SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

Securities Exchange Act of 1934

For the month of August 2014

ABBEY NATIONAL TREASURY SERVICES PLC

(Translation of registrant’s name into English)

2 Triton Square, Regent’s

Place, London NW1 3AN, England

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

The Registrant hereby incorporates all parts of this Report on Form 6-K by reference in Registration Statement no. 333-190509-01 filed by the Registrant with the Securities and Exchange Commission on Form F-3ASR under the Securities Act of 1933.

2014 Half Yearly Financial Report

Abbey National Treasury Services plc

PART OF THE SANTANDER GROUP

This page intentionally left blank

Abbey National Treasury Services plc

2014 Half Yearly Financial Report

Index

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 1 |

About us

Our Business and our Corporate Purpose

Our heritage

Abbey National Treasury Services plc (the ‘Company’) and its subsidiaries (collectively, ‘ANTS’ or the ‘ANTS group’) was established in 1989 for the purpose of managing the liquidity, risk management and wholesale banking needs of Abbey National plc (subsequently renamed Santander UK plc) and its subsidiaries (collectively, ‘Santander UK’ or the ‘Santander UK group’).

In 1997, Abbey National plc acquired the business and assets of Cater Allen Holdings plc (“CAH”) for £195m. The synergies between the ANTS group and the CAH business provided ANTS with opportunities for growth in strategically important markets comprising money markets, sharedealing, and onshore and offshore retail banking.

In 2010, all of the business and assets of Cater Allen International Limited, a subsidiary of CAH, and a significant participant in the repo and wholesale money markets, were transferred to the Company. The principal purpose of the transfer was to increase the efficiency of the ANTS group and the Santander UK group. No gain or loss was recognised on the transfer.

On 12 November 2004, Banco Santander, S.A., a company incorporated in Spain, completed the acquisition of the entire issued ordinary share capital of the parent company of ANTS, Santander UK plc, at which point the Company became an indirect subsidiary of Banco Santander, S.A..

The structural relationship of ANTS and Santander UK with the Banco Santander group

The Banco Santander group operates a ‘subsidiary model’. This model involves autonomous units, such as the Santander UK group (of which ANTS is a significant part) operating in core markets with each unit being responsible for its own liquidity, funding and capital management on an ongoing basis. The model is designed to minimise the risk to the Banco Santander group and all its units from problems arising elsewhere in the Banco Santander group.

The subsidiary model gives both ANTS and Santander UK considerable financial flexibility, yet enables them to continue to take advantage of the significant synergies and strengths that come from being part of the global Banco Santander group, in brand, products, systems, platforms, development capacity and management capability. In the subsidiary model, the Banco Santander group facilitates the sharing of best practice and provides common technology, operations and support services to all of its subsidiaries via independent operating entities, themselves established by the Banco Santander group so as to be able to continue operating as viable standalone businesses.

On 10 January 2014, Santander UK Group Holdings Limited became the holding company of Santander UK plc following its acquisition of Santander UK plc from Banco Santander S.A.. The acquisition was satisfied by the issue of shares in Santander UK Group Holdings Limited. The new holding company was put in place in light of UK regulatory developments relating to Banking Reform and Resolution and Recovery planning under which having a holding company above the operating banking companies is considered preferable.

For more information, see the Directors’ Report on page 99 of the Annual Report and Accounts for the year ended 31 December 2013 (the ‘2013 Annual Report’).

| | |

| 2 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

About us

Our Strategy

ANTS today

ANTS is regulated by the UK Prudential Regulation Authority (‘PRA’) and the Financial Conduct Authority (‘FCA’) and is part of the Santander UK group which is, in turn, part of the Banco Santander, S.A. group (comprising Banco Santander, S.A. and its subsidiaries, the ‘Banco Santander group’). Banco Santander, S.A. is incorporated in Spain and is the ultimate parent company of ANTS.

Corporate purpose

ANTS provides treasury, corporate and wholesale banking services. ANTS provides these services to the wider Santander UK group, of which ANTS is a significant part, and also to UK clients. ANTS is also the treasury support function for the Santander UK group. In this regard, ANTS’s role is to provide access to financial markets and central bank facilities in order to meet the Santander UK group’s liquidity, funding, capital and balance sheet management requirements. As such, ANTS is one of the main debt issuance vehicles in the Santander UK group.

ANTS contains part of a number of Santander UK’s business segments. Whether transactions are booked in ANTS or another Santander UK group entity reflects historic or operational reasons and does not necessarily reflect any particular business split.

The Company has given a full and unconditional guarantee in respect of the unsubordinated liabilities of Santander UK plc incurred prior to 30 June 2015 under a deed poll guarantee entered into by the Company on 10 May 2012. Santander UK plc has given a reciprocal guarantee in respect of the unsubordinated liabilities of the Company incurred prior to 30 June 2015.

As a result of these guarantees, the results and creditworthiness of ANTS should not be viewed in isolation. Account should also be taken of the position of the Santander UK group into which the assets and liabilities of ANTS are fully consolidated.

ANTS has also entered into agreements to provide capital and/or liquidity to Santander UK plc and other members of the Santander UK group, in accordance with UK regulatory requirements. For further details, see Note 25 to the Condensed Consolidated Interim Financial Statements.

Our businesses

ANTS is headed by Jacques Ripoll, Chief Executive Officer, and operates three business divisions as follows:

| | |

Business division | | About |

| Commercial Banking | | Commercial Banking offers a wide range of products and financial services to UK companies. Commercial Banking products and services include loans, bank accounts, deposits, and treasury services. The Large Corporates business offers specialist treasury services in fixed income and foreign exchange, lending, transactional banking services, capital markets and money markets to large multinational corporate customers. Lending includes syndicated loans and structured finance. Transactional banking includes trade finance and cash management. Money market activities include securities lending/borrowing and repos. |

| |

| Markets | | Markets offers risk management and other services to financial institutions, as well as to other Santander UK divisions. Its main product areas are fixed income and foreign exchange, equity, capital markets and institutional sales. |

| |

| Corporate Centre | | Corporate Centre consists of Financial Management & Investor Relations (‘FMIR’) and the non-core portfolios of social housing loans and structured credit assets. FMIR is responsible for managing capital and funding, balance sheet composition and structure, and strategic liquidity risk for the Santander UK group. The non-core portfolios are being run-down and/or managed for value. |

Our strategy

ANTS’s strategy is to continue to provide treasury support functions for the Santander UK group and to provide treasury, corporate and wholesale banking services to UK clients.

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 3 |

Detailed Business Review

Group and Divisional Results

GROUP SUMMARY

KEY PERFORMANCE INDICATORS

Key performance indicators are set at the Santander UK group level, rather than separately for the ANTS group.

SUMMARISED CONSOLIDATED INCOME STATEMENT

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Net interest expense | | | (50 | ) | | | (8 | ) |

Non-interest income | | | 240 | | | | 436 | |

| | | | | | | | |

Total operating income | | | 190 | | | | 428 | |

| | | | | | | | |

Administrative expenses | | | (125 | ) | | | (108 | ) |

Depreciation, amortisation and impairment | | | (1 | ) | | | (1 | ) |

| | | | | | | | |

Total operating expenses excluding impairment losses | | | (126 | ) | | | (109 | ) |

| | | | | | | | |

Impairment losses on loans and advances | | | — | | | | (18 | ) |

| | | | | | | | |

Total operating impairment losses | | | — | | | | (18 | ) |

| | | | | | | | |

Profit before tax | | | 64 | | | | 301 | |

Taxation credit/(charge) | | | 1 | | | | (45 | ) |

| | | | | | | | |

Profit for the period | | | 65 | | | | 256 | |

| | | | | | | | |

Six months ended 30 June 2014 compared to six months ended 30 June 2013

Profit before tax decreased by £237m to £64m in the first half of 2014 (2013: £301m). By income statement line, the movements were:

| | • | | Net interest expense increased by £42m to £50m in the first half of 2014 (2013: £8m) as the returns on our structural hedge strategy were lower than in the first half of 2013 following the maturity of historic contracts that benefited from higher returns. This was partially offset by increased interest income as a result of continued growth in customer loans at improved spreads. |

| | • | | Non-interest income decreased by £196m to £240m in the first half of 2014 (2013: £436m) principally due to reduced mark-to-market gains on certain derivatives, which are only treated as hedging for Santander UK group purposes. In addition, non-interest income decreased due to a significantly reduced credit arising from the debit valuation adjustments on derivatives written by ANTS. |

| | • | | Administrative expenses increased by £17m to £125m in the first half of 2014 (2013: £108m). The increase reflected the continued investment in the Commercial Banking and Markets businesses, partially offset by effective cost control. |

| | • | | Depreciation, amortisation and impairment costs were unchanged at £1m in the first half of 2014 (2013: £1m). |

| | • | | Impairment losses on loans and advances decreased by £18m to £nil in the first half of 2014 (2013: £18m). Credit quality in the loan books continued to be good, supported by the improving economic environment. |

| | • | | The taxation charge decreased by £46m to a credit of £1m in the first half of 2014 (2013: £45m) principally due to reduced profits. The tax charge in both periods was also reduced by the effect of other non-equalised items and adjustments in respect of prior year provisions. |

| | |

| 4 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Group and Divisional Results continued

