Exhibit 99.2

|

|

| |

| T A B L E O F C O N T E N T S |

|

| |

| Introduction | |

| | |

| Shareholder Letter | |

| | |

| Quarterly Overview | |

| | |

Ñ Third Quarter Highlights | |

| | |

Ñ Quarterly Earnings and Analysis | |

| | |

Ñ Book Value | |

| | |

Ñ Capital Allocations | |

| | |

Ñ 2019 Updated Financial Outlook | |

| | |

Ñ Segment Results | |

| | |

Ñ Balance Sheet Analysis | |

| | |

| Financial Tables | |

| | |

| Appendix | |

| | |

Ñ Dividends | |

| | |

Ñ Non-GAAP Measurements | |

| | |

Ñ Forward-Looking Statements | |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 1 |

|

|

| |

| F O R W A R D - L O O K I N G S T A T E M E N T S |

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar expressions or their negative forms, or by references to strategy, plans, goals, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: statements we make regarding Redwood’s business strategy and strategic focus, statements related to our financial outlook and expectations for 2019, statements regarding our available capital and sourcing additional capital both internally and from the capital markets, and other statements regarding pending business activities and expectations and estimates relating to our business and financial results. Additional detail regarding the forward-looking statements in this Redwood Review and the important factors that may affect our actual results in 2019 are described in the Appendix of this Redwood Review under the heading “Forward-Looking Statements.”

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 2 |

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). These documents, as well as information about our business and a glossary of terms we use in this and other publications, are available through our website, www.redwoodtrust.com. We encourage you to review these documents.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. Note that because we round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding. References to the “third quarter” refer to the quarter ended September 30, 2019, and references to the “second quarter” refer to the quarter ended June 30, 2019, unless otherwise specified.

We hope you find this Review helpful to your understanding of our business. We thank you for your input and suggestions, which have resulted in our changing the form and content of The Redwood Review over time.

|

| | | | | | | | | | | | | | | |

| | Selected Financial Highlights |

| |

| | Quarter:

Year | | GAAP Income

(Loss) per Share | | REIT Taxable

Income per

Share (1) | | Annualized

GAAP Return

on Equity | | GAAP Book

Value per

Share | | Dividends

per Share | | Economic Return on Book Value (2) | | Recourse Leverage (3) |

| | Q319 | | $0.31 | | $0.34 | | 9% | | $15.92 | | $0.30 | | 1.3% | | 2.7x |

| | Q219 | | $0.30 | | $0.25 | | 8% | | $16.01 | | $0.30 | | 1.9% | | 3.1x |

| | Q119 | | $0.49 | | $0.30 | | 15% | | $16.00 | | $0.30 | | 2.6% | | 2.9x |

| | Q418 | | $(0.02) | | $0.32 | | —% | | $15.89 | | $0.30 | | (1.4)% | | 3.5x |

| | Q318 | | $0.42 | | $0.27 | | 12% | | $16.42 | | $0.30 | | 3.0% | | 3.1x |

| | | | | | | | | | | | | | | | |

| |

| (1) | REIT taxable income per share for 2019 is an estimate until we file our tax return. |

| |

| (2) | Economic return on book value is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period. |

| |

| (3) | See Table 7 in the Financial Tables section of this Redwood Review for details of how our recourse debt to equity leverage ratio is calculated. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 3 |

|

|

| |

| S H A R E H O L D E R L E T T E R |

Dear Fellow Shareholders:

Two years ago, we announced a comprehensive new business strategy to leverage our housing credit competencies across a broader residential landscape. This entailed not only the expansion of our consumer mortgage business, but also a commitment to offering similar solutions for housing investors who purchase residential real estate for business income (i.e., rent or refurbishment). Over the course of the past 18 months, we've developed the skills and operations necessary to grow in this market, and have taken tangible steps towards building a best-in-class specialty finance platform that serves the liquidity needs of all homebuyers - homeowners and investors alike.

Our expansion into the business-purpose lending ("BPL") space began organically, but quickly evolved into a partnership with our 5 Arches team in Irvine. We were extremely fortunate to bring 5 Arches fully into the fold this year, and their business has fit squarely within Redwood's DNA. The investment opportunities we have seen through 5 Arches have validated the thesis underpinning our new strategy; that is, a significant imbalance exists between the rate of new household formation in the United States and the rate of new homebuilding. Earlier this month, we had the opportunity to further solidify business-purpose lending as a core strategy at Redwood, and we announced a second new partner - CoreVest.

CoreVest is an industry leading BPL originator with over $900 million of total assets, and brings an extremely talented team to Redwood that shares our values of working with integrity and fostering deep relationships with our customers and business partners. Since their inception in 2014, CoreVest has funded over $4 billion of loans while developing industry-leading technology that offers a seamless borrower experience. The platform has generated attractive returns to date, with its highly scalable mortgage banking business significantly contributing to the company's profitability. The firm also recently completed its ninth securitization of single-family rental loans since it began issuing in 2015, more such transactions than any other issuer. Pairing this channel with our own market-leading Sequoia program further expands our lead in the private-label securitization market. This transaction strengthens our position as a leading lender in a market whose size we estimate to be in excess of $100 billion.

While our BPL expansion has been a key area of focus, we continue to expand our core consumer residential business. We are committed to growing expanded credit and non-qualified residential mortgage (non-QM) loans by leveraging our approach to credit, speed to close, and reliable execution we deliver to our loan sellers. We see a tremendous opportunity for this business thanks to announcements made regarding impending changes to housing finance rules made by regulators over the course of this year. Most recently, the CFPB announced in late July that they intend to let the so called "QM Patch" expire. As we laid out in a presentation we published in May, the QM Patch is a regulatory-driven competitive advantage afforded to the public mortgage sector that resulted in an unlevel playing field for non-QM mortgage lending. We estimate the patch expiration will open the private sector to a market in upwards of $185 billion of non-QM loans produced annually by Fannie Mae and Freddie Mac. To contextualize this opportunity, we

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 4 |

|

|

| |

| S H A R E H O L D E R L E T T E R |

purchased about $7 billion of loans in 2018, a successful and profitable year for our consumer mortgage banking business.

The CFPB's announcement in July included a notice of proposed rulemaking seeking information relating to the expiration of the QM Patch. In late August, we published a presentation on our perspective for potential changes focused on redefining Qualified Mortgages; improving pricing transparency at the GSEs; and refining certain rules that in our view, unnecessarily inhibit access to the public securitization markets. Our presentations can be viewed on the Newsroom section of our website at: http://www.redwoodtrust.com/Presentations.

The success of our operating businesses has been directly complimented by the great work done within our investment portfolio. The portfolio team continues to deploy capital at a record pace, leveraging unique and durable relationships forged over several years. A key differentiator for Redwood has always been our ability to source and structure investments our competitors cannot easily replicate. Our collective suite of businesses makes that truer than ever before, with over $670 million of capital deployed year-to-date, through October 29th, including our acquisition of the CoreVest investment portfolio. As we grow our mortgage banking platforms, our portfolio activities and efficiency of our corporate functions will be key to profitably scaling our consolidated platform and maximizing the growth of earnings per share.

As we reflect on the current state of our industry, the present marks an exciting time for Redwood. After years of fundraising, markets are awash in capital and credit-oriented strategies are in demand as the yield curve flattens and investors seek alternative means to source real estate-related assets. The product sourcing capabilities and operating know-how required to succeed, however, remain in scarce supply. At Redwood, we have built a solutions-based platform that possesses a unique ability to bridge the gap between the customized needs of non-agency borrowers - whether BPL, non-QM, or traditional jumbo and the liquidity options available to them in the marketplace. We are already making necessary investments in technology and infrastructure to further automate our loan purchase process in anticipation of these opportunities. Our 25-year track record speaks to our ability to operate efficiently, while developing nascent, emerging products into scalable funding solutions that are transformative in nature. With an eye towards integrating our consumer mortgage and BPL businesses over time across our national correspondent network, our vision of becoming the preeminent, and most profitable, specialty finance operator in the mortgage industry can be realized.

