TO: Ridgewood Electric Power Trust I, Trust III, Trust IV, and the Providence B Fund Shareholders

RE: I. Potential Sale of Providence and Olinda Landfill Methane

II. Combining the Interests of Trusts I, III, IV, and the

Providence B Fund to Maximize the Value of the Providence

Development Opportunity in a Sale

III. The Sale Process for Providence and Olinda

IV. Summary and Exhibits

We are pleased to report what we believe is very positive news for shareholders of Trust I, Trust III, Trust IV, and the Providence B Fund. After spending several years doing preliminary development work towards major capacity expansions of the Olinda landfill methane power project in California, and the Providence landfill methane power project in Rhode Island, this development process is now far enough along that we can commence the process for selling them, with the goal of achieving liquidity for the shareholders of these Trusts. This letter is a follow-up to the brief letter I sent out on December 8, which included an article from the Providence Journal about the development of the Providence Project.

Both Olinda and Providence landfills have existing power generation capacity on them owned by the respective Trusts. However, we believe that, through our preliminary development work (discussed below), we have unlocked substantial new value, which we hope to realize through a sale. Due to our efforts, both Providence and Olinda present potential purchasers with the opportunity to install significant new renewable power generation capacity that is fueled by low-cost methane gas that is captured from the landfills. Landfill methane power is recognized as one of the most reliable, cost-effective, and environmentally-friendly forms of renewable power. Once completed, these projects stand to be the crown-jewel assets of a purchaser’s portfolio of renewable power assets.

There still remains a great deal of work that must be accomplished to consummate a sale of these assets. At this stage, we are still in the process of receiving initial indications of interest from prospective buyers. After we have negotiated and signed a final sale agreement, we must then obtain the consent of over 50% of the shareholder interests in each Trust to be able to close the transaction. If all goes well, we hope to close a sale in the second or third quarter of 2009.

This letter is long and somewhat complicated because it describes the potential sale of two major projects owned by four different Trusts. This letter aims to provide you with a background of the projects and to explain our strategy for selling them in order to realize additional value for the Trust shareholders.

PART I: Potential Sale of Providence and Olinda Landfill Methane Renewable Power Projects

A. BACKGROUND TO THE SALE

Ridgewood Renewable Power’s management team has been working for the past 3 years to prepare the Olinda and Providence landfill methane projects for major new capacity-expansions. The Olinda Project, located in Brea, California (in Orange County, near L.A.), is wholly-owned by Trust I. The Providence Project, in Johnston, Rhode Island (just west of Providence) is owned by Trust I, Trust III, Trust IV and the B Fund. After several years of preliminary development work, we are now in a position to potentially realize substantial additional value from these assets for our investors.

Generating clean, renewable electric power has been one of our nation’s goals for decades, and it is certainly expected to be one of the priorities of the Obama Administration. Today, the highest-profile forms of new renewable power are solar and wind power. These types of plants received considerable attention from the financial press and from investors over the last several years. The sun and wind are attractive renewable fuels because they are practically limitless in size, which means that developers could plan enormous projects. A major drawback to solar and wind power that is rarely discussed, however, is that these projects don’t reliably produce power because the sun and the wind are only intermittent power sources. You cannot run your solar-powered electric lights after the sun has set. The wind is even more unpredictable. Because battery storage technologies don’t currently exist to economically store intermittently-produced electricity, significant back-up power generation facilities have to be built and kept on stand-by for times when the sun’s not shining or the wind isn’t blowing. Therefore, solar and wind power sources cannot offer the 24/7 reliability of coal, natural gas, or nuclear-powered electricity plants.

In contrast, landfill methane gas (the gas that is generated by rotting garbage in a landfill) is an environmentally-friendly renewable power source that offers 24/7 reliability (garbage rots day in and day out). This means that landfill methane power projects do not require back-up generating capacity to ensure reliability. Our Olinda and Providence Projects are two of the largest landfill methane power projects in the country, and because of the advantages of landfill methane power, we believe that they are two of the best, most cost-effective and environmentally friendly renewable power sites in the country. Because most landfill methane power plants are small (typically about 3 MW on average nationwide), they do not get a lot of attention from the media. However, notwithstanding the lack of media coverage, we consider landfill methane gas power to be one of the most desirable forms of renewable power.

