| Introduction | 3 |

| | |

| Shareholder Letter | 4 |

| | |

| Quarterly Overview | 6 |

| | |

| Financial Insights | 10 |

| | |

| GAAP Income | 23 |

| | |

| Taxable Income | 26 |

| | |

| Dividends | 28 |

| | |

| Capital and Liquidity | 29 |

| | |

| Mark-to-Market Adjustments | 30 |

| | |

| Residential Real Estate Securities | 35 |

| | |

| Commercial Real Estate Securities | 42 |

| | |

| Investments in Sequoia | 44 |

| | |

| Investments in Acacia | 47 |

| | |

| | |

| Appendix | |

| | |

| Accounting Discussion | 50 |

| | |

| Glossary | 52 |

| | |

| Financial Tables | 61 |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 1 |

Cautionary Statement

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as "anticipate," "estimate," "will," "should," "expect," "believe," "intend," "seek," "plan" and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2008 under the caption "Risk Factors." Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) the ability of our current and future investments to generate attractive future cash flows and returns with a comfortable margin of safety, (ii) our ability to prosper in the current environment and build our business in the future, (iii) our belief that our common stock offering in January 2009, and the investment of the proceeds thereof, will be accretive to our future financial results and significantly extend the duration of our investment cash flows, (iv) our estimate of how long it will take to invest the proceeds of common stock offering in January 2009, (v) our expectation that we will generate over $100 million in positive cash flow from existing investments after operating and interest expenses in 2009, (vi) our expectations regarding future declines in home values, (vii) our credit loss expectations for investment grade securities and the sensitivity of investment grade securities to credit risk, (viii) our Board of Directors’ intention to pay a regular quarterly dividend of $0.25 per share in 2009 and our expectation that such dividends will constitute a return of capital, and (ix) our belief that government initiatives could result in an increase in mortgage prepayment rates.

Important factors, among others, that may affect our actual results include: changes in interest rates; changes in mortgage prepayment rates; the timing of credit losses within our portfolio; our exposure to adjustable-rate and negative amortization mortgage loans; the state of the credit markets and other general economic conditions, particularly as they affect the price of earning assets and the credit status of borrowers; the concentration of the credit risks we are exposed to; the ability of counterparties to satisfy their obligations to us; legislative and regulatory actions affecting the mortgage industry or our business; the availability of high quality assets for purchase at attractive prices; declines in home prices and commercial real estate prices; increases in mortgage payment delinquencies; changes in the level of liquidity in the capital markets which may adversely affect our ability to finance our real estate asset portfolio; changes in liquidity in the market for real estate securities, the re-pricing of credit risk in the capital markets, inaccurate ratings of securities by rating agencies, rating agency downgrades of securities, and increases in the supply of real estate securities available-for-sale, each of which may adversely affect the values of securities we own; the extent of changes in the values of securities we own and the impact of adjustments reflecting those changes on our income statement and balance sheet, including our stockholders’ equity; our ability to maintain the positive stockholders’ equity necessary to enable us to pay the dividends required to maintain our status as a real estate investment trust (REIT) for tax purposes; our ability to generate the amount of cash flow we expect from our investment portfolio; changes in our investment, financing, and hedging strategies and the new risks that those changes may expose us to; changes in the competitive landscape within our industry, including changes that may affect our ability to retain or attract personnel; our failure to manage various operational risks associated with our business; our failure to maintain appropriate internal controls over financial reporting; our failure to properly administer and manage our securitization entities; risks we may be exposed to if we expand our business activities, such as risks relating to significantly increasing our direct holdings of loans; limitations imposed on our business due to our REIT status and our status as exempt from registration under the Investment Company Act of 1940; our ability to successfully deploy the proceeds from our recent common equity offering and raise additional capital to fund our investing activity; and other factors not presently identified. This Redwood Review may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

| 2 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents, which are available through our web site, www.redwoodtrust.com.

This document, called the Redwood Review, provides supplemental information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as taxable income and economic book value. We believe that these figures provide additional insight into Redwood’s business and future prospects. In each case in which we discuss a non-GAAP metrics, you will find an explanation of how it has been calculated, why we think the figure is important, and a reconciliation between the GAAP and non-GAAP figures. We hope you find the Redwood Review to be helpful to your understanding of our business.

We thank you for your input and suggestions, which have resulted in our changing the form and content of the Redwood Review over time. We welcome your continued interest and comments.

| | | | | | | |

| Selected Financial Highlights |

| | | | | | | |

| Quarter:Year | GAAP Income per Share | Taxable Income per Share | Annualized Return on Equity | GAAP Book Value per Share | Economic Book Value per Share** | Total Dividends per Share |

| Q406 | $1.32 | $1.45 | 15% | $37.51 | $31.42 | $3.70 |

| Q107 | $0.66 | $1.48 | 8% | $34.06 | $32.22 | $0.75 |

| Q207 | $0.41 | $1.66 | 5% | $31.50 | $33.11 | $0.75 |

| Q307 | ($2.18) | $1.74 | (26%) | $5.32 | $27.55 | $0.75 |

| Q407* | ($36.49) | $0.92 | (610%) | $23.18 | $22.29 | $2.75 |

| Q108 | ($5.28) | $0.79 | (83%) | $17.89 | $18.04 | $0.75 |

| Q208 | ($1.40) | $0.11 | (28%) | $17.00 | $16.72 | $0.75 |

| Q308 | ($3.34) | $0.07 | (80%) | $12.40 | $13.18 | $0.75 |

| Q408 | ($3.46) | $0.25 | (103%) | $9.02 | $11.10 | $0.75 |

| * | The GAAP book value per share is after giving retroactive effect to the adoption of FAS 159 on January 1, 2008. Without giving retroactive effect to FAS 159, the GAAP book value per share was negative $22.18. |

| ** | Economic book value per share is calculated using bid-side marks for our financial assets and offer-side marks for our financial liabilities and we believe it more accurately reflects liquidation value than does GAAP book value per share. Economic book value is reconciled to GAAP book value in Table 6 of the Financial Tables. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 3 |

Dear Fellow Shareholders:

We all know by now that we are in the midst of a multifaceted downturn that is the worst since the Great Depression. But as someone who has been in the business world for many years and seen many cycles, I can assure you that this dreadful period will pass and that the economy, housing, and the financial system will right themselves — setting the stage, yet again, for a new cycle of growth to begin.

Before looking to the future, I want to take a moment to review 2008. While we were not surprised by the downturn, we underestimated the extraordinary level and complexity of the financial risks that market participants had taken, the extreme level of leverage employed, and the degree to which the fates of most financial institutions and markets were intertwined. With the clarity of hindsight, we were too early with some of the investments we made in the first half of 2008, although we believe these investments will ultimately yield acceptable returns.

On the positive side, we financed our 2008 investments with permanent capital, which allows us to hold these securities to maturity without the risk of margin calls or forced redemptions. In addition, starting in mid-June we ceased all investing activity, so that we could assess the impact of the unprecedented developments occurring in the financial markets and the implications of government intervention in the mortgage market. We resumed acquiring assets late in the fourth quarter, after we got our arms around the potential investment risks and rewards.

Looking ahead to 2009 and 2010, no matter how I adjust the prism, it’s not a pretty picture on so many levels. If there were an easy fix for this situation, the smart, hard-working, and experienced people addressing these problems would already have found it. In the absence of a silver bullet, we expect governments and the private sector to continue probing for solutions that enable homeowners and the markets to stabilize. Complicating the problem is the extreme level of anger from all quarters (in some cases, justifiably so) at banks, regulators, Wall Street, and Washington, among others. We are not yet at the point at which emotions can subside and people can resume working with and trusting each other again. We believe it is simply going to take time, and that eventually, market forces will take hold and provide the needed stability for the economy to recover.

