United States

Securities And Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8820

The Markman MultiFund Trust

(Exact name of registrant as specified in charter)

6600 France Avenue South, Minneapolis, Minnesota 55435

(Address of principal executive offices) (Zip code)

Robert J. Markman, 6600 France Avenue South, Minneapolis, Minnesota 55435

(Name and address of agent for service)

Registrant's telephone number, including area code: (952) 920-4848

Date of fiscal year end: 12/31

Date of reporting period: 06/30/09

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Markman Core Growth Fund Semiannual Report

06.30.2009

Semi-Annual Report

(unaudited)

| Dear Fellow Shareholders, |

After six consecutive years of significant outperformance relative to the S&P 500 and our large cap peer group—culminating with a Lipper Leader Award for the best performing large cap growth fund for the three year period ended December 31, 2008—the Markman Core Growth Fund experienced its worst six month period since inception. This has been extremely disappointing.

Looking back on the past six months, the reason for the poor showing can be largely attributed to two major market directional calls that proved to be wrong. As you know, as a result of getting extremely cautious, the Fund managed to have excellent relative performance in the latter portion of 2008. Unfortunately, we began the year believing the market would experience an ‘Obama Bounce’ off what seemed to be oversold levels in the market. We repositioned the portfolio to give greater exposure to the market, especially in areas that had been hardest hit previously. As we now know, that was a premature call, as the market experienced a sickening slide in the first two months of the year. This early bullish call was a major contributor to the performance decline at the beginning of the year.

By mid March, the losses were greater than anticipated, and we made the decision to ‘draw the line’ and do everything we could to stabilize the portfolio. As a result, not only did the Fund suffer from the decline of the year’s first ten weeks, our late winter repositioning caused us to also significantly lag during the historic rebound in the second quarter.

The Three Keys to the Economy and the Markets: Jobs, jobs and….jobs!

America has spent the better part of the last quarter century building a consumer-based economy. By 2007 some 70% of our GDP was a direct result of consumer spending. It’s not rocket science to understand that an unemployed or underemployed citizen is not going to spend like someone with a steady and secure job. That is why it is so vitally important to understand what is happening on the employment front. Unfortunately, the media either misunderstands what is happening with employment or highlights those statistics that confirm their preconceived ideas, seeming to purposely avoid data that blows holes in their story.

When the economic stimulus bill was passed early this year, the administration claimed that it would help keep unemployment from rising above 8%. How quaint that now seems. In June, the unemployment rate hit 9.5%. And all objective observers—including those in the Obama administration—agree that not only will we see 10%+ well before the end of the year, the rate could climb even higher in 2010.

You will, of course, hear talk that employment is a ‘lagging indicator,’ meaning that it tells us where we’ve been but not where we may be going. We are told that the economy and the financial markets will tend to begin to recover even while reported unemployment numbers are worsening. This is true. In fact, unemployment sometimes continues to increase even after the economy has started to grow again. But what few people know is that not all employment statistics are lagging indicators. Some components of the employment report, such as hours worked and temporary help, are actually leading indicators and provide insight as to where we may well be headed. And that’s where the really bad news comes in. The employment data that most clearly is predictive of where the economy is headed continues to deteriorate, signaling that a recovery in the economy is not imminent. In our opinion, this is what you need to look for:

| • | Average work week: Currently, the average hours worked per week by folks who are still employed continues to shrink. This leading indicator tells us that business is still in a shrinking mode. |

| • | The number of Americans who have been forced into part time work—now a record nine million—continues to grow. They do not show up in the numbers of unemployed, but they do, of course, have a depressing effect on the economy. Keep in mind that part-time worker data is a leading indicator. As you can see from the chart below, part-time employment usually drops suddenly just as the recession has ended. If the part-time numbers are still going up, odds are we are not close to the end of the recession. |

| • | The number of American who are unemployed, underemployed, or have simply stopped looking has grown to 17% of the workforce and, in our opinion, will likely hit 20% in 2010. That means one out of five workers is stressed from an income standpoint. In our opinion, the implications of this continuing reduction in workers’ income are nothing less than catastrophic. |

Watch Part-Time Employment: A Leading Indicator

Source: Bureau of Labor Statistics

| • | Have you ever wondered why it is true that in a garden-variety business cycle recession, unemployment is a lagging indicator? That’s because in past recessions the consumer, after regrouping, began to buy things once again—using credit! So let’s get real. There is no way that the consumer will want to or be able to fund new credit expansion any time in the foreseeable future. Thus, in a credit cycle recession unemployment is NOT a lagging indicator; it is what we call a ‘coincident’ indicator cycling back into the economy in a negative way. All post World War II recessions have ending with a consumer who is pent up and ready to spend. Sadly, the American consumer is ‘spent up,’ not pent up. |

| • | This economic cycle is, indeed different from others with which the media like to make comparisons. Three-quarters of the workers that were fired over the last year were let go on a permanent, not a temporary basis. There are good paying jobs in industries across the economy—financial services, construction, autos—that are gone and will never come back. |

| • | The unavoidable conclusion to be gleaned from the employment data is that the recovery will come later rather than sooner and will be more fragile and subject to backsliding than previous recoveries. |

The fact that the market has rallied so strongly does not change these essential facts. That is what makes us so skeptical of the optimists who are hopeful that the economy will rebound and stay on the mend over the coming year. There��s a wise old saying on Wall Street that ‘the market takes the stairway up and the elevator down.’ We believe the optimism and complacency that are the underpinnings of the recent market melt up will soon be shown to be a poor foundation for a real and extended recovery. Accordingly, we are positioning the portfolio in sectors and companies that we feel can outperform in an environment with multiple headwinds.

