Exhibit 15.2

RELX Group is a global provider of information and analytics for professional and business customers across industries.

We help scientists make new discoveries, lawyers win cases, doctors save lives and insurance companies offer customers lower prices. We save taxpayers and consumers money by preventing fraud and help executives forge commercial relationships with their clients.

In short, we enable our customers to make better decisions, get better results and be more productive.

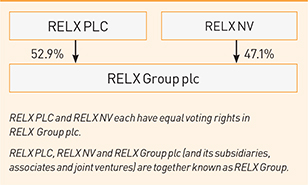

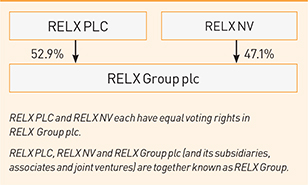

RELX PLC is a London listed holding company which owns 52.9% of RELX Group.

RELX NV is an Amsterdam listed holding company which owns 47.1% of RELX Group.

Forward-looking statements

This Results Announcement contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to a number of risks and uncertainties that could cause actual results or outcomes to differ materially from those currently being anticipated. The terms “outlook”, “estimate”, “project”, “plan”, “intend”, “expect”, “should be”, “will be”, “believe”, “trends” and similar expressions identify forward-looking statements. Factors which may cause future outcomes to differ from those foreseen in forward-looking statements include, but are not limited to: current and future economic, political and market forces; changes in law and legal interpretations affecting the Group’s intellectual property rights; regulatory and other changes regarding the collection, transfer of use of third party content and data; demand for the Group’s products and services; competitive factors in the industries in which the Group operates; compromises of our data security systems and interruptions in our information technology systems; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC and RELX NV with the US Securities and Exchange Commission.

| | |

| 2 | | RELX Group Annual reports and financial statements 2016 |

|

|

2016 Financial highlights

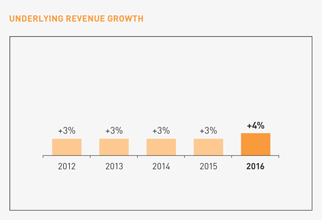

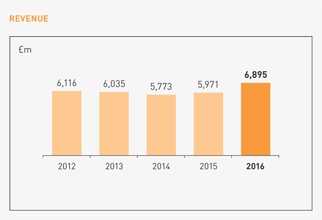

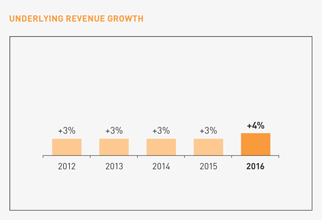

| ∎ | Underlying revenue up 4% |

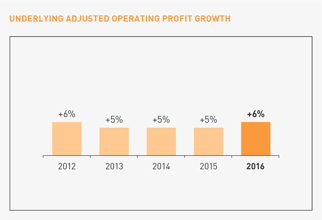

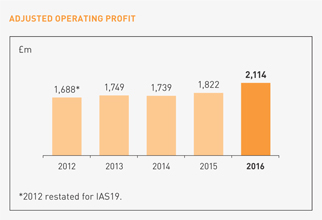

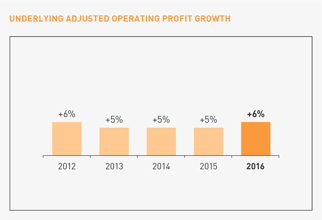

| ∎ | Underlying adjusted operating profit up 6% |

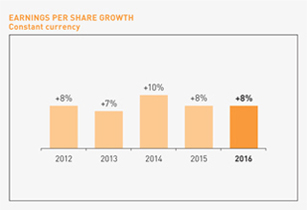

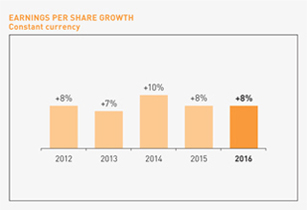

| ∎ | Adjusted EPS up 19% to 72.2p (60.5p); up 5% to€0.880 (€0.835); up 8% constant currency |

| ∎ | Reported EPS 56.3p (46.4p) for RELX PLC;€0.687 (€0.682) for RELX NV |

| ∎ | Full-year dividend up 21% to 35.95p for RELX PLC and up 5% to€0.423 for RELX NV |

| ∎ | Strong financial position and cash flow; leverage 2.2x EBITDA pensions and lease adjusted (1.8x unadjusted) |

RELX Group encompasses RELX PLC, RELX NV, RELX Group plc and its subsidiaries, associates and joint ventures. The corporate structure is set out on page 71.

RELX Group uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. Reconciliations between the reported and adjusted figures are set out on pages 56, 58, 127, 141 and 188. Underlying growth rates are calculated at constant currencies, and exclude the results of acquisitions and disposals made in both the year and prior year and of assets held for sale. Underlying revenue growth rates also exclude the effects of exhibition cycling. Constant currency growth rates are based on 2015 full-year average and hedge exchange rates. RELX NV comparative earnings and dividends per share have been adjusted retrospectively to reflect the bonus issue of shares declared on 30 June 2015.

| | |

| Overview Chairman’s statement | | 3 |

|

|

Chairman’s statement

Anthony Habgood

Chairman

The gradual improvement in our revenue growth rate reflects the progress that has been made as RELX Group has continued to execute well on its strategic priorities.

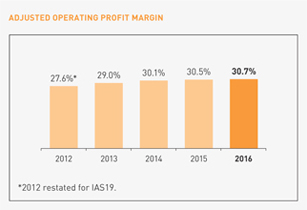

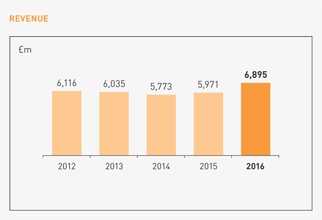

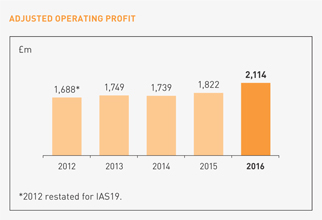

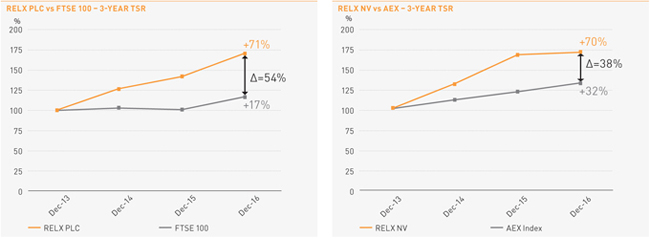

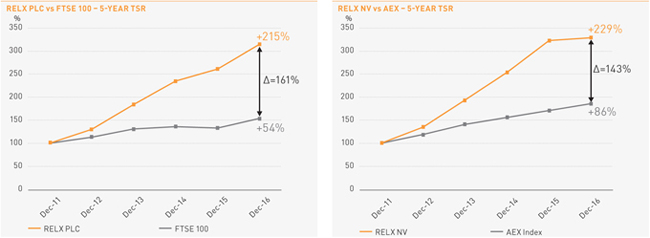

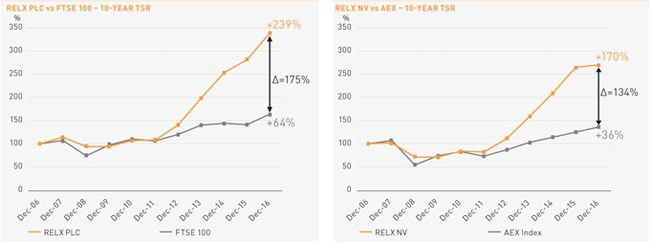

Our largest markets remained resilient during 2016 and we continued to execute against our strategic priorities aimed at achieving more predictable revenues, a higher growth profile and improving returns. As a result, growth of underlying revenues gradually improved to 4% and underlying adjusted operating profits grew 6%, as we continued to grow revenues ahead of costs. The mid-year reduction in the value of the pound associated with the UK’s decision to leave the European Union was the reason why sterling adjusted operating profit increased by 16% to £2,114m while euros adjusted operating profit increased by 3% to€2,579m.

Constant currency adjusted earnings per share (EPS) grew at 8%. The devaluation of sterling was a major contributor to the growth of adjusted EPS of 19% to 72.2p for RELX PLC while the growth in euro EPS was 5% to€0.880 for RELX NV. Reported EPS increased 21% to 56.3p for RELX PLC and 1% to€0.687 for RELX NV.

Dividends

The other major impact of sterling’s downward movement was on dividends where the Boards are recommending final dividends of 25.7p for RELX PLC and€0.301 for RELX NV. This brings the total dividends for the year to 35.95p for RELX PLC, up 21% and to€0.423 for RELX NV, up 5%. Our long-term dividend policy remains unchanged.

Balance sheet

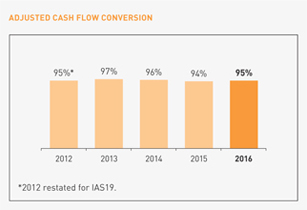

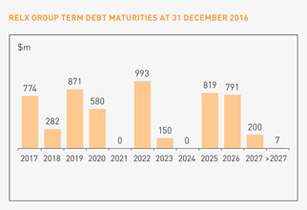

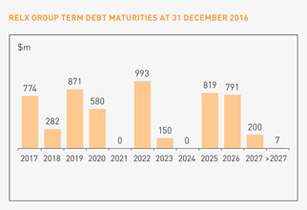

With the majority of our debts dollar and euro denominated, net debt was £4.7bn/€5.5bn on 31 December 2016, compared with £3.8bn/€5.1bn last year. Net debt/EBITDA on a pensions and lease adjusted basis for 2016 was 2.2x, the same level as last year and on an unadjusted basis, it was 1.8x, also the same as last year. Adjusted cash flow conversion was 95%, up from 94% in 2015, with capital expenditure at 4.8% of revenues.

Share buybacks

During the year, we bought back shares worth £700m. In 2017, we intend to deploy a total of £700m on share buybacks. By February, £100m of this year’s total had already been completed, leaving a further £600m to be deployed during the year.

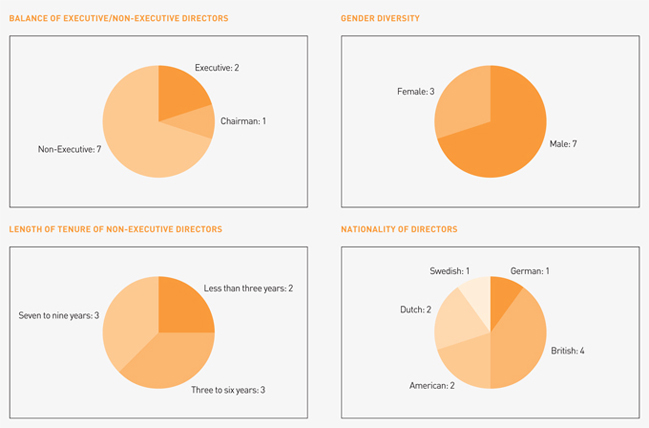

The Boards

We continue to refresh the Boards. Lisa Hook and Robert Polet retired as Non-Executive Directors following the AGMs in April 2016. After a search by external consultants, Carol Mills and Robert MacLeod joined the Boards also in April. Carol has nearly 30 years’ experience in technology companies including extensive US Board experience. Robert is Chief Executive Officer of Johnson Matthey, the FTSE 100 speciality chemicals company and global leader in sustainable technologies. I would like to thank Lisa and Robert for their advice and help over many years and am delighted that Carol and Robert have joined RELX Group.

