As filed with the Securities and Exchange Commission on June 28, 2023

Commission File No. ___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________

JACKSON NATIONAL LIFE INSURANCE COMPANY

(Exact Name of registrant as specified in its charter)

__________________________________

| | | | | | | | | | | | | | |

| Michigan | | 6311 | | 38-1659835 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1 Corporate Way, Lansing, Michigan 48951

(517) 381-5500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________________

Carrie L. Chelko, Esq.

Executive Vice President and General Counsel

Jackson National Life Insurance Company

1 Corporate Way, Lansing, MI 48951

(517) 381-5500

(Name and Address of Agent for Service)

Copy to:

Alison Samborn, Esq.

Associate General Counsel, Insurance Legal

Jackson National Life Insurance Company

1 Corporate Way, Lansing, MI 48951

__________________________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register addition securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. □

| | | | | | | | | | | | | | |

| Large accelerated filer □ | Accelerated filer □ | Non-accelerated filer x

| Smaller reporting company □ | Emerging growth company □ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. □

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THE PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

[NAME TBD]

CONTINGENT DEFERRED ANNUITY

Issued by

Jackson National Life Insurance Company®

The date of this prospectus is __________, 2023. This prospectus contains information about [TBD], a contingent deferred annuity (the "Certificate") issued by Jackson National Life Insurance Company (“Jackson®”) that you should know before investing. Currently, the Certificate is offered to investors who have engaged a registered investment advisor ("RIA") to provide advice on the management of their investment account ("Account") at a Financial Institution approved by us. This prospectus is a disclosure document and describes all of the Certificate’s material features, benefits, rights, and obligations of annuity purchasers under the Certificate. The description of the Certificate’s material provisions in this prospectus is current as of the date of this prospectus. If certain material provisions under the Certificate are changed after the date of this prospectus, in accordance with the Certificate, those changes will be described in a supplemented prospectus. It is important that you also read the Certificate and endorsements, which may reflect additional non-material state variations. Jackson's obligations under the Certificate are subject to our financial strength and claims-paying ability. The information in this prospectus is intended to help you decide if the Certificate will meet your investment and financial planning needs.

The[TBD] Certificate is an annuity with a Guaranteed Minimum Withdrawal Benefit ("GMWB") designed to help support your retirement income needs or other long-term investment goals. An investor who purchases the Certificate (the "Owner") is required to maintain an investment Account at a financial institution that is approved by Jackson. The Owner may only invest in an eligible Investment Portfolio, as designated by Jackson under the Certificate, and must maintain the Investment Portfolio's assets in accordance with our investment allocation requirements. The Owner owns and controls the assets in the Account, not Jackson.

The GMWB guarantees an annual level of guaranteed income in the form of lifetime withdrawals (the "Guaranteed Annual Withdrawal Amount" or "GAWA") (which will never be less than your Required Minimum Distribution ("RMD"), if applicable) each year after the person (or the younger person under joint & survivor coverage) on whose life the GMWB is based (the "Covered Person(s)") has reached attained age 60 ("Minimum Activation Age"). The GAWA is guaranteed even if the value of the Account drops to zero, other than due to a withdrawal taken before the Covered Person (or youngest Covered Person, if applicable) reaches the Minimum Activation Age (an "Early Withdrawal"), a withdrawal that exceeds the total GAWA or RMD, if applicable, on the date of the withdrawal (an "Excess Withdrawal"), or election of a Conversion Option which requires the transfer of all Account Value for conversion into guaranteed annuity payments.

The Certificate is available for use in Non-Qualified Accounts, Qualified Accounts, Traditional IRAs, SEP IRAs, and Roth IRAs. The Certificate is a complex insurance vehicle. Investors should speak with a financial professional about the Certificate's features, benefits, risks, and fees, and whether the Certificate is appropriate for the investor based upon his or her financial situation and objectives.

Jackson is located at 1 Corporate Way, Lansing Michigan, 48951. The telephone number is [ ]. Jackson is the principal underwriter for these Contracts. Jackson National Life Distributors LLC (“JNLD”), located at 300 Innovation Drive, Franklin, Tennessee 37067, serves as the distributor of the Contracts.

The Certificate is subject to rules regarding withdrawals, Contributions, investment allocations, and other matters relating to your Account. Violating these rules, or exceeding the limits established by these rules, may significantly reduce the value of the GMWB, and may even cause your Certificate (and the GMWB) to terminate. An investment in this Contract is subject to risk including the possible loss of principal . See “Risk Factors” beginning on page 6 for more information.

| | |

| Neither the SEC nor any state securities commission has approved or disapproved these securities or passed upon the adequacy of this prospectus. It is a criminal offense to represent otherwise. We do not intend for this prospectus to be an offer to sell or a solicitation of an offer to buy these securities in any state where this is not permitted. |

| | |

| • Not FDIC/NCUA insured • Not Bank/CU guaranteed • May lose value • Not a deposit • Not insured by any federal agency |

| | | | | |

| TABLE OF CONTENTS |

| KEY FACTS | |

| SUMMARY | |

| RISK FACTORS | |

| GLOSSARY | |

| THE CERTIFICATE | |

| Owner | |

| Covered Person | |

| Assignment | |

| State Variations | |

| Guaranteed Minimum Withdrawal Benefit | |

| Guaranteed Withdrawal Balance | |

| Withdrawals | |

| Subsequent Contributions | |

| Step Up | |

| Account Value is Zero | |

| Required Minimum Distributions under Certain Tax Qualified Accounts (“RMDs”) | |

| Early, Excess, and Inadvertent Activation Withdrawals | |

| Death of Owner or Covered Person | |

| Divorce | |

| Conversion Option | |

| Termination | |

| PURCHASING THE CERTIFICATE | |

| Initial Contribution | |

| Subsequent Contributions | |

| Maximum Total Contributions | |

| Free Look | |

| CERTIFICATE CHARGE | |

| Annual Fee Allowance | |

| INVESTMENT REQUIREMENTS | |

| Investment Portfolios | |

| Allocation Drift | |

| Ineligible Investments/Non-Compliant Investment Allocations | |

| Financial Institution | |

| TAXES | |

| CERTIFICATE OWNER TAXATION | |

| Non-Qualified Accounts - Separate Treatment of a Certificate and an Account | |

| Non-Qualified Accounts - Treatment of Benefit Payments under a Certificate | |

| Non-Qualified Accounts - Your Account | |

| Non-Qualified Accounts - Payment of the Certificate Charges | |

| Non-Qualified Accounts - Transfers, Assignments, or Designation of Payees | |

| Tax-Qualified Accounts - General Discussion | |

| Tax-Qualified Accounts - Types of Tax-Qualified Accounts | |

| Tax-Qualified Accounts - Tax on Certain Distributions Relating to Qualified Accounts | |

| | | | | |

| OTHER TAX MATTERS | |

| Definition of Spouse | |

| Annuity Purchases by Nonresident Aliens and Foreign Corporations | |

| Medicare Tax | |

| Foreign Account Tax Compliance Act ("FATCA") | |

| Tax Law Changes | |

| JACKSON TAXATION | |

| OTHER INFORMATION | |

| General Account | |

| Distribution of Contracts | |

| Modification of Your Certificate | |

| Confirmation of Transactions | |

| State Variations | |

| Legal Proceedings | |

| JACKSON | |

| CAUTION REGARDING FORWARD-LOOKING STATEMENTS | |

| RISKS RELATED TO OUR BUSINESS AND INDUSTRY | |

| OUR BUSINESS | |

| Overview | |

| Our Product Offerings by Segment | |

| Distribution and Operations | |

| Risk Management | |

| Reinsurance | |

| Regulation | |

| Environmental, Social and Governance | |

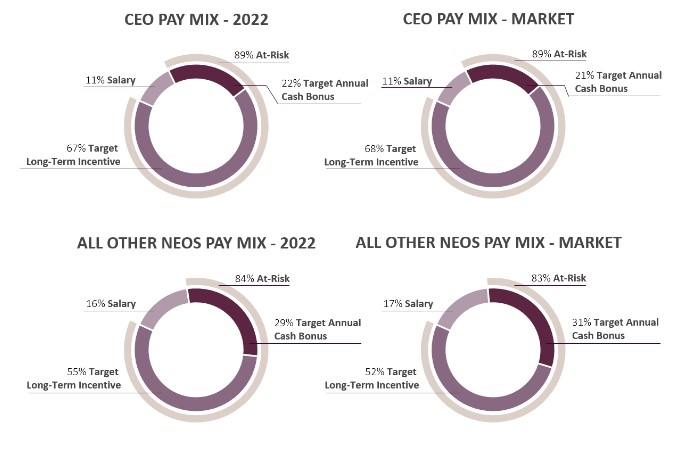

| Human Capital Resources | |

| Properties | |

| Information About Our Executive Officers | |

| Executive Compensation | |

| Security Ownership of Certain Beneficial Owners | |

| Certain Relationships and Related Party Transactions | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | |

| FINANCIAL STATEMENTS | |

| APPENDIX A (CALCULATION EXAMPLES) | |

| APPENDIX B (STATE VARIATIONS) | |

| BACK COVER | |

KEY FACTS

•The Certificate has no surrender value or cash value.

•Account assets are subject to negative investment performance, and the Certificate does not guarantee against a loss of principal and/or a loss of previously earned interest on those assets.

•The Certificate guarantees that you may take withdrawals up to the greater of the Guaranteed Annual Withdrawal Amount ("GAWA") or your Required Minimum Distribution ("RMD"), if applicable, from your Account each year after the Covered Person (or youngest Covered Person, if applicable) has reached the Minimum Activation Age of 60. All other withdrawals (other than withdrawals to pay the Certificate Charge covered by the Annual Fee Allowance) are either Early Withdrawals or Excess Withdrawals. You should not purchase this Certificate if you plan to take withdrawals before the Covered Person (or youngest Covered Person, if applicable) has reached the Minimum Activation Age or in excess of the GAWA or RMD amount, if greater, because such Early Withdrawals or Excess Withdrawals may significantly reduce the value of the GMWB or even cause the Certificate (and the GMWB) to terminate.

•The longer you wait before making the first withdrawal after the Minimum Activation Age (the "Activation Date"), the less time you have to benefit from the GMWB because as time passes, your life expectancy is reduced. On the other hand, the longer you wait to trigger the Activation Date, the greater your GAWA may be, due to positive investment performance and/or a higher GAWA%. You should carefully consider when to trigger the Activation Date.

•If the Certificate Charge is not paid, the Certificate will terminate, and no future GAWA payments will be made, even if the Account Value reduces to zero.

•If the Account assets cease to meet our investment requirements (including certain periodic rebalancing requirements) or your Account is no longer at an approved Financial Institution or you do not provide us with the information necessary to monitor the investments in your Investment Portfolio, the Certificate will terminate and no future GAWA payments will be made, even if the Account Value reduces to zero.

•You will begin paying a fee we charge for the administration of the Certificate and the GMWB ("the "Certificate Charge") as of the date we issue the Certificate to you, rather than as of the date you start making withdrawals. Thus, you could be paying the Certificate Charge for many years before realizing the benefit of the GMWB guarantees under the Certificate. If you never make withdrawals, you will have paid the Certificate Charge without having realized the benefit of the guarantees under the Certificate. We will not refund the Certificate Charges you have paid if you choose to never make withdrawals. In addition, if the Account Value is never reduced to zero, the Company's payment obligations under the Certificate will not be triggered, and you will have paid the Certificate Charge without having received any payments from Jackson.

•Your receipt of any payments under the Certificate is subject to our financial strength and claims paying ability.

•The Certificate does not provide tax deferral benefits, beyond those already provided under the Internal Revenue Code, as amended, for Qualified Accounts, or any tax deferral for individuals purchasing outside a Qualified Account.

•The Certificate may not be available in every state. This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made.

•There have been relatively few contracts introduced to date that offer the kind of benefit available under the Certificate. Although the Internal Revenue Service has issued private letter rulings concerning products similar to the Certificate, these rulings are not binding on the Internal Revenue Service with respect to the Certificate. Jackson is pursuing its own private letter ruling concerning the Certificate, but such private letter ruling has not yet been issued. If and when such private letter ruling is issued, only Jackson will be able to rely on it in any potential action by the Internal Revenue Service. Accordingly, you should consult a tax advisor before you purchase a Certificate. Please see "Certificate Owner Taxation" beginning on page 28 for more information.

SUMMARY

[NAME TBD] is a Contingent Deferred Annuity (“CDA”). The Certificate is designed to protect investors who are concerned that, either because of withdrawals (other than Early or Excess Withdrawals) and/or poor market performance, their Account may be depleted during their lifetime. Put another way, the Certificate provides a limited form of insurance against outliving your assets.

If you comply with the conditions of the Certificate, we will provide you a guaranteed level of annual income for the life of one or more Covered Persons, even if your Account Value drops to zero. The guaranteed level of annual income is established when a Covered Person who is age 60 or older (the youngest Covered Person when the Joint and Survivor Option is elected) takes the first partial withdrawal from their Account. We call the date of that first withdrawal the Activation Date. On the Activation Date, your Guaranteed Annual Withdrawal Amount percentage is locked-in (based on your attained age or the youngest Covered Person's attained age at that time), and the initial Guaranteed Annual Withdrawal Amount ("GAWA") is established. We guarantee that the greater of the GAWA or your Required Minimum Distribution ("RMD"), if applicable, can be withdrawn each Certificate Year after the Activation Date for the life of the Covered Person(s). If your Account Value drops to zero due to withdrawals of the GAWA or RMD, if greater, and/or poor investment performance and/or permitted fee deductions (fees covered by the "Annual Fee Allowance"), we will continue to make payments to you of at least the same GAWA each Certificate Year, provided the Certificate remains in-force. If the value of assets in your Account (the "Account Value") are sufficient to pay the GAWA, GAWA payments are in the form of withdrawals from your Account. If your Account Value drops to zero for any reason other than an Early or Excess Withdrawal, Jackson will continue the GAWA payments from its assets.

We treat any portion of a withdrawal (or cumulative withdrawals) in a Certificate Year that exceeds the greater of the GAWA or RMD, if applicable, to be an Excess Withdrawal. Excess Withdrawals may significantly reduce your GAWA, and could terminate the Certificate if an Excess Withdrawal causes your Account Value to drop zero. In order to fully realize the protections under the Certificate, you should limit the amount you withdraw from your Account in any given Certificate Year to your GAWA (or RMD, if greater). Your GAWA can increase after the Activation Date due to automatic Step-Ups of the Guaranteed Withdrawal Balance (GWB), and/or any subsequent contributions, if permitted. Your GAWA can decrease after the Activation Date due to Excess Withdrawals. Such decreases could be substantial.

All Early Withdrawals will reduce the value of your Guaranteed Withdrawal Balance ("GWB") and any future GAWAs. An Early Withdrawal that causes your Account Value to drop to zero will terminate the Certificate, and no future GAWA payments will be made. If your Account Value drops to zero due to investment performance and fee deductions covered by the Annual Fee Allowance before the Covered Person (or youngest Covered Person, if applicable) reaches the Minimum Activation Age of attained age 60, the Activation Date will be the date the Account Value drops to zero. In this scenario, we will use the the youngest Attained Age band to determine your locked-in your GAWA percentage, and then determine your GAWA payment. For more information on the GAWA and the GAWA percentages (including applicable Attained Age bands), see the GAWA table on page 15.

The Certificate does not provide a guarantee that your Account Value will not decline.

