| Introduction | | | 2 | |

| Shareholder Letter | | | 3 | |

| Quarterly Overview | | | 4 | |

| Financial Insights | | | 8 | |

| | | | | |

| Financial & Investments Modules | | | | |

| Financial | | | 13 | |

| - GAAP Income & Core Earnings | | | 13 | |

| - Taxable Income | | | 17 | |

| - Capital & Liquidity | | | 19 | |

| - Dividends | | | 21 | |

| Mark-to-Market Adjustments | | | 23 | |

| Residential Real Estate Securities | | | 28 | |

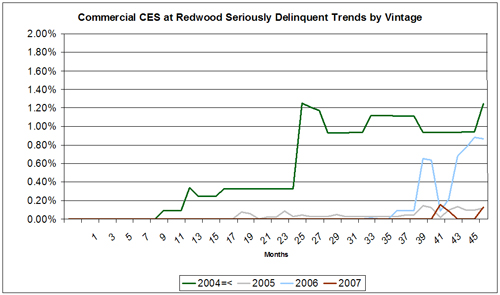

| Commercial Real Estate Securities | | | 39 | |

| CDO Securities | | | 42 | |

| Investments in Sequoia | | | 43 | |

| Investments in Acacia | | | 47 | |

| | | | | |

| Appendix | | | | |

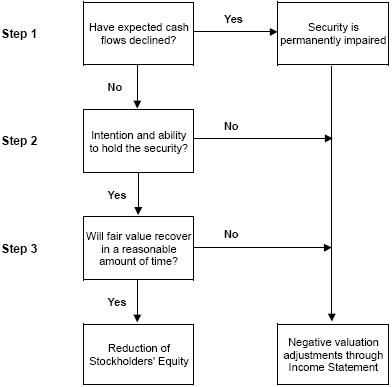

| Accounting Discussion | | | 54 | |

| Glossary | | | 57 | |

| Financial Tables | | | 65 | |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 1 |

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents which are available through our web site, www.redwoodtrust.com.

This document, called the Redwood Review, provides supplemental information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as core earnings, taxable income, and economic book value. We believe that these figures provide additional insight into Redwood’s business and future prospects. In each case in which we discuss a non-GAAP metric, you will find an explanation of how it has been calculated and why we think the figure is important, and a reconciliation between the GAAP and non-GAAP figures. We hope you find the Redwood Review to be helpful to your understanding of our business.

The form and content of the Redwood Review will likely continue to change over time. We welcome your input and suggestions.

Selected Financial Highlights

Quarter: Year | GAAP

Income

per Share | Core

Earnings

per Share | Total Taxable Earnings per

Share | Adjusted

Return on

Equity | GAAP Book

Value per

Share | Core Book

Value per Share | Total

Dividends

per Share |

| Q106 | $1.09 | $1.16 | $1.44 | 13% | $38.11 | $34.90 | $0.70 |

| Q206 | $1.20 | $0.97 | $1.91 | 14% | $39.13 | $35.58 | $0.70 |

| Q306 | $1.22 | $1.20 | $1.96 | 14% | $40.02 | $36.38 | $0.70 |

| Q406 | $1.32 | $1.12 | $1.45 | 15% | $37.51 | $34.02 | $3.70 |

| Q107 | $0.66 | $1.08 | $1.48 | 8% | $34.06 | $34.29 | $0.75 |

| Q207 | $0.41 | $1.35 | $1.66 | 5% | $31.50 | $34.40 | $0.75 |

| Q307 | ($2.18) | $1.43 | $1.74 | (26%) | $5.32 | $31.58 | $0.75 |

| Q407* | ($36.49) | $1.21 | $0.91 | (610%) | $23.18 | $26.24 | $2.75 |

Q108 | ($5.28) | $0.68** | $0.79 | (83%) | $17.89 | $20.74 | $0.75 |

| * The book values per share are after giving retroactive effect to the adoption of FAS 159 on January 1, 2008. Without giving retroactive effect to FAS 159, the GAAP book value per share and core book value per share were a negative $22.18 and a negative $4.46, respectively. |

| ** Core earnings for this quarter are not directly comparable to core earnings for prior periods due to the adoption of FAS 159. |

CAUTIONARY STATEMENT: This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2007 under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission (SEC), including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Important factors, among others, that may affect our actual results include: changes in interest rates; changes in prepayment rates; general economic conditions, particularly as they affect the price of earning assets and the credit status of borrowers; the availability of high quality assets for purchase at attractive prices; declines in home prices; increases in mortgage payment delinquencies; changes in the level of liquidity in the capital markets which may adversely affect our ability to finance our real estate asset portfolio; changes in liquidity in the market for real estate securities, the re-pricing of credit risk in the capital markets, rating agency downgrades of securities and increases in the supply of real estate securities available for sale, each of which may adversely affect the values of securities we own; the extent of changes in the values of securities we own and the impact of adjustments reflecting those changes on our income statement and balance sheet, including our stockholders’ equity; our ability to maintain the positive stockholders’ equity necessary to enable us to pay the dividends required to maintain our status as a real estate investment trust for tax purposes; and other factors not presently identified. This Redwood Review may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

2 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

Dear Fellow Shareholders:

We continue to believe that the severe dislocations in the mortgage and financial markets will benefit Redwood and its shareholders in many ways in the longer run. We are on track to capitalize on the opportunities that are opening up for us – taking a balanced approach towards investing in today’s attractive assets while developing new ways to capitalize on our competitive advantages in the real estate markets of the future.

Meanwhile, short-term challenges and volatility remain. Delinquencies continue to grow. Default frequency and loss severities are higher, and realized credit losses are coming through more quickly than we had projected only a few months ago. Prime residential and commercial mortgage pools are sharing the pain, although of course to a far lesser degree than subprime and alt-a residential mortgage pools. Asset prices have continued their descent (although they bounced back somewhat in March and April).

While the near-term costs are higher than expected, they remain manageable given our strong balance sheet and liquidity. At March 31, 2008, we had $257 million of cash, only $2 million of short-term debt, and our investment cash flows remain strong. Unlike many other financial institutions that have been damaged in this credit and liquidity crisis, we do not need to raise capital under highly dilutive terms to survive or to restore our capital adequacy.

The potential for benefit is also greater than we expected, even recently. Since the beginning of the fourth quarter of 2007 through May 5th, we have put $272 million of capital to work at purchase prices that we believe will provide attractive long-term returns. We expect to see multi-year benefits from real estate moving to reasonable valuations, underwriting moving back to historical guidelines, securitization structures and rating agencies moving back to conservatism, competitors less adventurous, the supply of mortgage capital shrinking (making our capital more valuable), and asset pricing more attractive.

Our job is to make sure we invest prudently, develop our businesses, and harvest the benefits in the years ahead for our shareholders.

Thank you for your continued support.

| | | | |

| | George E. Bull, II | | Douglas B. Hansen | |

| | Chairman and CEO | | President | |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 3 |

Our quarterly overview discussion is more extensive this quarter than in previous periods due to the many factors affecting the real estate and capital markets during the quarter and the impact of new accounting conventions on our reported results of operations. It is our objective in preparing the Redwood Review to promote transparency in our financial disclosure and provide you with information that will enhance your understanding of our complex business and enable you to analyze our performance more effectively. We hope you find this overview discussion and the material that follows informative.

In the first quarter of 2008, the public and private sectors finally began to acknowledge the full depth and complexity of problems in the real estate and capital markets. Initial positive steps have been taken – rate cuts, liquidity infusions, a stimulus package, increasing write-offs, and capital raising initiatives – to address the problems and bring financial stability.

Fixing the mortgage turmoil is not going to be easy and the road ahead will be bumpy. The forces that created this disarray were at work for several years and it is logical to expect that it will take at least a few years to resolve. It is going to be a drawn-out process, intertwined with legal, political, and regulatory issues, that will require structural changes in the credit and capital markets. The correction taking place is healthy and will benefit those companies, such as Redwood, that are prepared and have remained disciplined investors.

During the first quarter, we had several notable accomplishments despite extremely difficult market conditions. We remain challenged, however, by rising credit costs, primarily from residential loans originated in 2006 and 2007.

During the first quarter, we put $65 million of capital to work at what we believe are attractive yield rates. Our investments generated $52 million of cash flow in excess of operating and interest costs. Additionally, the Opportunity Fund described below, which we formed for the purpose of investing in distressed securities, received capital commitments of $46 million from new limited partners.

We invested $38 million in seasoned prime residential securities, $20 million in distressed subprime residential and CDO securities on behalf of the Opportunity Fund, and $7 million to acquire a portion of the investment-grade asset-backed securities (ABS) issued by Acacia entities in 2004 and 2005. Our weighted average cost for these Acacia ABS purchases was 21% of their principal value.