Corporate responsibility

Good governance is the foundation of our business. We prioritise training on our Code of Ethics and Business Conduct – the guide to our corporate and individual behaviour – and other key policies. Our compliance courses are clear and engaging to ensure employees understand how to act ethically in conducting our business; we achieve a 100% course completion rate within 90 days of issuance. We have a strong focus on data privacy and security given its importance to our customers. In the year, we developed a comprehensive plan for complying with EU General Data Protection Regulations coming into force in 2018, and reviewed and updated internal privacy policies.

We are guided in our understanding of the role companies must play in furthering human rights by the UNGC, the UN Guiding Principles on Business and Human Rights, and the OECD Guidelines for Multinational Enterprises. In 2016, we published our first Modern Slavery Act Statement, available on our homepage, to outline the steps we are taking internally, in our supply chain and through research, partnerships and advocacy to avert slavery and human trafficking.

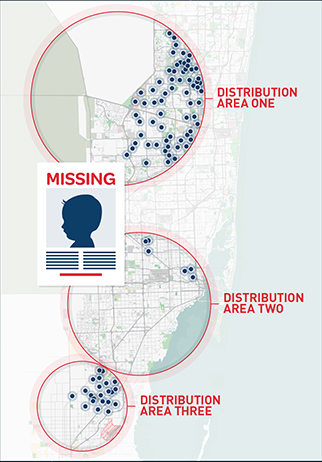

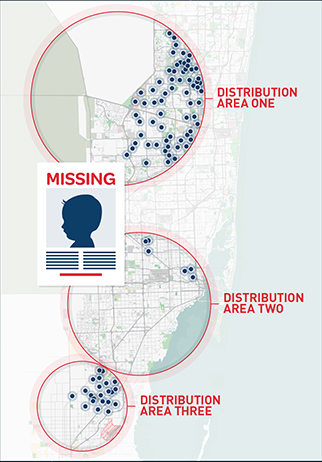

By focusing on excellence in governance and compliance, as in other areas, we perform to our highest ability. In doing so, we realise our aim to make unique contributions to society, including universal, sustainable access to information, as described in the Corporate responsibility section of this report. There we highlight our support of the ADAM programme which applies our expertise in the search for missing children and the Rule of Law Impact Tracker, which we developed in 2016 to demonstrate the link between the rule of law and development.

Anthony Habgood

Chairman

| | |

| 4 | | RELX Group Annual reports and financial statements 2016 |

|

|

Chief Executive Officer’s report

Erik Engstrom

Chief Executive Officer

We achieved good underlying revenue growth in 2016 and continued to generate underlying operating profit growth ahead of revenue growth, with underlying revenue and adjusted operating profit growth across all four business areas.

Strategic direction

Our strategy remains consistent: to be a global professional information solutions provider, a company that delivers improved outcomes for professional and business customers across industries. Our number one priority remains the organic development of increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to our customers.

Our goal is to help our customers make better decisions, get better results and be more productive. We do this by leveraging a deep understanding of our customers to create innovative solutions which combine content and data with analytics and technology in global platforms. These solutions often account for about 1% of our customers’ total cost base but can have a significant and positive impact on the economics of the remaining 99%.

We aim to build leading positions in long-term global growth markets and leverage our skills, assets and resources across RELX Group, both to build solutions for our customers and to pursue cost efficiencies.

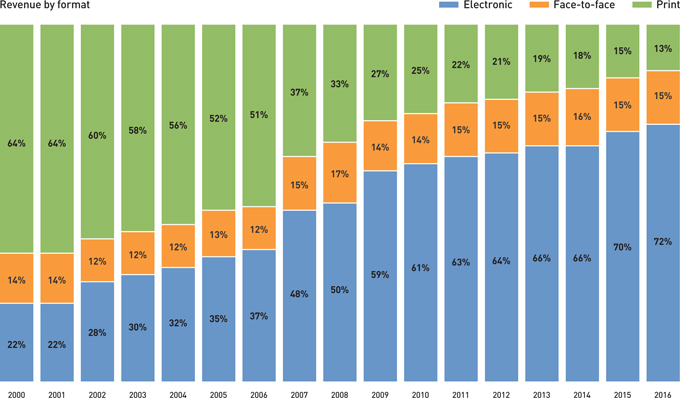

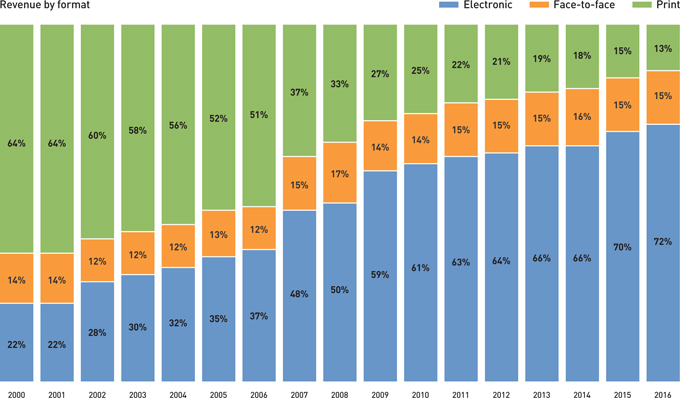

During the year we continued to make progress in this strategic direction. We are systematically migrating all of our businesses across RELX Group towards electronic decision tools, adding broader datasets, embedding more sophisticated analytics and leveraging more powerful technology, primarily through organic development.

We are transforming our core business, building out new products and expanding into higher growth adjacencies and geographies. We are supplementing this organic development with selective acquisitions of targeted data sets and analytics, and assets in high-growth markets that support our organic growth strategies, and are natural additions to our existing businesses.

By focusing on evolving the fundamentals of our business we believe that, over time, we are improving our business profile and the quality of our earnings. This is leading to more predictable revenues through a better asset mix and geographic balance; a higher growth profile by expanding in higher growth segments, exiting from structurally challenged businesses and gradually reducing the drag from print format declines; and improved returns by focusing on organic development with strong cash generation.

| | |

| Overview Chief Executive Officer’s report | | 5 |

|

|

2016 progress

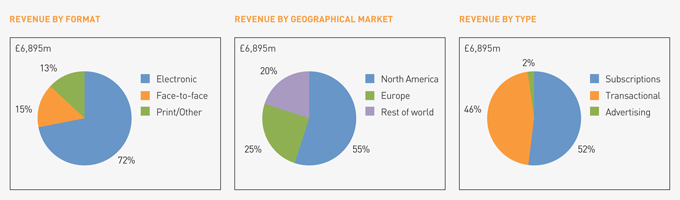

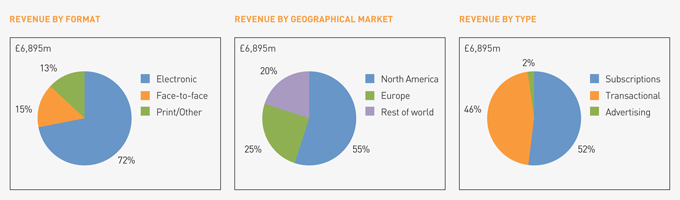

In 2016 we made further strategic and operational progress, and continued to evolve our business profile. Our preferred formats, electronic and face-to-face, now generate 87% of our total revenues, growing in mid-single digits.

We continued to focus our acquisitions on select, targeted data sets and analytics, and assets in high-growth markets that support our organic growth strategies. We completed 17 transactions of small content, data and exhibition assets for a total consideration of £338m, and disposed of assets for £16m.

With a strong balance sheet and an inherently cash-generative business, the strategic priority order for using our cash is unchanged. First to invest in the organic development of our businesses to drive underlying revenue growth; second to support our organic growth strategy with targeted acquisitions; third to grow dividends predictably, broadly in line with EPS growth; fourth to maintain our leverage in a comfortable range; and finally use any remaining cash to buy back shares. As part of this we bought back shares for £700m in 2016, and announced £700m in buybacks for 2017.

Financial performance

Our positive financial performance continued throughout 2016, with underlying revenue and profit growth across all four business areas. Underlying revenue growth was 4%. Underlying operating profit growth was 6%, and adjusted earnings per share at constant currencies grew 8%.

Key business trends in ourScientific, Technical & Medicalbusiness remained positive, with underlying profit growth slightly exceeding underlying revenue growth. In primary research, strong growth in usage and article submissions continued. Good growth continued in databases and tools, as well as in electronic reference products.

Underlying revenue growth improved atRisk & Business Analytics with strong growth across all key segments in both subscription and transactional revenues. Underlying profit growth broadly matched underlying revenue growth.

Underlying revenue growth inLegal improved slightly, with continued efficiency gains driving strong underlying operating profit growth. US and European markets remained stable but subdued.

Exhibitions achieved strong underlying revenue growth, in line with the previous year. Revenue growth was strong in the US and moderate in Europe. Japan grew strongly and China saw good growth.

| | |

| 6 | | RELX Group Annual reports and financial statements 2016 |

|

|

Corporate responsibility

Corporate responsibility is at the heart of our business. In improving outcomes for our customers, we make an important contribution to society. Our products and services advance science and health, protect people, further the rule of law and access to justice, and foster communities. These contributions are aligned with the 17 United Nations Sustainable Development Goals (SDGs) and we are dedicated to doing our part towards their attainment.

We are focused on making continual improvements in the conduct of our business. Among the ways we did that in 2016 was by training more employees to respond to compliance concerns and conducting a mental health at work campaign to destigmatise the issue and raise awareness of support mechanisms. We created more resources to help staff reference our CR focus in discussions with customers. We charted the impact of our charitable giving on beneficiaries and worked to ensure diverse

suppliers in the US had greater chances to work with us. We also purchased more electricity from renewable sources.

With the help of our CR Forum and CR networks (like the Quality First Working Group, Green Teams, RE Cares Champions and Socially Responsible Supply Chain Network) we will progress an ambitious agenda for 2017, which the Boards and other senior leaders, will be monitoring.

Outlook

Key business trends in the early part of 2017 are consistent with the early part of 2016 and we are confident that, by continuing to execute on our strategy, we will deliver another year of underlying revenue, profit and earnings growth in 2017.

Erik Engstrom

Chief Executive Officer

| | |

| 8 | | RELX Group Annual reports and financial statements 2016 |

|

|

RELX Group business overview

RELX Group is a global provider of information and analytics for professional and business customers across industries.