Investment Requirements: You are required to invest the assets in your Account in an approved Investment Portfolio. You can choose from among multiple approved Investment Portfolios, each of which is subject to different investment allocation requirements. Each Investment Portfolio has a different Certificate Charge. You must make your initial allocation election at or prior to the Certificate Date. Each Investment Portfolio's investment requirements are designed to minimize the risk to the Company that we will be required to pay the GAWA from our own assets. You may change your Investment Portfolio election at any time to any Investment Portfolio currently available for election. If you change your Investment Portfolio, we will begin assessing the new Certificate Charge on the date of your reallocation to the new Investment Portfolio. Changing your Investment Portfolio does not impact the guarantees of your Certificate.

You are required to rebalance your Account allocations quarterly on February 1, May 1, August 1, and November 1 ("the Required Rebalance Dates"), or the next Business Day following those dates if those dates fall on a non-Business Day, in order to conform with our investment requirements.

You must maintain your Account at an approved Financial Institution.

You must provide us with the information we deem necessary, in our discretion, to monitor the investments in your Investment Portfolio.

If you do not comply with these requirements, we will notify you as described in this prospectus. If you do not take timely corrective action, we will terminate your Certificate, and no future GAWA payments will be made, even if your Account Value drops to zero.

Guaranteed Withdrawal Balance. The Guaranteed Withdrawal Balance ("GWB") is the amount we use to calculate your Guaranteed Annual Withdrawal Amount. The GWB is established for the sole purpose of determining the GAWA. The GWB is not an Account Value and cannot be withdrawn as a lump sum or otherwise. On the Certificate Date, the GWB is equal to your initial Contribution. After the Certificate Date, the GWB is increased dollar-for-dollar (net of any applicable taxes) for any subsequent Contribution, and by any automatic Step-Up that occurs on a Certificate Anniversary. A Step-Up is a Certificate feature under which we automatically increase the GWB to reflect increases in the Account Value due to positive investment performance during the Certificate Year. This means your GWB (and your GAWA) can increase after the Activation Date. For more information on Step-Ups, please see "Step-Up" on page 17. The GWB can never be more than $10 million (including upon Step-Up). The GWB is reduced by each withdrawal, as discussed below under "Withdrawals" and in more detail later in the prospectus.

Guaranteed Annual Withdrawal Amount. The Guaranteed Annual Withdrawal Amount ("GAWA") (or the RMD, if greater) is the maximum amount you can withdraw from the Account each Certificate Year after the Activation Date (in addition to the Certificate Charge covered by the Annual Fee Allowance) without reducing the GAWA in future Certificate Years. If the Account Value drops to zero for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option, the GAWA, net of any applicable taxes, will be paid annually from the Company's assets through the life of the last surviving Covered Person. On the Activation Date, the GAWA is equal to the Guaranteed Withdrawal Balance (GWB) multiplied by the GAWA percentage (the "GAWA%"). The GAWA% is locked-in at the earlier of (1) the Activation Date, and (2) the date the Account Value drops to zero for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option. The GAWA% is determined using the attained age of the Covered Person (or youngest Covered Person, if applicable), upon (1) or (2), above, according to the following:

| | | | | | | | |

| Attained Age | Standard GAWA% | Joint and Survivor GAWA% |

| 60-64 | 4.00% | 3.50% |

| 65-69 | 5.00% | 4.50% |

| 70-74 | 5.25% | 4.75% |

| 75+ | 5.50% | 5.00% |

If the Account Value drops to zero (for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option) before the Covered Person (or youngest Covered Person, if applicable) reaches the Minimum Activation Age of attained age 60, the GAWA will be determined using the youngest Attained Age band in the table above.

Your GAWA can increase after the Activation Date due to automatic Step-Ups, and/or any subsequent contributions, if permitted. Your GAWA can decrease after the Activation Date due to Excess Withdrawals. Such decreases could be substantial.

Withdrawals. Withdrawals cause the GWB and/or GAWA to be recalculated in the following ways:

•Early Withdrawals. Withdrawals taken prior to the Minimum Activation Age are considered Early Withdrawals, and cause the GWB to be reduced in the same proportion that the Account Value is reduced on the date of the withdrawal. This means if you take an Early Withdrawal of 10% of your Account Value, your GWB will also be reduced by 10%. This means that if you take an Early Withdrawal, it is possible that your GWB will be decreased by more than the amount of the withdrawal; in other words, on more than a dollar-for-dollar basis. Such decreases could be substantial. Any decrease in the GWB due to an Early Withdrawal will result in a lower GAWA on the Activation Date, and an Early Withdrawal may even terminate the Certificate.

•Guaranteed Annual Withdrawal Amounts. Withdrawals taken on or after the Activation Date that do not cause the cumulative total of all withdrawals taken in the Certificate Year to exceed the greater of the GAWA or the RMD, if applicable, will cause the GWB to be reduced by the dollar amount of the withdrawal. The GAWA is unchanged.

•Excess Withdrawals. Any portion of a withdrawal taken on or after the Activation Date that causes the cumulative total of all withdrawals taken in the Certificate Year to exceed the greater of the GAWA or the RMD, if applicable, will cause the GWB and GAWA to be reduced in the same proportion as the Account Value for the portion of the

withdrawal considered to be an Excess Withdrawal. Any portion of the withdrawal not exceeding the greater of the GAWA or RMD, if applicable, will cause the GWB to be reduced by the dollar amount of that portion of the withdrawal. In recalculating the GWB and GAWA, the GWB and GAWA could be reduced by more than the dollar amount of the withdrawal. Therefore, please note that withdrawing more than the greater of the GAWA or RMD, if applicable, in a Certificate Year may have a significantly negative impact on the value of this benefit.

For examples illustrating the impact of various types withdrawals at different times during your Certificate's life cycle on your GWB and GAWA values, please see Appendix A, Examples 4, 5, 7 and 8, beginning on page A-1. Certificate Charge. We assess a charge for the benefits provided under the Certificate. We refer to this charge as the "Certificate Charge." The withdrawal of the Certificate Charge from your Account Value will reduce the investment return of your Account. The Certificate Charge is expressed as an annual percentage of the GWB. The percentage varies depending on which Investment Portfolio option you elect (see table below). For more information about the GWB, please see "Guaranteed Withdrawal Balance" beginning on page 15. For more information on the different Investment Portfolio options, please see "Investment Portfolios" beginning on page 25. The Certificate Charge compensates us for costs associated with providing the Guaranteed Minimum Withdrawal Benefit under the Certificate, expenses associated with administration of the Certificates, certain acquisition expenses including marketing expenses, and risks we assume in connection with the Certificates.

| | | | | | | | | | | |

| Certificate Charge |

| Investment Portfolio | Current Annual Charge | Maximum Annual Charge | Maximum Increase to Annual Charge (at one time) |

| Tier 1 | 1.35% | 2.35% | 0.10% |

| Tier 2 | 1.45% | 2.65% | 0.10% |

| Tier 3 | 1.75% | 3.00% | 0.10% |

| Charge Basis | GWB |

| Charge Frequency | Quarterly |

On each fifth Certificate Anniversary, we reserve the right to increase the Certificate Charge, subject to the applicable maximum annual charge and maximum increase to annual charge, as shown in the table above. If the Certificate Charge is to increase, a notice will be sent to you 45 days prior to the Certificate Anniversary. If we elect not to increase the Certificate Charge on any fifth Certificate Anniversary, the earliest date on which the Certificate Charge is eligible to be increased again is the next fifth Certificate Anniversary.

The Certificate Charge is due following each calendar quarter (on the first Business Day after the conclusion of the calendar quarter to which the charge applies) for as long as your Account Value is greater than zero. Account withdrawals made in a Certificate Year for the purpose of paying the Certificate Charge (including any incidental charges assessed by your Financial Institution as part of the withdrawal) are covered by the Annual Fee Allowance and will not be considered withdrawals for the purpose of calculating any GMWB values.

The first Certificate Charge will be prorated from the Certificate Date to the end of the first calendar quarter. Upon termination of the Certificate, the Certificate Charge is prorated for the period since the last quarterly charge.

