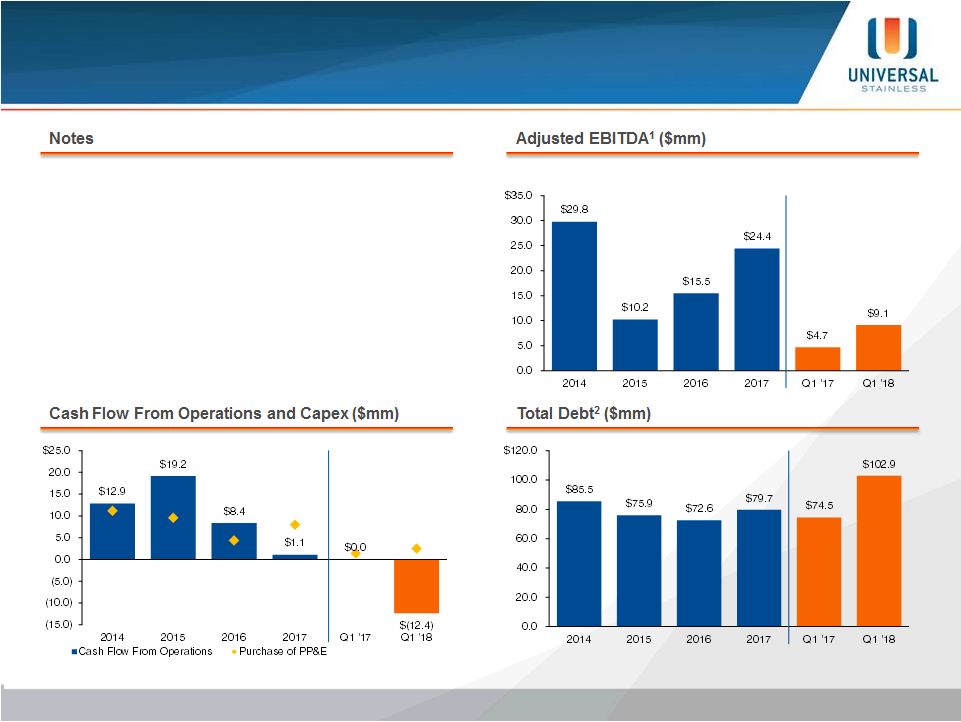

© Copyright 2018 Universal Stainless & Alloy Products, Inc. All Rights Reserved. Forward Looking Statement Except for historical information contained herein, the statements in this presentation are forward-looking statements that are made pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among others, the concentrated nature of the Company’s customer base to date and the Company’s dependence on its significant customers; the receipt, pricing and timing of future customer orders; changes in product mix; the limited number of raw material and energy suppliers and significant fluctuations that may occur in raw material and energy prices; risks related to property, plant and equipment, including the Company’s reliance on the continuing operation of critical manufacturing equipment; risks associated with labor matters; the Company’s ongoing requirement for continued compliance with laws and regulations, including applicable safety and environmental regulations; the ultimate outcome of the Company’s current and future litigation and matters; risks related to acquisitions that the Company may make; and the impact of various economic, credit and market risk uncertainties. Many of these factors are not within the Company’s control and involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from any future performance suggested herein. Any unfavorable change in the foregoing or other factors could have a material adverse effect on the Company’s business, financial condition and results of operations. Further, the Company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the Company’s control. Certain of these risks and other risks are described in the Company's filings with the Securities and Exchange Commission (SEC) over the last 12 months, copies of which are available from the SEC or may be obtained upon request from the Company. Non-GAAP Financial Measures Some of the information included in this presentation is derived from the Company’s consolidated financial information but is not presented in the Company’s financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Some of this data is considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliation to the most directly comparable GAAP financial measure is provided. 2 |