Exhibit (a)(1)(i)

Indonesian Offer to Purchase

Series B Shares

Representing up to an Aggregate of 1,314,466,775 Series B Shares

(including Series B Shares underlying ADSs tendered into

the U.S. Offer for ADSs)

of

PT Indosat Tbk.

at

Indonesian Rupiah 7,388 per Series B Share

by

Indonesia Communications Pte. Ltd.,

a wholly-owned indirect subsidiary of

Qatar Telecom (Qtel) Q.S.C.

|

The Indonesian Offer and Withdrawal Rights will expire at 3:00 p.m., Jakarta time (which is 3:00 a.m., New York City time), on February 18, 2009, unless the Indonesian Offer is extended. |

Qatar Telecom (Qtel) Q.S.C., a corporation organized under the laws of Qatar (“Qtel”), through Indonesia Communications Pte. Ltd., a company incorporated under the laws of Singapore and a wholly-owned indirect subsidiary of Qtel (“ICLS” and, together with Qtel, the “Offeror” or “we” or “us”), is offering to purchase outstanding Series B Shares, par value Rp100 per share (“Series B Shares”), of PT Indosat Tbk., an Indonesian company (“Indosat” or the “Company”), other than Series B Shares held by Qtel and its affiliates and Series B Shares underlying American Depositary Shares (“ADSs”), at a purchase price of Indonesian Rupiah 7,388 per Series B Share, net to the seller in cash (without interest and subject to any required withholding of taxes) (the “Offer Price”), upon the terms and subject to the conditions set forth in this Indonesian Offer to Purchase (the “Offer to Purchase”) and in the related Tender Offer Form (the “Tender Offer Form”), as they may be amended or supplemented from time to time (the “Indonesian Offer”).

Concurrently with this Indonesian Offer, the Offeror is offering to purchase ADSs (other than ADSs held by Qtel and its affiliates) pursuant to a separate U.S. offer (the “U.S. Offer for ADSs” and, together with this Indonesian Offer, the “Offers”). Each ADS represents fifty (50) Series B Shares.

In the aggregate, the Offeror is offering to purchase up to 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis, representing approximately 24.19% of the total issued and outstanding Series B Shares (including Series B Shares underlying ADSs). If more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) are validly tendered and not withdrawn in the Offers, then the proration rules will apply, as described in “The Indonesian Offer — Section 4,” so that the Offeror will purchase no more than an aggregate of 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers.

This Indonesian Offer is open only to holders of Series B Shares, and ADSs will not be accepted in this Indonesian Offer. All holders of ADSs who wish to tender their ADSs must tender such ADSs into the U.S. Offer for ADSs. U.S. holders of Series B Shares may deposit, at no cost to such holders, their Series B Shares (with the ADS Custodian (as defined herein)) for issuance of ADSs and tender of such ADSs into the U.S. Offer. However, holders of ADSs may surrender their ADSs for withdrawal of Series B Shares represented by such ADSs, which subsequently may be tendered into this Indonesian Offer. See “The Indonesian Offer — Section 2.”

This Indonesian Offer is not conditioned on any minimum number of Series B Shares being tendered or any other conditions, except that in order to be accepted for purchase (subject to proration), Series B Shares must be validly tendered and not withdrawn as of the expiration of this Indonesian Offer.

The Offeror currently has no plans in place and has not submitted any proposal to Indosat which, immediately after the Offers, would result in the delisting of the Series B Shares from the Indonesia Stock

Exchange (“IDX”) or the delisting of ADSs from the New York Stock Exchange (“NYSE”). See “The Indonesian Offer — Sections 1 and 11.”

Indosat has filed, under the Securities Exchange Act of 1934, as amended, a solicitation/recommendation statement on Schedule 14D-9 with the Securities and Exchange Commission (the “SEC”) on the same day as the filing of this Offer to Purchase with the SEC, pursuant to which the board of directors of Indosat has stated that it would express no opinion and remain neutral with respect to the Offers.

This Indonesian Offer is made in accordance with the applicable laws of the Republic of Indonesia. This Offer to Purchase is meant solely for holders of Series B Shares, other than Series B Shares held by Qtel and its affiliates and Series B Shares underlying ADSs. Separate offering materials for holders of ADSs are being published concurrently pursuant to the U.S. Offer for ADSs. This Indonesian Offer and the U.S. Offer for ADSs are collectively referred to herein as the “Offers” or the “mandatory tender offer.”

This transaction has not been approved or disapproved by the SEC or any state securities commission, nor has any such commission passed upon the fairness or merits of such transaction or upon the accuracy or adequacy of the information contained in this Offer to Purchase. Any representation to the contrary is a criminal offense. The U.S. Offer for ADSs will commence on January 20, 2009 and will run concurrently with this Indonesian Offer. The review of the SEC is a simultaneous review carried out while the Offers are open. Should the SEC require any modifications of the Offer to Purchase or any separate documentation relating to this Indonesian Offer, we will file an amendment or supplement with the SEC to the extent required by applicable law.

For assistance with this Indonesian Offer, please contact PT Danareksa Sekuritas (the “Share Tender Agent”) at its address and telephone number set forth on the back cover of this Offer to Purchase.

Offer to Purchase dated January 20, 2009

2

IMPORTANT INFORMATION

TENDERING SERIES B SHARES.

If you want to tender all or part of your Series B Shares, you must do the following before this Indonesian Offer expires:

| | • | | if your Series B Shares are registered in your name on the Company’s share register and are in the form of share certificate(s), you should contact PT EDI Indonesia (the “Appointed Share Registrar”) at the telephone number and address appearing on the back cover of this Offer to Purchase to convert your share certificates into “scripless” shares no later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. You will bear any costs relating to such conversion. You should then open a securities account with an Indonesian securities company or custodian bank holding an account with PT Kustodian Sentral Efek Indonesia (“KSEI”) prior to submitting the Tender Offer Form to the Appointed Share Registrar; and |

| | • | | you must deliver to the Appointed Share Registrar, at the address appearing on the back cover of this Offer to Purchase, an application consisting of (i) five (5) sets of the original properly completed and duly executed Tender Offer Form, (ii) evidence of power of attorney, if necessary, and (iii) proof of identity, upon acceptance of which the Appointed Share Registrar will issue a certified receipt of your participation in this Indonesian Offer (the “Receipt”); and |

| | • | | you must then deliver the Receipt to the Indonesian securities company or custodian bank holding an account with KSEI, and instruct such Indonesian securities company or custodian bank to instruct KSEI to transfer your Series B Shares held by such securities company or custodian bank under your name to the KSEI Temporary Escrow Account designated as “KSEI 1-1092-001-96” (the “Escrow Account”).In the event that the securities company/custodian bank fails to instruct KSEI to transfer such Series B Shares into the Escrow Account prior to the expiration of this Indonesian Offer, your tender of Series B Shares will not be deemed to have been validly made and will not be accepted for purchase by the Offeror in this Indonesian Offer. Once the Series B Shares have been transferred to the Escrow Account, such Series B Shares will be verified by the Share Tender Agent and the Appointed Share Registrar. Once such verification is complete, the Share Tender Agent will provide KSEI with a confirmation. You will be charged a transaction fee by the Share Tender Agent, which includes commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia. |

In this Indonesian Offer, shareholders tendering Series B Shares must tender Series B Shares in increments of 500 shares. Under the tender offer practices in Indonesia, lots of less than 500 shares cannot be transferred into the account of KSEI and, therefore, cannot be tendered into this Indonesian Offer.

In addition, if proration rules apply such that a proration factor must be applied to the aggregate number of Series B Shares tendered by each tendering shareholder in order to determine the number of Series B Shares that the Offeror may purchase from such tendering shareholder in this Indonesian Offer, then the resulting product will be rounded up or down to the nearest 500 Series B Shares in order to determine the number of Series B Shares that the Offeror will accept for purchase in this Indonesian Offer.

Questions and requests for assistance may be directed to the Share Tender Agent or the Appointed Share Registrar at their respective addresses and telephone numbers set forth on the back cover page of this Offer to Purchase. Requests for additional copies of this Offer to Purchase or original sets of the Tender Offer Form also may be directed to the Share Tender Agent or the Appointed Share Registrar.

See “The Indonesian Offer — Section 2.”

SETTLEMENT OF THE OFFER PRICE.

The Offer Price for the Series B Shares accepted for payment in this Indonesian Offer will be paid in Indonesian Rupiah no later than fifteen (15) days following the expiration of this Indonesian Offer.

The Offeror will remit the cash consideration for the Series B Shares accepted for payment in this Indonesian Offer to KSEI on the date of the settlement of the Offer Price (the “Payment Date”) to KSEI. KSEI will transmit payment to the tendering holders of Series B Shares by making the appropriate credits to the respective accounts of the tendering holders of Series B Shares maintained with their respective Indonesian securities company or custodian bank.