Of course, of particular interest to Redwood is the health of the housing sector. It is clearly in Redwood’s interest for home values to stabilize as soon as possible. Unfortunately, despite all the good intentions of government programs, we believe that home values will continue to fall for some time, until housing inventories decline and values come back in line with income and rental fundamentals. The rapid increase in home values between January 2000 and December 2006 — a period during which home prices doubled — was driven not by fundamentals but by excessive leverage and creative "affordability" mortgage products that stretched the purchasing power of borrowers. Home ownership rates, which had averaged 65% in the 20 years prior to 2000, rose to 69% between 2004 and 2006. We believe we are now in the midst of a painful retrenchment period during which home values and home ownership rates will decline until they are in line with historical norms. Realistically, this is likely to take years.

| 4 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

We continue to offer support for government programs designed to alleviate the housing and credit crisis, but we believe that as a nation, we must determine what long-term role the government should play in the mortgage market. We are of the opinion that governmental entities can not do it all, and that private sector financing will be essential to getting the mortgage markets back on track. We will continue to support the creative exploration of securitization solutions and we look forward to resuming our role of facilitating credit risk transfers. In the meantime, we will continue to invest carefully and patiently in assets that we believe will generate attractive returns with comfortable margins of safety.

Redwood has a strong balance sheet, solid operations, and management depth, which we believe will enable us to prosper in the current environment and continue to build our franchise in the months and years ahead. We appreciate the support you have shown us throughout a very challenging year in 2008, and more recently during our capital raise. Rest assured that we remain focused on building shareholder value as we navigate through what is likely to be a challenging 2009.

George E. Bull, III

Chairman and CEO

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 5 |

Fourth Quarter 2008

In the spirit of keeping our commentary as topical as possible, we are changing the focal point of this letter to a Q&A discussion that recaps the most frequent questions investors asked during our recent common stock offering road show. Our usual summary of quarterly results seems out-of-date, as we released fourth quarter financial information a month-and-a-half ago in connection with our common stock offering. Rest assured that all of the numbers and usual commentary regarding the fourth quarter are addressed in detail in the relevant modules later in this Review.

Before we turn to the Q&A, let’s start with a quick recap of the current market conditions. Unfortunately, for many companies and homeowners, the real-life horror story continues. The credit markets remain under intense pressure as housing and economic activity continue to deteriorate, available credit and liquidity continue to contract, and the rating agencies busily issue a barrage of downgrades. In response, prices for residential and commercial real estate loans and securities saw a steep decline during the fourth quarter. So far in 2009, asset prices seem to be holding relatively steady from year-end levels. We would caution that this price stability may be temporary, especially as we expect significant additional downgrades of AAA residential and commercial mortgage-backed securities.

Various arms of the federal government have issued an alphabet soup of programs, legislation, and stimulus packages, all aimed at stemming the decline in home values, slowing the rate of foreclosures, and getting the economy and banking system back on track. Overall, these and other initiatives should be positive for Redwood. We support government policy aimed at helping homeowners, and actions that improve conditions in the housing market will directly benefit Redwood if they lead to lower losses and higher prepayments. We believe, however, that there is unlikely to be a near-term recovery in housing or the economy.

In spite of the gloomy outlook, and after spending four months watching and analyzing from the sidelines, we have been active investors in residential mortgage-backed securities (RMBS) since the latter part of the fourth quarter. We will go into more detail on the prospective returns from these investments later in the Review, but we believe we can now make attractive long-term residential mortgage-related investments with a comfortable margin of safety. We invested $50 million in the fourth quarter of 2008 and $98 million in the first quarter through February 24, 2009. The vast majority of these investments were in senior residential mortgage securities backed by prime or near-prime loans.

It was clear from our market analysis that the size of the investment opportunity was substantially larger than the excess capital we had on hand to invest. After much research and analysis, we concluded that raising common stock equity (at the right price) would be accretive to earnings after the proceeds were deployed into new investments and, therefore would be in the best interest of the company and shareholders. When we commenced the offering road show in mid-January, we were immediately tested by strong stock market headwinds. Nevertheless, thanks to the support of existing shareholders and some new large institutional investors we were successful in raising $283 million of new equity capital for Redwood.

During the road show, we met with over 100 institutional investors who asked many thoughtful, hard-hitting questions. The majority of these questions touched on the purpose of the offering, the investment opportunities we see, the impact of government initiatives, and the sensitivity of our balance sheet and cash flows to further credit deterioration. Below are the most frequent questions and our answers.

| 6 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Fourth Quarter 2008 (continued)

The Offering

Q: Did Redwood need to raise additional capital?

A: No, we did not need to raise capital. This was an offensive capital raise. At December 31, 2008, we had $126 million of unrestricted cash and no short-term debt. We also expect to generate over $100 million in positive cash flow from our existing investments after operating and interest expenses in 2009.

Q: Will the offering be accretive?

A: One of the core values that we remain deeply committed to (and which was articulated at Redwood’s inception in 1994) is this: We ask for new capital from our shareholders only when we believe we have investment opportunities in our business that should lead us to higher levels of earnings and dividends per share. We believe this offering will be accretive since we will be able to leverage our existing overhead to invest the additional capital without adding personnel, systems, or space. Furthermore, Redwood will benefit as the planned investments will significantly extend the duration of our investment cash flows.

Q: Why common equity?

A: We reviewed several alternative forms of capital and structures that did not involve common equity. The net result of this review was that these alternative forms of capital were either prohibitively expensive, or would give rise to REIT or Investment Company Act issues, or just added too much complexity to the story. In the end, we decided that common equity was the best alternative for Redwood and its shareholders. Common equity was simple, transparent, and appealing to the broadest range of potential investors.

The Investment Opportunity

Q: Why now? Many other smart investors have lost a fortune calling a bottom to this down cycle.

A: We are not in the business of calling market tops or bottoms, but we do have a view on when it is a better time to invest and when it is a better time to sell. We are now active buyers.

We have based our analysis on our expectation that more bad things will happen in housing. In our base case, we expect, on average, another 18% decline in nationwide home values and as much as a 35% further decline in some major markets. We make our investment decisions based on a range of outcomes. In this market, our target investment has attractive mid- to high-teen returns in an unlevered base case, well-protected stress case returns, and exceptional upside returns if we benefit from faster prepayments or lower than expected credit losses.

As we intend to fund these investments with permanent capital, we can sustain any future price volatility without the risk of margin calls or equity redemptions. Furthermore, if market discount rates go higher and asset prices go lower, it does not change our long-term investment returns. So if we are a little early or a little late, it’s okay. We are still acquiring assets that we believe will generate attractive long-term cash flows.

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 7 |

Fourth Quarter 2008 (continued)

Q: How will you invest the proceeds?

A: Our primary focus will be on assets similar to our recent purchases — senior cash flows from prime and near-prime residential mortgage securities. To a lesser degree, we may selectively purchase very credit-sensitive securities with a shorter duration, but with the expectation of high projected rates of return. We have no current plans to purchase commercial mortgage-backed securities, although we constantly monitor the commercial market and the steps the government is taking in this area. Additionally, we may use a portion of the proceeds to co-invest with third party investors in investment funds which we may sponsor and manage.

Q: What separates you from your competitors?

A: To make successful investment decisions, you need both the right people and the right tools. Over the past 14 years, we have built a team comprised of seasoned mortgage and capital markets professionals. These include former loan servicers, originators, underwriters, as well as bond research analysts, structuring experts, and senior managers with extensive Wall Street investment backgrounds. They provide invaluable experience and street-level insights into our investment assumptions and decisions. But that’s not enough. To properly evaluate the projected cash flow from a residential mortgage-backed security (RMBS), you need to have an opinion on each of the thousands of underlying loans. The market often only gives us an hour to bid on a security. Traditional underwriting methods and analytical tools are too slow to react. That is why our propriety analytical tools are so crucial — they allow us to leverage our extensive mortgage knowledge to make quick, well-informed decisions in the limited time available without sacrificing detailed loan level analysis.

Q: How long will it take to invest the proceeds?

A: We intend to invest the proceeds in a focused and patient manner. We conservatively estimate it will take about six months to invest the proceeds from the offering, but we caution that the time period is difficult to project. For example, we invested $50 million in the fourth quarter, but $33 million was invested within a short period in mid-December. In contrast, from mid-June through late October 2008, we were on the sidelines. The opportunities to invest the proceeds can change rapidly depending upon a number of factors including changes in the economy, the state of the banking industry, and changes in government regulation and policy. We consistently bid on considerably more securities than we purchase.

