UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of April, 2016

Commission File Number: 333-13302

ETABLISSEMENTS DELHAIZE FRÈRES

ET CIE “LE LION” (GROUPE DELHAIZE)

(Exact name of registrant as specified in its charter)*

DELHAIZE BROTHERS AND CO.

“THE LION” (DELHAIZE GROUP)

(Translation of registrant’s name into English)*

SQUARE MARIE CURIE 40

1070 BRUSSELS, BELGIUM

(Address of principal executive offices)

| * | The registrant’s charter (articles of association) specifies the registrant’s name in French, Dutch and English. |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

| | |

| | Interim Financial Reporting First Quarter 2016 Regulated Information April 27, 2016 – 7:00 a.m. CET |

DELHAIZE GROUP FIRST QUARTER 2016 RESULTS

Financial Summary

| | » | Revenue growth of 4.3% at identical exchange rates |

| | » | Comparable store sales growth of 2.6% in the U.S. (3.7% real growth), 2.9% in Belgium and 10.8% in Southeastern Europe |

| | » | Group underlying operating profit of €221 million (+26.0% at identical exchange rates) |

| | » | Group underlying operating margin of 3.6% (3.9% in the U.S., 2.7% in Belgium and 4.1% in Southeastern Europe) |

» CEO Comments

Frans Muller, President and Chief Executive Officer of Delhaize Group, commented: “We have started 2016 with further improving revenue trends. In the U.S., although we continued to see deflation, we are also realizing ongoing solid 3.7% real growth. In Belgium, we reported good comparable store sales growth of 2.9% and a 50 basis points improvement in our market share compared to the first quarter of last year. While our sales trend continued to be largely driven by the Affiliated network, we remained focused on improving execution in our integrated stores. Finally, our Southeastern European operations reported an outstanding performance. In Greece, our Alfa Beta stores, uniquely positioned, have implemented successful promotional and marketing plans, in a grocery market that continues to shrink. In Romania, our operations continued to build on their strong momentum and commercial programs and benefited from favorable economic conditions, driven by lower VAT. Finally, we also enjoyed positive comparable store sales growth in Serbia.”

“We realized a robust performance in our first quarter profitability with a 3.6% underlying operating margin. Although the group benefited from a slightly stronger gross margin mainly in the U.S., profitability was especially boosted by lower SG&A as a percentage of revenues in Belgium and Southeastern Europe. We reported a negative free cash flow in the first quarter but we remain confident to generate a healthy free cash flow for the full year. ”

“Following shareholders’ approval for the merger obtained on March 14, our main focus for this year is to complete the merger with Royal Ahold on schedule. The remaining major milestone is to receive approval from the U.S. Federal Trade Commission in order to be able to complete the transaction by mid-2016.”

» Financial Summary

| | | | | | | | | | | | |

| | | Q1 2016(1) | |

€ in millions, except EPS (in €) | | Actual Results | | | At Actual

Rates | | | At Identical

Rates | |

Revenues | | | 6 153 | | | | +5.7 | % | | | +4.3 | % |

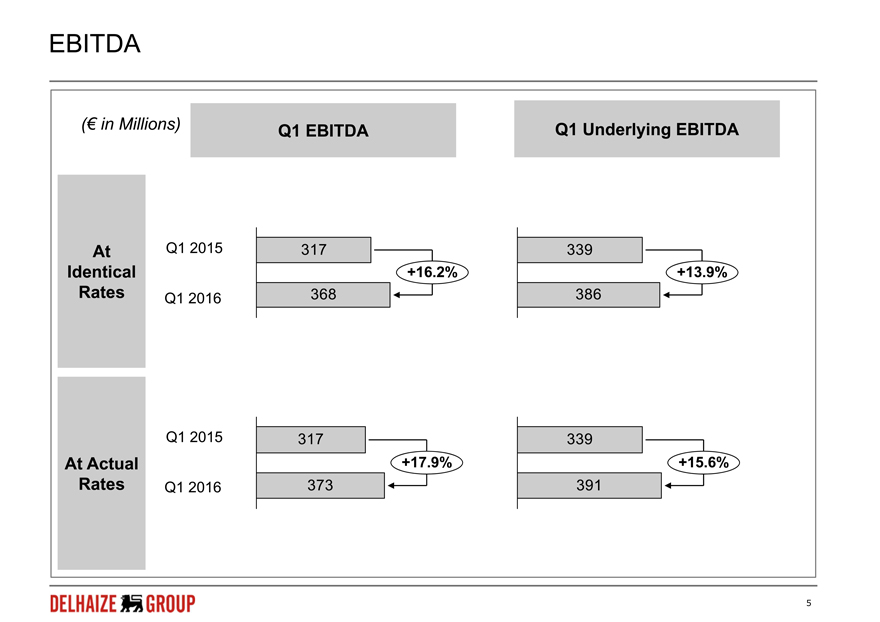

Underlying EBITDA | | | 391 | | | | +15.6 | % | | | +13.9 | % |

Operating profit | | | 191 | | | | +32.7 | % | | | +30.6 | % |

Operating margin | | | 3.1 | % | | | — | | | | — | |

Underlying operating profit | | | 221 | | | | +27.9 | % | | | +26.0 | % |

Underlying operating margin | | | 3.6 | % | | | — | | | | — | |

Profit before taxes and discontinued operations | | | 145 | | | | +194.0 | % | | | +189.7 | % |

Net profit from continuing operations | | | 109 | | | | +205.9 | % | | | +201.6 | % |

Group share in net profit | | | 109 | | | | +291.0 | % | | | +285.6 | % |

Basic earnings per share - Group share in net profit | | | 1.05 | | | | +285.1 | % | | | +279.8 | % |

| (1) | The average exchange rate of the U.S. dollar against the euro strengthened by 2.2% in the first quarter of 2016 (€1= $1.102) compared to the first quarter of 2015. |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 1 of 19 | |

» First Quarter 2016 Income Statement

Revenues

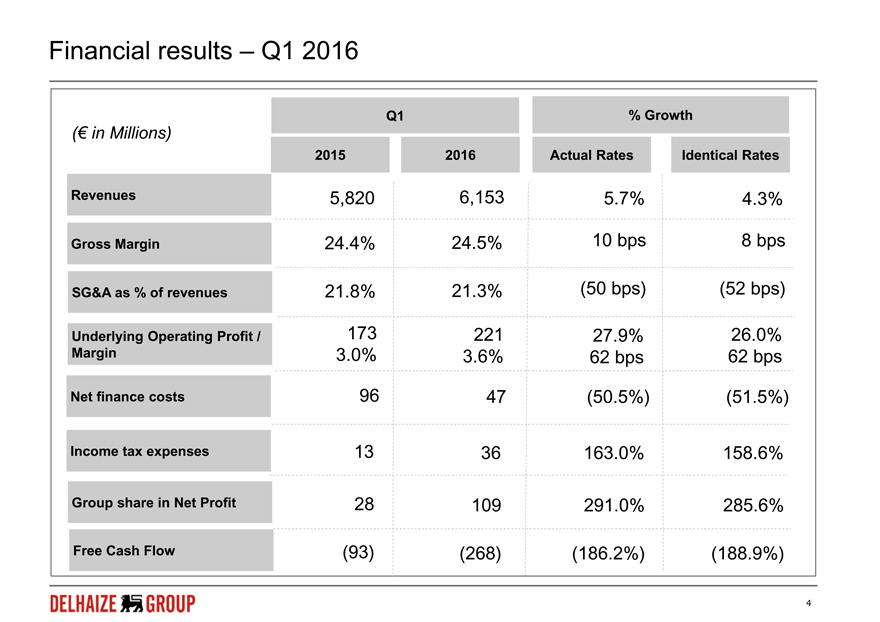

In the first quarter of 2016, Delhaize Group’s revenues increased by 5.7% and 4.3% at actual and identical exchange rates, respectively. The latter equals the organic revenue growth.

