Exhibit 99.2

REPORT OF THE SPECIAL COMMITTEE TO

RIDGEWOOD RENEWABLE POWER, LLC, AS MANAGING SHAREHOLDER OF

RIDGEWOOD ELECTRIC POWER TRUST I,

RIDGEWOOD ELECTRIC POWER TRUST III,

RIDGEWOOD ELECTRIC POWER TRUST IV

AND

RIDGEWOOD POWER B FUND/PROVIDENCE EXPANSION

November 17, 2008

TABLE OF CONTENTS

| I. | INTRODUCTION. | 1 |

| | | | | |

| II. | EXECUTIVE SUMMARY. | 1 |

| | | | | |

| III. | BACKGROUND OF THE PROPOSED TRANSACTION. | 10 |

| | | | | |

| | 3.1 | The Landfill. | 10 |

| | | | | |

| | 3.2 | Landfill Operations, Gas Collection Systems and Gas Rights. | 11 |

| | | | | |

| | | 3.2.1 | Phases of Landfill Expansion | 11 |

| | | | | |

| | | 3.2.2 | Gas Collection Systems and Gas Rights | 12 |

| | | | | |

| | 3.3 | Electric Generating Facilities and Power Sales. | 12 |

| | | | | |

| | | 3.3.1 | The Providence Project | 12 |

| | | | | |

| | | 3.3.2 | The Expansion Project | 13 |

| | | | | |

| | 3.4 | Site Expansion Plans | 13 |

| | | | | |

| IV. | CONSIDERATION OF THE PROPOSED TRANSACTION. | 15 |

| | | | | |

| V. | THE PROPOSED TRANSACTION. | 19 |

| | | | | |

| | 5.1 | Description of the Proposed Transaction. | 19 |

| | | | | |

| | 5.2 | Plans or Proposals Relating to the Proposed Transaction. | 20 |

| | | | | |

| | 5.3 | Purpose of the Proposed Transaction. | 20 |

| | | | | |

| | 5.4 | Effects of the Proposed Transaction. | 21 |

| | | | | |

| | 5.5 | Effects on Investors in the Trusts. | 21 |

| | | | | |

| | 5.6 | Effects on the Managing Shareholder. | 21 |

| | | | | |

| VI. | OPINION OF THE SPECIAL COMMITTEE'S FINANCIAL ADVISOR. | 22 |

| | | | | |

| VII. | CONCLUSION OF THE SPECIAL COMMITTEE. | 22 |

| | | | | |

| VIII. | REASONS FOR THE SPECIAL COMMITTEE'S DETERMINATION. | 23 |

I. INTRODUCTION.

In January 2008, Ridgewood Renewable Power, LLC, as the managing shareholder (the “Managing Shareholder”) of Ridgewood Electric Power Trust I (“Trust I”), Ridgewood Electric Power Trust III (“Trust III”), Ridgewood Electric Power Trust IV (“Trust IV”) and Ridgewood Power B Fund/Providence Expansion (the “Power B Fund”, and with Trust I, Trust III and Trust IV, the “Trusts”), formed a special committee of independent individuals (the “Special Committee”). The Special Committee, consisting of Jonathan C. Kaledin, Esq. and Joseph Ferrante, Esq, was established, in part, to consider an internal recapitalization of the assets held by each Trust relating to existing landfill gas electricity generation projects located at the Central Landfill in Johnston, Rhode Island (the "Central Landfill" or the "landfill"). The recapitalization plan, proposed by the Managing Shareholder, would, if implemented, result in the ownership of such assets by one consolidated legal entity (“Newco”), with each Trust owning a membership interest in Newco (the “Proposed Transaction”). The Managing Shareholder ratified its designation of the Special Committee in a written consent dated April 23, 2008.

The Special Committee consulted with counsel and other professionals for assistance in connection with its evaluation of the Proposed Transaction. Specifically, the Special Committee retained Lowenstein Sandler PC (“Lowenstein Sandler”) to act as counsel to the Special Committee and to provide legal advice and assistance with respect to the Proposed Transaction. The Special Committee also engaged Duff & Phelps, LLC (“Duff & Phelps”) to provide an opinion as to the fairness, from a financial point of view, to each Trust individually of the consideration to be received by each Trust in the Proposed Transaction and to provide advice to the Special Committee regarding the Proposed Transaction.

This Report summarizes the findings of the Special Committee and has been prepared for submission by the Special Committee to the Managing Shareholder.

II. EXECUTIVE SUMMARY.

The following is a summary of information contained elsewhere in this Report. This summary is subject to the detailed information appearing elsewhere in this Report and the attachments hereto.

| The Proposed Transaction |

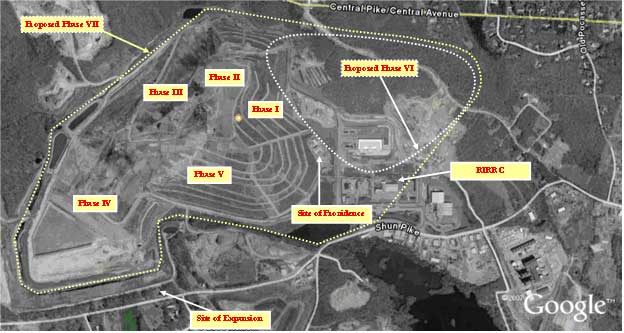

| Structure of the Proposed Transaction | The Proposed Transaction involves the internal recapitalization of the assets owned by the Trusts relating to two landfill gas electricity generation facilities located at the Central Landfill in Johnston, Rhode Island. Upon consummation of the plan of recapitalization, such assets will be owned by a newly formed entity (Rhode Island LFG Genco, LLC, referred to herein as "Newco"), with each Trust owning a membership interest in Newco. The landfill gas facilities at issue are the Providence Project and the Expansion Project. A map showing the location of these facilities at the landfill is attached to this Report as Appendix A. |

Prior to the Proposed Transaction: Ownership of the Providence Project The Providence Project consists of Waukesha reciprocating engine generator sets producing approximately 12 megawatts of net electricity. The station commenced commercial operation in 1990. The current owner of the Providence Project is Ridgewood Providence Power Partners, L.P., or “RPPP”. Prior to the Proposed Transaction, Trust III (35.33%), Trust IV (63.67%) and Ridgewood Providence Power Corporation, or “RPPC” (1.00%), the General Partner of RPPP, own 100% of the equity interests in RPPP. RPPC is owned 35.7% by Trust III and 64.3% by Trust IV. |

Prior to the Proposed Transaction: Ownership of the Expansion Project The Expansion Project consists of six containerized engine generator sets, two of which are Deutz units located near the Providence Project and four of which are Caterpillar units located in a separate compound. The Deutz and Caterpillar gensets produce approximately 8.5 megawatts of net electricity. The project was formed in 2002 and has been expanded in several stages, the last of which occurred in 2005. The current owner of the Expansion Project is Ridgewood Rhode Island Generation LLC, or “RRIG”. Prior to the Proposed Transaction, Trust I, through its wholly-owned subsidiary Ridgewood Olinda, LLC, or “Olinda” (15.00%), and the Power B Fund (85.00%) own 100% of the equity interests in RRIG. |

