Exhibit 99.2

Q2 2015 results July 30, 2015

Forward looking statements

This presentation includes forward-looking statements within the meaning of the U.S. federal securities laws that are subject to risks and uncertainties. Forward-looking statements describe further expectations, plans, options, results or strategies. Actual outcomes and results may differ materially from those projected depending upon a variety of factors, including but not limited to changes in the general economy or the markets of Delhaize Group, in consumer spending, in inflation or currency exchange rates or in legislation or regulation; competitive factors; adverse determination with respect to claims; inability to timely develop, remodel, integrate or convert stores; and supply or quality control problems with vendors. Additional risks and uncertainties that could cause actual results to differ materially from those stated or implied by such forward-looking statements are described in our most recent annual report or Form 20-F and other filings with the Securities and Exchange Commission. Delhaize Group disclaims any obligation to update or revise the information contained in this presentation.

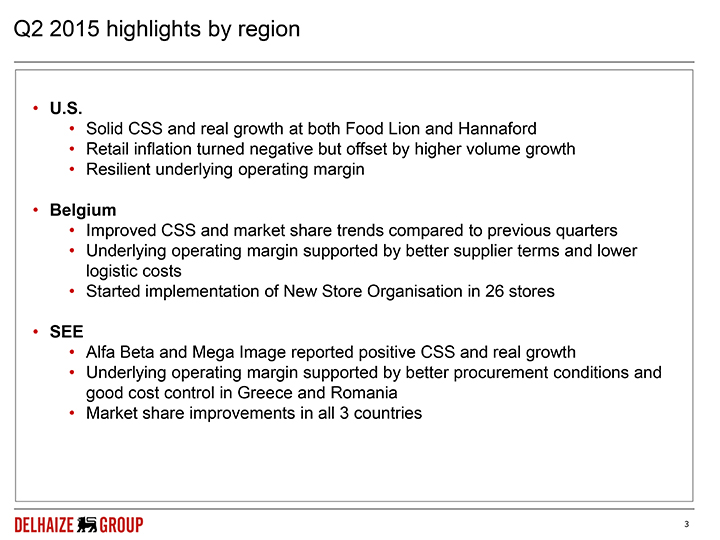

Q2 2015 highlights by region

U.S.

Solid CSS and real growth at both Food Lion and Hannaford

Retail inflation turned negative but offset by higher volume growth

Resilient underlying operating margin

Belgium

Improved CSS and market share trends compared to previous quarters

Underlying operating margin supported by better supplier terms and lower logistic costs

Started implementation of New Store Organisation in 26 stores

SEE

Alfa Beta and Mega Image reported positive CSS and real growth

Underlying operating margin supported by better procurement conditions and good cost control in Greece and Romania

Market share improvements in all 3 countries

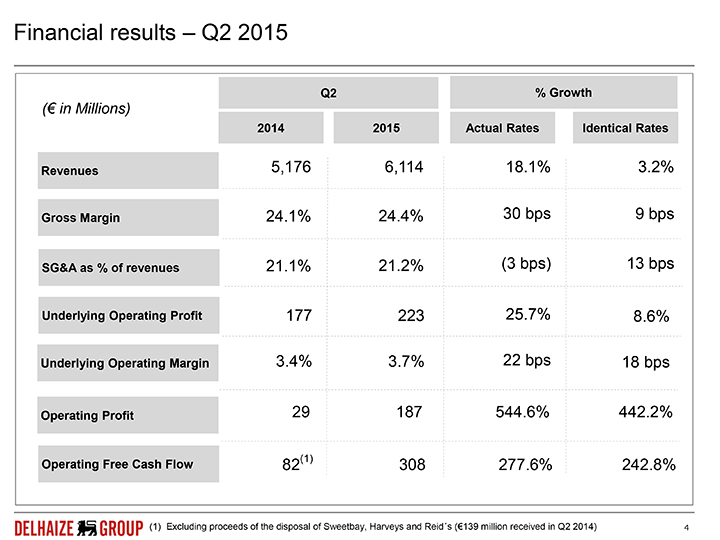

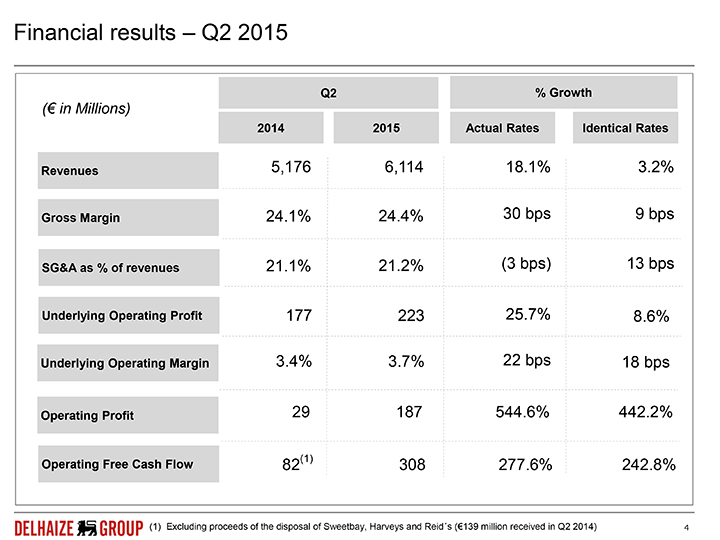

Financial results – Q2 2015

Q2% Growth

(€ in Millions)

