|  |

| TABLE OF CONTENTS |

| Introduction | 3 |

| | |

| Shareholder Letter | 4 |

| | |

| Quarterly Overview | 6 |

| | |

| Financial Insights | 12 |

| | |

u Book Value | 12 |

| | |

u Balance Sheet | 14 |

| | |

u GAAP Income | 18 |

| | |

u Taxable Income and Dividends | 22 |

| | |

u Cash Flow | 23 |

| | |

| New Securitization Initiative | 26 |

| | |

| Residential Real Estate Securities | 32 |

| | |

| Commercial Real Estate | 39 |

| | |

| Investments in Securitization Entities | 42 |

| | |

| | |

| Appendix | |

| | |

| Accounting Discussion | 46 |

| | |

| Glossary | 47 |

| | |

| Financial Tables | 53 |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 1 |

| |

| CAUTIONARY STATEMENT |

Cautionary Statement

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2009 under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) our competitive position and our ability to compete efficiently in the future; (ii) our future capital needs, our ability to access additional capital if needed, and our expectations regarding the use of short-term debt financing, including through warehouse credit and repurchase facilities; (iii) our future investment strategy and our ability to find attractive investments and future trends relating to our pace of acquiring or selling assets, including, without limitation, statements relating to our efforts to acquire residential mortgage loans in bulk transactions or on a flow basis and about the likelihood of, and our participation in, future securitization transactions and our potential future investment activity in the commercial real estate sector; (iv) the future returns we may earn on our investment portfolio, our future interest income, and our belief that the business of intermediating mortgage credit over time; (v) future market and economic conditions, including, without limitation, future conditions in the residential and commercial real estate markets and related financing markets; (vi) our beliefs about the future direction of housing market fundamentals, including, without limitation, home prices, mortgage delinquencies, loan modification programs, foreclosure rates, prepayment rates, inventory of homes for sale, and mortgage interest rates; (vii) our views on the sustainability of government interventions into various financial markets and the possible future effects of the government’s withdrawal from such interventions; (viii) the future of the status of Fannie Mae and Freddie Mac, the role of the Federal Housing Administration, and other issues the resolution of which may depend on political factors and actions; (ix) our expectations regarding future credit losses and impairments on our investments (including as compared to our original expectations and credit reserve levels) and our ability to generate attractive returns even if losses increase above current estimates; (x) the drivers of our future earnings, future earnings volatility, and future trends in operating expenses; (xi) our expectation that we will consolidate onto our balance sheet the securitization transaction we executed in April 2010, (xii) our board of directors’ intention to pay a regular dividend of $0.25 per share per quarter in 2010; (xiii) our anticipation of additional losses for tax accounting purposes; and (xiv) our expectations relating to tax accounting that quarterly taxable income (loss) may be volatile, that we will report a taxable loss in 2010, and that we expect any 2010 dividends will be characterized as a return of capital.

Important factors, among others, that may affect our actual results include: general economic trends, the performance of the housing, mortgage, credit, and broader financial markets, and their effects on the prices of earning assets and the credit status of borrowers; federal and state legislative and regulatory developments, and the actions of governmental authorities, including those affecting the mortgage industry or our business; our exposure to credit risk and the timing of credit losses within our portfolio; the concentration of the credit risks we are exposed to, including due to the structure of assets we hold and the geographical concentration of real estate underlying assets we own; our exposure to adjustable-rate and negative amortization mortgage loans; the efficacy and expense of our efforts to manage or hedge credit risk, interest rate risk, and other financial and operational risks; changes in credit ratings on assets we own and changes in the rating agencies’ credit rating methodologies; changes in interest rates; changes in mortgage prepayment rates; the availability of high-quality assets for purchase at attractive prices and our ability to reinvest cash we hold; changes in the values of assets we own; changes in liquidity in the market for real estate securities; our ability to finance the acquisition of real estate-related assets with short-term debt; the ability of counterparties to satisfy their obligations to us; our involvement in securitization transactions and the risks we are exposed to in executing securitization transactions; exposure to litigation arising from our involvement in securitization transactions; whether we have sufficient liquid assets to meet short-term needs; our ability to successfully compete and retain or attract key personnel; our ability to adapt our business model and strategies to changing circumstances; changes in our investment, financing, and hedging strategies and new risks we may be exposed to if we expand our business activities; exposure to environmental liabilities and the effects of global climate change; failure to comply with applicable laws and regulations; our failure to maintain appropriate internal controls over financial reporting and disclosure controls and procedures; changes in accounting principles and tax rules; our ability to maintain our status as a real estate investment trust (REIT) for tax purposes; limitations imposed on our business due to our REIT status and our status as exempt from registration under the Investment Company Act of 1940; decisions about raising, managing, and distributing capital; and other factors not presently identified.

This Redwood Review may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

| 2 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents, which are available through our web site, www.redwoodtrust.com.

This document, called The Redwood Review, is an additional format for providing information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as taxable income and economic book value. Supplemental information is also provided in the Financial Tables in this Review to facilitate more detailed understanding and analysis of Redwood. When we use non-GAAP metrics it is because we believe that these figures provide additional insight into Redwood’s business. In each case in which we discuss a non-GAAP metric you will find an explanation of how it has been calculated, why we think the figure is important, and reconciliations between the GAAP and non-GAAP figures.

We hope you find this Review helpful to your understanding of our business. We thank you for your input and suggestions, which have resulted in our changing the form and content of The Redwood Review over time.

We welcome your continued interest and comments.

| | | | | | | |

| Selected Financial Highlights |

| | | | | | | |

| Quarter:Year | GAAP Income (Loss) per Share | Taxable Income (Loss) per Share(1) | Annualized Return on Equity | GAAP Book Value per Share | Non-GAAP Economic Value per Share (2) | Total Dividends per Share |

| Q108 | ($5.28) | $0.79 | (95%) | $17.89 | $18.04 | $0.75 |

| Q208 | ($1.40) | $0.11 | (30%) | $17.00 | $16.72 | $0.75 |

| Q308 | ($3.34) | $0.07 | (83%) | $12.40 | $13.18 | $0.75 |

| Q408 | ($3.46) | ($0.39) | (124%) | $9.02 | $11.10 | $0.75 |

| Q109 | ($0.65) | ($0.22) | (25%) | $8.40 | $10.01 | $0.25 |

| Q209 | $0.10 | ($0.16) | 5% | $10.35 | $11.30 | $0.25 |

| Q309 | $0.34 | ($0.30) | 13% | $11.68 | $12.28 | $0.25 |

| Q409 | $0.51 | ($0.44) | 17% | $12.50 | $13.03 | $0.25 |

| Q110 | $0.58 | $0.01 | 19% | $12.84 | $13.32 | $0.25 |

| (1) Taxable income (loss) per share for 2009 and 2010 are estimates until we file our tax returns. |

| |

| (2) Non-GAAP economic value per share is calculated using estimated bid-side values (which take into account available bid-side marks) for our financial assets and estimated offer-side values (which take into account available offer-side marks) for our financial liabilities and we believe it more accurately reflects liquidation value than does GAAP book value per share. Non-GAAP economic value per share is reconciled to GAAP book value per share in Table 4 in the Financial Tables in this Review. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 3 |

| |

| SHAREHOLDER LETTER |

Dear Fellow Shareholders:

Redwood Trust began as an idea in 1994 that a company with integrity and strong principles could invest in high-quality residential mortgage credit risk and build enduring competitive advantages. This idea ultimately led to Redwood’s initial public offering in August 1995.

From the beginning, Redwood has always been focused on generating long-term value for shareholders, and shareholders have always included management. Our decision to organize as an internally-managed company, to require executive ownership, and to provide the majority of incentive compensation in shares that vest over time, were all decisions intended to closely align management with shareholders, who we regard as our partners.

Our original premise in establishing Redwood was that we could compete with companies many times our size by investing in and managing prime mortgage credit risk, operating efficiently, and maintaining a prudent capital structure. We focused on prime mortgage credit because there was substantial history from which to make investment decisions. We elected to be taxed as a real estate investment trust so we could distribute pretax earnings to shareholders. We issued common equity and structured debt to minimize liquidity risk since permanent capital cannot be called away. As a result of our capital structure, we have been able to invest in illiquid securities with long tail cash flows, hold them in periods of substantial price volatility, and take advantage of opportunities to add to our portfolio. Our strategies have served us well from the beginning, and in particular during the past few years when many companies failed, including highly regulated companies.