As we had forewarned in previous letters, delinquencies and credit losses increased during the first quarter. We believe we have adequate credit reserves for GAAP purposes, but we are not allowed to establish reserves for tax purposes. Our credit losses for tax purposes were $14 million in the first quarter, up from $5 million in the prior quarter. This increase was due in part to timing considerations as a higher level of short sales of residential mortgages has accelerated loss realization. Nevertheless, our estimates of cumulative losses are also increasing and we expect to realize higher levels of credit losses during the remainder of 2008 and, likely, into 2009. We believe a portion of these credit losses may be recoverable from third parties, including mortgage originators, due to breaches of representations and warranties regarding the mortgage loans underlying our investments in securities. We intend to pursue those remedies to the extent it is appropriate to do so.

Trading activity for real estate securities remained extremely light during the quarter. New residential jumbo securitization activity was at the lowest level in recent years. Origination volume dropped primarily due to rising mortgage rates, tightened underwriting, and declining home sales.

4 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

First Quarter 2008 (continued)

Additionally, buyers of AAA-rated non-agency securities are currently requiring significantly higher yield premiums, thus rendering new securitization activity uneconomic. As a result, banks and other large originators have been forced to hold most of their non-agency residential loans on their balance sheets. Our residential team is working with banks to find innovative ways other than securitization to effect significant credit risk transfers.

We expect that attractive residential credit investment opportunities will come our way as financial institutions slowly restructure their balance sheets and the capital markets resume functioning. We are disciplined long-term investors, and we will invest only at the pace that will enable us to find or create truly attractive opportunities for our shareholders.

While it may take a few quarters for residential credit-sensitive investment opportunities to develop fully, we have recently increased our pace of less credit-sensitive residential investments. Since the end of the first quarter through May 5th, we invested $84 million of capital, primarily to acquire seasoned residential investment-grade securities. We acquired these securities at 72% of face value. Our base case returns, which assume no price appreciation or leverage, fall within our equity hurdle rate of 12% to 18%.

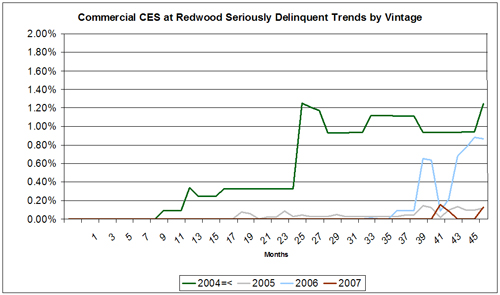

In the first quarter, the commercial real estate finance market was hit hard, after having been somewhat insulated from the severe price declines observed in the residential mortgage markets. Technical forces took hold during this quarter when bearish speculators began driving down prices for commercial securities and their derivatives. Yield spreads on commercial securities quickly rose, becoming more correlated with spreads on residential securities. This has severely affected the commercial securitization markets and originators that use securitization as a financing strategy have been unable to quote competitive new loans to income-property owners.

The economic headwinds facing commercial property owners and their tenants are becoming more severe. Property values continue to fall as capitalization rates on commercial real estate rise. Tightened underwriting standards have made it difficult for some borrowers to refinance their loans at maturity. Still, observable credit deterioration to date has been moderate. Serious delinquencies for U.S. commercial real estate securitizations hit record lows during the first quarter before trending upward in March. We expect that delinquencies will continue to rise and we expect more negative ratings actions and eventual credit losses. We believe wider market spread pricing levels are attractive for some CMBS, despite increased risks, especially for well-protected investment grade securities. There are good opportunities to acquire high-quality CMBS, commercial loans, and other commercial real estate assets producing good yields and bringing significant upside potential once the economy begins to strengthen.

On March 31, 2008, we completed an important step in the expansion of our asset management business by closing the Opportunity Fund with $96 million of capital commitments, including $46 million from new limited partner investors and $50 million from Redwood. From these commitments, actual fundings through quarter-end were $8 million from partners and $40 million from Redwood. The offer and sale of interests in this private fund were not registered under the federal securities laws. This fund was formed to capitalize on the dislocation in the subprime RMBS and CDO markets. Redwood will earn management and incentive fees on the third-party capital invested and earn a return on its direct capital investment. The fund invested $20 million in the first quarter of this year and $22 million during the fourth quarter of 2007. Expansion of our asset management business is an important part of our long-term growth strategy.

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 5 |

First Quarter 2008 (continued)

Moving on to quarterly results: Mark-to-market (MTM) accounting has, in our opinion, made our earnings under GAAP more difficult to interpret, more volatile, and more divergent from economics. In addition, our core earnings measure has become less meaningful due to FAS 159 and other MTM accounting issues. Alternative measures of results, such as cash flow, taxable income, and changes in economic book value are not simple and require careful analysis and cautious interpretation.

Our reported GAAP loss for the first quarter of 2008 was $172 million (negative $5.28 per share). This loss includes $194 million ($5.96 per share) of net negative market valuation adjustments.

Core earnings were $22 million ($0.68 per share). Core earnings for this quarter are not directly comparable to prior quarters due to the adoption of FAS 159 for the Acacia assets and liabilities. Previously, purchase discount amortization on Acacia assets ($0.21 per share in the fourth quarter of 2007) was included in core income. This component of income is now excluded from core income. We no longer calculate purchase discount amortization for securities in the Acacia entities as it has become, in effect, one of the components of the FAS 159 market valuation adjustments.

Estimated taxable earnings for this quarter were $26 million ($0.79 per share). These taxable earnings included $14 million ($0.41 per share) of charges related to credit losses.

Our economic (total rate of return) earnings during the first quarter were a loss of $3.50 per share. This non-GAAP measure represents the change in our economic book value per share during the quarter after dividends. Economic book value per share reflects the MTM value of all our financial assets at the current bid-side of the market, net of the MTM value of our liabilities at the offer-side. Economic earnings are heavily influenced by short-term movements in market prices, which may or may not reflect changes in expected cash flows. Long-term cash flow generation remains our ultimate goal; unfortunately our progress towards this goal is difficult to measure on a quarterly basis.

Our GAAP book value at March 31, 2008 was $17.89 per share. Our quarter-end estimate of our economic book value was $18.04 per share. The market values of the assets and liabilities underlying our economic book value estimates can be thought of as the discounted net present value calculations of future loss-adjusted cash flows. Changes in market values can be driven by changes in the discount rate as well as by changes in projected cash flows. Based on our estimate of the future loss-adjusted cash flows underlying our calculation of economic book value at March 31, 2008, the overall implied yield for our financial assets (excluding cash) was 32% and for our financial liabilities was 14%.

Details and caveats regarding the use and determination of these calculations, and the reconciliation of non-GAAP measures to GAAP, are found later in this Review.

We expect that GAAP earnings will remain volatile. Early into the second quarter, prices for some real estate securities have increased. This is the first time in a year that prices and spreads have found support. It is still too early to project whether prices will hold, but if they do, GAAP and economic earnings could improve. We may still encounter MTM volatility from our consolidation of the Acacia entities, however, due to the technical valuation methodologies required under FAS 159. In addition, we may recognize additional GAAP impairment losses on residential, commercial, and CDO securities held at Redwood. Negative MTM balance sheet write-downs that have not yet been realized through the income statement totaled $67 million at March 31, 2008. Income statement impairment charges related to these unrealized losses will not affect GAAP book value, since these MTM losses were already deducted from stockholders’ equity at March 31, 2008.

6 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

First Quarter 2008 (continued)

During the first quarter, we raised $10 million through equity sales under our direct stock purchase and dividend reinvestment plan. We ended the first quarter with reported capital of $735 million, including excess capital of $247 million available to make new investments. Our capital base consists of $585 million of common equity and $150 million of subordinated debt due in 2037. The calculation of our excess capital is discussed in the Capital and Liquidity module that follows later in this Review.

Our rate of capital deployment has increased significantly from first quarter levels as noted above. It is difficult to project with precision our rate of capital deployment for the remainder of 2008 as it will depend on the overall level of market trading activity, which could quickly accelerate due to forced liquidations or balance sheet re-structuring by other financial institutions. Our capital deployment will also depend on our success in designing and completing new forms of risk transfers from and credit-enhancements for banks. As we get more clarity around the size and likelihood of these investment opportunities, we will review our options for raising additional capital. Any new capital raised should be accretive to economic book value and should be deployed within a reasonable period of time. Our best estimate is that our current excess capital will take us through the third quarter of 2008.

Our REIT taxable income for 2008 will depend on, among other things, our ability to deploy our excess capital effectively and on the level of realized credit losses. We anticipate that credit losses, as measured for tax purposes, will increase substantially in 2008 relative to our recent experience. If the realization of credit losses becomes concentrated in any one quarter or series of quarters, taxable income may be less than our regular dividend rate. However, the board of directors has indicated it intends to maintain the regular quarterly dividend rate of $0.75 per share during 2008.

Although it is still early in the year and much could change, our best current estimate is that taxable income for 2008, plus taxable income carried over from 2007, will exceed our regular dividend rate for this year. We believe it is unlikely that we will pay a special dividend in 2008, since we currently estimate that any excess taxable income available at year-end is not likely to exceed the amounts that we customarily retain or defer distributing until the next year.