We are grateful to have your continued support.

|

| | |

| | |

| Christopher J. Abate | | Dashiell I. Robinson |

| Chief Executive Officer | | President |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 5 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Third Quarter Highlights

| |

| Ñ | During the third quarter, we issued $228 million of common stock and generated $248 million of capital through portfolio optimization, ending the quarter with approximately $590 million of available capital and reducing our recourse leverage ratio to 2.7x, below our historical target range of 3.0x - 4.0x. |

| |

| Ñ | Our portfolio optimization activities during the quarter included the sale of $262 million of lower yielding securities, which freed-up $118 million of capital, and the completion of a new $185 million, non-mark-to-market, 3-year term facility, collateralized by a portion of our retained Sequoia securities, which generated $130 million of capital, after repayment of existing financing. |

| |

| Ñ | We deployed $152 million of capital toward new investments in the third quarter of 2019, including $55 million into proprietary investments and $98 million into third-party investments (which included $73 million into subordinate re-performing loan (RPL) securities issued by Freddie Mac). On page 12, we provide a supplemental overview of our RPL investment strategy. |

| |

| Ñ | We purchased $1.5 billion of residential jumbo loans during the third quarter of 2019, including a record $0.7 billion of Choice loans, and sold $1.6 billion of loans, through a combination of whole loan sales and three Sequoia securitizations, including our 100th overall. At September 30, 2019, our pipeline of jumbo residential loans identified for purchase was $1.3 billion. |

| |

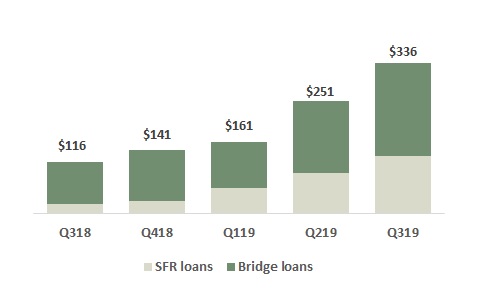

| Ñ | We originated $162 million of business purpose residential loans (BPLs) during the third quarter and at September 30, 2019, our total portfolio of BPLs was $336 million, including both single-family rental and residential bridge loans. On page 21, we provide additional detail on BPL activity at our 5 Arches subsidiary. |

| |

| Ñ | In September, we issued $201 million of 5.75% 6-year exchangeable debt, which is excluded from our available capital, and will replace our $201 million of exchangeable debt maturing in November 2019. |

| |

| Ñ | Following the end of the third quarter, we completed our acquisition of CoreVest, a leading nationwide originator and portfolio manager of business purpose residential loans. The acquisition included CoreVest's operating platform and $900 million of related financial assets. Total transaction consideration was $492 million, net of in-place financing on certain of the financial assets. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 6 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Quarterly Earnings and Analysis

Below we present GAAP net income and non-GAAP core earnings for the third and second quarters of 2019.

|

| | | | | | | | |

| |

| GAAP Net Income |

| ($ in millions, except per share data) |

| | Three Months Ended | |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| Net interest income | $ | 34 |

| | $ | 32 |

| |

| | | | | |

| Non-interest income | | | | |

| Mortgage banking activities, net | 10 |

| | 19 |

| |

| Investment fair value changes, net | 11 |

| | 3 |

| |

| Other income, net | 2 |

| | 2 |

| |

| Realized gains, net | 5 |

| | 3 |

| |

| Total non-interest income, net | 27 |

| | 28 |

| |

| Operating expenses | (27 | ) | | (26 | ) | |

| Provision for income taxes | — |

| | (2 | ) | |

| | | | | |

| GAAP net income | $ | 34 |

| | $ | 31 |

| |

| | | | | |

| GAAP diluted earnings per common share | $ | 0.31 |

| | $ | 0.30 |

| |

| | | | | |

| |

Non-GAAP Core Earnings (1) |

| ($ in millions, except per share data) |

| | Three Months Ended | |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| GAAP net interest income | $ | 34 |

| | $ | 32 |

| |

| Change in basis and hedge interest | (3 | ) | | 1 |

| |

Non-GAAP economic net interest income (1) | 31 |

| | 34 |

| |

| | | | | |

| Non-interest income | | | | |

| Mortgage banking activities, net | 10 |

| | 19 |

| |

Core investment fair value changes, net (1) | — |

| | — |

| |

Core other income, net (1) | 4 |

| | 4 |

| |

Core realized gains, net (1) | 25 |

| | 16 |

| |

| Total non-interest income, net | 38 |

| | 40 |

| |

| Core operating expenses | (25 | ) | | (26 | ) | |

Core provision for income taxes (1) | — |

| | (4 | ) | |

| | | | | |

Core earnings (1) | $ | 43 |

| | $ | 43 |

| |

| | | | | |

Core diluted earnings per common share (2) | $ | 0.37 |

| | $ | 0.39 |

| |

| |

| (1) | During the third quarter of 2019, we updated our definition of core earnings and economic net interest income. Prior period amounts presented above have been conformed. Additional information on Redwood's non-GAAP measures, including: economic net interest income; core investment fair value changes, net; core other income, net; core realized gains, net; core provision for income taxes; and core earnings as well as reconciliations to associated GAAP measures, is included in the Non-GAAP Measurements section of the Appendix. |

| |

| (2) | Additional information on the calculation of non-GAAP core diluted EPS can be found in Table 2 in the Financial Tables section of this Redwood Review. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 7 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Overview

During the third quarter of 2019, we accelerated our pace of portfolio optimization and raised equity capital in early September, which together generated $476 million of available capital. These activities resulted in increased levels of core realized gains, but dampened economic net interest income, as our average undeployed capital increased. While lower rates generally persisted throughout the quarter, helping maintain residential loan purchase volume levels in our mortgage banking business, we experienced higher prepayments in our investment portfolio, which further impacted economic net interest income. Additionally, mortgage banking margins were negatively impacted by the rally in rates, which impacted execution on securitizations we completed during the quarter. Execution improved for our most recent securitization, completed in October. Despite the rate volatility, overall we continued to see strong demand for yield, resulting in positive investment fair value changes for the quarter.

Line Item Review

| |

| Ñ | Net interest income increased from the second quarter of 2019, as the benefit from continued capital deployment during the third quarter was partially offset by capital inflows that resulted from increased portfolio optimization activities, including an increase in opportunistic asset sales and the addition of incremental term financing within our investment portfolio. |

| |

| Ñ | Non-GAAP economic net interest income declined from the second quarter of 2019, due to lower mortgage rates and strong prepayment activity. Faster prepayments helped to improve the fair value of our subordinate investments, but negatively impacted our portfolio investments held at a premium. |

| |

| Ñ | Mortgage banking activities decreased primarily due to lower gross margins in our residential mortgage banking business, on similar loan purchase volume as the second quarter. Gross margins were driven lower primarily due to the impact of rate volatility on securitizations we executed during the third quarter. |

| |

| Ñ | Investment fair value changes was positively impacted by tightening credit spreads in our securities portfolio during the third quarter, benefiting fair values to a greater extent than in the second quarter. Our non-GAAP core earnings excludes these market valuation adjustments. |

| |

| Ñ | Realized gains in the third quarter resulted from the sale of $262 million of securities. After the repayment of associated debt, the security sales freed up $118 million of capital for reinvestment. |

| |

| Ñ | GAAP operating expenses increased primarily due to $2 million of transaction costs incurred in relation to the acquisition of CoreVest. We exclude these expenses from our non-GAAP core operating expenses. |

| |

| Ñ | The provision for income tax declined during the third quarter due to lower residential mortgage banking income at our taxable subsidiary during the third quarter, as compared with the second quarter. A reconciliation of GAAP and taxable income is set forth in Table 6 in the Financial Tables section of this Redwood Review. |

| |

| Ñ | Additional details on our earnings are included in the Segment Results section. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 8 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Book Value

|

| | | | | | | | |

| |

| Changes in GAAP Book Value per Share |

| ($ in per share) |

| | Three Months Ended | |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| Beginning book value per share | $ | 16.01 |

| | $ | 16.00 |

| |

| Earnings | 0.31 |

| | 0.30 |

| |

| Changes in unrealized gains on securities, net, from: | | | | |

| Realized gains recognized in earnings | (0.03 | ) | | (0.02 | ) | |

| Amortization income recognized in earnings | (0.01 | ) | | (0.02 | ) | |

| Mark-to-market adjustments, net | 0.06 |

| | 0.11 |

| |

| Total change in unrealized gains on securities, net | 0.02 |

| | 0.07 |

| |

| Dividends | (0.30 | ) | | (0.30 | ) | |

| Equity compensation, net | 0.02 |

| | 0.02 |

| |

| Changes in unrealized losses on derivatives hedging long-term debt | (0.11 | ) | | (0.10 | ) | |

| Other, net | (0.03 | ) | | 0.02 |

| |

| | | | | |

| Ending book value per share | $ | 15.92 |

| | $ | 16.01 |

| |

| |

Ñ | Our GAAP book value declined $0.09 per share to $15.92 per share during the third quarter of 2019. While GAAP earnings exceeded our third quarter dividend, book value decreased primarily due to an $0.11 per share decline in the value of derivatives hedging our long-term debt, which were impacted by the decline in benchmark interest rates during the third quarter. |

| |

| Ñ | Combining our third quarter dividend with our change in book value during the third quarter contributed to a positive economic return on book value(1) of 1.3% for the quarter. |