Both the Olinda and Providence landfills are very large, regional landfills that are expected to remain open for many years to come, thereby providing a long-term source of future methane gas. The methane gas that powers our electric generating equipment is the gas given off by rotting garbage, which we collect and use as a fuel to generate electricity. It is a waste product and, therefore, is much cheaper than conventional fuels like coal or natural gas. But while it is an inexpensive waste product (we pay a royalty to the landfill owners to use it), it is of lower quality than the ordinary natural gas you would cook with, which means you have to use more expensive equipment to handle it. Plus, this equipment requires more frequent and costly maintenance than conventional natural gas power plants. While conventional natural gas-fired power facilities are relatively inexpensive and easy to install and operate, successfully designing, installing, and operating landfill methane power plants requires experience and expertise. Fortunately, Ridgewood Renewable Power has been in the landfill methane power business for over sixteen years at Olinda, at Providence, and in the U.K. We have demonstrated that, with the right expertise and skill set, landfill methane power can be quite profitable.

In light of this opportunity, Ridgewood Renewable Power, on behalf of the Trusts, has been working to prepare the Olinda and Providence sites for major expansions to their power generating capacity. Our plan is to expand the Olinda Plant from its current 5.6 megawatts (MW) of power generation to 37.2 MW when development is completed (projected to be in late 2010). Similarly, our plan is to expand the Providence Project from its current 23 MW (the aggregate capacity of the plants owned by Power Trusts I, III, IV, and the Providence B Fund) to 47.6 MW, once developed. (Some previous letters have described Providence as having total capacity of 20.6 MW project; 23 MW is the gross capacity of the current sites, while 20.6 is the net capacity.) This represents more than a tripling of our total landfill methane capacity, and together, once developed, these plants will have the ability to serve about 84,000 homes.

Together, these plants represent a very attractive bundle of highly-desirable renewable power projects, which is why our strategy is to market them together as we look for prospective buyers. We believe that stronger, better-capitalized buyers will be attracted to an acquisition offering the critical mass created by packaging these assets together for sale. We expect the output rate of our new plants to be about 90% of capacity while wind projects generally run at around of 30% capacity, which means that our 84.8 MW of capacity is equivalent to roughly 250 MW of wind power, making these projects significant, prized-assets to a prospective buyer.

In addition to being very significant projects in terms of size, these projects will use the most modern and sophisticated gas-cleanup and power-generation technology available for landfill methane gas-fueled power plants. The new development projects will use gas turbines similar to jet engines (a sophisticated type of turbine). Plus, in addition to using methane gas to drive the turbine, the waste heat from the turbine’s exhaust will be used to generate additional electricity in what is called a “combined cycle” process, thereby further increasing output and efficiency. While many conventional natural gas-fired power plants use combined-cycle technology, applying it to a landfill methane power plant is a breakthrough that is achievable here due to the large size of these projects.

Gas turbine engines are not only very fuel-efficient, they are very space-efficient, which is an important consideration at landfills, where open space is very limited and, therefore, very valuable. Plus, gas turbines are very clean burning (meeting the strict emissions standards necessary to receive air permits) and generally have lower operating costs than the internal combustion generators currently installed at Olinda and Providence.

Most of the planning, design, and engineering work for both of these projects has already been completed, and we are hopeful that the air permits and construction permits will be issued very shortly. To get to this point, over the past 3 years, between Olinda and Providence, approximately $12 million has been invested (or is planned to be invested prior to any sale) in preliminary development work. Major costs have included engineering studies and design work, consultants and lawyers for permitting work (especially the air permits), and transaction lawyers to prepare the contracts securing the development rights. Of course, the costs attributable to the development work at each site were allocated to the Trusts owning each asset in their pro-rata share.

The capital to finance this preliminary development work came, in part, from operating income from the respective Trusts (as reported in the quarterly distribution letters to Trust investors). The balance has come directly or indirectly from Ridgewood Renewable Power, the Managing Shareholder, itself. Since 2005, Ridgewood Renewable Power has waived a total of $1 million in management fees to which we were entitled from Trust I, III, and IV, even though we had to continue to pay our senior staff to work on the development of these projects. These fees were permanently waived and will not be recouped by Ridgewood upon a sale of the assets.

