Exhibit 99.2

Exhibit 99.2

Transformation plan Delhaize

Belgium

Press Conference

11 June 2014

determination

integrity

courage

humility

humor

Agenda press conference

11.00 am : Announcement Denis Knoops – CEO Delhaize Belgium 11.20 am : Q&A

Denis Knoops – CEO Delhaize Belgium

Sylvie Van Den Eynde – SVP Human Resources Delhaize Belgium

11.30 am : Availability for interviews

1.00 pm : End

2

Transformation plan Delhaize Belgium

1. Context

2. Strategy Delhaize Belgium

3. Accelerated strategy implementation

4. Proposed transformation plan

3

1. Context

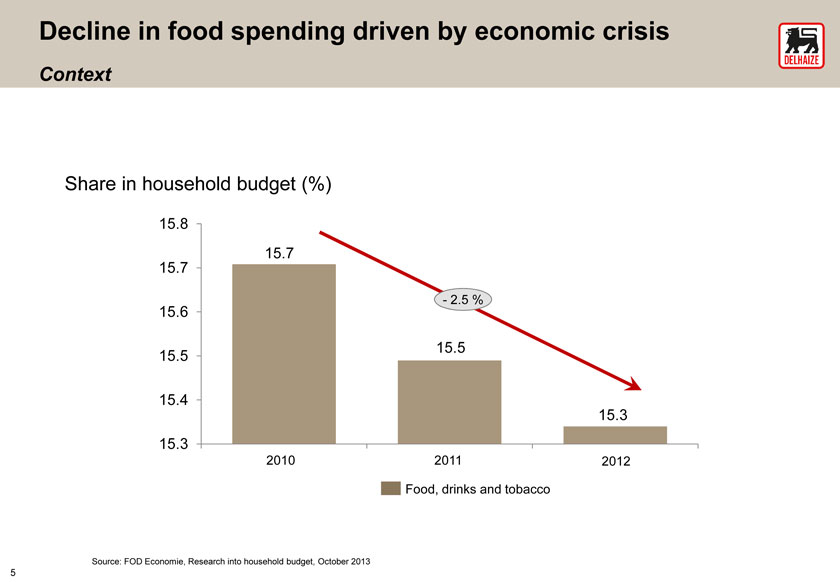

The economic crisis has impacted the purchasing behaviour of Belgian consumers.

The Belgian food retail market has recently become one of the most competitive markets in Europe where international operators are able to fully leverage their scale and cost benefits.

Volumes and market share of Delhaize´s company operated supermarkets are under severe pressure.

Delhaize Belgium is impacted by a significant and increasing cost handicap in wage and labour conditions.

The negative evolution in market share and profitability of the company operated supermarkets is not sustainable.

4

Decline in food spending driven by economic crisis

Context

Share in household budget (%)

15.8

15.7

15.7

- 2.5 %

15.6

15.5

15.5

15.4

15.3

15.3

2010 2011 2012

Food, drinks and tobacco

Source: FOD Economie, Research into household budget, October 2013

5

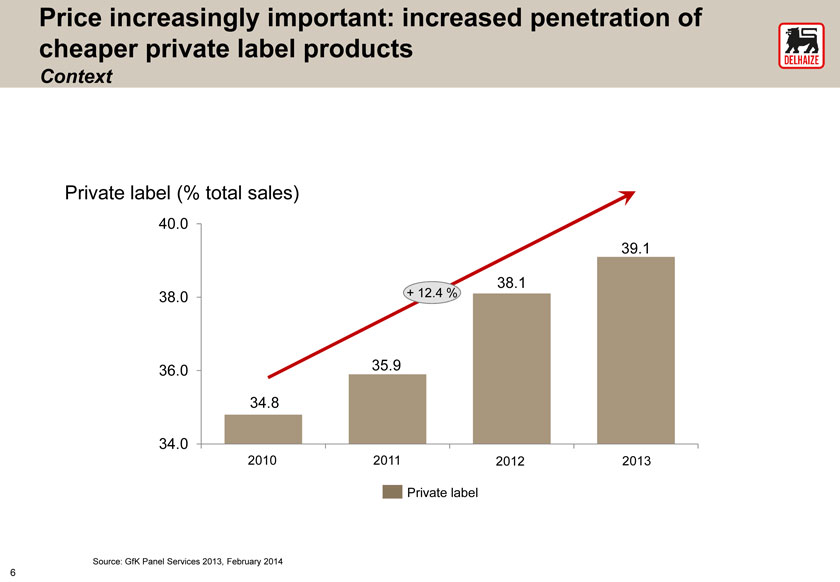

Price increasingly important: increased penetration of cheaper private label products