The Group serves customers in more than 180 countries and has offices in about 40 countries. It employs approximately 30,000 people of whom almost half are in North America.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RELX Group financial summary | | | | | | | | | | | | | | | | | | | | | |

| REPORTED FIGURES | | £ | | | € | | | Change at | | | | |

| For the year ended 31 December | | 2016 £m | | 2015 £m | | | Change | | | 2016 €m | | | 2015 €m | | | Change | | | constant currencies | | | Change underlying | |

Revenue | | 6,895 | | | 5,971 | | | | +15% | | | | 8,412 | | | | 8,240 | | | | +2% | | | | +4% | | | | +4% | |

Operating profit | | 1,708 | | | 1,497 | | | | +14% | | | | 2,084 | | | | 2,066 | | | | +1% | | | | | | | | | |

Profit before tax | | 1,473 | | | 1,312 | | | | +12% | | | | 1,797 | | | | 1,811 | | | | -1% | | | | | | | | | |

Net profit | | 1,161 | | | 1,008 | | | | | | | | 1,416 | | | | 1,391 | | | | | | | | | | | | | |

Net margin | | 16.8% | | | 16.9% | | | | | | | | 16.8% | | | | 16.9% | | | | | | | | | | | | | |

Net borrowings | | 4,700 | | | 3,782 | | | | | | | | 5,499 | | | | 5,144 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED FIGURES | | £ | | | € | | | Change at | | | | |

| For the year ended 31 December | | 2016 £m | | 2015 £m | | | Change | | | 2016 €m | | | 2015 €m | | | Change | | | constant currencies | | | Change underlying | |

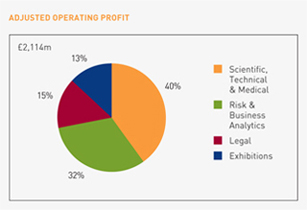

Operating profit | | 2,114 | | | 1,822 | | | | +16% | | | | 2,579 | | | | 2,514 | | | | +3% | | | | +4% | | | | +6% | |

Operating margin | | 30.7% | | | 30.5% | | | | | | | | 30.7% | | | | 30.5% | | | | | | | | | | | | | |

Profit before tax | | 1,934 | | | 1,669 | | | | +16% | | | | 2,359 | | | | 2,303 | | | | +2% | | | | +4% | | | | | |

Net profit | | 1,488 | | | 1,275 | | | | +17% | | | | 1,815 | | | | 1,760 | | | | +3% | | | | +5% | | | | | |

Net margin | | 21.6% | | | 21.4% | | | | | | | | 21.6% | | | | 21.4% | | | | | | | | | | | | | |

Cash flow | | 2,016 | | | 1,712 | | | | +18% | | | | 2,460 | | | | 2,363 | | | | +4% | | | | +5% | | | | | |

Cash flow conversion | | 95% | | | 94% | | | | | | | | 95% | | | | 94% | | | | | | | | | | | | | |

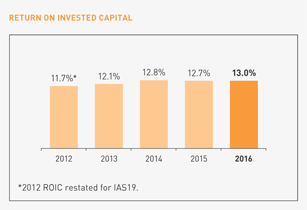

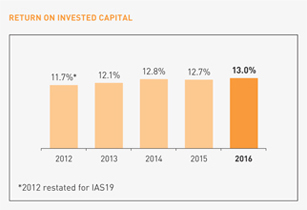

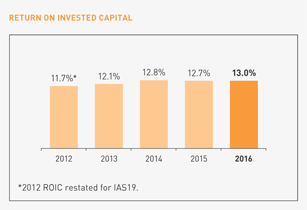

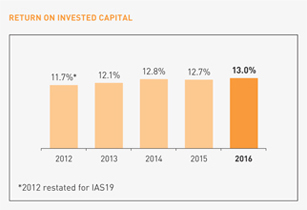

Return on invested capital | | 13.0% | | | 12.7% | | | | | | | | 13.0% | | | | 12.7% | | | | | | | | | | | | | |

Parent companies | | | | | | | | | | | | | | | | | | | | | |

| | | | | RELX PLC | | | RELX NV | | | Change at | |

| | | | | | | | | | | | | | | | | | | | | | | constant | |

| | | | | 2016 | | | 2015 | | | Change | | | 2016 | | | 2015 | | | Change | | | currencies | |

Adjusted earnings per share | | | | | 72.2p | | | | 60.5p | | | | +19% | | | | €0.880 | | | | €0.835 | | | | +5% | | | | +8% | |

Reported earnings per share | | | | | 56.3p | | | | 46.4p | | | | +21% | | | | €0.687 | | | | €0.682 | | | | +1% | | | | | |

Ordinary dividend per share | | | | | 35.95p | | | | 29.7p | | | | +21% | | | | €0.423 | | | | €0.403 | | | | +5% | | | | | |

RELX PLC and RELX NV are separate, publicly held entities. RELX PLC’s ordinary shares are listed in London and New York, and RELX NV’s ordinary shares are listed in Amsterdam and New York. In New York the listings are in the form of American Depositary Shares (ADSs), evidenced by American Depositary Receipts (ADRs). RELX PLC and RELX NV jointly own RELX Group plc, which, with effect from February 2015, holds all the Group’s operating businesses and financing activities. With effect from 1 July 2015, following a bonus issue of shares in RELX NV, one RELX PLC ordinary share confers an equivalent economic interest to one RELX NV ordinary share. RELX PLC, RELX NV, RELX Group plc and its subsidiaries, joint ventures and associates are together known as “the Group”.

| | |

| Business review RELX Group business overview | | 9 |

|

|

Market segments*

| | |

| | | Segment position |

| | |

Scientific, Technical & Medicalprovides information and analytics that help institutions and professionals progress science, advance healthcare and improve performance. | | Global #1 |

| | |

Risk & Business Analyticsprovides customers with solutions and decision tools that combine public and industry-specific content with advanced technology and analytics to assist them in evaluating and predicting risk and enhancing operational efficiency. | | Key verticals #1 |

| | |

Legalis a leading global provider of legal, regulatory and business information and analytics that help professional customers make more informed decisions, increase productivity and serve their clients better. | | US #2 Outside US #1 or 2 |

| | |

Exhibitionsis the world’s leading events business, enhancing the power of face to face through data and digital tools at over 500 events, in more than 30 countries, attracting more than 7m participants. | | Global #1 |

* For additional information regarding revenue from our business activities and geographical markets, see market segments section starting on page 13.

Financial summary by market segment

| | | | | | | | | | | | | | | | | | |

| | | Revenue | | | | | Adjusted operating profit | |

| | | 2016 £m | | | Change

underlying* | | | | | 2016 £m | | | Change

underlying* | |

Scientific, Technical & Medical | | | 2,320 | | | | +2% | | | | | | 853 | | | | +3% | |

Risk & Business Analytics | | | 1,906 | | | | +9% | | | | | | 686 | | | | +9% | |

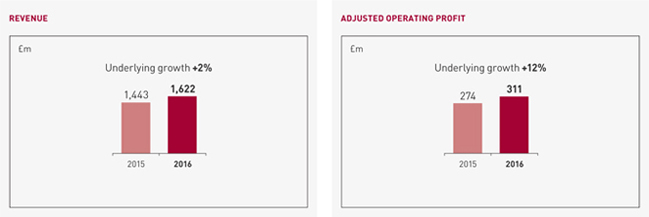

Legal | | | 1,622 | | | | +2% | | | | | | 311 | | | | +12% | |

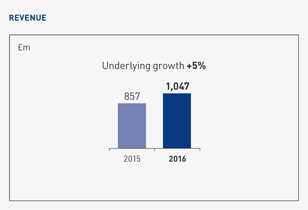

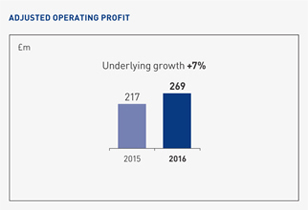

Exhibitions | | | 1,047 | | | | +5% | | | | | | 269 | | | | +7% | |

Unallocated items | | | | | | | | | | | | | (5 | ) | | | | |

| | | | 6,895 | | | | +4% | | | | | | 2,114 | | | | +6% | |

| * | RELX Group uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. Reconciliations between the reported and adjusted figures are set out on pages 56, 58, 127, 141 and 188. Underlying growth rates are calculated at constant currencies, and exclude the results of acquisitions and disposals made in both the year and prior year and of assets held for sale. Underlying revenue growth rates also exclude the effects of exhibition cycling. Constant currency growth rates are based on 2015 full-year average and hedge exchange rates. |

| | |

| 10 | | RELX Group Annual reports and financial statements 2016 |

|

|

| | |

| Business review RELX Group business overview | | 11 |

|

|

| | |

| |

| 12 | | RELX Group Annual reports and financial statements 2016 |

|

|

| | |

| 14 | | RELX Group Annual reports and financial statements 2016 |

|

|

Scientific, Technical & Medical

| | |

| |

We help researchers make new discoveries, collaborate with their colleagues and give them the knowledge they need to find funding. We help governments and universities evaluate and improve their research strategies. We help doctors save lives, providing insight for physicians to find the right clinical answers and we support nurses and other healthcare professionals throughout their careers. Our goal is to expand the boundaries of knowledge for the benefit of humanity. |

| | |

| | |

| ∎ | | We enhance the quality of research output by organising the review, editing and dissemination of16% of the world’s scientific articles. |

| |

| ∎ | | ScienceDirect, the world’s largest database of peer-reviewed primary scientific and medical research, has14m monthly users. |

| |

| ∎ | | Scopus is the most extensive abstract and citation database of research literature in the world, with over65m information records from5,000publishers. |

| |

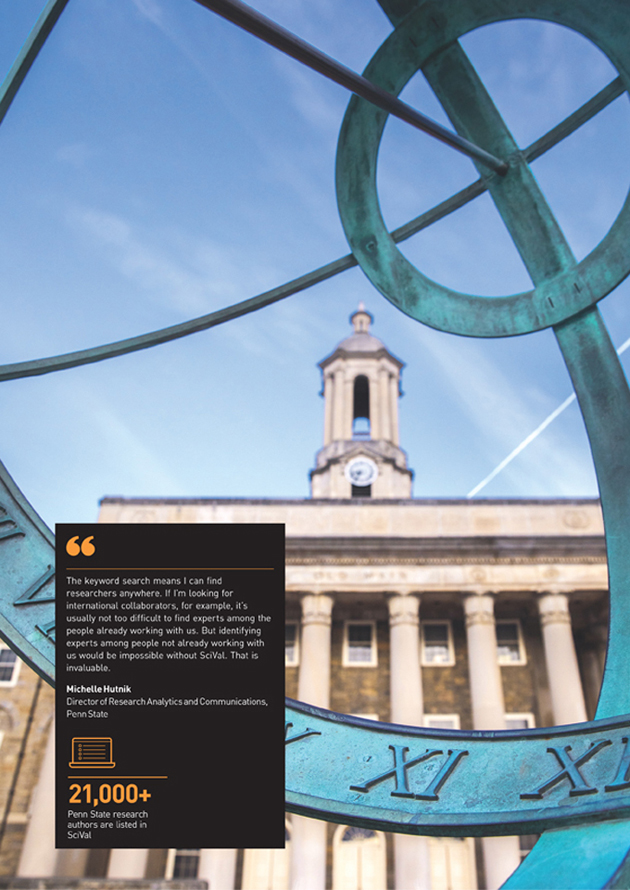

| ∎ | | SciVal offers insights into the research performance of7,500research institutions. |

| |

| ∎ | | ClinicalKey, the flagship clinical reference platform, is accessed by more than4,200 institutions. |

| |

| ∎ | | Elsevier journals have at some point featured articles by163 of 164 science and economics Nobel prize winners since 2000. |

Business overview

Scientific, Technical & Medical provides information and analytics that help institutions and professionals progress science, advance healthcare and improve performance.

Elsevier is a global business with principal operations in Amsterdam, Beijing, Boston, Chennai, Delhi, London, Madrid, Munich, New York, Oxford, Paris, Frankfurt, Philadelphia, Rio de Janeiro, St. Louis, San Diego, Singapore and Tokyo. It has 7,500 employees and serves customers in over 180 countries.