Markman

CORE GROWTH FUND

A Value – Added

Large Growth Strategy

Top Ten Holdings

by Market Value 06.30.09

| | | percent of net assets | |

| SLM Corporation | | | 5.12 | % |

| WellPoint | | | 4.93 | % |

| Apple | | | 4.73 | % |

| Lincoln National | | | 4.41 | % |

| Google | | | 4.38 | % |

| Amazon.com | | | 4.17 | % |

| Cerner Systems | | | 4.10 | % |

| Infosys | | | 3.97 | % |

| Baidu.com | | | 3.96 | % |

| Hartford Insurance | | | 3.94 | % |

| Total in Top Ten | | | 43.71 | % |

Top Five Weighted Sectors

by Market Value 06.30.09

| | | percent of net assets | |

| Financial Services | | | 24.4 | % |

| Health Care/Medical | | | 22.4 | % |

| Internet Commerce | | | 12.5 | % |

| Telecommunications | | | 6.1 | % |

| Consumer Electronics | | | 4.7 | % |

Information about the Fund’s holdings, asset allocation, or country diversification is historical and is not an indication of future portfolio composition which will vary.

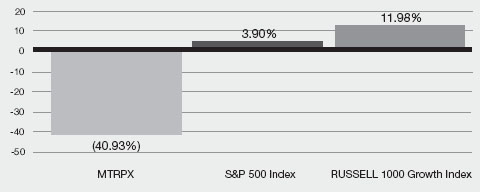

Performance Comparisons Against Market Indices*

for six months ended 06.30.09

The S&P 500 Index, a market capitalization-weighted unmanaged index based on the average weighted performance of 500 widely held common stocks. An index does not include transaction costs associated with buying and selling securities or any mutual fund expenses. It is not possible to invest directly in an index.

The Russell 1000 Growth Index measures the performance of those stocks in the Russell 1000 with higher price-to-book ratios and higher relative forecasted growth rates. An index does not include transaction costs associated with buying and selling securities or any mutual fund expenses. It is not possible to invest directly in an index.

Past performance is not a guarantee of future results.

The investment returns and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost.

| * | Average annual return is calculated to include reinvestment of all income dividends and capital gains distributions. |

Portfolio of Investments June 30, 2009 (Unaudited)

| | Shares | | | | Market Value | |

| COMMON STOCKS — 82.8% | |

| FINANCIAL SERVICES — 24.4% | |

| | | 72,000 | | SLM Corp.* † | | $ | 739,440 | |

| | | 37,000 | | Lincoln National Corp. | | | 636,770 | |

| | | 48,000 | | The Hartford Financial Services Group, Inc. | | | 569,760 | |

| | | 1,500 | | CME Group, Inc. | | | 466,665 | |

| | | 7,100 | | Visa, Inc. – Class A | | | 442,046 | |

| | | 29,000 | | Bank of America Corp. | | | 382,800 | |

| | | 2,000 | | The Goldman Sachs Group, Inc. | | | 294,880 | |

| | | | | | | $ | 3,532,361 | |

| HEALTH CARE/MEDICAL — 22.4% | |

| | | 14,000 | | WellPoint, Inc.* | | $ | 712,460 | |

| | | 9,500 | | Cerner Corp.* | | | 591,755 | |

| | | 10,000 | | Quest Diagnostics, Inc. | | | 564,300 | |

| | | 7,000 | | Express Scripts, Inc. – Class A* | | | 481,250 | |

| | | 10,000 | | Abbott Laboratories | | | 470,400 | |

| | | 2,500 | | Intuitive Surgical, Inc.* | | | 409,150 | |

| | | | | | | $ | 3,229,315 | |

| INTERNET COMMERCE — 12.5% | |

| | | 1,500 | | Google, Inc. – Class A* | | $ | 632,385 | |

| | | 7,200 | | Amazon.com, Inc.* | | | 602,352 | |

| | | 1,900 | | Baidu.com, Inc. – ADR* | | | 572,071 | |

| | | | | | | $ | 1,806,808 | |

| TELECOMMUNICATIONS — 6.1% | |

| | | 9,000 | | China Mobile Ltd. | | $ | 450,720 | |

| | | 14,000 | | Verizon Communications, Inc. | | | 430,220 | |

| | | | | | | $ | 880,940 | |

| CONSUMER ELECTRONICS — 4.7% | |

| | | 4,800 | | Apple, Inc.* | | $ | 683,664 | |

| SOFTWARE & SERVICES — 4.0% | |

| | | 15,600 | | Infosys Technologies Ltd. – ADR | | $ | 573,768 | |

| COMPUTERS & INFORMATION — 2.9% | |

| | | 4,000 | | International Business | | | | |

| | | | | Machines Corp. (IBM) | | $ | 417,680 | |

| EDUCATIONAL SERVICES — 2.4% | |

| | | 4,800 | | Apollo Group, Inc. – Class A* | | $ | 341,376 | |

| ENGINEERING SERVICES — 2.2% | |

| | | 20,000 | | ABB Ltd. – ADR | | $ | 315,600 | |

| DEFENSE — 1.2% | |

| | | 3,000 | | General Dynamics Corp. | | $ | 166,170 | |

| TOTAL COMMON STOCKS | | $ | 11,947,682 | |

| EXCHANGE TRADED FUNDS — 16.7% | |

| | | 27,000 | | UltraShort Basic Materials ProShares | | $ | 510,300 | |

| | | 25,500 | | UltraShort Real Estate ProShares | | | 501,840 | |

| | | 20,000 | | iShares S&P North American Technology– | | | | |

| | | | | Multimedia Networking Index Fund | | | 473,000 | |

| | | 88,500 | | Direxionshares Financial Bear 3X Shares* | | | 412,410 | |

| | | 9,000 | | UltraShort QQQ ProShares | | | 288,180 | |

| | | 10,500 | | Direxionshares Energy Bear 3X Shares* | | | 232,995 | |

| TOTAL EXCHANGE TRADED FUNDS | | $ | 2,418,725 | |

| TOTAL INVESTMENT SECURITIES — 99.5% | | $ | 14,366,407 | |

| | | | | (Cost $13,433,801) | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.5% | | | 77,623 | |

| NET ASSETS — 100.0% | | $ | 14,444,030 | |

| * | Non-income producing security. |

| † | Security is partially pledged as collateral for the outstanding borrowings on June 30, 2009. Market value designated as collateral was $81,679 on June 30, 2009. |

ADR - American Depository Receipt.

