UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2009 |

| or |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

LIN TV Corp.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-31311

LIN Television Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 000-25206

| Delaware | Delaware |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) |

| 05-0501252 | 13-3581627 |

| (I.R.S. Employer Identification No.) | (I.R.S. Employer Identification No.) |

One West Exchange Street, Suite 5A, Providence, Rhode Island 02903

(Address of principal executive offices)

(401) 454-2880

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer þ | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates (based on the last reported sale price of the registrant’s class A common stock on June 30, 2009 on the New York Stock Exchange) was approximately $86 million.

DOCUMENTS INCORPORATED BY REFERENCE

| Document Description | Form 10-K |

| Portions of the Registrant’s Proxy Statement on Schedule 14A for the Annual Meeting of Stockholders to be held on May 11, 2010 | Part III |

NOTE:

This combined Form 10-K is separately filed by LIN TV Corp. and LIN Television Corporation. LIN Television Corporation meets the conditions set forth in general instruction I(1) (a) and (b) of Form 10-K and is, therefore, filing this form with the reduced disclosure format permitted by such instruction.

LIN TV Corp. Class A common stock, $0.01 par value, issued and outstanding at March 3, 2010: 29,407,317 shares.

LIN TV Corp. Class B common stock, $0.01 par value, issued and outstanding at March 3, 2010: 23,502,059 shares.

LIN TV Corp. Class C common stock, $0.01 par value, issued and outstanding at March 3, 2010: 2 shares.

LIN Television Corporation common stock, $0.01 par value, issued and outstanding at March 3, 2010: 1,000 shares.

| EXHIBITS | |

| 10.14 | Summary of Director Compensation Policies |

| 10.30 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Vincent L. Sadusky |

| 10.31 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Scott M. Blumenthal |

| 10.32 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Denise M. Parent |

| 10.33 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Richard J. Schmaeling |

| 10.34 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Robert Richter |

| 10.35 | Second Amendment to Employment Agreement dated February 28, 2010 between LIN TV Corp., LIN Television Corporation and Nicholas N. Mohamed |

| |

| |

| |

| |

| |

| |

| |

| |

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements with respect to our financial condition, results of operations and business, including statements under the captions Item 1. Business and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. All of these forward-looking statements are based on estimates and assumptions made by our management, which, although we believe them to be reasonable, are inherently uncertain. Therefore, you should not place undue reliance upon such forward-looking statements. We cannot assure you that any of such statements will be realized and it is likely that actual results may differ materially from those contemplated by such forward-looking statements. Factors that may cause such differences include those discussed under the caption Item 1A. Risk Factors, as well as the following:

| · | volatility and disruption of the capital and credit markets and further adverse changes in the national and local economies in which our stations operate; |

| · | volatility and periodic changes in our advertising revenues; |

| · | restrictions on our operations due to, and the effect of, our significant indebtedness; |

| · | our ability to continue to comply with financial debt covenants dependent on cash flows; |

| · | our guarantee of the General Electric Capital Corporation (“GECC”) note; |

| · | effects of complying with accounting standards, including with respect to the treatment of our intangible assets; |

| · | increases in our cost of borrowings or inability or unavailability of additional debt or equity capital; |

| · | increased competition, including from newer forms of entertainment and entertainment media, or changes in the popularity or availability of programming; |

| · | increased costs, including increased news and syndicated programming costs and increased capital expenditures as a result of acquisitions or necessary technological enhancements; |

| · | effects of our control relationships, including the control that HM Capital Partners LLC (“HMC”) and its affiliates have with respect to corporate transactions and activities we undertake; |

| · | adverse state or federal legislation or regulation or adverse determinations by regulators, including adverse changes in, or interpretations of, the exceptions to the FCC duopoly rule and the allocation of broadcast spectrum; |

| · | declines in the domestic advertising market; |

| · | further consolidation of national and local advertisers; |

| · | global or local events that could disrupt television broadcasting; |

| · | risks associated with acquisitions including integration of acquired businesses; |

| · | changes in television viewing patterns, ratings and commercial viewing measurement; |

| · | changes in our television network affiliation agreements; |

| · | changes in our retransmission consent agreements; |

| · | seasonality of the broadcast business due primarily to political advertising revenues in even years; and |

| · | impact of union activity, including possible strikes or work stoppages or our inability to negotiate favorable terms for contract renewals. |

Many of these factors are beyond our control. Forward-looking statements contained herein speak only as of the date hereof. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements, to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Overview

LIN TV Corp. is a local television and digital media company, owning and/or operating 28 television stations and interactive television station and niche web sites in 17 U.S. markets. Our highly-rated stations deliver superior local news and community stories, along with top-rated sports and entertainment programming, to 8% of U.S. television homes, reaching an average of 9.7 million households per week. All of our television stations are affiliated with a national broadcast network. We are a leader in the convergence of local broadcast television and the Internet through our television station web sites and a growing number of local interactive initiatives and Internet-based products and services. Our stations are primarily located in the top 75 Designated Market Areas (“DMA”) as measured by Nielsen Media Research (“Nielsen”). In this report, the terms “Company,” “LIN TV”, “we”, “us” or “our” mean LIN TV Corp. and all subsidiaries included in our consolidated financial statements. Our class A common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “TVL”.

We provide free, over-the-air broadcasts of our programming 24 hours per day to the communities we are licensed to serve. We are committed to serving the public interest by providing free daily local news coverage, making public service announcements and providing advertising time to political candidates.

We seek to have the largest local media presence in each of our local markets by combining strong network and syndicated programming with leading local news, and by pursuing our multi-channel strategy. This multi-channel strategy enables us to increase our audience share by operating multiple stations on multiple platforms in the same market. We currently deliver content over the air, on-line and on mobile applications. We also operate multiple stations in nine of our markets.

Development of Our Business

Ownership and organizational structure

Our Company (including its predecessors) has owned and operated television stations since 1966 and was incorporated on February 11, 1998. A group of investors led by the predecessor of HMC acquired LIN Television Corporation, our wholly-owned subsidiary, on March 3, 1998 and was incorporated on June 18, 1990. On May 3, 2002, we completed our initial public offering and our class A common stock began trading on the NYSE. Our corporate offices are at One West Exchange Street, Suite 5A, Providence, Rhode Island 02903.

We have three classes of common stock. The class A common stock and the class C common stock are both voting common stock, with the class C common stock having 70% of the aggregate voting power. The class B common stock is held by affiliates of HMC and has no voting rights, except that without the consent of a majority of the class B common stock, we cannot enter into a wide range of corporate transactions.

This capital structure allowed us to issue voting stock while preserving the pre-existing ownership structure in which the class B stockholders did not have an attributable ownership interest in our television broadcast licenses pursuant to the rules of the Federal Communications Commission (“FCC”).

