Exhibit 99. 2

Depositary’s Notice of Extraordinary

Shareholders’ Meeting of Delhaize Group SA/NV

| ADSs: | American Depositary Shares. |

| ADS CUSIP No.: | 29759W101. |

| ADS Record Date: | January 25, 2016 (close of business in New York). Date to determine ADS Holders and Beneficial Owners who are to receive these materials and who are eligible to give voting instructions to the Depositary upon the terms described herein. |

| Share Record Date: | February 29, 2016. Date on which ADS Holders are required under Belgian Law to hold their interests in the shares of the Company in order to be eligible to vote at the Meeting |

| Meeting Specifics: | Extraordinary Shareholders’ Meeting to be held Monday, March 14, 2016 at 2:00 p.m. (CET) at the Proximus Lounge, rue Stroobantsstraat 51 in 1140 Brussels, Belgium (the “Meeting”). |

| Meeting Agenda: | Please see the Royal Ahold N.V. Prospectus, Notice of Availability of Proxy Materials and the ADS Voting Instruction Form enclosed herewith. |

| ADS Voting Deadline: | Please see the ADS Voting Instruction Form enclosed herewith. |

| Deposited Securities: | Ordinary shares, without nominal value, of Delhaize Group, a société anonyme/naamloze vennootschap organized under the laws of Belgium (the “Company”). |

| ADS Ratio: | 1 ordinary share to 4 ADSs. |

| Depositary: | Citibank, N.A. |

Custodian of Deposited Securities: | Citibank International Plc London. |

| Deposit Agreement: | Second Amended and Restated Deposit Agreement, dated as of May 3, 2013. |

To be counted, your voting instructions need to be received by the Depositary prior to the applicable ADS Voting Deadline. No voting rights will be exercised by the Depositary for voting instructions received after the applicable ADS Voting Deadline. In addition, your voting instructions will be disregarded if the Depositary is unable to confirm your continued ownership of the ADS as of the Share Record Date.

The Company has announced that the Meeting will be held at the date, time and location identified in the enclosed ADS Voting Instruction Form. Enclosed is a copy of the Royal Ahold N.V. Prospectus as well as a Notice of Availability of Proxy Materials which will enable you to determine how you may obtain a copy of the Company’s Notice of Meeting.

Subject to Belgian law, the Articles of Association of the Company, the provisions of or governing the Deposited Securities, the terms of the Deposit Agreement, Registered Holders (as defined below) and DTC Holders (as defined below), in each case as of the close of business on the ADS Record Date, will be entitled to instruct the Depositary as to the exercise of voting rights pertaining to the Deposited Securities represented by their ADSs. However, as mentioned above, the voting instructions of any such holder will be disregarded if the Depositary is unable to confirm such holder’s continued ownership of the ADSs as of the Share Record Date.

DTC Holders

In order to vote their ADSs, owners of ADSs (“DTC Holders”) holding their ADSs in a brokerage or custodian account through The Depository Trust Company (“DTC”) as of the ADS Record Date must continue to own their ADSs as of the Share Record Date and must instruct their broker or custodian to give voting instructions to the Depositary and to confirm ownership of the ADSs to the Depositary. On the Share Record Date the Depositary will verify the continued ownership of the ADSs by the instructing DTC Holders with the applicable brokers or custodians (through which the instructing DTC Holders provided voting instructions to the Depositary). Failure to confirm continued ownership of ADSs as of the Share Record Date will invalidate the voting instructions previously delivered.

Registered Holders

In order to vote their ADSs, Holders of ADSs registered in their name on the books of the Depositary (“Registered Holders”) must timely deliver a Voting Instruction Form to the Depositary and continue to be the Registered Holders of their ADSs as of the Share Record Date. If a Registered Holder transfers or cancels ADSs at any time before the Share Record Date any voting instructions delivered to the Depositary will be invalidated. On the Share Record Date, the Depositary will verify the continued registration on its books of the ADSs in the name of the instructing Registered Holders (who also held the ADSs as of the ADS Record Date) and will recognize as valid only the voting instructions that were timely received from Registered Holders as of the ADS Record Date who continue to be the Registered Holders of the ADS as of the Share Record Date.

