Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: March 2006

ADECCO SA

(Exact name of Registrant as specified in its charter)

Commission # 0-25004

Sägereistrasse 10

CH-8152 Glattbrugg

Switzerland

+41 1 878 88 88

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F]

Form 20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934]

Yes ¨ No x

Attached:

| - | Adecco Annual Report 2005 |

Table of Contents

Table of Contents

Table of Contents

Mission

We inspire individuals and organisations to create greater efficiencies, effectiveness, and choice in the domain of work, for the benefit of all stakeholders. As the world’s largest employment services group, a business that positively impacts millions of people every year, we are conscious of our global role and mission. |

2

Table of Contents

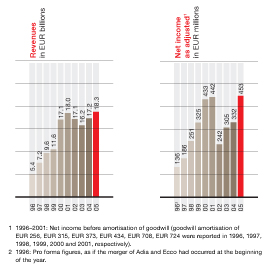

| For the fiscal years (in million EUR) | 2005 (52 weeks) | 2004 (53 weeks) | 2003 (52 weeks) | 2002 (52 weeks) | 2001 (52 weeks) | ||||||

Statement of operations data | |||||||||||

Revenues | 18,303 | 17,239 | 16,226 | 17,085 | 18,034 | ||||||

Gross profit | 3,086 | 2,874 | 2,757 | 3,039 | 3,387 | ||||||

Operating income1 | 614 | 530 | 509 | 454 | 48 | ||||||

Net income as adjusted2 | 453 | 332 | 305 | 242 | 442 | ||||||

Net income/(loss) | 453 | 332 | 305 | 242 | (282 | ) | |||||

Other financial indicators | |||||||||||

Cash flow from operating activities | 298 | 542 | 453 | 442 | 929 | ||||||

Free cash flow3 | 230 | 475 | 401 | 342 | 737 | ||||||

Net debt4 | 424 | 299 | 924 | 1,411 | 1,751 | ||||||

Key ratios (as % of revenues) | |||||||||||

Gross margin | 16.9% | 16.7% | 17.0% | 17.8% | 18.8% | ||||||

Cost ratio | 13.5% | 13.6% | 13.9% | 15.1% | 18.5% | ||||||

Operating margin | 3.4% | 3.1% | 3.1% | 2.7% | 0.3% | ||||||

Per share figures | |||||||||||

Basic EPS in EUR5 | 2.43 | 1.77 | 1.63 | 1.30 | (1.52 | ) | |||||

Diluted EPS in EUR6 | 2.34 | 1.69 | 1.61 | 1.28 | (1.52 | ) | |||||

Cash dividend in CHF | 1.00 | 1.00 | 0.70 | 0.60 | 1.00 | ||||||

Number of shares | |||||||||||

Basic weighted-average shares | 186,599,019 | 187,074,416 | 186,744,214 | 186,527,178 | 185,880,663 | ||||||

Diluted weighted-average shares | 196,546,937 | 201,328,174 | 195,777,267 | 193,469,123 | 185,880,663 | ||||||

Outstanding | 186,097,645 | 187,330,240 | 186,989,728 | 186,697,162 | 186,174,880 |

| 1 | Operating income includes amortisation of intangibles of EUR 3, EUR 1, EUR 6, EUR 4, and EUR 6 for 2005, 2004, 2003, 2002, and 2001, respectively. It also includes amortisation of goodwill of EUR 724 for 2001. |

| 2 | Net income as adjusted is excluding amortisation of goodwill in 2001 of EUR 724. Effective the first day of fiscal year 2002, the Company adopted Statement of Financial Accounting Standard No. 142, “Goodwill and Other Intangible Assets”, that requires that goodwill no longer be amortised to earnings. |

| 3 | Free-cash flow is a non-U.S. GAAP measure and is defined herein as cash-flow from operating activities minus capital expenditures, net. |

| 4 | Net debt is a non-U.S. GAAP measure and comprises short-term and long-term debt, and off-balance sheet debt of EUR 36, EUR 59 and EUR 74, in 2003, 2002, and 2001, respectively, relating to the securitisation of receivables, less cash and cash equivalents and short-term investments. There was no off balance sheet debt at the end of 2005 and 2004. |

| 5 | Basic earning per share including the impact of discontinued operations of EUR 0.16, EUR (0.01), and EUR (0.04) in 2004, 2003, and 2002, respectively, and the cumulative effect of change in accounting principle of EUR (0.02) in 2003. There were no discontinued operations in 2005 and 2001. |

| 6 | Diluted earning per share including the impact of discontinued operations of EUR 0.15, EUR (0.01), and EUR (0.04) in 2004, 2003, and 2002, respectively, and the cumulative effect of change in accounting principle of EUR (0.01) in 2003. There were no discontinued operations in 2005 and 2001. |

| ||||||||

Tickers | ||||||||

SWX/virt-x | ADEN | |||||||

NYSE | ADO | |||||||

Euronext | ADE | |||||||

Reuters | ADEN.VX | |||||||

Reuters (ADR) | ADO.N | |||||||

Bloomberg | ADEn Vx | |||||||

Bloomberg (ADR) | ADO US | |||||||

ISIN | CH0012138605 | |||||||

ISIN (ADS) | US0067541054 | |||||||

Share price 2005 | ||||||||

Year-end | 60.60 CHF | |||||||

Average | 60.73 CHF | |||||||

3

Table of Contents

5 | ||||||

7 | ||||||

9 | ||||||

11 | ||||||

27 | ||||||

29 | ||||||

33 | ||||||

36 | ||||||

60 | ||||||

4

Table of Contents

2005 was a year of change. Adecco faced significant challenges but met these with a wide-ranging strategic review leading to important structural developments. The company entered 2006 realigned to deliver enhanced growth and profitability through a focus on professional staffing services coordinated in six new global business lines. | ||||||

| ||||||

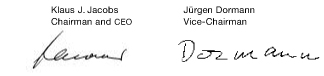

Financial results In 2005, Adecco Group sales increased by 6%, a below-expectation performance. In France and the U.S., our largest markets, we did not maintain market share. Gross margin improved slightly from 16.7% to 16.9%. At the same time we decreased SG&A only 10 basis points to 13.5%, although the previous year’s costs were inflated with charges associated with the 2003 financial reporting delay. We expanded our network with around 350 new offices and appointed 3,000 new employees. Operating margin was 3.4% in 2005, compared with 3.1% in 2004. Receivables grew more than we hoped in 2005 and reducing these will be a particular focus in 2006. While these results are disappointing, they accompany a year of fundamental reappraisal and reconstruction. We enter 2006 as a company energised for ambitious expansion via organic growth and acquisitions, focused on our global opportunities for enhanced profitability and professionalism, and learning to act as a unified group under one brand – Adecco.

Market developments The labour market in our core countries is changing dramatically. We will stay true to “better work, better life”, our mission of promoting efficiency, effectiveness and choice in the domain of work, as we adapt to the key trends. Longer life expectancy is resulting in more people staying at work into older age. Low birth rates in recent decades also mean there are fewer young adults entering the workforce. In this environment, as skills become increasingly scarce, Adecco must attract and retain high value professional associates, for both temporary and permanent work, in order to meet our clients’ growing needs. | ||||||

Table of Contents

Further developing our coaching and training activities for associates will become increasingly important. Outsourcing, already widely used to reduce labour costs by large corporations, will be more accessible to medium-sized companies as an on-site Adecco service offering. We are also adopting new approaches to further develop our managed services. As the beneficial impact of our activities becomes apparent we believe that more governments will revise their approach to public sector employment and to managing unemployment. Adecco’s experience in outplacement, assessment, training and coaching enables us to partner effectively in these areas for the benefit of society. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||||

Our goals in 2006 Professional staffing services will be a key focus. To create a strong platform for growth, our existing operations in this area have been realigned into six global business lines defined by specific occupational fields, complementing our established office and industrial offer. All group companies and business lines will increasingly use the Adecco brand name. In 2006 the brand will benefit from significant advertising support as our portfolio of services expands. Building one strong name will deliver the best return on our marketing efforts as well as encouraging group cohesion and best practice sharing. We will also drive efficiency gains through further consolidating our back office operations.

Ethics and corporate governance It is our firm belief that only proper moral and ethical conduct will allow our business to grow well in the long-term. As a business entirely concerned with people, impacting the personal well-being of so many associates around the world, we can never compromise on these standards, or the principles of sustainable business practice. We continue to foster all efforts to make Adecco synonymous in our industry with ethical conduct and sound corporate governance.