_____________________

| |

| (1) | Economic return on book value is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 9 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Capital Allocations

| |

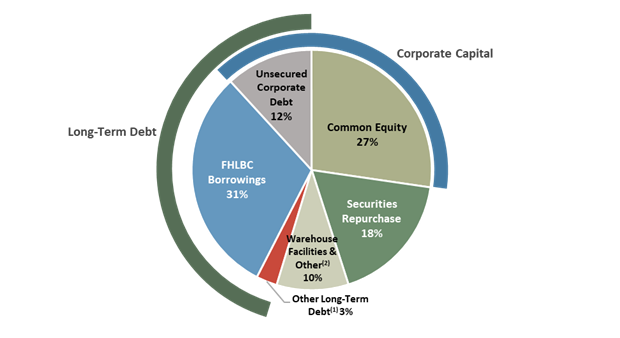

| Ñ | We capitalize our business with a combination of equity and long-term unsecured corporate debt (which we collectively refer to as corporate “capital”). Our total capital of $2.6 billion at September 30, 2019 was comprised of $1.8 billion of equity capital and $0.8 billion of convertible notes and other long-term unsecured debt. |

| |

| Ñ | We also utilize various forms of collateralized debt to finance certain investments and to warehouse our inventory of certain loans held-for-sale. We do not consider this collateralized debt as "capital" and, therefore, exclude it from our capital allocation analysis. |

| |

| Ñ | Collectively, over 73% of our total funding sources are corporate capital and other long-term secured debt. |

Funding Sources

(as of September 30, 2019)

| |

| Ñ | During the third quarter, capital raising combined with the completion of a new secured financing facility and portfolio optimization raised over $476 million of capital. This combined activity included $228 million of common equity raised in early September, a $185 million long-term, non-mark-to-market, 3-year-term secured debt facility collateralized by retained Sequoia residential securities (that generated $130 million of capital, after repayment of existing financing), and $118 million from security sales. |

| |

| Ñ | In late September, we issued $201 million of 5.75% 6-year exchangeable debt. This issuance will replace our exchangeable notes maturing in November of this year, and we therefore do not consider it incremental capital. |

_____________________

(1) Other long-term debt represents a non-mark-to-market secured-term facility.

(2) Other includes our exchangeable notes due in November 2019, which are classified as short-term.

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 10 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

|

| | | | | | | | | | | | | | | | | | |

| |

| Capital Allocation Detail |

| By Investment Type |

| September 30, 2019 |

| ($ in millions) |

| | GAAP Fair Value | | Collateralized Short-Term Debt | | Collateralized Long-Term Debt | | Allocated Capital | | % of Total Capital | |

| | | | | | | | | | | |

Residential loans (1) | $ | 2,420 |

| | $ | — |

| | $ | (1,945 | ) | | $ | 475 |

| | 19% | |

| Business purpose residential loans | 226 |

| | (139 | ) | | (14 | ) | | 72 |

| | 3% | |

| | | | | | | | | | | |

| Securities portfolio | | | | | | | | | | |

| Sequoia residential securities | 505 |

| | (155 | ) | | (185 | ) | | 166 |

| | 6% | |

| Agency CRT securities | 141 |

| | (8 | ) | | — |

| | 133 |

| | 5% | |

| Multifamily securities | 683 |

| | (517 | ) | | — |

| | 167 |

| | 7% | |

Re-performing residential loan securities (2) | 627 |

| | (315 | ) | | (41 | ) | | 270 |

| | 11% | |

| Other third-party residential securities | 254 |

| | (163 | ) | | — |

| | 91 |

| | 4% | |

Total securities portfolio (3) | 2,211 |

| | (1,158 | ) | | (226 | ) | | 827 |

| | 32% | |

| | | | | | | | | | | |

| Other investments | 201 |

| | — |

| | — |

| | 201 |

| | 8% | |

| Other assets/(liabilities) | | | | | | | (74 | ) | | (3)% | |

| Cash and liquidity capital | | | | | | | 868 |

| | N/A | |

| | | | | | | | | | | |

| Total Investments | $ | 5,057 |

| | $ | (1,297 | ) | | $ | (2,185 | ) | | $ | 2,370 |

| | 93% | |

| | | | | | | | | | | |

| Residential mortgage banking | | | | | | | 130 |

| | 5% | |

| Business purpose mortgage banking | | | | | | | 55 |

| | 2% | |

| | | | | | | | | | | |

| Total Mortgage banking | | | | | | | $ | 185 |

| | 7% | |

| | | | | | | | | | | |

| Total | | | | | | | $ | 2,554 |

| | 100% | |

| |

| (1) | Includes $43 million of FHLB stock, $34 million of cash and cash equivalents, and $77 million of restricted cash. |

| |

| (2) | Re-performing residential loan securities represent third-party securities collateralized by seasoned re-performing residential loans. |

| |

| (3) | In addition to our $1.3 billion of securities on our GAAP balance sheet, securities presented above also include $257 million, $454 million, and $214 million of securities retained from Sequoia Choice, Freddie Mac SLST, and Freddie Mac K-Series securitizations, respectively. For GAAP purposes, we consolidate these securitizations. |

| |

| Ñ | During the third quarter, we deployed capital into re-performing residential loan securities and business purpose residential loans, and reduced our capital allocations to Agency CRT securities, other third-party residential securities, and multifamily mezzanine securities. |

| |

| Ñ | Over the last several quarters, we have increased our allocation of capital to re-performing residential loan securities. The following section provides a summary of this investment opportunity. |

| |

| Ñ | At September 30, 2019, our cash and liquidity capital included $590 million of available capital. |

| |

| Ñ | In October 2019, we completed the acquisition of CoreVest for $492 million, net of in-place financing on financial assets acquired, with a mix of cash on hand and shares of Redwood stock. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 11 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Overview of Re-Performing Loan Securities Investments

Since late 2016, we have deployed $270 million of capital into primarily Freddie Mac-issued securitizations backed by seasoned, re-performing and, to a lesser extent, non-performing single-family mortgage loans (RPLs). In most cases, these loans have experienced a credit event leading up to the securitization and have been modified in order to keep the borrower in their home and current in their payments under recast loan terms. Freddie Mac transfers credit risk by selling the subordinate securities and keeping or guaranteeing the senior tranches.

The majority of our deployed capital in this asset class is invested in a securitization structure in which we own 100% of the subordinate securities and that is consolidated on our balance sheet. The senior securities in the structure represent term financing for our investment in the underlying loans and carry a low interest rate for up to 10 years. Our estimated base case returns on our securities - which represent more than 20% of the transaction capital structure - range between 10-13% on a loss-adjusted basis, inclusive of the effects of leverage applied to the mezzanine tranches.

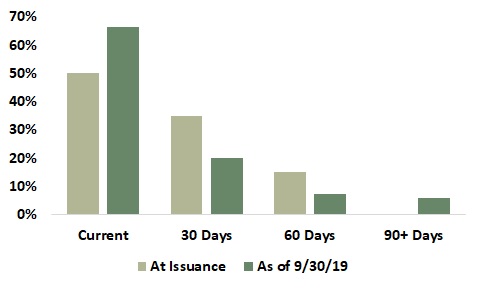

Central to the investment thesis in these securities is the view that a significant percentage of the underlying borrowers will improve upon their delinquency history and continue paying steadily under the modified or recast terms of the loan. This improvement in performance can sometimes be linked to the assumption of servicing duties by a more “high-touch” servicer that specializes in working with borrowers to keep them current in their payments. The performance of the first consolidated RPL transaction we invested in continues to trend favorably as delinquencies have declined from 50% to 33% in less than one year. The chart below details the trends in payment status for this transaction, which we invested in during December 2018. To date, the transaction has had 0.01% in realized losses, and 5% of the original principal balance has prepaid in full.