The capital markets appear to be slowly recovering. The fundamentals of loan quality, pricing, and competition have all tipped in our favor. Redwood’s capital and core expertise in credit enhancement has become more valuable in this recovery period. We believe it will continue to be valuable in the future because credit enhancement is necessary for the long-term efficiency and stability of the mortgage market. The capable professionals at Redwood are upbeat and determined. We are stepping forward and helping to rebuild the mortgage business. Every day, we are driven by the opportunities and possibilities that are in front of us.

| | | | |

| | Martin S. Hughes | | Brett D. Nicholas | |

| | Chief Financial Officer Co-Chief Operating Officer | | Chief Investment Officer Co-Chief Operating Officer | |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 7 |

Components of Book Value

| ► | The following supplemental non-GAAP balance sheet presents our assets and liabilities as calculated under GAAP and as adjusted to reflect our estimate of economic value. We show our investments in the Sequoia and Acacia securitization entities in separate line items, similar to the equity method of accounting, reflecting the reality that the underlying assets and liabilities owned by these entities are legally not ours. We own only the securities that we have acquired from these entities. This table, except for our estimates of economic value, is derived from the consolidating balance sheet presented on page 11. |

| |

Components of Book Value |

March 31, 2008 |

| ($ in millions, except per share data) |

| |

| | | | | | | Management’s Estimated Economic | |

| | | As Reported | | Adj | | Value | |

| Real estate securities (excluding Sequoia and Acacia) | | | | | | | | | | |

| Residential | | $ | $126 | | | | | $ | 126 | |

| Commercial | | | 100 | | | | | | 100 | |

| CDO | | | 42 | | | | | | 42 | |

| Subtotal real estate securities | | | 268 | | | | | | 268 | |

| Cash and cash equivalents | | | 257 | | | | | | 257 | |

| Investments in Sequoia | | | 146 | | | (54 | )(a) | | 92 | |

| Investments in Acacia | | | 68 | | | (19 | )(b) | | 49 | |

| Other assets/liabilities, net (d) | | | (4 | ) | | | | | (4 | ) |

| Subordinated notes | | | (150 | ) | | 78 | (c) | | (72 | ) |

Stockholders' Equity | | $ | 585 | | | | | $ | 590 | |

| | | | | | | | | | | |

Book Value Per Share | | $ | 17.89 | | | | | $ | 18.04 | |

| | | | | | | | | | | |

| (a) | Our actual Sequoia investments consist of CES, IGS, and IOs acquired by Redwood from the Sequoia entities. We calculated the $92 million estimate of economic value for these securities using the same valuation process that we followed to fair value all other real estate securities. In contrast, the $146 million of GAAP carrying value of these investments represents the difference between residential real estate loans owned by the Sequoia entities and the asset-backed securities (ABS) issued by those entities to third party investors. We account for these loans and ABS issued at cost, not at fair value. This is the primary reason for the $54 million disparity between the GAAP carrying value and our estimate of economic value. |

| (b) | Our actual Acacia investments consist of equity interests, and to a lesser extent ABS issued, that we acquired from the Acacia entities. The $49 million estimate of economic value of our investment interests in the Acacia entities represents the net present value of projected cash flows from our Acacia investments and management fees discounted at 45%, except for the CDO ABS that we recently repurchased at substantial discounts from face value, which are valued at cost. The reason for the difference between economic and GAAP carrying values is complex and relates to a significant difference in valuation methodology. This difference is discussed in detail in the Investments in Acacia section in this Review. |

| (c) | We have issued $150 million of 30-year subordinated notes at an interest rate of LIBOR plus 225 basis points. Under GAAP, these notes are carried at cost. Economic value is difficult to estimate with precision as the market of the notes is currently inactive. We estimated the $72 million economic value using the same valuation process used to fair value our other financial assets and liabilities. Estimated economic value is $78 million lower than our GAAP carrying value because given the significant overall contraction in credit availability and re-pricing of credit risk, if we had issued these subordinated notes at March 31, 2008, investors would have required a substantially higher interest rate. |

| (d) | Other assets/liabilities, net are comprised of real estate loans of $5 million, restricted cash of $11 million, and other assets of $24 million, less Redwood debt of $2 million, dividend payable of $25 million, and other liabilities of $17 million. |

8 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| ► | Total real estate securities (excluding our investments in Sequoia and Acacia) were $268 million at March 31, 2008, of which $232 million were held at Redwood and $36 million were held in the Opportunity Fund. |

| ► | The table below provides product type and vintage information regarding the $232 million of securities at Redwood at March 31, 2008. |

| |

Real Estate Securities at Redwood |

Excludes Investments in Sequoia and Acacia and Securities at Opportunity Fund |

| March 31, 2008 |

| ($ in millions) |

| |

| | | 2004 & | | | | | | | | | | | |

| | | Earlier | | 2005 | | 2006 | | 2007 | | 2008 | | Total | |

Residential | | | | | | | | | | | | | | | | | | | |

| Prime | | | | | | | | | | | | | | | | | | | |

| IGS | | $ | 4 | | $ | 1 | | $ | 9 | | $ | - | | $ | 6 | | $ | 20 | |

| CES | | | 48 | | | 15 | | | 5 | | | 8 | | | 2 | | | 78 | |

Prime Total | | | 52 | | | 16 | | | 14 | | | 8 | | | 8 | | | 98 | |

| Alt-a | | | | | | | | | | | | | | | | | | | |

| IGS | | | - | | | - | | | 1 | | | 4 | | | - | | | 5 | |

| CES | | | 1 | | | 4 | | | 1 | | | 3 | | | - | | | 9 | |

| OREI | | | - | | | - | | | 2 | | | 1 | | | - | | | 3 | |

Alt-a Total | | | 1 | | | 4 | | | 4 | | | 8 | | | - | | | 17 | |

| Subprime | | | | | | | | | | | | | | | | | | | |

| IGS | | | 1 | | | - | | | - | | | - | | | - | | | 1 | |

| CES | | | - | | | - | | | - | | | 1 | | | - | | | 1 | |

Subprime Total | | | 1 | | | - | | | - | | | 1 | | | - | | | 2 | |

Residential Total | | $ | 54 | | $ | 20 | | $ | 18 | | $ | 17 | | $ | 8 | | $ | 117 | |

| | | | | | | | | | | | | | | | | | | | |

Commercial CES | | $ | 16 | | $ | 21 | | $ | 48 | | $ | 15 | | $ | - | | $ | 100 | |

| | | | | | | | | | | | | | | | | | | | |

CDO IGS | | $ | 7 | | $ | 7 | | $ | - | | $ | 1 | | $ | - | | $ | 15 | |

Total at Redwood | | $ | 77 | | $ | 48 | | $ | 66 | | $ | 33 | | $ | 8 | | $ | 232 | |

| ► | In the first quarter, we acquired $38 million of securities for Redwood's portfolio. These included $10 million of prime residential credit-enhancement securities (CES) and $28 million of prime residential investment grade securities (IGS). We acquired these securities at attractive prices equal to an average of 37% of face value. |

| ► | For GAAP balance sheet purposes, we are required to value securities using bid-side marks (an exit price). Bid/offer spreads are generally wide for these illiquid securities, and in today’s turbulent market, spreads are particularly wide. We reduced the carrying (market) value of the $38 million of our new investments by $11 million below our investment cost at March 31, 2008 primarily as a result of the bid/offer spread difference. |

| ► | Over 80% of our investments in real estate securities at March 31, 2008 were residential and commercial CES. These securities bear most of the credit risk with respect to the underlying loans that were securitized. We acquire CES at a significant discount to principal value as credit losses could reduce or totally eliminate the principal value of these bonds. Our return on these investments is based on how much principal and interest we receive and how quickly we receive it. In an ideal environment we would experience fast prepayments and low credit losses allowing us to recover a substantial part of the discount as income. Conversely, in the least beneficial environment, we would experience slow prepayments and high credit losses. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 9 |

Real Estate Securities (continued)

| ► | We provide additional discussion and analysis regarding the adequacy of our credit reserves and the potential earnings upside from an increase in prepayments in the residential and commercial real estate securities modules that follow. |

| ► | The following table presents the components of GAAP carrying value (which equals fair value determined in accordance with GAAP) for residential and commercial CES at Redwood. |

| |

|

Excludes Investments in Sequoia and Acacia and Securities at Opportunity Fund |

| March 31, 2008 |

| ($ in millions) |

| |

| | | Residential | | | |

| | | Prime | | Alt-a | | Commercial | |

| | | | | | | | |

| Current face | | $ | 538 | | $ | 217 | | | 523 | |

| Unamortized discount, net | | | (61 | ) | | (1 | ) | | (37 | ) |

| Discount designated as credit reserve | | | (358 | ) | | (205 | ) | | (378 | ) |

| Amortized cost | | | 119 | | | 11 | | | 108 | |

| Unrealized gains | | | 3 | | | 0 | | | 2 | |

| Unrealized losses | | | (44 | ) | | (2 | ) | | (10 | ) |

Total Carrying value of CES at Redwood | | $ | 78 | | $ | 9 | | $ | 100 | |

Carrying value as a percentage of face | | | 14 | % | | 4 | % | | 19 | % |

| ► | We also own $1 million subprime CES with a face value of $36 million. |

| ► | The table below provides product type and vintage information regarding the $36 million of securities held by the Opportunity Fund at March 31, 2008. |

| |

Securities at Opportunity Fund |

| March 31, 2008 |

| ($ in millions) |

| |

| | | 2004 & | | | | | |

| | | Earlier | | 2005 | | Total | |

Residential Subprime IGS | | $ | 9 | | $ | - | | $ | 9 | |

| | | | | | | | | | | |

CDO IGS | | $ | 17 | | $ | 10 | | $ | 27 | |

| | | | | | | | | | | |

Total at Opportunity Fund | | $ | 26 | | $ | 10 | | $ | 36 | |

| ► | In the first quarter, we acquired $20 million of IGS for the Opportunity Fund, which included $12 million CDO IGS and $8 million in subprime IGS. We acquired these securities at an average price of 43% of face value. |

