Washington, D.C. 20549

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

For Immediate Release

Contact:

María Paz Yañez

Planning & Control Manager

Phone: (56-2) 351-1209

Fax: (56-2) 679-2320

E-mail: myanezm@bbvaprovida.cl

Santiago, Chile – February 27, 2009 – AFP PROVIDA (NYSE: PVD) announces its consolidated financial results for the period ended December 31, 2008. All figures are expressed in constant Chilean pesos and are prepared in accordance with the Chilean Generally Accepted Accounting Principles (Chilean GAAP). Figures as of December 31, 2007 are inflation adjusted by the year on year CPI figure of 8.9%.

AFP PROVIDA S.A. reports its results as of December 31, 2008

GENERAL HIGHLIGHTS FOR 2008

| Ü | During 2008, a net loss of Ch$10,753.9 million was recorded, lower in Ch$59,965.4 million with respect to net income recorded in the same period of 2007. This result was mainly attained by negative returns obtained by pension funds, which caused losses on mandatory investments, a negative deviation of Ch$52,148.8 million with respect to the gains obtained in 2007. |

| | |

| | Additionally, the period recorded higher costs of Ch$33,895.9 million in the life and disability insurance, where around 25% of the higher expense was explained by the effect of negative returns of pension funds over the casualty costs to be covered by the AFP, and around 50% was caused by the expected increase of the casualty rate. The latter was covered by the increment of fees charged to clients partly explaining the growth of fee income, adding the growing salary base of contributors that have reduced the aforementioned negative effects.

In addition to the above were higher non operating losses recorded in 2008, stemming from lower profits in investments in related companies, since foreign subsidiaries were also affected by returns of their assets under management, and the higher inflation of the period that affected the price level restatement. |

| Ü | Regarding the operating income, this amounted to Ch$8,567.2 million, lower in Ch$58,434.0 million than the income recorded in 2007. One of the factors originating this result was losses on mandatory investments that implied a negative deviation (Ch$52,148.8 million) with respect to the last year's figure, due to the strong falls exhibited by global stock markets. All the remaining components of operating revenues exhibited a favorable performance, contributing with a positive deviation of Ch$25,770.6 million regarding the levels recorded in 2007, highlighting the increase in Ch$22,540.6 million of fee income given the growing trend of the salary base of contributors and the increment in fees charged to clients. |

| | |

| | With respect to operating expenses, they increased by Ch$32,055.7 million, basically due to the higher cost of life and disability insurance (Ch$33,895.9 million) explained in more than 50% by expected factors (updating of mortality tables and new benefits granted to women by the Pension Reform Law) to be financed with the aforesaid increment in fees, adding the growth of taxable base of clients. The rest of the variation was driven by the negative returns of pension funds that increased the valuation of the differential cost of casualties that the Company must cover, adding the increment of disability claims, which in the pension industry's view was mainly attained by the implementation of the Pension Reform Law. Regarding the other components of the operating |

| | expenses, the Company made especial efforts during the year aimed at obtaining efficiency gains, recording savings in remunerations, data processing expenses and administrative costs. |

| | |

| Ü | In non-operating terms, a loss of Ch$15,756.4 million was recorded, higher in Ch$7,069.2 million than the loss registered in the same period of last year. This deviation was basically explained by higher losses in price level restatement (Ch$6,377.8 million) due to the superior inflation applied in the period (8.9% in 2008 v/s 7.4% in 2007), and the negative effect of depreciation of Chilean peso against the dollar in the debt maintained with Provida Internacional. Additionally, the period recorded lower profits in related companies (Ch$3,364.1 million), as a result of the returns in assets under management of foreign subsidiaries. The above was partially offset by lower interest expenses as a consequence of the lower balance of the short term banking debt maintained during the period. |

| Ü | Since Provida became the sole shareholder in AFP Genesis (Ecuador) Provida’s financial statements are consolidated with this subsidiary, which implied to acknowledge in different components of its results, a net income of Ch$2,044.5 million during 2008, representing an increase of 85.1% with respect to the last year. |

| Ü | As of December 31, 2008, Provida continued leading the Chilean pension fund industry in terms of assets under management, totaling US$22,854.9 million equating to a market share of 30.8%. Also, Provida is a leader in terms of clients with an average portfolio of 3.4 million affiliates and 1.8 million of contributors, with market shares of 41.9% and 40.5% respectively. |

GENERAL HIGHLIGHTS FOR THE FOURTH QUARTER OF 2008

| Ü | In the fourth quarter of 2008 (4Q08) a net loss of Ch$9,937.6 million was recorded, a deviation of Ch$19,497.6 million than the net income recorded in the fourth quarter of 2007 (4Q07). This result was basically due to the unfavorable evolution of local and foreign markets, affecting the pension funds results in the 4Q08, therefore Provida and its foreign subsidiaries recorded losses on mandatory investments. Moreover, also the higher cost of life and disability insurance was partly explained (around 30% of the higher expense) by the negative returns increasing the cost of casualties to be covered by the AFP, adding other effects stemming from the Solidarity Principle over the disability claims and from expected factors over the casualty rate, the latter financed by the rise in fees charged to clients. |

| Ü | The operating component recorded a loss of Ch$3,182.5 million in the 4Q08, a deviation of Ch$15,262.8 million than the income recorded in the 4Q07. This result was basically driven by losses on mandatory investments that implied a deviation of Ch$14,350.4 million given the strong drops recorded by the worldwide stock markets. Additionally, the period recorded higher costs of life and disability insurance, which deviation (Ch$8,469.3 million) was partly (55%) caused by negative returns of pension funds that increased the casualty costs to be covered by the AFP, and the growth observed in disability claims, related to the Pension Reform Law start up. The other part of the deviation was related to both, the expected factor of updating the mortality tables and additional benefits granted to women by the Pension Reform Law, as well as, the higher client portfolio covered. The other components of operating revenues contributed with a positive deviation of Ch$7,525.3 million, highlighting the higher fee income attained by Provida and the subsidiary AFP Genesis in Ecuador. |

| Ü | In non-operating terms, a loss of Ch$6,400.5 million was registered in the 4Q08, higher in Ch$5,146.9 million than the loss recorded in the same period of last year. This result was basically driven by investments in related companies due to returns of assets under management in foreign subsidiaries. It added to the above, lower other non-operating income (expenses) since the 4Q07 incorporated profits from the sale of AFP Crecer in the Dominican Republic. |

AFP PROVIDA, leading company in the Chilean pension fund industry, provides pension fund management and related services throughout the country and has invested in similar companies in Peru, Ecuador and Mexico. In July 1999, PROVIDA was incorporated into the financial holding BBVA Group that enjoys pride of place in the pension fund industry and is one of the principal financial conglomerates in Latin America.