Balance Sheet and Cash Flows

Q: Can you discuss the credit sensitivity of your balance sheet? What are your cash flow expectations for your existing investment portfolio?

A: These are critical questions that require reference to data and tables. Please see the Real Estate Securities at Redwood section (pages 14-17) and the Cash Flow section (pages 20-22) in the Financial Insights section of this Redwood Review for an analysis that addresses these questions.

| 8 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Fourth Quarter 2008 (continued)

Governmental Actions

Q: Please provide the Company’s thoughts on loan modifications and the impact on Redwood’s returns.

A: As the government becomes further enmeshed in the banking system, and as support builds for a bankruptcy law cramdown amendment that will enable bankruptcy courts to modify mortgage loan terms, we believe the industry will continue to see mounting pressure (and incentives) to accept loan modifications (or be forced to accept them through a cramdown in bankruptcy).

At Redwood, we believe that loan modifications will have a relatively small financial impact on our existing portfolio. We expect that the biggest impact of modifications will be on lower-rated non-prime securities. Our capital investment in these types of securities is minimal ($0.24 per share at December 31, 2008). For new investments, our analysis takes into account the likely negative impact to investors of projected loan modifications.

Q: How would the proposal to allow for bankruptcy cramdowns affect Redwood?

A: We don’t think cramdowns will have a major impact on Redwood. Like modifications, we believe cramdowns will have more of an impact on non-prime securities, where we have an increasingly smaller exposure. We note that for December 2008 only 0.22% of prime borrowers were in bankruptcy proceedings compared to 2.65% for subprime borrowers, according to data from LoanPerformance.

The proposed cramdown amendment may result in additional downgrades of AAA securities and additional forced selling by investors whose capital allocation is ratings-sensitive. This would present attractive investment opportunities for Redwood.

We are delighted that we completed the capital raise during difficult market conditions. We are pleased by the support our equity offering received from several new and existing shareholders. Now comes the crucial job of successfully deploying the capital. We intend to invest patiently and wisely, and we fully appreciate the trust and confidence you have shown us. Thank you for your continuing support.

| |

Martin S. Hughes President, Chief Financial Officer, and Co-Chief Operating Officer | Brett D. Nicholas Chief Investment Officer and Co-Chief Operating Officer |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 9 |

Book Value

Summary

| u | The following supplemental non-GAAP balance sheet presents our assets and liabilities as calculated under GAAP and adjusted to reflect our estimate of economic value. We show our investments in the Redwood Opportunity Fund, L.P. (the Fund) and the Sequoia and Acacia securitization entities in separate line items, similar to the equity method of accounting, reflecting the reality that the underlying assets and liabilities owned by these entities are legally not ours. We own only the securities or interests that we have acquired from these entities. |

| u | This table, except for our estimates of economic value, is derived from the consolidating balance sheet presented on page 19. Our estimate of economic value of $11.10 per share is calculated using bid-side asset marks, as required to determine fair value under GAAP. This method of calculating economic value more closely represents liquidation value and does not represent the higher amount we would have to pay at the offered-side to replace our existing assets. |

| | | | | | | | | | |

| Components of Book Value |

| December 31, 2008 |

| ($ in millions, except per share data) |

| | | | | | | | | | |

| | | As Reported | | Adj. | | | Management's Estimate of Economic Value |

| Cash and cash equivalents | $ | 126 | | $ | | | $ | 126 | |

| | | | | | | | | | |

| Real estate securities at Redwood | | | | | | | | | |

| Residential | | 145 | | | | | | 145 | |

| Commercial | | 42 | | | | | | 42 | |

| CDO | | 4 | | | | | | 4 | |

| Total real estate securities at Redwood | | 191 | | | | | | 191 | |

| | | | | | | | | | |

| Investments in the Fund | | 28 | | | | | | 28 | |

| Investments in Sequoia | | 97 | | | (32) | (a) | | 65 | |

| Investments in Acacia | | 16 | | | (7) | (b) | | 9 | |

| Total securities and investments | $ | 332 | | | | | $ | 293 | |

| | | | | | | | | | |

| Long-term debt | | (150) | | | 108 | (c) | | (42) | |

| | | | | | | | | | |

| Other assets/liabilities, net (d) | | (6) | | | | | | (6) | |

| | | | | | | | | | |

| Stockholders' equity | $ | 302 | | | | | $ | 371 | |

| | | | | | | | | | |

| Book value per share | $ | 9.02 | | | | | $ | 11.10 | |

(a) Our Sequoia investments consist of credit enhancement securities, investment grade securities, and interest-only securities issued by Sequoia entities. We calculated the $65 million estimate of economic value for these securities using the same valuation process that we followed to fair value our other real estate securities. In contrast, the $97 million of GAAP carrying value of these investments represents the difference between residential real estate loans owned by the Sequoia entities and the asset-backed securities (ABS) issued by these entities to third-party investors. Under GAAP, we account for these loans and ABS issued at cost, not at fair value.

(b) Our Acacia investments consist of ABS and equity interests issued by Acacia entities; we also have management agreements with each entity. The $9 million estimate of economic value of our investments in Acacia entities represents the fair value of the ABS acquired plus the net present value of projected cash flows from our Acacia management fees discounted at 45%. We valued our equity interests at zero. In contrast, the $16 million GAAP value of these investments represents the difference between securities owned by the Acacia entities and the ABS issued by these entities to third-party investors. Under GAAP we account for these securities and ABS issued at fair value.

(c) We have issued $150 million of 30-year long-term debt at an interest rate of LIBOR plus 225 basis points. Under GAAP, this debt is carried at cost. Economic value is difficult to estimate with precision as the market for this debt is currently inactive. We estimated the $42 million economic value using the same valuation process used to fair value our other financial assets and liabilities. Estimated economic value is $108 million lower than our GAAP carrying value because given the significant overall contraction in credit availability and re-pricing of credit risk, we believe that if we had issued this long-term debt at December 31, 2008, investors would have required a substantially higher interest rate.

(d) Other assets/liabilities, net are comprised of real estate loans of $3 million, $4 million of deferred taxes, $6 million of accrued interest receivable, and other assets of $27 million, less dividends payable of $25 million and accrued interest and other liabilities of $21 million.

| 10 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Book Value (continued)

| u | In the fourth quarter, our GAAP book value declined by $110 million, or $3.38 per share, to $9.02 per share. Our estimated economic book value declined by $67 million, or $2.08 per share, to $11.10 per share. These declines were largely due to mark-to-market write-downs that were driven by the continuing and unprecedented lack of liquidity in the marketplace. Credit deterioration continues to persist in most parts of our portfolio at rates consistent with the expectations we established in prior quarters. We believe the steep rate of market price declines in the fourth quarter was exaggerated relative to the change in, and trend of, the fundamentals underlying these securities. |

| u | Based on our estimate of the future loss-adjusted cash flows underlying our calculation of economic book value at December 31, 2008, the overall cash flow yield for our $419 million economic value of financial assets was 21% (including $126 million of cash yielding less than 1%) and 36% (excluding cash). The implied yield for our $42 million of market value of financial liabilities was 18%. Details and caveats regarding the use and determination of these calculations and reconciliations of non-GAAP measures to GAAP are found later in this Review. |

| u | The following table highlights the components of the change in economic book value per share that occurred during the fourth quarter. This table highlights the performance of our different investment categories and shows other sources and uses of cash that impacted economic value. Our investment performance, expressed below as the change in the non-GAAP economic value of investments, gives effect to mark-to-market adjustments, new investments, and principal and interest collected. |

| | | | | | |

| Changes in the Components of Economic Value Per Share |

| Three Months Ended December 31, 2008 |

| (in $ per share) |

| | | | | | |

| | | | | | |

| Management's estimate of economic value at 9/30/08 | | | $ | 13.18 | |

| | | | | | |

| Change in economic value of securities and investments | | | | | |

| Real estate securities at Redwood | | | | (1.73) | |

| Investments in the Fund | | | | (0.12) | |

| Investments in Sequoia | | | | 0.21 | |

| Investments in Acacia | | | | (0.09) | |

| Total change in economic value of securities and investments | | | | (1.73) | |

| | | | | | |

| Operating expenses and working capital | | | | (0.51) | |

| Interest expense and change in long-term debt valuation | | | | 0.98 | |

| Equity issuance, net | | | | (0.07) | |

| Changes in economic value before dividends | | | | (1.33) | |

| | | | | | |

| Dividends | | | | (0.75) | |

| | | | | | |

| Total changes to economic value | | | | (2.08) | |

| | | | | | |

| Management's estimate of economic value at 12/31/08 | | | $ | 11.10 | |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 11 |

