Exhibit 99.2

Polaris Industries Inc. 4th Quarter & Full-Year 2009 Earnings Results January 28, 2010

Other Placeholder: 1 Safe Harbor Except for historical information contained herein, the matters set forth in this document, including but not limited to management’s expectations regarding 2010 sales, shipments, net income and cash flow, are forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those forward-looking statements. Potential risks and uncertainties include such factors as product offerings, promotional activities and pricing strategies by competitors; warranty expenses; foreign currency exchange rate fluctuations; effects of the KTM relationship; environmental and product safety regulatory activity; effects of weather; commodity costs; uninsured product liability claims; uncertainty in the retail and wholesale credit markets; and overall economic conditions, including inflation, consumer confidence and spending and relationships with dealers and suppliers. Investors are also directed to consider other risks and uncertainties discussed in our 2008 annual report and Form 10-K filed by the Company with the Securities and Exchange Commission.The data source for retail sales figures included in this presentation is registration information provided by Polaris dealers in North America and compiled by the Company or Company estimates. The Company must rely on information that its dealers supply concerning retail sales, and other retail sales data sources and this information is subject to revision.

Polaris Industries Inc. 4th Quarter & Full-Year 2009 Earnings Results Scott Wine CEO

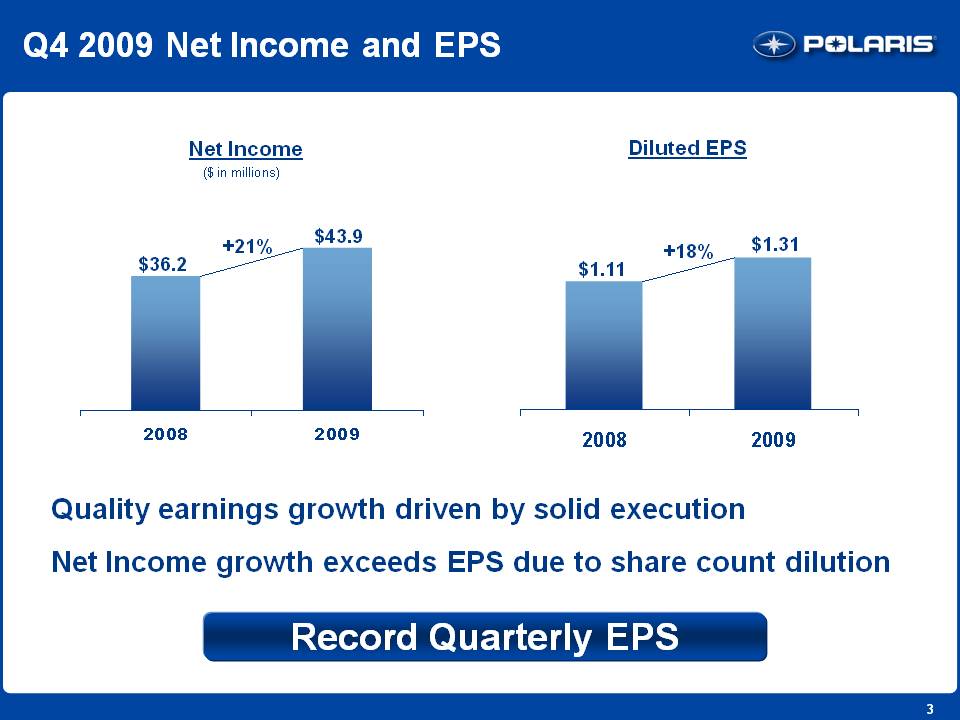

Q4 2009 Net Income and EPS Diluted EPS $1.11 $1.31 +18% Net Income ($ in millions) $36.2 $43.9 +21% 2008 2009 Quality earnings growth driven by solid execution Net Income growth exceeds EPS due to share count dilution Record Quarterly EPS

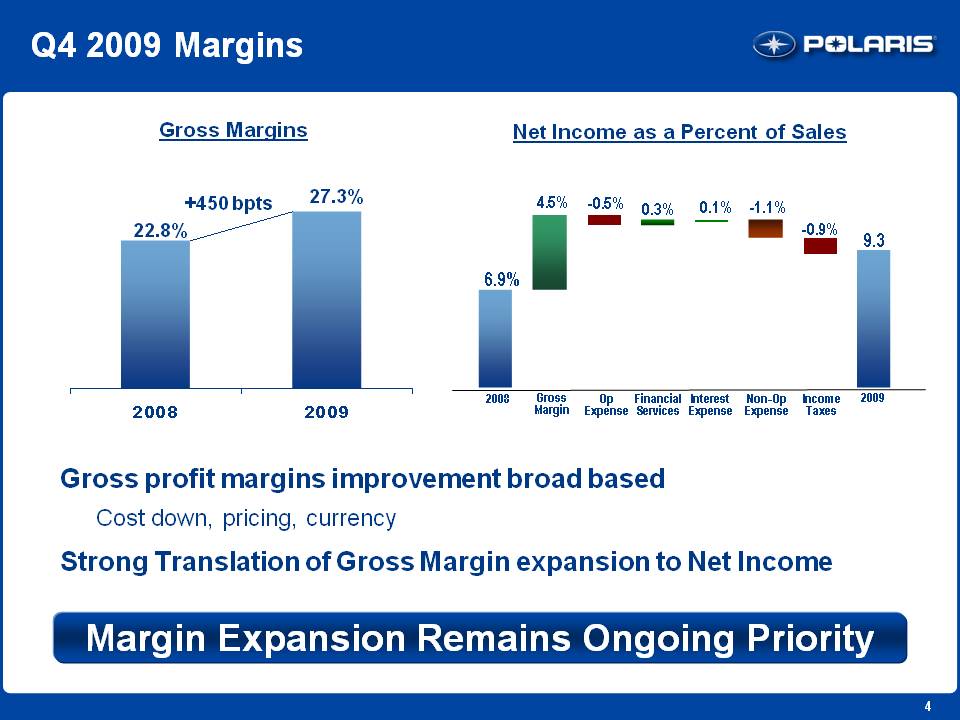

22.8% 27.3% +450 bpts 2009 2008 Q4 2009 Margins Gross profit margins improvement broad based Cost down, pricing, currency Strong Translation of Gross Margin expansion to Net Income Net Income as a Percent of Sales Gross Margins Gross Margin Op Expense FinancialServices Interest Expense Non-Op Expense Income Taxes 6.9% 9.3 2008 2009 Margin Expansion Remains Ongoing Priority 4.5% -0.5% 0.3% 0.1% -1.1% -0.9%