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 12,235,862 | | | $ | — | | | $ | — | | | $ | 12,235,862 | |

| Mutual Fund | | $ | 2,130,545 | | | $ | — | | | $ | — | | | $ | 2,130,545 | |

| | | | | | | | | | | | | | | $ | 14,366,407 | |

See accompanying notes to financial statements.

Statement of Assets and Liabilities June 30, 2009 (Unaudited)

| ASSETS | | | |

| Investment securities: | | | |

| At acquisition cost | | $ | 13,433,801 | |

| At market value | | $ | 14,366,407 | |

| Accrued income | | | 1,651 | |

| Receivable for securities sold | | | 2,476,700 | |

| Receivable for capital shares sold | | | 42 | |

| Other assets | | | 20,205 | |

| TOTAL ASSETS | | | 16,865,005 | |

| | | | | |

| LIABILITIES | | | | |

| Line of Credit | | | 57,175 | |

| Payable for securities purchased | | | 2,145,951 | |

| Payable for capital shares redeemed | | | 7,920 | |

| Payable to Adviser | | | 7,411 | |

| Payable to other affiliates | | | 50,137 | |

| Payable to Trustees | | | 16,336 | |

| Other accrued expenses and liabilities | | | 136,045 | |

| TOTAL LIABILITIES | | | 2,420,975 | |

| | | | | |

| NET ASSETS | | $ | 14,444,030 | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 58,922,675 | |

| Accumulated net investment loss | | | (314,760 | ) |

| Accumulated net realized losses from security transactions | | | (45,096,491 | ) |

| Net unrealized appreciation on investments | | | 932,606 | |

| NET ASSETS | | $ | 14,444,030 | |

Pricing of Class I Shares | | | | |

Net assets attributable to Class I shares | | $ | 14,444,030 | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 2,518,989 | |

| Net asset value, offering price and redemption price per share | | $ | 5.73 | |

See accompanying notes to financial statements.

Statement of Operations For the Six Months Ended June 30, 2009 (Unaudited)

| INVESTMENT INCOME | | | |

Dividends from non-affiliated securities | | $ | 140,516 | |

Dividends from affiliated securities | | | 1,940 | |

| | | | | |

TOTAL INVESTMENT INCOME | | | 142,456 | |

| | | | | |

| EXPENSES | | | | |

Professional fees | | | 113,410 | |

Investment advisory fees | | | 82,408 | |

Custodian fees | | | 48,058 | |

Compliance fees and expenses | | | 41,895 | |

Sub transfer agent fees | | | 31,511 | |

Trustees fees and expenses | | | 27,293 | |

Administration fees | | | 25,000 | |

Shareholder report costs | | | 22,378 | |

Accounting services fees | | | 15,000 | |

Transfer agent fees | | | 15,000 | |

Interest expense | | | 12,078 | |

Postage and supplies | | | 10,050 | |

Registration fees | | | 9,078 | |

Bank overdraft fees | | | 792 | |

Other expenses | | | 3,265 | |

TOTAL EXPENSES | | | 457,216 | |

| | | | | |

| NET INVESTMENT LOSS | | | (314,760 | ) |

| | | | | |

| REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | | |

Net realized losses from security transactions | | | (11,389,399 | ) |

Net realized losses from affiliated security transactions | | | (569,725 | ) |

Net realized losses on closed short positions | | | (138,787 | ) |

Net change in unrealized appreciation/depreciation on investments | | | (542,427 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (12,640,338 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (12,955,098 | ) |

See accompanying notes to financial statements.

| Statement of Changes in Net Assets |

| | | | | | | |

| | | For the Six Months Ended June 30, 2009 (Unaudited) | | | For the Year Ended December 31, 2008(a) | |

| FROM OPERATIONS | | | | | | |

| Net investment loss | | $ | (314,760 | ) | | $ | (695,282 | ) |

| Net realized losses from security transactions | | | (11,389,399 | ) | | | (10,721,661 | ) |

| Net realized losses from affiliated security transactions | | | (569,725 | ) | | | (165,639 | ) |

| Net realized losses on closed short positions | | | (138,787 | ) | | | (23,372 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (542,427 | ) | | | (8,627,071 | ) |

| Net decrease in net assets from operations | | | (12,955,098 | ) | | | (20,233,025 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

CLASS I | | | | | | | | |

| Proceeds from shares sold | | | 1,793,518 | | | | 3,025,324 | |

| Payments for shares redeemed | | | (7,183,972 | ) | | | (12,243,086 | ) |

| Net decrease in net assets from Class I capital share transactions | | | (5,390,454 | ) | | | (9,217,762 | ) |

| | | | | | | | | |

| CLASS A | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 174,965 | |

| Payments for shares redeemed | | | — | | | | (479,087 | ) |

| Net decrease in net assets from Class A capital share transactions | | | — | | | | (304,122 | ) |

| TOTAL DECREASE IN NET ASSETS | | | (18,345,552 | ) | | | (29,754,909 | ) |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 32,789,582 | | | | 62,544,491 | |

| End of period | | $ | 14,444,030 | | | $ | 32,789,582 | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | (314,760 | ) | | $ | — | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Sold | | | 230,442 | | | | 267,065 | |

| Redeemed | | | (1,093,529 | ) | | | (1,094,657 | ) |

| Net decrease in shares outstanding | | | (863,087 | ) | | | (827,592 | ) |

| Shares outstanding, beginning of period | | | 3,382,076 | | | | 4,209,668 | |

| Shares outstanding, end of period | | | 2,518,989 | | | | 3,382,076 | |

| (a) | Except for Class A shares, which represents the period from beginning of fiscal year (January 1, 2008) through the date Class A shares were exchanged into Class I shares (April 30, 2008). |

See accompanying notes to financial statements.