Context

Private label (% total sales)

40.0

39.1

+ 12.4 % 38.1

38.0

36.0 35.9

34.8

34.0

2010 2011 2012 2013

Private label

Source: GfK Panel Services 2013, February 2014

6

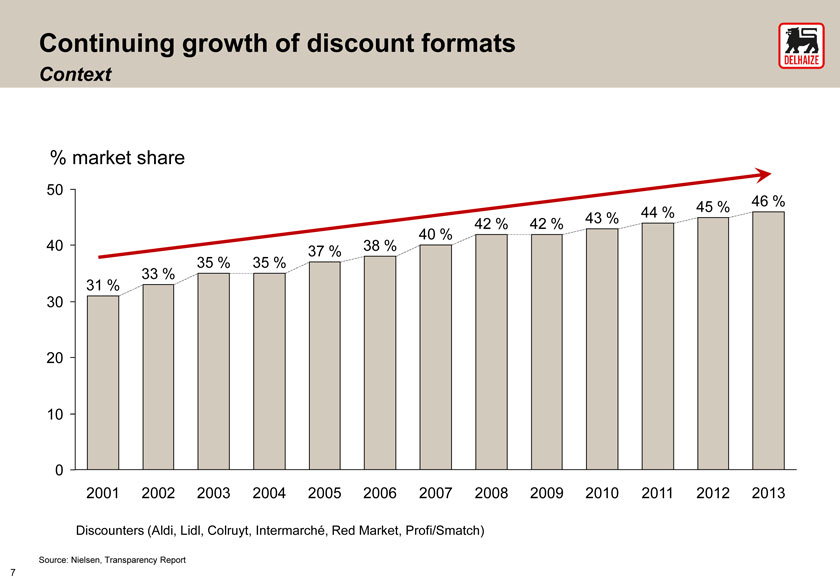

Continuing growth of discount formats

Context

% market share

50 46 %

45 %

44 %

43 %

40 40 % 42 % 42 %

0 38 %

35 % 35 % 37 %

31 % 33 % 30

20

10

0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Discounters (Aldi, Lidl, Colruyt, Intermarché, Red Market, Profi/Smatch)

Source: Nielsen, Transparency Report

7

Increased competition on the Belgian food retail market

Context

COUNTRY Belgium The Switzerland Austria Netherlands

# Large retailers

8 5 4 6

Local vs

2 local 3 local 2 local 2 local international 6 international 2 international 2 international 4 international operators

* Stores at least 500m², at least 10 stores, open for all customers

8

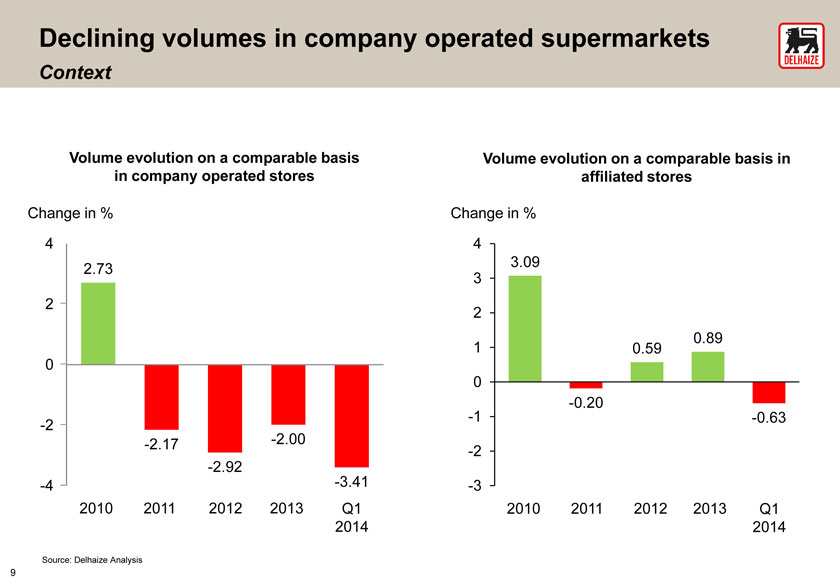

Declining volumes in company operated supermarkets

Context

Volume evolution on a comparable basis Volume evolution on a comparable basis in in company operated stores affiliated stores