Our thanks In closing we would like to recognise everyone that has contributed to Adecco’s first ten years of success, our colleagues, for their terrific dedication and energy; our clients and associates, without whom our business could not function; and our investors, whose support has been critical to our growth. Our thanks go to all of them for sharing our vision and helping to build Adecco as the world leader in work. | ||||||||

| ||||||||

6

Table of Contents

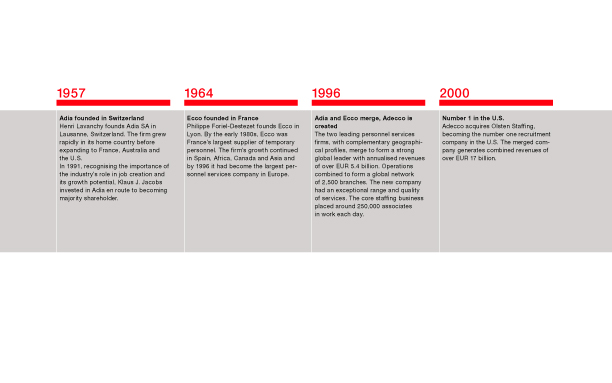

Deep roots, strong foundations Adecco is taking forward the vision of its founders, recognising the focal role for employment service providers in fast-moving, modern economies; we enable skills to flow where they are needed and free individuals to establish the patterns of work commitment that suit them best. Today, Adecco is the world’s largest single provider of employment opportunities, helping companies everywhere optimise relationships with their most valuable resource – people.

Engineered for growth Following the initial merger, strategic acquisitions have created new opportunities for economies of scale and organic growth in an industry expanding at several times the rate of GDP in most advanced economies. Global expansion and local focus mean that insights and lessons learnt in one market are quickly re-applied and adapted to comparable ones. We are committed to benefiting our clients and associates through working smart as well as working hard. Innovation – originating in and shared amongst the global network – is the Adecco way. The momentum continues. |

| ||||||

7

Table of Contents

Freedom to flourish Dramatic economic growth and rising demand for skills are opening up new growth opportunities in emerging markets such as India and China. A wave of responsible labour market deregulation, most notably in Japan, Italy, Germany and France, is expanding our spheres of activity. The race is on to attract, inspire and retain the best people wherever they may be. Our role, successfully played, delivers a win-win-win for individuals, organisations and society at large. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

It’s about everyone We provide employment services across virtually every business function, seniority level and age group. Our competence extends beyond temporary and permanent placement to genuine career partnership for individuals. We are also committed to helping those people for whom finding work can be difficult due to limited skills or disabilities, enabling them to overcome those obstacles and obtain meaningful employment. We are transforming, driven by a shared mission, to be a global force for prosperity and for good. |

| ||||||||

8

Table of Contents

| In an era of enormous and rapid change, Adecco has a clear sense of how to realise the opportunities this generates, both for commercial advantage and the benefit of all its stakeholders. | ||||||

Demographic change The challenge of baby boomer retirement and falling birth rates in recent decades is beginning to bite, particularly in Europe. At the same time, despite their dwindling numbers, youth unemployment is high in advanced economies such as France and Germany. We believe societies need to focus upon improved youth education and work-related training to minimise youth unemployment and its accompanying social and economic stress. Adecco is playing its part and is involved in many programmes and projects to help people start and progress their careers. Going beyond this, to help maintain employability throughout their working lives, we are committed to expanding our training and coaching for lifelong learning. | ||||||

Skill shortages Today we see skills shortages worldwide, especially in professional sectors where we anticipate growth. Demographic change means that for the foreseeable future these shortages in developed economies will only increase. The U.S. Government predicts that job creation will grow fastest in professional segments, with over 6 million new jobs between 2005 and 2012. With pressure on the supply of qualified people, temporary professional assignments contribute to the efficient allocation of labour and are increasingly attractive to qualified individuals. We call this shift “the professional revolution” and it is driving our own strategy of professionalisation, upon which we base our expectations of future growth and productivity. Defining our new global business lines by occupational fields takes us closer to both associates and clients. These closer relationships will be vital to our ability to serve client needs and benefit all stakeholders, including associates. In a volatile labour market with both pressures and incentives to |

9

Table of Contents

adopt portfolio careers, many individuals will value a supportive and highly informed partner through whom they are consistently able to access work that is right for them. This is the role we aspire to fulfil in relation to both current and potential associates. The specialist business line approach has precursors at both country and international levels. For example, in 2005 we launched a certification programme for catering and hospitality associates across Europe. Nevertheless, the approach marks a step change. It will enable us to concentrate and distribute industry insight, best practice and new initiatives with a planetary oversight, thus realising optimal economies of scale and leveraging our critical mass to advantage. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

Our six professional global business lines are: – Engineering & Technical – Finance & Legal – Human Capital Solutions – Information Technology – Medical & Science – Sales, Marketing & Events | ||||||

Naturally these will complement our established business lines in office and industrial services. | ||||||

Full service capability Under one brand – Adecco – each business line will have the capability to deliver best-in-class services across the board: temporary staffing, permanent placement, and project staffing and solutions. All services will be delivered at country level. Adecco will become a matrix-managed organisation, devised to ensure the maximum flow of information. This strategy capitalises upon our main asset: our people, with their outstanding skills, operational capabilities and “can do” service attitude. It also reflects a commitment to associates, which will be increasingly important as the market evolution we now see starting to happen become more established and pronounced. | ||||||

10

Table of Contents

Complementing the national operation of our core Office and Industrial Business Lines, Adecco has established six Global Business Lines. These align with occupational fields to bring us closer to current and potential associates, ensuring that we can meet our clients’ requirements for expertise. These fast-moving business units leverage our global scale to optimise the flow of information and best practice around the group. | ||||||

Engineering & Technical From concept to implementation, engineering and technical specialists are vital to both traditional and emerging industries, creating an unprecedented need for highly qualified individuals. We are building a leading position in the fully globalised engineering and technical fields, capitalising upon an associate and client base established from early acquisitions and organic growth. Staying ahead of the technology curve requires insight, innovation, information, proven practices and exceptional resources. Our people – working through contract, permanent or outsourced arrangements – help design and build aircraft, oil and gas pipelines and platforms, nuclear facilities, roads and skyscrapers. They are also involved with the design, development, testing and manufacturing of industrial machinery, electric and electronic equipment, medical devices and consumer products. Our goal is to build partnerships with highly skilled individuals with the training, experience and motivation to deliver high project value worldwide. | ||||||

Finance & Legal New standards, systems and continuously developing regulatory requirements mean that finance and legal functions are increasingly change-oriented. There are fewer new professional entrants relative to demand in many established economies, making it increasingly difficult to attract and retain talent. Across banking, insurance, accounting, risk control and the full breadth of finance and legal functions, we offer professional temporary and permanent recruitment through a network operated by finance and legal professionals. Increasingly, our range of services includes specialist highly skilled consulting and project oriented individuals, targeted to meet the evolving needs of CEOs and CFOs in risk management, financial consulting and specialist M&A project law, amongst other areas. |

11

Table of Contents

Human Capital Solutions Today, restructuring is virtually an ongoing process in the search for productivity gains, and talent has become a prised asset as a result of demographic change and the scarcity of highly skilled personnel. Adecco Human Capital Solutions is a global leader in a range of restructuring services and talent solutions for organisations aiming to build their human capital and for individuals determined to develop their career potential and employability. Assessment, career development and transition, training and retraining, employee engagement and retention, managing the impact of an ageing workforce – these are just some of increasingly prevalent challenges facing organisations and individuals. Our consultants leverage proprietary methodologies and provide access to a range of practical tools either on-site, in-branch or on-line. |

Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

Information Technology IT and communications services are being transformed by constant innovation, outsourcing and offshoring trends. These continuous waves of change fuel new employment opportunities for IT and communications technology professionals. Systems analysts, software engineers, IT consultants and electronic and telecom engineers – qualified to meet the standards demanded by the Service Legal Agreements that predominate in this field – can expect a widening array of global opportunities and flexible contract arrangements. Adecco Information Technology is harnessing market-leading positions in most territories to build the single most recognised employment brand in IT and communications sectors. We will continue to expand access for associates to continuous learning and accredited training and build deeper partnerships with clients increasingly seeking fully outsourced HR solutions. | ||||||