Financial Highlights Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

| | | Six Months Ended June 30, 2009 (Unaudited) | | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | | | Year Ended December 31, 2006 | | | Year Ended December 31, 2005 | | | Year Ended December 31, 2004 | |

| | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | $ | 9.70 | | | $ | 14.78 | | | $ | 12.71 | | | $ | 11.00 | | | $ | 10.24 | | | $ | 9.02 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.12 | ) | | | (0.21 | ) | | | (0.07 | ) | | | (0.04 | ) | | | 0.05 | | | | 0.07 | |

| Net realized and unrealized gains (losses) on investments | | | (3.85 | ) | | | (4.87 | ) | | | 2.14 | | | | 1.75 | | | | 0.76 | | | | 1.22 | |

| Total from investment operations | | | (3.97 | ) | | | (5.08 | ) | | | 2.07 | | | | 1.71 | | | | 0.81 | | | | 1.29 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.07 | ) |

| Net asset value at end of period | | $ | 5.73 | | | $ | 9.70 | | | $ | 14.78 | | | $ | 12.71 | | | $ | 11.00 | | | $ | 10.24 | |

| Total return | | | (40.93 | %)(a) | | | (34.37 | %) | | | 16.29 | % | | | 15.55 | % | | | 7.94 | % | | | 14.31 | % |

| Net assets at end of period (000s) | | $ | 14,444 | | | $ | 32,790 | | | $ | 62,210 | | | $ | 55,122 | | | $ | 55,115 | | | $ | 60,132 | |

| Ratio of net expenses to average net assets | | | 4.42 | %(b) | | | 3.13 | % | | | 1.70 | % | | | 1.58 | % | | | 1.58 | % | | | 1.44 | % |

| Ratio of net investment income (loss) to average net assets | | | (3.04 | %)(b) | | | (1.49 | %) | | | (0.45 | %) | | | (0.33 | %) | | | 0.46 | % | | | 0.71 | % |

| Portfolio turnover rate | | | 12,610 | %(b) | | | 3,452 | % | | | 1,098 | % | | | 799 | % | | | 658 | % | | | 472 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(a) Not annualized.

(b) Annualized.

See accompanying notes to financial statements.

Notes to Financial Statements June 30, 2009 (Unaudited)

1. Significant Accounting Policies

Markman MultiFund Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end diversified management investment company. The Trust was organized as a Massachusetts business trust on September 7, 1994. The Trust offers one series of shares to investors, the Markman Core Growth Fund (the “Fund”).

The Fund seeks long-term growth of capital by investing in securities including individual securities, open-end mutual funds, closed-end funds, and exchange traded funds. Under normal market conditions, at least 80% of the Fund’s assets will be invested in the common stock of large U.S. companies selected for their growth potential. Up to 20% of the Fund's assets will be invested in open-end or closed-end investment companies, including exchange traded funds (underlying funds). The Fund may invest in underlying funds for hedging purposes or generally for purposes of enhancing its investment return. The Fund may also invest in real estate investment trusts, money market securities and high yield debt securities.

The following is a summary of the Trust’s significant accounting policies:

Securities valuation – Shares of the underlying funds (other than closed-end investment companies and exchange traded funds that are listed on a securities exchange) are valued at their respective net asset values under the 1940 Act. Shares of closed-end investment companies and exchange traded funds that are listed on a securities exchange typically are valued at their respective closing market quotations. The Fund, with respect to its individual securities, values securities for which market quotations are readily available at their current market value (generally the last reported sale price as of the close of the regular session of trading on the day the securities are being valued). Fixed-income securities which have available market quotations are priced according to the most recent bid price quoted by one or more of the major market makers. If market quotations are not readily available or if available market quotations are not reliable, securities are valued at their fair value as determined in good faith in accordance with procedures established by and under the general supervision of the Board of Trustees. The Fund may use fair value pricing if the value of a security has been materially affected by events occurring before the Fund’s calculation of NAV but after the close of the primary markets on which the security is traded. The Fund may also use fair value pricing if reliable market quotations are unavailable due to infrequent trading or if trading in a particular security was halted during the day and did not resume prior to the Fund’s calculation of NAV. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account.

The Fund has adopted Financial Accounting Standards Board (“FASB”) Statement on Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | • | Level 1 – quoted prices in active markets for identical securities |

| | • | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, money market securities are valued using amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The aggregate value by input level, as of June 30, 2009, for the Fund’s investments is included in the Fund’s Portfolio of Investments, which also includes a breakdown of the Fund’s investments by industry concentration.

Short sales – The Fund may sell securities short. In a short sale, the Fund sells stock it does not own and makes delivery with securities "borrowed" from a broker. The Fund then becomes obligated to replace the security borrowed by purchasing it at the market price at the time of replacement. This price may be more or less than the price at which the security was sold by the Fund. Until the security is replaced, the Fund is obligated to pay to the lender any dividends or interest accruing during the period of the loan. In order to borrow the security, the Fund may be required to pay a premium that would increase the cost of the security sold. The proceeds of the short sale will be retained by the broker, to the extent necessary to meet margin requirements, until the short position is closed out. The amount of any gain will be decreased and the amount of any loss increased by the amount of any premium, dividends or interest the Fund may be required to pay in connection with a short sale.

When it engages in short sales, the Fund must also deposit in a segregated account an amount of cash or U.S. Government securities equal to the difference between (1) the market value of the securities sold short at the time they were sold short and (2) the value of the collateral deposited with the broker in connection with the short sale (not including the proceeds from the short sale).

Share valuation – The net asset value per share of the Fund is calculated daily by dividing the total value of assets minus liabilities by the number of shares outstanding, rounded to the nearest cent. The offering and redemption price per share are equal to the net asset value per share.

Investment income – Dividend income is recorded on the ex-dividend date. For financial reporting purposes, the Funds record distributions of short-term capital gains made by mutual funds in which the Funds invest as dividend income and long-term capital gains made by mutual funds in which the Fund invests as realized capital gains.

Distributions to shareholders – Distributions to shareholders arising from net investment income and net realized capital gains, if any, are distributed at least once each year. Income distributions and capital gain distributions are determined in accordance with income tax regulations.