Registered Holders as of the ADS Record Date may provide their voting instructions to the Depositary through the Internet, via telephone or by mail.

| | ● | Voting by Internet: Log on to the Internet and go to www.citi.com/dr. Click on “Investors” and then click on “Voting by Internet”. Follow the steps outlined on the secured website. |

| | | |

| | | Or with your Smartphone scan the QR code to cast your vote now. |

| | | |

| | ● | Voting by Telephone: Call toll free 1-800-652-Vote (8683) within the USA, US territories and Canada. There is NO CHARGE to you for the call. Follow the instructions provided in the recorded message. |

| | | |

| | | Enter your Proxy Access Number which is the circled number located on the front of the card in the shaded bar. |

| | | |

| | | Complete the Voting Instructions provided on the mobile optimized website by the Voting Deadline. |

| | | |

| | ● | Voting by Mail: Mark, sign and date your Voting Instruction Form which is included with this notice. Detach your Voting Instruction Form. Return your Voting Instruction Form in the postage-paid envelope provided with the Voting Instruction Form. |

NO VOTING RIGHTS WILL BE EXERCISED BY THE DEPOSITARY IF IT DOES NOT RECEIVE TIMELY VOTING INSTRUCTIONS. VOTING INSTRUCTIONS WHICH DO NOT CLEARLY IDENTIFY THE HOLDER PROVIDING VOTING INSTRUCTIONS FOR THEIR ADSs WILL BE DEEMED BY THE DEPOSITARY AND THE COMPANY TO BE NULL AND VOID.

The right of any ADS holder to give instructions to the Depositary as to the exercise of voting rights or the right of any ADS holder to vote withdrawn ordinary shares in person or by proxy may be limited if such ADS holder fails to (i) comply with the information requests, (ii) comply with ownership restrictions, (iii) meet reporting obligations, (iv) obtain regulatory approvals (if any), or (v) disclose their interest held in the Company as described in the Deposit Agreement.

If a Voting Instruction Form is signed and timely returned to the Depositary by a holder of ADSs (who otherwise satisfied all conditions for voting) but no specific voting direction is marked as to one or more of the proposals, such holder will be deemed to have directed the Depositary to vote as to such proposal(s) in the manner set forth on the Voting Instruction Form.

ADS holders who have delivered voting instructions agree that such voting instruction may, at the request of the Company, be disclosed by the Company, for purposes of compliance with Belgian law, in connection with the Meeting, whether prior, during or after such Meeting.

The information with respect to the Meeting has been provided by the Company. Citibank, N.A. is making this information available to you, at the request of the Company, solely in its capacity as Depositary and in accordance with the terms of the Deposit Agreement, and disclaims any responsibility with respect to the accuracy or completeness of such information. Citibank, N.A. does not, and should not be deemed to, express any opinion with respect to the proposals to be considered at the Meeting. A copy of the Deposit Agreement has been filed with the Securities and Exchange Commission as an exhibit to a Registration Statement on Form F-6 (Registration No. 333-156798) and can be retrieved from the Securities and Exchange Commission’s website (www.sec.gov).

If you have any questions concerning the enclosed materials or if you need further explanation of the materials covered therein, please call Citibank, N.A. - ADR Shareholder Services toll-free at 877-853-2191.

