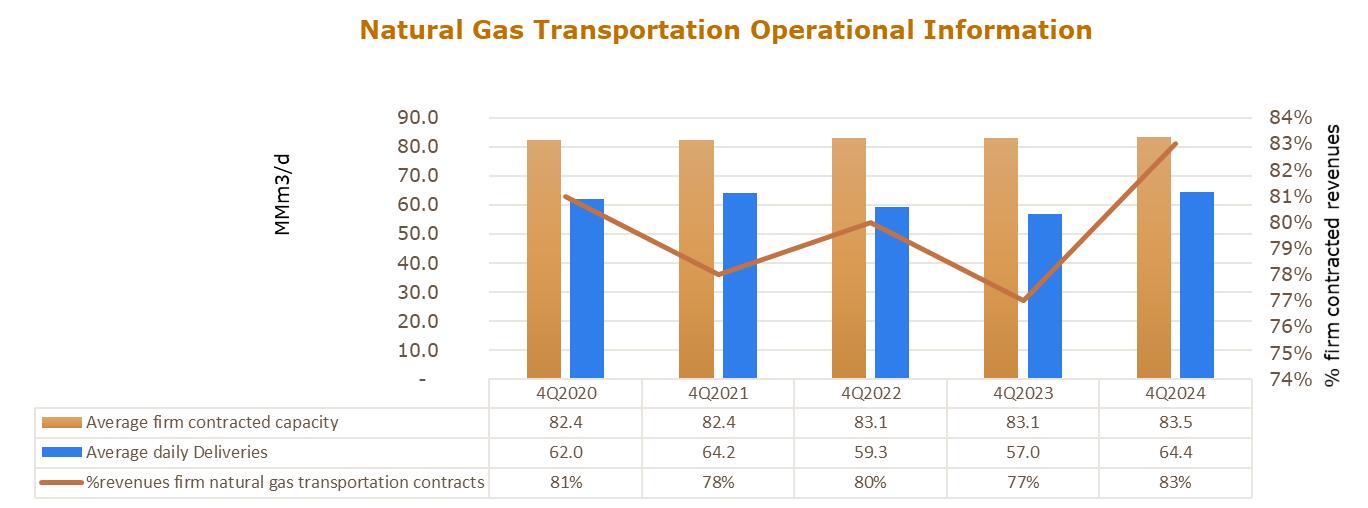

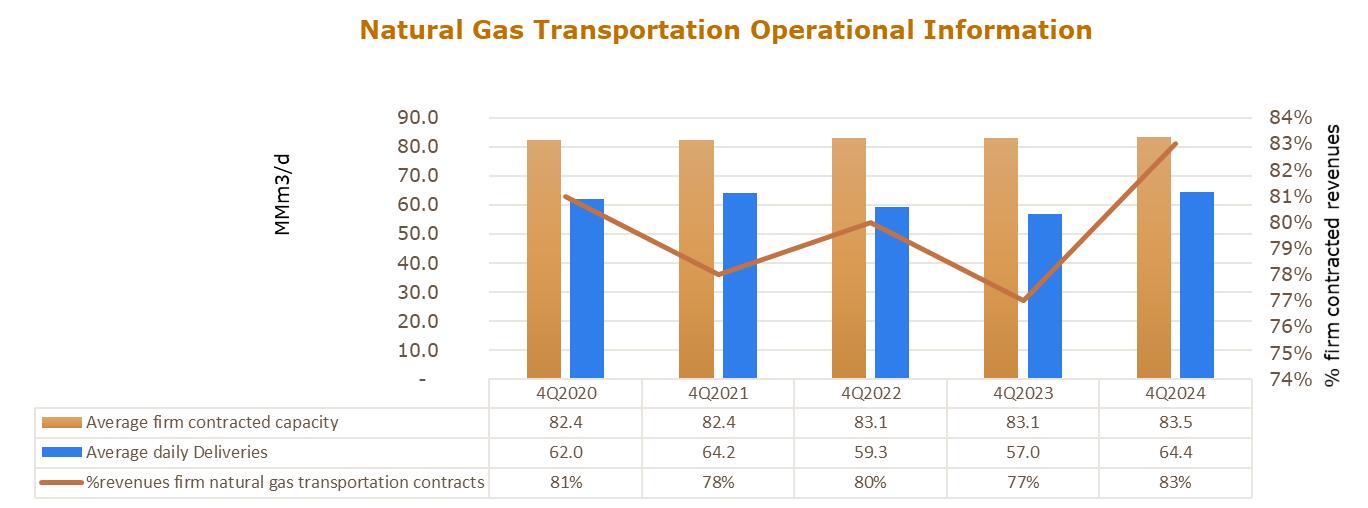

Transportadora de Gas del Sur ("tgs", "the Company", “us”, “our”, or “we”) is the leader in Argentina in the transportation of natural gas, transporting approximately 60% of the gas consumed in the country, through more than 5,700 miles of gas pipelines, with average firm-contracted capacity of 83.5 MMm3/d. We are one of the main natural gas processors. In addition, our infrastructure investment in the Vaca Muerta formation places us as one of the main Midstreamers in Argentina.

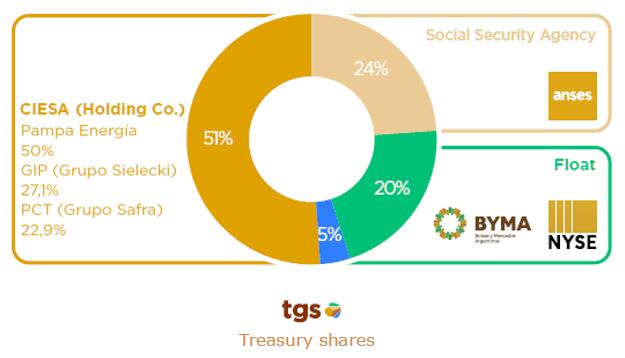

Our shares are traded on NYSE (New York Stock Exchange) and BYMA (Bolsas y Mercados Argentinos S.A.).

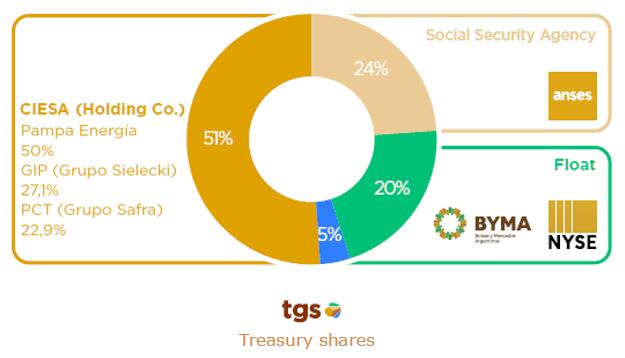

Our controlling company is Compañía de Inversiones de Energía S.A. ("CIESA"), which owns 51% of the total share capital. CIESA’s shareholders are: (i) Pampa Energía S.A. with 50%, (ii) led by the Sielecki family, Grupo Investor Petroquímica S.L. (GIP), and PCT L.L.C. hold the remaining 50%.

For further information, see our website https://www.tgs.com.ar/inversores/servicio-para-inversores?lang=EN

Stock Information

BYMA Symbol: TGSU2

NYSE Symbol: TGS (1 ADS = 5 ordinary shares)

Shareholding structure as of December 31, 2024

tgs holds 794,495,283 issued shares and 752,761,058 outstanding shares.