| | | | December | | Market | |

| | Business Drivers | | 2008 | | Share | |

| | | | | | | |

| | Average number of affiliates | | 3,449,679 | | 41.9% | |

| | Average number of contributors | | 1,809,857 | | 40.5% | |

| | Average number of pensioners | | 402,546 | (1) | 38.1% | (1) |

| | | | | | | |

| | Average salary base (US$ Million) | | 990 | | 32.8% | |

| | AUM (US$ Million) | | 22,855 | | 30.8% | |

| | Average real return of Pension Fund (cumm December 08) | | -24.00% | | | |

| | Pension Fund Type A real return (cumm December 08) | | -41.33% | | | |

| | Pension Fund Type B real return (cumm December 08) | | -30.55% | | | |

| | Pension Fund Type C real return (cumm December 08) | | -19.49% | | | |

| | Pension Fund Type D real return (cumm December 08) | | -9.89% | | | |

| | Pension Fund Type E real return (cumm December 08) | | -0.71% | | | |

| | | | | | | |

| | | | | | | |

| | | | December | | Market | |

| | Other Variables | | 2008 | | Share | |

| | | | | | | |

| | Average number of branches | | 109 | | 43.8% | (1) |

| | Average number of administrative employees | | 1,032 | | 30.3% | (1) |

| | Average number of sales agents | | 605 | | 22.2% | (1) |

| | | | | | | |

| | | | | | | |

| (1) Figure as of September, 2008 | | | | | |

AFP PROVIDA S.A.

COMPARATIVE ANALYSIS FOR 2008

At a global level, the macroeconomic scenario has continued suffering changes in the last months. Worldwide growth perspectives have presented severe deterioration, prices of row materials have fallen significantly and global credit conditions are tighter.

In Chile, the figures of the last quarter of 2008 reported relevant slowdowns in activity and demand. The latter have been observed in the expenditure components most sensible to credit conditions changes, such as durable consumption especially new cars sales, capital good expenditures, new housing sales and inventory indicators.

It is important to highlight that in order to revitalize the economy, the Chilean Government on January 5, 2009, informed about a package of measures inserted in a fiscal encouragement plan aimed at productive investment to generate new jobs, tools to promote training in order to avoid dismissals, encouragement of young workers hiring trough subsidies, infusions of capital to SMEs (small & medium sized entities) and to people through bonuses, anticipated devolution of taxes and tax reductions.

The monthly economic activity indicator (Imacec) recorded in December a growth of 0.5% with respect to the same month of the last year, basically due to the slowdown of economy, boosted by the falls of the mining and industrial sectors, adding the lower growth shown by commerce due to the brake on consumption.

The preliminary growth figure released by the Central Bank for the close of 2008 is 3.4%, a figure that is below the last projection' estimation that situated it between 4.5% and 5.0%. For 2009, the Central Bank forecasts an economic growth from 2.0% to 3.0%.

With respect to foreign trade, the trade balance accrued a positive balance of US$11,178.6 million during 2008, lower by 52.7% than the figure recorded in 2007, because of imports grew higher than exports. In figures, exports amounted to US$68,787.9 million during 2008, a growth of 1.7% with respect to 2007, while imports totaled US$57,609.3 million, growing by 31.0%.

The annual inflation has reduced during the latest months, basically due to strong drops in fuels, although it is still high and over the Central Bank’s target. The consumer price index (CPI) recorded a negative monthly variation of 1.2% as of December 2008, recording most of decreases in transport, housing and food sectors. Likewise, inflation accrued an increase of 7.1% during the year, where the main groups contributing to this increment were food and housing.

Given the slowdown shown in the economic growth and the inflation negative figures recorded during the last three months (November 2008 -0.1%, December 2008 -1.2%, January 2009 -0.8%), the Central Bank strongly adjusted the monetary policy rate, decreasing 100 basis points in January up to 7.25% and 250 basis points in February 2009 up to 4.75%.

In relation to labor market, the unemployment rate was 7.5% in the mobile quarter October/December 2008, an increase of 0.3 percent points in comparison with the same quarter of the last year, and it maintained at the same rate than the previous quarter. The average unemployment rate was 7.8% in 2008, 0.7 percent points higher than in 2007.

The increase of unemployment in the twelve month period was the outcome of the higher increase in labor force (2.9%) with respect to occupation (2.6%). However, both categories decreased their expansion rate during the quarter, unlike what was mostly observed in 2008. A similar performance was recorded by the salaried sector that after having grown at rates around 5% during the first half of 2008, recorded an increase of just 3.8% in twelve months.

The non-occupied sector increased by 6.6%, due the increase of unemployed people (12.7%), since people searching for a job for the first time decreased (21.0%).

Regarding the Pension Reform Law, during 2008, specifically in July, the first stage of this new regulation was implemented -the solidarity principle- aimed at the country’s poorest sectors. The latter included granting basic solidarity pensions to people who were not entitled to receive pensions and seniority and disability solidarity pension contributions to people receiving low-pensions previously fulfilling certain requirements. According to the Government's estimations during the first year of the Pension Reform Law implementation (July 2008-July 2009), 610,000 people should have become beneficiaries, although due to the diffusion process made, as of December 2008 more than 98% of them (581,196 people) had already received some benefits from the solidarity principle.

In October 2008, the second stage of the Pension Reform Law started, focused on the active sector, that is, workers and employers. The most relevant topics of this stage were related to the collective voluntary pension savings, the governmental subsidy to formalize the young people hiring, voluntary affiliation and life and disability insurance (women's entitlement up to 65 years old, entitlement to women’s spouses to became beneficiaries of the insurance, elimination of the second determination in cases of total disability).

Additionally, investments matters were implemented, such as the expansion of investment alternatives to pension funds at local and abroad level; gradual expansion of investment limits

abroad; establishment of an investment regime fixing limits to indirect investment and authorization to Fund Type E to invest in variable income (up to 5% of its portfolio).

The main topics that will be developed in 2009 are related to the new affiliates bidding process (workers entering in the labor sector), bidding process of life and disability insurance.

It is important to highlight that in the Administration's view, Provida has carried out all the processes and developments in order to fulfill in the best way with all the modifications inserted in this Pension Reform Law and has continued training its workers to grant the best service to customers.

Net income

During 2008, the Company recorded a net loss of Ch$10.753.9 million representing a decrease of Ch$59,965.4 million with respect to the net income recorded in 2007, basically attained by negative returns of pension funds that generated losses on mandatory investments and increased the cost of casualties to be covered by the AFP (explaining around the 25% of the expense growth). Moreover, the non-operating result recorded higher losses, basically due to the higher inflation over price level restatement and lower profits generated by investments in foreign related companies, also affected by the returns of their assets under management. Regarding fee income, it continued exhibiting its growing trend as a consequence of both, a higher salary base of clients and the increase in the fee charged to affiliates in order to cover the higher casualty rate expected (caused by the updating of mortality tables that explained more than 40% of the insurance cost increment). Finally, and in light of this context, the Company continued its efforts for attaining efficiency gains that implied cost savings in remunerations, administrative and data processing expenses.