See “The Indonesian Offer — Sections 1 and 4.”

FOREIGN CURRENCY

In this document, references to “Indonesian Rupiah,” “Rp” or “Rupiah” are to Indonesian currency, and references to “United States dollars,” “U.S. dollars,” “US$,” “$” or “dollars” are to U.S. currency and references to “Singaporean Dollar” or “S$” are to Singaporean currency.

IMPORTANT

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your Series B Shares in this Indonesian Offer. You should rely only on the information contained in this document or to which we have referred you. We have not authorized any person to give any information or to make any representations in connection with this Indonesian Offer other than the information and representations contained in this document or in the Tender Offer Form. If anyone makes any recommendation or representation to you or gives you any information, you must not rely on that recommendation, representation or information as having been authorized by us or any agent working for us.

The distribution of the Offer to Purchase and any separate documentation relating to this Indonesian Offer (e.g., the Tender Offer Form, various notices and press releases) and the making of this Indonesian Offer may, in some jurisdictions, be restricted or prohibited by applicable law. This Indonesian Offer is not being made, directly or indirectly, in or into, and may not be accepted from within, any jurisdiction in which the making of this Indonesian Offer or the acceptance of this Indonesian Offer would not be in compliance with the laws of that jurisdiction. Persons who come into possession of the Offer to Purchase or other documentation relating to this Indonesian Offer should inform themselves of and observe all of these restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of that jurisdiction. None of ICLS, Qtel or any of their respective officers, directors, employees, advisors, affiliates or agents assume any responsibility for any violation by any person of any of these restrictions. Any holder of Series B Shares of the Company who is in any doubt as to his or her position should consult an appropriate professional advisor without delay.

TABLE OF CONTENTS

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience. It highlights certain material information in this Offer to Purchase and the Indonesian Tender Offer Statement (an English translation of which is attached to this document as Annex A and constitutes part of this Offer to Purchase) but you should understand that it does not describe all of the details of this Indonesian Offer to the same extent described elsewhere in this Offer to Purchase. We urge you to read this entire Offer to Purchase (including the English translation of the Indonesian Tender Offer Statement) and the Tender Offer Form because they contain the full details of this Indonesian Offer. We have included references to the sections of this Offer to Purchase where you will find a more complete discussion.

WHO IS OFFERING TO PURCHASE MY SERIES B SHARES?

Qtel, through its wholly-owned indirect subsidiary, ICLS, is offering to purchase outstanding Series B Shares of the Company, upon the terms and subject to the conditions of this Offer to Purchase and the Tender Offer Form. See “The Indonesian Offer — Sections 1 and 8B.”

WHAT ARE THE CLASSES AND AMOUNTS OF SECURITIES SOUGHT IN THIS INDONESIAN OFFER?

In this Indonesian Offer, we are seeking to purchase Series B Shares of the Company, other than Series B Shares held by Qtel and its affiliates. Concurrently with this Indonesian Offer, the Offeror is offering to purchase ADSs, other than ADSs held by Qtel and its affiliates, pursuant to a separate U.S. Offer (the “U.S. Offer for ADSs” and, together with this Indonesian Offer, the “Offers”). In the aggregate, the Offeror is seeking to purchase up to 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis.

If more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) are validly tendered and not properly withdrawn in this Indonesian Offer and the U.S. Offer for ADSs, then proration rules will apply so that we purchase no more than an aggregate of 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis. See “The Indonesian Offer — Sections 1 and 4.”

HOW MUCH ARE YOU OFFERING TO PAY FOR MY SERIES B SHARES AND WHAT IS THE FORM OF PAYMENT? WILL I HAVE TO PAY ANY FEES OR COMMISSIONS?

In this Indonesian Offer, we are offering to pay each tendering Series B holder Rp7,388 per Series B Share, net to the seller in cash (without interest and subject to any required withholding of taxes), upon the terms and subject to the conditions set forth in this Offer to Purchase and the Tender Offer Form. The consideration for tendered Series B Shares will be paid in Indonesian Rupiah.

If your Series B Shares are registered in your name on the Company’s share register and are in the form of share certificate(s), you should contact the Appointed Share Registrar at the telephone number and address appearing on the back cover of this Offer to Purchase to convert your share certificates into “scripless” shares no later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. You will bear any costs relating to such conversion. You will also be charged a transaction fee by the Share Tender Agent, which includes commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia. Holders who surrender ADSs and withdraw the Series B Shares represented by the ADSs, including for the purpose of tendering those Series B Shares into this Indonesian Offer, will bear all associated fees and expenses under the Deposit Agreement under which such ADSs were issued (the “Deposit Agreement”), not to exceed a maximum of $5 per 100 ADSs surrendered plus a cable fee of $12.50, and must comply with any other applicable terms and conditions thereunder. See “The Indonesian Offer — Section 2.”

1

WHO CAN PARTICIPATE IN THIS INDONESIAN OFFER?

This Indonesian Offer is open to all holders of Series B Shares, wherever the holders are located. See “The Indonesian Offer — Sections 1 and 2.”

I HOLD ADSs. HOW CAN I PARTICIPATE IN THIS INDONESIAN OFFER?

If you hold ADSs and wish to participate in this Indonesian Offer, you may surrender your ADSs to The Bank of New York Mellon, as the depositary for the ADS facility (the “ADS Depositary”), withdraw the Series B Shares represented by your ADSs (each ADS representing fifty (50) Series B Shares), and subsequently tender your Series B Shares into this Indonesian Offer (subject to proration) in accordance with the tender procedures and requirements of this Indonesian Offer.

Holders will bear all fees and expenses under the Deposit Agreement, not to exceed a maximum of $5 per 100 ADSs surrendered plus a cable fee of $12.50, in connection with any withdrawal of Series B Shares under the Deposit Agreement, and must comply with any other applicable terms and conditions thereunder. Holders who choose to surrender their ADSs for delivery of Series B Shares and tender into this Indonesian Offer also will be charged a transaction fee by the Share Transfer Agent (which includes commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia) and will bear the risk of any fluctuation in the exchange rate after the consummation of the Offers if they later wish to convert their Indonesian Rupiah into U.S. dollars and such other risks and costs associated with tendering Series B Shares into this Indonesian Offer.

Holders of ADSs wishing to surrender their ADSs for Series B Shares should contact the ADR Division of The Bank of New York Mellon at +1 (212) 815-2231 to determine what steps need to be taken in order to complete the surrender in a timely manner to permit the Series B Shares withdrawn to be validly tendered pursuant to this Indonesian Offer. See “The Indonesian Offer — Section 2.”

CAN I TENDER SERIES B SHARES INTO THE U.S. OFFER FOR ADSs?

No. However, U.S. holders of Series B Shares who wish to participate in the U.S. Offer for ADSs may deposit their Series B Shares (“Deposited Series B Shares”) for issuance of ADSs that will be tendered into the U.S. Offer (subject to proration). To do so:

| | • | | prior to the expiration of the U.S. Offer for ADSs, U.S. holders of Series B Shares must (1) deposit their Series B Shares with either HSBC Indonesia or PT Bank Mandiri (Persero) Tbk., as custodian (the “ADS Custodian”), for the account of The Bank of New York Mellon, as the ADS tender agent for the U.S. Offer (the “ADS Tender Agent”), and (2) deliver an ADS Letter of Transmittal and any other required documents to the ADS Tender Agent. |

| | • | | to the extent that the Offeror accepts ADSs for purchase in the U.S. Offer for ADSs, after the application of proration, if applicable, the ADS Tender Agent will deposit with the ADS Depositary the Deposited Series B Shares for issuance of ADSs and deliver those purchased ADSs as instructed by the Offeror. U.S. holders will not be responsible for any fees relating to the deposit of Series B Shares with the ADS Tender Agent for issuance of ADSs to be tendered into the U.S. Offer for ADSs. |

Each ADS will represent fifty (50) Deposited Series B Shares. U.S. holders of “Odd-lots” (lots of fewer than fifty (50) Series B Shares) who wish to participate in the U.S. Offer for ADSs may deposit these Odd-lots of Series B Shares with the ADS Custodian as described above. To the extent practicable, the ADS Tender Agent will combine Odd-lots of Series B Shares that the Offeror accepts for purchase with other Odd-lots to create whole ADSs that will be delivered for purchase by the Offeror. All Deposited Series B Shares not accepted for purchase in the form of ADSs in the U.S. Offer for ADSs will be returned to the holder, in accordance with his or her instructions, in the form of Series B Shares.

2

For more information, see “The Indonesian Offer — Sections 1 and 2.”

WHY IS THERE A SEPARATE U.S. OFFER FOR ADSs?