Change in % Change in %

4

3.09

2.73

3

2

2

0.89

1 0.59 0 0 -0.20

-1 -0.63 -2 -2.17 -2.00 -2 -2.92 -4 -3.41 -3

2010 2011 2012 2013 Q1 2010 2011 2012 2013 Q1 2014 2014

Source: Delhaize Analysis

9

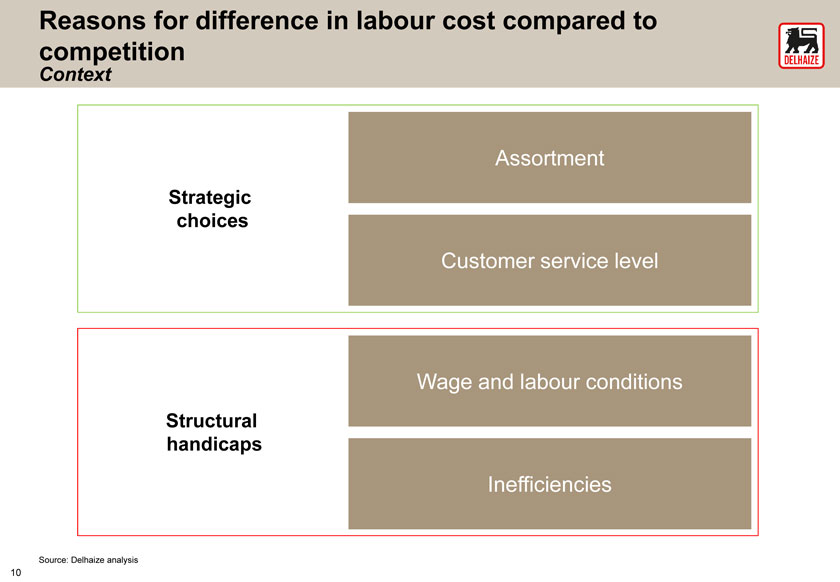

Reasons for difference in labour cost compared to

competition

Context

Assortment

Strategic

choices

Customer service level

Wage and labour conditions

Structural

handicaps

Inefficiencies

Source: Delhaize analysis

10

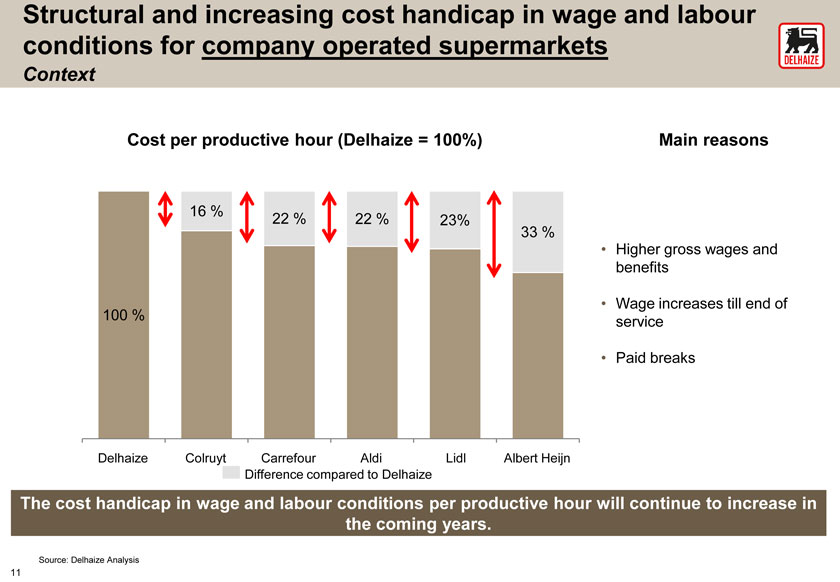

Structural and increasing cost handicap in wage and labour conditions for company operated supermarkets

Context

Cost per productive hour (Delhaize = 100%) Main reasons

16 %

22 % 22 % 23%

33 %

Higher gross wages and benefits

Wage increases till end of 100 % service

Paid breaks

Delhaize Colruyt Carrefour Aldi Lidl Albert Heijn Difference compared to Delhaize

The cost handicap in wage and labour conditions per productive hour will continue to increase in the coming years.