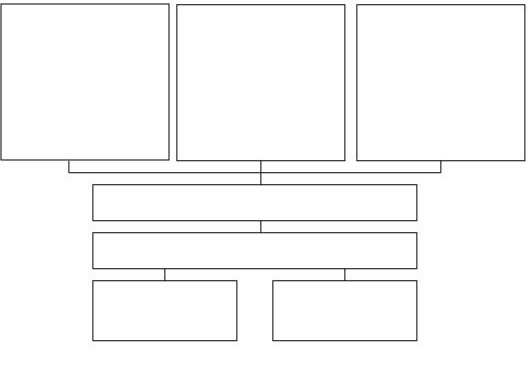

The following diagram summarizes our corporate structure as of March 3, 2010:

Class A Common

Stock

29,407,317 shares outstanding

listed on the NYSE under the

symbol “TVL”

30% voting power

Class B Common

Stock

23,502,059 shares

outstanding, all of which are

currently held by affiliates or

former affiliates of HMC

Non-voting

Class C Common

Stock

2 shares outstanding, 1 of

which is held by affiliates of

Mr. Royal W. Carson III, a

director, and the other by HMC

70% voting power

LIN TV Corp.

LIN Television Corporation

Television Stations

and

Digital Operations

Joint Ventures

All of the shares of our class B common stock are held by affiliates of HMC or former affiliates of HMC. The class B common stock is convertible into class A common stock or class C common stock in various circumstances. The class C common stock is also convertible into class A common stock in certain circumstances. If affiliates of HMC converted their shares of class B common stock into shares of class A common stock and the shares of class C common stock were converted into shares of class A common stock as of March 3, 2010, the holders of the converted shares of class C common stock would own less than 0.01% of the total outstanding shares of class A common stock and resulting voting power, and the affiliates of HMC would own 44.4% of the total outstanding shares of class A common stock and resulting voting power.

HMC has advised us that it has no current intention of converting its shares of class B common stock into shares of class A voting common stock or shares of class C voting common stock.

Our television stations

We own, operate and/or program 28 stations, including two stations pursuant to local marketing agreements and one low-power station, which operates as a stand-alone station. We also have an equity investment in other stations through a joint venture. The following table lists the stations that we own, operate and/or program, or in which we have an equity investment:

| Market | | DMA Rank (1) | | Station | Affiliation | | Digital Channel | | Status(2) | FCC license expiration | |

| | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Grand Rapids-Kalamazoo-Battle Creek, MI | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Norfolk-Portsmouth-Newport News, VA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Providence, RI-New Bedford, MA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

NBC Universal/LIN Joint Venture: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (1) | DMA estimates and rankings are taken from Nielsen Local Universe Estimates for the 2009-2010 Broadcast Season, effective September 21, 2009. There are 210 DMAs in the United States. All Nielsen data included in this report represents Nielsen’s estimates, and Nielsen has neither reviewed nor approved the data included in this report. |

| | |

| (2) | All of our stations are owned and operated except for those stations noted as “LMA” which indicates stations to which we provide services under a local marketing agreement (see “Distribution of Programming — local marketing agreements” for a description of these agreements) and noted as “JV” which indicates a station owned and operated by a joint venture to which we are a party. |

| | |

| (3) | WISH-TV includes a low-power station, WIIH-CA. WOOD-TV, WAVY-TV, KNVA-TV, WLUK-TV each include a group of low-power stations. KRQE-TV includes two satellite stations, KBIM-TV and KREZ-TV. We own and operate all of these satellite stations and low-power stations, which broadcast identical programming as the primary station. |

| | |

| (4) | KBVO-TV is a satellite station of KXAN-TV on which programming is provided through MyNetworkTV’s program service. |

| | |

| (5) | License renewal applications have been filed with the FCC and are currently pending. |

| | |

For more information about our joint venture with NBC Universal, see “Joint Venture with NBC Universal” below and Item 1A. “Risk Factors — The GECC Note could result in significant liabilities, including (i) requiring us to make short-term cash payments to the NBC Universal joint venture to fund interest payments, and (ii) potentially giving rise to a change of control under our existing indebtedness, which could cause such indebtedness to become immediately due and payable,” as well as the description in the Liquidity and Capital Resources section under Item 7. Management’s Discussion and Analysis and Note 14 – “Commitments and Contingencies” to our consolidated financial statements.

Description of Our Business

Strategy

We seek to increase our revenues and cash flow through achievement of a number of key strategic and operating goals, which include: a) sustaining leadership in our core television business; b) building new audiences for our multiplatform product offerings; and c) continuing our implementation of cost efficiencies and use of new technology to streamline operations.

The principal components of our strategy are to:

| · | Preserve Our Local News Leadership. We operated the number one or number two local news station in 91% of our news markets1 for the year ended December 31, 2009. Our stations are committed to a “localist” approach, which sustains our strong news positions and enhances our brand equity in the community. We have been recognized for our local news expertise and have won many awards during the past year, including several Emmy, Associated Press, Edward R. Murrow and other local and regional awards. We believe that strong local news programming is among the most important elements in attracting local advertising revenue. In addition, news audiences serve as vital lead-ins for other programming and help minimize the impact of changes in network programming. |

| · | Sustain and Grow Our Revenue Share Through a Focus on Local Programming. We are committed to improving the quality of our existing products, developing new local products, and investing in our future. Local programming allows us to leverage our existing production teams and on-air talent while limiting our exposure to long-term syndicated programming contracts. It also allows us to be more creative and go beyond selling :30 and :60 second spots, and is supported by our advertisers. In 2009, we added nearly 1,500 hours of local programming and now have unique programs tailored to the communities we serve in the majority of our markets. As a result of our strong local station brands, market-leading news and sales expertise, we achieved market share growth in 2009. |

| · | Continue to Pursue Our Multi-Channel Strategy. We continued to expand our presence in our local markets in 2009 through the launch of MyAustinTV on KBVO-TV in Austin, TX, and myRITV, a digital channel in Providence, RI. These added channels and distribution capacity mark an innovative advance in our digital strategy, which is focused on reinventing existing channels and creating new brands that deliver targeted, niche programming to a multiplatform audience, when we believe there is a revenue growth opportunity. Our strategy also helps us appeal to a wider audience and market of advertisers while providing economies of scale to pursue additional and new programming services. As a result, we believe our duopoly stations provide us with a substantial competitive advantage. For the long term, we believe our spectrum has value beyond traditional television channels and digital technology enables us to separate a portion of that spectrum for incremental services. We have been active in exploring use of that spectrum and have partnered with the Open Mobile Video Coalition to launch new technology that will provide live, local and national over-the-air digital television to consumers via next-generation portable and mobile devices. |