The operating income was lower in Ch$58,434.0 million with respect to the figure recorded in 2007. The above was attained partly by the loss of Ch$30,638.5 million recorded by mandatory investments that implied a negative deviation of Ch$52,148.8 million, basically due to negative returns obtained by pension funds throughout 2008, as a consequence of drops observed in the worldwide stock markets. It added to the above, the higher cost of life and disability insurance (Ch$33,895.9 million), where more than 50% of such variation was explained by expected factors such as the increase of casualty rate due to the updating of mortality tables, and the growth observed in the salary base. The rest of the deviation stemmed from negative returns of pension funds that affected the cost of casualties to be covered by the Company; adding the increase in the number of disability claims, which at industry level was associated with the implementation of the Pension Reform Law. The above was partially offset by higher fee income, given the positive evolution recorded by mandatory collection and the increase of fees charged to clients in order to cover the higher casualty rate. It added to the latter, an appropriate management of the operating expenses reflecting savings, especially in remunerations and administrative costs.

In relation to the non-operating result, this recorded a higher loss of Ch$7,069.2 million with respect to the loss recorded in 2007. This result was mainly explained by losses in price level restatement due to the higher inflation applied during the period (8.9% in 2008 versus 7.4% in 2007) and the negative effect in foreign exchange rate. Additionally, investments in related companies generated lower profits caused by foreign subsidiaries in view of the returns of their assets under management. The latter was partially offset by lower interest expenses as a result of the lower balance of the short term banking debt maintained during the year.

Regarding income taxes, although losses were recorded, the period recorded tax expenses since certain adjustments to earnings before taxes are required to measure the tributary basis, mainly

related to unrealized gains and losses (results on mandatory investments and price level restatement). Therefore, the period recorded savings of 50.6% with respect to 2007.

| | | Dec-08 | | | Dec-07 | | | Change | | | % | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | |

| Operating income | | | 8,567.2 | | | | 67,001.2 | | | | (58,434.0 | ) | | | -87.2 | % |

| Total operating revenues | | | 177,082.0 | | | | 203,460.3 | | | | (26,378.3 | ) | | | -13.0 | % |

| Total operating expenses | | | (168,514.9 | ) | | | (136,459.1 | ) | | | (32,055.7 | ) | | | 23.5 | % |

| | | | | | | | | | | | | | | | | |

| Other non operating expenses (income) | | | (15,756.4 | ) | | | (8,687.1 | ) | | | (7,069.2 | ) | | | 81.4 | % |

| | | | | | | | | | | | | | | | | |

| Income taxes | | | (3,564.7 | ) | | | (9,102.5 | ) | | | 5,537.8 | | | | -60.8 | % |

| | | | | | | | | | | | | | | | | |

| Net income | | | (10,753.9 | ) | | | 49,211.5 | | | | (59,965.4 | ) | | | -121.9 | % |

| | | | | | | | | | | | | | | | | |

During 2008, it was recorded losses per share (each ADR represents fifteen shares) of Ch$32.46 compared to earnings per share of Ch$148.53 obtained in 2007. As of December 31, 2008, the total number of outstanding shares stood at 331,316,623, recording no changes with respect to the same date of 2007.

BUSINESS DEVELOPMENT

Operating revenues

During 2008, operating revenues were Ch$177,082.0 million, representing a real decrease of 13.0% or Ch$26,378.3 million with respect to 2007. This result was sustained by the loss of Ch$30,638.5 million obtained by mandatory investments that implied a negative deviation (Ch$52,148.8 million) with respect to the gains recorded in 2007 due to falls observed in foreign and local markets. The latter overshadowed the favorable performance of the remaining components of operating revenues, where it highlights a higher fee income of Ch$22,540.6 million due to the increment of mandatory collection levels and the increase of variable fee. Moreover, the period recorded higher other operating revenues of Ch$2,218.2 million as a result of AFP Genesis' fee income increase. Also, higher financial revenues of Ch$1,011.8 million were recorded, stemming from both the increase in cash flows and returns obtained by the insurance company related to the contract in force since January 2005.

| · | Fee income amounted to Ch$195,876.4 million in 2008, representing an increase of 13.0% or Ch$22,540.6 million with respect to the last year. This evolution was in line with the growth observed in mandatory fees that increased by 13.2% during the year, as consequence of the real increase in salary base (4.8% in real terms) and the adjustments made in the variable fee over mandatory contributions in light of the higher expected levels of casualty rate. The first adjustment noticeable since February 2008 (from 2.39% to 2.59%) was driven by the updating of mortality tables to calculate the cost of casualties and the next adjustment noticeable since November to 2.64% as a consequence of the Pension Reform Law that introduced modifications in the insurance coverage to the females and their spouses. |

In consistence with the growing trend shown by fee income mentioned above, Provida has maintained its leading position in the pension industry with average market shares over 40% in terms of clients and over 30% in terms of salary base and assets under management as of December 2008. In figures, the average number of contributors amounted to 1,809,857 in 2008, the monthly average salary base reached Ch$990.0 million and the assets under management were US$22,884.9 million.

| · | Losses on mandatory investment were Ch$30,638.5 million in 2008, a deviation of Ch$52,148.8 million with respect to the gains recorded during 2007. This result was driven by the strong drops observed in the worldwide stock markets, especially during September and October 2008, pursuant to the global financial crisis. In figures, the stock markets have recorded the following falls year to date: IPSA -22.1%, Mexbol -24.2%, MSCI LA -52.8%, Nasdaq -40.5%, Dow Jones -33.8%, Hang Seng -48.3%, Nikkei -42.1%, Dax -40.4% and FTSE -31.3%. The latter implied that the weighted average nominal return of pension funds was -17.0% in 2008, which was compared to +13.7% obtained in 2007. |

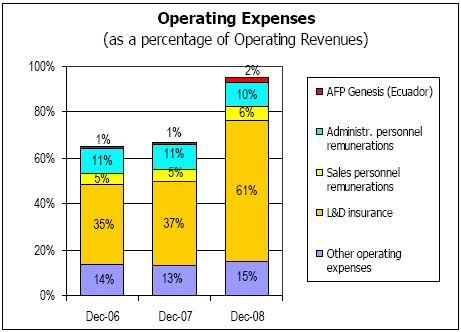

Operating expenses They increased by 23.5% or Ch$32,055.7 million from Ch$136,459.1 million in 2007 to Ch$168,514.9 million in the same period of 2008, basically due to the higher life and disability insurance cost partly explained by the updating of mortality tables and the negative returns exhibited by pension funds over the cost of casualties that the AFP must cover. Isolating the above, the expenses different from the insurance cost decreased by 3.0%, due to lower remunerations to administrative personnel, adding savings achieved in administrative expenses and data processing costs. | |

| · | Remunerations of administrative personnel amounted to Ch$20,298.6 million in 2008, lower in Ch$2,411.1 million or 10.6% with respect to the figure recorded in the same period of the last year. This result was partly boosted by the commercial efficiency gains generated by focusing incentives in certain profitable segments, thus decreasing the extraordinary competitions and related awards paid to sales supervisors. It added to the above, the acknowledgment of the Company's minimum amount of profit bonuses in light of the losses recorded in the period, and lower severance payments recorded during the year with respect to the level registered in 2007. The latter, as informed in our press release of year 2007, due to the 2007 period registered higher severance payments in connection with the efficiency and transformation plan of the Company. Although, the plan began to be implemented in 2008, as it was a known commitment, Provida, applying a conservative criterion, made accruals involved in such plan at the end of 2007. |