Medical & Science Demand for qualified people is outstripping supply – specialy in the healthcare and pharmaceutical industry segments. Research and discovery programmes are expanding, and testing requirements spiralling. Public and private hospital and home care sectors are enlarging, as people live longer and expectations of healthcare standards rise. Adecco Medical & Science, with strengths in nursing, paramedical, laboratory technicians and quality assurance, provides a platform to build a globally recognised brand profile in this high growth sector. |

12

Table of Contents

Sales, Marketing & Events The most in-demand associates in these fields are increasingly specialised. New trends create fresh demand: for example, fast moving consumer goods clients seeking qualified support to execute simultaneous global product launches; or fast-growing companies using an outsourced sales force or promotion team to enter new markets. In this dynamic area, our focus is on three main lines of competencies; Sales & Marketing – with main products as recruitment and selection of professionals and sales force outsourcing; Events & Promotions – with promotional teams outsourcing and customer events solutions; and Call Center Solutions with a focus on managed services. Adecco has real caliber across this range of skills – sourcing and training excellent associates to fulfil an exciting range of temporary and permanent opportunities for high profile clients in all major markets. |

| ||

13

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Our markets are on the move and so is Adecco. Uniting global expert- ise with constant innovation and development at country level, we are leveraging our scale to enhance all our services, skills and operations. | ||||||

Old markets wake up! Japan and Germany, with growing skill shortages and recent regulatory changes, are two major economies where the concept of flexible work – already well established in other major economies – is gaining ground. In both, Adecco is at the forefront of innovation, enlarging the flexible segments of the workforce – which are currently less than 1%. Adecco invested in Japan in 2005, opening new branches and stepping up our specialised focus on the IT and Sales and Marketing professional segments. With the launch of Adecco On-Demand, a just-in-skill service filling light industrial positions, Adecco Japan is growing faster than the national market. France and Italy have recently deregulated to allow employment agencies to fill permanent positions. Permanent placement has therefore become a prime source of growth and increased profitability. After deregulation in Italy in 2004, Adecco was ready to capitalise and in 2005 we hired fifty new permanent recruiters and opened strategic offices in the business districts of Milan, Turin, Rome, Padua and Bari. In January 2005 France removed barriers to permanent placement. Adecco entered this arena, employing 80 specialist consultants and establishing 30 offices focused purely on the highly qualified professional segments. Our goal is to lead France’s permanent recruitment sector by 2007. Strategic acquisitions greatly strengthened our capabilities in key geographies in 2005. HumanGroup brought additional scale and outsourcing expertise to our Spanish operation. In the U.S. acquiring StaffWise Legal strengthened our professional legal staffing business. Altedia greatly increased our presence in France and across the EU in HR consulting, adding capabilities in reorganisation, mobility and social engineering, human capital development, external communications and public affairs. | ||||||

Emerging markets Wherever we identify opportunities for growth beyond our established markets, Adecco will be present. Our approach is to combine local insight with proven global methodolo- gies. Peopleone India Ltd., acquired by Adecco in 2004, has grown rapidly and by the end of 2005 had 450 staff in 33 offices. During that year it placed associates up to 17,000 temporary and around 4,500 permanent positions, almost doubling its size and contribution. |

27

Table of Contents

In India we focus on the growth of professional staffing, providing flexibility in a market where client demand is growing strongly. As the economy booms, clients find skilled people increasingly hard to source directly. In this environment salaries for many functions are rising (at a rate of over 10% for graduates) and temporary positions offer comparable benefits to permanent roles, while lowering economic risk to employers. Since its inception, Adecco has been present in the dynamic markets of China, Taiwan and Hong Kong. In China, where unskilled and semi-skilled workers number hundreds of millions, our focus is on professional and managerial associates. These are in short supply. We are well placed to both help associates find the best opportunities and clients to optimise their investment and returns on key people, thus supporting the rise in economic prosperity. China is a challenging environment for most multinationals. Intense competition for people drives a high turnover of local staff, who can be easily tempted away by relatively small pay gains. Helping develop loyalty and sustained employer-employee relationships is part of our role here, one to which we bring extensive knowledge and experience. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

Across Russia, the rest of Eastern Europe and the Balkans, Adecco is building a fast growing network. Adecco’s growth is strongest in Russia and Poland, where large domestic markets are attracting significant foreign investment. Adecco is playing a key role in supporting multi-national clients near-shoring projects with a spectrum of services including temporary and permanent placement and outplacement support. Our client base is expanding across automotive, FMCG, logistics, call centre and IT segments. Argentina, Brazil and Mexico are experiencing increasing GDP growth and provide a favourable environment for our industry. Adecco has been present in nearly all Latin American markets for many years. Most recently we have increased our focus on Brazil, ranked 5thin the world by population size with 186 million people. Brazil’s rapid technological development represents a great opportunity for Adecco’s professional services. |

28

Table of Contents

We understand the importance of work to our associates. As a company we make serious efforts towards maximising people’s chances of success in their careers and to making workplaces more welcoming to people for whom, for whatever reason, finding a job can be challenging. | ||||||

Working together Building sustained and productive relationships with associates involves understanding their individual character and aspirations from the start. Adecco’s Xpert® methodology and software enables this and was used in all of our countries and territories in 2005. This innovative “can do, will do, will fit” programme evaluates potential associates’ capability, motivation and, crucially, their cultural fit with prospective employers. This is just one example of how with Adecco, individual associates can start to build a career roadmap. | ||||||

Train and empower Relevant and regular training is essential for individuals to fulfil the aspiration to take charge of their working life and professional development. Our commitment to associate training is global, with approaches varying locally. In North America our virtual university introduced around 30 new courses for professional associates in Information Technology. The virtual university is a web-based continuing education resource which offers associates opportunities to grow their careers through accredited courses they can take in their own time and at their own pace. The curriculum is organised in four continuous education modules; Business skills, Technical skills, Professional development and Management development. Around 1,700 associates undertook virtual university courses in 2005. Among the most popular new courses were those on Six Sigma and Leadership Development. | ||||||

| ||||||

29

Table of Contents

Adecco U.K.’s Flexible Learning programme is also an online resource. Some 6,500 U.K. associates took courses in 2005. In France, over 35,000 associates participated in some form of training. In Spain, where Adecco helps employers fulfil a regulatory requirement to invest the equivalent of 1.25% of salary in training, over 47,000 associates were trained. The Adecco Enterprise Learning Group in India trained over 10,000 associates. In Japan “Adecco Career-Up School” was extended to a total of 25 locations nationwide, reaching 20,000 associates. Various subjects are available for study, such as computer skills, writing business documents, foreign languages and bookkeeping. Demonstrating our ability to orchestrate diverse training needs for major projects, Adecco recruited and trained 20,000 volunteers in readiness for the 2006 Olympic Winter games in Turin. Volunteers were trained in roles ranging from interpreting to folding the flags of participating countries. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

Productive Ageing Demographic trends in developed economies mean that the employment services industry, governments and companies need to support productive ageing. The essence of this view is that as average life span increases, so should “work spans”. To sustain individual lifestyle aspirations, counter rising public expenditure and sustain economic productivity, retaining and reintegrating older people in the workforce is increasingly vital. In place of the linear life pattern – education, work and retirement – we are increasingly recognising a parallel model, in which these three elements can repeat and interchange. Adecco is encouraging productive ageing. In Europe we have explored the impact of ageing workforces with the International University of Bremen, Germany. This resulted in a groundbreaking study of companies in Germany and the Netherlands which demonstrated the existence of ageism in the workplace, yet found no negative correlation between ageing and performance. Indeed, it showed that job satisfaction and loyalty increase with age. | ||||||

| ||||||

30

Table of Contents

This provided the basis for the 2005 launch in Europe of the Adecco “Demographic Fitness Test”. This is a tool to analyse how well prepared client companies are to cope with demographic change and enable them to develop strategies to balance organisational demographics. The test provides a framework for action on five key dimensions: Career Management, Lifelong Learning, Knowledge Management, Health Management and Diversity Management. Since 2000, Adecco USA has run the Renaissance programme (www. AdeccoUSA.com/Renaissance). This supports older workers who choose to return to work – offering benefit packages tailored to their needs and assignments that fit their lifestyle aspirations. The programme highlights to clients the value of older workers’ life experience, positive attitudes and strong work ethic. In 2005, the A.A.R.P. – an organisation dedicated to enhancing people’s quality of life as they age – recognised our positive role by making Adecco one of 13 featured employers on their website that is designed to help job-seekers find companies that appreciate mature workers. | ||||||