Critical factors affecting results

The preparation of our Condensed Consolidated Interim Financial Statements requires management to make estimates and judgements that affect the reported amount of assets and liabilities at the balance sheet date and the reported amount of income and expenses during the reporting period. Management evaluates its estimates and judgements on an ongoing basis. Management bases its estimates and judgements on historical experience and other factors believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. Estimates and judgements that are considered important to the portrayal of our financial condition including, where applicable, quantification of the effects of reasonably possible ranges of such estimates are set out in “Critical Accounting Policies” in Note 1 on page 127 of the 2013 Annual Report.

The rest of this section contains a summary of the results, and commentary thereon, by Income Statement line item for each segment.

Basis of results presentation

The segmental information in this Half Yearly Financial Report reflects the reporting structure in place at the reporting date in accordance with which the segmental information in Note 2 to the Condensed Consolidated Interim Financial Statements has been presented. The Company’s board of directors (the ‘Board’) is the chief operating decision maker for the ANTS group. The segment information below is presented on the basis used by the Board to evaluate performance and allocate resources. The Board reviews discrete financial information for each segment of the business which follows the ANTS group’s normal accounting policies and principles, including measures of operating results, assets and liabilities.

PROFIT BEFORE TAX BY SEGMENT

| | | | | | | | | | | | | | | | |

30 June 2014 | | Commercial

Banking

£m | | | Markets

£m | | | Corporate

Centre

£m | | | Total

£m | |

Net interest income/(expense) | | | 90 | | | | 1 | | | | (141 | ) | | | (50 | ) |

Non-interest income | | | 110 | | | | 57 | | | | 73 | | | | 240 | |

| | | | | | | | | | | | | | | | |

Total operating income | | | 200 | | | | 58 | | | | (68 | ) | | | 190 | |

| | | | | | | | | | | | | | | | |

Administration expenses | | | (50 | ) | | | (56 | ) | | | (19 | ) | | | (125 | ) |

Depreciation, amortisation and impairment | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

| | | | | | | | | | | | | | | | |

Total operating expenses excluding impairment losses | | | (50 | ) | | | (57 | ) | | | (19 | ) | | | (126 | ) |

| | | | | | | | | | | | | | | | |

Impairment losses on loans and advances | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total operating impairment losses | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Profit/(loss) before tax | | | 150 | | | | 1 | | | | (87 | ) | | | 64 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

30 June 2013 | | Commercial

Banking

£m | | | Markets

£m | | | Corporate

Centre

£m | | | Total

£m | |

Net interest income/(expense) | | | 69 | | | | (1 | ) | | | (76 | ) | | | (8 | ) |

Non-interest income | | | 114 | | | | 40 | | | | 282 | | | | 436 | |

| | | | | | | | | | | | | | | | |

Total operating income | | | 183 | | | | 39 | | | | 206 | | | | 428 | |

| | | | | | | | | | | | | | | | |

Administration expenses | | | (42 | ) | | | (48 | ) | | | (18 | ) | | | (108 | ) |

Depreciation, amortisation and impairment | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

| | | | | | | | | | | | | | | | |

Total operating expenses excluding impairment losses | | | (42 | ) | | | (49 | ) | | | (18 | ) | | | (109 | ) |

| | | | | | | | | | | | | | | | |

Impairment losses on loans and advances | | | (18 | ) | | | — | | | | — | | | | (18 | ) |

| | | | | | | | | | | | | | | | |

Total operating impairment losses | | | (18 | ) | | | — | | | | — | | | | (18 | ) |

| | | | | | | | | | | | | | | | |

Profit/(loss) before tax | | | 123 | | | | (10 | ) | | | 188 | | | | 301 | |

| | | | | | | | | | | | | | | | |

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 5 |

Detailed Business Review

Group and Divisional Resultscontinued

COMMERCIAL BANKING

Commercial Banking offers a wide range of products and financial services to customers through a network of regional CBCs and through telephony and e-commerce channels. Commercial Banking products and services include loans, bank accounts, deposits and treasury services. The management of our customers is organised according to the annual turnover of their business, enabling us to offer a differentiated service to small and medium enterprises (‘SMEs’), mid and large corporate customers.

The SME and mid corporate business principally serves SMEs with an annual turnover of more than £250,000 up to £50m, and other corporate customers with an annual turnover of up to £500m. This also includes real estate lending.

The Large Corporates business offers specialist treasury services in fixed income and foreign exchange, lending, transactional banking services, capital markets and money markets to large multinational corporate customers with an annual turnover of more than £500m. Lending includes syndicated loans and structured finance. Transactional banking includes trade finance and cash management. Money market activities include securities lending/borrowing and repos.

Summarised income statement

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Net interest income | | | 90 | | | | 69 | |

Non-interest income | | | 110 | | | | 114 | |

| | | | | | | | |

Total operating income | | | 200 | | | | 183 | |

| | | | | | | | |

Administration expenses | | | (50 | ) | | | (42 | ) |

Depreciation, amortisation and impairment | | | — | | | | — | |

| | | | | | | | |

Total operating expenses excluding impairment losses | | | (50 | ) | | | (42 | ) |

| | | | | | | | |

Impairment losses on loans and advances | | | — | | | | (18 | ) |

| | | | | | | | |

Total operating impairment losses | | | — | | | | (18 | ) |

| | | | | | | | |

Profit before tax | | | 150 | | | | 123 | |

| | | | | | | | |

Commercial Banking profit before tax

Six months ended 30 June 2014 compared to six months ended 30 June 2013

Profit before tax increased by £27m to £150m in the first half of 2014 (2013: £123m). By income statement line, the movements were:

| | • | | Net interest income increased by £21m to £90m in the first half of 2014 (2013: £69m), principally as a result of continued growth in customer loans at improved spreads. |

| | • | | Non-interest income decreased by £4m to £110m in the first half of 2014 (2013: £114m) reflecting lower income from Large Corporates, primarily as a result of lower demand for interest rate risk management products in a relatively stable, low interest rate environment, partially offset by increased client short-term market activity. |

| | • | | Administration expenses increased by £8m to £50m in the first half of 2014 (2013: £42m). The increase reflected the continued investment in the Commercial Banking business. |

| | • | | Depreciation, amortisation and impairment were unchanged at £nil in the first half of 2014 (2013: £nil). |

| | • | | Impairment losses on loans and advances decreased by £18m to £nil in the first half of 2014 (2013: £18m). Credit quality in the loan books continued to be good, supported by the improving economic environment. |

| | |

| 6 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Group and Divisional Results continued

MARKETS

Markets offers risk management and other services to financial institutions, as well as to other Santander UK divisions. Its main product areas are fixed income and foreign exchange, equity, capital markets and institutional sales.