The Offeror’s primary objective in making two (2) separate offers is to comply with various Indonesian and U.S. legal and regulatory requirements and restrictions applicable to tender offers, which are different and inconsistent in some ways. The Offeror has requested from the U.S. Securities and Exchange Commission (the “SEC”), and the SEC has granted, exemptive relief from Rule 14d-10(a)(1) of Regulation 14D under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which permits the Offeror to make two (2) separate offers. See “Exemptions Requested from the U.S. Securities and Exchange Commission.”

WHAT ARE THE PRINCIPAL DIFFERENCES IN MY RIGHTS UNDER THIS INDONESIAN OFFER AND THE U.S. OFFER FOR ADSs?

Although the terms and conditions of the two (2) offers are substantially similar, because of differences in law and market practice between Indonesia and the United States, the rights of tendering shareholders pursuant to the two (2) offers are not identical. The most significant differences are:

| | • | | Under Indonesian law, unless otherwise stipulated by the Chairman of the Capital Market and Financial Institution Supervisory Board of the Department of Finance of the Republic of Indonesia (“BAPEPAM-LK”), the offering period of a tender offer may not exceed thirty (30) calendar days. U.S. law requires that a tender offer must remain open for at least twenty (20) U.S. business days. In addition, U.S. law requires that a tender offer be kept open at least ten (10) U.S. business days from the date that notice of a material change to the offer price or share levels is sent or given to security holders; and at least five (5) U.S. business days from the date that notice of a material change not involving the offer price or share levels is sent or given to security holders. If such material change to the offer price or share levels were to occur during the last ten (10) U.S. business days of the offer period, or such material change not involving the offer price or share levels were to occur during the last five (5) U.S. business days of the offer period, the U.S. Offer for ADSs would be required to remain open longer than the maximum thirty (30) calendar days allowed under Indonesian law. |

The Offeror presently does not intend to extend the offer period for the Offers and intends to make the offer periods for the Offers the same. However, in the event an extension of this Indonesian Offer is required beyond the currently scheduled expiration date pursuant to U.S. law, then the Offeror would require the approval of the Chairman of BAPEPAM-LK to so extend the offer period for this Indonesian Offer and the U.S. Offer so that both Offers expire at the same time. There can be no assurance that the Chairman of BAPEPAM-LK will approve such extension of this Indonesian Offer.

| | • | | U.S. holders of Series B Shares may participate in the U.S. Offer by depositing their Series B Shares with either ADS Custodian for the ADS Depositary. Those holders must also deliver the ADS Letter of Transmittal and other documentation required for tendering ADSs to the ADS Tender Agent. To the extent that the Offeror accepts ADSs for purchase in the U.S. Offer for ADSs, after the application of proration, if applicable, the ADS Tender Agent will deposit with the ADS Depositary the Deposited Series B Shares for issuance of ADSs and deliver those purchased ADSs as instructed by the Offeror. The Offeror will bear all fees charged by the ADS Depositary in connection with any deposit of Series B Shares for the issuance of ADSs to be tendered into the U.S. Offer. |

| | • | | In this Indonesian Offer, pursuant to the rules and regulations of the IDX, shareholders tendering Series B Shares into this Indonesian Offer must tender in lots of 500 shares. |

| | • | | In this Indonesian Offer, the Offer Price will be paid in Indonesian Rupiah. In the U.S. Offer, the consideration for tendered ADSs will be paid in U.S. dollars calculated by converting the Offer Price into U.S. dollars based on the Applicable Exchange Rate. The Applicable Exchange Rate will be the average of the daily U.S. dollar/Indonesian Rupiah sell rates for transactions as reported by Bank |

3

| | Indonesia at 4:00 p.m., Jakarta time, on each of the last five (5) Indonesian business days of the offer period (excluding the last day of the offer period) on its official website at http://www.bi.go.id/web/en/Moneter/Kurs+Bank+Indonesia/Kurs+Transaksi/. |

See “Risks of Tendering Series B Shares Into this Indonesian Offer” and “The Indonesian Offer — Sections 1, 2 and 13.”

WHAT IS THE PURPOSE OF THIS INDONESIAN OFFER?

This Indonesian Offer, together with the U.S. Offer for ADSs, is the mandatory tender offer being conducted in accordance with the Capital Market and Financial Institution Supervisory Board of the Department of Finance of the Republic of Indonesia (“BAPEPAM-LK”) Regulation IX.H.1, which requires that a party who acquires fifty percent (50%) or more of an Indonesian public company’s shares or the capability to directly or indirectly control the management and/or the policy of the public company must make a tender offer for the remaining shares of such company, subject to certain limitations and exclusions. The Offeror is making this Indonesian Offer and the U.S. Offer for ADSs as a result of Qtel’s indirect acquisition of 2,217,590,000 Series B Shares (representing approximately 40.81% of the total issued and outstanding shares of Indosat) pursuant to a Share Purchase Agreement, dated June 6, 2008 (the “Share Purchase Agreement”), between Qtel and STT Communications Ltd, a company incorporated under the laws of Singapore. Under BAPEPAM-LK Regulation IX.H.1, Qtel is deemed to have acquired “control” in Indosat as a result of such acquisition pursuant to such Share Purchase Agreement. See “The Indonesian Offer —Sections 1 and 9.”

On December 19, 2008, the Capital Investment Coordinating Board of the Republic of Indonesia determined that foreign capital ownership in the cellular telecommunication network operation sector of Indonesia should be limited to a maximum amount of 65%. BAPEPAM-LK, through its letter No. S-9186/BL/2008 dated December 23, 2008 (the “BAPEPAM-LK Letter”), notified Qtel that Qtel is allowed to acquire a maximum of 65% ownership interest in Indosat. Therefore, the maximum number of Series B Shares (including Series B Shares underlying ADSs) that Qtel is permitted to acquire pursuant to this Indonesian Offer and the U.S. Offer for ADSs is 1,314,466,775 Series B Shares, representing approximately 24.19% of the outstanding Series B Shares (including Series B Shares underlying ADSs). However, the implementation by Qtel of the Offers for up to an additional 24.19% of the outstanding Series B Shares, on a combined basis, in accordance with and pursuant to the BAPEPAM-LK Letter shall not be deemed as its, or its affiliates’, acceptance or acknowledgment that the restriction on foreign investment under the Indonesian investment regulation applies to Indonesian companies whose shares are listed and traded on the stock exchange.

We are making this Indonesian Offer for Series B Shares and the separate U.S. Offer for ADSs for the purpose of acquiring, in the aggregate, 1,314,466,775 outstanding Series B Shares (including Series B Shares underlying ADSs), in accordance with BAPEPAM-LK Regulation IX.H.1 and BAPEPAM-LK Regulation X.F.1 and the BAPEPAM-LK Letter. If more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) are validly tendered and not properly withdrawn in the Offers, then the proration rules will apply, as described in “The Indonesian Offer — Section 4,” so that we will purchase no more than an aggregate of 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs). Qtel currently has no plans in place and has not submitted any proposal to Indosat which, immediately after the Offers, would result in the delisting of the Series B Shares from the IDX or the delisting of ADSs from the NYSE. See “The Indonesian Offer — Sections 1 and 11.”

WILL I HAVE TO PAY ANY FEES OR COMMISSIONS IF I CHOOSE TO TENDER MY SERIES B SHARES?

If your Series B Shares are registered in your name on the Company’s share register and are in the form of share certificate(s), you should contact the Appointed Share Registrar at the telephone number and address appearing on the back cover of this Offer to Purchase to convert your share certificates into “scripless” shares no

4

later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. You will bear any costs relating to such conversion. You will also be charged a transaction fee by the Share Tender Agent, which includes a commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia. Holders who surrender ADSs and withdraw the Series B Shares represented by the ADSs, including for the purpose of subsequently tendering those Series B Shares into this Indonesian Offer, will bear all associated fees and expenses under the Deposit Agreement, not to exceed a maximum of $5 per 100 ADSs surrendered plus a cable fee of $12.50, and must comply with any other applicable terms and conditions thereunder.

DOES THE OFFEROR HAVE THE FINANCIAL RESOURCES TO MAKE THE PAYMENTS REQUIRED IN THE OFFERS?

The Offeror has sufficient funds to purchase the Series B Shares and ADSs being sought in the Offers and to pay related costs and expenses. The Offeror’s source of funds will be cash on hand. The Offers are not conditioned upon the receipt of financing by the Offeror. For more information, see “The Indonesian Offer — Section 7.”

IS THE OFFEROR’S FINANCIAL CONDITION MATERIAL TO MY DECISION WHETHER TO TENDER INTO THIS INDONESIAN OFFER?

No. The Offeror does not believe that its financial condition is material to your decision whether to tender into this Indonesian Offer because only cash consideration is being offered, and the Offers are not subject to any financing condition.

See “The Indonesian Offer — Section 7.”