Prior to the Transaction: Ownership of the Gas Collection Systems for the Projects Certain gas collection systems at the Central Landfill necessary to fuel the Providence Project and the Expansion Project are owned and operated by Ridgewood Gas Services LLC, or “RGS.” Prior to the Proposed Transaction, Trust III and Trust IV own 100% of the equity interests in Rhode Island Gas Management LLC, or RIGM, which in turn owns 100% of the equity interests in RGS. |

After the Proposed Transaction: Ownership of Newco In the Proposed Transaction, the Managing Shareholder (as the managing shareholder of the Power B Fund and Trust I) will cause the Power B Fund, and will cause Trust I (as the 100% equity owner and manager of Olinda) to cause Olinda to contribute to Newco 100% of their respective equity interests in RRIG in exchange for equity interests in Newco. As a result, Newco will own 100% of RRIG. At the same time, the Managing Shareholder (as the managing shareholder of Trust III and Trust IV) will cause Trust III and Trust IV to contribute to Newco (x) 100% of their respective equity interests in RPPP and RPPC, together with (y) 100% of their respective equity interests in RIGM, in exchange for equity interests in Newco. As a result, Newco will own 100% of RPPP (99% directly and 1% through its ownership of RPPC) and 100% of RIGM. Following the contribution, RIGM will merge into Newco, leaving RGS as a wholly owned subsidiary of Newco. After giving effect to the foregoing contributions, Newco would hold, as direct or indirect wholly-owned subsidiaries, RGS, RPPP and RRIG. |

| Consideration | Pursuant to the Managing Shareholder's October 29, 2008 proposal, if the Proposed Transaction is consummated, each of the Trusts will receive in exchange for their Central Landfill assets the following percentage equity interests in Newco: |

Trust I | 6.7800% |

Power B Fund | 38.4200% |

| Trust III | 19.5636% |

Trust IV | 35.2364% |

| | |

| Parties to the Proposed Transaction -- Trust I | Ridgewood Electric Power Trust I, or “Trust I”, is an unincorporated business association organized in the form of a Delaware business trust managed by the Managing Shareholder. Trust I was formed in 1991 and raised $10,600,000 as an unspecified pool. Trust I is the sole owner of Olinda, which currently owns 15% of the equity interests in RRIG. |

| Parties to the Proposed Transaction -- Trust III | Ridgewood Electric Power Trust III, or “Trust III”, is an unincorporated business association organized in the form of a Delaware business trust managed by the Managing Shareholder. Trust III was formed in 1994 and raised $39,200,000 as an unspecified pool. Trust III currently owns 35.33% of the equity interests in RPPP and 35.7% of the equity interests in RPPC. |

| Parties to the Proposed Transaction -- Trust IV | Ridgewood Electric Power Trust IV, or “Trust IV”, is an unincorporated business association organized in the form of a Delaware business trust managed by the Managing Shareholder. Trust IV was formed in 1995 and raised $47,000,000 as an unspecified pool. Trust IV currently owns 63.37% of the equity interests in RPPP and 64.3% of the equity interests in RPPC. |

| Parties to the Proposed Transaction – Power B Fund | Ridgewood Power B Fund/Providence Expansion, or the “Power B Fund”, is an unincorporated business association organized in the form of a Delaware business trust managed by the Managing Shareholder. The Power B Fund was formed in 2002 and raised $8,100,000 for the specific purpose of financing RRIG. The Power B Fund currently owns 85% of the equity interests in RRIG. |

| Parties to the Proposed Transaction – RRRP | Ridgewood Providence Power Partners, L.P., or “RPPP”, is a Delaware limited partnership formed in 1997. RPPP owns the assets comprising the Providence Project. The general partner of RPPP is RPPC and the limited partners of RPPP are Trust III and Trust IV. Trust III currently owns 35.33% of the equity interests in RPPP, Trust IV currently owns 63.67% of the equity interests in RPPP and RPPC currently owns 1% of the equity interests in RPPP. |

| Parties to the Proposed Transaction – RPPC | Ridgewood Providence Power Corporation, or “RPPC”, is a Delaware corporation incorporated in 1995. RPPC is the general partner of RPPP. |

| Parties to the Proposed Transaction – RRIG | Ridgewood Rhode Island Generation LLC, or “RRIG”, is a Delaware limited liability company formed in 2002. RRIG owns the assets comprising the Deutz/Caterpillar facilities. Trust I owns 15% of RRIG though its wholly owned subsidiary, Olinda, and the Power B Fund owns 85% of RRIG. |

| Parties to the Proposed Transaction – RIGM | Rhode Island Gas Management LLC, or “RIGM”, is a Delaware limited liability company formed in 2002. RIGM is the sole owner of RGS and provides administrative services to RGS. Trust III owns 35.7% of RIGM and Trust IV owns 64.3% of RIGM. |

| Parties to the Proposed Transaction – RGS | Ridgewood Gas Services LLC, or “RGS”, is a Delaware limited liability company formed in 2002. RGS operates the gas collection facilities supplying the Providence Project and the Expansion Project with landfill gas and owns a portion of such gas collection facilities. RIGM owns 100% of the equity interests in RGS. RGS is a cost pass-through entity. As a result, neither the Special Committee nor its financial advisor ascribed any economic value to RGS for purposes of analyzing the Proposed Transaction. |

| Parties to the Proposed Transaction – the Managing Shareholder | Ridgewood Renewable Power LLC, or the "Managing Shareholder", is a New Jersey limited liability company formed in 1999. The Managing Shareholder is the managing shareholder for each of Trust I, Trust III, Trust IV and the Power B Fund. |

| Advisors | Day Pitney LLP (“Day Pitney”) has provided legal advice, and Ewing Bemiss & Company (“Ewing Bemiss”) has provided financial advice, to the Managing Shareholder in connection with the Proposed Transaction. Lowenstein Sandler has provided legal advice, and Duff & Phelps has provided an opinion letter, to the Special Committee in connection with the Proposed Transaction. |

Background and Purpose of the Proposed Transaction | The Landfill has been operational for several decades and is expected to accept waste for several decades into the future. The Landfill is currently owned and operated by Rhode Island Resource Recovery Corporation, or “RIRRC”, a corporation created by the Rhode Island General Assembly in 1974. RIRRC and its predecessors have expanded the Landfill's capacity in several phases. At present, five phases exist at the site; the first three phases are closed and have been capped. The fourth phase is closed to new waste and has a temporary cap in place. The fifth phase continues to accept new waste, but is projected to be closed within two years. Two additional phases (referred to in this Report as Phases VI and VII) are contemplated for planned expansion at the Landfill. However, given the configuration at the Site, substantial capital expenditures will be required in order to build out Phases VI and VII. |

| | |

| | The principal purpose of the Proposed Transaction is to facilitate the development of a substantial increase in the electricity generating capacity installed at the landfill by consolidating ownership of the Trust assets associated with the landfill into Newco so that Newco, on behalf of each of the Trusts, has the ability to execute the agreements listed below with RIRRC: |