Coaching and Mentoring Adecco is increasingly involved in supporting professionals near the summit of business decision-making. Leadership Consulting – a coaching and mentoring service – is based upon fresh methodologies and is delivered by accomplished business professionals. As “continuous learning” changes from a mantra to mainstream business practice, this service is in increasing demand. Investing in our own future leadership is an internal priority too. By the end of 2005, 230 Adecco managers, from 39 countries, had participated in the Adecco leadership programme that is run in conjunction with the IMD business school in Lausanne, Switzerland. |

31

Table of Contents

| Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

32

Table of Contents

As the world’s largest provider of work opportunities, social commitment is part of Adecco’s DNA. Although in 2005 we placed around 4 million people in jobs, our social contribution goes further than this. Every year we take pride in supporting a range of initiatives that stem from the caring spirit and abilities of our people. | ||||||

Making our values count In March 2005 we launched our new Code of Business Conduct and a Compliance and Ethics Awareness programme – for all existing and new Adecco colleagues – to help instil the Code throughout Adecco. Called “The Way We Work”, the Code is built upon the values of respect, responsibility, honesty and integrity. The values support a comprehensive array of existing policies, on issues such as diversity and ethical sales practice, which ensure the integrity and sustainability of our global role. In addition to consolidating our ethical policies, the Code also reflects our commitment to the United Nations Global Compact, which we joined in 2004. | ||||||

Championing inclusion We believe that access to opportunities for work should be based upon people’s skills, not their disabilities. Work is a key factor in most adults’ sense of social inclusion, and having a disability does not change that. In many European countries Adecco runs “Disability and Skills” programmes to raise awareness of the importance of focusing on skills, and provides practical approaches to achieving better integration at work for people with disabilities. For example, we run disability demystification workshops for colleagues. Through role playing, using a wheelchair, being blindfolded or having sound excluded from their ears, colleagues are sensitized to the difficulties faced by disabled people at work, so they are better able to help them find a suitable opportunity. We further train our own colleagues on the specifics of disabilities by building partnerships with national associations and NGOs. Clients are given guidance about how to welcome someone with a specific disability within their teams, and prepare the working environment. We also share real examples of how people with disabilities successfully use their skills at work. We are spreading the word: non-discrimination isn’t just morally better; it also makes good business sense. |

33

Table of Contents

In 2005, in eight European countries alone, Adecco found employment for over 12,000 workers with disabilities. Through out 2005/6, we are taking part in an EU sponsored programme to collect and disseminate best practices to support the inclusion of people with disabilities. This is part of our involvement in the European “Business and Disability” network, of which we are a founding member. Governments across the world use different means to encourage work for people with disabilities, including anti-discrimination measures, quotas and subsidies. Adecco’s approach always builds on our “skills first” doctrine, from our “Dimensions” diversity programme in the U.S. to the “Adecco Soleil” programme in Japan. | Board message A vision, a passion Market opportunities Global business lines Adecco around the world Investing in people Social commitments Corporate governance Financial review | |||||

People potential Our activities championing inclusion go beyond helping disabled people realise their potential. Through country-specific initiatives and Adecco Foundations in Belgium, France, Germany, Italy and Spain, we support other often excluded groups, such as youth, young mothers and seniors. In 2005 for example, our Foundation in Italy helped over 2,500 single mothers and almost 10,000 people over 40 into work. Our Foundation in France financed 50 non-profit organisations to help youth gain basic workrelated skills and make the transition from education to work, in cooperation with the National Education Service. The same aim inspires the hundreds of Adecco colleagues in 25 American states who give their own time to support the Jobs for American Graduates programme. | ||||||

Global Citizens Responding instantly to hurricane Katrina in October 2005, Adecco colleagues got moving – literally – to help in the aftermath. Mobile recruiting teams visited evacuees in shelters across the Southern states. This face-to- face approach, giving practical support, helped get over 500 evacuees back into work and start rebuilding their lives. |

34

Table of Contents

In 2005, we also began a sustained effort to help the recovery of communities hit by the Asian Tsunami at the end of 2004. Our activities are aimed at making a difference “on the ground” through partnering local support groups in practical initiatives. In India, we helped fund 6 information centres in coastal villages that publicise work opportunities. In Indonesia, we have contributed to new houses, schools and the building of 20 fishing boats to enable normality to return and directly support work opportunities. Group management involvement has been a reflection of the sustained commitment of Adecco colleagues around the world. In early 2006, through the Adecco Volunteers programme, a group of forty colleagues from Australia, Belgium, Austria and Germany committed their time to help in local reconstruction and work generating projects in Banda Aceh, over a year after the original disaster. |

35

Table of Contents

Applicable standards This Corporate Governance disclosure reflects the requirements of the Directive on Information Relating to Corporate Governance, issued by the SWX Swiss Stock Exchange and entered into force on July 1, 2002. The principles and the more detailed rules of Adecco S.A.’s Corporate Governance are defined in Adecco S.A.’s Articles of Incorporation, the Internal Policies, and in the Charters of the Committees of the Board of Directors. Adecco S.A.’s principles take into account the recommendations set out in the Swiss Code of Best Practice for Corporate Governance applicable since July 1, 2002. | ||||||

Statements throughout this Corporate Governance discussion using the term “the Company” refer to the Adecco Group which comprises Adecco S.A., a Swiss corporation, its majority-owned subsidiaries and other affiliated entities. Corporate Governance financial information is presented as of December 31, unless indicated otherwise, as the statutory fiscal year of Adecco S.A. is the calendar year. In 2005, the Company decided to change its fiscal year-end. Instead of the Company’s fiscal year ending on the Sunday nearest to December 31, the Company now has a fiscal year that coincides with the calendar year. The change did not have a material impact on the consolidated financial statements. For 2005, the Company’s fiscal year included 52 weeks ending December 31, 2005. In 2004, the Company’s fiscal year contained 53 weeks ending on January 2, 2005. The Company’s reporting currency is the Euro. Accordingly, the consolidated financial statements of the Company are provided in Euro. The financial statements of Adecco S.A. (Holding Company) are reported in Swiss francs. The Corporate Governance information included in this report is presented in Euro, except for information on shares, share capital, and dividends, which is provided in Swiss francs. Income, expenses, and cash flows are translated at the average exchange rates prevailing during the period, and assets and liabilities are translated at period-end exchange rates. The NYSE rules require foreign private issuers, such as Adecco S.A., to disclose any significant ways in which their Corporate Governance practices differ from the Corporate Governance practices followed by U.S. companies under the NYSE rules. This information is published on the Internet: www.nyse.adecco.com. | ||||||