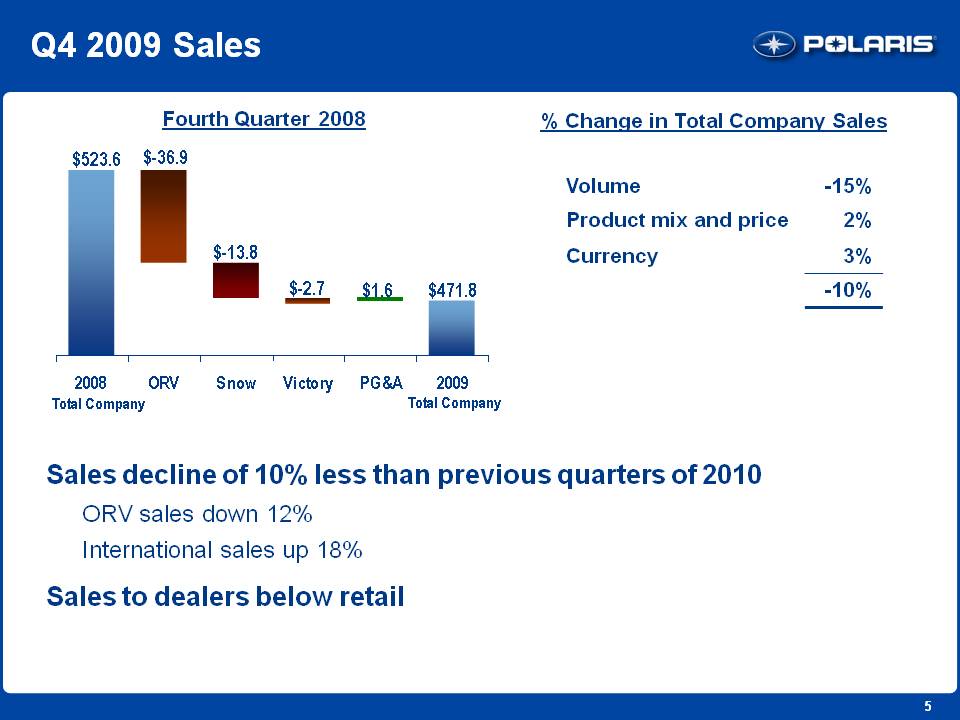

Q4 2009 Sales Fourth Quarter 2008 $523.6 $-36.9 $-13.8 $-2.7 $1.6 $471.8 Total Company Total Company % Change in Total Company Sales Sales decline of 10% less than previous quarters of 2010ORV sales down 12% International sales up 18% Sales to dealers below retail -15% 2% 3% Q3-08 Q4-08 Q1-09 Q2-09 Q3-09 Q4-09 Q3-09 Q4-09

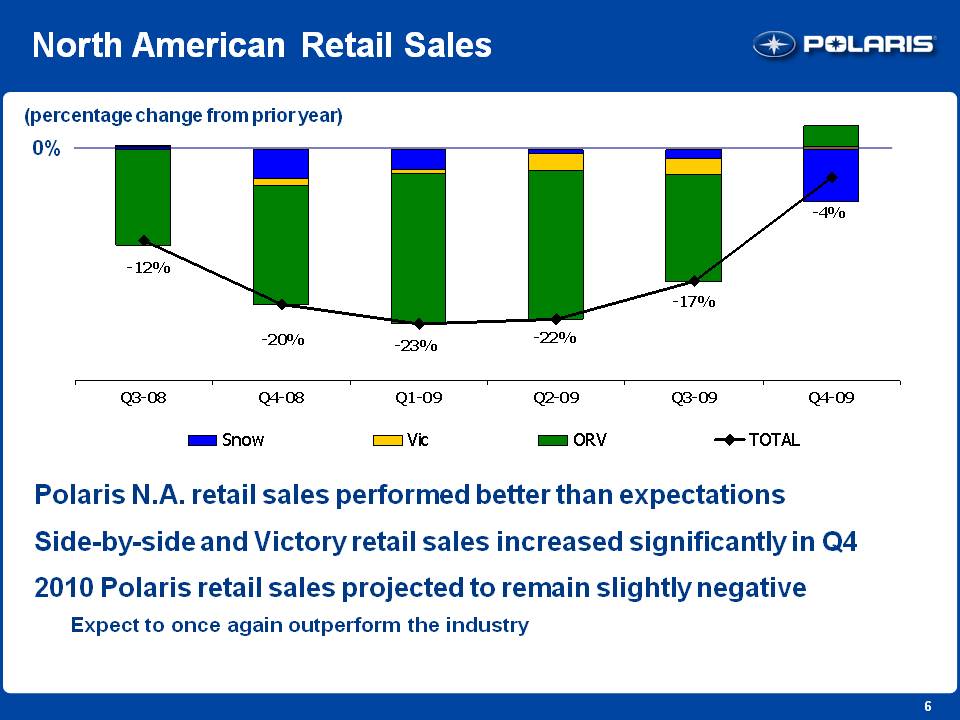

North American Retail Sales Polaris N.A. retail sales performed better than expectations Side-by-side and Victory retail sales increased significantly in Q4 2010 Polaris retail sales projected to remain slightly negative Expect to once again outperform the industry 0% (percentage change from prior year) -12% -20% -23% -22% -17% -4% Snow Vic ORV TOTAL

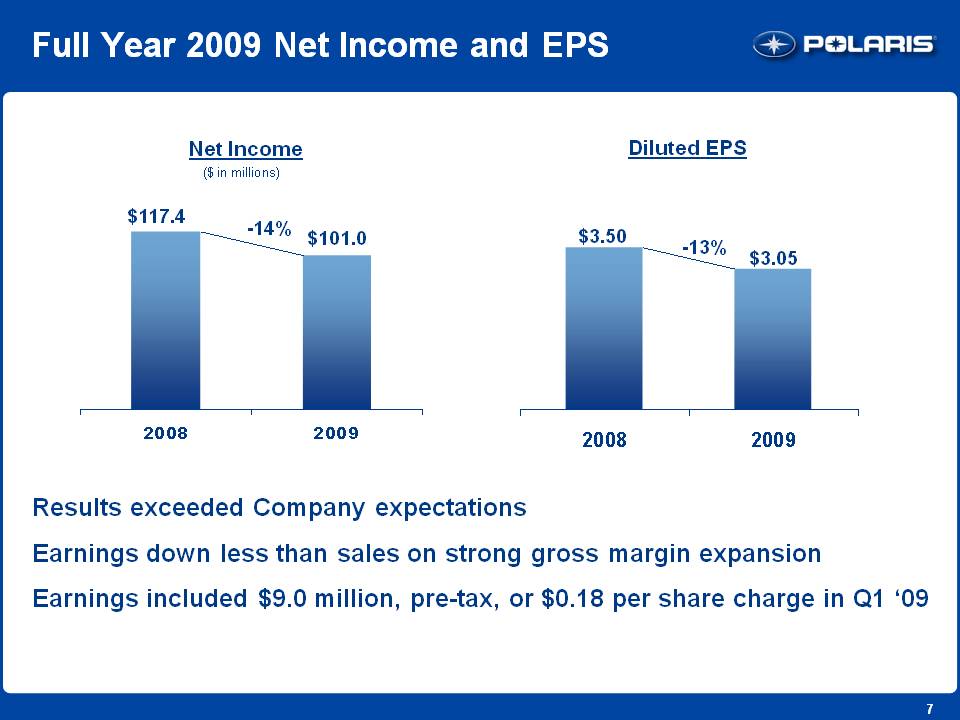

Full Year 2009 Net Income and EPS Diluted EPS $3.50 $3.05 -13% Net Income ($ in millions) $117.4 $101.0 -14% 2008 2009 Results exceeded Company expectations Earnings down less than sales on strong gross margin expansion Earnings included $9.0 million, pre-tax, or $0.18 per share charge in Q1 ‘09