| | · an amended and restated site lease granting Newco the sole and exclusive right to use all landfill gas produced at the Central Landfill; |

| | · an amended and restated gas services agreement granting RGS the sole and exclusive right to operate all gas collection systems at the Central Landfill; and |

| | · a purchase agreement pursuant to which RGS will acquire the gas collection facilities currently owned by RIRRC and located at the Central Landfill. The Managing Shareholder has advised the Special Committee that it is the Managing Shareholder's view that the above-mentioned agreements, each of which have been fully negotiated, are a prerequisite to the implementation of a redevelopment plan developed by the Managing Shareholder to increase the electricity generating capacity installed at the Central Landfill in connection with RIRRC's plans to build out Phases VI and VII. |

| Opinion of the Financial Advisor to the Special Committee | Duff & Phelps, the financial advisor to the Special Committee, has concluded that the consideration of 6.7800%, 38.4200%, 19.5636%, and 35.2364% of the total membership interests in Newco as determined by the Managing Shareholder to be received by Trust I, the Power B Fund, Trust III and Trust IV, respectively, in the Proposed Transaction is fair, within a range, from a financial point of view, to each Trust individually. The conclusions of Duff & Phelps and the assumptions used by Duff & Phelps in arriving at its conclusions can be found in its opinion letter addressed to the Special Committee attached to this Report as Appendix B. |

| Conclusion of the Special Committee | The Special Committee has advised the Managing Shareholder that it is advisable with respect to each of the Trusts to structure the Proposed Transaction such that 6.7800%, 38.4200%, 19.5636%, and 35.2364% of the total membership interests in Newco is received by Trust I, the Power B Fund, Trust III and Trust IV, respectively. |

| Interests of the Managing Shareholder, Officers and Related Parties | In reaching its conclusion regarding the allocation of equity interests in Newco, the Special Committee considered the fact that the Managing Shareholder and related parties have agreements or arrangements that provide them with interests that differ from those of investors in the Trusts. Upon consummation of the Proposed Transaction and entry into an amended and restated site lease and gas services agreement with RIRRC, the Trusts will be free to pursue several alternatives for financing the proposed expansion of electrical generating capacity, which financing may include the sale of Newco as well as the sale of the electrical generating facility on the Olinda Alpha landfill in Brea, California (to be distinguished from Olinda, the wholly owned subsidiary of Trust I), and other developmental assets owned by the Managing Shareholder (the “Proposed Sale”). Upon consummation of a Proposed Sale: · the Managing Shareholder will share in the proceeds of the disposition as an equity owner of the Trusts; and · the Managing Shareholder may receive a success fee of up to 2% of the proceeds of the disposition in the event it provides services typically performed by a broker. |

| | However, the Managing Shareholder has advised the Special Committee that the Managing Shareholder will hire an investment banker in connection with a Proposed Sale and will forego the 2% success fee. The Special Committee also considered the terms in the declarations of trusts establishing the Trusts which provide for the Managing Shareholder to receive "carry payments", representing payments to the Managing Shareholder which are contingent on certain minimum payments having been made to the other equity owners of the Trusts. The Special Committee reviewed, among other things, the impact on the carry payments of changes in the relative allocation of membership interests among the four Funds. |

| | |

III. BACKGROUND OF THE PROPOSED TRANSACTION.

Based on information supplied to the Special Committee by the Managing Shareholder, which information has been relied upon by the Special Committee in reaching its conclusion with respect to the Proposed Transaction, the Special Committee understands the relevant background facts to be as follows:

3.1 The Landfill.

The Central Landfill is located in the town of Johnston, a suburb of Providence, Rhode Island. The landfill is currently owned and operated by RIRRC, a corporation created by the Rhode Island General Assembly in 1974. The landfill has been in continuous operation since the mid-1950s and is expected to continue to accept waste past 2020. It is the only landfill that remains open in the State of Rhode Island.1 Since 1990, a portion of the landfill gas from the landfill has been used to fuel reciprocating engines that produce electricity. The landfill gas is produced by anaerobic bacteria that consume the organic constituents in the waste deposited at the landfill. The landfill gas contains approximately 50% methane, and under applicable environmental laws, RIRRC is required to install systems to collect and destroy the landfill gas produced at the landfill.

| | |

| 1 The Special Committee understands that the State of Rhode Island currently expects the landfill to dispose of approximately 900,000 tons of waste during 2008, a figure which is substantially decreased from earlier projections. The Special Committee has been advised that the decrease reflects a reduction in tipping volumes associated with the downturn in the economy and a recent increase in tipping fees charged by RIRRC to contract waste haulers. The Managing Shareholder advised Stantec Consulting Services, a consultant to the Managing Shareholder, on October 29, 2008 that, based upon information the Managing Shareholder had received from RIRRC, the extrapolated annual landfilled solid waste at the landfill is approximately 750,000 tons per year currently. The gas curves produced by Stantec, which have been relied upon by Duff & Phelps in providing its advice to the Special Committee and have been relied upon by the Special Committee, assume growth from that extrapolated rate. This assumption, as recommended by the Managing Shareholder, is predicated upon the Managing Shareholder's view that it will be necessary for RIRRC to reduce its tipping fees in order to encourage contract haulers to restore their usage of the landfill and that over time economic recovery will occur and will result in increased usage of the landfill. |

There are currently 15 reciprocating engines operating on the landfill, with approximately 20.5 megawatts, or MW, of net electric generating capacity. However, the landfill is currently producing approximately 11,500 standard cubic feet per minute, or SCFM, of landfill gas, and it is estimated that the total volume of landfill gas available at the landfill will support up to 40 MW of electric generating capacity. Based on statistics compiled by the U.S. Environmental Protection Agency, if that amount of electric generation were installed on the landfill, then the landfill would become the second largest landfill gas-to-electricity generating facility in the entire U.S.

3.2 Landfill Operations, Gas Collection Systems and Gas Rights.

In order to understand the issues and the parties participating in the combined efforts of landfill gas collection, destruction and electricity generation at the landfill, it is necessary to review the history of the operations and the development of the different facilities at the landfill. Since the contractual arrangements among the parties are complex and date from 1987, numerous amendments and supplemental agreements have been entered into by one or more of the parties. In compiling this report, the Special Committee and its advisors, with the permission of the Managing Shareholder, have relied exclusively upon the conclusions of the Managing Shareholder regarding the gas rights at the landfill held by the Providence Project, the Expansion Project and RIGM pursuant to these contractual arrangements.

3.2.1 Phases of Landfill Expansion. RIRRC has expanded the landfill in phases over time. As one phase is filled with waste, it is covered over and capped, and a new phase is opened to receive the waste. Currently, there are seven separate phases at the landfill. Phases I, II and III are closed and capped, Phase IV has a temporary cap and Phase V is currently accepting waste. Phase VI and Phase VII are planned expansions, and it is possible that additional phases may be developed in the future.

