization

At the close of business on April 21, 2023, the Fund acquired the assets and assumed the identified liabilities of Wanger Select (the Acquired Fund), a series of Wanger Advisors Trust. The reorganization was completed after the Board of Trustees of the Acquired Fund approved a plan of reorganization at a meeting held in December 2022. The purpose of the reorganization was to combine two funds with comparable investment objectives and strategies.

The aggregate net assets of the Fund immediately before the reorganization were $444,473,441 and the combined net assets immediately after the reorganization were $515,356,670.

The reorganization was accomplished by a tax-free exchange of 10,431,451 shares of the Acquired Fund valued at $70,883,229 (including $781,384 of unrealized appreciation/(depreciation)).

In exchange for the Acquired Fund’s shares, the Fund issued 5,916,758 shares.

For financial reporting purposes, net assets received and shares issued by the Fund were recorded at fair value; however, the Acquired Fund’s cost of investments was carried forward.

The Fund’s financial statements reflect both the operations of the Fund for the period prior to the reorganization and the combined Fund for the period subsequent to the reorganization. Because the combined investment portfolios have been managed as a single integrated portfolio since the reorganization was completed, it is not practicable to separate the amounts of revenue and earnings of the Acquired Fund that have been included in the combined Fund’s Statement of Operations since the reorganization was completed.

Assuming the reorganization had been completed on January 1, 2023, the Fund’s pro-forma results of operations for the year ended December 31, 2023 would have been approximately:

| |

| |

| |

Net change in unrealized appreciation/(depreciation) | |

Net increase in net assets from operations | |

Note 9. Significant risks

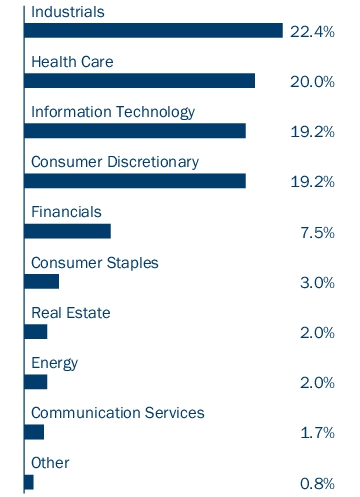

The Fund is vulnerable to the particular risks that may affect companies in the health care sector. Companies in the health care sector are subject to certain risks, including restrictions on government reimbursement for medical expenses, government approval of medical products and services, competitive pricing pressures, and the rising cost of medical products and services (especially for companies dependent upon a relatively limited number of products or services). Performance of such companies may be affected by factors including government regulation, obtaining and protecting patents (or the failure to do so), product liability and other similar litigation as well as product obsolescence.