2014 2015 Actual Rates Identical Rates

Revenues 5,176 6,114 18.1% 3.2%

Gross Margin 24.1% 24.4% 30 bps 9 bps

SG&A as % of revenues 21.1% 21.2%(3 bps) 13 bps

Underlying Operating Profit 177 223 25.7% 8.6%

Underlying Operating Margin 3.4% 3.7% 22 bps 18 bps

Operating Profit 29 187 544.6% 442.2%

Operating Free Cash Flow 82(1) 308 277.6% 242.8%

(1) | | Excluding proceeds of the disposal of Sweetbay, Harveys and Reid´s (€139 million received in Q2 2014) |

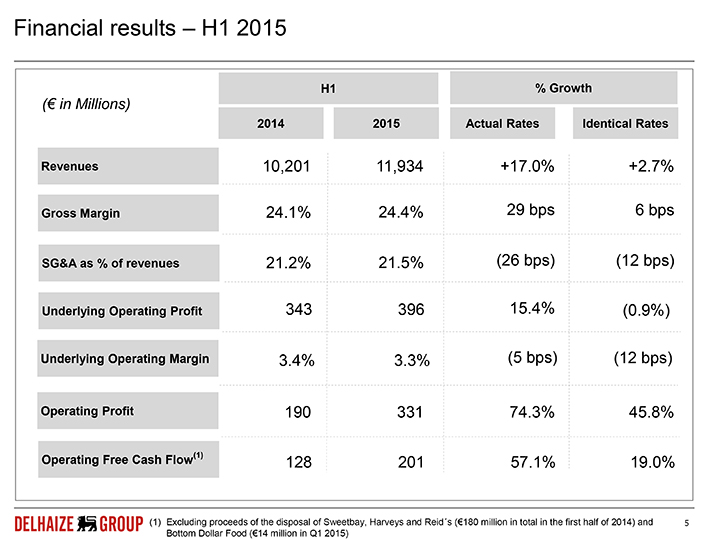

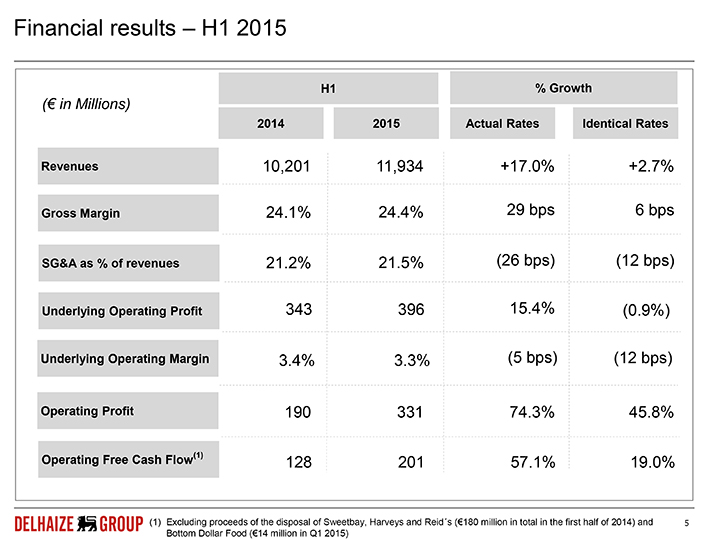

Financial results – H1 2015

H1% Growth

(€ in Millions)

2014 2015 Actual Rates Identical Rates

Revenues 10,201 11,934 +17.0% +2.7%

Gross Margin 24.1% 24.4% 29 bps 6 bps

SG&A as % of revenues 21.2% 21.5%(26 bps)(12 bps)

Underlying Operating Profit 343 396 15.4%(0.9%)

Underlying Operating Margin 3.4% 3.3%(5 bps)(12 bps)

Operating Profit 190 331 74.3% 45.8%

Operating Free Cash Flow(1) 128 201 57.1% 19.0%

(1) Excluding proceeds of the disposal of Sweetbay, Harveys and Reid´s (€180 million in total in the first half of 2014) and Bottom Dollar Food (€14 million in Q1 2015)