Landfill gas collection systems are included in the planning and permitting of each phase. The landfill gas collection systems typically consist of temporary collection systems that operate while each phase is being filled and permanent collection systems that are installed when that phase is filled and capped. Landfill gas production from each phase peaks within a year or two after capping is completed, and then begins to decline as the anaerobic bacteria consume the organic components of the waste. However, so long as new phases continue to be developed, the decline of landfill gas production from closed phases is offset by increased landfill gas production as new phases are opened up. Once the landfill is closed and completely capped, landfill gas production will begin to decline, although it will take many years for all of the landfill gas to be depleted from the landfill.

3.2.2 Gas Collection Systems and Gas Rights. Originally, Rhode Island Solid Waste Management Corporation, or “RISWMC,” the predecessor to RIRRC, was the owner of all of the landfill gas collection systems installed at the landfill, as well as the landfill gas collected by those systems. Over the years, however, RISWMC or RIRRC entered into two major sets of agreements and arrangements under which they assigned rights in those gas collection systems, the landfill gas, or both, to other parties. These sets of agreements and arrangements are referred to generically herein as the “1987 Agreements” and the “2003 Agreements.”

Although the language of the 2003 Agreements makes it clear that the supply needs of the RPPP generating facility and the RRIG generating facility have priority over other potential uses for the landfill gas from the landfill, the Special Committee understands that neither RPPP nor RRIG is granted any vested rights to “excess” gas above that priority. The 2003 Agreements set forth specific procedures by which RPPP or RRIG or its affiliates can acquire the rights to excess landfill gas by undertaking the development of an additional project. The Special Committee has been advised that neither RPPP, RRIG nor any other affiliate of RPPP or RRIG has taken any of the required steps under the 2003 Agreements to acquire the rights to additional landfill gas that would be necessary to support an additional generating project. Accordingly, it is the Special Committee's understanding that RPPP's and RRIG’s landfill gas rights are currently limited to the landfill gas needed to operate their respective existing projects.

3.3 Electric Generating Facilities and Power Sales.

3.3.1 The Providence Project. The 1987 Agreements contemplate the development of an electricity generating facility using reciprocating engines running on landfill gas as a fuel. As a result, RPPP's predecessor designed and built a facility using eight Waukesha 12B AT 25GL engine/generator sets, or gensets, having an aggregate maximum rated electrical output of 13.8 MW. The Providence Project commenced commercial operation in January, 1990, but was quickly beset by operational problems. The Providence Project was designed to use catalytic converters to meet its air emissions requirements, but siloxane contaminants in the landfill gas rapidly fouled the catalytic converters. As a result, when it commenced operations, the Providence Project was only able to meet its emission requirements by operating at a reduced rate of about 8 MW of output. Within six months after RPPP acquired the Providence Project, RPPP amended the air permits for the facility to permit increased output of the facility to 12 MW or the full capacity of the facility and the associated offtake contract. However, RPPP experienced ongoing reductions in capacity factors arising from engine malfunctions. As a result, in 1998 RPPP installed a ninth Waukesha genset at the Providence Project in order to create redundancy. Although the installation of this ninth genset raised the maximum potential output of the facility to 15.5 MW, the Special Committee understands that RPPP has never attempted to run the Providence Project at this higher output because the air permits for the facility restricted operations above the 12 MW level. After the installation of the ninth genset, annual capacity factors for the Providence Project have routinely exceeded 95%, and this facility is currently operating at those levels. Electrical output from the Providence Project is sold under a long-term power sales agreement with Narragansett Electric Company (now known as “National Grid”). Although the stated term of the National Grid agreement runs through 2020, the favorable fixed price portion of the agreement expires early in 2010. Thereafter, the pricing available under this agreement is the wholesale spot market power price in the New England Power Pool.

3.3.2 The Expansion Project. The 2003 Agreements entered into by RRIG contemplated the construction of a new electrical generating facility of approximately 10 MW that would use the “Late Phase Landfill Gas” available from gas collection systems owned by RIRRC (which included the collection system for Phase IV and subsequent expansion phases at the landfill). A new facility of this size would require a “major source” air permit review, which would be lengthy. However, RRIG determined that if the project were built in stages, it would be possible to qualify the first, smaller, stage under a “minor source” air permit that could be more rapidly obtained. Furthermore, RRIG had immediate access to two nearly new Deutz TBG 620V 16K gensets that were owned by Olinda, but were not currently being used. RRIG determined that by using this immediately available equipment and a minor source air permit, it could get at least a portion of the new generating facility in operation quickly. Accordingly, RRIG acquired these two Deutz gensets from Olinda in exchange for a 15% equity interest in RRIG. RRIG was successful in obtaining a minor source air permit for these engines, and the first stage of the Expansion Project, with 2.5 MW of electrical generating capacity, was located adjacent to the Providence Project and became operational in 2004.

While working on the acquisition of the Deutz gensets for the Expansion Project, RRIG also signed equipment purchase orders to purchase four new Caterpillar 3520 gensets having an additional 6 MW of electrical generating capacity. After obtaining the major source air permit and installing new transmission lines, the Caterpillar gensets were located along Shun Pike at the edge of the landfill and became operational in October 2005. The 2003 site lease contemplates that the stage one Deutz gensets will be moved to the Caterpillar site along Shun Pike. However, the Managing Shareholder now anticipates that the costs to obtain new permits for the Deutz gensets will be prohibitive in the short term, and the current expectation is that the Deutz gensets will be taken out of service sometime in 2009 and stored as backup units for the Caterpillar equipment. The entire 8.5 MW output of the Expansion Project is currently sold in the wholesale merchant power market in the New England Power Pool. If the Deutz gensets are taken out of service, the total output of the Expansion Project will drop to 6 MW.

3.4 Site Expansion Plans. Phase V is the only phase at the landfill open to receive waste, and is filling quickly. RIRRC has filed permit applications to create new Phase VI and new Phase VII at the landfill. The output of the existing generating facilities is very near the maximum capacity of the transmission lines in the area. As a practical matter, building any meaningful addition to the existing generating capacity would require a substantial upgrade of the adjacent transmission system. The Managing Shareholder has advised the Special Committee that in its view the cost of a transmission upgrade, which is estimated to be approximately $5,000,000, is not justified absent a major expansion of generating capacity at the landfill.

The landfill is a prolific producer of gas. The Providence Project consumes approximately 4,850 cubic feet of landfill gas per minute at standard conditions of temperature, pressure and humidity, or “SCFM,” and the Expansion Project consumes approximately 3,100 SCFM. The landfill is currently producing approximately 11,109 SCFM of landfill gas. Since the Providence Project and the Expansion Project together use a total of approximately 7,950 SCFM for electricity generation, the remaining 3,159 SCFM is sent to flares and “wasted.” RIRRC has expressed interest in finding uses for the excess landfill gas that will provide additional revenues streams for RIRRC, because the royalty revenues from the existing generating facilities do not cover the costs incurred by RIRRC in operating the gas collection systems.