10 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

Consolidating Balance Sheet

| ► | GAAP requires us to produce a balance sheet that consolidates the assets and liabilities of the Sequoia and Acacia securitization entities (which had a combined $8.1 billion of assets and $7.9 billion of liabilities) even though the assets are owned by the securitization entities and the liabilities are obligations of the securitization entities payable only from the cash flows generated by the assets owned by the entities. |

| ► | The table below shows the consolidating components of our consolidated balance sheet at March 31, 2008. The purpose of this presentation is to show the effect each of the components had on our consolidated shareholders' equity at March 31, 2008. The Acacia and Sequoia components represent investments and are not separate business segments. |

| |

Consolidating Balance Sheet |

| March 31, 2008 |

| ($ in millions) |

| | | Redwood | | | | | | | | | |

| | | and | | | | | | | | Redwood | |

| | | Opportunity Fund | | Sequoia | | Acacia | | Intercompany | | Consolidated | |

| Real estate loans | | $ | 5 | | $ | 6,751 | | $ | 19 | | $ | - | | $ | 6,775 | |

| Real estate securities | | | 268 | | | - | | | 1,014 | | | (88 | ) | | 1,194 | |

| Non-real estate investments | | | - | | | - | | | 79 | | | - | | | 79 | |

| Cash and cash equivalents | | | 257 | | | - | | | - | | | - | | | 257 | |

| Total earning assets | | | 530 | | | 6,751 | | | 1,112 | | | (88 | ) | | 8,305 | |

| Investment in Sequoia | | | 146 | | | - | | | - | | | (146 | ) | | - | |

| Investment in Acacia | | | 68 | | | - | | | - | | | (68 | ) | | - | |

| Other assets | | | 35 | | | 49 | | | 157 | | | - | | | 241 | |

Total Assets | | $ | 779 | | $ | 6,800 | | $ | 1,269 | | $ | (302 | ) | $ | 8,546 | |

| Redwood debt | | $ | 2 | | $ | - | | $ | - | | $ | - | | $ | 2 | |

| Asset-backed securities issued - Sequoia | | | - | | | 6,632 | | | - | | | (88 | ) | | 6,544 | |

| Asset-backed securities issued - Acacia | | | - | | | - | | | 1,046 | | | - | | | 1,046 | |

| Other liabilities | | | 42 | | | 22 | | | 155 | | | - | | | 219 | |

| Subordinated notes | | | 150 | | | - | | | - | | | - | | | 150 | |

Total Liabilities | | | 194 | | | 6,654 | | | 1,201 | | | (88 | ) | | 7,961 | |

| Total Stockholders’ Equity | | | 585 | | | 146 | | | 68 | | | (214 | ) | | 585 | |

Total Liabilities and Stockholders’ Equity | | $ | 779 | | $ | 6,800 | | $ | 1,269 | | $ | (302 | ) | $ | 8,546 | |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 11 |

| ► | As a supplement to our Consolidated Statement of Cash Flows included in our Quarterly Report on Form 10-Q, we have included the table below that details the sources and uses of our cash for the first quarter. This table excludes the gross cash flows generated by our securitization entities, but does include the cash flow generated by our investments in those entities. |

| |

Redwood |

Sources and Uses of Cash |

First Quarter 2008 Activity |

| Sources: | | | | |

| Cash from investments | | $ | 70 | |

| Equity raised | | | 10 | |

| Acacia management fees | | | 2 | |

| 3rd party funds (Opp Fund) | | | 8 | |

| Total Sources | | | 90 | |

| Uses: | | | | |

| Acquisitions | | | (65 | ) |

| Dividends paid | | | (25 | ) |

| Operating expenses paid | | | (15 | ) |

| Subordinated notes interest expense | | | (3 | ) |

| Redwood debt paydown | | | (6 | ) |

| Changes in working capital | | | (3 | ) |

| Restricted cash held by Opp. Fund | | | (6 | ) |

| Total Uses | | | (123 | ) |

Net Uses of Cash | | $ | (33 | ) |

Beginning Cash Balance at 12/31/07 | | $ | 290 | |

Ending Cash Balance at 03/31/08 | | $ | 257 | |

| ► | The cash generated by our investments is one of the financial metrics on which we focus. In the first quarter our investments generated cash from principal and interest payments of $70 million. The net investment cash flow after deducting subordinated note interest expense of $3 million and cash operating expenses of $15 million was $52 million. |

| ► | Our investments at Redwood generated $40 million of cash, and our direct investments in Sequoia and Acacia generated $23 million and $7 million of cash, respectively. |

| ► | Other sources of cash included $10 million of equity sales under our direct stock purchase and dividend reinvestment plan, $2 million of management fees, and $8 million from the Opportunity Fund’s third-party investors. |

| ► | The primary uses of cash this quarter were $65 million for acquisitions and $25 million for the payment of dividends. |

12 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | GAAP INCOME & CORE EARNINGS |

Summary

What is this?

GAAP income is income calculated under generally accepted accounting principles in the United States.

Core earnings is a profitability measure that highlights earnings that we believe are more likely to be ongoing in nature. In calculating core earnings, we start with GAAP income and then exclude realized gains and losses on calls and sales, unrealized market value adjustments, and one-time items that are unlikely to be repeated. Table 2 in the Appendix shows a reconciliation of core earnings to GAAP income.

Quarterly Update

| ► | The GAAP loss of $172 million for the first quarter, or $5.28 per share, was primarily due to $194 million ($5.96 per share) of negative market valuation adjustments. Market valuation adjustments are discussed in detail in the Mark-to-Market Adjustments module later in this Review. |

| ► | The table below provides a summary of our GAAP (loss) income for the first quarter of 2008, the fourth quarter of 2007, and the first quarter of 2007. |

| | | | |

| | | For the Quarter Ended | |

GAAP Income ($ millions) | | Mar-08 | | Dec-07 | | Mar-07 | |

| | | | | | | | |

| Interest income | | $ | 168 | | $ | 202 | | $ | 215 | |

| Interest expense | | | (128 | ) | | (153 | ) | | (168 | ) |

| Net interest income before market valuation adjustments | | | 40 | | | 49 | | | 47 | |

| | | | | | | | | | | |

| Market valuation adjustments, net | | | (194 | ) | | (1,119 | ) | | (10 | ) |

| Net Interest (loss) Income | | | (154 | ) | | (1,070 | ) | | 37 | |

| | | | | | | | | | | |

| Operating expenses | | | (16 | ) | | (16 | ) | | (18 | ) |

| Realized gains (losses) on sales | | | - | | | 7 | | | - | |

| Realized gains on calls | | | - | | | - | | | 1 | |

| Credit (provision) for taxes | | | (2 | ) | | 2 | | | (2 | ) |

| | | | | | | | | | | |

GAAP (loss) income | | $ | (172 | ) | $ | (1,077 | ) | $ | 18 | |

| | | | | | | | | | | |

| GAAP (loss) income per share | | $ | (5.28 | ) | $ | (36.49 | ) | $ | 0.66 | |

| ► | Net interest income before market valuation adjustments for the first quarter decreased by $9 million from the previous quarter. The decline resulted from slower prepayments on residential loans underlying our CES, increased credit provisions on loans owned by Sequoia, and the impact of our adoption of a new accounting standard, FAS 159, on January 1, 2008. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 13 |

| | |

GAAP INCOME & CORE EARNINGS | |

Quarterly Update (continued)

| ► | Total market valuation adjustments were $194 million in the first quarter, down significantly from $1.1 billion in the fourth quarter. The primary reason for the reduction in the level of negative market valuation adjustments was the fair value option election under FAS 159 which now permits us to MTM both the assets and liabilities of Acacia. |

| ► | Operating expenses remained at the same level as in the prior quarter. |

| ► | We accrue for income taxes throughout the year based on our estimates of taxable income and our planned distribution and retention of this income. |

| ► | The following tables detail the components of our consolidated income statements for the first quarter of 2008 and the fourth quarter of 2007. |