We believe that this was money well spent—well invested. By investing in this preliminary development work and setting these sites up as premiere renewable power development projects, we believe we have unlocked significant value, potentially yielding a high return on these Trust dollars as we pursue a sale of these assets.

The next steps will be to begin ordering equipment and commit to a construction schedule. We estimate that the remaining development work at Olinda will require about $77 million of capital investment, and the remaining development at Providence will require about $93 million. We believe that, through our ongoing efforts over the last several years, we have brought both of these projects to the point where the Trusts have added all the value they can add. The preliminary development work is largely completed, but the Trusts do not have the capital necessary to commit to these expensive construction programs, which is why we feel now is the right time to sell these assets to a well-capitalized buyer who can invest the money needed to execute on the final development process. We believe that seeking to monetize the assets in this way will yield the best result for our investors. Hence, we have initiated the sale process discussed later in this letter.

Ridgewood and Ewing Bemiss & Co., the investment banking firm we engaged to facilitate the sale, which specializes in renewable power assets, expect the value attributable to the Providence Project may be significantly higher than the value attributable to the Olinda Project by prospective buyers. We do not want investors to be surprised if this is the result. The decision of how much value is received for each of the Olinda and Providence sales is not up to us; it is up to the ultimate purchaser, who will place a specific value on each project.

There are several reasons why we expect Providence to command a higher value than Olinda. Even though the two projects will use the same kind of equipment and have similar arrangements with their host landfill, the Providence Project (i) is larger and (ii) can take advantage of government-backed financial incentive programs for renewable power that exist in New England, but do not in California. New England states have some of the best financial incentive programs for renewable power in the U.S. while California’s program is much less robust. (This may seem counterintuitive, given people’s impression of the environmentally-conscious political climate in California, however when it comes to providing premium pricing for green power, California falls short.) So, the new Providence Project will be both larger and regarded as potentially more profitable, likely making it the more valuable asset. We will not close any transaction unless our investment banking firm concludes that each of the projects is receiving a fair price in light of the current market conditions.

B. SELLING PROVIDENCE AND OLINDA IN THIS CHALLENGING MARKET

Notwithstanding the current negative economic environment, Ridgewood Renewable Power believes there is the potential to sell the Olinda and Providence Projects—with these extremely valuable new development opportunities—for an amount that would result in a substantial profit over the capital invested by the Trusts, to date, in these projects. While it is true that the current global economic and financial crisis has depressed the value of many asset classes (including equities, bonds, real estate, and commodities), we believe that long-lived, hard assets that generate highly-efficient renewable electric power will remain an attractive acquisition to many purchasers. Given the momentum behind renewable power, we believe this area still remains a bright spot in market activity. And, as challenging as the general market environment is today, there are no assurances that conditions will improve any time in the foreseeable future, and they could get worse, therefore we believe it is best to proceed now with the sale process. It is our hope that, in the minds of prospective buyers, the impressive scale and desirability of these renewable power assets will offset concerns about our nation’s current, hopefully temporary, adverse economic climate. Our investment bankers are in the process of marketing these assets to both strategic investors seeking to diversify into major renewable power projects, as well as to investment funds and other financial buyers that focus on renewable power investments. Many of these funds raised their capital prior to the current economic crisis and have mandates to invest in renewable power. Of course, given the uncertainty in the markets, we cannot guarantee that we will be able to successfully sell the Providence and Olinda Projects. However, we do want to assure you that we, along with our investment bankers and counsel, will work very hard towards this goal.

Part II: Combining the Interests of Trusts I, III, IV, and the Providence B Fund to Maximize the Value of the Providence Development Opportunity in a Sale

In order to turn the Providence Project into a saleable development project capable of achieving the best possible price, we faced a special challenge. The Providence Project actually consists of two separate power plants located at different locations on the landfill site. The landfill on which these plants are located (and from which they draw gas) is owned and operated by Rhode Island Resource Recovery Corp., a Rhode Island governmental entity. However, the two separate power plants at Providence were built at different times and each had its own ownership and gas-rights contract with the landfill and were owned by different Power Trusts. The historical evolution of the Providence site that led to this structure is discussed below. In order to prepare Providence for sale to a potential buyer, however, we needed to form a single entity that owned long-term gas rights to the entirety of the Providence landfill. The structure needed to be simplified and streamlined in order to maximize the development potential—and the value—of the Providence Project. As I described above, the development plans for Providence call for installing new state-of-the art equipment to bring the total generating capacity up to 47.6 MW, while retiring some of the existing, less-efficient generating capacity.