Certificate Overview

| | | | | |

| Certificate | Contingent deferred annuity certificate |

| Minimum Initial Contribution | $50,000 |

| Issue Ages | 50 - 80 |

| Minimum Activation Age | 60 |

| Account Value | The market value of a Certificate Owner's Account as of the close of any Business Day |

| Covered Person(s) | The life or lives on which guaranteed payments are based. If the Certificate Owner is a natural person, then the Certificate Owner is the Covered Person. If the Certificate Owner is a legal entity, the Annuitant (or Annuitants if the Joint and Survivor Option is elected) is the Covered Person(s). Up to two Covered Persons are permitted, but in the event there is more than one Covered Person, the Covered Persons must be spouses as defined by federal law. On Qualified Account Certificates, the Annuitant and the contingent Annuitant will each be considered a Covered Person. On Non-Qualified Account Certificates, the Certificate Owner and sole spousal Account beneficiary or spousal joint Certificate Owners will each be considered a Covered Person. The Covered Person(s) may not be subsequently changed. |

| Guaranteed Annual Withdrawals | Once the Covered Person (or youngest Covered Person, if applicable) reaches the Minimum Activation Age, you may withdraw the greater of the GAWA or RMD, if applicable, all at once or in multiple withdrawals throughout the Certificate Year while your Account Value is greater than zero. Once your Account Value falls to zero, for any reason other than an Early Withdrawal or Excess Withdrawal, we will pay you the GAWA annually for the remainder of your life (and your spouse's life if the Joint and Survivor Option is elected). |

| Investment Requirements | You must invest your full Account Value in an approved Investment Portfolio option and in compliance with our investment allocation requirements. You are required to rebalance your Account on the Required Rebalance Dates to maintain compliance with your elected Investment Portfolio allocation requirements. Failure to comply with the investment requirements of the Certificate may result in termination of your Certificate. |

| Charges and Expenses | You will bear the following charges and expenses: •Certificate Charge; and •Premium and Other Taxes. |

| Free Look Provision | You may cancel your Certificate by providing written notice to us within ten calendar days of the Certificate Date. In some states, the Free Look period may be longer. Please see the front page of your Certificate for the Free Look period that applies to your Certificate. If you cancel your Certificate during this period, we will refund any Certificate Charge paid. |

RISK FACTORS

The purchase of the Certificate and the features you elect involve certain risks. You should carefully consider the following factors, in addition to considerations listed elsewhere in this prospectus, prior to purchasing the Certificate.

You may lose money.

An investment in a contingent deferred annuity is subject to the risk of loss. You may lose money, including the loss of principal.

You may never receive GAWA payments from the Company's assets, as provided under the Certificate, because your Investment Portfolio may perform sufficiently well.

The Certificate's GMWB includes several restrictions, including investment allocation restrictions and restrictions on the amount of withdrawals you may make without reducing your Guaranteed Withdrawal Balance ("GWB") and Guaranteed Annual Withdrawal Amount ("GAWA"). These requirements are designed to reduce the risk that we will be required to make GAWA payments to you from our assets. These restrictions also might increase the likelihood that your Investment Portfolio will perform sufficiently well, such that even if you outlive your life expectancy there will be Account Value available to fund your desired lifetime GAWA. If the value of the Account assets is never reduced to zero, the Company's payment obligations under the Certificate will not be triggered, and you will have paid the Certificate Charge without having received any GAWA payments from the Company.

The date you start taking withdrawals from your Account may impact the amounts you receive under the Certificate. The longer you wait to set the Activation Date, the less likely you will benefit fully from the GMWB, due to decreasing life expectancy as you age. You will also be paying for a benefit you are not using. On the other hand, the longer you wait to set the Activation Date, the more opportunities you will have to increase your GWB through the operation of automatic Step-Ups. Waiting longer to set your Activation Date could also result in a higher GAWA percentage, which would result in a higher GAWA payment. You should, of course, carefully consider when to set the Activation Date and begin taking withdrawals, but there is a risk that you will not begin taking withdrawals at the most financially opportune time.

You should also remember that the Certificate Charge begins accruing on the effective date of the Certificate (the "Certificate Date"), even if you do not begin taking withdrawals from your Account for many years, or ever, and whether or not we ever make GAWA payments to you from our assets. If you choose never to take withdrawals, and/or if you never receive any payment of the GAWA from our assets, you will not receive a refund of the Certificate Charges you have paid.

You may die before your Account Value is reduced to zero.

If you (or you and your spouse if the Joint and Survivor Option is elected) die before the Account Value is reduced to zero, neither you nor your estate will ever receive any payments of the GAWA from our assets. Instead, the source of any amounts you may have withdrawn will have been your own contributions (adjusted for investment performance). The Certificate does not have any cash value, surrender value, or provide a death benefit.

Furthermore, even if you begin to receive payments of the GAWA from our assets, you may die before receiving an amount equal to or greater than the amount you have paid in Certificate Charges.

You may take Early Withdrawals or Excess Withdrawals which will reduce your GMWB values, and may even terminate, the Certificate (and the GMWB).

Due to the long-term nature of the Certificate guarantee, there is a risk that you may encounter a financial situation in which you need to take withdrawals in excess of the GAWA or prior to the Minimum Activation Age. In addition, dividends and capital gains generated by the Account that are distributed to you (i.e. not automatically reinvested) are considered withdrawals from the Account, and may contribute to an Early Withdrawal (to the extent they predate the Minimum Activation Age) or Excess Withdrawal to the extent they exceed the GAWA or RMD, if applicable, when added to other withdrawals you have taken that Certificate Year. Early Withdrawals and/or Excess Withdrawals can substantially decrease the value of the Certificate's GMWB:

•Early Withdrawals will reduce your GWB in the same proportion that the Account Value is reduced on the date of the withdrawal. For example, if an Early Withdrawal reduces your Account Value by 10%, your GWB will also be reduced by 10%. This means that if you take an Early Withdrawal, it is possible that your GWB will be decreased by

more than the dollar amount of the withdrawal; in other words, on more than a dollar-for-dollar basis. Such decreases could be substantial. Any decrease in the GWB due to any Early Withdrawal will result in a lower GAWA on the Activation Date. An Early Withdrawal may even terminate the Certificate.

•Excess Withdrawals will reduce your GWB and GAWA in the same proportion that the Account Value is reduced on the date of the withdrawal. This means if an Excess Withdrawal reduces your Account Value by 10%, your GWB and GAWA will also be reduced by 10%. This reduction could be substantially more than the actual dollar amount of the withdrawal. Your reduced GAWA will not be eligible for any increase unless your make a subsequent Contribution, if permitted, or your GWB is increased through the operation of an automatic Step-Up. An Excess Withdrawal may even terminate the Certificate.

We will notify you of any withdrawal from your Account that we consider an Early Withdrawal or Excess Withdrawal. If you do not follow the procedure for reinvesting that withdrawal within the required time limit thereafter, it will be treated as an Early Withdrawal or Excess Withdrawal, as applicable. Please see "Early, Excess, and Inadvertent Activation Withdrawals" beginning on page 19.

Also, please keep in mind that for any withdrawal that you make from your Account, federal and state income taxes will apply, and if the withdrawal is from a Qualified Account, a 10% federal tax penalty may also apply if you have not yet reached age 59 1/2.

A Step-Up to your GWB does not guarantee an increase in your GAWA, and all withdrawals (especially Excess Withdrawals) reduce the likelihood that Step-Ups will increase your GAWA.

Each Certificate Anniversary before your Account Value drops to zero, your GWB is eligible for an annual reset called a “Step-Up.” If, on such Certificate Anniversary, your Account Value is greater than your GWB, your GWB will be stepped-up to equal your Account Value. Immediately after any Step-Up that occurs after your Activation Date, your GAWA will be recalculated to equal the greater of (a) your stepped-up GWB multiplied by the GAWA%, or (b) your GAWA immediately prior to the Step-Up. If your stepped-up GWB multiplied by the GAWA% is greater, your GAWA will increase. If not, your GAWA will remain the same, even though the GWB was stepped-up.