Book Value (continued)

Summary (continued)

| u | The following table shows the components of management’s estimate of economic book value at December 31, 2008 on a pro forma basis after giving retroactive effect to the receipt of $283 million of net proceeds from our public offering of common stock in January 2009. |

| | | | | | | | | | | | | | | |

| Pro forma Components of Economic Value |

reflecting the January 2009 equity offering (a) |

| ($ in millions, except per share data) |

| | | | | | | | | | | | | | | |

| | | December 31, 2008 | | Pro forma | |

| | | | | | | | | | | | | | | |

| | | | Management's Estimate of Economic Value | Per Share | | Management's Estimate of Economic Value | Per Share | |

| Cash and cash equivalents | | $ | 126 | | | $ | 3.76 | $ | 409 | | | $ | 6.81 | |

| | | | | | | | | | | | | | | |

| Total securities and investments | | | 293 | | | | 8.77 | | 293 | | | | 4.88 | |

| | | | | | | | | | | | | | | |

| Long-term debt | | | (42) | | | | (1.25) | | (42) | | | | (0.70) | |

| | | | | | | | | | | | | | | |

| Other assets/liabilities, net | | | (6) | | | | (0.18) | | (6) | | | | (0.10) | |

| | | | | | | | | | | | | | | |

| Stockholders' equity | | $ | 371 | | | $ | 11.10 | $ | 654 | | | $ | 10.89 | |

| (a) Reflects net proceeds of $283 million and issuance of 26,450,000 shares from the common stock offering. |

| u | The shares of common stock issued in the January 2009 public offering were priced at $11.25 per share and, after underwriting fees and other offering expenses of $0.53 per share, the net proceeds to Redwood were $10.72 per share. This is the reason pro forma economic book value declined from $11.10 per share pre-offering to $10.89 per share post-offering. |

| u | At year-end, our cash was $3.76 per share and management’s non-GAAP estimate of the economic value of our securities and investments was $8.77 per share. After giving retroactive effect to the offering, on a pro forma basis, our cash was $6.81 per share and management’s non-GAAP estimate of the economic value of our securities and investments was $4.88 per share. This table highlights that our cash position, after the offering, accounts for a significant amount of value per share and, as a result, our future returns will depend upon our investment success. |

| 12 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Quarterly Activity

| u | The total fair value of securities at Redwood (which is the same as GAAP carrying value) decreased during the fourth quarter by $37 million to $191 million. The table below presents the changes in fair value for our real estate securities portfolio during the fourth quarter. |

| | | | |

| Real Estate Securities at Redwood |

| Three Months Ended December 31, 2008 |

| ($ in millions) |

| | | | |

| Fair value at September 30, 2008 | $ | 228 | |

| | | | |

| Acquisitions | | 50 | |

| Sales | | (1) | |

| Principal payments | | (10) | |

| Discount amortization | | (2) | |

| Mark-to-market adjustments, net | | (74) | |

| | | | |

| Fair value at December 31, 2008 | $ | 191 | |

| u | In the fourth quarter we invested $46 million in AAA RMBS at a weighted average price of 64% of face value and with average credit support of 12 percentage points. In addition, we invested $4 million in residential CES at a weighted average price of 2% of face value. We have continued to acquire assets in the first quarter of 2009 and through February 24, 2009, we invested $98 million in IGS at a weighted average price of 63% of face value and with average credit support of 11 percentage points. The vast majority of these IGS are in senior cash flow securities backed by prime or near-prime loans. |

Impact of Potential Credit Ratings Downgrades

| u | Our investment decisions are based on our projection of the underlying collateral cash flows and the level of subordination protecting against future credit losses. We do not rely on credit ratings as part of our investment decision process. We emphasize this point because in the near future we expect significant downgrades by rating agencies of prime and non-prime AAA RMBS issued from 2005 through 2008. The overall credit performance of loans underlying these vintages is significantly worse than the rating agencies’ original expectations. In many cases, we expect securities currently rated AAA to be downgraded below investment grade, and in some cases downgraded to CCC. |

| u | Additionally, the proposed bankruptcy cramdown legislation, if enacted, could result in additional downgrades of prime and Alt-A RMBS, as technical loss sharing arrangements in many of these securitization structures require that the AAA securities share in a portion of the credit losses resulting from bankruptcies. |

| u | So what does this all mean for Redwood? Although there could be downward pressure on prices for our existing portfolio, there may also be buying opportunities as many current AAA investors could be pressured to sell. Some AAA investors are rating-sensitive (meaning they can only own securities that are rated AAA) and others, such as banks, would face significantly higher capital requirements to hold lower-rated securities. |

| u | It also means that next quarter we are going to re-think how we present our information on our securities. We are considering presenting our residential securities by their senior and subordinate cash flow designations instead of IGS and CES (as presented in the table on the next page). Unfortunately, communicating the Redwood story just never seems to get any easier. Nevertheless, we remain committed to transparency and will adapt our presentations to keep up with the changing times. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 13 |

Components

Cash and Cash Equivalents

| u | At December 31, 2008, we had $126 million in cash and cash equivalents, or $3.76 per share. Adjusted for the $283 million net proceeds from our January 2009 public offering of common stock, we had, on a pro forma basis, $409 million in cash and cash equivalents, or $6.81 per share. All of our cash is currently invested in U.S. Treasury Bills or bank deposits insured by the Federal Deposit Insurance Corporation. |

Real Estate Securities at Redwood

| u | The following table provides a breakout of our real estate securities portfolio by residential, commercial, and CDO, and by vintage at December 31, 2008. |

| | | | | | | | | | | | |

| Real Estate Securities at Redwood |

| December 31, 2008 |

| ($ in millions) |

| | | | | | | | | | | | | | | % of Total | |

| | | <=2004 | | 2005 | | 2006-2008 | | Total | | Securities | |

| | | | | | | | | | | | | | | | | | |

| Residential | | | | | | | | | | | | | | | | | |

| IGS | | | | | | | | | | | | | | | | | |

| Prime | | $ | 16 | | | $ | 41 | | | $ | 16 | | | $ | 73 | | | | 38 | % | |

| Non-prime | | | - | | | | 25 | | | | 17 | | | | 42 | | | | 22 | % | |

| Total IGS | | $ | 16 | | | $ | 66 | | | $ | 33 | | | $ | 115 | | | | 60 | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| CES | | | | | | | | | | | | | | | | | | | | | |

| Prime | | $ | 18 | | | $ | 2 | | | $ | 2 | | | $ | 22 | | | | 12 | % | |

| Non-prime | | | 1 | | | | 1 | | | | 6 | | | | 8 | | | | 4 | % | |

| Total CES | | $ | 19 | | | $ | 3 | | | $ | 8 | | | $ | 30 | | | | 16 | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Residential | | $ | 35 | | | $ | 69 | | | $ | 41 | | | $ | 145 | | | | 76 | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Commercial CES | | $ | 10 | | | $ | 9 | | | $ | 23 | | | $ | 42 | | | | 22 | % | |

| CDO | | $ | - | | | $ | 4 | | | $ | - | | | $ | 4 | | | | 2 | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 45 | | | $ | 82 | | | $ | 64 | | | $ | 191 | | | | 100 | % | |

| 14 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Real Estate Securities at Redwood (continued)