Buenos Aires, Argentina, February 27, 2025

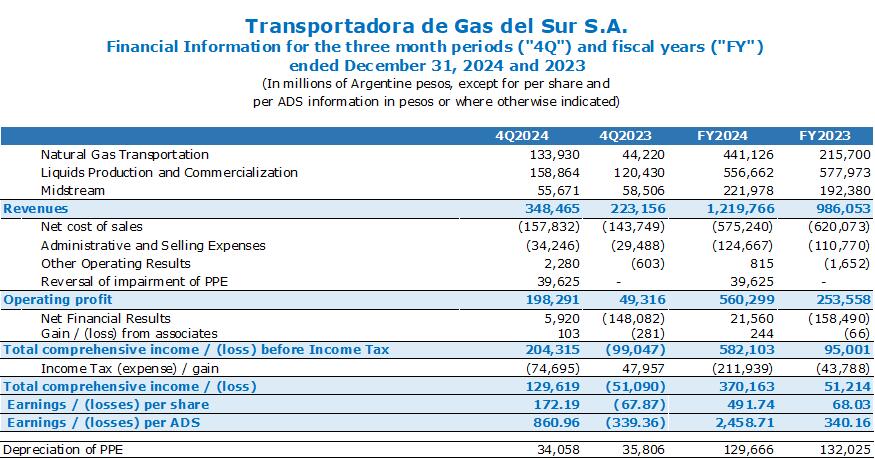

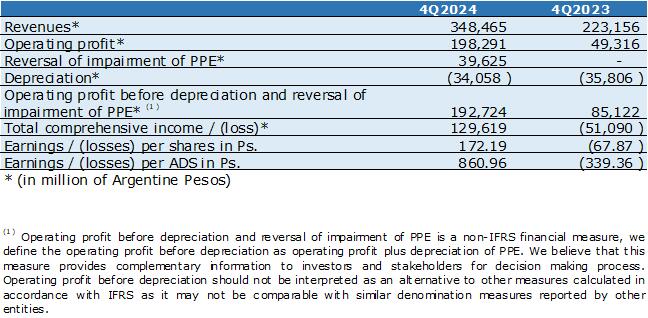

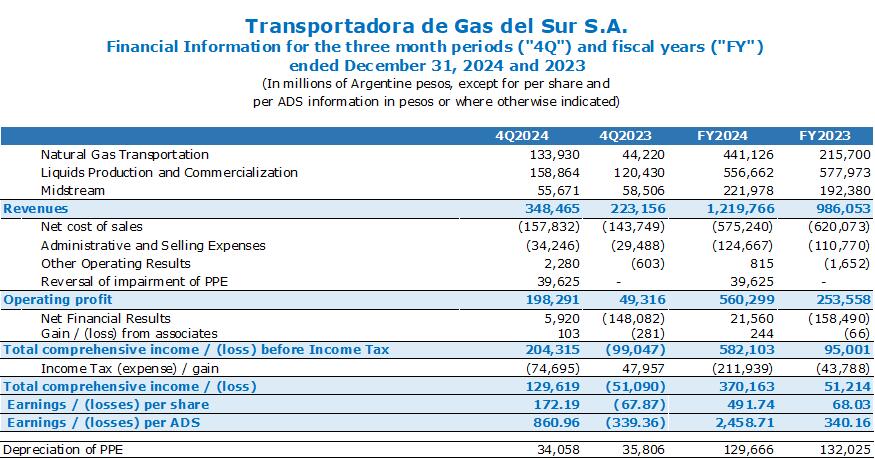

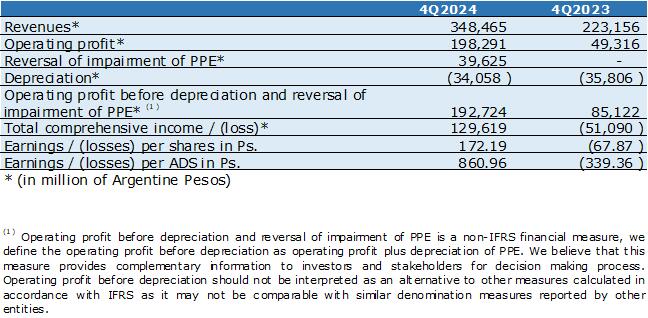

During the 4Q2024, total comprehensive income amounted to Ps. 129,619 million, or a Ps. 172.19 income per share (Ps. 860.96 per ADS), compared to a total comprehensive loss of Ps. 51,090 million, or Ps. 67.87 loss per share (Ps. 339.36 per ADS) in the fourth quarter ended on December 31, 2023 (“4Q2023”).