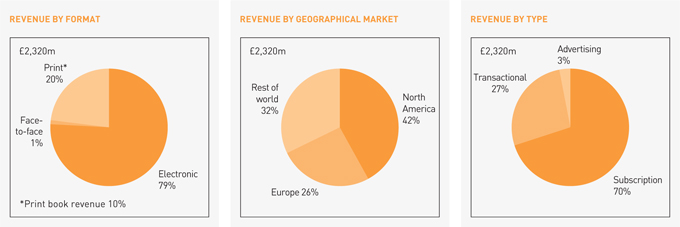

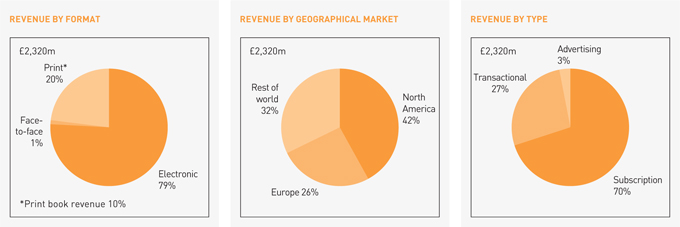

Revenues for the year ended 31 December 2016 were £2,320m, compared with £2,070m in 2015 and £2,048m in 2014. In 2016, 42% of revenue by geographical market was derived from North America, 26% from Europe and the remaining 32% from the rest of the world. Subscription sales generated 70% of revenue, transactional sales 27% and advertising 3%.

Elsevier serves the needs of scientific, technical and medical markets by organising the review, editing and disseminating of primary research, reference and professional education content, as well as by providing a range of database and decision tools. Elsevier’s customers are scientists, academic institutions, research leaders and administrators, medical researchers, doctors, nurses, allied health professionals and students, as well as hospitals, research institutions, health insurers, managed healthcare organisations, research-intensive corporations and governments. All these customers rely on Elsevier to provide high-quality content and critical information for making scientific and medical decisions; review, edit, disseminate and preserve research findings; and create innovative tools to help focus research strategies, increase research effectiveness, improve medical outcomes, and enhance the efficiency of healthcare and healthcare education.

In the primary research market during 2016, over 1.5m research papers were submitted to Elsevier. More than 20,000 editors managed the peer review and selection of these papers, resulting in the publication of 420,000 articles in about 2,500 journals, many of which are the foremost publications in their field and a primary point of reference for new research. This content was accessed by around 14m people, with over 900m full-text article downloads last year. Elsevier’s journals are primarily produced and delivered through the ScienceDirect platform, the world’s largest database of scientific and medical research, hosting over 14m pieces of content and 35,000 e-books. Flagship journals include Cell and The Lancet families of titles.

| | |

| Business review Scientific, Technical & Medical | | 15 |

|

|

In 2016, Elsevier launched 64 new subscription and author-pays journals, including Chem from Cell Press and The Lancet Gastroenterology & Hepatology and The Lancet Public Health from The Lancet. Elsevier is also a global leader in scientific, technical and medical reference markets, providing authoritative and current professional reference content. Elsevier has been a leader in driving the shift from print to electronic. Flagship titles include works such as Gray’s Anatomy, Nelson’s Pediatrics and Netter’s Atlas of Human Anatomy.

Elsevier’s flagship clinical reference platform, ClinicalKey, provides physicians with access to leading Elsevier and third-party reference and evidence-based medical content in a single, fully integrated site. ClinicalKey is growing strongly, and is currently accessed by more than 4,200 institutions.

In medical education, Elsevier serves students of medicine, nursing and allied health professions in a number of formats including electronic books and electronic solutions. For example, HESI, an online testing and remediation solution designed to help students of nursing and allied health professions, conducted over 775,000 tests in 2016.

Elsevier’s products provide a range of tools and solutions for professionals in the scientific, technical and medical fields. Customers include academic and corporate researchers, research administrators and healthcare professionals.

For academic and corporate researchers, significant products include Scopus, Reaxys and Knovel. Scopus, the largest abstract and citation database of peer-reviewed literature with over 65m records from more than 21,800 journals and 5,000 international publishers, allows researchers to track, analyse and visualise the world’s research output. Reaxys supports the early stages of drug development in the pharmaceutical industry, exploratory chemistry research in academia, and product development in industries such as chemicals and oil & gas. Knovel is a decision support tool for

engineers that helps them to select the right materials, a mission-critical use case in product development across chemicals, oil & gas and other engineering-focused industries.

Elsevier serves academic and government research administrators through its Research Intelligence suite of products. Leveraging bibliometric data from Scopus and other data types such as patent citations and usage data, SciVal is a decision tool that helps institutions to establish, execute and evaluate research strategies. Pure is a comprehensive research information management system which enables evidence-based research management decisions, promotes collaboration, simplifies administration and optimises impact. Our Analytical Services team provides accurate, unbiased analysis on research performance by combining high-quality data sources with technical and research metrics expertise. Expert LookUp helps funding bodies find the best peer reviewers for evaluating grant applications.

For healthcare professionals, Elsevier develops products to deliver patient-specific solutions at the point of care to improve patient outcomes. Its clinical solutions include Interactive Patient Education, which provides patient education and discharge information, and Care Planning, which provides a data-driven framework to support nurses in undertaking procedures.

| | |

| 16 | | RELX Group Annual reports and financial statements 2016 |

|

|

Market opportunities

Scientific, technical and medical information markets have good long-term growth characteristics. The importance of research and development to economic performance and competitive positioning is well understood by governments, academic institutions and corporations. This is reflected in the long-term growth in research and development spending and in the number of researchers worldwide. Growth in health markets is driven by ageing populations in developed markets, rising prosperity in developing markets and the increasing focus on improving medical outcomes and efficiency. Given that a significant proportion of scientific research and healthcare is funded directly or indirectly by governments, spending is influenced by governmental budgetary considerations. The commitment to research and health provision does, however, remain high, even in more difficult budgetary environments.

Strategic priorities

Elsevier’s strategic goal is to lead the way in providing information solutions that advance science, technology and health. To achieve this, Elsevier creates solutions that reflect deep insight into the way its users work and the outcomes they are seeking to achieve; strives for excellence in content, service and execution; constantly adapts and revitalises its products, business models and technology; and leverages its institutional skills, assets and resources to promote innovation and efficiency.

Elsevier’s strategic priorities are to: continue to increase content volume and quality; expand content coverage, building out integrated solutions and decision tools combining Elsevier, third-party and customer data; increase content utility, using “Smart Content” to enable new e-solutions; combine content with analytics and technology, focused on measurably improving productivity and outcomes for customers; and continue to drive operational efficiency and effectiveness.

In the primary research market, Elsevier aims to grow volume through new journal launches, expansion of author-pays journals and growth from emerging markets; enhance quality by building on our premium brands; and add value to core platforms by implementing new capabilities such as advanced recommendations on ScienceDirect and social collaboration through Mendeley.

In clinical reference markets, priorities are to expand content coverage and ensure consistent and seamless linking of content assets across products.

Business model, distribution channels and competition

Science and medical research is principally disseminated on a paid subscription basis to the research facilities of academic institutions, governments and corporations, and, in the case of medical and healthcare journals, to individual practitioners and medical society members. For the past decade content has been provided free or at very low cost in over 100 countries and territories in the developing world through Research4Life, a United Nations partnership initiative. For a number of journals, advertising and promotional income represents a small proportion of revenues, predominantly from pharmaceutical companies in healthcare titles.

Over the past 15 years, alternative payment models for the dissemination of research such as author-pays or author’s- funder-pays have emerged. While it is expected that paid subscription will remain the primary distribution model, Elsevier has long invested in alternative business models to address the needs of customers and researchers. Over 1,850 of Elsevier’s journals now offer the option of funding publication and distribution via a sponsored article fee. In addition, Elsevier now produces around 170 stand-alone author-pays open access journals. In 2016 we published over 24,000 author-pays and sponsored open access articles, up over 22% on the previous year, making us one of the top three open access publishers in the world.

Electronic products, such as ScienceDirect, Scopus and ClinicalKey, are generally sold direct to customers through a dedicated sales force that has offices around the world. Subscription agents sometimes facilitate the sales and administrative process for remaining print sales. Reference and educational content is sold directly to institutions and individuals and accessed on Elsevier platforms. Sometimes it is still sold in printed book form through retailers, wholesalers or directly to end users.

Competition within science and medical reference content is generally on a title-by-title and product-by-product basis. Competition in research and reference products is typically with learned societies and professional information providers, such as Springer Nature, Thomson Reuters and Wolters Kluwer. Decision tools face similar competition, as well as from software companies and internal solutions developed by customers.

| | |

| Business review Scientific, Technical & Medical | | 17 |

|

|

2016 financial performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016 £m | | | 2015 £m | | | Underlying growth | | | Acquisitions/ disposals | | | Currency effects | | | Total growth | |

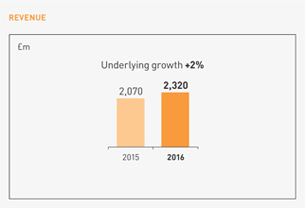

Revenue | | | 2,320 | | | | 2,070 | | | | +2% | | | | 0% | | | | +10% | | | | +12% | |

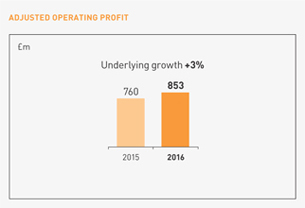

Adjusted operating profit | | | 853 | | | | 760 | | | | +3% | | | | -1% | | | | +10% | | | | +12% | |

Key business trends remained positive in 2016, with underlying profit growth slightly exceeding underlying revenue growth.

Underlying revenue growth was +2%. The difference between the reported and underlying growth rates primarily reflects the impact of exchange rate movements.

Underlying adjusted operating profit growth of +3% was slightly ahead of revenue growth, resulting in a small underlying margin improvement which was partly offset by exchange rate movements.

In primary research, strong growth in usage and article submissions continued. In 2016 we launched 64 new journals.

Good growth continued in databases & tools, as well as in electronic reference products.

Print books, which now represent around 10% of divisional revenues, saw steeper second half declines than in recent years, reflecting market conditions. Print pharma promotion revenues were stable.