| 1. Structure and shareholders | ||||||

| 1.1 Legal and management structure | ||||||

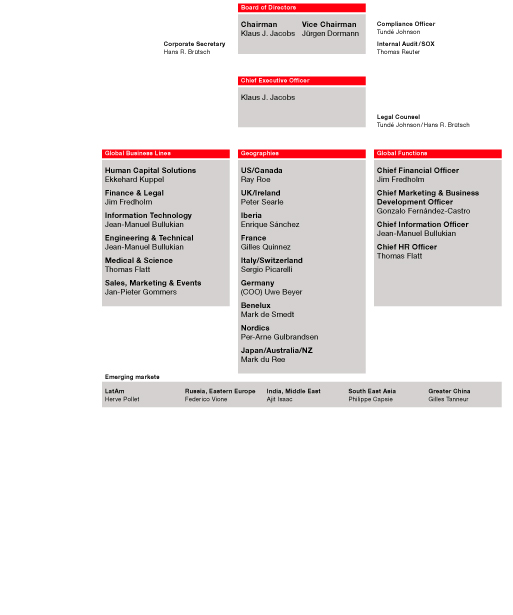

Adecco S.A. is a company limited by shares (société anonyme) organised under the laws of Switzerland with its registered office at Chéserex, Switzerland. The Company’s principal corporate office is the office of its management company, Adecco management & consulting S.A., at Sägereistrasse 10, Glattbrugg, Switzerland. Adecco S.A. is listed on the SWX Swiss Exchange (trading on virt-x, symbol ADEN, security number 1213860; ISIN CH0012138605) and on the Euronext Premier Marché (symbol ADE, security number 12819). Furthermore, Adecco S.A. has American Depository Receipts (ADRs) listed on the New York Stock Exchange (symbol ADO; ISIN US0067541054). As of December 31, 2005, the market capitalisation of Adecco S.A., based on the then outstanding number of shares and the closing price of shares on the SWX Swiss Exchange, amounted to approximately CHF 11.3 billion. On March 15, 2006, this market capitalisation amounted to approximately CHF 13.6 billion. The Company is the global leader in human resource services including temporary staffing and permanent placement, specialist and professional staffing, and career services consulting and outplacement. During 2005, these services were marketed and managed through three divisions: Adecco Staffing – which provided flexible temporary staffing and permanent placement services to a broad range of businesses and industries including the banking, electronics, retail, chemical/pharmaceutical, manufacturing, and telecommunications sectors; Ajilon Professional – which offered specialised temporary staffing, permanent placement, and consulting services, with particular emphasis in the areas of information technology, finance, accounting and legal, engineering, and high end clerical support; and LHH Career Services – which provided outplacement, restructuring, and talent solutions services. In January 2006, the division structure was replaced by a geographical structure combined with newly introduced global business lines through which the Group’s main professional services will now be marketed and managed: Adecco Finance & Legal; Adecco Engineering & Technical; Adecco Information Technology; Adecco Medical & Science; Adecco Sales, Marketing & Events; and Adecco Human Capital Solutions. The Company’s country heads continue to manage directly the industrial and office staffing business, while supporting the expansion of and driving efficiency across the global business lines at country level. | ||||||

36

Table of Contents

Corporate Governance |

The Company provides services to businesses and organisations located throughout North America, Europe, Asia Pacific, Latin America, and Africa. As of January 1, 2006, Senior Management of the Company is composed as follows: – Klaus J. Jacobs, Chairman, Chief Executive Officer of the Company. – Jim Fredholm, Chief Financial Officer of the Company, Head of Global Business Line Adecco Finance & Legal. – Jean-Manuel Bullukian, Chief Information Officer, Head of Global Business Line Adecco Information Technology and Head of Global Business Line Adecco Engineering & Technical. – Thomas Flatt, Chief Human Resources Officer, Head of Global Business Line Adecco Medical & Science. – Jan-Pieter Gommers, Head of Global Business Line Adecco Sales, Marketing & Events. – Ekkehard Kuppel, Head of Global Business Line Adecco Human Capital Solutions. – Gonzalo Fernández-Castro, Chief Marketing & Business Development Officer. | ||||||

| The Company comprises numerous legal entities around the world, mainly organised along the business lines. The major consolidated subsidiaries are listed on page 127 of this Annual Report. No subsidiary of the Company is listed on a Stock Exchange; however, certain subsidiaries have issued convertible notes, as described further in this section. | ||||||

1.2 Significant shareholders As of December 31, 2005, the total number of shareholders directly registered with Adecco S.A. was 17,999. The major shareholders and their shareholdings were disclosed as follows (for all disclosures see http://www.swx.com): – 42,804,180 shares representing 22.8% of the total Adecco S.A. registered share capital, excluding 12,000,000 registered shares acquired subject to certain conditions precedent that are to be transferred to the group by June 30, 2007, were held by a group consisting of Jacobs Holding AG (formerly KJ Jacobs AG), Zurich, Switzerland, which represents the group and whose own shares and participation certificates are held by Jacobs Foundation and by the association Jacobs Familienrat (both Zurich, Switzerland), Jacobs Venture AG, Baar, Switzerland, Triventura AG, Baar, Switzerland, Klaus J. Jacobs, Renata I. Jacobs, Lavinia Jacobs, Nicolas Jacobs, Philippe Jacobs, and Nathalie Jacobs (“the Group”). The members of the Group have entered into a voting trust agreement and have agreed on an understanding regarding the potential future acquisition of Adecco S.A. shares by Jacobs Venture AG. Jacobs Holding AG does not hold any shares outside the Group. See the respective updated disclosure published in the “Swiss Official Gazette of Commerce” (SHAB No. 245, December 16, 2005). – 22,188,580 shares representing 11.8% of the total Adecco S.A. registered share capital, including 12,000,000 registered shares sold subject to certain conditions precedent that are to be transferred to the above mentioned group by June 30, 2007 were held by Akila Finance S.A., Luxem- bourg, which is owned and controlled by Philippe Foriel-Destezet. See the respective disclosure published in the “Swiss Official Gazette of Commerce” (SHAB No. 245, December 16, 2005). – As mentioned above, subject to certain conditions precedent, the above mentioned Group represented by Jacobs Holding AG is entitled and obliged to acquire from Akila Finance S.A., Luxembourg, an additional 12,000,000 shares representing 6.4% of the total Adecco S.A. registered share capital to be transferred by June 30, 2007; the voting rights attached to these shares remain with Akila Finance S.A. until their transfer. – As per November 1, 2005, 9,258,434 shares representing 4.9% of the total Adecco S.A. registered share capital were held under discretionary management by The Capital Group Companies, Inc., on behalf of funds managed by Capital Research and Management Company, and clients managed by Capital Guardian Trust Company, Capital International Limited, Capital International Inc. and Capital International S.A. The shareholding was reported to have decreased from 5.1%. See the respective disclosure published in the “Swiss Official Gazette of Commerce” (SHAB No. 220, November 11, 2005). | ||||||

Furthermore, Adecco S.A. has received the following additional notices on disclosures of shareholders according to Article 20 of the Swiss Stock Exchange Act: – Deutsche Bank AG, Germany, together with various subsidiaries, has disclosed on December 16, 2005 (1) to hold under a Bilateral Equity Linked Contract between themselves and Jacobs Venture AG a call option to acquire up to 10,294,665 shares (5.5%) during the term of the contract, granted by Jacobs Venture AG; (2) to have granted under the same contract to Jacobs Venture AG a put option to sell up to 32,170,829 shares (17.2%) at the maturity of the contract and (3) to currently hold 2,492,043 shares (1.3%) in the course of its ordinary trading and asset management activities. Deutsche Bank AG, Germany, has further mentioned that Sonata Securities S.A., Luxembourg, (“Sonata”) intends to issue bonds in the total amount of CHF 767,300,000 due 2010 exchangeable into shares of Adecco S.A. The proceeds will be used to acquire a limited | ||||||

37

Table of Contents

| Corporate Governance |

recourse instrument from Deutsche Bank AG on the same terms. In connection with these arrangements and, in particular, to enable Deutsche Bank AG to obtain the shares deliverable under the limited recourse instrument, Deutsche Bank AG has entered into a contract with Jacobs Venture AG containing the call option for 10,294,665 Adecco S.A. shares and the put option for 32,170,829 Adecco S.A. shares. The proceeds obtained by Deutsche Bank AG under the limited recourse instrument are passed on to Jacobs Venture AG in order to finance the acquisition of Adecco S.A. shares. For further detail, see the respective disclosure of Deutsche Bank AG as published in the “Swiss Official Gazette of Commerce” (SHAB No. 249, December 22, 2005, and No. 7, January 11, 2006). – A disclosure notice has been provided by Sonata on December 29, 2005, according to which (1) Sonata has the right to exchange the notes owned by it for up to 10,294,665 (5.5%) Adecco S.A. shares during the term of the notes and (2) that Deutsche Bank AG has the right – in certain circumstances and subject to additional legal requirements relating to the enforcement of security interests – to deliver to Sonata up to 32,170,829 Adecco S.A. shares (17.2%) in satisfaction of Deutsche Bank AG’s obligations under the notes. Deutsche Bank would only be in a position to exercise their right if there is an event of default under the bilateral equity linked contract between Jacobs Venture AG and Deutsche Bank AG dated as of December 6, 2005. Sonata intended to issue on December 30, 2005 CHF 767,300,000 1.5 percent collateralised equity-linked limited liability obligations bonds due 2010 exchangeable for ordinary shares of Adecco S.A. The proceeds of the issuance of the bonds will be used to acquire the notes. For further detail see the respective disclosure of Sonata as published in the “Swiss Official Gazette of Commerce” (SHAB No. 7, January 11, 2006). These bonds have been issued before December 31, 2005. | ||||||