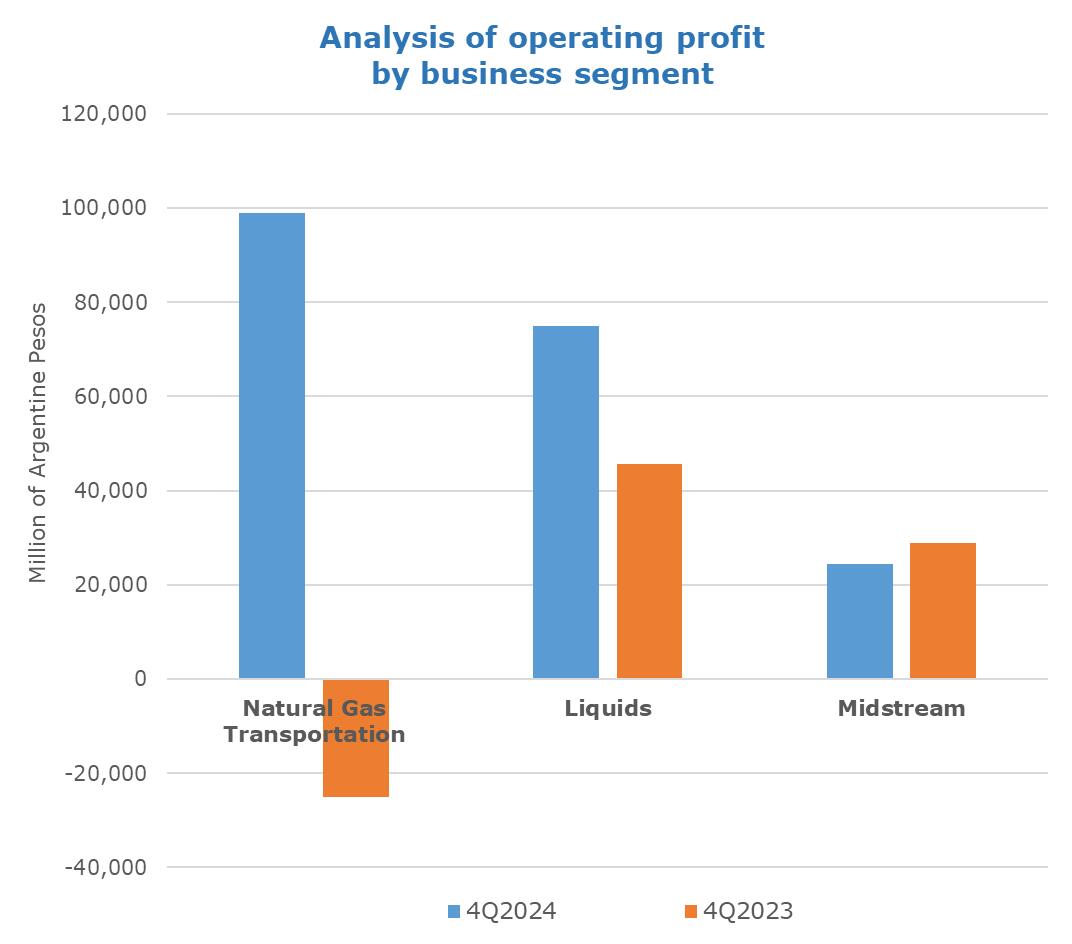

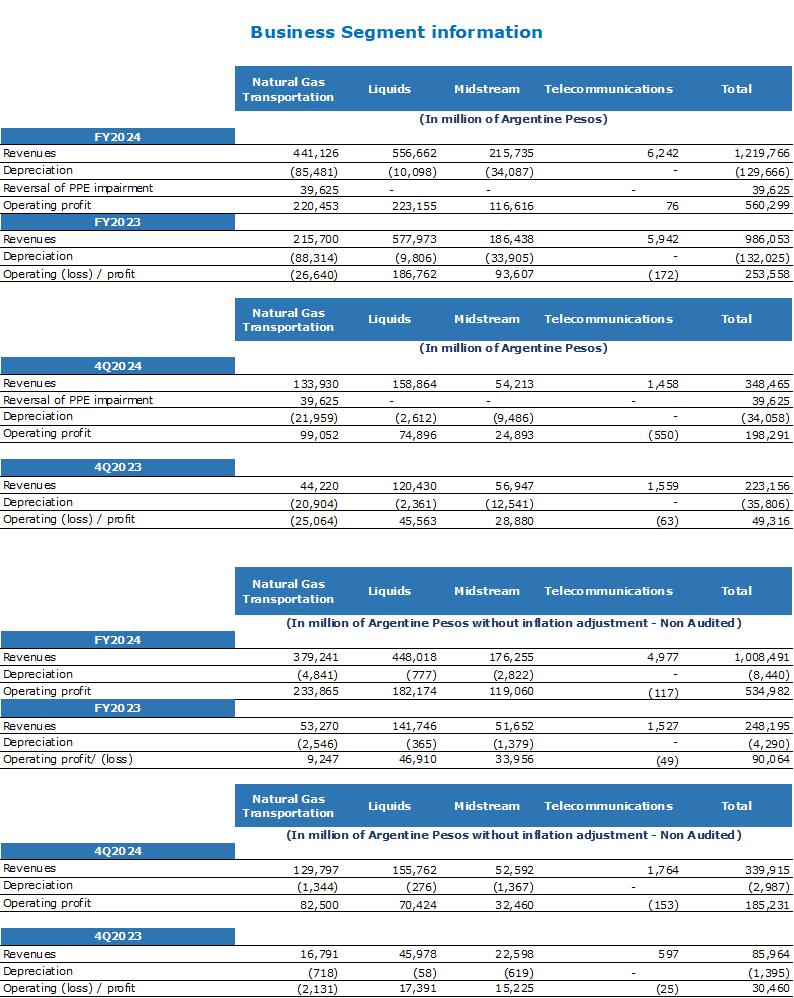

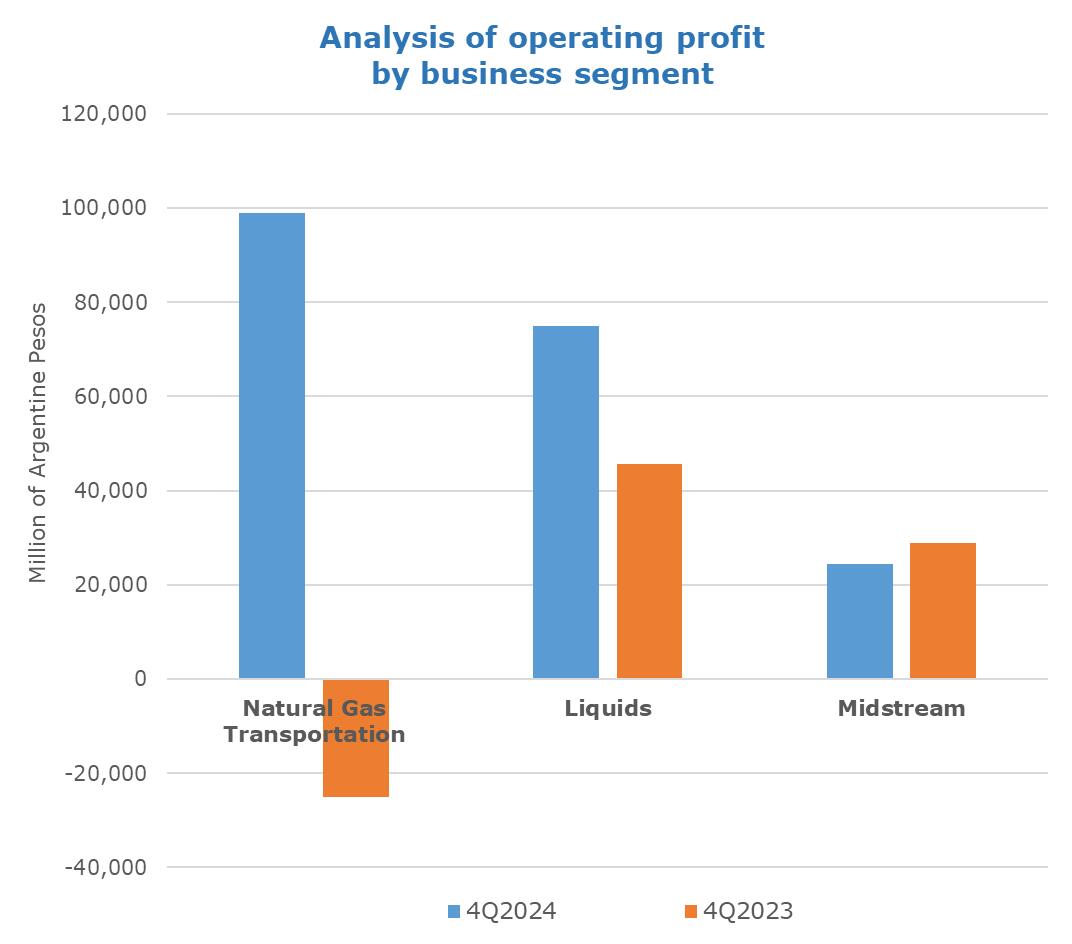

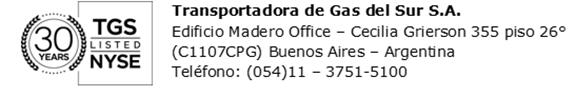

The operating profit for 4Q2024 amounted to Ps. 198,291 million, Ps. 148,975 million above 4Q2023. This variation was mainly due to higher revenues from the Natural Gas Transportation and Liquids Production and Commercialization segments ("Liquids") of Ps. 89,710 million and Ps. 38,434 million, respectively, and the reversal of the PPE impairment assigned to the Natural Gas Transportation segment of Ps. 39,625 million.

These effects were partially offset by higher net cost of sales and administrative and selling expenses of Ps. 18,421 million.

Financial results reflected a positive variation of Ps. 154,002 million, mainly as a consequence of the lower exchange rate variation.

(1)The financial information presented in this press release is based on consolidated financial statements presented in constant Argentine pesos as of December 31, 2024 (Ps.) which is based on the application of the International Financial Reporting Standards (IFRS).

Transportadora de Gas del Sur S.A. 2

Edificio Madero Office – 355 Cecilia Grierson St. 26th floor

(C1107CPG), Autonomous City of Buenos Aires, Argentina.

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

Highlights during 4Q2024 and beyond

·ENARGAS published new transitional tariff charts which included increases effective on December 4, January 1 and February 1, of 3%, 2.5%, and 1.5%, respectively.

·On February 6, 2025, a public hearing was held to consider, among other issues, the Five-Year Tariff Review ("RQT") for natural gas transportation and distribution, as well as the methodology for periodic adjustments for natural gas transportation and distribution tariffs. As of today, ENARGAS resolution with the new tariff charts and the regulatory framework of the RQT, which will be in force for the period 2025 – 2029, is pending issuance.

·On January 24, 2025, the Secretary of Energy issued Resolution No. 15/2025, which, effective from that date, eliminates the maximum sale price set for products supplied under the Plan Hogar (with the export parity price published by the SE under Law No. 26,020 being the sale price limit). Furthermore, although this resolution maintains the obligation of LPG producers to supply the domestic market, it eliminates the previously existing supply contributions.