2017 outlook

Our customer environment remains largely unchanged. Overall we expect another year of modest underlying revenue growth, with underlying operating profit growth continuing to exceed underlying revenue growth.

| | |

| 18 | | RELX Group Annual reports and financial statements 2016 |

|

|

| | |

| 20 | | RELX Group Annual reports and financial statements 2016 |

|

|

Risk & Business Analytics

| | |

| | |

We help US auto insurance companies with better risk assessment so they can offer their customers lower prices and enable healthcare providers to keep down medical costs. We make the world a safer place from criminals, rescue missing children and help save the lives of police officers. We prevent fraudsters from exploiting stolen identities and give banks the data and tools to help combat money laundering. We enable millions of disadvantaged people to obtain credit, often for the first time. We help farmers with their efforts in precision agriculture and airlines to improve their operations and services for passengers. | | |

| | | | |

| | | |

| ∎ | | 70% of car owners in the US have lower premiums thanks to Risk Solutions products. | | |

| | | |

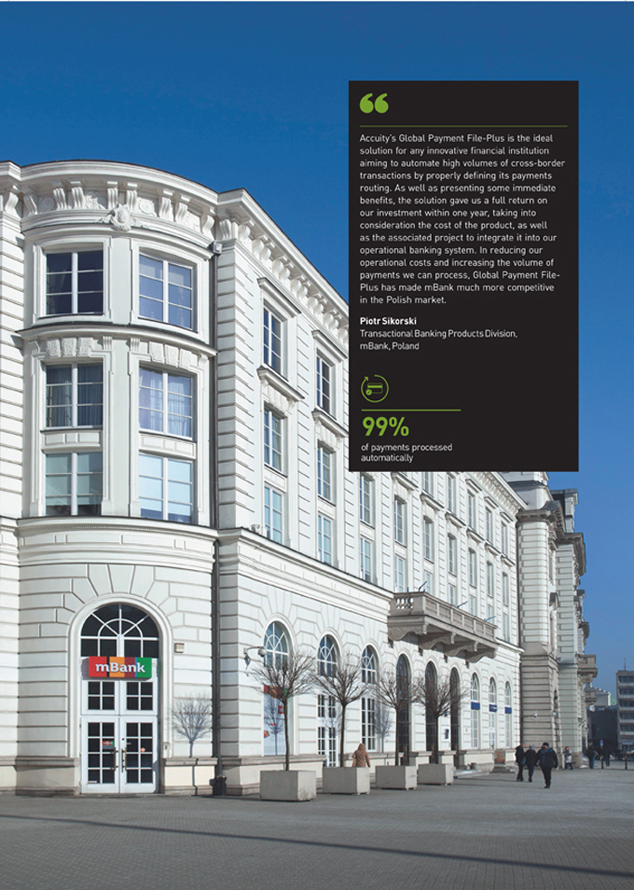

| ∎ | | Accuity delivers accurate payments data on over819,000 bank branches worldwide, especially in emerging markets. | | |

| | | |

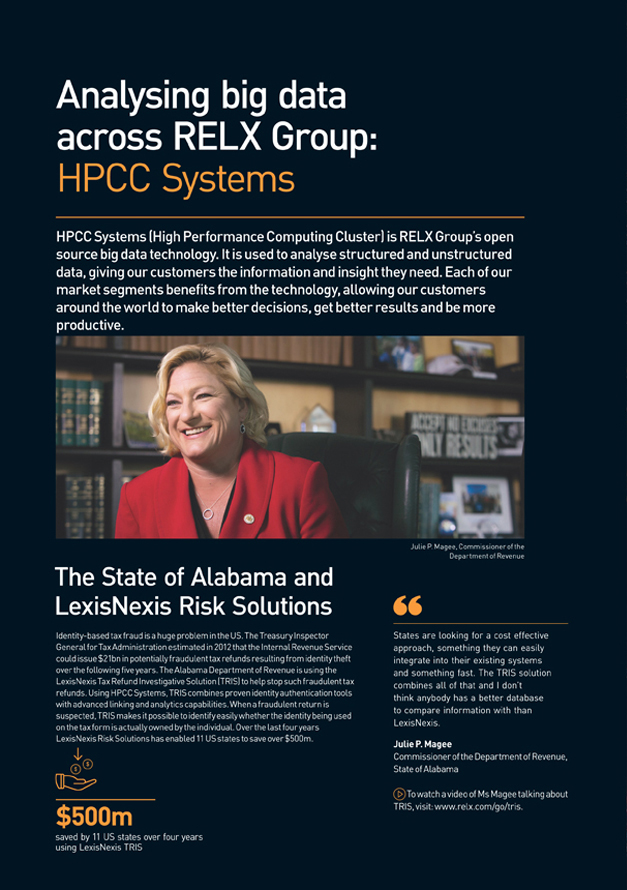

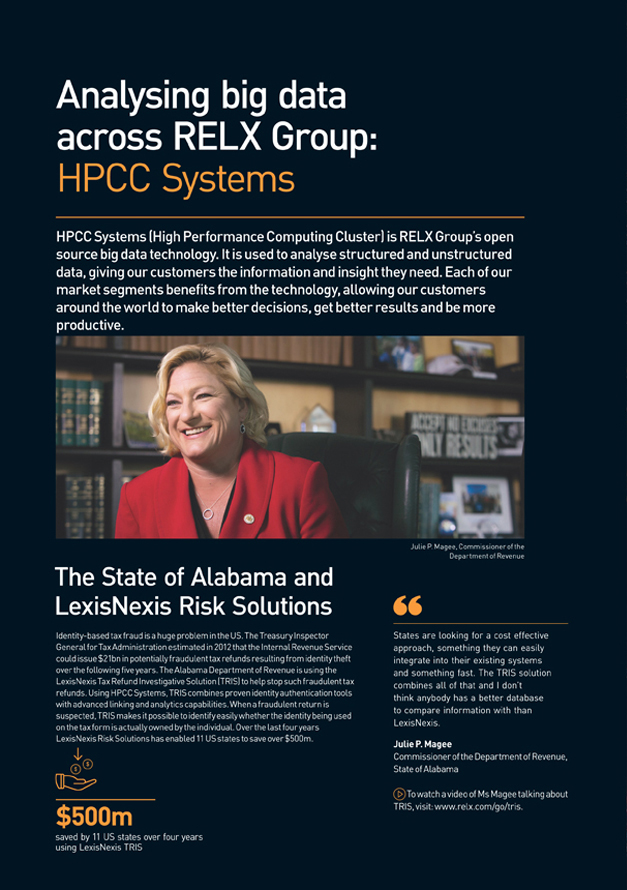

| ∎ | | Our Tax Refund Investigative Solution (TRIS) has saved11 US states a total of more than$500m over four years. | | |

| | | |

| ∎ | | LexisNexis eCrash cuts the average time it takes to file a traffic accident report from60 minutes to 19, reducing the threat to life for police officers at the scene. | | |

Business overview

Risk & Business Analytics provides customers with solutions and decision tools that combine public and industry-specific content with advanced technology and analytics to assist them in evaluating and predicting risk and enhancing operational efficiency.

The business has principal operations in Georgia, Florida, Illinois and Ohio in the US and London, Amsterdam and Shanghai. It has 8,200 employees and serves customers in more than 170 countries.

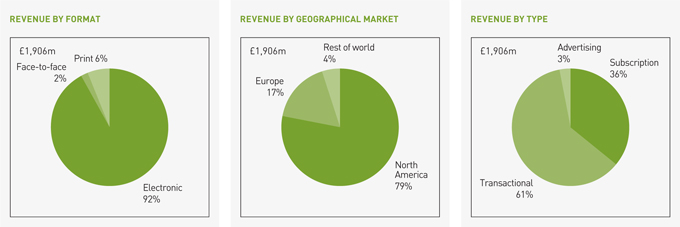

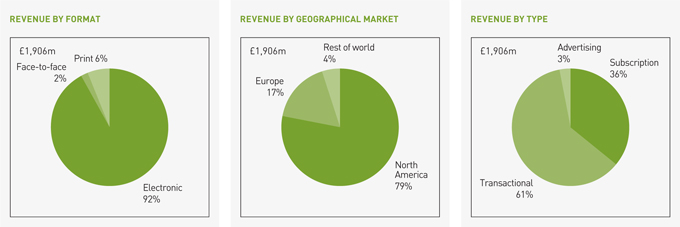

Revenues for the year ended 31 December 2016 were £1,906m, compared with £1,601m in 2015 and £1,439m in 2014. In 2016, 79% of revenue came from North America, 17% from Europe and the remaining 4% from the rest of the world. Subscription sales generated 36% of revenues, transactional sales 61% and advertising 3%.

The business is organised around market-facing industry/sector groups: Insurance Solutions, Business Services, Government Solutions, Health Care Solutions, as well as Major Data Services (including banking, energy and chemicals, and human resources).

Insurance Solutions, the largest segment, provides comprehensive data, analytics and decision tools for personal, commercial and life insurance carriers in the US to improve critical aspects of their business. Information solutions, including the most comprehensive US personal loss history database, C.L.U.E., help insurers assess risks and provide important inputs to pricing and underwriting insurance policies. Additional key products include LexisNexis Data Prefill, which provides information on customers directly into the insurance workstream and LexisNexis Current Carrier, which identifies insurance coverage details and any lapses in coverage.

In the US, we remain focused on delivering innovative decision tools through a single point of access within an insurer’s infrastructure. LexisNexis Active Insights, our solution for active risk management, connects proprietary linking algorithms with vast amounts of data to proactively inform insurers of key events impacting their policyholders. We are advancing our strategy to drive more consistency and efficiency in claims through our solution suite, Claims Compass. Our Risk Classifier solution, which uses public and motor vehicle records and predictive modelling, is used by more than 25 life insurers to better understand risk and improve underwriting efficiency.

We continue to make progress outside the US. In the UK, the contributory No Claims Discount module, which automates verification of claims history, is now available for insurers at the point of quote. In China, the Genilex joint venture is delivering key vehicle data to auto insurers and is looking to add more analytics solutions. In India, we launched our Intelligence Exchange contributory platform and Risk Insights solution for life insurers to predict, better assess and manage risk within the underwriting and claims management processes.

In 2016, Risk and Business Analytics acquired the Crash and Project business of Appriss. This increased the number of US law enforcement agency customers to more than 5,000, and improved crash report dissemination. The acquisition of Insurance Initiatives Limited (IIL) expanded offerings to UK insurers and improved the delivery of information predominantly at the point of quote in the UK’s property and casualty insurance industry.

| | |

| Business review Risk & Business Analytics | | 21 |

|

|

Business Services provides organisations with risk management, identity management, fraud detection and prevention, credit risk decision-making and compliance solutions. These include Know Your Customer (KYC) and Anti-Money Laundering (AML) products. Collection solutions help debt recovery professionals in the segmentation, management and collection of consumer and business debt. We leverage the combination of our big data technology (HPCC Systems), our vast repository of alternative data and advanced analytics to provide better economic information for consumers and businesses.

In 2016 we launched our new fraud and identity platform that enables companies to customise their identity verification and authentication customer experience to the risk level of each individual consumer. Our small business credit scores, credit reports and risk attributes enable lenders to increase the number of potential small business applicants by 60% so that more start-ups and privately held companies can be included earlier in the funding process. We enhanced our AML suite by combining Bridger Insight XG, a Bank Secrecy Act and AML solution and our WorldCompliance high-risk individuals database with an alert remediation service to mitigate financial crime risks and accelerate growth in Europe, Asia and Latin America.

Government Solutions provides identity intelligence to US federal, state and local law enforcement and government agencies to help solve criminal cases and identify fraud, waste and abuse in government programmes. In 2016, we launched LexisNexis Accurint Virtual Crime Center, which combines data from police departments with public records data to give agencies visibility into cross-jurisdictional data in one interface. We continued to grow our contributory database footprint in the health, human services and public safety markets. We developed a contributory solution linking an agency’s data with nationwide

LexisNexis business networks to identify businesses not complying with the law.