The efficiency plan previously mentioned has not implied a reduction in the number of staff, since the workers belonging to the Comercializadora (an outsourcing company that during 2007 implied administrative expenses) were partly transferred to the Company's commercial area, overshadowing the staff adjustments made in the supportive areas. In figures, by comparing at the end of both periods, the administrative staff increased by 1.3% from 1,024 as of December 2007 to 1,037 workers as of December 2008, while the average figure of administrative staff was 1,032 workers in 2008, compared to the average of 1,024 workers in 2007.

| · | Remunerations of sales personnel increased from Ch$11,351.1 million in 2007 to Ch$11,789.7 million in 2008, a variation of Ch$438.6 million (3.9%). This result was basically explained by higher variable remunerations paid to sales agents, as a result of higher production levels achieved by the sales force, specially referred to transfers due to both, higher number of cases entered, as well as the increase of salary base net stemming from transfers. The latter was partially offset by severance payments due the change of staff taken place in 2007, and the acknowledgment of the minimum amount of the Company's profit bonuses, given the losses recorded during the year. |

In figures, the average number of sales agents in 2008 was 605 workers, increasing by 2.6% with respect to the staff maintained in 2007 (590 sales agents). With respect to the evolution at the each period end, the sales force increased by 8.8% from 577 salespeople in December 2007 to 628 in December 2008.

| · | The cost of life and disability insurance was Ch$108,616.9 million during 2008, an increase of Ch$33,895.9 million or 45.4% with respect to 2007. One of the most relevant factors in this variation and also explaining more than 40% of such variation, was related to the expected effect of updating the mortality tables, which higher costs were financed by the increment of variable fee charged to affiliates (2.39% to 2.59% over taxable incomes). In view of the changes in the market conditions described above affecting the insurance contract since February 2008, the maximum casualty rate was increased from 1.27% to 1.70% over the base portfolio covered, by mutual agreement of the parties; while the temporary premium grew from 0.70% to 1.00%. Additionally, the Pension Reform Law also affected the expected cost of the casualty rate, increasing the coverage period of females (from 60 to 65 years old) and including their spouses as beneficiaries. Consequently, Provida increased the variable fee charged to affiliates from 2.59% to 2.64% over their taxable incomes, commencing on November 2008. |

Another expected factor increasing the life and disability insurance cost was related to the growth of the client portfolio covered, noticeable in the higher salary base of clients. This factor explained more than 10% of the life and disability insurance expense variation.

Around 25% of such variation was explained by the evolution of returns achieved by pension funds, since the negative returns exhibited in 2008 implied a lower balance in the affiliates' accounts and thus, higher contributions to be made by the Company, since the difference between the required capital to finance survival and disability benefits and the funds held by the affiliates in their accounts must be covered by Provida. It is important to notice that in recent years, the pension funds achieved positive returns contributing to reduce the insurance cost. In fact, negative returns implied an effective loss only for casualties paid during the second half of 2008 and those casualties to be paid at the beginning of 2009. For the remaining cases, the cost will depend, among other variables, on the future pension fund returns until the date of payment.

Finally, the last variable was related with the solidarity principle implementation that implied a strong increase in disability claims, an effect that at industry level was estimated to be the result of people's great expectations at requesting benefits, adding redirecting of people not entitled to receive benefits from the solidarity principle towards the AFPs to request disability pensions.

| · | Other operating expenses were in line with the expenses recorded in 2007, increasing only by 0.5% from Ch$27,677.2 million in 2007 to Ch$27,809.6 million in 2008. In this evolution, AFP Génesis contributed with higher other operating expenses of Ch$285.8 million basically related to administrate and marketing expenses. If the above is isolated, Provida’s other operating expenses decrease by Ch$153.4 million, highlighting in this performance the savings (Ch$699.8 million) achieved in administrative expenses, partly because of the APV marketing is being made by the Company’s personnel and not by the Comercializadora' s, implying a reduction of outsourcing services in comparison with last year. In addition to the above, the period recorded savings in suppliers, communications and traveling expenses. |

Also, the period recorded lower data processing expenses of Ch$103.1 million, given the lower corrective activities required in the period associated to the Unified Platform and lower tariffs achieved by international feeder services during 2008. The latter was offset by higher cost of Ch$330.1 million in amortization given the evolutionary developments added to Unified Platform asset made in 2007.

Finally, higher selling and marketing expenses of Ch$419.2 million were recorded in the period, in view of greater publicity referred to APV promotions and higher expenses in the elaboration of the quarterly balance sheet, leaflets and brochures to affiliates and employers required by law.

Operating income

It amounted to Ch$8,567.2 million in 2008, lower in Ch$58,434.0 million or 87.2%, basically due to the adverse effect of negative returns achieved by pension funds over mandatory investments and the life and disability insurance.

Other non-operating expenses (income)

During 2008, they recorded a loss of Ch$15,756.4 million higher in Ch$7,069.2 million or 81.4% with respect to the loss recorded in 2007. This result was partly explained by the negative deviation of Ch$6,377.8 million recorded by the price level restatement due to the higher inflation applied in the period and the effect of foreign exchange rate. Adding to the above were lower profits of Ch$3,364.1 million in investments in related companies yield by lower performance of foreign subsidiaries. The above was partially offset by lower interest expenses (Ch$1,636.0 million) due to the lower balance of the short term banking debt maintained during the period.

| · | The results in related companies recorded an income of Ch$447.9 million in 2008, lower in Ch$3,364.1 million or 88.3% with respect to the income attained in 2007. This result was sustained by lower results generated by foreign subsidiaries that contributed in the aggregate of Ch$4,215.1 million, especially the losses recorded by AFORE Bancomer in Mexico that offset the favorable performance experienced by local subsidiaries that contributed in the aggregate of Ch$851.1 million. |

| | | | Dec-08 | | | Dec-07 | | | Change | | | % | |

| Company | Country | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | | |

| Horizonte | Peru | | | 75.9 | | | | 1,400.4 | | | | (1,324.6 | ) | | | -94.6 | % |

| | | | | | | | | | | | | | | | | | |

| Bancomer | Mexico | | | (578.8 | ) | | | 2,072.4 | | | | (2,651.2 | ) | | | -127.9 | % |

| | | | | | | | | | | | | | | | | | |

| Crecer | The Dom.Republic | | | - | | | | 239.4 | | | | (239.4 | ) | | n.a | |

| | | | | | | | | | | | | | | | | | |

| DCV | Chile | | | 80.0 | | | | 64.6 | | | | 15.5 | | | | 23.9 | % |

| | | | | | | | | | | | | | | | | | |

| PreviRed.com | Chile | | | 785.2 | | | | 419.5 | | | | 365.7 | | | | 87.2 | % |

| | | | | | | | | | | | | | | | | | |

| AFC | Chile | | | 85.5 | | | | (384.3 | ) | | | 469.9 | | | | -122.3 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL | | | | 447.9 | | | | 3,811.9 | | | | (3,364.1 | ) | | | -88.3 | % |

| | | | | | | | | | | | | | | | | | |

In Peru, Provida Internacional is present in AFP Horizonte since 1993, currently holding a 15.87% of the shares. During 2008, this subsidiary generated an income of Ch$75.9 million for Provida, representing a decrease of Ch$1,324.6 million or 94.6% with respect to 2007. This result was mainly explained by losses on mandatory investments in view of falls observed in stock markets, which were partially offset by the growth recorded by fee income. As of December 2008, this subsidiary accounted for a total of 1,151,051 affiliates and assets under management for US$3,587.6 million, figures equivalent to market shares of 27% and 23% respectively, situating it in first place in terms of affiliates and in third place regarding assets under management.