| |

Consolidating Income Statement |

| Three Months Ended March 31, 2008 |

| ($ in millions) |

|

| | | | | | | | | | | Redwood | |

| | | | Sequoia | | Acacia | | Elimination | | Consolidated | |

| Interest income | | $ | 24 | | $ | 94 | | $ | 48 | | $ | (2 | ) | $ | 164 | |

| Net discount (premium) amortization | | | 12 | | | (7 | ) | | - | | | - | | | 5 | |

| Total interest income | | | 36 | | | 87 | | | 48 | | | (2 | ) | | 169 | |

| Management fees | | | - | | | - | | | 1 | | | - | | | 1 | |

| Interest expense | | | (3 | ) | | (83 | ) | | (45 | ) | | 2 | | | (129 | ) |

| Net interest income before market valuation adjustments | | $ | 33 | | $ | 4 | | $ | 4 | | $ | - | | $ | 41 | |

| Market valuation adjustments, net | | | (167 | ) | | - | | | (27 | ) | | - | | | (194 | ) |

| Net interest (loss) income | | | (134 | ) | | 4 | | | (23 | ) | | - | | | (153 | ) |

| Operating expenses | | | (17 | ) | | - | | | - | | | - | | | (17 | ) |

| Realized gains on sales and calls, net | | | - | | | - | | | - | | | - | | | - | |

| Income from Sequoia | | | 4 | | | - | | | - | | | (4 | ) | | - | |

| Loss from Acacia | | | (23 | ) | | - | | | - | | | 23 | | | - | |

| Provision for income taxes | | | (2 | ) | | - | | | - | | | - | | | (2 | ) |

Net (Loss) Income | | $ | (172 | ) | $ | 4 | | $ | (23 | ) | $ | 19 | | $ | (172 | ) |

| |

Consolidating Income Statement |

| Three Months Ended December 31, 2007 |

| ($ in millions) |

|

| | | | | | | | | | | Redwood | |

| | | | Sequoia | | Acacia | | Elimination | | Consolidated | |

| Interest income | | $ | 26 | | $ | 110 | | $ | 55 | | $ | (2 | ) | $ | 189 | |

| Net discount (premium) amortization | | | 11 | | | (7 | ) | | 7 | | | - | | | 11 | |

| Total interest income | | | 37 | | | 103 | | | 62 | | | (2 | ) | | 200 | |

| Management fees | | | - | | | - | | | 2 | | | - | | | 2 | |

| Interest expense | | | (3 | ) | | (96 | ) | | (56 | ) | | 2 | | | (153 | ) |

| Net interest income before market valuation adjustments | | | 34 | | | 7 | | | 8 | | | - | | | 49 | |

| Market valuation adjustments, net | | | (130 | ) | | - | | | (989 | ) | | - | | | (1,119 | ) |

| Net interest (loss) income | | | (96 | ) | | 7 | | | (981 | ) | | - | | | (1,070 | ) |

| Operating expenses | | | (16 | ) | | - | | | - | | | - | | | (16 | ) |

| Realized gains on sales and calls, net | | | 9 | | | - | | | (2 | ) | | - | | | 7 | |

| Income from Sequoia | | | 7 | | | - | | | - | | | (7 | ) | | - | |

| Loss from Acacia | | | (983 | ) | | - | | | - | | | 983 | | | - | |

| Provision for income taxes | | | 2 | | | - | | | - | | | - | | | 2 | |

Net (Loss) Income | | $ | (1,077 | ) | $ | 7 | | $ | (983 | ) | $ | 976 | | $ | (1,077 | ) |

14 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | GAAP INCOME & CORE EARNINGS |

Quarterly Update (continued)

| ► | Market valuation adjustments were greater in the first quarter on securities we hold as available-for-sale (AFS) than the prior quarter as credit performance continued to deteriorate and we no longer believe some of the valuations will return to cost on many of these illiquid securities within a reasonable period. We expect the amount of future impairments at Redwood to decline since we have permanently impaired the majority of our earning assets. Our CES have been written down to 15% of face value at March 31, 2008. More detailed information about our accounting impairments is found in the Mark-to-Mark Adjustments section of this Review. |

| ► | Market valuation adjustments at Acacia were negative $27 million in the first quarter reflecting the net changes in the fair values of the assets and liabilities within these securitization entities. Under FAS 159 accounting, these changes flow through the income statement. In the fourth quarter of 2007, prior to the adoption of FAS 159, the market valuation adjustments of negative $1.0 billion consisted only of impairments on certain of Acacia's assets and did not reflect any offsetting change in value of the associated Acacia liabilities. |

| ► | Net interest income from Sequoia securitization entities was $3 million lower in the first quarter than the prior quarter as a result of a $4 million increase in provisions for credit losses partially offset by lower premium amortization from slower prepayment speeds. |

| ► | For Acacia, net interest income before market valuation adjustments in the first quarter declined by $4 million from the previous quarter, primarily as the result of the adoption of FAS 159. We now only include the cash coupon on the assets less the cash expense on the ABS issued in net interest income. Previously, net interest income included discount amortization, which in the fourth quarter of 2007, totaled $7 million. Under FAS 159, this amount is effectively included in the market valuation adjustments of these assets. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 15 |

| | |

GAAP INCOME & CORE EARNINGS | |

Quarterly Update (continued)

| ► | The table below provides a summary of our core earnings for the first quarter of 2008, the fourth quarter of 2007, and the first quarter of 2007. |

| | | | |

| | | For the Quarter Ended | |

Core Earnings | | Mar-08 | | Dec-07 | | Mar-07 | |

| | | | | | | | |

| Interest income | | $ | 168 | | $ | 202 | | $ | 215 | |

| Interest expense | | | (128 | ) | | (153 | ) | | (168 | ) |

| Net interest income | | | 40 | | | 49 | | | 47 | |

| | | | | | | | | | | |

| Market valuation adjustments, net | | | - | | | - | | | - | |

| Net interest (loss) income | | | 40 | | | 49 | | | 47 | |

| | | | | | | | | | | |

| Operating expenses | | | (16 | ) | | (15 | ) | | (15 | ) |

| Realized gains (losses) on sales | | | - | | | - | | | - | |

| Realized gains on calls | | | - | | | - | | | - | |

| Credit (provision) for taxes | | | (2 | ) | | 2 | | | (2 | ) |

| | | | | | | | | | | |

Core earnings | | $ | 22 | | $ | 36 | | $ | 30 | |

| | | | | | | | | | | |

| Core earnings per share | | $ | 0.68 | | $ | 1.21 | | $ | 1.08 | |

| ► | Our first quarter core earnings were $0.68 per share. The reasons for the decrease in the level of core earnings from prior periods include the impact of the adoption of FAS 159, higher loan loss provisions, and slower prepayments on residential loans underlying our CES. |

| ► | Core earnings for this quarter of 2008 are not directly comparable to core earnings for prior quarters due to the adoption of FAS 159 for Acacia entities. Prior to the first quarter, purchase discount amortization on Acacia assets ($0.21 per share in the fourth quarter of 2007) was included in core income. This component of income is now excluded from core income. We no longer calculate purchase discount amortization for securities in the Acacia entities since it has become, in effect, one of the components of the FAS 159 mark-to-market adjustments. |

16 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

Summary

What is this?

Total taxable income is our pre-tax income as calculated for tax purposes. Total taxable income differs materially from GAAP income. Table 3 in the Appendix reconciles these two profitability measures.

REIT taxable income is the primary determinant of the minimum amount of dividends we must distribute in order to maintain our tax status as a real estate investment trust (REIT). REIT taxable income is pre-tax profit, as calculated for tax purposes, excluding taxable income earned at our non-REIT taxable subsidiaries. Over time, we must distribute at least 90% of our REIT taxable income as dividends.

For our quarterly taxable earnings estimates, we project our taxable earnings for the year based upon various assumptions of events that will occur during the year. However, some of the events that could have significant impact on our taxable earnings are difficult to project, including the amount and timing of credit losses, prepayments, and employee stock option exercises. Thus, our quarterly taxable earnings are likely to remain volatile.