Residential IGS

| u | Our investment strategy has shifted over the past year towards acquiring residential prime and near-prime senior cash flows with a comfortable margin of safety to protect against escalating credit losses. As a result, the fair value of our residential IGS at December 31, 2008 was $115 million, representing 60% of our total securities portfolio at December 31, 2008, up from 51% at the end of the third quarter and 11% at the end of last year. |

| u | Due to the unprecedented dislocations in the credit markets, we are currently able to buy IGS at significant discounts to principal value. Our returns on these IGS investments will be based on how much principal and interest we ultimately receive and how quickly we receive it. As these investments primarily represent senior cash flows, we do not expect a high level of losses. Our IGS returns are generally more sensitive to changes in prepayment rates than they are to credit risk. |

| u | The following table presents the components of fair value (which equals GAAP carrying value determined in accordance with GAAP) for residential prime and non-prime IGS at Redwood at December 31, 2008. |

| | | | | | | |

| Residential Investment Grade Securities at Redwood |

| December 31, 2008 |

| ($ in millions) |

| | | | | | | |

| | | | | | | |

| | | Prime | | Non-Prime | | Total |

| Current face | $ | 195 | $ | 104 | $ | 299 |

| Unamortized premium (discount), net | | (100) | | (44) | | (144) |

| Discount designated as credit reserve | | (24) | | (7) | | (31) |

| Amortized cost | | 71 | | 53 | | 124 |

| | | | | | | |

| Unrealized gains | | 3 | | 1 | | 4 |

| Unrealized losses | | (1) | | (12) | | (13) |

| | | | | | | |

| Fair value | $ | 73 | $ | 42 | $ | 115 |

| | | | | | | |

| Fair value as a percentage of face | | 37% | | 40% | | 38% |

| u | The $115 million fair value of our IGS represents 38% of face value at December 31, 2008. The IGS credit reserve of $31 million represents 10% of face value, while the IGS unamortized discount (the face amount we expect to recoup over time) of $144 million represents 48% of face value. |

| u | The lifetime prepayment assumptions used to value our IGS range from 8 to 15 CPR for securities backed by prime loans and from 2 to 10 CPR securities backed by non-prime loans. While these rates are representative of current prepayment speeds for non-agency securities, we note that they are extremely low relative to historical prepayment rates. |

| u | As has been well publicized, many borrowers are currently having difficulty refinancing due to high non-agency mortgage rates, insufficient home equity, and stringent underwriting. A pick-up in refinance activity either from lower non-agency mortgage rates or from the government’s initiatives to stimulate refinancing would likely benefit our IGS returns. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 15 |

Book Value (continued)

Components (continued)

Real Estate Securities at Redwood (continued)

Residential CES

| u | The fair value of our residential CES portfolio was $30 million, representing 16% of our total securities portfolio at December 31, 2008, down from 42% a year ago. This decline resulted from a reduction in market values due to negative mark-to-market adjustments and from our decision to re-direct our investment focus to senior cash flows (i.e., IGS). |

| u | We acquire CES at a significant discount to principal value, as credit losses could reduce or eliminate the principal value of these bonds. In an ideal environment, we would experience fast prepayments and low credit losses, allowing us to recover a substantial part of the discount as income. Conversely, the least beneficial environment is the environment we are currently experiencing, with slow prepayments and high credit losses. |

| u | The table below presents the components of fair value (which equals GAAP carrying value) of residential CES at Redwood at December 31, 2008. |

| | | | | | | | | |

| Residential Credit Enhancement Securities at Redwood |

| December 31, 2008 |

| ($ in millions) |

| | | | | | | | | |

| | | Vintage | | | | |

| | | <=2004 | | >=2005 | | | Total | |

| Current face | $ | 208 | $ | 593 | | $ | 801 | |

| Unamortized premium (discount), net | | (35) | | (33) | | | (68) | |

| Discount designated as credit reserve | | (151) | | (549) | | | (700) | |

| Amortized cost | | 22 | | 11 | | | 33 | |

| | | | | | | | | |

| Unrealized gains | | 1 | | 3 | | | 4 | |

| Unrealized losses | | (5) | | (2) | | | (7) | |

| | | | | | | | | |

| Fair value | $ | 18 | $ | 12 | | $ | 30 | |

| | | | | | | | | |

| Fair value as a percentage of face | | 9% | | 2% | | | 4% | |

| u | We believe it is best to analyze and discuss our CES investments by vintage — 2004 and prior and 2005 to 2008 — as the potential return profiles differ significantly. |

| u | The fair value of our CES from 2004 and prior vintages totals $18 million, representing 9% of face value. From a credit standpoint, these vintages are generally performing in line with or better than our initial expectations. We believe there is still potential earnings upside from these investments if actual credit losses are below our credit reserves of $151 million. These investments would also benefit from an increase in refinance activity. |

| u | The fair value of our CES from 2005 to 2008 vintages totals $12 million, representing 2% of face value. Based on the poor credit trends underlying these vintages, we expect future credit losses to eliminate nearly all of the principal or face amount of these securities. Therefore, the fair value ascribed to these securities primarily represents the present value of future interest we expect to collect before actual credit losses are realized. Even if prepayments increase, it will be too late to benefit these CES to any material extent. We do not expect any upside from these investments. |

| 16 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Components (continued)

Real Estate Securities at Redwood (continued)

Commercial CES

| u | Our commercial CES represents 22% of our securities portfolio, down from 41% a year ago. We have not purchased commercial securities since the first quarter of 2007 and we remain on the sidelines. Due to the continuing deterioration in the fundamentals (increasing vacancies, falling rents, and difficulty in refinancing) in an increasingly weakening economy, we wrote down our commercial CES to $42 million, or 8% of face value in the fourth quarter. |

| u | The table below presents the components of fair values (which equals GAAP carrying values) of commercial CES at Redwood at December 31, 2008. |

| | | | | | | | | | | | | |

| Commercial Credit Enhancement Securities at Redwood |

| December 31, 2008 |

| ($ in millions) |

| | | | | | | | | | | | | |

| | | Vintage | | | | |

| | | <=2004 | | 2005 | | 2006 | | 2007 | | | Total | |

| Current face | $ | 48 | $ | 124 | $ | 261 | $ | 81 | | $ | 514 | |

| Unamortized premium (discount), net | (6) | | 12 | | 23 | | 7 | | | 36 | |

| Discount designated as credit reserve | (34) | | (123) | | (260) | | (81) | | | (498) | |

| Amortized cost | | 8 | | 13 | | 24 | | 7 | | | 52 | |

| | | | | | | | | | | | | |

| Unrealized gains | | 2 | | - | | - | | - | | | 2 | |

| Unrealized losses | | - | | (4) | | (7) | | (1) | | | (12) | |

| | | | | | | | | | | | | |

| Fair value | $ | 10 | $ | 9 | $ | 17 | $ | 6 | | $ | 42 | |

| | | | | | | | | | | | | |

| Fair value as a percentage of face | | 21% | | 7% | | 7% | | 7% | | | 8% | |

| u | Our $498 million commercial CES credit reserve reflects our belief that we will not receive much principal from these investments. Since commercial CES do not prepay like residential securities, our returns will be based on our receiving interest on the outstanding face value until the anticipated losses occur. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 17 |

Investments in the Fund

| u | The fair value (which equals GAAP carrying value) of our investments in the Fund was $28 million at December 31, 2008. This investment represents a 52% interest in the Fund, which closed in March 2008 and is fully invested, primarily in non-prime RMBS. The Fund is managed by a subsidiary of Redwood. |

Investments in Sequoia

| u | At December 31, 2008, the fair value of our investments in Sequoia was $65 million and the GAAP carrying value was $97 million. These investments consist primarily of interest-only securities (IOs) and to a lesser extent IGS and CES. Our returns on these IOs are most sensitive to prepayments and faster prepayments would negatively impact returns. Material changes in interest rates also have a short-term impact on cash flows generated. |

Investments in Acacia

| u | At December 31, 2008, the fair value of our investments in Acacia was $9 million and the GAAP carrying value was $16 million. These investments represent equity interests and ABS issued from our Acacia CDO securitization entities and the management fees we receive from those entities. Due to various provisions in each CDO securitization, our equity interests are generally cut off from cash flows and we only expect limited returns on the ABS issued we own. We value the management fees at $5 million, which equals our projected management fees discounted at a 45% rate. |

Short-term Debt

| u | We had no short-term debt at December 31, 2008. We believe that it is currently prudent to fund our investments with permanent capital (equity and long-term debt) that is not subject to margin calls and financial covenants. |