Regarding Mexico, in November 2000, Provida Internacional materialized the purchase of 7.50% of AFORE Bancomer’s equity. During 2008, this subsidiary recorded a loss of Ch$578.8 million for Provida, a deviation of Ch$2,651.2 million with respect to the income recorded in 2007. This result was partly due to losses on mandatory investments, adding losses on foreign exchange rate that affected the income net under Chilean GAAP when the balance sheet is translated from Mexican pesos to dollars (negative effective due to the 23.7% depreciation of Mexican peso against dollar). The latter was partially offset by the increase of fee income. As of December 2008, AFORE Bancomer maintained an affiliate portfolio of 4,453,187 and funds of US$10,368.7 million, representing market shares of 11% and 16%, respectively, situating it in third place on the industry in terms of affiliates and in second place in terms of assets under management.

Regarding the local subsidiaries, it highlights the positive variation jointly recorded that amounted to Ch$851.1 million. Individually, the electronic collection company PreviRed.com where Provida holds a 37.9% ownership, generated earnings of Ch$785.2 million for Provida in 2008 a positive variation of Ch$365.7 million with respect to 2007, in light of a higher activity level, the increase of tariffs charged to clients and an appropriate management of expenses. The Unemployment Funds Administrator of Chile S.A. (AFC), a company that started operations in October 2002 and where Provida has a 37.8% ownership, recorded an income of Ch$85.5 million for Provida, a positive variation of Ch$469.9 million with respect to the loss recorded in 2007, basically due to higher fee income accompanied by a lower increment of expenses. Finally, Investments DCV, represented for Provida an income of Ch$80.0 million in 2008, an increase of Ch$15.5 million with respect to 2007. In this company which main purpose is to invest in entities engaged in public offering securities, Provida participates has a 23.14% stake. The rest of its main shareholders are other AFPs in the industry, the same as the other two local investments (AFC and PreviRed.com), adding other financial institutions that also participate.

| · | During 2008, the price level restatement recorded a loss of Ch$13,371.5 million, Ch$6,377.8 million higher than the loss recorded in 2007. Of such variation, Ch$4,314.3 million were explained by the higher inflation of 8.9% applied over the Company’s net liability exposure in 2008, while in 2007, the inflation was 7.4%. Additionally, the higher loss generated by the foreign exchange rate during the period contributed to explain the deviation, given the effect of the depreciation of 28.1% in the Chilean peso against the dollar over the dollar debt with Provida Internacional in 2008, whereas in 2007 an appreciation of 6.7% in the Chilean peso against the dollar was recorded. |

Income taxes

As of December 31, 2008, the income taxes amounted to Ch$3,564.7 million, recording a positive variation of Ch$5,537.8 million or 60.8% with respect to December 2007. Although losses were recorded during the year, the period registered tax expenses since certain adjustments to earnings before taxes are required to determine tributary basis. Such adjustments are basically related to unrealized results that for Provida have basically implied a reverse of the losses on mandatory investments and price level restatement so, the Company registered positive taxable basis.

Consolidated balance sheet

| · | As of December 31, 2008, total assets were Ch$298,541.7 million, lower in Ch$16,368.9 million (5.2%) with respect to the close of December 2007. This variation was basically sustained by the decrease in mandatory investments of Ch$41,174.3 million due to negative returns obtained by pension funds during the last twelve months, which could not be offset by the normal contributions recorded in the growing contributor’s base. |

It added to the above lower other assets of Ch$3,474.8 million as a consequence of the lower goodwill (Ch$4,387.1 million) in connection with the normal amortization of goodwill, mainly ex AFP Protección and ex AFP Unión.

Partially offsetting the above were higher current assets of Ch$28,650.5 million in view of the surplus of cash flows generated by the Company (Ch$ 25,956.4 million) evidenced in the higher levels of cash and time deposits. Additionally, the period recorded higher receivables from the State (Ch$3,615.5 million) stemming from allowances granted by the State to workers that were temporary financed by the Company.

| · | Total liabilities increased by Ch$7,067.5 million or 12.5% from Ch$56,492.2 million in 2007 to Ch$63,559.6 million in 2008. The latter was basically sustained by higher current liabilities of Ch$10,779.4 million, due to higher accruals (Ch$8,856.3 million) basically due to unfavorable casualty rate of the life and disability insurance and higher notes and accounts due to related companies, mainly to BBVA Seguros de Vida regarding temporary premiums pending of payment. |

Additionally, long term liabilities decreased by Ch$3,712.0 million or 36.0%, mainly due to lower deferred taxes, associated with lower earnings on mandatory investments.

| · | Shareholders’ equity decreased by Ch$23,436.4 million or 9.1% from Ch$258,418.3 million as of December 31, 2007 to Ch$234,982.0 million at the close of December 2008, basically due to the distribution of definite dividends of year 2007 and the loss recorded in 2008. |

Exchange rate

As of December 31, 2008, it was Ch$636.45 per dollar, while in the same period of the last year it was Ch$496.89 per dollar. During 2008, a depreciation of 28.1% in the Chilean peso against the dollar was recorded, while in 2007, an appreciation of 6.7% in the Chilean peso against the dollar was registered.

| CONSOLIDATED INCOME STATEMENT |

| | | Dec-08 | | | Dec-07 | | | Change | | | % Change | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | |

| OPERATING REVENUES | | | | | | | | | | | | |

| Fee income | | | 195,876.4 | | | | 173,335.9 | | | | 22,540.6 | | | | 13.0 | % |

| Gains (loss) on mandatory investments | | | (30,638.5 | ) | | | 21,510.3 | | | | (52,148.8 | ) | | | -242.4 | % |

| Financial revenues on life and disability insurance | | | 2,937.0 | | | | 1,925.2 | | | | 1,011.8 | | | | 52.6 | % |

| Other operating revenues | | | 8,907.1 | | | | 6,688.9 | | | | 2,218.2 | | | | 33.2 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Revenues | | | 177,082.0 | | | | 203,460.3 | | | | (26,378.3 | ) | | | -13.0 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | | |

| Administrative personnel remunerations | | | (20,298.6 | ) | | | (22,709.8 | ) | | | 2,411.1 | | | | -10.6 | % |

| Sales personnel remunerations | | | (11,789.7 | ) | | | (11,351.1 | ) | | | (438.6 | ) | | | 3.9 | % |

| Life and disability insurance | | | (108,616.9 | ) | | | (74,721.0 | ) | | | (33,895.9 | ) | | | 45.4 | % |