Security transactions – Security transactions are accounted for on the trade date. Securities sold are determined on a specific identification basis.

Estimates – The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements — In June 2009, the FASB issued Statement of Financial Accounting Standards No. 168, “The FASB Accounting Standards Codification™ and the Hierarchy of Generally Accepted Accounting Principles – a replacement of FASB Statement No. 162” (“SFAS 168”). SFAS 168 replaces SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” and establishes the “FASB Accounting Standards Codification™” (“Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with generally accepted accounting principles in the United States. All guidance contained in the Codification carries an equal level of authority. On the effective date of SFAS 168, the Codification will supersede all then-existing non-SEC accounting and reporting standards. All other nongrandfathered non-SEC accounting literature not included in the Codification will become nonauthoritative. SFAS 168 is effective for financial statements issued for interim and annual periods ending after September 15, 2009. The Fund evaluated this new statement, and has determined that it will not have a significant impact on the determination or reporting of the Funds' financial statements.

Notes to Financial Statements June 30, 2009 (Unaudited), continued

Federal income tax – It is the Fund’s policy to continue to comply with the special provisions of the Internal Revenue Code (the “Code”) available to regulated investment companies. As provided therein, in any fiscal year in which the Funds so qualify and distribute at least 90% of their taxable net income, the Funds (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare and pay as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the calendar year) plus undistributed amounts from prior years.

The following information is computed on a tax basis as of December 31, 2008:

| Tax cost of portfolio investments | | $ | 45,060,248 | |

| Gross unrealized appreciation | | | | |

| on investments | | $ | — | |

| Gross unrealized depreciation | | | | |

| on investments | | | (12,834,565 | ) |

| Net unrealized depreciation | | | | |

| on investments | | | (12,834,565 | ) |

| Capital loss carryforward | | | (18,688,982 | ) |

| Accumulated deficit | | $ | (31,523,547 | ) |

As of December 31, 2008, the Fund has the capital loss carryforwards expiring as follows:

| Amount | | Expires |

| $ | 12,127,416 | | 2009 |

| | 6,188,292 | | 2010 |

| | 373,274 | | 2016 |

| $ | 18,688,982 | | |

To the extent future capital gains are offset by capital loss carryforwards, such gains will not be distributed. Based on certain provisions in the Internal Revenue Code, various limitations regarding the future utilization of these carryforwards of the Fund, brought forward as a result of the acquisitions in 2002, may apply. Based on such limitations, unless the tax law changes, approximately $10,880,110 of these losses will expire unutilized. During the year ended December 31, 2008, $8,407,034 of capital loss carryforwards of the Fund expired unutilized.

As of June 30, 2009, the Fund’s federal tax cost of securities was $27,743,399 resulting in net unrealized depreciation of $13,376,992 derived from $13,376,992 of gross depreciation.

The Fund did not pay any distributions for the years ended December 31, 2007 or 2008.

Certain reclassifications, the result of permanent differences between financial statement and income tax reporting requirements have been made to the components of capital. Reclassifications resulted primarily from the expiration of capital loss carryforwards and net investment losses. These reclassifications have no impact on the net assets or net asset value per share of the Fund and are designed to present the Fund's capital accounts on a tax basis. For the year ended December 31, 2008, the Fund made the following reclassification:.

| | Accumulated | Accumulated |

| | Net Investment | Realized |

| Paid-In Capital | Income | Capital Gains |

| $ (9,102,316) | $ 695,282 | $ 8,407,034 |

The Fund adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to the meet the “more-likely-than-not” threshold would be recorded as a tax benefit or expense in the current year. The Fund has analyzed its tax positions taken on Federal income tax returns for all open years (December 31, 2005 through 2008) for purposes of implementing FIN 48 and have concluded that no provision for income tax is required in the financial statements.

2. Investment Transactions

During the six months ended June 30, 2009, the cost of purchases and proceeds from sales (including maturities) of securities (excluding short-term investments and government securities) amounted to $1,366,424,466 and $1,371,782,192, respectively.

3. Transactions with Affiliates

The Chairman of the Board of Trustees (the “Board”) and President of the Trust is also the President of Markman Capital Management, Inc. (the “Adviser”). Certain other officers of the Trust are also officers of the Adviser or of JPMorgan Chase Bank, N.A. (“JPMorgan”), the administrative services agent, shareholder servicing and transfer agent, and accounting services agent for the Trust.

INVESTMENT MANAGEMENT AGREEMENT

The Fund’s investments are managed by the Adviser pursuant to the terms of an Investment Management Agreement. The Fund pays the Adviser a fee (Investment Advisory Fee) composed of: (1) a base fee, calculated daily and paid monthly, at an annual rate of 0.85% of the Fund’s average daily net assets (the “Base Fee”), and (2) a Performance Fee Adjustment that will add to or subtract from the Base Fee depending on the performance of the Fund in relation to the investment performance of the S&P 500 Index (the “Index”), the Fund’s benchmark index, for the preceding twelve month period (the “Performance Fee Adjustment”).

The Base Fee will be decreased in a series of breakpoints as the total assets under management for the Fund increase. The break points and the corresponding Base Fee are as follows:

| $0 - $200 million | 0.85% | |

| Next $150 million | 0.80% | (on assets from $200 - $350 million) |

| Next $150 million | 0.75% | (on assets from $350 - $500 million) |

| Next $150 million | 0.70% | (on assets from $500 - $650 million) |

| Next $150 million | 0.65% | (on assets from $650 - $800 million) |

| All additional dollars | 0.60% | (on assets over $800 million) |

The maximum yearly Performance Fee Adjustment would be 10 basis points, or one-tenth of a percent, up or down. The Performance Fee Adjustment is made at the end of each calendar month, based on the performance of the Fund relative to the Index for the preceding twelve months, to determine the Investment Advisory Fee payable for that month. During the six months ended June 30, 2009, the Adviser’s base fee was decreased by $5,879 under the Performance Fee Adjustment.