2018 Consolidated RPL Transaction

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 12 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

The following table details our RPL securities by asset type as of September 30, 2019.

|

| | | | | | | | | | | | | | | | |

| |

| Re-Performing Residential Loan Securities by Type |

| September 30, 2019 |

| ($ in millions) |

| | GAAP Fair Value | | Collateralized Short-Term Debt | | Collateralized Long-Term Debt | | Allocated Capital | |

| | | | | | | | | |

| Consolidated RPL securities | | | | | | | | |

| Subordinate | $ | 454 |

| | $ | (289 | ) | | $ | — |

| | $ | 165 |

| |

| | | | | | | | | |

| Other RPL securities | | | | | | | | |

| Senior / IO | 70 |

| | — |

| | (41 | ) | | 29 |

| |

| Subordinate | 103 |

| | (26 | ) | | — |

| | 76 |

| |

| Total other RPL securities | 173 |

| | (26 | ) | | (41 | ) | | 105 |

| |

| | | | | | | | | |

| Total Re-Performing Residential Loan Securities | $ | 627 |

| | $ | (315 | ) | | $ | (41 | ) | | $ | 270 |

| |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 13 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

2019 Updated Financial Outlook(1)

We currently anticipate our full year results will be towards the higher end, overall, of the original range we provided in our fourth quarter 2018 Redwood Review.

For the remainder of 2019, we will continue to focus on key strategic initiatives to increase sustainable earnings - namely integrating the CoreVest operating platform, improving investment returns through portfolio optimization, implementing operational efficiencies to maintain strong returns on equity for our residential mortgage banking platform, and disciplined cost management to unlock operating leverage as we scale our business.

While we do not anticipate the CoreVest acquisition to meaningfully impact our 2019 expected range of returns on equity, we do expect a slight impact to the capital allocation expectations we set at the beginning of the year. Additionally, as a result of the acquisition, we expect our leverage ratio to increase toward the higher end of our historical 3.0x - 4.0x target range.

The following are additional details on our expected activity in 2019:

For our investment portfolio

| |

| Ñ | Our investment portfolio returns through the first nine months of 2019, were near the high end of the 11-13% return on equity range previously provided, benefiting from higher gains associated with increased portfolio optimization activity. For the remainder of 2019, we expect economic net interest income to increase and core realized gains to moderate, keeping expected returns for this portfolio for the full year towards the higher end of our original range of 11-13%. With the acquisition of CoreVest, we expect to allocate approximately 85% of our capital to our investment portfolio for the remainder of 2019. |

| |

| Ñ | Investment returns include an estimate of portfolio economic net interest income, interest expense on corporate debt capital, core realized gains, direct operating expenses, and taxes. |

____________________

| |

| (1) | As with all forward-looking statements, our forward-looking statements relating to our 2019 financial outlook are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K under the caption “Risk Factors” and other risks, uncertainties, and factors that could cause actual results to differ materially from those described above and under the heading "Forward-Looking Statements" in the Appendix to this Redwood Review, including those described in the “Forward-Looking Statements” at the beginning of this Redwood Review. Although we may update our 2019 financial outlook subsequently in 2019, as a general matter we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 14 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

For our residential mortgage banking platform

| |

| Ñ | Our residential mortgage banking platform had strong performance through the first nine months of 2019, generating a return on equity in excess of our originally projected range of mid to high teens. The outperformance was driven by gross margins above our long-term expectations of 75-100 basis points and strong volume growth. For the remainder of 2019, we expect gross margins to be within our long-term expected range and volume to remain stable, supporting full year results that we expect to be above our previously disclosed return range. We expect to maintain our current 5% allocation of capital to this platform for the remainder of 2019. |

| |

| Ñ | Mortgage banking returns include an estimate of loan purchase volume, gross margins, direct operating expenses, and taxes. |

For our business purpose mortgage banking platform

| |

| Ñ | In May, subsequent to the acquisition of 5 Arches, we estimated we would allocate 3-4% of our capital to our business purpose mortgage banking platform for the remainder of 2019 and generate a return on equity in the low double digits. |

| |

| Ñ | Inclusive of both CoreVest's origination platform and 5 Arches, we expect to allocate approximately 10% of our capital to our business purpose mortgage banking platform for the remainder of 2019. This includes the platform premiums for both businesses and the working capital required to fund single-family rental loans in inventory. For the remainder of 2019, we expect to generate an overall return on equity from the platforms of 12-14%, bringing full-year results slightly below our previously disclosed return range. |

| |

| Ñ | Additionally, we expect both of these businesses to provide new accretive business purpose loans and securities for our investment portfolio, the anticipated returns on which are included in our investment portfolio outlook. |

| |

| Ñ | Expected returns include an estimate of mortgage banking income (including origination points and fees), other income, direct operating expenses, and taxes. Return expectations exclude the amortization of purchase-related intangibles and other items, consistent with what we exclude for core earnings. |

For our corporate overhead

| |

| Ñ | We continue to expect our baseline corporate operating expenses to be between $48 million and $50 million, exclusive of any CoreVest acquisition-related expenses, with variable compensation commensurate with company performance. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 15 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Analysis and Outlook for Economic Net Interest Income

| |

| Ñ | Over the past several quarters, as demand for residential mortgage credit has continued to strengthen and drive prices higher, we have taken advantage of the opportunity to rotate out of portfolio investments whose forward return profile fell below our long-term targets. Year-to-date through the third quarter of 2019, we have sold over $500 million of securities and freed-up approximately $230 million of capital through portfolio optimization, locking in $53 million in core realized gains. These activities have benefited our GAAP and core results, but have impacted economic net interest income (ENII) as we have been selective in redeploying capital due to the overall credit spread environment. ENII is also impacted by hedging costs and premium amortization, and as such has been affected by the sharp rally in rates and overall heightened interest rate volatility we have observed since early in the second quarter of 2019. |

| |

| Ñ | With substantial portfolio optimization and the CoreVest acquisition complete, our investment portfolio has meaningfully increased sustainable earnings potential and we expect ENII to begin growing in the fourth quarter of 2019 and into 2020. We anticipate the key drivers towards this increase will be: |

| |

| Ñ | the investments acquired as part of the CoreVest acquisition; |

| |

| Ñ | a full quarter of income from our most recent investment in RPL securities issued by Freddie Mac; |

| |

| Ñ | improved returns on SFR loans originated by 5 Arches that we expect to be financed with long-term FHLB debt; and |

| |

| Ñ | incremental interest income from higher-returning BPL investments created by our newly expanded BPL origination platform |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 16 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Segment Results

Investment Portfolio

The following table presents segment contribution from our investment portfolio for the third and second quarters of 2019.

|

| | | | | | | | |

| |

| Investment Portfolio Segment Contribution |

| ($ in millions) |

| | Three Months Ended | |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| GAAP net interest income | $ | 38 |

| | $ | 38 |

| |

| Change in basis and hedge interest | (3 | ) | | 1 |

| |

Non-GAAP economic net interest income (1) | 36 |

| | 39 |

| |

| | | | | |

Non-GAAP other fair value changes, net (2) | 15 |

| | 2 |

| |

| Other income, net | 2 |

| | 3 |

| |

| Realized gains, net | 5 |

| | 3 |

| |

| Operating expenses | (2 | ) | | (2 | ) | |

| Provision for income taxes | — |

| | (1 | ) | |

Segment contribution (3) | $ | 55 |

| | $ | 44 |

| |

Core earnings adjustments (4) | | | | |

Eliminate non-GAAP other fair value changes, net (2) | (15 | ) | | (2 | ) | |

| Include cumulative gain on long-term investments sold, net | 20 |

| | 13 |

| |

| Income taxes associated with core earnings adjustments | — |

| | (1 | ) | |

| Non-GAAP core segment contribution | $ | 60 |

| | $ | 54 |

| |

| |

| (1) | During the third quarter of 2019, we updated our definition of non-GAAP economic net interest income. Consistent with management's definition of non-GAAP economic net interest income set forth in the Non-GAAP Measurements section of the Appendix, this measure, as presented above, is calculated in the same manner, inclusive only of amounts allocable to this segment. |

| |

| (2) | Non-GAAP other fair value changes, net, represents GAAP investment fair value changes adjusted to exclude the change in basis and hedge interest that is presented in the table above and included in non-GAAP economic net interest income. |

| |

| (3) | Segment contribution totals above are presented in accordance with GAAP. Within the table, "Change in basis and hedge interest" has been reallocated between investment fair value changes and net interest income as described above. |