Our experience over the past 16 years with prime mortgage borrowers who make sufficient down payments has been good. Through our Sequoia program, which dates back to 1997, we have securitized a total of $35 billion original principal amount of residential mortgage loans through 48 transactions. To date, none of the triple-A securities originally issued in those transactions has incurred credit losses. Through March 2010, losses within these transactions have totaled 28 basis points of the aggregate original principal amount and have only impacted the subordinate securities issued in these transactions.

Over the years the pace of our investment activity has varied and we have not been afraid to sit on the sidelines when appropriate, as we did in 1997 and 1998 and for most of 2008. We have always understood that the mortgage business was cyclical and that there were appropriate times to invest and other times that would require patience. We have never been held hostage to externally determined earnings targets, nor do we intend to be in the future.

Our founding premises, principles, and strategies have served shareholders well. From our initial public offering through April 2010, the total rate of return to shareholders who reinvested their dividends has been 320%, which compares favorably to the major indexes over this same period.

| 4 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

|  |

| SHAREHOLDER LETTER |

Comparative Total Returns*

(August 5, 1995 - - April 30, 2010)

* Assumes dividends were invested Source: Bloomberg |

As I prepare to step aside later this month from my daily responsibilities as Redwood’s Chief Executive Officer, I am very pleased to be able to pass the leadership role to others in the management team. When Redwood was established, the intention was that the company would continue beyond the retirement of its founders. The Board of Directors and I are confident that Marty Hughes and Brett Nicholas are well prepared to lead Redwood for the next stage of the company’s growth. They played a major role in successfully managing Redwood through the credit crisis, executing our investment strategies, and re-establishing our residential securitization credit enhancement business.

I am proud of the Redwood team for successfully executing the first non-government backed securitization of newly originated residential mortgages since the market froze in mid-2008. This transaction proves that the private market will support a responsible securitization with prime collateral and strong sponsorship. However, this was only an ice breaker and much more work is required on the part of policy makers, regulators, and industry participants to establish the new ground rules that properly balance the interests of home owners, lenders, and investors before the government can withdraw from its near total support of the residential mortgage market. As a result, in addition to my responsibilities as Chairman of the Board and working with the management team on strategic issues, I will be focusing attention on regulatory and legislative matters to help restore a healthy mortgage market.

I sincerely appreciate the support my team and I have received over many years from you — our shareholders and partners — as Redwood grew from an idea to a successful industry-leading and robust company in the prime mortgage market.

George E. Bull, III

Chairman and CEO

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 5 |

| |

| QUARTERLY OVERVIEW |

First Quarter 2010

A Busy Start to 2010

We have had a busy and productive start to 2010. We have been actively managing our investment portfolio, working diligently on helping to restart the private label securitization market, and continuing to make progress on re-establishing our core business of structuring and investing in prime residential loans and securities. It has been gratifying to be able to help break the ice by cooperating with others to get the first prime jumbo residential mortgage securitization since August 2008 off the ground. In this transaction, we worked painstakingly to respond to the expressed needs of triple-A investors and to the concerns and issues of regulators, policy makers, and rating agencies. This securitization, however, represents just a small step along a continuum for Redwood.

In this letter, we will briefly review our first quarter results. Full details can be found in the modules of the Redwood Review that follow. We will spend the bulk of this letter addressing the topics about which you are likely most curious: our recent securitization and our plans.

First Quarter Results

Overall, we feel reasonably good about our first quarter results. We reported $47 million in GAAP net income, or $0.58 per share. This compares with $40 million in GAAP net income, or $0.51 per share in the prior quarter. First quarter results included the benefit of significant gains ($37 million in gains on sale of securities and a $7 million gain on repurchasing Sequoia asset-backed securities). The outsized contribution from gains was only partially offset by a $9 million loan loss provision, $2 million in impairments, and $4 million in non-recurring equity compensation costs related to the retirement of George E. Bull III, our CEO and co-founder. While securities gains as a percentage of income has been quite high in the past two quarters, we are not counting on sustaining gains at this pace in the future.

We estimate that taxable income will be $1 million for the first quarter. We would caution against drawing a trend line from this quarter’s taxable income as the realization of credit losses was slowed by governmental programs aimed at stalling and reducing mortgage foreclosures. We expect realized credit losses to pick back up as the backlog of defaulted loans is eventually processed. Thus, we do not currently expect to have a REIT requirement to pay dividends based on taxable income for 2010.

Book value per share on a GAAP basis ended the quarter at $12.84, increasing by $0.34 from the $12.50 reported at the end of 2009. Our estimate of non-GAAP economic book value per share rose to $13.32 by March 31, 2010 as compared with $13.03 at the end of 2009. Book value increases reflect earnings plus positive market valuation adjustments less dividends.

We invested $189 million and sold $124 million in non-agency mortgage-backed securities during the first quarter. Our cash balance at quarter-end was $242 million. We have been positioning our investment portfolio to seek to maintain its value in light of possible higher interest rates. We continue to take advantage of strong demand for non-agency RMBS to sell certain assets the market is bidding to a level that no longer reflects the risk of continuing to hold them. At the same time, during the first quarter we entered into swap agreements to fix the cost of our long-term borrowings (at 6.75% for 27 years).

| 6 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

First Quarter Results (continued)

During April 2010, we purchased $5 million in securities while selling $94 million in securities. We also invested $28 million in the securitization we sponsored. While we are acutely aware of the opportunity cost of holding cash, we will not let impatience drive us to make poor risk/reward trade-offs. We are increasingly willing to let cash build, as we see potentially significant opportunities to invest our capital as we grow our residential and commercial businesses. Further, we believe the world is still a dangerous place and there could be real value in having excess cash.

Private Securitizations: There is a real need in the market

While regulators and stakeholders differ on financial reform proposals, one thing most everyone seems to agree on is that the U.S. government cannot continue to support the vast majority of the mortgage market. In fact, in the first quarter of 2010, government-sponsored enterprises (GSEs) backed 96.5% of all home loans, according to Inside Mortgage Finance. Private mortgage liquidity needs to return to reduce reliance on Fannie Mae and Freddie Mac. While private securitization will initially be aimed at prime jumbo (i.e., non-conforming) mortgage loans, private securitization could also provide an alternative to the GSEs, for prime mortgages as it has in the past. For example, over one quarter of the loans underlying the $35 billion in Sequoia securitizations we sponsored earlier met the conforming balance limits of the GSEs in place at the time of origination. In addition, securitizations can also help broaden the product set of mortgages by allowing banks to make loans that they might not want to hold on their balance sheet (for example, 30-year fixed rate mortgages).

We think balancing safety and soundness with economics will be critical to effective securitization. We want to increase the level of private mortgage liquidity in a manner that protects investors and deters excessive risk-taking. This is central to providing credit to qualified homebuyers at the best possible interest rate. In our opinion, the proposed rules governing risk retention (referred to as “skin-in-the-game”) are especially important.

In order to have a securitization sponsor’s interests aligned properly with the interests of the other securitization investors, there are various legislative and regulatory proposals to require the sponsors to retain risk (or “eat their own cooking”). Setting risk retention requirements properly is important to keeping the risk in check and to making credit available to good borrowers at a reasonable interest rate. And that is the point of securitization in the first place: to channel private sources of liquidity to good borrowers in the most efficient way possible to keep the cost of credit affordable.

Proposals on risk retention typically call for either the originator or the securitization sponsor to retain risk. We have a lot to say on this topic later in this Review. In summary, we believe that a securitization sponsor should retain risk. The level of risk retained should vary based on product type (i.e., prime, Alt-A, or sub-prime). A fixed, one-size fits all, approach for skin-in-the-game may render a safe and much needed prime securitization uneconomic and may prove to be an insufficient deterrent to prevent the return of risky lending and securitization practices. Further, we believe that the sponsor should hold its skin-in-the-game by retaining the most subordinated tranches that are the first tranches to absorb credit losses.