Summarised income statement

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Net interest income/(expense) | | | 1 | | | | (1 | ) |

Non-interest income | | | 57 | | | | 40 | |

| | | | | | | | |

Total operating income | | | 58 | | | | 39 | |

| | | | | | | | |

Administration expenses | | | (56 | ) | | | (48 | ) |

Depreciation, amortisation and impairment | | | (1 | ) | | | (1 | ) |

| | | | | | | | |

Total operating expenses excluding impairment losses | | | (57 | ) | | | (49 | ) |

| | | | | | | | |

Impairment losses on loans and advances | | | — | | | | — | |

| | | | | | | | |

Total operating impairment losses | | | — | | | | — | |

| | | | | | | | |

Profit/(loss) before tax | | | 1 | | | | (10 | ) |

| | | | | | | | |

Markets profit/(loss) before tax

Six months ended 30 June 2014 compared to six months ended 30 June 2013

Profit/(loss) before tax increased by £11m to £1m in the first half of 2014 (2013: loss of £10m). By income statement line, the movements were:

| | • | | Net interest income/(expense) increased by £2m to £1m in the first half of 2014 (2013: expense of £1m), primarily due to a decrease in funding costs. |

| | • | | Non-interest income increased by £17m to £57m in the first half of 2014 (2013: £40m). Following a refocusing of the Equity Derivatives and Securities Financing businesses in 2013, non-interest income recovered to more normalised levels. |

| | • | | Administration expenses increased by £8m to £56m in the first half of 2014 (2013: £48m), reflecting investment in developing interest rate and fixed income product capabilities offset by tight cost control. |

| | • | | Depreciation, amortisation and impairment remained unchanged at £1m in the first half of 2014 (2013: £1m). |

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 7 |

Detailed Business Review

Group and Divisional Resultscontinued

CORPORATE CENTRE

Corporate Centre consists of FMIR and the non-core portfolios of social housing loans and structured credit assets. FMIR is responsible for managing capital and funding, balance sheet composition and structure, and strategic liquidity risk for the Santander UK group. The non-core portfolios are being run-down and/or managed for value.

Summarised income statement

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Net interest expense | | | (141 | ) | | | (76 | ) |

Non-interest income | | | 73 | | | | 282 | |

| | | | | | | | |

Total operating (expense)/income | | | (68 | ) | | | 206 | |

| | | | | | | | |

Administration expenses | | | (19 | ) | | | (18 | ) |

Depreciation, amortisation and impairment | | | — | | | | — | |

| | | | | | | | |

Total operating expenses excluding impairment losses | | | (19 | ) | | | (18 | ) |

| | | | | | | | |

Impairment losses on loans and advances | | | — | | | | — | |

| | | | | | | | |

Total operating impairment losses | | | — | | | | — | |

| | | | | | | | |

(Loss)/profit before tax | | | (87 | ) | | | 188 | |

| | | | | | | | |

Corporate Centre (loss)/profit before tax

Six months ended 30 June 2014 compared to six months ended 30 June 2013

(Loss)/profit before tax decreased by £275m to £(87)m in the first half of 2014 (2013: £188m). By income statement line, the movements were:

| | • | | Net interest expense increased by £65m to £141m in the first half of 2014 (2013: £76m) as the returns on our structural hedge strategy were lower than in the first half of 2013 following the maturity of historic contracts that benefited from higher returns. |

| | • | | Non-interest income decreased by £209m to income of £73m in the first half of 2014 (2013: £282m) principally due to reduced mark-to-market gains on certain derivatives, which are only treated as hedging for Santander UK group purposes. In addition, non-interest income decreased due to a significantly reduced credit arising from the debit valuation adjustments on derivatives written by ANTS. |

| | • | | Administration expenses increased by £1m to £19m in the first half of 2014 (2013: £18m) reflecting effective cost control. |

| | |

| 8 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Balance Sheet Review

This Balance Sheet Review describes the ANTS group’s significant assets and liabilities and its strategy and reasons for entering into such transactions. Throughout this section, references to UK and non-UK, in the geographic analysis, refer to the location of the office where the transaction is recorded.

This Balance Sheet Review focuses on those areas that have changed significantly during the first half of 2014, and represents an update to the Balance Sheet Review in the 2013 Annual Report, with which it should be read in conjunction. The Balance Sheet Review in the 2013 Annual Report contains additional disclosures which have not changed significantly during the first half of 2014.

SUMMARISED CONDENSED CONSOLIDATED BALANCE SHEET

| | | | | | | | |

| | | 30 June 2014

£m | | | 31 December 2013

£m | |

Assets | | | | | | | | |

Cash and balances at central banks | | | 7,452 | | | | 4,911 | |

Trading assets | | | 18,307 | | | | 21,897 | |

Derivative financial instruments | | | 21,379 | | | | 21,550 | |

Financial assets designated at fair value | | | 2,543 | | | | 2,534 | |

Loans and advances to banks | | | 110,454 | | | | 113,649 | |

Loans and advances to customers | | | 38,032 | | | | 41,108 | |

Loans and receivables securities | | | 96 | | | | 128 | |

Available for sale securities | | | 2,550 | | | | 2,962 | |

Macro hedge of interest rate risk | | | 399 | | | | 379 | |

Property, plant and equipment | | | 7 | | | | 6 | |

Tax, intangibles and other assets | | | 201 | | | | 203 | |

| | | | | | | | |

Total assets | | | 201,420 | | | | 209,327 | |

| | | | | | | | |

Liabilities | | | | | | | | |

Deposits by banks | | | 118,326 | | | | 120,698 | |

Deposits by customers | | | 4,824 | | | | 7,780 | |

Trading liabilities | | | 17,848 | | | | 21,275 | |

Derivative financial instruments | | | 21,607 | | | | 21,496 | |

Financial liabilities designated at fair value | | | 3,252 | | | | 3,407 | |

Debt securities in issue | | | 31,717 | | | | 30,889 | |

Tax, other liabilities and provisions | | | 549 | | | | 614 | |

| | | | | | | | |

Total liabilities | | | 198,123 | | | | 206,159 | |

| | | | | | | | |

Equity | | | | | | | | |

Total shareholders’ equity | | | 3,297 | | | | 3,168 | |

| | | | | | | | |

Total equity | | | 3,297 | | | | 3,168 | |

| | | | | | | | |

Total liabilities and equity | | | 201,420 | | | | 209,327 | |

| | | | | | | | |

A more detailed consolidated balance sheet is contained in the Condensed Consolidated Interim Financial Statements.

30 June 2014 compared to 31 December 2013

Assets

Cash and balances at central banks

Cash and balances held at central banks increased to £7,452m at 30 June 2014 (2013: £4,911m). The increase was due to additional cash placed with the Federal Reserve Bank of New York as part of normal liquid asset portfolio management activity.

Trading assets

Trading assets decreased by 16% to £18,307m at 30 June 2014 (2013: £21,897m) reflecting lower levels of activity relating to securities purchased under resale agreements to both banks and customers partially offset by increased holdings of equity instruments as part of short-term markets trading activity.

Derivative financial instruments - assets

Derivative assets remained broadly unchanged at £21,379m at 30 June 2014 (2013: £21,550m).

Financial assets designated at fair value through profit and loss

Financial assets designated at fair value through profit and loss remained broadly unchanged at £2,543m at 30 June 2014 (2013: £2,534m).

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 9 |

Business Review

Balance Sheet Review continued

Loans and advances to banks

Loans and advances to banks decreased by 3% at £110,454m at 30 June 2014 (2013: £113,649m). These balances largely consisted of loans to Santander UK to support its retail and commercial banking activities.

Loans and advances to customers

Loans and advances to customers decreased by 7% to £38,032m at 30 June 2014 (2013: £41,108m) due to reduced on-lending of covered bond issuances.

Available for sale securities

Available for sale securities decreased to £2,550m at 30 June 2014 (2013: £2,962m) as part of normal liquid asset portfolio management activity.

Loans and receivables securities

Loans and receivables securities decreased by 25% to £96m at 30 June 2014 (2013: £128m). The decrease principally reflected the continuing run-down of the Treasury asset portfolio.

Tax, intangibles and other assets

Tax, intangibles and other assets remained broadly unchanged at £201m at 30 June 2014 (2013: £203m).

Liabilities

Deposits by banks

Deposits by banks were relatively stable at £118,326m at 30 June 2014 (2013: £120,698m). This largely consisted of deposits by Santander UK representing on-lending to ANTS of retail and commercial deposits.

Deposits by customers

Deposits by customers decreased by 38% to £4,824m at 30 June 2014 (2013: £7,780m). The decrease was attributable to lower levels of deposits as part of a plan for the management of our less relationship driven deposit base.

Trading liabilities

Trading liabilities decreased by 16% to £17,848m at 30 June 2014 (2013: £21,275m). A decrease in securities sold under repurchase activities and the cash collateral received as part of normal trading activity were offset by an increase in short-term deposits and short positions in securities.

Derivative financial instruments - liabilities

Derivative liabilities were broadly unchanged at £21,607m at 30 June 2014 (2013: £21,496m).

Financial liabilities designated at fair value

Financial liabilities designated at fair value decreased by 5% to £3,252m at 30 June 2014 (2013: £3,407m). The decrease principally reflected a slight reduction in issuances of structured notes.

Debt securities in issue

Debt securities in issue increased by 3% to £31,717m at 30 June 2014 (2013: £30,889m) with increases in issuance of certificates of deposit, partially offset by maturities under the covered bond programme.