WHAT DOES THE COMPANY’S BOARD OF DIRECTORS RECOMMEND REGARDING THE TENDER OFFER?

Indosat has filed, under the Exchange Act, a solicitation/recommendation statement on Schedule 14D-9 with the SEC on the same day as the filing of this Offer to Purchase with the SEC, pursuant to which the board of directors of Indosat has stated that it would express no opinion and remain neutral with respect to the Offers. See “The Indonesian Offer — Section 1.”

ARE THERE ANY CONDITIONS TO THIS INDONESIAN OFFER?

Currently, this Indonesian Offer is unconditional other than that in order to be accepted for payment (subject to proration), Series B Shares must be validly tendered and not withdrawn as of the expiration of this Indonesian Offer. The Offeror reserves the right, at any time or from time to time, in its sole discretion, to amend this Indonesian Offer to impose one or more conditions on this Indonesian Offer by giving notice of such amendment to the Share Tender Agent, making a public announcement thereof and making any required filings with the SEC and BAPEPAM-LK. See “The Indonesian Offer — Section 1.”

HOW LONG DO I HAVE TO DECIDE WHETHER TO TENDER SERIES B SHARES INTO THIS INDONESIAN OFFER?

You have until 3:00 p.m., Jakarta time (which is 3:00 a.m., New York City time), on February 18, 2009, to tender your Series B Shares into this Indonesian Offer. If your Series B Shares are held by a broker, bank or other nominee, your nominee may require notification before the expiration of this Indonesian Offer in order to have sufficient time to comply with Indonesian tender procedures and requirements for tendering Series B Shares into this Indonesian Offer, including the conversion of your Series B Shares into “scripless” form and other tender procedures and requirements of this Indonesian Offer. U.S. holders who wish to deposit their Series B Shares with the ADS Tender Agent for issuance of ADSs to be tendered into the U.S. Offer must allow sufficient time to do so prior to the expiration of the U.S. Offer. See “The Indonesian Offer — Section 2.”

5

CAN THIS INDONESIAN OFFER BE EXTENDED AND UNDER WHAT CIRCUMSTANCES?

Pursuant to BAPEPAM-LK Regulation No. IX.F.1, this Indonesian Offer and the U.S. Offer for ADSs may not be open for longer than thirty (30) days, unless otherwise stipulated by the Chairman of BAPEPAM-LK.

The Offeror presently does not intend to extend the offer period for the Offers and intends to make the offer periods for the Offers the same. However, in the event an extension of this Indonesian Offer is required beyond the currently scheduled expiration date pursuant to U.S. laws applicable to the Indonesian Offer, then the Offeror would require the approval of the Chairman of BAPEPAM-LK to so extend the offer period for this Indonesian Offer and the U.S. Offer. There can be no assurance that the Chairman of BAPEPAM-LK will approve such extension.

See “The Indonesian Offer — Sections 1 and 13.”

HOW WILL I BE NOTIFIED IF THIS INDONESIAN OFFER IS EXTENDED?

In the event an extension of the Offers is required beyond the currently scheduled expiration date pursuant to U.S. law, then the Offeror would require the approval of the Chairman of BAPEPAM-LK to so extend the offer period so that both Offers expire at the same time. If the extension is approved, (i) under Indonesian law, public announcement of such extension must be made no later than two (2) days prior to the commencement of the extended offer period and (ii) under U.S. law, public announcement of the extension must be made no later than 9:00 a.m., New York City time, on the first U.S. business day following the day on which the Offers were scheduled to expire. For more information, see “The Indonesian Offer — Section 13.”

I HOLD SERIES B SHARES IN “STREET” NAME. HOW DO I PARTICIPATE IN THIS INDONESIAN OFFER?

If you hold Series B Shares in “street” name, instruct your broker or custodian to arrange, before the expiration of this Indonesian Offer, for the conversion of your share certificates into “scripless” shares no later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. You will bear any costs relating to such conversion. You will be provided with a Tender Offer Form by your broker or custodian to instruct your broker or custodian to tender your Series B Shares. This form will also be available from the Appointed Share Registrar or the Share Tender Agent. See “The Indonesian Offer — Section 2.”

CAN I WITHDRAW MY PREVIOUSLY-TENDERED SERIES B SHARES?

Yes. You can withdraw your previously-tendered Series B Shares at any time before 3:00 p.m., Jakarta time (which is 3:00 a.m., New York City time), on February 18, 2009, unless the expiration date is extended in accordance with applicable law, in which event you will have until the later day and time to which this Indonesian Offer is extended. In addition, if the Offeror has not accepted tendered Series B Shares for payment by March 20, 2009, under U.S. law you can withdraw your Series B Shares at any time after such date and prior to such acceptance. See “The Indonesian Offer — Sections 1 and 3.”

HOW DO I WITHDRAW MY PREVIOUSLY-TENDERED SERIES B SHARES?

To withdraw your previously-tendered Series B Shares from this Indonesian Offer, you must, through the securities company or custodian bank (that holds an account with KSEI) where you have opened a securities account, provide a written notification regarding such cancellation to the Appointed Share Registrar (with a copy delivered to KSEI) while you have the right to withdraw Series B Shares. See “The Indonesian Offer — Section 3.”

6

WHAT HAPPENS IF HOLDERS TENDER SERIES B SHARES REPRESENTING MORE SERIES B SHARES THAN YOU ARE WILLING TO PURCHASE?

If more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs validly tendered into the U.S. Offer for ADSs) are validly tendered and not properly withdrawn in this Indonesian Offer and the U.S. Offer for ADSs on a combined basis, we will purchase up to an aggregate of 1,314,466,775 Series B Shares including Series B Shares underlying ADSs) from tendering holders in this Indonesian Offer and the U.S. Offer for ADSs on a pro rata basis, subject to certain adjustments. This means that we will purchase from you that number of Series B Shares calculated by multiplying the number of Series B Shares you validly tendered and did not properly withdraw as of the expiration of this Indonesian Offer by a proration factor. The proration factor will be the quotient of 1,314,466,775 divided by the total number of Series B Shares (including Series B Shares underlying ADSs) validly tendered and not properly withdrawn in this Indonesian Offer and the U.S. Offer for ADSs on a combined basis. For example, if 1,752,622,366 Series B Shares (including Series B Shares underlying ADSs) are validly tendered and not properly withdrawn as of the expiration of the Offers on a combined basis, we will purchase seventy-five percent (75%) of the number of Series B Shares that you tender (with adjustments to avoid the purchase of fractional Series B Shares from any holder). See “The Indonesian Offer — Section 4.”

IF YOU PRORATE, WHEN WILL I KNOW HOW MANY SERIES B SHARES WILL ACTUALLY BE PURCHASED?

If proration of tendered Series B Shares is required, we do not expect to announce the final results of proration until on or about February 20, 2009. This is because we will not know the precise number of Series B Shares and ADSs validly tendered into this Indonesian Offer and the U.S. Offer for ADSs, respectively, until all supporting documentation for those tenders is reviewed. Beginning on or about February 23, 2009, holders of Series B Shares may also obtain this information from the Appointed Share Registrar for this Indonesian Offer, at the telephone number set forth on the back cover of this Offer to Purchase. See “The Indonesian Offer — Section 4.”

HOW WAS THE OFFER PRICE DETERMINED?

In accordance with BAPEPAM-LK Regulation IX.H.I, the purchase price for the Series B Shares in the mandatory tender offer must be equal to or greater than the average of the highest daily trading price of the Series B Shares traded on the IDX within the period of the last ninety (90) days prior to June 8, 2008, which is the announcement date of the execution of the Share Purchase Agreement. The offer price for Series B Shares in this Indonesian Offer, which is higher than such minimum price required by Indonesian regulations, is the price per Series B Share paid by Qtel to STT in connection with the Share Purchase Agreement. See “The Indonesian Offer — Sections 1 and 9.”

WHEN AND HOW WILL YOU PAY FOR THE SERIES B SHARES I TENDER?

We will pay the purchase price for the Series B Shares that we accept for purchase, net in cash in Indonesian Rupiah (without interest and subject to any required withholding of taxes), as promptly as practicable following the expiration of this Indonesian Offer, but in any event no later than fifteen (15) calendar days after the expiration of this Indonesian Offer in accordance with Indonesian law. We will remit the cash consideration for the Series B Shares accepted for payment to KSEI on the date of the settlement of the purchase price, and KSEI will transmit the payment to you by making the appropriate credit to your account. See “The Indonesian Offer — Section 4.”

7

WHAT ARE THE U.S. FEDERAL INCOME TAX CONSEQUENCES IF I TENDER MY SERIES B SHARES?

Generally, if you are a U.S. holder you will be subject to U.S. federal income taxation when you receive cash from us in exchange for the Series B Shares you tender. A U.S. holder will recognize gain or loss for U.S. federal income tax purposes equal to the difference between the amount realized in exchange for the Series B Shares and its adjusted tax basis in such shares.