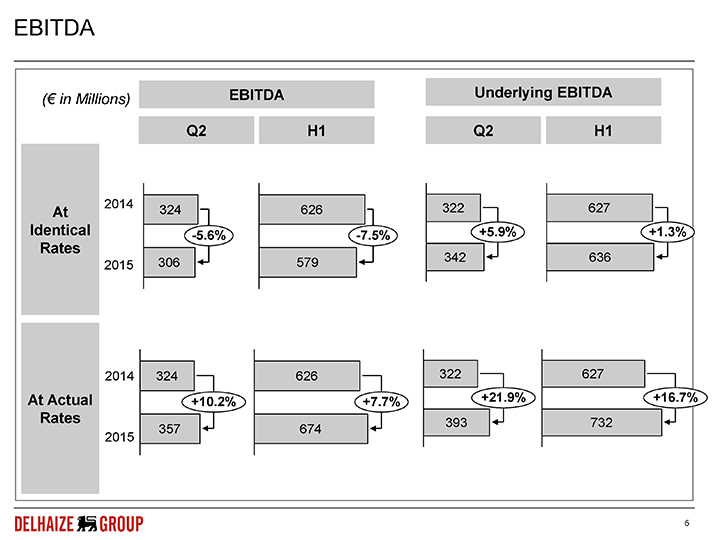

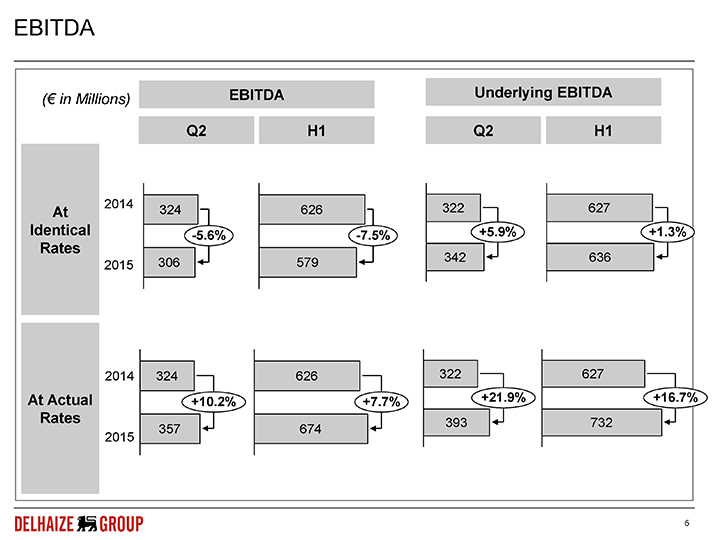

EBITDA

(€ in Millions) EBITDA Underlying EBITDA

Q2 H1 Q2 H1

At 2014 324 626 322 627

Identical -5.6% -7.5% +5.9% +1.3%

Rates

2015 306 579 342 636

2014 324 626 322 627

At Actual +10.2% +7.7% +21.9% +16.7%

Rates 393 732

2015 357 674

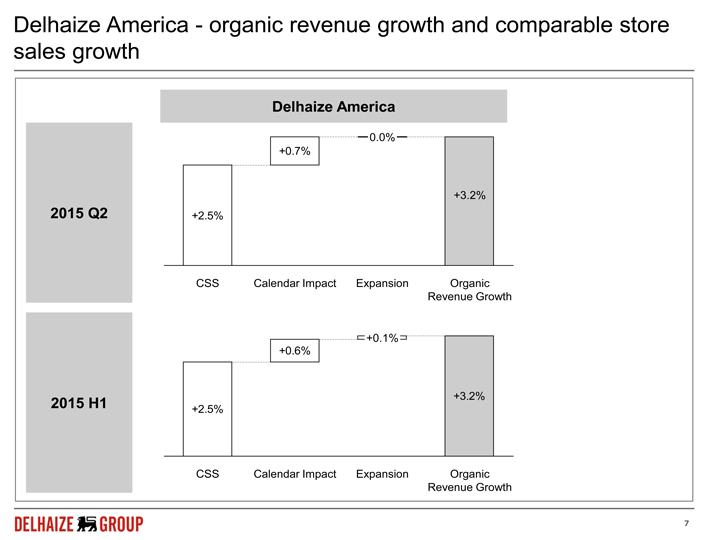

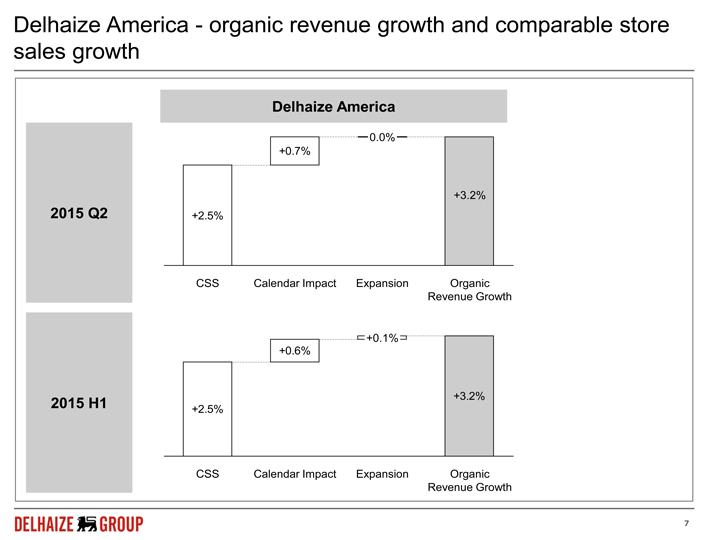

Delhaize America — organic revenue growth and comparable store sales growth

Delhaize America

+0.7%

-0.0-%

+3.2%

2015 Q2 +2.5%

CSS Calendar Impact Expansion Organic

Revenue Growth

+0.6%

+0.1%

2015 H1 +3.2%

+2.5%

CSS Calendar Impact Expansion Organic

Revenue Growth

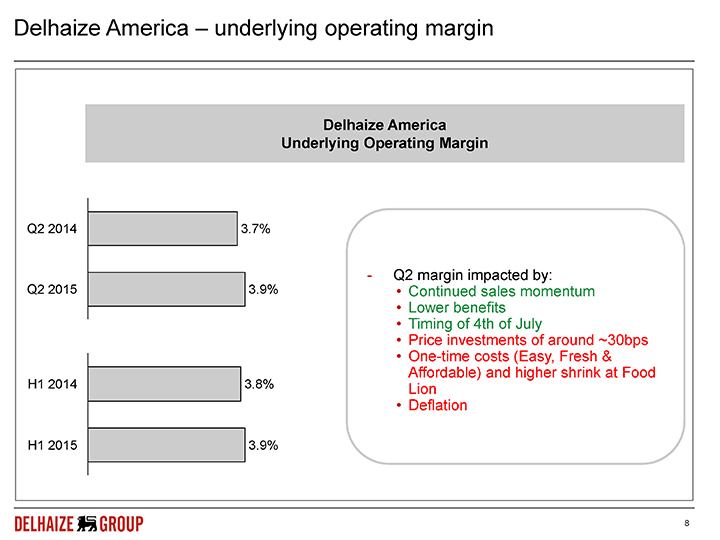

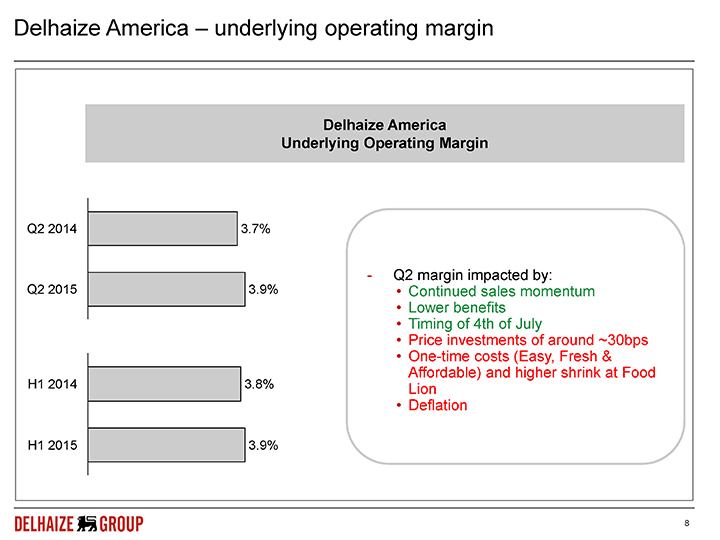

Delhaize America – underlying operating margin

Delhaize America

Underlying Operating Margin

Q2 2014 3.7%

—Q2 margin impacted by:

Q2 2015 3.9% Continued sales momentum

Lower benefits

Timing of 4th of July

Price investments of around ~30bps

One-time costs (Easy, Fresh &

Affordable) and higher shrink at Food

H1 2014 3.8% Lion

Deflation

H1 2015 3.9%

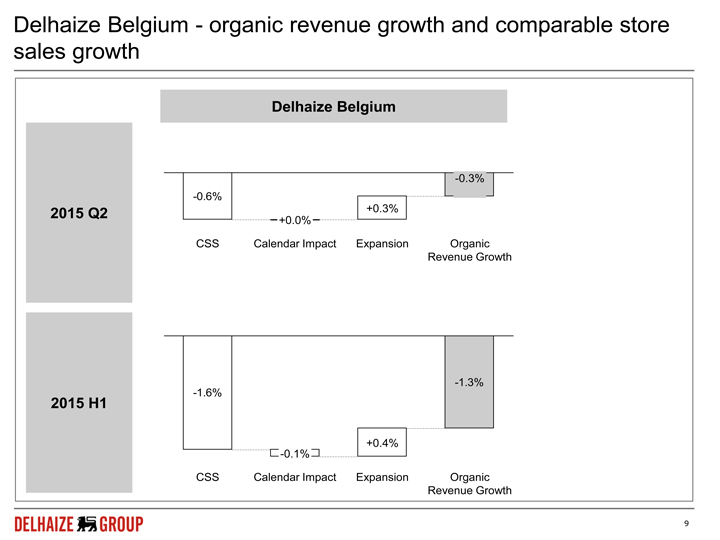

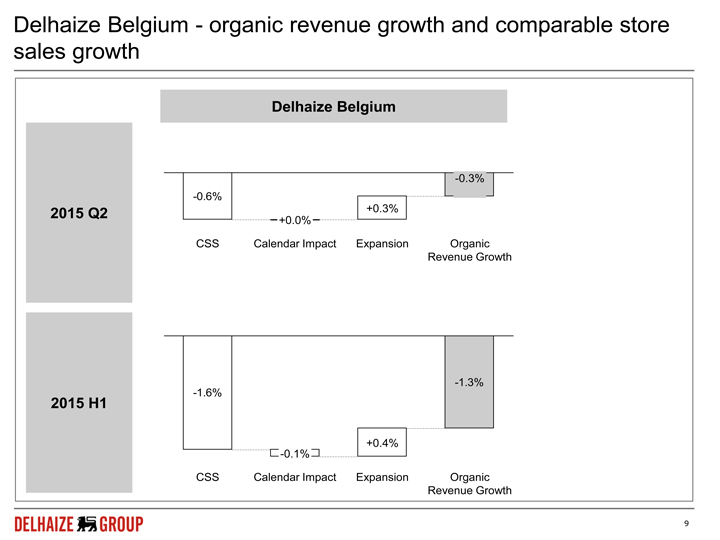

Delhaize Belgium—organic revenue growth and comparable store sales growth

Delhaize Belgium

-0.3%

-0.6%

2015 Q2 +0.3%

+0.0%

CSS Calendar Impact Expansion Organic

Revenue Growth

-1.3%

-1.6%

-0.1%

+0.4%

2015 H1

CSS Calendar Impact Expansion Organic

Revenue Growth

9

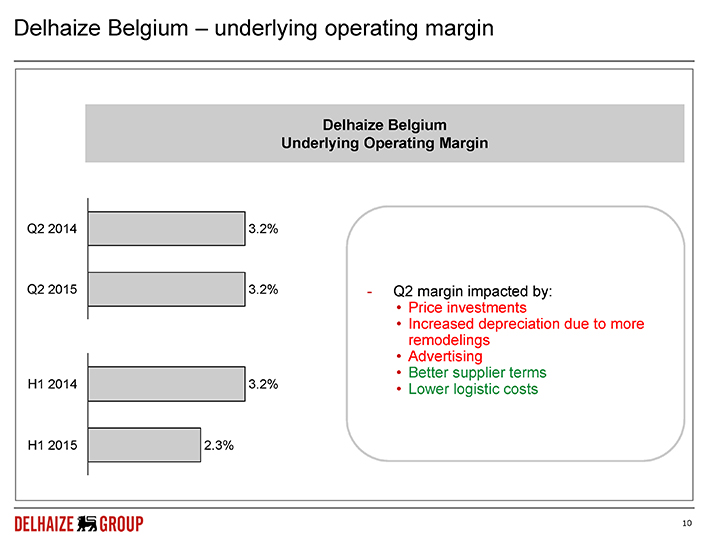

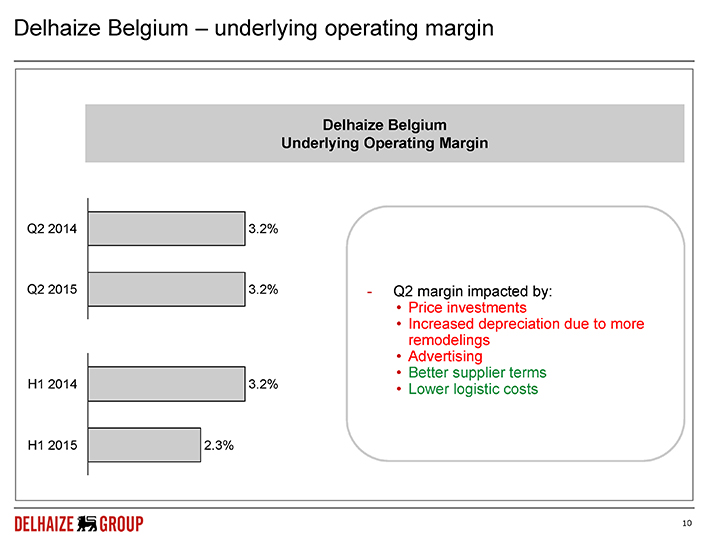

Delhaize Belgium – underlying operating margin

Delhaize Belgium

Underlying Operating Margin

Q2 2014 3.2%

Q2 2015 3.2%—Q2 margin impacted by:

Price investments

Increased depreciation due to more

remodelings

Advertising

Better supplier terms

H1 2014 3.2% Lower logistic costs

H1 2015 2.3%

10

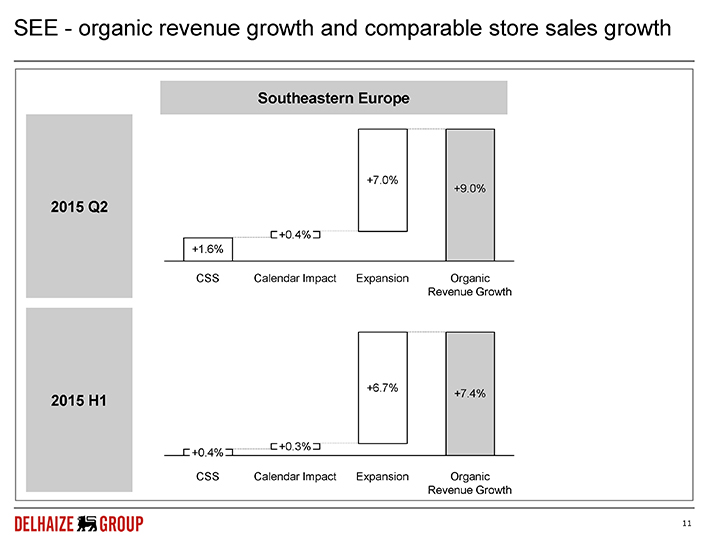

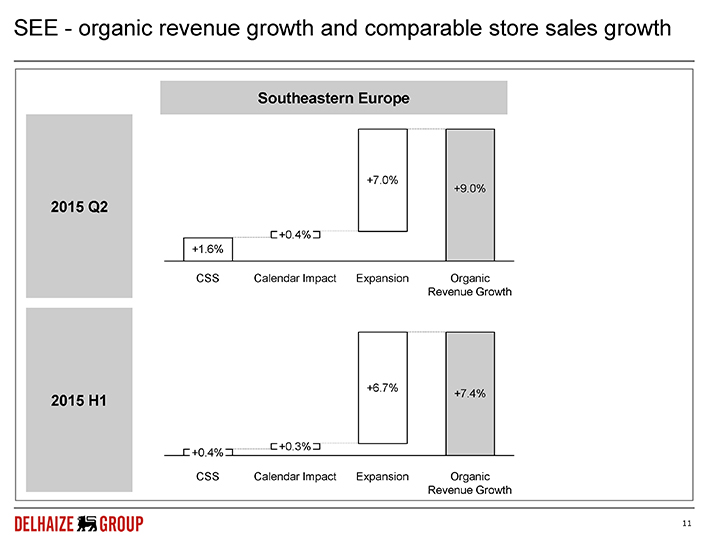

SEE—organic revenue growth and comparable store sales growth

Southeastern Europe

+7.0%

+9.0%

2015 Q2

+0.4%

+1.6%

CSS Calendar Impact Expansion Organic

Revenue Growth

+6.7%

2015 H1 +7.4%

CSS Calendar Impact Expansion Organic

Revenue Growth

11