Notes to Financial Statements June 30, 2009 (Unaudited), continued

ADMINISTRATION, ACCOUNTING AND TRANSFER AGENCY AGREEMENT

Under the terms of the Administration, Accounting, and Transfer Agency Agreement between the Trust and JPMorgan, JPMorgan supplies non-investment related statistical and research data, internal regulatory compliance services and executive and administrative services for the Fund. JPMorgan coordinates the preparation of tax returns for the Fund, reports to shareholders of the Fund, reports to and filings with the Securities and Exchange Commission and state securities commissions and materials for meetings of the Board. In addition, JPMorgan maintains the records of each shareholder’s account, answers shareholders’ inquiries concerning their accounts, processes purchases and redemptions of the Fund’s shares, acts as dividend and distribution disbursing agent and performs other shareholder service functions. JPMorgan also calculates the daily net asset value per share and maintains the financial books and records of the Fund. For the performance of these services, the Fund pays JPMorgan an asset-based administrative fee and accounting fee, and a transfer agent fee based on the number of shareholder accounts. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage and supplies.

COMPLIANCE SERVICES

The Trust has contracted with the Adviser to provide the Chief Compliance Officer to the Trust, subject to approval by the Board. The Chief Compliance Officer and his or her designees perform the duties and responsibilities in accordance with Rule 38a-1 under the 1940 Act. The Chief Compliance Officer, among other things, oversees an annual review of the policies and procedures of the Trust and its service providers and provides a summary report of his or her findings to the Board. The Chief Compliance Officer’s compensation is paid by the Adviser and the Trust reimburses the Adviser for such costs.

In addition, the Trust has contracted with JPMorgan to provide certain compliance services on behalf of the Trust. Subject to the direction of the Trustees of the Trust, JPMorgan developed and assisted in implementing a compliance program for JPMorgan on behalf of the Fund and provides administrative support services to the Fund’s Compliance Program and Chief Compliance Officer. For these services, JPMorgan receives a quarterly fee from the Trust.

AFFILIATED INVESTMENTS

The Fund invested in the Markman Global Build-Out Fund, prior to the closing of the Markman Global Build-Out Fund (April 27, 2009), subject to compliance with Rule 12d1-2 of the 1940 Act, and consistent with its investment strategy. To the extent that the Fund was invested in the Markman Global Build-Out Fund, the Adviser was paid additional fees from the Markman Global Build-Out Fund subject to the Expense Limitation Agreement that was in place with respect to the Markman Global Build-Out Fund, pursuant to which the Adviser agreed to waive fees and/or reimburse expenses.

A summary of the Fund’s investment in the Markman Global Build-Out Fund, for the six months ended June 30, 2009, is noted below:

| | | Share Activity | |

| Balance 12/31/08 | | | 112,191 | |

| Purchases | | | — | |

| Sales | | | (112,191 | ) |

| Balance 6/30/09 | | | — | |

| Dividends | | $ | 1,940 | |

| Realized Losses | | $ | (569,725 | ) |

| Value 6/30/09 | | $ | — | |

5. Revolving Credit Agreement

Effective February 25, 2008, the Trust entered into a Revolving Credit Agreement (the “Agreement”) on behalf of the Fund with the Fund’s custodian, first amended on March 27, 2008. Under the Agreement, the Fund may borrow up to $15 million. Proceeds from such borrowings will be used only for the Fund’s daily cash needs as a temporary measure for extraordinary or emergency purposes, or for clearance of transactions, including without limitation the payment of redemptions occurring after the Fund’s cash funds have already been committed to overnight investments and which might otherwise require the untimely disposition of the Fund’s portfolio securities, or to finance the purchase (on an interim basis) of portfolio securities.

As required by the Agreement, the Fund must designate securities as being pledged as collateral for the amounts outstanding under the Agreement. The collateral value shall equal the actual fair market value of the securities as determined by the Fund in good faith multiplied by the applicable collateral percentage.

As of June 30, 2009, the Fund had $57,175 outstanding under the Agreement and designated securities as collateral with a market value of $81,679. The securities pledged as collateral are denoted as such on the Portfolio of Investments.

6. Commitments and Contingencies

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

7. Subsequent Events

The Fund evaluated subsequent events from June 30, 2009, the date of these financial statements, through August 28, 2009, the date these financial statements were issued and available. On August 19, 2009, the Board approved a plan of liquidation with respect to the Fund and the subsequent termination of the Trust. Pursuant to the plan of liquidation with respect to the Fund, the Fund will be closed and liquidated on or about September 28, 2009. In connection with its liquidation, the Fund was closed to new and subsequent investments effective as of the close of business August 19, 2009, except that the Fund may continue to accept systematic contributions until September 28, 2009, from defined contribution and similar plans, until such time as it is administratively feasible to terminate these arrangements.

Additional Notes June 30, 2009 (Unaudited)

PROXY VOTING GUIDELINES

The Adviser is responsible for exercising the voting rights associated with the securities purchased and held by the Fund. A description of the policies and procedures the Adviser uses in fulfilling this responsibility and information regarding how those proxies were voted during the twelve month period ended June 30 are available without charge, upon request, by calling 800-707-2771. They are also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

QUARTERLY PORTFOLIO DISCLOSURE

The Trust files a complete listing of portfolio holdings as of the end of the first and third quarters of each fiscal year on Form N-Q. The complete listing (i) is available on the Commission’s website at http://www.sec.gov; (ii) may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; and (iii) will be made available to shareholders upon request by calling 800-707-2771. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

SCHEDULE OF SHAREHOLDER EXPENSES

As a shareholder of the Fund, you incur ongoing costs, including investment advisory fees and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2009 through June 30, 2009).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Six Months Ended June 30, 2009" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | Net Expense Ratio Annualized June 30, 2009 | | | Beginning Account Value January 1, 2009 | | | Ending Account Value June 30, 2009 | | | Expenses Paid Six Months Ended June 30, 2009* | |

| Actual | | | 4.42 | % | | $ | 1,000.00 | | | $ | 590.70 | | | $ | 17.42 | |

| Hypothetical | | | 4.42 | % | | $ | 1,000.00 | | | $ | 1,002.89 | | | $ | 21.94 | |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by [number of days in most recent fiscal half-year/365 [or 366] (to reflect the one-half year period). |

Approval of Management Agreement (Unaudited)

The Board, and by a separate vote, the Trustees who are not considered to be “interested persons” of the Trust or the Adviser as defined under the Investment Company Act of 1940 (the “Independent Trustees”), approved the Management Agreement between the Trust and the Adviser with respect to the Fund at a meeting held on February 3, 2009.