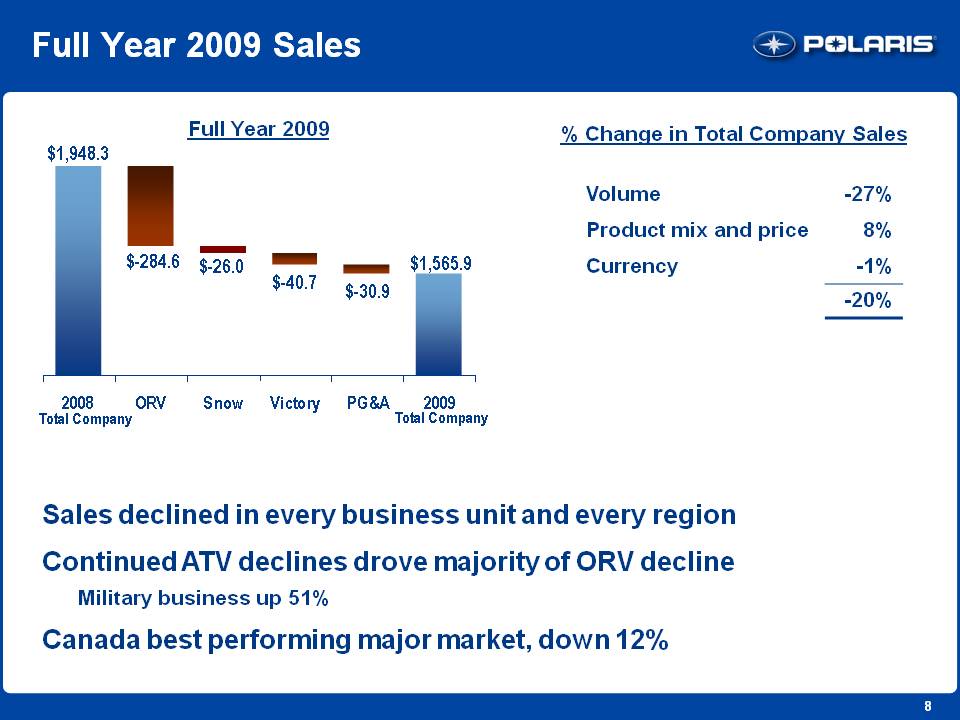

Full Year 2009 Sales Full Year 2009 $1,948.3 $-284.6 $-26.0 $-40.7 $-30.9 $1,565.9 2008 Total Company 2009 Total Company % Change in Total Company Sales Sales declined in every business unit and every regionContinued ATV declines drove majority of ORV declineMilitary business up 51% Canada best performing major market, down 12% -27% 8% -1% -20%

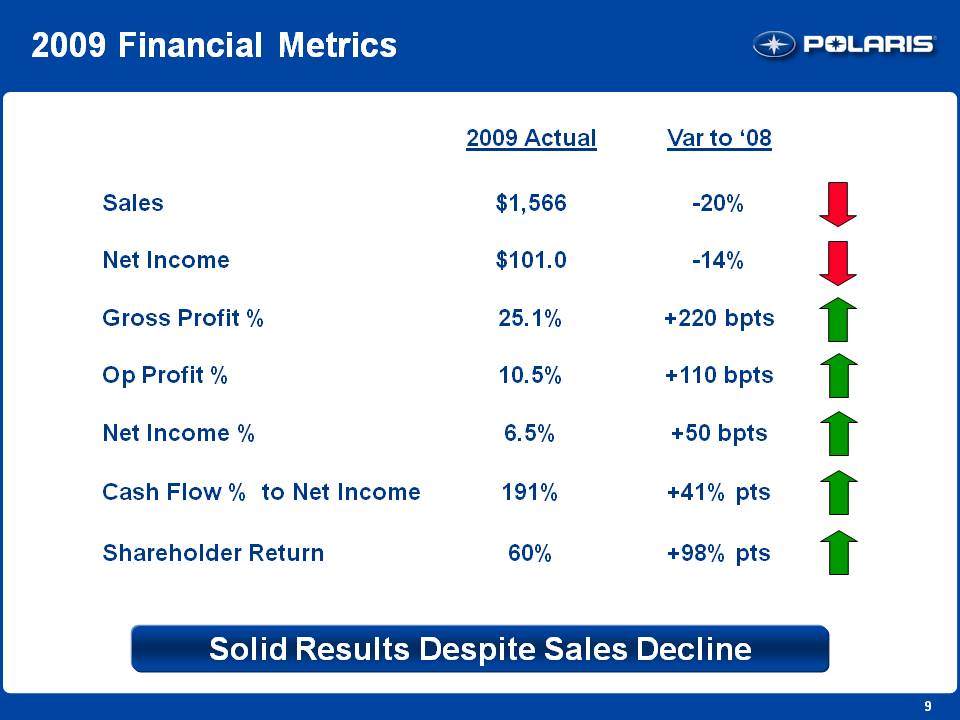

2009 Financial Metrics Solid Results Despite Sales Decline 2009 Actual Var to ‘08 Sales $1,566 -20% Net Income $101.0 -14% Gross Profit % 25.1% +220 bpts Op Profit % 10.5% +110 bpts Net Income % 6.5% +50 bpts Cash Flow % to Net Income 191% +41% pts Shareholder Return 60% +98% pts

2009 Investments Created ORV Structure ATVs and Side-by-sides combined Created On-Road DivisionVictory investmentsLaunched LEV businessAdded VP Global New Market DevelopmentGMs in EMEA and ChinaVP of Business DevelopmentStrengthened Balance Sheet Adjacency investments on-track and growingMilitary and BobcatInnovation Leadership Confirmed 34 New Products Introduced Polaris 2009: Delivered Results AND Invested in our Future

Polaris Industries Inc. 4th Quarter & Full-Year 2009 Earnings Results Bennett Morgan President & COO