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 7 |

| |

| QUARTERLY OVERVIEW |

Details on our Recent Securitization

We recently closed a private securitization backed by $238 million of prime, jumbo residential first mortgage loans that were originated by Citigroup within the past 11 months. The weighted average credit score of the borrower was 768 at origination. The weighted average loan-to-value on these recently originated loans was 57% at origination. The average loan size at origination was nearly $933,000. The securitization has been rated by Moody’s.

As sponsor of the securitization, Redwood invested $28 million in the transaction, taking a “belt and suspenders” approach to risk retention. Specifically, we held all securities rated below triple-A — or 6.5% of the face value of the transaction — plus the interest-only securities. In addition, Redwood took a vertical slice — buying 5% of the triple-A securities. We would not normally have retained triple-A securities, but did so to accommodate alternative risk retention proposals until final rules are adopted.

We customized this securitization in response to the new environment. We listened to all interested parties and tried to address their expressed concerns. We believe that the best structured securitization has separate parties acting as (1) originator/servicer, (2) trustee, and (3) sponsor. Please see the New Securitization Initiative module later in this Review for specifics relating to our securitization and issues surrounding risk retention, disclosure, enforcement of representations and warranties, and more.

What Is Our Vision?

Our vision since inception has been to build a company that produces high quality, long-term cash flows. We believe our best long-term opportunity is to re-establish our core residential credit business, a business in which we facilitate credit risk transfers in the mortgage market. We are not building a securitization business, per se. Securitization is a means to an end — it is an efficient way to direct capital from investors to the mortgage originators who lend money to borrowers.

We believe we are well suited to structure and hold credit risk in residential mortgages. We believe we are good at evaluating credit and other mortgage-related risks. We understand how to structure risk to make it available to investors, according to their appetite for risks and associated returns. We like taking subordinated credit risk and we have a balance sheet that is built to hold illiquid assets. We also have a high tolerance for complexity. Our team has never been stronger, we have capital to invest, and we are not constrained by bank regulations. We have solid relationships with originators and investors and understand that each is our client.

| 8 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Our Plans — Opening the Market

We worked long and hard with a team of other institutions to help bring back private-market securitizations. We have focused on addressing those issues and concerns of relevant parties that seemed most important. Our goal was to be the leader in issuing the first securitization following a roughly two-year hiatus. Although the press has been mostly favorable, we were not driven by headlines. We wanted to be first so we could be “under the tent,” helping to shape the new structures, debating standards, and trying to inform government policy. We know that many important issues will be decided in the early days of new securitizations and we think we are well qualified to weigh in on those issues. It was an arduous process for us and all who worked with us as together we tried to “break the ice” to get securitization re-started. While we are encouraged by the response to our first step, we expect it will take some time before processes evolve and the nation again has a fully functioning private mortgage securitization market.

Our Plans — What’s Next

So how are we approaching the business of intermediating mortgage credit risk? We approached the process by thinking of how to bring the highest value to borrowers, lenders, and triple-A investors. We led with a bulk purchase of loans from one originator, immediately followed by a securitization to help finance that purchase. We may do additional bulk purchases. Our primary goal, however, is to establish relationships with lenders to purchase on a loan by loan basis newly issued mortgages that meet our underwriting and collateral criteria.

As we formulated our plans, where did we start? In designing a prime residential mortgage-backed securitization, we believe the process should start with triple-A investors who represent more than 90% of the overall investment. We think a securitization has to give the triple-A investors what they want: they should be able to dictate the collateral and loan type they want and the information they need at origination and on an ongoing basis. We want investors to come to rely on Redwood for producing high quality triple-A securities they can depend on. Further, triple-A investors can take comfort that our interests are aligned as we are investing in the credit securities below them. In summary, we are trying to bring the highest all-in value to triple-A investors and have them look first to Redwood for ongoing mortgage investments.

We also made process changes to benefit lenders. We have invested in technology that will allow us to give lenders a price commitment to buy loans on a flow basis that meet our collateral requirements. We want originators to have the flexibility to sell us loans when they want. We want them to be positioned to offer their customers additional products, including loans they may not want to keep on their balance sheets. An efficient yield to the triple-A investors can be passed through to the lender and on to the borrower. This should allow the originator to offer better priced products to their qualified customers. This will also allow banks to offload risk from their balance sheets, free up capital for additional lending, and potentially reduce hedging costs.

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 9 |

| |

| QUARTERLY OVERVIEW |

Capital and Returns

We had two goals as we contemplated this recent transaction: (1) help create the new standards in the interests of borrowers and securitization investors and (2) create an economic transaction. We did create an economic transaction that we expect will deliver attractive investment returns to us over time. We invested more capital in this transaction than we might have done for purely economic reasons: we wanted to cover all bases on possible skin-in-the-game proposals. That is why we held a horizontal and vertical slice of risk. Once the requirement for capital in a securitization is set by the regulators, we may consider withdrawing some or all of the capital in excess of the required amount.

We have enough capital to support investments in this business for some time. If we need additional capital in the future, we will ask for new capital from our shareholders (as has been our history) only when we believe we have accretive investment opportunities. We believe we are enhancing our franchise and we expect to earn and protect franchise type returns by offering investors and originators what they want at a fair price. The good news is that we perceive significant investment opportunities over time as demand for prime (non-conforming) mortgages returns and as the government gradually pulls back on its support of the mortgage market.

Securitization — Accounting for the Risks

The Financial Accounting Standards Board (FASB) recently enacted new accounting guidelines (FAS 166 and 167) to address those circumstances under which parties to a securitization transaction are required to consolidate the assets and liabilities of the securitization entity. These new accounting guidelines have been pointed to by many as key to preventing the return of off-balance sheet securitization liabilities or “shadow banking” transactions that were considered to be a large contributor to the financial crisis.

We generally believe that consolidation by at least one party to a securitization transaction is important to making sure that risk is properly and fully disclosed. However, based on our recent interpretation of FAS 166 and 167 and discussions with various accounting firms and industry participants, it is our opinion that there will be fewer securitization transactions consolidated than conventional wisdom has thought. The new FASB guidelines require that any party with a significant economic interest in a securitization entity and control over the most significant activities of the securitization entity should consolidate the assets and liabilities of the entity on its balance sheet. Seems simple, right? Well, it is turning out not to be so simple. What constitutes a “significant economic interest” and what constitutes “control” are each subject to interpretation — and there are no bright lines. Further, there are cross currents at play with respect to following policy makers’ suggestions to cede the resolution of delinquent loans to servicers in order to streamline loan modifications, as well as with respect to policy makers’ attempts to define what skin-in-the-game should mean.

This is a complicated and multi-faceted topic to understand, but given its importance to the future of securitization, we attempt to explain it in the New Securitization Initiative module later in the Review.

| 10 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

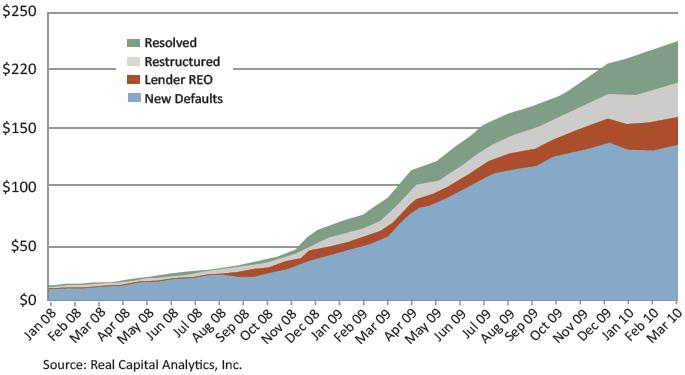

Commercial Mortgage Opportunities: Are we there yet?

In a word: no. There are huge investment opportunities in commercial real estate: anyone will tell you that. Hundreds of billions of dollars will need to be refinanced each year over the next several years — so the story goes. Yet lots of would-be investors who want to intelligently put money to work in this important sector sit idle. Gridlock in this market is caused not by lack of financing but by a lack of realism. Lenders and borrowers alike are satisfied to pretend values have not declined by 30% to 50%. Why would they want to recognize that type of loss? In the commercial mortgage debacle of the early 1990s, write-offs were not taken until they were forced by bank regulators.