| |

| (4) | During the third quarter of 2019, we updated our definition of core earnings. Consistent with management's definition of core earnings set forth on page 41, non-GAAP core segment contribution reflects GAAP segment contribution adjusted to reflect the portion of core earnings adjustments allocable to this segment. |

| |

| Ñ | Segment contribution from our investment portfolio improved during the third quarter, as we experienced a benefit to investment fair value changes from spread tightening and higher realized gains from sales of available-for-sale securities, offset by increased hedging costs from interest rate volatility and higher levels of prepayments on loans and securities held at premiums. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 17 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

| |

| Ñ | Core segment contribution improved during the third quarter, driven by an increase in gain on sale of long-term investments from portfolio optimization activities. |

| |

| Ñ | We deployed $152 million of capital in the third quarter, including $55 million into proprietary investments and $98 million into third-party investments. Proprietary investments included $21 million of business purpose loans originated by 5 Arches, $21 million into Sequoia RMBS, and $12 million into a home equity shared appreciation investment. Third-party investments included $73 million of Freddie Mac subordinate re-performing loan securities, $16 million of Agency CRT securities, a $5 million multifamily mezzanine loan, $3 million of Agency multifamily securities, and $1 million of third-party securities. |

| |

| Ñ | During the third quarter, we sold $262 million of lower yielding securities, which freed up approximately $118 million of capital for redeployment. Additionally, we completed a 3-year secured, non-mark-to-market term securities repurchase facility that generated approximately $130 million of capital for redeployment (after repayment of existing financing), while effectively enhancing the yield on the portfolio. |

| |

| Ñ | Credit fundamentals in our investment portfolio remain strong, benefiting from continued stability in the general economy and in housing. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 18 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Mortgage Banking

|

| | | | | | | | |

| |

| Mortgage Banking Segment Contribution |

| ($ in millions) |

| | Three Months Ended | |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| Residential Mortgage Banking | | | | |

| Net interest income | $ | 5 |

| | $ | 4 |

| |

| Mortgage banking activities, net | 5 |

| | 15 |

| |

| Mortgage banking income | 10 |

| | 20 |

| �� |

| | | | | |

| Other income, net | — |

| | — |

| |

| Operating expenses | (6 | ) | | (6 | ) | |

| Provision for income taxes | — |

| | (1 | ) | |

| Residential mortgage banking segment contribution | $ | 5 |

| | $ | 13 |

| |

| | | | | |

| Business Purpose Mortgage Banking | | | | |

| Net interest income | $ | 1 |

| | $ | — |

| |

| Mortgage banking activities, net | 4 |

| | 4 |

| |

| Mortgage banking income | 5 |

| | 4 |

| |

| | | | | |

| Other income, net | | | | |

| Loan administration fees and other | 2 |

| | 2 |

| |

| Amortization of intangible asset expense | (2 | ) | | (2 | ) | |

| Operating expenses | (6 | ) | | (6 | ) | |

| Provision for income taxes | — |

| | — |

| |

| Business purpose mortgage banking segment contribution | $ | (1 | ) | | $ | (2 | ) | |

| | | | | |

| Mortgage banking segment contribution | $ | 3 |

| | $ | 11 |

| |

| | | | | |

Core earnings adjustments (1) | 2 |

| | 2 |

| |

Non-GAAP core segment contribution (2) | $ | 5 |

| | $ | 12 |

| |

| Jumbo loan purchase commitments | $ | 1,700 |

| | $ | 1,695 |

| |

| |

| (1) | Includes amounts to eliminate purchase accounting adjustments and income tax adjustments of $0.4 million for both the third and second quarters of 2019, related to our business purpose mortgage banking operations. |

| |

| (2) | Consistent with management's definition of core earnings set forth on page 41, non-GAAP core segment contribution reflects GAAP segment contribution adjusted to reflect the portion of core earnings adjustments allocable to this segment. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 19 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Residential Mortgage Banking

| |

| Ñ | Segment contribution from our residential mortgage banking operations decreased to $5 million in the third quarter from $13 million in the second quarter, due to lower gross margins on stable volume of purchase commitments. We define gross margins for this segment as mortgage banking income divided by loan purchase commitments. |

| |

| Ñ | Rate volatility during the quarter negatively impacted margins as the sharp decline in rates impacted execution on our mortgage loan pipeline. Toward the end of the quarter, volatility decreased and we saw pricing and margins improve. |

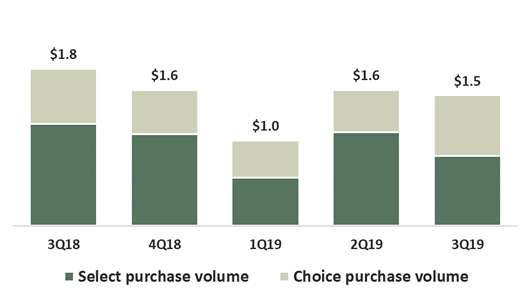

Quarterly Jumbo Loan Purchase Volume

($ in billions)

| |

| Ñ | The continued lower interest rate environment helped keep mortgage purchase volumes elevated, and we saw a 37% increase in Choice purchase volume, representing record quarterly volume for this loan type. At September 30, 2019, our pipeline of jumbo residential loans identified for purchase was $1.3 billion. |

| |

| Ñ | During the third quarter, we completed one Select securitization of $376 million and two Choice securitizations totaling $727 million. Additionally, we sold $470 million of whole loans to third parties. |

Business Purpose Mortgage Banking

| |

| Ñ | Non-GAAP core segment contribution from our business purpose mortgage banking operations was $0.2 million for the third quarter. |

| |

| Ñ | During the third quarter of 2019, we originated $162 million of loans and associated funding commitments, including $126 million of residential bridge loans and $36 million of single-family rental loans. Loan fundings during this period totaled $127 million, including $91 million of residential bridge loans and $36 million of single-family rental loans. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 20 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Update on Contribution from 5 Arches

| |

| Ñ | The third quarter of 2019 represented our second full quarter of ownership of the 5 Arches platform, following our initial 20% investment in the platform in May 2018 and our full acquisition of the company in March 2019. We currently retain the majority of the single-family rental and bridge loans originated by 5 Arches, and at September 30, 2019, our portfolio of these assets totaled $336 million. Since the end of the third quarter, 5 Arches has originated an additional $140 million of business purpose loans (through October 28th), all of which we have retained on our balance-sheet. |

Cumulative Business Purpose Loans on Balance Sheet

($ in millions)

| |

| Ñ | Since our initial minority investment in 5 Arches and through September 30, 2019, we have deployed $68 million of capital into $207 million of bridge loans created by 5 Arches, which have generated core returns on capital of approximately 11% for our investment portfolio. Optimizing this capital for our currently available financing terms, we estimate levered returns to increase to 12-15%. |

| |

| Ñ | Additionally, during the third quarter we began financing 5 Arches originated SFR loans using our FHLB financing facility and as of September 30, 2019, we had $17 million of these loans financed with FHLB borrowings. Going forward, we anticipate transferring the majority of our remaining 5 Arches-originated SFR loans to our investment portfolio and financing them at the FHLB with an estimated core return on capital of 11-12%. |

| |

| Ñ | Total operating revenue in the third quarter of 2019 from 5 Arches origination and asset management activities rose 16% from the prior quarter, versus a 6% increase in operating expenses. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 21 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Balance Sheet Analysis

The following table presents our consolidated balance sheets at September 30, 2019 and June 30, 2019.