The offer consideration paid in Indonesian Rupiah will be included in the income of a U.S. holder in a U.S. dollar amount calculated by reference to the exchange rate in effect on the date of receipt by such U.S. holder, regardless of whether the cash consideration is in fact converted into U.S. dollars. U.S. holders should consult their own tax advisors regarding the treatment of foreign currency gain or loss, if any, on any Indonesian Rupiah received by a U.S. holder that are converted into U.S. dollars on a date subsequent to receipt.

See “The U.S. Offer — Section 5.”

WILL INDOSAT CONTINUE AS A PUBLIC COMPANY?

We presently anticipate that Indosat will continue as a public company and will maintain its listing on the IDX and the NYSE following consummation of the Offers. We currently have no plans in place and have not submitted any proposal to Indosat which, immediately after the Offers, would result in the delisting of the Series B Shares from the IDX or the delisting of the ADSs from the NYSE. However, after the completion of the Offers, it is possible that the ADSs may no longer satisfy the requirements for listing on the NYSE. It is possible that, due to decreases in trading volume and the number of ADS holders following the purchase of ADSs pursuant to the U.S. Offer for ADSs, the ADSs will no longer meet the continued listing requirements of the NYSE. If the ADSs fail to meet the continued listing requirements, the NYSE may choose, at its discretion, to delist the ADSs, and the ADSs will no longer be an exchange-traded security. See “The Indonesian Offer — Section 11.”

IF I DECIDE NOT TO TENDER, HOW WILL THIS INDONESIAN OFFER AFFECT MY SECURITIES?

The purchase of the Series B Shares and ADSs pursuant to the Offers will reduce the number of such securities that might otherwise trade publicly and could adversely affect the liquidity and market value of the remaining securities held by the public. In addition, as discussed above, it is possible that after consummation of the Offers, the ADSs would no longer meet the continued listing requirements on the NYSE. See “The Indonesian Offer — Section 11.”

WHAT IS THE RECENT MARKET PRICE FOR THE SERIES B SHARES?

On June 6, 2008, the last full trading day before the announcement of the plan to commence the Offers, the last reported sale price on the IDX of the Series B Shares was Rp5,650 per Series B Share. On January 19, 2009, the last full trading day before the commencement of this Indonesian Offer, the last reported sale price on the IDX of the Series B Shares was Rp5,800 per Series B Share. You are urged to obtain current market quotations for Series B Shares. See “The Indonesian Offer — Section 6.”

WHO CAN I TALK TO IF I HAVE QUESTIONS?

The Share Tender Agent can help answer your questions. The Share Tender Agent for this Indonesian Offer is PT Danareksa Sekuritas, whose contact information is on the back cover of this Offer to Purchase.

This Offer to Purchase (and the English translation of the Indonesian Tender Offer Statement, which is attached as Annex A and constitutes part of this Offer to Purchase) and the form of the Tender Offer Form contain important information, and you should read them in their entirety before you make a decision to tender your Series B Shares into this Indonesian Offer.

8

EXEMPTIONS REQUESTED FROM

THE U.S. SECURITIES AND EXCHANGE COMMISSION

This Indonesian Offer qualifies as a “Tier II” offer in accordance with the rules of the SEC promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, as a result, is exempt from certain provisions of otherwise applicable statutes and rules. In addition, we have requested from, and have been granted by, the SEC, exemptive relief from Rule 14d-10(a)(1) under the Exchange Act to permit the Offeror to make this Indonesian Offer only to holders of Series B Shares and the U.S. Offer for ADSs only to holders of ADSs (the “Rule 14d-10 Exemption”).

Rule 14d-10(a)(1) under the Exchange Act provides that no person shall make a tender offer unless the offer is open to all security holders of the class of securities subject to the tender offer. The Rule 14d-10 Exemption permits the Offeror to utilize the dual offer structure described herein to conduct this Indonesian Offer and the U.S. Offer for ADSs as two (2) separate offers, with this Indonesian Offer being made to holders of Series B Shares, and the U.S. Offer for ADSs being made to holders of ADSs.

9

RISKS OF TENDERING SERIES B SHARES INTO THIS INDONESIAN OFFER

This Indonesian Offer is open to all holders of Series B Shares, wherever the holders are located, but is not open to holders of ADSs. However, holders of ADSs who wish to participate in this Indonesian Offer may surrender their ADSs to the ADS Depositary, withdraw the Series B Shares represented by their ADSs and subsequently tender their Series B Shares into this Indonesian Offer, in accordance with the tender procedures and requirements of this Indonesian Offer. Although the terms and conditions of the U.S Offer and Indonesian Offer are substantially similar, because of differences in law and market practice between the United States and Indonesia, the rights of tendering holders under the two (2) Offers are not identical.

Extension of Offer Period. Indonesian law requires that a tender offer may not remain open for more than thirty (30) calendar days, unless otherwise stipulated by the Chairman of BAPEPAM-LK. On the other hand, U.S. law requires that a tender offer remain open for a minimum of twenty (20) U.S. business days. In addition, U.S. law requires that a tender offer be kept open at least ten (10) U.S. business days from the date that notice of a material change to the offer price or share levels is sent or given to security holders and at least five (5) U.S. business days from the date that notice of a material change not involving the offer price or share levels is sent or given to security holders. If such material change to the offer price or share levels were to occur during the last ten (10) U.S. business days of the offer period, or such material change not involving the offer price or share levels were to occur during the last five (5) U.S. business days of the offer period, the Offers would be required to remain open longer than the maximum thirty (30) calendar days allowed under Indonesian law. The Offeror presently intends to make the offer periods for this Indonesian Offer and the U.S. Offer for ADSs the same. However, in the event an extension of the Offers is required beyond the currently scheduled expiration date pursuant to U.S. law, then the Offeror would require the approval of the Chairman of BAPEPAM-LK to so extend the offer period so that both Offers expire at the same time. There can be no assurance that the Chairman of BAPEPAM-LK will approve such extension of this Indonesian Offer.

Tender Offer Procedures. The procedures for tendering Series B Shares into this Indonesian Offer are different from the U.S. Offer for ADSs. Under the terms of this Indonesian Offer, among other requirements:

| | • | | If your Series B Shares are registered in your name on the Company’s share register and are in the form of share certificate(s), you must contact the Appointed Share Registrar to convert your share certificates into “scripless” shares no later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. If you own your Series B Shares through a financial institution, you are urged to consult with these financial institutions to determine how, and by what time and means, you must give instructions to that financial institution. You will bear any costs relating to such conversion into “scripless” shares. |

| | • | | You must open a securities account with an Indonesian securities company or custodian bank holding an account with KSEI prior to submitting a Tender Offer Form and any other required documentation for this Indonesian Offer to the Appointed Share Registrar, whose telephone number and address appear on the back cover of the Indonesian Tender Offer Statement. Upon acceptance of the Tender Offer Form and other required documentation, the Appointed Share Registrar will issue a certified receipt of your participation in this Indonesian Offer. |

| | • | | You must then deliver a copy of the Appointed Share Registrar’s certified receipt to the Indonesian securities company or custodian bank holding an account with KSEI, and instruct such Indonesian securities company or custodian bank to instruct KSEI to transfer your Series B Shares held by such securities company or custodian bank under your name to the KSEI Temporary Escrow Account designated as “KSEI 1-1092-001-96” (the “Escrow Account”).In the event that the securities company/custodian bank fails to instruct KSEI to transfer such Series B Shares into the Escrow Account prior to the expiration of this Indonesian Offer, your tender of Series B Shares will not be deemed to have been validly made and will not be accepted for purchase by the Offeror in this Indonesian Offer. Once the Series B Shares have been transferred to the Escrow Account, such |

10

| | Series B Shares will be verified by the Share Tender Agent and the Appointed Share Registrar. Once such verification is complete, the Share Tender Agent will provide KSEI with a confirmation. You will be charged a transaction fee by the Share Tender Agent, which includes commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia. |

Holders of ADSs who wish to participate in this Indonesian Offer must allow sufficient time to comply with Indonesian tender procedures and requirements for tendering Series B Shares into this Indonesian Offer.

Treatment of Odd-Lots. In this Indonesian Offer, shareholders tendering Series B Shares must tender Series B Shares in increments of 500 shares. Under the tender offer practices in Indonesia, lots of less than 500 shares cannot be transferred into the account of KSEI and, therefore, cannot be tendered into this Indonesian Offer.

In addition, if proration rules apply such that a proration factor must be applied to the aggregate number of Series B Shares tendered by each tendering shareholder in order to determine the number of Series B Shares that the Offeror may purchase from such tendering shareholder in this Indonesian Offer, then the resulting product will be rounded up or down to the nearest 500 Series B Shares in order to determine the number of Series B Shares that the Offeror will accept for purchase in this Indonesian Offer.