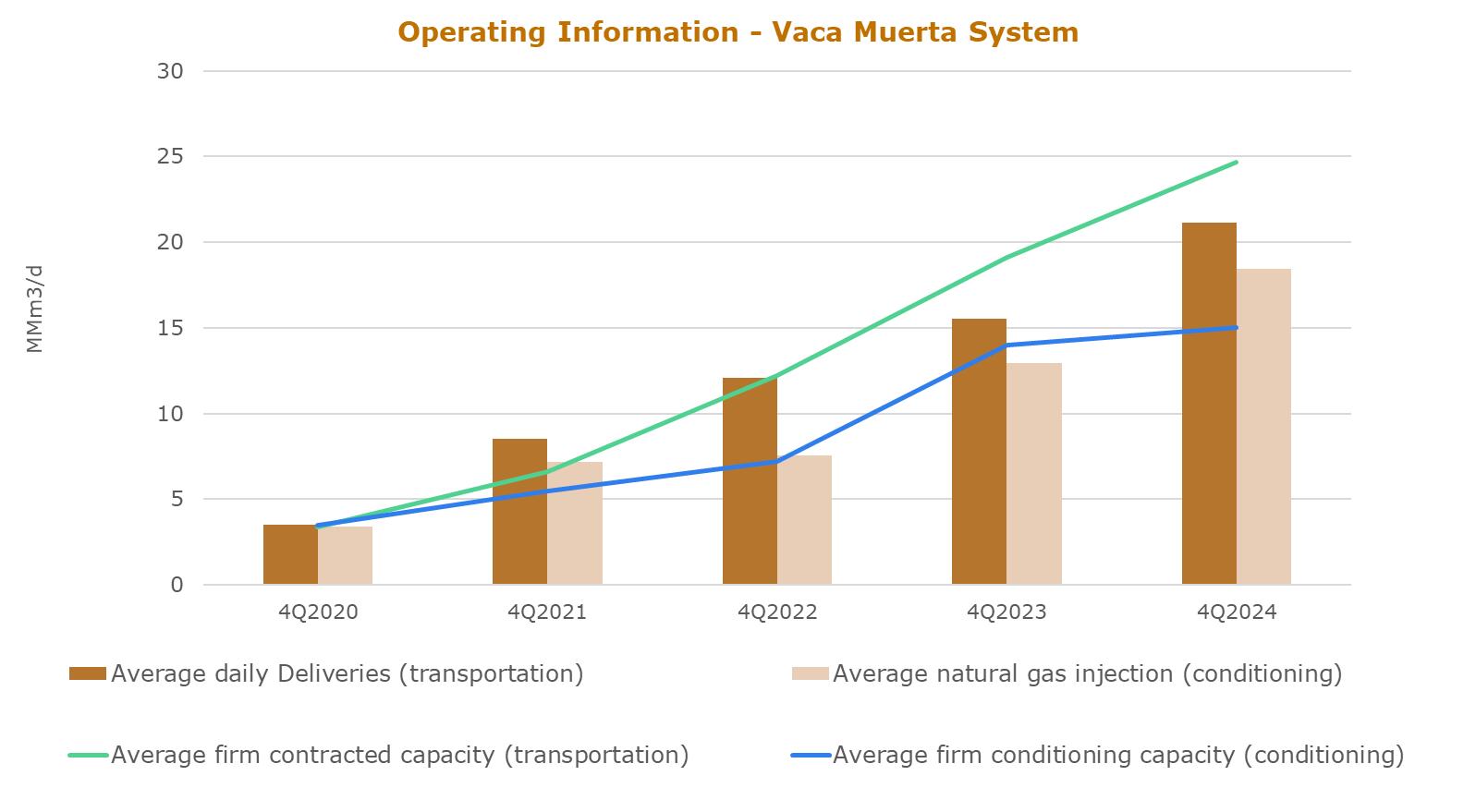

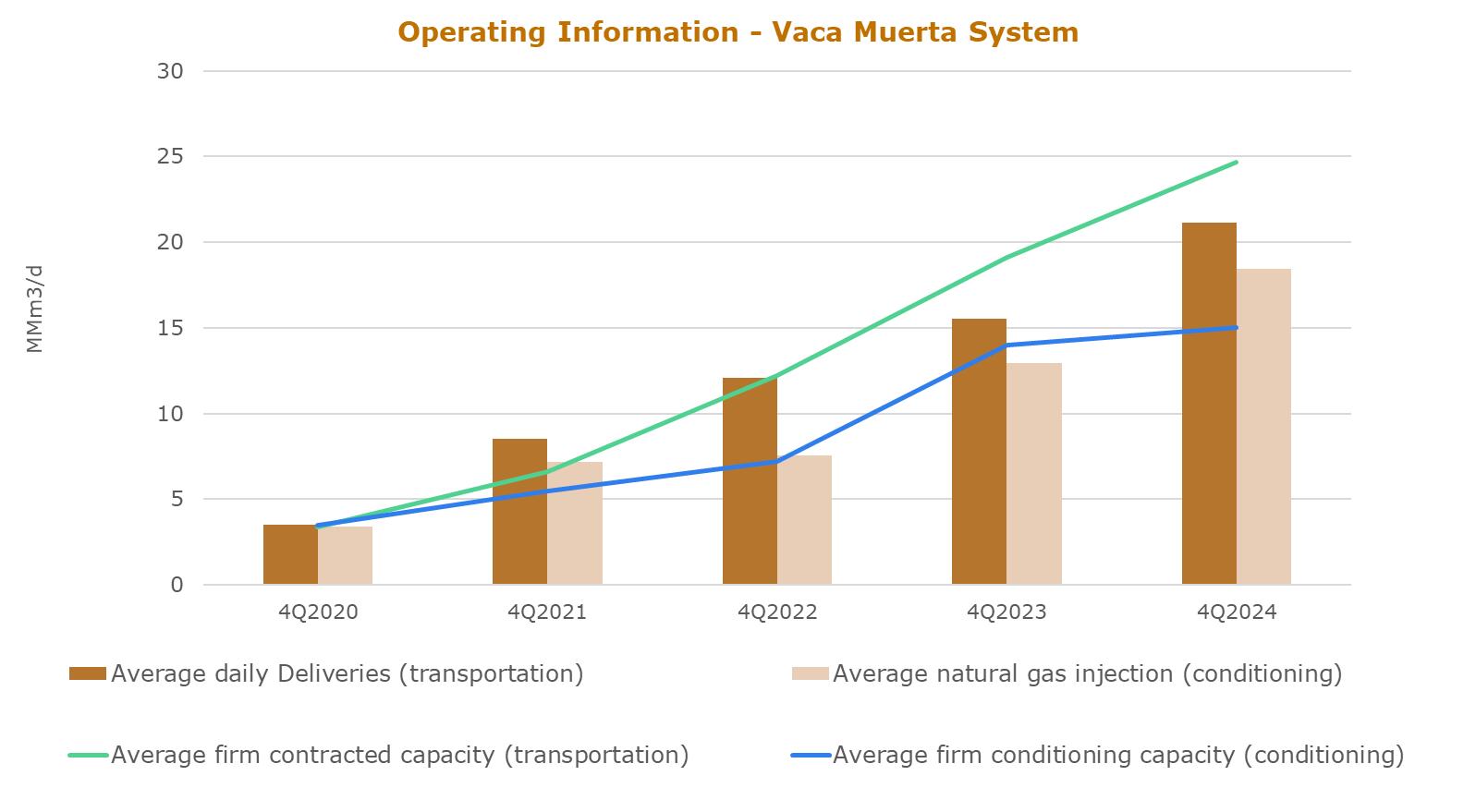

·During February 2025, the construction and commissioning of the second natural gas conditioning module at the Tratayén Plant was completed, increasing conditioning capacity by 6.6 MMm³/d. With the completion of this last stage of the project which initiated in 2022, the total conditioning capacity of the Tratayén plant totals 28 MMm³/d.

·On February 5, 2025, as a result of the upward revision of Argentina's Transfer and Convertibility rating, S&P Global Ratings upgraded tgs's local and international debt credit rating from "CCC" to "B-".

Analysis of the results

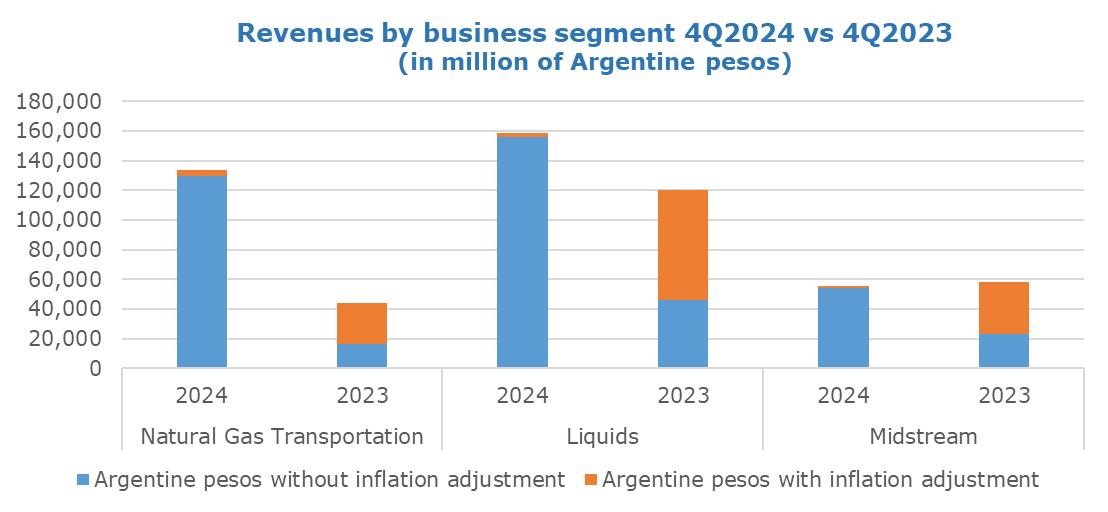

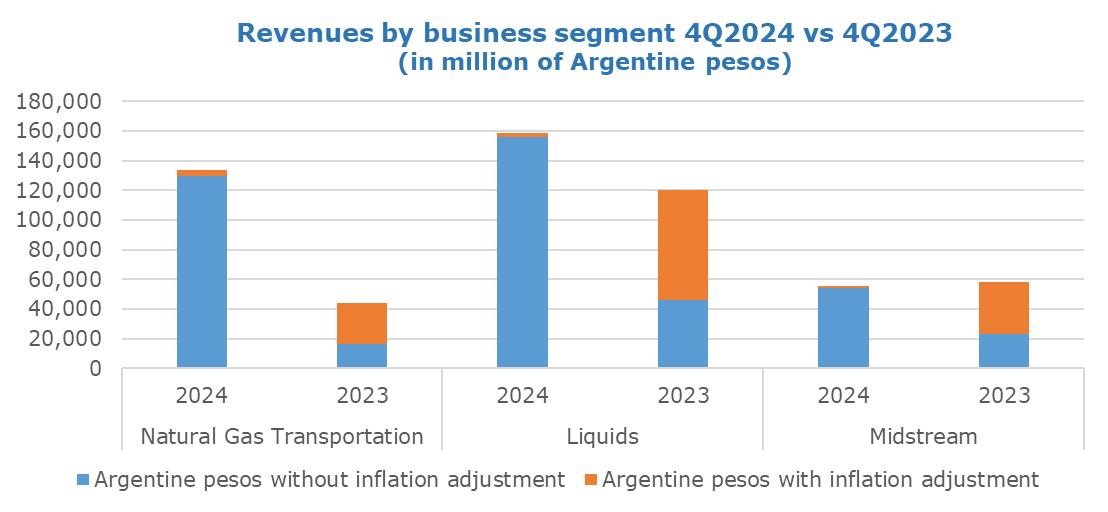

Total revenues amounted to Ps. 348,465 million in 4Q2024, a Ps. 125,309 million increase compared to Ps. 223,156 million in 4Q2023.

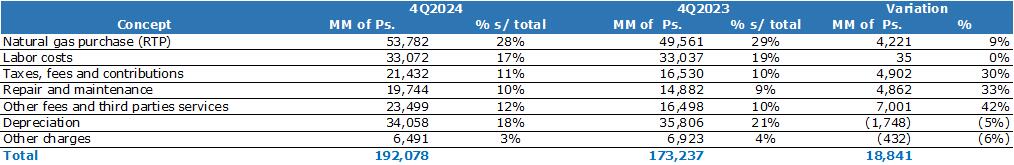

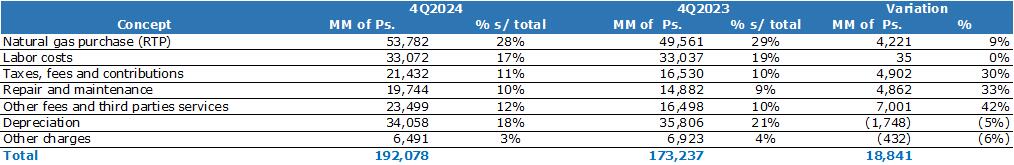

The breakdown of net cost of sales, administrative and selling expenses for 4Q2024 and 4Q2023 is shown in the table below:

3

3

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

Net cost of sales and administrative and selling expenses increased by Ps. 18,841 million mainly due to higher: (i) services and third-party fees of Ps. 7,001 million, (ii) PPE repair and maintenance expenses of Ps. 4,862 million, (iii) taxes, fees, and contributions (increase in turnover tax and export withholdings) of Ps. 4,902 million, and (iv) the cost of natural gas acquired for the production of Liquids (mainly impacted by a higher volume, which was partially offset by lower restated price according to IAS 29) of Ps. 4,221 million.