| · | Continue to Invest in Digital Media. Our new media teams are focused on embracing new technologies and growing our portfolio of multimedia products and services that provide audiences around-the-clock access to our trusted local news and information. We delivered our largest audience to-date across all of our web sites in 2009, including 824 million user actions and approximately 3 billion advertising impressions, with users engaging our content for more than 23 minutes on average. In addition, over 95 million page impressions were served to users accessing our content via mobile devices. Our syndication strategy helped distribute video to users who consumed over 90 million video views. We will continue to focus on the depth and breadth of our content in order to become the local online destination for news and information in our markets, as well as expand our new media platform through Mobility, Short Message Service (SMS) and interactive television. Additionally, on October 2, 2009, we completed the acquisition of Red McCombs Media, LP (“RMM”), an online advertising and media services company based in Austin, Texas. This acquisition significantly expands our local multi-platform offerings by providing national advertising and enhanced services, including targeted display, rich media, video advertising, custom-built vertical channels, search engine marketing, search engine optimization and mobile marketing. |

| · | Secure Subscriber Fees from Pay-Television Operators. Local broadcast stations reach 90% of U.S. television households through carriage on cable, telecommunications and satellite multi-channel video systems2. The surge of competition from satellite and telecommunications companies, combined with our strong local and national programming, provides us with compelling negotiating positions to obtain compensation for our channels. We currently have agreements with every major cable, telecommunications and satellite company in the markets we serve. |

| · | Continue to Improve Our Operating Efficiencies. We have achieved company-wide operating efficiencies through economies of scale in the purchase of programming, ratings services, research services, national sales representation, capital equipment and other vendor services. In addition, we operate two regional television technology centers that have centralized engineering, operations and administration for multiple stations at a single location. In 2009, we successfully integrated all of our major mid-west, New England and mid-Atlantic stations into our technology centers, saving manpower and reducing capital costs. A current initiative is to improve our newsgathering and production process by sharing resources and multitasking. We are transitioning to journalists that have a wide range of skills, including video camera operation, writing and editing. Our modern newsrooms create a unique and instantaneous reporting culture that drives cost reduction and efficiency. As a result of careful planning, training and communication, our stations are embracing our new culture and working hard to produce more local news on a 24/7 real-time basis for our web, mobile and television using fewer resources. |

Principal Sources of Revenue

Local, national and political advertising revenues

Local, national and political advertising, net of agency commissions, represented approximately 84%, 90% and 92% of our total net revenues for the years ended December 31, 2009, 2008 and 2007, respectively. We receive these revenues principally from advertising time sold in our local news, network and syndicated programming. Advertising rates are based upon a variety of factors, including:

| · | size and demographic makeup of the market served by the television station; |

| · | a program’s popularity among television viewers; |

| · | number of advertisers competing for the available time; |

| · | availability of alternative advertising media in the station’s market area; |

| · | our station’s overall ability to attract viewers in its market area; |

| · | our station’s ability to attract viewers among particular demographic groups that an advertiser may be targeting; and |

| · | effectiveness of our sales force. |

Network compensation

The three oldest networks, ABC, CBS and NBC, had historically made cash compensation payments for our carriage of their network programming. However, in accordance with prevailing trends in our industry, our recent agreements with these networks now reflect a reduction and eventual elimination of network compensation payments to us and or require us to pay compensation to the network.

The newer networks, such as FOX, CW and MyNetworkTV, provide less network programming, pay no network compensation and, in some instances, require us to pay network compensation. However, these newer networks provide us with more advertising inventory to sell than ABC, NBC or CBS.

1 Source: Average of LIN TV’s 2009 Nielsen Household Ratings: March, May, July, and November. Monday-Friday, Early Morning, Early Evening, Late News. 2 Source: Nielsen DMA Universe Estimates. January, 2010.

Barter revenues

We occasionally barter our unsold advertising inventory for goods and services that are required to operate our television stations or are used in sales and marketing efforts. We also acquire certain syndicated programming by providing a portion of the available advertising inventory within the program, in lieu of cash payments.

Digital revenues

We generate digital revenues from advertising produced by our television stations’ Internet web sites, from retransmission consent fees received from cable, satellite and telecommunications companies for the rights to carry our signals in their pay television services to consumers and by providing online advertising and media services through RMM.

Other revenues

We receive other revenues from sources such as renting space on our television towers, renting our production facilities, copyright royalties and providing television production services.

Sources and Availability of Programming

We program our television stations from the following program sources:

| · | News and general entertainment programming that is produced by our local television stations; |

| · | Network programming: such as “CSI” or “Ugly Betty”; |

| · | Syndicated programming: off-network programs, such as “The Simpsons” or “Two and a Half Men”, and first-run programs, such as “Jeopardy”, “Entertainment Tonight” or “Wheel of Fortune”; |

| · | Paid programming: arrangements where a third party pays our stations for a block of time, generally in one half hour or one hour time periods to air long-form advertising or “infomercials”; and |

| · | Local Weather Station: we provide a 24-hour weather channel to local cable systems in certain of our television markets. |

Locally produced news and general entertainment programming

Our stations produce an aggregate of 521 hours of local news programming per week that we broadcast on all but one of our stations. We believe that successful local news programming is an important element in attracting local advertising revenues. In addition, our news programs which have had historically high ratings and strong viewership, have served as strong lead-ins for other programs and have created strong local station brands in each of our local communities. Local news programming also allows us greater control over our programming costs.

Our current network affiliations and number of weekly hours of network, local news and other local programming are as follows:

| | Network | | DMA | | DMA Rank | | Station | | Weekly Hours of Network Programming | | Weekly Hours of Local News Programming | | Weekly Hours of Other Local Programming | | Network Affiliation End Date | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Grand Rapids-Kalamazoo-Battle Creek, MI | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Providence, RI-New Bedford, MA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Grand Rapids-Kalamazoo-Battle Creek, MI | | | | | | | | | | | | | |

| | | | Norfolk-Portsmouth-Newport News, VA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Norfolk-Portsmouth-Newport News, VA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Providence, RI-New Bedford, MA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Grand Rapids-Kalamazoo-Battle Creek, MI | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) | On September 28, 2009, MyNetworkTV changed its status from a broadcast-network model to a program service model. The program service differs from a broadcast network in that it is closer to a television syndication business. |

Network programming

All of our stations are affiliated with one of the national television networks. Our network affiliation agreements provide a local station certain exclusive rights and an obligation, subject to certain limited preemption rights, to carry the network programming. While the networks retain most of the advertising time within their programs for their own use, the local station also has the right to sell a limited amount of advertising time within the network programs. Other time periods, which are not programmed by the networks, are programmed by the local station, for which the local station retains all of the advertising revenues. Networks also share certain of their programming with cable networks and make certain of their programming available through their web site or on web sites such as hulu.com. These outlets compete with us for viewers in the communities served by our stations.

The programming strength of a particular national television network may affect a local station’s competitive position. Our stations, however, are diversified among the various networks, reducing the potential impact of any one network’s performance. We believe that national television network affiliations remain an efficient means of obtaining competitive programming, both for established stations with strong local news franchises and for newer stations with greater programming needs.