It is important to note that all withdrawals from your Account (including GAWA withdrawals) make it less likely that future Step-Ups to your GWB (if any) will increase your GAWA. This is because all withdrawals reduce your Account Value and GWB. It is also important to note that Excess Withdrawals may significantly reduce the likelihood that your GAWA will increase due to a Step-Up, as Excess Withdrawals (unlike GAWA withdrawals) result in a proportionate reduction to your GWB and may cause your GWB to be reduced by even more than the amount withdrawn.

You may cancel the Certificate prior to a severe market downturn.

If you cancel the Certificate, we no longer have any obligation to make GAWA payments to you, even if your Account Value drops to zero. If you were to cancel your Certificate prior to a severe market downturn, you would not receive any GAWA payments. Therefore, you would have foregone the benefit of your guarantee in a market scenario in which such guarantee may be of significant value to you.

Your investments may experience a higher return if you were not subject to the Certificate's investment requirements.

Only certain investments are available under the Certificate. The eligible investments may be more conservative than other investments otherwise available to you. These investment requirements are designed to minimize risk to the Company that we will be required to pay the GAWA to you out of our assets, by reducing the likelihood that your Account Value will drop to zero. If you were not subject to the investment constraints under the Certificate, you might instead purchase other investments (such as other mutual or exchange traded funds) that experience higher growth or lower losses than the permitted eligible investments. You should consult your financial professional to assist you in determining whether the permitted assets are suited for your financial needs and risk tolerance. Of course, if you were to reallocate or transfer the investments in your Account so that you are no longer invested in the eligible investments, we would terminate your Certificate and any future GAWA payments, even if the Account Value were to drop to zero.

Your investments may experience a higher return without the Certificate Charge.

We charge a Certificate Charge, which will reduce your assets that are invested. If you did not have to pay this charge, those funds would be available for investment and could increase due to a positive investment return. This potential growth could be greater than the benefits you receive under the Certificate.

Your receipt of any GAWA payments from our assets is subject to our financial strength and claims paying ability.

The Certificate is not a separate account product. This means that the assets supporting the Certificate are not held in a segregated account for the exclusive benefit of Certificate Owners. Rather, payments of the GAWA we make when the Account Value is zero come from our general account, which is not insulated from the claims of other policyholders and our creditors. Thus, your receipt of payments from us is subject to our financial strength and claims paying ability. You should review and be comfortable with the financial strength of Jackson for its claims-paying ability.

You should be aware of the various regulatory protections that do and do not apply to the Certificate.

The offer and sale of your Certificate has been registered in accordance with the Securities Act of 1933. We are not an investment advisor and do not provide investment advice to you in connection with the Certificate or your Account. We are also not an investment company and therefore we are not registered under the Investment Company Act of 1940, as amended, and the protections provided by the Investment Company Act of 1940 are not applicable with respect to your Certificate.

You should be aware of the governing law with regard to the Certificate.

The Certificate is issued under a master group contract. Therefore, the Certificate will be governed by and construed in accordance with the laws of the state in which the master group contract is issued, and the obligations, rights and remedies of the Owner and/or Covered Person(s) will be determined in accordance with such laws.

We may cancel the Certificate, and make no GAWA payments under the GMWB, if you fail to meet the Certificate Conditions as follows:

•If the assets in your Account fail to meet the investment requirements (including certain periodic rebalancing requirements), or if you do not provide us with information necessary to monitor the investments of your Investment Portfolio.

You are required to invest the assets in your Account in eligible investments only, which are Investment Portfolios made available under the Certificate. You must allocate your Account Value in accordance with investment requirements within the Investment Portfolio you elect. If ineligible investments are added to your Account and/or you reallocate your Account Value in a way that is not in compliance with our investment allocation restrictions and/or the allocations of the Investment Portfolio deviate from our prescribed investment requirements due to investment performance "drift" and are not timely rebalanced, we will send a notice of non-compliance to you and you will have ten Business Days from mailing of the notice to bring the Investment Portfolio into compliance. If you fail to do so, the Company will terminate the Certificate, and no future GAWA payments will be made, even if the Account Value were to drop to zero.

In addition, if you do not provide us with the information necessary to monitor the investments of your Investment Portfolio, we will assume you are not complying with our investment requirements and provide you with ten Business Days to provide us the necessary information, after which we will also terminate your Certificate, and no GAWA payments will be made, even if your Account Value drops to zero.

•If the Certificate Charge is not paid.

If we do not receive the applicable Certificate Charge by the due date, we will send a late notice. The Certificate will be terminated and no future GAWA payments will be made, even if the Account Value drops to zero, if we do not receive the applicable Certificate Charge within ten Business Days from mailing of the late notice.

•If we remove a Financial Institution from our list of approved Financial Institutions and you do not move your Account to an approved Financial Institution.

We may remove a Financial Institution from our list of approved Financial Institutions at any time. If we do so, you must move your Account to an approved Financial Institution. Your Certificate will terminate, including any future GAWA payments, even if the Account Value were to drop to zero, unless you (i) move your Account to an approved Financial Institution within 90 calendar days of the date we send notice of our disapproval of your then current Financial Institution, (ii) maintain compliance with our investment requirements and provide or give us access to the

information or data necessary to monitor the allocations of your Account at all times, and (iii) comply with all other applicable terms of the Certificate.

In addition, your Certificate will terminate, including all future GAWA payments, even if the Account Value were to drop to zero, if the disapproved Financial Institution is the custodian or sponsor of your IRA, or the custodian or trustee of another Qualified Account and that custodian/sponsor/trustee discontinues its services unless (i) you replace the custodian/sponsor/trustee within 90 calendar days of discontinuance of service, and (ii) maintain compliance with our investment requirements and provide or give us access to the information or data necessary to monitor the allocations of your Account at all times.

You have the right to move your Account to another Financial Institution from our list of approved Financial Institutions at any time, provided you maintain compliance with our investment requirements and provide or give us access to the information or data necessary to monitor the allocations of your Account at all times. Different Financial Institutions may assess different fees and charges for their services. If you transfer your Account to another Financial Institution, you may be subject to higher fees and charges associated with maintaining your Account.

Your payment of the Certificate Charge from your Account may have tax consequences and affect the benefits provided under your Certificate.

There may be tax consequences if you elect to liquidate assets in your Account to pay the Certificate Charge. In the case of a Qualified Account, a 10% federal tax penalty may also apply if you have not yet reached age 59 ½. You should consult your tax advisor before doing so. You should consult your tax advisor, and financial advisor before purchasing a Certificate.

GLOSSARY

These terms are capitalized when used throughout this prospectus because they have special meaning. In reading this prospectus, please refer back to this glossary if you have any questions about these terms.

Account - an investment account established and maintained with a Financial Institution that is used to determine guarantee coverage under the Certificate. The Account can only hold assets that are covered by the guarantee under the Certificate, and those assets must be maintained in the Account in accordance with the terms of the Certificate at all times.

Account Value - the market value of a Certificate Owner's Account as of the close of any Business Day, as determined by the Financial Institution.

Activation Date - the date on which the first withdrawal is taken after the Covered Person (or youngest Covered Person, if applicable) has reached the Minimum Activation Age.

Annual Fee Allowance - the total eligible fees that may be withdrawn from the Account each Certificate Year without being considered a withdrawal for purposes of calculating GMWB values. The Certificate Charge and any incidental fees assessed by your Financial Institution as part of a withdrawal to pay the Certificate Charge are covered under the Annual Fee Allowance.

Annuitant – the natural person(s) on whose life the Company determines the amount of GAWA payments provided by the Certificate when the owner is a legal entity. Any reference to the Annuitant includes any joint Annuitant or contingent Annuitant, if applicable.

Business Day - any day that the New York Stock Exchange is open for business during the hours in which the New York Stock Exchange is open.

Certificate - the contingent deferred annuity Certificate, which provides the benefits, rights and terms of the Certificate Owner's agreement with the Company.

Certificate Anniversary - the Business Day on or immediately following each one-year anniversary of the Certificate Date.