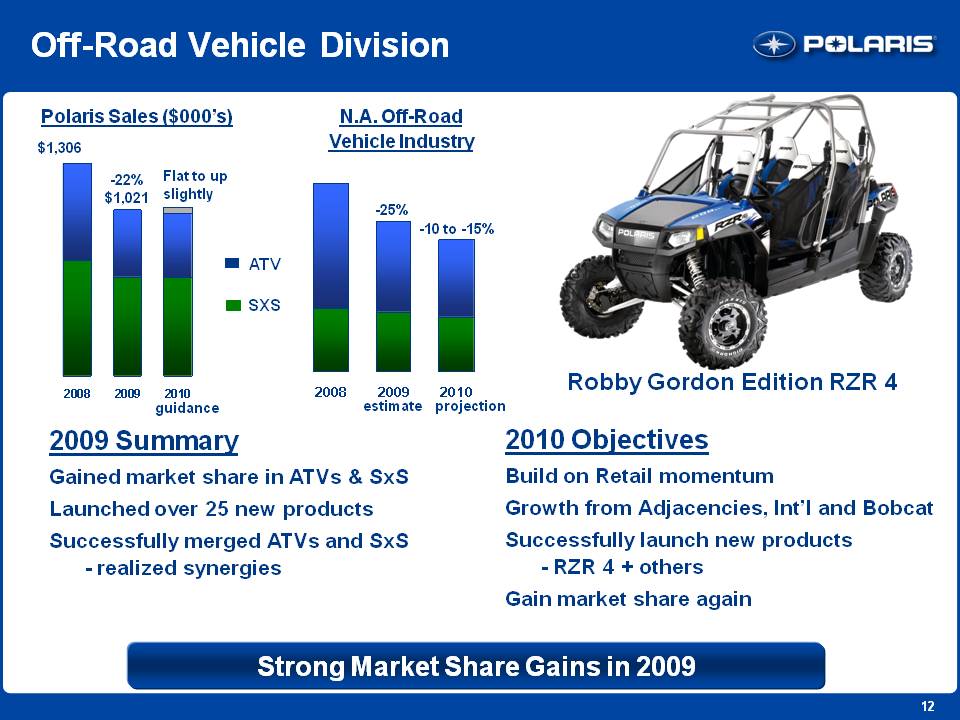

Off-Road Vehicle Division Polaris Sales ($000’s) N.A. Off-Road Vehicle Industry $1,306 -22% $1,021 Flat to up slightly -25% -10 to -15% 2010 projection 2009 estimate 2010 guidance 2008 2009 SXS ATV Robby Gordon Edition RZR 4 2009 SummaryGained market share in ATVs & SxSLaunched over 25 new productsSuccessfully merged ATVs and SxS- realized synergies 2010 ObjectivesBuild on Retail momentumGrowth from Adjacencies, Int’l and BobcatSuccessfully launch new products- RZR 4 + othersGain market share again Strong Market Share Gains in 2009

Adjacencies – Military / Bobcat Polaris Military Sales ($000’s) Military Strong growth continued Expanded Margins Expanded customer base Expand product line in 2010 +51% Up 20% to 30% guidance +42% ATV deployed in Afghanistan Bobcat Strategic Alliance On track to source Bobcat utility Vehicles in 2H 2010 Co-developed product planned for the future (Gp:) + Expected Sales Trends from Bobcat Alliance 2010 2011 2012 expectations Significant Growth Opportunity

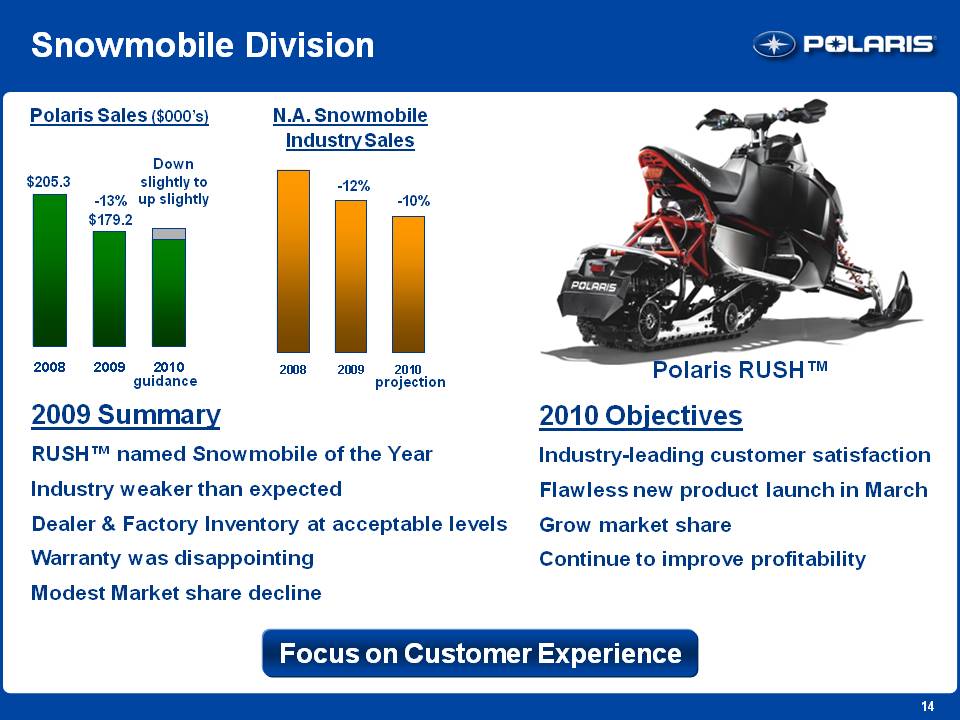

Snowmobile Division Polaris Sales ($000’s) $205.3 -13% $179.2 Down slightly to up slightly -10% 2008 2009 2010 projection Polaris RUSH™ 2010 guidance N.A. Snowmobile Industry Sales 2009 Summary RUSH™ named Snowmobile of the Year Industry weaker than expected Dealer & Factory Inventory at acceptable levels Warranty was disappointing Modest Market share decline 2010 Objectives Industry-leading customer satisfaction Flawless new product launch in March Grow market share Continue to improve profitability -12% Focus on Customer Experience