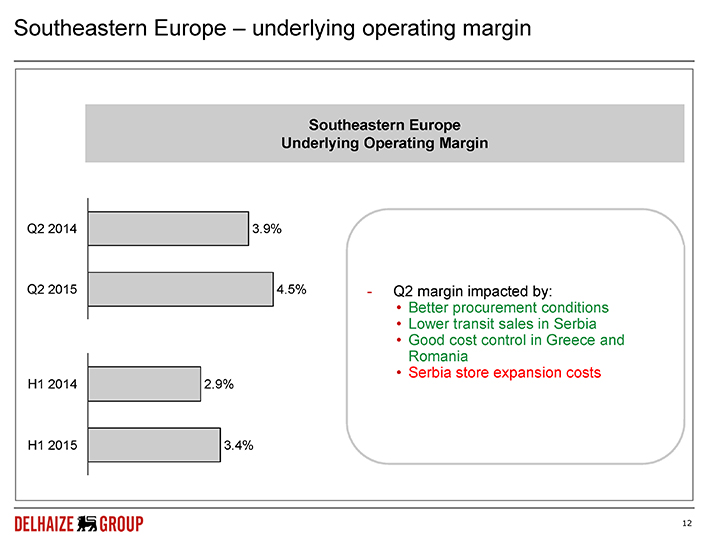

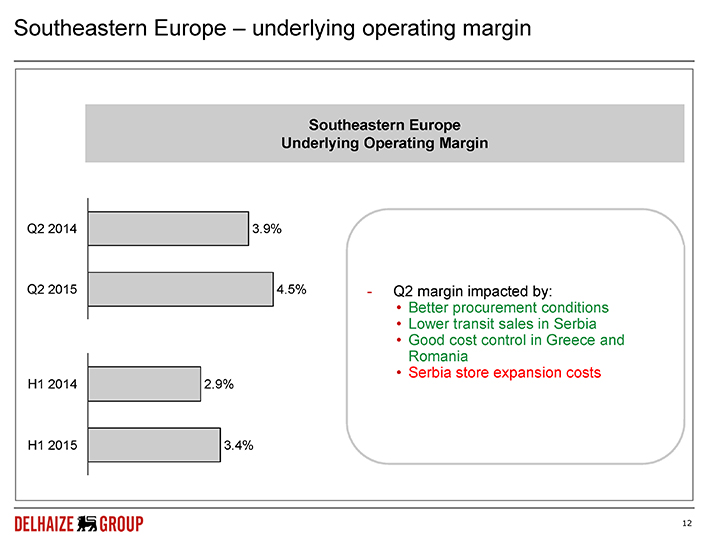

Southeastern Europe – underlying operating margin

Southeastern Europe

Underlying Operating Margin

Q2 2014 3.9%

Q2 2015 4.5%—Q2 margin impacted by:

• Better procurement conditions

• Lower transit sales in Serbia

• Good cost control in Greece and

Romania

• Serbia store expansion costs

H1 2014 2.9%

H1 2015 3.4%

12

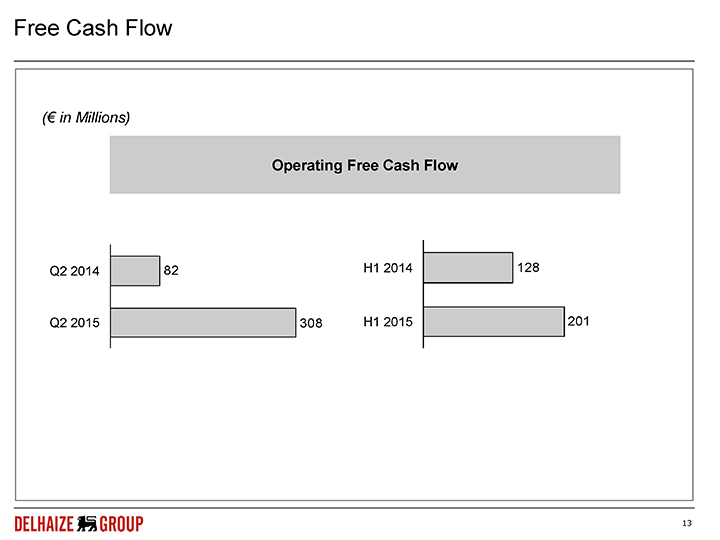

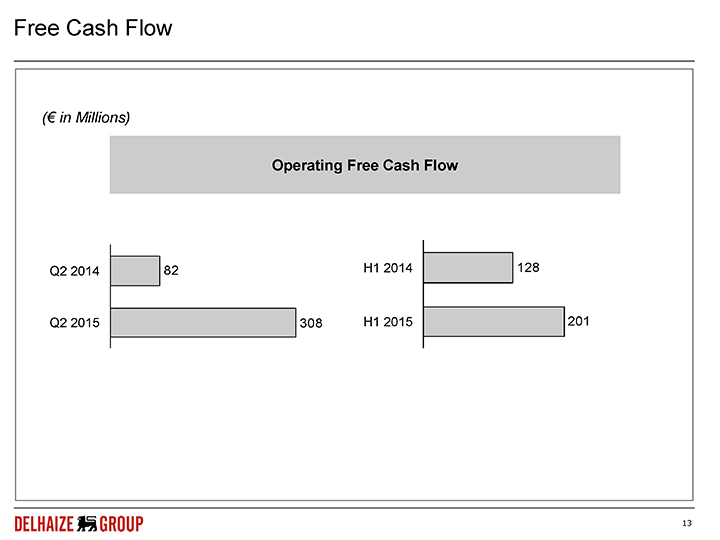

Free Cash Flow

(€ in Millions)