|

| | | | | | | | |

| |

Consolidated Balance Sheets (1) |

| ($ in millions) |

| | 9/30/2019 | | 6/30/2019 | |

| | | | | |

| Residential loans | $ | 8,682 |

| | $ | 7,283 |

| |

| Business purpose residential loans | 336 |

| | 251 |

| |

| Multifamily loans | 3,792 |

| | 3,750 |

| |

| Real estate securities | 1,285 |

| | 1,477 |

| |

| Other investments | 348 |

| | 372 |

| |

| Cash and cash equivalents | 395 |

| | 218 |

| |

| Other assets | 639 |

| | 500 |

| |

| | | | | |

| Total assets | $ | 15,476 |

| | $ | 13,852 |

| |

| | | | | |

| Short-term debt | | | | |

| Mortgage loan warehouse facilities | $ | 233 |

| | $ | 638 |

| |

| Business purpose mortgage loan warehouse facilities | 198 |

| | 174 |

| |

| Security repurchase facilities | 1,158 |

| | 1,214 |

| |

| Servicer advance financing | 191 |

| | 236 |

| |

| Convertible notes, net | 201 |

| | 200 |

| |

| Other liabilities | 410 |

| | 340 |

| |

| Asset-backed securities issued | | | | |

| Residential | 4,768 |

| | 3,370 |

| |

| Multifamily | 3,578 |

| | 3,543 |

| |

| Long-term debt, net | 2,954 |

| | 2,573 |

| |

| Total liabilities | 13,691 |

| | 12,288 |

| |

| | | | | |

| Stockholders’ equity | 1,785 |

| | 1,564 |

| |

| | | | | |

| Total liabilities and equity | $ | 15,476 |

| | $ | 13,852 |

| |

| |

| (1) | Our consolidated balance sheets include assets of consolidated variable interest entities (“VIEs”) that can only be used to settle obligations of these VIEs and liabilities of consolidated VIEs for which creditors do not have recourse to the primary beneficiary (Redwood Trust, Inc.). At September 30, 2019 and June 30, 2019, assets of consolidated VIEs totaled $9.6 billion and $7.9 billion, respectively, and liabilities of consolidated VIEs totaled $8.6 billion and $7.2 billion, respectively. See Table 10 in the Financial Tables section of this Redwood Review for additional detail on consolidated VIEs. |

| |

| Ñ | We have invested in several securitizations that we were required to consolidate under GAAP. See Table 9 in the Financial Tables section of this Redwood Review for additional information on these securitizations and other entities that we consolidate. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 22 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Residential Loan Investments

| |

| Ñ | At September 30, 2019, we had $2.3 billion of residential loans held-for-investment. These loans are prime-quality, first lien jumbo loans, most of which were originated between 2013 and 2019. At September 30, 2019, 88% of these loans were fixed rate and the remainder were hybrid, and in aggregate, had a weighted average coupon of 4.16%. |

| |

| Ñ | At September 30, 2019, the weighted average FICO score of borrowers backing these loans was 768 (at origination) and the weighted average loan-to-value ("LTV") ratio of these loans was 66% (at origination). At September 30, 2019, 0.03% of these loans (by unpaid principal balance) were more than 90 days delinquent. |

| |

| Ñ | We finance our residential loan investments with $1.9 billion of variable-rate FHLB debt through our FHLB-member subsidiary. In connection with these borrowings, our FHLB-member subsidiary is required to hold $43 million of FHLB stock. |

| |

| Ñ | We seek to minimize the interest rate risk in this portfolio by using a combination of swaps, TBAs, and other derivative instruments. |

Business Purpose Residential Loan Investments

| |

| Ñ | At September 30, 2019, our $226 million of business purpose residential loans held-for-investment were comprised of $207 million of short-term, residential bridge loans, which were originated in 2018 and 2019, and $19 million of single-family rental loans, which were financed with variable-rate FHLB debt through our FHLB-member subsidiary. |

| |

| Ñ | At September 30, 2019, the residential bridge portfolio contained 392 loans with a weighted average coupon of 8.90% and a weighted average LTV ratio of 70% (at origination). At September 30, 2019, nine of these loans with a cumulative unpaid principal balance and fair value of $6 million were more than 90 days delinquent or in foreclosure. These delinquent loans had a weighted average LTV ratio of 79% (at origination), and we currently expect to recover the full carrying amount of these loans. Since September 30, 2019, two of these loans with a cumulative unpaid principal balance and fair value of $1 million were resolved with full repayment of principal, regular interest and expenses. |

| |

| Ñ | We finance our residential bridge loan investments with warehouse debt that had a balance of $139 million at September 30, 2019. |

| |

| Ñ | At September 30, 2019, our business purpose residential warehouse capacity for financing residential bridge loans totaled $330 million across four separate counterparties. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 23 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

Securities Portfolio

The following table presents the fair value of our real estate securities at September 30, 2019.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| Securities Portfolio - By Source and Security Type |

| September 30, 2019 |

| ($ in millions) |

| | Interest-Only Securities | | Senior | | Mezzanine | | Subordinate | | Total | | % of Total Securities | |

| | | | | | | | | | | | | |

Sequoia (1) | $ | 55 |

| | $ | — |

| | $ | 251 |

| | $ | 200 |

| | $ | 505 |

| | 23 | % | |

Re-performing (2) | 29 |

| | 41 |

| | 416 |

| | 140 |

| | 627 |

| | 28 | % | |

| Agency CRT | — |

| | — |

| | — |

| | 141 |

| | 141 |

| | 6 | % | |

| Other third-party | — |

| | 84 |

| | 89 |

| | 81 |

| | 254 |

| | 12 | % | |

| | | | | | | | | | | | | |

| Total residential securities | $ | 84 |

| | $ | 125 |

| | $ | 756 |

| | $ | 562 |

| | $ | 1,527 |

| | 69 | % | |

| | | | | | | | | | | | | |

Multifamily securities (3) | — |

| | — |

| | 494 |

| | 190 |

| | 683 |

| | 31 | % | |

| Total securities portfolio | $ | 84 |

| | $ | 125 |

| | $ | 1,249 |

| | $ | 752 |

| | $ | 2,211 |

| | 100 | % | |

| |

| (1) | Presents securities retained from our Sequoia securitizations that were issued from 2012 through 2019. These securities included $13 million of interest-only securities, $181 million of mezzanine securities, and $63 million of subordinate securities retained from our Sequoia Choice securitizations, which were consolidated for GAAP purposes. |

| |

| (2) | Re-performing securities included $454 million of mezzanine and subordinate securities issued from Agency residential securitizations that are consolidated for GAAP purposes. |

| |

| (3) | Multifamily securities included $24 million of mezzanine securities and $190 million of subordinate securities issued from Agency multifamily securitizations that are consolidated for GAAP purposes. |

At September 30, 2019, our securities consisted of fixed-rate assets (90%), adjustable-rate assets (7%), hybrid assets that reset within the next year (2%), and hybrid assets that reset between 12 and 36 months (1%). For the portions of our securities portfolio that are sensitive to changes in interest rates, we seek to minimize this interest rate risk by using various derivative instruments.

We finance our holdings of real estate securities with a combination of capital and collateralized debt in the form of repurchase (or “repo”) financing and long-term debt. At September 30, 2019, we had short-term debt incurred through repurchase facilities totaling $1.2 billion with nine separate counterparties, which was secured by $1.4 billion of real estate securities. Additionally, we had long-term debt incurred through FHLB borrowings and secured term facilities totaling $226 million which was secured by $294 million of securities. The remaining $474 million of securities were financed with capital.

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 24 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

The following table presents the fair value of our real estate securities that are financed with repurchase debt, at September 30, 2019.

|

| | | | | | | | | | | | | | | | | | | |

| |

| Real Estate Securities Financed with Repurchase Debt |

| September 30, 2019 |

| ($ in millions, except weighted average price) |

| | Real Estate Securities (3) | | Repurchase Debt | | Allocated Capital | | Weighted Average Price (1) | | Financing Haircut (2) | |

| | | | | | | | | | | |

| Residential securities | | | | | | | | | | |

| Senior | $ | 84 |

| | $ | (77 | ) | | $ | 7 |

| | $ | 101 |

| | 8 | % | |

| Mezzanine | 289 |

| | (249 | ) | | 40 |

| | 104 |

| | 14 | % | |

| Re-performing | 416 |

| | (315 | ) | | 101 |

| | 91 |

| | 24 | % | |

| Total residential securities | 789 |

| | (641 | ) | | 148 |

| | | | | |

| Multifamily securities | 653 |

| | (517 | ) | | 137 |

| | 88 |

| | 21 | % | |

| | | | | | | | | | | |

| Total | $ | 1,443 |

| | $ | (1,158 | ) | | $ | 285 |

| | $ | 93 |

| | 20 | % | |

| |

| (1) | GAAP fair value per $100 of principal. |

| |

| (2) | Allocated capital divided by GAAP fair value. |

| |

| (3) | Includes $113 million, $385 million, and $209 million of securities we owned that were issued by consolidated Sequoia Choice, Freddie Mac SLST, and Freddie Mac K-Series securitizations, respectively. |

| |

| Ñ | In addition to the allocated capital listed in the table above that directly supports our repurchase facilities (i.e., “the haircut”), we continue to hold a designated amount of supplemental risk capital available for potential margin calls or future obligations relating to these facilities. |

| |

| Ñ | Additional information on the residential securities we own is set forth in Table 9 in the Financial Tables section of this Redwood Review. |