As of December 31, 2005, Adecco S.A. is not aware of any person or legal entity, other than those stated above, that directly or indirectly owned more than 5% of Adecco S.A.’s shares with voting rights, whether or not such rights may be exercised. Adecco S.A. is not aware of shareholders’ agreements, other than those described above, between its shareholders pertaining to Adecco S.A. shares held. According to Art. 20 of the Swiss Stock Exchange Act, any investor who directly, indirectly or together with another person acquires, holds or disposes of Adecco S.A. shares, for his own account, and thereby attains, falls below, or exceeds the thresholds of 5, 10, 20, 331/3, 50 or 662/3% of the voting rights, whether or not such rights may be exercised, must notify Adecco S.A. and the Disclosure Office of the SWX Swiss Exchange. Such notification must be made no later than four trading days after the obligation to disclose arises. Adecco S.A.’s management is also under an obligation to publish the disclosure no later than two trading days after receipt. | ||||||

1.3 Cross-shareholdings and shareholdings in listed companies As of December 31, 2005, there were no cross-shareholdings exceeding 5% of a party’s share capital and Adecco S.A. was not a major shareholder of any listed company. On January 9, 2006, the Company announced that it had entered into an agreement to acquire approximately 29% of DIS Deutscher Industrie Service AG (“DIS”) total shares outstanding at a price per share of EUR 54.50, subject to regulatory approval. At the same time, the Company also announced its intention to launch a voluntary public tender offer for the remaining shares at the same price. The tender offer was launched on February 6, 2006. On February 13, 2006, an agreement was reached with certain shareholders to purchase an additional 38% of DIS shares (some of which were subject to regulatory approval) at a price of EUR 58.50 per share, thereby increasing the tender offer price to EUR 58.50 per share. Regulatory approval was obtained from the European Union on March 3, 2006 and on March 8, 2006 the tender offer was concluded. As a result of the various agreements, purchase of shares on the open market, and the tender offer, the Company’s total shareholding in DIS amounts to approximately 83% as of March 22, 2006. | ||||||

2. Capital structure 2.1 Share capital As of December 31, 2005, Adecco S.A.’s issued share capital amounted to CHF 187,607,395 divided into 187,607,395 fully paid registered shares with a nominal value of CHF 1 each. | ||||||

2.2 Authorised and conditional capital Adecco S.A. has no authorised capital in the sense of the Swiss Code of Obligations. Conditional capital of up to 5,822,915 shares (approximately CHF 5.8 million) is reserved for the exercise of option rights granted to employees and members of the Board of Directors of Adecco S.A. or of its affiliated companies. The subscription rights of shareholders as well as the option subscription rights of the shareholders are excluded. The exercise conditions depend on the respective underlying stock option plan; the share capital will only be increased if and when the holder of the option exercises such stock option. | ||||||

38

Table of Contents

Corporate Governance |

Conditional capital of up to 15,400,000 shares (CHF 15.4 million) is reserved for the exercise of option or conversion rights granted in relation to financial instruments such as bonds or similar debt instruments of Adecco S.A. or its affiliates. The subscription rights of the shareholders regarding the subscription of the shares are excluded. The shareholders’ bond subscription rights in the issue of the bonds or similar debt instruments may be limited or excluded by the Board of Directors. Part of this conditional capital is reserved for the convertible debt issued by Adecco Financial Services (Bermuda) Ltd. (see section 2.7 “Convertible notes and options”). For details on the terms and conditions of the issuance/creation of shares under conditional capital, see Art. 3ter, and 3quater of the Articles of Incorporation; Internet: www.aoi.adecco.com.

2.3 Changes in capital Adecco S.A.’s capital structure as of the dates indicated below was as follows: |

| Issued shares | Authorised capital | Conditional capital | Reserves1 | Retained earnings Amount | ||||||||||||||

| In CHF millions, except shares | Shares | Amount | Shares | Amount | Shares | Amount | Amount | |||||||||||

30.12.2002 | 186,869,980 | 186.9 | 19,000,000 | 19.0 | 21,960,330 | 22.0 | 1,981 | 1,544 | ||||||||||

Changes | 288,420 | 0.3 | (288,420 | ) | (0.3 | ) | 15 | 969 | ||||||||||

28.12.2003 | 187,158,400 | 187.2 | 19,000,000 | 19.0 | 21,671,910 | 21.7 | 1,996 | 2,513 | ||||||||||

Changes | 190,715 | 0.2 | (190,715 | ) | (0.2 | ) | 1 | 352 | ||||||||||

2.1.2005 | 187,349,115 | 187.4 | 19,000,000 | 19.0 | 21,481,195 | 21.5 | 1,997 | 2,865 | ||||||||||

Changes | 258,280 | 0.3 | Lapsed | Lapsed | (258,280 | ) | (0.3 | ) | 102 | 909 | ||||||||

31.12. 2005 | 187,607,395 | 187.6 | – | – | 21,222,915 | 21.2 | 2,099 | 3,774 | ||||||||||

1 Reserves includes both the general reserve and the reserve for treasury shares. |

| |||||||||||||||||

Details of Adecco S.A.’s general reserves and retained earnings are included in Note 4 to the Adecco S.A. (Holding Company) Notes to financial statements. Additional information and exact wording can be found in the Articles of Incorporation of Adecco S.A. (Internet: www.aoi.adecco.com).

2.4 Shares and participation certificates Adecco S.A.’s shares have a par value of CHF 1 each. All shares are fully paid-up registered shares and bear the same dividend and voting rights. Pursuant to Art. 7 of the Articles of Incorporation (Internet: www.aoi.adecco.com), the right to vote and all other rights associated with a registered share may only be exercised by a shareholder, usufructuary or nominee who is registered in the share register as the shareholder, usufructuary or nominee with right to vote. Some interests in shares are held by investors in the form of American Depository Receipts (“ADRs”). As of December 31, 2005, there were no outstanding participation certificates.

2.5 Bonus certificates Adecco S.A. has not issued bonus certificates (“Genussscheine”).

2.6 Limitations on registration, nominee registration, and transferability Each Adecco S.A. share represents one vote. Acquirers of registered shares are recorded in the share register as shareholders with the right to vote upon request, provided that they declare explicitly to have acquired the registered shares in their own name and for their own account (Art. 4 sec. 2 of the Articles of Incorporation; Internet: www.aoi.adecco.com). Upon such declaration, any person or entity will be registered with the right to vote. The Board of Directors may register nominees with the right to vote in the share register to the extent of up to 5% of the registered share capital as set forth in the commercial register. Registered shares held by a nominee that exceed this limit may be registered in the share register if the nominee discloses the names, addresses, and the number of shares of the persons for whose account it holds 0.5% or more of the registered share capital as set forth in the commercial register. Nominees within the meaning of this provision are persons who do not explicitly declare in the request for registration to hold the shares for their own account or with whom the Board of Directors has entered into a corresponding agreement (see Art. 4 sec. 3 of the Articles of Incorporation; |

39

Table of Contents

| Corporate Governance |

Internet: www.aoi.adecco.com). The Board of Directors may grant exemptions to this registration restriction (see Art. 4 sec. 6 of the Articles of Incorporation; Internet: www.aoi.adecco.com). In 2005, there were no such exemptions granted. Corporate bodies and partnerships or other groups of persons or joint owners who are interrelated to one another through capital ownership, voting rights, uniform management or otherwise linked as well as individuals or corporate bodies and partnerships who act together to circumvent the regulations concerning the nominees (especially as syndicates), are treated as one nominee respectively as one person within the meaning of paragraph 3 of this article (see Art. 4 sec. 4 of the Articles of Incorporation; Internet: www.aoi.adecco.com). For further information regarding the procedure and conditions for cancelling statutory privileges and limitations on transferability of shares, see the Articles of Incorporation; Internet: www.aoi.adecco.com. | ||||||