Operating Free Cash Flow

Q2 2014 82 H1 2014 128

Q2 2015 308 H1 2015 201

13

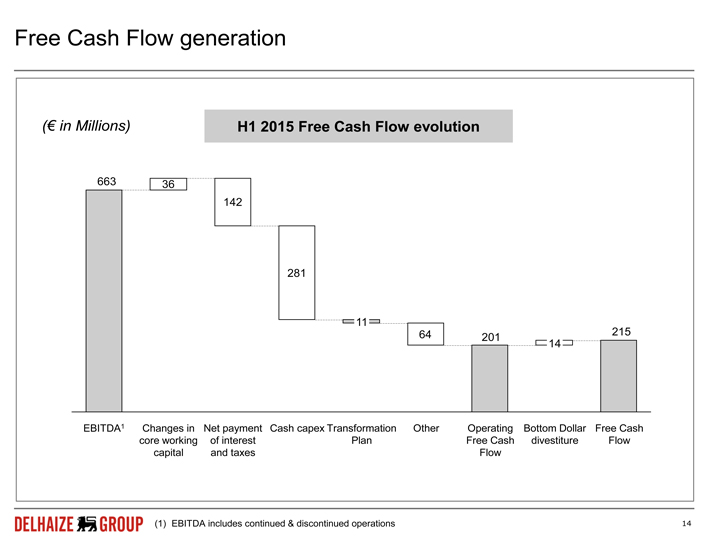

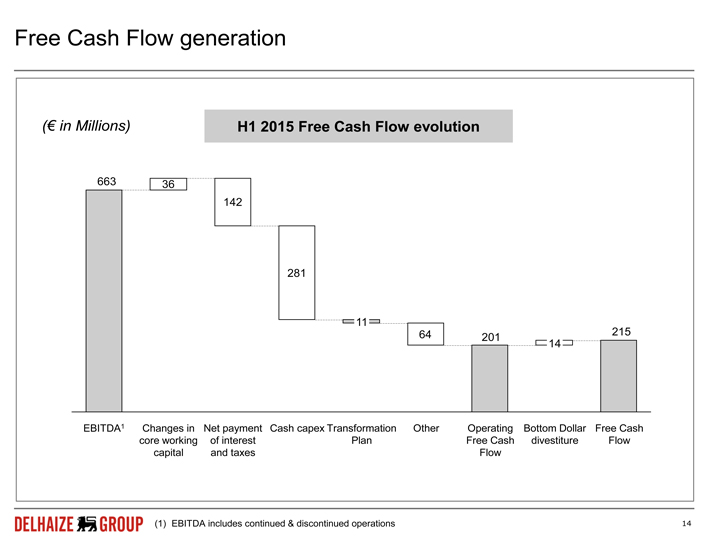

Free Cash Flow generation

(€ in Millions) H1 2015 Free Cash Flow evolution

663 36

142

281

11

EBITDA1

Changes in

core working capital

Net payment of interest and taxes

Cash capex

Transformation Plan

Other

Operating Free Cash Flow

Bottom Dollar divestiture

Free Cash Flow

(1) | | EBITDA includes continued & discontinued operations |

14

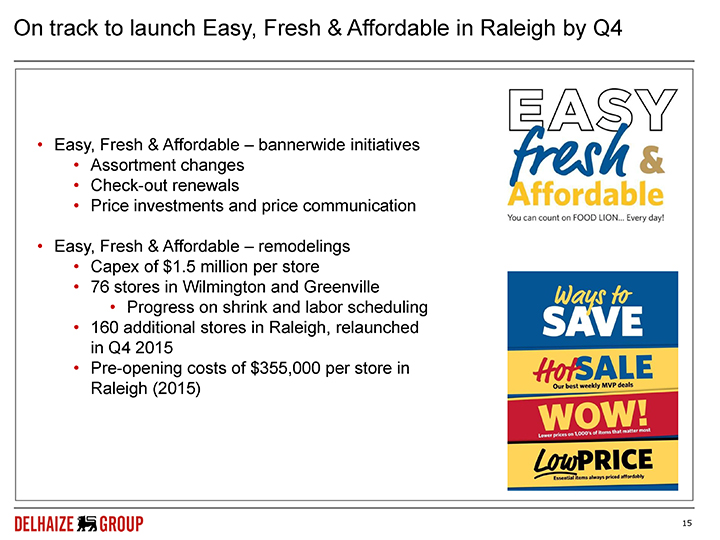

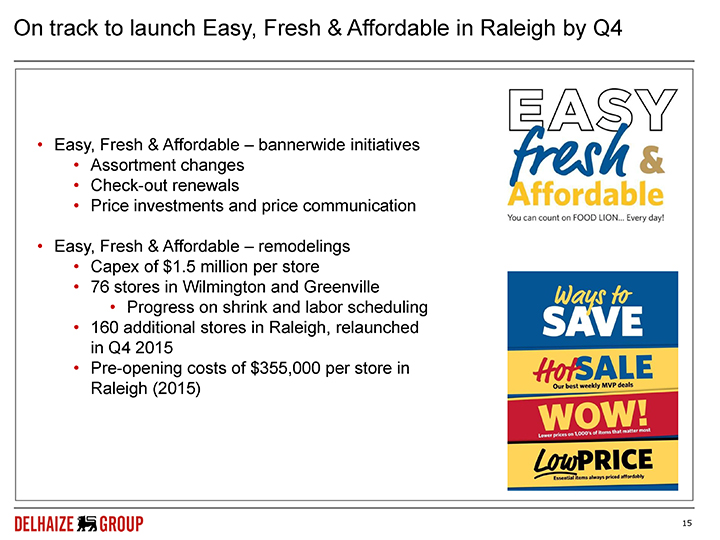

On track to launch Easy, Fresh & Affordable in Raleigh by Q4

Easy, Fresh & Affordable – bannerwide initiatives

Assortment changes

Check-out renewals

Price investments and price communication

Easy, Fresh & Affordable – remodelings

Capex of $1.5 million per store

76 stores in Wilmington and Greenville

Progress on shrink and labor scheduling

160 additional stores in Raleigh, relaunched in Q4 2015

Pre-opening costs of $355,000 per store in Raleigh (2015)