Our stations generated an average of approximately 19% of their total net revenue from the sale of advertising within network programming for the year ended December 31, 2009. Our stations that are affiliated with ABC, CBS, FOX and NBC generate a higher percentage of revenue from the sale of advertising within network programming than stations affiliated with CW and MyNetwork.

Our affiliation agreements have terms with scheduled expiration dates ranging through December 31, 2017. These agreements are subject to earlier termination by the networks under specified circumstances, including a change of control of our Company, which would generally result from the acquisition of shares having 50% or more of the voting power of our Company.

Syndicated programming

We acquire the rights to programs for time periods in which we do not air our local news or network programs. These programs generally include reruns of current or former network programs, such as “The Simpsons” or “Two and a Half Men”, or first-run syndicated programs, such as “Jeopardy”, “Entertainment Tonight” or “Wheel of Fortune”. We pay cash for these programs or exchange advertising time within the program for the cost of the program rights. We compete with other local television stations to acquire these programs, which has caused the cost of program rights to increase over time. In addition, a television viewer can now choose to watch many of these programs on national cable networks or purchase these programs on DVDs or via downloads to computers, mobile video devices or web-based video players, which has contributed to increasing fragmentation of our local television audience.

Distribution of Programming

The programming that airs on our television stations can reach the television audience by one or more of the following distribution systems:

| · | Full-power television stations; |

| · | Stations we operate under local marketing agreements; |

| · | Low-power television stations; |

| · | Satellite television systems; |

| · | Telecommunications systems; and |

Full-power television stations

We own and/or operate 27 full-power television stations that operate on the digital over-the-air channels 2 through 54. Our full-power television stations include two full-power stations for which we provide programming, sales and other related services under local marketing agreements. During 2009, we successfully completed the digital transition of all of our stations as mandated by the FCC. See “Our television stations” for a listing of our full-power television stations.

Local marketing agreements

The FCC television licenses for the two stations for which we provide programming, sales and other related services under local marketing agreements (“LMAs”) are not owned by us. Revenues generated by these stations contributed 5%, 4% and 5% to our net revenue for the years ended December 31, 2009, 2008 and 2007, respectively. We incur programming costs, operating costs and capital expenditures related to the operation of these stations, and retain all advertising revenues. In Providence and Austin, the two local markets where these stations are located, we own and operate another station. These local marketing agreement stations are an important part of our multi-channel strategy. We have a purchase option to acquire the FCC licenses for the LMA stations in Providence and Austin.

Low-power television stations

We own and operate a number of low-power television stations. We operate these stations either as stand-alone station or as satellite stations. These low-power broadcast television stations are licensed by the FCC to provide service to substantially smaller areas than those of full-power stations. These stations contributed approximately 1% of our total net revenue in each of the years ended December 31, 2009, 2008 and 2007.

In five of our markets, Albuquerque, Austin, Green Bay, Indianapolis and Norfolk-Portsmouth-Newport News, we use our low power stations to extend the geographic reach of our primary stations in these markets. In Grand Rapids we have affiliated WXSP-TV, a group of low-power television stations, with MyNetworkTV, to cover substantially all of the local market.

Cable, satellite television and telecommunications systems

According to Nielsen, cable, satellite television and telecommunications companies currently provide video program services to approximately 90% of total U.S. television households, with cable and telecommunications companies serving 62% of US households and satellite providers serving 28%. As a result, cable, satellite television and telecommunications companies are not only primary competitors, but the primary means by which our television audience views our television stations. Most of our stations are distributed pursuant to retransmission consent agreements with multichannel video program distributors that operate in markets we serve. As of December 31, 2009, we had retransmission consent agreements with 106 distributors, including 102 MSOs and regional telecommunications companies, the two major satellite television providers, and two national telecommunications providers. For an overview of FCC regulations governing carriage of television broadcast signals by multichannel video program distributors, see “Federal Regulation of Broadcasting - Cable and Satellite Carriage of Local Television Signals.”

Internet

We operate interactive television station and niche web sites in 17 U.S. markets and offer a growing portfolio of Internet-based products and services that provide traditional and new audiences around-the-clock access to our trusted local news and information. We delivered our largest audience to-date across all of our web sites in 2009, including 824 million user actions and approximately 3 billion advertising impressions, with users engaging our content for more than 23 minutes on average. In addition, over 95 million page impressions were served to users accessing our content via mobile devices. Our syndication strategy helped distribute video to users who consumed over 90 million video views.

Seasonality of Our Business

Our advertising revenues are generally highest in the second and fourth quarters of each calendar year, due generally to higher advertising in the spring season and in the period leading up to and including the end-of-year holiday season. Our operating results are also significantly affected by annual cycles, as advertising revenues are generally higher in even-numbered years (i.e., 2008, 2010) due to additional revenues associated with election years from advertising spending by political candidates and incremental advertising revenues associated with Olympic broadcasts.

The broadcast television industry is also cyclical in nature and affected by prevailing economic conditions. Since we rely on sales of advertising time for substantially all of our revenues, our operating results are sensitive to general economic and regional conditions in each local market where our stations operate.

Joint Venture with NBC Universal

We hold an approximately 20% equity interest, and NBC Universal holds the remaining approximately 80% equity interest, in a joint venture which is a limited partner in a business that owns television stations KXAS-TV, an NBC affiliate in Dallas, and KNSD-TV, an NBC affiliate in San Diego. We and NBC Universal each have a 50% voting interest in the joint venture. NBC Universal operates the two stations pursuant to a management agreement.

The joint venture is the obligor on an $815.5 million non-amortizing senior secured note due 2023 (the “GECC Note”) held by General Electric Capital Corporation (“GECC”), which provided financing to the venture. The GECC Note bears interest at a rate of 8% per annum until March 2, 2013 and 9% per annum thereafter. LIN TV has guaranteed the payment of principal and interest on the GECC Note.

The joint venture with NBC Universal has been adversely impacted by the recent economic downturn, and it did not distribute any cash to NBC Universal or us during the year ended December 31, 2009. In light of the adverse effect of the economic downturn on the joint venture’s operating results, in 2009 we entered into an agreement with NBC Universal (the “Original Shortfall Funding Agreement”) which provided that: a) we and NBC waived the requirement that the joint venture maintain debt service reserve cash balances of at least $15 million; b) the joint venture would use a portion of its existing debt service reserve cash balances to fund interest payments in 2009; c) NBC agreed to defer its receipt of 2008 and 2009 management fees; and d) we agreed that if the joint venture does not have sufficient cash to fund interest payments on the GECC Note through April 1, 2010, we and NBC Universal would each provide the joint venture with a shortfall loan on the basis of our percentage of economic interest in the joint venture. During the year ended December 31, 2009, the joint venture used approximately $14.9 million of the existing debt service cash reserves, leaving approximately $0.2 million available. As of March 15, 2010, we have not yet provided any funding under the Original Shortfall Funding Agreement.