The 23 MW of current capacity at Providence actually consists of two separate facilities installed many years apart. In 1996, Power Trusts III and IV purchased an existing 13.8 MW power plant installed at the Providence landfill that has been in operation since 1990. The investment was made 35.7% by Trust III and 64.3% by Trust IV. The plant had been underperforming (operating at only about 70-75% output), so Ridgewood’s plan for adding value was to hire more experienced operators, streamline procedures, negotiate changes to the air permit, and make capital improvements to increase the output. We accomplished this, and within two years, the plant was operating at over 90% of capacity and has been doing so ever since. We will refer to this original 13.8 MW plant as “Providence Plant 1” (or simply “Plant 1”).

A second power plant, with a capacity of 9.2 MW, was later built on the Providence site starting in 2002. This new 9.2 MW plant was built through a joint venture owned 15% by Power Trust I and 85% by the Ridgewood Providence B Fund. This new power-generating capacity, which is separate from the Providence Plant 1, was installed to generate electricity from additional methane gas being produced by new “phases” of the expanding Providence landfill. We will refer to this 9.2 MW of power plant as “Providence Plant 2” (or simply “Plant 2”).

As we approached the potential to turn the Providence site into a massive new development project, we faced an interesting situation. Providence Plant 1 had the gas rights with the landfill it needed to run its 13.8 MW (for which it paid a royalty), while Providence Plant 2 owned the gas rights that it needed to run its 9.2 MW (for which it also paid a royalty). However, as the landfill expanded over the years, it has been generating significant excess methane gas that’s been flared—simply burned and wasted, so that the gas wouldn’t escape into the atmosphere. Neither Providence Plant 1 nor Plant 2 had rights to this excess gas, it was not being used to generate electricity, and, therefore, wasn’t generating valuable royalty income for the landfill owner. The opportunity existed for a third party to contract with Rhode Island Resource Recovery, the owner of the landfill, to collect the excess methane gas and develop additional new uses for the excess gas produced at the landfill. If a third party did this, it would likely create tremendous operating problems for Plants 1 and 2 because they would be competing for gas with a hostile third party. If the landfill entered into such a contract, it would be like having too many straws in a milkshake and would result in constant conflict between Ridgewood and the new party for gas. This would not be a desirable result for any of the Ridgewood Trusts owning Plants 1 and 2.

This situation created a terrific new “win-win-win” development opportunity for the owners of Plant 1 (Trusts III and IV), the owners of Plant 2 (Trust I and the B Fund), and the state of Rhode Island. The opportunity existed to aggregate all the gas rights and development rights on the entire landfill into a single entity that has significant potential value.

Starting about 3 years ago, Ridgewood began negotiating terms of a new arrangement with Rhode Island Resource Recovery under which the Ridgewood entities could consolidate control over all the gas generated by the landfill in perpetuity, not only from the landfill as it exists, but also as the landfill is expanded over the coming years. The objective was to create a valuable development opportunity using this gas, while simultaneously addressing the landfill’s desire to generate significant royalty revenue from the gas, rather than waste it.

After spending several years negotiating for this contract, Ridgewood’s management team finally succeeded in obtaining it. In order to enter into this global landfill gas contract, Ridgewood had to combine the existing interests of Providence Plant 1 and Providence Plant 2, which each owned partial gas rights at the landfill, into a new entity that would have all the gas rights necessary to support the development of a new, state-of-the-art 47.6 MW plant. In order to develop this project, a potential purchaser—one prepared to spend $93 million of new capital in addition to the money invested to buy the valuable development rights—would need to see that all of the necessary gas rights had been consolidated into a single entity with clear and simple title. To accomplish this, Trusts III and IV, as the owners of Plant 1, and Trust I and the B Fund, as owners of Plant 2, contributed their respective interests into a new entity that we will refer to here as “Providence Newco” (or just “Newco”). In exchange for their contribution, each of the four Trusts received an ownership interest in Newco that reflected the value each contributed to it.