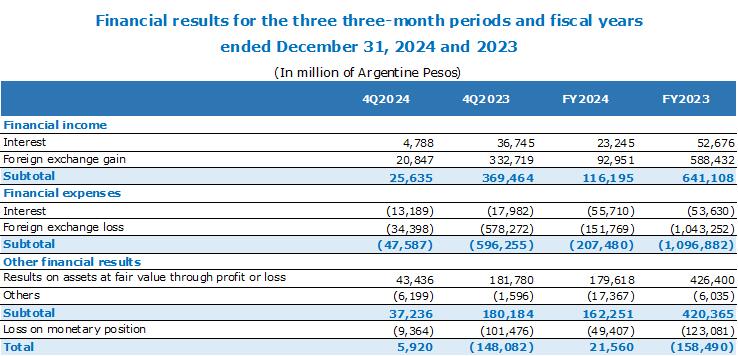

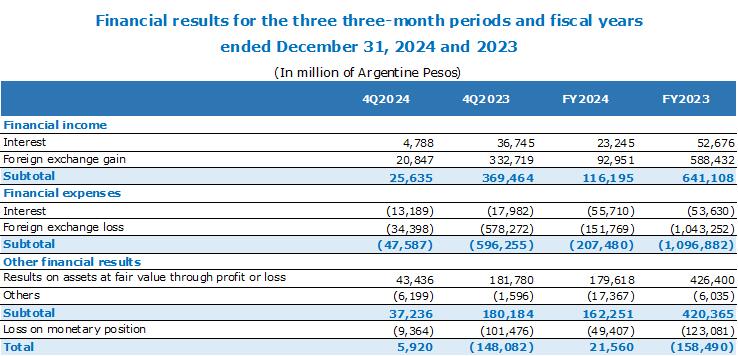

Financial results are presented in gross terms considering the effect of change in the currency purchasing power ("Loss on monetary position") in a single separate line. In 4Q2024, financial results recorded a positive variation of Ps. 154,002 million compared to 4Q2023. This variation is mainly explained by a lower exchange difference loss of Ps. 232,002 million (as a consequence of the lower exchange rate variation during 4Q2024) as well as a lower monetary position loss of Ps. 92,112 million. These effects were partially offset by the lower result obtained from financial assets by Ps. 170,301 million.

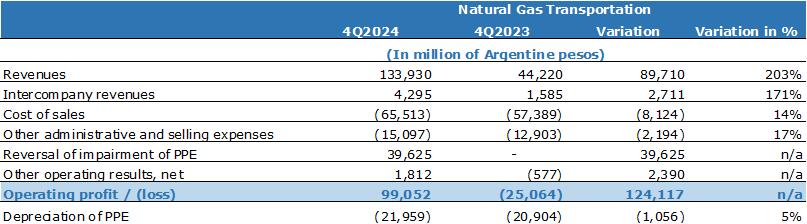

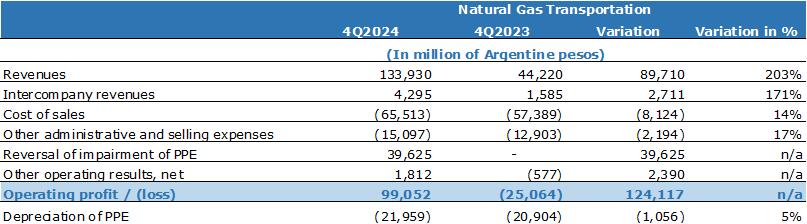

Natural Gas Transportation

Operating profit of the Natural Gas Transportation segment for the 4Q2024 was Ps. 99,052 million, while in 4Q2023 this business segment recorded an operating loss of Ps. Ps. 25,064 million.

4

4

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

Natural gas transportation revenues accounted for approximately 38% and 20% of total revenues in 4Q2024 and 4Q2023, respectively.

Revenues from this segment are derived mainly from firm natural gas transportation contracts, which represented approximately 83% and 77% of the total revenues for this segment in 4Q2024 and 4Q2023, respectively.

During 2024, this business segment, subject to ENARGAS regulation, received an initial tariff increase of 675% effective April 2024. Subsequently, effective on August 1, September 2, October 1, November 4, December 4, 2024, January 1, and February 1, 2025, ENARGAS published new transitional tariff charts that included increases of 4%, 1%, 2.7%, 3.5%, 3%, 2.5%, and 1.5%, respectively.

At the public hearing held on February 6, 2025, as part of the RQT process, tgs presented its OPEX and CAPEX plans for the 2025-2029 period, including a Regulatory asset base and capital rate (WACC of 9.98% in real terms, after tax) resulting in a tariff increase of 22.7%. tgs also proposed alternatives for periodic tariff adjustment based on Domestic Wholesale Price Index (“WPI”) and a polynomial formula with INDEC data.

As of the date of this earnings release, ENARGAS had not issued a final RQT resolution. However, during the public hearing it proposed a WACC rate of 7.18% and a periodic tariff adjustment composed of 50% CPI and 50% WPI.

The increase in operating profit was mainly due to higher revenues amounting to Ps. 89,710 million following the aforementioned tariff adjustment; an effect that was partially offset by the inflation restatement as provided by IAS 29 and higher repair and maintenance expenses and turnover tax.

Additionally, during 4Q2024, the reversal of the PPE impairment of Ps. 39,625 million was recorded in accordance with International Accounting Standard ("IAS 36").