Source: Delhaize Analysis

11

Increased wage costs not reflected in price levels

Context

Delhaize Belgium – Internal food inflation 129 Delhaize Belgium – Labour cost Index 126

120

115

112 112 110 108 108 107 107 106 103 102 100 100

2006 = 100

2006 2007 2008 2009 2010 2011 2012 2013

Source: Delhaize Analysis

12

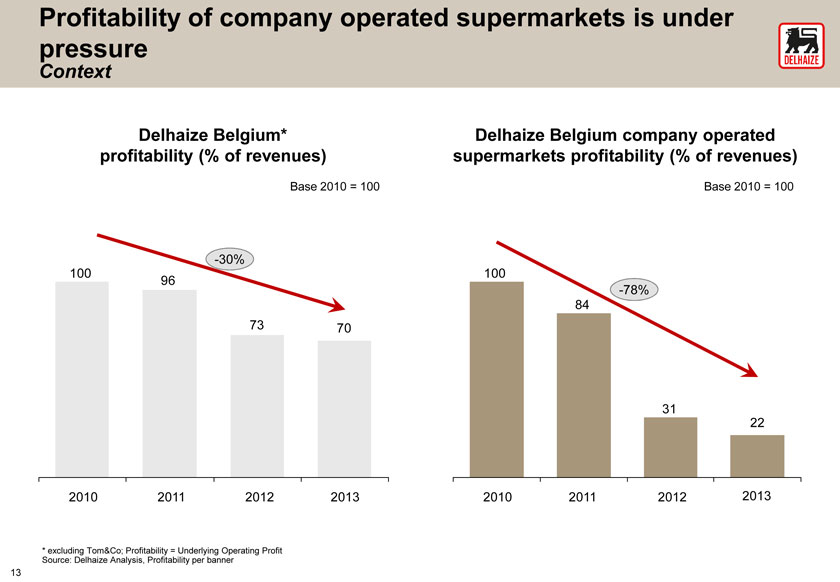

Profitability of company operated supermarkets is under pressure

Context

Delhaize Belgium* Delhaize Belgium company operated profitability (% of revenues) supermarkets profitability (% of revenues)

Base 2010 = 100 Base 2010 = 100

-30%

100 100

96 -78% 84

73 70

31

22

2010 2011 2012 2013 2010 2011 2012 2013

* excluding Tom&Co; Profitability = Underlying Operating Profit

Source: Delhaize Analysis, Profitability per banner

13

2. Clear long-term strategy aimed at strengthening the Delhaize brand

14

3. Acceleration of the strategy implementation

We have taken the first steps in the transformation process, but we have to take further steps to ensure a sustainable future for Delhaize Belgium.

We have to make 450 million EUR of additional investments during the period 2015-2017 in our company operated stores, our associates, our distribution centers, our products, our prices & e-commerce.

We will have to adapt our organization and our cost handicap in wages and labour conditions in order to invest in the operations.