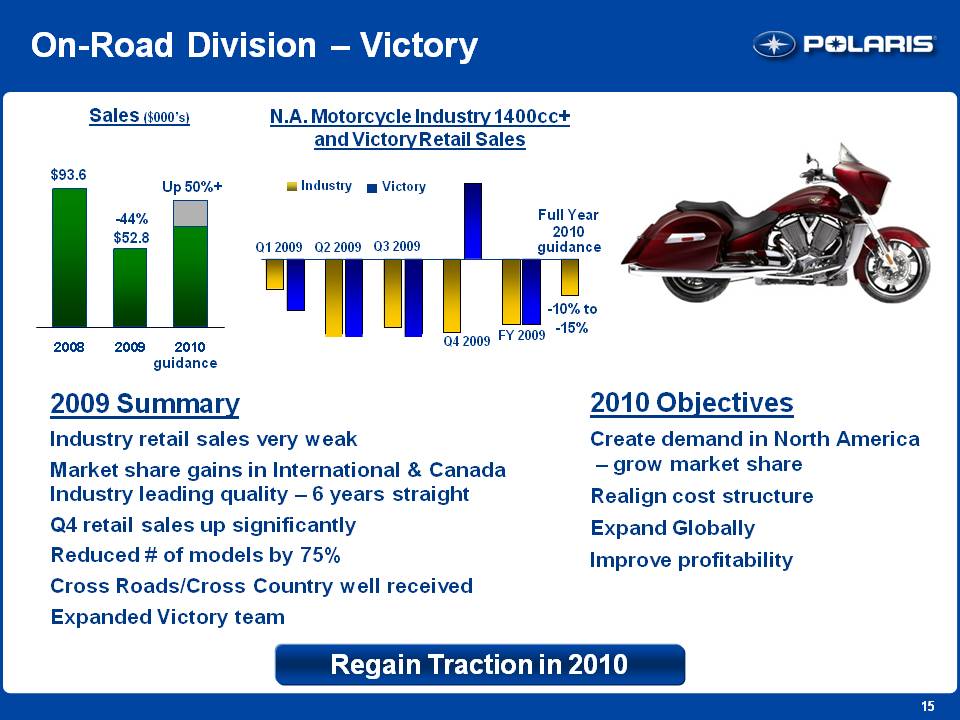

On-Road Division – Victory Sales ($000’s) $93.6 -44% $52.8 Up 50%+ 2010 guidance 2009 2008 2009 2009 Summary Industry retail sales very weak Market share gains in International & Canada Industry leading quality – 6 years straight Q4 retail sales up significantly Reduced # of models by 75%Cross Roads/Cross Country well received Expanded Victory team 2010 Objectives Create demand in North America – grow market share Realign cost structure Expand Globally Improve profitability -10% to -15% Q1 2009 Q2 2009 Q3 2009 Q4 2009 Full Year 2010 2010 guidance Industry Victory N.A. Motorcycle Industry 1400cc+ and Victory Retail Sales Regain Traction in 2010 FY 2009

On-Road Division – LEV N.A. LEV Industry Up mid single digits -23% 2010 projection 2009 estimate 2008 2009 Summary Launched 1st electric low emission vehicle Breeze™ well received Signed 10 dealers to date Learning the business 2010 Objectives Continue aggressive expansion Expand product line Grow profitability Electric Vehicles Category Offers Incremental Growth

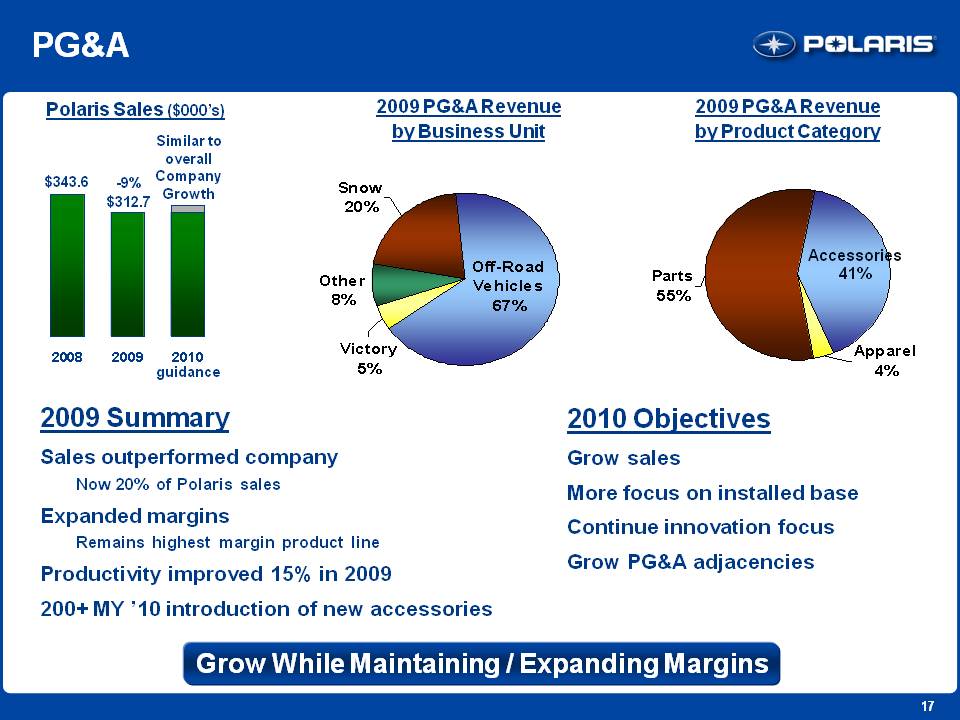

PG&A Polaris Sales ($000’s) $343.6 -9% $312.7 Similar to overall Company Growth 2010 guidance 2009 PG&A Revenue by Business Unit 2009 PG&A Revenue by Product Category Accessories 41% 2009 Summary Sales outperformed company Now 20% of Polaris sales Expanded margins Remains highest margin product line Productivity improved 15% in 2009 200+ MY ’10 introduction of new accessories 2010 Objectives Grow sales More focus on installed base Continue innovation focus Grow PG&A adjacencies Grow While Maintaining / Expanding Margins Snow 20% Other 8% Victory 5% Off-Road Vehicles 67% Parts 55% Accessories 41% Apparel 4%

International Division Polaris Sales ($000’s) $304.2 -17% $252.4 Up 10% to 15% Growth 2010 guidance 2009 2008 2009 Revenue by Geography 2009 Revenue by Business Unit 2009 Summary Gained share in ORV in EMEA Sales up 18% in Q4 2009 – currencies helpful Added GM in ChinaInitiated plan to enter Brazilian market 2010 ObjectivesGrow sales Further Strengthen Core EMEA business Develop new markets – China, Brazil Expand Victory Global distribution Goal: >25% of Total Company Sales in 3-5 Years Aus/NZ 12% Asia 1% Latin America 7% ME / Africa 8% Europe 72% Snow 30.7 12% Off-Road Vehicles 164.1 65% Victory 10.9 4% PG&A 46.8 19% Total 252.5 100%