In order to maximize the amount of space available for waste disposal at Phase VI, the Providence Project, the Deutz gensets of the Expansion Project and RIRRC’s headquarters building must be moved from their current location or be demolished. Since 2003, RIRRC and the Managing Shareholder have had sporadic discussions about taking action with regard to the Providence Project. Initially, the discussions revolved around RIRRC's paying the costs of physically moving the Providence Project. On examination, it became evident that this approach would be very expensive because the probable costs of merely moving the Providence Project would add up to a substantial portion of the costs necessary to build an entirely new 12 MW facility. During this period, the Managing Shareholder made several proposals to RIRRC that involved RIRRC's paying for, or bearing the entire cost of, the construction of a new generating facility that would replace the Providence Project. RIRRC objected to those proposals because RIRRC wanted RPPP to contribute to the costs of the new generating facility rather than getting a completely new plant for “free.” To break a stalemate and to avoid the uncertainties and expense of a protracted eminent domain process, the Managing Shareholder has proposed a redevelopment plan for Phases VI and VII to increase the electricity generating capacity installed at the landfill. Central to the redevelopment plan is the execution of a series of agreements to be entered into by RIRRC with a new entity, Rhode Island LFG Genco, LLC ("Newco"), which would own all of the Providence Project and the Expansion Project. Pursuant to these agreements:

| | · | Newco would have the sole and exclusive right to use all landfill gas produced at the landfill; |

| | · | RGS, as a wholly-owned subsidiary of Newco, would have the sole and exclusive right to operate all gas collection systems at the landfill; and |

| | · | RGS would acquire the gas collection facilities currently owned by RIRRC and located at the Central Landfill. |

More specifically, the proposed agreements have been described to the Special Committee as follows:

The Amended and Restated Site Lease. The amended and restated site lease will give Newco the sole and exclusive right to use all landfill gas produced at the landfill, including without limitation for the production of electricity and for sale to third parties, for so long as Newco generates electricity on the landfill or otherwise makes economic use of any product using landfill gas. Unlike the site leases currently in effect between RIRRC and each of RRRP and RRIG, the arrangement will apply to all gas at the landfill, eliminating the risk that RIRRC could sell similar rights to a third party.

In exchange for such rights, Newco will agree to develop a new gas collection facility on the landfill, relocate certain portions of the Power B Fund facility and decommission and transfer the Waukesha facility to RIRRC prior to the earlier of the opening of the new facility or June 1, 2010. Newco will also agree to make a net revenue payment to RIRRC equal to that paid under RPPP and RRIG’s existing site leases until such time as Newco is able to develop its new gas collection facility on the landfill, and then will make a net revenue payment to RIRRC equal to 15% of the net revenues received by Newco from the sale or use of landfill gas or landfill gas products. The revenue payments will be phased-in over a ten year period and will be netted against any payments made by RGS to RIRRC under the service agreement described below.

The Amended and Restated Services Agreement. The amended and restated services agreement will give RGS the sole and exclusive right to operate all gas collection systems at the landfill for so long as the site lease remains in effect. In doing so, RRIC will grant RGS complete authority for all operations, maintenance, upgrades and administration of the gas collection systems located at the landfill.

In exchange for such rights, RGS will make payments in accordance with the existing gas services agreement until the earlier of such time as Newco is able to develop its new gas collection facility on the landfill or October 31, 2012, at which such time RGS will be responsible for all costs incurred in collecting and treating landfill gas, including without limitation all electricity costs, capital costs, fines and penalties associated with the flares. In any given calendar month, any payment owed by Newco to RIRRC under the site lease will be netted against any payment for such month owed by RIRRC to RGS under the services agreement.

The Purchase Agreement. Pursuant to the purchase agreement, RGS will have the right to acquire the gas collection facilities located at the landfill, currently owned by RIRRC, for a purchase price of $1.00. Included in the sale will be the systems for the collection, treatment and disposal of condensate produced by the Waukesha facility, the Power B Fund facility and the new facility to be built by Newco, but will exclude all equipment devoted to the collection, treatment and disposal of leachate produced at the landfill. This purchase will give RGS ownership of all of the gas collection systems at the landfill.

IV. CONSIDERATION OF THE PROPOSED TRANSACTION.

The Managing Shareholder has concluded that its redevelopment plan represents the most viable approach available to the Trusts and the State of Rhode Island for Phases VI and VII of the landfill. In order to implement this plan, the Managing Shareholder has also concluded that it is necessary to reorganize the manner in which the Providence Project and the Expansion are owned, such that these projects are owned by a single entity (Newco) that, in turn, is owned by the four Trusts. The Proposed Transaction constitutes the methodology for affecting that reorganization.

In early January 2008, the Managing Shareholder decided to form a special committee to analyze the advisability, with respect to each of the Trusts, of the allocation of equity interests in Newco among the four trusts, as well as the advisability of the Proposed Sale.2 The Managing Shareholder designated Jonathan C. Kaledin, Esq. and Joseph Ferrante, Esq. as the Special Committee members. Both members of the Special Committee previously served as independent trustees of Trust III and Ridgewood Electric Power Trust II and as independent panel members of Ridgewood Electric Power Trust V. Other than with respect to that prior service, neither member of the Special Committee was, at or before the time of his appointment to the Special Committee, or is currently, an officer of the Managing Shareholder or the Trusts or was or is otherwise affiliated with the Managing Shareholder or the Trusts. The Managing Shareholder requested the Special Committee to provide its opinion as to the advisability, with respect to each of the Trusts, of the allocation of equity interests in Newco effected pursuant to the Proposed Transaction and to render a report to the Managing Shareholder respecting its conclusions.

| | |

2 Initially, the Managing Shareholder sought the assistance of the Special Committee with respect to the sale of certain biomass and hydroelectric assets by affiliates of the Managing Shareholder. However, ultimately it was determined that the Special Committee would not be asked to evaluate the sale of those assets. Furthermore, while the Special Committee has received some information regarding the Proposed Sale, the Special Committee has not yet analyzed the advisability of the Proposed Sale. |

Initially, the Managing Shareholder provided the members of the Special Committee with a memorandum describing the history of the development of the Providence Project and the Expansion Project, a series of organizational diagrams reflecting the current ownership structure of the two projects and the proposed structure and forecast models for the two facilities. Subsequently, as detailed below, the Managing Shareholder has provided the Special Committee and its advisors with access to an electronic dataroom containing numerous documents relevant to the Special Committee's deliberations and, through its representatives, has met with the Special Committee and its representatives on several occasions.

During January 2008, the Special Committee interviewed representatives of several law firms in order to select legal counsel. On January 23, 2008, the Special Committee retained Lowenstein Sandler as its legal counsel.

On February 23, 2008, the Special Committee held a telephonic meeting where Lowenstein Sandler summarized the obligations of the Special Committee and the functions of independent committees. The members of the Special Committee and Lowenstein Sandler then identified the elements of the Proposed Transaction as previously explained to them by the Managing Shareholder. It was noted that representatives of the Managing Shareholder had previously advised the members of the Special Committee that RIRRC was in the process of restructuring its board of commissioners, and that RIRRC did not expect to take any action with regards to generation facilities at the landfill until the Rhode Island State Senate had approved nominees to the RIRRC board. The Managing Shareholder advised the Special Committee that it was unclear when such approval would take place, but that it thought that it would be in the near future, and expressed its desire that the Proposed Transaction be consummated prior to such approval so that an arrangement giving Newco exclusive rights over the gas produced by the landfill could be presented to RIRRC’s board of commissioners promptly after the RIRRC Board is reconstituted.