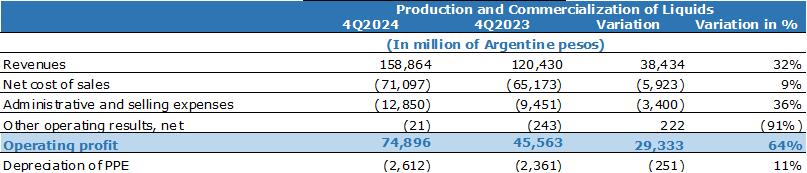

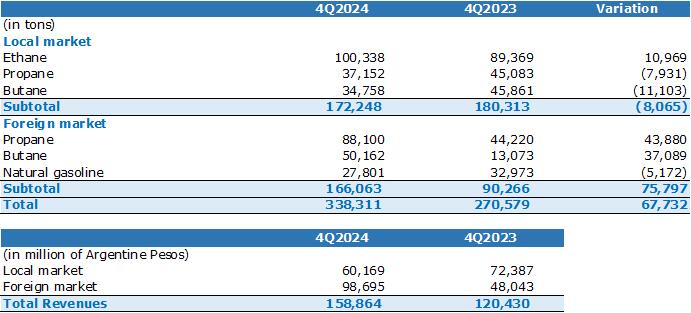

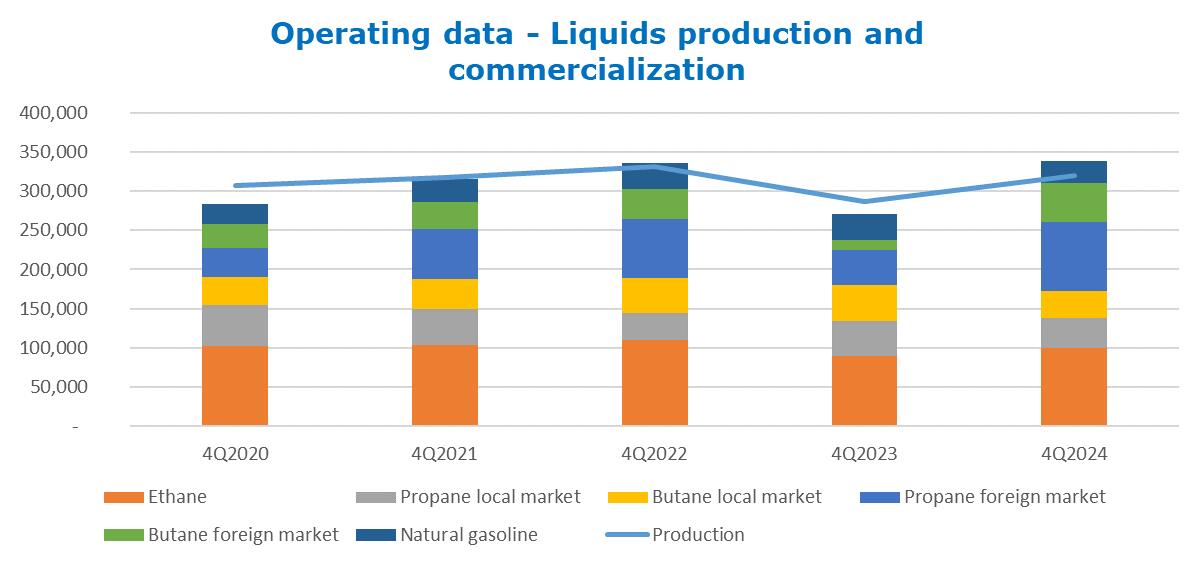

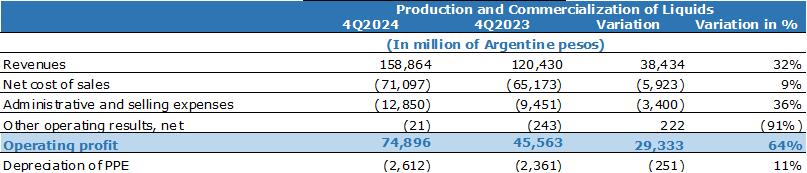

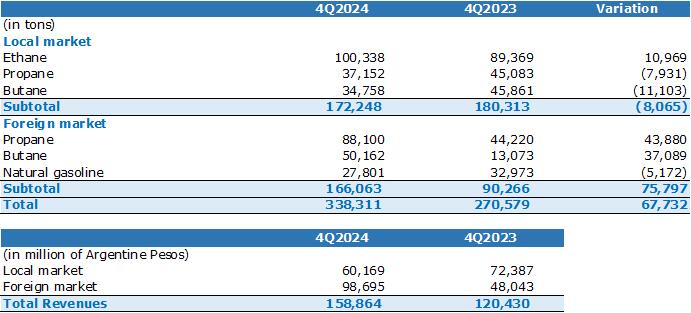

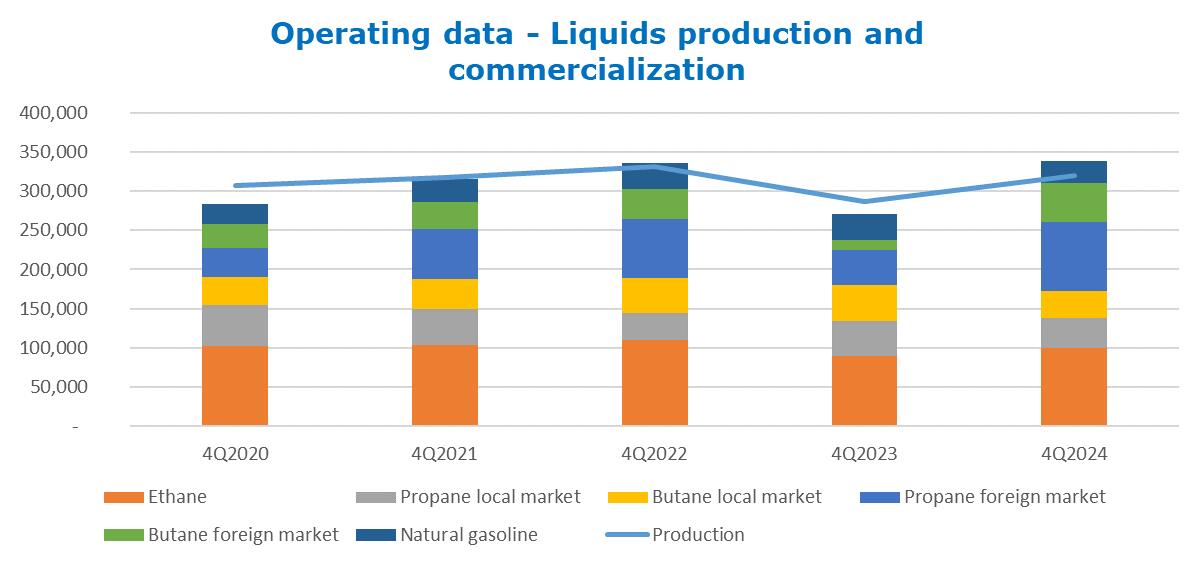

Liquids Production and Commercialization

Liquids Production and Commercialization revenues accounted for approximately 46% and 54% of total revenues in 4Q2024 and 4Q2023, respectively. During 4Q2024, the production increased by 33,163 tons, reaching 319,980 tons.

5

5

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

Operating profit of this business segment for 4Q2024 was Ps. 29,333 million above 4Q2023, reaching Ps. 74,896 million (compared to Ps. 45,563 million in 4Q2023). This increase was mainly due to higher revenues of Ps. 38,434 million, an effect that was partially offset by higher net cost of sales and administrative and selling expenses of Ps. 9,323 million.

Regarding revenues, which amounted to Ps. 158,864 million in 4Q2024, compared to Ps. 120,430 million in 4Q2023. This increase is mainly due to: (i) higher nominal exchange rate variation on revenues denominated in US dollars, which amounted to Ps. 52,128 million, (ii) higher volumes of propane and butane dispatched of Ps. 38,484 million, (iii) higher international reference prices of Ps. 9,779 million, and (iv) higher price of butane and propane sold in the local market of Ps. 12,230 million, and (v) higher volume of ethane by of Ps. 3,541 million. These effects were partially offset by the negative impact of the restatement according to IAS 29, which resulted in a decrease of Ps. 71,351 million and the lower price of ethane of Ps. 7,463 million.

Sales volumes increased by 67,732 tons (25%) compared to 4Q2023.

The breakdown of volumes dispatched by market and product and revenues by market is included below:

6

6

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

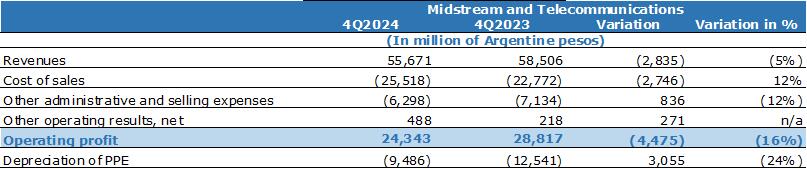

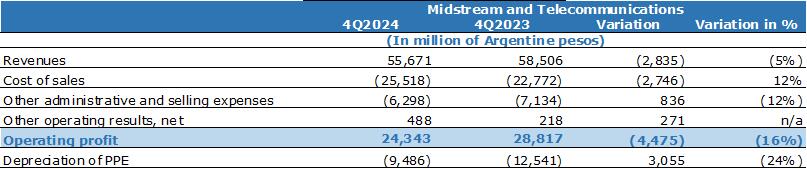

Midstream and Telecommunications

Midstream and Telecommunications business segment includes mainly services provided by tgs at Vaca Muerta, representing approximately 16% and 26% of our total revenues in 4Q2024 and 4Q2023, respectively.

Operating profit decreased by Ps. 4,475 million mainly as a result of the Ps. 2,385 million decline in revenues and the increase in net cost of sales, administrative and selling expenses of Ps. 1,910 million.

The decrease in revenues was primarily related to the inflation adjustment in accordance with IAS 29, amounting to Ps. 33,811 million. This effect was partially offset by the nominal increase in the exchange rate on revenues denominated in U.S. dollars, totaling Ps. 25,320 million, higher natural gas transportation and conditioning services in Vaca Muerta of Ps. 3,797 million, and increased O&M services of Ps. 1,281 million.

7

7

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

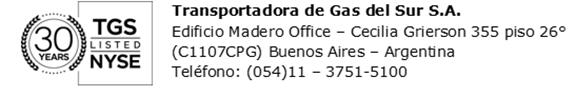

Financial position analysis

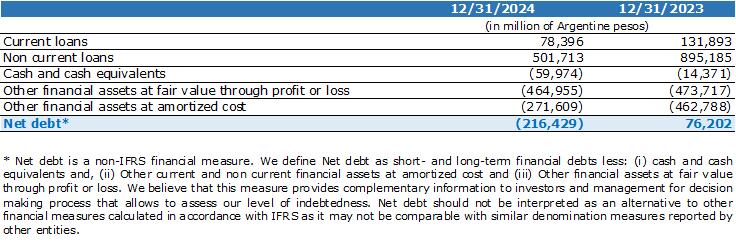

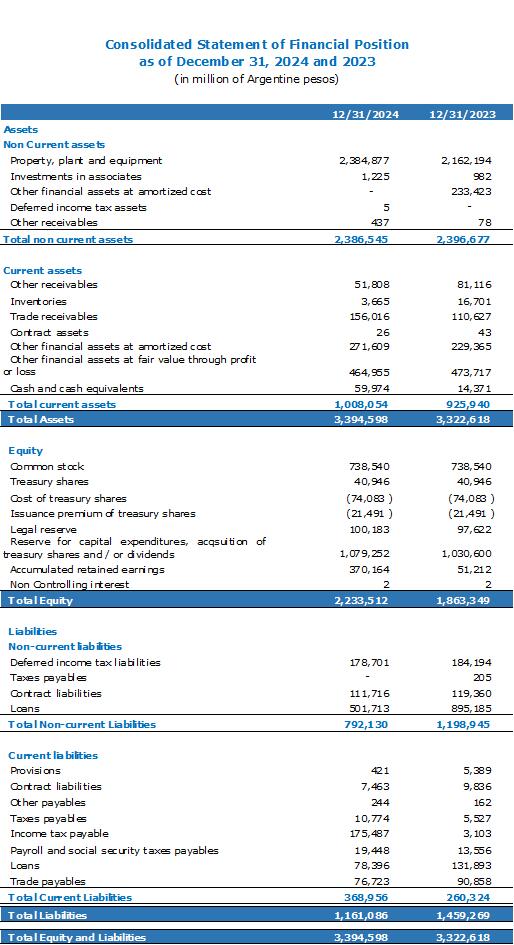

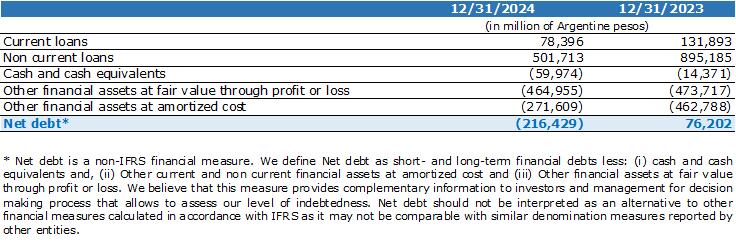

Net debt

As of December 31, 2024, our negative net debt amounted to Ps. 216,429 million, which compares to the positive net debt of Ps. 76,262 million as of December 31, 2023. Our total net financial debt is denominated in foreign currency for both periods.