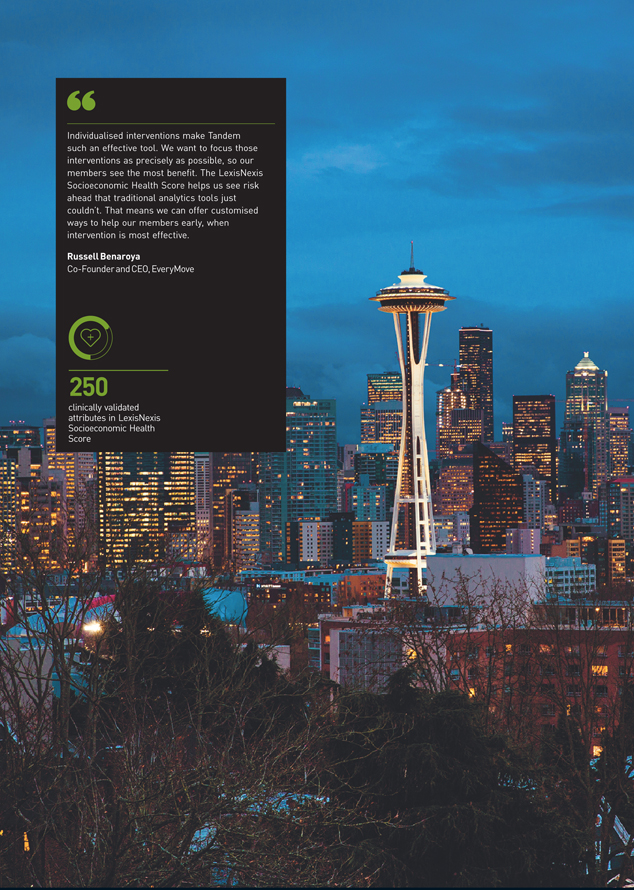

Health Care Solutions utilises socioeconomic, consumer, provider and medical claims data to deliver leading identity, fraud, compliance and health risk analytics solutions across key stages of healthcare to enable intelligent decision-making for payers, providers, life sciences organisations and pharmacies. Key developments in 2016 included successfully validating the use of the LexisNexis Socioeconomic Health Score as a predictor of health risk without the use of medical or claims data, and launching LexisNexis VerifyHCP, a provider directory accuracy solution that helps payers and providers to meet key federal and state requirements by ensuring the accuracy of data published to consumers through directories.

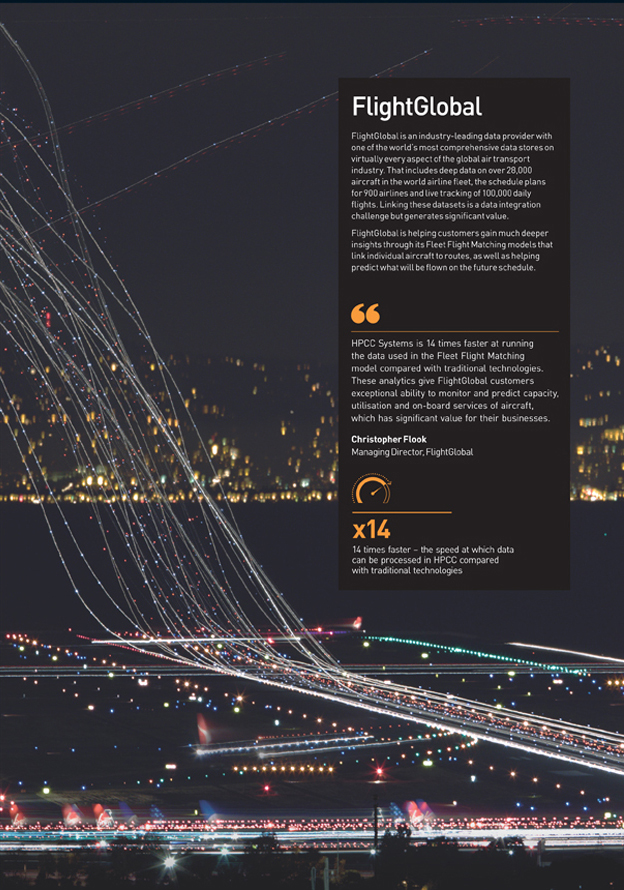

Major Data Services include: Accuity, a provider of services and solutions to the banking and corporate sectors focused on payment efficiency, KYC, AML and compliance; ICIS, an information and data service in chemicals, energy and fertilisers; XpertHR, an online service providing regulatory guidance, best practices and tools for HR professionals; Nextens, a provider of tools and services for tax professionals; FlightGlobal, a leading provider of data and analytics for the global commercial aviation and travel industry; Proagrica, a provider of software, connectivity solutions, data, analytics and media streams for the global agriculture sector; and Estates Gazette, which delivers a mix of high-quality data, decision tools and high-value news and information to the UK’s commercial real estate market. During the year FlightGlobal acquired Diio and FlightStats, two leading aviation data and analytics companies based in the US. Accuity also completed the acquisition of Fire Solutions, a provider of compliance and training solutions to US regulated investment advisers and broker dealers.

| | |

| 22 | | RELX Group Annual reports and financial statements 2016 |

|

|

The risk and identity management solutions described above utilise a comprehensive database of public records and proprietary information with more than six petabytes of unique data, which makes it the largest database of its kind in the US market today. Our market-leading HPCC Systems technology enables Risk & Business Analytics to provide its customers with highly relevant decision-making insights and to create new, low-cost solutions quickly and efficiently.

In 2016, we continued to reshape our portfolio, exiting areas not core to our strategy. A number of magazine titles and brands in the Netherlands were divested, including Elsevier Weekblad, Beleggers Belangen, P&O Actueel and PBNA.

Market opportunities

We operate in markets with strong long-term growth in demand for high-quality advanced analytics based on industry information and insight including: insurance underwriting transactions; insurance acquisition, retention and claims handling; healthcare, tax and entitlement fraud; credit defaults, identity solutions and financial crime compliance; due diligence requirements surrounding customer enrolment; security and privacy considerations; and data and advanced analytics for the banking, energy and chemicals, human resources and aviation sectors.

In the insurance segment, growth is supported by increasing transactional activity in the auto, property and life insurance markets and the increasing adoption by insurance carriers of more sophisticated data and analytics in the prospecting, underwriting and claims evaluation processes, to assess underwriting risk, increase competitiveness and improve operating cost efficiency. Transactional activity is driven by growth in insurance quoting and policy switching, as consumers seek better policy terms.

This activity is stimulated by competition among insurance companies, high levels of carrier advertising and rising levels of internet quoting and policy binding.

A number of factors support growth in banking and financial services markets, including cross-border payments and trade finance levels. New credit originations, continued high fraud losses, stringent regulatory compliance requirements, escalating anti-money laundering fines and high-profile anti-bribery and corruption cases impact growth opportunities for us with all entities, including financial institutions, e-commerce, communications, mobile and media companies. In collections, demand is driven mainly by levels of consumer debt and the prospect of recovering that debt, which is impacted by employment conditions in the US.

Growth in government markets is driven by the increasing use of data and analytics to combat criminal activity, fraud and tax evasion, and to address security issues. The level and timing of demand in this market are influenced by government funding and revenue considerations. In healthcare, there are numerous growth drivers for identity, fraud and clinical analytics solutions including the expansion of compliance requirements driven by new regulations.

Growth in the global energy and chemicals markets is driven by increasing trade and demand for more sophisticated information solutions. Aviation information markets are being driven by increases in air traffic and in the number of aircraft transactions. Growth in agriculture markets is being driven by adoption of technology and data solutions plus increasing supply chain connectivity.

| | |

| Business review Risk & Business Analytics | | 23 |

|

|

Strategic priorities

Our strategic goal is to help businesses and governments achieve better outcomes with information and decision support in their individual markets through better understanding of the risks and opportunities associated with individuals, other businesses, transactions and regulations. By providing the highest quality industry data and decision tools, we assist customers in understanding their markets and managing risks efficiently and cost-effectively. To achieve this, we are focused on: delivering innovative new products; expanding the range of risk management solutions across adjacent markets; addressing international opportunities in selected markets to meet local needs; further growing our data services businesses and continuing to strengthen our content, technology and analytical capabilities.

Business model, distribution channels and competition

Our products are for the most part sold directly, typically on a subscription or transactional basis. Pricing is predominantly on a transactional basis for insurance carriers and corporations, and primarily on a subscription basis for government entities.

In the insurance sector, our competitor Verisk sells data and analytics solutions to insurance carriers but largely addresses different activities to ours. Principal competitors in Business Services and government segments include Thomson Reuters and major credit bureaus, which in many cases address different activities in these segments as well.

Major Data Services competes with a number of information providers on a service and title-by-title basis including: Platts, Thomson Reuters and IHS as well as many niche and privately owned competitors.

Transactional and subscription revenues now account for 97% of the total business with the remaining 3% derived from advertising.

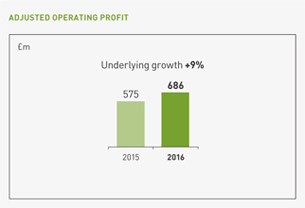

2016 financial performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016

£m | | | 2015

£m | | | Underlying

growth | | | Acquisitions/

disposals | | | Currency

effects | | | Total

growth | |

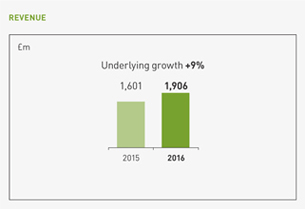

Revenue | | | 1,906 | | | | 1,601 | | | | +9% | | | | -1% | | | | +11% | | | | +19% | |

Adjusted operating profit | | | 686 | | | | 575 | | | | +9% | | | | -1% | | | | +11% | | | | +19% | |

Underlying revenue growth improved in 2016, with strong growth across all key segments in both subscription and transactional revenues. Underlying profit growth broadly matched underlying revenue growth.

Underlying revenue growth was +9%. The difference between the reported and underlying growth rates reflects the impact of exchange rate movements and a minor effect from portfolio changes. Underlying adjusted operating profit growth broadly matched underlying revenue growth as we continued to develop new products and services.

The insurance segment continued to see strong growth, driven by volume growth and strong take up of new products and services across the insurance workflow, and by expansion in adjacent verticals including life and home insurance. The international

initiatives continued to progress well, with strong growth in the UK, and early stage developments in China and India.

In Business Services, growth was driven by demand for identity authentication and fraud detection solutions across the financial services and corporate sectors.

The government and healthcare segments continued to develop strongly. Major Data Services saw strong underlying revenue growth, and other brands & services remained stable.

2017 outlook

The fundamental growth drivers of Risk & Business Analytics remain strong, and we expect underlying operating profit growth to broadly match underlying revenue growth.

| | |

| Business review Review & Business Analytics | | 25 |

|

|

| | |

| 26 | | RELX Group Annual reports and financial statements 2016 |

|

|

| | |

| 28 | | RELX Group Annual reports and financial statements 2016 |

|

|

Legal

| | | | |

| | |

We help lawyers win cases for their clients, manage their work more efficiently, and grow their practices. We assist corporations to better understand their markets and prevent bribery and corruption within their supply chains. We aid universities in their efforts to help students become successful legal professionals, and we support governments and courts by making laws accessible and strengthening legal infrastructures. We help collect evidence against war criminals and provide tools to combat human trafficking. We endeavour to advance the rule of law across the world. | | |

| | | | |

| | | |

| ∎ | | More than10m docket entries are included in Lex Machina, which provides legal analytics to companies and law firms, enabling them to craft successful strategies, win cases, and close business by mining litigation data. This data reveals insights never before available about judges, lawyers, parties and the subjects of the cases themselves, sourced from millions of pages of litigation information. | | |

| | | |

| ∎ | | More than27m SEC filings are held in Intelligize, helping securities and M&A professionals find standard language for corporate agreements and identify critical areas for SEC examiners when preparing filings for submission. Intelligize offers powerful filtering tools to hone in on relevant SEC staff opinions ensuring professionals have a higher degree of relevance in their filings. | | |

| | | |

| ∎ | | Almost4bn people live outside the protection of the rule of law. LexisNexis publishes many of the world’s primary laws. We continue our collaboration with the United Nations to develop the Global Rule of Law Business Principles. | | |

| | | |

| ∎ | | More than20bn connections within the LexisNexis database are continually explored and updated to deliver the latest legal information via computer, tablet or smartphone. | | |

| | | |

| ∎ | | 2.4 petabytes of data are held in the LexisNexis Legal & Professional database. | | |

Business overview

Legal is a leading global provider of legal, regulatory and business information and analytics that help professional customers make more informed decisions, increase productivity and serve their clients better.