On March 27, 2008, the Special Committee met at the New York offices of Lowenstein Sandler to interview three candidates to retain as its financial advisor, including Duff & Phelps. After completing the interviews, the members of the Special Committee requested that its legal counsel contact additional candidates for consideration. Between March 27, 2008 and May 7, 2008, the Special Committee met in person or by telephone on several occasions for the purposes of selecting a financial advisor to assist it in its deliberations and analyzing particular aspects of the Proposed Transaction.

At one of those meetings, on May 2, 2008, the Special Committee met in person at the New York offices of Day Pitney with representatives of the Managing Shareholder, the Managing Shareholder's financial advisor, Ewing Bemiss, and the Special Committee's counsel to discuss further the Proposed Transaction. Representatives of the Managing Shareholder described the structure of the Proposed Transaction, the Proposed Sale and the corporate history of the assets being sold, as well as the mechanics of the sale. The representatives of the Managing Shareholder indicated that in addition to ownership of the Providence Project and the Expansion Project and the assets located at the Olinda Alpha Landfill, the Managing Shareholder would also include in the Proposed Sale certain managerial assets owned by the Managing Shareholder pertaining to the management of the projects at the Central Landfill and at the Olinda Alpha Landfill. In response to questions from the members of the Special Committee, the representatives of the Managing Shareholder indicated that confirmation of the nominees to RIRRC's board could occur within the next six weeks.

On May 16, 2008 the Special Committee met with representatives of the Managing Shareholder and Day Pitney to provide an overview of the Proposed Transaction to Duff & Phelps for the purpose of assisting Duff & Phelps in understanding the Proposed Transaction. Representatives of the Managing Shareholder reviewed the organization of the electronic datasite established by the Managing Shareholder to permit the Special Committee, its advisors and third parties to perform due diligence with respect to the Proposed Transaction and the Proposed Sale. Representatives of the Managing Shareholder also described the mechanics used to determine the cash flows derived from the assets at the landfill.

Later in the day on May 16, 2008, Duff & Phelps finalized its draft engagement letter and, upon approval from the Managing Shareholder, the Special Committee retained Duff & Phelps pursuant to such engagement letter to, among other matters, render a fairness opinion in connection with the Proposed Transaction.3 Duff & Phelps is a nationally recognized investment banking firm that is regularly engaged to render financial advice and opinions in connection with mergers and acquisitions, recapitalizations and similar transactions. The Special Committee retained Duff & Phelps based upon Duff & Phelps' experience in rendering fairness opinions and in valuing businesses and their securities in connection with these types of transactions. At the time of engagement, no material relationship existed between Duff & Phelps, the Managing Shareholder, the Trusts or any of their respective affiliates, nor did the parties contemplate any material relationship other than the terms of their engagement.4

On June 3, 2008, the Special Committee met with representatives of Duff & Phelps, Ewing Bemiss and the Managing Shareholder to discuss the Proposed Transaction, the assets to be contributed in the Proposed Transaction and the assets to be sold in the Proposed Sale. On June 4, 2008, representatives of Duff & Phelps traveled to Johnston, Rhode Island and inspected the assets owned by the Trusts located at the landfill. Specifically, the Duff & Phelps team inspected the equipment rooms, the gensets and the facilities pumping landfill gas to the gensets for both the Providence Project and the Expansion Project. Duff & Phelps representatives provided an oral report to the Special Committee with respect to this inspection at a meeting of the Special Committee held on June 10, 2008.

| | |

3 The engagement letter, dated as of May 13, 2008, was amended by an addendum dated as of September 30, 2008. 4 Previously, Duff & Phelps was retained by an affiliate of the Managing Shareholder to provide a fairness opinion with respect to the sale of projects that are unrelated to the Providence Project and the Expansion Project. The Special Committee concluded that that engagement did not adversely impact the ability of Duff & Phelps to provide independent services to the Special Committee pursuant to its engagement letter. |

At meetings of the Special Committee held on June 13, 2008, June 27, 2008 and July 1, 2008, representatives of the Managing Shareholder presented the Special Committee and its advisors with updates regarding the status of the confirmation of the Governor's nominees to the RIRRC board.

On July 9, 2008, the members of the Special Committee met first with its advisors and then in a joint meeting with its advisors and representatives of the Managing Shareholder. During the initial meeting, the Duff & Phelps representatives presented their preliminary analysis of the percentages of Newco to be received by each of the Trusts, as proposed by the Managing Shareholder. As part of this presentation, Duff & Phelps reviewed the steps taken by the Managing Shareholder in formulating its proposal and the analytical approaches followed by Duff & Phelps in performing its own analysis. The analytical approaches used by Duff & Phelps and the Managing Shareholder were similar, but not exactly the same, and produced slightly different results. Duff & Phelps noted that under either analytical approach Duff & Phelps would come to the same conclusions in its opinion, but the Special Committee members requested Duff & Phelps to meet with the Managing Shareholder to discuss the approaches taken. When the representatives of the Managing Shareholder joined the meeting, the analytical approaches were discussed and questions raised by the Special Committee were answered. After considering the differences in the approaches utilized by Duff & Phelps and the Managing Shareholder, the Managing Shareholder advised the Special Committee that it would revise its analysis using the methods employed by Duff & Phelps.

Subsequent to the July 9, 2008 meeting, the Managing Shareholder advised the Special Committee that it expected the Rhode Island Senate to confirm the Governor's appointees by the end of the summer. However, on August 21, 2008, the Managing Shareholder advised the Special Committee that the Rhode Island Senate had not yet confirmed the appointees and that the Managing Shareholder could no longer predict when such confirmations would occur. Pending resolution of this issue, the Special Committee temporarily suspended its deliberations.

In late September 2008, the Managing Shareholder was advised that in the absence of Senate confirmation of the RIRRC board, the Governor of Rhode Island had taken over the landfill under his emergency powers. The Managing Shareholder was also advised that the Governor's counsel would certify that the Governor has the authority to approve the execution of the documents proposed by the Managing Shareholder in the absence of a newly appointed Board. Accordingly, in late September 2008, the Managing Shareholder (i) advised the Special Committee that RIRRC was planning to request the Governor to approve the proposed new agreements with Newco pursuant to the Governor's emergency powers and (ii) requested the Special Committee to resume its deliberations.