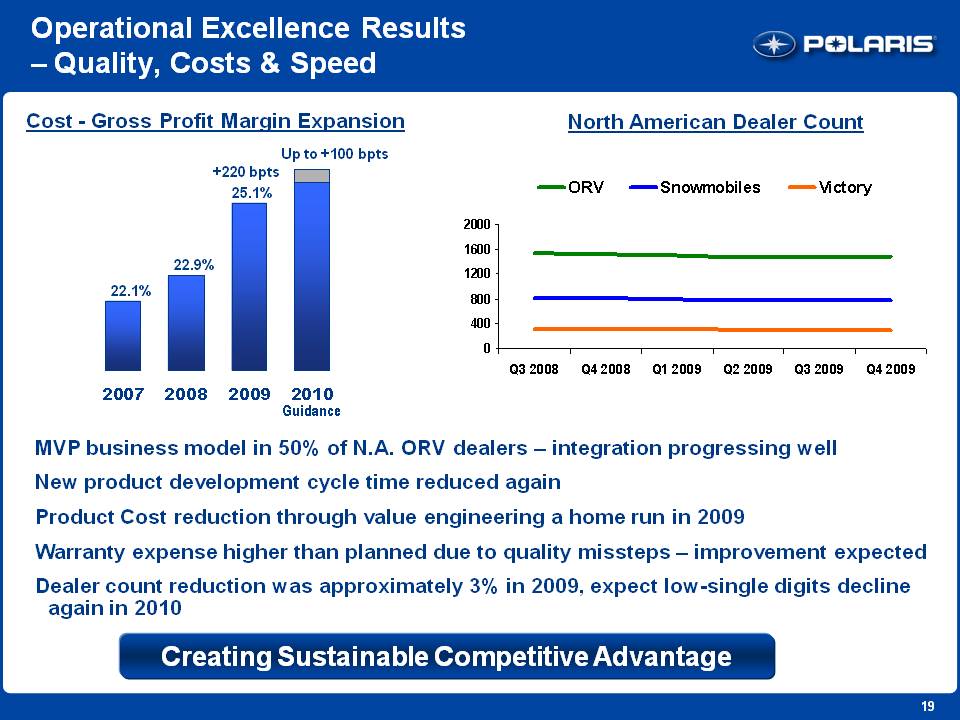

Operational Excellence Results – Quality, Costs & Speed Cost - Gross Profit Margin Expansion Up to +100 bpts Guidance 22.1% 22.9% 25.1% MVP business model in 50% of N.A. ORV dealers – integration progressing well New product development cycle time reduced again Product Cost reduction through value engineering a home run in 2009 Warranty expense higher than planned due to quality missteps – improvement expected Dealer count reduction was approximately 3% in 2009, expect low-single digits decline again in 2010 Creating Sustainable Competitive Advantage +220 bpts North American Dealer Count snowmobiles victory Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 2000 1600 1200 800 400 0

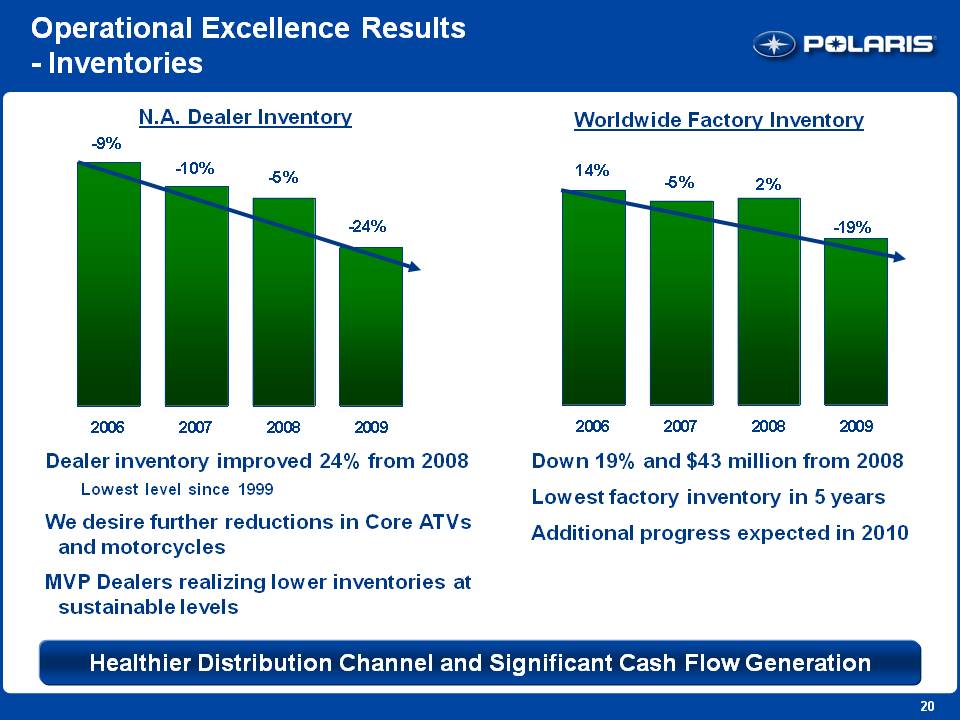

Operational Excellence Results - Inventories Dealer inventory improved 24% from 2008 Lowest level since 1999 We desire further reductions in Core ATVs and motorcycles MVP Dealers realizing lower inventories at sustainable levels Down 19% and $43 million from 2008 Lowest factory inventory in 5 years Additional progress expected in 2010 N.A. Dealer Inventory Worldwide Factory Inventory Healthier Distribution Channel and Significant Cash Flow Generation 2006 2007 2008 2009 -9% -10% -5% -24% -14% -5% 2% -19%

Polaris Industries Inc. 4th Quarter & Full-Year 2009 Earnings Results Mike Malone V.P. Finance and CFO