Equity

Total shareholders equity increased by 4% to £3,297m at 30 June 2014 (2013: £3,168m). The increase was principally attributable to retained profit for the period and an increase in the cash flow hedging reserve.

| | |

| 10 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Business Review

Balance Sheet Review continued

SHORT-TERM BORROWINGS

The ANTS group includes short-term borrowings within deposits by banks, trading liabilities, financial liabilities designated at fair value and debt securities in issue and does not show short-term borrowings separately on the balance sheet. Short-term borrowings are defined by the US Securities and Exchange Commission (the ‘SEC’) as amounts payable for short-term obligations that are US Federal funds purchased and securities sold under repurchase agreements, commercial paper, borrowings from banks, borrowings from factors or other financial institutions and any other short-term borrowings reflected on the ANTS group’s balance sheet. The ANTS group’s only significant short-term borrowings are securities sold under repurchase agreements, commercial paper, borrowings from banks, negotiable certificates of deposit, and certain other debt securities in issue. Additional information on short-term borrowings is provided in the table below for each of the six months ended 30 June 2014 and 30 June 2013.

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Securities sold under repurchase agreements | | | | | | | | |

- Period end balance | | | 13,217 | | | | 23,664 | |

- Period-end interest rate | | | 0.63 | % | | | 0.35 | % |

- Average balance(1) | | | 22,872 | | | | 19,607 | |

- Average interest rate(1) | | | 0.44 | % | | | 0.39 | % |

- Maximum balance(1) | | | 25,927 | | | | 23,664 | |

Commercial paper | | | | | | | | |

- Period-end balance | | | 3,862 | | | | 4,687 | |

- Period-end interest rate | | | 0.61 | % | | | 0.47 | % |

- Average balance(1) | | | 4,043 | | | | 4,223 | |

- Average interest rate(1) | | | 0.39 | % | | | 0.53 | % |

- Maximum balance(1) | | | 4,610 | | | | 4,687 | |

Borrowings from banks (Deposits by banks) | | | | | | | | |

- Period-end balance | | | 602 | | | | 223 | |

- Period-end interest rate | | | 0.50 | % | | | 0.45 | % |

- Average balance(1) | | | 467 | | | | 563 | |

- Average interest rate(1) | | | 1.27 | % | | | 0.27 | % |

- Maximum balance(1) | | | 602 | | | | 1,149 | |

Negotiable certificates of deposit | | | | | | | | |

- Period-end balance | | | 4,119 | | | | 2,336 | |

- Period-end interest rate | | | 2.00 | % | | | 1.96 | % |

- Average balance(1) | | | 3,588 | | | | 2,299 | |

- Average interest rate(1) | | | 2.51 | % | | | 1.77 | % |

- Maximum balance(1) | | | 4,119 | | | | 2,724 | |

Other debt securities in issue | | | | | | | | |

- Period-end balance | | | 4,793 | | | | 4,661 | |

- Period-end interest rate | | | 2.87 | % | | | 2.92 | % |

- Average balance(1) | | | 4,922 | | | | 6,211 | |

- Average interest rate(1) | | | 3.11 | % | | | 2.95 | % |

- Maximum balance(1) | | | 5,938 | | | | 7,888 | |

| (1) | Calculated using monthly data. |

The ANTS group issues commercial paper generally in denominations of not less than US$50,000, with maturities of up to 365 days. Commercial paper is issued by the Company and its subsidiary Abbey National North America LLC.

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 11 |

Business Review

Balance Sheet Review continued

LIQUIDITY AND FUNDING

Sources and uses of liquidity and funding

ANTS is the treasury support function for the Santander UK group. In this regard, ANTS’s role is to provide access to financial markets and central bank facilities in order to meet the Santander UK group’s liquidity, funding, capital and balance sheet management requirements.

The Company has given a full and unconditional guarantee in respect of the unsubordinated liabilities of Santander UK plc incurred prior to 30 June 2015 under a deed poll guarantee entered into by the Company on 10 May 2012. Santander UK plc has given a reciprocal guarantee in respect of the unsubordinated liabilities of the Company incurred prior to 30 June 2015.

Liquidity and funding risk is managed on a Santander UK group basis and it is not therefore appropriate to consider these risks separately at an ANTS group level. In addition, under the PRA’s regulatory liquidity regime, Santander UK and ANTS together with Cater Allen Limited, a fellow subsidiary of Santander UK plc, form the Santander UK Defined Liquidity Group (‘DLG’). Under these arrangements, each member of the DLG is liable to support each other in terms of transferring or receiving surplus liquidity in times of stress. In considering the liquidity resources available to the ANTS group, both its own liquid assets and also those of the rest of the Santander UK group are separately presented.

In addition, the Company, Santander UK plc, and Cater Allen Limited, which are the three PRA-regulated entities within the Santander UK group, are party to a capital support deed dated 14 December 2012 (the “Capital Support Deed”) with certain other non-regulated subsidiaries of Santander UK plc. The parties to the Capital Support Deed constitute a core UK group for the purposes of the large exposures provisions of CRD IV. Under article 4001(f) of the Capital Requirements Regulations, exposures of each of the three regulated entities to other members of the core UK group are exempt from large exposure limits that would otherwise apply. The purpose of the Capital Support Deed is to facilitate the prompt transfer of available capital resources from, or repayment of liabilities by, the non-regulated parties to any of the regulated parties in the event that one of the regulated parties has breached or is at risk of breaching its capital resources requirements or risk concentrations requirements.

Santander UK primarily generates funding and liquidity through UK retail and corporate deposits, as well as in the financial markets through its own debt programmes and facilities to support its business activities and liquidity requirements. It does this in reliance on the strength of its balance sheet and profitability and its own network of investors.

Liquidity and funding risks are identified and encompassed within Santander UK’s Risk Framework and subject to Santander UK’s three-tier risk governance framework.

The debt issuance programmes managed by ANTS are set out in Notes 30 and 31 to the Consolidated Financial Statements in the 2013 Annual Report.

Further information is set out in “Liquidity and funding risk” in the Risk Management Report.

Cash flows

| | | | | | | | |

| | | Six months ended

30 June 2014

£m | | | Six months ended

30 June 2013

£m | |

Net cash inflow/(outflow) from operating activities | | | 11,450 | | | | (1,771 | ) |

Net cash inflow from investing activities | | | 381 | | | | 843 | |

Net cash inflow/(outflow) from financing activities | | | 405 | | | | (3,596 | ) |

| | | | | | | | |

Increase/(decrease) in cash and cash equivalents | | | 12,236 | | | | (4,524 | ) |

| | | | | | | | |

The major activities and transactions that affected the ANTS group’s cash flows during the first six months of 2014 were as follows:

In the six months ended 30 June 2014, the net cash inflow from operating activities of £11,450m resulted from decreased loans and advances to banks and customers.

In the six months ended 30 June 2014, the net cash inflow from investing activities of £381m resulted primarily from the net proceeds of acquisitions and disposals of UK Treasury bills and other government securities.

In the six months ended 30 June 2014, the net cash inflow from financing activities of £405m reflected new issues of debt securities of £9,977m, partially offset by repayments of debt securities maturing in the period of £9,572m.