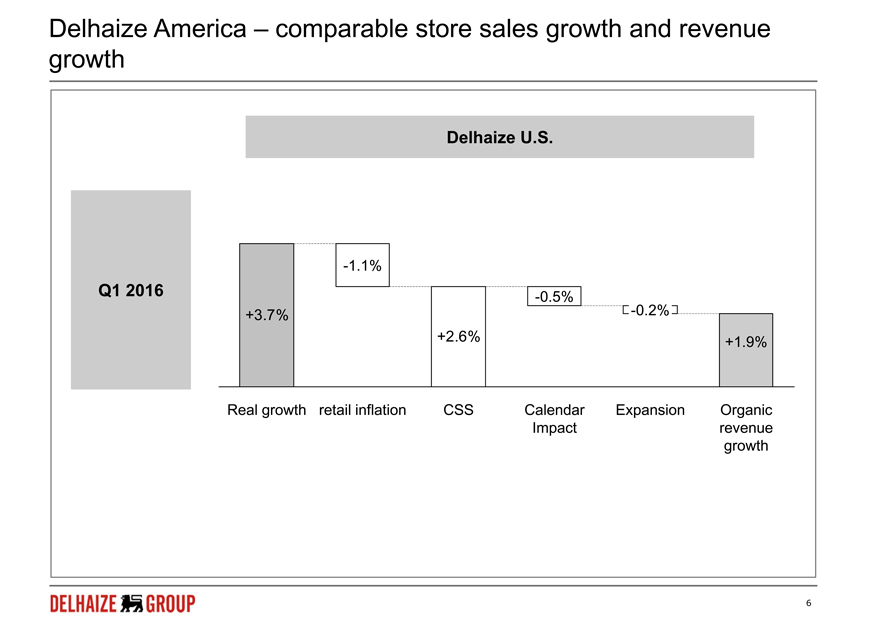

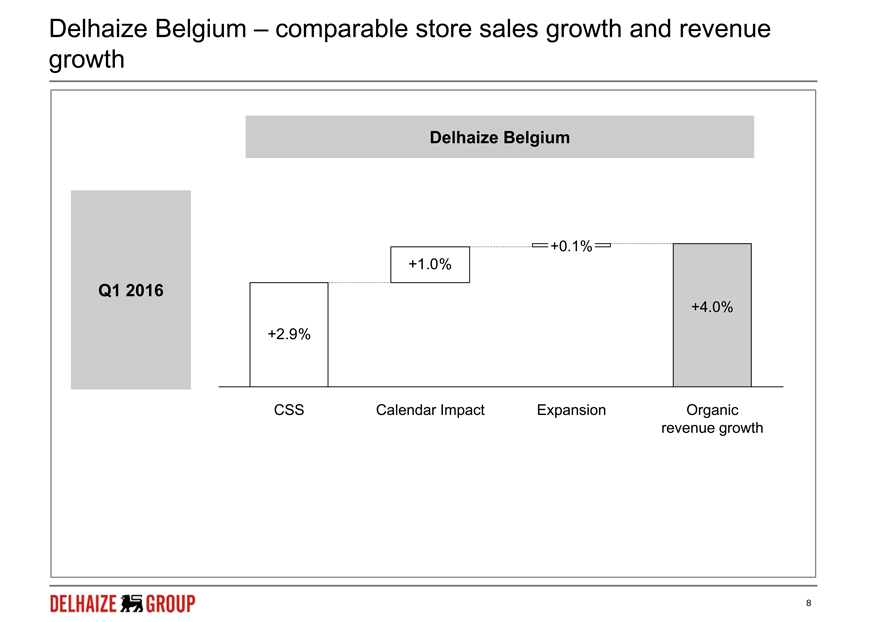

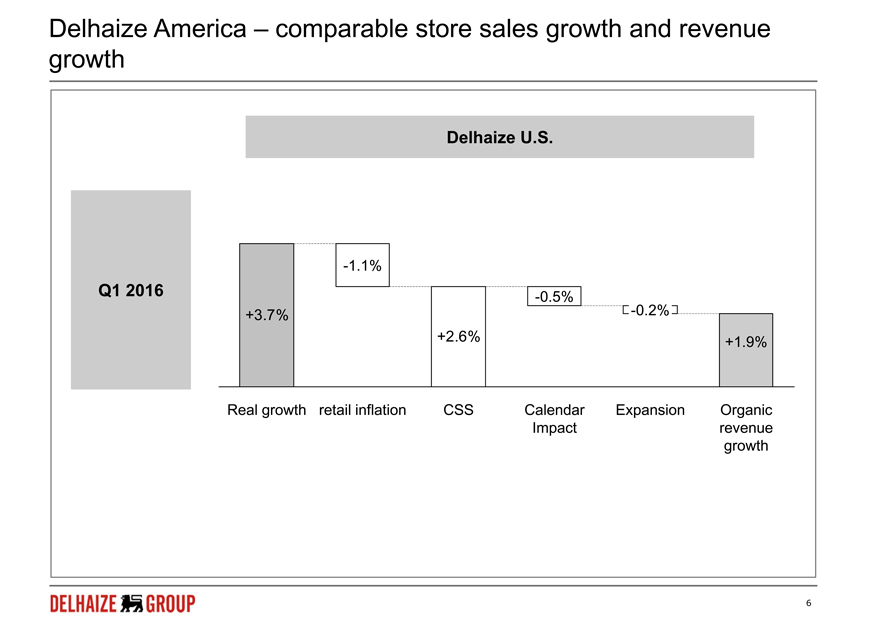

In the U.S., our comparable store sales grew by 2.6% excluding a 0.5% negative calendar impact mainly due to the timing of Easter, and our revenue grew by 1.9% in local currency. The 2.6% U.S. comparable store sales growth was fueled by positive real growth at both Food Lion and Hannaford, despite fewer winter storms compared to last year. Retail inflation remained negative and was -1.1% for the quarter. Revenues in Belgium increased by 4.0%, driven by comparable store sales growth of 2.9% excluding a positive calendar impact of 1.0%. Retail inflation in Belgium increased to 2.2%. Revenues in Southeastern Europe increased by 17.0% at identical exchange rates, driven by a comparable store sales growth of 10.8%, store network expansion and a 0.5% positive calendar impact, whereas inflation was nearly flat for the region.

Gross margin

Gross margin was 24.5% of revenues, an 8 basis points increase at identical exchange rates (+10 basis points at actual exchange rates), as a result of decreased shrink in fresh in the U.S., in particular at Food Lion.

Other operating income

Other operating income was almost in line with last year and amounted to €24 million.

Selling, general and administrative expenses

Selling, general and administrative expenses (SG&A) were 21.3% of revenues and decreased by 52 basis points at identical exchange rates compared to last year (-50 basis points at actual exchange rates) as a result of cost savings resulting from the Transformation Plan in Belgium and sales leverage and good cost management in Southeastern Europe, while SG&A as a percentage of revenues were flat in the U.S.

Other operating expenses

Other operating expenses were €28 million compared to €30 million last year, and included €11 million of merger related costs and €12 million of impairment charges in Belgium.

Underlying operating profit

Underlying operating profit increased by 27.9% at actual exchange rates and by 26.0% at identical exchange rates. This increase was due to an increase of over 100% in the underlying operating profit from Delhaize Belgium, resulting from higher sales compared to a weak first quarter in 2015 and savings from the Transformation Plan, but also from strong sales and cost management in Southeastern Europe. In the U.S., underlying operating profit increased by 6.1% in local currency. Underlying operating margin was 3.6% of revenues compared to 3.0% in the first quarter of 2015.

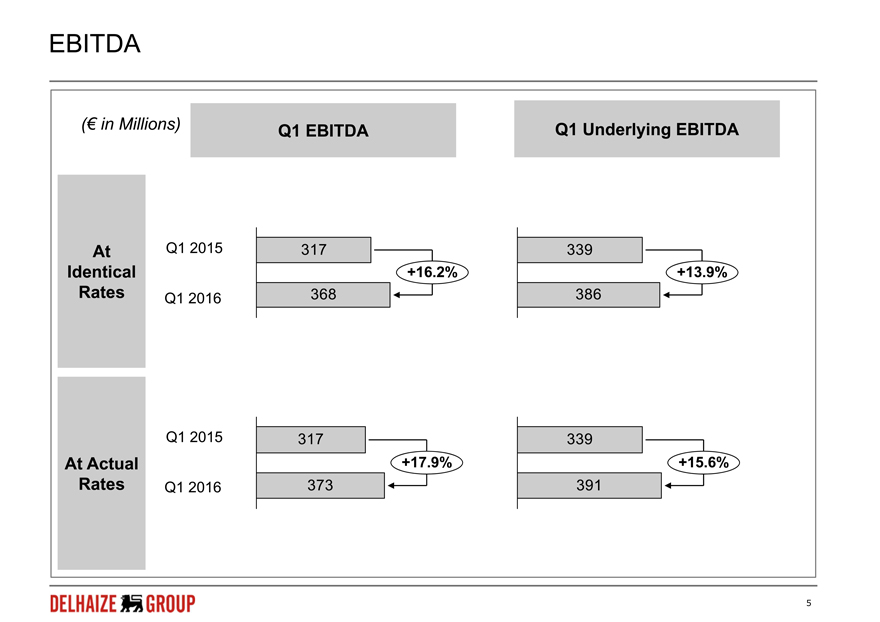

EBITDA

EBITDA increased by 17.9% to €373 million (+16.2% at identical exchange rates), while underlying EBITDA increased by 15.6% to €391 million (+13.9% at identical exchange rates).

Operating profit

Operating profit increased by 32.7% to €191 million.

Net financial expenses

Net financial expenses stood at €47 million compared to €96 million last year, which included a €40 million one-off charge relating to the bond tender transactions which took place in February 2015.

Income tax

In the first quarter of 2016, the effective tax rate (from continued operations) was 24.9% compared to 28.3% in the first quarter of last year. The difference between both years is the result of the non-deductible competition authority fine we accrued and tax leakage on internal dividend distributions, both in 2015.

Net profit from continuing operations

Net profit from continuing operations was €109 million compared to €36 million in last year’s first quarter. This resulted in €1.05 basic earnings per share compared to €0.35 in the first quarter of 2015.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 2 of 19 | |

Net profit

Group share in net profit amounted to €109 million compared to €28 million last year. Basic and diluted net profit per share were €1.05 and €1.04, respectively, compared to €0.27 in both cases last year.

» Cash Flow Statement and Balance Sheet

Free cash flow

In the first quarter of 2016, free cash flow was negative and stood at minus €268 million, which included cash out of €25 million related to the Transformation Plan in Belgium and €16 million merger related costs. The decrease compared to the negative €93 million (including €14 million proceeds on the sale of Bottom Dollar Food) of the first quarter of 2015 is mainly due to increased capex and working capital movements, partly offset by a higher EBITDA and lower taxes paid.

Net debt

The net debt to EBITDA ratio improved to 0.7 at the end of the first quarter compared to 1.0 at the end of the first quarter 2015. Compared to the end of 2015, net debt increased by €201 million to €1.0 billion as a result of negative free cash flow.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 3 of 19 | |

» Segment Information (at actual exchange rates)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Q1 2016 | | | | Revenues | | | Underlying Operating

Margin(3) | | | Underlying Operating

Profit/(Loss)(3) | |

(in millions) | | | | Q1 2016 | | | Q1 2015 | | | 2016

/2015 | | | Q1 2016 | | | Q1 2015 | | | Q1 2016 | | | Q1 2015 | | | 2016

/2015 | |

United States(1) | | $ | | | 4 446 | | | | 4 363 | | | | +1.9 | % | | | 3.9 | % | | | 3.8 | % | | | 175 | | | | 165 | | | | +6.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

United States(1) | | € | | | 4 035 | | | | 3 875 | | | | +4.1 | % | | | 3.9 | % | | | 3.8 | % | | | 159 | | | | 147 | | | | +8.5 | % |

Belgium | | € | | | 1 224 | | | | 1 177 | | | | +4.0 | % | | | 2.7 | % | | | 1.4 | % | | | 33 | | | | 16 | | | | +102.2 | % |

Southeastern Europe(2) | | € | | | 894 | | | | 768 | | | | +16.5 | % | | | 4.1 | % | | | 2.3 | % | | | 36 | | | | 18 | | | | +101.5 | % |

Corporate | | € | | | — | | | | — | | | | N/A | | | | N/A | | | | N/A | | | | (7 | ) | | | (8 | ) | | | +9.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL | | € | | | 6 153 | | | | 5 820 | | | | +5.7 | % | | | 3.6 | % | | | 3.0 | % | | | 221 | | | | 173 | | | | +27.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The segment “United States” includes the banners Food Lion and Hannaford. |

| (2) | The segment “Southeastern Europe” includes our operations in Greece, Serbia and Romania. Our operations in Indonesia are accounted for under the equity method. |

| (3) | For a definition of underlying operating profit, please refer to the “Definitions” page of this document. A reconciliation with reported operating profit is provided on page 15. |

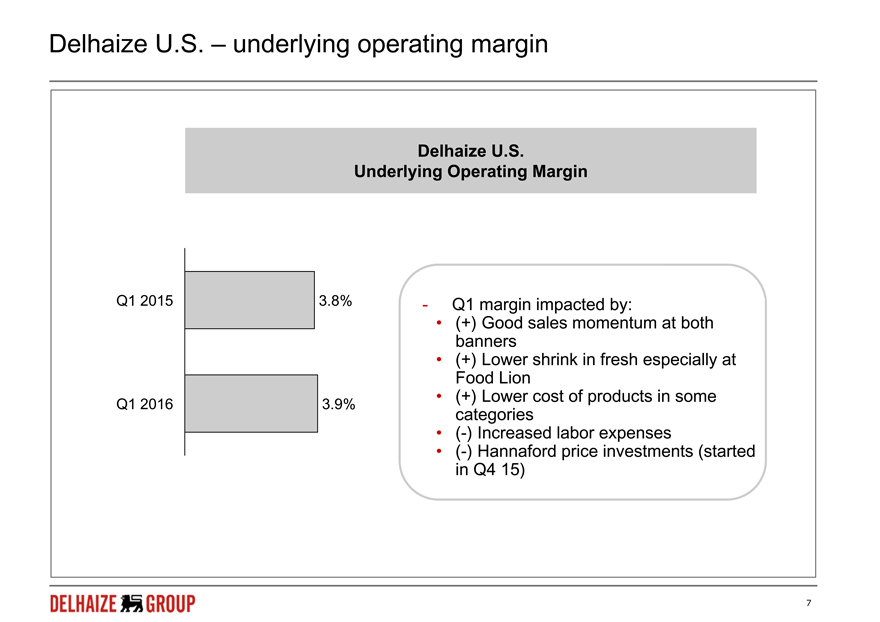

United States

In the first quarter of 2016, revenues in the U.S. increased by 1.9% to $4.4 billion (€4.0 billion). Comparable store sales increased by 2.6% (excluding a negative calendar impact of 0.5%), and both Food Lion and Hannaford posted positive comparable store sales and real growth. Both retail and cost inflation remained negative in this first quarter, with retail inflation standing at -1.1% for the quarter, driven by price decreases in meat and dairy.