2.7 Convertible notes and options On August 26, 2003, Adecco Financial Services (Bermuda) Ltd., a wholly-owned subsidiary of the Company, issued CHF 900 unsubordinated bonds guaranteed by and convertible into shares of Adecco S.A., due August 26, 2013. The bonds are structured as zero-coupon, 10-year premium redemption convertible bonds with a yield to maturity of 1.5%. Investors may put the bonds on October 26, 2010, at the accreted principal amount. The issuer may call the bonds at any time after the end of year seven (August 26, 2010) at the accreted principal amount or at any time after a substantial majority of the bonds have been redeemed, converted, or repurchased. At any time from October 6, 2003 to August 12, 2013, at the option of the bondholder, the bonds are convertible into shares of Adecco S.A. at a conversion price of CHF 94.50. If all bonds are converted, Adecco S.A. would issue an additional 9,523,810 shares (Art. 3quater of the Articles of Incorporation; Internet: www.aoi.adecco.com). If not converted, the Company will pay a redemption price of up to 116.05% of the principal amount of the bonds. The Company has several stock option plans whereby employees and members of the Board of Directors receive options to purchase shares. There are global and country-specific plans in place. Certain options granted under the plans are tradeable at the SWX Swiss Exchange (virt-x). The options are granted to employees or members of the Board of Directors of the Company and give the optionee a choice of selling the option in the public market or exercising the option to receive an Adecco S.A. share. If the option holder chooses to sell the option in the public market, the options may be held by a non-employee or non-director of the Company. The trading and valuation of the tradeable options is managed by a Swiss bank. The purpose of the plans is to furnish incentives to selected employees and directors, to encourage employees to continue employment with the Company, and to align the interests of selected employees and directors with those of the shareholders. Upon exercise of options, Adecco S.A. may deliver either shares from its conditional capital, of which up to 5,822,915 shares are reserved for this purpose, or treasury shares bought back in the public market. The Nomination & Compensation Committee is responsible for making proposals, based upon the recommendations of Senior Management, to the Board of Directors regarding the individuals to whom options shall be granted, the size of the option grant for each optionee, the conditions, the exercise price, and the grant date. The Board of Directors must approve all the option grants as well as the conditions thereof. The exercise price for one share is generally fixed at or above the fair market value at the date of grant. Depending on the conditions of the plans, options vest with certain waiting periods of up to five years and are subsequently exercisable over a number of years. All options may be exercised and tradeable options may be sold at any time within the exercise period except for limitations set forth in the Company Insider Trading Statement of Policy and by regulatory authorities. During 2005, no stock options were granted to directors, officers or employees of the Company. Except under certain circumstances, unvested options granted under a plan lapse upon termination of employment or Board of Directors membership. The Board of Directors may modify, amend, suspend, or discontinue the plans. |

40

Table of Contents

Corporate Governance |

Options outstanding as of December 31, 2005:

| ||||||||||||

Exercise price per share (in CHF) | Number | Weighted-average remaining life (in years) | Weighted-average exercise price per share (in CHF) | |||||||||

43–53 | 904,515 | 1.1 | 51 | |||||||||

54–84 | 4,725,333 | 4.4 | 66 | |||||||||

85–107 | 4,817,232 | 2.7 | 90 | |||||||||

108–170 | 588,816 | 2.5 | 109 | |||||||||

171–298 | 9,450 | 2.0 | 176 | |||||||||

43–298 | 11,045,346 | 3.3 | 78 | |||||||||

For further details, see Note 11 in the Notes to consolidated financial statements.

3. Board of Directors Areas of responsibility of the Board of Directors and the management are defined by law and by the Articles of Incorporation of Adecco S.A. (Internet: www.aoi.adecco.com). As of December 31, 2005, the Board of Directors of Adecco S.A. consisted of nine members. Under Swiss law, a majority of the members of the Board of Directors of a Swiss company must be citizens of Switzerland or an EU or EFTA country and be domiciled in Switzerland. Adecco S.A. has been granted an exemption from this requirement.

3.1 Biographies of members of the Board of Directors The following table sets forth the name, year of birth, entry date and terms of office, nationality, professional education, and principal positions of those individuals who served as members of the Board of Directors as of December 31, 2005:

Jakob Baer (1944) – Member of the Board of Directors, Chairman of the Audit Committee, and member of the Corporate Governance Committee (all since October 1, 2004); term of office ends on the day of the General Meeting of Shareholders 2006. – Swiss nationality. – Graduated Dr. iur. from the University of Bern, Switzerland. – Mr. Baer was member of the KPMG Switzerland executive team from 1992 until 1994, from then until September 30, 2004, KPMG Switzerland’s Chief Executive and member of KPMG’s European and International Leadership Board. Non-executive Board member of Swiss Re1, Switzerland, Allreal Holding AG1, Switzerland, Emmentalische Mobiliar-Versicherungs-Gesellschaft, and of IFBC – Integrated Financial Business Consulting AG, all Switzerland.

Jürgen Dormann (1940) – Vice-Chairman of the Board of Directors since November 2005, member of the Board of Directors, and member of the Nomination & Compensation Committee since June 2004; term of office ends on the day of the General Meeting of Shareholders 2006. – German nationality. – Masters degree in Economics from the University of Heidelberg, Germany. – Mr. Dormann held a series of positions with Hoechst AG and held the position of Chief Executive Officer from 1994 until 1999. In 1999, Mr. Dormann was appointed Chairman of the Management Board of Aventis and in May 2002, was elected Chairman of the Supervisory Board of Aventis. With the creation of Sanofi-Aventis in 2004 he was elected Vice-Chairman of Sanofi-Aventis1. A member of the Board of ABB Ltd.1, Switzerland, since 1998, he became ABB’s Chairman of the Board in 2001 and served as Chief Executive Officer from 2002 to 2004. Mr. Dormann is a member of the Board of Directors of IBM1, USA, and of BG-Group1, UK.

Philippe Foriel-Destezet (1935) – Member of the Board of Directors since August 1996, Co-Chairman of the Board of Directors from June 2004 until November 2005; term of office ends on the day of the General Meeting of Shareholders 2006. – French nationality. – Graduated from HEC Paris; Chevalier de la Légion d’Honneur. – Founder of Ecco S.A. in France in 1964. Joint Chairman of the Board of Directors of Adecco S.A. from August 1996 to April 2002. – Board memberships: Akila Finance S.A., Luxembourg (Chairman). | ||||||||||||

41

Table of Contents

| Corporate Governance |

Klaus J. Jacobs2(1936) – Chairman of the Board of Directors and Chief Executive Officer since November 2005, member and Co-Chairman of the Board of Directors from June 2004 until November 2005; term of office ends on the day of the General Meeting of Shareholders 2006. – Swiss nationality. – Dr. h.c. from the University of Basel, Switzerland. – Chairman of ADIA from 1992 to 1996, member and Joint Chairman of the Board of Directors of Adecco S.A. from August 1996 to April 2002. – Board memberships: member of the Board of Jacobs Foundation. – Member of the World Scout Foundation, co-founder and member of the National Park of Hohe Tauern.

Philippe Marcel (1953) – Member of the Board of Directors since April 2002; term of office ends on the day of the General Meeting of Shareholders 2006. – French nationality. – Graduated from EM Lyon (Ecole de Management) in France. – As a member of the Board of Directors, Mr. Marcel performed executive functions until September 2004. Until his appointment to the Board of Directors in 2002, he was a member of the Senior Management team of the Company. In the Executive Committee, Mr. Marcel was Zone Manager for France, Morocco and South Africa. He was Chairman of Adecco South Africa and Adecco Morocco and CEO of Adecco France. – Board memberships: Adecco France (Chairman), April Group1, France (member), GL Events1, France (member).

Francis Mer (1939) – Member of the Board of Directors, Chairman of the Corporate Governance Committee, and member of the Nomination & Compensation Committee (all since June 2004); term of office ends on the day of the General Meeting of Shareholders 2006. – French nationality. – Graduated from the Ecole Polytechnique; Commandeur de la Légion d’Honneur. – Mr. Mer joined St. Gobain Group in 1970 and was appointed Chairman and Chief Executive Officer of Pont-au-Mousson S.A. in 1982. – Chairman of the steel group Usinor Sacilor from 1986 until 2002 and Chairman of Eurofer from 1990 until 1997. Co-Chairman of the Board of Arcelor1in 2002. From 1997 to 1998, Chairman of the International Iron and Steel Institute. – Board memberships: Alstom S.A.1, France (from 2005), Inco Ltd.1, Canada (from 2005), Rhodia SA1, France, member of the Supervisory Board from 2004. – French Minister of Economy, Finance and Industry from May 2002 until March 2004. – Fondation pour l’Innovation Politique, France, Member of the Supervisory Board.