In the six months ended 30 June 2014, cash and cash equivalents increased by £11,657m resulted principally from an increase in short-term loans and advances to banks, and an increase in cash and balances at central banks.

| | |

| 12 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Business Review

Balance Sheet Review continued

AVERAGE BALANCE SHEET

As period-end statements may not be representative of the ANTS group’s activity throughout the period, average balance sheets for the ANTS group are presented below. The average balance sheets summarise the significant categories of assets and liabilities, together with average interest rates.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended 30 June 2014 | | | Six months ended 30 June 2013 | |

| | | Average

Balance(1)

£m | | | Interest(4) (5)

£m | | | Average

rate

% | | | Average

balance(1)

£m | | | Interest(4) (5)

£m | | | Average

rate

% | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Loans and advances to banks: | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | 102,469 | | | | 628 | | | | 1.23 | | | | 110,903 | | | | 1,021 | | | | 1.84 | |

- Non-UK | | | 13,380 | | | | 15 | | | | 0.22 | | | | 5,634 | | | | 9 | | | | 0.32 | |

Loans and advances to customers:(3) | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | 40,195 | | | | 523 | | | | 2.60 | | | | 41,078 | | | | 542 | | | | 2.64 | |

Other interest-earning financial assets | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | 2,717 | | | | 18 | | | | 1.32 | | | | 4,464 | | | | 20 | | | | 0.90 | |

- Non-UK | | | — | | | | — | | | | — | | | | 289 | | | | 1 | | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total average interest-earning assets, interest income(2) | | | 158,761 | | | | 1,184 | | | | 1.49 | | | | 162,368 | | | | 1,593 | | | | 1.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Impairment loss allowances | | | (56 | ) | | | — | | | | — | | | | (114 | ) | | | — | | | | — | |

Trading business | | | 18,930 | | | | — | | | | — | | | | 26,320 | | | | — | | | | — | |

Assets designated at FVTPL | | | 2,605 | | | | — | | | | — | | | | 3,236 | | | | — | | | | — | |

Other non-interest-earning assets | | | 28,840 | | | | — | | | | — | | | | 37,147 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total average assets | | | 209,080 | | | | — | | | | — | | | | 228,957 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-UK assets as a % of total | | | 6.40 | % | | | — | | | | — | | | | 2.59 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits by banks: | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | (113,290 | ) | | | (666 | ) | | | 1.18 | | | | (117,862 | ) | | | (998 | ) | | | 1.69 | |

- Non-UK | | | (9 | ) | | | — | | | | — | | | | (2 | ) | | | — | | | | — | |

Deposits by customers – wholesale: | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | (6,341 | ) | | | (72 | ) | | | 2.27 | | | | (5,665 | ) | | | (67 | ) | | | 2.37 | |

- Non-UK | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Bonds and medium-term notes: | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | (28,451 | ) | | | (491 | ) | | | 3.45 | | | | (27,099 | ) | | | (525 | ) | | | 3.87 | |

- Non-UK | | | (4,287 | ) | | | (5 | ) | | | 0.23 | | | | (4,357 | ) | | | (11 | ) | | | 0.50 | |

Dated and undated loan capital and other subordinated liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

- UK | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total average interest-bearing liabilities, interest expense(2) | | | (152,378 | ) | | | (1,234 | ) | | | 1.62 | | | | (154,985 | ) | | | (1,601 | ) | | | 2.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Trading business | | | (25,891 | ) | | | — | | | | — | | | | (31,233 | ) | | | — | | | | — | |

Liabilities designated at FVTPL | | | (4,085 | ) | | | — | | | | — | | | | (4,902 | ) | | | — | | | | — | |

Non-interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

- Other | | | (23,486 | ) | | | — | | | | — | | | | (33,935 | ) | | | — | | | | — | |

- Shareholders’ funds | | | (3,240 | ) | | | — | | | | — | | | | (3,902 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total average liabilities and shareholders’ funds | | | (209,080 | ) | | | — | | | | — | | | | (228,957 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-UK liabilities as a % of total | | | 2.05 | % | | | — | | | | — | | | | 1.90 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Average balances are based upon monthly data. |

| (2) | The ratio of average interest-earning assets to interest-bearing liabilities for the six months ended 30 June 2014 was 104.19% (Six months ended 30 June 2013: 104.76%). |

| (3) | Loans and advances to customers include non-performing loans. See the “Credit Risk” section of the Risk Management Report. |

| (4) | The net interest margin for the six months ended 30 June 2014 was (0.06)% (Six months ended 30 June 2013: (0.01)%). Net interest margin is calculated as net interest income divided by average interest-earning assets. |

| (5) | The interest spread for the six months ended 30 June 2014 was (0.13)% (Six months ended 30 June 2013: (0.1)%). Interest spread is the difference between the rate of interest earned on average interest-earning assets and the rate of interest paid on average interest-bearing liabilities. |

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 13 |

Detailed Business Review

Risk Management Report

This Risk Management Report contains information that forms an integral part of the Condensed Consolidated Interim Financial Statements.

This Risk Management Report focuses on those areas that have changed significantly during the first half of 2014, and represents an update to the Risk Management Report in the 2013 Annual Report, with which it should be read in conjunction. The Risk Management Report in the 2013 Annual Report contains additional disclosures which have not changed significantly during the first half of 2014.

| | |

| 14 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Risk Management Report continued

RISK MANAGEMENT REPORT

This Risk Management Report contains information that forms an integral part of the Condensed Consolidated Interim Financial Statements

The ANTS group provides treasury, corporate and wholesale banking services to UK clients and also to the wider Santander UK group, of which ANTS is a significant part. ANTS is also the treasury support function for the Santander UK group. In this regard, ANTS’s role is to provide access to financial markets and central bank facilities in order to meet the Santander UK group’s liquidity, funding, capital and balance sheet management requirements. As such, ANTS is one of the main debt issuance vehicles in the Santander UK group.

ANTS contains part of a number of Santander UK’s business segments. Specifically, ANTS consists of part of the Santander UK group’s Commercial Banking and Corporate Centre business segments and its entire Markets business segment. Whether transactions are booked in ANTS or another Santander UK group entity reflects historical or operational reasons and does not necessarily reflect any particular business split.

Santander UK plc has given a full and unconditional guarantee in respect of the liabilities of ANTS incurred up to 30 June 2015. The Company has given a reciprocal guarantee in respect of the unsubordinated liabilities of Santander UK plc incurred up to 30 June 2015. As a consequence of the reciprocal guarantee given by the Company in respect of the unsubordinated liabilities of Santander UK plc, the Company is exposed to the same risks as the Santander UK group, of which ANTS is a significant part.

As a subsidiary of Santander UK plc, ANTS has adopted the Santander UK Risk Framework. As a consequence, the ANTS group’s risks are managed at a Santander UK group level in accordance with the Santander UK group’s Risk Framework. The Risk Management Report describes the Santander UK group’s Risk Framework and includes more detail on the key risks (on a segmental basis or aggregated where relevant) to which the ANTS group is directly exposed. In addition, as a consequence of the guarantee given by the ANTS group in respect of the liabilities of Santander UK plc, the ANTS group is indirectly exposed to risks that arise in parts of the Santander UK group that are wholly outside the ANTS group. Those risks consist of retail credit risk and pension obligations risk.

Throughout the Risk Management Report, except where stated otherwise, references to Santander UK should be taken to include the ANTS group (reflecting both the risks that ANTS is directly exposed to through its own activities and the risks arising elsewhere in the Santander UK group that ANTS is indirectly exposed to due to the existence of the cross guarantees described above).

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 15 |

Detailed Business Review

Risk Management Reportcontinued

RISK MANAGEMENT

INTRODUCTION

As a significant financial services provider, risk is at the core of Santander UK’s day-to-day activities. The understanding and control of risk is critical for the effective management of the business. Santander UK aims to employ a prudent approach and advanced risk management techniques to facilitate the delivery of robust financial performance, and ultimately build sustainable value for all our stakeholders, including our people, customers, shareholders and the communities in which we operate. Santander UK aims to maintain a predictable medium-low risk profile.

RISK FRAMEWORK

The Risk Framework in place at 30 June 2014 was based upon the following key components:

| • | | Risk definition and structure; |

| • | | Risk Culture, overriding principles and minimum standards; |

| • | | Governance, roles and responsibilities; and |

| • | | System of internal control for risk. |

In December 2013, the Board of Santander UK plc (the “Santander UK Board”) approved an updated Risk Framework, which operated throughout the first half of 2014.As a subsidiary group of Santander UK, ANTS has adopted this Risk Framework. The key risk types were simplified and the lines of defence model streamlined. There was no change to the overriding principles. The main changes were:

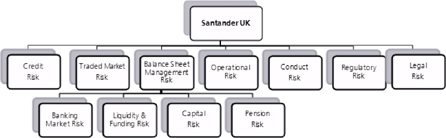

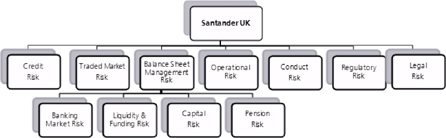

| • | | With respect to risk definition and structure, the key risk types were reorganised as: Credit, Traded Market, Balance Sheet Management (previously known as Structural) including Banking Market (previously known as Non-traded Market), Operational, Conduct, Regulatory and Legal, as set out diagrammatically below; and |

| • | | The additional classification of financial / non-financial risks was removed; |

| • | | With respect to governance, roles and responsibilities, a Conduct & Regulatory Risk Committee was created which reports to the Executive Risk Committee; and |

| • | | A Risk Culture statement was included. |

Risk definition and structure

| | |

| 16 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Risk Management Report continued

CREDIT RISK REVIEW

ANTS GROUP EXPOSURE

Maximum exposure to credit risk

The tables below set out the ANTS group’s maximum exposure to credit risk. For balance sheet assets, the maximum exposure to credit risk represents the carrying value after allowance for impairment losses. Off-balance sheet exposures comprise guarantees, formal standby facilities, credit lines and other commitments. For off-balance sheet guarantees, the maximum exposure is the maximum amount that ANTS would have to pay if the guarantees were to be called upon. For formal standby facilities, credit lines and other commitments that are irrevocable over the life of the respective facilities, the maximum exposure is the full amount of the committed facilities.