Clearly, combining the interests of these four Trusts created a complex situation in which each Trust was “bargaining” for a share of Newco in exchange for its respective contribution. This was, in essence, a valuation question. Ridgewood’s management team was very sensitive to the complexity and potential conflicts inherent in this task, and we took numerous steps to ensure that each Trust—and its shareholders—were treated fairly. These steps, which included forming an independent Special Committee, represented by its own law firm and investment bank, are described in detail below.

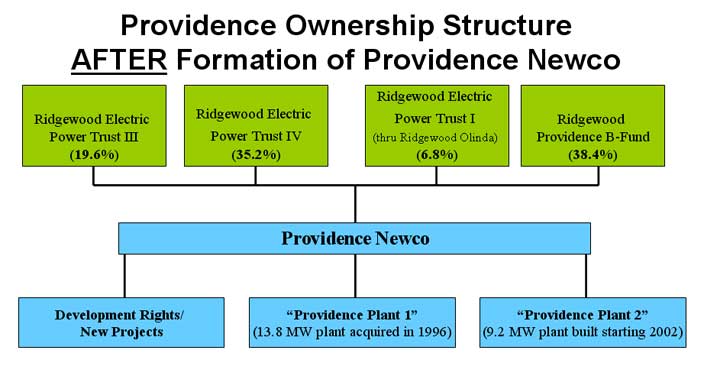

After conclusion of a thorough valuation process, the final determination was that, in exchange for contributing Plant 1 and related gas rights, Trusts III and IV would receive an aggregate of 54.8% of Newco, and in exchange for contributing Plant 2 and related gas rights, Trust I and the B Fund would receive an aggregate of 45.2% of Newco. (The percentages of Newco ultimately owned by each Trust is determined simply by multiplying the percentage interest it originally owned in Plant 1 or Plant 2 times its new percentage ownership in Newco. For example, since Trust III owned 35.7% of Plant 1, Trust III now owns 19.6% of Newco (35.7% x 54.8% = 19.6%).) Exhibit B, attached to the end of this letter, provides a “Before and After” organizational chart showing the ownership interests in the Providence Project before and after the formation of Providence Newco.

The key factor driving the valuation of Plant 1 versus Plant 2 in determining each one’s percentage ownership of Newco was a present value calculation of the expected future net earnings of each plant. You can see the ownership interests in Newco are close to—but not exactly equal to—the respective, pro-rata megawatt contribution of each Plant. In fact, the actual analysis was much more complex and technical than simply dividing 13.8 MW and 9.2 MW by the total 23 MW.

Despite the fact that they use the same basic technology (engines with generators), Plant 1 and Plant 2 have very different operating characteristics. The generating equipment of Plant 1 is over 18 years old, whereas the generating equipment of Plant 2 is newer and more technologically advanced. This makes Plant 2 more efficient and less expensive to operate. Also, a portion of the output of Plant 2 qualifies for federal production tax credits because the new generation capacity came online after the enactment of these incentive programs, while Plant 1 does not qualify because it was placed in service years earlier. These factors, along with others, combined to yield a calculation of net present value expected for each Plant 1 and Plant 2 that drove the ultimate determination of the contribution of value each made to Providence Newco.

INDEPENDENT SPECIAL COMMITTEE FORMED TO REVIEW THE OWNERSHIP INTERESTS IN PROVIDENCE NEWCO

As described above, an independent Special Committee was set up to advise the Managing Shareholder with respect to the allocation of ownership interests in Providence Newco among Trusts I, III, IV and the B Fund. This committee is represented by its own legal counsel and investment banking advisor to assist them in this process.

The members of the independent Special Committee are Jonathan Kaledin, Esq. and Joseph Ferrante, Jr., Esq. Exhibit C, attached at the end of this letter, contains short backgrounds on Messrs. Kaledin and Ferrante. These two individuals were asked to serve on the independent Special Committee both because they are experienced, knowledgeable attorneys, and because they served as independent trustees for the Ridgewood Renewable Power Trusts during the 1990s.