In determining whether to approve the continuation of the Management Agreement, the Board evaluated information furnished by the Adviser that the Board deemed necessary to determine whether continuance of the Management Agreement was in the best interests of the Fund and its shareholders. In making the recommendation to approve the Management Agreement, the Board gave careful consideration to all factors deemed to be relevant to the Fund, including, but not limited to: (1) the nature, extent and the quality of the services to be provided to the Fund by the Adviser, including the history, reputation, qualifications and background of the Adviser, as well as the qualifications of its key personnel; (2) the investment performance of the Fund as compared to similar mutual funds and relevant indices; (3) the level of fees paid to the Adviser as compared to similar mutual funds; (4) the cost of services to be provided and the profits to be realized by the Adviser from its relationship with the Trust; and (5) the possible economies of scale that would be realized due to Fund growth and whether fee levels reflect such economies of scale for the benefit of shareholders.

In addition to the materials received in connection with the annual consideration of the Management Agreement, the Board also took into account certain information distributed at previous meetings, as well as the Board’s familiarity with the Adviser through the Trustees’ experience as trustees of the Fund and other investment companies managed by the Adviser.

Prior to voting, the Independent Trustees reviewed the proposed continuance of the Management Agreement with management and with experienced independent legal counsel and received materials from such counsel discussing the legal standards for their consideration of the proposed continuation of the Management Agreement with respect to the Fund. The Independent Trustees also reviewed the proposed continuation of the Management Agreement in a private session with counsel at which no representatives of management were present.

In considering the nature, extent and quality of services to be provided by the Adviser, the Board reviewed the investment advisory and other services provided to the Trust and its shareholders, and the Adviser’s personnel. The Board considered the level and depth of knowledge of the Adviser. In evaluating the quality of services provided by the Adviser, the Board took into account its familiarity with the Adviser’s management through Board meetings, conversations and reports during the preceding year. The Board also took into account the Adviser’s compliance policies and procedures. The Board also considered the allocation of the Fund’s brokerage, including the Adviser’s process for obtaining “best execution.” The Board also received a copy of the Adviser’s financial statements and considered the financial condition of the Adviser and that the Adviser had the financial wherewithal to continue to provide the same scope and quality of services under the Management Agreement. The Board also considered the Adviser’s role in coordinating the activities of the Fund’s other service providers, as well as the services that the Adviser provides to the Fund’s shareholders.

The Board reviewed the Fund’s performance and expenses. The Board considered the structure of the advisory fee, including the performance fee component. The Board also noted that the Board reviews on a quarterly basis information about the Fund’s performance results, portfolio composition and investment strategy. The Board took into account the Fund’s overall performance relative to its peer group, noting that the Fund outperformed the average of both its Lipper and Morningstar peer groups for the one-, three-, and five-year periods ended December 31, 2008. The Board also noted that the Fund outperformed the S&P 500 Index for the same periods and outperformed the Russell 1000 Growth Index for the one- and three-year periods and underperformed the Russell 1000 Growth Index for the five-year period. Among other performance data, the Board also noted the Fund’s 5-star Morningstar ranking for the three- and five-year periods and that the Fund ranked in the 8th, 2nd and 3rd percentiles, respectively, of its Lipper and Morningstar peer groups for the one-, three- and five-year periods. The Board also took into account management’s discussion of the Fund’s performance.

The Board also considered the information provided in the Board materials comparing the expenses of the Fund to its peers. The Board compared the advisory fees and total expense ratios for the Fund with various comparative data, including the average advisory fees and expense ratios in the Fund’s Morningstar category. The Board noted that the Fund’s advisory fee and total expenses were above the average of other mutual funds in the Fund’s Morningstar category. The Board took into account the impact that the current size of the Fund has on Fund expenses. The Board also took into account management’s discussion of the Fund’s expenses. The Board also took into account the quality of services received by the Fund from the Adviser, as well as the Fund’s performance.

The Board also considered the financial condition and profitability of the Adviser and any indirect benefits derived by the Adviser from the Adviser’s relationship with the Fund. In considering the Adviser’s profitability, the Board reviewed the cost to the Adviser of providing services to the Fund and the resulting profitability. The Board concluded that the Adviser has the financial wherewithal to perform the services under the Management Agreement and that the Adviser’s level of profitability from its relationship with the Fund was reasonable. The Board further concluded that any indirect benefits the Adviser derives from its relationship with the Fund are incidental to the management fee the Adviser earns.

The Board considered the relatively small size of the Fund and the effect of any potential future growth on its expenses and performance, noting that the advisory fee contains breakpoints, which could potentially result in economies of scale if the Fund’s assets grow. The Board also noted that if the Fund’s assets increase over time, the Fund may also realize other economies of scale if assets increase proportionally more than certain other expenses.

In considering the approval of the Management Agreement, the Board, including the Independent Trustees, did not identify any single factor as controlling and each Trustee may have contributed different weight to different factors. After consideration of the foregoing, the Board also reached the following conclusions regarding the Management Agreement, in addition to the ones discussed above, among others: (a) the Adviser has demonstrated that it possesses the capability and resources to perform the duties required of it under the Management Agreement; (b) the performance of the Fund is reasonable in relation to the performance of funds with similar investment objectives and to relevant indices; and (c) the Fund’s advisory expenses are reasonable in relation to those of similar funds and in light of the services provided by the Adviser, the Fund’s performance and the other factors discussed above with respect to the Adviser and the Fund. Based upon all of the above-mentioned factors and their related conclusions, the Board, including a majority of the Independent Trustees, determined that approval of the Management Agreement would be in the best interests of the Fund and its shareholders.