Because of anticipated future cash shortfalls at the joint venture, on March 9, 2010, NBC Universal and we entered into a new agreement (the “2010 Shortfall Funding Agreement”) covering the period through April 1, 2011. Under the terms of the 2010 Shortfall Funding Agreement: a) the joint venture may continue to access any portion of its existing debt service reserve cash balances to fund interest payments; b) NBC will continue to defer the payment of 2008 and 2009 management fees and will defer payment of 2010 management fees through March 31, 2011; and c) we agreed that if the joint venture does not have sufficient cash to fund interest payments on the GECC Note through April 1, 2011, we and NBC Universal would each provide the joint venture with a shortfall loan on the basis of our percentage of economic interest in the joint venture.

Based on our latest estimate of cash flow requirements of the joint venture through April 1, 2010, our share of the estimated shortfall through April 1, 2010 is $3.0 million. Of this amount, we had accrued $2.0 million as of September 30, 2009. Subsequent to September 30, 2009, we: (a) received with the joint venture’s 2010 budget and (b) as noted above, entered into the 2010 Shortfall Funding Agreement to cover debt service shortfalls through April 1, 2011. Based on the 2010 budget provided by the joint venture, and our discussions with the joint venture's management, we believe there will be an additional debt service shortfall at the joint venture from April 2, 2010 through April 1, 2011 of $13.0 million to $15.0 million, of which, our share of the shortfall could be approximately $3.0 million.

As a result, we have accrued our portion of the estimated shortfalls through April 1, 2011, bringing the total accrual for our joint venture shortfall obligations to $6 million as of December 31, 2009. This amount reflects our probable and estimable obligations through the expiration of the 2010 Shortfall Funding Agreement on April 1, 2011. We do not believe our funding obligations related to the joint venture, if any, beyond April 1, 2011 are currently probable and estimable, therefore, we have not accrued for any potential obligations beyond the $6 million discussed above. However, our actual cash shortfall funding could exceed our estimate.

Our ability to honor our shortfall loan obligations under the Original Shortfall Funding Agreement and/or the 2010 Shortfall Funding Agreement is limited by certain covenants contained in our Amended Credit Agreement and the indentures governing our senior subordinated notes. If we are unable to make payments under the Original Shortfall Funding Agreement or 2010 Shortfall Funding Agreement, the joint venture may be unable to fund interest obligations under the GECC Note, resulting in an event of default. In addition, if the joint venture experiences further cash shortfalls beyond April 1, 2011, we may decide to fund such cash shortfalls, or to fund such shortfalls through further loans or equity contributions to the joint venture.

On December 3, 2009, General Electric Corporation (“GE”), which wholly owns GECC, and Comcast Corporation (“Comcast”) announced a definitive agreement to form a joint venture that will be 51 percent owned by Comcast, 49 percent owned by GE and managed by Comcast. The proposed joint venture will include NBC Universal. As of March 15, 2010, the proposed transaction is undergoing regulatory review and it is not certain whether or when the transaction will receive the approvals required to close. Furthermore, assuming the transaction is completed, we cannot predict the effect the joint venture between Comcast and GE may have on our joint venture with NBC Universal.

For more information about our joint venture with NBC Universal, see Item 1A. “Risk Factors — The GECC Note could result in significant liabilities, including (i) requiring us to make short-term cash payments to the NBC Universal joint venture to fund interest payments, and (ii) potentially giving rise to a change of control under our existing indebtedness, which could cause such indebtedness to become immediately due and payable,” as well as the description in the Liquidity and Capital Resources section under Item 7. Management’s Discussion and Analysis and Note 14 – “Commitments and Contingencies” to our consolidated financial statements.

Competitive Conditions in the Television Industry

The television broadcast industry has become highly competitive as a result of new technologies and new program distribution systems. In most of our local markets, we compete directly against other local broadcast stations, cable, satellite television and telecommunication systems for audience. We also compete with online video services, including web sites such as Hulu.com, which provide access to some of the same programming, including network programming that we provide and other emerging technologies including mobile television.

Federal Regulation of Television Broadcasting

Overview of Regulatory Issues. Our television operations are subject to the jurisdiction of the FCC under the Communications Act of 1934, as amended (the "Communications Act"). The Communications Act prohibits the operation of broadcast stations except pursuant to licenses issued by the FCC and empowers the FCC, among other things, to issue, renew, revoke and modify broadcasting licenses; assign frequency bands; determine stations' frequencies, locations and power; and regulate the equipment used by stations.

The Communications Act prohibits the assignment of a broadcast license or the transfer of control of a license without the FCC's prior approval. The FCC also regulates certain aspects of the operation of cable television systems, direct broadcast satellite ("DBS") systems and other electronic media that compete with broadcast stations. In addition, the FCC regulates matters such as television station ownership, network-affiliate relations, cable and DBS systems' carriage of television station signals, carriage of syndicated and network programming on distant stations, political advertising practices, children’s programming and obscene and indecent programming.

License Renewals. Under the Communications Act, the FCC generally may grant and renew broadcast licenses for terms of eight years, though licenses may be renewed for a shorter period under certain circumstances. The Communications Act requires the FCC to renew a broadcast license if the FCC finds that (i) the station has served the public interest, convenience and necessity; (ii) there have been no serious violations of either the Communications Act or the FCC's rules and regulations by the licensee; and (iii) there have been no other serious violations that taken together constitute a pattern of abuse. In making its determination, the FCC may consider petitions to deny but cannot consider whether the public interest would be better served by issuing the license to a person other than the renewal applicant. We are in good standing with respect to each of our FCC licenses. Our licenses have expiration dates ranging between 2006 and 2015. The table on page 7 includes the expiration date of each of our licenses. We have timely filed license renewal applications for each of our stations. Once an application for renewal is filed, each station remains licensed while its application is pending, even after its license expiration date has passed. Certain of our licenses have pending applications for renewal. We expect the FCC to renew each of these licenses but we make no assurance that it will do so.

Ownership Regulation. The Communications Act and FCC rules limit the ability of individuals and entities to have ownership or other attributable interests in certain combinations of broadcast stations and other media. In 1999, the FCC modified its local television ownership rules. In 2003, the FCC issued an order that would have liberalized most of the ownership rules, permitting us to acquire television stations in certain markets where we are currently prohibited from acquiring additional stations. In 2004, the Third Circuit Court of Appeals stayed and remanded several of the FCC’s 2003 ownership rule changes. In July 2006, as part of the FCC’s statutorily required quadrennial review of its media ownership rules, the FCC sought comment on how to address the issues raised by the Third Circuit Court of Appeals’s decision. In February 2008, the FCC released an order that re-adopted its 1999 local television ownership rules, and those rules are currently in effect. Several parties have appealed the FCC’s February 2008 decision. In November, 2009 the FCC initiated its statutorily required quadrennial review process, but it has not yet proposed any rule changes. We cannot predict how pending appeals of prior FCC ownership rule decisions or the pending quadrennial review proceeding may result in changes to the FCC’s broadcast ownership rules. The FCC's currently effective ownership rules that are material to our operations are summarized below.