| Other operating expenses | | | (27,809.6 | ) | | | (27,677.2 | ) | | | (132.4 | ) | | | 0.5 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | (168,514.9 | ) | | | (136,459.1 | ) | | | (32,055.7 | ) | | | 23.5 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | 8,567.2 | | | | 67,001.2 | | | | (58,434.0 | ) | | | -87.2 | % |

| | | | | | | | | | | | | | | | | |

| NON OPERATING EXPENSES (INCOME) | | | | | | | | | | | | | |

| Gains on financial investments | | | 353.9 | | | | 37.1 | | | | 316.7 | | | | 852.7 | % |

| Profit (loss) in related companies | | | 447.9 | | | | 3,811.9 | | | | (3,364.1 | ) | | | -88.3 | % |

| Amortization of goodwill | | | (5,695.8 | ) | | | (5,813.3 | ) | | | 117.5 | | | | -2.0 | % |

| Interest expense | | | (603.6 | ) | | | (2,239.6 | ) | | | 1,636.0 | | | | -73.0 | % |

| Other non operating income (expenses) net | | | 3,112.8 | | | | 2,510.5 | | | | 602.3 | | | | 24.0 | % |

| Price level restatement | | | (13,371.5 | ) | | | (6,993.7 | ) | | | (6,377.8 | ) | | | 91.2 | % |

| | | | | | | | | | | | | | | | | |

| Total Non Operating Expenses (Income) | | | (15,756.4 | ) | | | (8,687.1 | ) | | | (7,069.2 | ) | | | 81.4 | % |

| | | | | | | | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | (7,189.2 | ) | | | 58,314.0 | | | | (65,503.2 | ) | | | -112.3 | % |

| | | | | | | | | | | | | | | | | |

| INCOME TAXES | | | (3,564.7 | ) | | | (9,102.5 | ) | | | 5,537.8 | | | | -60.8 | % |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | | (10,753.9 | ) | | | 49,211.5 | | | | (59,965.4 | ) | | | -121.9 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEET |

| | | | | | | | | | | | | |

| | | Dec-08 | | | Dec-07 | | | Change | | | % | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | |

| Current Assets | | | 43,842.2 | | | | 15,191.7 | | | | 28,650.5 | | | | 188.6 | % |

| Marketable Securities - Reserve | | | 141,882.4 | | | | 183,056.8 | | | | (41,174.3 | ) | | | -22.5 | % |

| Premises and Equipment | | | 28,764.8 | | | | 29,135.1 | | | | (370.3 | ) | | | -1.3 | % |

| Other Assets | | | 84,052.2 | | | | 87,527.0 | | | | (3,474.8 | ) | | | -4.0 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL ASSETS | | | 298,541.7 | | | | 314,910.6 | | | | (16,368.9 | ) | | | -5.2 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | |

| Current Liabilities | | | 56,951.6 | | | | 46,172.2 | | | | 10,779.4 | | | | 23.3 | % |

| Long-Term Liabilities | | | 6,608.1 | | | | 10,320.0 | | | | (3,712.0 | ) | | | -36.0 | % |

| | | | | | | | | | | | | | | | | |

| Minority Interest | | | 0.0 | | | | 0.1 | | | | (0.0 | ) | | | -16.9 | % |

| | | | | | | | | | | | | | | | | |

| Shareholders' Equity | | | 234,982.0 | | | | 258,418.3 | | | | (23,436.4 | ) | | | -9.1 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | | 298,541.7 | | | | 314,910.6 | | | | (16,368.9 | ) | | | -5.2 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| CONSOLIDATED CASH FLOW STATEMENT |

| | | | | | | | | | | | | |

| | | Dec-08 | | | Dec-07 | | | Change | | | % | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | |

| CASH FLOW FROM OPERATING ACTIVITIES | | | 66,808.1 | | | | 44,970.1 | | | | 21,838.0 | | | | 48.6 | % |

| Total Operating Revenues | | | 233,310.1 | | | | 189,513.6 | | | | 43,796.5 | | | | 23.1 | % |

| Total Operating Expenses | | | (166,502.0 | ) | | | (144,543.5 | ) | | | (21,958.5 | ) | | | 15.2 | % |

| | | | | | | | | | | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | (35,161.3 | ) | | | (46,220.6 | ) | | | 11,059.2 | | | | 23.9 | % |

| | | | | | | | | | | | | | | | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | (5,039.2 | ) | | | 1,347.2 | | | | (6,386.4 | ) | | | -474.0 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL NET CASH FLOW | | | 26,607.5 | | | | 96.7 | | | | 26,510.8 | | | | 27413.8 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

A.F.P. PROVIDA S.A.

COMPARATIVE ANALYSIS OF THE FOURTH QUARTER 2008

Net income

The fourth quarter of 2008 (4Q08) recorded a net loss of Ch$9,937.6 million, a variation of Ch$19,497.6 million with respect to the net income recorded in the fourth quarter of 2007 (4Q07). This result was basically triggered by the negative returns recorded by the pension funds that generated losses on mandatory investments (a deviation of Ch$14,350.4 million with respect to the gains recorded in 4Q07), which also affected the increase observed in the life and disability insurance cost (explaining around 30% of such higher expense). Likewise, fee income continued exhibiting its growing trend, given the increase in the salary base of contributors and the increment in fees charged to clients in order to finance the expected increase in the insurance contract cost (a higher casualty rate explained around 40% of the higher expense). In non-operating terms, the period recorded a loss higher than the loss recorded in the 4Q07, mainly due to the losses generated by foreign related companies which were also affected by the returns of their assets under management.

Regarding the operating result, the quarter recorded a loss of Ch$3,182.5 million, lower in Ch$15,262.8 million with respect to the income recorded in the 4Q07. This result was mainly attained by losses on mandatory investments that recorded a negative deviation of Ch$14,350.4 million due to the strong drops recorded by worldwide stock markets, especially during October. In addition to the above was the higher cost of life and disability insurance of Ch$8,469.3 million, where around 55% of this deviation stemmed from negative returns of pension funds (increase of casualty costs), and the growth observed in disability claims as a consequence of the Pension Reform Law start up. The remaining 45% of the variation was explained by expected factors related to the increase of casualty rate (updating of mortality tables and additional benefits for the affiliated females established by the Pension Reform Law) and the growth of salary base of clients. Partly offsetting the above was higher fee income (Ch$5,382.8 million) driven by higher mandatory collection levels and the increase of fees charged to clients in order to compensate the effect of the higher casualty rate expected.