The table presented below include only those financial assets subject to credit risk, and therefore excludes equity securities.

| | | | | | | | | | | | | | | | |

| | | 30 June 2014 | | | 31 December 2013 | |

| | | Maximum exposure | | | Maximum exposure | |

| | | Balance

sheet asset

£bn | | | Off-balance

sheet(1)

£bn | | | Balance

sheet asset

£bn | | | Off-balance

sheet(1)

£bn | |

Cash and balances at central banks | | | 7.5 | | | | — | | | | 4.9 | | | | — | |

Trading assets | | | 15.5 | | | | — | | | | 21.6 | | | | — | |

Financial assets designated at fair value | | | 2.5 | | | | 0.2 | | | | 2.5 | | | | 0.2 | |

Available-for-sale debt securities | | | 2.6 | | | | — | | | | 3.0 | | | | — | |

Derivative financial instruments | | | 21.4 | | | | — | | | | 21.6 | | | | — | |

Loans and advances to banks | | | 110.5 | | | | 155.3 | | | | 113.6 | | | | 149.9 | |

Loans and advances to customers | | | 38.0 | | | | 11.9 | | | | 41.1 | | | | 10.7 | |

Loans and receivables securities | | | 0.1 | | | | — | | | | 0.1 | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | 198.1 | | | | 167.4 | | | | 208.4 | | | | 160.8 | |

| | | | | | | | | | | | | | | | |

| (1) | Off balance sheet exposure includes the cross guarantee of the liabilities of Santander UK plc, as set out in Note 20 to the Condensed Consolidated Interim Financial Statements. |

Credit quality

ANTS uses a single rating scale to provide a consistent approach for reporting default risk across all the credit risk portfolios. The scale is comprised of eight grades for non-defaulted exposures numbered from 9 (lowest risk) to 2 (highest risk). Each grade is defined by an upper and lower probability of default (‘PD’) value and is scaled so that the default risk increases by a factor of 10 for every 2 step reduction in the grade number. For example, risk grade 9 equates to an average PD of 0.01%, and risk grade 7 equates to an average PD of 0.1%. Defaulted exposures are assigned to grade 1 and a PD value of 100%. An approximation to the equivalent credit rating grade used by Standard and Poor’s Rating Services (‘S&P’) is shown in the final column of the table.

| | | | | | | | | | | | | | | | |

| | | PD range | | | | |

ANTS risk grade | | Mid

% | | | Lower

% | | | Upper

% | | | S&P equivalent | |

9 | | | 0.010 | | | | 0.000 | | | | 0.021 | | | | AAA to AA- | |

8 | | | 0.032 | | | | 0.021 | | | | 0.066 | | | | A+ to A | |

7 | | | 0.100 | | | | 0.066 | | | | 0.208 | | | | A- to BBB+ | |

6 | | | 0.316 | | | | 0.208 | | | | 0.658 | | | | BBB to BBB- | |

5 | | | 1.000 | | | | 0.658 | | | | 2.081 | | | | BB+ to BB- | |

4 | | | 3.162 | | | | 2.081 | | | | 6.581 | | | | B+ to B | |

3 | | | 10.000 | | | | 6.581 | | | | 20.811 | | | | B- to CCC | |

2 | | | 31.623 | | | | 20.811 | | | | 99.999 | | | | CC TO C | |

1 Default | | | 100.000 | | | | 100.000 | | | | 100.000 | | | | D | |

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 17 |

Detailed Business Review

Risk Management Reportcontinued

Non-performing loans and advances(1)(2)

An analysis of ANTS’s NPLs is presented below. The information is presented for Commercial Banking only as there are no NPLs in other business divisions.

| | | | | | | | |

| | | 30 June 2014

£m | | | 31 December 2013

£m | |

Loans and advances to customers of which:(2) | | | 6,838 | | | | 6,317 | |

Commercial Banking Arrears including NPLs(3) | | | 130 | | | | 94 | |

Commercial Banking NPLs - impaired(3) (4) (5) | | | 130 | | | | 94 | |

Commercial Banking NPLs - not impaired(3) (4) | | | — | | | | — | |

| | | | | | | | |

Commercial Banking NPLs | | | 130 | | | | 94 | |

| | | | | | | | |

Impairment loan loss allowances | | | 50 | | | | 63 | |

| | | | | | | | |

| | | % | | | | % | |

| | | | | | | | |

Arrears ratio(6) | | | 1.90 | | | | 1.49 | |

NPLs ratio(7) | | | 1.90 | | | | 1.49 | |

Coverage ratio(8) | | | 38 | | | | 67 | |

| | | | | | | | |

| (1) | Loans and advances are classified as non-performing typically when the counterparty fails to make payments when contractually due for three months or where it is deemed probable that this will occur in the near future. |

| (2) | All Commercial Banking NPL balances are UK and continue accruing interest. For the data presented, the balances include interest charged to the customer’s account, but exclude interest accrued but not yet charged to the account. |

| (3) | Commercial Banking loans and advances to customers include finance leases. |

| (4) | All the Non-Performing Loans are impaired for purposes of provisioning. |

| (5) | NPLs against which an impairment loss allowance has been established. |

| (6) | Commercial Banking loans and advances to customers in arrears as a percentage of Commercial Banking loans and advances to customers. |

| (7) | Commercial Banking NPLs as a percentage of Commercial Banking loans and advances to customers. |

| (8) | Impairment loan loss allowances as a percentage of NPLs. |

Concentrations of credit risk exposures

The management of risk concentration is a key part of risk management. ANTS tracks the degree of concentration of its credit risk portfolios using various criteria, including geographic areas and countries, economic sectors, products and groups of customers. Although ANTS’s operations are based mainly in the UK, it has built up exposures to various entities around the world and is therefore exposed to concentrations of risk related to geographic area.

Geographic concentrations

As part of its approach to credit risk management and risk appetite, ANTS sets exposure limits to countries and certain geographic areas. These limits are set with reference to the country limits set by Banco Santander, S.A. These are determined according to the classification of the country (whether it is a developed OECD country or not), the rating of the country, its gross domestic product and the type of business activities and products the Banco Santander group wishes to engage in within that country. For additional geographic information, see “Country Risk Exposure” on pages 35 to 38.

Credit risk exposures by industry

As part of its approach to credit risk management and risk appetite, ANTS sets exposure limits to certain key industry sectors. For additional industry information, see “Country Risk Exposure” on pages 35 to 38.

Forbearance

Commercial Banking is the only business division that undertakes forbearance activities. Discussion and analysis of forbearance activities in Commercial Banking are set out on page 22.

| | |

| 18 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Risk Management Report continued

CREDIT RISK – COMMERCIAL BANKING

In Commercial Banking, credit risk arises on asset balances and on committed off-balance sheet transactions such as credit facilities or guarantees. Consequently, committed exposures are typically higher than asset balances. However, in the following committed exposures tables, Sovereigns are presented net of short positions and include Sovereign exposures established for liquidity management purposes managed by Short Term Markets on behalf of Corporate Centre. Large Corporate reverse repos are presented net of repo liabilities and include OTC derivatives. As a result, the committed exposures are smaller than the asset balances recognised on the balance sheet.