Local Television Ownership. Under the FCC's current local television ownership (or "duopoly") rule, a party may own multiple television stations without regard to signal contour overlap provided they are located in separate Nielsen DMAs. In addition, the rules permit parties to own up to two TV stations in the same DMA so long as (i) at least one of the two stations is not among the top four-ranked stations in the market based on audience share at the time an application for approval of the acquisition is filed with the FCC, and (ii) at least eight independently owned and operating full-power commercial and non-commercial television stations would remain in the market after the acquisition. In addition, without regard to the number of remaining or independently owned television stations, the FCC will permit television duopolies within the same DMA so long as the Grade B signal contours of the stations involved do not overlap. Stations designated by the FCC as "satellite" stations, which are full-power stations that typically rebroadcast the programming of a "parent" station, are exempt from the local television ownership rule. Also, the FCC may grant a waiver of the local television ownership rule if one of the two television stations is a "failed" or "failing" station or if the proposed transaction would result in the construction of a new television station (an unbuilt-station waiver). We are currently in compliance with the local television ownership rule.

The FCC’s 1999 ownership order established a new rule attributing LMAs for ownership purposes. The FCC grandfathered LMAs that were entered into prior to November 5, 1996, permitting those stations to continue operations pursuant to the LMAs until the conclusion of the FCC’s 2004 biennial review. The FCC stated it would conduct a case-by-case review of grandfathered LMAs and assess the appropriateness of extending the grandfathering periods. Subsequently, the FCC invited comments as to whether, instead of beginning the review of the grandfathered LMAs in 2004, it should do so in 2006. The FCC did not initiate any review of grandfathered LMAs in 2004 or as part of its 2006 quadrennial review. We do not know when, or if, the FCC will conduct any such review of grandfathered LMAs. Grandfathered local marketing agreements can be freely transferred during the grandfather period, but duopolies may be transferred only where the two-station combination continues to qualify under the duopoly rule.

We must obtain FCC approval before acquiring ownership of additional television stations, including the stations in Providence and Austin for which we have option agreements. In the event that the FCC determines that the grandfathered LMA that we have in Providence is ineligible for conversion to full ownership, we have the right to assign our purchase option to a third party and we believe we can arrange a suitable disposition, including alternative non-attributable operating arrangements with such a party, such as a more limited programming and services agreement or joint sales agreement, if necessary, which will not be materially less favorable to us than the current local marketing agreement. In Austin, we assigned our purchase option for KNVA-TV, for which we also have a grandfathered LMA, to a third party, Vaughan Media, LLC, that during 2009 exercised the option and acquired the outstanding shares of the entity that holds the FCC license for that station. We continue to provide programming and other services to KNVA-TV pursuant to the grandfathered LMA with that station.

National Television Ownership Cap. The Communications Act, as amended in 2004, limits the number of television stations one entity may own nationally. Under the rule, no entity may have an attributable interest in television stations that reach, in the aggregate, more than 39% of all U.S. television households. The FCC currently discounts the audience reach of a UHF station by 50% when computing the national television ownership cap. Our stations reach is approximately 8% of U.S. households.

Media Cross-Ownership. The FCC historically has prohibited the licensee of a radio or TV station from directly or indirectly owning, operating, or controlling a daily newspaper if the station's specified service contour encompasses the entire community where the newspaper is published. The FCC revised its newspaper/broadcast cross-ownership rule in December 2007; however, since the order revising that rule was appealed the rule is not yet effective. Under the revised rule, newspaper/broadcast cross-ownership would nonetheless be permissible if (i) the market at issue is one of the 20 largest DMAs; (ii) the transaction involves the combination of only one major daily newspaper and only one television or radio station; (iii) where the transaction involves a television station, at least eight independently owned and operating major media voices (major newspapers and full-power television stations) would remain in the DMA following the transaction; and (iv) where the transaction involves a television station, that station is not among the top four-ranked stations in the DMA. For all other proposed newspaper/broadcast transactions, the FCC's historic prohibition generally would remain in place. The cross-ownership rules also permit cross ownership of radio and television stations under a graduated test based on the number of independently owned media voices in the local market. In large markets (markets with at least 20 independently owned media voices), a single entity can own up to one television station and seven radio stations or, if permissible under the local television ownership rule (if eight full-power television stations would remain in the market post transaction), two television stations and six radio stations.

Attribution of Ownership. Under the FCC's attribution policies, the following relationships and interests generally are attributable for purposes of the FCC's broadcast ownership restrictions:

| · | holders of 5% or more of the licensee's voting stock, unless the holder is a qualified passive investor, in which case the threshold is a 20% or greater voting stock interest; |

| · | all officers and directors of a licensee and its direct or indirect parent(s); |

| · | any equity interest in a limited partnership or limited liability company, unless properly "insulated" from management activities; and |

| · | equity and/or debt interests which in the aggregate exceed 33% of a licensee's total assets, if the interest holder supplies more than 15% of the station's total weekly programming, or is a same-market broadcast company, cable operator or newspaper (the "equity/debt plus" standard). |

Under the single majority shareholder exception to the FCC's attribution policies, otherwise attributable interests under 50% are not attributable if a corporate licensee is controlled by a single majority shareholder and the minority interest holder is not otherwise attributable under the "equity/debt plus" standard. Thus, in our case, where we have a single majority shareholder, ownership of minority stock interests of up to 33% are not attributable absent other factors.

Because of these multiple ownership and cross-ownership rules, any person or entity that acquires an attributable interest in us may violate the FCC’s rules if that purchaser also has an attributable interest in other television or radio stations, or in daily newspapers, depending on the number and location of those radio or television stations or daily newspapers. Such person or entity also may be restricted in the companies in which it may invest to the extent that those investments give rise to an attributable interest. If the holder of an attributable interest violates any of these ownership rules or if a proposed acquisition by us would cause such a violation, we may be unable to obtain from the FCC one or more authorizations needed to conduct our television station business and may be unable to obtain the FCC’s consents for certain future acquisitions.

Digital Television Transition. We terminated all analog broadcasts on our full power stations on or before June 12, 2009 in connection with the transition to digital television. Following the transition, each of our full power stations broadcasts a 19.4 megabit-per-second (Mbps) data stream, rather than a single analog program stream. FCC regulations permit substantial flexibility in how we use that data stream. For example, we are permitted to provide a mix of high definition and standard television program streams free-to-air, additional program-related data, subscription video or audio streams, and non-broadcast services. A new technical standard, currently being tested, would permit digital stations to provide video and data streams that can be more readily received on mobile devices (such as computers and smart phones), if those devices incorporate the technology. These digital channels remain subject to specific FCC regulations. For example, we are required to carry additional children’s educational programming if we transmit multiple program streams, and we must pay the U.S. Treasury 5% of gross revenues for any non-broadcast services we provide using our digital signals. The FCC is evaluating whether to impose further public interest programming requirements on digital broadcasters. The FCC’s current digital transition implementation plan would maintain the secondary status of low-power television stations with respect to DTV operations and many low-power television stations, particularly in major markets, could be displaced, including some of ours.