Long-term Debt

| u | In 2006 and 2007, we issued $150 million of 30-year long-term debt at Redwood (due in 2037) at an interest rate of LIBOR plus 2.25%. Under GAAP, this debt is carried at cost. At December 31, 2008, we estimated a $63 million fair value for this liability using the same valuation process used to fair value our other financial assets and liabilities. Estimated economic value is lower than our GAAP carrying value because we believe that investors would have required an 18% yield on this debt (currently equal to LIBOR + 16.75%) had we issued it at December 31, 2008, and the low LIBOR rates have decreased anticipated interest payments. |

| 18 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Consolidating Balance Sheet

| u | GAAP requires us to consolidate all of the assets and liabilities of the Sequoia and Acacia securitization entities (which had a combined $5.2 billion of assets and $5.1 billion of liabilities at December 31, 2008), even though the assets are owned by securitization entities and the liabilities are obligations of these securitization entities payable only from the cash flows generated by the assets owned by these entities. Additionally, we are required to consolidate all of the assets and liabilities of the Fund, even though Redwood owns only the general partnership interest in the Fund and just over half of the limited partnership interests. |

| u | The table below shows the consolidating components of our consolidated balance sheet at December 31, 2008. The purpose of this presentation is to show the effect each of the components had on our consolidated shareholders’ equity at December 31, 2008. The Fund, Sequoia, and Acacia components represent investments and are not separate business segments. |

| | | | | | | | | | | | | | | | | | | | |

| Consolidating Balance Sheet |

| December 31, 2008 |

| ($ in millions) |

| | | | | | | | | | | | | | | | | | | | |

| | | Redwood | The Fund | | Sequoia | | Acacia | Intercompany | | Redwood Consolidated |

| Real estate loans | | $ | 3 | | $ | - | | $ | 4,644 | | $ | 12 | | $ | - | | $ | 4,659 | |

| Real estate securities | | | 191 | | | 48 | | | - | | | 408 | | | (74) | | | 573 | |

| Investments in the Fund | | | 28 | | | - | | | - | | | - | | | (28) | | | - | |

| Investments in Sequoia | | | 97 | | | - | | | - | | | - | | | (97) | | | - | |

| Investments in Acacia | | | 16 | | | - | | | - | | | - | | | (16) | | | - | |

| Other investments | | | - | | | - | | | - | | | 78 | | | - | | | 78 | |

| Cash and cash equivalents | | | 126 | | | - | | | - | | | - | | | - | | | 126 | |

| Total earning assets | | | 461 | | | 48 | | | 4,644 | | | 498 | | | (215) | | | 5,436 | |

| | | | | | | | | | | | | | | | | | | | |

| Other assets | | | 37 | | | 5 | | | 44 | | | 60 | | | - | | | 146 | |

| | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 498 | | $ | 53 | | $ | 4,688 | | $ | 558 | | $ | (215) | | $ | 5,582 | |

| | | | | | | | | | | | | | | | | | | | |

| Short-term debt | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Other liabilities | | | 46 | | | 2 | | | 9 | | | 195 | | | - | | | 252 | |

| Asset-backed securities issued - Sequoia | - | | | - | | | 4,582 | | | - | | | (74) | | | 4,508 | |

| Asset-backed securities issued - Acacia | - | | | - | | | - | | | 347 | | | - | | | 347 | |

| Long-term debt | | | 150 | | | - | | | - | | | - | | | - | | | 150 | |

| Total liabilities | | | 196 | | | 2 | | | 4,591 | | | 542 | | | (74) | | | 5,257 | |

| | | | | | | | | | | | | | | | | | | | |

| Minority interest | | | - | | | 23 | | | - | | | - | | | - | | | 23 | |

| | | | | | | | | | | | | | | | | | | | |

| Total stockholders’ equity | | | 302 | | | 28 | | | 97 | | | 16 | | | (141) | | | 302 | |

| | | | | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders’ equity | $ | 498 | | $ | 53 | | $ | 4,688 | | $ | 558 | | $ | (215) | | $ | 5,582 | |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 19 |

| u | As a supplement to the Consolidated Statement of Cash Flows included in our Annual Report on Form 10-K, we have included the table below, which summarizes the sources and uses of our cash during the fourth quarter in a manner consistent with the way management analyzes them. This table excludes the gross cash flows generated by our Sequoia and Acacia securitization entities and the Fund (cash flows that are not available to Redwood), but does include the cash flows distributed to Redwood as a result of our investments in these entities. |

| u | As shown in the table below, fourth quarter business cash flow totaled $27 million, down $19 million from the third quarter. The majority of the decline resulted from a $20 reduction in cash flow received from our investments, which was consistent with our warning in the third quarter Review. Other factors included a $1 million reduction in asset management fees and a $2 million reduction in cash operating expenses. |

| |

| Redwood |

| Sources and Uses of Cash |

| Three Months Ended December 31, 2008 |

| ($ in millions) |

| | | | |

| Beginning cash balance at 9/30/08 | $ | 177 | |

| Business Cash Flows: | | | |

| Cash flow from investments | $ | 40 | |

| Asset management fees | | 1 | |

| Operating expenses | | (12) | |

| Interest expense on debt | | (2) | |

| Total business cash flows | | 27 | |

| | | | |

| Other Sources and Uses: | | | |

| Proceeds from asset sales | | 1 | |

| Proceeds from equity issuance | | 2 | |

| Changes in working capital | | 2 | |

| Acquistions | | (50) | |

| Dividends | | (26) | |

| Repayment of debt | | (7) | |

| Net other uses | | (78) | |

| | | | |

| Net uses of cash | $ | (51) | |

| Ending cash balance at 12/31/08 | $ | 126 | |

| u | The beginning cash balance at September 30, 2008 and the ending cash balance at December 31, 2008 presented in the table above are GAAP amounts. The presentation of our sources and uses of cash in the table is derived from our GAAP Consolidated Statement of Cash Flows for the fourth quarter of 2008 by aggregating and netting all items within our GAAP Consolidated Statement of Cash Flows in order to present our sources and uses of cash in a manner consistent with the way management analyzes them. |

| 20 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

| u | Our cash flow from investments in the fourth quarter declined from the prior quarter due for three reasons; slower prepayments (reducing principal paid on our securities), lower interest rates (reducing the interest paid on our securities and investments in Sequoia), and the lack of one-time events (which had increased our third quarter cash flows from our investments in the Fund and in Acacia). The table below presents the changes in cash flows from the third to the fourth quarter from our securities and investments. |

| | | | | | | | | | |

| Redwood | |

| Cash Flow From Investments | |

| ($ in millions) | |

| | | | | | | | | | |

| | Three Months Ended | | | |

| | | 9/30/08 | | | 12/31/08 | | | Change | |

| | | | | | | | | | |

| Securities at Redwood | | | | | | | | | |

| Residential principal | $ | 17 | | $ | 10 | | $ | (7) | |

| Residential interest | | 13 | | | 11 | | | (2) | |

| Commercial and CDO interest | | 5 | | | 5 | | | - | |

| Total Securities at Redwood | | 35 | | | 26 | | | (9) | |

| | | | | | | | | | |

| Investments in Sequoia | | 13 | | | 9 | | | (4) | |

| Investments in Acacia | | 5 | | | 2 | | | (3) | |

| Investments in the Fund | | 7 | | | 3 | | | (4) | |

| Total Cash Flow from Securities and Investments | $ | 60 | | $ | 40 | | $ | (20) | |

| u | The $40 million of cash flow from our investments included $27 million of coupon interest and $13 million of principal. We caution readers that given the nature of our investments (deep discount credit-sensitive securities, IGS at discounts, IOs, equity investments in Acacia, and other types) it is difficult to draw conclusions in any one period about what portion of our cash flow represents "income" and what is a "return of capital." It is only at the end of an asset’s life that we can accurately determine what portion of the cumulative cash received (whether principal or interest) was truly income and what was a return of capital. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 21 |

| u | The following table provides information regarding the investment source and vintage of cash flows from our investments. As shown, most of our cash flows are generated by assets from earlier vintages, which we believe provides a level of comfort about our ongoing ability to generate cash, as these assets generally continue to perform within our expectations. |