Certificate Charge - the fee we charge the Certificate Owner for the Certificate. The Certificate Charge is expressed as an annual percentage of the GWB, and is assessed on a calendar quarterly basis. The Certificate Charge varies based on the Investment Portfolio the Certificate Owner elects. An amount withdrawn from Account Value to pay the Certificate Charge is covered under the Annual Fee Allowance and will not count towards an Early Withdrawal or Excess Withdrawal.

Certificate Date - the date the Certificate is effective.

Certificate Owner, Owner, you or your - the natural person(s) or legal entity entitled to exercise all rights and privileges under the Certificate. The Certificate allows for joint Owners. Any reference to the Certificate Owner includes any joint Owner. (We do not capitalize "you" or "your" in the prospectus.)

Certificate Year - the succeeding twelve months from the Certificate Date and every Certificate Anniversary

thereafter. The first Certificate Year starts on the Certificate Date and extends to, but does not include, the

first Certificate Anniversary. Subsequent Certificate Years start on Certificate Anniversary date and extend to, but do not include, the next Certificate Anniversary date.

For example, if the Certificate Date is January 15, 2023 then the end of Certificate Year 1 would be January 14, 2024, and January 15, 2024, which is the first Certificate Anniversary, begins Certificate Year 2.

Company, Jackson, JNL, we, our, or us – Jackson National Life Insurance Company. (We do not capitalize “we,” “our,” or “us” in the prospectus.)

Contributions - amounts invested in the Account by or on behalf of the Certificate Owner.

Conversion Option - an option you may elect any time after the first Certificate Year that permits you to convert your full Account Value to guaranteed annuity payments.

Covered Person(s) - the life or lives on which guaranteed payments are based. If the Certificate Owner is a natural person, then the Certificate Owner is the Annuitant and the Covered Person. If the Certificate Owner is a legal entity, the Annuitant is the Covered Person. Up to two Covered Persons are permitted, but in the event there is more than one Covered Person, the Covered Persons must be spouses as defined by federal law. On Qualified Account Certificates, the Annuitant and the contingent Annuitant will each be considered a Covered Person if the Joint and Survivor Option is elected. On Non-Qualified Account Certificates, the Certificate Owner and sole spousal Account beneficiary or spousal joint Certificate Owners will each be considered a Covered Person. The Covered Person(s) may not be subsequently changed.

Early Withdrawal - any withdrawal taken from the Account prior to the Activation Date other than a withdrawal to pay fees covered by the Annual Fee Allowance.

Excess Withdrawal - any portion of a withdrawal taken on or after the Activation Date that causes total withdrawals taken during that Certificate Year to exceed the greater of the Guaranteed Annual Withdrawal Amount or Required Minimum Distribution ("RMD"), if applicable, on the date of the withdrawal. Withdrawals to pay fees covered by the Annual Fee Allowance do not count towards the calculation of Excess Withdrawals.

Financial Institution - an entity approved by the Company to establish and maintain the Account on behalf of the Certificate Owner. We may designate additional Financial Institutions, and may, for any reason, disapprove a previously approved Financial Institution.

Good Order - when our administrative requirements, including all information, documentation and instructions deemed necessary by us, in our sole discretion, are met in order to issue a Certificate or execute any requested transaction pursuant to the terms of the Certificate.

Guaranteed Annual Withdrawal Amount (GAWA) - the maximum amount the Certificate Owner can withdraw from the Account each Certificate Year after the Activation Date, in addition to the Annual Fee Allowance, without reducing the guaranteed annual level of income the Certificate Owner can withdraw in future Certificate Years. Where there is an applicable RMD, the Certificate Owner may withdraw the greater of the GAWA or the RMD amount without reducing the guaranteed annual level of income the Certificate Owner can withdraw in future Certificate Years. The GAWA is established on the Activation Date and then can subsequently increase or decrease. The GAWA before the Activation Date is zero. If the Account Value drops to zero by any means other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option, the GAWA, net of any applicable taxes, is the amount guaranteed to be paid annually for the life of the Covered Person (or last surviving Covered Person, if applicable).

Guaranteed Annual Withdrawal Amount Percentage (GAWA%) - the percentage, which is locked-in on the Activation Date based on the Covered Person's (or youngest Covered Person's) attained age, and is used to determine the Guaranteed Annual Withdrawal Amount. The GAWA% will not change after the Activation Date for any reason.

Guaranteed Minimum Withdrawal Benefit (GMWB) - the guarantee inherent to the Certificate which provides for a Guaranteed Annual Withdrawal Amount that is withdrawn from Account Value while the Account Value is greater than zero, and paid by the Company from its assets for the lives of the Covered Person(s) if the Account Value drops to zero by any means other than an Early Withdrawal or Excess Withdrawal.

Guaranteed Withdrawal Balance (GWB) - the amount we use to calculate your Guaranteed Annual Withdrawal Amount, which is initially equal to your initial Contribution on the Certificate Date, and then can subsequently increase or decrease. It is also the value upon which the Certificate Charge is based.

Inadvertent Activation Withdrawal - a partial withdrawal taken before the Activation Date and after the Covered Person (or youngest Covered Person, if applicable) has reached the Minimum Activation Age, that will not trigger the Activation Date under the Certificate so long as you notify us of your intent to reinvest the entire withdrawal amount within five Business Days of the date of the withdrawal, and the entire withdrawal amount is reinvested into the Account within ten Business Days of the date of the withdrawal.

Joint and Survivor Option - an election under which the GAWA is calculated based on the attained age of the youngest of the two spousal Covered Person(s) and under which GAWA payments are guaranteed until the death of the last surviving Covered Person. On Qualified Account Certificates, the Joint and Survivor Option can only be elected where an Annuitant and contingent Annuitant have been named.

Minimum Activation Age - the minimum permitted attained age of the Covered Person (or youngest Covered Person) on the Activation Date in order for GAWA payments to begin under the GMWB. The Minimum Activation Age is 60.

Investment Portfolio - a specific grouping of required investments and allocation requirements in which the Certificate Owner must invest their Account assets. Multiple Investment Portfolios may be available to choose from, however, the Account can only be allocated to one Investment Portfolio at a given time.

Non-Qualified Account - an Account held outside any tax advantaged retirement and savings arrangement as provided for under the Internal Revenue Code, as amended.

Qualified Account - an Account held as part of a retirement plan which qualifies for favorable tax treatment under the Internal Revenue Code, as amended.

Required Minimum Distribution (RMD) - for certain Qualified Accounts, the RMD is the minimum amount, calculated pursuant to Section 401(a)(9)(A) of the Internal Revenue Code and regulations thereunder, that must be distributed annually to a beneficial owner of certain Qualified Accounts, beginning within the time period prescribed under Section 401(a)(9)(C) of the Internal Revenue Code and regulations thereunder. Any portion of the RMD that is greater than the GAWA will not count as an Early Withdrawal or Excess Withdrawal.

Required Rebalance Dates - the dates on which we require you to rebalance your Account allocations in order to conform with our investment requirements. The Required Rebalance Dates are February 1, May 1, August 1, and November 1. If those dates fall on a non-Business Day, then the Required Rebalance Date shall be the next Business Day following those dates.

Step-Up - a Certificate feature under which we automatically increase the GWB to reflect any increases in the Account Value due to positive investment performance during the Certificate Year.

THE CERTIFICATE

Your Certificate is a contract between you, the Owner, and us. The Certificate is a contingent deferred annuity. Your Certificate and any endorsements are the formal contractual agreement between you and the Company. The Certificate is available in connection with Accounts held outside any formal retirement arrangement (i.e., Nonqualified Accounts). The Certificate is also available in connection with Qualified Accounts. The Certificate is offered to individuals who are members of [___], have engaged a registered investment advisor ("RIA"), and have established an online account with [___], and who own certain financial assets in an Account maintained at an approved Financial Institution.

The Certificate provides a Guaranteed Minimum Withdrawal Benefit ("GMWB"), which is designed to protect investors who are concerned that, either because of withdrawals (other than Early or Excess Withdrawals) and/or poor market performance, their Account may be depleted during their lifetime causing them to outlive their Account assets. Put another way, the Certificate provides a limited form of insurance against outliving your assets.