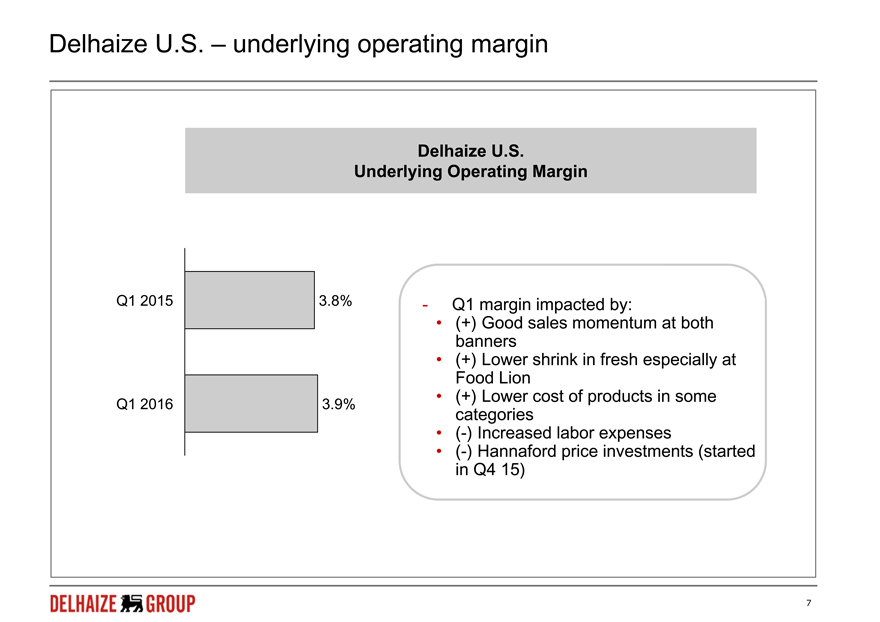

Underlying operating profit increased by 6.1% in local currency, while the underlying operating margin increased from 3.8% to 3.9%. Gross margin increased slightly, due to lower shrink in fresh categories, especially at Food Lion, partly offset by the Hannaford price investments made in the fourth quarter of 2015. SG&A as a percentage of revenues remained flat as the positive impact of higher volumes offset an increase in labor expenses.

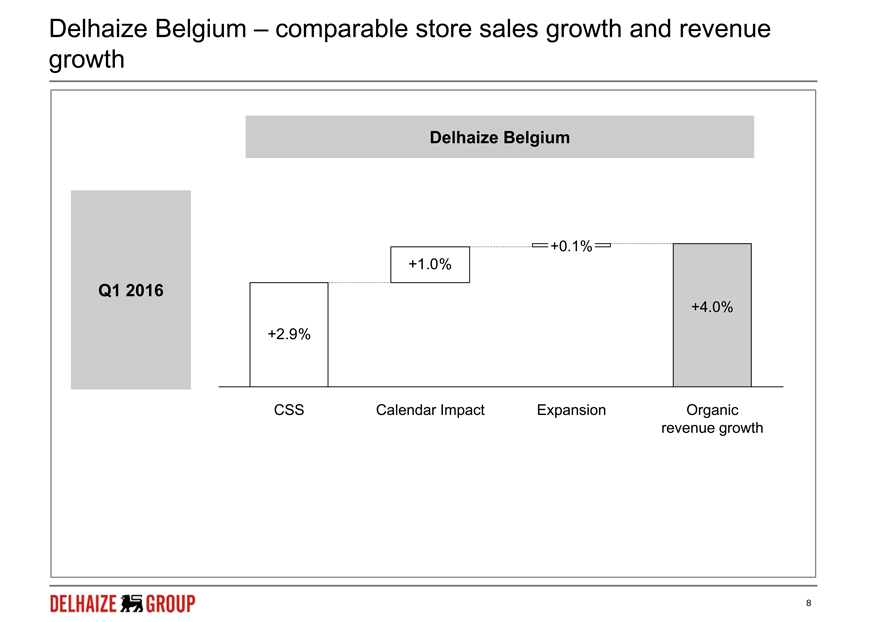

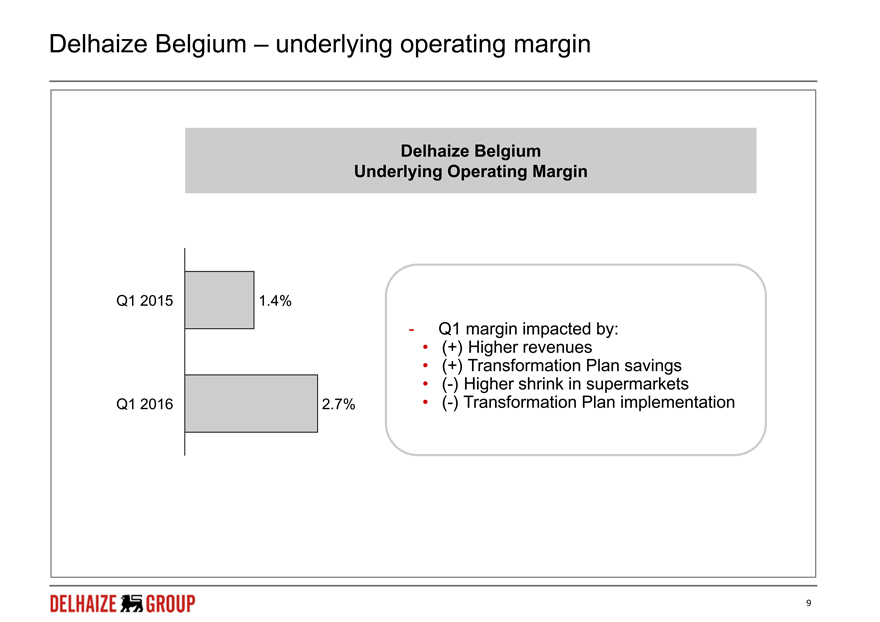

Belgium

Revenues in Belgium were €1.2 billion, an increase of 4.0% compared to the first quarter of 2015, with comparable store sales evolution reaching 2.9% (excluding a positive 1.0% calendar impact), supported by a 2.2% retail inflation. While our revenues and market share continued to recover from the disruptions faced during the Transformation Plan, top-line performance in our company-operated stores remained below our expectations.

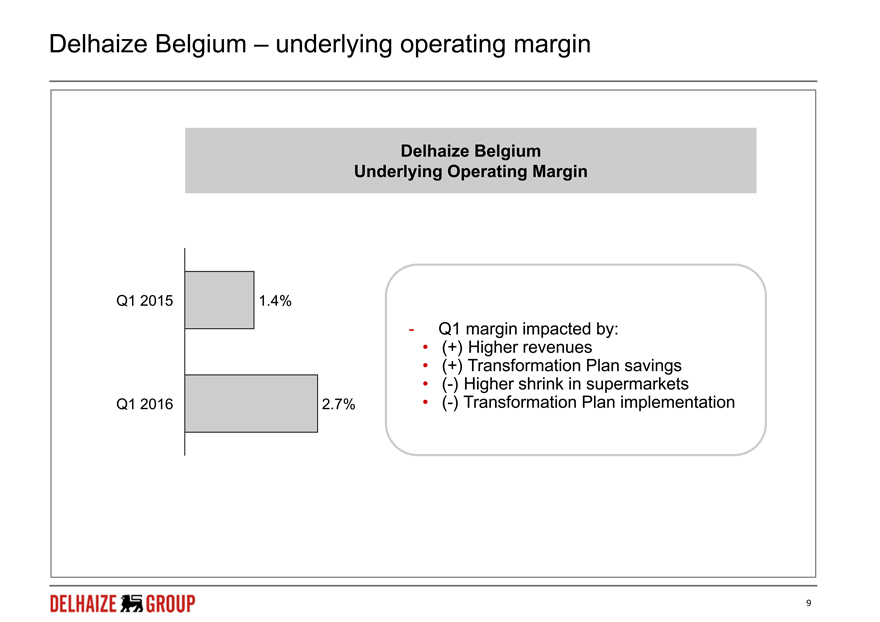

Underlying operating profit increased to €33 million, more than double the low of €16 million recorded in the first quarter of 2015. This was the result of a strong improvement in SG&A as a percentage of revenues, due to the Transformation Plan savings and lower advertising expenses, while our gross margin decreased slightly due to higher shrink in supermarkets. Underlying operating margin was 2.7% compared to 1.4% last year.

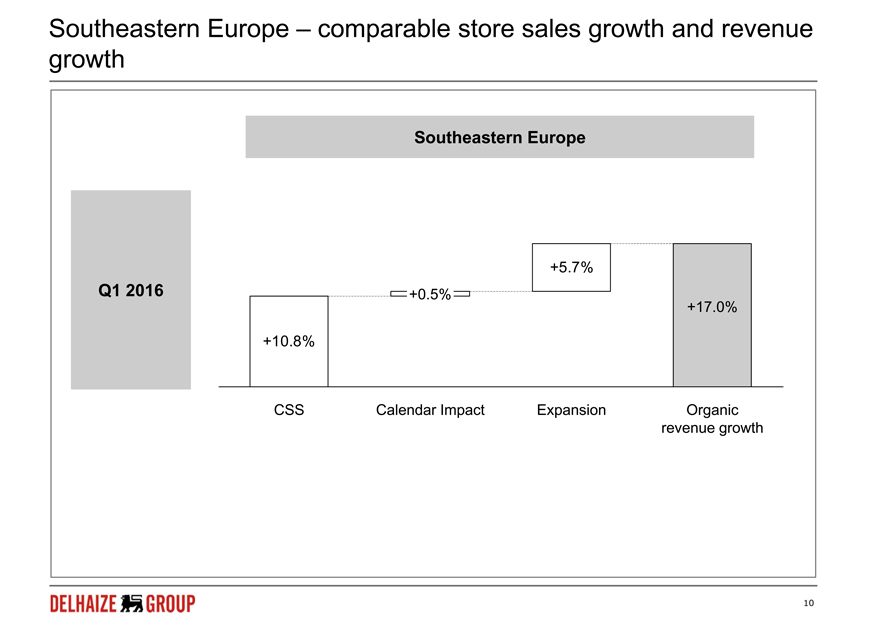

Southeastern Europe

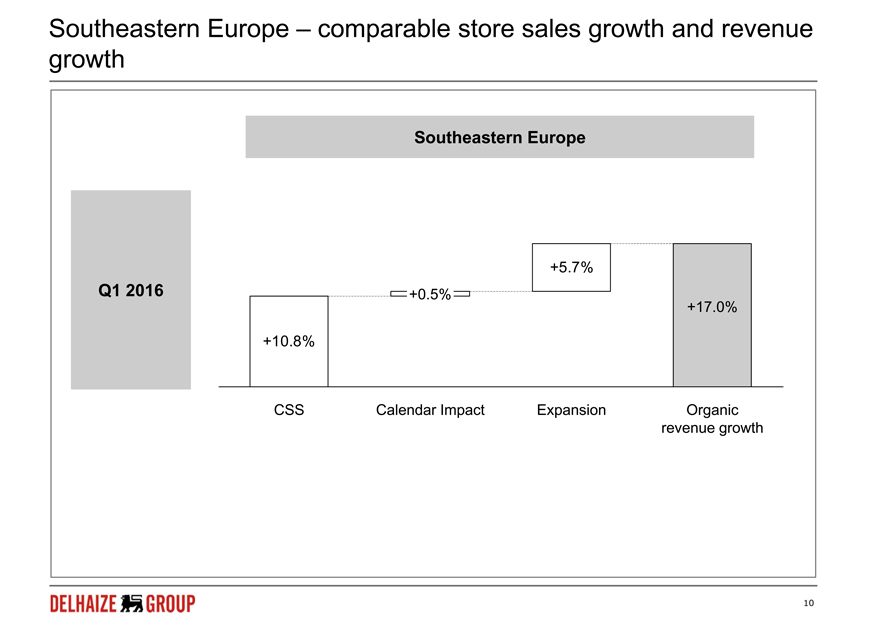

In the first quarter of 2016, revenues in Southeastern Europe increased by 16.5% to €894 million (+17.0% at identical exchange rates), driven by a very strong 10.8% comparable store sales growth, network expansion and a 0.5% positive calendar impact. Comparable store sales growth and real growth were positive across the segment and were particularly strong in Greece and in Romania, whereas inflation was flat for the region overall.