Citibank, N.A., as Depositary

Annex 1 to Exhibit 99.2

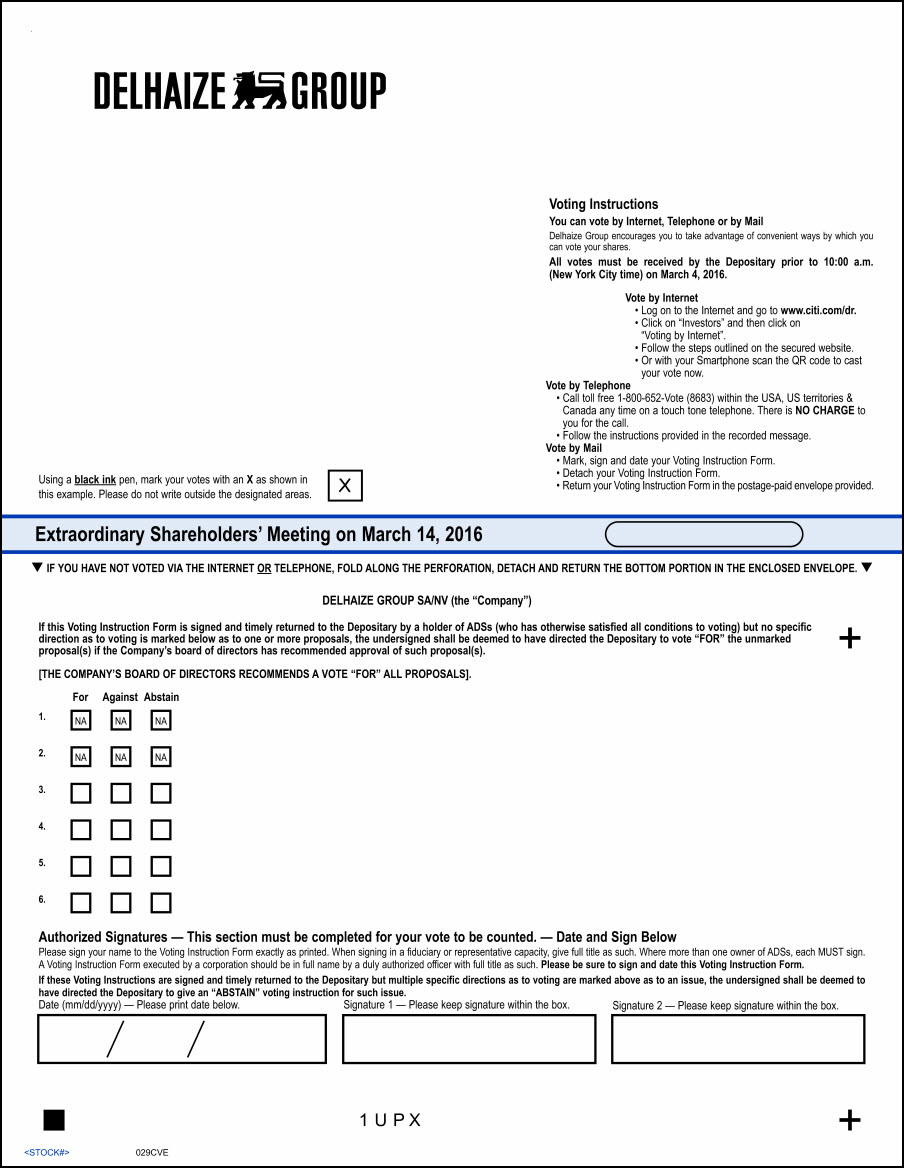

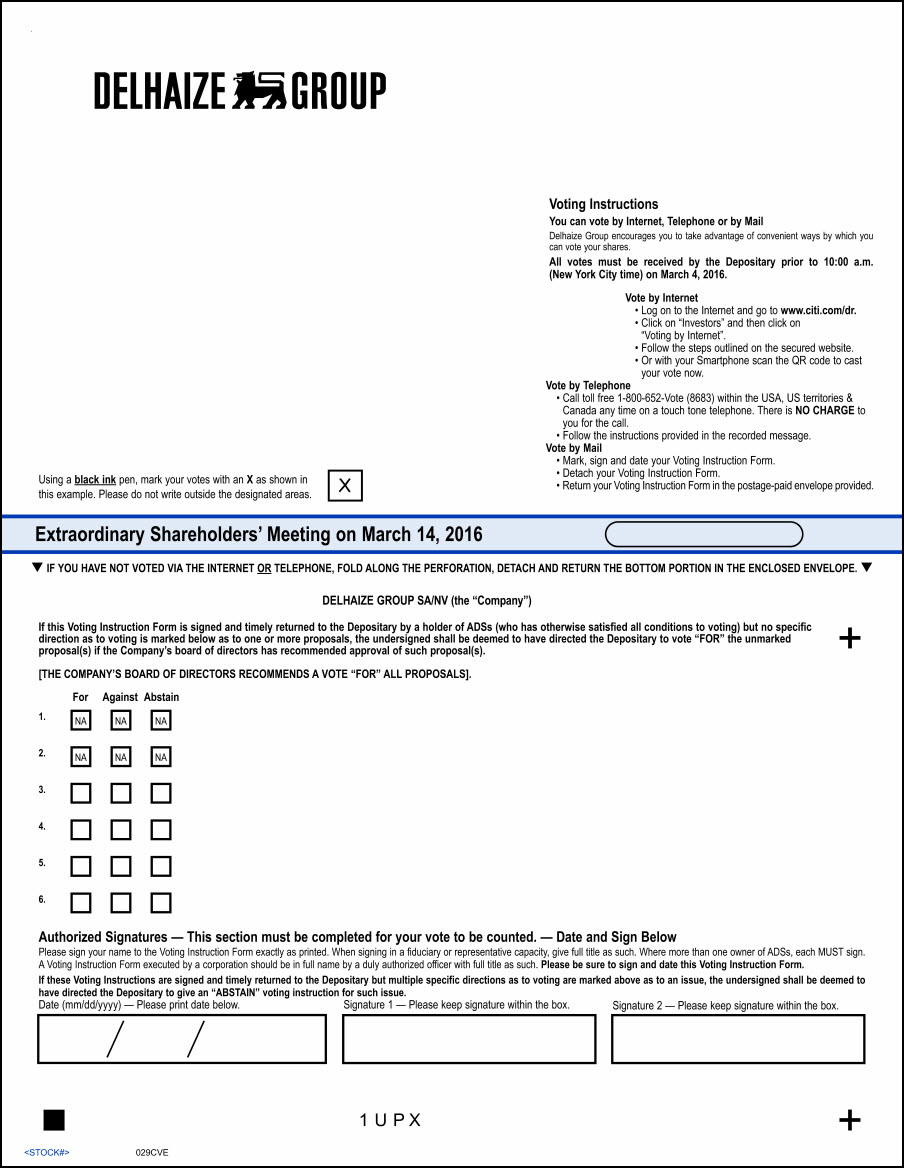

Voting Instructions You can vote by Internet, Telephone or by Mail Delhaize Group encourages you to take advantage of convenient ways by which you can vote your shares. All votes must be received by the Depositary prior to 10:00 a.m. (New York City time) on March 4, 2016. Vote by Internet Log on to the Internet and go to www.citi.com/dr. Click on “Investors” and then click on “Voting by Internet”. Follow the steps outlined on the secured website. Or with your Smartphone scan the QR code to cast your vote now. Vote by Telephone Call toll free 1-800-652-Vote (8683) within the USA, US territories & Canada any time on a touch tone telephone. There is NO CHARGE to you for the call. Follow the instructions provided in the recorded message. Vote by Mail Mark, sign and date your Voting Instruction Form. Detach your Voting Instruction Form. Return your Voting Instruction Form in the postage-paid envelope provided. Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. Extraordinary Shareholders’ Meeting on March 14, 2016 IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. DELHAIZE GROUP SA/NV (the “Company”) If this Voting Instruction Form is signed and timely returned to the Depositary by a holder of ADSs (who has otherwise satisfied all conditions to voting) but no specific direction as to voting is marked below as to one or more proposals, the undersigned shall be deemed to have directed the Depositary to vote “FOR” the unmarked proposal(s) if the Company’s board of directors has recommended approval of such proposal(s). [THE COMPANY’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL PROPOSALS]. For Against Abstain 1. NA NA NA 2. NA NA NA 3. 4. 5. 6. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below Please sign your name to the Voting Instruction Form exactly as printed. When signing in a fiduciary or representative capacity, give full title as such. Where more than one owner of ADSs, each MUST sign. A Voting Instruction Form executed by a corporation should be in full name by a duly authorized officer with full title as such. Please be sure to sign and date this Voting Instruction Form. If these Voting Instructions are signed and timely returned to the Depositary but multiple specific directions as to voting are marked above as to an issue, the undersigned shall be deemed to have directed the Depositary to give an “ABSTAIN” voting instruction for such issue. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. 1 U P X <STOCK#> 029CVE