15

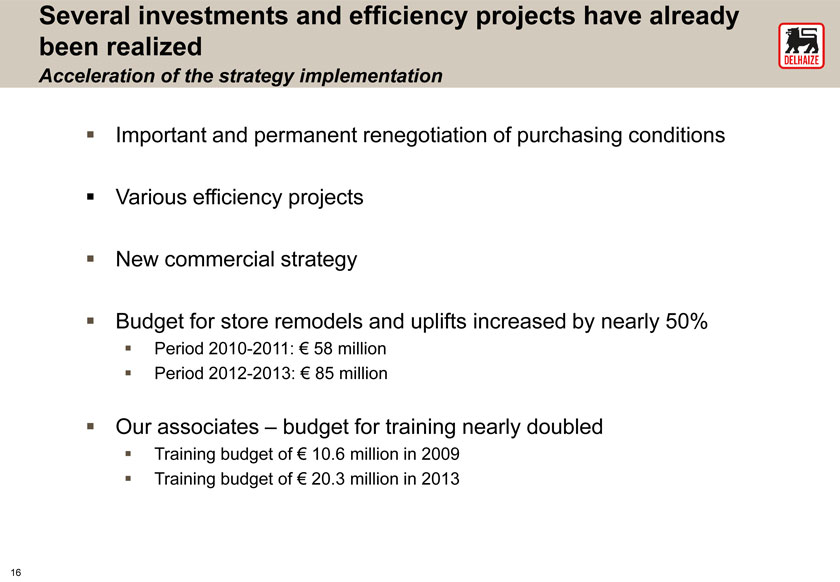

Several investments and efficiency projects have already been realized

Acceleration of the strategy implementation

Important and permanent renegotiation of purchasing conditions

Various efficiency projects

New commercial strategy

Budget for store remodels and uplifts increased by nearly 50%

Period 2010-2011: € 58 million

Period 2012-2013: € 85 million

Our associates – budget for training nearly doubled

Training budget of € 10.6 million in 2009

Training budget of € 20.3 million in 2013

16

Our strategy results in a positive customer satisfaction trend

Acceleration of the strategy implementation

8.08

8.05

8.02

2011 2012 2013

Customer satisfaction significantly higher after remodeling or uplift store

Source: Delhaize internal customer satisfaction study

17

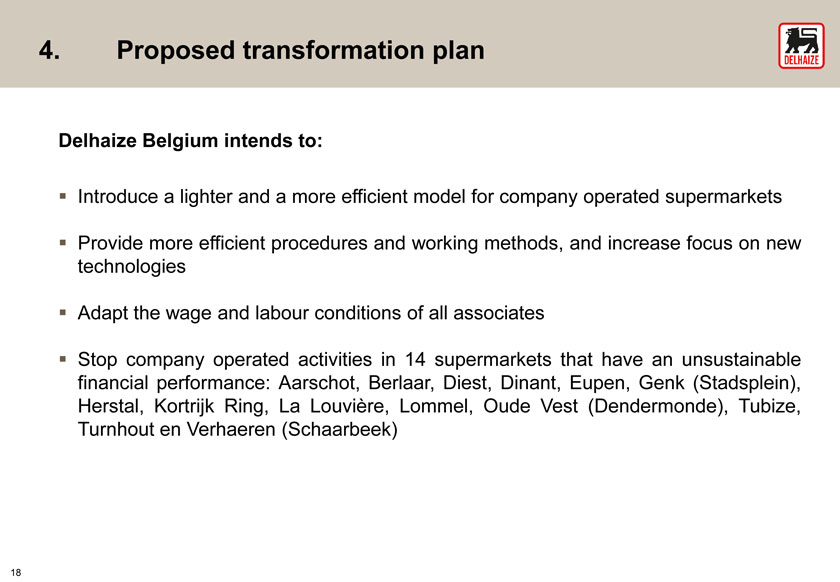

4. Proposed transformation plan

Delhaize Belgium intends to:

Introduce a lighter and a more efficient model for company operated supermarkets

Provide more efficient procedures and working methods, and increase focus on new technologies

Adapt the wage and labour conditions of all associates

Stop company operated activities in 14 supermarkets that have an unsustainable financial performance: Aarschot, Berlaar, Diest, Dinant, Eupen, Genk (Stadsplein), Herstal, Kortrijk Ring, La Louvière, Lommel, Oude Vest (Dendermonde), Tubize, Turnhout en Verhaeren (Schaarbeek)