Activity by thoughtful investors is likely to be limited until the “extend and pretend” environment has ended. Redwood expects there will be significant opportunities once lenders and borrowers are more realistic about the value of their collateral. Until that time, we will be willing to wait as needed, build our team, and continue scouring the markets for information and appropriate opportunities. We maintain a belief that the keys to success will include patience, operational skill, and the supply of long-term debt. We will target solid co-investors and properties that allow us to deploy capital in high-quality subordinate debt investments.

Closing

Again, we would like to thank you for your patience and continued support. We have been talking about restarting securitization for some time and we are proud our team was able to deliver. We have taken a first step. We will continue to work to improve the process to ensure that lenders and investors get what they want, which makes credit more available to homebuyers. We are encouraged that we will be able to deploy a significant amount of capital over time in transferring and taking mortgage credit risk. If you are a lender or a triple-A investor, we are open for business. Please call us at 415-389-7373. We welcome your call.

| |

| Martin S. Hughes | Brett D. Nicholas |

| President and Co-Chief Operating Officer | Chief Investment Officer and |

| Co-Chief Operating Officer |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 11 |

| |

| FINANCIAL INSIGHTS |

Book Value

Summary

| u | The following table shows the components of our GAAP Book Value and Management’s Estimate of Non-GAAP Economic Value at March 31, 2010. |

| | | | | | | | | | |

| Components of Book Value* |

| March 31, 2010 |

| ($ in millions, except per share data) |

| | | | | | | Management's | |

| | | | | | | Estimate of | |

| | GAAP | | | | Non-GAAP | |

| | Book Value | Adj. | | Economic Value | |

| Cash and cash equivalents | $ | 242 | | | | $ | 242 | |

| | | | | | | | | | |

| Real estate securities at Redwood | | | | | | | | | |

| Residential | | 830 | | | | | | 830 | |

| Commercial | | 9 | | | | | | 9 | |

| CDO | | 1 | | | | | | 1 | |

| Total real estate securities at Redwood | $ | 840 | | | | | $ | 840 | |

| | | | | | | | | | |

| Investments in the Fund | | 16 | | | | | | 16 | |

| Investments in Sequoia | | 77 | | (29) | | | | 48 | |

| Investments in Acacia | | 1 | | | | | | 1 | |

| Total cash, securities, and investments | $ | 1,176 | | | | | $ | 1,147 | |

| | | | | | | | | | |

| Long-term debt | | (140) | | 67 | | | | (73) | |

| | | | | | | | | | |

| Other assets/liabilities, net | | (38) | | | | | | (38) | |

| | | | | | | | | | |

| Stockholders' equity | $ | 998 | | | | | $ | 1,036 | |

| | | | | | | | | | |

| Book value per share | $ | 12.84 | | | | | $ | 13.32 | |

| u | During the first quarter our GAAP book value increased by $0.34 per share to $12.84 per share. The change resulted from an aggregate of $0.59 per share from earnings and market value increases on investments during the quarter, partially offset by $0.25 per share of dividends paid to shareholders. |

| u | During the first quarter our estimate of non-GAAP economic value increased by $0.29 per share to $13.32 per share. The increase resulted from $0.76 per share from net cash flows and net positive market valuation adjustments on our securities and investments, less $0.22 per share of cash operating and interest expense and $0.25 per share of dividends. |

* The components of book value table presents our assets and liabilities as calculated and reported under GAAP and as adjusted to reflect our estimate of economic value, a non-GAAP metric. We show our investments in the Redwood Opportunity Fund, L.P. (the Fund) and in Sequoia and Acacia securitization entities in separate line items, similar to the equity method of accounting, reflecting the reality that the underlying assets and liabilities owned by these entities are legally not ours. We own only the securities and interests that we have acquired from these entities. See page 16 for an explanation of the adjustments set forth in this table.

| 12 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Book Value (continued)

Summary (continued)

| u | In the chart below we present our March 31, 2010 securities portfolio by acquisition period, which highlights that 93% of the economic value of cash, securities, and investments were held in cash or in securities acquired since the beginning of 2008. Our future earnings will be driven primarily by the performance of these recent investments along with how we deploy our existing cash and future cash flow. |

Cash, Securities, and Investments at Redwood

March 31, 2010 ($ in millions)

* Estimate of non-GAAP economic value; see pages 12

and 16 for explanation and reconciliation to GAAP.

| u | During April 2010, we purchased $5 million of residential securities and sold $94 million of residential securities. These sales of securities were executed at prices generally in excess of their fair values at the end of the first quarter. As part of the management of our portfolio, we sell securities when we believe conditions merit. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 13 |

| |

| FINANCIAL INSIGHTS |

Balance Sheet

| u | The following table shows the components of our balance sheet at March 31, 2010. |

| | | | | | | | | | | | | | | | | |

| Consolidating Balance Sheet | |

| March 31, 2010 | |

| ($ in millions) | |

| | | | | | | | | | | | | | | | |

| | | Redwood | | | The Fund | | | Securitization Entities | | | Intercompany | | | Redwood Consolidated | |

| Real estate loans | | $ | 2 | | | $ | - | | | $ | 3,660 | | | $ | - | | | $ | 3,662 | |

| Real estate securities | | | 840 | | | | 27 | | | | 269 | | | | - | | | | 1,136 | |

| Investments in the Fund | | | 16 | | | | - | | | | - | | | | (16 | ) | | | - | |

| Investment in securitization entities | | | 78 | | | | - | | | | - | | | | (78 | ) | | | - | |

| Other investments | | | - | | | | - | | | | 11 | | | | - | | | | 11 | |

| Cash and cash equivalents | | | 242 | | | | - | | | | - | | | | - | | | | 242 | |

| Total earning assets | | | 1,178 | | | | 27 | | | | 3,940 | | | | (94 | ) | | | 5,051 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other assets | | | 23 | | | | 3 | | | | 118 | | | | - | | | | 144 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,201 | | | $ | 30 | | | $ | 4,058 | | | $ | (94 | ) | | $ | 5,195 | |

| Short-term debt | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Other liabilities | | | 63 | | | | 1 | | | | 143 | | | | - | | | | 207 | |

| Asset-backed securities issued | | | - | | | | - | | | | 3,837 | | | | - | | | | 3,837 | |

| Long-term debt | | | 140 | | | | - | | | | - | | | | - | | | | 140 | |

| Total liabilities | | | 203 | | | | 1 | | | | 3,980 | | | | - | | | | 4,184 | |

| | | | | | | | | | | | | | | | | | | | | |

| Stockholders’ equity | | | 998 | | | | 16 | | | | 78 | | | | (94 | ) | | | 998 | |

| Noncontrolling interest | | | - | | | | 13 | | | | - | | | | - | | | | 13 | |

| Total equity | | | 998 | | | | 29 | | | | 78 | | | | (94 | ) | | | 1,011 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 1,201 | | | $ | 30 | | | $ | 4,058 | | | $ | (94 | ) | | $ | 5,195 | |

| u | We are required under GAAP to consolidate all of the assets, liabilities, and noncontrolling interest of the Fund due to our significant general and limited partnership interests in the Fund and ongoing asset management responsibilities. |

| u | We are required to consolidate the assets and liabilities of certain Sequoia and Acacia securitization entities that are treated as secured borrowing transactions under GAAP. However, the securitized assets of these entities are not available to Redwood. Similarly, the liabilities of these entities are obligations payable only from the cash flow generated by their securitized assets and are not obligations of Redwood. |

| 14 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Balance Sheet (continued)