Agenda 1.Acknowledgment and discussion of the following documents of which the shareholders could receive a copy free of charge: i.the joint cross-border merger proposal, drawn up by the Management Board of Koninklijke Ahold N.V. (“Ahold”) and the Board of Directors of the Company, in accordance with Article 5 of Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005 on cross-border mergers of limited liability companies, Article 772/6 of the Belgian Companies Code and section 2:312 juncto 2:326 juncto 2:333d of the Dutch Civil Code (the “Merger Proposal”); ii.the board report, drawn up by the Board of Directors of the Company, in accordance with Article 7 of Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005 on cross-border mergers of limited liability companies and Article 772/8 of the Belgian Companies Code (the “Board Report”); and iii.the report, drawn up by the Company’s statutory auditor, in accordance with Article 8 of Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005 on cross-border mergers of limited liability companies and Article 772/9 of the Belgian Companies Code (the “Auditor’s Report”). 2.Communication of any material changes in the assets and liabilities of the companies involved in the merger between the date of the Merger Proposal and the date of the merger, in accordance with Article 696 juncto 772/1 of the Belgian Companies Code. 3.Cross-border merger by acquisition of the Company by Ahold – Reference provisions of the Dutch Law Role Employees at European Legal Entities – Transfer of real estate Proposed resolution: approval of: i.the Merger Proposal, conditional upon the satisfaction of the conditions precedent set out in the Merger Proposal and effective as from 00:00 a.m. CET on the first day after the day on which a Dutch civil law notary executes the Dutch notarial deed of cross-border merger (the “Effective Time”); ii.the cross-border merger by acquisition of the Company by Ahold within the meaning of Article 2.2 a) of Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005 on crossborder mergers of limited liability companies, Articles 671 and 772/1 of the Belgian Companies Code and Section 2:309 juncto Section 2:333 of the Dutch Civil Code, in accordance with the terms of the Merger Proposal, conditional upon the satisfaction of the conditions precedent set out in the Merger Proposal and effective as from and conditional upon the Effective Time, and hence dissolution without liquidation of the Company; iii.the application of the reference provisions of Section 1:31, subsections 2 and 3 of the Dutch Law Role Employees at European Legal Entities (Wet Rol Werknemers bij Europese Rechtspersonen) (the “RWER Law”) instead of initiating negotiations with a special negotiating body (as referred to in Section 2:333k subsection 12 of the Dutch Civil Code) and, hence, to continue the existing situation at the level of Ahold or at the level of the Company with respect to employee participation as defined in Article 1:1 of the RWER Law; and iv.the fact that the real property and immovable rights in rem of which the Company declares to be the owner shall be the subject of separate notarial deeds which shall contain the legal formalities to be complied with regarding the transfer of such real property and immovable rights in rem (without prejudice to the legal formalities which are contained in the minutes of this extraordinary shareholders’meeting) and which shall be transcribed in the records of the competent mortgage registries. 4.Grant of Delhaize EU PSUs to Mr. Frans Muller Proposed resolution: approval of the exceptional grant to Mr. Frans Muller of Delhaize EU PSUs prior to the day on which a Dutch civil law notary executes the Dutch notarial deed of cross-border merger (the “Closing”) and with a value of EUR 1.5 million. The vesting of the Delhaize EU PSUs shall occur three years after grant, subject to company performance against financial targets, which currently relate to shareholder value creation, fixed upon grant. The number of shares to be received upon vesting of the Delhaize EU PSUs will vary from 0% to 150% of the awarded number of Delhaize EU PSUs, in function of the achieved company performance against financial targets and upon Closing the performance will be measured against targets as set for the combined company’s long-term incentive plan. Vesting of the Delhaize EU PSUs granted under this exceptional grant will be conditional upon (i) Closing taking place, and (ii) Mr. Frans Muller’s continued work under his management contract with the Company on the date of Closing. If any of these vesting conditions is not met, vesting will not take place and the Delhaize EU PSUs granted under this exceptional grant will automatically expire and become null and void. Upon Closing, the Delhaize EU PSUs granted under this exceptional grant will be converted into performance shares under the combined company’s long-term incentive plan. 5.Release from liability of the directors Proposed resolution: approval of the release of the directors from any liability arising from the performance of their duties during the period from 1 January 2016 until the date of this extraordinary shareholders’ meeting. 