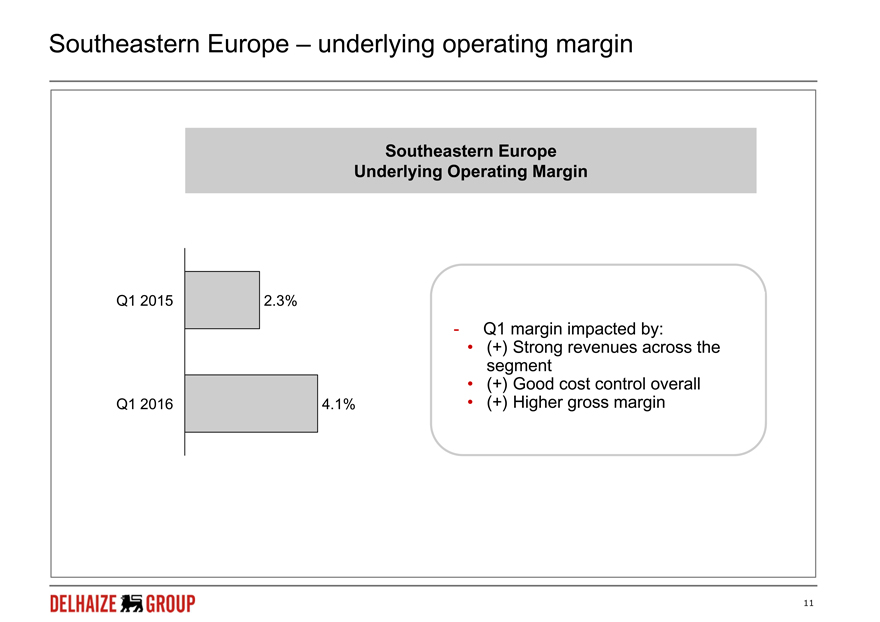

Underlying operating profit increased by 101.5% to €36 million (+102.4% at identical exchange rates), mainly driven by positive sales leverage, while the underlying operating margin increased from 2.3% to 4.1%.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 4 of 19 | |

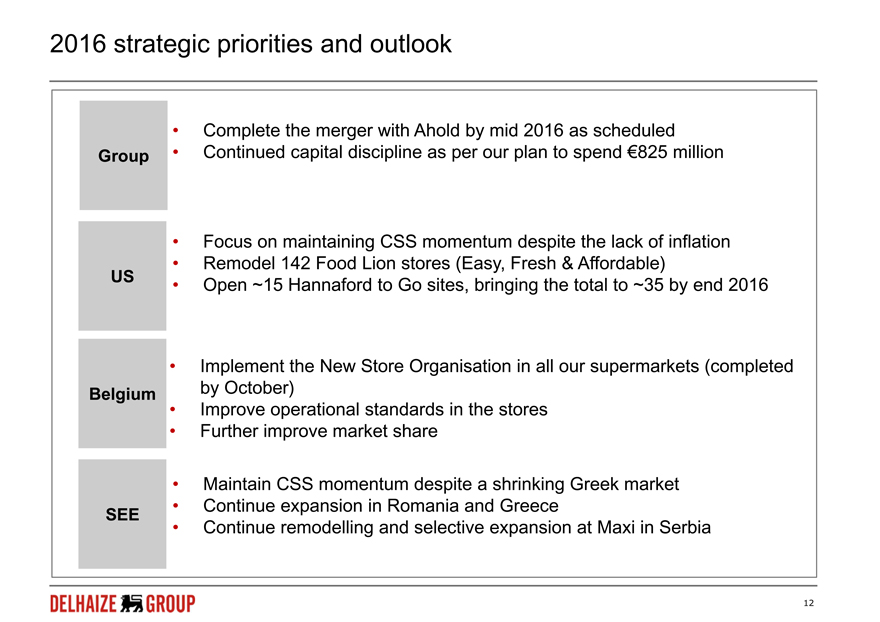

» 2016 Outlook

Although our priority this year is to complete the merger with Ahold by mid-2016 as planned, we remain focused on our action plan and notably on:

| | - | | consolidating our competitive price positioning in all our operations, |

| | - | | continuing to expand our Easy, Fresh & Affordable initiative at Food Lion with 142 store remodelings, |

| | - | | implementing the New Store Organization in all our Belgian company-operated stores by October, and |

| | - | | expanding our network in Southeastern Europe. |

For 2016, we are encouraged by our solid first quarter results. Annual Group cash capital expenditures are expected to be approximately €825 million at identical exchange rates. We intend to grow revenues and market shares while continuing to generate a solid level of free cash flow.

» Conference Call and Webcast

Delhaize Group’s management will comment on the first quarter 2016 results during a conference call starting April 27, 2016 at 09:00 am CET / 03:00 am ET. The conference call can be attended by calling +44 (0)20 3427 1908 (U.K.), +1 718 354 1157 (U.S.) or +32 2 404 0662 (Belgium), with “Delhaize” as password. The conference call will also be broadcast live over the internet athttp://www.delhaizegroup.com. An on-demand replay of the webcast will be available after the conference call athttp://www.delhaizegroup.com.

» Delhaize Group

Delhaize Group is a Belgian international food retailer present in seven countries on three continents. On March 31, 2016, Delhaize Group’s sales network consisted of 3 524 stores. In 2015, Delhaize Group recorded €24.4 billion ($27.1 billion) in revenues and €366 million ($407 million) net profit (Group share). At the end of 2015, Delhaize Group employed approximately 154 000 people. Delhaize Group’s stock is listed on NYSE Euronext Brussels (DELB) and the New York Stock Exchange (DEG).

This press release is available in English, French and Dutch. You can also find it on the websitehttp://www.delhaizegroup.com. Questions can be sent toinvestor@delhaizegroup.com.

» Financial Calendar

| | | | |

• Ordinary Shareholder’s Meeting | | | May 26, 2016 | |

» Contacts

Investor Relations: + 32 2 412 21 51

Media Relations: + 32 2 412 86 69

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 5 of 19 | |

DELHAIZE GROUP CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

» Condensed Consolidated Balance Sheet (Unaudited)

| | | | | | | | | | | | |

(in millions of €) | | March 31, 2016 | | | December 31, 2015 | | | March 31, 2015 | |

Assets | | | | | | | | | | | | |

Non-current assets | | | 8 613 | | | | 8 950 | | | | 8 832 | |

Goodwill | | | 3 335 | | | | 3 465 | | | | 3 491 | |

Intangible assets | | | 765 | | | | 800 | | | | 822 | |

Property, plant and equipment | | | 4 213 | | | | 4 386 | | | | 4 229 | |

Investment property | | | 93 | | | | 97 | | | | 105 | |

Investments accounted for using the equity method | | | 37 | | | | 36 | | | | 34 | |

Financial assets | | | 44 | | | | 44 | | | | 31 | |

Derivative instruments | | | 10 | | | | 9 | | | | 11 | |

Other non-current assets | | | 116 | | | | 113 | | | | 109 | |

Current assets | | | 3 837 | | | | 4 082 | | | | 3 688 | |

Inventories | | | 1 484 | | | | 1 476 | | | | 1 503 | |

Receivables | | | 692 | | | | 640 | | | | 606 | |

Financial assets | | | 233 | | | | 231 | | | | 242 | |

Other current assets | | | 153 | | | | 152 | | | | 152 | |

Cash and cash equivalents | | | 1 271 | | | | 1 579 | | | | 1 181 | |

Assets classified as held for sale | | | 4 | | | | 4 | | | | 4 | |

| | | | | | | | | | | | |

Total assets | | | 12 450 | | | | 13 032 | | | | 12 520 | |

| | | | | | | | | | | | |

| | | |

Liabilities | | | | | | | | | | | | |

Total equity | | | 6 124 | | | | 6 171 | | | | 6 032 | |

Shareholders’ equity | | | 6 124 | | | | 6 168 | | | | 6 026 | |

Non-controlling interests | | | — | | | | 3 | | | | 6 | |

Non-current liabilities | | | 3 221 | | | | 3 350 | | | | 3 463 | |

Long-term debt | | | 1 902 | | | | 1 949 | | | | 1 969 | |

Obligations under finance lease | | | 447 | | | | 480 | | | | 517 | |

Deferred tax liabilities | | | 388 | | | | 404 | | | | 363 | |

Derivative instruments | | | 52 | | | | 71 | | | | 80 | |

Provisions | | | 371 | | | | 381 | | | | 469 | |

Other non-current liabilities | | | 61 | | | | 65 | | | | 65 | |

Current liabilities | | | 3 105 | | | | 3 511 | | | | 3 025 | |

Long-term debt - current portion | | | 9 | | | | 10 | | | | 2 | |

Obligations under finance lease | | | 72 | | | | 75 | | | | 76 | |

Bank overdrafts | | | 1 | | | | — | | | | 20 | |

Accounts payable | | | 2 179 | | | | 2 510 | | | | 2 009 | |

Provisions | | | 144 | | | | 175 | | | | 211 | |

Other current liabilities | | | 700 | | | | 741 | | | | 707 | |

| | | | | | | | | | | | |

Total liabilities and equity | | | 12 450 | | | | 13 032 | | | | 12 520 | |

| | | | | | | | | | | | |

$ per € exchange rate | | | 1.1385 | | | | 1.0887 | | | | 1.0759 | |

| | | | | | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 6 of 19 | |

» Condensed Consolidated Income Statement (Unaudited)

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Revenues | | | 6 153 | | | | 5 820 | |

Cost of sales | | | (4 645 | ) | | | (4 400 | ) |

| | | | | | | | |

Gross profit | | | 1 508 | | | | 1 420 | |

Gross margin | | | 24.5 | % | | | 24.4 | % |

Other operating income | | | 24 | | | | 25 | |

Selling, general and administrative expenses | | | (1 313 | ) | | | (1 271 | ) |

Other operating expenses | | | (28 | ) | | | (30 | ) |

| | | | | | | | |

Operating profit | | | 191 | | | | 144 | |

Operating margin | | | 3.1 | % | | | 2.5 | % |

Finance costs | | | (47 | ) | | | (94 | ) |

Income from investments | | | — | | | | (2 | ) |

Share of results of joint venture equity accounted | | | 1 | | | | 1 | |

| | | | | | | | |

Profit before taxes and discontinued operations | | | 145 | | | | 49 | |

Income tax expense | | | (36 | ) | | | (13 | ) |

| | | | | | | | |

Net profit from continuing operations | | | 109 | | | | 36 | |

| | | | | | | | |

Result from discontinued operations, net of tax | | | — | | | | (8 | ) |

Net profit | | | 109 | | | | 28 | |

| | | | | | | | |

Net profit attributable to non-controlling interests | | | — | | | | — | |

Net profit attributable to equity holders of the Group - | | | | | | | | |

Group share in net profit | | | 109 | | | | 28 | |

| | |

(in €, except number of shares) | | | | | | |

Group share in net profit from continuing operations: | | | | | | | | |

Basic earnings per share | | | 1.05 | | | | 0.35 | |

Diluted earnings per share | | | 1.04 | | | | 0.35 | |

| | | | | | | | |

Group share in net profit: | | | | | | | | |

Basic earnings per share | | | 1.05 | | | | 0.27 | |

Diluted earnings per share | | | 1.04 | | | | 0.27 | |

| | | | | | | | |

Weighted average number of shares outstanding: | | | | | | | | |

Basic | | | 103 510 047 | | | | 101 944 135 | |

Diluted | | | 104 490 376 | | | | 103 046 896 | |

| | | | | | | | |

Shares issued at the end of the period | | | 104 253 387 | | | | 103 514 900 | |

| | | | | | | | |

Shares outstanding at the end of the period | | | 103 774 900 | | | | 102 633 826 | |

| | | | | | | | |

Average $ per € exchange rate | | | 1.1020 | | | | 1.1261 | |

| | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 7 of 19 | |

» Condensed Consolidated Statement of Comprehensive Income (Unaudited)

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Net profit of the period | | | 109 | | | | 28 | |

| | | | | | | | |

Total items that will not be reclassified to profit or loss | | | — | | | | — | |

| | | | | | | | |

Items that are or may be reclassified subsequently to profit or loss | | | | | | | | |

Unrealized gain (loss) on financial assets available for sale | | | 5 | | | | 2 | |

Reclassification adjustment to net profit | | | — | | | | — | |

Tax (expense) benefit | | | (1 | ) | | | — | |

| | | | | | | | |

Unrealized gain (loss) on financial assets available for sale, net of tax | | | 4 | | | | 2 | |

Exchange gain (loss) on translation of foreign operations | | | (189 | ) | | | 484 | |