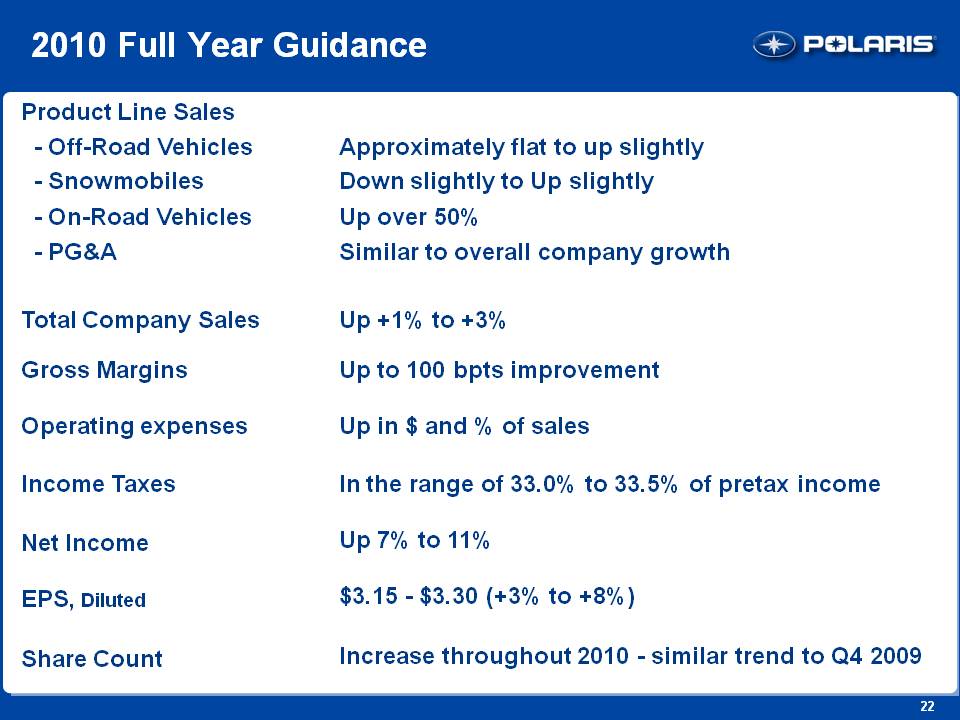

2010 Full Year Guidance Product Line Sales - Off-Road Vehicles Approximately flat to up slightly - Snowmobiles Down slightly to Up slightly - On-Road Vehicles Up over 50% - PG&A Similar to overall company growth Total Company Sales Up +1% to +3% Gross Margins Up to 100 bpts improvement Operating expenses Up in $ and % of sales Income Taxes In the range of 33.0% to 33.5% of pretax income Net Income Up 7% to 11% EPS, Diluted $3.15 - $3.30 (+3% to +8%) Share Count Increase throughout 2010 - similar trend to Q4 2009

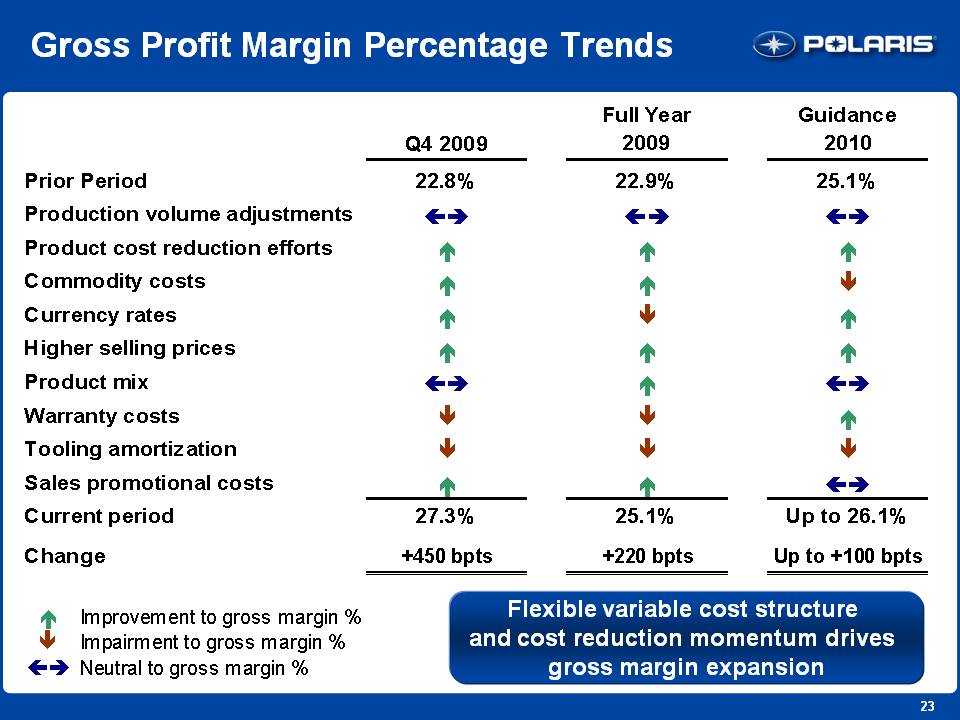

Gross Profit Margin Percentage Trends Flexible variable cost structure and cost reduction momentum drives gross margin expansion Q4 2009 "Full Year 2009" "Guidance 2010" Prior Period 22.8% 22.9% 25.1% Production volume adjustments Product cost reduction efforts Commodity costs Currency rates Higher selling prices Product mix Warranty costs Tooling amortization Sales promotional costs Current period 27.3% 25.1% Up to 26.1% Change +450 bpts +220 bpts Up to +100 bpts Improvement to gross margin % Impairment to gross margin % Neutral to gross margin %

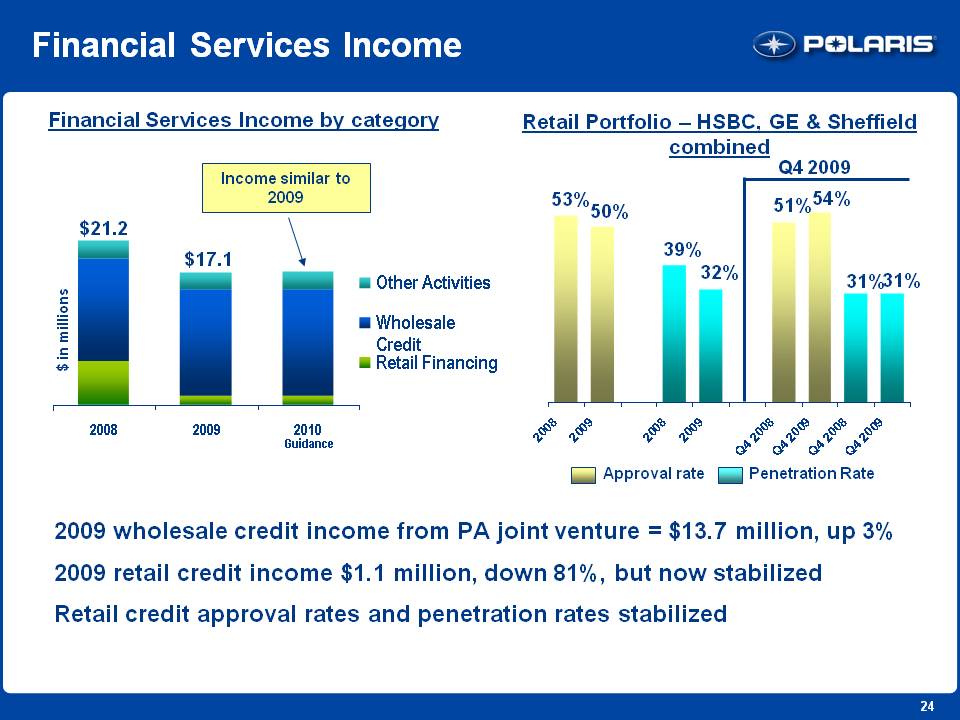

Financial Services Income 2009 wholesale credit income from PA joint venture = $13.7 million, up 3% 2009 retail credit income $1.1 million, down 81%, but now stabilized Retail credit approval rates and penetration rates stabilized Financial Services Income by category Retail Portfolio – HSBC, GE & Sheffield combined Penetration Rate Approval rate 53% Q4 2009 50% 32% 39% 51% 31% $17.1 $21.2 $ in millions Income similar to 2009 2010 Guidance 54% 31% Q4 2008 Q4 2009