COMMERCIAL BANKING - COMMITTED EXPOSURES

Rating distribution

The rating distribution tables show the credit risk exposure by ANTS’s internal rating scale (see page 17) for each portfolio within Commercial Banking. Within this scale, the higher the rating, the better the quality of the counterparty.

| | | | | | | | | | | | | | | | | | | | | | | | |

30 June 2014 | | Sovereign and

Supranational(2)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial Real

Estate

£m | | | Social Housing

£m | | | Total

£m | |

9 | | | 1,483 | | | | 3 | | | | 90 | | | | — | | | | 339 | | | | 1,915 | |

8 | | | 3,614 | | | | 1,664 | | | | 377 | | | | 259 | | | | 385 | | | | 6,299 | |

7 | | | 680 | | | | 2,738 | | | | 1,655 | | | | 793 | | | | 219 | | | | 6,085 | |

6 | | | — | | | | 4,022 | | | | 2,984 | | | | 2,580 | | | | 90 | | | | 9,676 | |

5 | | | — | | | | 1,271 | | | | 1,400 | | | | 1,202 | | | | — | | | | 3,873 | |

4 | | | — | | | | 100 | | | | 125 | | | | 159 | | | | — | | | | 384 | |

1 to 3 | | | — | | | | 85 | | | | 115 | | | | 99 | | | | — | | | | 299 | |

Other(1) | | | — | | | | — | | | | 3 | | | | 4 | | | | — | | | | 7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 5,777 | | | | 9,883 | | | | 6,749 | | | | 5,096 | | | | 1,033 | | | | 28,538 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

31 December 2013 | | Sovereign and

Supranational(2)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial Real

Estate

£m | | | Social Housing

£m | | | Total

£m | |

9 | | | 1,295 | | | | 14 | | | | 139 | | | | 126 | | | | 263 | | | | 1,837 | |

8 | | | 3,894 | | | | 1,242 | | | | 280 | | | | 278 | | | | 359 | | | | 6,053 | |

7 | | | 860 | | | | 3,122 | | | | 1,571 | | | | 1,419 | | | | 231 | | | | 7,203 | |

6 | | | — | | | | 3,454 | | | | 2,830 | | | | 1,797 | | | | 115 | | | | 8,196 | |

5 | | | — | | | | 1,336 | | | | 899 | | | | 1,061 | | | | — | | | | 3,296 | |

4 | | | — | | | | — | | | | 84 | | | | 200 | | | | — | | | | 284 | |

1 to 3 | | | — | | | | — | | | | 10 | | | | 112 | | | | — | | | | 122 | |

Other(1) | | | — | | | | — | | | | 12 | | | | 1 | | | | — | | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 6,049 | | | | 9,168 | | | | 5,825 | | | | 4,994 | | | | 968 | | | | 27,004 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Represents smaller exposures predominantly within the commercial mortgages portfolio which are subject to scorecards rather than a rating model. |

| (2) | An international organisation, whereby member states transcend national boundaries or interests to share in the decision-making and vote on issues pertaining to the to the geographical focus of the organisation. |

Geographical distribution

The geographic location is classified by country of risk, being the country where each counterparty’s main business activity or assets are located. For clients whose operations are more geographically dispersed, the country of incorporation is applied.

| | | | | | | | | | | | | | | | | | | | | | | | |

30 June 2014 | | Sovereign and

Supranational(1)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial Real

Estate

£m | | | Social Housing

£m | | | Total

£m | |

UK | | | — | | | | 7,710 | | | | 6,477 | | | | 5,096 | | | | 1,033 | | | | 20,316 | |

Peripheral eurozone | | | 680 | | | | 323 | | | | 8 | | | | — | | | | — | | | | 1,011 | |

Rest of Europe | | | 1,191 | | | | 1,393 | | | | 237 | | | | — | | | | — | | | | 2,821 | |

US | | | — | | | | 358 | | | | 4 | | | | — | | | | — | | | | 362 | |

Rest of world | | | 3,906 | | | | 99 | | | | 23 | | | | — | | | | — | | | | 4,028 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 5,777 | | | | 9,883 | | | | 6,749 | | | | 5,096 | | | | 1,033 | | | | 28,538 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

31 December 2013 | | Sovereign and

Supranational(1)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial

Real Estate

£m | | | Social Housing

£m | | | Total

£m | |

UK | | | — | | | | 7,520 | | | | 5,601 | | | | 4,994 | | | | 968 | | | | 19,083 | |

Peripheral eurozone | | | 860 | | | | 317 | | | | 18 | | | | — | | | | — | | | | 1,195 | |

Rest of Europe | | | 1,029 | | | | 861 | | | | 87 | | | | — | | | | — | | | | 1,977 | |

US | | | — | | | | 284 | | | | — | | | | — | | | | — | | �� | | 284 | |

Rest of world | | | 4,160 | | | | 186 | | | | 119 | | | | — | | | | — | | | | 4,465 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 6,049 | | | | 9,168 | | | | 5,825 | | | | 4,994 | | | | 968 | | | | 27,004 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | An international organisation, whereby member states transcend national boundaries or interests to share in the decision-making and vote on issues pertaining to the to the geographical focus of the organisation. |

30 June 2014 compared to 31 December 2013

During the first half of 2014, total committed exposures increased by £1.5bn or 6% to £28.5bn principally within the Large Corporate, and Mid Corporate and SME portfolios. Large Corporate exposures increased by 8% as a result of the development of the franchise focused in high-rated multinational companies. Growth was focused on the UK and other European countries with counterparties with good credit quality and primarily reflects the provision of financial products to support the working capital and liquidity needs of our clients. The Mid Corporate and SME portfolio grew by 16%, reflecting the continued development of the franchise especially in the SME segment. This was reflected in the rise in the mid-range rating bands as this is where counterparties in this segment typically rate.

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 19 |

Detailed Business Review

Risk Management Reportcontinued

COMMERCIAL BANKING - CREDIT RISK MITIGATION

At 30 June 2014, collateral held against impaired loans amounted to 54% (2013: 61%) of the carrying amount of impaired loan balances.

COMMERCIAL BANKING – CREDIT PERFORMANCE

Exposures exhibiting potentially higher risk characteristics are subject to risk monitoring under the Watchlist process (described in “The Credit Cycle” section under “Risk monitoring” on page 39 in the 2013 Annual Report). The table below sets out the portfolio showing exposures subject to risk monitoring under the Watchlist process and those classified as non-performing by portfolio at 30 June 2014 and 31 December 2013.

| | | | | | | | | | | | | | | | | | | | | | | | |

30 June 2014 | | Sovereign and

Supranational(7)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial

Real Estate

£m | | | Social Housing

£m | | | Total

£m | |

Total Committed Exposure of which:(1) | | | 5,777 | | | | 9,883 | | | | 6,749 | | | | 5,096 | | | | 1,033 | | | | 28,538 | |

-Watchlist: Enhanced Monitoring | | | — | | | | 99 | | | | 225 | | | | 147 | | | | 30 | | | | 501 | |

-Watchlist: Proactive Management | | | — | | | | — | | | | 201 | | | | 104 | | | | — | | | | 305 | |

-Remaining Performing Exposure | | | 5,777 | | | | 9,784 | | | | 6,323 | | | | 4,713 | | | | 1,003 | | | | 27,600 | |

Subtotal Performing Exposure | | | 5,777 | | | | 9,883 | | | | 6,749 | | | | 4,964 | | | | 1,033 | | | | 28,406 | |

Non-Performing Exposure(2) | | | — | | | | — | | | | — | | | | 132 | | | | — | | | | 132 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Impaired Exposure of which:(3) | | | — | | | | — | | | | 242 | | | | 383 | | | | 30 | | | | 655 | |

-Performing – Watchlist | | | — | | | | — | | | | 242 | | | | 251 | | | | 30 | | | | 523 | |

-Non-Performing Exposure(2) | | | — | | | | — | | | | — | | | | 132 | | | | — | | | | 132 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Observed impairment loss allowances of which:(4) | | | — | | | | — | | | | 1 | | | | 44 | | | | — | | | | 45 | |

-Performing – Watchlist | | | — | | | | — | | | | 1 | | | | 15 | | | | — | | | | 16 | |

-Non-Performing Exposure(2) | | | — | | | | — | | | | — | | | | 29 | | | | — | | | | 29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

IBNO(5)(6) | | | | | | | | | | | | | | | | | | | | | | | 5 | |

Total Impairment loss allowance | | | | | | | | | | | | | | | | | | | | | | | 50 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

31 December 2013 | | Sovereign and

Supranational(7)

£m | | | Large

Corporate

£m | | | Mid Corporate

and SME

£m | | | Commercial

Real Estate

£m | | | Social Housing

£m | | | Total

£m | |

Total Committed Exposure of which:(1) | | | 6,049 | | | | 9,168 | | | | 5,825 | | | | 4,994 | | | | 968 | | | | 27,004 | |

-Watchlist: Enhanced Monitoring | | | — | | | | 111 | | | | 143 | | | | 130 | | | | 35 | | | | 419 | |

-Watchlist: Proactive Management | | | — | | | | — | | | | 77 | | | | 193 | | | | — | | | | 270 | |