LexisNexis Legal & Professional is headquartered in New York and has principal operations in the New York area, Ohio and North Carolina in the US, Toronto in Canada, London and Paris in Europe, and cities in several other countries in Africa and Asia Pacific. It has 10,700 employees worldwide and serves customers in more than 130 countries.

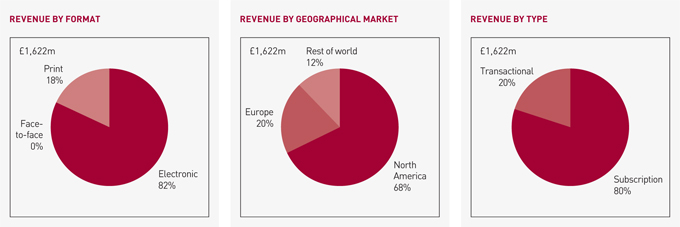

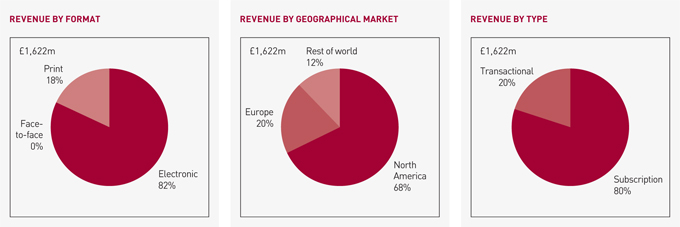

Revenues for the year ended 31 December 2016 were £1,622m, compared with £1,443m in 2015 and £1,396m in 2014. By geographical market, 68% of revenue in 2016 was derived from North America, 20% from Europe and the remaining 12% from the rest of the world. In 2016, 80% of the revenue came from subscription sales and 20% from transactional sales.

LexisNexis Legal & Professional is organised in market-facing groups. These are supported by global shared services organisations providing platform and product development, operational and distribution services, and other support functions.

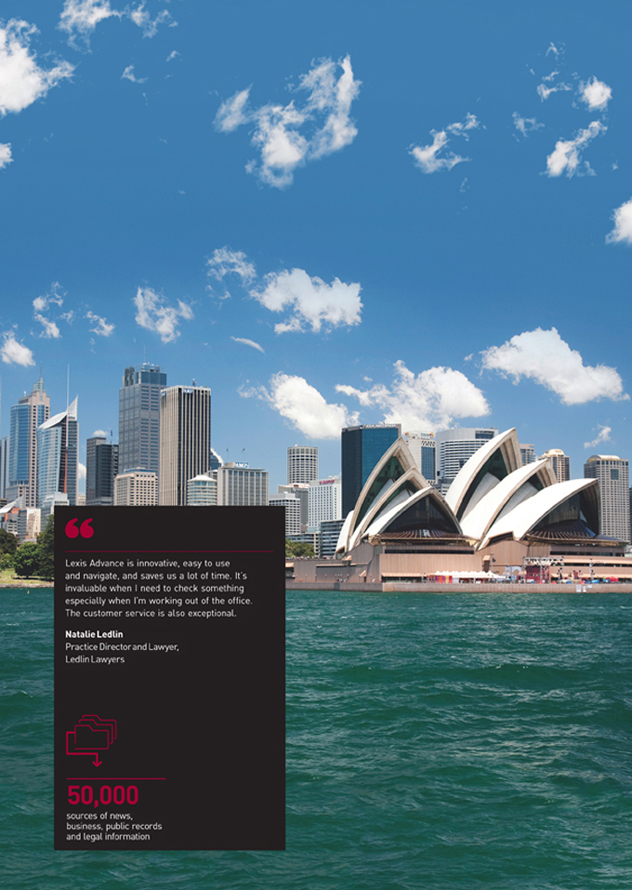

In North America, electronic reference and decision tools from Research Solutions help legal and business professionals make better informed decisions in the practice of law and in managing their businesses. Flagship products for legal research are Lexis.com and Lexis Advance, which provide federal and state statutes and case law, together with analysis and expert commentaries from sources such as Matthew Bender and Michie and the leading citation service Shepard’s, which advises on the continuing relevance of case law precedents. Research solutions also include news and business information, ranging from daily news to company filings, as well as public records information and analytics. LexisNexis also partners with law schools to provide services to students as part of their training.

In 2016, LexisNexis continued to release new versions of Lexis Advance, an innovative web application designed to transform how legal professionals conduct research. Built on the New Lexis advanced technology platform, Lexis Advance allows primary researchers within legal and professional organisations to find relevant information more easily and efficiently, helping to drive better outcomes. Future releases will continue to expand content and outreach and add new innovative tools. LexisNexis employs lawyers and trained editors with professional legal backgrounds who review, annotate and update its legal content to help ensure each document in the collection is current and comprehensive. This domain expertise combined with the application of the Group’s big data HPCC Systems technology means LexisNexis is able to update its entire legal collection faster and more efficiently than before, while also identifying and linking content, enabling customers to identify previously undiscovered relationships between documents.

New analytical tools and content sets are regularly introduced on Lexis Advance. For example, in 2016 LexisNexis released Search Term Maps, enabling a graphical visualisation of term hits within results and documents. In 2016 LexisNexis continued to make enhancements to Lexis Practice Advisor to improve the homepage and build out new modules and content. Additional product releases, tailored to improving attorney productivity, include Get a Document forms, which enable users to retrieve a single document by citation, title or number and a redesigned Shepard’s Brief Check for Lexis Advance.

In Canada, LexisNexis released new versions of Lexis Advance Quicklaw with significant content enhancements in areas like Securities or Labour & Employment, and new functionalities such as the launch of a French interface.

LexisNexis Business & Litigation Software Solutions provides law firms with practice management solutions, including time and billing systems, case management, cost recovery and document management services. Its litigation software provides lawyers with a suite of tools covering case preparation to processing and review to trial preparation.

In international markets outside North America, LexisNexis serves legal, corporate, government, accounting and academic markets in Europe, Africa and Asia Pacific with local and international legal, regulatory and business information. The most significant businesses are in the UK, France, Australia, Canada and South Africa.

LexisNexis focuses on providing customers with leading collections of content and innovative online solutions to help legal and business professionals make better decisions more efficiently. Adoption of online information services has grown strongly and electronic solutions now account for over 70% of revenue outside the US.

In the UK, LexisNexis is a leading legal information provider offering an unrivalled collection of primary and secondary legislation, case law, expert commentary, current awareness, forms and precedents.

Its extensive portfolio includes a number of leading brands: Halsbury’s, Tolleys Butterworths, Mlex and Jordan Publishing. Jordan Publishing business and its market-leading content offering includes flagship titles such as Family Court Practice, Family Law Reports and Gore-Browne on Companies. In 2016, MLex launched a subscription service on Brexit, recognising the need for insights on the UK’s decision to leave the EU. MLex Brexit coverage continues to break news and has become a regularly cited source for mainstream news outlets. The content is delivered through multiple formats – including online, mobile apps and embedded in customers’ work practices.

In 2016, LexisNexis continued to build on its UK LexisPSL product suite with new Property Litigation and Planning modules and significantly upgraded search performance through the introduction of a new search engine. Additionally, LexisNexis launched a new International Comparator Tool on LexisPSL to allow users to compare multi-jurisdictional practical content more easily.

In France, LexisNexis is a leading online provider of information to lawyers, notaries and courts. JurisClasseur and other leading authoritative content is provided through multiple formats. These content sources are, as in the UK, being combined with new content and innovative decision tools to develop practical guidance and practice management solutions. LexisNexis France’s main offering is Lexis 360, the first online semantic search tool combining legal information, practical content and results from the web by providing tailored solutions for the public sector and the accounting markets.

In 2016, LexisNexis France launched major improvements to Lexis 360 Practical Guidance with new value-added services (indemnity calculator visualisation, online codes commentaries, document version comparison), features and back-office improvements to enhance mobile services.

| | |

| 30 | | RELX Group Annual reports and financial statements 2016 |

|

|

In the Asia Pacific region LexisNexis released Advanced Search Forms on Lexis Advance Pacific and launched the Lexis Advance research application in New Zealand. LexisNexis launched Lexis Red 3.0, extending this award-winning digital product beyond Australia and New Zealand into Hong Kong, Singapore and Malaysia. LexisNexis also launched Practical Guidance in Singapore and India, with four modules available in each country and another five to be delivered by the end of the year. Australia and Japan both launched regulatory compliance solutions – new multi-platform databases of regulatory content with plain language commentary, checklists, registers, alerts and audit tools that serve the corporate non-legal markets.

Market opportunities

Longer-term growth in legal and regulatory markets worldwide is driven by increasing levels of legislation, regulation, regulatory complexity and litigation, and an increasing number of lawyers. Additional market opportunities are presented by the increasing demand for online information solutions, legal analytics and other solutions as well as practice management tools that improve the quality and productivity of research, deliver better legal outcomes and improve business performance. Notwithstanding this, legal activity and legal information markets are also influenced by economic conditions and corporate activity, as has been seen with the subdued environment in North America and Europe in the aftermath of the global recession.

Strategic priorities

LexisNexis Legal & Professional’s strategic goal is to enable better legal outcomes and be the leading provider of productivity- enhancing information, analytics and information-based decision tools in its market. To achieve this, LexisNexis is focused on introducing next-generation products and solutions on the global New Lexis platform and infrastructure; leveraging New Lexis globally to continue to drive print-to-electronic migration and long-term international growth; and upgrading operational infrastructure, improving process efficiency and gradually improving margins.

In the US, LexisNexis’ focus is on the continuing development of next-generation legal research and practice solutions. It is also conducting a major upgrade in operations infrastructure and customer service and support platforms. This will provide customers with an integrated and superior experience across multiple products and solutions. Over the next few years, progressive product introductions, often based on the New Lexis platform, leveraging big data HPCC Systems technology, will combine advanced technology with enriched content, sophisticated analytics and applications to enable LexisNexis’ customers to make better legal decisions and drive better outcomes for their organisations and clients.

Outside the US, LexisNexis is focused on growing online services and developing further high-quality actionable content and decision tools, including the continuous development of practical guidance and practice management applications. In 2017, LexisNexis will continue to expand the New Lexis platform globally. Additionally, LexisNexis is focusing on the expansion of its activities in emerging markets.

Business model, distribution channels and competition

LexisNexis Legal & Professional products and services are generally sold directly to law firms and to corporate, government, accounting and academic customers on a paid subscription basis, with subscriptions with law firms often under multi-year contracts.

Principal competitors for LexisNexis in US legal markets are Westlaw (Thomson Reuters), CCH (Wolters Kluwer) and Bloomberg. In news and business information they are Bloomberg and Factiva (News Corporation). Competitors in litigation solutions also include software companies. Significant international competitors include Thomson Reuters, Wolters Kluwer and Factiva.