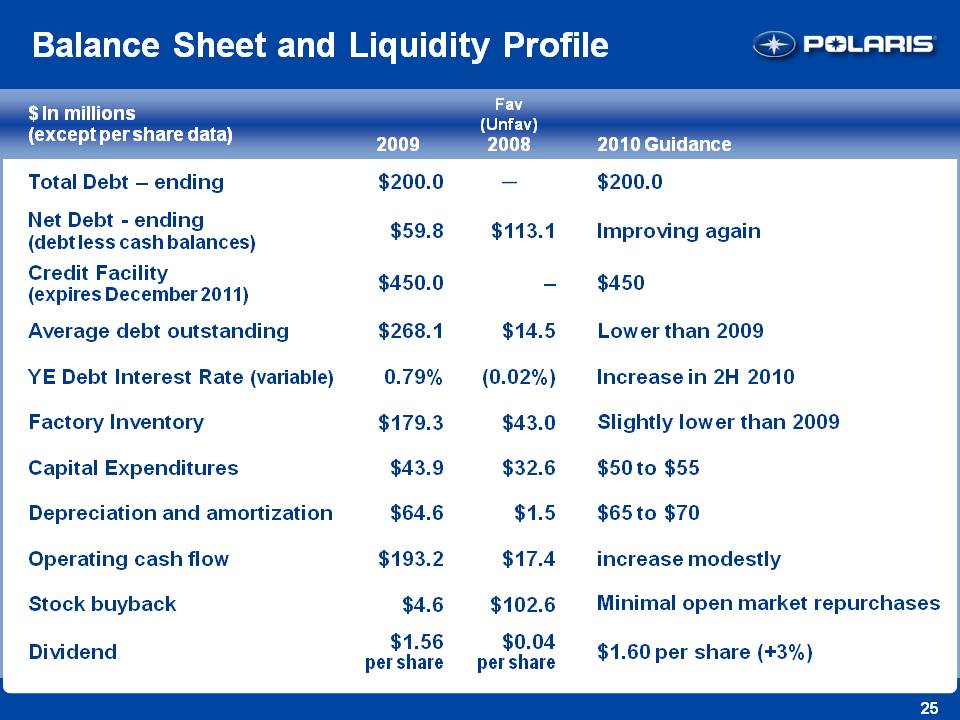

Balance Sheet and Liquidity Profile $ In millions (except per share data) 2009 Fav (Unfav) 2008 2010 Guidance Total Debt – ending $200.0 ─ $200.0 Net Debt - ending (debt less cash balances) $59.8 $113.1 Improving again Credit Facility (expires December 2011) $450.0 – $450 Average debt outstanding $268.1 $14.5 Lower than 2009 YE Debt Interest Rate (variable) 0.79% (0.02%) Increase in 2H 2010 Factory Inventory $179.3 $43.0 Slightly lower than 2009 Capital Expenditures $43.9 $32.6 $50 to $55 Depreciation and amortization $64.6 $1.5 $65 to $70 Operating cash flow $193.2 $17.4 increase modestly Stock buyback $4.6 $102.6 Minimal open market repurchases Dividend $1.56 per share $0.04 per share $1.60 per share (+3%)

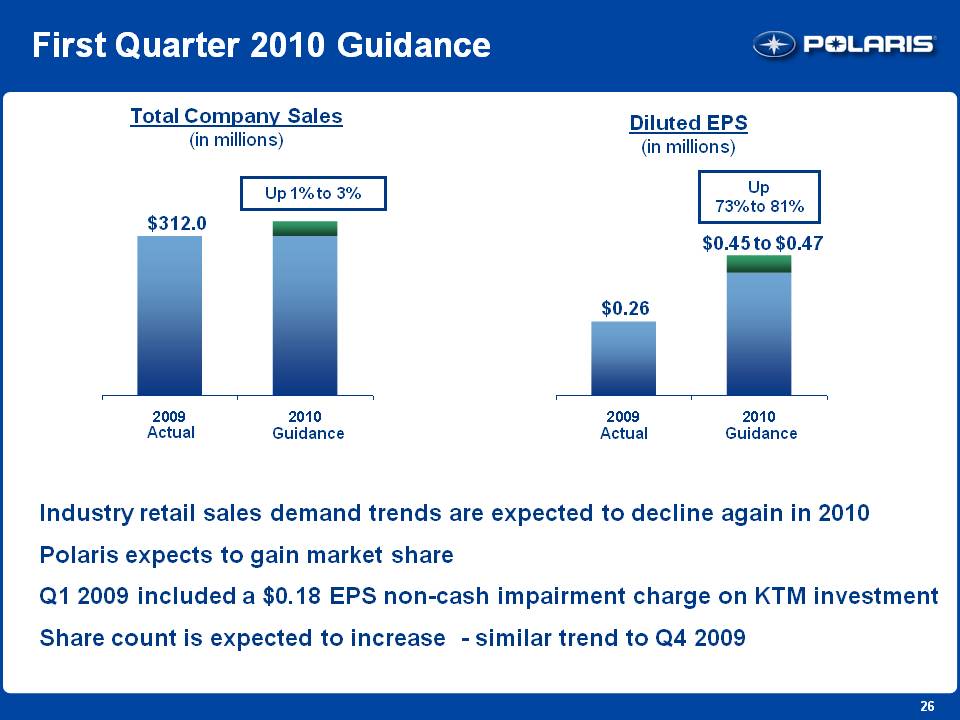

First Quarter 2010 Guidance Industry retail sales demand trends are expected to decline again in 2010 Polaris expects to gain market share Q1 2009 included a $0.18 EPS non-cash impairment charge on KTM investment Share count is expected to increase - similar trend to Q4 2009 Total Company Sales (in millions) Diluted EPS (in millions) $312.0 Up 1% to 3% Actual Guidance $0.26 $0.45 to $0.47 Up 73% to 81% 2009 Actual 2010 Guidance

Polaris Industries Inc.4th Quarter & Full-Year 2009 Earnings Results Scott WineCEO

What to Expect in 2010 Conservative outlook for powersports industry Double digit declines in NA & EMEA, better in BRIC Increased focus on growth International expansion gains traction Military, Bobcat, LEV drive adjacency growth Acquisition activity will increase Victory progress accelerates Margin expansion continues Operational Excellence becomes standard Consistent Strategy; Expect Return to Growth

Polaris Industries Inc.Thank you. Q & A