| | | | | | | | | | | | | | |

| Cash Flow from Investments by Vintage |

| Three Months Ended December 31, 2008 |

| ($ in millions) |

| | | | | | | | | | | | | | |

| | | <=2004 | | 2005 | | 2006 | | 2007 | | 2008 | | Total | |

| Redwood | $ | 11 | $ | 6 | $ | 5 | $ | 4 | $ | - | $ | 26 | |

| The Fund | | 2 | | 1 | | - | | - | | - | | 3 | |

| Sequoia | | 6 | | - | | - | | 3 | | - | | 9 | |

| Acacia | | 2 | | - | | - | | - | | - | | 2 | |

| | | | | | | | | | | | | | |

| Total | $ | 21 | $ | 7 | $ | 5 | $ | 7 | $ | - | $ | 40 | |

| u | At this time, we believe our 2009 quarterly cash flows from our existing investments (excluding the small amount of interest we receive on our cash) at December 31, 2008 will be similar to the cash flows in the fourth quarter of 2008. That is, we currently expect our net investment cash flow, after operating and interest expenses, to exceed $100 million for 2009. We caution that the projection of cash flows from existing investments at December 31, 2008 is subject to risks and the actual cash flows may vary and will depend upon, among other things, the amount and timing of credit losses, the amount and timing of prepayments, and the nature and impact of legislative and regulatory actions. |

| u | Cash flow will be reduced in future periods as a consequence of credit losses, since interest payments will be based on reduced principal balances. Credit losses reduce our potential to recover the full face value. |

| u | Future increases in cash flow could be generated by successfully reinvesting the cash flow from our existing investments, from investing our $126 million of cash at December 31, 2008, and from investing the $283 million in proceeds from our January 2009 common stock offering. |

| 22 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Summary

What is this?

GAAP income is income calculated under generally accepted accounting principles in the United States.

Quarterly Update

| u | Our reported consolidated GAAP loss for the fourth quarter of 2008 was $116 million ($3.46 per share) compared to a loss of $111 million ($3.34 per share) for the third quarter of 2008. Negative market valuation adjustments (MVA) recognized through our income statement continue to be the driving factor in our results. |

| u | The table below provides a summary of our GAAP loss for the fourth and third quarters of 2008. |

| | | | | | |

| GAAP (Loss) Income |

| ($ in millions, except per share data) |

| | | Three Months Ended |

| | | 12/31/08 | | 9/30/08 | |

| Interest income | $ | 123 | $ | 131 | |

| Management fees | | 1 | | 1 | |

| Interest expense | | (100) | | (93) | |

| Net interest income | | 24 | | 39 | |

| | | | | | |

| Provision for loan losses | | (19) | | (18) | |

| Market valuation adjustments, net | | (111) | | (127) | |

| Net interest income (loss) after provision and market valuation adjustments | (106) | | (106) | |

| | | | | | |

| Operating expenses | | (14) | | (17) | |

| Realized gains on sales | | 6 | | - | |

| Realized gains on calls | | - | | - | |

| Minority interest allocation | | 2 | | 2 | |

| Benefit from (provision for) income taxes | | (4) | | 10 | |

| | | | | | |

| GAAP (loss) income | $ | (116) | $ | (111) | |

| | | | | | |

| GAAP (loss) income per share | $ | (3.46) | $ | (3.34) | |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 23 |

Quarterly Update (continued)

| u | The table below shows the consolidating components of our consolidated income statements for the fourth and third quarters of 2008. The purpose of this presentation is to show the effect each of the components had on our consolidated income statements for these periods. The Fund, Sequoia, and Acacia components represent investments and are not separate business segments. |

| | | | | | | | | | | | | | | | | | | | |

| Consolidating Income Statement |

| Three Months Ended December 31, 2008 |

| ($ in millions) |

| |

| | | Redwood | The Fund | Sequoia | Acacia | Intercompany Adjustments | Redwood Consolidated |

| Interest income | | $ | 18 | | $ | 2 | | $ | 71 | | $ | 36 | | $ | (1) | | $ | 126 | |

| Net discount (premium) amortization | | | (3) | | | 1 | | | (1) | | | - | | | - | | | (3) | |

| Total interest income | | | 15 | | | 3 | | | 70 | | | 36 | | | (1) | | | 123 | |

| | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 1 | | | - | | | - | | | - | | | - | | | 1 | |

| Interest expense | | | (2) | | | - | | | (64) | | | (35) | | | 1 | | | (100) | |

| Net interest income | | | 14 | | | 3 | | | 6 | | | 1 | | | - | | | 24 | |

| | | | | | | | | | | | | | | | | | | | |

| Provision for loan losses | | | - | | | - | | | (19) | | | - | | | - | | | (19) | |

| Market valuation adjustments, net | | | (103) | | | (7) | | | (3) | | | (4) | | | 6 | | | (111) | |

| Net interest income (loss) after provision and market valuation adjustments | (89) | | | (4) | | | (16) | | | (3) | | | 6 | | | (106) | |

| | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | (13) | | | (1) | | | - | | | - | | | - | | | (14) | |

| Realized gains on sales and calls, net | | | - | | | - | | | 12 | | | - | | | (6) | | | 6 | |

| Loss from the Fund, Sequoia, and Acacia | | | (10) | | | - | | | - | | | - | | | 10 | | | - | |

| Minority interest allocation | | | - | | | 2 | | | - | | | - | | | - | | | 2 | |

| Benefit from (provision for) income taxes | | | (4) | | | - | | | - | | | - | | | - | | | (4) | |

| | | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | $ | (116) | | $ | (3) | | $ | (4) | | $ | (3) | | $ | 10 | | $ | (116) | |

| | | | | | | | | | | | | | | | | | | | |

| Consolidating Income Statement |

| Three Months Ended September 30, 2008 |

| ($ in millions) |

| | | | | | | | | | | | | | | | | | | | |

| | | Redwood | The Fund | Sequoia | Acacia | Intercompany Adjustments | Redwood Consolidated |

| Interest income | | $ | 17 | | $ | 2 | | $ | 71 | | $ | 37 | | $ | (1) | | $ | 126 | |

| Net discount (premium) amortization | | | 6 | | | 2 | | | (3) | | | - | | | - | | | 5 | |

| Total interest income | | | 23 | | | 4 | | | 68 | | | 37 | | | (1) | | | 131 | |

| | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 1 | | | - | | | - | | | - | | | - | | | 1 | |

| Interest expense | | | (2) | | | - | | | (63) | | | (29) | | | 1 | | | (93) | |

| Net interest income | | | 22 | | | 4 | | | 5 | | | 8 | | | - | | | 39 | |

| | | | | | | | | | | | | | | | | | | - | |

| Provision for loan losses | | | - | | | - | | | (18) | | | - | | | - | | | (18) | |

| Market valuation adjustments, net | | | (88) | | | (8) | | | (2) | | | (29) | | | - | | | (127) | |

| Net interest income (loss) after provision and market valuation adjustments | (66) | | | (4) | | | (15) | | | (21) | | | - | | | (106) | |

| | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | (17) | | | - | | | - | | | - | | | - | | | (17) | |

| Realized gains on sales and calls, net | | | - | | | - | | | - | | | - | | | - | | | - | |

| Loss from the Fund, Sequoia, and Acacia | | | (38) | | | - | | | - | | | - | | | 38 | | | - | |

| Minority interest allocation | | | - | | | 2 | | | - | | | - | | | - | | | 2 | |

| Benefit from (provision for) income taxes | | | 10 | | | - | | | - | | | - | | | - | | | 10 | |

| | | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | $ | (111) | | $ | (2) | | $ | (15) | | $ | (21) | | $ | 38 | | $ | (111) | |

| 24 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Quarterly Update (continued)

| u | At Redwood, net interest income declined from the prior quarter by $8 million to $14 million in the fourth quarter. This decline was due to the reduction in face value on our securities due to credit losses in this and prior quarters, slower prepayments (which reduced the rate at which we accrete discount into income), and lower coupon rates as a result of lower short-term interest rates (approximately 70% of our investments are variable-rate investments). Negative MVA on our securities increased by $15 million to $103 million as many of the continued declines in market values on our securities resulted in other-than-temporary impairments this quarter. |