Other Investments

| |

| Ñ | At September 30, 2019, our other investments were primarily comprised of $238 million of servicer advance investments and associated excess servicing ($75 million of capital invested, net of non-recourse securitization debt collateralized by servicing-related assets), $40 million of MSRs retained from our Sequoia securitizations, $17 million of other excess servicing investments, and a $32 million investment in a light-renovation multifamily loan fund. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 25 |

|

|

| |

| F I N A N C I A L I N S I G H T S |

Residential Loans Held-for-Sale

| |

| Ñ | At September 30, 2019, we had $926 million of residential mortgages held-for-sale financed with $233 million of warehouse debt. These loans included $647 million of Select loans and $279 million of expanded-prime Choice loans. |

| |

| Ñ | Our residential warehouse capacity at September 30, 2019 totaled $1.4 billion across four separate counterparties. |

| |

| Ñ | At September 30, 2019, our pipeline of jumbo residential loans identified for purchase was $1.3 billion. |

| |

| Ñ | We seek to minimize the exposure we have to interest rates on our loan pipeline (for loans both on balance sheet and identified for purchase) by using a combination of TBAs, interest rate swaps, and other derivative instruments. |

| |

| Ñ | At September 30, 2019, we had 482 loan sellers, which included 184 jumbo sellers and 298 MPF Direct sellers from various FHLB districts. |

Business Purpose Residential Loans Held-for-Sale

| |

| Ñ | At September 30, 2019, we had $110 million of single-family rental loans held-for-sale that were financed with $59 million of short-term warehouse debt. Going forward, we anticipate transferring the majority of our 5 Arches originated SFR loans to our investment portfolio and financing them at the FHLB. |

| |

| Ñ | At September 30, 2019, the weighted average coupon on these loans was 5.35% and the LTV ratio was 68% (at origination). |

| |

| Ñ | At September 30, 2019, our business purpose residential warehouse capacity for financing single-family rental loans totaled $400 million across two separate counterparties. |

| |

| Ñ | We seek to minimize the exposure we have to interest rates on our business purpose loan pipeline by using interest rate swaps and other derivative instruments. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 26 |

|

|

| |

| Q U A R T E R L Y O V E R V I E W |

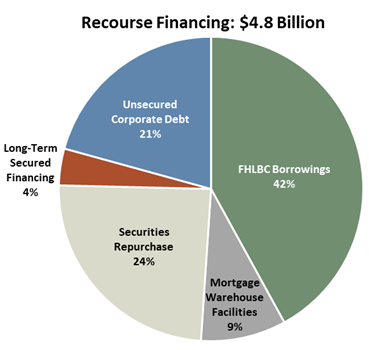

Recourse Financing

We finance our business with a diversified mix of long-term and short-term recourse debt. The following charts present the composition of our recourse debt and its characteristics at the end of the third quarter of 2019:

|

| | | |

| |

| Borrowing Type | Average Cost of Funds | Average Remaining Term (yrs.) |

| | | |

| FHLBC Borrowings | 2.5% | 6 |

| Unsecured Corporate Debt | 6.1% | 6 |

| Long-Term Secured Financing | 4.3% | 3 |

| Mortgage Warehouse | 4.2% | <1 |

| Securities Repurchase | 3.4% | <1 |

| | | |

| Weighted Average Cost of Funds | 3.7% | |

| | | |

| |

| Ñ | Our unsecured corporate debt is comprised of $201 million of 5.75% exchangeable notes due in 2025, $200 million of 5.625% convertible notes due in 2024, $245 million of 4.75% convertible notes due in 2023, $201 million of 5.625% exchangeable notes due in 2019, and $140 million of trust-preferred securities due in 2037 (that we hedge to yield approximately 6.9%). |

| |

| Ñ | Proceeds from the issuance of our new exchangeable notes in September were used to pay down mortgage warehouse debt and we expect the balance of these borrowings to increase when we repay our exchangeable notes maturing in November 2019. |

| |

| Ñ | Our recourse debt to equity leverage ratio(1) decreased to 2.7x at the end of the third quarter from 3.1x at the end of the second quarter, primarily resulting from the issuance of $228 million of equity capital during the third quarter. As a result of the CoreVest acquisition, we expect our leverage ratio to increase toward the higher-end of our historical 3.0x - 4.0x target range. |

| |

| Ñ | In addition to our recourse financing, we have non-recourse ABS debt issued by securitization entities and other non-recourse short-term securitization debt that we consolidate. |

_____________________

| |

| (1) | See Table 7 in the Financial Tables section of this Redwood Review for details of how our recourse debt to equity leverage ratio is calculated. |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 27 |

|

|

| |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 |

| 28 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 1: GAAP Earnings (in thousands, except per share data) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2019 Q3 | | 2019

Q2 | | 2019

Q1 | | 2018

Q4 | | 2018

Q3 | | 2018

Q2 | | 2018 Q1 | | 2017

Q4 | | 2017

Q3 | | | Nine Months 2019 | | Nine Months 2018 | |

| Interest income | $ | 148,283 |

| | $ | 146,483 |

| | $ | 129,111 |

| | $ | 116,858 |

| | $ | 96,074 |

| | $ | 79,128 |

| | $ | 72,559 |

| | $ | 67,370 |

| | $ | 58,106 |

| | | $ | 423,877 |

| | $ | 247,761 |

| |

| Discount amortization on securities, net | 1,834 |

| | 2,059 |

| | 1,930 |

| | 2,867 |

| | 3,323 |

| | 3,848 |

| | 4,060 |

| | 4,098 |

| | 4,631 |

| | | 5,823 |

| | 11,231 |

| |

| Total interest income | 150,117 |

| | 148,542 |

| | 131,041 |

| | 119,725 |

| | 99,397 |

| | 82,976 |

| | 76,619 |

| | 71,468 |

| | 62,737 |

| | | 429,700 |

| | 258,992 |

| |

| Interest expense on short-term debt | (21,100 | ) | | (21,141 | ) | | (19,090 | ) | | (16,567 | ) | | (14,146 | ) | | (12,666 | ) | | (10,424 | ) | | (9,841 | ) | | (7,158 | ) | | | (61,331 | ) | | (37,236 | ) | |

Interest expense on short-term convertible notes (1) | (3,139 | ) | | (3,134 | ) | | (3,128 | ) | | (1,594 | ) | | — |

| | (509 | ) | | (3,011 | ) | | (3,025 | ) | | (3,024 | ) | | | (9,401 | ) | | (3,520 | ) | |

| Interest expense on ABS issued from consolidated trusts | (71,065 | ) | | (70,113 | ) | | (55,295 | ) | | (44,258 | ) | | (27,421 | ) | | (16,349 | ) | | (11,401 | ) | | (7,917 | ) | | (3,956 | ) | | | (196,473 | ) | | (55,171 | ) | |

| Interest expense on long-term debt | (21,300 | ) | | (21,832 | ) | | (21,763 | ) | | (22,542 | ) | | (22,784 | ) | | (18,689 | ) | | (16,678 | ) | | (15,325 | ) | | (13,305 | ) | | | (64,895 | ) | | (58,151 | ) | |

| Total interest expense | (116,604 | ) | | (116,220 | ) | | (99,276 | ) | | (84,961 | ) | | (64,351 | ) | | (48,213 | ) | | (41,514 | ) | | (36,108 | ) | | (27,443 | ) | | | (332,100 | ) | | (154,078 | ) | |