Currency Risk. In the U.S. Offer for ADSs, the Offer Price for the ADSs accepted for payment in the U.S. Offer for ADSs will be paid in U.S. dollars, based on the Offer Price of Indonesian Rupiah 369,400 per ADS and the “Applicable Exchange Rate,” where the Applicable Exchange Rate will be the average of the daily U.S. dollar/Indonesian Rupiah sell rates for transactions as reported by Bank Indonesia at 4:00 p.m., Jakarta time, on each of the last five (5) Indonesian business days of the offer period (excluding the last day of the offer period) on its official website at http://www.bi.go.id/web/en/Moneter/Kurs+Bank+Indonesia/Kurs+Transaksi/. In this Indonesian Offer, the offer price of Indonesian Rupiah 7,388 per Series B Share will be paid in local currency. If you later wish to convert the consideration received in this Indonesian Offer into U.S. dollars, you will bear any exchange rate risks, which may be more or less favorable to you than the Applicable Exchange Rate.

11

THE INDONESIAN OFFER

1. TERMS OF THE INDONESIAN OFFER; EXPIRATION DATE.

Qatar Telecom (Qtel) Q.S.C., a corporation organized under the laws of Qatar (“Qtel”), through Indonesia Communications Pte. Ltd., a company incorporated under the laws of Singapore and a wholly-owned indirect subsidiary of Qtel (“ICLS” and, together with Qtel, the “Offeror” or “we” or “us”), is offering to purchase Series B Shares, par value Rp100 (“Series B Shares”), of PT Indosat Tbk., an Indonesian company (“Indosat” or the “Company”), other than Series B Shares held by Qtel and its affiliates and Series B Shares underlying American Depositary Shares (“ADSs”), at a purchase price of Indonesian Rupiah 7,388 per Series B Share, net to the seller in cash (without interest and subject to any required withholding of taxes) (the “Offer Price”), upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Tender Offer Form, as they may be amended or supplemented from time to time (together, the “Indonesian Offer”). Payment for Series B Shares accepted for purchase in this Indonesian Offer will be Indonesian Rupiah and will be made no later than fifteen (15) calendar days following the expiration of this Indonesian Offer. For more information, see “The Indonesian Offer — Section 4.”

Concurrently with this Indonesian Offer, the Offeror is offering to purchase outstanding ADS of Indosat (other than ADSs held by Qtel and its affiliates) pursuant to a separate U.S. Offer (the “U.S. Offer for ADSs” and, together with this Indonesian Offer, the “Offers”) at a purchase price of the U.S. dollar equivalent of Rp369,400 per ADS.

In the aggregate, the Offeror is offering to purchase up to 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis, representing approximately 24.19% of the total issued and outstanding Series B Shares (including Series B Shares underlying ADSs). If more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) are validly tendered and not withdrawn in the Offers on a combined basis, then the proration rules will apply, as described in “The Indonesian Offer — Section 4,” so that the Offeror will purchase no more than an aggregate of 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis.

This Indonesian Offer is open to all holders of Series B Shares, wherever the holders are located, but is not open to holders of ADSs. All holders of ADSs who wish to tender their ADSs must tender such ADSs into the U.S. Offer for ADSs. Holders of ADSs who wish to participate in this Indonesian Offer may surrender their ADSs to The Bank of New York Mellon, as depositary for the ADS facility (the “ADS Depositary”), withdraw the Series B Shares represented by their ADSs and subsequently tender those Series B Shares into this Indonesian Offer. Holders of ADSs will bear all fees and expenses under the Deposit Agreement (not to exceed a maximum of $5 per 100 ADSs surrendered plus a cable fee of $12.50) in connection with any such withdrawal of Series B Shares under the Deposit Agreement and such other fees and expenses for tendering Series B Shares pursuant to the terms and conditions of this Indonesian Offer. See “Risks of Tendering Series B Shares Into this Indonesian Offer” and “See “The Indonesian Offer — Section 2.”

The U.S. Offer is open only to holders of ADSs, and Series B Shares will not be accepted in the U.S. Offer. All holders of Series B Shares who wish to tender their Series B Shares must tender such shares into this Indonesian Offer. However, U.S. holders of Series B Shares may participate in the U.S. Offer by depositing their Series B Shares with either HSBC Indonesia or PT Bank Mandiri (Persero) Tbk., as custodian (the “ADS Custodian”) for the ADS Depositary. Those holders must also deliver the ADS Letter of Transmittal and other documentation required for tendering ADSs to the ADS Tender Agent. To the extent that the Offeror accepts ADSs for purchase in the U.S. Offer, after the application of proration, if applicable, the ADS Tender Agent will deposit with the ADS Depositary the Deposited Series B Shares for issuance of ADSs and deliver those purchased ADSs as instructed by the Offeror. The Offeror will bear all fees charged by the ADS Depositary in connection with any deposit of Series B Shares for the issuance of ADSs to be tendered into the U.S. Offer. See “The Indonesian Offer — Section 2.”

12

Holders who wish to withdraw or deposit their Series B Shares from or into the ADS facility before tendering must allow sufficient time to do so.

This Indonesian Offer is not conditioned on any minimum number of Series B Shares being tendered or any other conditions other than that in order to be accepted for payment (subject to proration), Series B Shares must be validly tendered and not withdrawn as of the expiration of this Indonesian Offer.

Except for the purchase of ADSs in the U.S. Offer for ADSs, the Offeror has not purchased or made any arrangement to purchase, and will not purchase or make any arrangement to purchase, ADSs or Series B Shares outside of this Indonesian Offer from June 8, 2008 until the expiration of this Indonesian Offer.

Indosat has filed, under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), a solicitation/recommendation statement on Schedule 14D-9 with the Securities and Exchange Commission (the “SEC”) on the same day as the filing of this Offer to Purchase with the SEC, pursuant to which the board of directors of Indosat has stated that it would express no opinion and remain neutral with respect to the Offers.

Purpose of the Indonesian Offer. Upon the terms and subject to the conditions of this Indonesian Offer, we will purchase (subject to proration) outstanding Series B Shares of the Company, other than Series B Shares held by Qtel and its affiliates and Series B Shares underlying ADSs, from all holders who validly tender and have not properly withdrawn their Series B Shares before the expiration of this Indonesian Offer at a purchase price of Rp7,388 per Series B Share, net to the seller in cash (without interest and subject to any required withholding of taxes). If, in the aggregate, more than 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs validly tendered into the separate U.S. Offer for ADSs) are validly tendered and not properly withdrawn in the Offers, then the proration rules will apply, as described in “The Indonesian Offer — Section 4,” so that the Offeror will purchase no more than an aggregate of 1,314,466,775 Series B Shares (including Series B Shares underlying ADSs) in the Offers on a combined basis.