-Remaining Performing Exposure | | | 6,049 | | | | 9,057 | | | | 5,600 | | | | 4,582 | | | | 933 | | | | 26,221 | |

Subtotal Performing Exposure | | | 6,049 | | | | 9,168 | | | | 5,820 | | | | 4,905 | | | | 968 | �� | | | 26,910 | |

Non-Performing Exposure(2) | | | — | | | | — | | | | 5 | | | | 89 | | | | — | | | | 94 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Impaired Exposure of which:(3) | | | — | | | | — | | | | 225 | | | | 412 | | | | 35 | | | | 672 | |

-Performing – Watchlist | | | — | | | | — | | | | 220 | | | | 323 | | | | 35 | | | | 578 | |

-Non-Performing Exposure(2) | | | — | | | | — | | | | 5 | | | | 89 | | | | — | | | | 94 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Observed impairment loss allowances of which:(4) | | | — | | | | — | | | | 6 | | | | 55 | | | | — | | | | 61 | |

-Performing – Watchlist | | | — | | | | — | | | | 1 | | | | 16 | | | | — | | | | 17 | |

-Non-Performing Exposure(2) | | | — | | | | — | | | | 5 | | | | 39 | | | | — | | | | 44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

IBNO(5)(6) | | | | | | | | | | | | | | | | | | | | | | | 2 | |

Total Impairment loss allowance | | | | | | | | | | | | | | | | | | | | | | | 63 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes committed facilities and derivatives. The terms ‘Enhanced Monitoring’ and ‘Proactive Management’ are defined on page 41 of the 2013 Annual Report. |

| (2) | Non-Performing Exposure in the table above include committed facilities and derivative exposures and therefore are larger than the NPLs in the tables on page 21 which only include drawn balances. All the Non-Performing Exposures are impaired for the purposes of provisioning. |

| (3) | Corporate loans are assessed individually or collectively assessed for impairment. Assets reported as impaired represent, for collective assessment, that portion of the loan portfolio where it is estimated that a loss has been incurred, plus those assets individually impaired. |

| (4) | Excludes IBNO provision. |

| (5) | Allowance for incurred inherent losses (i.e. incurred but not observed (‘IBNO’)) as described in Note 1 to the Consolidated Financial Statements in the 2013 Annual Report. |

| (6) | There is no impairment allowance attributable to Sovereign and Supranational, Large Corporate or Social Housing. |

| (7) | An international organisation, whereby member states transcend national boundaries or interests to share in the decision-making and vote on issues pertaining to the to the geographical focus of the organisation. |

| | |

| 20 | | Abbey National Treasury Services plc 2014 Half Yearly Financial Report |

Detailed Business Review

Risk Management Report continued

Non-performing loans and advances (1) (2)

An analysis of Commercial Banking NPLs is presented below.

| | | | | | | | |

| | | 30 June 2014

£m | | | 31 December 2013

£m | |

Loans and advances to customers of which:(2) | | | 6,838 | | | | 6,317 | |

Commercial Banking Arrears including NPLs(3) | | | 130 | | | | 94 | |

Commercial Banking NPLs - impaired(3)(4)(5) | | | 130 | | | | 94 | |

Commercial Banking NPLs - not impaired(3)(4) | | | — | | | | — | |

| | | | | | | | |

Commercial Banking NPLs | | | 130 | | | | 94 | |

| | | | | | | | |

Impairment loss allowances | | | 50 | | | | 63 | |

| | | | | | | | |

| | | % | | | | % | |

| | | | | | | | |

Arrears ratio(6) | | | 1.90 | | | | 1.49 | |

NPLs ratio(7) | | | 1.90 | | | | 1.49 | |

Coverage ratio(8) | | | 38 | | | | 67 | |

| | | | | | | | |

| (1) | Loans and advances are classified as non-performing typically when the counterparty fails to make payments when contractually due for three months or where it is deemed probable that this will occur in the near future. |

| (2) | Commercial Banking loans and advances to customers include finance leases. |

| (3) | All Commercial Banking balances are UK and continue accruing interest. For the data presented, the balances include interest charged to the customer’s account, but exclude interest accrued but not yet charged to the account. |

| (4) | All the Non-Performing Loans are impaired for purposes of provisioning. |

| (5) | NPLs against which an impairment loss allowance has been established. |

| (6) | Commercial Banking loans and advances to customers in arrears as a percentage of Commercial Banking loans and advances to customers. |

| (7) | Commercial Banking NPLs as a percentage of Commercial Banking loans and advances to customers. |

| (8) | Impairment loss allowances as a percentage of NPLs. |

Movements in NPLs during the first six months are set out in the table below. ‘Transfers in’ represent loans which have become classified as NPLs during the period. ‘Exits (including repayments)’ represent that element of loans to customers that have been repaid (in full or in part) plus those returned to performing status. ‘Write-offs’ represent the unrecovered element of a loan where recovery options, including realisation of any collateral, have been exhausted. Forbearance activity does not result in a change in the NPL status.

| | | | |

| | | £m | |

At 1 January 2014 | | | 94 | |

Transfers in to NPL: | | | | |

- Entries | | | 85 | |

Transfers out of NPL: | | | | |

- Exits (including repayments) | | | (35 | ) |

- Write-Offs | | | (14 | ) |

| | | | |

At 30 June 2014 | | | 130 | |

| | | | |

30 June 2014 compared to 31 December 2013

During the first six months of 2014, Watchlist exposures subject to proactive management increased to £305m (2013: £270m), largely driven by an increase in the Mid Corporate and SME portfolio, partially offset by a reduction in Commercial Real Estate. Watchlist exposures subject to enhanced monitoring increased slightly. In the Sovereign and Supranational, Large Corporate, and Social Housing portfolios, there were no exposures subject to proactive management with only 1% (2013: 1%) of these portfolio exposures subject to enhanced monitoring.

Loans and advances to customers in arrears increased to £130m (2013: £94m) largely due to a single long-standing loan of £65m which moved to non-performance. A successful restructure of this loan is still anticipated and a conservative provision is held against it. Consequently, loans and advances to customers in arrears as a percentage of loans and advances to customers increased to 1.90% (2013: 1.49%).

During the first six months of 2014, the NPLs ratio also increased slightly to 1.90% (2013: 1.49%) due to the same single long-standing loan noted above.

In the first half of 2014, interest income recognised on impaired loans amounted to £1m (six months ended 30 June 2013: £1m).

| | |

| Abbey National Treasury Services plc 2014 Half Yearly Financial Report | | 21 |

Detailed Business Review

Risk Management Reportcontinued

COMMERCIAL BANKING LOANS - FORBEARANCE

Forbearance commenced during the period/year(1)

No arrangements have been entered into with respect to Sovereign and Supranational, Large Corporate or Social Housing counterparties. The exposures that entered forbearance during the six months period ended 30 June 2014 and the year ended 31 December 2013 were:

| | | | | | | | | | | | |

| | | Mid Corporate

and SME | | | Commercial

Real Estate | | | Total | |

30 June 2014 | | £m | | | £m | | | £m | |

Forbearance of NPL | | | — | | | | — | | | | — | |

Forbearance of Non-NPL | | | 7 | | | | 58 | | | | 65 | |

| | | | | | | | | | | | |

| | | 7 | | | | 58 | | | | 65 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Mid Corporate

and SME | | | Commercial

Real Estate | | | Total | |

31 December 2013 | | £m | | | £m | | | £m | |

Forbearance of NPL | | | — | | | | 31 | | | | 31 | |

Forbearance of Non-NPL | | | — | | | | 72 | | | | 72 | |

| | | | | | | | | | | | |

| | | — | | | | 103 | | | | 103 | |

| | | | | | | | | | | | |

| (1) | The figures by period/year reflect the amount of forbearance activity undertaken during the period/year irrespective of whether any forbearance activity has previously been undertaken on the forborne accounts. |

Forbearance cumulative position

At 30 June 2014, 97% (2013: 98%) of the forbearance related to the Commercial Real Estate portfolio.

a) Performance status when entering forbearance

The status of forborne exposures at 30 June 2014 and 31 December 2013 when they originally entered forbearance, analysed by their payment status, was:

| | | | | | | | | | | | | | | | |

30 June 2014 | | Forbearance of NPL

£m | | | Forbearance of Non-NPL

£m | | | Total

£m | | | Impairment allowance

£m | |

Performing | | | — | | | | 224 | | | | 224 | | | | 18 | |