| u | Total operating expenses at Redwood decreased by $4 million to $13 million in the fourth quarter of 2008. As discussed in the third quarter Review, prior period expenses included non-recurring legal and consulting costs. |

| u | In the fourth quarter, we recorded a $4 million provision for income taxes relating to timing differences between GAAP and taxable income recognition. As noted in the third quarter Review, the decision of our board of directors to distribute 100% of our 2007 and 2008 REIT taxable income resulted in a $10 million credit for income taxes in that quarter. |

| u | For reasons noted below, the losses from our investments in the Fund, Sequoia, and Acacia were $10 million in the fourth quarter, as compared to a loss of $38 million from these investments in the third quarter. As a result of all the following factors, Redwood’s loss in the fourth quarter of $116 million was similar to the loss of $111 million in the prior quarter. |

| u | The Fund generated $3 million of net interest income, a slight decrease from the prior quarter. Negative MVA on the securities in the Fund totaled $7 million in the fourth quarter, a slight improvement from the prior quarter. After minority interests, the net loss from our investments in the Fund was $3 million in the fourth quarter, which was similar to the net loss of $2 million in the third quarter. |

| u | At Sequoia, net interest income after loan loss provision and MVA in the fourth quarter was negative $16 million, similar to the third quarter result of negative $15 million. The sale of our interests in certain Sequoia entities resulted in a $12 million gain at Sequoia this quarter (as discussed further in the Investment in Sequoia section of this Review). As a result, our loss from our investments in Sequoia of $4 million was lower than the $15 million loss in the third quarter. |

| u | At Acacia, net interest income declined as expected to $1 million in the fourth quarter as distributions on our equity investments were terminated due to rating agency downgrades of securities held by the Acacia entities. The negative MVA of $4 million in the fourth quarter was significantly less than in the prior quarter. As a result, our loss of $3 million on our investment in Acacia In the fourth quarter was down than the $21 million loss in the third quarter. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 25 |

Summary

What is this?

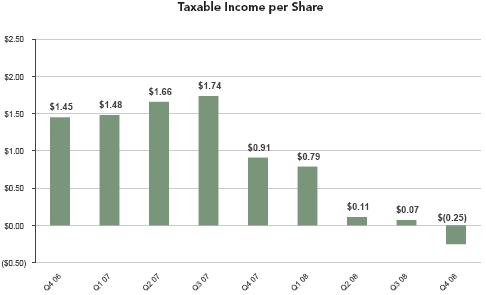

Taxable income is our pre-tax income as calculated for tax purposes. Taxable income differs materially from GAAP income. Table 3 in the Appendix reconciles these two earnings measures.

REIT taxable income is the primary determinant of the minimum amount of dividends we must distribute in order to maintain our tax status as a REIT. REIT taxable income is pre-tax profit, as calculated for tax purposes, excluding taxable income earned at our taxable subsidiaries. Over time, we must distribute at least 90% of our REIT taxable income as dividends.

For our quarterly taxable earnings estimates, we project our taxable earnings for the year based upon various assumptions of events that will occur during the year. However, some of the events that could have significant impact on our taxable earnings are difficult to project, including the amount and timing of credit losses, prepayments, and employee stock option exercises. Thus, our quarterly taxable earnings are likely to remain volatile.

Quarterly Update

| u | The charts below provide a summary of our taxable income per share and REIT taxable income per share of each for the nine most recently completed fiscal quarters. |

| 26 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Quarterly Update (continued)

| u | Our fourth quarter taxable earnings included $40 million of deductions related to credit losses, an increase of $7 million over the previous quarter. |

| u | We caution that the realization of credit losses can vary significantly from quarter to quarter, depending on a number of variables (e.g., the level of loan modifications, short sales, and the impact of new legislation) that could decelerate or accelerate the timing of recognition of losses. For example, federal and state regulatory actions are giving delinquent borrowers additional time to resolve mortgage delinquency issues. Nevertheless, we expect credit losses to continue to increase in 2009. |

| u | We are not permitted to establish credit reserves for tax purposes and we do not generally recognize changes in the market values of assets for tax purposes until the asset is sold. As a result, at December 31, 2008, the tax basis of our residential, commercial, and CDO CES at Redwood (excluding investments in Sequoia and Acacia) was $479 million higher than our GAAP basis. As a result, future credit losses will have a more significant impact on our taxable income than on our GAAP income. Over time, cumulative GAAP and taxable income will converge. Given our projected losses, we expect taxable income to be less than GAAP income for the next few quarters (although negative MVA could decrease reported GAAP income significantly). |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 27 |

Summary

What is this?

As a REIT, we are required to distribute at least 90% of our REIT taxable income in the form of dividends to shareholders. Our board of directors can declare dividends in excess of this minimum requirement.

The chart below shows the regular and special dividends per share paid to shareholders for the indicated periods and our projected regular dividend for 2009.

Quarterly Update

| u | On November 10, 2008, our board of directors declared a regular dividend of $0.75 per share for the fourth quarter, which was paid on January 21, 2009 to shareholders of record on December 31, 2008. |

| u | We paid $3.00 per share in regular dividends in 2008 and have announced that these dividends consisted of $2.75 per share of ordinary income and $0.25 per share of return of capital. |

| u | On November 10, 2008, our board of directors announced its intention to pay a regular dividend of $0.25 per share per quarter in 2009. |

| u | There was no undistributed REIT taxable income at December 31, 2008. |

| u | We expect a tax loss at the REIT level for 2009 due to the expected realization of credit losses. We currently expect that Redwood’s 2009 regular dividend will constitute a return of capital and, as such, will not be taxable to shareholders. |

| u | We currently believe it is unlikely that we will pay a special dividend in 2009. |

| 28 | THE REDWOOD REVIEW 4TH QUARTER 2008 | |

Summary

What is this?

We use capital to fund our operations, invest in earning assets that are generally illiquid, fund working capital, and meet lender capital requirements with respect to collateralized borrowings, if any.

Through our internal risk-adjusted capital policy, we allocate a prudent level of capital for our earning assets to meet liquidity needs that may arise. In most cases, the amount of allocated capital is equal to 100% of the fair value of the asset. The amount of capital that exceeds our risk-adjusted capital guideline, less short-term debt, pending investment settlements, operating expense allocations, and other miscellaneous capital allocations, is excess capital that can be invested to support business growth.

Our capital base includes common equity plus $150 million of long-term debt at Redwood, which is due in 2037.

Declines in the fair value of assets do not have an effect on excess capital, as asset value declines equally reduce both available capital and capital required for these investments.

Quarterly Update

| u | At December 31, 2008, our unrestricted cash totaled $126 million. |

| u | At December 31, 2008, our reported capital totaled $452 million, compared to $562 million at September 30, 2008. The decline in our reported capital during the quarter generally reflects the decrease in the market value of our assets. |

| u | Our excess capital position was $121 million at December 31, 2008, a decrease from $163 million at September 30, 2008. During the fourth quarter, our sources of capital were $27 million from portfolio cash flows and management fees in excess of operating costs and financing costs. Other sources of capital included $1 million from asset sales, $2 million from the sale of shares pursuant to our dividend reinvestment plan, and $4 million of net changes in operating capital (per our internal risk-adjusted guidelines). Uses of capital included the payment of $26 million in dividends and the funding of $50 million of asset acquisitions. |

| u | In January 2009, we raised $283 million, net of offering expenses, from a public offering of common stock. |

| | THE REDWOOD REVIEW 4TH QUARTER 2008 | 29 |

| | |

| MARK-TO-MARKET ADJUSTMENTS | |

Market Conditions

| u | No sector of the non-agency RMBS or CMBS market was spared from pricing pressure during the fourth quarter of 2008. In particular, the AAA space saw relentless declines in market value. We believe multiple factors drove the market lower, including the following: |

| - | Hedge funds, facing redemptions, were persistent and relatively price insensitive sellers. |

| - | Mutual funds were also persistent sellers in the face of redemptions. |