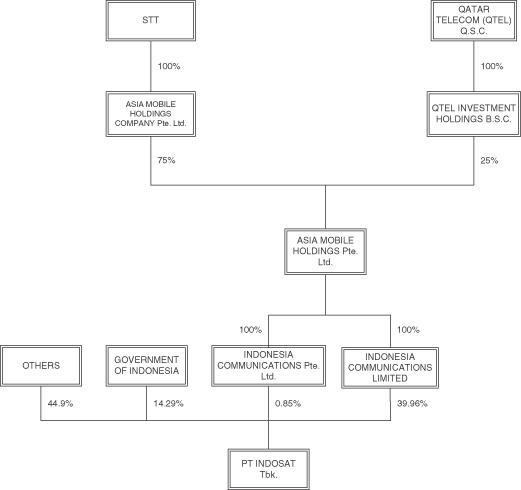

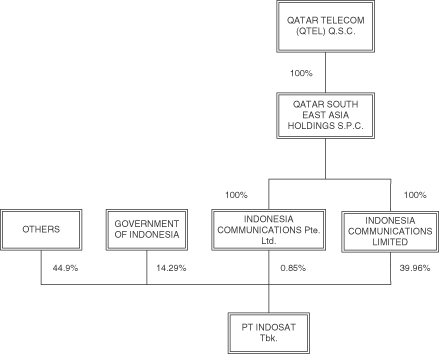

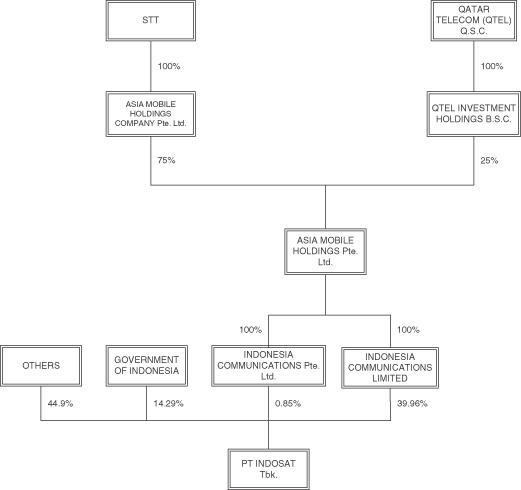

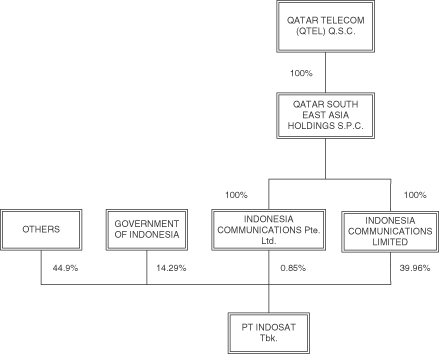

Reasons for the Indonesian Offer. This Indonesian Offer, together with the U.S. Offer for ADSs, is a mandatory tender offer being conducted in accordance with Capital Market and Financial Institution Supervisory Board of the Department of Finance of the Republic of Indonesia (“BAPEPAM-LK”) Regulation IX.H.1, which requires that a party that acquires fifty percent (50%) or more of an Indonesian public company’s shares or the capability to directly or indirectly control the management or policy of an Indonesian public company must make a tender offer for the remaining shares of such company, subject to certain limitations and exclusions. The Offeror is making this Indonesian Offer as a result of Qtel’s indirect acquisition of 2,217,590,000 Series B Shares (representing approximately 40.81% of the total issued and outstanding shares of Indosat) pursuant to a Share Purchase Agreement, dated June 6, 2008 (the “Share Purchase Agreement”), between Qtel and STT Communications Ltd., a company incorporated under the laws of Singapore (“STT”), which gave Qtel the capability to indirectly control the management or policy of Indosat. Prior to the Share Purchase Agreement, no management relationship between Qtel and Indosat existed, other than the appointment of H.E. Sheikh Mohammed bin Suhaim Al Thani, Qtel’s Vice Chairman, to the Board of Commissioners of Indosat. Pursuant to the Share Purchase Agreement, Qtel acquired the shares of Indonesia Communications Limited, a company incorporated under the laws of Mauritius (“ICLM”) and ICLS, which are the direct holders of the 2,217,590,000 Series B Shares held by Asia Mobile Holdings Pte. Ltd., a company incorporated under the laws of Singapore (“AMH”), which is 75% owned by STT and 25% indirectly owned by Qtel, and ICLM and ICLS became wholly-owned indirect subsidiaries of Qtel. See “The Indonesian Offer — Section 9.”

On December 19, 2008, the Capital Investment Coordinating Board of the Republic of Indonesia determined that foreign capital ownership in the cellular telecommunication network operation sector of Indonesia will be limited to a maximum amount of 65%. BAPEPAM-LK, through its letter No. S-9186/BL/2008 dated December 23, 2008 (the “BAPEPAM-LK Letter”), notified Qtel that Qtel is allowed to acquire a maximum of 65% ownership interest in Indosat. Therefore, the maximum number of Series B Shares (including Series B Shares underlying ADSs) that Qtel is permitted to acquire pursuant to this Indonesian Offer and U.S. Offer for

13

ADSs is 1,314,466,775 Series B Shares, representing approximately 24.19% of the outstanding Series B Shares (including Series B Shares underlying ADSs). However, the implementation by Qtel of the Offers for up to an additional 24.19% of the outstanding Series B Shares, on a combined basis in accordance with and pursuant to the BAPEPAM-LK Letter, shall not be deemed as its, or its affiliates’, acceptance or acknowledgment that the restriction on foreign investment under the Indonesian investment regulation applies to Indonesian companies whose shares are listed and traded on the stock exchange.

Expiration Date. This Indonesian Offer and withdrawal rights will expire at 3:00 p.m., Jakarta time (which is 3:00 a.m., New York City time), on February 18, 2009, unless the expiration date is extended in accordance with applicable law, in which event you will have until the later day and time to which the Indonesian Offer is extended to tender your Series B Shares into this Indonesian Offer.

See “The Indonesian Offer — Section 3” for a description of your withdrawal rights.

See “The Indonesian Offer — Section 4” for a description of our right to purchase Series B Shares tendered by you on a pro rata basis.

See “The Indonesian Offer — Section 13” for a description of our right to extend, delay, terminate or amend this Indonesian Offer.

2. PROCEDURES FOR TENDERING SHARES.

In this Indonesian Offer, shareholders tendering Series B Shares must tender Series B Shares in increments of 500 shares. Under the tender offer practices in Indonesia, lots of less than 500 shares cannot be transferred into the account of KSEI and, therefore, cannot be tendered into this Indonesian Offer.

For Series B Shares to be validly tendered pursuant to this Indonesian Offer, you must follow the tender procedures set forth in Section VI of the Indonesian Tender Offer Statement (an English translation of which is attached hereto as Annex A) and the Tender Offer Form, including the following procedures:

| | • | | If your Series B Shares are registered in your name on the Company’s share register and are in the form of share certificate(s), you should contact the Appointed Share Registrar at the telephone number and address appearing on the back cover of this Offer to Purchase to convert your share certificates into “scripless” shares no later than five (5) Indonesian business days prior to the expiration of this Indonesian Offer. You will bear any costs relating to such conversion. You should then open a securities account with an Indonesian securities company or custodian bank holding an account with KSEI prior to submitting the Tender Offer Form to the Appointed Share Registrar. |

| | • | | You must deliver to the Appointed Share Registrar, at the address appearing on the back cover of this Offer to Purchase, an application consisting of (i) five (5) sets of the properly completed and duly executed original Tender Offer Form, which was provided by the Appointed Share Registrar or the Share Tender Agent, (ii) evidence of power of attorney (if your Tender Offer Form has been executed by someone other than you) that is satisfactory to the Appointed Share Registrar and (iii) proof of identity (consisting of a copy of your Indonesian identification card, passport or, if you are a corporate or other entity, your Articles of Association or similar organizational document). Upon your proper submission of the Tender Offer Form and proof of identity that is satisfactory to the Appointed Share Registrar, you will receive from the Appointed Share Registrar the evidence of receipt of the Tender Offer Form, consisting of the fourth and fifth copies of your Tender Offer Form that will have been dated and signed by the authorized representative of the Appointed Share Registrar (the “Receipt”). |

| | • | | You must then deliver the Receipt to the Indonesian securities company or custodian bank holding an account with KSEI, and instruct such Indonesian securities company or custodian bank to instruct KSEI to transfer your Series B Shares held by such securities company or custodian bank under your |

14

| | name to the KSEI Temporary Escrow Account designated as “KSEI 1-1092-001-96” (the “Escrow Account”).In the event that the securities company/custodian bank fails to instruct KSEI to transfer such Series B Shares into the Escrow Account prior to the expiration of this Indonesian Offer, your tender of Series B Shares will not be deemed to have been validly made and will not be accepted for purchase by the Offeror in this Indonesian Offer. Once the Series B Shares have been transferred to the Escrow Account, such Series B Shares will be verified by the Share Tender Agent and the Appointed Share Registrar, and, once such verification is complete, the Share Tender Agent will provide KSEI with a confirmation. You will also be charged a transaction fee by the Share Tender Agent, which includes commission, the prevailing stock exchange transaction fee and the final withholding tax pursuant to the prevailing laws and regulations in Indonesia. |

Tendering holders who hold Series B Shares through financial institutions are urged to consult these financial institutions to determine how, and by what time and means, the holder must give instructions to that financial institution.

Series B Shares will be deemed delivered only when transferred to the Escrow Account and verified by the Share Tender Agent and the Appointed Share Registrar. In all cases, sufficient time should be allowed to ensure timely conversion of the Series B Shares and timely delivery of any required documents.

Surrender of ADSs for Delivery of Series B Shares.If you hold ADSs and wish to participate in this Indonesian Offer, you may surrender your ADSs to The Bank of New York Mellon (as ADS Depositary), withdraw the Series B Shares represented by your ADSs (each ADS representing fifty (50) Series B Shares) and subsequently tender your Series B Shares into this Indonesian Offer (subject to proration). Holders will bear any fees and expenses under the Deposit Agreement in connection with any withdrawal of Series B Shares under the Deposit Agreement and any fees and expenses associated with tendering Series B Shares into this Indonesian Offer, and must comply with any other applicable terms and conditions thereunder. The requirements for surrendering ADSs for Series B Shares include, among other things, payment of a surrender fee of a maximum of $5 per 100 ADSs surrendered (or portion thereof) plus a cable fee of $12.50, all taxes, governmental charges, stock transfer fees and registration fees payable in connection with the surrender of the ADRs evidencing the ADSs and the withdrawal of the Series B Shares. Also, the ADS Depositary may require, among other things, the ADRs evidencing the ADSs surrendered in exchange for Series B Shares to be properly endorsed in blank or accompanied by proper instruments of transfer in blank. Holders of ADSs wishing to surrender their ADSs for Series B Shares are urged to contact the ADR Division of the ADS Depositary at +1 (212) 815-2231 immediately to determine what steps need to be taken in order to complete the surrender in a timely manner to permit the Series B Shares withdrawn to be validly tendered pursuant to this Indonesian Offer.