2016 financial performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016

£m | | | 2015

£m | | | Underlying

growth | | | Acquisitions/

disposals | | | Currency

effects | | | Total

growth | |

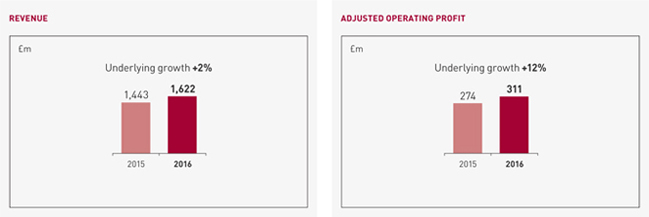

Revenue | | | 1,622 | | | | 1,443 | | | | +2% | | | | 0% | | | | +10% | | | | +12% | |

Adjusted operating profit | | | 311 | | | | 274 | | | | +12% | | | | -10% | | | | +12% | | | | +14% | |

Underlying revenue growth improved slightly in 2016, with continued efficiency gains driving strong underlying operating profit growth.

Underlying revenue growth was +2%. The difference between the reported and underlying growth rates reflects the impact of exchange rate movements and minor portfolio changes.

Underlying adjusted operating profit growth was +12%. The margin increase reflects organic process improvement and the ongoing decommissioning of systems, largely offset by lower profits from joint ventures and other portfolio effects.

Electronic revenues saw continued growth, partially offset by print declines.

US and European markets remained stable but subdued. Revenue from other international markets continued to grow well.

The roll out of new platform releases in the US and international markets continued, and adoption and usage rates progressed well.

2017 outlook

Trends in our major customer markets are unchanged, continuing to limit the scope for underlying revenue growth. We expect underlying profit growth to remain strong.

| | |

| 32 | | RELX Group Annual reports and financial statements 2016 |

|

|

| | |

| 34 | | RELX Group Annual reports and financial statements 2016 |

|

|

Exhibitions

| | |

| |

We help match customers with the right solution. Our events enable customers to learn about a market, source products and complete transactions, generating billions of dollars of revenues for the economic development of local markets and national economies around the world. |

| | |

| | |

| ∎ | | More than500events are in the Reed Exhibitions portfolio. |

| | |

| ∎ | | 43 industry sectors are served across the globe. |

| | |

| ∎ | | Our digital products increase the value of our events to participants, enabling them to make new contacts and meet face-to-face to do business – over80 events offered matchmaking in 2016. |

Business overview

Exhibitions is the world’s leading events business, enhancing the power of face to face through data and digital tools at over 500 events, in more than 30 countries, attracting more than 7m participants.

Reed Exhibitions is a global business headquartered in London and has principal offices in Paris, Vienna, Norwalk (Connecticut), São Paulo, Mexico City, Abu Dhabi, Moscow, Beijing, Tokyo and Sydney. Reed Exhibitions has 4,000 employees worldwide, and its portfolio of events serves 43 industry sectors in more than 30 countries.

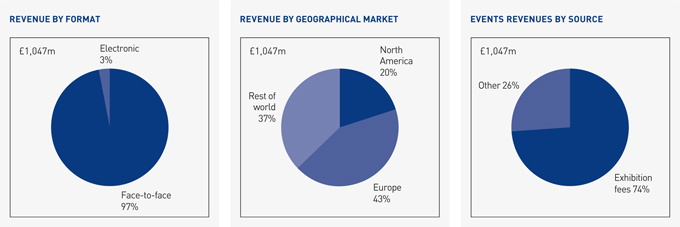

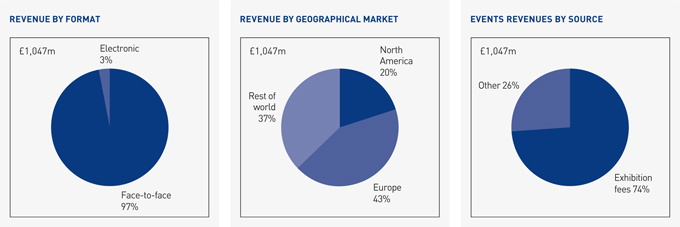

Revenues for the year ended 31 December 2016 were £1,047m compared with £857m in 2015 and £890m in 2014. In 2016, 20% of Reed Exhibitions’ revenue came from North America, 43% from Europe and the remaining 37% from the rest of the world on an event location basis.

Reed Exhibitions organises market-leading events which are relevant to industry needs, where participants from around the world meet face-to-face to do business, to network and to learn. Its events encompass a wide range of sectors. They include construction, cosmetics, electronics, energy and alternative energy, engineering, entertainment, gifts and jewellery, healthcare, hospitality, interior design, logistics, manufacturing, pharmaceuticals, real estate, recreation, security and safety, transport and travel.

Market opportunities

Growth in the exhibitions market is influenced both by business-to-business marketing spend and by business investment. Historically, these have been driven by levels of corporate profitability, which in turn has followed overall growth in gross domestic product. Emerging markets and higher growth sectors provide additional opportunities. Reed Exhibitions’ broad geographical footprint allows it to effectively and efficiently capture growth opportunities globally as they emerge.

As some events are held other than annually, growth in any one year is affected by the cycle of non-annual exhibitions.

| | |

| Business review Exhibitions | | 35 |

|

|

Strategic priorities

Reed Exhibitions’ strategic goal is to understand and to respond to its customers’ evolving needs and objectives better than its competition through deep knowledge of its customers and the markets they serve.

Reed Exhibitions delivers a platform for industry communities to conduct business, to network and to learn through a range of market-leading events in all major geographic markets and higher growth sectors, enabling exhibitors to target and reach new customers quickly and cost-effectively.

Organic growth will be achieved by continuing to generate greater customer value through the intelligent application of customer knowledge and data, by developing new events, and by building out technology platforms to ensure the rapid deployment of innovation and best practices across the organisation. Reed Exhibitions is also shaping its portfolio through a combination of strategic partnerships and acquisitions in high-growth sectors and geographies, as well as by withdrawing from markets and industries with lower growth prospects over the longer term.

Reed Exhibitions is committed to improving customer solutions and experience continuously by developing global technology platforms based on industry databases, digital tools and analytics. By providing a variety of services, including its integrated web platform, the company continues to drive up customer satisfaction by proactively putting the right buyers and sellers together on the event floor. Increasingly, digital and multichannel services such as active matchmaking are becoming part of the customer expectation and product offering, enhancing the value delivered through attendance at the event. Using customer insights, Reed Exhibitions has developed an innovative product offering that underpins the value proposition for exhibitors by broadening their options in terms of the type and location of stand they take and the channels through which they can address potential buyers.

In 2016 Reed Exhibitions launched 32 new events. These included many events which delivered on the strategy of taking sector expertise, customer relationships and leading brands from one market and extending them into new geographies using local operational capability.

Reed Exhibitions Japan continued its successful launch programme, the highlights being the cloning of Manufacturing World, taking it to its third location of Nagoya and its first show covering international building and urban development, which takes place in Tokyo.

After a successful launch of in-cosmetics Korea in 2015, the team continued to branch out and followed up with an event in New York.

Following the 2015 acquisition of Jewelers International Showcase in the US, the US team launched JIS Exchange, which took place alongside JCK Las Vegas, one of Reed Exhibitions’ best-known brands.

The fashion portfolio Agenda added to its number of events by working with the fashion, pop culture, music and sports magazine Complex to launch the event ComplexCon.

A number of small acquisitions and investments were completed during 2016. These included REX in Russia (commercial real estate industry), Franchise Seoul in Korea, K Fairs in Korea (electronics manufacturing and home decoration) and Reed Exhibitions increased its interest and acquired control of Thebe Reed Exhibitions in South Africa.

| | |

| 36 | | RELX Group Annual reports and financial statements 2016 |

|

|

Business model, distribution channels and competition

Over 70% of Reed Exhibitions’ revenue is derived from exhibitor fees, with the balance primarily consisting of admission charges, conference fees, sponsorship fees and online and offline advertising. Exhibition space is sold directly or through local agents where applicable. Reed Exhibitions often works in collaboration with trade associations, which use the events to promote access for members to domestic and export markets, and with governments, for which events can provide important support to stimulate foreign investment and promote regional and national enterprise. Increasingly, Reed Exhibitions is offering visitors and exhibitors the opportunity to interact before and after the show through the use of digital tools such as online directories and matchmaking and mobile apps.

Reed Exhibitions is the global market leader in a fragmented industry, holding less than a 10% global market share. Other international exhibition organisers include UBM, Informa IIR and some of the larger German Messen, including Messe Frankfurt, Messe Düsseldorf and Messe Munich. Competition also comes from industry trade associations and convention centre and exhibition hall owners.

| | |

| Business review Exhibitions | | 37 |

|

|

2016 financial performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016 £m | | | 2015 £m | | | Underlying growth | | | Acquisitions/ disposals | | | Currency effects | | | Total growth | |

Revenue | | | 1,047 | | | | 857 | | | | +5% | | | | +1% | | | | +13% | | | | +22% | |

Adjusted operating profit | | | 269 | | | | 217 | | | | +7% | | | | +1% | | | | +16% | | | | +24% | |

Exhibitions achieved strong underlying revenue growth in 2016, in line with prior year.

Underlying revenue growth was +5%. After portfolio changes and three percentage points of cycling effects, constant currency revenue growth was +9%. The difference between the reported and constant currency growth rates reflects the impact of exchange rate movements.

Underlying adjusted operating profit growth was +7%. The 40 basis point improvement in reported margin largely reflects exchange rate movements.

Revenue growth was strong in the US and moderate in Europe. Japan grew strongly, and China saw good growth. Revenues in Brazil continued to reflect the general weakness of the wider economy. Most other markets continued to grow strongly.

We continued to pursue growth opportunities, launching 32 new events and completing seven small acquisitions.

2017 outlook

We expect underlying revenue growth trends to continue. In 2017 we expect cycling out effects to decrease the reported revenue growth rate by four to five percentage points.

| | |

| Business review Exhibitions | | 39 |

|

|

| | |

Corporate Responsibility | | |

The Corporate Responsibility Report is an integral part of our Annual Reports and Financial Statements. This section highlights progress on our 2016 corporate responsibility objectives. You can read the full 2016 Corporate Responsibility Report at www.relx.com/go/CRReport | |

| | |

| 42 | | RELX Group Annual reports and financial statements 2016 |

|

|

Corporate responsibility

Corporate responsibility (CR) ensures good management of risks and opportunities, helps us attract and retain the best people and strengthens our corporate reputation. It means performing to the highest commercial and ethical standards and channelling our knowledge and strengths, as global leaders in our industries, to make a difference to society.

Consistent engagement with stakeholders, including shareholders, employees, governments and communities where we operate, helps us identify our material corporate responsibility issues. Stakeholder feedback ensures alignment with our non-financial objectives. The Board of Directors, senior management and the Corporate Responsibility Forum oversee CR objectives and monitor performance against them.

|

We concentrate on the contributions we make as a business and on good management of the material areas that affect all companies: 1. Our unique contributions 2. Governance 3. People 4. Customers 5. Community 6. Supply chain 7. Environment |

1. Our unique contributions

We make a positive impact on society through our knowledge, resources and skills, including:

| ∎ | universal sustainable access to information |

| ∎ | advance of science and health |

| ∎ | promotion of the rule of law and justice |

Scientific, Technical & Medical

Elsevier, the world’s leading provider of scientific, technical and medical information, plays an important role in advancing human welfare and economic progress through its science and health