On October 29, 2008, representatives of the Managing Shareholder advised Duff & Phelps that based on developments affecting the landfill and further review by the Managing Shareholder of the approaches taken by Duff & Phelps and the Managing Shareholder, the Managing Shareholder had updated its analysis and revised its proposal regarding the allocation of Newco's membership interests among the four Trusts. Under the Managing Shareholder's revised proposal, membership interests in Newco are to be allocated as follows:

| Trust I | 6.7800% |

| | |

| Power B Fund | 38.4200% |

| | |

| Trust III | 19.5636% |

| | |

| Trust IV | 35.2364% |

On October 30, 2008, the Special Committee first met with its advisors and then met jointly with its advisors and representatives of the Managing Shareholder. In the first meeting, the Duff & Phelps representatives reported on the steps that they had taken to update their analysis since the July 9, 2008 meeting. They also described the information that they had received from the Managing Shareholder in support of the above-mentioned allocation of equity interests in Newco. In the second meeting, the Managing Shareholder's representatives reviewed with the Special Committee the conditions at the landfill, the absence of material undisclosed contingent liabilities, their views regarding the tonnage of waste to be processed at the landfill and their views regarding the appropriateness of the above-mentioned allocation of equity interests. At the conclusion of the meeting, Duff & Phelps advised the Special Committee as to the text of the opinion that it would likely be prepared to render with respect to the above-mentioned allocation.

On November 17, 2008, after confirming its understanding with respect to the underlying facts, Duff & Phelps delivered the opinion described below. On the same date, after meeting with its advisors, the Special Committee resolved to advise the Managing Shareholder that the proposed allocation of equity interests set forth above is advisable with respect to each of the Trusts.

V. THE PROPOSED TRANSACTION.

5.1 Description of the Proposed Transaction.

Immediately prior to the execution of the revised agreements with RIRRC, the Managing Shareholder (as the managing shareholder of the Power B Fund and Trust I) and Trust I (as the sole equity owner of Olinda) will cause the Power B Fund and Olinda to contribute to Newco 100% of their ownership interests in RRIG in exchange for equity interests in Newco. In a contemporaneous transaction, the Managing Shareholder (as the managing shareholder of Trust III and Trust IV) will cause Trust III and Trust IV to contribute to Newco (x) 100% of their respective ownership interests in RPPP and RPPC, together with (y) 100% of their respective ownership interests in RGS and RIGM, in exchange for equity interests in Newco. Following these contributions, RIGM will merge into Newco, leaving RGS as a wholly-owned subsidiary of Newco.

After giving effect to the foregoing contributions, Newco would hold, as direct or indirect wholly-owned subsidiaries, RGS, RPPP, RRIG and RPPC. Newco would therefore have the ability to cause any of those subsidiaries to take actions to comply with any agreements entered into with RIRRC and/or as otherwise required to conduct operations at the landfill.

The Managing Shareholder has proposed that the economic interests in Newco be allocated as follows:

| Trust I | 6.7800% |

| | |

| Power B Fund | 38.4200% |

| | |

| Trust III | 19.5636% |

| | |

| Trust IV | 35.2364% |

The proposed allocation is based on the relative contributions of Trust I, Trust III, Trust IV and the Power B Fund to Newco. As RGS is a cost pass-through entity, no separate value has been ascribed to RGS or to RIGM, which provides administrative support to RGS.

5.2 Plans or Proposals Relating to the Proposed Transaction.

Initially it was planned that upon confirmation of RIRRC's newly appointed board, the Managing Shareholder would submit to RIRRC’s board for approval a new site lease, a new service agreement and an agreement to acquire RIRRC’s gas collection facilities located at the landfill. However, the Rhode Island Senate has not yet given a clear indication of when it will vote upon the new board. In response, the Governor of Rhode Island has issued an executive order directing RIRRC to continue operating the landfill and authorizing the director of RIRRC to report to the Governor as to business that has been or needs to be conducted at the landfill. The Special Committee has been advised that a meeting was held in which the Governor of Rhode Island authorized the executive director of RIRRIC to enter into the proposed site lease, service agreement and agreement to acquire RIRRC's gas collection facilities with Newco.

It is anticipated that, subsequent to the Proposed Transaction, Newco, and/or the entities owning the landfill gas electricity generation project located at the Olinda Alpha landfill in Brea California, as well as certain other assets owned by the Managing Shareholder or its affiliates, may be offered for sale to a third party buyer or partner. As of the date of this Report, no decision relating to any such Proposed Sale has been communicated to the Special Committee. While the possibility that the Proposed Sale may occur has been considered by the Special Committee as part of its analysis of the Proposed Transaction, the Special Committee's conclusion reflected in this Report is not based on any assumptions regarding whether or not any Proposed Sale might occur and is not based on any assumptions regarding the terms that eventually might be obtained if the Proposed Sale were to occur.

5.3 Purpose of the Proposed Transaction.

The principal purpose of the Proposed Transaction is to facilitate the development of a substantial increase in the electricity generating capacity installed at the landfill by consolidating ownership of the Trust assets associated with the landfill into Newco so that Newco has the ability to negotiate the amended and restated site lease, the amended and restated gas services agreement and the purchase agreement described above. Such agreements will grant Newco the sole and exclusive right to use all landfill gas produced at the landfill and will grant RGS the sole and exclusive right to operate all gas collection systems at the landfill and are expected to facilitate negotiations pertaining to the financing for the new generating facilities, which financing may include the Proposed Sale.

5.4 Effects of the Proposed Transaction.

The Proposed Transaction will have the effect of causing the Trusts to indirectly own the subsidiaries holding the landfill facilities. If the Proposed Transaction is consummated, each of the Trusts will receive in exchange for their landfill assets the following percentage membership interest in Newco:

| Trust I | 6.7800% |

| | |

| Power B Fund | 38.4200% |

| | |

| Trust III | 19.5636% |

| | |

| Trust IV | 35.2364% |

After giving effect to the foregoing contributions, Newco would hold, as direct or indirect wholly-owned subsidiaries, RGS, RPPP, RRIG and RPPC.

5.5 Effects on Investors in the Trusts.

Investors holding shares in the Trusts will receive no distributions in connection with the Proposed Transaction. Upon consummation of the Proposed Transaction, all Trust investors will retain their current shareholdings in the Trusts. The Trusts, in turn, will own membership interests in Newco, which in turn will own electric generating assets at the landfill.

5.6 Effects on the Managing Shareholder.

The Managing Shareholder is the manager of Newco as well as the managing shareholder of the Trusts. Subsequent to the Proposed Transaction, the Managing Shareholder will remain the managing member of Newco and will direct Newco in managing the facilities. The functions that the Managing Shareholders will perform as the manager of Newco are comparable to the functions that the Managing Shareholder performs as the managing shareholder of each of the Trusts.

In the event that Newco and/or the entities owning the landfill gas electricity generation project located at the Olinda Alpha landfill in Brea, California, as well as certain other assets owned by the Managing Shareholder or its affiliates, are sold to a third party buyer or partner, the Managing Shareholder will share in the proceeds to the extent provided in the terms of the applicable trust agreements. The declarations of trust for each of the Trusts contain provisions permitting the Managing Shareholder to share in the proceeds of a disposition of the assets of the Trusts in proportion to the investors in the Trusts. In general, after the payment in full of the initial capital contributions of investors in the Trusts, the proceeds of a disposition of the assets of the Trusts will be paid 80% to investors and 20% to the Managing Shareholder, with the exception of the Power B Fund, where the proceeds of a disposition of the assets of the Trusts will be paid 75% to investors and 25% to the Managing Shareholder.