6.Delegation of powers Proposed resolution: approval of the delegation of powers to: i.B-Docs BVBA, having its registered office at Willem De Zwijgerstraat 27, 1000 Brussels, with the power to sub-delegate, to perform all formalities with the Register of Legal Entities, the VAT administration and any business one-stop-shop in order to amend and/or cancel the registration of the Company with the Crossroads Bank for Enterprises, as well as to perform all formalities resulting from the dissolution of the Company; ii.any current director of the Company, as well as to Philippe Dechamps, Nicolas Jérôme, Els Steen and Benoit Stockman, acting individually and with the power to sub-delegate, to sign, jointly with one or more representative(s) to be appointed by the general meeting of Ahold, the notarial deeds referred to in resolution 3.iv. above, as well as any rectifying notarial deeds regarding any material errors or omissions with respect to the real property or immovable rights in rem of the Company; and iii.any current director of the Company, as well as to Philippe Dechamps and Nicolas Jérôme, acting individually and with the power to sub-delegate, to implement the decisions taken by the extraordinary shareholders’ meeting and to carry out all necessary or useful formalities to that effect. More information concerning the above resolutions is available on the Company’s website www.delhaizegroup.com. IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Extraordinary Shareholders’ Meeting to be held on March 14, 2016 The Voting Instruction Form must be signed, completed and received at the indicated address prior to 10:00 a.m. (New York City time) on March 4, 2016 for action to be taken. VOTING INSTRUCTION FORMAMERICAN DEPOSITARY SHARES DELHAIZE GROUP SA/NV (the “Company”) CUSIP No.:29759W101. ADS Record Date:January 25, 2016. Share Record Date:February 29, 2016. (Date on which ADS Holders are required under Belgian Law to hold their interest in the shares of the Company in order to be eligible to vote at the Meeting). Meeting Specifics:Extraordinary Shareholders’ Meeting to be held on Monday, March 14, 2016 at 2:00 p.m. (CET) at the Proximus Lounge, rue Stroobantsstraat 51 in 1140 Brussels, Belgium (the “Meeting”). Meeting Agenda:Please refer to the enclosed Royal Ahold N.V. Prospectus and Notice of Availability of Proxy Materials. Depositary:Citibank, N.A. Deposit Agreement:Second Amended and Restated Deposit Agreement, dated as of May 3, 2013. Deposited Securities:Ordinary shares of the Company. Custodian:Citibank International Plc London. The undersigned holder, as of the ADS Record Date, of the American Depositary Shares identified above (the “ADSs”), acknowledges receipt of a copy of the Depositary’s Notice of Meeting and hereby authorizes and directs the Depositary to cause to be voted at the Meeting (and any adjournment or postponement thereof) the Deposited Securities represented by the undersigned’s ADSs in the manner indicated on the reverse side hereof. The undersigned recognizes that any sale, transfer or cancellation of ADSs before the Share Record Date will invalidate these voting instructions if the Depositary is unable to verify the continued ownership of ADSs as of the Share Record Date. The right of any holders of ADSs to give instructions to the Depositary as to the exercise of voting rights may be limited if such Holder fails to comply with the disclosure of interest requirements under Belgian law (which are summarized in Section 3.7 of the Deposit Agreement). In order to exercise voting rights, an owner who is not the registered holder of ADSs on the books of the Depositary will be required, subject to applicable provisions of the laws of Belgium, the Articles of Association of the Company and the Deposit Agreement, to have such ownership of ADS, verified by the Depositary as of the Share Record Date. Please indicate on the reverse side hereof how the Deposited Securities are to be voted. The Voting Instruction Form must be marked, signed and returned on time in order to be counted. By signing on the reverse side hereof, the undersigned represents to the Depositary and the Company that the undersigned is duly authorized to give the voting instructions contained therein.

Annex 2 to Exhibit 99.2

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary Shareholders Meeting to Be Held on March 14, 2016.

This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting.

A complete version of the proxy materials relating to the March 14, 2016 Extraordinary Shareholders Meeting is available at http://www.delhaizegroup.com/en/CorporateGovernance/ShareholderInformation/GeneralMeetings/ExtraordinaryGeneralMeetingofMarch14th2016.aspx

If you wish to receive a paper or email copy of these documents, you must request one. There is no charge for requesting a copy. Please make your request to our Depositary Bank, Citibank, by contacting the Delhaize Group ADR Shareholder Services line toll free at 1-877-853-2191, Monday through Friday from 08:30 AM through 06:00 PM Eastern Time. Alternatively, you may request these materials in writing to the address below.

Citibank Shareholder Services

P.O. Box 43077

Providence, Rhode Island 02940-5000