Reclassification adjustment to net profit | | | — | | | | — | |

| | | | | | | | |

Exchange gain (loss) on translation of foreign operations | | | (189 | ) | | | 484 | |

| | | | | | | | |

Total items that are or may be reclassified subsequently to profit or loss | | | (185 | ) | | | 486 | |

| | | | | | | | |

Other comprehensive income | | | (185 | ) | | | 486 | |

Attributable to non-controlling interests | | | — | | | | — | |

Attributable to equity holders of the Group | | | (185 | ) | | | 486 | |

| | | | | | | | |

Total comprehensive income for the period | | | (76 | ) | | | 514 | |

Attributable to non-controlling interests | | | — | | | | — | |

Attributable to equity holders of the Group | | | (76 | ) | | | 514 | |

| | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 8 of 19 | |

» Condensed Consolidated Statement of Changes in Equity (Unaudited)

| | | | | | | | | | | | |

(in millions of €, except number of shares) | | Shareholders’

Equity | | | Non-controlling

Interests | | | Total Equity | |

Balances at January 1, 2016 | | | 6 168 | | | | 3 | | | | 6 171 | |

Other comprehensive income | | | (185 | ) | | | — | | | | (185 | ) |

Net profit | | | 109 | | | | — | | | | 109 | |

| | | | | | | | | | | | |

Total comprehensive income for the period | | | (76 | ) | | | — | | | | (76 | ) |

| | | | | | | | | | | | |

Capital increase | | | 19 | | | | — | | | | 19 | |

Treasury shares purchased | | | (3 | ) | | | — | | | | (3 | ) |

Treasury shares sold upon exercise of employee stock options | | | 13 | | | | — | | | | 13 | |

Excess tax benefit on employee stock options and restricted stock units | | | 3 | | | | — | | | | 3 | |

Share-based compensation expense | | | 3 | | | | — | | | | 3 | |

Purchase of non-controlling interests | | | (3 | ) | | | (3 | ) | | | (6 | ) |

| | | | | | | | | | | | |

Balances at March 31, 2016 | | | 6 124 | | | | — | | | | 6 124 | |

| | | | | | | | | | | | |

Shares issued | | | 104 253 387 | | | | | | | | | |

Treasury shares | | | 478 487 | | | | | | | | | |

Shares outstanding | | | 103 774 900 | | | | | | | | | |

| | | |

(in millions of €, except number of shares) | | Shareholders’

Equity | | | Non-controlling

Interests | | | Total Equity | |

Balances at January 1, 2015 | | | 5 447 | | | | 6 | | | | 5 453 | |

Other comprehensive income | | | 486 | | | | — | | | | 486 | |

Net profit | | | 28 | | | | — | | | | 28 | |

| | | | | | | | | | | | |

Total comprehensive income for the period | | | 514 | | | | — | | | | 514 | |

| | | | | | | | | | | | |

Capital increases | | | 44 | | | | — | | | | 44 | |

Treasury shares purchased | | | (21 | ) | | | — | | | | (21 | ) |

Treasury shares sold upon exercise of employee stock options | | | 32 | | | | — | | | | 32 | |

Excess tax benefit on employee stock options and restricted stock units | | | 5 | | | | — | | | | 5 | |

Share-based compensation expense | | | 5 | | | | — | | | | 5 | |

| | | | | | | | | | | | |

Balances at March 31, 2015 | | | 6 026 | | | | 6 | | | | 6 032 | |

| | | | | | | | | | | | |

Shares issued | | | 103 514 900 | | | | | | | | | |

Treasury shares | | | 881 074 | | | | | | | | | |

Shares outstanding | | | 102 633 826 | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 9 of 19 | |

» Condensed Consolidated Statement of Cash Flows (Unaudited)

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Operating activities | | | | | | | | |

Net profit | | | 109 | | | | 28 | |

Adjustments for: | | | | | | | | |

Share of results of joint venture equity accounted | | | (1 | ) | | | (1 | ) |

Depreciation and amortization | | | 170 | | | | 166 | |

Impairment | | | 12 | | | | 7 | |

Income taxes, finance costs and income from investments | | | 83 | | | | 107 | |

Other non-cash items | | | 5 | | | | 8 | |

Changes in operating assets and liabilities | | | (484 | ) | | | (265 | ) |

Interest paid | | | (27 | ) | | | (34 | ) |

Interest received | | | 5 | | | | 3 | |

Income taxes paid | | | (15 | ) | | | (44 | ) |

Net cash used in operating activities | | | (143 | ) | | | (25 | ) |

| | | | | | | | |

Investing activities | | | | | | | | |

Business acquisitions, net of cash and cash equivalents acquired | | | (10 | ) | | | (2 | ) |

Business disposals, net of cash and cash equivalents disposed | | | — | | | | 14 | |

Purchase of tangible and intangible assets (capital expenditures) | | | (120 | ) | | | (85 | ) |

Sale of tangible and intangible assets | | | 4 | | | | 5 | |

Sale and maturity of (investment in) term deposits, net | | | (16 | ) | | | (24 | ) |

Other investing activities | | | 9 | | | | (26 | ) |

Net cash used in investing activities | | | (133 | ) | | | (118 | ) |

| | | | | | | | |

Financing activities | | | | | | | | |

Proceeds from the exercise of share warrants and stock options | | | 32 | | | | 76 | |

Treasury shares purchased | | | (3 | ) | | | (21 | ) |

Purchase of non-controlling interests | | | (6 | ) | | | — | |

Repayments of long-term loans, net of direct financing costs | | | (16 | ) | | | (452 | ) |

Settlement of derivative instruments | | | — | | | | 4 | |

Net cash provided by (used in) financing activities | | | 7 | | | | (393 | ) |

| | | | | | | | |

Effect of foreign currency translation | | | (40 | ) | | | 97 | |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | (309 | ) | | | (439 | ) |

| | | | | | | | |

Cash and cash equivalents at beginning of period | | | 1 579 | | | | 1 600 | |

Cash and cash equivalents at end of period | | | 1 270 | (2) | | | 1 161 | (1) |

| (1) | Includes €20 million bank overdrafts |

| (2) | Includes €1 million bank overdrafts |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 10 of 19 | |

»Selected Explanatory Notes

General information

Delhaize Group is a Belgian international food retailer with operations in seven countries on three continents. The Company’s stock is listed on NYSE Euronext Brussels (DELB) and the New York Stock Exchange (DEG).

The condensed interim financial statements of the Group for the three months ended March 31, 2016 were authorized for issue by the Board of Directors on April 26, 2016.

This interim report only provides an explanation of events and transactions that are significant to an understanding of the changes in financial position and reporting since the last annual reporting period, and should therefore be read in conjunction with the consolidated financial statements for the financial year ended on December 31, 2015.

Basis of presentation and accounting policies

These condensed interim financial statements have been prepared in accordance with International Accounting Standard (IAS) 34Interim Financial Reporting, as issued by the International Accounting Standards Board (IASB), and as adopted by the European Union (EU).

The condensed interim financial statements are presented in millions of euros, the Group’s presentation currency, except where stated otherwise.

The accounting policies applied in this report are consistent with those of the previous financial year except for the following new, amended or revised IFRS standards and IFRIC interpretations that have been adopted as of January 1, 2016:

| | • | | Improvements to IFRS 2012 – 2014 Cycle; |

| | • | | Amendments to IAS 16 and IAS 38 Clarification of Acceptable Methods of Depreciation and Amortisation; |

| | • | | Amendments to IFRS 11 Accounting for Acquisitions of Interest in Joint Operations; and |

| | • | | Amendments to IAS 1 Disclosure Initiative. |

The adoption of these new, amended or revised pronouncements did not have a significant impact on the condensed financial statements of the Group.

Delhaize Group did not early adopt any new IASB pronouncements that were issued but not yet effective at the balance sheet date.

Segment reporting

Segment information, including a reconciliation from operating profit to underlying operating profit, required by IAS 34, can be found on page 15 of this press release and forms an integral part of this report.

Business combinations and acquisition of non-controlling interests

At the end of the first quarter of 2016, Delhaize Group acquired a chain of 6 supermarkets in Southeastern Europe that was accounted for as a business combination for a consideration of €13 million, of which €10 million already paid. No goodwill has yet been determined as the purchase price allocation is still in a preliminary status.

In February 2016, Delhaize Group acquired, through a squeeze-out procedure, an additional 7.6% non-controlling interests in C-Market for a consideration of almost €6 million. As a result, the Group currently owns 99.3% in this Serbian subsidiary.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 11 of 19 | |

»Balance Sheet and Cash Flow Statement

Capital expenditures

During the first quarter of 2016, Delhaize Group incurred capital expenditures of €120 million, consisting of €105 million in property, plant and equipment and €15 million in intangible assets.

In the first quarter of 2016, the Group did not add any property under finance leases. The carrying amount of tangible and intangible assets that were sold or disposed during the first quarter of 2016 was €7 million.

Equity

In the first quarter of 2016, Delhaize Group issued 248 435 new shares, purchased 53 931 treasury shares (via the automatic exercise of call options by a financial institution) and used 385 059 treasury shares to satisfy the exercise of stock options that were granted as part of the share-based incentive plans. At March 31, 2016, the Group owned 478 487 treasury shares.

Dividends

The gross dividend payment of €1.80 per share, proposed by the Board of Directors in the 2015 financial statements is subject to shareholder’s approval at the Ordinary Shareholders’ Meeting of May 26, 2016 and will be paid thereafter.

Financial instruments

Financial instruments measured at fair value by fair value hierarchy:

| | | | | | | | | | | | | | | | |

| | | March 31, 2016 | |

(in millions of €) | | Quoted

prices in

active

markets

(Level 1) | | | Significant

other

observable

inputs

(Level 2) | | | Significant

unobservable

inputs

(Level 3) | | | Total | |

Financial Assets | | | | | | | | | | | | | | | | |

Non-Current | | | | | | | | | | | | | | | | |

Derivative instruments | | | — | | | | 10 | | | | — | | | | 10 | |

Current | | | | | | | | | | | | | | | | |

Financial assets – measured at fair value | | | 174 | | | | — | | | | — | | | | 174 | |

| | | | | | | | | | | | | | | | |

Total financial assets measured at fair value | | | 174 | | | | 10 | | | | — | | | | 184 | |

Financial assets measured at amortized cost | | | | | | | | | | | | | | | 2 066 | |

| | | | | | | | | | | | | | | | |

Total financial assets | | | | | | | | | | | | | | | 2 250 | |

Financial Liabilities | | | | | | | | | | | | | | | | |

Non-Current | | | | | | | | | | | | | | | | |

Derivative instruments | | | — | | | | 52 | | | | — | | | | 52 | |

| | | | | | | | | | | | | | | | |

Total financial liabilities measured at fair value | | | — | | | | 52 | | | | — | | | | 52 | |

Financial liabilities being part of a fair value hedge relationship | | | | | | | | | | | | | | | 252 | |

Financial liabilities measured at amortized cost | | | | | | | | | | | | | | | 4 358 | |

| | | | | | | | | | | | | | | | |

Total financial liabilities | | | | | | | | | | | | | | | 4 662 | |

In 2016, there were no transfers between fair value hierarchy levels and there were no changes in the valuation techniques and inputs applied.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 12 of 19 | |

Fair value of financial instruments not measured at fair value:

| | | | | | | | |

(in millions of €) | | Carrying

amount | | | Fair value | |

Financial liabilities being part of a fair value hedge relationship | | | 252 | | | | 274 | |

Financial liabilities at amortized cost | | | 1 659 | | | | 2 084 | |

| | | | | | | | |

Total long-term debt | | | 1 911 | | | | 2 358 | |

The fair value of the receivables, other financial assets, cash and cash equivalents and accounts payable, all measured at amortized cost, approximate their carrying amounts.