Real Estate Securities

| u | The following table presents the fair value of real estate securities at Redwood at March 31, 2010. We segment our securities portfolio by vintage (the year(s) the securities were issued), priority of cash flow (senior, re-REMIC, and subordinate) and, for residential securities, by quality of underlying loans (prime and non-prime). |

| | | | | | | | | | | | | | | | |

| Real Estate Securities at Redwood |

| March 31, 2010 |

| ($ in millions) |

| | | | | | | | | | | | | | | % of Total | |

| | | <=2004 | | | 2005 | | | | 2006-2008 | | | Total | | | Securities | |

| | | | | | | | | | | | | | | | | |

| Residential | | | | | | | | | | | | | | | | |

| Seniors | | | | | | | | | | | | | | | | |

| Prime | | $ | 14 | | | $ | 286 | | | $ | 72 | | | $ | 372 | | | | 44 | % |

| Non-prime | | | 117 | | | | 232 | | | | 19 | | | | 368 | | | | 44 | % |

| Total Seniors | | $ | 131 | | | $ | 518 | | | $ | 91 | | | $ | 740 | | | | 88 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Re-REMIC | | | | | | | | | | | | | | | | | | | | |

| Prime | | $ | 5 | | | $ | 8 | | | $ | 54 | | | $ | 67 | | | | 8 | % |

| Total Re-REMIC | | $ | 5 | | | $ | 8 | | | $ | 54 | | | $ | 67 | | | | 8 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Subordinates | | | | | | | | | | | | | | | | | | | | |

| Prime | | $ | 12 | | | $ | 3 | | | $ | 2 | | | $ | 17 | | | | 2 | % |

| Non-prime | | | 6 | | | | - | | | | - | | | | 6 | | | | 1 | % |

| Total Subordinates | | $ | 18 | | | $ | 3 | | | $ | 2 | | | $ | 23 | | | | 3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Total Residential | | $ | 154 | | | $ | 529 | | | $ | 147 | | | $ | 830 | | | | 99 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Commercial Subordinates | | $ | 7 | | | $ | 2 | | | $ | - | | | $ | 9 | | | | 1 | % |

| CDO Subordinates | | $ | - | | | $ | 1 | | | $ | - | | | $ | 1 | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 161 | | | $ | 532 | | | $ | 147 | | | $ | 840 | | | | 100 | % |

| u | During the first quarter, our securities portfolio grew to $840 million from $781 million, primarily as a result of acquisitions of $180 million (excluding the acquisition of $9 million of Sequoia asset-backed debt) exceeding sales and paydowns. In addition, the value of securities held during the first quarter increased by $15 million during the period. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 15 |

| |

| FINANCIAL INSIGHTS |

Balance Sheet (continued)

Investments in the Fund and the Securitization Entities

| u | Our investments in the Fund and Sequoia and Acacia securitization entities, as reported under GAAP, totaled $94 million, or 8% of our cash, securities, and investments at March 31, 2010. |

| u | The fair value (which equals GAAP carrying value) of our investment in the Fund was $16 million. The Fund is primarily invested in non-prime residential securities and is managed by a subsidiary of Redwood. Our investment represents a 52% interest in the Fund. |

| u | Our investments in Sequoia entities consist predominately of interest-only securities (IOs) and, to a smaller extent, senior and subordinate securities issued by these entities. The $77 million of GAAP carrying value of our investments represents the difference between the carrying costs of the assets and liabilities owned by the Sequoia entities. In contrast, we estimated the $48 million of non-GAAP economic value for our investments in Sequoia entities using the same valuation process that we follow to fair value our other real estate securities. |

| u | The GAAP carrying value and the fair value of our investments in Acacia entities was $1 million, which primarily reflects the present value of the management fees we expect to earn from these entities. The equity interests and securities we own in the Acacia entities have minimal value. |

Debt

| u | We had no short-term recourse debt at March 31, 2010. We currently fund our investments with permanent capital (equity and long-term debt) that is not subject to margin calls or financial covenants. |

| u | In future periods, we expect to utilize short-term debt to finance the acquisition of prime mortgage loans prior to securitizing those loans through our Sequoia program. We are in discussion with counterparties to re-establish warehouse credit facilities for this purpose. In the interim, we are likely to use our excess cash to purchase mortgage loans. We are also considering utilizing repurchase facilities, collateralized by certain of our existing senior residential mortgage-backed securities (RMBS), to temporarily finance our mortgage loan acquisitions. |

| u | At March 31, 2010, we had $140 million of long-term debt outstanding, which, as a result of interest rate hedging had an effective fixed interest rate of 6.75%, net of interest rate swap expense. For GAAP purposes, this long-term debt, which is due in 2037, is reported at its outstanding principal amount. We estimated the $73 million non-GAAP economic value of this debt using the same valuation process that we follow to fair value our other financial assets and liabilities. Economic value is difficult to estimate with precision as the market for this debt is largely inactive. |

| 16 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Balance Sheet (continued)

Capital and Cash

| u | At March 31, 2010, our total capital equaled $1.1 billion, including $998 million in shareholders’ equity and $140 million of long-term debt. This represented a $26 million increase from total capital at December 31, 2009. |

| u | At March 31, 2010, our cash totaled $242 million and our excess capital was $181 million. At April 30, 2010, our cash totaled $275 million and our excess capital was $233 million. |

| u | While it is painful to consider the opportunity cost of holding so much cash, we believe our patience will serve Redwood investors well. Besides, many argue that holding excess cash in a dangerous and uncertain world is not a bad problem to have. Rather than reach for marginal investment opportunities, we prefer to hold capital for sizeable investment opportunities we anticipate in our core credit enhancement business within a number of quarters. We note that when financial companies cave to pressure and put money to work in ways that do not support their base franchise, it often does not end well. We prefer investments that end well. |

| u | We use our capital to invest in earning assets, meet lender capital requirements, and to fund our operations and working capital needs. The difference between our current cash balance and excess capital is primarily unsettled trades and the amount of capital set aside for our outstanding hedging agreements. We allocate capital to our investments under our risk-adjusted capital guidelines based on numerous factors including the liquidity of the assets and the availability of financing. |

| u | We currently allocate capital equal to 100% of the fair value of all our investments — meaning we fund these assets with capital. Over the past several years, we have been well served by our lack of short-term borrowings. While our asset values were adversely impacted by market conditions during 2008 and 2009, we were not forced to unload assets at fire-sale prices. Our memories will be long on this topic and we will be thoughtful about managing funding risk as we put our toe back into the short-term borrowing water. |

| u | As we return to creating attractive investment opportunities through our Sequoia program we will increase our short-term borrowings in order to fund the loans we accumulate prior to securitizations. We are looking to enter into loan warehouse facilities and to borrow against our senior securities to provide additional funding sources for our acquisitions. |

| u | In addition, we may change the amount of capital we allocate to the more liquid securities we own. Consistent with our past practices, we will make these changes only when we believe it is in the best long-term interest of our shareholders. We believe we have significantly greater capital capacity than reflected in our stated excess capital amounts, given our conservative choice to allocate 100% capital to all our assets. Given our capacity, we would likely look to our own balance sheet for sources of liquidity before looking externally and are unlikely to seek additional capital in the near term. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 17 |

| |

| FINANCIAL INSIGHTS |

GAAP Income

Summary

| u | The following table provides a summary of our GAAP income for the first quarter of 2010 and the fourth quarter of 2009. |

| | | | | | | |

| GAAP Income | |

| ($ in millions, except per share data) | |

| | Three Months Ended | |

| | 3/31/2010 | | | 12/31/2009 | |

| Interest income | | $ | 58 | | | $ | 62 | |

| Interest expense | | | (18 | ) | | | (21 | ) |

| Net interest income | | | 40 | | | | 41 | |

| | | | | | | | | |

| Provision for loan losses | | | (9 | ) | | | (9 | ) |

| Market valuation adjustments, net | | | (11 | ) | | | (4 | ) |

| Net interest income (loss) after provision and market valuation adjustments | | | 20 | | | | 28 | |

| | | | | | | | | |

| Operating expenses | | | (17 | ) | | | (11 | ) |

| Realized gains, net | | | 44 | | | | 20 | |

| Noncontrolling interest | | | - | | | | - | |

| Benefit from (provision for) income taxes | | | - | | | | 3 | |

| | | | | | | | | |

| GAAP income | | $ | 47 | | | $ | 40 | |

| | | | | | | | | |

| GAAP income per share | | $ | 0.58 | | | $ | 0.51 | |

| u | Our reported GAAP income for the first quarter of 2010 was $47 million, or $0.58 per share, as compared to $40 million, or $0.51 per share, for the fourth quarter of 2009. Our increase in earnings reflects the continued strong performance of our senior securities portfolio at Redwood and higher realized gains on the sale of securities, partially offset by lower net returns on the assets and liabilities at Acacia and non-recurring operating expense. |

| 18 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

GAAP Income (continued)