Cable and Satellite Carriage of Local Television Signals. Pursuant to FCC rules, full power television stations can obtain carriage of their signals by multichannel program distributors in one of two ways: via mandatory carriage or via “retransmission consent.” Once every three years each station must formally elect either mandatory carriage (“must-carry” for cable distributors and “carry one-carry all” for satellite television providers) or retransmission consent. The next election must be made by October 1, 2011, and will be effective January 1, 2012. A mandatory carriage election invokes FCC rules that requires the distributor to carry a single program stream and related data in the station’s local market. Distributors may decline carriage for a variety of reasons, including a lack of channel capacity, the station’s failure to deliver a good quality signal, the presence of a nearby affiliate of the same network or, in the case of satellite distributors, if the distributor does not carry any other local broadcast stations in the electing station’s market. Distributors do not pay a fee to stations that elect mandatory carriage.

A station that elects retransmission consent waives its mandatory carriage rights, and the station and the distributor must negotiate in good faith for carriage of the station’s signal. Negotiated terms may include channel position, service tier carriage, carriage of multiple program streams, compensation and other consideration. If a station elects to negotiate retransmission terms, it is possible that the station and the distributor will not reach agreement and that the distributor will not carry the station’s signal.

FCC rules govern which local television signals a satellite subscriber may receive. Congress has also imposed certain requirements relating to satellite distribution of local television signals to “unserved” households that do not receive a useable signal from a local network-affiliated station. One law that facilitates satellite distribution of local broadcast signals, the Satellite Home Viewer Extension and Reauthorization Act of 2004 (“SHVERA”), would have expired by its terms at the end of 2009. However, Congress extended SHVERA until March 28, 2010. We believe Congress will again extend the SHVERA regime, with some changes, before the end of that period, but we cannot provide assurances that Congress will do so.

Programming and station operations. The Communications Act requires broadcasters to serve the public interest. Broadcast station licensees are required to present programming that is responsive to community problems, needs and interests and to maintain records demonstrating such responsiveness. Stations must follow various rules that regulate, among other things, children’s television programming and advertising, political advertising, sponsorship identification, contest and lottery advertising and program ratings guidelines. The FCC has proposed to re-establish a number of formalized procedures designed to improve television broadcasters’ service to their local communities. These proposals include the establishment of community advisory boards, quantitative programming guidelines and maintenance of a main studio in a station’s community of license.

The FCC is also charged with enforcing restrictions or prohibitions on the broadcast of obscene and indecent programs and in recent years has increased its enforcement activities in this area, issuing large fines against radio and television stations found to have carried such programming (even if originated by a third-party program supplier, such as a network). In June 2007, the FCC increased the maximum monetary penalty for carriage of indecent programming tenfold to $325,000 per station per violation with a cap of $3 million for any "single act," and put the licenses of repeat offenders in jeopardy. Court challenges to the FCC’s indecency enforcement regime are pending at various stages. We are unable to predict whether the enforcement of the indecency regulations will have a material adverse effect on our ability to provide competitive programming.

Recent regulatory developments, proposed legislation and regulation. Congress and the FCC currently have under consideration, and may in the future adopt, new laws, regulations and policies regarding a wide variety of matters that could affect, directly or indirectly, the operation and ownership of our stations. The foregoing discussion summarizes the federal statutes and regulations material to our operations, but does not purport to be a complete summary of all the provisions of the Communications Act or of other current or proposed statutes, regulations, and policies affecting our business. The summaries should be read in conjunction with the text of the statutes, rules, regulations, orders, and decisions described herein. We are unable at this time to predict the outcome of any of the pending FCC rule-making proceedings referenced above, the outcome of any reconsideration or appellate proceedings concerning any changes in FCC rules or policies noted above, the possible outcome of any proposed or pending Congressional legislation, or the impact of any of those changes on our stations.

Employees

As of December 31, 2009, we employed approximately 1,840 full time employees, 221 of which were represented by labor unions. We believe that our employee relations are generally good.

Available Information

We file annual, quarterly, and current reports, proxy statements, and other documents with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934 (the “Exchange Act”). The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet web site that contains reports, proxy and information statements, and other information regarding issuers, including our filings, which we file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

We also make available free-of-charge through our Internet web site (at http://www.lintv.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish such material, to the SEC.

We also make available on our web site our corporate governance guidelines, the charters for our audit committee, compensation committee, and nominating and corporate governance committee, and our code of business conduct and ethics, and such information is available there to any stockholder who is interested in reviewing this information. In addition, we intend to disclose on our web site any amendments to, or waivers from, our code of business conduct and ethics that are required to be publicly disclosed pursuant to rules of the SEC and the NYSE.

Risks Associated with Our Business Activities

Our operating results are primarily dependent on advertising revenues, which can vary substantially from period-to-period based on many factors beyond our control, including economic downturns and viewer preferences.

Our operations and performance are materially affected by a number of factors beyond our control, including economic conditions and viewer preferences. For example, the economic downturn adversely affected local and national advertising revenues across all of our stations during 2009. Advertising revenue, including local, national and political advertising revenues, consisted of approximately 84%, 90% and 92% of our total revenues for the years ended December 31, 2009, 2008 and 2007, respectively. Local advertising revenues decreased 13% and 9% for the years ended December 31, 2009 and 2008, respectively, compared to their respective prior periods. National advertising revenues decreased 17%, 16% and 1% for the years ended December 31, 2009, 2008 and 2007, respectively, compared to their respective prior periods. This volatility in advertising revenues results in decreased revenues and weaker results of operations for us. While we have seen some signs of recovery, continued weakness in advertising revenues caused by economic conditions could have a material adverse effect on our financial condition, cash flows and results of operations, which could impair our ability to comply with the covenants in our debt instruments, as more fully described below.

In addition to economic conditions, our ability to generate advertising revenues depends on factors such as:

| · | the relative popularity of the programming on our stations; |

| · | the demographic characteristics of our markets; and |

| · | the activities of our competitors. |

Our programming may not attract sufficient targeted viewership or we may not achieve favorable ratings. Our ratings depend partly upon unpredictable and volatile factors beyond our control, such as viewer preferences, competing programming and the availability of other entertainment activities. A shift in viewer preferences could cause our programming not to gain popularity or to decline in popularity, which could cause our advertising revenues to decline. We, and those on whom we rely for programming, may not be able to anticipate and react effectively to shifts in viewer tastes and interests of our local markets. In addition, political advertising revenue from elections and advertising revenues from Olympic Games, which generally occur in the even years, create large fluctuations in our operating results on a year-to-year basis. For example, during 2009, we had political advertising revenues of $13.2 million, compared to $47.0 million in the prior year.

