Dear Fellow Shareholders:

The well publicized mortgage credit and liquidity crisis extended its reach during the fourth quarter, driving market values for residential, commercial, and CDO real estate securities to deeply discounted levels. In many cases, these declines were warranted in our opinion, as the likelihood or near-certainty of credit losses significantly diminished the intrinsic value of future expected cash flows. In other cases, we believe the general lack of liquidity and increased risk premiums have caused the market value for select assets to fall well below intrinsic value. To us, this market condition represents a buying opportunity.

After spending the last couple of quarters largely on the sidelines, we were active investors in the fourth quarter, putting $123 million of capital to work.

We did not deploy this capital under the presumption that conditions in the housing market have improved or that the credit contagion has ended. Rather, we purchased high quality long-term assets at prices that provide us with a margin of safety against further deterioration, while at the same time offer significant upside potential. We expect these investments to create long-term value for shareholders in spite of continued pressure on market pricing levels that will likely persist over the coming months or even quarters.

We ended 2007 with $282 million of excess capital and look forward to putting this capital to work in 2008.

We are first and foremost a credit driven company. We rely on our independent analysis and views on real estate. As such, we are proud of our track record over the past fourteen years. We hold ourselves to high performance standards. The credit performance of our 2005 and prior investments in residential and CDO assets and our commercial investments, in total representing 85% of our invested capital, continues to meet or exceed our initial expectations. We are, however, disappointed with many of our residential and CDO investments originated during 2006 and the first half of 2007.

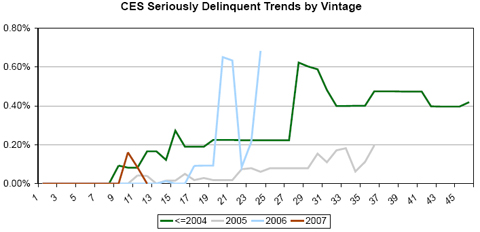

We have been publicly bearish on residential credit investing since late 2005, believing that the high asset prices were out of line with the steady deterioration in underwriting and overall loan quality. We sold many of our riskier residential credit assets beginning later that year. We were cautious investors in 2006 and the first half of 2007, and in many cases our credit loss modeling assumptions were two to three times more severe than market estimates. Unfortunately, based on the very poor early credit results from 2006 and 2007 loan vintages, especially for non-prime loans, it is now clear that we were not bearish enough. These 2006 and 2007 residential CES (including Sequoia) and CDO investments (including Acacia) represented approximately 15% of our total capital base at December 31, 2007.

In our view, recent efforts by the federal government – lower interest rates, steeper yield curve, temporarily higher residential jumbo limits for Freddie Mac and Fannie Mae loans, mortgage interest rate renegotiations, fiscal stimulus, etc. – won’t hurt but probably won’t make a big difference either, in our investment returns.

Despite the bad news in the real estate and capital markets that has been revealed so far, we believe there remains considerable complacency regarding the probable severity and duration of the real estate and capital markets correction the U.S. is facing. The bad news is not over. There is no short-term or easy fix, and the magnitude of the possible downside scenarios should not be underestimated.

The Redwood Review 4th Quarter 2007 | | 3 |