Thomas O’Neill (1945) – Member of the Board of Directors and member of the Audit Committee (both since June 2004); term of office ends on the day of the General Meeting of Shareholders 2006. – Canadian nationality. – Graduated from Queen’s University in Kingston, Ontario, with a Bachelor of Commerce degree in 1967 and received his Chartered Accountant designation in 1970, FCA designation in 1987. Honorary LLD from Queen’s University Kingston, Canada in 2005. – In 1967, Mr. O’Neill joined the audit staff of Price Waterhouse in Toronto and became a partner of Price Waterhouse in 1978. From 1990 to 1996, Mr. O’Neill acted as Chief Operating Officer, and from 1996 to 1998 as Chief Executive Officer for Price Waterhouse, Canada. From 1998 to 2000, he was CEO of the new PricewaterhouseCoopers LLP in Canada and served as a member of PwC’s Global Oversight Board. In 2000, he assumed the role of Chief Operating Officer of the PricewaterhouseCoopers LLP global organisation. He assumed the role of Chief Executive Officer of PwC Consulting (global) in January 2002. In May 2002, Mr. O’Neill was appointed Chairman of PwC Consulting (global), a role that he held until October 2002, when the business was acquired by IBM. – Board memberships: BCE Inc.1, Canada; Dofasco Inc.1(until February 21, 2006), Canada; Loblaw Companies Ltd.1, Canada; Nexen Inc.1, Canada; Ontario Teachers’ Pension Plan. – Not-for-profit board memberships include: Queen’s University Kingston, Canada (Vice-Chairman) and St. Michael’s Hospital, Canada (member). |

1 Listed company. 2 Executive member of the Board of Directors since November 2005. |

42

Table of Contents

Corporate Governance |

David Prince (1951) – Member of the Board of Directors, member of the Audit Committee, and member of the Corporate Governance Committee (all since June 2004); term of office ends on the day of the General Meeting of Shareholders 2006. – British nationality. – Awarded management trainee scholarship with British Gas and attended Business School in the U.K. – Associate member of CIMA. – Early career included four years at Cable & Wireless in both general management and group marketing roles before going on to spend some 12 years working in the Hong Kong telecommunications market, where Mr. Prince held a variety of Senior Management and public company board positions. – From 1994 to 2000, he was Group Finance Director and later Deputy CEO of Hong Kong Telecom. – In 2000, Mr. Prince went on to join PCCW plc as Group CFO before becoming Group Finance Director of Cable & Wireless in 2002. – Board memberships: Member of the Board of Directors and Chairman of the Audit Committee for ARK Therapeutics1, U.K. Member of the Board of Directors of SmarTone Telecommunications Holdings Ltd.1, Hong Kong.

Peter V. Ueberroth (1937) – Member of the Board of Directors and Chairman of the Nomination & Compensation Committee (both since June 2004); term of office ends on the day of the General Meeting of Shareholders 2006. – U.S. nationality. – Graduated San Jose University, California. Awarded the French Légion d’Honneur and received the Olympic Order-Gold from the International Olympic Committee. – In 1962, founded First Travel Corporation. – From 1980 to 1984, Mr. Ueberroth served as President of the Los Angeles Olympic Organizing Committee (LAOOC). – He served as the sixth Commissioner of Major League Baseball from 1984 to 1989. – Mr. Ueberroth served as Co-Chairman of Doubletree Corporation from 1993 to 2000 and since 1999 has served as owner and Co-Chairman of the Pebble Beach Company. – Since 1990, he has acted as the Managing Director of Contrarian Group, Inc. (investments in small and medium-size companies, taking management roles and providing strategic guidance). – Board memberships: Chairman of the Board of Ambassadors International (AMIE)1, USA; member of the Board of Directors of The Coca-Cola Company1, USA; and of Hilton Hotels Corporation1, USA. – Chairman 2005 United States Olympic Committee.

1 Listed company.

3.2 Other activities and vested interests of the Board of Directors Except those described in section 3.1, no permanent management/consultancy functions for significant domestic or foreign interest groups and no official functions or political posts are held by the members of the Board of Directors of Adecco S.A. The Board of Directors assesses independence of its members. With the exception of Klaus J. Jacobs (CEO since November 2005), all members of the Board of Directors are non-executive. The members of the Board of Directors do not have important business connections with Adecco S.A. or with any of its subsidiaries or affiliates. A family member of the Chairman & CEO, Mr. Klaus J. Jacobs, is a partner with the law firm White & Case. Adecco S.A. from time to time procures legal services from said firm. The fee charged is based on the amount of time spent by the firm. In addition, the Company provides services in the normal course of business at arm’s length terms to entities that are affiliated with certain of its officers and significant shareholders through investment or board directorship.

3.3 Cross-involvement Cross-involvements at the level of the Board of Directors of Adecco S.A. and other listed companies exist according to the information provided in the table under 3.1 “Biographies of members of the Board of Directors”. |

43

Table of Contents

| Corporate Governance |

3.4 Elections and terms of office Pursuant to the Articles of Incorporation, the Board of Directors consists of five to nine members (Art. 20 sec. 1 of the Articles of Incorporation; Internet: www.aoi.adecco.com). Members of the Board of Directors are elected for a term of office of one year, until the date of the next General Meeting of Shareholders, and may be re-elected for successive terms (Art. 20 sec. 2 and 3 of the Articles of Incorporation; Internet: www.aoi.adecco.com). Adecco S.A.’s Articles of Incorporation do not limit the number of terms a member may be re-elected to the Board of Directors. Candidates to be elected or re-elected to the Board of Directors are proposed by the Board of Directors to the General Meeting of Shareholders.

3.5 Internal organisation structure The Board of Directors holds the ultimate decision-making authority of Adecco S.A. for all matters except those reserved by law or the Articles of Incorporation to the shareholders. It determines the overall strategy of the Company and supervises Senior Management. The Board of Directors operates under the direction of the Chairman and the Vice-Chairman who are appointed by the Board of Directors. Currently, the Board of Directors is composed of one executive and eight non-executive members. The agenda of the Board of Directors meetings is set by the Chairman. Any member of the Board of Directors may request that an item be included on the agenda. Members of the Board of Directors are provided, in advance of meetings, with adequate materials to prepare for the items on the agenda. The Board of Directors recognises the importance of being fully informed on material matters involving the Company and seeks to ensure that it has sufficient information to make appropriate decisions through inviting members of Senior Management to report on their areas of responsibility, conducting regular meetings of the respective committees with the management, and retaining outside consultants and external auditors in order to review the business, as well as through regular distribution of important information to its members. Decisions are taken by the Board of Directors as a whole, with the support of its three committees described below (the Audit Committee, the Corporate Governance Committee, and the Nomination & Compensation Committee). However, if a member has a personal interest in a matter, other than an interest in his capacity as a shareholder of Adecco S.A., the member of the Board of Directors has to abstain from voting. Amongst others, the Board of Directors has established Statements of Policy on Insider Trading as well as on Conflicts of Interest. The compliance with all Statements of Policy is closely monitored. Each committee has a written charter outlining its duties and responsibilities. Committee members are provided, in advance of meetings, with adequate materials to prepare for the items on their agenda.

Attendance at meetings & phone conferences during 2005:

|

Full Board of Directors | Audit Committee | Corporate Governance Committee | Nomination & Compensation Committee | |||||||||

Number of meetings & phone conferences | 14 | 12 | 4 | 4 | ||||||||

Jakob Baer | 13 | 12 | 4 | |||||||||

Jürgen Dormann | 12 | 4 | ||||||||||

Philippe Foriel-Destezet | 13 | 11 3 | 4 3 | 4 3 | ||||||||

Klaus J. Jacobs | 14 | 9 1 | 3 1 | 4 1 | ||||||||

Philippe Marcel | 13 | 3 2 | ||||||||||

Francis Mer | 13 | 4 | 4 | |||||||||

Thomas O’Neill | 11 | 12 | ||||||||||

David Prince | 14 | 12 | 4 | |||||||||

Peter V. Ueberroth | 10 | 3 | ||||||||||

1 Guest ex officio, without voting right; 2 Guest, without voting right; 3 Guest ex officio, without voting right, until November 2005 | ||||||||||||

| The Board of Directors has discussed and assessed its own and its members’ performance. The Board was found to be efficiently and appropriately organised. | ||||||

44

Table of Contents

Corporate Governance |

3.5.1 Audit Committee (“AC”) The AC’s primary responsibility is to assist the Board of Directors in carrying out its responsibilities as they relate to the Company’s accounting policies, internal controls, and financial reporting practice, thus overseeing management regarding the: | ||||||