Summary (continued)

| u | The following tables show the effect that Redwood, the Fund, and the Sequoia and Acacia securitization entities had on our consolidated GAAP income for the first quarter of 2010 and the fourth quarter of 2009. These components of our income statement are not separate business segments. |

| | | | | | | | | | | | | | | | |

| Consolidating Income Statement | |

| Three Months Ended March 31, 2010 | |

| ($ in millions) | |

| | | | | | | | | | | | | | | | |

| | Redwood | | | The Fund | | | Securitization Entities | | | Intercompany Adjustments | | | Redwood Consolidated | |

| Interest income | | $ | 18 | | | $ | 1 | | | $ | 31 | | | $ | - | | | $ | 50 | |

| Net discount (premium) amortization | | | 9 | | | | 1 | | | | (2 | ) | | | - | | | | 8 | |

| Total interest income | | | 27 | | | | 2 | | | | 29 | | | | - | | | | 58 | |

| | | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 1 | | | | - | | | | - | | | | (1 | ) | | | - | |

| Interest expense | | | (1 | ) | | | - | | | | (17 | ) | | | - | | | | (18 | ) |

| Net interest income | | | 27 | | | | 2 | | | | 12 | | | | (1 | ) | | | 40 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for loan losses | | | - | | | | - | | | | (9 | ) | | | - | | | | (9 | ) |

| Market valuation adjustments, net | | | (3 | ) | | | - | | | | (8 | ) | | | - | | | | (11 | ) |

| Net interest income after provision and market valuation adjustments | | | 24 | | | | 2 | | | | (5 | ) | | | (1 | ) | | | 20 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | (17 | ) | | | (1 | ) | | | - | | | | 1 | | | | (17 | ) |

| Realized gains (losses), net | | | 38 | | | | (1 | ) | | | 7 | | | | - | | | | 44 | |

| Income from the Fund | | | - | | | | - | | | | - | | | | - | | | | - | |

| Income from Securitization Entities | | | 2 | | | | - | | | | - | | | | (2 | ) | | | - | |

| Noncontrolling interest | | | - | | | | - | | | | - | | | | - | | | | - | |

| Benefit from income taxes | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 47 | | | $ | - | | | $ | 2 | | | $ | (2 | ) | | $ | 47 | |

| | | | | | | | | | | | | | | | |

| Consolidating Income Statement | |

| Three Months Ended December 31, 2009 | |

| ($ in millions) | |

| | | | | | | | | | | | | | | | |

| | Redwood | | | The Fund | | | Securitization Entities | | | Intercompany Adjustments | | | Redwood Consolidated | |

| Interest income | | $ | 19 | | | $ | 1 | | | $ | 38 | | | $ | - | | | $ | 58 | |

| Net discount (premium) amortization | | | 6 | | | | 1 | | | | (3 | ) | | | - | | | | 4 | |

| Total interest income | | | 25 | | | | 2 | | | | 35 | | | | - | | | | 62 | |

| | | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 1 | | | | - | | | | - | | | | (1 | ) | | | - | |

| Interest expense | | | (1 | ) | | | - | | | | (20 | ) | | | | | | | (21 | ) |

| Net interest income | | | 25 | | | | 2 | | | | 15 | | | | (1 | ) | | | 41 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for loan losses | | | - | | | | - | | | | (9 | ) | | | - | | | | (9 | ) |

| Market valuation adjustments, net | | | (2 | ) | | | (1 | ) | | | (1 | ) | | | - | | | | (4 | ) |

| Net interest income after provision and market valuation adjustments | | | 23 | | | | 1 | | | | 5 | | | | (1 | ) | | | 28 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | (11 | ) | | | (1 | ) | | | - | | | | 1 | | | | (11 | ) |

| Realized gains, net | | | 20 | | | | - | | | | - | | | | - | | | | 20 | |

| Income from the Fund | | | - | | | | - | | | | - | | | | - | | | | - | |

| Income from Securitization Entities | | | 5 | | | | - | | | | - | | | | (5 | ) | | | - | |

| Noncontrolling interest | | | - | | | | - | | | | - | | | | - | | | | - | |

| Provision for income taxes | | | 3 | | | | - | | | | - | | | | - | | | | 3 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 40 | | | $ | - | | | $ | 5 | | | $ | (5 | ) | | $ | 40 | |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 19 |

| |

| FINANCIAL INSIGHTS |

GAAP Income (continued)

Summary (continued)

Redwood

| u | At Redwood, net interest income was $27 million for the first quarter of 2010, as compared to $25 million for the fourth quarter of 2009. An increase in amortization income on securities due to higher expected future interest rates contributed to the increase in quarterly interest income. |

| u | In the near term, we continue to expect net interest income to be driven primarily by our residential senior securities, which comprised 88% of the securities we held at March 31, 2010. During the first quarter, these securities generated $17 million of interest income, or a 13% effective annual yield on amortized cost that was comprised of 6% coupon interest and 7% discount amortization income. Over time, net interest income will be affected by how we deploy our cash balances and future cash flow. |

| u | Gains on sale of securities amounted to $38 million (and generated total proceeds of $124 million) in the first quarter, compared to $20 million of gains reported in the fourth quarter of 2009. Of the $38 million of gains, $28 million were already reflected in our balance sheet as of the beginning of the quarter and $10 million were increases in value during the quarter. |

| u | Negative market valuation adjustments (MVA) were $3 million in the first quarter, a slight increase from the MVA in the prior quarter primarily due to impairments on securities. To the extent our loss expectations do not significantly change, we expect the pace of future impairments on securities to remain near levels observed in recent quarters. |

| u | Operating expenses of $17 million for Redwood included $4 million of one-time compensation costs related to the retirement of our CEO and co-founder, George E. Bull, III. Additionally, operating expenses were reduced in the fourth quarter to reflect an adjustment to our 2009 variable compensation expense. The current quarter’s operating expenses (excluding the non-recurring charge of $4 million) are at a level that we currently believe to be a good estimate of the run-rate for the remainder of this year. |

Investments in the Fund and Securitization Entities

| u | We recognized net income of $2 million in the first quarter from our investments in the Fund and in the consolidated Sequoia and Acacia securitization entities. |

| u | Net interest income was $14 million in the first quarter, a decrease of $3 million from the fourth quarter of 2009. This decrease was primarily due to the poor credit performance on securities held at Acacia, resulting in lower interest income. |

| u | The provision for loan losses at Sequoia totaled $9 million in the first quarter, unchanged from the fourth quarter of 2009. Although serious delinquencies (90+ days past due) continued to rise to 4.32% in the first quarter from 3.98% at the end of the fourth quarter, the rate of increase was consistent with the fourth quarter. There are currently three Sequoia entities for which we have expensed aggregate loan loss provisions of $2 million in excess of our reported investment for GAAP purposes. At this time we do not expect to deconsolidate any Sequoia entities in 2010. |

| 20 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

GAAP Income (continued)

Summary (continued)

Investments in the Fund and Securitization Entities (continued)

| u | Market valuation adjustments were negative $8 million for interest rate hedges at the Acacia securitization entities. This reflects the net changes in the values of, and net interest payments associated with, these derivative instruments. |

| u | Realized gains of $6 million resulted from the gain of $7 million from the repurchase of asset-backed securities issued by one of the Sequoia entities, partially offset by losses of $1 million from the sale of securities at the Fund. |

| u | Our consolidated securitization entities are subject to a number of economic uncertainties that can result in volatility to our reported income. For example, changes in the market values of securitized assets may not move in tandem with changes in the market values of securitized liabilities due to liquidity and other market factors. Derivative hedging instruments in Acacia may also not move in conjunction with the market values of the hedged liabilities, and the timing of interest payments on these derivatives may not occur in the same accounting period as the payments on the hedged liabilities. In addition, varying accounting classifications and treatments for certain of our Sequoia and Acacia entities can contribute to volatility in our earnings. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 21 |

| |

| FINANCIAL INSIGHTS |

Taxable Income and Dividends

Summary

| u | Taxable income is pre-tax profit as calculated for tax purposes. REIT taxable income is income earned at the Redwood REIT together with income earned at REIT subsidiaries and excludes undistributed taxable income earned at our taxable subsidiaries. We are required to distribute at least 90% of our REIT taxable income in the form of dividends to shareholders in order to maintain our tax status as a REIT. Our board of directors can declare dividends in excess of this minimum requirement. |