The Special Committee engaged the law firm of Lowenstein Sandler as their legal counsel to assist them in their duties. In addition, the Special Committee hired the investment bank Duff & Phelps as their financial advisor. Duff & Phelps (NYSE: DUF) is a provider of independent financial advisory and investment banking services, supporting client needs principally in the areas of valuation, fairness opinions, financial restructurings and mergers & acquisition advisory services. Duff & Phelps was engaged by and solely responsible to the Special Committee.

Prior to even initiating the process of forming Providence Newco, Ridgewood Renewable Power’s management generated its own internal valuation model for the respective interests of Providence Plant 1 and Providence Plant 2. Our model was based on the anticipated future cash flow to the respective Plants. On behalf of the independent Special Committee and as part of its due diligence investigations in connection with its fairness analysis performed on behalf of the Special Committee, Duff & Phelps reviewed Ridgewood’s model and made an extensive review of the projects themselves. Based on its review of the analysis and on discussions with its legal and financial advisors, the independent Special Committee made recommendations to us that we incorporated into our analysis. In addition, Ridgewood Renewable Power, as Managing Shareholder, also engaged its own independent financial advisor, Ewing Bemiss & Co., to provide an additional level of review in this valuation process. Ewing Bemiss, headquartered in Richmond, Virginia, is a boutique investment bank that is recognized as one of the leading advisory firms on renewable power project transactions.

The final determination of the ownership interests in Providence Newco was the result of a process of review and discussion between Ridgewood’s management, Ewing Bemiss, and the Special Committee, with consultation by the Special Committee’s legal and financial advisors.

When Ridgewood Renewable Power, the Special Committee (and the Special Committee’s legal and financial advisors), and Ewing Bemiss were all satisfied that the process had been thorough and the analysis was accurate and complete, Ridgewood Renewable Power made its final proposal to the Special Committee for the ownership interests each Trust would receive in Providence Newco. Ewing Bemiss concluded that the allocations of ownership interests to the Trusts were fair, within a range, from a financial perspective. In addition, Duff & Phelps provided an opinion to the Special Committee, as to the fairness, within a range, of the proposed allocations determined by Ridgewood’s management.

After doing months of preliminary work in conjunction with its legal and financial advisors, Lowenstein Sandler and Duff & Phelps, the independent Special Committee met on November 16 to formally conclude that proposed allocation of equity interests in Providence Newco, as shown in the table below (and in exhibit B), was advisable with respect to each of the Trusts.

| Trust | Ownership Interest in Providence Newco |

| Trust I | 6.8% |

| Trust III | 19.6% |

| Trust IV | 35.2% |

| Providence B Fund | 38.4% |

| Total | 100.0% |

The report of the Special Committee, the fairness opinion of Duff & Phelps addressed to the Special Committee, and the fairness opinion of Ewing Bemiss addressed to Ridgewood Renewable Power are based on independent, detailed evaluations of the projects and are filed with the SEC as part of our Form 8-K filed on November 20, 2008.

On the following day, November 17, Randy Holmes, CEO of Ridgewood Renewable Power, went to Providence and signed the agreements with the landfill, finally cementing the rights of Providence Newco, and allowing us to go forward with the further development of the Providence Project. As of November 17, 2008, there is now one entity owning the rights so there can be an efficient sale of this valuable development project.

PART III: THE SALE PROCESS FOR PROVIDENCE AND OLINDA

Ridgewood Renewable Power and our investment bank, Ewing Bemiss, believe that the new development projects owned by Olinda and Providence Newco have very substantial value. However, the development capital required for Providence is estimated to be about $93 million, and the development capital for Olinda is estimated to be about $77 million. (While this letter does not go into great detail on the Olinda Project, our quarterly distribution letters to Trust I shareholders have described the major efforts we have taken to prepare that site for a significant capacity expansion, as well.) Because none of the Trusts in question has sufficient capital to develop these projects, we believe that selling the projects, along with the development and gas rights, represents the best way to realize value for each of the Trust’s shareholders, even in this tough market.