In non operating terms, the period registered a loss of Ch$6,400.5 million, higher in Ch$5,146.9 million than the loss recorded in the 4Q07. This result was the outcome of losses in investments in related companies, due to returns of foreign subsidiaries' assets under management that overshadowed the favorable performance generated by local subsidiaries. The period also recorded lower other non operating income, since the 4Q07 included profits from the sale of AFP Crecer in the Dominican Republic.

| | | | 4Q08 | | | | 4Q07 | | | Change | | | % | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | | | |

| Operating income | | | (3,182.5 | ) | | | 12,080.3 | | | | (15,262.8 | ) | | | -126.3 | % |

| Total operating revenues | | | 39,288.2 | | | | 46,113.3 | | | | (6,825.1 | ) | | | -14.8 | % |

| Total operating expenses | | | (42,470.7 | ) | | | (34,033.0 | ) | | | (8,437.7 | ) | | | 24.8 | % |

| | | | | | | | | | | | | | | | | |

| Other non operating expenses (income) | | | (6,400.5 | ) | | | (1,253.6 | ) | | | (5,146.9 | ) | | | 410.6 | % |

| | | | | | | | | | | | | | | | | |

| Income taxes | | | (354.6 | ) | | | (1,266.7 | ) | | | 912.2 | | | | -72.0 | % |

| | | | | | | | | | | | | | | | | |

| Net income | | | (9,937.6 | ) | | | 9,560.0 | | | | (19,497.6 | ) | | | -203.9 | % |

The 4Q08 recorded losses per share (each ADR represents fifteen shares) of Ch$29.99 while in the same quarter of last year, the earnings per share were Ch$28.85. At the close of the 4Q08, the total number of shares stood at 331,316,623, recording no changes with respect to the level observed in the 4Q07.

Operating revenues

They amounted to Ch$39,288.2 million in the 4Q08, a decrease of 14.8% or Ch$6,825.1 million with respect to the 4Q07. This result was driven by losses on mandatory investments pursuant to the falls experimented by stock markets that negatively affected the returns of pension funds. The above was partially offset by higher fee income, as a result of higher collection levels as well as, the increase in fees charged to customers. Additionally, other operating revenues increased basically due to fees charged by the subsidiary AFP Genesis in Ecuador, and higher financial revenues because of higher rates applied over the growing cash flows of life and disability insurance contract currently in force.

| ● | Fee income increased by 12.2% or Ch$5,382.8 million with respect to the 4Q07, amounting to Ch$49,638.8 million in the period, an evolution in line with the 12.6% achieved by mandatory contributions, basically as a result of the increase in variable fees (2.39% to 2.59% noticeable in results since February 2008, and 2.64% noticeable in results since November) applied over the taxable salary of clients, increments made to cover the higher casualty rate expected. Additionally, the increment of salary base (2.6% in real terms) contributed to this result. |

In terms of clients, the average number of contributors was 1,805,050 in the fourth quarter of 2008; hence, Provida maintains its leading position with an average market share of 40%.

| ● | During 4Q08, losses on mandatory investments were Ch$14,028.1 million, a negative deviation of Ch$14,350.4 million with respect to the income recorded in the 4Q07. This result was basically driven by lower returns achieved by stock markets during the quarter (MSCI LA -34.8%, Nasdaq -24.6%, Dow Jones -19.1%, Mexbol -10.1%, Hang Seng -20.1%, Nikkei -21.3%, Dax -17.5% and IPSA -13.7%). The latter implied a negative weighted average nominal return of pension funds of 8.4% in the 4Q08, while in the same period of last year, the return was positive in 0.5%. |

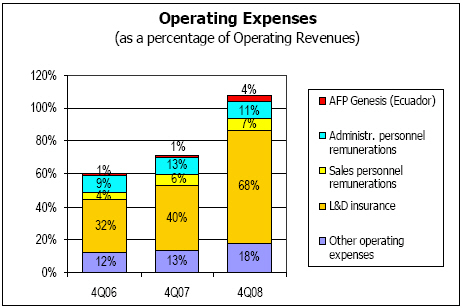

Operating expenses They reached Ch$42,470.7 million during the quarter, an increase of 24.8% or Ch$8,437.7 million with respect to the 4Q07. This result was mainly explained by higher cost of life and disability insurance due to expected factors to be covered by the increase in fees charged to clients, as well as the negative returns of pension funds, and the increase of disability claims in view of the start up of the Pension Reform Law. In | |

addition to the above were higher other operating expenses related to the Pension Reform Law implementation and the increase in data processing expenses affected by effects from foreign exchange rate. The above evolution was partly offset by savings registered in administrative personnel remunerations.

| · | The administrative personnel remunerations amounted to Ch$5,014.9 million in the 4Q08, lower in Ch$1,256.0 million or 20.0% with respect to the same quarter of 2007. This result was partly due to the adjustments made in the profit bonuses given the performance recorded in the quarter, adding lower expenses in indemnities, since the 4Q07 incorporated accrual for indemnities referred to the efficiency and transformation plan developed in 2008. |

In figures, the average administrative staff increased by 1.1% in the 4Q08 with respect to the 4Q07, from 1,024 employees to 1,035.

| · | The sales personnel remunerations were Ch$3,108.6 million in the 4Q08, an increment of Ch$45.6 million (1.5%) with respect to the same quarter of the last year. This variation was explained by higher costs stemming from AFP Génesis of Ch$189.5 million due to the increase in its sales staff. If this effect is isolated, Provida’s expenses decrease by Ch$143.9 million or 4.9% driven by lower awards paid to sales agents in connection with an appropriate management of extraordinary incentives, which were partially offset by higher fees as a result of higher levels of production achieved during the period, especially transfers. Additionally, lower profit bonuses were recorded due to the Company's performance during the quarter. |

Regarding sales staff, the average number of sales agents increased from 578 in the 4Q07 to 608 in the 4Q08, a rise of 5.1%.

| · | During the 4Q08 the life and disability insurance expense was Ch$26,880.4 million, higher in Ch$8,469.3 million or 46.0% with respect to the figure recorded in the same period of last year. This deviation was partly (around 30% of the higher cost) caused by the negative returns of pension funds that increased the valuation of the casualty costs to be covered by the AFP. It is worth mentioning that negative returns implied an effective loss only for those casualties paid during the second half of 2008 and those casualties to be paid at the beginning of 2009. For the remaining cases included in the insurance reserve, the cost will depend on the future pension fund returns until the date of payment. |

In addition, the deviation was affected by the increase of disability claims submitted in the period (explaining around 25% of the higher cost), stemming from the implementation of the solidarity principle established by the Pension Reform Law, increasing and redirecting the demand of benefits in relation with disability.

The remaining 45% of this variation was explained by expected factors. Firstly, the casualty rate increased as a consequence of updating the mortality tables, which implied to increase the variable fee (2.39% to 2.59%) charged to affiliates over their taxable incomes in order to finance this higher cost. Additionally, with the start up of the Pension Reform Law, the casualty rate was affected again, as a result of the increment in the females' coverage period (from 60 to 65 years old) and the inclusion of their spouses as beneficiaries. The latter implied that Provida rose its fee charged to affiliates from 2.59% to 2.64% over the taxable income, which effects were noticeable since November 2008. Moreover, the growing trend of the Company’ s salary base of clients increased the portfolio covered by the insurance, thus the associated premium.

| · | Other operating expenses increased by 18.7% or Ch$1,178.8 million, from Ch$6,288.0 million recorded in the 4Q07 to Ch$7,466.9 million in the 4Q08. This variation was partly the result of higher data processing expenses (Ch$542.5 million) given the negative effect that the foreign exchange rate had over these costs; adding higher costs in amortization (Ch$92.7 million) related to new developments made. Also, the period recorded higher administrative expenses (Ch$65.5 million), basically referred to advisory services related to the Pension Reform Law and selling and marketing expenditures (Ch$310.0 million) also affected by the Pension Reform Law and the APV campaign. |

Operating income

It totaled a loss of Ch$3,182.5 million, a decrease of Ch$15,262.8 million with respect to the 4Q07, mainly due to losses recorded by mandatory investments stemming from negative returns achieved by pension funds that also affected the life and disability insurance.