Overview

| u | Estimated taxable income for the first quarter of 2010 was $1 million, or $0.01 per share, as compared to negative $34 million, or $(0.44) per share, for the fourth quarter of 2009. |

| u | Although taxable income turned positive in the first quarter, we still expect to realize a taxable loss for the full year in 2010. The timing of credit losses on securities we own has a large impact on our quarterly taxable income. In the first quarter, our credit losses were lower than in the prior quarter ($24 million versus $54 million) due to ongoing efforts by the government to promote loan modifications and reduce foreclosures. These efforts will likely continue to affect timing of loss recognition. We anticipate an additional $252 million of losses on securities in future periods for tax purposes; for GAAP purposes we have reserves for these anticipated losses. |

| u | There are differences that exist in accounting under GAAP and for tax purposes that can lead to significant variances in the amount and timing of when income and losses are recognized under these two accounting methods. The most significant difference continues to be the realization of credit losses. Another difference is sales. Taxable gains may be offset by prior period capital losses, which totaled $85 million at March 31, 2010. To the extent we sell assets and recognize gains for GAAP there may be no gain included in taxable income. Reconciliations of GAAP and tax income are shown in Table 2 in the Financial Tables in this Review. |

| u | Under the tax code, REIT dividend distribution requirements are tied to taxable income. Given our net operating loss carryforwards and our projection of a taxable loss in 2010, we currently expect to have no dividend distribution requirements. However, in November 2009, our board of directors announced its intention to pay a quarterly regular dividend of $0.25 per share in 2010. We do not expect to pay any special dividends in 2010. |

| u | On March 17, 2010, our board of directors declared a regular dividend of $0.25 per share for the first quarter, which was paid on April 21, 2010 to shareholders of record on March 31, 2010. |

| u | As a result of our tax loss expectations in 2010, we currently expect that this year’s dividend distributions will be characterized as return of capital. However, if credit losses remain at lower levels than experienced in recent quarters and we do generate positive taxable income, a portion of this year’s dividend distributions would be characterized as ordinary income (to the extent of the 2010 income). |

| 22 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

Cash Flow

| u | In the first quarter, our business cash flow remained strong and in line with our expectations. Our business cash flow exceeded dividend distributions and this excess funded our acquisitions. We ended the quarter with about the same cash balance as we started the quarter — $242 million. |

| u | We believe our current GAAP income statements are reflective of our current underlying business trends, especially given the nature of the assets we currently hold. We also consider cash flow one of a number of other important operating metrics; however, we realize that quarterly cash flow measures have limitations. In particular, we note: |

| • | When securities are purchased at large discounts from face value it is difficult to determine what portion of the cash received is a return “of” principal and what portion is a return “on” principal. It is only at the end of an asset’s life that we can accurately determine what portion of the cumulative cash received (whether principal or interest) was income and what was a return of capital. |

| • | Certain investments may generate cash flow in a quarter that is not necessarily reflective of the long-term economic yield we will earn on the investments. For example, we acquired certain re-REMIC support securities at what we believe to be attractive yields. Due to their terms, however, these securities are locked out of receiving any principal payments for years. Because of the deferred receipt of principal payments, formulating any conclusions on the value or performance of these securities by looking solely at the early quarterly cash flow may not be indicative of economic returns. |

| • | Cash flow from securities and investments can be volatile from quarter to quarter depending on the level of invested capital, the timing of credit losses, acquisitions, sales, and changes in prepayments and interest rates. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 23 |

| |

| FINANCIAL INSIGHTS |

Cash Flow (continued)

| u | The sources and uses of cash in the table below are derived from our GAAP Consolidated Statement of Cash Flow for the first quarter of 2010 and the fourth quarter of 2009 by aggregating and netting all items in a manner consistent with the way management analyzes them. This table excludes the gross cash flow generated by our Sequoia and Acacia securitization entities and the Fund (cash flow that is not available to Redwood), but does include the cash flow distributed to Redwood as a result of our investments in these entities. The beginning and ending cash balances presented in the table below are GAAP amounts. |

| | | | | | | |

Redwood Sources and Uses of Cash | |

| ($ in millions) | |

| | | Three Months Ended | |

| | | 3/31/2010 | | | 12/31/2009 | |

| | | | | | | |

| Beginning cash balance | | $ | 243 | | | $ | 217 | |

| Business cash flow: | | | | | | | | |

| Cash flow from securities and investments | | $ | 193 | | | $ | 134 | |

| Asset management fees | | | 1 | | | | 1 | |

| Cash operating expenses | | | (16 | ) | | | (11 | ) |

| Interest expense on long-term debt | | | (1 | ) | | | (1 | ) |

| Total business cash flow | | | 177 | | | | 123 | |

| | | | | | | | | |

| Other sources and uses: | | | | | | | | |

| Changes in working capital | | | (2 | ) | | | (9 | ) |

Acquistions (1) | | | (156 | ) | | | (68 | ) |

| Dividends | | | (20 | ) | | | (20 | ) |

| Net other uses | | | (178 | ) | | | (97 | ) |

| | | | | | | | | |

| Net (uses) sources of cash | | $ | (1 | ) | | $ | 26 | |

| Ending cash balance | | $ | 242 | | | $ | 243 | |

| (1)Total acquisitions in the first quarter of 2010 were $189 million, $33 million which are not reflected in this table because they did not settle until early April 2010. In the fourth quarter of 2009, all acquisitions were settled within the period. |

| 24 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

| u | As detailed in the table below, we now include proceeds from sales as a component of business cash flow. While it is generally our intention when we acquire assets to hold them to maturity and receive principal and interest payments over their lives, we sell assets from time to time as part of our continuing management of risk and return expectations. A sale effectively accelerates the receipt of these cash flows. |

| | | | | | | |

| Redwood | |

| Cash Flow from Securities and Investments | |

| ($ in millions) | |

| | | | | | | |

| | | Three Months Ended | |

| | | 3/31/2010 | | | 12/31/2009 | |

| | | | | | | |

| Securities at Redwood | | | | | | |

| Residential Seniors | | | | | | |

| Principal and Interest | | $ | 40 | | | $ | 41 | |

| Proceeds from Sales | | | 73 | | | | 27 | |

| Total | | | 113 | | | | 68 | |

| | | | | | | | | |

| Residential Re-REMICs | | | | | | | | |

| Principal and Interest | | | 3 | | | | 4 | |

| Proceeds from Sales | | | 51 | | | | 31 | |

| Total | | | 54 | | | | 35 | |

| | | | | | | | | |

| Residential Subordinates principal and interest | | | 8 | | | | 10 | |

| | | | | | | | | |

| Commercial and CDO Subordinates | | | | | | | | |

| Principal and Interest | | | 1 | | | | 1 | |

| Proceeds from Sales | | | - | | | | 8 | |

| Total | | | 1 | | | | 9 | |

| Total cash flow from securities at Redwood | | | 176 | | | | 122 | |

| | | | | | | | | |

| Investments in the Fund | | | 9 | | | | 2 | |

| Investments in Sequoia entities | | | 8 | | | | 10 | |

| Investments in Acacia entities | | | - | | | | - | |

| Total cash flow from securities and investments | | $ | 193 | | | $ | 134 | |

| u | Total cash flow from securities and investments was $193 million for the first quarter, an increase of $59 million from the prior quarter, primarily due to an increased level of sales. |

| u | Total proceeds from the sale of securities were $124 million in the first quarter. Redwood’s investment in the Fund generated $9 million of cash flow due to sales of securities during the period. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 25 |

| |

| NEW SECURITIZATION INITIATIVE |

Summary

In April 2010, Redwood (through Sequoia) sponsored a $238 million residential prime jumbo mortgage securitization, referred to as SEMT 2010-H1. This was the first prime jumbo securitization to be backed by newly originated loans in nearly two years and was well received by triple-A investors and, importantly, did not require credit support from the government. SEMT 2010-H1 incorporates many of the suggestions we received as a result of meetings and conversations with triple-A investors, major originators and servicers, rating agencies, legislators, regulators, trade groups, and others.