In addition to being engaged by Ridgewood Renewable Power to review the fairness of the formation of Providence Newco and the sale of the Providence and Olinda Projects, Ewing Bemiss has been engaged to assist in the sale of other projects owned by Ridgewood Renewable Power Trusts. The sales processes for which Ewing Bemiss has been engaged include the sale of the large biomass plants in Maine owned by Power Trust IV and Power Trust V (for which there is a potential sale pending) and the sale of the hydroelectric project portfolios owned by the Trusts. While no definitive agreements for the sale of the hydroelectric projects have yet been signed, that process is also in an advanced stage. Ridgewood has been working with Ewing Bemiss on the potential sale of these assets since early 2007.

A. THE SALE PROCESS

As advisor to Ridgewood on the potential sale of the Olinda and Providence Projects, Ewing Bemiss anticipates that it will contact over 70 interested and qualified potential purchasers. Ewing Bemiss is only able to contact potential buyers who have demonstrated their ability to purchase assets of this size and who have entered into confidentiality agreements.

Ewing Bemiss and Ridgewood currently hope to receive indicative bids from potential purchasers in January 2009. We will then, with the assistance of Ewing Bemiss, evaluate these indicative bids and then select the top bidders from among them, which will then be invited to conduct detailed due diligence (which includes touring the existing facilities and being given access to the electronic data room set-up to facilitate the potential purchasers’ examination of the projects). The criteria for selecting bidders for the second round will include not only the indicative price for the projects, but also the general reputation of the bidder, their experience with these types of assets, their financial strength, their source of financing for the acquisition, and other relevant factors.

Ridgewood and Ewing Bemiss anticipate receiving final bids from prospective buyers during the second quarter of 2009. Once a finalist has been identified, Ridgewood Renewable Power will then enter into negotiations with the finalist towards a definitive purchase and sale agreement. The negotiation process could take 2 to 4 weeks, though possibly longer.

B. CONSENT SOLICITATION FROM RIDGEWOOD FUND SHAREHOLDERS FOR THE SALE

Once the final agreements have been negotiated, a consent solicitation form (similar to a proxy form) will be prepared by Ridgewood Renewable Power, in consultation with our outside attorneys. Because Power Trusts III and IV are “public reporting companies”, their consent solicitation documents must be filed with the SEC for its review before they can be sent to Trust III and IV shareholders. Because the SEC might make comments on the consent solicitation documents (requiring modification of the documents), this process could take 6 to 10 weeks, or even longer, to complete.

Once the SEC review of the consent solicitation documents has been completed, Ridgewood Renewable Power will mail consent solicitations to the shareholders of all four Trusts. In order for the sale to close, over 50% of the shareholdings of each of the four Trusts must approve the transaction.

There is no guarantee that, in this challenging market environment, we will attract bidders to buy these assets. Even after purchasing the development rights from the Ridgewood Trusts, developing these projects will require a large capital commitment of over $170 million, which may limit the number of willing and able buyers. However, because we believe that these two landfill methane power plants would be the second and third largest landfill methane gas power projects in the U.S. (if they existed today), and because they would have the most modern equipment and be highly efficient producers of renewable power from waste gas, we believe that the sale of these assets will attract considerable interest, even in this difficult market. However, there can be no assurance that we will be successful in attracting favorable bids.

PART IV: SUMMARY AND EXHIBITS

This letter is long and complex. We are commencing the sales process of the Providence Project and the Olinda Project. At each site, we plan to sell the existing power generating assets along with the very valuable development rights to construct new renewable power capacity. We anticipate that the sales process will take at least 6 months to effectuate, if we are successful in finding a buyer. This letter, and all subsequent letters on this matter, must be filed with the SEC because they are ultimately deemed part of the shareholder consent solicitation process. Attached to this letter, we include the following Exhibits:

| A. | An artist’s rendering of the proposed new power plants to be developed at the Providence and Olinda sites |

| B. | An organization chart showing the Before and After ownership structure of the Providence Project |

| C. | Biographical information on Special Committee members Jonathan Kaledin, Esq. and Joseph Ferrante, Esq. |

As I hope this letter has outlined, the staff of Ridgewood Renewable Power has worked very hard over the last several years to get these assets to the point where they are ready to be sold. Though, in this challenging market environment, there are never any assurances, we are hopeful that we will be able to achieve a positive result. As we pursue this sale process, we will continue to work hard maximize the value of these assets for our shareholders.