15

Transformation Plan in Belgium executed according to plan

Final agreement with unions reached in February 2015

Plan to generate at least €80 million savings by 2018

First wave of voluntary leaves took place in May (950 leavers out of 1,500 signed up so far), second wave in Q4

Closed Kortrijk-Ring store and plan to Affiliate 4 out of 9 stores in 2015

New Store Organisation implemented in 26 stores in June

Second batch of 27 stores being prepared

Pleased with performance of 4 New Generation stores

Learnings to be included in 2016 remodelling plan

16

SEE increases profitable growth through consistent customer focus

Strong performance in the region, driven by growth in Greece and Romania with a stable performance in Serbia

Maxi remodelings continue to post positive CSS

All three countries are seeing further market share gains

Greek situation limits visibility

17

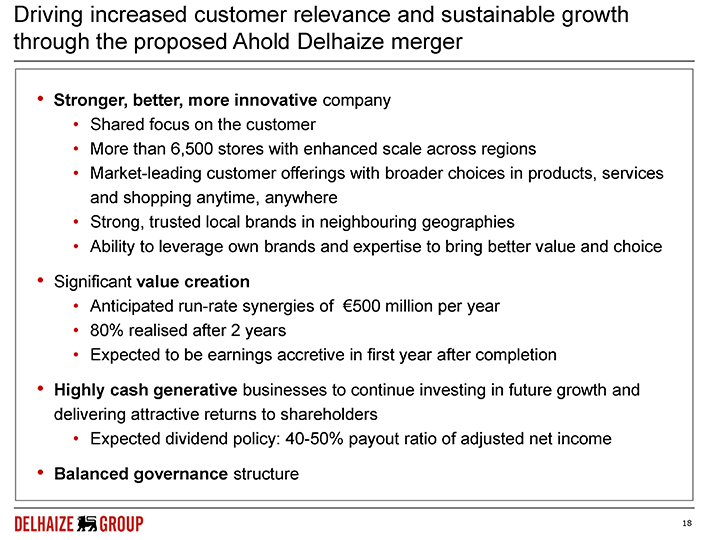

Driving increased customer relevance and sustainable growth through the proposed Ahold Delhaize merger

Stronger, better, more innovative company

Shared focus on the customer

More than 6,500 stores with enhanced scale across regions

Market-leading customer offerings with broader choices in products, services and shopping anytime, anywhere

Strong, trusted local brands in neighbouring geographies

Ability to leverage own brands and expertise to bring better value and choice

Significant value creation

Anticipated run-rate synergies of €500 million per year

80% realised after 2 years

Expected to be earnings accretive in first year after completion

Highly cash generative businesses to continue investing in future growth and delivering attractive returns to shareholders

Expected dividend policy: 40-50% payout ratio of adjusted net income

Balanced governance structure

18

Ahold Delhaize: an exciting future together

Focused management team to achieve synergies

Creating a stronger, international food retailer and delivering value for all stakeholders

A superior customer offering

Attractive opportunities for our associates

Better serving our communities

A compelling value proposition for shareholders

19

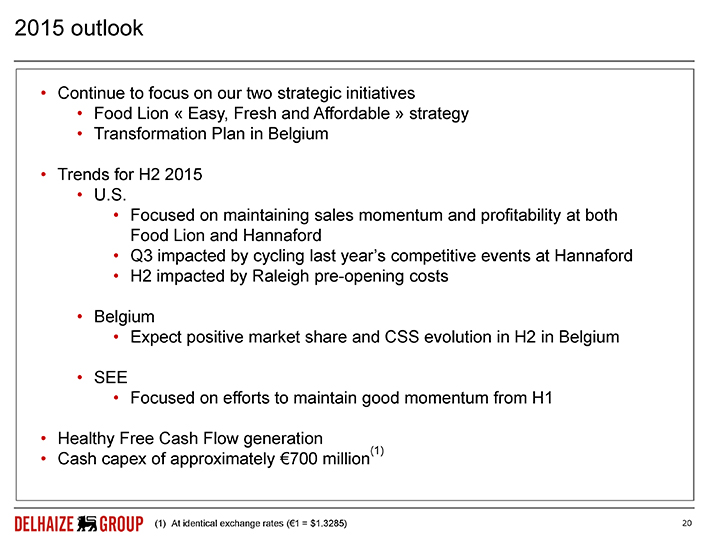

2015 outlook

Continue to focus on our two strategic initiatives

Food Lion « Easy, Fresh and Affordable » strategy

Transformation Plan in Belgium

Trends for H2 2015

U.S.

Focused on maintaining sales momentum and profitability at both Food Lion and Hannaford

Q3 impacted by cycling last year’s competitive events at Hannaford

H2 impacted by Raleigh pre-opening costs

Belgium

Expect positive market share and CSS evolution in H2 in Belgium

SEE

Focused on efforts to maintain good momentum from H1

Healthy Free Cash Flow generation (1)

Cash capex of approximately €700 million

(1) | | At identical exchange rates (€1 = $1.3285) |

20