| Net interest income | 33,513 |

| | 32,322 |

| | 31,765 |

| | 34,764 |

| | 35,046 |

| | 34,763 |

| | 35,105 |

| | 35,360 |

| | 35,294 |

| | | 97,600 |

|

| 104,914 |

| |

| Non-interest income | | | | | | | | | | | | | | | | | | | | | |

|

| |

| Mortgage banking activities, net | 9,515 |

| | 19,160 |

| | 12,309 |

| | 11,170 |

| | 11,224 |

| | 10,596 |

| | 26,576 |

| | 3,058 |

| | 21,200 |

| | | 40,984 |

| | 48,396 |

| |

| Investment fair value changes, net | 11,444 |

| | 3,138 |

| | 20,159 |

| | (38,519 | ) | | 10,332 |

| | 889 |

| | 1,609 |

| | 384 |

| | 324 |

| | | 34,741 |

| | 12,830 |

| |

| Realized gains, net | 4,714 |

| | 2,827 |

| | 10,686 |

| | 5,689 |

| | 7,275 |

| | 4,714 |

| | 9,363 |

| | 4,546 |

| | 1,734 |

| | | 18,227 |

| | 21,352 |

| |

| Other income, net | 1,825 |

| | 2,407 |

| | 3,587 |

| | 3,981 |

| | 3,453 |

| | 3,322 |

| | 2,118 |

| | 2,963 |

| | 2,812 |

| | | 7,819 |

| | 8,893 |

| |

| Total non-interest income (loss), net | 27,498 |

| | 27,532 |

| | 46,741 |

| | (17,679 | ) | | 32,284 |

| | 19,521 |

| | 39,666 |

| | 10,951 |

| | 26,070 |

| | | 101,771 |

| | 91,471 |

| |

| Fixed compensation expense | (9,391 | ) | | (9,252 | ) | | (8,205 | ) | | (6,309 | ) | | (5,922 | ) | | (5,775 | ) | | (6,439 | ) | | (5,555 | ) | | (5,233 | ) | | | (26,848 | ) | | (18,136 | ) | |

| Variable compensation expense | (4,090 | ) | | (4,021 | ) | | (4,402 | ) | | (934 | ) | | (4,923 | ) | | (1,825 | ) | | (6,907 | ) | | (5,861 | ) | | (6,467 | ) | | | (12,513 | ) | | (13,655 | ) | |

| Equity compensation expense | (3,155 | ) | | (4,024 | ) | | (2,953 | ) | | (2,823 | ) | | (3,033 | ) | | (3,835 | ) | | (2,697 | ) | | (2,507 | ) | | (2,337 | ) | | | (10,132 | ) | | (9,565 | ) | |

| Loan acquisition costs | (1,392 | ) | | (1,516 | ) | | (1,477 | ) | | (1,837 | ) | | (1,887 | ) | | (2,155 | ) | | (1,818 | ) | | (1,625 | ) | | (1,187 | ) | | | (4,385 | ) | | (5,860 | ) | |

| Other operating expense | (8,787 | ) | | (7,442 | ) | | (6,122 | ) | | (7,350 | ) | | (5,725 | ) | | (5,419 | ) | | (5,169 | ) | | (4,819 | ) | | (4,698 | ) | | | (22,351 | ) | | (16,313 | ) | |

| Total operating expenses | (26,815 | ) | | (26,255 | ) | | (23,159 | ) | | (19,253 | ) | | (21,490 | ) | | (19,009 | ) | | (23,030 | ) | | (20,367 | ) | | (19,922 | ) | | | (76,229 | ) | | (63,529 | ) | |

| (Provision for) benefit from income taxes | 114 |

| | (2,333 | ) | | (883 | ) | | 1,255 |

| | (4,919 | ) | | (2,528 | ) | | (4,896 | ) | | 4,989 |

| | (5,262 | ) | | | (3,102 | ) | | (12,343 | ) | |

| Net income (loss) | $ | 34,310 |

| | $ | 31,266 |

| | $ | 54,464 |

| | $ | (913 | ) | | $ | 40,921 |

| | $ | 32,747 |

| | $ | 46,845 |

| | $ | 30,933 |

| | $ | 36,180 |

| | | $ | 120,040 |

| | $ | 120,513 |

| |

Diluted average shares (2) | 136,523 |

| | 130,697 |

| | 126,278 |

| | 83,217 |

| | 114,683 |

| | 100,432 |

| | 108,195 |

| | 109,621 |

| | 102,703 |

| | | 131,203 | | 107,792 | |

| Diluted earnings (loss) per common share | $ | 0.31 |

| | $ | 0.30 |

| | $ | 0.49 |

| | $ | (0.02 | ) | | $ | 0.42 |

| | $ | 0.38 |

| | $ | 0.50 |

| | $ | 0.35 |

| | $ | 0.41 |

| | | $ | 1.09 |

| | $ | 1.30 |

| |

| |

| (1) | Represents interest expense on $201 million of exchangeable notes and $250 million of convertible notes, respectively, that were reclassified from Long-term debt to Short-term debt as the maturity of the notes was less than one year as of the dates presented. Convertible notes of $250 million were repaid in April 2018 and exchangeable notes of $201 million are due in November 2019. |

| |

| (2) | Diluted average shares includes shares from the assumed conversion of our convertible and/or exchangeable debt in certain periods, in accordance with GAAP diluted EPS provisions. See Table 2 that follows for details of this calculation for the current and prior quarter and our respective Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K for prior periods. |

|

| | |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 | | Table 1: GAAP Earnings 29 |

|

| | | | | | | | | |

| Table 2: GAAP and Non-GAAP Core Basic and Diluted Earnings (1) per Common Share (in thousands, except per share data) | |

| | | | | | |

| | | 2019 Q3 | | 2019

Q2 | |

| GAAP Earnings per Common Share ("EPS"): | | | | |

| Net income attributable to Redwood | $ | 34,310 |

| | $ | 31,266 |

| |

| Less: Dividends and undistributed earnings allocated to participating securities | (856 | ) | | (877 | ) | |

| Net income allocated to common shareholders for GAAP basic EPS | 33,454 |

| | 30,389 |

| |

| Incremental adjustment to dividends and undistributed earnings allocated to participating securities | (180 | ) | | (176 | ) | |

Add back: Interest expense on convertible notes for the period, net of tax (2) | 8,887 |

| | 8,698 |

| |

| Net income allocated to common shareholders for GAAP diluted EPS | $ | 42,161 |

| | $ | 38,911 |

| |

| | | | | |

| Basic weighted average common shares outstanding | 101,872 |

| | 96,984 |

| |

| Net effect of dilutive equity awards | 363 |

| | 271 |

| |

Net effect of assumed convertible notes conversion to common shares (2) | 34,288 |

| | 33,443 |

| |

| Diluted weighted average common shares outstanding | 136,523 |

| | 130,697 |

| |

| | | | | |

| GAAP Basic Earnings per Common Share | $ | 0.33 |

| | $ | 0.31 |

| |

| GAAP Diluted Earnings per Common Share | $ | 0.31 |

| | $ | 0.30 |

| |

| | | | | |

| Non-GAAP Core Earnings per Common Share: | | | | |

| Non-GAAP core earnings | $ | 43,326 |

| | $ | 43,286 |

| |

| Less: Dividends and undistributed earnings allocated to participating securities | (1,099 | ) | | (1,219 | ) | |

| Non-GAAP core earnings allocated to common shareholders for core basic EPS | 42,227 |

| | 42,067 |

| |

| Incremental adjustment to dividends and undistributed earnings allocated to participating securities | (121 | ) | | (89 | ) | |

Add back: Interest expense on convertible notes for the period, net of tax (2) | 8,887 |

| | 8,698 |

| |

| Non-GAAP core earnings allocated to common shareholders for core diluted EPS | $ | 50,993 |

| | $ | 50,676 |

| |

| | | | | |

| Basic weighted average common shares outstanding | 101,872 |

| | 96,984 |

| |

| Net effect of dilutive equity awards | 363 |

| | 271 |

| |

Net effect of assumed convertible notes conversion to common shares (2) | 34,288 |

| | 33,443 |

| |

| Diluted weighted average common shares outstanding | 136,523 |

| | 130,697 |

| |

| | | | | |

| Non-GAAP Core Basic Earnings per Common Share | $ | 0.41 |

| | $ | 0.43 |

| |

| Non-GAAP Core Diluted Earnings per Common Share | $ | 0.37 |

| | $ | 0.39 |

| |

| | | | | |

| |

| (1) | A reconciliation of GAAP net income to non-GAAP core earnings and a definition of core earnings (which we updated during the third quarter of 2019) is included in the Non-GAAP Measurements section of the Appendix. |

| |

| (2) | Certain convertible notes were determined to be dilutive in the periods presented and were included in the calculations of diluted EPS under the "if-converted" method. Under this method, the periodic interest expense (net of applicable taxes) for dilutive notes is added back to the numerator and the number of shares that the notes are entitled to (if converted, regardless of whether they are in or out of the money) are included in the denominator. |

|

| | |

| THE REDWOOD REVIEW I 3RD QUARTER 2019 | | Table 2: GAAP and Non-GAAP Core Earnings per Basic and Diluted Common Share 30 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 3: Segment Results ($ in thousands) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2019

Q3 | | 2019

Q2 | | 2019

Q1 | | 2018