During 4Q2024, the Company did not incur any new short-term debt financing. On the other hand, cancellations amounted to Ps. 21,143 million (US$ 20.6 million) in the period.

The table below shows a reconciliation of our net debt:

8

8

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

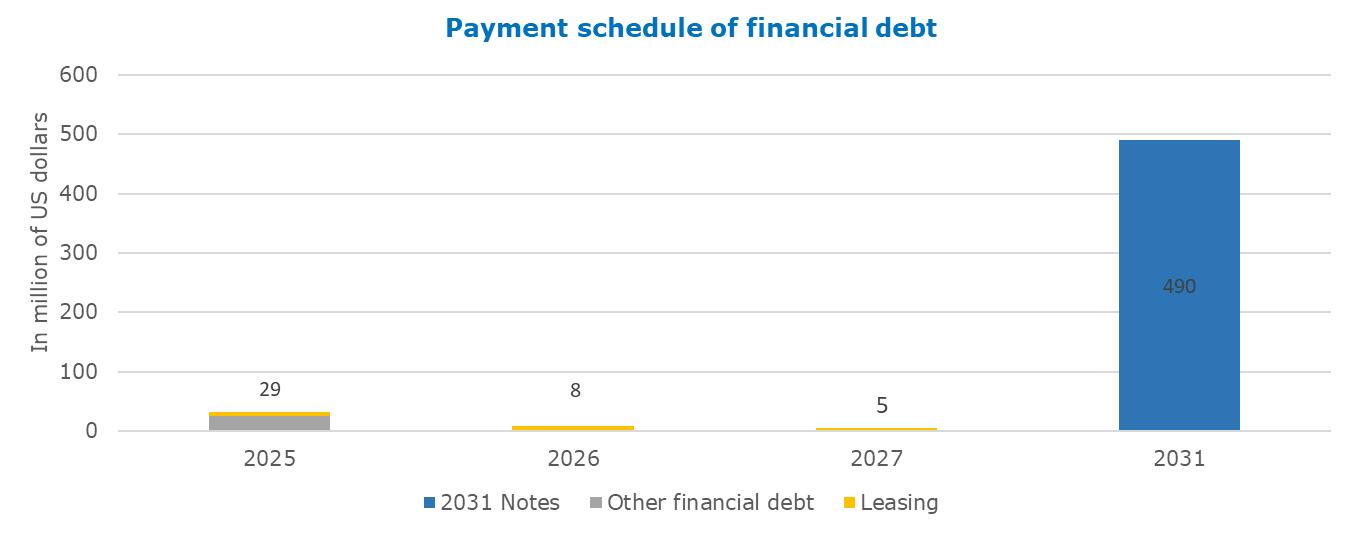

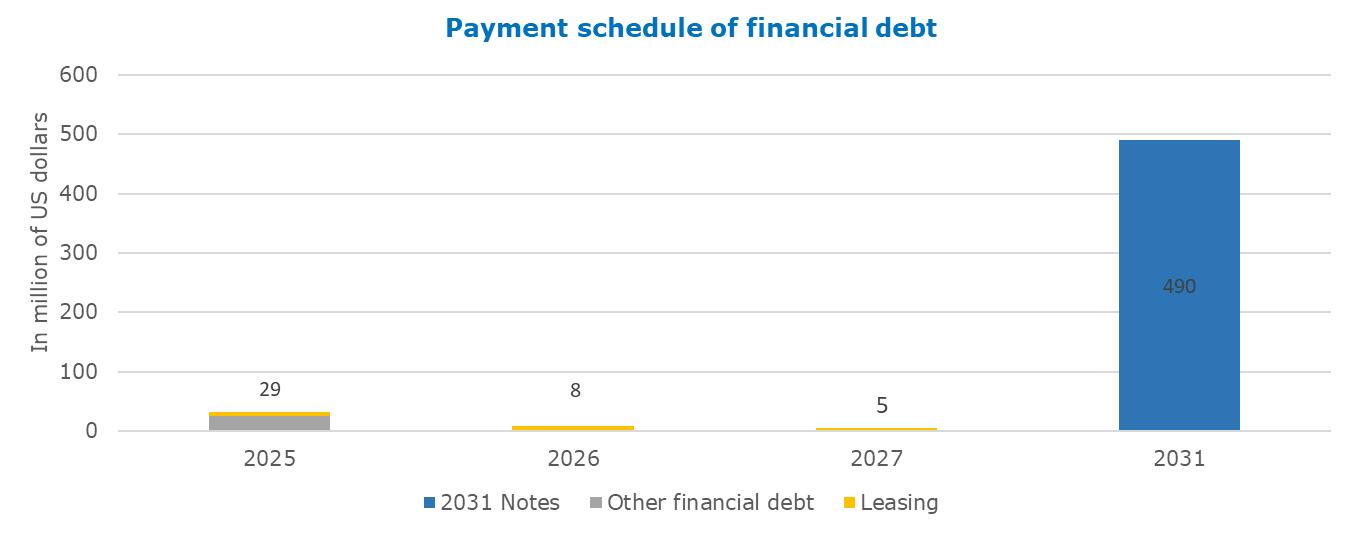

The maturity profile of our financial debt as of December 31, 2024 is as follows:

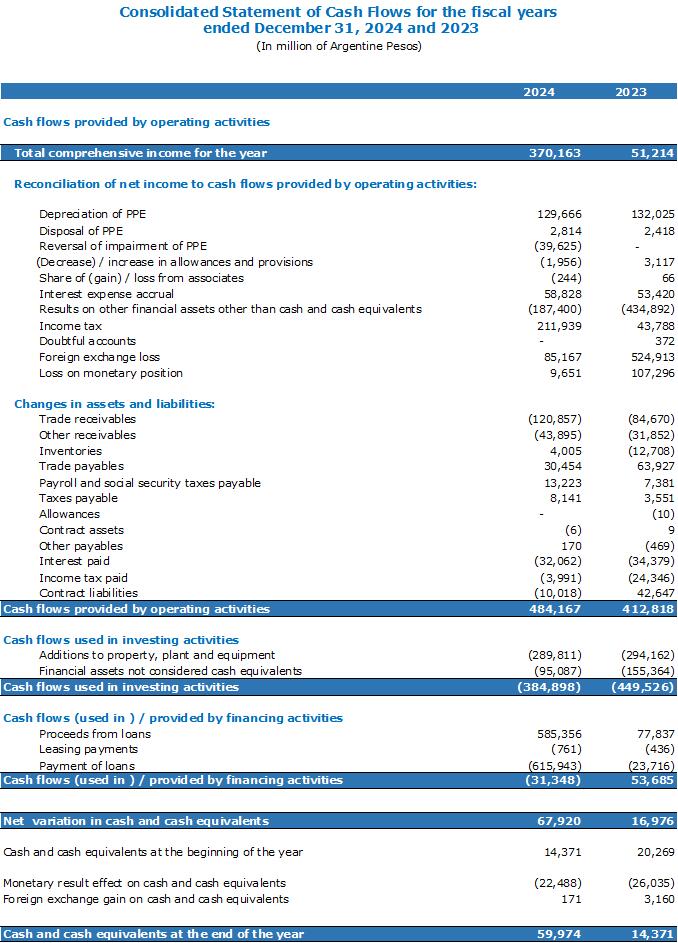

Liquidity and capital resources

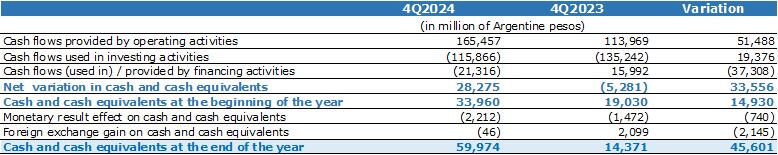

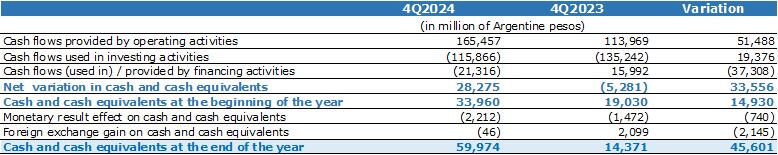

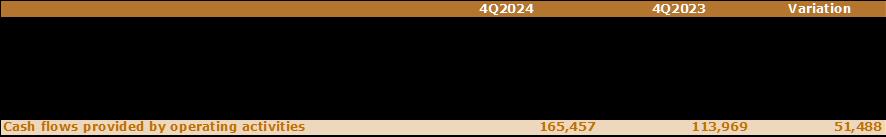

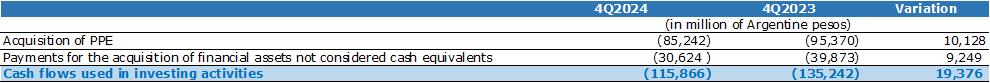

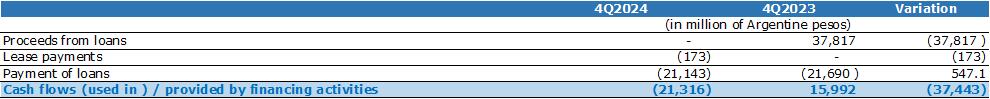

The net variation in cash and cash equivalents for 4Q2024 and 4Q2023 is broken down as follows:

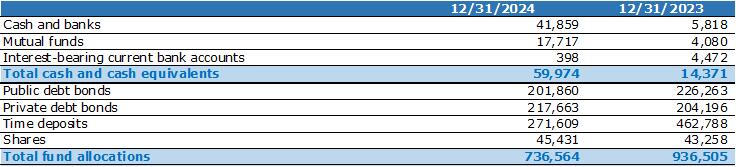

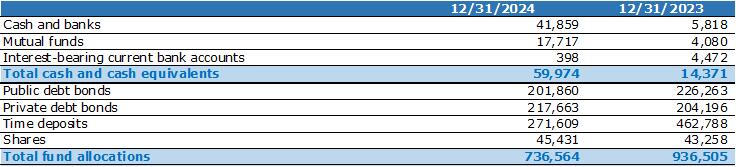

As of December 31, 2024 and 2023, the funds allocation was as follows:

9

9

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

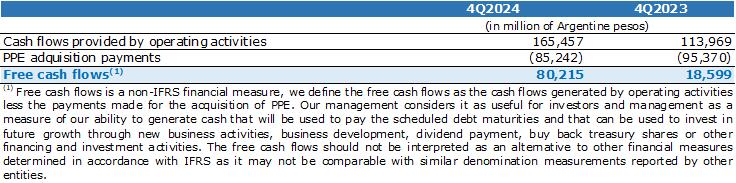

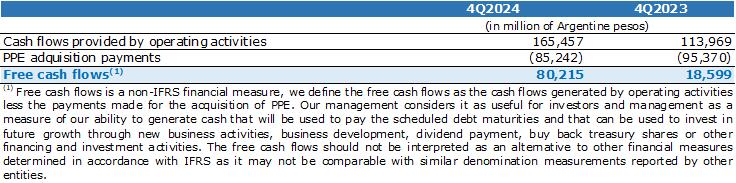

The table below shows a reconciliation of the free cash flows for the 4Q2024 and 4Q2023 periods:

4Q2024 vs. 4Q2023

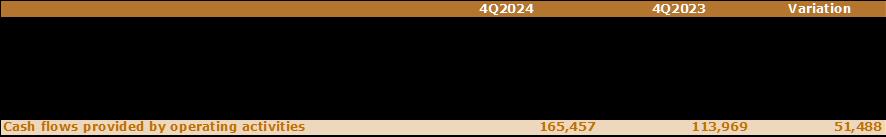

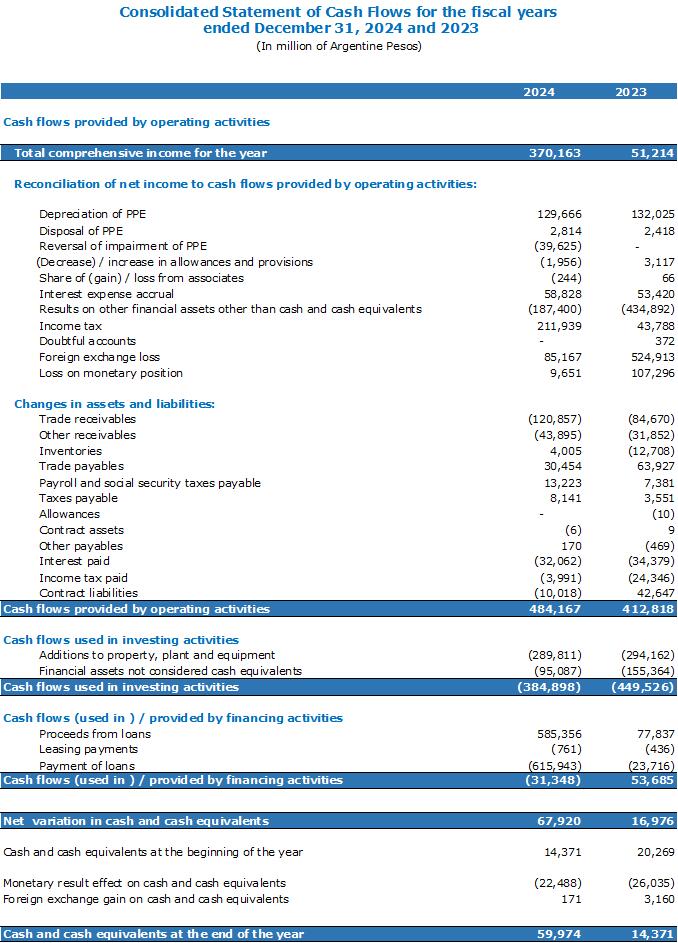

During 4Q2024, the cash flow provided by operating activities amounted to Ps. 165,457 million, while in 4Q2023 the cash flow provided by operating activities totaled Ps. 113,969 million. The positive variation is mainly related to lower interest payments and the increase in working capital.

Cash flow used in investing activities amounted to Ps. 115,866 million in 4Q2024, compared to Ps. 135,242 in 4Q2023. The decrease was mainly due to lower payments for the acquisition of PPE and financial assets not considered cash equivalents under IFRS.

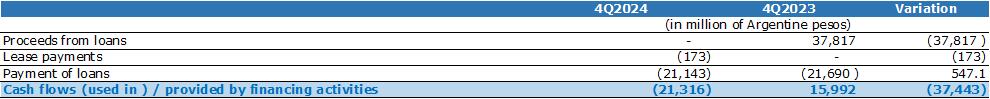

Finally, cash flow (used in) / provided by financing activities amounted to Ps. 21,316 million in 4Q2024, compared to cash flow provided by Ps. 15,992 million obtained in 4Q2023, mainly due to the lower proceeds of financial loans, net during the 4Q2024.

4Q2024 earnings videoconference

We invite you to participate in the videoconference to discuss the 4Q2024 financial results on Friday February 28, 2025 at 9:00 a.m. Eastern Time / 11:00 a.m. Buenos Aires time.

For those interested in participating in our earnings videoconference, there will be a live webcast that you can access at:

https://us02web.zoom.us/webinar/register/WN_b0MgBHM3S_K7gr3Yg8QLEA

10

10

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements include, but are not limited to, all statements other than statements of historical facts contained in this press release, including, without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and targets, future developments in the markets in which we operate or are seeking to operate or anticipated regulatory changes in the markets in which we operate or intend to operate. In some cases, you can identify forward-looking statements by terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "guidance," "may,", "should" or "will" or the negative of such terms or other similar expressions or terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements speak only as of the date of this press release and are not guarantees of future performance and are based on numerous assumptions. Our actual results of operations, financial condition and the development of events may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking statements. Except as required by law, we do not undertake any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof or to reflect anticipated or unanticipated events or circumstances.

Investors should read the section entitled " Item 3. Key Information—D. Risk Factors " and the description of our segments and business sectors in the section entitled "Item 4.B. Information on the Company—Business Overview", each in our Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Securities and Exchange Commission (“SEC”), for a more complete discussion of the risks and factors that could affect us.

Forward-looking statements include, but are not limited to, statements relating to: operating profits, new investments and projects, including their expected development, completion, commercial operations date, expected financial and operating performance (including enterprise value to EBITDA multiples), expected output capacity, anticipated synergies and market dynamics relating to such investments and projects; the Inflation Reduction Act in the U.S (“IRA”) and benefits thereunder; our anticipated limited exposure to current market risks, including our position with respect current market risks and the potential impact from foreign exchange rates and interest rates on CAFD; the impact from potential caps on market prices in the net value of our assets; taxes on energy companies in Spain; equity investments; estimates and targets; escalation factors in relation to inflation; net corporate leverage based on CAFD estimates; financial flexibility; the use of non-IFRS measures as a useful predicting tool for investors; and various other factors, including those factors discussed under “Item 3. Key Information—D. Risk Factors” and “Item 5.A—Operating Results”in our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the SEC.

Non-IFRS Financial Measures

This press release also includes certain non-IFRS financial measures. Non-IFRS financial measures are not measurements of our performance or liquidity under IFRS as issued by IASB and should not be considered alternatives to operating profit or profit for the period or net cash provided by operating activities or any other performance measures derived in accordance with IFRS as issued by the IASB or any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities.

We present non-IFRS financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-IFRS financial measures may not be comparable to other similarly titled measures employed by other companies and may have limitations as analytical tools. These measures may not be fit for isolated consideration or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-IFRS financial measures and ratios are not measurements of our performance or liquidity under IFRS as issued by the IASB. Thus, they should not be considered as alternatives to operating profit, profit for the period, any other performance measures derived in accordance with IFRS as issued by the IASB, any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities.

Rounding: Certain figures included in this press release have been rounded for ease of presentation. Percentage figures included in this press release have not, in all cases, been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this press release may vary from those obtained by performing the same calculations using the figures in our Financial Statements. Certain numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them due to rounding.

11

11

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

12

12

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

13

13

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

14

14

https://www.tgs.com.ar/investors/Press-releases

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

15

15

https://www.tgs.com.ar/investors/Press-releases

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Transportadora de Gas del Sur S.A.

By: | /s/Alejandro M. Basso |

Name: | Alejandro M. Basso |

Title: | Chief Financial Officer and Services Vice President |

By: | /s/Hernán D. Flores Gómez |

Name: | Hernán Diego Flores Gómez |

Title: | Legal Affairs Vice President |

Date: February 27, 2025.

4Q2024 EARNINGS RELEASE

4Q2024 EARNINGS RELEASE

3

3