In the event of a sale or disposition of the assets of Trust III or the Power B Fund in which the Managing Shareholder performs services typically performed by a broker or financial advisor, the Managing Shareholder will also be entitled to a fee of up to 2% of the proceeds of such sale. However, the Managing Shareholder has advised the Special Committee that the Managing Shareholder will retain an investment banker in connection with a Proposed Sale and will forego the 2% success fee.

VI. OPINION OF THE SPECIAL COMMITTEE'S FINANCIAL ADVISOR.

Duff & Phelps, the financial advisor to the Special Committee, has concluded that, and has provided the Special Committee with its opinion letter dated the date hereof to the effect that, the consideration of 6.7800%, 38.4200%, 19.5636%, and 35.2364% of the total membership interests in Newco to be received by Trust I, the Power B Fund, Trust III and Trust IV, respectively, in the Proposed Transaction is fair, within a range, from a financial point of view, to each Trust individually. A copy of Duff & Phelps' opinion letter is annexed hereto as Appendix B.

Duff & Phelps' letter describes the documentation and other input that Duff & Phelps relied upon in reaching its conclusion. The letter also describes the assumptions that Duff & Phelps made in reaching its conclusion.

Duff & Phelps, among other approaches, utilized two discounted cash flow approaches to determine the relative value of the Providence Project and the Expansion Project to each other. In addition to performing a 15-year discounted cash flow analysis, Duff & Phelps also performed a 48-year discounted cash flow analysis in order to analyze the free cash flow (that is, cash available to either reinvest or to distribute to equity owners) of each project through the end of the gas flow projections provided by Stantec Consulting Services. This analysis reflects the expectation that as a result of a depleting fuel base, the Providence Project will become unprofitable in 2040; as a result, Duff & Phelps assumed that the Providence Project would cease operations at the end of 2039. The 48-year analysis assumes that the Expansion Project would remain profitable through 2055. Duff & Phelps did not explicitly analyze the proposed allocation with reference to selected public companies or selected M&A transactions. However, Duff & Phelps did use market multiples to check on the reasonableness of its conclusion.

VII. CONCLUSION OF THE SPECIAL COMMITTEE.

After considering the information made available to it and the advice furnished to it by its financial and legal advisors, the Special Committee has concluded that it is advisable with respect to each of the Trusts to structure the Proposed Transaction such that 6.7800%, 38.4200%, 19.5636%, and 35.2364% of the total membership interests in Newco are received by Trust I, the Power B Fund, Trust III and Trust IV, respectively.

VIII. REASONS FOR THE SPECIAL COMMITTEE'S DETERMINATION.

In the course of reaching its conclusion that the proposed allocation of equity interests in the Proposed Transaction is advisable with respect to each of the Trusts, the Special Committee consulted with senior management of the Managing Shareholder, the Managing Shareholder's counsel and the Special Committee's financial and legal advisors, reviewed a significant amount of information and considered a number of factors, including the following:

| | • | the contribution that each Trust will be making to Newco pursuant to the Proposed Transaction; |

| | • | the methodologies that may be used in valuing those contributions; |

| | • | the Special Committee's assessment of the current situation confronting RIRRC and the State of Rhode Island, including the facts that the landfill currently produces excess gas, that it is important to the State of Rhode Island that such excess gas be converted to electricity and then sold and that as the landfill is currently configured, the State will not be able to realize its objectives; |

| | • | the substantial difficulties that the State of Rhode Island would have in paying "just compensation" if it were to pursue an eminent domain solution in reconfiguring the landfill; |

| | • | the importance to Trust III and IV of securing access to landfill gas from the later stages of the landfill's development and the importance to each of the Trusts that access to later stage landfill gas is exclusive; |

| | • | the status of the current documentation relating to the landfill and the need to streamline and rationalize that documentation; |

| | • | the terms and conditions of the proposed documentation relating to the landfill; |

| | • | historical and current information concerning the Trusts' business, financial performance, condition, operations, technology, management and market conditions; |

| | • | internal estimates of the Trusts’ future financial performance, as well as the potential impact on such future financial performance if the challenges and risks to the Trusts' business identified were in fact realized; and |

| | • | the financial presentation of Duff & Phelps, including its opinion, dated the date of this Report, to the Special Committee that the consideration of 6.7800%, 38.4200%, 19.5636%, and 35.2364% of the total membership interests in Newco to be received by Trust I, the Power B Fund, Trust III and Trust IV, respectively, in the Proposed Transaction is fair, within a range, from a financial point of view, to each Trust individually. |

In the course of its deliberations, the Special Committee also considered a variety of risks and other countervailing factors, including:

| | • | the limitations inherent in valuing the respective contributions of the Trusts to Newco; |

| | • | the assumptions made by Duff & Phelps in reaching its conclusion and the possibility that one or more of those assumptions may not, in fact, be realized; |

| | • | the interests that the Managing Shareholder has which may differ from the interests of the other equity owners of the Trusts; |

| | • | the fact that the Special Committee's analysis is based, in part, on predictions regarding future performance, which performance may be significantly impacted by factors that the Special Committee cannot predict with certainty; |

| | • | the fact that the Proposed Sale may not occur or, if it does occur, may not occur on terms that would be favored by all equity owners of the Trusts; |

| | • | the uncertainties confronting the public's acceptance of expanding a landfill which currently represents the largest landfill in the State of Rhode Island; and |

| | • | the impact that competitors may have on the Proposed Sale and the operation of the landfill. |

The Special Committee believes that it is in the best interests of the Trusts to assure that the Trusts have exclusive access to the gas emitted from the landfill. The Special Committee further believes that inaction by the Trusts could lead the State to pursue eminent domain proceedings, with potentially adverse consequences for all parties involved. The Special Committee did not consider alternate approaches for assuring exclusive access and avoiding the eminent domain process. Instead, the Special Committee limited its review to the proposal made by the Managing Shareholder and focused its attention on the allocation of the membership interests in Newco among the four Trusts.

The foregoing discussion of the factors considered by the Special Committee is not intended to be exhaustive, but does set forth all of the material factors considered by the Special Committee. The Special Committee collectively reached the unanimous conclusion to approve the proposed allocation in light of the various factors described above and other factors that each member of the Special Committee felt were appropriate. In view of the wide variety of factors considered by the Special Committee in connection with its evaluation of the Proposed Transaction and the complexity of these matters, the Special Committee did not consider it practical, and did not attempt, to quantify, rank or otherwise assign relative weights to the specific factors the Special Committee considered in reaching its decision and did not undertake to make any specific determination as to whether any particular factor, or any aspect of any particular factor, was favorable or unfavorable to the ultimate determination of the Special Committee. Rather, the Special Committee reached its conclusion based on the totality of information presented to it and the investigation conducted by it. In considering the factors discussed above, the individual members of the Special Committee may have given different weights to different factors.

Appendix A

Site Map

Appendix B

Duff & Phelps Opinion

Attached as Exhibit 99.3 in this Current Report

Appendix C-1

Proposed Site Lease

Attached as Exhibit 10.3 in this Current Report

Appendix C-2

Proposed Service Agreement

Attached as Exhibit 10.4 in this Current Report

Appendix C-3

Proposed Purchase Agreement

Attached as Exhibit 10.5 in this Current Report