If you comply with the conditions of the Certificate, the GMWB provides you a guaranteed level of annual income for life, even if your Account Value reduces to zero. For as long as your Account Value is greater than zero, the guaranteed income is in the form of GAWA withdrawals (or RMDs if greater) that you may take each Certificate Year as withdrawals from your Account Value. If your Account Value drops to zero for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option, we will pay you the GAWA, or RMDs, if greater, from our assets for the remainder of your life (and your spouse's life if you have elected the Joint and Survivor Option).

There are three important dates to keep in mind that are relevant to the operation of your Certificate:

•the Certificate Date, when the Certificate we issue to you becomes effective. On the Certificate Date, your Guaranteed Withdrawal Balance is equal to your Account Value;

•the Activation Date, when the GAWA% is locked-in and your initial GAWA is determined. You elect the Activation Date, which is the date you choose to make the first withdrawal after the Covered Person (or younger Covered Person, if applicable) has reached age 60; and

•if applicable, the date on which your Account Value drops to zero other than by an Early or Excess Withdrawal. At that point, we would begin making GAWA (or RMD, if greater) payments from Company assets for the life of the Covered Person(s).

Owner. As Owner, you may exercise all ownership rights under the Certificate. The Owner is typically the Covered Person and Annuitant. The Certificate allows for joint Owners who are spouses (as defined under federal law). Only two joint Owners are allowed per Certificate. Any reference in this prospectus to the Owner includes any joint Owner. Joint Owners have equal ownership rights, and as such, each Owner must authorize any exercise of Certificate rights unless the joint Owners instruct us in writing to act upon authorization of an individual joint Owner. Please note that if you name joint Owners under the Certificate, the Joint and Survivor Option will automatically be elected, and both joint Owners will be considered Covered Persons.

In some cases, such as telephone and internet transactions, joint Owners may authorize each joint Owner to act individually. On jointly owned Certificates, correspondence and required documents will be sent to the address of record of the first Owner identified in your Certificate.

Ownership Changes. To the extent allowed by law, we reserve the right to refuse ownership changes at any time on a non-discriminatory basis. You may request to change the Owner or joint Owner of this Certificate by sending a signed, dated request to our Customer Care Center. The change of ownership will not take effect until it is approved by us, unless you specify another date, and will be subject to any payments made or actions taken by us prior to our approval. We will use the oldest Owner's age for all Certificate purposes. No person whose age exceeds the maximum issue age allowed by Jackson as of the Certificate Date may be designated as a new Owner. The Owner of the Certificate must also be the Owner of the Account, so an ownership change of the Account may also be required in connection with a Certificate ownership change.

Jackson assumes no responsibility for the validity or tax consequences of any ownership change. If you make an ownership change, you may have to pay taxes. We encourage you to seek legal and/or tax advice before requesting any ownership change.

Covered Person. The Covered Person is the natural person (or persons) whose life or lives are covered by the GMWB under the Certificate. If the Owner is a natural person, then the Owner is the Annuitant and the Covered Person. If the Owner is a legal entity, the Annuitant is the Covered Person. If the Owner is an entity and there are joint Annuitants, each joint Annuitant will be considered a Covered Person. When the Joint and Survivor Option is elected on Qualified Accounts, the Annuitant and the contingent Annuitant will each be considered a Covered Person. When the Joint and Survivor Option is elected on a Non-Qualified Account, the Certificate Owner and sole spousal Account beneficiary, or the spousal joint Owners, will each be considered a Covered Person. The Covered Person(s) may not be subsequently changed.

Assignment. To the extent allowed by state law, we reserve the right to refuse assignments at any time on a non-discriminatory basis. You may request to assign this Certificate by sending a signed, dated request to our Customer Care Center. The assignment will take effect on the date we approve it, unless you specify another date, subject to any payments made or actions taken by us prior to our approval. Your right to assign the Certificate is subject to the interest of any assignee. If the Certificate is issued pursuant to a qualified plan, it may not be assigned except under such conditions as may be allowed under the plan and applicable law. Generally, an assignment or pledge of a non-qualified annuity is treated as a distribution. The Owner of the Certificate must also be the Owner of the Account, so an assignment of the Account may also be required in connection with an assignment of the Certificate.

Jackson assumes no responsibility for the validity or tax consequences of any assignment. We encourage you to seek legal and/or tax advice before requesting any assignment.

State Variations. This prospectus describes the material rights and obligations under the Certificate. There may be some variations to the general description in this prospectus, where required by specific state laws. Please refer to your Certificate for specific variations applicable to you. All state variations will be included in your Certificate and any endorsements to your Certificate. For a list of material state variations, please refer to Appendix B.

Guaranteed Minimum Withdrawal Benefit. The GMWB is designed to help investors manage their lifetime income needs. In planning for lifetime income needs, investors face uncertainties as to (i) how much income their investments will produce, and (ii) how long they will live and need to withdraw income from those investments. The GMWB is designed to help investors manage these uncertainties.

The GMWB does not guarantee that the GAWA will be sufficient to cover any individual’s particular needs. Moreover, the GMWB does not assure that you will receive any positive return on your investments and/or that your Account Value will not lose money due to negative investment performance. While the GMWB's Step-Up feature may provide protection against inflation when there are strong investment returns that coincide with the availability of a Step-Up, the GMWB does not protect against any loss of purchasing power due to inflation that is provided by the GMWB's guaranteed annual lifetime income payments. Also, it is important to note that withdrawals from your Account (including GAWA withdrawals) make it less likely that future Step-Ups to your GWB (if any) will increase your GAWA. This is because all withdrawals reduce your Account Value and GWB. It is also important to note that Excess Withdrawals may significantly reduce the likelihood that your GAWA will increase due to a Step-Up, as Excess Withdrawals (unlike GAWA withdrawals) result in a proportional reduction to your GWB and may cause your GWB to be reduced by even more than the amount withdrawn.

The following description of this Guaranteed Minimum Withdrawal Benefit ("GMWB") is supplemented by the examples in Appendix A.

Subject to certain conditions, the Certificate guarantees annual lifetime income payments called the Guaranteed Annual Withdrawal Amount ("GAWA") regardless of the performance of the investments in the Account, subject to the following:

•The guarantee lasts for the lifetime of the Covered Person or if the Joint and Survivor Option is elected, the lifetime of the last surviving Covered Person.

•GAWA withdrawals begin on the Activation Date, which is the date you take the first withdrawal from your Account (other than for payment of the Certificate Charge covered by the Annual Fee Allowance) once the Covered Person (or youngest Covered Person, if applicable) has reached the Minimum Activation Age.

•The Guaranteed Withdrawal Balance ("GWB"), which is the value used to calculate the GAWA, will automatically "step up" to the current Account Value on each Certificate Anniversary if the current Account Value on that Certificate Anniversary is greater than the GWB. An increase in your GWB may increase your GAWA in the new Certificate Year.

•The GAWA payments, or any applicable RMDs, if greater, will be in the form of partial withdrawals from the Account Value while the Account Value is greater than zero. If the Account Value drops to zero for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option, the Company will make payments to you in an amount equal to the GAWA, net of any applicable taxes, for the lifetime of the Covered Person (or last surviving Covered Person if the Joint and Survivor Option is elected).

•If the Owner does not withdraw the GAWA or applicable RMD, if greater, during a Certificate Year, the Owner may not take more than the GAWA or RMD as part of the GAWA in subsequent years (i.e. the GAWA is not cumulative).

•The maximum cumulative withdrawals you may take in any Certificate Year, without reducing the value of the GMWB, or potentially terminating the Certificate, is the Guaranteed Annual Withdrawal Amount (GAWA), or any RMD under the Internal Revenue Code, if greater. Withdrawals exceeding the GAWA or RMD, if applicable ("Excess Withdrawals"), cause the GWB and GAWA to be recalculated and reduced, as discussed below under "Withdrawals". Such reductions could be substantial. In addition, if the Excess Withdrawal causes your Account Value to drop to zero, the Certificate will terminate and no future GAWA payments will be made.