Other non-operating expenses (income)

They recorded a loss of Ch$6,400.5 million, higher in Ch$5,146.9 million with respect to the loss recorded in the 4Q07. This result was basically explained by the losses in investments in related companies, implying a deviation of Ch$3,988.2 million with respect to the income attained in the 4Q07, as a result of the negative results obtained by foreign subsidiaries. Also, the period recorded lower other non-operating income (expenses) (Ch$1,021.8 million) due to the 4Q07 incorporated the profits obtained by the sale of AFP Crecer in the Dominican Republic.

| · | The results in related companies recorded a loss of Ch$3,675.2 million, a deviation of Ch$3,988.2 million with respect to the income recorded in the 4Q07. This variation was explained by results of foreign subsidiaries that decreased in the aggregate of Ch$4,145.6 million, mainly affected by returns obtained by their assets under management. Partially offsetting the above were the positive results achieved by local subsidiaries that favorably contributed in the aggregate of Ch$157.4 million. |

| | | | | 4Q08 | | | | 4Q07 | | | Change | | | % | |

| Company | Country | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | | | | |

| Horizonte | Peru | | | (502.5 | ) | | | 143.1 | | | | (645.5 | ) | | | -451.2 | % |

| | | | | | | | | | | | | | | | | | |

| Bancomer | Mexico | | | (3,441.1 | ) | | | 14.1 | | | | (3,455.2 | ) | | | -24478.9 | % |

| | | | | | | | | | | | | | | | | | |

| Crecer | The Dom.Republic | | - | | | | 44.9 | | | | (44.9 | ) | | n.a | |

| | | | | | | | | | | | | | | | | | |

| DCV | Chile | | | 26.0 | | | | 12.8 | | | | 13.1 | | | | 102.2 | % |

| | | | | | | | | | | | | | | | | | |

| PreviRed.com | Chile | | | 180.1 | | | | 162.5 | | | | 17.6 | | | | 10.8 | % |

| | | | | | | | | | | | | - | | | | | |

| AFC | Chile | | | 62.2 | | | | (64.5 | ) | | | 126.7 | | | | -196.5 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL | | | (3,675.2 | ) | | | 313.0 | | | | (3,988.2 | ) | | | -1274.4 | % |

| · | The price level restatement recorded a loss of Ch$2,630.8 million, higher in Ch$476.0 million with respect to the loss recorded in 2007. This variation was the outcome of the loss recorded in foreign exchange rate arisen in the period, associated with the maintenance of the dollar debt with Provida Internacional, since in the 4Q08 a depreciation of 15.4% in the Chilean peso against the dollar was recorded, while in the 4Q07 an appreciation of 2.8% was recorded. |

Income taxes

In the 4Q08, income taxes were Ch$354.6 million, lower in Ch$912.2 million or 72.0% with respect to the 4Q07, basically due to results to determine the tributary basis to make the tax payment. The 4Q08 recorded tax expenses although the losses recorded in the period, since certain adjustments to earnings before taxes are required, mainly to unrealized gains and losses (mandatory investments and price level restatement).

Exchange rate

In the 4Q08, a depreciation of 15.4% of the Chilean peso against the dollar was recorded, while in the 4Q07 an appreciation of 2.8% of the Chilean peso against the dollar was recorded.

| CONSOLIDATED INCOME STATEMENT | |

| | | | | | | | | | | | | |

| | | | 4Q08 | | | | 4Q07 | | | Change | | | % Change | |

| | | (Million of constant Chilean pesos at December 31, 2008, except percentages) | |

| | | | | | | | | | | | | | | |

| OPERATING REVENUES | | | | | | | | | | | | | | |

| Fee income | | | 49,638.8 | | | | 44,256.0 | | | | 5,382.8 | | | | 12.2 | % |

| Gains (loss) on mandatory investments | | | (14,028.1 | ) | | | 322.3 | | | | (14,350.4 | ) | | | -4452.2 | % |

| Financial revenues on life and disability insurance | | | 748.0 | | | | (105.5 | ) | | | 853.5 | | | | -808.9 | % |

| Other operating revenues | | | 2,929.4 | | | | 1,640.5 | | | | 1,288.9 | | | | 78.6 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Revenues | | | 39,288.2 | | | | 46,113.3 | | | | (6,825.1 | ) | | | -14.8 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | | |

| Administrative personnel remunerations | | | (5,014.9 | ) | | | (6,270.9 | ) | | | 1,256.0 | | | | -20.0 | % |

| Sales personnel remunerations | | | (3,108.6 | ) | | | (3,063.0 | ) | | | (45.6 | ) | | | 1.5 | % |

| Life and disability insurance | | | (26,880.4 | ) | | | (18,411.1 | ) | | | (8,469.3 | ) | | | 46.0 | % |

| Other operating expenses | | | (7,466.9 | ) | | | (6,288.0 | ) | | | (1,178.8 | ) | | | 18.7 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | (42,470.7 | ) | | | (34,033.0 | ) | | | (8,437.7 | ) | | | 24.8 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | (3,182.5 | ) | | | 12,080.3 | | | | (15,262.8 | ) | | | -126.3 | % |

| | | | | | | | | | | | | | | | | |

| NON OPERATING EXPENSES (INCOME) | | | | | | | | | | | | | |

| Gains on financial investments | | | 243.8 | | | | 18.3 | | | | 225.5 | | | | 1229.2 | % |

| Profit (loss) in related companies | | | (3,675.2 | ) | | | 313.0 | | | | (3,988.2 | ) | | | -1274.4 | % |

| Amortization of goodwill | | | (1,551.8 | ) | | | (1,366.2 | ) | | | (185.7 | ) | | | 13.6 | % |

| Interest expense | | | (45.3 | ) | | | (344.6 | ) | | | 299.3 | | | | -86.8 | % |

| Other non operating income (expenses) net | | | 1,258.9 | | | | 2,280.7 | | | | (1,021.8 | ) | | | -44.8 | % |

| Price level restatement | | | (2,630.8 | ) | | | (2,154.8 | ) | | | (476.0 | ) | | | 22.1 | % |

| | | | | | | | | | | | | | | | | |

| Total Non Operating Expenses (Income) | | | (6,400.5 | ) | | | (1,253.6 | ) | | | (5,146.9 | ) | | | 410.6 | % |

| | | | | | | | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | (9,583.0 | ) | | | 10,826.7 | | | | (20,409.8 | ) | | | -188.5 | % |

| | | | | | | | | | | | | | | | | |

| INCOME TAXES | | | (354.6 | ) | | | (1,266.7 | ) | | | 912.2 | | | | -72.0 | % |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | | (9,937.6 | ) | | | 9,560.0 | | | | (19,497.6 | ) | | | -203.9 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.