We depend to a significant degree on automotive advertising.

Approximately 19%, 24% and 28% of our net advertising revenues for the years ended December 31, 2009, 2008, and 2007, respectively, consisted of automotive advertising. A significant decrease in these revenues in the future could have a material adverse effect on our results of operations and cash flows, which could affect our ability to fund operations and service our debt obligations and affect the value of our common stock. Automotive advertising continues to be adversely affected by the difficulties experienced by the automotive industry.

The GECC Note could result in significant liabilities, including (i) requiring us to make short term cash payments to the NBC Universal joint venture to fund interest payments, and (ii) potentially giving rise to a change of control under our existing indebtedness, which would cause such existing indebtedness to become immediately due and payable.

We may be required to make cash payments to the joint venture to fund interest payments on the GECC Note. Our joint venture with NBC Universal has been adversely impacted by the current economic downturn. Under the Original Shortfall Funding Agreement, we may be required to provide shortfall loans to the joint venture, in an amount based on our approximately 20% economic interest in the joint venture, if the joint venture does not have sufficient cash to fund interest obligations under the GECC Note through April 1, 2010. As of March 15, 2010, we have not yet provided any funding under the Original Shortfall Funding Agreement.

Because of anticipated future cash shortfalls at the joint venture, on March 9, 2010, NBC Universal and we entered into the 2010 Shortfall Funding Agreement covering the period through April 1, 2011. Under the 2010 Shortfall Funding Agreement: a) the joint venture may continue to access any portion of its existing debt service reserve cash balances to fund interest payments; b) NBC will continue to defer the payment of 2008 and 2009 management fees and will defer payment of 2010 management fees through March 31, 2011; and c) we agreed that if the joint venture does not have sufficient cash to fund interest payments on the GECC Note through April 1, 2011, we and NBC Universal would each provide the joint venture with a shortfall loan on the basis of our percentage of economic interest in the joint venture. Under the terms of the Original Shortfall Funding Agreement and the 2010 Shortfall Funding Agreement, we estimate our share of shortfall funding could be $5.0 million to $7.0 million through the April 1, 2011 expiry of the 2010 Shortfall Funding Agreement. However, our actual cash shortfall funding could exceed our estimate.

Our ability to honor our shortfall loan obligations under the Original Shortfall Funding Agreement and the 2010 Shortfall Funding Agreement is subject to compliance with restrictions under our senior credit facility and the indentures governing our senior notes. Based on the 2010 budget provided by joint venture management, and our forecast of total leverage and consolidated EBITDA during 2010 and 2011, we expect to have the capacity within these restrictions to provide shortfall funding under the 2010 Shortfall Funding Agreement in proportion to our approximately 20 percent economic interest in the joint venture through the April 1, 2011 expiration of the 2010 Shortfall Funding Agreement. However, there can be no assurance that we will have the capacity within these restrictions to provide such funding. If we are required to fund a portion of a shortfall loan, we plan to use our available cash balances or available borrowings under our credit facility. In addition, if the joint venture experiences further cash shortfalls beyond April 1, 2011, we may decide to fund such cash shortfalls, or to fund such shortfalls through further loans or equity contributions to the joint venture. If we are unable to make payments under the Original Shortfall Funding Agreement or 2010 Shortfall Funding Agreement, the joint venture may be unable to fund interest obligations under the GECC Note, resulting in an event of default.

An event of default under the GECC Note will occur if the joint venture fails to make any scheduled interest payment within 90 days of the date due and payable, or to pay the principal amount on the maturity date. If the joint venture fails to pay interest on the GECC Note, and neither NBC Universal nor we make a shortfall loan to fund the interest payment within 90 days of the date due and payable, an event of default would occur and GECC could accelerate the maturity of the entire amount due under the GECC Note. Other than the acceleration of the principal amount upon an event of default, prepayment of the principal of the note is prohibited unless agreed upon by both NBC Universal and us. Upon an event of default under the GECC Note, GECC’s only recourse would be to the joint venture, our equity interest in the joint venture and, after exhausting all remedies against the assets of the joint venture and the other equity interests in the joint venture, to LIN TV pursuant to its guarantee of the GECC Note.

Under the terms of its guarantee of the GECC Note, LIN TV would be required to make a payment for an amount to be determined upon occurrence of the following events: a) there is an event of default; b) neither NBC Universal or us remedy the default; and c) after GECC exhausts all remedies against the assets of the joint venture, the total amount realized upon exercise of those remedies is less than the $815.5 million principal amount of the GECC Note. Upon the occurrence of such events, the amount owed by LIN TV to GECC pursuant to the guarantee would be equal to the difference between i) the total amount for which the joint venture’s assets were sold and ii) the principal amount and any unpaid interest due under the GECC Note. As of December 31, 2009, we estimate the fair value of the television stations in the joint venture to be approximately $366 million less than the outstanding balance of the GECC note of $815.5 million.

If an event of default occurs under the GECC Note, LIN TV, which conducts all of its operations through its subsidiaries, could experience material adverse consequences, including:

| · | GECC, after exhausting all remedies against the joint venture, could enforce its rights under the guarantee, which could cause LIN TV to determine that LIN Television should seek to sell material assets owned by it in order to satisfy LIN TV’s obligations under the guarantee; |

| · | GECC’s initiation of proceedings against LIN TV under the guarantee could result in a change of control or other material adverse consequences to LIN Television, which could cause an acceleration of LIN Television’s credit facility and other outstanding indebtedness; and |

| · | if the GECC Note is prepaid because of an acceleration on default or otherwise, we would incur a substantial tax liability of approximately $273.6 million related to our deferred gain associated with the formation of the joint venture, exclusive of any potential NOL utilization. |

We have a substantial amount of debt, which could adversely affect our financial condition, liquidity and results of operations, reduce our operating flexibility and put us at greater risk for default and acceleration of our debt.

As of December 31, 2009, we had approximately $683.0 million of consolidated indebtedness and a deficit of $169.2 million of consolidated stockholders’ equity. Our outstanding debt under our credit facility is due November 14, 2011 and all of our 6½% senior subordinated notes are due May 15, 2013. Subject to the limitations in our senior credit facility and the indentures governing the senior subordinated notes, we may incur additional material indebtedness in the future, and we may become more leveraged. Accordingly, we now have and will continue to have significant debt service obligations. We have also guaranteed the $815.5 million GECC Note as described above.

Our large amount of indebtedness could, for example:

| · | require us to use a substantial portion of our cash flow from operations to pay interest and principal on indebtedness and reduce the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate activities; |

| · | require us to dispose of television stations or other assets at times or on terms that may be less advantageous than those we might otherwise be able to obtain; |

| · | limit our ability to obtain additional financing in the future; |

| · | expose us to greater interest rate risk, because the interest rates on our credit facility vary; and |