Although this transaction was successful, market participants still have more work to do before a functioning private mortgage securitization market can fully re-emerge. In reviewing this transaction, we will focus on six areas where reform efforts are underway: (1) due diligence, (2) representations and warranties and enforcement, (3) skin-in-the-game, (4) disclosures, (5) trustee independence, and (6) securitization accounting.

Due Diligence

| u | Redwood performed due diligence relating to the mortgage loans backing this securitization. The securitization process started with Redwood identifying the general credit criteria, that is the loan size, LTV and other credit and loan characteristics, that it wanted to characterize the loans underlying this first securitization. In conjunction with this, Redwood representatives met with the originator to understand the originator’s underwriting process and procedures for originating jumbo loans. Once the pool of loans were identified as having met the general criteria, Redwood and a third party due diligence provider reviewed every loan for compliance with the originator’s underwriting guidelines and criteria and for adherence to all regulatory and legal requirements. In addition, Redwood and its third party due diligence provider reviewed each appraisal that the originator had obtained in originating the loans. Each loan had to be submitted to these reviews in order to be included in the final pool. This process enabled Redwood to buy only those loans that conformed to our own specific acquisition criteria compared to prior industry practices in which sellers would often assemble a package of loans that were then put out for bid to all interested parties and the buyers had to bid on the entire package. |

Representations and Warranties and Enforcement

| u | Representations and warranties provided by originators of mortgage loans included in securitizations have traditionally varied widely across transactions and credit classes (prime, Alt-A, subprime, etc.). The American Securitization Forum (ASF) has developed a set of industry standard representations and warranties to facilitate a consistent approach to enable investors to understand protections afforded them. Additionally, the rating agencies have also published their required representations and warranties, some of which are slightly different from the ASF. Redwood reviewed these various sets and developed a set of representations and warranties that meet or exceed both of these standards. |

| 26 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

| |

| NEW SECURITIZATION INITIATIVE |

Representations and Warranties and Enforcement (continued)

| u | In our view, the strength of the representations and warranties is only as good as the enforcement mechanism. To address this issue, we included a binding arbitration clause in SEMT 2010-H1. Binding arbitration enables the responsible parties to reach resolution on a disagreement without ending up in litigation. We believe this mechanism will facilitate more productive and timely responses to what, in many cases, are not always easily resolved issues. |

| u | To further facilitate the post-securitization review for violations of representations and warranties, all origination files were provided to Redwood as the buyer of the loans. |

Skin-in-the-Game

| u | It is being proposed by various policy makers that a fixed 5% of a securitization be retained. Others are advocating higher fixed rate percentages. A fixed percentage is enticing as it seems easy to understand and apply. However, we strongly believe this approach is too simplistic and could disrupt the flow of mortgage credit to prime borrowers while inappropriately providing an incentive to engage in securitizations of higher risk mortgage loans. Instead, we believe the amount of risk retention in a securitization should vary according to the underlying risk. |

| u | One approach, for example, would be to tie risk retention requirements to the rating agency subordination levels. We realize there is a desire on the part of some to reduce the amount of reliance on credit agencies and encourage investors to undertake their own analysis. However, in our opinion, rating agencies provide useful information. Furthermore, the rating process establishes subordination levels after taking into consideration the quality of the collateral and structure of the securitization, among other factors. |

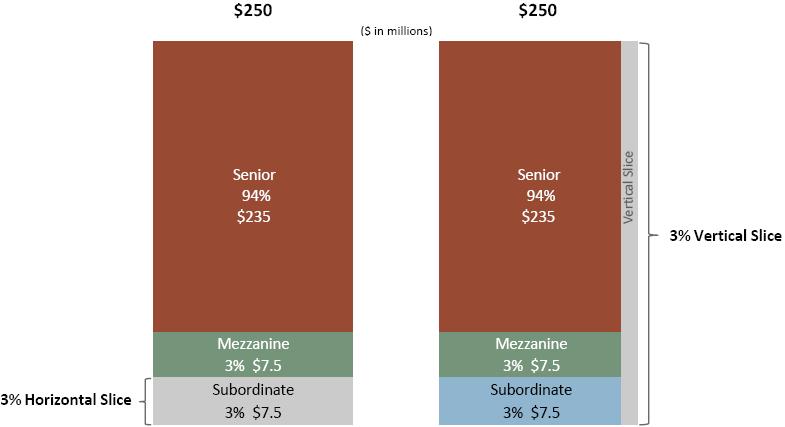

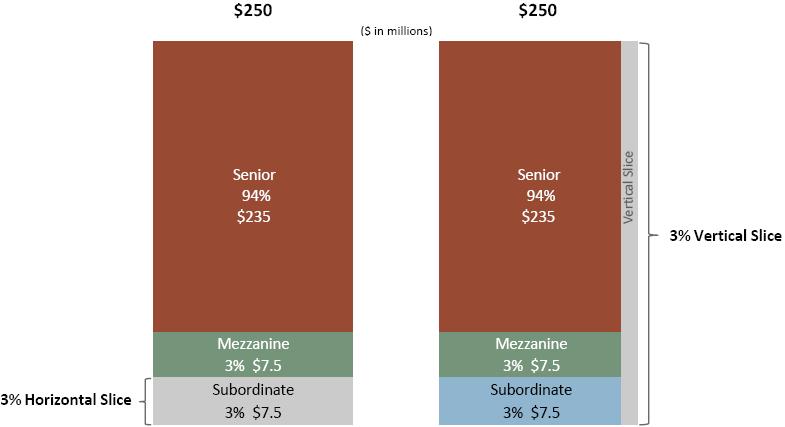

| u | For example, if the risk retention percentage was set at 100% of the non-investment grade subordinate securities, then a securitization backed by prime jumbo mortgages with the senior AAA investment grade securities representing 94% of the securitization, the mezzanine securities (AA, A, BBB) representing 3% of the securitization, and the subordinate or non-investment grade securities (BB, B, Not Rated) representing 3% of the securitization, the risk retention requirement would be 3%. Alternatively, for a securitization with lesser quality subprime mortgage collateral in a structure in which the senior AAA securities represent 70% of the securitization, the mezzanine securities represent 10%, and the subordinated securities represent 20%, the retention requirement for this transaction would be 20%. |

| u | A very important aspect of risk retention is how that risk is retained by sponsors. We are strong a advocate of retaining a “horizontal slice” of first-loss credit risk from the securitization structure. We are not advocates of the “vertical slice” approach because we strongly believe this structure does not properly incent sponsors to structure sound securitizations and does not necessarily align the sponsors’ interests with those of investors. In fact, only the horizontal slice structure fully exposes the sponsor to the majority of the credit risk in a securitization and, as the proposals note, having sponsors maintain the credit risk supports the notion that their interests will be properly aligned with investors’ interests. |

| THE REDWOOD REVIEW 1ST QUARTER 2010 | 27 |

| |

| NEW SECURITIZATION INITIATIVE |

Skin-in-the-Game (continued)

| u | Examples of the horizontal and vertical slices for a hypothetical $250 million securitization are displayed in the diagram below. In our recent securitization we retained both a horizontal and vertical slice of risk in order to satisfy alternate proposals until the final rule is adopted. However, we do not advocate this as the solution, as it will deter useful and productive securitizations. |

| u | These are two very different risk retention profiles. In the horizontal slice approach, the sponsor’s entire investment ($7.5 million in this example) is in a first loss position. Under the vertical slice approach, the sponsor has a small amount ($450,000) in the subordinated securities and the majority of its investment ($7.05 million) in the senior securities that are last in line to incur credit losses. It is our opinion that the sponsor that has all its capital in the first loss position has its interests most aligned with the interests of all the security holders because the sponsor is retaining the most significant portion of the risk. |

| 28 | THE REDWOOD REVIEW 1ST QUARTER 2010 |

| |

| NEW SECURITIZATION INITIATIVE |

Skin-in-the-Game (continued)