Quarterly Update

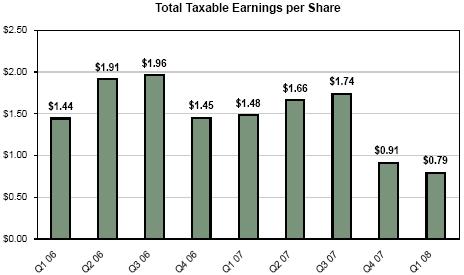

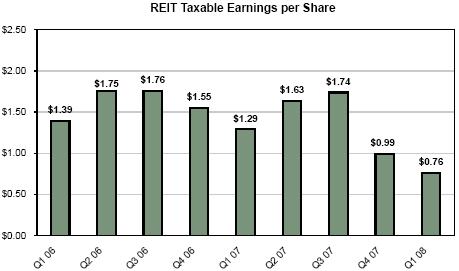

| ► | Total taxable income for the first quarter of 2008 was $26 million, or $0.79 per share. REIT taxable income was $25 million, or $0.76 per share, in the first quarter of 2008. |

| ► | Our taxable income decreased from the prior quarter by $3 million. Our first quarter taxable earnings included $14 million of charges related to credit losses, an increase of $9 million over the previous quarter. In addition, discount amortization for tax purposes decreased by $8 million from the fourth quarter to the first quarter primarily as the result of slower prepayments speeds. Offsetting these decreases in income was the fact that the fourth quarter included $14 million of write downs of assets for tax purposes. |

| ► | Our REIT taxable income for 2008 will depend on, among other things, our ability to deploy our excess capital effectively and on the level of realized credit losses. We anticipate that credit losses, as measured for tax purposes, will increase substantially in 2008 relative to our recent experience. If the realization of credit losses becomes concentrated in time, taxable income alone in any one quarter or series of quarters may be less than our regular dividend rate. |

| ► | Our taxable income continues to be higher than our GAAP income as we are not permitted to establish credit reserves for tax purposes and we do not generally recognize changes in market values of assets for tax purposes until the asset is sold. As a result of these differences at March 31, 2008, the tax basis of our residential, commercial, and CDO CES at Redwood was $377 million higher than our GAAP basis. Future credit losses will have a more significant impact on our taxable income than on our GAAP income. |

| ► | The tax basis on Sequoia IOs we own is $55 million. Most of the underlying pools of loans have paid down or will pay down within the next year to levels where they are callable. When these are called, losses on these IOs will be incurred and our taxable income and dividend distribution requirements will decrease. The actual losses will depend on the tax basis at the time of any calls as the monthly cash flows received on these IOs in the interim will reduce their cost basis. At this time, we do not anticipate calling Sequoia deals in 2008. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 17 |

Quarterly Update (continued)

| ► | The charts below provide a summary of our total taxable income per share and REIT taxable income per share for each for the nine most recently completed fiscal quarters. |

18 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

Summary

What is this?

We use capital to fund our operations, invest in earning assets which are primarily credit sensitive and illiquid, fund working capital, and meet lender capital requirements with respect to collateralized borrowings.

Through our internal risk-adjusted capital policy, we allocate a prudent level of capital for our earning assets to meet liquidity needs that may arise. In most cases, the amount of allocated capital is equal to 100% of the fair value of the asset. Any capital that exceeds our risk-adjusted capital guideline amount is excess capital that can be invested to support business growth.

Our capital base includes common equity plus $150 million of subordinated notes.

Declines in the fair value of assets do not have a large effect on excess capital, as asset value declines reduce equally both available capital and capital required for these investments.

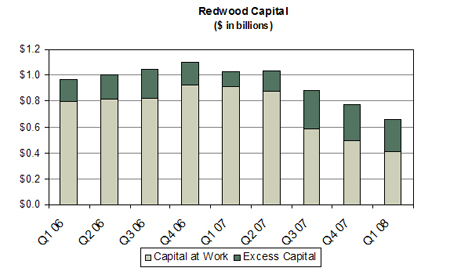

The chart below provides a summary of our aggregate capital at work and excess capital for each of the fiscal quarters noted.

Quarterly Update

| ► | At March 31, 2008, we had $247 million of excess capital, a decrease from $282 million at December 31, 2007, and an increase from the $114 million we had a year ago. The decrease in excess capital over the past quarter reflects our investment activity in the first quarter. |

| ► | Our net liquid assets at March 31, 2008 totaled $263 million and included $257 of unrestricted cash, $4 million of unsecuritized residential real estate loans at fair value, and $4 million of AAA-rated securities at fair value, less $2 million of Redwood debt. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 19 |

Quarterly Update (continued)

| ► | At March 31, 2008, our total available capital, defined as the sum of our excess capital plus our invested capital, amounted to $660 million, compared to $793 million at January 1, 2008 upon the adoption of FAS 159. The decline reflects market value adjustments on our employed capital. Our total available capital of $660 million differs from our GAAP capital (equity plus long-term debt) of $735 million because we adjust our GAAP capital for "economic" value changes to our investments in Sequoia and Acacia (as discussed on page 8) and we deduct net other assets and liabilities. |

| ► | Capital employed decreased in the first quarter by $83 million to $413 million mainly as a result of market value declines that were partially offset by $65 million of new acquisitions. |

| ► | We are long-term investors and we fund most of our investments with equity. We acquire our securities at discounts, and in many cases substantial discounts to face value, and we model a range of expected cash flows that we expect to collect over the life of each security. To the extent the fair values of our investments are lower or higher from time to time is of little consequence to us provided the cash flows remain within our range of expectations. |

| ► | The high level of excess capital and liquidity over the past several quarters reflects our intention to maintain a strong balance sheet during a time of market distress and our strategic decision to sell lower yielding, higher rated assets to position us to acquire higher yielding assets with the potential for more upside return. Over time, we expect our excess capital and net liquidity to decline as we fund new investments. However, as most of our investments are funded with equity, we have less need to maintain a large liquidity position. |

20 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

What is this?

We have established a regular quarterly dividend rate at a level we believe is likely to be sustainable unless realized credit losses rise dramatically or our business economics decline materially for some other reason. Distributions in excess of the regular dividend rate, if any, are typically paid in a fourth quarter special dividend.

Quarterly Update

| ► | On March 5, 2008, we declared a regular dividend of $0.75 per share for the second quarter payable on April 21, 2008 to shareholders of record on March 31, 2008. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 21 |

Quarterly Update (continued)

| ► | Total dividend distributions over the last four quarters were $5.00 per share, which included a $2.00 special dividend paid to shareholders on December 7, 2008. |

| ► | The amount of special dividends in 2008, if any, will depend upon the level of taxable income. With rising credit losses (for which there are no credit reserves for tax accounting), we do not currently anticipate paying a special dividend in 2008. |

| ► | Our dividend yield at the current regular annual dividend rate of $3.00 per share at the close of the market on May 1, 2008, was 8.26%. |

| ► | Over the past several years, we have distributed 100% of REIT capital gains income and 90% of REIT ordinary income, retaining 10% of the ordinary REIT income. We retain 100% of the after-tax income we generate in taxable subsidiaries. All of our dividend distributions in 2007 were ordinary income and we do not expect any capital gain distributions in 2008. |

| ► | As in prior periods, we are currently planning to retain a portion and defer the distribution of all or a portion of any excess REIT taxable income earned in 2008. At March 31, 2008, we had $47 million ($1.43 per outstanding share) of undistributed REIT taxable income that we anticipate distributing in 2008. |

22 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | MARK-TO-MARKET ADJUSTMENTS |

Market Conditions

| ► | During the first quarter of 2008, residential and commercial real estate prices remained under pressure and borrower delinquencies and defaults escalated. Additionally, banks and Wall Street firms substantially reduced their extension of credit and slashed advance rates for collateralized borrowings, even for repurchase borrowings backed by Fannie Mae and Freddie Mac securities. The combination of deteriorating credit fundamentals together with the contraction in market liquidity caused prices for real estate securities to record their steepest quarterly decline since the mortgage credit crisis began over a year ago. |

| ► | The capital markets for non-agency residential and commercial mortgages essentially shut down during the quarter. New residential non-agency securitizations were at their lowest level in several years and trading activity of existing securities through the mortgage capital markets remained extremely light. |

| ► | Market unrest peaked in early March. The actions by the Fed and the Treasury to reduce systemic financial risk, the 75 basis point rate cut in the federal funds rate, the opening of the Fed discount window to certain broker/dealers, and the reduction in the excess capital requirements for Fannie Mae and Freddie Mac appear to have reduced the substantial pressure that had built up and restored some stability to the markets. Trading remains light, but prices for real estate securities seem to be holding. We would caution that it is still early in this credit cycle and this stability may be temporary. |

| ► | The table below illustrates the additional interest rate spread that investors have required to compensate for the perceived credit risk of various types of residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS). |

| ► | For some assets, declines in fair values reflect the near-certainty of serious credit losses being realized. For others, significant future losses may not occur, but there is a perceived increase in the risk of loss resulting in a lower value. Finally, many assets are not at serious risk of loss but their declining value largely reflects a limited number of observed sales in the market. Many of the sales that did occur were by distressed sellers resulting in further downward pressure on market prices. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 23 |

| | |

MARK-TO-MARKET ADJUSTMENTS | |

Accounting Discussion

| ► | The accounting rules regarding MTM accounting are complex and may not clearly reflect the underlying economics. This topic is more fully discussed in the Accounting Discussion module in the Appendix. |

| ► | At Redwood, where we hold most of our securities as available-for-sale for accounting purposes, MTM changes that are other-than-temporary flow through our income statement while MTM changes that are temporary are charged to equity. |

| ► | For accounting purposes, we consolidate the balance sheets and income statements of the Acacia securitization entities. On January 1, 2008, we adopted a new accounting standard, FAS 159, and elected to fair value both the assets and liabilities of the Acacia entities. In accordance with FAS 159, we recorded a one-time, cumulative-effect adjustment to our January 1, 2008 opening balance sheet that decreased the carrying value of Acacia liabilities by $1.5 billion and increased equity. This new standard significantly reduces the disparity that existed between GAAP carrying value and our previous estimates of economic value. |

| ► | For Sequoia, we are required to consolidate the assets and liabilities, which we report at amortized cost. Thus, there was no effect on our financial statements from changes in fair values of Sequoia's loans or ABS issued. |

| ► | Financial Tables 19A, 19B, and 19C in the back of this Review detail the fair value of residential, commercial, and CDO securities at Redwood, the Opportunity Fund, and Acacia as a percentage of their face value as of March 31, 2008. |