»Income Statement

Other operating income

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Rental income | | | 14 | | | | 14 | |

Income from waste recycling activities | | | 5 | | | | 5 | |

Services rendered to wholesale customers | | | 1 | | | | 1 | |

Gain on sale of property, plant and equipment | | | 1 | | | | 1 | |

Other | | | 3 | | | | 4 | |

| | | | | | | | |

Total | | | 24 | | | | 25 | |

| | | | | | | | |

Other operating expenses

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Store closing expenses | | | (2 | ) | | | (2 | ) |

Reorganization expenses | | | 1 | | | | (3 | ) |

Impairment | | | (12 | ) | | | (7 | ) |

Loss on sale of property, plant and equipment | | | (4 | ) | | | (2 | ) |

Other | | | (11 | ) | | | (16 | ) |

| | | | | | | | |

Total | | | (28 | ) | | | (30 | ) |

| | | | | | | | |

In the first quarter of 2016, the caption “Other” mainly includes €11 million advisory and consulting costs related to the announced intention to merge with Royal Ahold N.V.

Income taxes

During the first quarter of 2016, the effective tax rate (on continued operations) was 24.9%, compared to previous year’s rate of 28.3%. The difference between both years is the result of the non-deductible competition authority fine we accrued and tax leakage on internal dividend distributions, both in 2015.

»Contingencies, Commitments and Guarantees

Following the closing of Delhaize Group’s agreed sale of Sweetbay, Harveys and Reid’s and Bottom Dollar Food, the Group will continue to provide guarantees for a number of existing operating or finance lease contracts, which extend through 2037. In the event of a future default of the buyer, Delhaize Group will be obligated to pay rent and otherwise perform the guaranteed leases. The nominal future minimum lease payments over the non-cancellable lease term of the guaranteed leases, excluding other direct costs such as common area maintenance expenses and real estate taxes, amount to $390 million (€343 million) as of March 31, 2016. The Group closely monitors the risks associated with these guarantees and currently does not expect to be required to pay any amounts in the foreseeable future.

Except for changes mentioned in these interim financial statements, other contingencies are materially unchanged from those described in Note 34 on page 161 of the 2015 Annual Report.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 13 of 19 | |

» Announced intention to merge with Royal Ahold

We refer to Note 36 of our 2015 annual report.

In March 2016, the shareholders of Delhaize Group and Royal Ahold approved the proposed merger at their respective extraordinary general meetings of shareholders.

Furthermore, in March 2016, the Belgian Competition Authorities (“BCA”) gave Delhaize Group and Royal Ahold regulatory clearance, subject to certain conditions. The BCA requests that a limited number of stores are divested in order to address competition concerns: eight Albert Heijn and five Delhaize affiliated stores are in the process of being sold.

The transaction is expected to be completed in mid-2016, following associate consultation procedures and regulatory clearance from the U.S. Federal Trade Commission (“FTC”).

» Subsequent Events

No significant events occurred after balance sheet date.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 14 of 19 | |

OTHER FINANCIAL AND OPERATING INFORMATION (UNAUDITED)

» Use of non-GAAP (Generally Accepted Accounting Principles) Financial Measures

Delhaize Group uses certain non-GAAP measures in its financial communication. Delhaize Group does not consider these measures as alternative measures to net profit or other financial measures determined in accordance with IFRS. These measures as reported by Delhaize Group may differ from similarly titled measures used by other companies. We believe that these measures are important indicators of our business performance and are widely used by investors, analysts and other interested parties. In the press release, the non-GAAP measures are reconciled to financial measures prepared in accordance with IFRS.

» Number of Stores

| | | | | | | | | | | | |

| | | End of 2015 | | | Change Q1 2016 | | | End of Q1 2016 | |

United States | | | 1 288 | | | | -2 | | | | 1 286 | |

Belgium & Luxembourg | | | 888 | | | | +10 | | | | 898 | |

Greece | | | 341 | | | | +3 | | | | 344 | |

Romania | | | 471 | | | | -1 | | | | 470 | |

Serbia | | | 396 | | | | — | | | | 396 | |

Indonesia | | | 128 | | | | +2 | | | | 130 | |

| | | | | | | | | | | | |

Total | | | 3 512 | | | | +12 | | | | 3 524 | |

| | | | | | | | | | | | |

» Organic Revenue Growth Reconciliation

| | | | | | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | | | % Change | |

Revenues | | | 6 153 | | | | 5 820 | | | | +5.7 | % |

Effect of exchange rates | | | (83 | ) | | | | | | | | |

Revenues at identical exchange rates | | | 6 070 | | | | 5 820 | | | | +4.3 | % |

| | | | | | | | | | | | |

Organic revenue growth | | | 6 070 | | | | 5 820 | | | | +4.3 | % |

| | | | | | | | | | | | |

» Underlying operating profit

Delhaize Group believes “underlying operating profit” is a measure that, for external users of the financial statements, offers a more detailed view than “operating profit” of the operating performance of the period for the Group as it adjusts for a number of elements that management considers as non-representative of underlying operating performance.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q1 2016 | |

(in millions) | | United

States | | | United

States | | | Belgium | | | SEE | | | Corporate | | | TOTAL | |

| | | $ | | | € | | | € | | | € | | | € | | | € | |

Operating Profit (as reported) | | | 167 | | | | 152 | | | | 20 | | | | 36 | | | | (17 | ) | | | 191 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Add/(substract): | | | | | | | | | | | | | | | | | | | | | | | | |

Store closing expenses (reversals) | | | 2 | | | | 2 | | | | — | | | | — | | | | — | | | | 2 | |

Reorganization expenses (reversals) | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | (1 | ) |

Fixed assets impairment charges (reversals) | | | — | | | | — | | | | 12 | | | | — | | | | — | | | | 12 | |

(Gains)/losses on disposal of fixed assets | | | 2 | | | | 2 | | | | 1 | | | | — | | | | — | | | | 3 | |

Other | | | 4 | | | | 3 | | | | 1 | | | | — | | | | 10 | | | | 14 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Underlying Operating Profit | | | 175 | | | | 159 | | | | 33 | | | | 36 | | | | (7 | ) | | | 221 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 15 of 19 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q1 2015 | |

(in millions) | | United

States | | | United

States | | | Belgium | | | SEE | | | Corporate | | | TOTAL | |

| | | $ | | | € | | | € | | | € | | | € | | | € | |

Operating Profit (as reported) | | | 156 | | | | 138 | | | | (4 | ) | | | 18 | | | | (8 | ) | | | 144 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Add/(substract): | | | | | | | | | | | | | | | | | | | | | | | | |

Store closing expenses (reversals) | | | 2 | | | | 2 | | | | — | | | | — | | | | — | | | | 2 | |

Reorganization expenses (reversals) | | | 3 | | | | 3 | | | | — | | | | — | | | | — | | | | 3 | |

Fixed assets impairment charges (reversals) | | | 3 | | | | 3 | | | | 4 | | | | — | | | | — | | | | 7 | |

(Gains)/losses on disposal of fixed assets | | | 1 | | | | 1 | | | | — | | | | — | | | | — | | | | 1 | |

Other | | | — | | | | — | | | | 16 | | | | — | | | | — | | | | 16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Underlying Operating Profit | | | 165 | | | | 147 | | | | 16 | | | | 18 | | | | (8 | ) | | | 173 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

In the first quarter of 2016, the caption “Other” primarily consists of €14 million advisory, consulting and other costs related to the planned merger with Royal Ahold N.V. (of which €11 million recorded in “Other operating expenses”).

The first quarter of 2015 was significantly impacted by a legal provision related to the antitrust investigation regarding the coordination of price increases of certain health and beauty products sold in Belgium between 2002 and 2007.

» EBITDA Reconciliation

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Operating profit | | | 191 | | | | 144 | |

Depreciation and amortization | | | 170 | | | | 166 | |

Impairment | | | 12 | | | | 7 | |

| | | | | | | | |

EBITDA | | | 373 | | | | 317 | |

| | | | | | | | |

» Underlying EBITDA Reconciliation

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Underlying operating profit | | | 221 | | | | 173 | |

Depreciation and amortization | | | 170 | | | | 166 | |

| | | | | | | | |

Underlying EBITDA | | | 391 | | | | 339 | |

| | | | | | | | |

» Free Cash Flow Reconciliation

| | | | | | | | |

(in millions of €) | | Q1 2016 | | | Q1 2015 | |

Net cash used in operating activities | | | (143 | ) | | | (25 | ) |

Net cash used in investing activities | | | (133 | ) | | | (118 | ) |

Net investment in debt securities, term deposits and derivative related collaterals | | | 8 | | | | 50 | |

| | | | | | | | |

Free cash flow | | | (268 | ) | | | (93 | ) |

| | | | | | | | |

Cash from sale Bottom Dollar Food (2015) | | | — | | | | (14 | ) |

Cash outflow related to the Transformation Plan | | | 25 | | | | — | |

Merger related cash expenses | | | 16 | | | | — | |

| | | | | | | | |

Operating free cash flow | | | (227 | ) | | | (107 | ) |

| | | | | | | | |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 16 of 19 | |

» Net Debt Reconciliation

| | | | | | | | | | | | |

(in millions of €, except net debt ratio’s) | | March 31, 2016 | | | December 31, 2015 | | | March 31, 2015 | |

Non-current financial liabilities | | | 2 349 | | | | 2 429 | | | | 2 486 | |

Current financial liabilities | | | 82 | | | | 85 | | | | 98 | |

Derivative liabilities | | | 52 | | | | 71 | | | | 80 | |

Derivative assets | | | (10 | ) | | | (9 | ) | | | (11 | ) |

Investment in securities - non-current | | | — | | | | — | | | | (9 | ) |

Investment in securities - current | | | (174 | ) | | | (176 | ) | | | (171 | ) |

Term deposits - current | | | (26 | ) | | | (12 | ) | | | (33 | ) |

Collaterals on derivative instruments | | | (20 | ) | | | (28 | ) | | | (27 | ) |

Cash and cash equivalents | | | (1 271 | ) | | | (1 579 | ) | | | (1 181 | ) |

| | | | | | | | | | | | |

Net debt | | | 982 | | | | 781 | | | | 1 232 | |

Net debt to equity ratio | | | 16.0 | % | | | 12.7 | % | | | 20.4 | % |

| | | |

EBITDA (last 12 months) | | | 1 448 | | | | 1 392 | | | | 1 181 | |

Net debt to EBITDA ratio | | | 67.8 | % | | | 56.1 | % | | | 104.3 | % |

» Identical Exchange Rates Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | |

(in millions of €, except per share amounts) | | Q1 2016 | | | Q1 2015 | | | 2016/2015 | |

| | | At Actual

Rates | | | Impact of

Exchange Rates | | | At Identical

Rates | | | At Actual Rates | | | At Actual Rates | | | At Identical

Rates | |

Revenues | | | 6 153 | | | | (83 | ) | | | 6 070 | | | | 5 820 | | | | +5.7 | % | | | +4.3 | % |

Operating profit | | | 191 | | | | (3 | ) | | | 188 | | | | 144 | | | | +32.7 | % | | | +30.6 | % |

Net profit from continuing operations | | | 109 | | | | (1 | ) | | | 108 | | | | 36 | | | | +205.9 | % | | | +201.6 | % |

Basic EPS from continuing operations | | | 1.05 | | | | (0.01 | ) | | | 1.04 | | | | 0.35 | | | | +201.7 | % | | | +197.5 | % |

Group share in net profit | | | 109 | | | | (1 | ) | | | 108 | | | | 28 | | | | +291.0 | % | | | +285.6 | % |

Basic EPS from Group share in net profit | | | 1.05 | | | | (0.01 | ) | | | 1.04 | | | | 0.27 | | | | +285.1 | % | | | +279.8 | % |

Free cash flow | | | (268 | ) | | | (3 | ) | | | (271 | ) | | | (93 | ) | | | +186.2 | % | | | +188.9 | % |

| | | |

(in millions of €) | | March 31, 2016 | | | December 31, 2015 | | | Change | |

Net debt | | | 982 | | | | (10 | ) | | | 972 | | | | 781 | | | | +25.7 | % | | | +24.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

CERTIFICATION OF RESPONSIBLE PERSONS

The undersigned Frans Muller, President and Chief Executive Officer of Delhaize Group, and Pierre Bouchut, Chief Financial Officer of Delhaize Group, confirm that to the best of their knowledge:

a) these interim condensed consolidated financial statements for the three-month period ending March 31, 2016 are prepared in accordance with IFRS (International Financial Reporting Standards) and give, in all material respects, a true and fair view of the consolidated financial position and consolidated results of Delhaize Group;

b) the interim financial report gives, in all material respects, a true and fair view of all important events and significant transactions with related parties that have occurred in the first three months of the financial year 2016 and their effects on the summary financial statements, as well as an overview of the most significant risks and uncertainties with which we are confronted.