Except for historical information, Ridgewood Renewable Power has made statements in this letter that constitute forward-looking statements, as defined by the federal securities laws, including the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties. Forward-looking statements include statements made regarding events, financial trends, future operating results, financial position, cash flows and other general information concerning possible or assumed future results of operations of the Ridgewood Electric Power Trusts. You are cautioned that such statements are only predictions, forecasts or estimates of what may occur and are not guarantees of future performance or of the occurrence of events or other factors used to make such predictions, forecasts or estimates. Actual results may differ materially from those results expressed, implied or inferred from these forward-looking statements and may be worse. Finally, such statements reflect the Trusts’ current views. The Trusts and Ridgewood Renewable Power undertake no obligation to publicly release the results of any revisions to the forward-looking statements made herein to reflect events or circumstances that occur after today or to reflect the occurrence of unanticipated events.

Additional Information and Where to Find It This communication may be deemed solicitation material in respect of the sale of assets of the Trusts’ landfill operations. Since the sale of these operations, owned in part by Ridgewood Electric Power Trust III and Ridgewood Electric Power Trust IV, may require the approval of the shareholders of these Trusts, Trust III and Trust IV may be required to file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement to be used by Trust III and Trust IV to solicit the approval of its shareholders for such a transaction. You are urged to read any proxy statement you receive regarding the transaction, if and when it becomes available, and any other relevant documents as may be filed by Trust III and Trust IV with the SEC because they will contain important information. You can obtain free copies of any such materials (including any proxy statement) filed by the Trusts with the SEC, as well as other filings containing information about the Trusts at the SEC’s Internet Site (http://www.sec.gov). The Trusts will also provide copies of any such proxy statement and other information filed with the SEC to any shareholder, at the actual cost of reproduction, upon written request to Dan Gulino, General Counsel, or via telephone at (201) 447-9000. Participants in Solicitation The Trusts and their executive officers and directors may be deemed, under SEC rules, to be participants in the solicitation of proxies or consents from the Trusts’ shareholders with respect to the sale of assets of the Trusts’ landfill operations. Information regarding the officers and directors of the Trusts, including direct or indirect interests in the transaction, by securities holdings or otherwise, will be set forth in a definitive proxy statement that will be filed with the SEC in the event such a transaction requiring shareholder approval were to occur. |

Jonathan C. Kaledin, Esq.

Jonathan C. Kaledin is the Director of The Nature Conservancy’s Blue Water Certification Program—a joint effort of the Conservancy’s legal, international government affairs, and global freshwater departments. From 2003-2004, Mr. Kaledin served as General Counsel of the Commonwealth of Massachusetts’s Executive Office of Environmental Affairs, and from 1995 to June 2008, he served as the New York State Counsel for the Conservancy. Mr. Kaledin has practiced law in both the private and public sectors, including with the law firm of Goulston & Storrs and with the U.S. Environmental Protection Agency. He also served as Director of the National Water Education & Funding Councils from 1991 to 1995, an advocacy and public policy project aimed at publicizing clean water infrastructure funding needs in the U.S. and advocating for increased federal funding of Clean Water Act and Safe Drinking Water Act projects.

Mr. Kaledin’s articles on environmental issues, as well as articles on his own work, have appeared in the Los Angeles Times, Boston Globe, Wall Street Journal, The American Prospect, Public Citizen, and elsewhere. He speaks internationally on environmental and water issues, most recently at the annual Stockholm World Water Week (August 2008) and the biennial World Water Congress (Vienna—September 2008).

Joseph Ferrante, Jr. Esq.

Mr. Ferrante is admitted to the New Jersey Bar and is a member of the New Jersey and American Bar Associations. In addition, he is a member of the State of New Jersey Advisory Council on Solid Waste Management and is Vice President of the Board of Trustees of the New Jersey Recycling Forum, Inc.

Mr. Ferrante received his Juris Doctorate from George Washington University National Law Center, his Masters Degree from New York University, and his Bachelor of Arts degree from Johns Hopkins University.