If you choose to surrender your ADSs for delivery of Series B Shares and subsequently tender into this Indonesian Offer, you will bear the risk of any fluctuation in the exchange rate after the consummation of the Offers if you later wish to convert your Indonesian Rupiah into U.S. dollars and such other risks and costs associated with tendering Series B Shares into this Indonesian Offer. See “Risks of Tendering Series B Shares Into this Indonesian Offer.”

Deposit of Series B Shares for Delivery of ADSs.If you are a U.S. holder of Series B Shares and wish to participate in the U.S. Offer for ADSs, you may deposit your Series B Shares in the ADS facility for issuance of ADSs that will be tendered into the U.S. Offer for ADSs (subject to proration). To do so, prior to the expiration of the U.S. Offer for ADSs, you must (i) deposit your Series B Shares with the ADS Custodian (ii) and deliver an ADS Letter of Transmittal and any other documents required by the ADS Letter of Transmittal to the ADS Tender Agent. To the extent that the Offeror accepts ADSs for purchase in the U.S. Offer for ADSs, after the application of proration, if applicable, the ADS Tender Agent will deposit with the ADS Depositary the Deposited Series B Shares for issuance of ADSs and deliver those purchased ADSs as instructed by the Offeror.

15

Each ADS will represent fifty (50) Deposited Series B Shares. If such converting shareholder deposits “Odd-lots” (lots of fewer than fifty (50) Series B Shares), such shareholder must deposit those Series B Shares with the ADS Custodian as described above. To the extent practicable, the ADS Tender Agent will combine Odd-lots of Series B Shares that the Offeror accepts for purchase with other Odd-lots to create whole ADSs that will be delivered for purchase by the Offeror. All Deposited Series B Shares not accepted for purchase in the form of ADSs in the U.S. Offer for ADSs due to proration, withdrawal or otherwise not purchased by the Offeror will be returned to the holder, in accordance with your instructions contained in the ADS Letter of Transmittal, in the form of Series B Shares. Holders will not be responsible for any fees relating to the deposit of Series B Shares with the ADS Tender Agent for issuance of ADSs to be tendered into the U.S. Offer for ADSs, whether or not they hold Series B Shares in “Odd-lots.”

U.S. holders of Series B Shares that would like to participate in the U.S. Offer for ADSs pursuant to the procedure described above are cautioned to provide for sufficient time to complete the tender before the U.S. Offer expires. Any questions concerning the U.S. Offer for ADSs, or requests for assistance or copies of the U.S. Offer to Purchase and ADS Letter of Transmittal for the U.S. Offer for ADSs, may be directed to the Information Agent for the U.S. Offer for ADSs at the following address and telephone number listed below:

BNY MELLON SHAREOWNER SERVICES

480 Washington Boulevard

Jersey City, NJ 07310

In the United States: 1-877-289-0143 (Toll-Free)

Outside the United States: 1-201-680-3285

Banks and Brokers: 1-201-680-3285

Tender Constitutes an Agreement. The tender of Series B Shares pursuant to any one of the procedures described above will constitute the tendering holder’s acceptance of the terms and conditions of this Indonesian Offer and an agreement between the tendering holder and us upon the terms and subject to the conditions of this Indonesian Offer, as well as the tendering holder’s representation and warranty to us that the tendering holder (1) has full power and authority to tender, sell, assign and transfer the Series B Shares tendered hereby and that, when the Series B Shares are accepted for payment by us, we will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances and not subject to any adverse claims; and (2) will, upon request, execute and deliver any additional documents deemed by us or the Share Tender Agent, as the case may be, to be necessary or desirable to complete the sale, assignment and transfer of the Series B Shares tendered hereby.

Determination of Validity; Rejection of Shares; Waiver of Defects; No Obligation to Give Notice of Defects. All questions as to the purchase price, the form of documents and the validity, eligibility (including time of receipt) and acceptance for payment of any tender of Series B Shares will be determined by us, in our sole discretion, which determination shall be final and binding on all parties. We reserve the absolute right to reject any or all tenders of Series B Shares determined by us not to be in proper form, or the acceptance of which or payment for which may, in the opinion of our counsel, be unlawful (including by reason of proration). We also reserve the absolute right to waive any defect or irregularity in any tender of a particular Series B Share, and our interpretation of the terms of this Indonesian Offer (including the instructions in the Tender Offer Form) will be final and binding on all parties. No tender of Series B Shares will be deemed to be properly made until all defects and irregularities have been cured or waived. Unless waived, any defects or irregularities in connection with tenders must be cured within such time as we shall determine. None of us, the Share Tender Agent, the Appointed Share Registrar or any other person will be under any duty to give notification of any defect or irregularity in tenders or incur any liability for failure to give any such notification.

Return or Release of Unpurchased Series B Shares. If any tendered Series B Shares are not purchased pursuant to this Indonesian Offer (including by reason of proration), or if less than all of a shareholder’s Series B Shares are tendered, KSEI shall return such Series B Shares to the tendering holder’s securities account on or

16

about February 23, 2009, as set forth in the Tender Offer Form. If any tendered Series B Shares are properly withdrawn before the expiration of this Indonesian Offer, KSEI shall return such Series B Shares to the holder’s account within two (2) days of receipt of the confirmation of withdrawal from the Appointed Share Registrar.

FIVE (5) SETS OF PROPERLY COMPLETED AND DULY EXECUTED ORIGINAL TENDER OFFER FORMS (BEARING AN ORIGINAL SIGNATURE) AND ANY OTHER DOCUMENTS REQUIRED BY THE TENDER OFFER FORM, MUST BE DELIVERED TO THE APPOINTED SHARE REGISTRAR AND NOT TO US. ANY SUCH DOCUMENTS DELIVERED TO US WILL NOT BE FORWARDED TO THE APPOINTED SHARE REGISTRAR AND THEREFORE WILL NOT BE DEEMED TO BE VALIDLY TENDERED. YOU MUST CONTACT THE SECURITIES COMPANY OR CUSTODIAN (THAT HOLDS AN ACCOUNT WITH KSEI) WHERE YOU MAINTAIN A SECURITIES ACCOUNT FOR DELIVERY OF ORIGINAL TENDER OFFER FORMS.

3. WITHDRAWAL RIGHTS.

Tenders of Series B Shares made pursuant to this Indonesian Offer may be withdrawn at any time prior to the expiration of this Indonesian Offer. If we are permitted to postpone payment for the Series B Shares, then, without prejudice to our rights under this Indonesian Offer, the Share Tender Agent may, on our behalf, respectively retain all Series B Shares tendered, and such Series B Shares may not be withdrawn except as otherwise provided in this Section 3. See “The Indonesian Offer — Section 13.”

Withdrawal of Shares. Prior to the expiration of this Indonesian Offer, a holder of Series B Shares may, through the Indonesian securities company or custodian bank (that holds an account with KSEI) where it maintains a securities account, cancel its participation in this Indonesian Offer for part or all of its tendered Series B Shares by providing a written notification regarding such cancellation to the Appointed Share Registrar (with a copy to KSEI). Upon receiving the notification and upon confirmation from the Appointed Share Registrar, KSEI shall transfer the withdrawn Series B Shares from the Escrow Account into the account of the withdrawing holder of Series B Shares maintained with the related Indonesian securities company or custodian bank within two (2) U.S. business days after the receipt of such notification.

General. Withdrawals may not be rescinded, and Series B Shares withdrawn will thereafter be deemed not tendered for purposes of this Indonesian Offer. However, withdrawn Series B Shares may be re-tendered by again following one of the procedures described in “The Indonesian Offer — Section 2” at any time prior to the expiration of this Indonesian Offer.

We will determine all questions as to the validity (including time of receipt) of any notice of withdrawal, in our sole discretion, which determination shall be final and binding. We also reserve the absolute right to waive any defect or irregularity in the withdrawal of Series B Shares by any shareholder, and such determination will be binding on all shareholders. None of us, the Share Tender Agent, the Appointed Share Registrar or any other person will be under any duty to give notification of any defect or irregularity in any notice of withdrawal or incur any liability for failure to give any such notification.

No Subsequent Offering Period. Indonesian law does not provide for a subsequent offering period and therefore there will be no subsequent offering period in connection with this Indonesian Offer.

4. PRORATION; PURCHASE OF SHARES AND PAYMENT OF PURCHASE PRICE.