Brussels, April 26, 2016

| | |

| Frans Muller | | Pierre Bouchut |

| President and CEO | | Executive Vice President and CFO |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 17 of 19 | |

REPORT OF THE STATUTORY AUDITOR

We have reviewed the consolidated interim financial information of Delhaize Brothers and Co “The Lion” (Delhaize Group) SA (“the company”) and its subsidiaries (jointly “the group”), prepared in accordance with International Financial Reporting Standard IAS 34 – Interim Financial Reporting as adopted by the European Union.

The consolidated condensed statement of financial position shows total assets of €12.450 million and the consolidated condensed income statement shows a consolidated profit (group share) for the year then ended of €109 million.

The board of directors of the company is responsible for the preparation and fair presentation of the consolidated interim financial information in accordance with IAS 34 – Interim Financial Reporting as adopted by the European Union. Our responsibility is to express a conclusion on this consolidated interim financial information based on our review.

We conducted our review of the consolidated interim financial information in accordance with International Standard on Review Engagements (ISRE) 2410 – Review of interim financial information performed by the independent auditor of the entity. A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit performed in accordance with the International Standards on Auditing (ISA) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion on the consolidated interim financial information.

Based on our review, nothing has come to our attention that causes us to believe that the consolidated interim financial information of Delhaize Brothers and Co “The Lion” (Delhaize Group) SA for the three-month period ended 31 March 2016 has not been prepared, in all material respects, in accordance with IAS 34 – Interim Financial Reporting as adopted by the European Union.

RISKS

In accordance with the Belgian Royal Decree of November 14, 2007, Delhaize Group states that the other fundamental risks confronting the Company are unchanged from those described on the pages 72 through 78 of the 2015 Annual Report. To the best of our knowledge as of April 26, 2016, there are no other fundamental risks confronting the Company and influencing the remaining months of the financial year 2016. On a regular basis, the Board of Directors and Company management evaluate the business risks that confront Delhaize Group.

DEFINITIONS

| | • | | American Depositary Share (ADS): An American Depositary Share represents ownership in the common share of a non-U.S. corporation. The underlying common shares are held by a U.S. bank, as depositary agent. The holder of an ADS benefits from dividend and voting rights pertaining to the underlying common share through the bank that issued the ADS. Four Delhaize ADSs represent one share of Delhaize Group common stock and are traded on the New York Stock Exchange. |

| | • | | Basic earnings per share: profit or loss attributable to ordinary equity holders of the parent entity divided by the weighted average number of ordinary shares outstanding during the period. Basic earnings per share are calculated on profit from continuing operations less non-controlling interests attributable to continuing operations, and on the group share in net profit. |

| | • | | Comparable store sales: sales from the same stores, including relocations and expansions, and adjusted for calendar effects. |

| | • | | Diluted earnings per share: is calculated by adjusting the profit or loss attributable to ordinary equity shareholders and the weighted average number of shares outstanding for the effects of all dilutive potential ordinary shares, including those related to convertible instruments, options or warrants or shares issued upon the satisfaction of specified conditions. |

| | • | | EBITDA: operating profit plus depreciation, amortization and impairment. |

| | • | | Free cash flow: cash flow before financing activities, investment in/sale and maturity of debt securities, term deposits and derivative related collaterals. |

| | • | | Net debt: non-current financial liabilities, plus current financial liabilities and derivative liabilities, minus derivative assets, investments in securities, term deposits, derivative related collaterals, and cash and cash equivalents. |

| | • | | Net financial expenses: finance costs less income from investments. |

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 18 of 19 | |

| | • | | Organic revenue growth: sales growth, excluding sales from acquisitions and divestitures, at identical currency exchange rates. |

| | • | | Outstanding shares: the number of shares issued by the Company, excluding treasury shares. |

| | • | | Underlying EBITDA: Underlying operating profit plus depreciation and amortization less any depreciation or amortization that has been excluded from underlying operating profit. |

| | • | | Underlying operating profit: operating profit excluding fixed assets impairment charges, reorganization charges, store closing expenses, gains/losses on disposal of fixed assets and businesses and other items that management considers as not being representative of the Group’s operating performance of the period. |

| | • | | Weighted average number of shares: number of shares outstanding at the beginning of the period less treasury shares, adjusted by the number of shares cancelled, repurchased or issued during the period multiplied by a time-weighting factor. |

| | • | | Working capital: inventories plus receivables and other current assets, minus accounts payable and other current liabilities. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements, which do not refer to historical facts but refer to expectations based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those included in such statements. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to Delhaize Group, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Many of these risks and uncertainties relate to factors that are beyond Delhaize Group’s control. Therefore, investors and shareholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the occurrence of any change, event or development that could give rise to the termination of the merger agreement or the proposed merger with Koninklijke Ahold N.V., also known as Royal Ahold; the risk that the necessary regulatory approvals for the proposed merger with Royal Ahold may not be obtained when expected or at all or may be obtained subject to conditions that are not anticipated; failure to satisfy other closing conditions with respect to the proposed merger with Royal Ahold on the proposed terms and timeframe; the possibility that the proposed merger with Royal Ahold does not close when expected or at all; the risks that the new businesses will not be integrated successfully or promptly or that the combined company will not realize when expected or at all the expected synergies and benefits from the proposed merger with Royal Ahold; Delhaize Group’s ability to successfully implement and complete its plans and strategies and to meet its targets; risks related to disruption of management time from ongoing business operations due to the proposed merger with Royal Ahold; the benefits from Delhaize Group’s plans and strategies being less than anticipated; the effect of the announcement or completion of the proposed merger with Royal Ahold on the ability of Delhaize Group to retain customers and retain and hire key personnel, maintain relationships with suppliers, and on their operating results and businesses generally; litigation relating to the transaction; the effect of general economic or political conditions; Delhaize Group’s ability to retain and attract employees who are integral to the success of the business; business and IT continuity, collective bargaining, distinctiveness, competitive advantage and economic conditions; information security, legislative and regulatory environment and litigation risks; and product safety, pension plan funding, strategic projects, responsible retailing, insurance and unforeseen tax liabilities. In addition, the actual outcomes and results of Delhaize Group may differ materially from those projected depending upon a variety of factors, including but not limited to changes in the general economy or the markets of Delhaize Group, in consumer spending, in inflation or currency exchange rates or in legislation or regulation; competitive factors; adverse determination with respect to claims; inability to timely develop, remodel, integrate or convert stores; and supply or quality control problems with vendors. Additional risks and uncertainties that could cause actual results to differ materially from those stated or implied by such forward-looking statements are described in Delhaize Group’s most recent annual report on Form 20-F and other filings with the SEC. Neither Delhaize Group nor any of its directors, officers, employees and advisors nor any other person is therefore in a position to make any representation as to the accuracy of the forward-looking statements included in this communication. The actual performance, the success and the development over time of the business activities of Delhaize Group may differ materially from the performance, the success and the development over time expressed in or implied from the forward-looking statements contained in this communication. The foregoing list of factors is not exhaustive. Forward-looking statements speak only as of the date they are made. Delhaize Group does not assume any obligation to update any public information or forward-looking statement in this communication to reflect events or circumstances after the date of this communication, except as may be required by applicable laws.

| | | | |

Delhaize Group – Earnings Release – First Quarter 2016 | | | 19 of 19 | |

Q1 2016 results

April 27, 2016

Forward looking statements

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements, which do not refer to historical facts but refer to expectations based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those included in such statements. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to Delhaize Group, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Many of these risks and uncertainties relate to factors that are beyond Delhaize Group’s control. Therefore, investors and shareholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the occurrence of any change, event or development that could give rise to the termination of the merger agreement or the proposed merger with Koninklijke Ahold N.V., also known as Royal Ahold; the risk that the necessary regulatory approvals for the proposed merger with Royal Ahold may not be obtained when expected or at all or may be obtained subject to conditions that are not anticipated; failure to satisfy other closing conditions with respect to the proposed merger with Royal Ahold on the proposed terms and timeframe; the possibility that the proposed merger with Royal Ahold does not close when expected or at all; the risks that the new businesses will not be integrated successfully or promptly or that the combined company will not realize when expected or at all the expected synergies and benefits from the proposed merger with Royal Ahold; Delhaize Group’s ability to successfully implement and complete its plans and strategies and to meet its targets; risks related to disruption of management time from ongoing business operations due to the proposed merger with Royal Ahold; the benefits from Delhaize Group’s plans and strategies being less than anticipated; the effect of the announcement or completion of the proposed merger with Royal Ahold on the ability of Delhaize Group to retain customers and retain and hire key personnel, maintain relationships with suppliers, and on their operating results and businesses generally; litigation relating to the transaction; the effect of general economic or political conditions; Delhaize Group’s ability to retain and attract employees who are integral to the success of the business; business and IT continuity, collective bargaining, distinctiveness, competitive advantage and economic conditions; information security, legislative and regulatory environment and litigation risks; and product safety, pension plan funding, strategic projects, responsible retailing, insurance and unforeseen tax liabilities. In addition, the actual outcomes and results of Delhaize Group may differ materially from those projected depending upon a variety of factors, including but not limited to changes in the general economy or the markets of Delhaize Group, in consumer spending, in inflation or currency exchange rates or in legislation or regulation; competitive factors; adverse determination with respect to claims; inability to timely develop, remodel, integrate or convert stores; and supply or quality control problems with vendors. Additional risks and uncertainties that could cause actual results to differ materially from those stated or implied by such forward-looking statements are described in Delhaize Group’s most recent annual report on Form 20-F and other filings with the SEC. Neither Delhaize Group nor any of its directors, officers, employees and advisors nor any other person is therefore in a position to make any representation as to the accuracy of the forward-looking statements included in this communication. The actual performance, the success and the development over time of the business activities of Delhaize Group may differ materially from the performance, the success and the development over time expressed in or implied from the forward-looking statements contained in this communication. The foregoing list of factors is not exhaustive. Forward-looking statements speak only as of the date they are made. Delhaize Group does not assume any obligation to update any public information or forward-looking statement in this communication to reflect events or circumstances after the date of this communication, except as may be required by applicable laws.