24 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | MARK-TO-MARKET ADJUSTMENTS |

Impact on Redwood

| ► | The tables below detail the MTM adjustments on securities held at Redwood and the Opportunity Fund (excluding Sequoia and Acacia) by underlying collateral type and by vintage. Net MTM adjustments were a negative $146 million in the first quarter of 2008. |

| |

Mark-To-Market Adjustments on Securities |

at Redwood and Opportunity Fund (Excluding Sequoia and Acacia) |

By Underlying Collateral Type |

| Three Months Ended March 31, 2008 |

| ($ in millions) |

| | | | | | | Loans, OREI & | | | | MTM | |

| | | IGS | | CES | | Derivatives | | Total | | Percent (a) | |

| Residential | | | | | | | | | | | | | | | | |

| Prime | | $ | (10 | ) | $ | (56 | ) | $ | (1 | ) | $ | (67 | ) | | (40 | )% |

| Alt-a | | | (5 | ) | | (13 | ) | | (2 | ) | | (20 | ) | | (53 | )% |

| Subprime | | | (1 | ) | | (1 | ) | | (1 | ) | | (3 | ) | | (21 | )% |

| Residential total | | | (16 | ) | | (70 | ) | | (4 | ) | | (90 | ) | | | |

| Commercial | | | - | | | (47 | ) | | - | | | (47 | ) | | (32 | )% |

| CDO | | | (1 | ) | | (2 | ) | | - | | | (3 | ) | | (6 | )% |

| Interest rate agreements & other derivatives | | | - | | | - | | | (6 | ) | | (6 | ) | | | |

Total mark-to-market adjustments | | $ | (17 | ) | $ | (119 | ) | $ | (10 | ) | $ | (146 | ) | | | |

| |

By Vintage & Equity |

| | | | | | | | | | | | | Loans & | | | |

| | | <= 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | Derivatives | | Total | |

| | | | | | | | | | | | | | | | |

Total mark-to-market adjustments | | $ | (35 | ) | $ | (22 | ) | $ | (34 | ) | $ | (38 | ) | $ | (10 | ) | $ | (7 | ) | $ | (146 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

MTM percent (a) | | | (22 | )% | | (22 | )% | | (27 | )% | | (34 | )% | | (43 | )% | | | | | | |

| (a) | This percentage represents the MTMs taken as a percentage of the reported fair values at the beginning of the period, or purchase price if acquired during the period. It is intended to highlight the price declines by collateral type for the three months ended March 31, 2008. These price declines are specific to our portfolio and may not be indicative of price declines in the market in general. |

| ► | Under GAAP, we value securities using bid-side markets (an exit price). Bid/offer spreads are generally wide for illiquid securities, and in today's turbulent market, spreads are especially wide. This difference in bid/offer spreads is the primary reason we recorded $11 million of negative MTM adjustments on purchases made in the first quarter. |

| ► | The following table shows the MTM impact on our balance sheet and income statement in the first quarter. |

| | |

Mark-to-Market Adjustments on Securities | |

at Redwood and Opportunity Fund (Excluding Sequoia and Acacia) | |

Balance Sheet and Income Statement Effect | |

| Three Months Ended March 31, 2008 | |

| ($ in millions) | |

| | | Redwood | |

Balance Sheet Effect | | | | |

| Adjustment to OCI | | $ | 21 | |

Income Statement Effect | | | | |

| Market valuation adjustments | | | | |

| FVO assets | | | (13 | ) |

| Impairment on AFS securities | | | (144 | ) |

| Changes in fair value on trading instruments | | | (10 | ) |

| Total income statement effect | | | (167 | ) |

Total mark-to-market adjustments | | $ | (146 | ) |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 25 |

| | |

MARK-TO-MARKET ADJUSTMENTS | |

Impact on Redwood (continued)

| ► | During the first quarter, there were gross negative market value adjustments of $167 million, and net adjustments of negative $146 million after reversing $21 million of prior period temporary adjustments from equity (other comprehensive income) as shown in the table above. |

| ► | The table below shows the first quarter MTM adjustments for the assets and liabilities at Acacia subesquent to the adoption of FAS 159 on January 1, 2008. |

| |

MTM Adjustments on Acacia Assets and Liabilities |

| Three Months Ended March 31, 2008 |

| ($ in millions) |

| |

Assets | | | | |

| Real estate securities and Loans | | $ | (787 | ) |

| Interest rate agreements and other derivatives | | | (50 | ) |

Liabilities | | | | |

| ABS issued | | | 810 | |

Net mark-to-market adjustments | | $ | (27 | ) |

| ► | During the first quarter, market prices for the assets collateralizing our CDOs and the related debt declined further due to elevating credit concerns and a market in which there was very light trading volume. |

| ► | At Acacia, the entire net negative $27 million of MTM adjustments were reflected in the income statement as required by FAS 159. |

| ► | As a result of the measurement techniques required by FAS 159, we expect to encounter some MTM earnings volatility in the future as a result of the consolidation of Acacia entities. We expect this volatility to be significantly less than we encountered in prior periods. This complex topic is more fully discussed in the Investments in Acacia module later in this Review. |

26 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | MARK-TO-MARKET ADJUSTMENTS |

Mark-to-Market Valuation Process

| ► | The fair values we use for our assets and liabilities reflect what we believe we would realize if we chose to sell our securities or would have to pay if we chose to buy back our asset-backed securities (ABS) issued liabilities. Establishing fair values is inherently subjective and is dependent upon many market-based inputs, including observable trades, information on offered inventories, bid lists, and indications of value obtained from dealers. Obtaining fair values for securities is especially difficult for illiquid securities (such as ours), and is made more difficult when there is limited trading visibility, as was the case in recent months. Where there are observable sales, many of them are from distressed sellers, and their sales tend to further depress asset prices. For these reasons, we expect market valuations to continue to be highly volatile. |

| ► | Fair values for our securities and ABS issued are dependent upon a number of market-based assumptions, including future interest rates, prepayment rates, discount rates, credit loss rates, and the timing of credit losses. We use these assumptions to generate cash flow estimates and internal values for each individual security. |

| ► | We request indications of value (marks) from dealers every quarter to assist in the valuation process. For March 31, 2008, we received dealer marks on 71% of the assets and 82% of our liabilities on our consolidated balance sheet. One major dealer that we have used in prior periods provided no marks. |

| ► | One of the factors we consider in our valuation process is our assessment of the quality of the dealer marks we receive. Dealers remain inundated with requests for quarter-end marks, and there continues to be limited observable trading information for them to rely upon. Thus, their marks were most likely generated by their own pricing models for which they did not share their inputs and we had little insight into their assumptions. |

| ► | Furthermore, the dealers continue to heavily qualify the information they send to us. The qualifications include statements to the effect that the markets are very volatile and are characterized by limited trading volume and poor price transparency, and in many cases, an increasing number of valuations are model-based due to a lack of observable trades. |

| ► | Our valuation process relied on our internal values to estimate the fair values of our securities at March 31, 2008. In the aggregate, our internal valuations of the securities on which we received dealer marks were 29% lower than the aggregate dealer marks at March 31, 2008. Our internal valuations of our ABS issued on which we received dealer marks were 14% lower than the aggregate dealer marks at March 31, 2008. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 27 |

| | |

RESIDENTIAL REAL ESTATE SECURITIES | |

Summary

What is this?

Redwood invests in securities that are backed by pools of residential real estate loans. These are primarily CES, and also include IGS and other real estate investments (OREI). Most of our investments in residential real estate securities are backed by prime residential loans and some are backed by alt-a or subprime loans. The following discussion refers only to the residential securities owned by Redwood and the Opportunity Fund, exclusive of the loans and securities owned by Sequoia and Acacia and Redwood’s investments in Sequoia and Acacia.

| ► | Our residential securities portfolio declined by $48 million (or 30%) from $160 million to $112 million in the first quarter.This decrease was primarily due to negative market value adjustments partially offset by $38 million of residential prime securities acquisitions. |

| ► | From a total market perspective, new securitizations of prime jumbo residential loans totaled $6 billion in the first quarter, a 71% decline from the fourth quarter, and a 91% decline from the year-ago period. Despite market conditions, we successfully worked with our banking partners to provide liquidity on three new prime securitizations. We purchased all of the CES securities ($5 million invested) and part of the IGS securities ($10 million invested) from these securitizations. Our base case returns, which assume no price appreciation or leverage, fall within our equity hurdle rate range of 12% to 18%. |

| ► | We remained active participants in the secondary mortgage markets, although market liquidity was hindered by forced liquidations and systemic credit concerns. We acquired $10 million of prime CES and $7 million of prime IGS from seasoned vintages during the quarter. We also acquired $1 million of prime CES and $10 million of prime IGS from 2006 and 2007 vintages at significant discounts to face value. While we are focused on building our prime credit enhancement business, we plan to accelerate our investments in new and seasoned prime IGS. |