•An Early Withdrawal will also reduce your GWB and any future GAWA payments and could cause your Certificate to terminate.

Please see Guaranteed Withdrawal Balance (“GWB”) and “Withdrawals” below for more information about the GWB and GAWA.

Guaranteed Withdrawal Balance (“GWB”). The GWB is established for the sole purpose of determining the GAWA. It is not an Account Value, and it cannot be withdrawn. On the Certificate Date, the GWB is equal to your initial Contribution. At the time of any subsequent Contribution, the GWB is recalculated to equal the GWB prior to the Contribution plus the dollar amount of the Contribution net of any applicable taxes. The GWB can also be increased by any automatic Step-Up that occurs on any Certificate Anniversary. A Step-Up is a Certificate feature under which we automatically increase the GWB to reflect increases in the Account Value due to positive investment performance during the Certificate Year.

It is important to note that withdrawals from your Account (including GAWA withdrawals) make it less likely that future Step-Ups to your GWB (if any) will increase your GAWA. This is because all withdrawals reduce your Account Value and GWB. It is also important to note that Excess Withdrawals may significantly reduce the likelihood that your GAWA will increase due to a Step-Up, as Excess Withdrawals (unlike GAWA withdrawals) result in a proportional reduction to your GWB and may cause your GWB to be reduced by even more than the amount withdrawn.

The GWB can never be more than $10 million (including upon Step-Up), and the GWB is reduced by each withdrawal. The GWB will be reduced proportionally by Early and Excess Withdrawals. Such reductions could be substantial. See "Withdrawals" below for more information on the impact of different types of withdrawals on the GWB.

Withdrawals. The Certificate is designed to permit annual withdrawals equal to the greater of the GAWA or RMD, if applicable, on and after the Activation Date. On the Activation Date, the GAWA is equal to the Guaranteed Withdrawal Balance (GWB) multiplied by the GAWA%. The GAWA% is locked-in at the earlier of (1) the Activation Date, and (2) the date the Account Value reduces to zero, other than due to an Early Withdrawal or Excess Withdrawal. The GAWA% is determined using the attained age of the Covered Person (or youngest Covered Person, if applicable) on the date it is locked-in, according to the following:

| | | | | | | | |

| Attained Age | Standard GAWA% | Joint and Survivor GAWA% |

| 60-64 | 4.00% | 3.50% |

| 65-69 | 5.00% | 4.50% |

| 70-74 | 5.25% | 4.75% |

| 75+ | 5.50% | 5.00% |

If the Account Value drops to zero (for any reason other than an Early Withdrawal, Excess Withdrawal, or election of the Conversion Option) before the Covered Person (or youngest Covered Person, if applicable) reaches the Minimum Activation Age of attained age 60, the GAWA will be determined using the youngest Attained Age band in the table above.

We reserve the right to prospectively change the GAWA%, including the age bands, on new Certificate sales. If we change the GAWA%, we will follow these procedures:

•When we issue your Certificate we will deliver a copy of the prospectus that includes the notice of change of GAWA% in the form of a prospectus supplement to you. You will have until the end of the Free Look period to cancel your Certificate by providing notice to us pursuant to the provisions of the Free Look section (please see “Free Look” on page 24).

The actual GAWA% applicable to your Certificate will be reflected in your Certificate Data Pages.

Recalculation of the GWB and/or the GAWA due to Withdrawals. Withdrawals cause the GWB and/or GAWA to be recalculated in the following ways:

•Recalculation of the GWB upon Early Withdrawals. Withdrawals taken prior to the Minimum Activation Age are considered Early Withdrawals, and cause the GWB to be reduced in the same proportion that the Account Value is reduced on the date of the withdrawal. For example, if you take an Early Withdrawal of 10% of your Account Value, your GWB will also be reduced by 10%. This means that if you take an Early Withdrawal, it is possible that your GWB could be decreased by more than the amount of the withdrawal; in other words, on more than a dollar-for-dollar basis. Such decreases could be substantial. Any decrease in the GWB due to an Early Withdrawal will result in a lower GAWA on your Activation Date. Early Withdrawals may even terminate the Certificate.

•Recalculation of the GWB upon GAWA Withdrawals. Withdrawals taken on or after the Activation Date that do not cause the cumulative total of all withdrawals taken in the Certificate Year to exceed the greater of the GAWA or the RMD, if applicable, will cause the GWB to be reduced by the dollar amount of the withdrawal, but will not trigger a recalculation of the GAWA.

•Recalculation of the GWB and GAWA upon Excess Withdrawals. Any portion of a withdrawal taken on or after the Activation Date that causes the sum of all withdrawals taken in the Certificate Year to exceed the greater of the GAWA or the RMD, if applicable, will cause the GWB to be reduced proportionally as follows:

◦The dollar-for-dollar portion (DFD Portion) of the partial withdrawal is equal to the greater of (1) the GAWA at the time of the partial withdrawal or the RMD, less all prior partial withdrawals made in the current Certificate Year, or (2) zero.

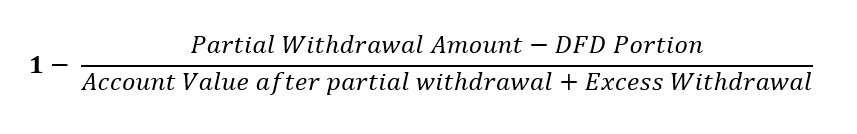

◦The Proportional Reduction Factor for the partial withdrawal is defined to be:

•The GWB is reduced to equal the greater of the GWB prior to the partial withdrawals less the DFD Portion, reduced for the Excess Withdrawal in the same proportion as the Account Value is reduced (i.e. GWB prior to the Excess Withdrawal, reduced for the DFD portion, then multiplied by the Proportional Reduction Factor); or zero.

•The GAWA is reduced for the Excess Withdrawal in the same proportion as the Account Value is reduced (i.e. the GAWA prior to the Excess Withdrawal is multiplied by the Proportional Reduction Factor).

◦In recalculating the GWB and GAWA, both values could be reduced by more than the withdrawal amount; in other words, on more than a dollar-for-dollar basis. Therefore, please note that withdrawing more than the greater of the GAWA or RMD, if applicable, in any Certificate Year may have a significantly negative impact on the value of the GMWB and could even cause the Certificate to terminate, in which case, no future GAWA payments would be made, even if the Account Value drops to zero.

Neither Early Withdrawals nor Excess Withdrawals will ever change the GAWA%.

For examples illustrating the impact of various types withdrawals at different times during your Certificate's life cycle on your GWB and GAWA values, please see Appendix A, Examples 4, 5, 7 and 8, beginning on page A-1. For certain Qualified Accounts, withdrawals greater than the GAWA are permitted in order to meet the applicable RMD without compromising the Certificate’s guarantees. Examples 4 and 5 in Appendix A supplement this description. Because the

intervals for the GAWA and RMDs are different, namely Certificate Years versus calendar years, and because RMDs are subject to other conditions and limitations, if your Account is a Qualified Account, please see “RMD NOTES” on page 18, for more information.

You may withdraw the greater of the GAWA or RMD, if applicable, all at once or in multiple withdrawals throughout the Certificate Year. Withdrawing less than the greater of the GAWA or RMD, if applicable, in a Certificate Year does not entitle you to withdraw more than the greater of the GAWA or RMD, if applicable, in the next Certificate Year. The amount you may withdraw each Certificate Year without causing the GWB and GAWA to be recalculated does not accumulate.

Withdrawals under this Certificate are assumed to be the total amount deducted from the Account Value, including any applicable charges or adjustments. All withdrawals count toward the total amount withdrawn in a Certificate Year, unless they are withdrawals under the Annual Fee Allowance. All withdrawals, even withdrawals covered by the Annual Fee Allowance, are treated the same for federal income tax purposes. For more information about Qualified and Non-Qualified Accounts, please see “TAXES” beginning on page 28.