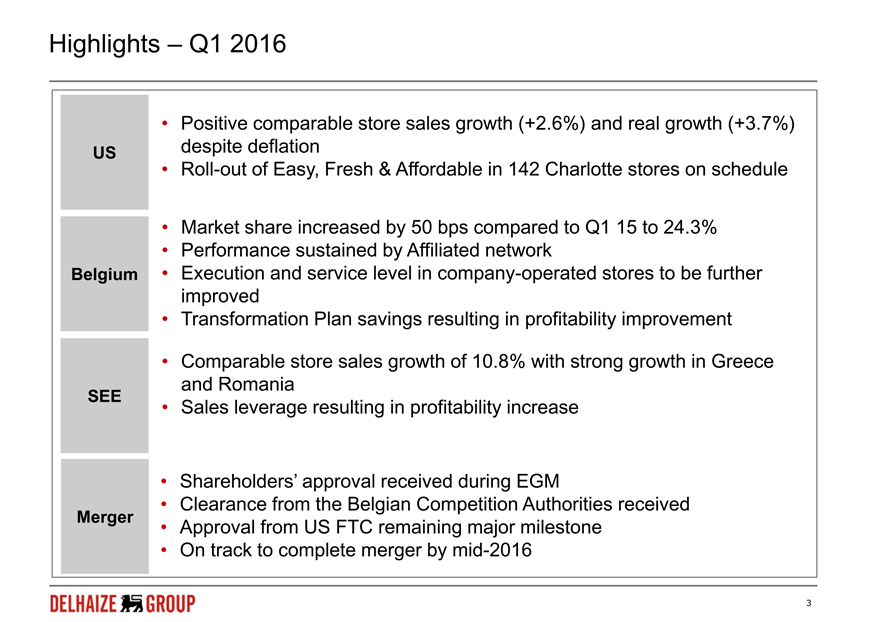

Highlights – Q1 2016

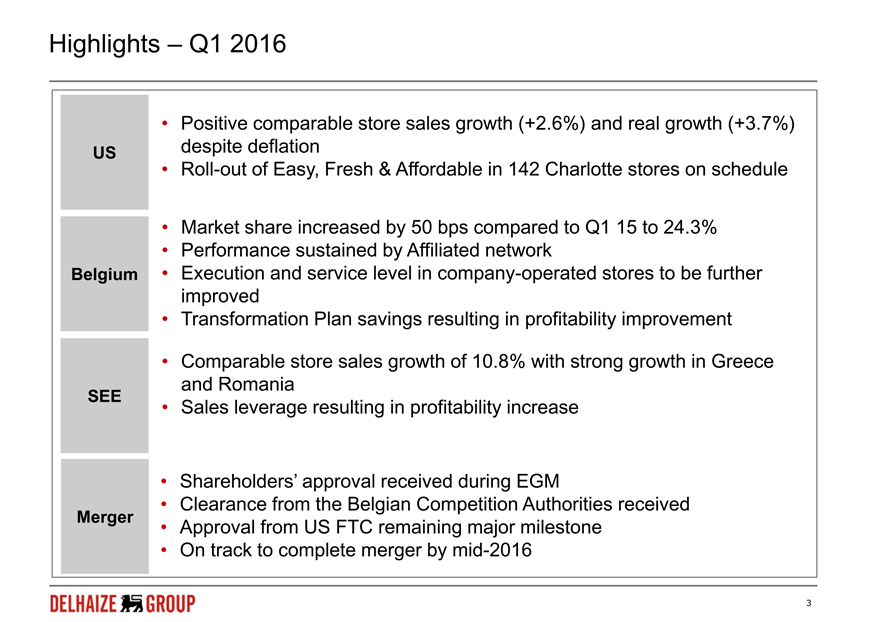

Positive comparable store sales growth (+2.6%) and real growth (+3.7%)

US despite deflation

Roll-out of Easy, Fresh & Affordable in 142 Charlotte stores on schedule

Market share increased by 50 bps compared to Q1 15 to 24.3%

Performance sustained by Affiliated network

Belgium Execution and service level in company-operated stores to be further

improved

Transformation Plan savings resulting in profitability improvement

Comparable store sales growth of 10.8% with strong growth in Greece

and Romania

SEE Sales leverage resulting in profitability increase

Shareholders’ approval received during EGM

Clearance from the Belgian Competition Authorities received

Merger Approval from US FTC remaining major milestone

On track to complete merger by mid-2016

3

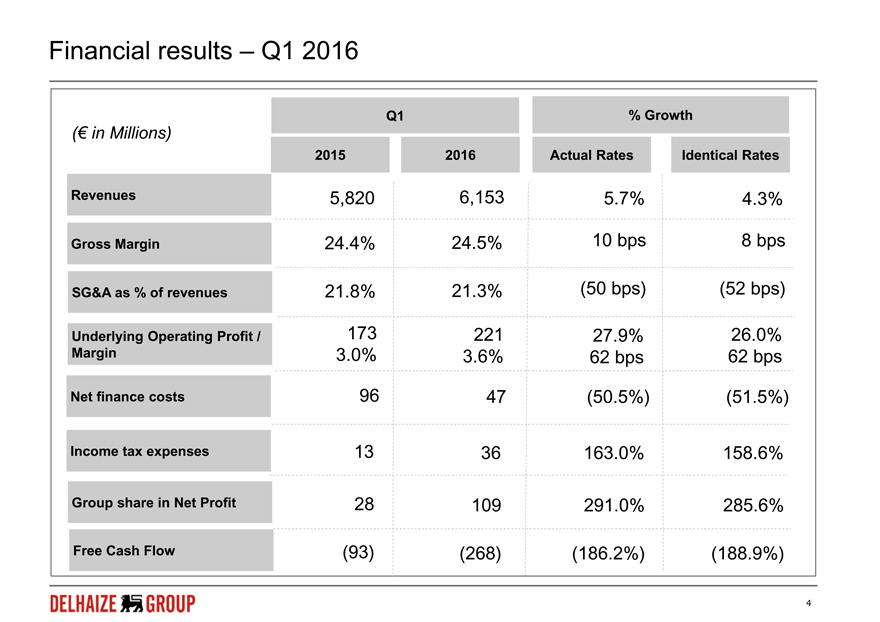

Financial results – Q1 2016

Q1 % Growth

(€ in Millions)

2015 2016 Actual Rates Identical Rates

Revenues 5,820 6,153 5.7% 4.3%

Gross Margin 24.4% 24.5% 10 bps 8 bps

SG&A as % of revenues 21.8% 21.3% (50 bps) (52 bps)

Underlying Operating Profit / 173 221 27.9% 26.0%

Margin 3.0% 3.6% 62 bps 62 bps

Net finance costs 96 47 (50.5%) (51.5%)

Income tax expenses 13 36 163.0% 158.6%

Group share in Net Profit 28 109 291.0% 285.6%

Free Cash Flow (93) (268) (186.2%) (188.9%)

4

EBITDA

(€ in Millions) Q1 EBITDA Q1 Underlying EBITDA

At Q1 2015 317 339

Identical +16.2% +13.9%

Rates Q1 2016 368 386

Q1 2015 317 339

At Actual +17.9% +15.6%

Rates Q1 2016 373 391

5

Delhaize America – comparable store sales growth and revenue

growth

Delhaize U.S.

-1.1%

Q1 2016 -0.5%

+3.7% -0.2%

+2.6% +1.9%

Real growth retail inflation CSS Calendar Expansion Organic

Impact revenue

growth

6

Delhaize U.S. – underlying operating margin

Delhaize U.S.

Underlying Operating Margin

Q1 2015 3.8% — Q1 margin impacted by:

(+) Good sales momentum at both

banners

(+) Lower shrink in fresh especially at

Food Lion

Q1 2016 3.9% (+) Lower cost of products in some

categories

(-) Increased labor expenses

(-) Hannaford price investments (started

in Q4 15)

7

Delhaize Belgium – comparable store sales growth and revenue

growth

Delhaize Belgium

+0.1%

+1.0%

Q1 2016

+4.0%

+2.9%

CSS Calendar Impact Expansion Organic

revenue growth

8

Delhaize Belgium – underlying operating margin

Delhaize Belgium Underlying Operating Margin

Q1 2015 1.4%

- Q1 margin impacted by:

(+) Higher revenues

(+) Transformation Plan savings

(-) Higher shrink in supermarkets Q1 2016 2.7% (-) Transformation Plan implementation

9

Southeastern Europe – comparable store sales growth and revenue

growth

Southeastern Europe

+5.7%

Q1 2016 +0.5%

+17.0%

+10.8%

CSS Calendar Impact Expansion Organic

revenue growth

10

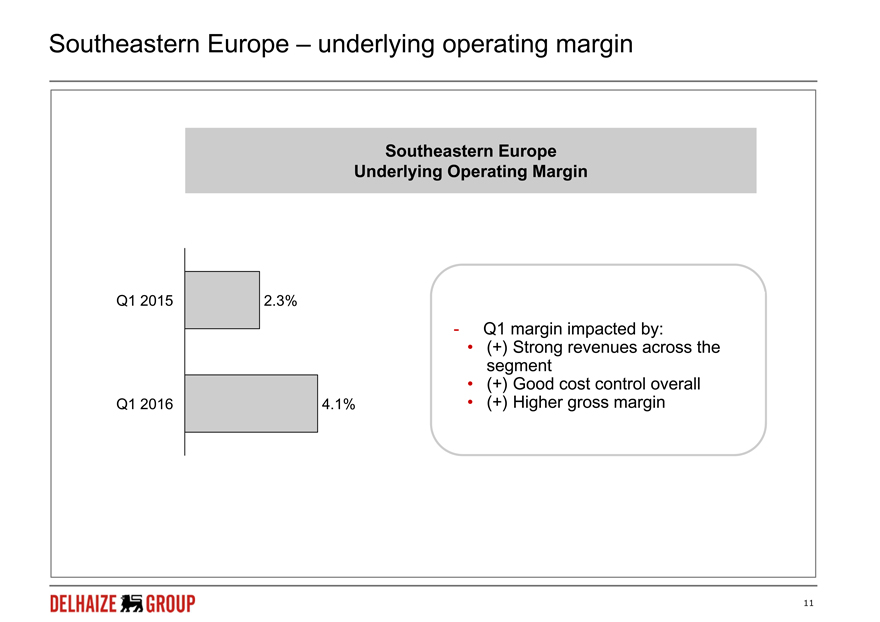

Southeastern Europe – underlying operating margin

Southeastern Europe

Underlying Operating Margin

Q1 2015 2.3%

— Q1 margin impacted by:

(+) Strong revenues across the

segment

(+) Good cost control overall

Q1 2016 4.1% (+) Higher gross margin

11

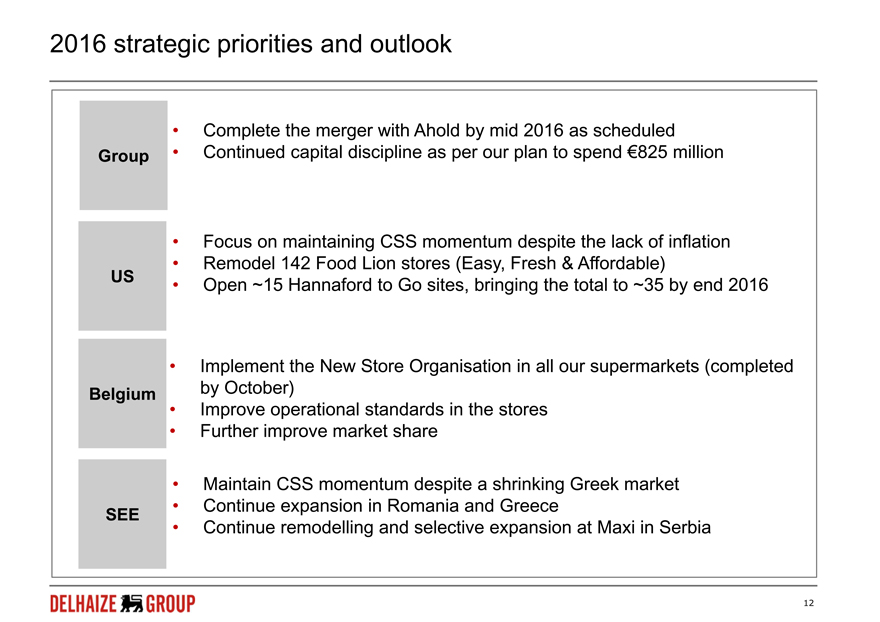

2016 strategic priorities and outlook

Complete the merger with Ahold by mid 2016 as scheduled

Group Continued capital discipline as per our plan to spend €825 million

Focus on maintaining CSS momentum despite the lack of inflation

Remodel 142 Food Lion stores (Easy, Fresh & Affordable)

US Open ~15 Hannaford to Go sites, bringing the total to ~35 by end 2016

Implement the New Store Organisation in all our supermarkets (completed

Belgium by October)

Improve operational standards in the stores

Further improve market share

Maintain CSS momentum despite a shrinking Greek market

SEE Continue expansion in Romania and Greece

Continue remodelling and selective expansion at Maxi in Serbia

12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | |

| | | | ETABLISSEMENTS DELHAIZE FRÈRES ET CIE “LE LION” (GROUPE DELHAIZE) |

| | | |

| Date: April 28, 2016 | | | | By: | | /s/ G. Linn Evans |

| | | | | | G. Linn Evans |

| | | | | | Senior Vice President |