Management of the Trust (Unaudited)

Listed below are the Trustees and principal officers of the Markman MultiFund Trust (the "Trust").

| Name/Address/Age | Position(s) Held With Trust | Term of Office1 and Length of Time Served | Principal Occupation(s) During Last 5 yrs | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee Outside the Fund Complex |

| INTERESTED TRUSTEE: | | | | | |

| | | | | | |

Robert J. Markman2 | Chairman of | Since Inception | President, Treasurer and | 1 | N/A |

| 6600 France Ave. South | the Board | | Secretary of Markman | | |

| Edina, MN 55435 | and President | | Capital Management, Inc. | | |

| Age: 57 | | | | | |

| 1 | Each Trustee is elected to serve in accordance with the Declaration of Trust and By-Laws of the Trust until his or her successor is duly elected and qualified. |

| 2 | Mr. Markman is an "interested person" of the Trust as defined in the Investment Company Act of 1940, as amended, because of his relationship with Markman Capital Management, Inc. Markman Capital Management, Inc. serves as the investment adviser to the Trust and, accordingly, as investment adviser to the Fund. |

| Name/Address/Age | Position(s) Held With Trust | Term of Office1 and Length of Time Served | Principal Occupation(s) During Last 5 yrs | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee Outside the Fund Complex |

| DISINTERESTED TRUSTEES: | | | | | |

| | | | | | |

| Susan Gale Levy | Trustee | Since Inception | Real Estate Advisor, | 1 | N/A |

| 6600 France Ave. South | | | Equitable Realty. | | |

| Edina, MN 55435 | | | | | |

| Age: 56 | | | | | |

| Melinda S. Machones | Trustee | Since Inception | Director of Technology | 1 | St. Luke’s |

| 6600 France Ave. South | | | and Strategy, Duluth | | Hospital; |

| Edina, MN 55435 | | | New Tribune; Self-employed | | St. Luke’s |

| Age: 54 | | | management and technology | | Foundation; |

| | | | consultant; Director of | | Marshall |

| | | | Information Technologies, | | School |

| | | | The College of St. Scholastica. | | |

| Michael J. Monahan | Trustee | Since Inception | Vice President–External | 1 | N/A |

| 6600 France Ave. South | | | Relations, Ecolab. | | |

| Edina, MN 55435 | | | | | |

| Age: 58 | | | | | |

| 1 | Each Trustee is elected to serve in accordance with the Declaration of Trust and By-Laws of the Trust until his or her successor is duly elected and qualified. |

| | Position(s) | | |

| | Held With | Term of Office and | Principal Occupation(s) |

| Name/Address/Age | Trust | Length of Time Served | During Last 5 yrs |

| PRINCIPAL OFFICERS: | | | |

| | | | |

| Judith E. Fansler | Secretary | Since Inception | Chief Operations Officer, |

| 6600 France Ave. South | Treasurer | Since May 2003 | Markman Capital Management, Inc. |

| Edina, MN 55435 | Chief | | |

| | Compliance | | |

| Age: 57 | Officer | Since October 2004 | |

The Statement of Additional Information contains additional information about the Trustees and is available without charge upon request by calling 800-707-2771.

Authorized for distribution only if preceded or accompanied by a current prospectus.

| Investment Adviser | Shareholder Services |

| Markman Capital Management, Inc. | c/o JPMorgan Chase Bank, N.A. |

| 6600 France Avenue South | P.O. Box 5354 |

| Minneapolis, Minnesota 55435 | Cincinnati, Ohio 54201-5354 |

| Telephone: 952-920-4848 | Toll-free: 800-707-2771 |

| Toll-free: 800-395-4848 | |

Check for net asset values and more Portfolio/Strategy Updates online

www.markman.com

For up-to-the-minute net asset values and account values, call the PriceLine

800-536-8679

For a prospectus, application forms, assistance in completing an application, or general administrative questions, call our HelpLine

800-707-2771

These forms are available:

| | • | Systematic Withdrawal Plan Request |

| | • | Automatic Investment Request |

| | • | Company Retirement Account Application |

| | • | 403(b) Plan and Application |

The minimum direct investment is $500. If you want to invest less than $500, you may purchase Markman Core Growth Fund through: Charles Schwab & Company (800-266-5623), Fidelity Investments (800-544-7558), and TD Waterhouse (800-934-4443), among others. There is no transaction fee when you purchase the Markman Core Growth Fund through these discount brokers.

For additional forms or answers to any questions just contact Markman Core Growth Fund between the hours of 8:30 AM and 5:30 PM EST, toll-free 800-707-2771.

Markman

CORE GROWTH FUND

A Value – Added

Large Growth Strategy

6600 France Avenue South

Minneapolis, Minnesota 55435

Item 2. Code of Ethics.

Not required in Semiannual report filings.

Item 3. Audit Committee Financial Expert.

Not required in Semiannual report filings.

Item 4. Principal Accountant Fees and Services.

Not required in Semiannual report filings.

Item 5. Audit Committee of Listed Companies.

Not applicable and not required in Semiannual report filings.

Item 6. Schedule of Investments.

The schedule is included as part of The Markman Core Growth Portfolio Semiannual Report file under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not Applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers.

Not Applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

(a) Based on an evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940), the registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures are effective as of a date within 90 days of the filing date of this report.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

| (a)(1) | Not applicable in Semiannual filing. |

| (a)(2) | Certifications required by Item 12(a) of Form N-CSR are filed herewith. |

| (b) | Certifications required by Item 12(b) of Form N-CSR are filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Markman MultiFund Trust

By (Signature and Title)

/s/ Robert J. Markman

President

Date: August 18, 2009

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)

/s/ Robert J. Markman

Robert J. MarkmanPresident

Date: August 18, 2009

By (Signature and Title)

/s/ Judith E. Fansler

Judith E. FanslerTreasurer and Chief Financial Officer

Date: August 17, 2009