Filed by RELX PLC

Pursuant to Rule 425 under the Securities Act of 1933

Commission File No.:1-13334

Subject Company: RELX NV

Commission File No.:1-13688

Date: February 15, 2018

The following is an excerpt from a presentation by RELX PLC and RELX NV on February 15, 2018.

RELX Group results 2017

Erik Engstrom, CEO

Nick Luff, CFO

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to a number of risks and uncertainties that could cause actual results or outcomes to differ materially from those currently being anticipated. The terms “outlook”, “estimate”, “project”, “plan”, “intend”, “expect”, “should be”, “will be”, “believe”, “trends” and similar expressions identify forward-looking statements. Factors which may cause future outcomes to differ from those foreseen in forward-looking statements include, but are not limited to: current and future economic, political and market forces; changes in law and legal interpretations affecting the RELX Group intellectual property rights; regulatory and other changes regarding the collection, transfer or use of third party content and data; demand for the RELX Group products and services; competitive factors in the industries in which the RELX Group operates; compromises of our data security systems and interruptions in our information technology systems; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC and RELX N.V. with the US Securities and Exchange Commission.

| | |

| | 3 |

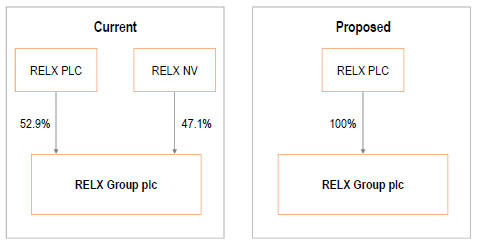

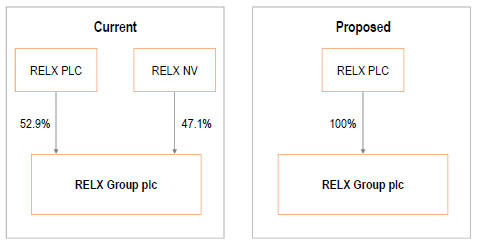

RELX Group further corporate structure simplification

| | |

| | 17 |

Corporate Structure Simplification

| | • | | Corporate structure reviewed periodically and evolved over time |

| | • | | Further simplification now possible without changing economic interests of shareholders |

| | • | | Natural next step, removing complexity, increasing transparency |

| | • | | No change to locations, activities or staffing levels of RELX Group or its four business areas |

| | • | | No change to strategy; cost and profit neutral before and after tax |

Further simplification of corporate structure

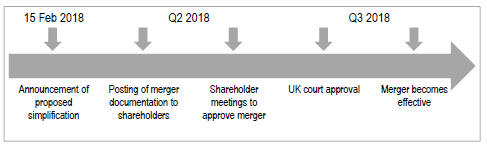

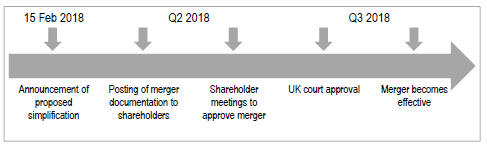

Process and indicative timetable

| | • | | Cross border merger of RELX PLC and RELX NV; RELX PLC to be sole parent company |

| | • | | RELX NV shareholders receive one RELX PLC share in exchange for every RELX NV held |

| | • | | Approval required by RELX PLC shareholders (75% majority*) and RELX NV shareholders (50% majority**) |

| * | And a majority in number |

| ** | Two thirds majority if less than half of shareholders vote |

| | |

| | 32 |

Further simplification of corporate structure

Implications for RELX shareholders

| | • | | No change for PLC shareholders |

| | • | | Continuity for NV shareholders |

| | | | | | | | | | |

| | | | | Current | | Proposed |

| | | PLC | | NV | | PLC |

| Listing | | • | | London | | • Amsterdam | | • | | London |

| | • | | New York (ADR) | | • New York (ADR) | | • | | Amsterdam |

| | | | | | | | • | | New York (ADR) |

| | | | | |

| Depository | | • | | CREST | | • Euroclear Nederland | | • | | CREST |

| | | | | | | | • | | Euroclear Nederland* |

| | | | | |

| Dividends | | • | | Sterling | | • Euros | | • | | Sterling or euro by election |

| | | | | | | | • | | Default based on where |

| | | | | | | | | | held |

| | | | | |

| Expected | | • | | FTSE 100(52.9%†) | | • AEX-Index(47.1%†) | | • | | FTSE 100 |

| index inclusion | | • | | STOXX Europe 600(52.9%†) | | • STOXX Europe 600(47.1%†) | | • | | AEX-Index |

| | | | | | | | • | | STOXX Europe 600 |

| | | | | |

| Market cap | | • | | £15bn | | • €15bn | | • | | £29bn |

| * | Can be moved to CREST at no cost; moving shares from CREST to Euroclear Nederland incurs 1.5% stamp duty |

| † | Percentage equals weighting of combined shares outstanding |

| | |

| | 33 |

CAUTIONARY NOTE

This Announcement does not constitute or form part of any offer to sell or subscribe for or any invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the simplification. It does not constitute a prospectus or prospectus equivalent document and investors should not make any investment decision in relation to any shares referred to in this Announcement. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and applicable European rules and regulations. A prospectus is expected to be made available to shareholders on RELX Group’s website (www.relx.com) in due course.

The release, publication or distribution of this Announcement in jurisdictions other than the UK, the Netherlands and the US may be restricted by law and, therefore, any persons who are subject to the laws of any jurisdiction other than the UK, the Netherlands or the US should inform themselves about, and observe, any applicable requirements. Failure to comply with any such restrictions may constitute a violation of the securities laws or regulations of such jurisdiction. This Announcement has been prepared to comply with UK, Dutch and US law and the information disclosed may not be the same as that which would have been disclosed if this Announcement had been prepared in accordance with the laws and regulations of any jurisdiction outside of the UK, the Netherlands and the US.

This Announcement contains inside information for the purposes of Article 7 of EU regulation 596/2014.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In addition to the prospectus to be made available to shareholders, RELX PLC will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on FormF-4 that will include the prospectus. RELX PLC plans to mail the prospectus to the holders of American Depositary Shares of RELX N.V. and U.S. holders of ordinary shares of RELX N.V. (collectively, “RELX NV U.S. Shareholders”) in connection with the Simplification. RELX N.V. U.S. SHAREHOLDERS ARE URGED TO READ THE PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RELX PLC, RELX N.V., THE SIMPLIFICATION AND RELATED MATTERS. RELX N.V. U.S. Shareholders will be able to obtain free copies of the prospectus and other documents filed with the SEC by RELX PLC and RELX N.V. through the website maintained by the SEC at www.sec.gov. In addition, RELX N.V. U.S. Shareholders will be able to obtain free copies of the prospectus and other documents filed by RELX PLC with the SEC by contacting RELX Investor Relations at1-3 Strand, London WC2N 5JR or by calling +44 20 7166 5634.

| | |

| | 70 |