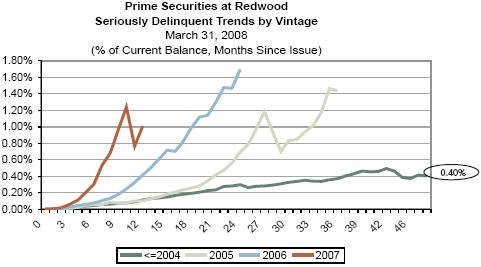

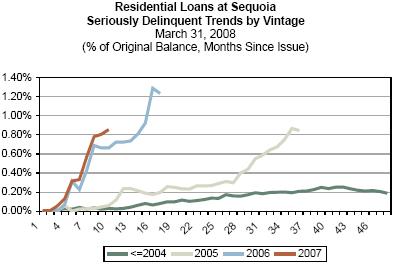

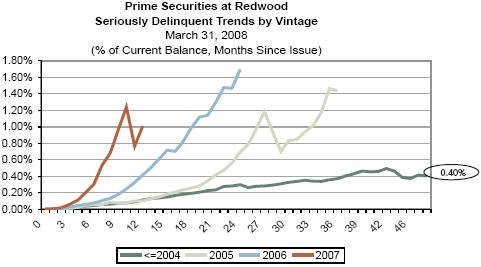

| ► | The credit performance of our residential securities worsened during the first quarter. Prime and alt-a CES originated prior to 2005 continued to perform within our range of expectations, while newer vintage CES (acquired prior to the third quarter of 2007) continued to perform worse than expected. In almost all pools of loans, we are experiencing increases in loan delinquencies and losses. Our GAAP credit reserve balances are reassessed quarterly for changes in our loss expectations. |

28 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | RESIDENTIAL REAL ESTATE SECURITIES |

Quarterly Update (continued)

| ► | Turmoil in the housing markets remains a significant concern. Home prices, as measured by the S&P/Case-Shiller Home Price Index (composite-10), were down 13.6% at the end of February from a year ago, and the index has declined for 20 consecutive months. Foreclosure filings were up 57% in March from a year ago, according to Realty Trac, marking the 27th consecutive month of year-over-year increases. |

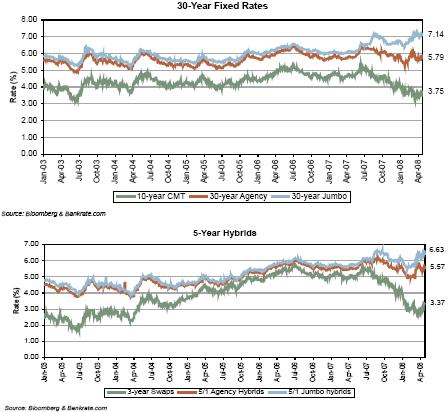

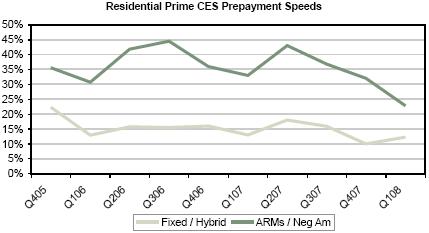

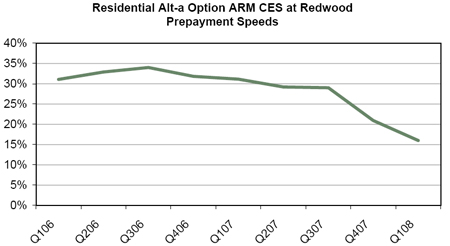

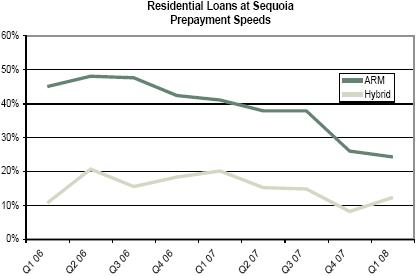

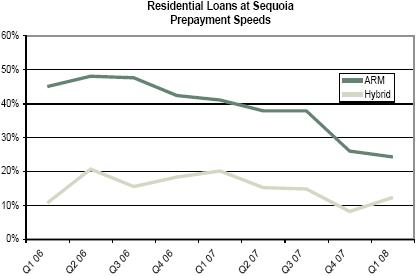

| ► | Prepayment rates on the residential loans in our portfolio declined or remained at low levels during the first quarter. The overall slowdown in refinancing activity has been largely due to increases in mortgage rates, declines in housing values, and tightening in underwriting standards. Prepayment speeds on prime residential ARMs and negative amortization mortgages declined to a 23% rate in the first quarter, compared to 32% in the fourth quarter. Prime residential hybrid loans prepaid at a 12% rate in the first quarter, compared to 10% in the fourth quarter. Prime residential alt-a option ARMs prepaid at a 16% rate in the first quarter, down from 21% in the fourth quarter. |

| ► | The new agency jumbo loan purchase programs (with loan limits of up to $729,750) began in April. Fannie Mae recently announced pricing of its jumbo loan product at 39 basis points over its conforming rate, as of April 17, 2008. This is encouraging, considering that recent premiums required by portfolio lenders have been about 150 basis points or more. It is still too early to assess the impact that these programs will have on new purchases and refinancings, however, as jumbo borrowers will face tighter underwriting guidelines, higher documentation standards, and declining home prices over the coming quarters. |

| | THE REDWOOD REVIEW 1ST QUARTER 2008 | 29 |

| | |

RESIDENTIAL REAL ESTATE SECURITIES | |

Prime Securities Portfolio

What is this?

Prime securities are mortgage-backed securities backed by high-credit quality residential loans. The borrowers typically have high FICO credit scores. The loans have relatively low loan-to-value (LTV) ratios. The following discussion refers only to the prime securities at Redwood, exclusive of any prime securities owned by Acacia and Redwood’s investments in Sequoia.

Quarterly Update

| ► | The following table presents the activity in our prime securities portfolio during the first quarter of 2008. |

| |

First Quarter Activity | |

| (by market value, $ in millions) | |

| | |

Market Value at December 31, 2007 | | $ | 129 | |

| Acquisitions | | | 38 | |

| Transfers to / from other portfolios | | | 1 | |

| Principal payments | | | (15 | ) |

| Discount amortization | | | 10 | |

| Changes in fair value, net | | | (65 | ) |

Market Value at March 31, 2008 | | $ | 98 | |

| ► | Total interest income generated by our prime securities was $17 million in the first quarter. Annualized interest income over our average amortized cost for prime securities was 26%. |

| ► | At March 31, 2008, our prime portfolio had an amortized cost of 25% of principal value and a fair value as reported on our balance sheet of 14% of principal value. The table below presents rating and vintage information of the prime securities in our portfolio at March 31, 2008. |

| | |

Prime Securities at Redwood | |

| By Rating and Vintage | |

| March 31, 2008 | |

| (by market value, $ in millions) | |

| | | | | <=2004 | | 2005 | | 2006 | | 2007 | | 2008 | | Total | |

| IGS | | | AAA | | $ | 1 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 1 | |

| | | AA | | | 1 | | | - | | | - | | | - | | | 3 | | | 4 | |

| | | A | | | - | | | - | | | 9 | | | - | | | 1 | | | 10 | |

| | | BBB | | | 2 | | | 1 | | | - | | | - | | | 2 | | | 5 | |

IGS | | | | | | 4 | | | 1 | | | 9 | | | - | | | 6 | | | 20 | |

| CES | | | BB | | | 12 | | | 7 | | | 2 | | | 3 | | | 1 | | | 25 | |

| | | B | | | 15 | | | 2 | | | 1 | | | 3 | | | 1 | | | 22 | |

| | | NR | | | 21 | | | 6 | | | 2 | | | 2 | | | - | | | 31 | |

CES Total | | | | | | 48 | | | 15 | | | 5 | | | 8 | | | 2 | | | 78 | |

Total | | | | | $ | 52 | | $ | 16 | | $ | 14 | | $ | 8 | | $ | 8 | | $ | 98 | |

| | |

| By Loan Type and Vintage | |

| | | <=2004 | | 2005 | | 2006 | | 2007 | | 2008 | | Total | |

| ARM | | $ | 4 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 4 | |

| Fixed | | | 14 | | | - | | | 9 | | | 4 | | | 4 | | | 31 | |

| Hybrid | | | 31 | | | 13 | | | 4 | | | 3 | | | 4 | | | 55 | |

| Option Arm | | | 3 | | | 3 | | | 1 | | | 1 | | | - | | | 8 | |

Total | | $ | 52 | | $ | 16 | | $ | 14 | | $ | 8 | | $ | 8 | | $ | 98 | |

30 | THE REDWOOD REVIEW 1ST QUARTER 2008 | |

| | | |

| | RESIDENTIAL REAL ESTATE SECURITIES |

Prime Securities Portfolio

Quarterly Update (continued)