18

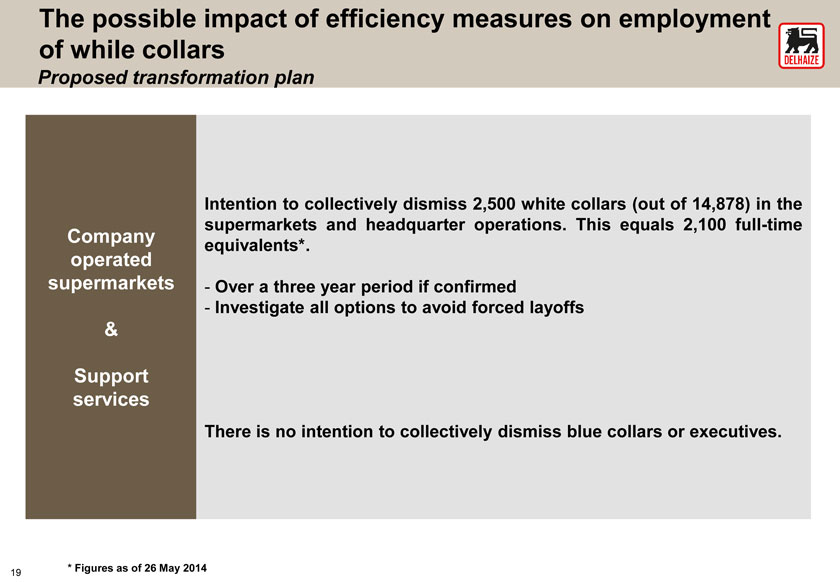

The possible impact of efficiency measures on employment of while collars

Proposed transformation plan

Intention to collectively dismiss 2,500 white collars (out of 14,878) in the supermarkets and headquarter operations. This equals 2,100 full-time

Company

equivalents*.

operated

supermarkets - Over a three year period if confirmed

- Investigate all options to avoid forced layoffs

&

Support services

There is no intention to collectively dismiss blue collars or executives.

* Figures as of 26 May 2014

19

Commitment to limit the impact on our associates as much as possible

Proposed transformation plan

We acknowledge the impact of this announcement on our associates and their families and we will therefore :

Investigate all possible options to reduce forced layoffs as much as possible

Provide accompanying measures and support

Search for best solutions for re-employment

Reduce the period of uncertainty and be as transparent as possible

Find the best possible solution for each impacted associate, in accordance with legal provisions

20

Legal Law Renault procedure

Proposed transformation plan

If intention is confirmed, Information sharing and the collective dismissal consultation process could be implemented as with social partners of Q1 2015

21

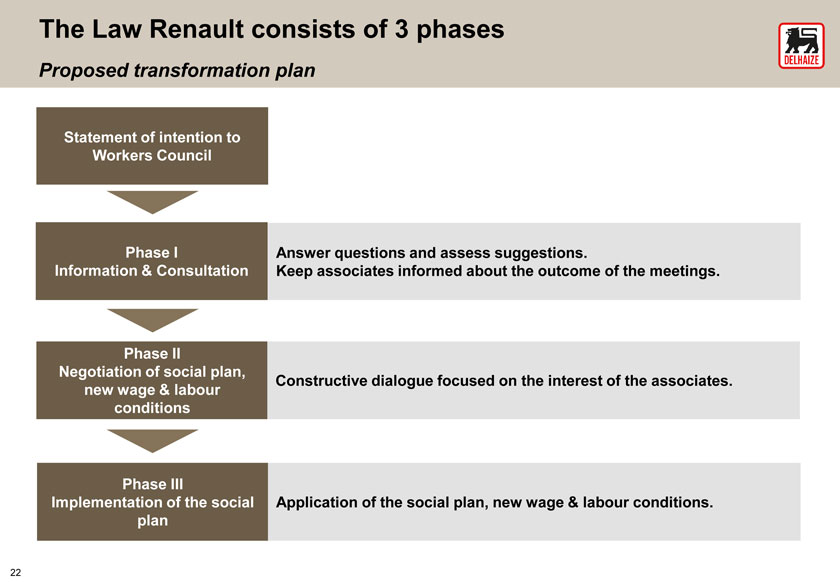

The Law Renault consists of 3 phases

Proposed transformation plan

Statement of intention to Workers Council

Phase I Answer questions and assess suggestions.

Information & Consultation Keep associates informed about the outcome of the meetings.

Phase II

Negotiation of social plan,

Constructive dialogue focused on the interest of the associates. new wage & labour conditions

Phase III

Implementation of the social Application of the social plan, new wage & labour conditions. plan

22

Ensure the future of our company

Build a sustainable business model for our company operated supermarkets

Reinforce revenues, growth, market share and profitability

Become again the favorite supermarket in the Belgian market by focusing on quality, health, assortment, shopping experience and service

23

Questions?

24

Interviews?

25